Attached files

| file | filename |

|---|---|

| EX-99.1 - LETTER OF INTENT - Greenfield Farms Food, Inc. | gras_991.htm |

| EX-16.1 - LETTER FROM KLJ & ASSOCIATES LLP - Greenfield Farms Food, Inc. | gras_161.htm |

| 8-K - FORM 8-K - Greenfield Farms Food, Inc. | gras_8k.htm |

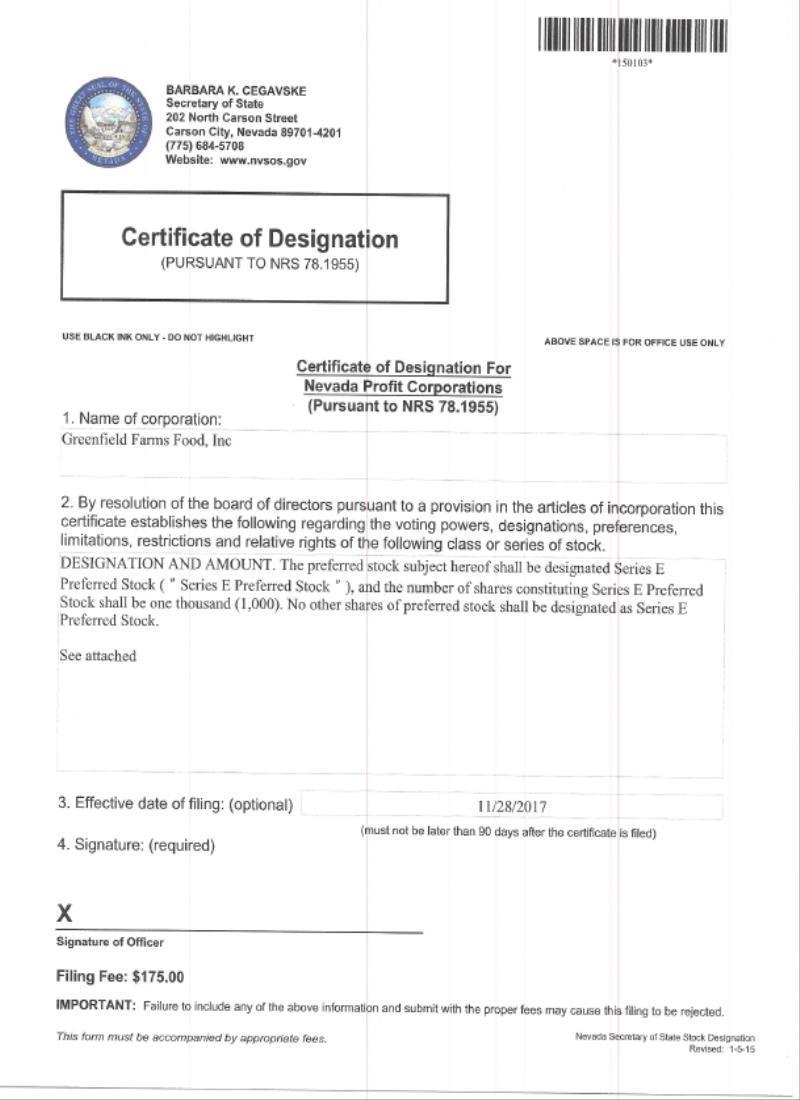

EXHIBIT 3.1

| 1 |

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF SERIES E PREFERRED STOCK, PAR VALUE $0.001 PER SHARE

OF

GREENFIELD FARMS FOOD, INC.

The undersigned, the Chief Executive Officer of Greenfield Farms Food, Inc., a Nevada corporation (the “Corporation”), does hereby certify, that, pursuant to authority conferred upon the Board of Directors and pursuant to the Nevada Revised Statutes, the following resolutions creating a Series of Series E Preferred Stock was duly adopted by the Corporation’s Board of Directors on November 28, 2017:

WHEREAS, the Articles of Incorporation of the Corporation, as amended, authorizes the Board of Directors of the Corporation to issue up to fifty million (50,000,000) shares of preferred stock, par value $.001 per share, issuable from time to time in one or more Serieses or series and

WHEREAS, the Board of Directors is authorized to fix the rights, terms and preferences and the number of shares constituting any series and the designation thereof, of any of them; and

NOW, THEREFORE, BE IT RESOLVED, that the Board of Directors does hereby provide for the issuance of Series E Preferred Stock and does hereby fix and determine the rights, preferences, restrictions and other matters relating to such Series E Preferred Stock as follows:

1. DESIGNATION AND AMOUNT. The preferred stock subject hereof shall be designated Series E Preferred Stock (“Series E Preferred Stock”), and the number of shares constituting Series E Preferred Stock shall be one thousand (1,000). No other shares of preferred stock shall be designated as Series E Preferred Stock.

2. Rank. In the event of the Corporation’s liquidation, the Series E Preferred Stock shall rank senior to any class or series of the Corporation’s capital stock hereafter created that ranks junior to the Series E Preferred Stock; pari passu with any class or series of the Corporation’s capital stock hereafter created that ranks on parity with the Series E Preferred Stock; and junior to any class or series of the Corporation’s capital stock hereafter created that ranks senior to the Series E Preferred Stock. The Series E Preferred Stock shall be senior to the Corporation’s common stock and on parity with the Corporation’s Series A Preferred Stock.

3. Conversion Rights. The total shares of Series E Preferred Stock outstanding are convertible, on a pro-rata basis, into that number of fully paid and non-assessable shares of Corporation’s common stock on terms that would equal 85% of the total issued and outstanding shares of the Corporation’s common stock on a fully-diluted basis (the “Conversion Shares”) immediately upon approval by the Corporation’s stockholders and the availability in the number of authorized shares of Common Stock sufficient to issue the Conversion Shares.

(a) The Conversion shares shall be rounded to the nearest full share; no fractional shares of common stock shall be issued upon any such conversion.

(b) As a condition to the Corporation’s obligation to issue and deliver certificates representing the Conversion Shares under this Section 3, holders of converted shares of Series E Preferred Stock shall return their certificates representing such preferred stock for cancellation on the Corporation’s books.

| 2 |

4. Voting Rights. The holders of Series E Preferred Stock shall have voting rights on any matters respecting the affairs of the Corporation submitted to the holders of the Corporation’s voting capital stock, on as if converted basis on the date of any vote.

5. Dividends. Unless otherwise declared from time to time by the Board of Directors, out of funds legally available thereof, the holders of shares of the outstanding shares of Series E Preferred Stock shall not be entitled to receive dividends.

6. No Preemptive Rights. Holders of Series E Preferred Stock shall not be entitled, as a matter of right, to subscribe for, purchase or receive any part of any stock of the Corporation of any class whatsoever, or of securities convertible into or exchangeable for any stock of any class whatsoever, whether now or hereafter authorized and whether issued for cash or other consideration or by way of dividend by virtue of the Series E Preferred Stock.

7. Liquidation Rights. The holder or holders of the Series E Preferred Stock shall not be entitled to receive any distributions in the event of any liquidation, dissolution or winding up of the Corporation, either voluntary or involuntary.

8. No Reissuance of Series E Preferred Stock. Any share or shares of Series E Preferred Stock acquired by the Corporation by reason of redemption, purchase, conversion or otherwise shall be cancelled, shall return to the status of authorized but unissued preferred stock of not designated series, and shall not be reissuable by the Corporation as a Series E Preferred Stock.

9. Loss, Theft, Destruction of Certificates. Upon the Corporation’s receipt of evidence of the loss, theft, destruction or mutilation of a certificate representing shares of Series E Preferred Stock (in form reasonable satisfactory to the Corporation) and, in the case of any such loss, theft or destruction, upon receipt of indemnity or security reasonably satisfactory to the Corporation, or, in the case of mutilation, upon surrender and cancellation of the mutilated certificate, the Corporation shall make, issue and deliver, in lieu of such lost, stolen, destroyed or mutilated certificate representing shares of Series E Preferred Stock, a new certificate representing shares of Series E Preferred Stock of like tenor.

10. Who Deemed Absolute Owner. The Corporation may deem the holder(s) in whose name shares of Series E Preferred Stock is registered upon the Corporation’s books, or their assigns, to be, and may treat it as, the absolute owner of such shares of Series E Preferred Stock for all purposes, and the Corporation shall not be affected or bound by any notice to the contrary.

11. Transfer Restrictions; Legend. Certificates representing all shares of Series E Preferred Stock, and all shares of the Corporation’s common stock issued upon conversion thereof have not been registered under the Securities Act or any state or foreign securities laws, and are and will continue to be restricted securities within the meaning of Rule 144 of the General Rules and Regulations under the Securities Act and applicable state statutes, and consents to the placement of an appropriate restrictive legend or legends on any certificates evidencing the securities and any certificates issued in replacement or exchange therefor and acknowledges that the Corporation will cause its stock transfer records to note such restrictions.

12. Stock-Transfer Register. The Corporation shall keep at its principal office an original or copy of a register in which it shall provide for the registration of the Series E Preferred Stock. Upon any transfer of Series E Preferred Stock in accordance with the provisions hereof, the Corporation shall register such transfer on its stock-transfer register.

| 3 |

13. Amendments. The Corporation may amend this Certificate of Designation only with the approving vote of holders of a majority of the then-outstanding shares of SERIES E Preferred Stock.

14. Headings. The headings of the sections, subsections and paragraphs of this Certificate of Designation are inserted for the convenience of the reader only and shall not affect the interpretation of the terms and provisions of this Certificate of Designation.

15. Severability. If any provision of this Certificate of Designation, or the application thereof to any person or any circumstance, is invalid or unenforceable, (i) a suitable and equitable provision shall be substituted therefore in order to carry out, so far as may be valid and enforceable, the intent and purpose of such invalid or unenforceable provision, and (ii) the remainder of this Certificate of Designation and the application of such provision to other persons, entities or circumstances shall not be affected by such invalidity or unenforceability, nor shall such invalidity or unenforceability affect the validity or enforceability of such provision, or the application thereof, in any other jurisdiction.

16. Governing Law. The terms of this Certificate of Designation shall be governed by the laws of the State of Nevada, without regard to its conflicts-of-law principles.

In Witness Whereof, Greenfield Farms Food, Inc. has caused this Certificate of Designation to be duly executed in its corporate name on this 28th day of November 2017.

|

GREENFIELD FARMS FOOD, INC.: |

||

| By: | /s/ Ronald Heineman | |

|

|

Ronald Heineman |

|

|

Chief Executive Officer |

||

|

4 |