Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMERICAN WOODMARK CORP | ex9912017121.htm |

| EX-10.1 - EXHIBIT 10.1 - AMERICAN WOODMARK CORP | ex101-commitmentletter.htm |

| EX-2.1 - EXHIBIT 2.1 - AMERICAN WOODMARK CORP | ex21-mergeragreement.htm |

| 8-K - 8-K - AMERICAN WOODMARK CORP | amwd-121178k.htm |

American Woodmark’s

Acquisition of

RSI Home Products

December 1, 2017

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

2

Forward Looking Statements

This communication contains certain “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements as to the anticipated timing of completion of the proposed transaction, expected

cost synergies, future financial and operating results, and other expected effects of the proposed transaction. These forward-

looking statements may be identified by the use of words such as “anticipate,” “estimate,” “forecast,” “expect,” “believe,”

“should,” “could,” “would,” “plan,” “may,” “ intend,” “prospect,” “goal,” “will,” “predict,” or “potential” or other similar words

or variations thereof. These statements are based on the current beliefs and expectations of the management of American

Woodmark and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ

materially from those expressed herein. These risks and uncertainties include, but are not limited to, the occurrence of any

event, change or other circumstances that could give rise to the termination of the merger agreement or a delay in the

completion of the proposed transaction, a failure by either or both parties to satisfy conditions to closing, a failure to obtain

any required regulatory or third-party approvals, including any required antitrust approvals, the effect of the announcement

of the proposed transaction on the ability of American Woodmark and RSI to retain customers, maintain relationships with

their suppliers and hire and retain key personnel, American Woodmark’s ability to successfully integrate RSI into its business

and operations, and the risk that the economic benefits, costs savings and other synergies anticipated by American

Woodmark are not fully realized or take longer to realize than expected. Additional risks and uncertainties that could impact

American Woodmark’s future operations and financial results are contained in American Woodmark’s filings with the

Securities and Exchange Commission (“SEC”), including in its Annual Report on Form 10-K for the year ended April 30, 2017

under the heading “Risk Factors” and its most recent Quarterly Report on Form 10-Q for the period ended July 31, 2017 under

the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Forward Looking

Statements.” These reports, as well as the other documents filed by American Woodmark with the SEC, are available free of

charge at the SEC’s website at www.sec.gov.

Estimated Financial Information

This presentation includes certain estimated financial information, including, but not limited to, CY 2017 Adj. EBITDA Margin,

CY 2017 Revenue and CY 2017 Adj. EBITDA. This information, which incorporates actual, unaudited financial results through

October 31, 2017, in the case of American Woodmark, and September 30, 2017, in the case of RSI, represents estimates by

both RSI's management and American Woodmark's management as of the date of this release only. These estimates (i)

are based upon a number of assumptions and estimates that are inherently subject to business, economic and competitive

uncertainties and contingencies, many of which are beyond our control, (ii) are based upon certain specific assumptions with

respect to future business decisions, some of which will change, and (iii) are necessarily speculative in nature. Some or all

of the assumptions and estimates utilized may not materialize or may vary significantly from actual results. As a result,

investors are urged to put the estimated numbers provided in context and not to place undue reliance on them.

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

3

Today’s Presenters

Cary Dunston – Chairman and

Chief Executive Officer

Scott Culbreth – Sr. Vice President

and Chief Financial Officer

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

4

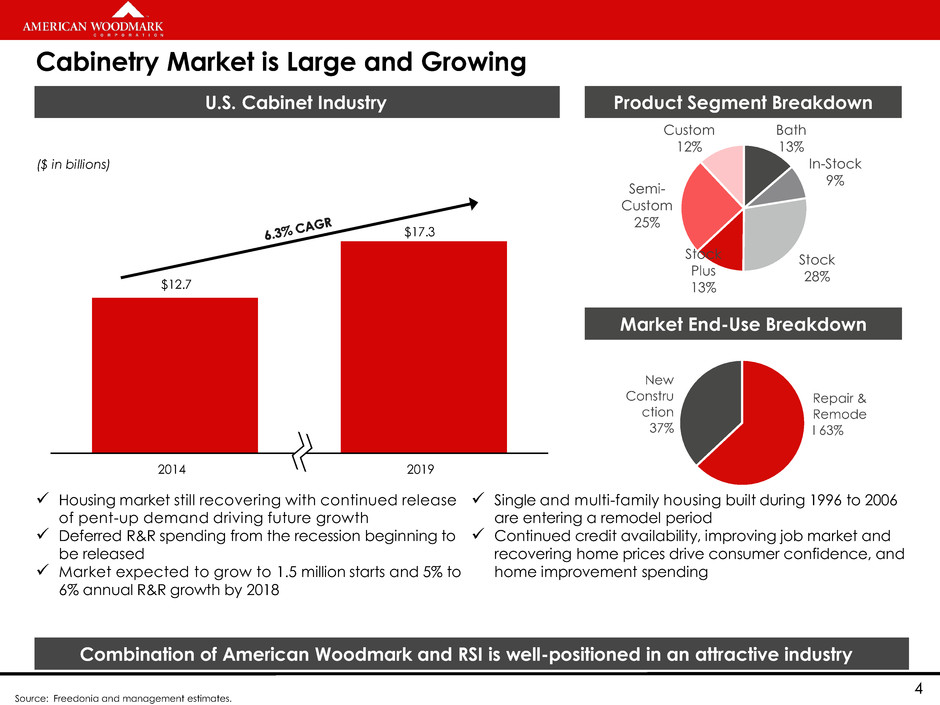

Cabinetry Market is Large and Growing

$12.7

$17.3

2014 2019

U.S. Cabinet Industry

($ in billions)

Housing market still recovering with continued release

of pent-up demand driving future growth

Deferred R&R spending from the recession beginning to

be released

Market expected to grow to 1.5 million starts and 5% to

6% annual R&R growth by 2018

Single and multi-family housing built during 1996 to 2006

are entering a remodel period

Continued credit availability, improving job market and

recovering home prices drive consumer confidence, and

home improvement spending

Combination of American Woodmark and RSI is well-positioned in an attractive industry

Source: Freedonia and management estimates.

Bath

13%

In-Stock

9%

Stock

28%

Stock

Plus

13%

Semi-

Custom

25%

Custom

12%

Product Segment Breakdown

Market End-Use Breakdown

Repair &

Remode

l 63%

New

Constru

ction

37%

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

5

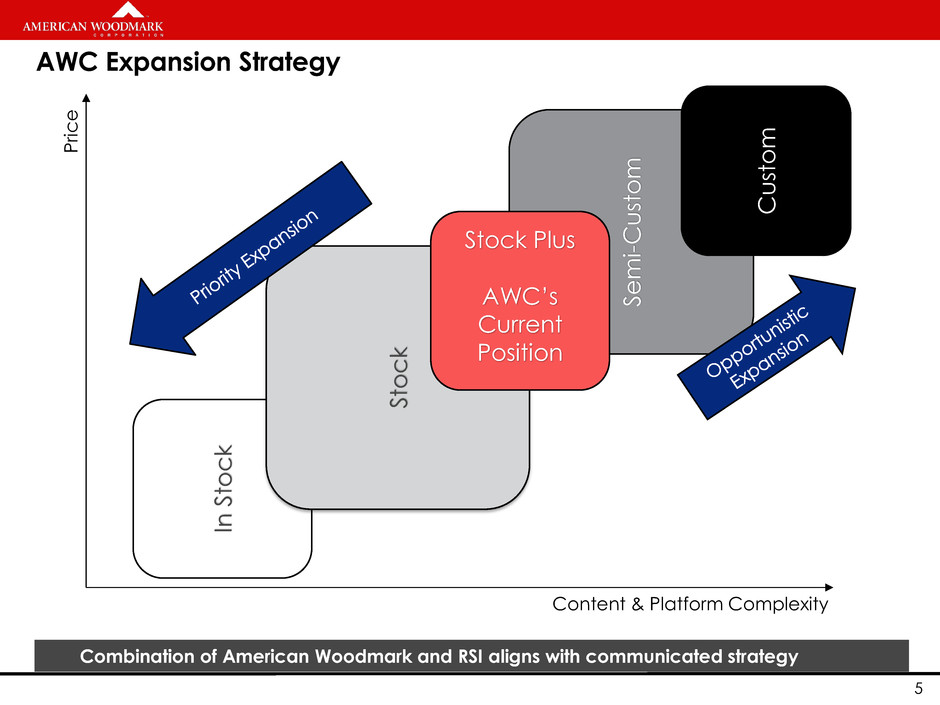

AWC Expansion Strategy

Combination of American Woodmark and RSI aligns with communicated strategy

P

ri

c

e

Content & Platform Complexity

In

S

toc

k

St

oc

k

Sem

i-

Cus

to

m

Cus

to

m

Stock Plus

AWC’s

Current

Position

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

6

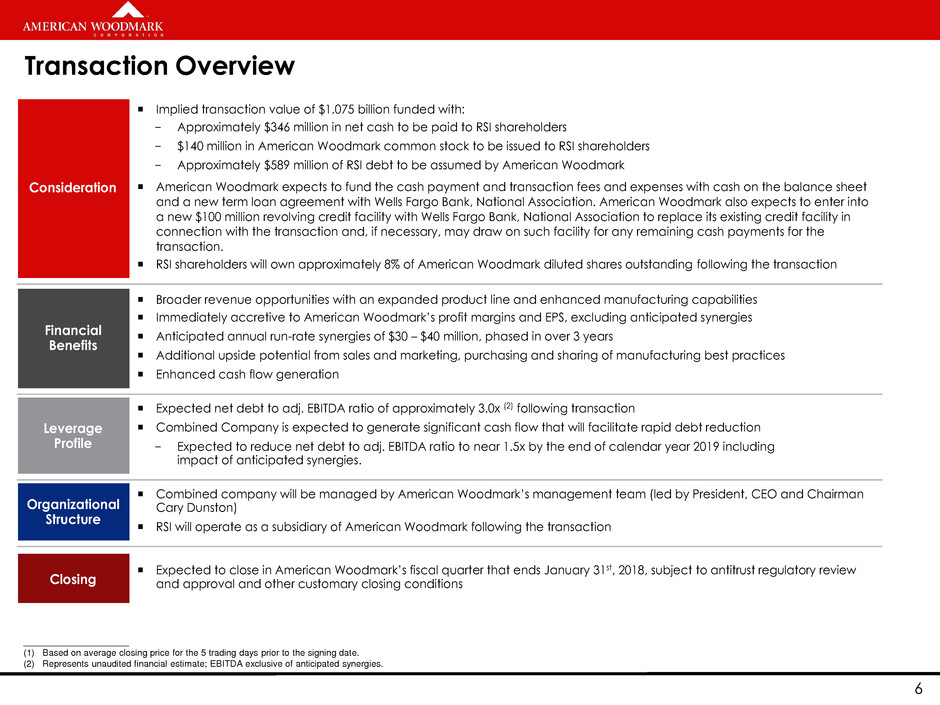

Transaction Overview

Consideration

¡ Implied transaction value of $1.075 billion funded with:

– Approximately $346 million in net cash to be paid to RSI shareholders

– $140 million in American Woodmark common stock to be issued to RSI shareholders

– Approximately $589 million of RSI debt to be assumed by American Woodmark

¡ American Woodmark expects to fund the cash payment and transaction fees and expenses with cash on the balance sheet

and a new term loan agreement with Wells Fargo Bank, National Association. American Woodmark also expects to enter into

a new $100 million revolving credit facility with Wells Fargo Bank, National Association to replace its existing credit facility in

connection with the transaction and, if necessary, may draw on such facility for any remaining cash payments for the

transaction.

¡ RSI shareholders will own approximately 8% of American Woodmark diluted shares outstanding following the transaction

Financial

Benefits

¡ Broader revenue opportunities with an expanded product line and enhanced manufacturing capabilities

¡ Immediately accretive to American Woodmark’s profit margins and EPS, excluding anticipated synergies

¡ Anticipated annual run-rate synergies of $30 – $40 million, phased in over 3 years

¡ Additional upside potential from sales and marketing, purchasing and sharing of manufacturing best practices

¡ Enhanced cash flow generation

Leverage

Profile

¡ Expected net debt to adj. EBITDA ratio of approximately 3.0x (2) following transaction

¡ Combined Company is expected to generate significant cash flow that will facilitate rapid debt reduction

– Expected to reduce net debt to adj. EBITDA ratio to near 1.5x by the end of calendar year 2019 including

impact of anticipated synergies.

Organizational

Structure

¡ Combined company will be managed by American Woodmark’s management team (led by President, CEO and Chairman

Cary Dunston)

¡ RSI will operate as a subsidiary of American Woodmark following the transaction

Closing

¡ Expected to close in American Woodmark’s fiscal quarter that ends January 31st, 2018, subject to antitrust regulatory review

and approval and other customary closing conditions

_____________________

(1) Based on average closing price for the 5 trading days prior to the signing date.

(2) Represents unaudited financial estimate; EBITDA exclusive of anticipated synergies.

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

7

RSI Home Products Inc.

A Proven Market Leader Within The

In-Stock and Value-Based Cabinetry Market

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

8

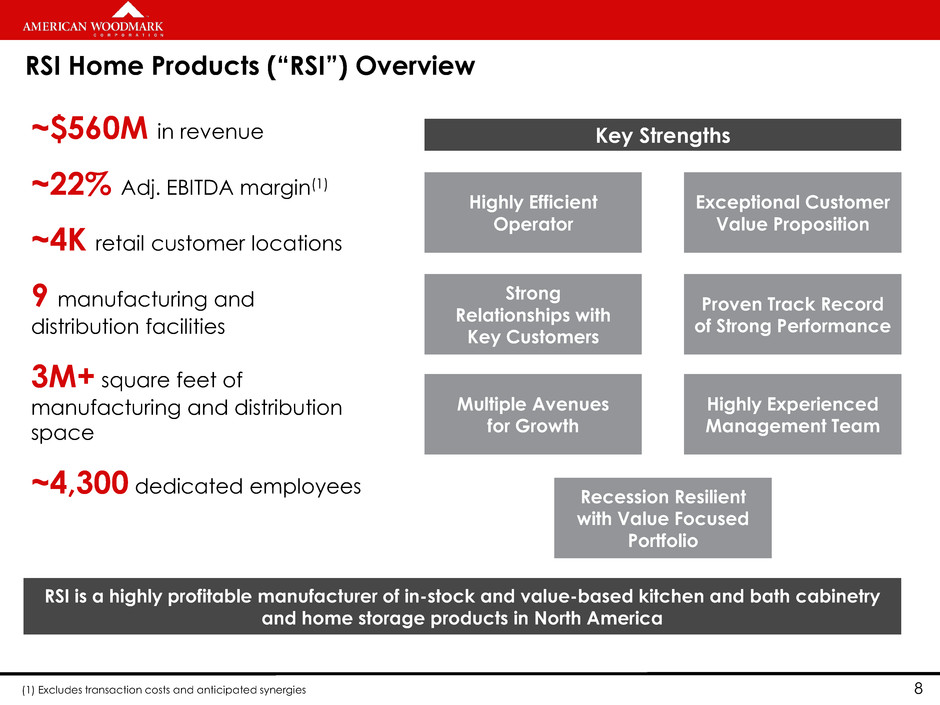

RSI Home Products (“RSI”) Overview

Key Strengths ~$560M in revenue

~22% Adj. EBITDA margin(1)

~4K retail customer locations

9 manufacturing and

distribution facilities

3M+ square feet of

manufacturing and distribution

space

~4,300 dedicated employees

Highly Efficient

Operator

Exceptional Customer

Value Proposition

Strong

Relationships with

Key Customers

Proven Track Record

of Strong Performance

Multiple Avenues

for Growth

Highly Experienced

Management Team

RSI is a highly profitable manufacturer of in-stock and value-based kitchen and bath cabinetry

and home storage products in North America

Recession Resilient

with Value Focused

Portfolio

(1) Excludes transaction costs and anticipated synergies

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

9

RSI’s Strong Reputation and Complementary Product Portfolio

Broad range of value-focused solutions for the Kitchen, Bath and Organization segments

Product

Category

Kitchen Solutions Bath Solutions Home Organization

Product

Offering

In-Stock Stock In-Stock Stock In-Stock

Kitchen cabinets

and accessories;

offering with basic

door styles, finishes

and box sizes

Frameless line

with broad

selection of door

styles, finishes,

drawer boxes

and accessories

Vanities, wood

medicine

cabinets, bath

storage cabinets,

vanity tops and

vanity / top

combination units

Vanities and tops;

broader selection

of sizes, finishes

and decorative

styles

Wall cabinets, closet systems and

garage storage products

Brands

Hampton Bay and Glacier Bay are a registered trademarks of The Home Depot. Home Decorators Collection is an exclusive brand of The Home Depot. Style Selections, Project Source and Blue Hawk

are registered trademarks of LF, LLC

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

10

The “New” American Woodmark

Improved diversification and positioned for growth

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

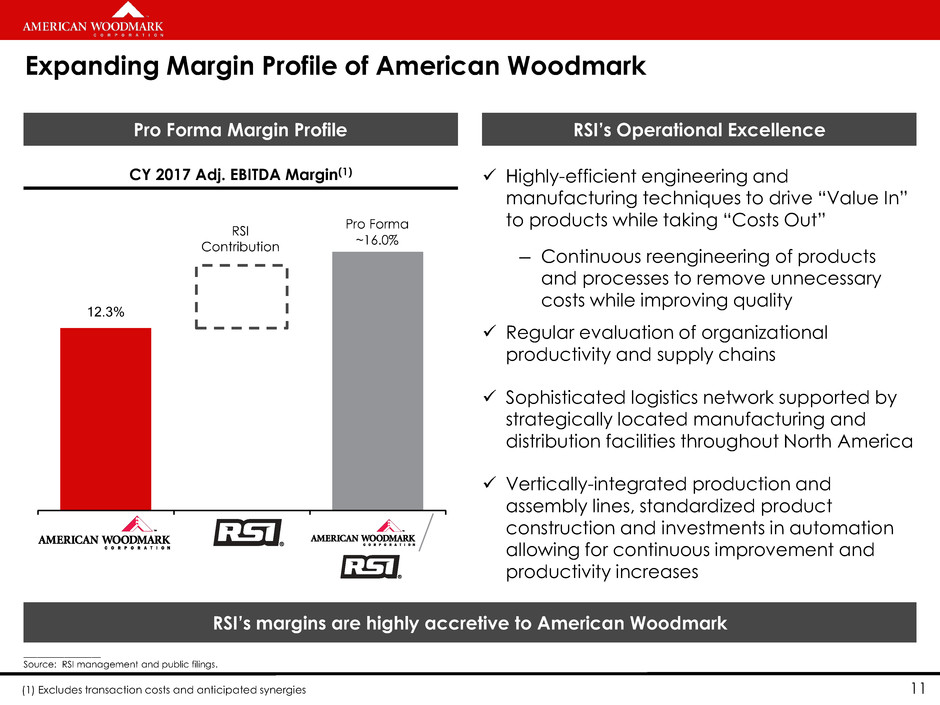

11

12.5%

11.8%

13.2%

Pro Forma

16.7%

Expanding Margin Profile of American Woodmark

Highly-efficient engineering and

manufacturing techniques to drive “Value In”

to products while taking “Costs Out”

― Continuous reengineering of products

and processes to remove unnecessary

costs while improving quality

Regular evaluation of organizational

productivity and supply chains

Sophisticated logistics network supported by

strategically located manufacturing and

distribution facilities throughout North America

Vertically-integrated production and

assembly lines, standardized product

construction and investments in automation

allowing for continuous improvement and

productivity increases

Pro Forma Margin Profile

CY 2017 Adj. EBITDA Margin(1)

RSI’s margins are highly accretive to American Woodmark

RSI’s Operational Excellence

_________________

Source: RSI management and public filings.

12.3%

RSI

Contribution

Pro Forma

~16.0%

(1) Excludes transaction costs and anticipated synergies

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

12

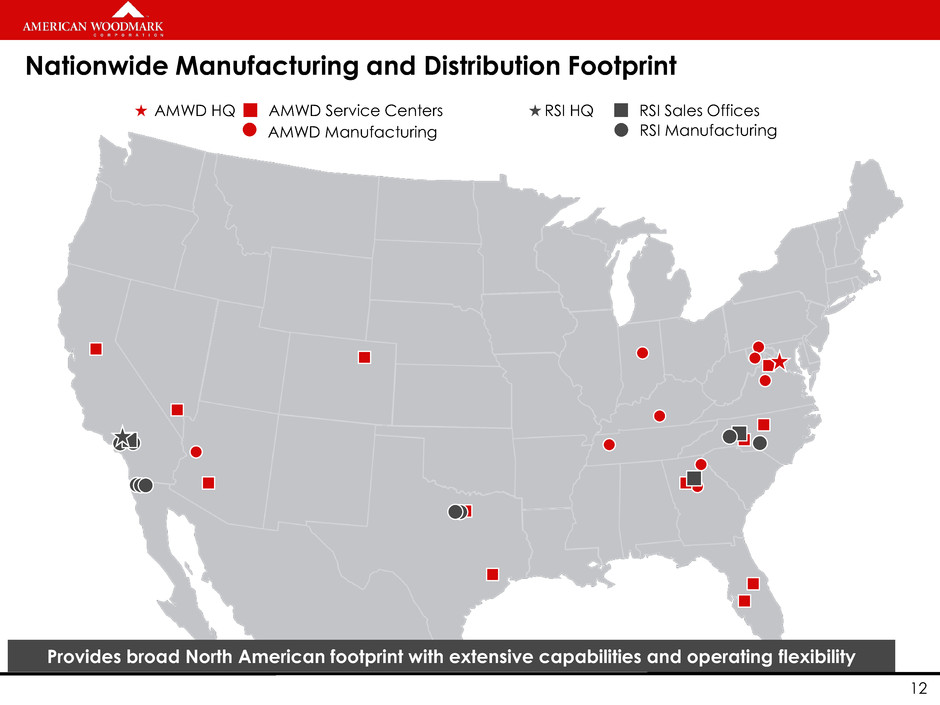

Nationwide Manufacturing and Distribution Footprint

AMWD Service Centers RSI Sales Offices AMWD HQ RSI HQ

AMWD Manufacturing

Provides broad North American footprint with extensive capabilities and operating flexibility

RSI Manufacturing

Map for Editing

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

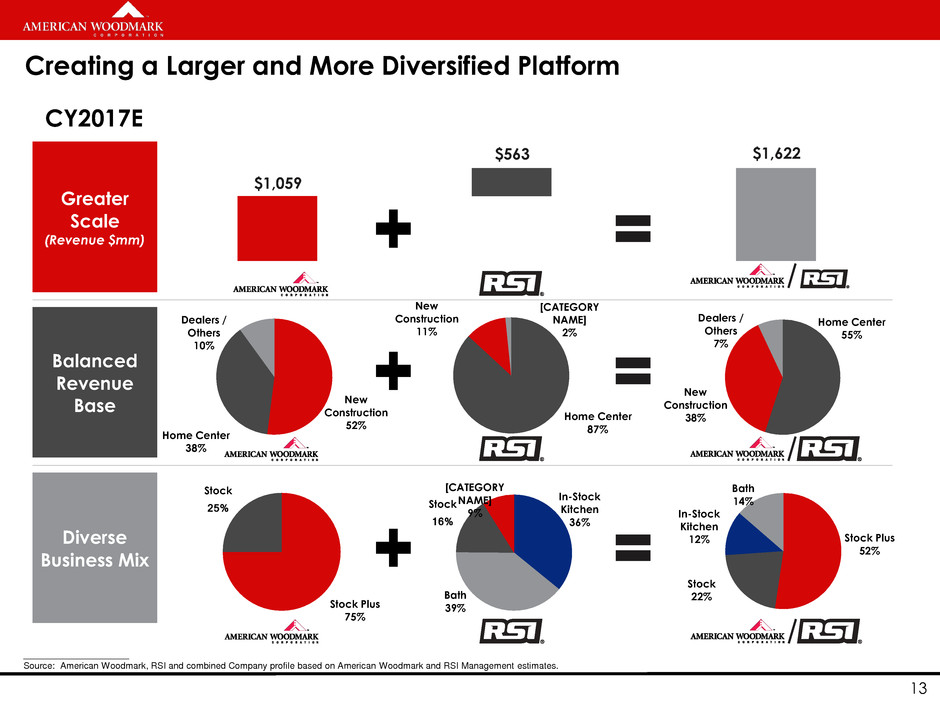

13

Greater

Scale

(Revenue $mm)

Balanced

Revenue

Base

Diverse

Business Mix

Home Center

55%

New

Construction

38%

Dealers /

Others

7%

Creating a Larger and More Diversified Platform

$1,059

$1,622 $563

_____________________

Source: American Woodmark, RSI and combined Company profile based on American Woodmark and RSI Management estimates.

Stock Plus

52%

Stock

22%

In-Stock

Kitchen

12%

Bath

14%

New

Construction

52%

Home Center

38%

Dealers /

Others

10%

Home Center

87%

New

Construction

11%

[CATEGORY

NAME]

2%

Stock Plus

75%

Stock

25%

In-Stock

Kitchen

36%

Bath

39%

Stock

16%

[CATEGORY

NAME]

9%

CY2017E

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

14

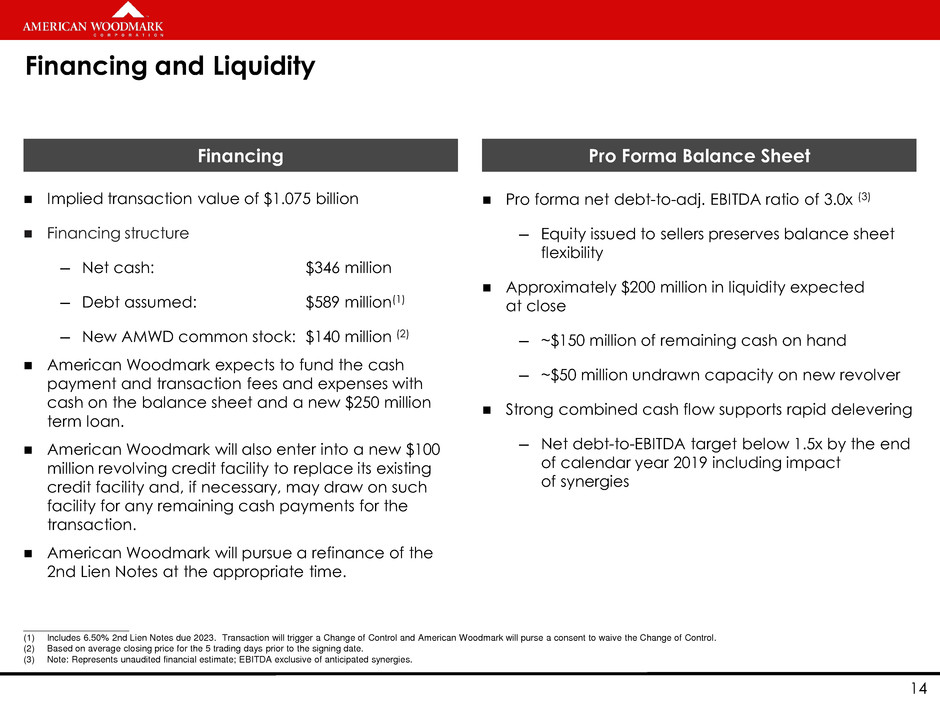

Financing and Liquidity

Pro Forma Balance Sheet Financing

Implied transaction value of $1.075 billion

Financing structure

― Net cash: $346 million

― Debt assumed: $589 million(1)

― New AMWD common stock: $140 million (2)

American Woodmark expects to fund the cash

payment and transaction fees and expenses with

cash on the balance sheet and a new $250 million

term loan.

American Woodmark will also enter into a new $100

million revolving credit facility to replace its existing

credit facility and, if necessary, may draw on such

facility for any remaining cash payments for the

transaction.

American Woodmark will pursue a refinance of the

2nd Lien Notes at the appropriate time.

Pro forma net debt-to-adj. EBITDA ratio of 3.0x (3)

― Equity issued to sellers preserves balance sheet

flexibility

Approximately $200 million in liquidity expected

at close

― ~$150 million of remaining cash on hand

― ~$50 million undrawn capacity on new revolver

Strong combined cash flow supports rapid delevering

― Net debt-to-EBITDA target below 1.5x by the end

of calendar year 2019 including impact

of synergies

_____________________

(1) Includes 6.50% 2nd Lien Notes due 2023. Transaction will trigger a Change of Control and American Woodmark will purse a consent to waive the Change of Control.

(2) Based on average closing price for the 5 trading days prior to the signing date.

(3) Note: Represents unaudited financial estimate; EBITDA exclusive of anticipated synergies.

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

15

Compelling Strategic Combination

Strategic combination will drive long-term shareholder value

(1) Excludes anticipated synergies.

Continued commitment to creating value through people

Solidifies American Woodmark’s position as an industry leader in cabinetry

Creates greater scale through a broader product and brand portfolio

Deepens relationships with key channel partners

Expands national footprint with low cost manufacturing and distribution

Strengthens operational expertise and manufacturing excellence

Shared focus on quality, value and customer satisfaction

Immediately accretive to American Woodmark’s margins and EPS (1)

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

16

13

212

6

6

23

65

39

71

71

71

147

149

152

5

42

125

140

10

10

17

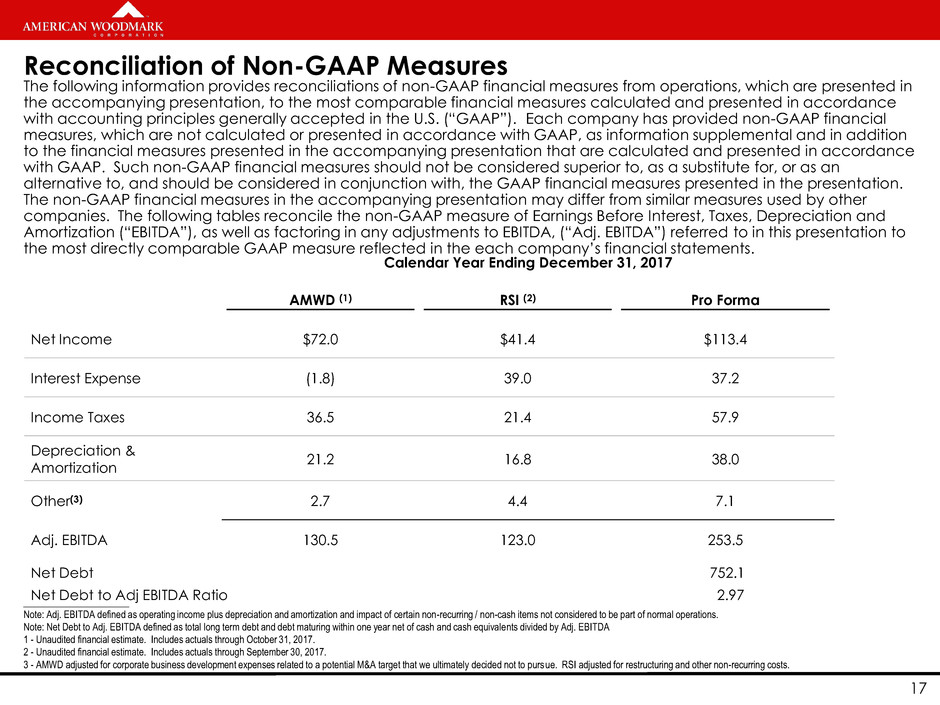

Calendar Year Ending December 31, 2017

AMWD (1) RSI (2) Pro Forma

Net Income $72.0 $41.4 $113.4

Interest Expense (1.8) 39.0 37.2

Income Taxes 36.5 21.4 57.9

Depreciation &

Amortization

21.2 16.8 38.0

Other(3) 2.7 4.4 7.1

Adj. EBITDA 130.5 123.0 253.5

Net Debt 752.1

Net Debt to Adj EBITDA Ratio 2.97

Reconciliation of Non-GAAP Measures

The following information provides reconciliations of non-GAAP financial measures from operations, which are presented in

the accompanying presentation, to the most comparable financial measures calculated and presented in accordance

with accounting principles generally accepted in the U.S. (“GAAP”). Each company has provided non-GAAP financial

measures, which are not calculated or presented in accordance with GAAP, as information supplemental and in addition

to the financial measures presented in the accompanying presentation that are calculated and presented in accordance

with GAAP. Such non-GAAP financial measures should not be considered superior to, as a substitute for, or as an

alternative to, and should be considered in conjunction with, the GAAP financial measures presented in the presentation.

The non-GAAP financial measures in the accompanying presentation may differ from similar measures used by other

companies. The following tables reconcile the non-GAAP measure of Earnings Before Interest, Taxes, Depreciation and

Amortization (“EBITDA”), as well as factoring in any adjustments to EBITDA, (“Adj. EBITDA”) referred to in this presentation to

the most directly comparable GAAP measure reflected in the each company’s financial statements.

_____________________

Note: Adj. EBITDA defined as operating income plus depreciation and amortization and impact of certain non-recurring / non-cash items not considered to be part of normal operations.

Note: Net Debt to Adj. EBITDA defined as total long term debt and debt maturing within one year net of cash and cash equivalents divided by Adj. EBITDA

1 - Unaudited financial estimate. Includes actuals through October 31, 2017.

2 - Unaudited financial estimate. Includes actuals through September 30, 2017.

3 - AMWD adjusted for corporate business development expenses related to a potential M&A target that we ultimately decided not to pursue. RSI adjusted for restructuring and other non-recurring costs.