Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 5, 2017 (November 29, 2017)

WILLSCOT CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-37552 |

|

82-3430194 |

|

(State or other jurisdiction of |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

901 S. Bond Street, #600

Baltimore, Maryland 21231

(Address, including zip code, of principal executive offices)

(410) 931-6000

(Registrant’s telephone number, including area code)

Double Eagle Acquisition Corp.

2121 Avenue of the Stars #2300

Los Angeles, California 90067

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Introductory Note

Unless the context otherwise requires, “we,” “us,” “our,” and the “Company” refer to WillScot Corporation and its subsidiaries. All references herein to the “Board” refer to the board of directors of the Company.

On November 29, 2017, Double Eagle Acquisition Corp., our predecessor company (“Double Eagle”), consummated the previously announced business combination (the “Business Combination”) pursuant to that certain Stock Purchase Agreement, dated as of August 21, 2017 as amended on September 6, 2017 and November 6, 2017 (the “Stock Purchase Agreement”), by and among Double Eagle, Williams Scotsman Holdings Corp. (the “Holdco Acquiror”), Algeco Scotsman Global S.à r.l., a Luxembourg société à responsabilité limitée (“Algeco Global” and together with its subsidiaries, the “Algeco Group”) and Algeco Scotsman Holdings Kft., a Hungarian limited liability company (“Algeco Holdings” and, together with Algeco Global, the “Sellers”). Double Eagle, through its wholly-owned subsidiary, the Holdco Acquiror, acquired all of the issued and outstanding shares of the common stock of Williams Scotsman International, Inc. (“WSII”) from the Sellers. Under the Stock Purchase Agreement, the Holdco Acquiror purchased WSII for $1.1 billion, of which (A) $1.0215 billion was paid in cash (the “Cash Consideration”), first to repay indebtedness as contemplated by the Stock Purchase Agreement, with the remainder paid directly to the Sellers, on a pro rata basis, with 86.44% to Algeco Holdings and 13.56% to Algeco Global, and (B) the remaining $78.5 million was paid to the Sellers, on a pro rata basis, in the form of (i) shares of common stock, par value $0.0001 per share of the Holdco Acquiror, which shares will be exchangeable for shares of our Class A common stock pursuant to an exchange agreement and (ii) shares of our Class B common stock, par value $0.0001 per share representing a non-economic voting interest the Company (the “Stock Consideration”). Immediately upon completion of the Business Combination and the other transactions contemplated by the Stock Purchase Agreement (collectively, including WSII’s offering of the Notes and its entry into the ABL Facility (as defined herein), the “Transactions”), WSII became our indirect subsidiary.

As noted above, in connection with the Business Combination the Sellers retained a 10% minority interest in the Holdco Acquiror (the “Sellers’ Rollover Interest”), which interest is exchangeable for shares of our Class A common stock, subject to certain anti-dilution protection, and transferable to certain permitted transferees.

Prior to the completion of the Business Combination, Algeco/Scotsman Holding S.à r.l., an affiliate of the Sellers (“A/S Holdings”), undertook an internal restructuring (the “Carve-Out Transaction”) in which it transferred certain assets related to WSII’s historical remote accommodations business from WSII to other entities owned by A/S Holdings. In addition, in conjunction with the Business Combination, Double Eagle changed its name to WillScot Corporation immediately prior to the completion thereof.

Item 1.01. Entry into a Material Definitive Agreement

ABL Credit Agreement

On November 29, 2017, in connection with the closing of the Business Combination, the Holdco Acquiror, WSII and certain of its subsidiaries entered into an ABL credit agreement that provided for relevant credit facilities in the aggregate principal amount of up to $600 million, consisting of: (i) a senior secured asset-based revolving credit facility in the aggregate principal amount of $530 million (the “US ABL Facility”), available to WSII and certain of its subsidiaries, including Williams Scotsman, Inc. and WillScot Equipment II, LLC, a Delaware limited liability company (collectively, the “US Borrowers”), and (ii) a senior secured asset-based revolving credit facility in the aggregate principal amount of $70 million (the “Canadian ABL Facility,” and together with the US ABL Facility, the “ABL Facility”), available to Williams Scotsman of Canada, Inc. (the “Canadian Borrower,” and together with the US Borrowers, the “Borrowers”). Approximately $190 million of proceeds from the ABL Facility were used to finance a portion of the consideration payable to the Sellers, as well as fees and expenses incurred by WSII and the Holdco Acquiror, in connection with the Business Combination. The ABL Facility matures four and one half years after the closing date of the ABL Facility (the “Closing Date”). Borrowings under the ABL Facility, at the Borrower’s option, bear interest either (1) an adjusted LIBOR or (2) a base rate, in each case plus an applicable margin. The applicable margin is 2.50% with respect to LIBOR borrowings and 1.50% with respect to base rate borrowings. Commencing at the completion of the first full fiscal quarter after the Closing Date, the applicable margin for borrowings under the ABL Facility are subject to one step-down of 0.25% and one step-up of 0.25% based on excess availability levels with respect to the ABL Facility.

The ABL Facility provides borrowing availability in respect of the US ABL Facility and the Canadian ABL Facility equal to the lesser of (i) (a) $530 million and (b) the US Borrowing Base (defined below) (the “US Line Cap”) with respect to

the US Borrowers and (ii) (a) $70 million and (b) the Canadian Borrowing Base (defined below) (together with the US Line Cap, the “Line Cap”) with respect to the Canadian Borrower.

The US Borrowing Base is, at any time of determination, an amount (net of reserves) equal to the sum of:

· 85% of the net book value of the US Borrowers’ eligible accounts receivable, plus

· the lesser of (i) 95% of the net book value of the US Borrowers’ eligible rental equipment and (ii) 85% of the net orderly liquidation value of the US Borrowers’ eligible rental equipment, minus

· customary reserves.

The Canadian Borrowing Base is, at any time of determination, an amount (net of reserves) equal to the sum of:

· 85% of the net book value of the Canadian Borrowers’ eligible accounts receivable, plus

· the lesser of (i) 95% of the net book value of the Canadian Borrowers’ eligible rental equipment and (ii) 85% of the net orderly liquidation value of the Canadian Borrowers’ eligible rental equipment, plus

· portions of the US Borrowing Base that have been allocated to the Canadian Borrowing Base, minus

· customary reserves.

The US ABL Facility and Canadian ABL Facility include borrowing capacity available for standby letters of credit of up to $60 million and $30 million, respectively, and for “swingline” loan borrowings of up to $50 million and $25 million, respectively. Any issuance of letters of credit or making of a swingline loan will reduce the amount available under the ABL Facility.

In addition, the ABL Facility provides the Borrowers with the option to increase commitments under the ABL Facility in an aggregate amount not to exceed $300 million plus any voluntary prepayments that are accompanied by permanent commitment reductions under the ABL Facility.

The obligations of the (i) US Borrowers under the US ABL Facility and certain of their obligations under hedging arrangements and cash management arrangements are unconditionally guaranteed by the Holdco Acquiror and each existing and subsequently acquired or organized direct or indirect wholly-owned US organized restricted subsidiary of the Holdco Acquiror (together with the Holdco Acquiror, the “US Guarantors”) and (ii) the Canadian Borrowers under the Canadian ABL Facility are unconditionally guaranteed by the Holdco Acquiror, the US Borrowers, the US Guarantors and each existing and subsequently acquired or organized direct or indirect wholly-owned Canadian organized restricted subsidiary of the Holdco Acquiror (together with the US Guarantors, the “ABL Guarantors”), in each case, other than certain excluded subsidiaries. The ABL Facility is secured by (i) a first priority pledge of the equity interests of the Borrowers and of each direct, wholly-owned restricted subsidiary of any Borrower or any ABL Guarantor and (ii) a first priority security interest in substantially all of the assets of the Borrowers and the ABL Guarantors (subject to customary exceptions), provided that the obligations under the US ABL Facility were not secured by assets of any Canadian Borrower or any Canadian Guarantor.

The ABL Facility requires the Borrowers to maintain a (i) minimum fixed charge coverage ratio of 1.00:1.00 and (ii) maximum total net leverage ratio of 5.50:1.00, in each case, at any time when the excess availability under the ABL Facility is less than the greater of (a) $50 million and (b) 10% of the Line Cap.

The ABL Facility also contains a number of customary negative covenants. Such covenants, among other things, limit or restrict the ability of each of the Borrowers, their restricted subsidiaries, and where applicable, the Holdco Acquiror, to:

· incur additional indebtedness, issue disqualified stock and make guarantees;

· incur liens on assets;

· engage in mergers or consolidations or fundamental changes;

· sell assets;

· pay dividends and distributions or repurchase capital stock;

· make investments, loans and advances, including acquisitions;

· amend organizational documents and master lease documents;

· enter into certain agreements that would restrict the ability to pay dividends or incur liens on assets;

· repay certain junior indebtedness;

· enter into sale leaseback; and

· change the conduct of its business.

The aforementioned restrictions are subject to certain exceptions including (i) the ability to incur additional indebtedness, liens, investments, dividends and distributions, and prepayments of junior indebtedness subject, in each case, to compliance with certain financial metrics and certain other conditions and (ii) a number of other traditional exceptions that grant the Borrowers continued flexibility to operate and develop their businesses. The ABL Facility also contains certain customary representations and warranties, affirmative covenants and events of default.

The foregoing description of the ABL Facility does not purport to be complete and is qualified in its entirety by the terms and conditions of the ABL Facility, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Indenture

In connection with the closing of the Business Combination, WSII issued $300,000,000 aggregate principal amount of 7.875% senior secured notes due 2022 (the “Notes”) under an indenture dated November 29, 2017 (the “Indenture”), which was entered into by and among WSII, the guarantors named therein (the “Note Guarantors”), and Deutsche Bank Trust Company Americas, as trustee (the “Trustee”) and as collateral agent (the “Collateral Agent”).

The Notes will mature on December 15, 2022. At any time and from time to time on and after December 15, 2019, WSII, at its option, may redeem the Notes, in whole or in part, at the redemption prices (expressed as percentages of principal amount set forth below plus accrued and unpaid interest to but not including the applicable redemption date (subject to the right of Holders on the relevant record date to receive interest due on an interest payment date falling on or prior to the redemption date), if redeemed during the 12 month period beginning on December 15 of each of the years set forth below.

|

Year |

|

Redemption Price |

|

|

2019 |

|

103.938 |

% |

|

2020 |

|

101.969 |

% |

|

2021 and thereafter |

|

100.000 |

% |

WSII may redeem the Notes at any time before December 15, 2019 at a redemption price equal to 100% of the principal amount thereof, plus a customary make whole premium for the Notes being redeemed, plus accrued and unpaid interest, if any, to but not including the redemption date. At any time prior to December 15, 2019, WSII may redeem up to 40% of the aggregate principal amount of the Notes at a price equal to 107.875% of the principal amount of the Notes being redeemed, plus accrued and unpaid interest, if any, to but not including the redemption date with the net proceeds of certain equity offerings. WSII may also redeem up to 10% of the aggregate principal amount of the Notes at any time prior to the second anniversary of the closing date of this offering at a redemption price equal to 103% of the principal amount of the Notes being redeemed during each twelve-month period commencing with the Closing Date, plus accrued and unpaid interest, if any, to but not including the redemption date. If WSII undergoes a change of control or sells certain of its assets, WSII may be required to offer to repurchase the Notes.

The Notes are unconditionally guaranteed by the Note Guarantors. The Company is not a guarantor of the Notes. The Note Guarantors as well as certain of our non-US subsidiaries are guarantors or borrowers under the ABL Facility. To the extent lenders under the ABL Facility release the guarantee of any Note Guarantor, such Note Guarantor will also be released from obligations under the Notes. These guarantees are secured by a second priority security interest in substantially all of the assets of WSII and the Note Guarantors (subject to customary exclusions). The guarantees of the Notes by WillScot Equipment II, LLC, a Delaware limited liability company (“WS Equipment II”) which holds certain of WSII’s assets in the United States, will be subordinated to its obligations under the ABL Facility.

The foregoing description of the Indenture and the Notes does not purport to be complete and is qualified in its entirety by the terms and conditions of the Indenture and the Form of Note, which are attached hereto as Exhibit 10.2 and 10.3, respectively and are incorporated herein by reference.

Subscription Agreement

On November 29, 2017, in connection with the closing of the Business Combination, the Company and Sapphire Holding S.á.r.l., a Luxembourg société à responsabilité limitée (the “TDR Investor”), entered into a subscription agreement (the “Subscription Agreement”) pursuant to which the TDR Investor purchased 43,568,901 shares of Class A common stock, par value $0.0001 per share, of the Company, at a price of $9.60 per share, for a total purchase price of $418.3 million (the “Private Placement”). The proceeds from the Private Placement were used by the Company, together with other funding to effectuate the transactions contemplated by the Stock Purchase Agreement.

In connection with the Subscription Agreement, each of the Company and the TDR Investor made customary representations. The TDR Investor also agreed that, except for limited exceptions or with the Company’s written consent, it will not transfer any shares acquired pursuant to the Subscription Agreement and beneficially owned by it until the expiration of the six-month period commencing on the Closing Date.

The shares of our common stock issued pursuant to the Subscription Agreement are “restricted securities” under applicable federal securities laws. The shares issued pursuant to the Subscription Agreement are subject to the Registration Rights Agreement discussed below which provides for certain demand, shelf and piggyback registration rights.

The foregoing description of the Subscription Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Subscription Agreement, which is attached hereto as Exhibit 10.4 and is incorporated herein by reference.

Earnout Agreement

On November 29, 2017, in connection with the closing of the Business Combination, Double Eagle Acquisition LLC and Harry E. Sloan (together, the “Founders”) and the TDR Investor entered into an earnout agreement (the “Earnout Agreement”), pursuant to which, on the Closing Date (as defined therein), the 12,425,000 shares of the Company’s Class A common stock held by the Founders were placed in escrow and the 19,500,000 warrants to purchase shares of the Company’s Class A common stock owned by certain Founders were deemed restricted, in each case to be released upon the occurrence of certain triggering events in the amounts and to the parties set forth below.

If, at any time during the period of three years following the Closing Date, the closing price of the shares of the Company (i) exceeds $12.50 per share for 20 out of any 30 consecutive trading days, then 6,212,500 shares will be released from escrow and distributed as follows: (a) if $350 million or more is available in the Double Eagle trust account on the Closing Date, 4,170,833 shares will be released to the Founders and 2,041,667 shares will be released to the TDR Investor and (b) if less than $350 million is available in the Double Eagle trust account on the Closing Date, 3,106,250 shares will be released to the Founders and 3,106,250 shares will be released to the TDR Investor; and (ii) exceeds $15.00 per share for 20 out of any 30 consecutive trading days, an additional 6,212,500 shares will be released from escrow and distributed as follows: (a) if $350 million or more is available in the Double Eagle trust account on the Closing Date, then 4,170,833 shares will be released to the Founders and 2,041,667 shares will be released to the TDR Investor; and (b) if less than $350 million is available in the Double Eagle trust account on the Closing Date, then 3,106,250 shares will be released to the Founders and 3,106,250 shares will be released to the TDR Investor.

If within 12 months after the Closing Date, the Company completes or enters into a material definitive agreement in respect of a Qualifying Acquisition (as defined in the Earnout Agreement) and the escrow account has not yet been reduced by the occurrence of the events in the preceding paragraph, then 4,000,000 shares will be released from escrow and distributed to the Founders upon the closing of such Qualifying Acquisition and the releases contemplated by the preceding paragraph will no longer apply. Such released shares will, however, continue to be subject to the trading restrictions contained in the insider letters executed by the Founders in connection with Double Eagle’s initial public offering. The 12-month period applicable to the completion of such Qualifying Acquisition is subject to extension, at the TDR Investor’s sole option. If at any time following the consummation of such Qualifying Acquisition during the period of three years following the Closing Date, if the closing price of the shares of the Company (i) exceeds $12.50 per share for 20 out of any 30 consecutive trading days, 5,616,667 shares will be released from escrow and distributed as follows: (a) if $350 million or more is available in the Double Eagle trust account on the Closing Date, then 3,744,444 shares will be released to the Founders and 1,872,223 shares will be released to the TDR Investor; and (b) if less than $350 million is available in the Double Eagle trust account on the Closing Date, 1,872,223 shares will be released to the Founders and 3,744,444 shares will be released to the TDR Investor; and (ii) exceeds $15.00 per share for 20 out of any 30 consecutive trading days, then 2,808,333 shares will be released from escrow and distributed as follows: (a) if $350 million or more is available in the Double Eagle trust account on the Closing Date, 1,872,222 shares will be released to the Founders and 936,111 shares will be released to the TDR Investor; and (b) if less than $350 million is available in the Double Eagle trust account on the Closing Date, 936,111 shares will be released to the Founders and 1,872,222 shares will be released to the TDR Investor. The triggering event set forth in clause (i) of this paragraph shall not apply, however, in the event the triggering event in clause (i) of the preceding paragraph has already occurred.

Each of the triggering events set forth in the Earnout Agreement will be independent events and in the event a triggering event occurs prior to the occurrence of a Qualifying Acquisition, the number of shares to be released upon such Qualifying Acquisition will be reduced on a pro rata basis.

Upon the expiration of the three year earnout period, any Founders’ shares remaining in escrow that were not released in accordance with the Earnout Agreement will be transferred to the Company for cancellation. The Founder’s warrants subject to the Earnout Agreement shall be deemed restricted for a period of 12-months from the Closing Date (or such later date as the TDR Investor agrees to in connection with the equity commitment letter). During this period, in the event that the Company consummates a Qualifying Acquisition, such warrants will be treated as follows: (i) if $350 million or more is available in the Double Eagle trust account on the Closing Date, the warrants will be released to the Founders free of all restrictions; and (ii) if less than $350 million is available in the Double Eagle trust account on the Closing Date, one third (1/3) of the warrants will be transferred to the TDR Investor and the Founders will retain ownership of the remaining two thirds (2/3) of the warrants.

The Earnout Agreement will be subject to termination upon: (i) mutual written consent of the parties; (ii) termination of the Stock Purchase Agreement; (iii) the Company being generally unable to pay its debts as they become due; or (iv) the earlier of the expiration of the time periods set forth therein and the depletion of all shares from the escrow account and expiration of the restricted period applicable to the warrants.

The foregoing description of the Earnout Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Earnout Agreement, which is attached hereto as Exhibit 10.5 and is incorporated herein by reference.

Escrow Agreement

On November 29, 2017, pursuant to the terms and conditions of the Earnout Agreement described above, the Company, the Founders, the TDR Investor and Continental Stock Transfer & Trust Company, as escrow agent, entered into an escrow agreement (the “Escrow Agreement”) that provides for, among other things, restricting the escrow shares in an escrow account until such time as the escrow shares are to be released by the escrow agent to the Founders and/or the TDR Investor, as the case may be, upon the occurrence of the triggering events set forth in the Earnout Agreement. All voting rights and other shareholder rights with respect to the escrow shares shall be suspended until such shares are released from the escrow account.

The Escrow Agreement will terminate on the earlier of the termination of the Earnout Agreement and five calendar days after all the escrow shares have been released.

The foregoing description of the Escrow Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Escrow Agreement, which is attached hereto as Exhibit 10.6 and is incorporated herein by reference.

Transition Services Agreement

On November 29, 2017, in connection with the closing of the Business Combination, the Company, WSII, the Holdco Acquiror and Algeco Global entered into a transition services agreement (the “Transition Services Agreement”). The purpose of the Transition Services Agreement is to ensure an orderly transition of WSII’s business and effectuate the Carve-Out Transaction. Pursuant to the Transition Services Agreement, each party will provide or cause to be provided (in such capacity, as “provider”) to the other party or its affiliates (in such capacity, as “recipient”) certain services, use of facilities and other assistance on a transitional basis.

The services to be provided pursuant to the Transition Services Agreement include use of office space and information technology, human resources, accounting, insurance, legal, tax, treasury and other services based on a pro-rata basis pass through of rent for office space and a pro-rata pass through of shared services, actual cost, estimated cost of benefits and a 5% mark-up to account for other overhead.

The services will be provided on an as needed and as requested basis on the terms listed on Schedule A of the Transition Services Agreement and will be for the sole use and benefit of the relevant recipient. A provider of services must use commercially reasonable efforts to provide services under the Transition Services Agreement and in causing a third party to perform services. Each provider will provide or cause to be provided to each recipient each service until the expiration of the applicable period set forth on the relevant service schedule or the mutual written agreement of the parties. The parties are required to use commercially reasonable efforts to become independent of the other party with respect to each service and assume responsibility for such services as promptly as practicable following the Closing Date.

Without the prior written consent of Algeco Global, the Company and the Holdco Acquiror will be prohibited from soliciting for employment, offering to hire or hiring, any employee of Algeco Global engaged in providing a service pursuant to the Transition Services Agreement until one year following the end of such employee’s provision of services thereunder.

The Transition Services Agreement will terminate on the last date on which a provider is obligated to provide a service or the mutual written agreement of the parties. Recipients may from time to time terminate the Transition Services Agreement with respect to any service prior to the end of the applicable service period or request a reduction in part of the scope or amount of any service upon providing 30 days’ written notice to a provider. The Transition Services Agreement may also be terminated in whole, but not in part, by a provider in the event that a recipient defaults in payment when due of any service fee and such default continues unremedied for a period of 90 days after receipt of written notice of such default or two defaults in the timely payment of two or more consecutive payments of service fees payable (other than failure to pay in connection with a good faith dispute).

The foregoing description of the Transition Services Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Transition Services Agreement, which is attached hereto as Exhibit 10.7 and is incorporated herein by reference.

Registration Rights Agreement

On November 29, 2017, in connection with the closing of the Business Combination, the Company, the TDR Investor, A/S Holdings, and certain other parties named on the signature pages thereto, entered into an amended and restated registration rights agreement (the “Registration Rights Agreement”), that amends and restates that certain registration rights agreement, dated September 10, 2015 by and among Double Eagle and certain of its initial investors and provides such initial investors, the TDR Investor and A/S Holdings with certain demand, shelf and piggyback registration rights covering all shares of our Class A common stock owned by each holder, until such shares cease to be Registrable Securities (as defined in the Registration Rights Agreement). The Registration Rights Agreement provides each of the TDR Investor, A/S Holdings and certain of the initial investors (the “Initiating Holders”), the right to request an unlimited number of demands, at any time following the Closing Date and customary shelf registration rights, subject to certain conditions. In addition, the Registration Rights Agreement grants each of the TDR Investor, A/S Holdings and the Initiating Holders, piggyback registration rights with respect to registration statements filed subsequent to the Closing Date. The Company is responsible for all Registration Expenses (as defined in the Registration Rights Agreement) in connection with any demand, shelf or piggyback registration by any of the TDR Investor, A/S Holdings or the Initiating Holders. The registration rights under the Registration Rights Agreement are subject to customary lock-up provisions.

The foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Registration Rights Agreement, which is attached hereto as Exhibit 10.8 and is incorporated herein by reference.

IP Agreement

On November 29, 2017, in connection with the closing of the Business Combination, WSII, A/S Holdings and the Holdco Acquiror entered into a trademark co-existence agreement (the “IP Agreement”). The IP Agreement provides for, among other things, the terms by which the parties will cooperate to simultaneously use certain trademarks that include the term “SCOTSMAN,” protect the goodwill of such trademarks, avoid customer confusion and ultimately wind down their use of such trademarks.

A/S Holdings, on behalf of itself, the Sellers and their respective subsidiaries, agreed to not, directly or indirectly:

· use, copy or otherwise exploit (i) certain of WSII’s trademarks or similar variations or acronyms thereof or (ii) the “SCOTSMAN” mark either alone or in any manner other than in a combination with its own trademarks;

· advertise or promote its goods or services in a manner that implies that the goods and services of A/S Holdings, the Sellers or any of their respective subsidiaries are affiliated or connected with our goods and services or the goods and services of the Holdco Acquiror, WSII or their subsidiaries;

· challenge any trademarks of WSII, the Holdco Acquiror or their subsidiaries; and

· sue, initiate or authorize an action based on WSII’s, the Holdco Acquiror’s or their subsidiaries’ use, licensing, ownership, registration or maintenance of certain trademarks in accordance with the IP Agreement.

WSII and the Holdco Acquiror agreed to not, and will cause their subsidiaries to not, directly or indirectly:

· use, copy or otherwise exploit (i) certain trademarks of A/S Holdings, the Sellers and their respective subsidiaries relating to their business, after giving effect to the Carve-Out Transaction or similar variations or acronyms thereof or (ii) the “SCOTSMAN” mark either alone or in any manner other than in a combination with its own trademarks;

· advertise or promote their goods or services in a manner that implies they are affiliated or connected with the respective goods and services of A/S Holdings, the Sellers and their respective subsidiaries;

· challenge any trademarks of A/S Holdings, the Sellers or their respective subsidiaries; and

· sue, initiate or authorize an action based on A/S Holdings’, the Sellers’ or their respective subsidiaries’ use, licensing, ownership, registration or maintenance of certain trademarks in accordance with the IP Agreement.

Pursuant to the IP Agreement, A/S Holdings, the Sellers and their respective subsidiaries will be entitled to (i) for one year after the Closing Date, use all of the stocks of signs, letterheads, labels, office forms, packaging, invoice stock, advertisements and promotional materials, inventory and other documents and materials, and all internet and other electronic content and communications, in each case, existing on the Closing Date that include the term “SCOTSMAN” or certain other trademarks of WSII’s or the Holdco Acquiror’s or their subsidiaries, and (ii) for two years after the Closing Date, display the term “SCOTSMAN” or certain other trademarks of WSII’s or the Holdco Acquiror’s or their subsidiaries on all modular units leased by A/S Holdings, any Seller or any of their respective subsidiaries to any third party in the ordinary course of business if such marks were displayed on such leased units as of the Closing Date. A/S Holdings, on behalf of itself, each Seller and their respective subsidiaries, will agree to remove or obliterate all marks that include the term “SCOTSMAN” and certain other trademarks listed in the IP Agreement on stock and leased units after the expiration of the applicable foregoing periods; and in the case of the aforementioned leased units, within 30 days of the return of any such leased units or, if any such leased units is inaccessible upon the expiration of the two year period, as soon as reasonably practicable. WSII, the Holdco Acquiror and their respective subsidiaries will be entitled to identical rights and obligations with respect to the term “SCOTSMAN” and certain other trademarks of A/S Holdings, the Sellers and their respective subsidiaries.

The foregoing description of the IP Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the IP Agreement, which is attached hereto as Exhibit 10.9 and is incorporated herein by reference.

Holdco Acquiror Shareholders Agreement

On November 29, 2017, in connection with the closing of the Business Combination, the Sellers, the Company and the Holdco Acquiror entered into a shareholders agreement (the “Shareholders Agreement”) in respect of the Sellers’ Rollover Interest and our ownership interests in the Holdco Acquiror. The Shareholders Agreement contains pre-emptive rights to permit the Sellers to avoid dilution and maintain their aggregate percentage ownership of the Holdco Acquiror on a fully diluted basis upon any future issuance of any additional shares of the Holdco Acquiror or the Company for cash. Any future issuances that are not for cash and not offered to other existing shareholders of the Holdco Acquiror on a pre-emptive basis or otherwise (i.e. derivatives issued by the Company, shares issued to a vendor on completion of an acquisition or the issuance of Class B common stock of the Company to the Sellers or a TDR Permitted Transferee(s), as defined below, as the case may be) would not trigger such pre-emptive rights. The Shareholders Agreement also contains customary tag along and drag along provisions and protective provisions for the Sellers, such that so long as the Sellers or a TDR Permitted Transferee(s), as the case may be, own any shares of the Holdco Acquiror common stock, the Holdco Acquiror will not, without the affirmative vote or unanimous written consent of all of the Sellers or TDR Permitted Transferee(s), as the case may be, amend its certificate of incorporation or bylaws or otherwise vary or amend the rights attaching to the Holdco Acquiror common stock, in each case in a manner that would have a materially disproportionate effect on the Sellers as minority shareholders as compared to the other shareholders of the Holdco Acquiror.

The Shareholders Agreement provides that during the one year period following the Closing Date, the Sellers may not transfer their shares of the Holdco Acquiror except to certain permitted transferees, including a TDR Permitted Transferee(s) (as defined below). Immediately following the closing of the Business Combination, Algeco Holdings transferred all of its shares in the Holdco Acquiror to Algeco Global. As noted under the heading “Holdco Acquiror Exchange Agreement” below, the Company has a right of first refusal to purchase the shares of the Holdco Acquiror common stock held by the Sellers or a TDR Permitted Transferee(s), as the case may be, except in the case of transfers to TDR Permitted Transferees or exchanges pursuant to the Exchange Agreement. The Sellers or TDR Permitted Transferee(s), as the case may be, will be entitled to vote that number of shares of the Holdco Acquiror common stock held thereby in all matters submitted for a vote to the holders of Holdco Acquiror common stock, voting together as a single class with holders of Holdco Acquiror common stock. The Shareholders Agreement also contains transfer restrictions regarding the shares of Class B common stock of the Company.

Pursuant to the terms of the Shareholders Agreement, the acquisition of any business similar to that of WSII will be consummated either by the Holdco Acquiror or a wholly-owned subsidiary of the Holdco Acquiror, subject to certain exceptions.

Notwithstanding the foregoing, in the event the board of directors of the Company determines in good faith that such acquisition should be consummated by a wholly-owned subsidiary of the Company that is a parent company of the Holdco Acquiror, which will hold the assets or stock of the target entity upon consummation thereof, because it would be materially adverse to the target entity to consummate the acquisition through the Holdco Acquiror or a wholly-owned subsidiary of the Holdco Acquiror, the Shareholders Agreement will provide that appropriate adjustments will be made to ensure that the Sellers or TDR Permitted Transferee(s), as the case may be, are not disadvantaged by the fact that the assets or stock, as applicable, of the target entity are not held directly by the Holdco Acquiror or a subsidiary thereof.

The foregoing description of the Shareholders Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Shareholders Agreement, which is attached hereto as Exhibit 10.10 and is incorporated herein by reference.

Holdco Acquiror Exchange Agreement

On November 29, 2017, in connection with the closing of the Business Combination, the Sellers, the Company and the Holdco Acquiror entered into an exchange agreement (the “Exchange Agreement”) in respect of the Stock Consideration. Subject at all times to the pre-emptive rights granted to the Sellers or a TDR Permitted Transferee, as the case may be, in the Holdco Acquiror Shareholders Agreement, described above, the Exchange Agreement provides that, among other things, the Holdco Acquiror common stock may be subject to downward adjustment by the issuance of additional shares of Holdco Acquiror common stock to the Company for: (1) subsequent issuances of Class A common stock of the Company, or any securities convertible or exchangeable into Class A common stock of the Company, after the Closing Date, including to the TDR Investor

(excluding (i) the release from escrow of any shares of Class A common stock of the Company, warrants of the Company held by the Founders and restricted under the Earnout Agreement and any shares of Class A common stock of the Company issued upon exercise of such warrants and (ii) any issued and outstanding public warrants or shares of Class A common stock of the Company issued upon exercise of such existing public warrants) and (2) subsequent issuances of Holdco Acquiror common stock to the Company in exchange for additional capital contributions by the Company to the Holdco Acquiror.

The Exchange Agreement provides that at any time within five years after the Closing Date, the TDR Investor has the right, but not the obligation, to exchange all, but not less than all, of its shares of the Holdco Acquiror into newly issued shares of our Class A common stock in a private placement transaction. The aggregate shares of Holdco Acquiror common stock will be converted into that number of our shares of Class A common stock as determined by an exchange ratio to be agreed to, taking into account the average trading price of our common stock over a 20 day trading period on the Nasdaq Stock Market (“Nasdaq”), or the applicable national securities exchange, and the aggregate ownership percentage of the TDR Investor of the issued and outstanding Holdco Acquiror common stock at the time of the exchange, as adjusted to take into account any election by the TDR Investor to exercise certain pre-emptive rights or the dilutive effect of certain other issuances of Holdco Acquiror common stock which do not trigger such pre-emptive rights. Upon such exchange, we will automatically redeem for no consideration all of the shares of our Class B common stock held by the TDR Investor.

The Exchange Agreement further provided that during the one year period following the Closing Date, the Sellers may only transfer their shares of the Holdco Acquiror to a permitted transferee, which includes TDR Capital LLP (“TDR”) or one of its affiliates; provided that, as a condition to such transfer, such transferee (each a “TDR Permitted Transferee”) executes a joinder to each of the Exchange Agreement and the Shareholders Agreement. The Company has a right of first refusal to purchase the shares of Holdco Acquiror common stock held by the Sellers or a TDR Permitted Transferee as the case may be, prior to any sale, transfer or other assignment of such shares to any person other than a TDR Permitted Transferee(s) and excluding the exchange rights described above.

The foregoing description of the Exchange Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Exchange Agreement, which is attached hereto as Exhibit 10.11 and is incorporated herein by reference.

Indemnification Agreements

On November 29, 2017, the Company entered into indemnification agreements with each of its directors and executive officers. Each indemnification agreement provides for indemnification and advancements by the Company of certain expenses and costs relating to claims, suits or proceedings arising from his or her service to the Company or, at our request, service to other entities, as officers or directors to the maximum extent permitted by applicable law.

The foregoing description of the indemnification agreements does not purport to be complete and is qualified in its entirety by the terms and conditions of the indemnification agreements, a form of which is attached hereto as Exhibit 10.12 and is incorporated herein by reference.

2017 Incentive Award Plan

Double Eagle’s board of directors approved the 2017 Incentive Award Plan (the “Incentive Plan”) on August 21, 2017 and Double Eagle’s shareholders approved the Incentive Plan at the extraordinary general meeting of the shareholders of Double Eagle (the “Extraordinary General Meeting”) held on November 16, 2017.

A description of the Incentive Plan is included in the Proxy Statement/Prospectus for Extraordinary General Meeting of Double Eagle Acquisition Corp. (No. 333-220356), filed with the Securities and Exchange Commission (the “SEC”) on November 7, 2017 (the “Proxy”) by Double Eagle, under the heading “The Incentive Award Plan Proposal” beginning on page 127 and is incorporated herein by reference.

The foregoing description of the Incentive Plan does not purport to be complete and is qualified in its entirety by the full text of the Incentive Plan that is attached hereto as Exhibit 10.13 and is incorporated herein by reference.

Employment Agreement with Bradley L. Soultz

On November 29, 2017, we entered into an employment agreement with Mr. Soultz. The agreement provides for an initial employment term of 36 months, with automatic successive one year extensions after the end of the initial term, unless either party provides a non-renewal notice to the other party at least 120 days before the expiration of the initial term or the renewal term, as applicable. Mr. Soultz’s agreement provides for an annual base salary of $600,000, along with a short term incentive target of 133% of annual salary and a long term incentive annual allocation of $1,000,000, or 125% of the short term incentive target — of 50% time-vested options and 50% restricted stock vesting ratably over four years. Upon the occurrence of an initial public offering, Mr. Soultz is entitled to certain additional benefits including a $1,600,000 one-time grant of 50% time-vested stock options and 50% restricted stock at the closing of such offering. Mr. Soultz’s agreement also includes a 12 month non-competition and non-solicitation provision.

If Mr. Soultz’s employment is terminated other than for cause, he will be entitled to 12 months base salary plus a pro-rata bonus for the year of termination, based on actual performance plus accrued and unpaid benefits and health insurance continuation for the severance period. If Mr. Soultz’s employment is terminated other than for cause, within the first year of either his initial long term incentive grant of $1,600,000 or his first annual long term incentive grant of $1,000,000, a minimum of 25% of the respective grant will vest. In the event of a change of control, if Mr. Soultz is terminated other than for cause within 12 months of such change of control, he will be entitled to 150% of his base salary, his target annual incentive award and a pro rata portion of his target bonus as well as a continuation of his health insurance for the severance period and vesting of any unvested equity awards.

The foregoing description of the employment agreement with Mr. Soultz does not purport to be complete and is qualified in its entirety by the terms and conditions of the employment agreement with Mr. Soultz, which is attached hereto as Exhibit 10.14 and is incorporated herein by reference.

Employment Agreement with Timothy D. Boswell

On November 29, 2017, we entered into an employment agreement with Mr. Boswell. The agreement provides for an initial employment term of 36 months, with automatic successive one year extensions after the end of the initial term, unless either party provides a non-renewal notice to the other party at least 120 days before the expiration of the initial term or the renewal term, as applicable. Mr. Boswell’s agreement provides for an annual base salary of $375,000, along with a short term incentive target of $225,000, or 60% of annual salary and a long term incentive annual allocation of $300,000 — of 50% time-vested options and 50% restricted stock vesting ratably over four years. Upon the occurrence of an initial public offering, Mr. Boswell is entitled to certain additional benefits including a $500,000 one-time grant of 50% time vested stock options and 50% restricted stock at the closing of such offering. Mr. Boswell’s agreement also includes a 12 month non-competition and non-solicitation provision.

If Mr. Boswell’s employment is terminated other than for cause, he will be entitled to 12 months base salary plus a pro rata bonus for the year of termination based on actual performance plus accrued and unpaid benefits and health insurance continuation for the severance period. If Mr. Boswell’s employment is terminated other than for cause, within the first year of either his initial long term incentive grant of $500,000 or his first annual long term incentive grant of $225,000, a minimum of 25% of the respective grant will vest. In the event of a change of control, if Mr. Boswell is terminated other than for cause within 12 months of such change of control, he will be entitled to his full base salary plus target annual incentive awards, his pro rata target bonus and health insurance continuation for the severance period, along with vesting of any unvested equity awards.

The foregoing description of the employment agreement with Mr. Boswell does not purport to be complete and is qualified in its entirety by the terms and conditions of the employment agreement with Mr. Boswell, which is attached hereto as Exhibit 10.15 and is incorporated herein by reference.

Employment Letter with Bradley L. Bacon

WSII entered into an employment letter with Mr. Bacon effective as of August 28, 2017. Mr. Bacon’s employment is ‘‘at will,’’ and his employment letter does not include a specific term. Mr. Bacon’s letter provides for an annual base salary of $292,500, along with a short term incentive target of $175,500, or 60% of annual salary and a long term incentive annual allocation of $175,500, or 60% of annual salary. Mr. Bacon also received a $30,000 signing bonus. Upon the commencement of the long term incentive plan, Mr. Bacon will also receive an initial award equal to $175,500, or 60% of annual salary.

If Mr. Bacon’s employment is terminated other than for cause, he is entitled to 12 months’ base salary plus the value of the accrued short term incentive plan for the year of termination based on actual performance plus accrued and unpaid benefits and health insurance continuation for the severance period.

The foregoing description of the employment letter with Mr. Bacon does not purport to be complete and is qualified in its entirety by the terms and conditions of the employment letter with Mr. Bacon, which is attached hereto as Exhibit 10.16 and is incorporated herein by reference.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The disclosure set forth in the “Introductory Note” above is incorporated into this Item 2.01 by reference. On November 16, 2017, the Business Combination was approved by the shareholders of Double Eagle at the Extraordinary General Meeting. The Business Combination was completed on November 29, 2017.

Consideration to Double Eagle Shareholders and Warrant Holders in the Business Combination

In connection with the Business Combination, Double Eagle domesticated as a Delaware corporation and was renamed WillScot Corporation. On the effective date of the domestication, Double Eagle’s Class B ordinary shares automatically

converted by operation of law, on a one-for-one basis, into Double Eagle’s Class A ordinary shares. Immediately thereafter, the Class A ordinary shares automatically converted by operation of law, on a one-for-one basis, into shares of our Class A common stock in accordance with the terms of our certificate of incorporation. We also issued shares of our Class B common stock to the Sellers in an amount equal to the equity interest in us represented by the Sellers’ Rollover Interest, which are exchangeable for shares of our Class A common stock pursuant to the Exchange Agreement. After the effectiveness of the domestication and before the closing of the Business Combination, each outstanding unit of Double Eagle (each of which consisted of one share of our Class A common stock and one warrant to purchase one-half of one share of our Class A common stock) was separated into its component common stock and warrant and the units were cancelled.

There are currently outstanding an aggregate of 69,500,000 warrants to acquire our Class A ordinary shares, which comprise 19,500,000 private placement warrants held by our initial shareholders and 50,000,000 public warrants. Each of our outstanding warrants is exercisable commencing 30 days following the closing of the Business Combination and, following the domestication, now entitle the holder thereof to purchase one-half of one share of our Class A common stock in accordance with its terms.

Consideration to the Sellers in the Business Combination

As discussed above, in accordance with the terms and subject to the conditions of the Stock Purchase Agreement, upon completion of the Business Combination on November 29, 2017, the Holdco Acquiror purchased from the Sellers all of the issued and outstanding shares of WSII. The total amount payable by the Holdco Acquiror under the Stock Purchase Agreement was $1.1 billion, of which $1.0215 billion was Cash Consideration, first, directly to repay indebtedness of WSII as contemplated by the Stock Purchase Agreement, with the remainder to be paid directly to the Sellers as consideration, on a pro rata basis, and the remaining $78.5 million was paid to the Sellers as Stock Consideration.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for the post- combination business. Specifically, forward-looking statements may include statements relating to:

· our ability to effectively compete in the modular space and portable storage industry;

· effective management of our rental equipment;

· our ability to properly design, manufacture, repair and maintain our rental equipment;

· operational, economic, political and regulatory risks;

· the effect of changes in state building codes on our ability to remarket our buildings;

· global or local economic movements;

· market conditions and global and economic factors beyond our control;

· our ability to effectively manage our credit risk, collect on our accounts receivable, or recover our rental equipment;

· our ability to use our net operating loss carryforwards and other tax attributes;

· foreign currency exchange rate exposure;

· increases in raw material and labor costs;

· our reliance on third party manufacturers and suppliers;

· risks associated with labor relations, labor costs and labor disruptions;

· failure to retain key personnel;

· our ability to successfully acquire and integrate new operations;

· the effect of impairment charges on our operating results;

· our inability to recognize deferred tax assets and tax loss carry forwards;

· our estimate of Run-Rate Adjusted EBITDA or our forecasts or other estimates failing to meet our expectations;

· our obligations under various laws and regulations;

· the effect of litigation, judgments, orders or regulatory proceedings on our business;

· unanticipated changes in our tax obligations;

· any failure of our management information systems;

· natural disasters and other business disruptions;

· our exposure to various possible claims and the potential inadequacy of our insurance;

· changes in demand within a number of key industry end-markets and geographic regions;

· our ability to deploy our units effectively;

· our ability to close our unit sales transactions as projected;

· any failure by Algeco Global or one of its affiliates to deliver services under the Transition Services Agreement or breach of the covenants in the IP Agreement;

· our future operating results fluctuating, failing to match performance or to meet expectations;

· our parent company’s ability to fulfill its public company obligations;

· our ability to operate as a standalone business, outside of the Algeco Group and potential unforeseen costs or expenses associated therewith;

· our ability to meet our debt service requirements and obligations;

· risks related to our obligations under the Notes; and

· other factors detailed under the section entitled “Risk Factors.”

These forward-looking statements are based on information available as of the date of this Current Report on Form 8-K and our management’s current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. The Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

The information presented in the sections “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business” below relates to the business and operations of WSII, our indirect subsidiary and the entity purchased in the Business Combination. Until the consummation of the Business Combination on November 29, 2017, the Company was a special purpose acquisition company with no operations of our own. As a result, our ongoing business will be the business of WSII as detailed below. References in this section to “we,” “us,” “our,” “Williams Scotsman,” and the “Company” refer to the business of WSII and its consolidated subsidiaries.

Business

Our Company

Founded more than 60 years ago, Williams Scotsman is a specialty rental services market leader providing modular space and portable storage solutions to diverse end markets across North America. Operating through our branch network of over 90 locations in the United States, Canada and Mexico, our 1,350 employees provide high quality, cost effective modular space and portable storage solutions to a diversified client base of approximately 25,000 customers. Our products include single mobile and sales office units, multi-unit office complexes, classrooms, ground-level and stackable steel-frame office units, other specialty units, and shipping containers for portable storage solutions. These products are delivered “Ready to Work” with our growing offering of value-added products and services (“VAPS”), such as the rental of steps, ramps, furniture packages, damage waivers, and other amenities. These turnkey solutions offer customers flexible, low-cost, and timely solutions to meet their space needs on an outsourced basis, whether short, medium or long-term. Our current modular space and portable storage lease fleet consists of over 34 million square feet of relocatable space, comprised of approximately 75,000 units. In addition to leasing, we offer both new and used units for sale and provide delivery, installation and other ancillary products and services. For the year ended December 31, 2016, the nine months ended September 30, 2017, and the twelve months ended September 30, 2017, Williams Scotsman generated revenues of approximately $428 million, $326 million, and $429 million, respectively. See “Unaudited Pro Forma Condensed Financial Information” contained elsewhere in this Current Report on Form 8-K for more information.

Our business model is primarily focused on leasing modular space and portable storage solutions to our customers. As of and for the year ended December 31, 2016 the business:

· generates highly visible recurring revenues from our leasing and services operations which have an average lease duration of 35 months and accounts for 90% of Adjusted Gross Profit;

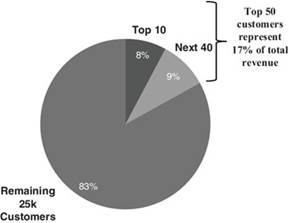

· services a diverse customer base across numerous end-markets with our top-50 customers accounting for 17% of lease revenue and no single customer accounting for more than 4% of lease revenue;

· has average monthly leasing and VAPS rates which recoup our average unit investment in approximately 36 months;

· deploys units with useful lives extending 20 years and beyond, which retain substantial residual values throughout these periods with proper maintenance;

· produces incremental leasing operating margins of more than 70% (i.e. the contribution of an existing unit put on lease and outfitted with VAPS after reductions for cost of leasing, associated commissions); and

· generates substantial Operating Free Cash Flow with highly discretionary capital investment opportunities and flexibility to source cash from working capital.

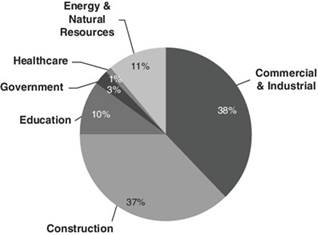

We lease our modular space and portable storage units to customers in diverse end-markets, including commercial and industrial, construction, education, energy and natural resources, government, and other end-markets. To enhance our product and service offerings and our gross profit margin, we offer delivery, installation and removal of our lease units and other VAPS. We believe this comprehensive offering, combined with our industry leading customer service capabilities, differentiates us from other providers of rental and business services and is captured in our “Ready to Work” value proposition. We complement our core leasing business by selling both new and used units, allowing us to leverage our scale, achieve purchasing benefits, and redeploy capital employed in our lease fleet.

We believe that our geographic scale and our end-market diversification increase the stability of our cash flows and provide significant operational advantages, including, the ability to optimize fleet utilization when demand fluctuates, the ability to offer VAPS through our supply chain, purchasing efficiencies and the ability to service large customers with national or multi-region footprints. Our size also allows us to transfer the fleet opportunistically to areas of higher or increasing customer demand to optimize the fleet’s utilization. With operating locations serving every major market in North America, we see additional opportunities to expand and leverage our platform through value-creating acquisitions that leverage our existing infrastructure.

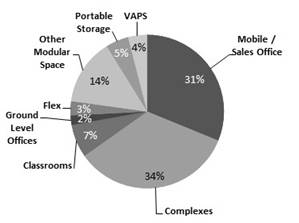

The following charts illustrate the breakdown of our fleet’s net book value between the various modular space product

types, portable storage, and VAPS as of September 30, 2017, and our Adjusted Gross Profit breakdown between our core leasing and services business and our sales business, a breakdown of customer concentration, as well as our revenue mix by end-market, each for the year ended December 31, 2016. For additional information about Adjusted Gross Profit, see the section entitled “Reconciliation of Non-GAAP Financial Measures”.

|

Fleet Breakdown by Net Book Value |

|

Adjusted Gross Profit Breakdown |

|

|

|

|

|

|

|

|

|

Net Book Value: $833 million |

|

Total Adjusted Gross Profit: $238 million |

|

|

|

|

|

Customer Diversification |

|

Revenue Mix by End Market |

|

|

|

|

|

|

|

|

Industry Overview

Our business primarily operates within the modular space and portable storage markets, however our services span across a variety of related sectors, including furniture rental, transportation and logistics, facilities services, and commercial real estate.

Modular Space Market

Modular space units are non-residential structures designed to meet federal, provincial, state and local building codes and, in most cases, are designed to be relocatable. Modular space units are constructed offsite, utilizing manufacturing techniques to prefabricate single or multi-story whole building solutions in deliverable modular sections. Units are typically constructed of steel, wood, and conventional building materials, and can be permanent or relocatable. The modular space market is highly fragmented and has evolved over the last 60 years as the number of applications for modular space has increased and the recognition of its value has grown.

The two key growth drivers in the modular space market are:

· Growing need and demand for space—growing need and demand for space is driven by general economic activity, including gross domestic product growth, industrial production, mining and resources activity, non-residential construction and urbanization. Other factors such as public and education spending, and the scale and frequency of special events also impact demand for modular space.

· Increasing shift from traditional fixed, on-site built space to modular space solutions—the increasing shift from traditional fixed, on-site built space to modular space solutions is driven by the speed of installation, flexibility and lower cost of modular space units. Modular space units are also increasingly associated with high levels of quality, as the units are built in controlled environments based on repeatable models and processes. Remote locations also favor modular space solutions over traditional installations, since pre-fabricated buildings can be transported into areas with limited construction workforce. Demand for modular space relative to fixed space has strengthened during economic downturns due to the length of typical leases and because modular space units are typically less expensive than fixed, on-site built space.

Modular space units offer several advantages as compared with fixed, on-site built space, including:

· Quick to install—the pre-fabrication of modular space units allows them to be put in place rapidly, providing potential long-term solutions to needs that may have quickly materialized.

· Flexibility—flexible assembly design allows modular space units to be built cost-effectively to suit a customer’s needs and allows customers the ability to adjust their space as their requirements change.

· Cost effectiveness—modular space units provide a cost effective solution for temporary and permanent space requirements and allow customers to improve returns on capital in their core business.

· Quality—the pre-fabrication of modular space units is based on a repeatable process in a controlled environment, resulting in more consistent quality.

· Mobility—modular space units can easily be disassembled, transported to a new location and re-assembled.

· Environmentally friendly—relocatable buildings promote the reuse of facilities only as needed and when needed by the occupants.

Portable Storage Market

The portable storage market is highly fragmented and remains primarily local in nature. Portable storage provides customers with a flexible and low-cost storage alternative to permanent warehouse space and fixed-site self-storage. In addition, portable storage addresses the need for security while providing for convenience and immediate accessibility to customers.

Other Related Markets

In the normal course of providing our “Ready to Work” solutions, we perform services that are characteristic of activities in other industries. For example, we coordinate a broad network of third-party and in-house transportation and service resources to support the timely delivery of our products to, as well as maintenance while on, customer sites. We design, source, lease, and maintain a broad offering of ancillary products, including furniture, that render our modular structures immediately functional in support of the customer’s needs. We provide technical expertise and oversight for customers regarding building

design and permitting, site preparation, and expansion or contraction of installed space based on changes in project requirements. And, we have the capability to compete in adjacent markets, such as commercial and institutional housing, that have received less focus historically. We believe that this broad service capability differentiates us from other rental and business services providers and clearly differentiates us in the marketplace.

Products and Services

Our products can be used to meet a broad range of customer needs. Our modular space products are used as, among other things, construction site offices, temporary and permanent commercial office space, sales offices, classrooms, accommodation/sleeper units, and special events headquarters. We have a lease fleet with over 34 million square feet of relocatable space, comprised of approximately 75,000 modular space and portable storage units. Our modular space fleet ranges from single-unit facilities to multi-unit office complexes, which combine two or more units into one structure for applications that require more space. Units typically range in size from eight to 14 feet in width and 16 to 70 feet in length and are wood, steel, or aluminum framed mounted on a steel chassis. Some units are fitted with axles and hitches and are towed to various locations while others are easily flat-bed trailer mounted and transported by truck. Most units contain materials used in conventional buildings and are equipped with air conditioning and heating, electrical and often Ethernet cable outlets and, where necessary, plumbing facilities.

Leasing, delivery and installation of modular space and portable storage units generated 90% and 92% of our Adjusted Gross Profit and sales of new and used modular units represented 10% and 8% of Adjusted Gross Profit during the year ended December 31, 2016 and the nine months ended September 30, 2017, respectively. In 2016 and the nine months ended September 30, 2017, the average purchase price for new modular space units (excluding storage products) was approximately $16,000 and $24,000, respectively. For the year ended December 31, 2016 and the nine months ended September 30, 2017, the average modular space monthly rental rate was $524, and $530 per month, respectively. Rates and unit costs vary depending upon size, product type, features and geographic region, however we maintain common hurdles for return on capital across products and regions. Products have varying lease terms, with average minimum contractual terms at delivery on modular space products of 11 months. However, most customers retain the product for a longer period as evidenced by the average duration of our current lease portfolio of 35 months as of December 31, 2016.

Our specific product offerings include:

Modular Space

Panelized and Stackable Offices. Our AS Flex TM panelized and stackable offices are the next generation of modular space technology and offer maximum flexibility and design configurations. This panelized solution provides a modern, innovative design, smaller footprint, ground level access and interchangeable panels—including all glass panels—that allow customers to configure the space to their precise requirements. With the ability to expand upwards (up to three stories) and outwards.

Single-Wide Modular Space Units. Single-wide modular space units, which include mobile offices and sales offices, offer maximum ease of installation and removal and are deployed across the broadest range of applications in our fleet. Units typically have “open interiors” which can be modified using movable partitions. Single-wide modular space units include tile floors, air conditioning/heating units, partitions and, if requested, toilet facilities.

Section Modulars and Redi-Plex. Section modulars are two or more units combined into one structure. Interiors are customized to match the customer needs. Redi-Plex complexes offer advanced versatility for large, open floor plans or custom layouts with private offices. Redi-Plex is built with clearspan construction, which eliminates interference from support columns, allowing for up to sixty feet of open building width and building lengths that increase in twelve foot increments, based on the number of units coupled together. Our proprietary design meets a wide range of national and state building, electrical, mechanical and plumbing codes, which creates versatility in fleet management. Examples of section modular units include hospital diagnostic annexes, special events headquarters, golf pro shops and larger general commercial offices.

Classrooms. Classroom units are generally double-wide units adapted specifically for use by school systems or universities. Classroom units usually feature teaching aids, air conditioning/heating units, windows alongside-walls and, if requested, toilet facilities.

Container Offices. Container offices are ISO-certified shipping containers that we convert for office use. They provide safe, secure, ground-level access with fully welded weather-resistant steel corrugated exteriors and exterior window

guards made of welded steel and tamper-proof screws. Container offices are available in 20 and 40 foot lengths and in office/storage or all-office floor plans.

Other Modular Space. We offer a range of other specialty products that vary across regions and provide flexibility to serve demands for local markets. Examples include workforce accommodation units used to house workers with dining facilities often in remote locations, toilet facilities to complement office and classroom units.

Portable Storage Products

Portable Storage. Storage products are windowless and are typically used for secure storage space. Storage units are primarily ground-level entry storage containers with swing doors and are typically ISO shipping containers repurposed for commercial storage applications with limited modifications. These units are made of heavy exterior metals for security and water tightness.

VAPS

We offer a thoughtfully curated portfolio of VAPS that make modular space and portable storage units more productive, comfortable, secure and “Ready to Work” for our customers the moment we arrive on-site. We lease furniture, steps, ramps, basic appliances, internet connectivity devices and other items to our customers for their use in connection with our products. We also offer our lease customers a damage waiver program that protects them in case the leased unit is damaged. For customers who do not select the damage waiver program, we bill them for the cost of repairs above and beyond normal wear and tear. Importantly, management believes that our scale, branch network, supply chain, and sales performance management tools give us a significant advantage in delivering “Ready to Work” solutions and growing VAPS revenue relative to our competitors.

For the nine months ended September 30, 2017, approximately 19% of our modular leasing revenue was derived from VAPS, up from approximately 17% for the year ended December 31, 2016, which was up from 15% for the year ended December 31, 2015.

Delivery and Installation

We provide delivery, site-work, installation and other services to our customers as part of our leasing and sales operations, and we charge our customers a separate fee for such services. Revenue from delivery, site-work and installation results from the transportation of units to a customer’s location, site-work required prior to installation and installation of the units which have been leased or sold. Typically, units are placed on temporary foundations constructed by our in-house service technicians or subcontractors who will also then generally install any ancillary products and VAPS. We also derive revenue from disassembling, unhooking and removing units once a lease expires.

We also complement our core leasing business with the sale of products, as more fully described below:

Sales of Products

We sell modular space and portable storage units from our branch locations. Generally, we purchase new units from a broad network of third-party manufacturers for sale. We do not generally purchase new units for resale until we have obtained firm purchase orders (which are generally non-cancelable and include up-front deposits) for such units. Buying units directly for resale adds scale to our purchasing, which is beneficial to overall supplier relationships and purchasing terms. Sales of new units is a natural extension of our leasing operations in situations where customers have long-lived or permanent projects, making it more cost-effective to purchase rather than to lease a standard unit.

In the normal course of managing our business, we also sell idle used rental units directly from our lease fleet at fair market value and will sell units that are already on rent if the customer expresses interest in owning, rather than continuing to rent the unit. The sale of units from our rental fleet has historically been both profitable and a cost-effective method to finance replenishing and upgrading the lease fleet, as well as generate free cash flow during periods of lower rental demand and utilization. Our sales business may include modifying or customizing units to meet customer requirements.

Customers

Our operating infrastructure is designed to enable us to meet or exceed our customers’ expectations by reacting quickly, efficiently and with consistent service levels. As a result, we have established strong relationships with a diverse customer base, ranging from large multi-national companies to local sole proprietors. Our more than 25,000 customers span all major industries, including commercial and industrial, construction, education, energy and natural resources, government, and other end-markets. Our top-50 customers accounted for approximately 17% of our revenue in 2016, with no customer accounting for more than 4% of our revenue during the year ended December 31, 2016. Approximately 75% of our business is done with repeat customers for the year ended December 31, 2016. We believe that our customers prefer our modular space products over fixed, on-site built space because, among other things, modular space products are a quick, flexible, cost-effective and risk-averse solution for expansion and modular space units are built in controlled environments which offer higher quality than on-site builds.

Our key customer end-markets include the commercial and industrial, construction, education, energy and natural resources, government, and other end-markets: