Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US BANCORP \DE\ | d466548d8k.htm |

Goldman Sachs U.S. Financial Services Conference 2017 December 5, 2017 Andy Cecere President, CEO Terry Dolan Vice Chairman, CFO Exhibit 99.1

Forward-looking Statements and Additional Information The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: Today’s presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. A reversal or slowing of the current economic recovery or another severe contraction could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities. Global financial markets could experience a recurrence of significant turbulence, which could reduce the availability of funding to certain financial institutions and lead to a tightening of credit, a reduction of business activity, and increased market volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets could cause credit losses and deterioration in asset values. In addition, changes to statutes, regulations, or regulatory policies or practices could affect U.S. Bancorp in substantial and unpredictable ways. U.S. Bancorp’s results could also be adversely affected by deterioration in general business and economic conditions; changes in interest rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of securities held in its investment securities portfolio; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in customer behavior and preferences; breaches in data security; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2016, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. However, factors other than these also could adversely affect U.S. Bancorp’s results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

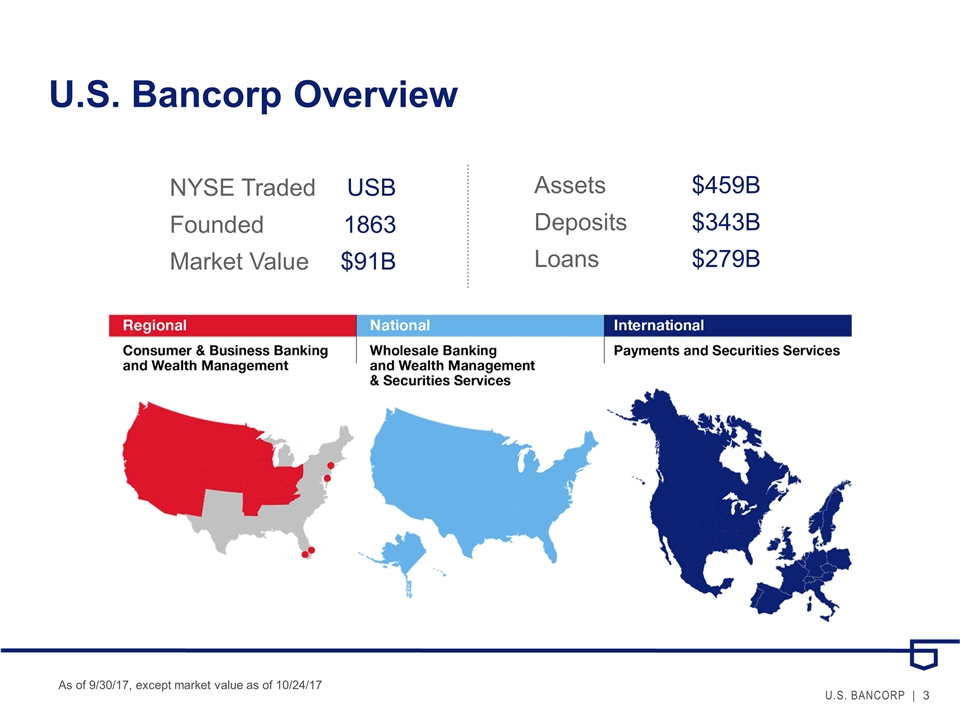

U.S. Bancorp Overview As of 9/30/17, except market value as of 10/24/17 NYSE TradedUSB Founded 1863 Market Value $91B Assets $459B Deposits $343B Loans $279B

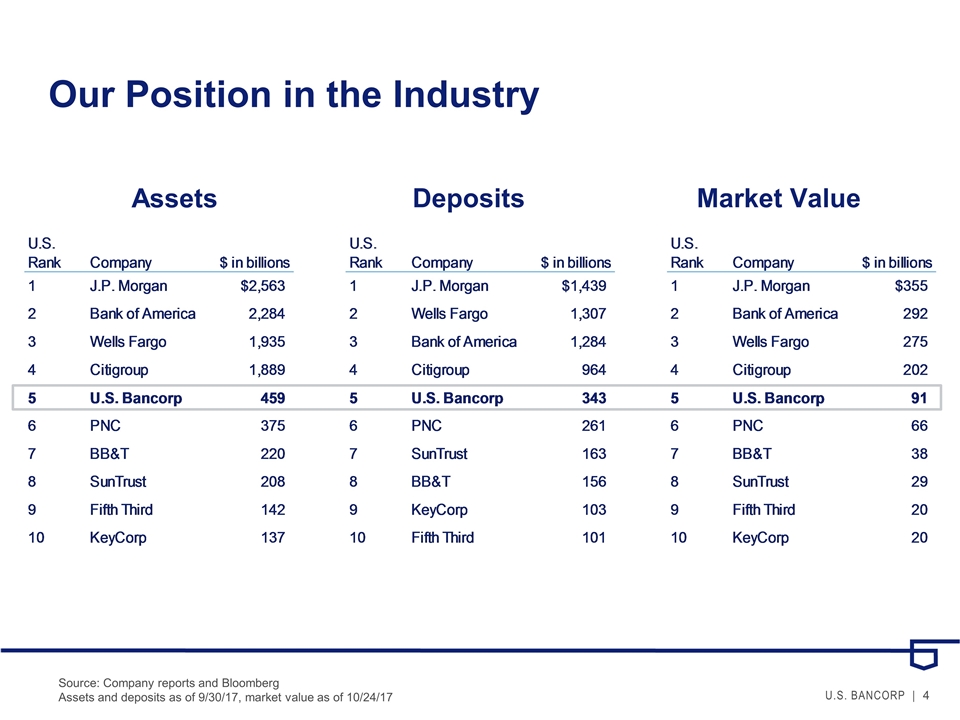

Our Position in the Industry Source: Company reports and Bloomberg Assets and deposits as of 9/30/17, market value as of 10/24/17 Assets Market Value Deposits

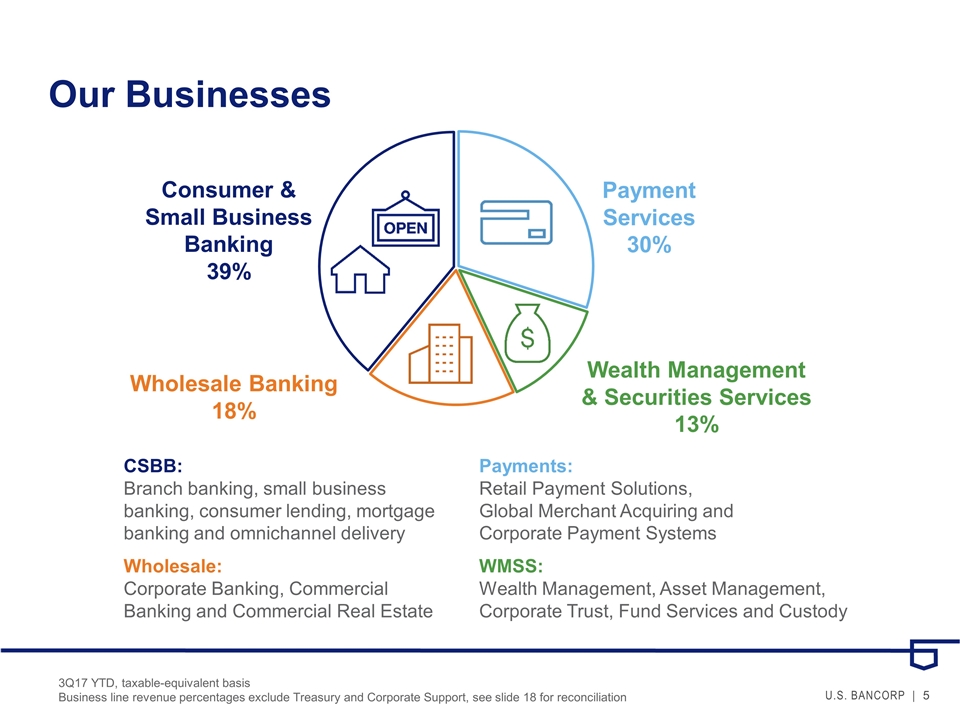

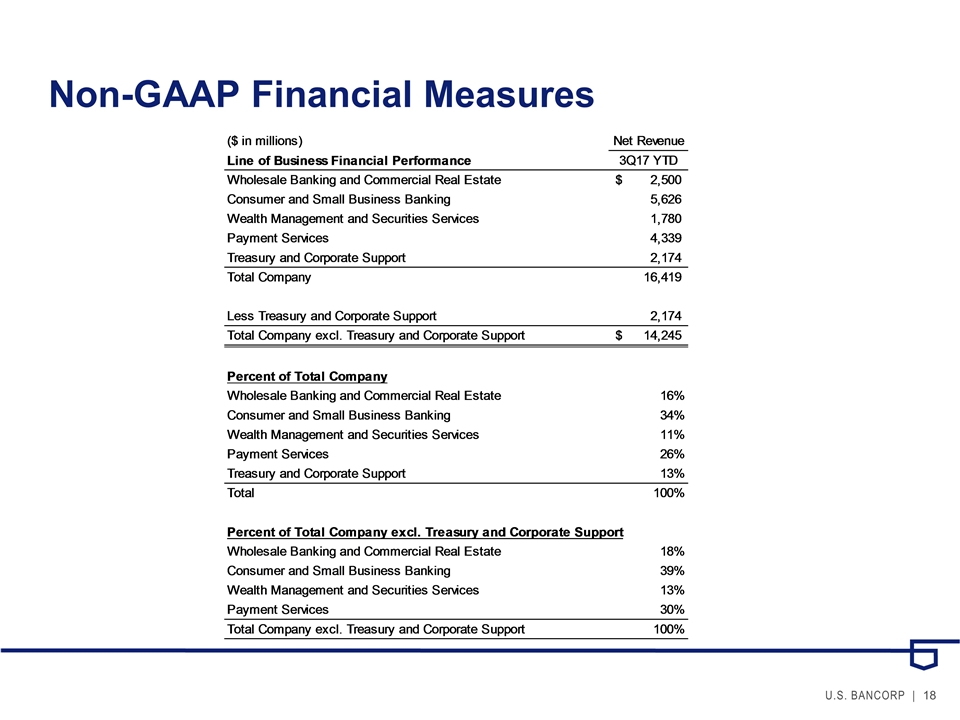

Our Businesses Payment Services 30% Wealth Management & Securities Services 13% Wholesale Banking 18% Consumer & Small Business Banking 39% CSBB: Branch banking, small business banking, consumer lending, mortgage banking and omnichannel delivery Payments: Retail Payment Solutions, Global Merchant Acquiring and Corporate Payment Systems Wholesale: Corporate Banking, Commercial Banking and Commercial Real Estate WMSS: Wealth Management, Asset Management, Corporate Trust, Fund Services and Custody 3Q17 YTD, taxable-equivalent basis Business line revenue percentages exclude Treasury and Corporate Support, see slide 18 for reconciliation

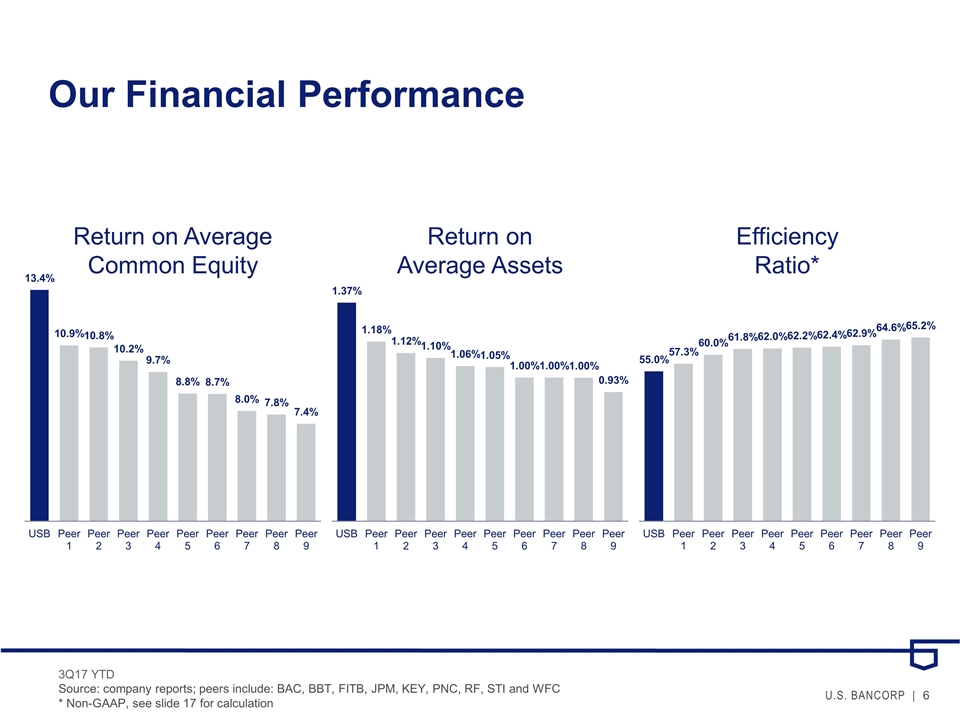

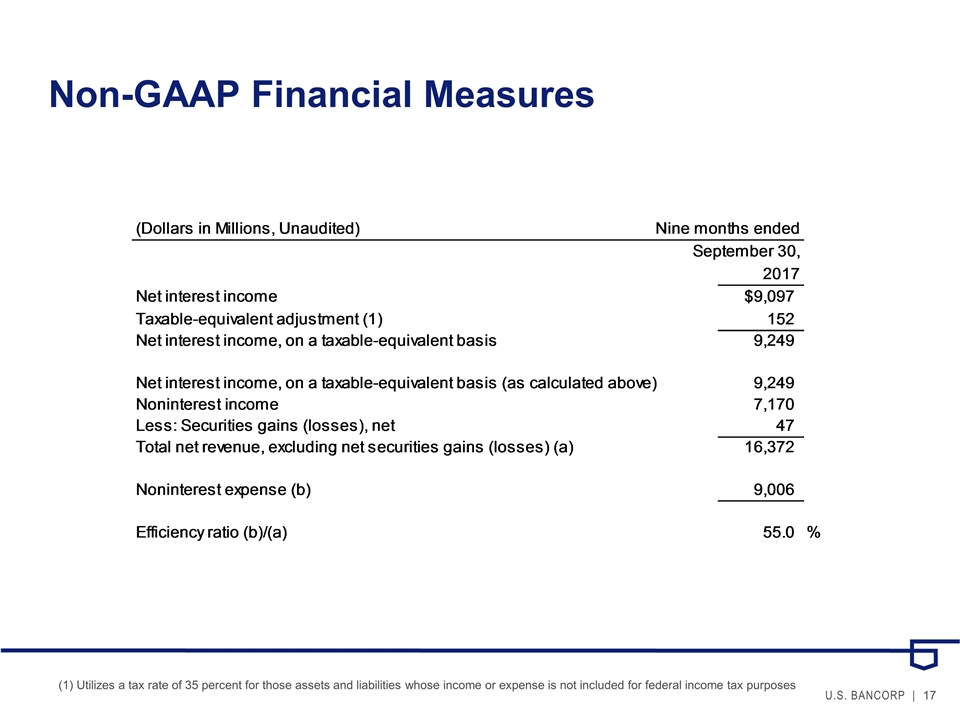

Our Financial Performance Return on Average Common Equity Return on Average Assets Efficiency Ratio* 3Q17 YTD Source: company reports; peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI and WFC * Non-GAAP, see slide 17 for calculation

Our Strategic Priorities 1) One U.S. Bank initiative: putting the customer in the center 2) Leveraging technology and innovation to drive growth and efficiency 3) A relentless focus on optimization one U.S. Bank

Our Approach to Technology and Innovation Improve the customer experience Create value for the customer Drive growth for the bank We are investing in technology and innovation that will enhance the customer experience, create value and drive growth.

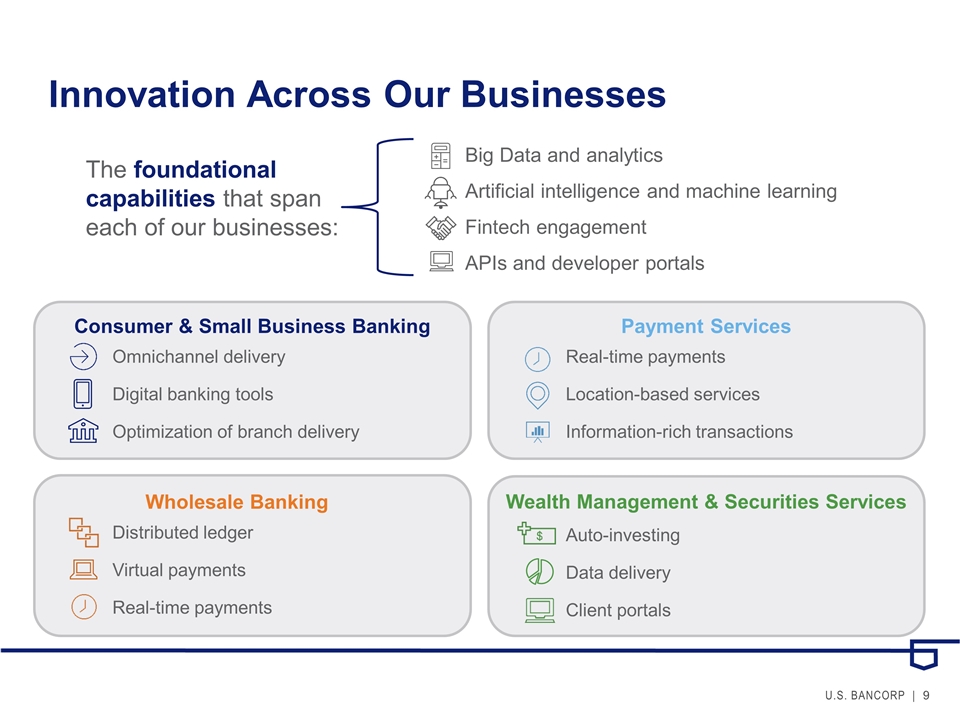

Innovation Across Our Businesses Payment Services Wholesale Banking Wealth Management & Securities Services Real-time payments Location-based services Information-rich transactions Consumer & Small Business Banking Omnichannel delivery Digital banking tools Optimization of branch delivery Distributed ledger Virtual payments Real-time payments Auto-investing Data delivery Client portals Big Data and analytics Artificial intelligence and machine learning Fintech engagement APIs and developer portals The foundational capabilities that span each of our businesses:

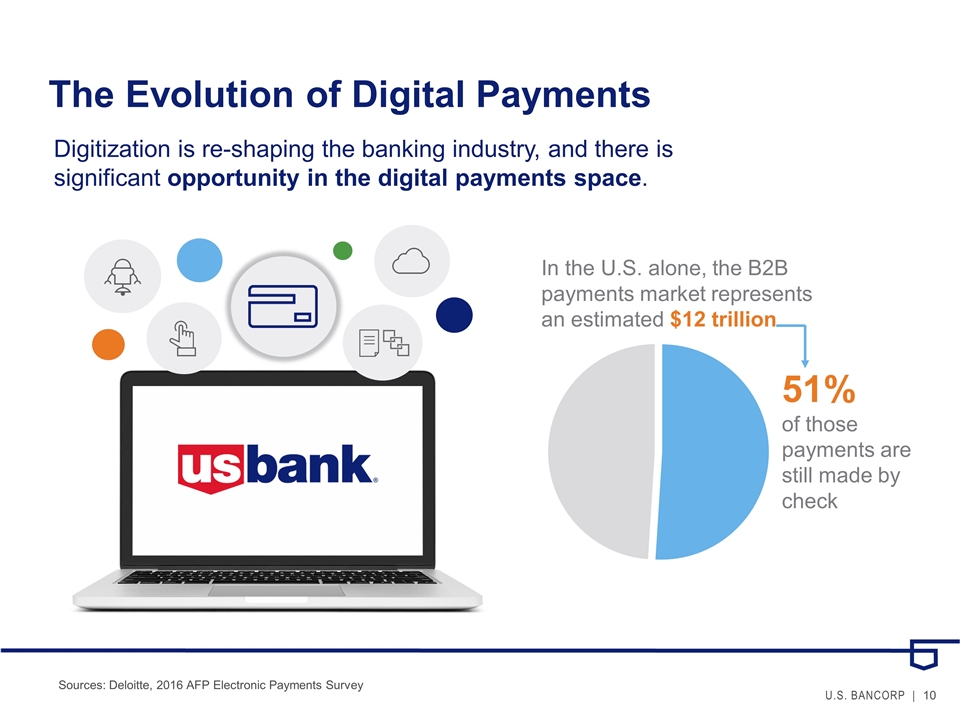

The Evolution of Digital Payments Digitization is re-shaping the banking industry, and there is significant opportunity in the digital payments space. In the U.S. alone, the B2B payments market represents an estimated $12 trillion 51% of those payments are still made by check Sources: Deloitte, 2016 AFP Electronic Payments Survey

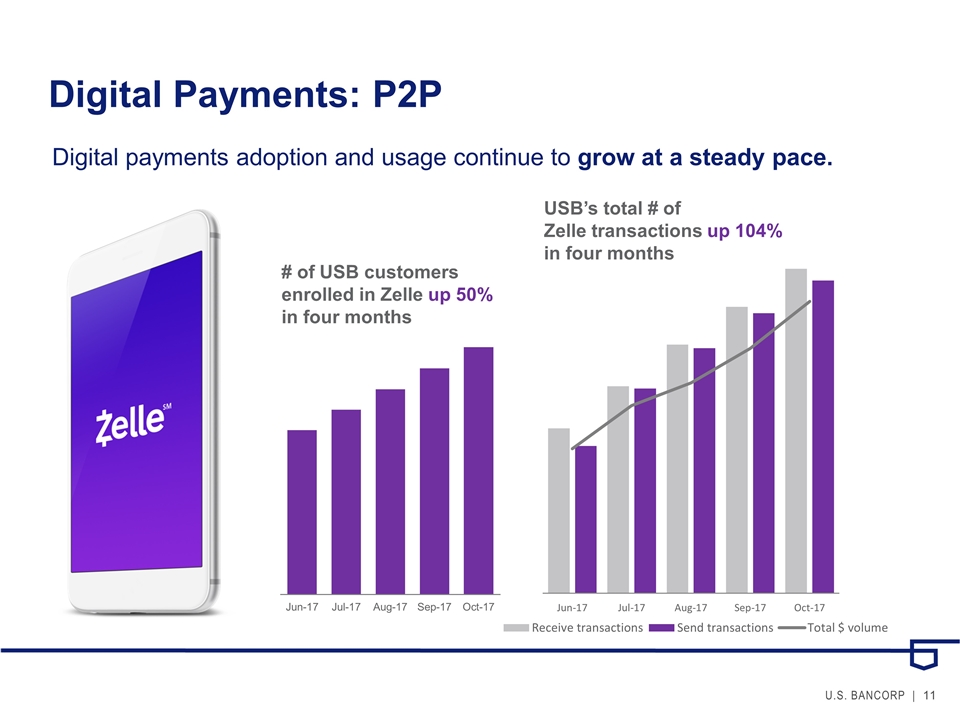

Digital Payments: P2P Digital payments adoption and usage continue to grow at a steady pace. # of USB customers enrolled in Zelle up 50% in four months USB’s total # of Zelle transactions up 104% in four months

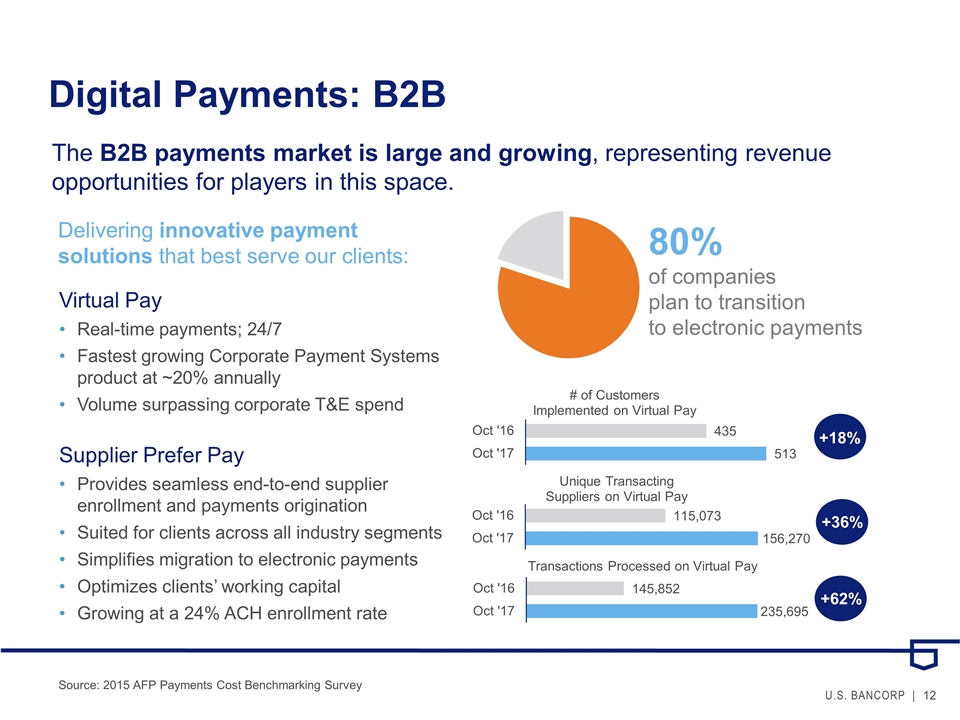

Digital Payments: B2B Virtual Pay Real-time payments; 24/7 Fastest growing Corporate Payment Systems product at ~20% annually Volume surpassing corporate T&E spend Supplier Prefer Pay Provides seamless end-to-end supplier enrollment and payments origination Suited for clients across all industry segments Simplifies migration to electronic payments Optimizes clients’ working capital Growing at a 24% ACH enrollment rate +18% +36% +36% +62% The B2B payments market is large and growing, representing revenue opportunities for players in this space. 80% of companies plan to transition to electronic payments Delivering innovative payment solutions that best serve our clients: Source: 2015 AFP Payments Cost Benchmarking Survey

Digital Payments: B2B The Clearing House® launch of RTP®, its real-time payments system, begins the next leg of the digital payments journey. USB participated in the first ever RTP transaction! Features rich data capabilities Lowers processing costs Adds value for both the sender and receiver Will enable future product development RTP: Data-rich messaging adds value as payments evolve from financial transactions to information transactions * Source: The Clearing House

Wrap-up The way banking is delivered is fundamentally changing, led by the digital revolution and real-time payments We are investing in those technologies and innovations that lay the foundation for the long-term Data-rich payment streams offer opportunities to add value, enhance the customer experience and grow revenues Drive growth for the bank Create value for the customer Improve the customer experience

4Q17 Guidance Loan growth Net interest margin Fee income Expenses Credit quality

Appendix

Non-GAAP Financial Measures (1) Utilizes a tax rate of 35 percent for those assets and liabilities whose income or expense is not included for federal income tax purposes

Non-GAAP Financial Measures