Attached files

| file | filename |

|---|---|

| 8-K - YSTRATEGIES CORP. | mainbody.htm |

YSTRATEGIES CORP. INVESTOR PRESENTATION OTC MARKETS: YSTR ACCELERATION AND INNOVATION FOR DISRUPTIVE EARLY - STAGE TECHNOLOGIES IN CLEANTECH AND RENEWABLE ENERGY

FORWARD LOOKING STATEMENTS YSTRATEGIES CORP. INVESTOR PRESENTATION // 2 Certain statements in this presentation constitute forward - looking statements as defined in the U . S . Private Securities Litigation Reform Act of 1995 . Forward - looking statements reflect current views with respect to future events and financial performance and include any statement that does not directly relate to a current or historical fact . Such statements can generally be identified by the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “will” and similar words . Forward - looking statements made in this presentation include, but are not limited to, our plans and expectations regarding the economic environment in which we operate, market opportunities, treatment, referral and approval trends, growth strategies and performance goals . Forward - looking statements cannot be guaranteed and actual results may vary materially due to the uncertainties and risks, known and unknown, associated with such statements . Examples of risks and uncertainties for Ystrategies include, but are not limited to, the impact of emerging and existing competitors, the effect of new legislation on our industry and business, the effectiveness of our sales and marketing and cost control initiatives, changes to reimbursement programs, as well as other factors described from time to time in our reports to the Securities and Exchange Commission (including our most recent Annual Report on Form 10 - K, as amended from time to time, and subsequent reports on Form 10 - Q and Form 8 - K) . Investors should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or potentially inaccurate assumptions investors should take into account when making investment decisions . You should not place undue reliance on “forward - looking statements,” as such statements speak only as of the date of this presentation . We undertake no obligation to update any of these forward - looking statements .

WHO IS YSTRATEGIES ? • We are a publicly - traded venture capital holding company that develops , accelerates and supports clean technology and renewable energy businesses. • Formed in June 2016 • Our primary investment criteria : ‒ New or early - stage opportunities ‒ Disruptive technologies / valuable IP ‒ Large, emerging addressable markets ‒ Products or services that fill market gaps • Ystrategies’ value - add : ‒ Innovation, experience and capital ‒ Acceleration of the commercialization cycle • Identify, attract and secure customers • Develop strategic partners • Corporate development support ‒ Deep and broad industry relationships ‒ Leadership with a proven, long - term track record YSTRATEGIES CORP. INVESTOR PRESENTATION // 3

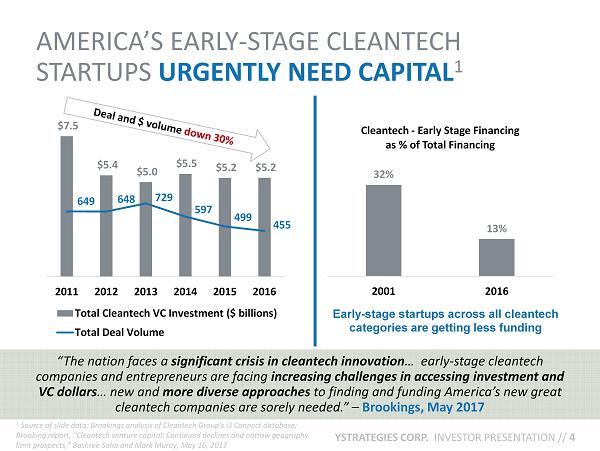

AMERICA’S EARLY - STAGE CLEANTECH STARTUPS URGENTLY NEED CAPITAL 1 YSTRATEGIES CORP. INVESTOR PRESENTATION // 4 1 Source of slide data: Brookings analysis of Cleantech Group's i3 Connect database; Brooking report, “Cleantech venture capital: Continued declines and narrow geography limit prospects,” Bashree Saha and Mark Muroy , May 16, 2017 Early - stage startups across all cleantech categories are getting less funding $7.5 $5.4 $5.0 $5.5 $5.2 $5.2 649 648 729 597 499 455 2011 2012 2013 2014 2015 2016 Total Cleantech VC Investment ($ billions) Total Deal Volume 32% 13% 2001 2016 Cleantech - Early Stage Financing as % of Total Financing “The nation faces a significant crisis in cleantech innovation … early - stage cleantech companies and entrepreneurs are facing increasing challenges in accessing investment and VC dollars … new and more diverse approaches to finding and funding America’s new great cleantech companies are sorely needed.” – Brookings, May 2017

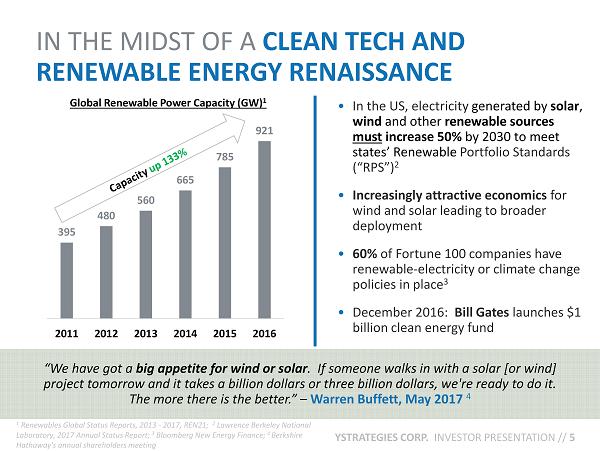

395 480 560 665 785 921 2011 2012 2013 2014 2015 2016 • In the US, electricity generated by solar , wind and other renewable sources must increase 50% by 2030 to meet states’ Renewable Portfolio Standards (“RPS”) 2 • Increasingly attractive economics for wind and solar leading to broader deployment • 60% of Fortune 100 companies have renewable - electricity or climate change policies in place 3 • December 2016: Bill Gates launches $1 billion clean energy fund “We have got a big appetite for wind or solar . If someone walks in with a solar [or wind] project tomorrow and it takes a billion dollars or three billion dollars, we're ready to do it. The more there is the better.” – Warren Buffett, May 2017 4 IN THE MIDST OF A CLEAN TECH AND RENEWABLE ENERGY RENAISSANCE YSTRATEGIES CORP. INVESTOR PRESENTATION // 5 1 Renewables Global Status Reports, 2013 - 2017, REN21; 2 Lawrence Berkeley National Laboratory, 2017 Annual Status Report; 3 Bloomberg New Energy Finance; 4 Berkshire Hathaway's annual shareholders meeting Global Renewable Power Capacity (GW) 1

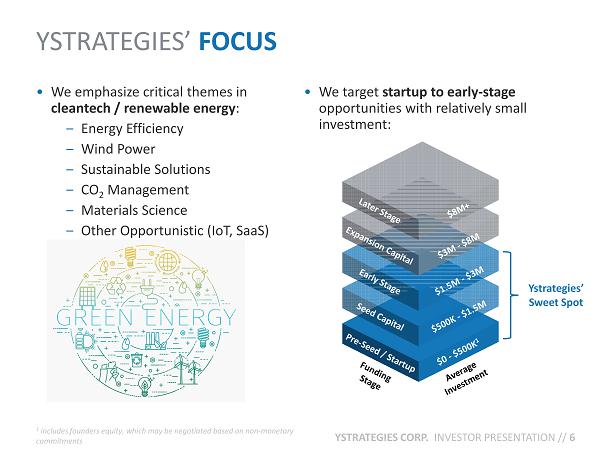

YSTRATEGIES’ FOCUS • We emphasize critical themes in cleantech / renewable energy : ‒ Energy Efficiency ‒ Wind Power ‒ Sustainable Solutions ‒ CO 2 Management ‒ Materials Science ‒ Other Opportunistic (IoT, SaaS) YSTRATEGIES CORP. INVESTOR PRESENTATION // 6 Ystrategies’ Sweet Spot 1 includes founders equity, which may be negotiated based on non - monetary commitments • We target startup to early - stage opportunities with relatively small investment:

Wisdom and Execution Combined – More than 200 Years of Collective Experience: GROUND FLOOR OPPORTUNITY TO INVEST WITH ACCOMPLISHED INDUSTRY VETERANS YSTRATEGIES CORP. INVESTOR PRESENTATION // 7 * For leadership bios, see appendix Executive Title Years of Experience Jim Kiles Founder & Chief Executive Officer 35+ Ashish Badjatia Chief Operating Officer 25+ Andrea Kates Chief Innovation Officer 20+ Neil Cohen Vice President, Marketing and Business Development 35+ Shirley Gee Senior Venture Partner 25+ Jon Sigerman Startup Coach and Strategic Advisor 35+

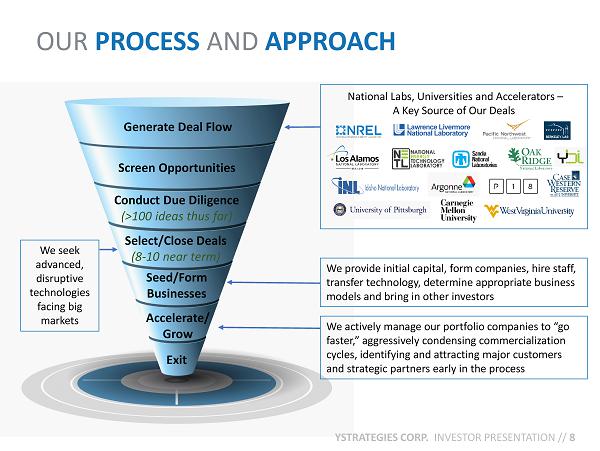

Generate Deal Flow Screen Opportunities Conduct Due Diligence (>100 ideas thus far) Select/Close Deals (8 - 10 near term) Exit Accelerate/ Grow Seed/Form Businesses OUR PROCESS AND APPROACH YSTRATEGIES CORP. INVESTOR PRESENTATION // 8 National Labs, Universities and Accelerators – A Key Source of Our Deals We seek advanced, disruptive technologies facing big markets We provide initial capital, form companies, hire staff, transfer technology, determine appropriate business models and bring in other investors We actively manage our portfolio companies to “go faster,” aggressively condensing commercialization cycles, identifying and attracting major customers and strategic partners early in the process

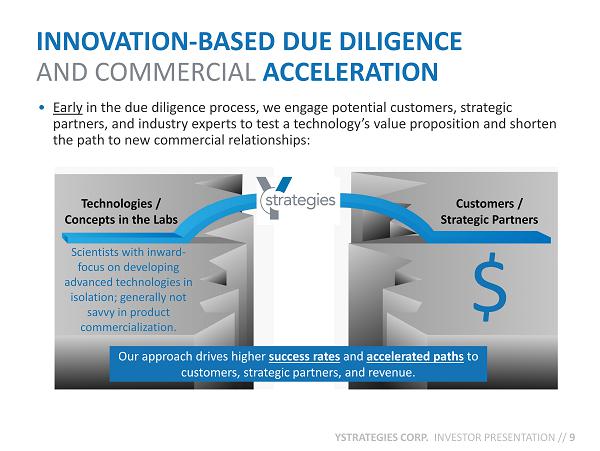

INNOVATION - BASED DUE DILIGENCE AND COMMERCIAL ACCELERATION YSTRATEGIES CORP. INVESTOR PRESENTATION // 9 • Early in the due diligence process, we engage potential customers, strategic partners, and industry experts to test a technology’s value proposition and shorten the path to new commercial relationships: Technologies / Concepts in the Labs Scientists with inward - focus on developing advanced technologies in isolation; generally not savvy in product commercialization. Customers / Strategic Partners $ Our approach drives higher success rates and accelerated paths to customers, strategic partners, and revenue.

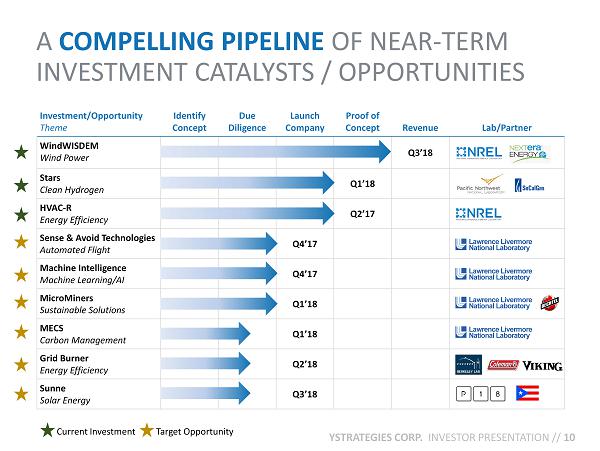

A COMPELLING PIPELINE OF NEAR - TERM INVESTMENT CATALYSTS / OPPORTUNITIES YSTRATEGIES CORP. INVESTOR PRESENTATION // 10 Investment/Opportunity Theme Identify Concept Due Diligence Launch Company Proof of Concept Revenue Lab/Partner WindWISDEM Wind Power Q3’18 Stars Clean Hydrogen Q1’18 HVAC - R Energy Efficiency Q2’17 Sense & Avoid Technologies Automated Flight Q4’17 Machine Intelligence Machine Learning/AI Q4’17 MicroMiners Sustainable Solutions Q1’18 MECS Carbon Management Q1’18 Grid Burner Energy Efficiency Q2’18 Sunne Solar Energy Q3’18 Current Investment Target Opportunity

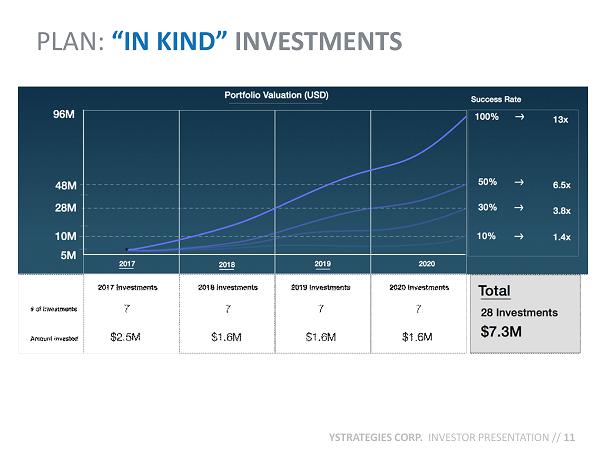

PLAN: “IN KIND” INVESTMENTS YSTRATEGIES CORP. INVESTOR PRESENTATION // 11

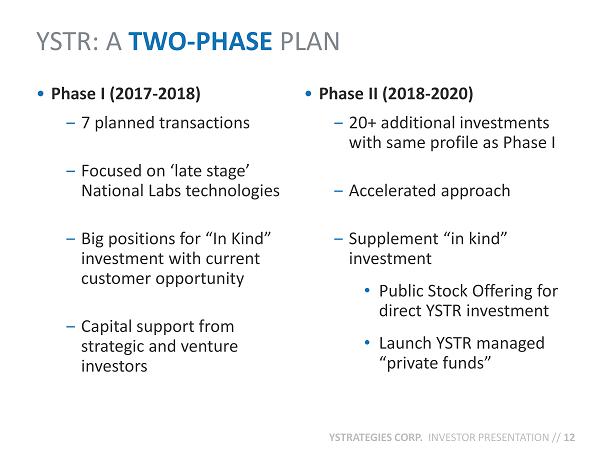

YSTR: A TWO - PHASE PLAN YSTRATEGIES CORP. INVESTOR PRESENTATION // 12 • Phase I (2017 - 2018) ‒ 7 planned transactions ‒ Focused on ‘late stage’ National Labs technologies ‒ Big positions for “In Kind” investment with current customer opportunity ‒ Capital support from strategic and venture investors • Phase II (2018 - 2020) ‒ 20+ additional investments with same profile as Phase I ‒ Accelerated approach ‒ Supplement “in kind” investment • Public Stock Offering for direct YSTR investment • Launch YSTR managed “private funds”

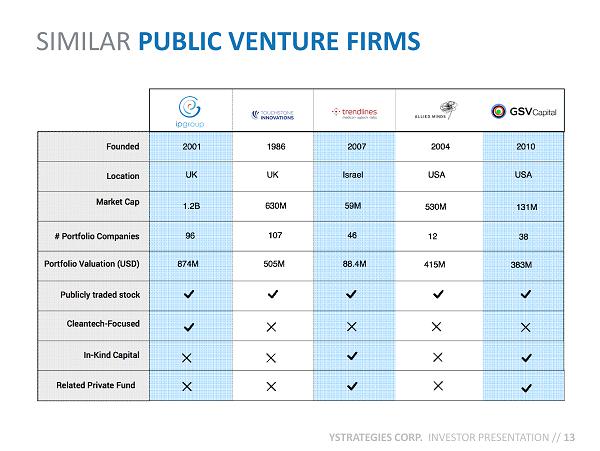

SIMILAR PUBLIC VENTURE FIRMS YSTRATEGIES CORP. INVESTOR PRESENTATION // 13

LAUNCH, INVEST, SELL CONSIDERATIONS YSTRATEGIES CORP. INVESTOR PRESENTATION // 14 • Launch : Early engagement with National Labs and incubator teams and technologies ‒ Concept development ‒ Formation strategies ‒ Commercialization and partnerships • Investment : Process control ‒ Investments made at Founding Stage after extensive commercialization due diligence ‒ Ystrategies in control of team; early focus on IP ‒ Identify and bring in co - investors ‒ Investment premised on technology advantage and clear path to quality strategic partnership ‒ Ystrategies able to take founder’s position at 40 - 50% ‒ Capital staged in agile methodology from minimal option commitment through larger $ at strategic partner/customer stage • Sell : ‒ Process driven by early, partial exit plans to empower team, enable new investors (strategic and financial), secure capital ‒ After initial sales additional exits are 100% driven by maximizing returns

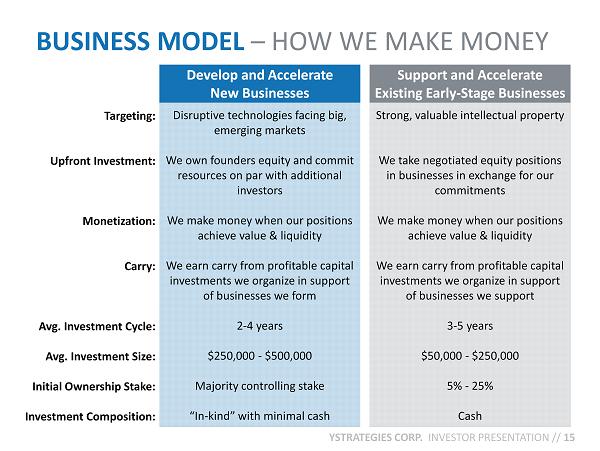

BUSINESS MODEL – HOW WE MAKE MONEY YSTRATEGIES CORP. INVESTOR PRESENTATION // 15 Disruptive technologies facing big, emerging markets We own founders equity and commit resources on par with additional investors We make money when our positions achieve value & liquidity We earn carry from profitable capital investments we organize in support of businesses we form 2 - 4 years $250,000 - $500,000 Majority controlling stake “In - kind” with minimal cash Strong, valuable intellectual property We take negotiated equity positions in businesses in exchange for our commitments We make money when our positions achieve value & liquidity We earn carry from profitable capital investments we organize in support of businesses we support 3 - 5 years $50,000 - $250,000 5% - 25% Cash Develop and Accelerate New Businesses Support and Accelerate Existing Early - Stage Businesses Targeting: Upfront Investment: Monetization: Carry: Avg. Investment Cycle: Avg. Investment Size: Initial Ownership Stake: Investment Composition:

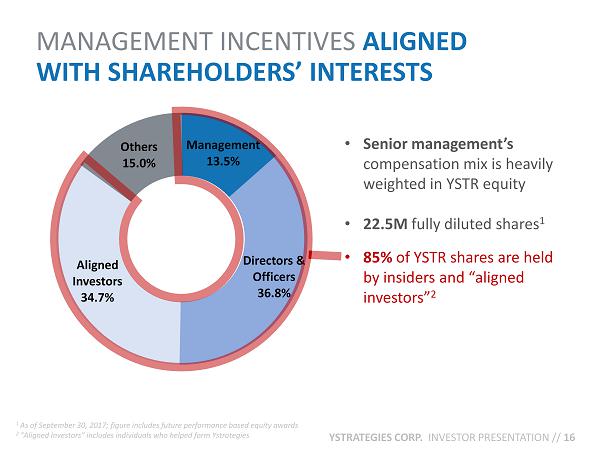

Management 13.5% Directors & Officers 36.8% Aligned Investors 34.7% Others 15.0% MANAGEMENT INCENTIVES ALIGNED WITH SHAREHOLDERS’ INTERESTS YSTRATEGIES CORP. INVESTOR PRESENTATION // 16 • Senior management’s compensation mix is heavily weighted in YSTR equity • 22.5M fully diluted shares 1 • 85% of YSTR shares are held by insiders and “aligned investors” 2 1 As of September 30, 2017; figure includes future performance based equity awards 2 “Aligned Investors” includes individuals who helped form Ystrategies

YSTRATEGIES CORP. INVESTOR PRESENTATION // 17 Jim Kile s – Founder & CEO • 35+ years of experience identifying, funding, building, managing a nd monetizing technologies and business startups • Former Managing Director for Enabling Technology Investments, Intel Capital • Investor, advisor, executive: Angel Investors, Eyetide Media, Living Networks, Visage Mobile, Cloudmark, SAFE, GroudControl Solutions • Member, Lawrence Livermore National Laboratory Industrial Advisory Board; Instructor, U.S. Department of Energy’s Lab - Corps (Ene rgy I - Corps) • Representative exits (IPO and/or Acquisition): Akamai, Williams Communications, Digital Island, Sightpath, Loudeye, Juno, iB eam , Convera Ashish Badjatia – COO • 20+ years of experience developing and managing small public companies • Former CEO and Founder of India Ecommerce, an internet software business focused on commerce opportunities between the U.S. a nd India • Former investment banker, Morgan Stanley - India Neil Cohen – Vice President, Marketing & Business Develoment • 35+ years of creating, building and managing brands for hundreds of companies, from startups to Fortune 500 corporations • Sales & marketing executive roles and consulting experience: Yahoo!, Pyramid Brewing, Blue Shield, Friendster, Alibaba, Hilto n, Arby’s, SEGA • Silicon - Valley Liaison/Mentor for Startup Mexico; Founder, Campsix , an eBusiness incubator; Marketing Lecturer, San Francisco State University Shirley Gee – Senior Venture Partner • 25+ years of executive - level experience in the entrepreneurship environment and investor ecosystem • Former Executive Staff Member and Department Head with Stanford University’s international research laboratory • Technical Advisory Committee Member, CalSeed ; Accredited Investor within the Keiretsu Forum Jon Sigerman – Director Systems Engineering, Wind Technology Group • 35+ years of experience as software company engineer, entrepreneur and executive as well as trial and appellate court litigat ion attorney • Former CEO and Co - Founder of Summation Legal Technologies, developer of litigation - support desktop, LAN and enterprise software products • BS, Mathematics, UCLA; MS, Mathematics, University of California; Riverside; JD, University of California, Hastings College o f t he Law. Paul Overby – Vice President, Strategy • 35+ years of experience as U.S. diplomat in the Middle East, executive in Bombardier’s rail business, start - up founder, and earl y - stage investor • Strategist for Wabtec Corporation • BA, Yale University; MBA, Harvard University SUCCESSFUL INVESTMENT TEAM

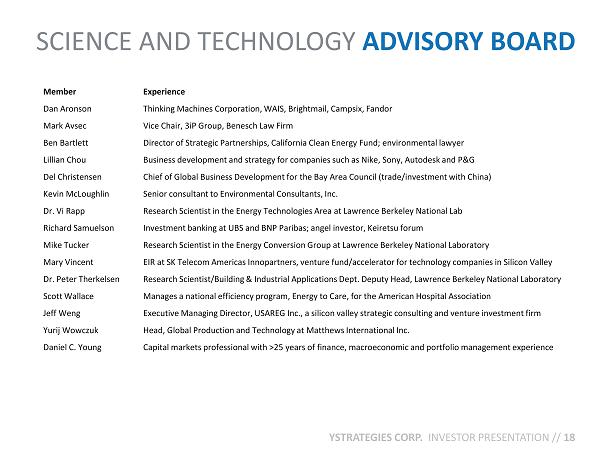

SCIENCE AND TECHNOLOGY ADVISORY BOARD YSTRATEGIES CORP. INVESTOR PRESENTATION // 18 Member Experience Dan Aronson Thinking Machines Corporation, WAIS, Brightmail , Campsix , Fandor Mark Avsec Vice Chair, 3iP Group, Benesch Law Firm Ben Bartlett Director of Strategic Partnerships, California Clean Energy Fund; environmental lawyer Lillian Chou Business development and strategy for companies such as Nike, Sony, Autodesk and P&G Del Christensen Chief of Global Business Development for the Bay Area Council (trade/investment with China) Kevin McLoughlin Senior consultant to Environmental Consultants, Inc. Dr. Vi Rapp Research Scientist in the Energy Technologies Area at Lawrence Berkeley National Lab Richard Samuelson Investment banking at UBS and BNP Paribas; angel investor, Keiretsu forum Mike Tucker Research Scientist in the Energy Conversion Group at Lawrence Berkeley National Laboratory Mary Vincent EIR at SK Telecom Americas Innopartners , venture fund/accelerator for technology companies in Silicon Valley Dr. Peter Therkelsen Research Scientist/Building & Industrial Applications Dept. Deputy Head, Lawrence Berkeley National Laboratory Scott Wallace Manages a national efficiency program, Energy to Care, for the American Hospital Association Jeff Weng Executive Managing Director, USAREG Inc., a silicon valley strategic consulting and venture investment firm Yurij Wowczuk Head, Global Production and Technology at Matthews International Inc. Daniel C. Young Capital markets professional with >25 years of finance, macroeconomic and portfolio management experience

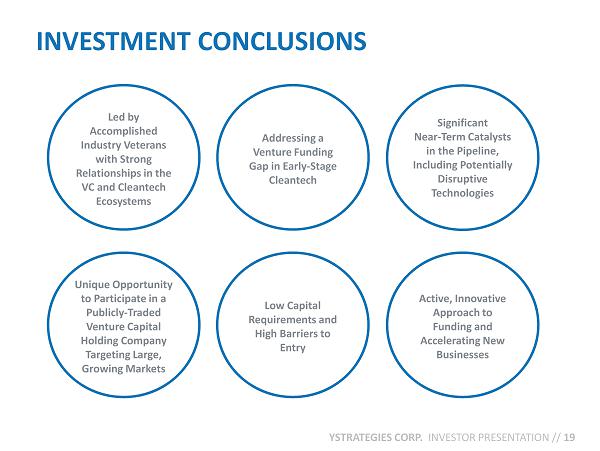

INVESTMENT CONCLUSIONS YSTRATEGIES CORP. INVESTOR PRESENTATION // 19 Led by Accomplished Industry Veterans with Strong Relationships in the VC and Cleantech Ecosystems Addressing a Venture Funding Gap in Early - Stage Cleantech Unique Opportunity to Participate in a Publicly - Traded Venture Capital Holding Company Targeting Large, Growing Markets Low Capital Requirements and High Barriers to Entry Active, Innovative Approach to Funding and Accelerating New Businesses Significant Near - Term Catalysts in the Pipeline, Including Potentially Disruptive Technologies

Kalle Ahl, CFA (212) 836 - 9614 kahl@equityny.com Devin Sullivan (212) 836 - 9608 dsullivan@equityny.com Jim Kiles, Founder and CEO jim@ystrategies.com Neil Cohen, VP Marketing & Bus. Dev. neil@ystrategies.com Ashish Badjatia, COO ashish@ystrategies.com