Attached files

| file | filename |

|---|---|

| 8-K - RAYONIER ADVANCED MATERIALS INC. | 8kbody.htm |

2017 Leverage Finance Conference November 29, 2017 Exhibit 99.1

Safe Harbor Certain statements in this document regarding anticipated financial, business, legal or other outcomes including business and market conditions, outlook and other similar statements relating to Rayonier Advanced Materials’ future events, developments, or financial or operational performance or results, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “should,” “expect,” “estimate,” “believe,” “intend,” “forecast,” “anticipate,” “guidance,” and other similar language. However, the absence of these or similar words or expressions does not mean a statement is not forward-looking. While we believe these forward-looking statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance these expectations will be attained and it is possible actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties.Such risks and uncertainties include, but are not limited to: competitive pressures in the markets in which we operate, especially with respect to increases in supply and pressures on demand for our products, which impact pricing; our ability to complete our announced cost and debt reduction initiatives and objectives within the planned parameters and achieve the anticipated benefits; our customer concentration, especially with our three largest customers; changes in global economic conditions, including currency; the Chinese dumping duties currently in effect for commodity viscose pulps; potential legal, regulatory and similar challenges relating to our permitted air emissions and waste water discharges from our facilities by non-governmental groups and individuals; the effect of current and future environmental laws and regulations as well as changes in circumstances on the cost and estimated future cost of required environmental expenditures; the potential impact of future tobacco-related restrictions; potential for additional pension contributions; labor relations with the unions representing our hourly employees; the effect of weather and other natural conditions; changes in transportation-related costs and availability; the failure to attract and retain key personnel; the failure to innovate to maintain our competitiveness, grow our business and protect our intellectual property; uncertainties related to the availability of additional financing to us in the future and the terms of such financing; our inability to make or effectively integrate current and future acquisitions and engage in certain other corporate transactions; any failure to realize expected benefits from our separation from Rayonier Inc.; risks related to our acquisition of Tembec Inc., including the failure to obtain the anticipated benefits and synergies from the acquisition and the impact of additional debt incurred and equity issued to finance the acquisition; financial and other obligations under agreements relating to our debt; and uncertainties relating to general economic, political, and regulatory conditions. Other important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements that may have been made in this document are described or will be described in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Rayonier Advanced Materials assumes no obligation to update these statements except as is required by law. 2

Non-GAAP Financial Measures These presentation materials contain certain non-GAAP financial measures, including EBITDA, adjusted free cash flows, pro forma operating income, pro forma net income and adjusted net debt. These non-GAAP measures are reconciled to each of their respective most directly comparable GAAP financial measures in the appendix of these presentation materials.We believe these non-GAAP measures provide useful information to our board of directors, management and investors regarding certain trends relating to our financial condition and results of operations. Our management uses these non-GAAP measures to compare our performance to that of prior periods for trend analyses, purposes of determining management incentive compensation and budgeting, forecasting and planning purposes. We do not consider these non-GAAP measures an alternative to financial measures determined in accordance with GAAP. The principal limitations of these non-GAAP financial measures are that they may exclude significant expenses and income items that are required by GAAP to be recognized in our consolidated financial statements. In addition, they reflect the exercise of management’s judgment about which expenses and income items are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, management provides reconciliations of the non-GAAP financial measures we use to their most directly comparable GAAP measures. Non-GAAP financial measures should not be relied upon, in whole or part, in evaluating the financial condition, results of operations or future prospects of the Company. 3

Rayonier Advanced Materials Global leader in high purity cellulose products, including cellulose specialties (CS)Only producer with five CS manufacturing lines in US, Canada and EuropeDiversified product offerings with integrated forest products, paper pulp, paperboard and newsprint businessesLTM Pro forma Revenue of $2.0 billion*LTM Pro forma EBITDA of ~$400 million*; including $50 million of expected synergies by 2020 4 NYSE-listed (“RYAM”) with 90 years of operating history * LTM Revenues and EBITDA based on fiscal quarter ended June 2017, based on USD/CAD exchange rate of 0.7540

6 $108 million of Cost Improvement since 2014Targeting additional $32 million of savings by end of 2018 Utilize assets to optimize existing products and market mixTarget $10-15 million of EBITDA in 2-3 years Leverage knowledge and history of innovation towards new marketsTarget $20-40 million of EBITDA in next 5 years Drives Growth and Shareholder Value Target investments that leverage core capabilities to grow and diversify businessIntegrate Tembec with $50 million of targeted synergies by 2020

Acquisition of Tembec Inc. 6 Strategic Opportunity Summary On November 17, 2017, Rayonier Advanced Materials acquired Tembec Inc. (“Tembec”) in a transaction valued at approximately $870 million+, including $481 million+ of assumed net debtTembec is a manufacturer of forest products, including High Purity Cellulose*, lumber, paper pulp, paperboard, and is a global leader in sustainable forest practicesThe combination of Rayonier Advanced Materials and Tembec will meaningfully enhance scale and diversify earnings and create growth opportunities through complementary products, operations and geographiesThe combined company has revenue and adjusted EBITDA for the twelve month period ended June 24, 2017 of $2.0 billion and $408 million**, respectivelyTotal initial leverage of 3.6x, based on LTM EBITDA and pro forma capital structure++ + In USD, USD/CAD exchange rate of 0.7540 and RYAM stock price of $15.17* High Purity Cellulose includes fluff and dissolving wood pulp (“DWP”) grades, including cellulose specialties (“CS”)** LTM Revenues and EBITDA based on fiscal quarter ended June 2017, based on USD/CAD exchange rate of 0.7540 ++ see page 12 for pro forma capital structure

Compelling Strategic and Financial Rationale 7 A Diversified High Purity Cellulose, Packaging, Paper and ForestProducts Company Complementary product offerings and technical capabilities across High Purity Cellulose gradesAdditional growth opportunities in packaging and forest productsProduct and geographic diversificationStronger, more balanced business with greater scale to drive growthShared vision on safety, operational excellence and environmental stewardship Revenue: ~$2.0 billion* Adjusted EBITDA: ~$400 million*Annual Run-Rate Cost Synergies: $50 million expected to be achieved over 3 yearsIncremental EBITDA benefits of at least $15 million from accelerated capital investmentImmediately accretive to EPSPurchase price of 4.3x LTM EBITDA with full synergies+ (5.6x pre-synergies)Moderate pro forma leverage of 3.6x before synergies * LTM Revenues and EBITDA based on fiscal quarter ended June 2017, based on USD/CAD exchange rate of 0.7540++ Includes $50 million of annual run-rate cost synergies but excludes $15 million benefit of accelerated capital investment

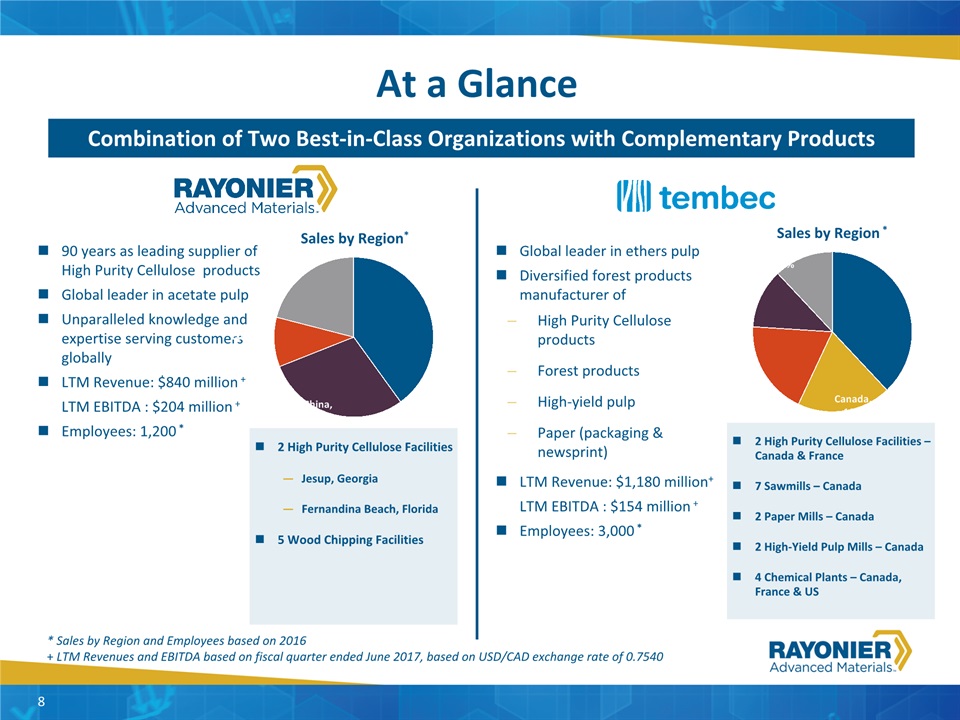

Granite Considerations---Granite Overview 8 At a Glance * Sales by Region and Employees based on 2016 + LTM Revenues and EBITDA based on fiscal quarter ended June 2017, based on USD/CAD exchange rate of 0.7540 90 years as leading supplier of High Purity Cellulose productsGlobal leader in acetate pulpUnparalleled knowledge and expertise serving customers globallyLTM Revenue: $840 million + LTM EBITDA : $204 million +Employees: 1,200 * Global leader in ethers pulp Diversified forest products manufacturer of High Purity Cellulose products Forest products High-yield pulpPaper (packaging & newsprint) LTM Revenue: $1,180 million+ LTM EBITDA : $154 million +Employees: 3,000 * Sales by Region * 2 High Purity Cellulose Facilities – Canada & France7 Sawmills – Canada2 Paper Mills – Canada2 High-Yield Pulp Mills – Canada4 Chemical Plants – Canada, France & US Sales by Region* 2 High Purity Cellulose Facilities Jesup, GeorgiaFernandina Beach, Florida5 Wood Chipping Facilities Combination of Two Best-in-Class Organizations with Complementary Products

Granite Considerations---Granite Overview 9 Integrated and Complementary Businesses Packaging & Newsprint Forest Products High-Yield Pulp PackagingMultiply Coated BoardNewsprintBook Paper Dimensional LumberFraming Materials Wood ChipsFuel (Chips, Sawdust,Shavings & Bark) Mechanical Hardwood Pulp(Maple & Aspen) High Purity Cellulose Products End Markets Dissolving Wood Pulp AcetateEthersSpecialtiesViscoseFluff Pulp

Granite Considerations---Granite Overview 10 Expanded Global Presence Increases geographical diversity and mitigates currency risk Rayonier Advanced Materials High Purity Cellulose Plant Fiber Facility Marketing & Research Center Sales Office Tembec High Purity Cellulose Facility Other Manufacturing Facility Other Pulp Facility SPF Lumber Facility Sales Office Headquarters Headquarters Sales and Research

Pro Forma EBITDApre-synergies Granite Considerations---Granite Overview 11 Diversified and Attractive Product Portfolio* * Based on Fiscal 2016, In USD, USD/CAD exchange rate of 0.7540 ~$2.0 billion ~$350 million+ High-Purity Cellulose Packaging & Newsprint High-Yield Pulp Forest Products Pro Forma Revenue RYAM Revenue Tembec Revenue Acetate Pulp EtherPulp Other CS Pulp Commodity & Other Packaging & Newsprint High-Yield Pulp Forest Products EtherPulp Other CS Pulp Commodity & Other Acetate Pulp Acetate Pulp Commodity & Other Other CS Pulp EtherPulp 3%

Acquisition Financing Pro Forma Capital Structure ($ in millions) Debt Amount Amount Term Interest Rate New Term Loan A-1 $ 230 2022 L + 2.25% New Term Loan A-2 $ 450 2024 L + 2.00%+ Other Secured Debt* $ 100 Various Various Senior Notes $ 506 2024 5.5% Total Debt $ 1,286 * Estimate+ Net of Cash Patronage 12 Balanced and Flexible Capital Structure Covenant** Estimated pro forma June 2017 Covenant Net Secured Leverage Covenant++ 2.2x <3.0x Interest Coverage Ratio 6.0x >3.0x Total Leverage 3.6x N/A ** Based on LTM Revenues and EBITDA based on fiscal quarter ended June 2017 and on USD/CAD exchange rate of 0.7540,++ assumes $100 million of cash on balance sheet

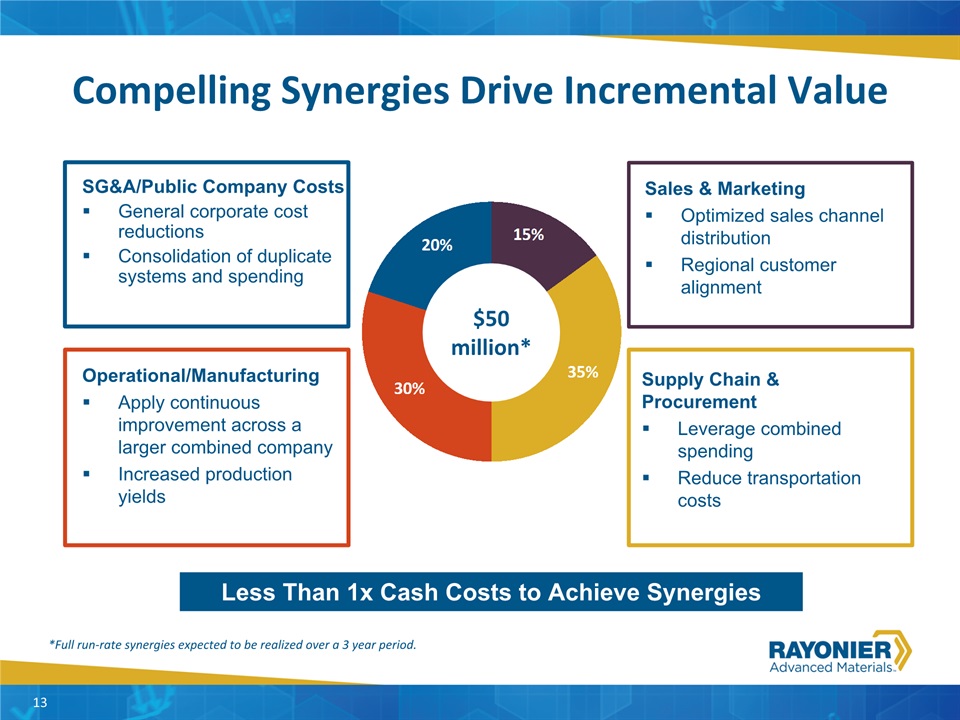

Granite Considerations---Granite Overview 13 Compelling Synergies Drive Incremental Value SG&A/Public Company CostsGeneral corporate cost reductionsConsolidation of duplicate systems and spending Supply Chain & ProcurementLeverage combined spendingReduce transportation costs Operational/ManufacturingApply continuous improvement across a larger combined companyIncreased production yields Less Than 1x Cash Costs to Achieve Synergies *Full run-rate synergies expected to be realized over a 3 year period. Sales & MarketingOptimized sales channel distributionRegional customer alignment $50 million*

Granite Considerations---Granite Overview 14 Combination Drives Successful Earnings Growth Enhanced scale drives ability to execute growth strategySuperior capabilities in high purity celluloseDiversified paper and forest products profileExpansion of cost transformation initiativeSignificant high return capital project opportunitiesAcceleration of product innovation