Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TTM TECHNOLOGIES INC | d488705dex991.htm |

| EX-10.1 - EX-10.1 - TTM TECHNOLOGIES INC | d488705dex101.htm |

| EX-2.1 - EX-2.1 - TTM TECHNOLOGIES INC | d488705dex21.htm |

| 8-K - 8-K - TTM TECHNOLOGIES INC | d488705d8k.htm |

TTM Technologies, Inc. Acquisition of Anaren, Inc. Investor Presentation December 4, 2017 Exhibit 99.2

Disclaimers Forward-Looking Statements This communication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements related to the future business outlook, events, and expected performance of TTM Technologies, Inc. (“TTM”, “we” or the “Company”). The words “anticipate,” “believe,” “plan,” “forecast,” “foresee,” “estimate,” “project,” “expect,” “seek,” “target,” “intend,” “goal” and other similar expressions, among others, generally identify “forward-looking statements,” which speak only as of the date the statements were made and are not guarantees of performance. Actual results may differ materially from these forward-looking statements. Such statements relate to a variety of matters, including but not limited to the operations of TTM’s businesses. These statements reflect the current beliefs, expectations and assumptions of the management of TTM, and we believe such statements to have a reasonable basis. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of the Company. These forward-looking statements are based on assumptions that may not materialize, and involve certain risks and uncertainties, many of which are beyond our control, that could cause actual events or performance to differ materially from those indicated in such forward-looking statements. Factors, risks, trends, and uncertainties that could cause actual results to differ materially from those projected, anticipated, or implied in forward-looking statements include, but are not limited to, TTM’s ability to successfully complete the transaction on a timely basis, including receipt of required regulatory approvals and satisfaction of other conditions; the conditions of the credit markets and TTM’s ability to issue debt to fund the transaction on acceptable terms; if the transaction is completed, the ability to retain Anaren’s customers and employees, the ability to successfully integrate Anaren’s operations, product lines, technology and employees into TTM’s operations, and the ability to achieve the expected synergies as well as accretion in earnings, demand for our products, market pressures on prices of our products, warranty claims, changes in product mix, contemplated significant capital expenditures and related financing requirements, our dependence upon a small number of customers, and other factors set forth in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q and in the Company’s other filings filed with the Securities and Exchange Commission (the “SEC”), including under the heading “Risk Factors”, and which are available at the SEC’s website at www.sec.gov. TTM does not undertake any obligation to update any of these statements to reflect any new information, subsequent events or circumstances, or otherwise, except as may be required by law, even if experience or future changes make it clear that any projected results expressed in this communication or future communications to stockholders, press releases or Company statements will not be realized. In addition, the inclusion of any statement in this communication does not constitute an admission by us that the events or circumstances described in such statement are material. None of Anaren, its affiliates or their respective representatives assume any responsibility for, or makes any representation or warranty, express or implied, (and they expressly disclaim any such representation or warranty and any liability related thereto) as to the accuracy, adequacy or completeness of the information contained in this communication or any other written or oral communication transmitted or made available to any person in connection with this communication. Use of Non-GAAP Financial Measures In addition to the financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”), TTM uses certain non-GAAP financial measures, including EBITDA, Adjusted EBITDA, Non-GAAP Operating Income, Non-GAAP Net Income, Non-GAAP Operating Margin, Non-GAAP Gross Margin , Non-GAAP EPS and Adjusted Operating Cash Flow. We present non-GAAP financial information to enable investors to see TTM through the eyes of management and to provide better insight into our ongoing financial performance. A material limitation associated with the use of the above non-GAAP financial measures is that they have no standardized measurement prescribed by GAAP and may not be comparable to similar non-GAAP financial measures used by other companies. We compensate for these limitations by providing full disclosure of each non-GAAP financial measure and reconciliation to the most directly comparable GAAP financial measure. However, the non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. See Appendix for reconciliations of Adjusted EBITDA and Non-GAAP Operating Income to the most comparable GAAP metric. Data Used in This Presentation Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures. Third Party Information This presentation has been prepared by the Company and includes information from other sources believed by the Company to be reliable. No representation or warranty, express or implied, is made as to the fairness, accuracy or completeness of any of the opinions and conclusions set forth herein based on such information. This presentation may contain descriptions or summaries of certain documents and agreements, but such descriptions or summaries are qualified in their entirety by reference to the actual documents or agreements. Unless otherwise indicated, the information contained herein speaks only as of the date hereof and is subject to change, completion or amendment without notice.

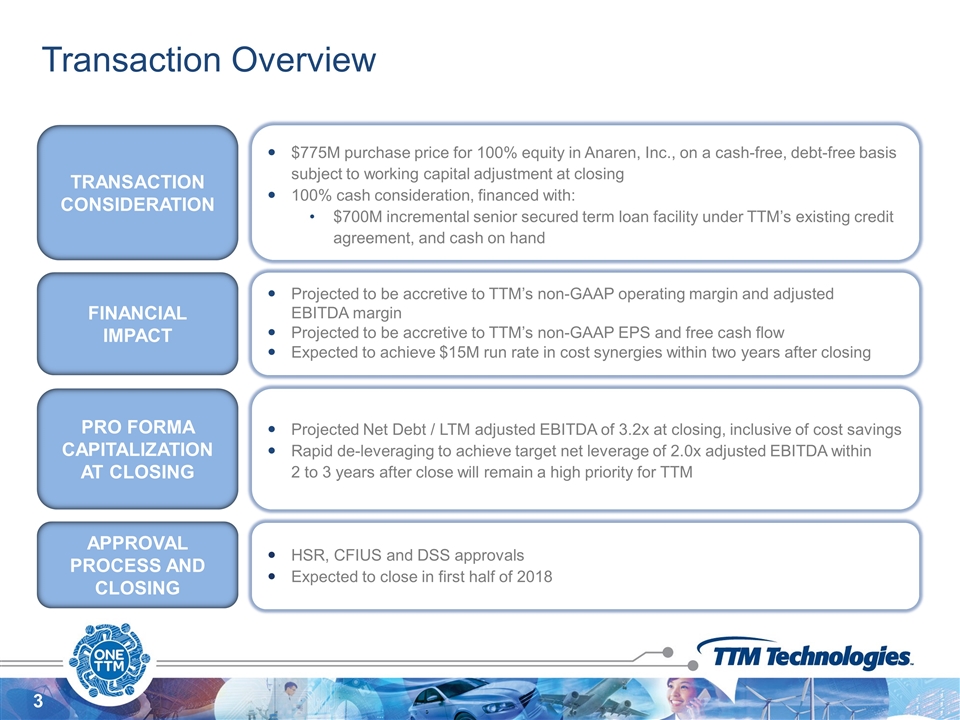

Transaction Overview $775M purchase price for 100% equity in Anaren, Inc., on a cash-free, debt-free basis subject to working capital adjustment at closing 100% cash consideration, financed with: $700M incremental senior secured term loan facility under TTM’s existing credit agreement, and cash on hand TRANSACTION CONSIDERATION HSR, CFIUS and DSS approvals Expected to close in first half of 2018 APPROVAL PROCESS AND CLOSING Projected to be accretive to TTM’s non-GAAP operating margin and adjusted EBITDA margin Projected to be accretive to TTM’s non-GAAP EPS and free cash flow Expected to achieve $15M run rate in cost synergies within two years after closing FINANCIAL IMPACT Projected Net Debt / LTM adjusted EBITDA of 3.2x at closing, inclusive of cost savings Rapid de-leveraging to achieve target net leverage of 2.0x adjusted EBITDA within 2 to 3 years after close will remain a high priority for TTM PRO FORMA CAPITALIZATION AT CLOSING

Strategic Rationale Provides differentiated RF expertise in space & defense and embedded technology critical to wireless infrastructure Enhances TTM’s strong A&D position and provides new market growth opportunity for the industrial, medical and automotive markets Significantly enhances TTM’s A&D business from “Build to Print” to “Build to Spec” Combined customer base includes industry leaders in aerospace & defense and wireless communication infrastructure markets Strong management and engineering talent with extensive experience in the RF design Compelling value creation with Anaren projected to be accretive to TTM’s non-GAAP operating margin, adjusted EBITDA margin, non-GAAP EPS and free cash flow

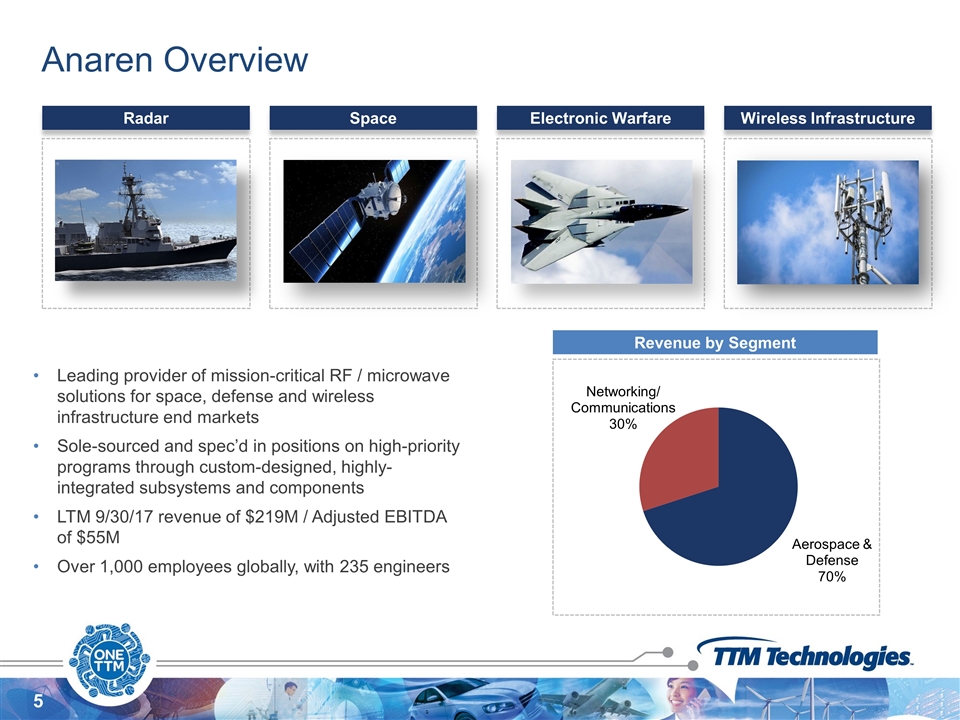

Anaren Overview Leading provider of mission-critical RF / microwave solutions for space, defense and wireless infrastructure end markets Sole-sourced and spec’d in positions on high-priority programs through custom-designed, highly- integrated subsystems and components LTM 9/30/17 revenue of $219M / Adjusted EBITDA of $55M Over 1,000 employees globally, with 235 engineers Revenue by Segment Radar Space Electronic Warfare Wireless Infrastructure

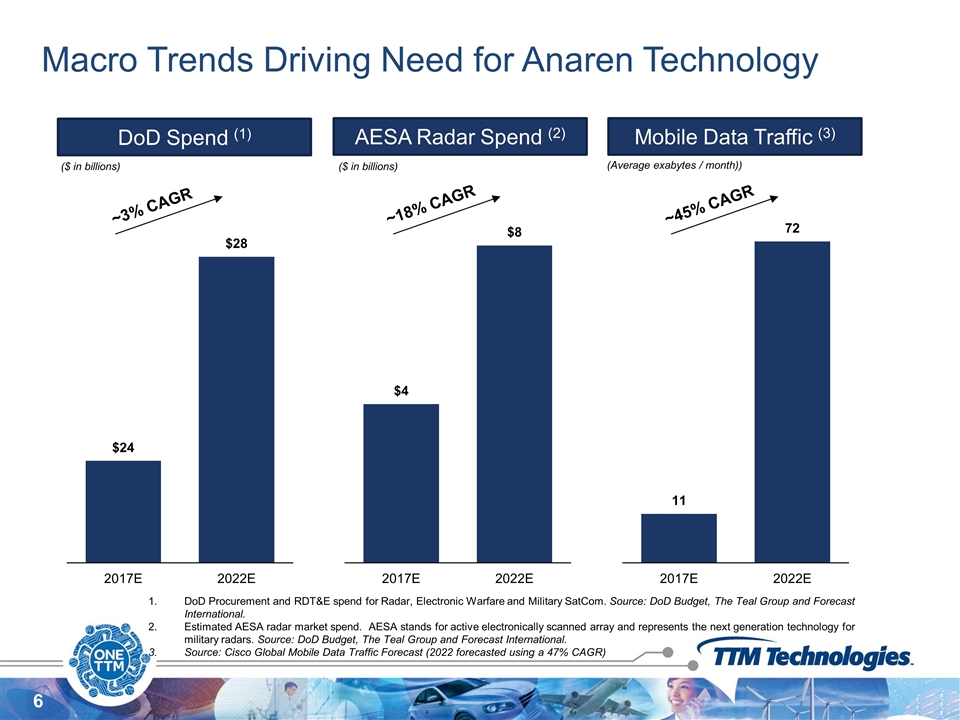

Macro Trends Driving Need for Anaren Technology DoD Spend (1) AESA Radar Spend (2) Mobile Data Traffic (3) ($ in billions) DoD Procurement and RDT&E spend for Radar, Electronic Warfare and Military SatCom. Source: DoD Budget, The Teal Group and Forecast International. Estimated AESA radar market spend. AESA stands for active electronically scanned array and represents the next generation technology for military radars. Source: DoD Budget, The Teal Group and Forecast International. Source: Cisco Global Mobile Data Traffic Forecast (2022 forecasted using a 47% CAGR) ($ in billions) ~3% CAGR ~18% CAGR ~45% CAGR (Average exabytes / month))

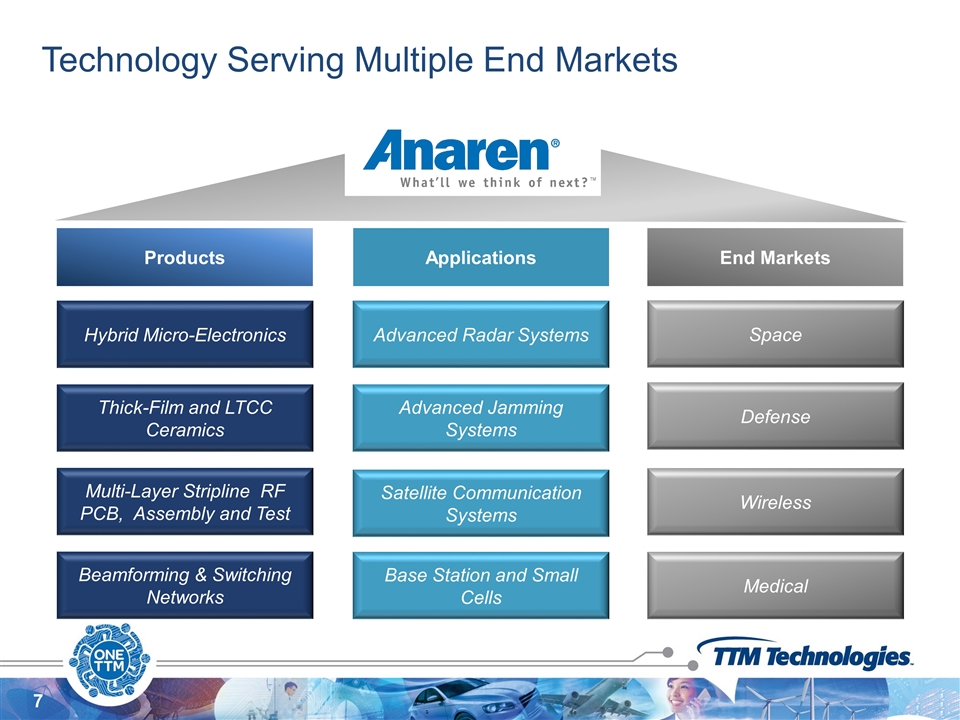

Technology Serving Multiple End Markets Hybrid Micro-Electronics Thick-Film and LTCC Ceramics Multi-Layer Stripline RF PCB, Assembly and Test Beamforming & Switching Networks Advanced Radar Systems Advanced Jamming Systems Base Station and Small Cells Satellite Communication Systems Products Applications End Markets Space Wireless Medical Defense

Select Missile Defense Select Air-Based Radar / EW Select Space-Based Systems Anaren is a Key Supplier to High Priority DoD Programs AMDR TPQ-53 SBIRS THAAD F-35 F-16 (SABR) E2D MH-60R Orion GPSIII AEHF

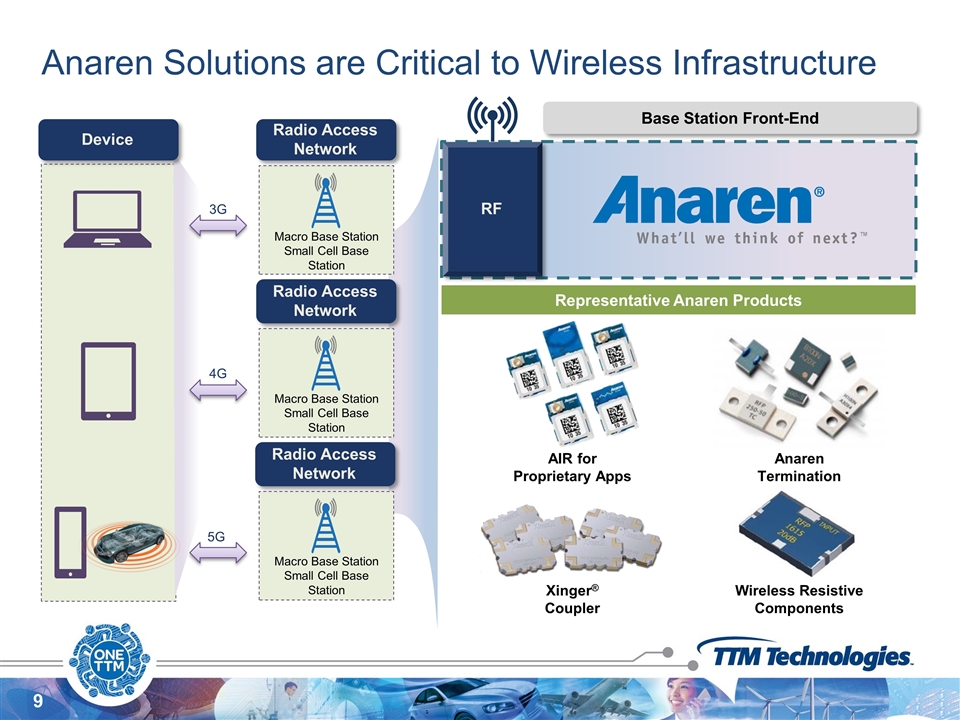

Base Station Front-End Representative Anaren Products Anaren Solutions are Critical to Wireless Infrastructure Device 3G 4G 5G Radio Access Network Macro Base Station Small Cell Base Station Radio Access Network Macro Base Station Small Cell Base Station Radio Access Network Macro Base Station Small Cell Base Station RF Anaren Termination AIR for Proprietary Apps Wireless Resistive Components Xinger® Coupler

Highly Complementary Customer Base Sourcing Different Products

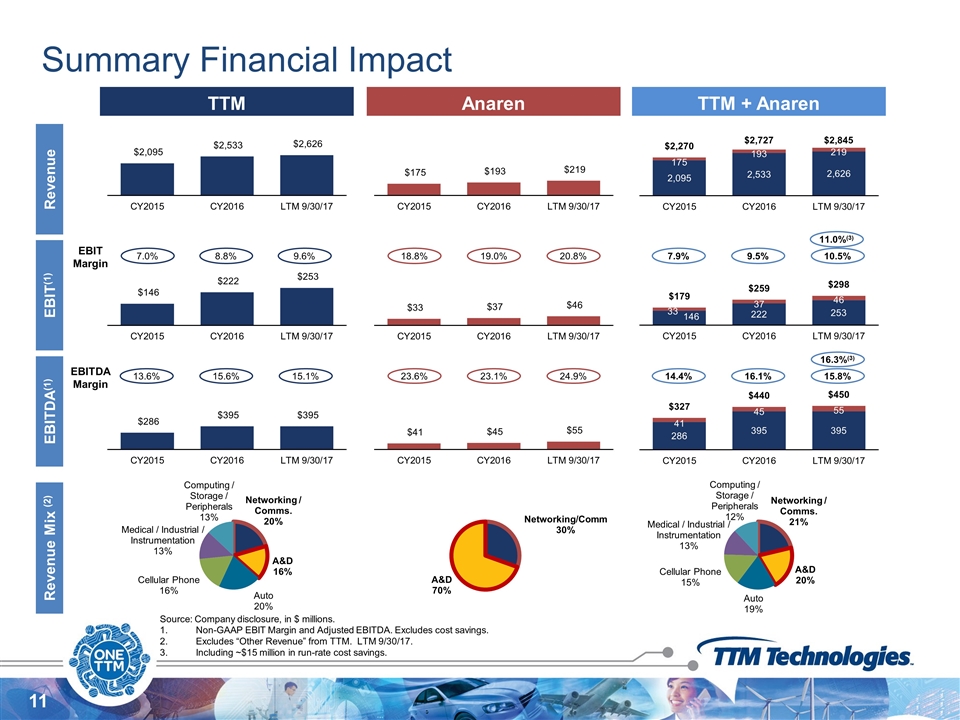

Summary Financial Impact TTM Anaren TTM + Anaren Revenue EBITDA(1) Revenue Mix (2) Source: Company disclosure, in $ millions. Non-GAAP EBIT Margin and Adjusted EBITDA. Excludes cost savings. Excludes “Other Revenue” from TTM. LTM 9/30/17. Including ~$15 million in run-rate cost savings. 13.6% 15.6% 15.1% 23.6% 23.1% 24.9% 14.4% 16.1% 15.8% EBITDA Margin 16.3%(3) EBIT(1) 7.0% 8.8% 9.6% 18.8% 19.0% 20.8% 7.9% 9.5% 10.5% EBIT Margin 11.0%(3)

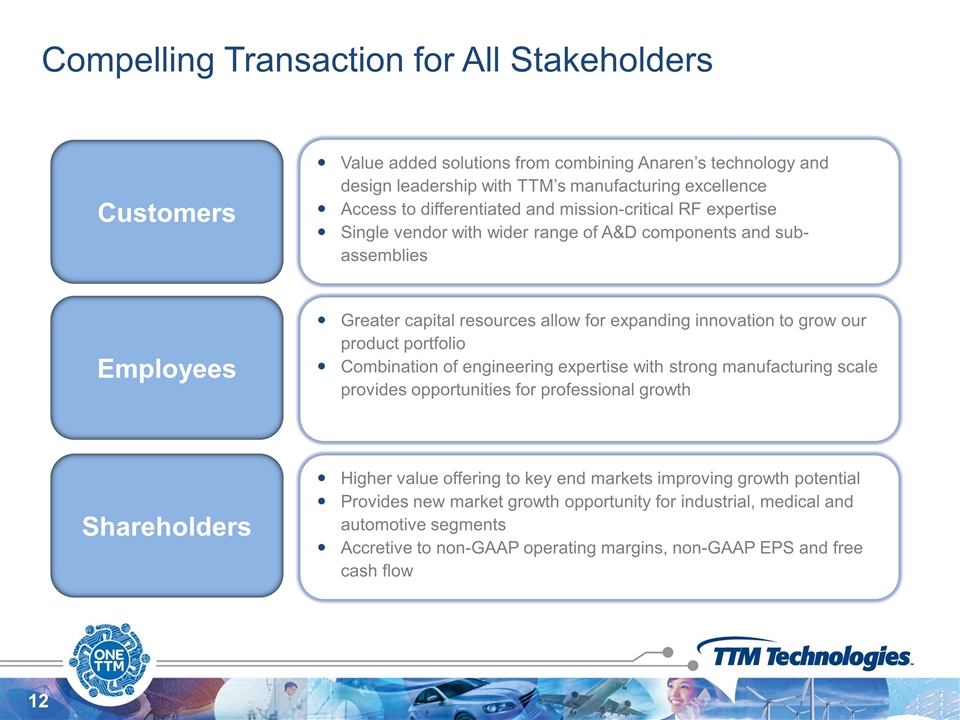

Value added solutions from combining Anaren’s technology and design leadership with TTM’s manufacturing excellence Access to differentiated and mission-critical RF expertise Single vendor with wider range of A&D components and sub-assemblies Greater capital resources allow for expanding innovation to grow our product portfolio Combination of engineering expertise with strong manufacturing scale provides opportunities for professional growth Higher value offering to key end markets improving growth potential Provides new market growth opportunity for industrial, medical and automotive segments Accretive to non-GAAP operating margins, non-GAAP EPS and free cash flow Customers Employees Shareholders Compelling Transaction for All Stakeholders

Appendix

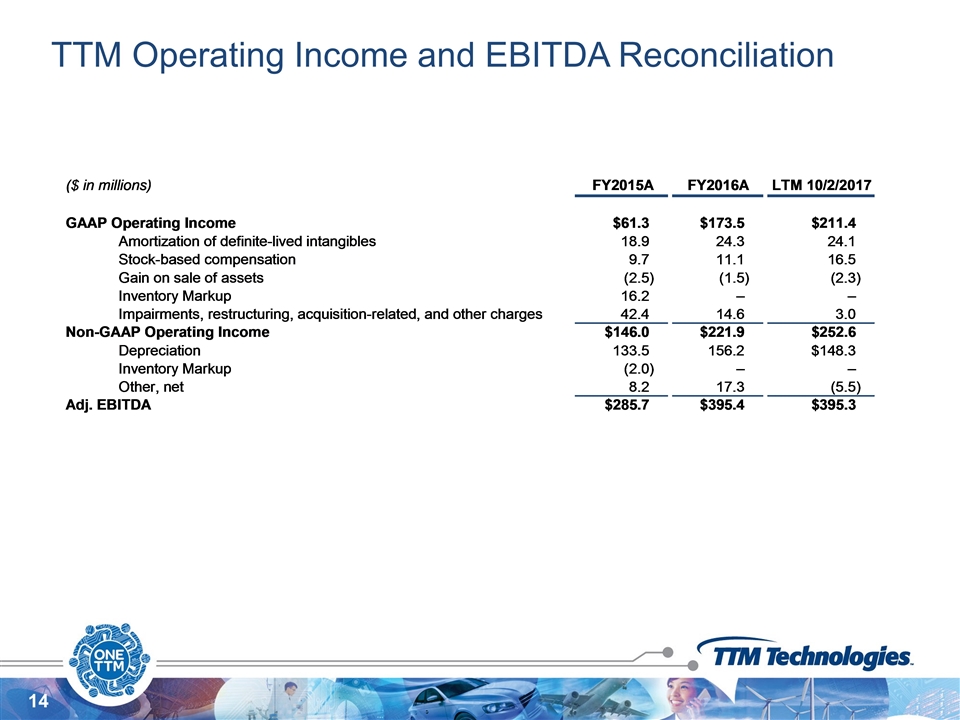

TTM Operating Income and EBITDA Reconciliation

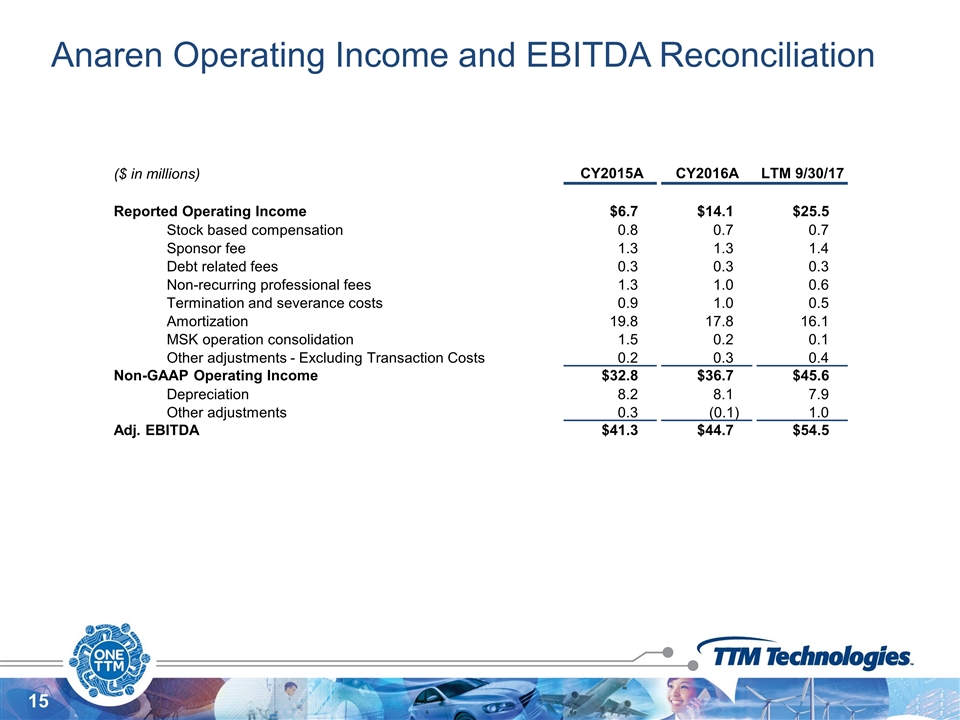

Anaren Operating Income and EBITDA Reconciliation ($ in millions) CY2015A CY2016A LTM 9/30/17 Reported Operating Income $6.7 $14.1 $25.5 Stock based compensation 0.8 0.7 0.7 Sponsor fee 1.3 1.3 1.4 Debt related fees 0.3 0.3 0.3 Non-recurring professional fees 1.3 1.0 0.6 Termination and severance costs 0.9 1.0 0.5 Amortization 19.8 17.8 16.1 MSK operation consolidation 1.5 0.2 0.1 Other adjustments - Excluding Transaction Costs 0.2 0.3 0.4 Non-GAAP Operating Income $32.8 $36.7 $45.6 Depreciation 8.2 8.1 7.9 Other adjustments 0.3 (0.1) 1.0 Adj. EBITDA $41.3 $44.7 $54.5