Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Nexeo Solutions, Inc. | q420178kexhibit991.htm |

| 8-K - 8-K - Nexeo Solutions, Inc. | q42017earningsrelease8k.htm |

1

FOURTH QUARTER & FISCAL YEAR 2017

Earnings Conference Call & Presentation

December 7, 2017 at 9:00 a.m. CT (10:00 a.m. ET)

EXHIBIT 99.2

2

Fourth Quarter and Fiscal Year 2017

Welcome to Nexeo’s Earnings Conference Call and Presentation

December 7, 2017 beginning at 9:00 a.m. CT (10:00 a.m. ET)

…Please stand by, we will begin momentarily

Dial-In Information

Domestic: +1.844.412.1004

International: +1.216.562.0451

Passcode: 7867188

EXHIBIT 99.2

3

Agenda and Management Introductions

1 INTRODUCTIONS AND SAFE HARBOR

2 BUSINESS COMMENTARY

3 FINANCIAL PERFORMANCE

4 CLOSING REMARKS

Michael Everett

VP, Treasurer, FP&A, Investor Relations

David Bradley

President & Chief Executive Officer

Ross Crane

Executive VP & Chief Financial Officer

David Bradley

President & Chief Executive Officer

5 Q&A

EXHIBIT 99.2

4

Non-GAAP Financial Measures and Safe Harbor

Non-GAAP Financial Measures

Certain financial measures presented herein, including EBITDA, Adjusted EBITDA, Conversion Ratio and Net Debt

were derived based on methodologies other than in accordance with generally accepted accounting principles (GAAP).

We have included these measures because we believe they are indicative of our operating performance, are used by

investors and analysts to evaluate us and can facilitate comparisons across periods. As presented by us, these

measures may not be comparable to similarly titled measures reported by other companies. EBITDA, Adjusted

EBITDA, Conversion Ratio and Net Debt should be considered in addition to, not as substitutes for, financial measures

presented in accordance with GAAP. For a reconciliation of EBITDA, Adjusted EBITDA and Net Debt to the most

comparable GAAP financial measure, see the appendix slides.

Safe Harbor

Forward Looking Statements: This presentation contains statements related to Nexeo Solutions, Inc.’s (“Nexeo” or the

“Company”) future plans and expectations and, as such, includes “forward-looking statements” within the meaning of

the federal securities laws. Forward-looking statements are those statements that are based upon management’s

current plans and expectations as opposed to historical and current facts. Although the forward-looking statements

contained in this presentation reflect management’s current assumptions based upon information currently available to

management and based upon that which management believes to be reasonable assumptions, the Company cannot

be certain that actual results will be consistent with these forward-looking statements. The Company’s future results

will depend upon various risks and uncertainties, including the risks and uncertainties discussed in the Company’s

SEC filings, including in the sections entitled “Risk Factors” in such SEC filings. The Company does not intend to

provide all information enclosed in this presentation on an ongoing basis.

EXHIBIT 99.2

BUSINESS COMMENTARY

David Bradley

President & Chief Executive Officer

EXHIBIT 99.2

Business Update

6

Fourth fiscal quarter revenue up 15%, full fiscal year up 7%

Fourth fiscal quarter net income of $13.6 million, or $0.18 per share, and full fiscal

year net income of $14.4 million, or $0.19 per share

Fourth fiscal quarter adjusted EBITDA* growth of 14%, full fiscal year growth of 6%

Successfully mitigated potential financial impact of natural disasters

Nine new authorizations from specialty suppliers, an 80% increase from last year

*Non-GAAP financial measure; See appendix slides for reconciliation to the most comparable GAAP financial measure

Adjusted EBITDA* Growth

Year-Over-Year

(14%)

10%

12% 14%

Q1-FY17 Q2-FY17 Q3-FY17 Q4-FY17

EXHIBIT 99.2

FINANCIAL PERFORMANCE

Ross Crane

Chief Financial Officer

EXHIBIT 99.2

Consolidated

Volume increased 8%

Average selling prices up 7%

Chemicals

Volume increased 6%

Average selling prices up 12%

Plastics

Volume increased 11%

Average selling prices up 2%

EPS growth of 64%

Adjusted EBITDA* growth of 14%

Fiscal Fourth Quarter 2017 Highlights

8

*Non-GAAP financial measure; See appendix slides for reconciliation to the most comparable GAAP financial measure

**Non-GAAP financial measure; Calculated as adjusted EBITDA divided by gross profit

In millions (except per share data) Successor Successor

Three Months

Ended

Sep-30-2017

Three Months

Ended

Sep-30-2016

4Q-FY17 4Q-FY16 $ %

Sales and operating revenues

Chemicals 455.9$ 383.9$ 72.0 18.8 %

Plastics 491.3 436.8 54.5 12.5 %

Other 34.5 30.7 3.8 12.4 %

Total sales and operating revenues 981.7 851.4 130.3 15.3 %

Gross profit

Chemicals 58.0 46.1 11.9 25.8 %

Margin 12.7% 12.0%

Plastics 42.3 36.9 5.4 14.6 %

Margin 8.6% 8.4%

Other 8.8 6.6 2.2 33.3 %

Total gross profit 109.1 89.6 19.5 21.8 %

Total gross profit margin 11.1% 10.5%

SG&A 79.0 72.5 6.5 9.0 %

Transaction related costs 0.6 3.3 (2.7) (81.8)%

Change in fair value related to contingent consideration (3.6) (8.9) 5.3 59.6 %

Operating income 33.1 22.7 10.4 45.8 %

Other income - 0.5 (0.5) (100.0)%

Interest expense, net (13.0) (12.0) (1.0) (8.3)%

Net income (loss) from continuing operations before income taxes 20.1 11.2 8.9 79.5 %

Income tax expense (benefit) 6.5 2.5 4.0 160.0 %

Net income (loss) Attributed to Nexeo Solutions, Inc. 13.6$ 8.7$ 4.9$ 56.3 %

Net income (loss) per share available to common stockholders

Basic and Diluted 0.18$ 0.11$

Adjusted EBITDA* 52.7$ 46.4$ 6.3$ 13.6 %

Adjusted EBITDA* % of sales 5.4% 5.4%

Conversion Ratio** 48.3% 51.8%

Variance

YoY

70 bps

20 bps

(350) bps

60 bps

0 bps

EXHIBIT 99.2

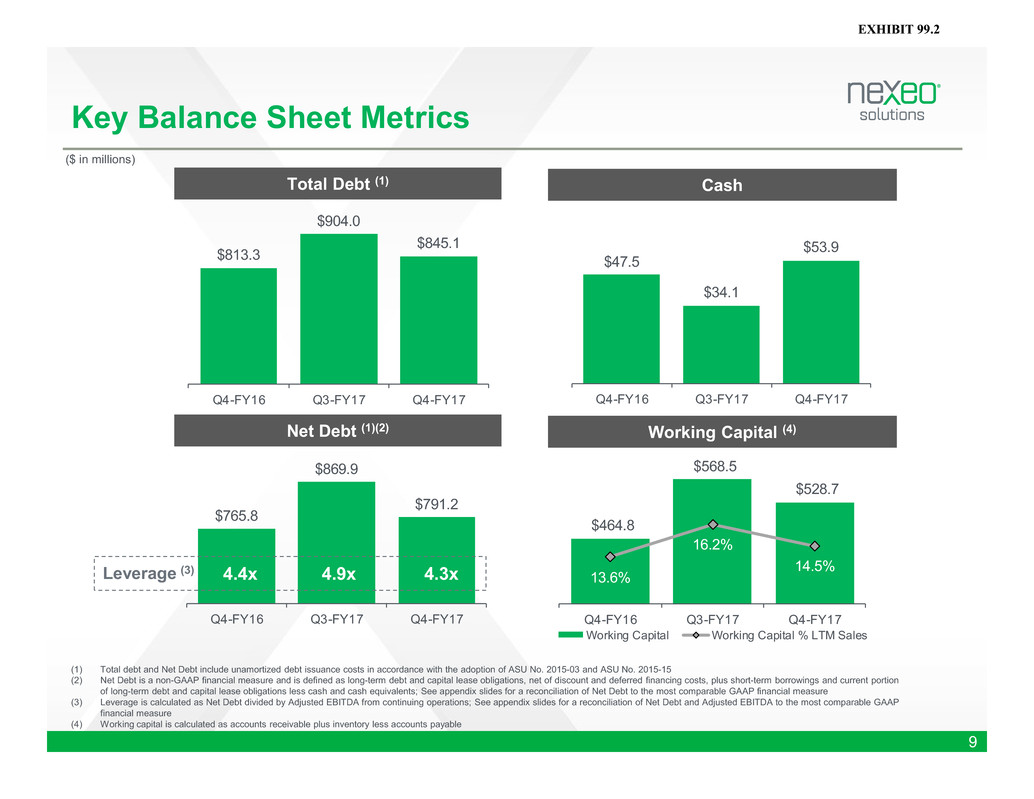

Key Balance Sheet Metrics

9

(1) Total debt and Net Debt include unamortized debt issuance costs in accordance with the adoption of ASU No. 2015-03 and ASU No. 2015-15

(2) Net Debt is a non-GAAP financial measure and is defined as long-term debt and capital lease obligations, net of discount and deferred financing costs, plus short-term borrowings and current portion

of long-term debt and capital lease obligations less cash and cash equivalents; See appendix slides for a reconciliation of Net Debt to the most comparable GAAP financial measure

(3) Leverage is calculated as Net Debt divided by Adjusted EBITDA from continuing operations; See appendix slides for a reconciliation of Net Debt and Adjusted EBITDA to the most comparable GAAP

financial measure

(4) Working capital is calculated as accounts receivable plus inventory less accounts payable

Working Capital (4)Net Debt (1)(2)

CashTotal Debt (1)

$765.8

$869.9

$791.2

Q4-FY16 Q3-FY17 Q4-FY17

($ in millions)

4.3x4.9x4.4xLeverage (3)

$813.3

$904.0

$845.1

Q4-FY16 Q3-FY17 Q4-FY17

$47.5

$34.1

$53.9

Q4-FY16 Q3-FY17 Q4-FY17

$464.8

$568.5

$528.7

13.6%

16.2%

14.5%

Q4-FY16 Q3-FY17 Q4-FY17

Working Capital Working Capital % LTM Sales

EXHIBIT 99.2

CLOSING REMARKS

David Bradley

President & Chief Executive Officer

EXHIBIT 99.2

Strategic Objectives

11

Long-term growth objectives

Grow commodity volumes equal to or better than GDP

Grow specialty volumes at two to three times the rate of commodities

Supplement growth through targeted bolt-on acquisitions at reasonable multiples

Strategic plan for margin expansion

Leverage industry-leading, centralized, proprietary operating platform to drive

productivity and cost enhancements across the company

Improve specialty mix by continuing to expand specialty line card with new

supplier authorizations and targeted acquisitions

EXHIBIT 99.2

QUESTION AND ANSWER

To ask a question live over the phone, please press * then the

number 1 on your telephone keypad to queue our operator

If your question has been answered or you wish to remove

yourself from the queue, please press #

EXHIBIT 99.2

THANK YOU FOR ATTENDING

We look forward to hosting you next quarter!

Please feel free to reach out to our Investor Relations Personnel via the contact

information below with any outstanding questions you have or if you would like to

discuss our strategy and investment proposition in further detail

+1.281.297.0856

Investor.Relations@nexeosolutions.com

EXHIBIT 99.2

Appendix

EXHIBIT 99.2

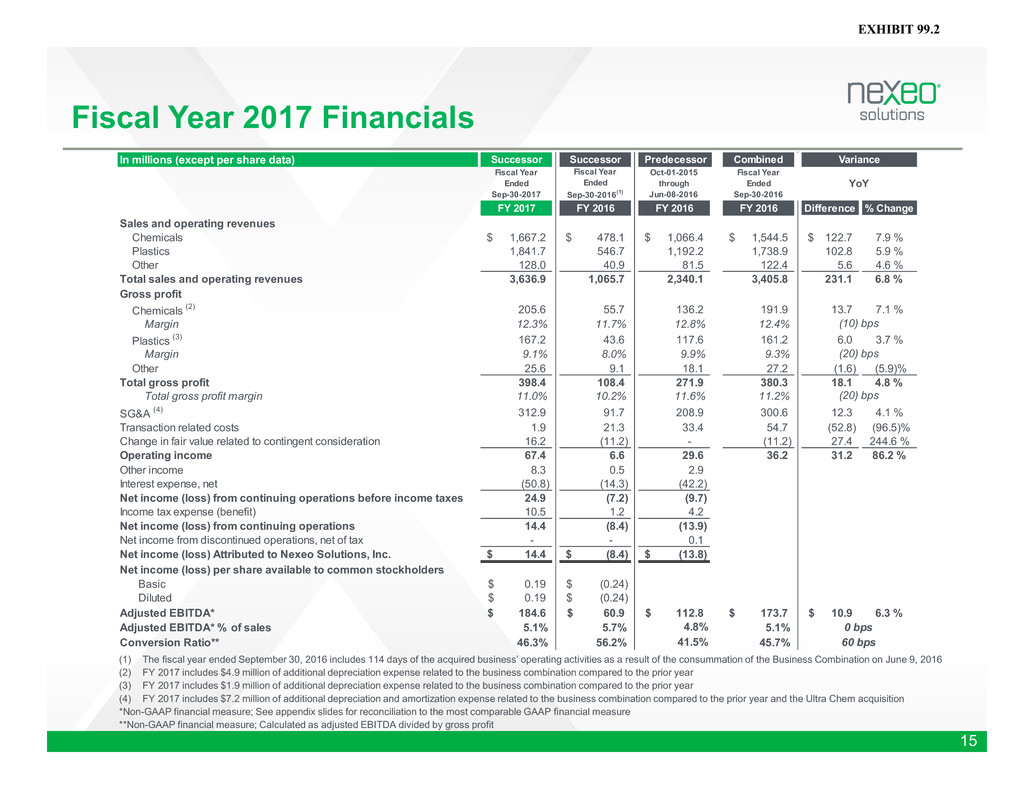

15

(1) The fiscal year ended September 30, 2016 includes 114 days of the acquired business’ operating activities as a result of the consummation of the Business Combination on June 9, 2016

(2) FY 2017 includes $4.9 million of additional depreciation expense related to the business combination compared to the prior year

(3) FY 2017 includes $1.9 million of additional depreciation expense related to the business combination compared to the prior year

(4) FY 2017 includes $7.2 million of additional depreciation and amortization expense related to the business combination compared to the prior year and the Ultra Chem acquisition

*Non-GAAP financial measure; See appendix slides for reconciliation to the most comparable GAAP financial measure

**Non-GAAP financial measure; Calculated as adjusted EBITDA divided by gross profit

In millions (except per share data) Successor Successor Combined

Fiscal Year

Ended

Sep-30-2017

Fiscal Year

Ended

Sep-30-2016(1)

Oct-01-2015

through

Jun-08-2016

Fiscal Year

Ended

Sep-30-2016

FY 2017 FY 2016 FY 2016 FY 2016 Difference % Change

Sales and operating revenues

Chemicals 1,667.2$ 478.1$ 1,066.4$ 1,544.5$ 122.7$ 7.9 %

Plastics 1,841.7 546.7 1,192.2 1,738.9 102.8 5.9 %

Other 128.0 40.9 81.5 122.4 5.6 4.6 %

Total sales and operating revenues 3,636.9 1,065.7 2,340.1 3,405.8 231.1 6.8 %

Gross profit

Chemicals (2) 205.6 55.7 136.2 191.9 13.7 7.1 %

Margin 12.3% 11.7% 12.8% 12.4%

Plastics (3) 167.2 43.6 117.6 161.2 6.0 3.7 %

Margin 9.1% 8.0% 9.9% 9.3%

Other 25.6 9.1 18.1 27.2 (1.6) (5.9)%

Total gross profit 398.4 108.4 271.9 380.3 18.1 4.8 %

Total gross profit margin 11.0% 10.2% 11.6% 11.2%

SG&A (4) 312.9 91.7 208.9 300.6 12.3 4.1 %

Transaction related costs 1.9 21.3 33.4 54.7 (52.8) (96.5)%

Change in fair value related to contingent consideration 16.2 (11.2) - (11.2) 27.4 244.6 %

Operating income 67.4 6.6 29.6 36.2 31.2 86.2 %

Other income 8.3 0.5 2.9

Interest expense, net (50.8) (14.3) (42.2)

Net income (loss) from continuing operations before income taxes 24.9 (7.2) (9.7)

Income tax expense (benefit) 10.5 1.2 4.2

Net income (loss) from continuing operations 14.4 (8.4) (13.9)

Net income from discontinued operations, net of tax - - 0.1

Net income (loss) Attributed to Nexeo Solutions, Inc. 14.4$ (8.4)$ (13.8)$

Net income (loss) per share available to common stockholders

Basic 0.19$ (0.24)$

Diluted 0.19$ (0.24)$

Adjusted EBITDA* 184.6$ 60.9$ 112.8$ 173.7$ 10.9$ 6.3 %

Adjusted EBITDA* % of sales 5.1% 5.7% 5.1%

Conversion Ratio** 46.3% 56.2% 45.7% 60 bps

(10) bps

(20) bps

(20) bps

0 bps

41.5%

Predecessor

4.8%

Variance

YoY

Fiscal Year 2017 Financials

EXHIBIT 99.2

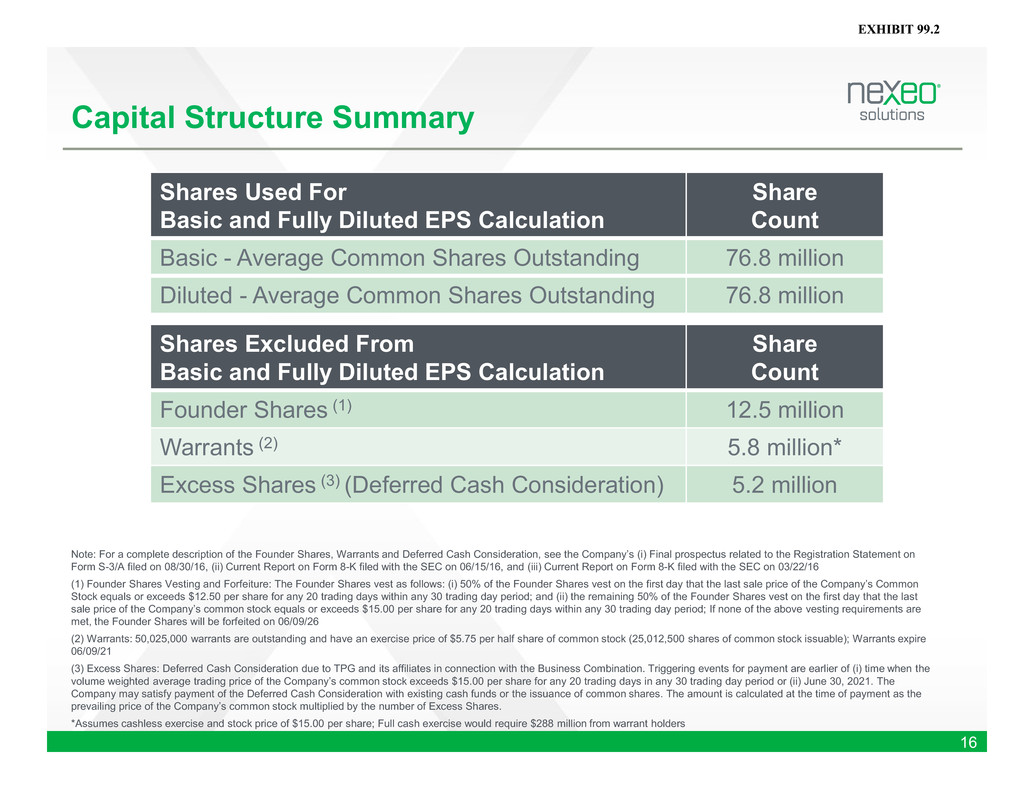

Capital Structure Summary

16

Shares Used For

Basic and Fully Diluted EPS Calculation

Share

Count

Basic - Average Common Shares Outstanding 76.8 million

Diluted - Average Common Shares Outstanding 76.8 million

Shares Excluded From

Basic and Fully Diluted EPS Calculation

Share

Count

Founder Shares (1) 12.5 million

Warrants (2) 5.8 million*

Excess Shares (3) (Deferred Cash Consideration) 5.2 million

Note: For a complete description of the Founder Shares, Warrants and Deferred Cash Consideration, see the Company’s (i) Final prospectus related to the Registration Statement on

Form S-3/A filed on 08/30/16, (ii) Current Report on Form 8-K filed with the SEC on 06/15/16, and (iii) Current Report on Form 8-K filed with the SEC on 03/22/16

(1) Founder Shares Vesting and Forfeiture: The Founder Shares vest as follows: (i) 50% of the Founder Shares vest on the first day that the last sale price of the Company’s Common

Stock equals or exceeds $12.50 per share for any 20 trading days within any 30 trading day period; and (ii) the remaining 50% of the Founder Shares vest on the first day that the last

sale price of the Company’s common stock equals or exceeds $15.00 per share for any 20 trading days within any 30 trading day period; If none of the above vesting requirements are

met, the Founder Shares will be forfeited on 06/09/26

(2) Warrants: 50,025,000 warrants are outstanding and have an exercise price of $5.75 per half share of common stock (25,012,500 shares of common stock issuable); Warrants expire

06/09/21

(3) Excess Shares: Deferred Cash Consideration due to TPG and its affiliates in connection with the Business Combination. Triggering events for payment are earlier of (i) time when the

volume weighted average trading price of the Company’s common stock exceeds $15.00 per share for any 20 trading days in any 30 trading day period or (ii) June 30, 2021. The

Company may satisfy payment of the Deferred Cash Consideration with existing cash funds or the issuance of common shares. The amount is calculated at the time of payment as the

prevailing price of the Company’s common stock multiplied by the number of Excess Shares.

*Assumes cashless exercise and stock price of $15.00 per share; Full cash exercise would require $288 million from warrant holders

EXHIBIT 99.2

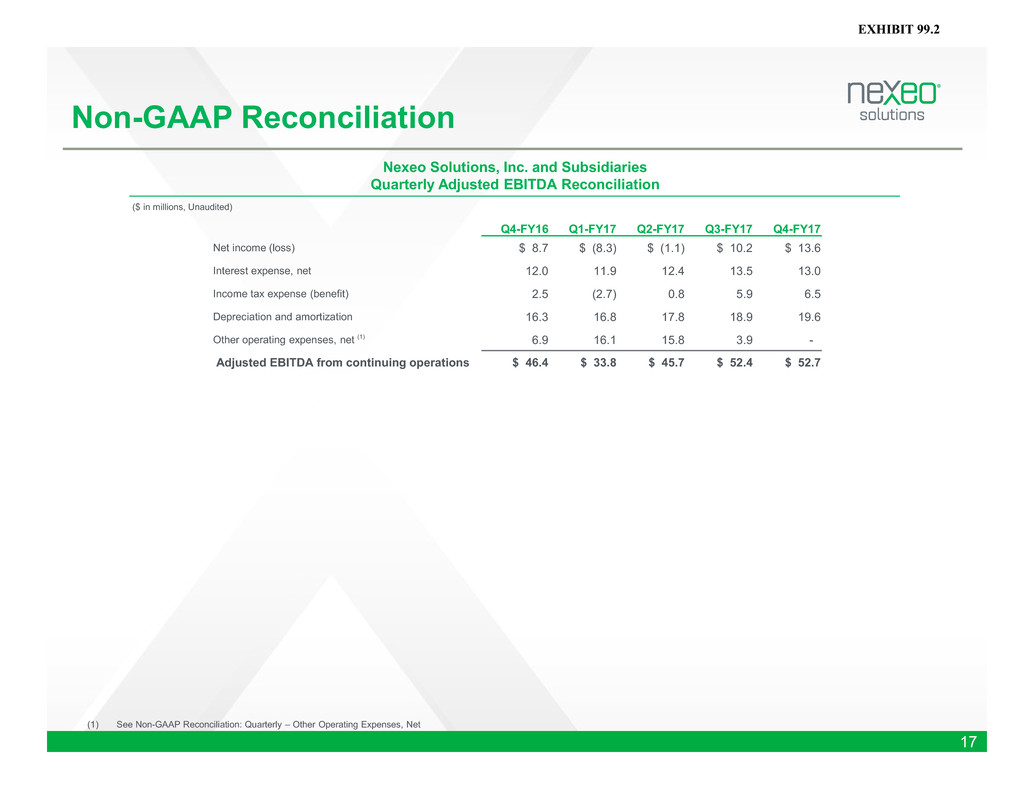

Non-GAAP Reconciliation

17

(1) See Non-GAAP Reconciliation: Quarterly – Other Operating Expenses, Net

Nexeo Solutions, Inc. and Subsidiaries

Quarterly Adjusted EBITDA Reconciliation

Q4-FY16 Q1-FY17 Q2-FY17 Q3-FY17 Q4-FY17

Net income (loss) $ 8.7 $ (8.3) $ (1.1) $ 10.2 $ 13.6

Interest expense, net 12.0 11.9 12.4 13.5 13.0

Income tax expense (benefit) 2.5 (2.7) 0.8 5.9 6.5

Depreciation and amortization 16.3 16.8 17.8 18.9 19.6

Other operating expenses, net (1) 6.9 16.1 15.8 3.9 -

Adjusted EBITDA from continuing operations $ 46.4 $ 33.8 $ 45.7 $ 52.4 $ 52.7

($ in millions, Unaudited)

EXHIBIT 99.2

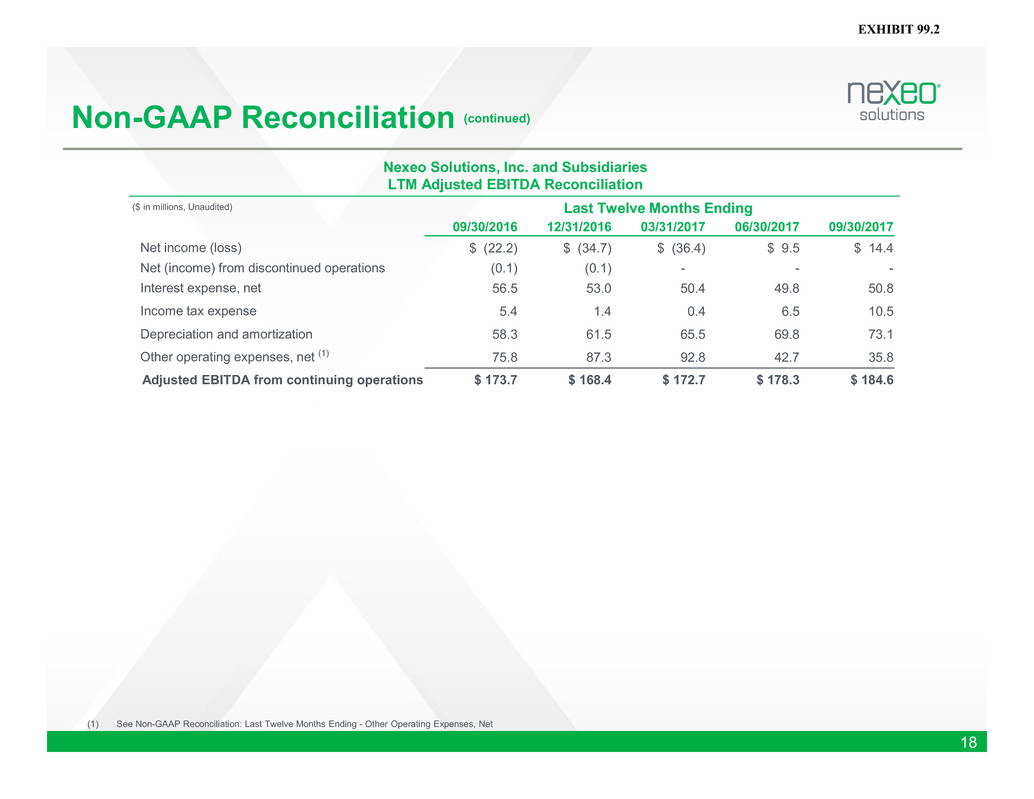

Non-GAAP Reconciliation (continued)

18

(1) See Non-GAAP Reconciliation: Last Twelve Months Ending - Other Operating Expenses, Net

Nexeo Solutions, Inc. and Subsidiaries

LTM Adjusted EBITDA Reconciliation

09/30/2016 12/31/2016 03/31/2017 06/30/2017 09/30/2017

Net income (loss) $ (22.2) $ (34.7) $ (36.4) $ 9.5 $ 14.4

Net (income) from discontinued operations (0.1) (0.1) - - -

Interest expense, net 56.5 53.0 50.4 49.8 50.8

Income tax expense 5.4 1.4 0.4 6.5 10.5

Depreciation and amortization 58.3 61.5 65.5 69.8 73.1

Other operating expenses, net (1) 75.8 87.3 92.8 42.7 35.8

Adjusted EBITDA from continuing operations $ 173.7 $ 168.4 $ 172.7 $ 178.3 $ 184.6

Last Twelve Months Ending($ in millions, Unaudited)

EXHIBIT 99.2

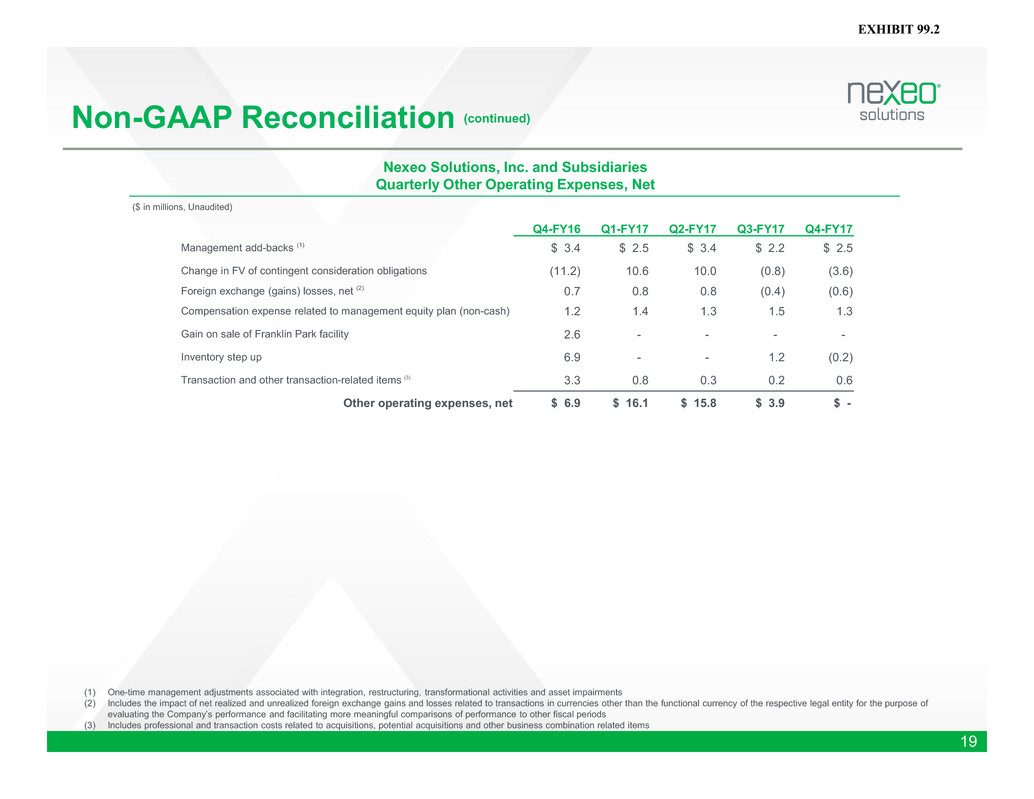

Non-GAAP Reconciliation (continued)

19

Nexeo Solutions, Inc. and Subsidiaries

Quarterly Other Operating Expenses, Net

Q4-FY16 Q1-FY17 Q2-FY17 Q3-FY17 Q4-FY17

Management add-backs (1) $ 3.4 $ 2.5 $ 3.4 $ 2.2 $ 2.5

Change in FV of contingent consideration obligations (11.2) 10.6 10.0 (0.8) (3.6)

Foreign exchange (gains) losses, net (2) 0.7 0.8 0.8 (0.4) (0.6)

Compensation expense related to management equity plan (non-cash) 1.2 1.4 1.3 1.5 1.3

Gain on sale of Franklin Park facility 2.6 - - - -

Inventory step up 6.9 - - 1.2 (0.2)

Transaction and other transaction-related items (3) 3.3 0.8 0.3 0.2 0.6

Other operating expenses, net $ 6.9 $ 16.1 $ 15.8 $ 3.9 $ -

($ in millions, Unaudited)

(1) One-time management adjustments associated with integration, restructuring, transformational activities and asset impairments

(2) Includes the impact of net realized and unrealized foreign exchange gains and losses related to transactions in currencies other than the functional currency of the respective legal entity for the purpose of

evaluating the Company’s performance and facilitating more meaningful comparisons of performance to other fiscal periods

(3) Includes professional and transaction costs related to acquisitions, potential acquisitions and other business combination related items

EXHIBIT 99.2

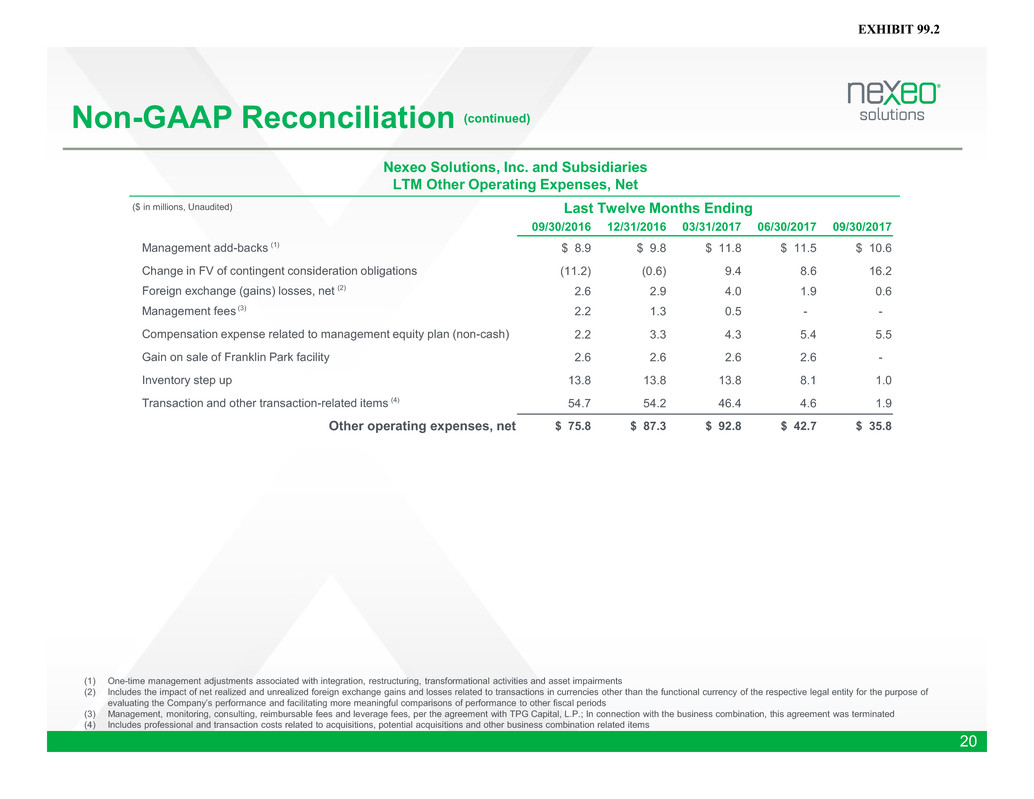

Non-GAAP Reconciliation (continued)

20

Nexeo Solutions, Inc. and Subsidiaries

LTM Other Operating Expenses, Net

09/30/2016 12/31/2016 03/31/2017 06/30/2017 09/30/2017

Management add-backs (1) $ 8.9 $ 9.8 $ 11.8 $ 11.5 $ 10.6

Change in FV of contingent consideration obligations (11.2) (0.6) 9.4 8.6 16.2

Foreign exchange (gains) losses, net (2) 2.6 2.9 4.0 1.9 0.6

Management fees (3) 2.2 1.3 0.5 - -

Compensation expense related to management equity plan (non-cash) 2.2 3.3 4.3 5.4 5.5

Gain on sale of Franklin Park facility 2.6 2.6 2.6 2.6 -

Inventory step up 13.8 13.8 13.8 8.1 1.0

Transaction and other transaction-related items (4) 54.7 54.2 46.4 4.6 1.9

Other operating expenses, net $ 75.8 $ 87.3 $ 92.8 $ 42.7 $ 35.8

(1) One-time management adjustments associated with integration, restructuring, transformational activities and asset impairments

(2) Includes the impact of net realized and unrealized foreign exchange gains and losses related to transactions in currencies other than the functional currency of the respective legal entity for the purpose of

evaluating the Company’s performance and facilitating more meaningful comparisons of performance to other fiscal periods

(3) Management, monitoring, consulting, reimbursable fees and leverage fees, per the agreement with TPG Capital, L.P.; In connection with the business combination, this agreement was terminated

(4) Includes professional and transaction costs related to acquisitions, potential acquisitions and other business combination related items

Last Twelve Months Ending($ in millions, Unaudited)

EXHIBIT 99.2

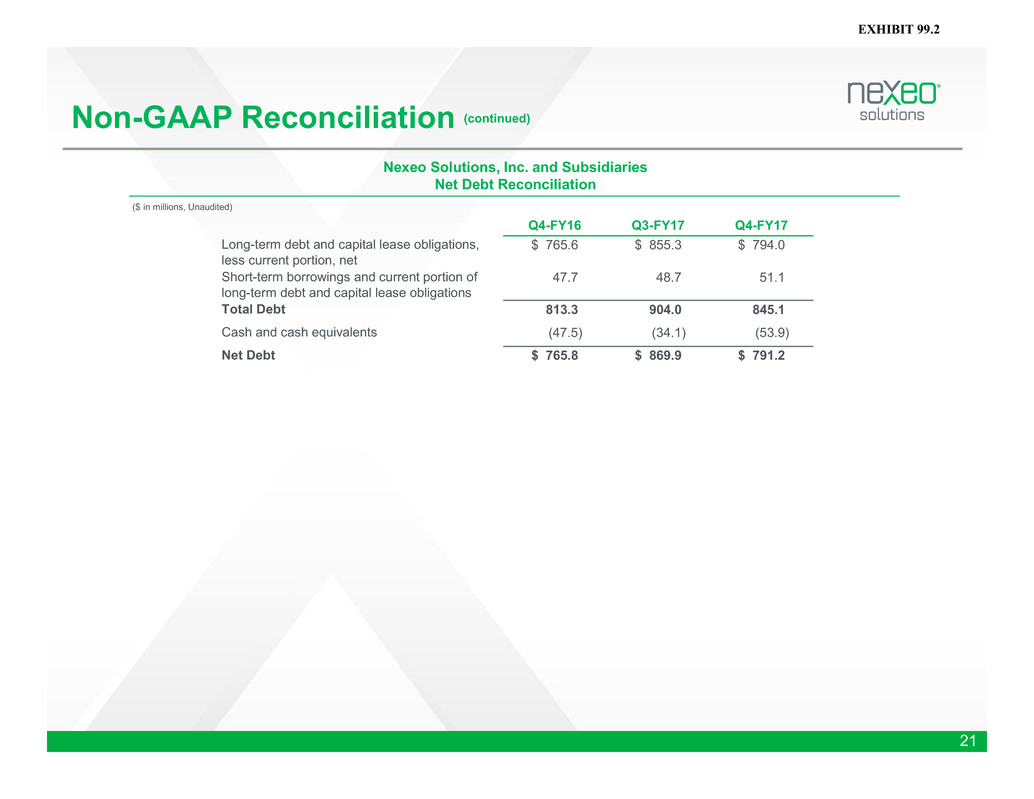

Non-GAAP Reconciliation (continued)

21

Nexeo Solutions, Inc. and Subsidiaries

Net Debt Reconciliation

Q4-FY16 Q3-FY17 Q4-FY17

Long-term debt and capital lease obligations,

less current portion, net

$ 765.6 $ 855.3 $ 794.0

Short-term borrowings and current portion of

long-term debt and capital lease obligations

47.7 48.7 51.1

Total Debt 813.3 904.0 845.1

Cash and cash equivalents (47.5) (34.1) (53.9)

Net Debt $ 765.8 $ 869.9 $ 791.2

($ in millions, Unaudited)

EXHIBIT 99.2

NEXEO SOLUTIONS, INC.

EXHIBIT 99.2