Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DARLING INGREDIENTS INC. | dar-20171129x8k.htm |

BofAML Leveraged

Finance Conference

Presentation

November 2017

Exhibit 99.1

1

Date

Safe Harbor Statement

This presentation contains “forward-looking” statements regarding the business operations and prospects of Darling Ingredients Inc. (the “Company”) and industry factors affecting

it. These statements are identified by words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “could,” “may,” “will,” “should,” “planned,” “potential,” “continue,”

“momentum,” and other words referring to events that may occur in the future. These statements reflect the Company’s current view of future events and are based on its

assessment of, and are subject to, a variety of risks and uncertainties beyond its control, each of which could cause actual results to differ materially from those indicated in the

forward-looking statements. These factors include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make

their cash flow available to the Company for payments on the Company's indebtedness or other purposes; global demands for bio-fuels and grain and oilseed commodities, which

have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products;

reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or

other factors, reduced volume from food service establishments, or otherwise; reduced demand for animal feed; reduced finished product prices, including a decline in fat and

used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas emissions that adversely affect programs like

the Renewable Fuel Standards Program, low carbon fuel standards (“LCFS”) and tax credits for biofuels both in the Unites States and abroad; possible product recall resulting from

developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of Bird Flu including, but not limited to H5N1 flu, bovine spongiform

encephalopathy ("BSE"), porcine epidemic diarrhea ("PED") or other diseases associated with animal origin in the United States or elsewhere; unanticipated costs and/or reductions

in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign (including, without limitation, China) regulations affecting the

industries in which the Company operates or its value added products (including new or modified animal feed, Bird Flu, PED or BSE or similar or unanticipated regulations); risks

associated with the renewable diesel plant in Norco, Louisiana owned and operated by a joint venture between Darling Ingredients and Valero Energy Corporation, including

possible unanticipated operating disruptions and issues related to the announced expansion project; difficulties or a significant disruption in our information systems or failure to

implement new systems and software successfully, including our ongoing enterprise resource planning project; risks relating to possible third party claims of intellectual property

infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-sponsored defined benefit pension plans as required by

legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and

registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere; uncertainty regarding the likely exit of the U.K. from the European Union;

and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, climate conditions, currency exchange fluctuations, general

performance of the U.S. and global economies, disturbances in world financial, credit, commodities and stock markets, and any decline in consumer confidence and discretionary

spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could negatively impact the Company's

results of operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may

have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or discontinued at any time and purchases of

shares under the program are subject to market conditions and other factors, which are likely to change from time to time. Other risks and uncertainties regarding the Company, its

business and the industries in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. The Company is under no

obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

This presentation includes estimates of industry data and forecasts that have been obtained from industry publications and surveys or internal company sources. Estimates

regarding any industry data presented in this presentation, in particular as they relate to market share, size and growth rates and general expectations, involve risks and

uncertainties and are subject to change based on various factors. We cannot guarantee the accuracy or completeness of such information contained in this presentation.

The financial information in this presentation includes financial information that is not presented in accordance with generally accepted accounting principles (“GAAP”). Non-GAAP

financial measures may be considered in addition to GAAP financial information, but should not be used as substitutes for the corresponding GAAP measures. Non-GAAP measures

in this presentation may be calculated in a way that is not comparable to similarly titled measures reported by other companies. See the Appendix of this presentation for a

reconciliation between GAAP and these non-GAAP measures.

2

Date

Company & Segment Overview

CREATING SUSTAINABLE FOOD, FEED, AND FUEL INGREDIENTS

FOR A GROWING POPULATION

3

Date

Our Strategy

…thus generating substantial cash flow and

growing shareholder value.

We seek to BUILD, ACQUIRE and DEVELOP businesses within geographies

where we can achieve a sustainable Top 3 market position within 5 years…

To be the Global Leader

in the production of high quality

sustainable protein and nutrient-recovered ingredients.

markets to satisfy a growing population.

FOOD

FEED

FUEL

Supplying ingredients for the

4

Date

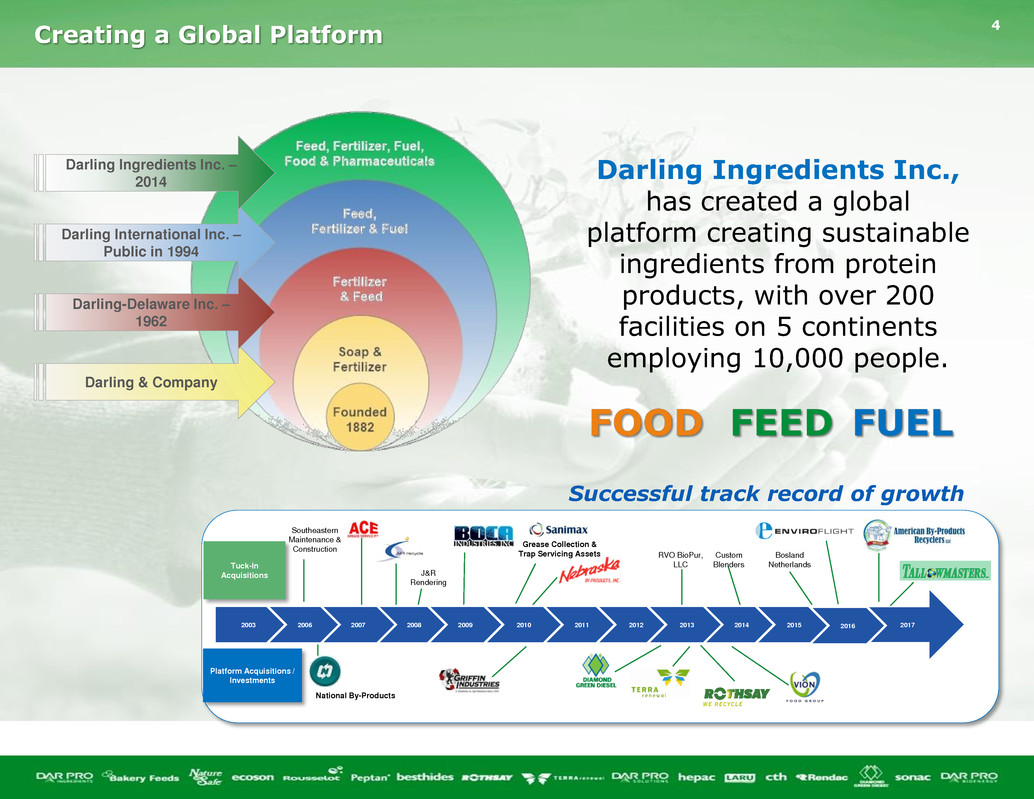

Creating a Global Platform

Darling & Company

Darling-Delaware Inc. –

1962

Darling International Inc. –

Public in 1994

Darling Ingredients Inc. –

2014

Southeastern

Maintenance &

Construction

2003 2006 2008 2010 2017

Tuck-In

Acquisitions

Platform Acquisitions /

Investments

2011 2012 2013 2014

J&R

Rendering

National By-Products

Grease Collection &

Trap Servicing Assets

201520092007

Bosland

Netherlands

Custom

Blenders

RVO BioPur,

LLC

Successful track record of growth

2016

Darling Ingredients Inc.,

has created a global

platform creating sustainable

ingredients from protein

products, with over 200

facilities on 5 continents

employing 10,000 people.

5

Date

With Population Growth and Wealth Creation…

...better nutrition evolves, and meat proteins

become a staple in the global diet

Source: Company, based on multiple population data reports

Source: Food & Agriculture Organization of the United Nations;

Organization for Economic Competitionand Development (forecast)

FORECAST

Africa

India

Latin America

Asia-Pacific

Europe

No. America

6

Date

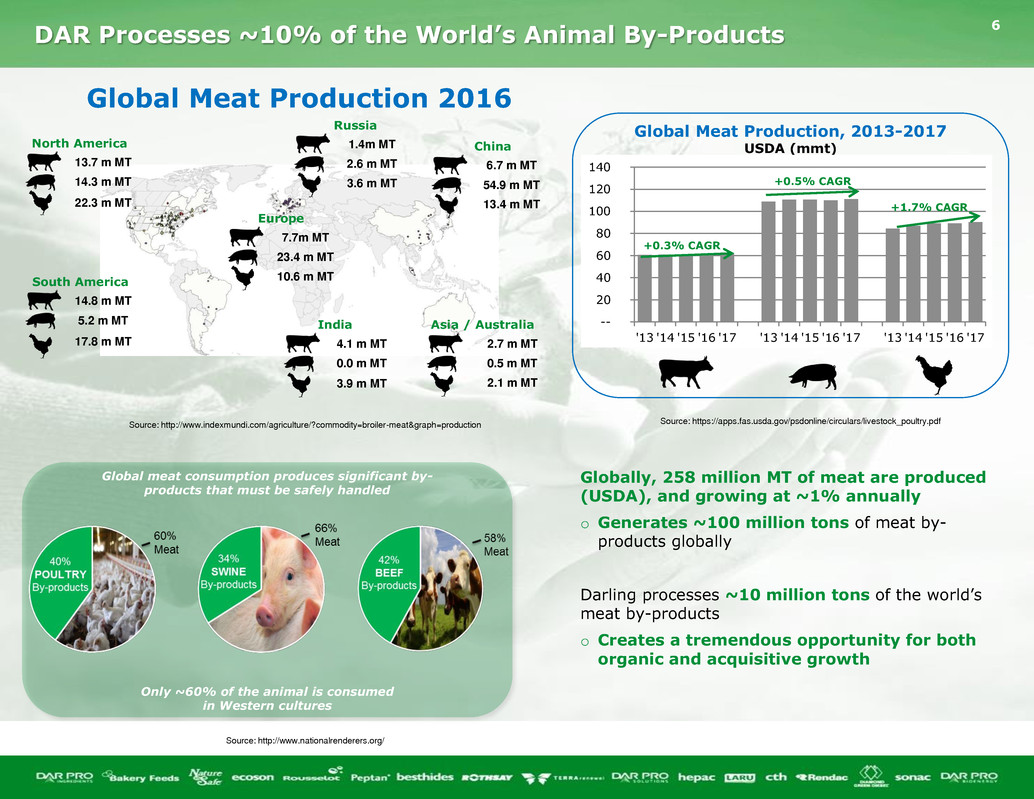

DAR Processes ~10% of the World’s Animal By-Products

Global Meat Production 2016

13.7 m MT

14.3 m MT

22.3 m MT

North America

14.8 m MT

5.2 m MT

17.8 m MT

South America

4.1 m MT

0.0 m MT

3.9 m MT

India

2.7 m MT

0.5 m MT

2.1 m MT

Asia / Australia

6.7 m MT

54.9 m MT

13.4 m MT

China1.4m MT

2.6 m MT

3.6 m MT

Russia

7.7m MT

23.4 m MT

10.6 m MT

Europe

Global Meat Production, 2013-2017

USDA (mmt)

Global meat consumption produces significant by-

products that must be safely handled

Globally, 258 million MT of meat are produced

(USDA), and growing at ~1% annually

o Generates ~100 million tons of meat by-

products globally

Darling processes ~10 million tons of the world’s

meat by-products

o Creates a tremendous opportunity for both

organic and acquisitive growth

Only ~60% of the animal is consumed

in Western cultures

--

20

40

60

80

100

120

140

'13 '14 '15 '16 '17 '13 '14 '15 '16 '17 '13 '14 '15 '16 '17

+0.3% CAGR

+0.5% CAGR

+1.7% CAGR

Source: https://apps.fas.usda.gov/psdonline/circulars/livestock_poultry.pdfSource: http://www.indexmundi.com/agriculture/?commodity=broiler-meat&graph=production

Source: http://www.nationalrenderers.org/

7

Date

Darling Has a Diversified and Unique Portfolio

Processed 1.08 million metric tons

of raw material in 2016

$1.1bn revenue, $131mm Adj. EBITDA

Processed 1.18 million metric tons

of raw material in 2016

$247mm revenue, $58mm Adj. EBITDA,

$87mm DAR share of DGD Adj. EBITDA

Processed 7.97 million metric tons

of raw material in 2016

$2.1bn revenue, $295mm Adj. EBITDA

Restaurant Services

8

Date

A defined model of identified and managed risk

Fee for Service

•Competition

•Government

regulations

Commodity Exposed

• Fat price

•Soymeal price

•Corn Price

Spread Managed

Margin

•Raw material

availability

• Food demand

• Pharma demand

Shared Margin

• Fat price

• Poultry meal pet food

spread price

BUSINESS DRIVERS

9

Date

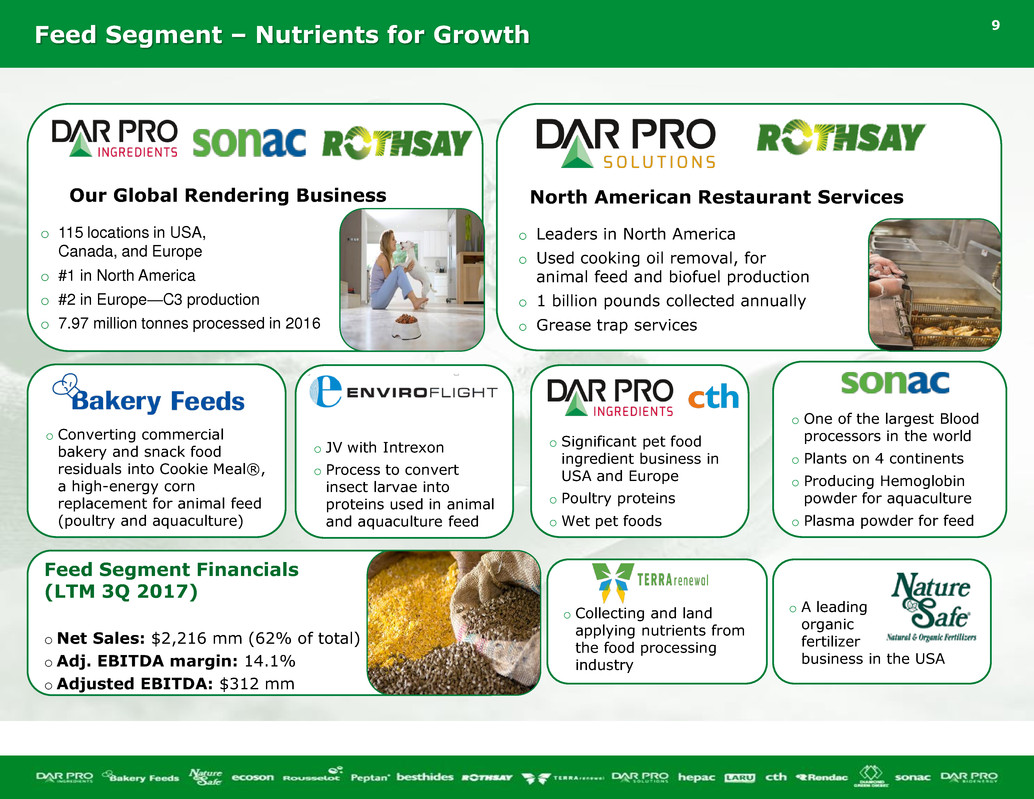

Feed Segment – Nutrients for Growth

o Converting commercial

bakery and snack food

residuals into Cookie Meal®,

a high-energy corn

replacement for animal feed

(poultry and aquaculture)

o Leaders in North America

o Used cooking oil removal, for

animal feed and biofuel production

o 1 billion pounds collected annually

o Grease trap services

o Collecting and land

applying nutrients from

the food processing

industry

o JV with Intrexon

o Process to convert

insect larvae into

proteins used in animal

and aquaculture feed

Feed Segment Financials

(LTM 3Q 2017)

o Net Sales: $2,216 mm (62% of total)

o Adj. EBITDA margin: 14.1%

o Adjusted EBITDA: $312 mm

o A leading

organic

fertilizer

business in the USA

North American Restaurant Services

o One of the largest Blood

processors in the world

o Plants on 4 continents

o Producing Hemoglobin

powder for aquaculture

o Plasma powder for feed

Our Global Rendering Business

o 115 locations in USA,

Canada, and Europe

o #1 in North America

o #2 in Europe—C3 production

o 7.97 million tonnes processed in 2016

o Significant pet food

ingredient business in

USA and Europe

o Poultry proteins

o Wet pet foods

10

Date

EBITDA Bridge Q3-2016 to Q3-2017

(millions)

Feed Segment Performance

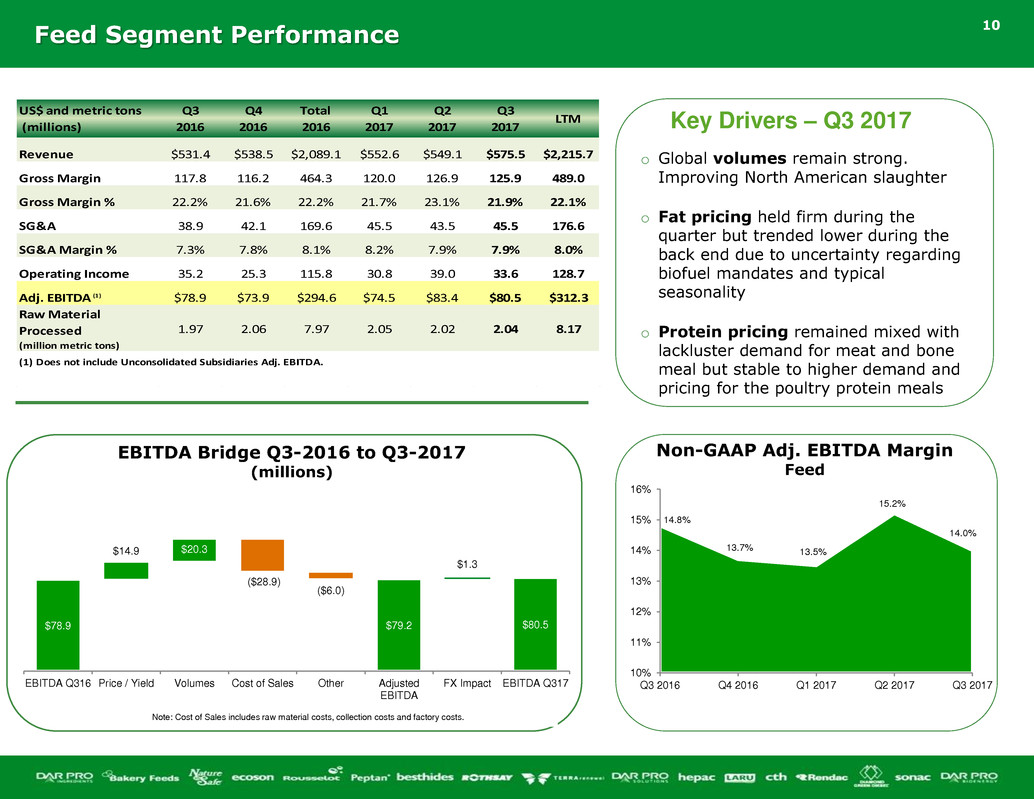

Key Drivers – Q3 2017

o Global volumes remain strong.

Improving North American slaughter

o Fat pricing held firm during the

quarter but trended lower during the

back end due to uncertainty regarding

biofuel mandates and typical

seasonality

o Protein pricing remained mixed with

lackluster demand for meat and bone

meal but stable to higher demand and

pricing for the poultry protein meals

US$ and metric tons

(millions)

Q3

2016

Q4

2016

Total

2016

Q1

2017

Q2

2017

Q3

2017

LTM

Revenue $531.4 $538.5 $2,089.1 $552.6 $549.1 $575.5 $2,215.7

Gross Margin 117.8 116.2 464.3 120.0 126.9 125.9 489.0

Gross Margin % 22.2% 21.6% 22.2% 21.7% 23.1% 21.9% 22.1%

SG&A 38.9 42.1 169.6 45.5 43.5 45.5 176.6

SG&A Margin % 7.3% 7.8% 8.1% 8.2% 7.9% 7.9% 8.0%

Operating Income 35.2 25.3 115.8 30.8 39.0 33.6 128.7

Adj. EBITDA (1) $78.9 $73.9 $294.6 $74.5 $83.4 $80.5 $312.3

Raw Material

Processed

(million metric tons)

1.97 2.06 7.97 2.05 2.02 2.04 8.17

(1) Does not include U consolidated Subsidiaries Adj. EBITDA.

Non-GAAP Adj. EBITDA Margin

Feed

10%

11%

12%

13%

14%

15%

16%

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

$78.9 $79.2 $80.5

$14.9 $20.3

($28.9)

($6.0)

$1.3

EBITDA Q316 Price / Yield Volumes Cost of Sales Other Adjusted

EBITDA

FX Impact EBITDA Q317

14.8%

13.7% 13.5%

15.2%

14.0%

Note: Cost of Sales includes raw material costs, collection costs and factory costs.

11

Date

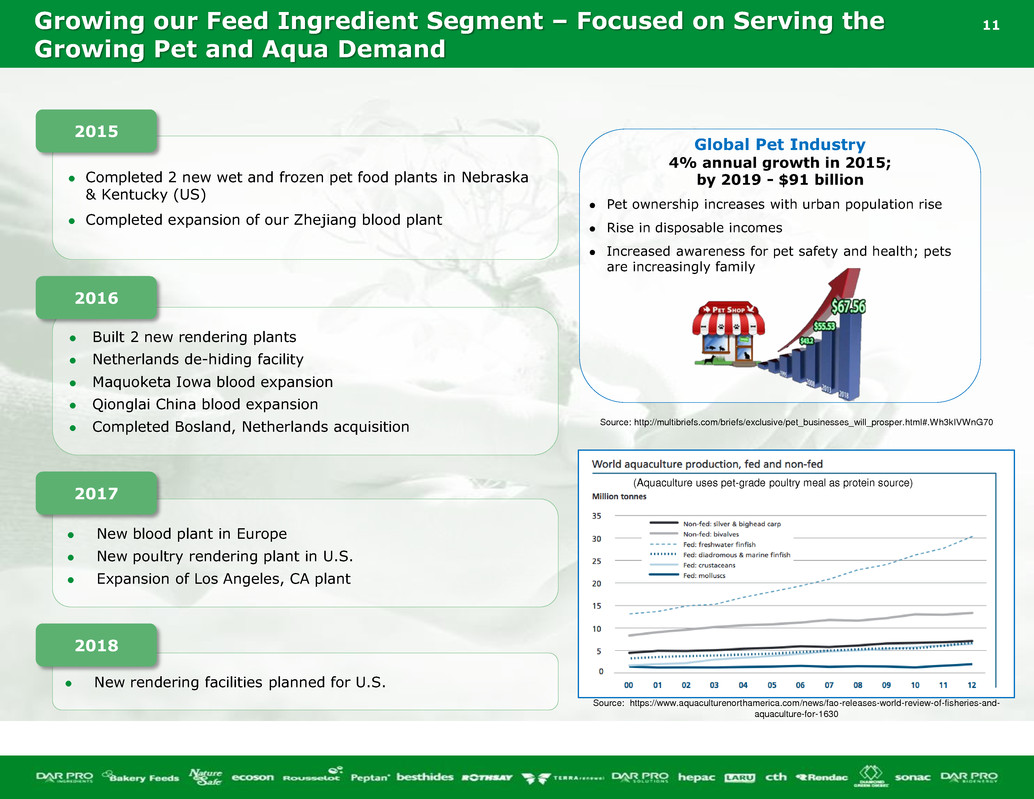

Growing our Feed Ingredient Segment – Focused on Serving the

Growing Pet and Aqua Demand

Global Pet Industry

4% annual growth in 2015;

by 2019 - $91 billion

Pet ownership increases with urban population rise

Rise in disposable incomes

Increased awareness for pet safety and health; pets

are increasingly family

Completed 2 new wet and frozen pet food plants in Nebraska

& Kentucky (US)

Completed expansion of our Zhejiang blood plant

2015

Built 2 new rendering plants

Netherlands de-hiding facility

Maquoketa Iowa blood expansion

Qionglai China blood expansion

Completed Bosland, Netherlands acquisition

2016

New blood plant in Europe

New poultry rendering plant in U.S.

Expansion of Los Angeles, CA plant

2017

Source: http://multibriefs.com/briefs/exclusive/pet_businesses_will_prosper.html#.Wh3kIVWnG70

Source: https://www.aquaculturenorthamerica.com/news/fao-releases-world-review-of-fisheries-and-

aquaculture-for-1630

(Aquaculture uses pet-grade poultry meal as protein source)

New rendering facilities planned for U.S.

2018

12

Date

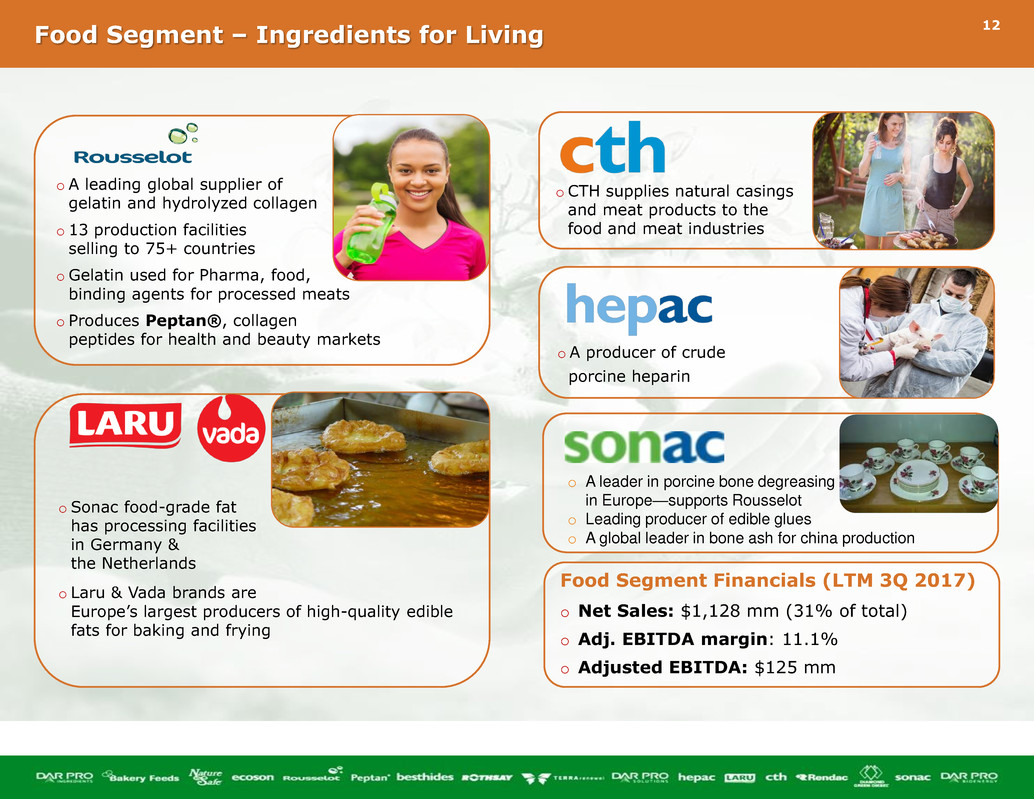

Food Segment – Ingredients for Living

o A producer of crude

porcine heparin

o Sonac food-grade fat

has processing facilities

in Germany &

the Netherlands

o Laru & Vada brands are

Europe’s largest producers of high-quality edible

fats for baking and frying

o A leading global supplier of

gelatin and hydrolyzed collagen

o 13 production facilities

selling to 75+ countries

o Gelatin used for Pharma, food,

binding agents for processed meats

o Produces Peptan®, collagen

peptides for health and beauty markets

Food Segment Financials (LTM 3Q 2017)

o Net Sales: $1,128 mm (31% of total)

o Adj. EBITDA margin: 11.1%

o Adjusted EBITDA: $125 mm

o CTH supplies natural casings

and meat products to the

food and meat industries

o A leader in porcine bone degreasing

in Europe—supports Rousselot

o Leading producer of edible glues

o A global leader in bone ash for china production

13

Date

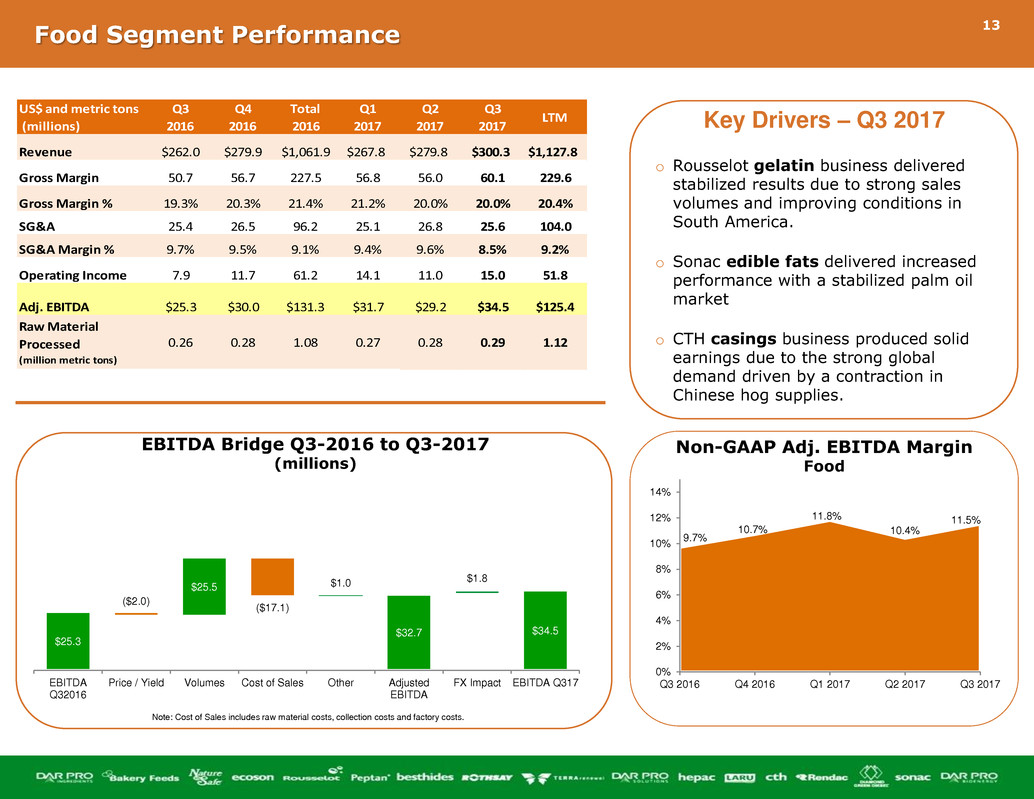

Food Segment Performance

Key Drivers – Q3 2017

o Rousselot gelatin business delivered

stabilized results due to strong sales

volumes and improving conditions in

South America.

o Sonac edible fats delivered increased

performance with a stabilized palm oil

market

o CTH casings business produced solid

earnings due to the strong global

demand driven by a contraction in

Chinese hog supplies.

US$ and metric tons

(millions)

Q3

2016

Q4

2016

Total

2016

Q1

2017

Q2

2017

Q3

2017

LTM

Revenue $262.0 $279.9 $1,061.9 $267.8 $279.8 $300.3 $1,127.8

Gross Margin 50.7 56.7 227.5 56.8 56.0 60.1 229.6

Gross Margin % 19.3% 20.3% 21.4% 21.2% 20.0% 20.0% 20.4%

SG&A 25.4 26.5 96.2 25.1 26.8 25.6 104.0

SG&A Margin % 9.7% 9.5% 9.1% 9.4% 9.6% 8.5% 9.2%

Operating Income 7.9 11.7 61.2 14.1 11.0 15.0 51.8

Adj. EBITDA $25.3 $30.0 $131.3 $31.7 $29.2 $34.5 $125.4

Raw Material

Processed

(million metric tons)

0.26 0.28 1.08 0.27 0.28 0.29 1.12

Note: Cost of Sales includes raw material costs, collection costs and factory costs.

Non-GAAP Adj. EBITDA Margin

Food

EBITDA Bridge Q3-2016 to Q3-2017

(millions)

0%

2%

4%

6%

8%

10%

12%

14%

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

$25.3

$32.7 $34.5

($2.0)

$25.5

($17.1)

$1.0 $1.8

EBITDA

Q32016

Price / Yield Volumes Cost of Sales Other Adjusted

EBITDA

FX Impact EBITDA Q317

9.7%

10.7%

11.8%

10.4%

11.5%

14

Date

Food Segment Performance

Film coating

Expansion of Gelatin plant in France

Dubuque Iowa expansion

Wenzhou China expansion

CTH sheep casing sorting workshop in China

Gelatin expansions in China, USA, Brazil

Expanded Peptan production--Fish

Halal dedicated gelatin production

Canadian edible animal fats

2018

Pill coatings

Confectionaries

Binding

agents

Gelatin

for binding, texturizing, gelling,

smoothness, foaming,

stabilizing, filming, emulsifying,

reducing fat content..

a natural protein source

2015 – 2017

15

Date

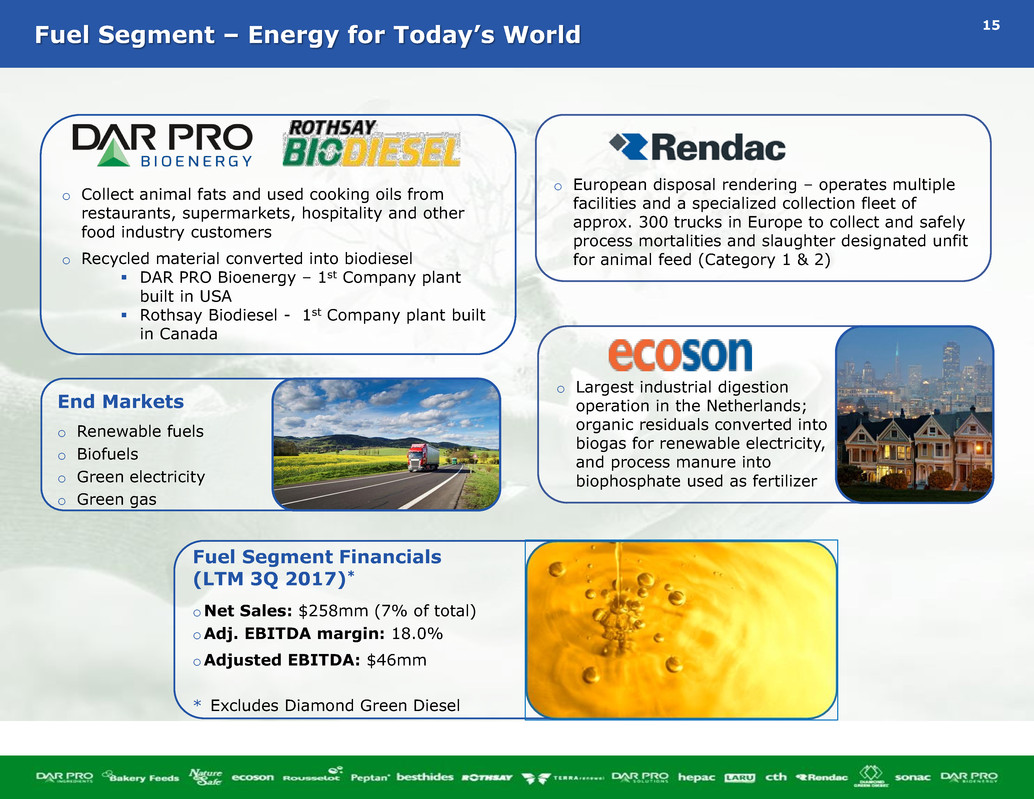

Fuel Segment – Energy for Today’s World

o Collect animal fats and used cooking oils from

restaurants, supermarkets, hospitality and other

food industry customers

o Recycled material converted into biodiesel

DAR PRO Bioenergy – 1st Company plant

built in USA

Rothsay Biodiesel - 1st Company plant built

in Canada

End Markets

o Renewable fuels

o Biofuels

o Green electricity

o Green gas

o European disposal rendering – operates multiple

facilities and a specialized collection fleet of

approx. 300 trucks in Europe to collect and safely

process mortalities and slaughter designated unfit

for animal feed (Category 1 & 2)

o Largest industrial digestion

operation in the Netherlands;

organic residuals converted into

biogas for renewable electricity,

and process manure into

biophosphate used as fertilizer

Fuel Segment Financials

(LTM 3Q 2017)*

oNet Sales: $258mm (7% of total)

oAdj. EBITDA margin: 18.0%

oAdjusted EBITDA: $46mm

* Excludes Diamond Green Diesel

16

Date

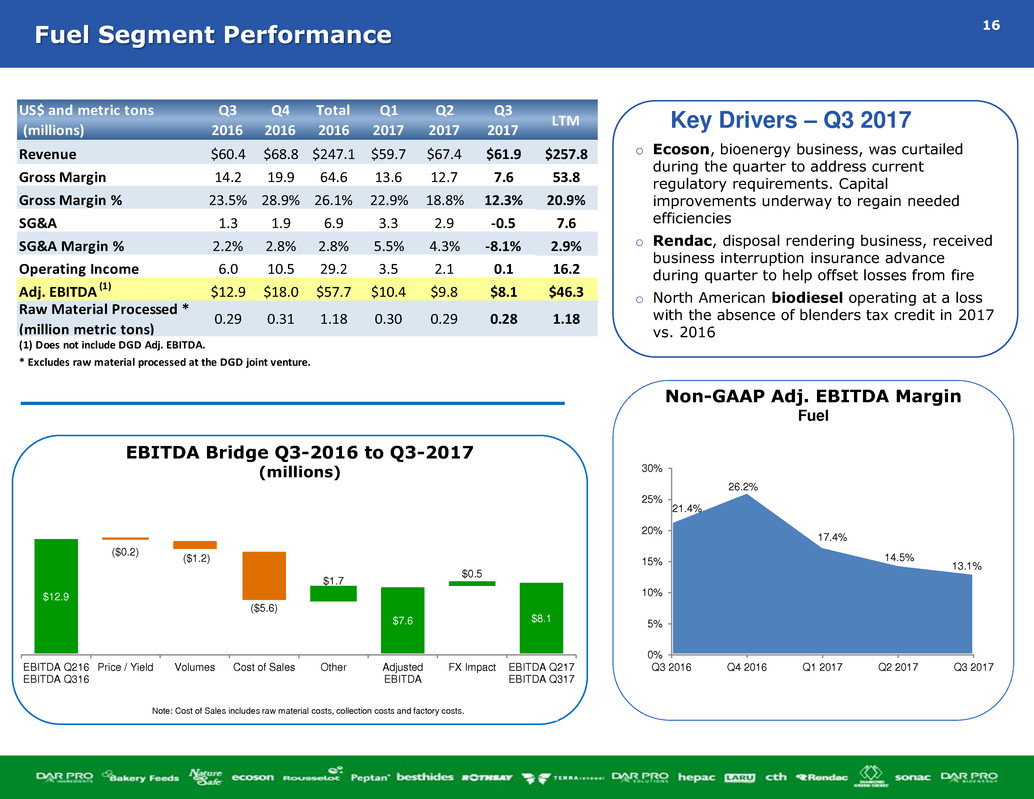

Fuel Segment Performance

o Ecoson, bioenergy business, was curtailed

during the quarter to address current

regulatory requirements. Capital

improvements underway to regain needed

efficiencies

o Rendac, disposal rendering business, received

business interruption insurance advance

during quarter to help offset losses from fire

o North American biodiesel operating at a loss

with the absence of blenders tax credit in 2017

vs. 2016

Key Drivers – Q3 2017

US$ and metric tons

(millions)

Q3

2016

Q4

2016

Total

2016

Q1

2017

Q2

2017

Q3

2017

LTM

Revenue $60.4 $68.8 $247.1 $59.7 $67.4 $61.9 $257.8

Gross Margin 14.2 19.9 64.6 13.6 12.7 7.6 53.8

Gross Margin % 23.5% 28.9% 26.1% 22.9% 18.8% 12.3% 20.9%

SG&A 1.3 1.9 6.9 3.3 2.9 -0.5 7.6

SG&A Margin % 2.2% 2.8% 2.8% 5.5% 4.3% -8.1% 2.9%

Operating Income 6.0 10.5 29.2 3.5 2.1 0.1 16.2

Adj. EBITDA (1) $12.9 $18.0 $57.7 $10.4 $9.8 $8.1 $46.3

Raw Material Pr cesse *

(million metric tons)

0.29 0.31 1.18 0.30 0.29 0.28 1.18

(1) Does not include DGD Adj. EBITDA.

* Excludes raw material processed at the DGD joint venture.

$12.9

$7.6 $8.1

($0.2)

($1.2)

($5.6)

$1.7

$0.5

EBITDA Q216

EBITDA Q316

Price / Yield Volumes Cost of Sales Other Adjusted

EBITDA

FX Impact EBITDA Q217

EBITDA Q317

0%

5%

10%

15%

20%

25%

30%

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

Non-GAAP Adj. EBITDA Margin

Fuel

EBITDA Bridge Q3-2016 to Q3-2017

(millions)

21.4%

26.2%

17.4%

14.5%

13.1%

Note: Cost of Sales includes raw material costs, collection costs and factory costs.

17

Date

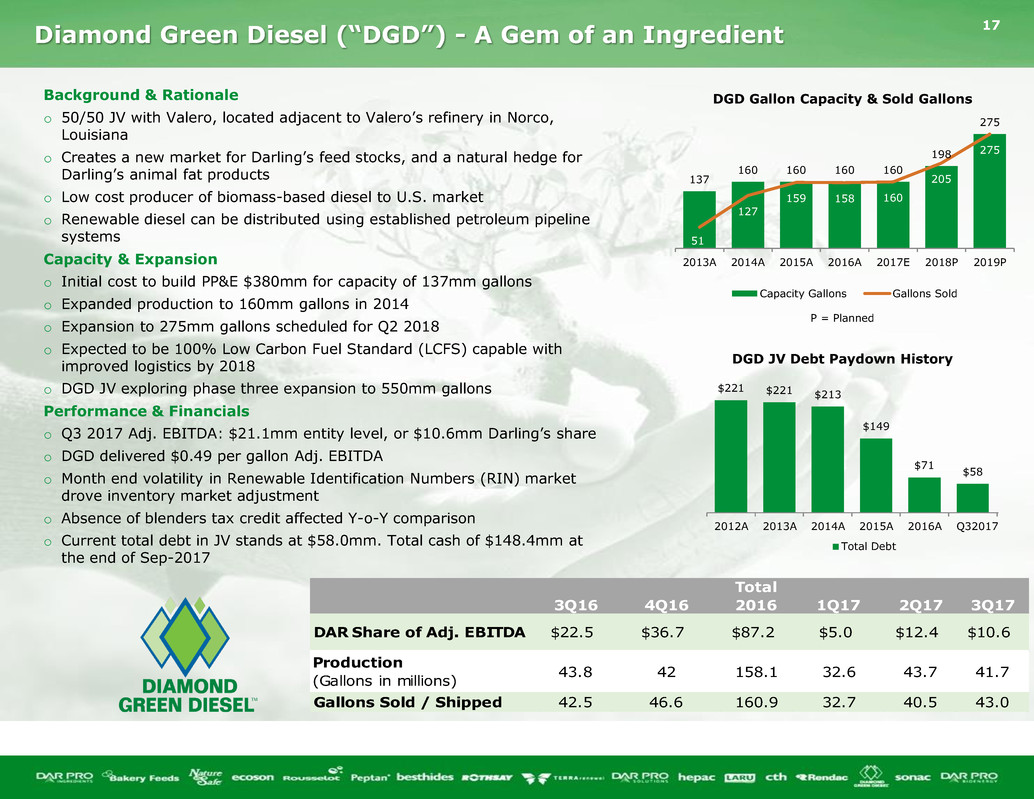

Diamond Green Diesel (“DGD”) - A Gem of an Ingredient

3Q16 4Q16

Total

2016 1Q17 2Q17 3Q17

DAR Share of Adj. EBITDA $22.5 $36.7 $87.2 $5.0 $12.4 $10.6

Production

(Gallons in millions)

43.8 42 158.1 32.6 43.7 41.7

Gallons Sold / Shipped 42.5 46.6 160.9 32.7 40.5 43.0

Background & Rationale

o 50/50 JV with Valero, located adjacent to Valero’s refinery in Norco,

Louisiana

o Creates a new market for Darling’s feed stocks, and a natural hedge for

Darling’s animal fat products

o Low cost producer of biomass-based diesel to U.S. market

o Renewable diesel can be distributed using established petroleum pipeline

systems

Capacity & Expansion

o Initial cost to build PP&E $380mm for capacity of 137mm gallons

o Expanded production to 160mm gallons in 2014

o Expansion to 275mm gallons scheduled for Q2 2018

o Expected to be 100% Low Carbon Fuel Standard (LCFS) capable with

improved logistics by 2018

o DGD JV exploring phase three expansion to 550mm gallons

Performance & Financials

o Q3 2017 Adj. EBITDA: $21.1mm entity level, or $10.6mm Darling’s share

o DGD delivered $0.49 per gallon Adj. EBITDA

o Month end volatility in Renewable Identification Numbers (RIN) market

drove inventory market adjustment

o Absence of blenders tax credit affected Y-o-Y comparison

o Current total debt in JV stands at $58.0mm. Total cash of $148.4mm at

the end of Sep-2017

137

160 160 160 160

198

275

51

127

159 158 160

205

275

2013A 2014A 2015A 2016A 2017E 2018P 2019P

Capacity Gallons Gallons Sold

DGD Gallon Capacity & Sold Gallons

DGD JV Debt Paydown History

P = Planned

$221 $221 $213

$149

$71

$58

2012A 2013A 2014A 2015A 2016A Q32017

Total Debt

18

Date

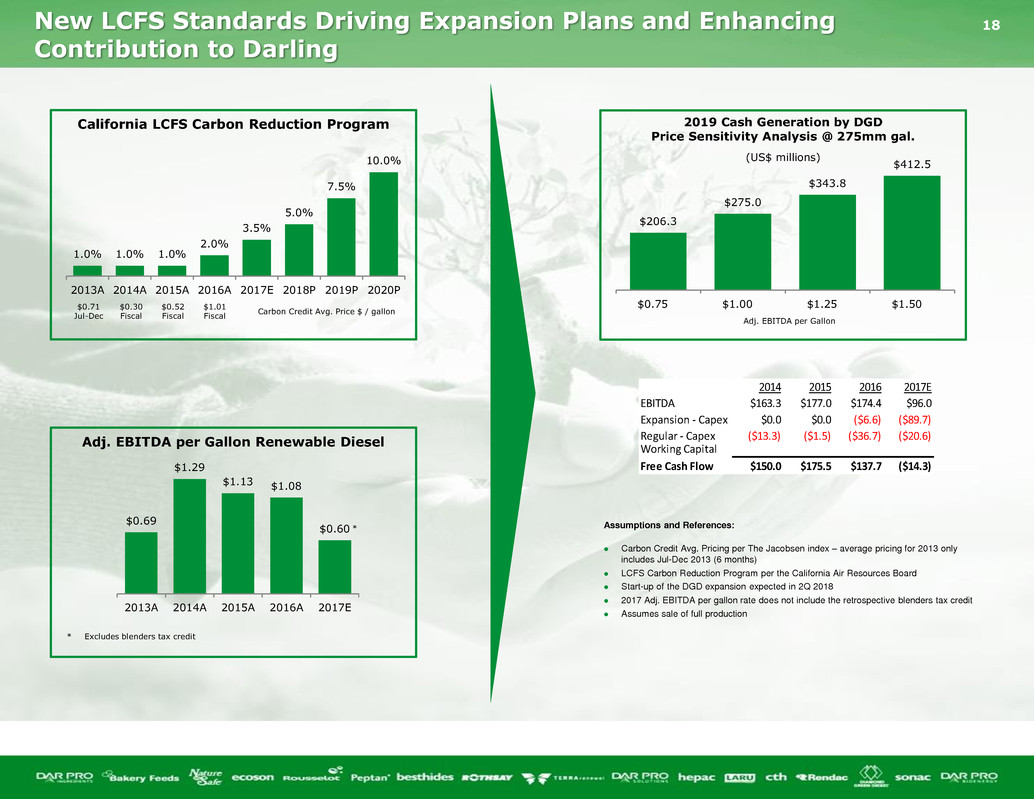

New LCFS Standards Driving Expansion Plans and Enhancing

Contribution to Darling

1.0% 1.0% 1.0%

2.0%

3.5%

5.0%

7.5%

10.0%

2013A 2014A 2015A 2016A 2017E 2018P 2019P 2020P

California LCFS Carbon Reduction Program

$0.71

Jul-Dec

$0.30

Fiscal

$0.52

Fiscal

$1.01

Fiscal

Carbon Credit Avg. Price $ / gallon

Adj. EBITDA per Gallon Renewable Diesel

$0.69

$1.29

$1.13 $1.08

$0.60

$1.25 $1.25

2013A 2014A 2015A 2016A 2017E 2018P 2019P

* Excludes blenders tax credit

2014 2015 2016 2017E

EBITDA $163.3 $177.0 $174.4 $96.0

Expansion - Capex $0.0 $0.0 ($6.6) ($89.7)

Regular - Capex ($13.3) ($1.5) ($36.7) ($20.6)

Working Capital

Free Cash Flow $150.0 $175.5 $137.7 ($14.3)

Assumptions and References:

Carbon Credit Avg. Pricing per The Jacobsen index – average pricing for 2013 only

includes Jul-Dec 2013 (6 months)

LCFS Carbon Reduction Program per the California Air Resources Board

Start-up of the DGD expansion expected in 2Q 2018

2017 Adj. EBITDA per gallon rate does not include the retrospective blenders tax credit

Assumes sale of full production

$206.3

$275.0

$343.8

$412.5

$0.75 $1.00 $1.25 $1.50

2019 Cash Generation by DGD

Price Sensitivity Analysis @ 275mm gal.

(US$ millions)

Adj. EBITDA per Gallon

*

19

Date

Financial Review

CREATING SUSTAINABLE FOOD, FEED, AND FUEL INGREDIENTS

FOR A GROWING POPULATION

20

Date

The 2017 Strategy – “A World of Growth”

Continue to target debt reduction in 2017

o Paid down debt by $18.5 million in third quarter; YTD paid down $69.5 million

o Total leverage ratio of 3.56x, secured debt leverage ratio of 1.30x as of 30-Sep-2017 (1)

Targeting Working Capital improvement for 2017

YTD CAPEX spend at $196.4 million

o Seven ongoing construction, expansion, and conversion projects in various regions

• 2 U.S. rendering plants

• China blood and gelatin expansion, including new gelatin plant

• New European blood plant

• U.S. rendering expansion

• First EnviroFlight aquaculture plant in JV with Intrexon

o DGD expanding capacity from 160 million gallons to 275 million gallons annually, scheduled to be completed in

2Q18

• Exploring phase three expansion to 550 million gallons

SG&A current run-rate of $82-83 million/quarter in 2017; Q3 at $83.1 million

Goal is to deploy capital with 15-20% Return on Capital Employed (ROCE)

1) Leverage ratios calculated based on Credit Facility definitions.

21

Date

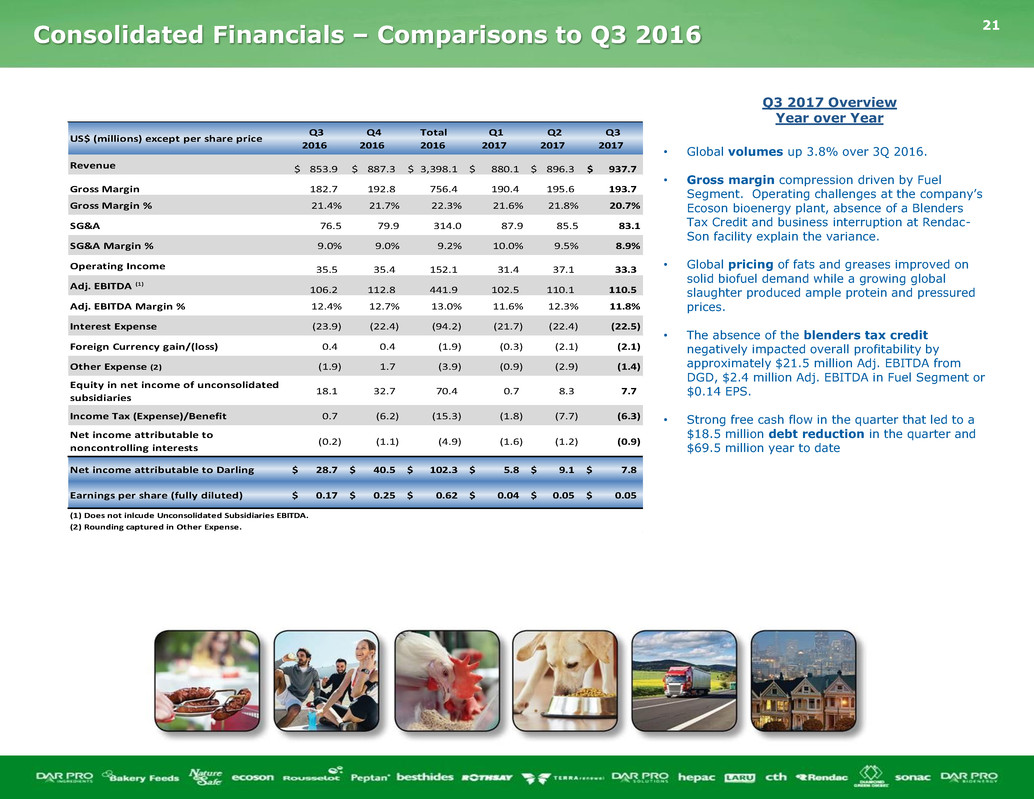

Q3 2017 Overview

Year over Year

• Global volumes up 3.8% over 3Q 2016.

• Gross margin compression driven by Fuel

Segment. Operating challenges at the company’s

Ecoson bioenergy plant, absence of a Blenders

Tax Credit and business interruption at Rendac-

Son facility explain the variance.

• Global pricing of fats and greases improved on

solid biofuel demand while a growing global

slaughter produced ample protein and pressured

prices.

• The absence of the blenders tax credit

negatively impacted overall profitability by

approximately $21.5 million Adj. EBITDA from

DGD, $2.4 million Adj. EBITDA in Fuel Segment or

$0.14 EPS.

• Strong free cash flow in the quarter that led to a

$18.5 million debt reduction in the quarter and

$69.5 million year to date

US$ (millions) except per share price

Q3

2016

Q4

2016

Total

2016

Q1

2017

Q2

2017

Q3

2017

Revenue 853.9$ 887.3$ 3,398.1$ 880.1$ 896.3$ 937.7$

Gross Margin 182.7 192.8 756.4 190.4 195.6 193.7

Gross Margin % 21.4% 21.7% 22.3% 21.6% 21.8% 20.7%

SG&A 76.5 79.9 314.0 87.9 85.5 83.1

SG&A Margin % 9.0% 9.0% 9.2% 10.0% 9.5% 8.9%

Operating Income 35.5 35.4 152.1 31.4 37.1 33.3

Adj. EBITDA (1) 106.2 112.8 441.9 102.5 110.1 110.5

Adj. EBITDA Margin % 12.4% 12.7% 13.0% 11.6% 12.3% 11.8%

Interest Expense (23.9) (22.4) (94.2) (21.7) (22.4) (22.5)

Foreign Currency gain/(loss) 0.4 0.4 (1.9) (0.3) (2.1) (2.1)

Other Expense (2) (1.9) 1.7 (3.9) (0.9) (2.9) (1.4)

Equity in net income of unconsolidated

subsidiaries

18.1 32.7 70.4 0.7 8.3 7.7

Income Tax (Expense)/Benefit 0.7 (6.2) (15.3) (1.8) (7.7) (6.3)

Net income attributable to

noncontrolling interests

(0.2) (1.1) (4.9) (1.6) (1.2) (0.9)

Net income attributable to Darling 28.7$ 40.5$ 102.3$ 5.8$ 9.1$ 7.8$

Earnings per sh e (fully diluted) 0.17$ 0.25$ 0.62$ 0.04$ 0.05$ 0.05$

(1) Does not inlcude Unconsolidated Subsidiaries EBITDA.

(2) Rounding captured in Other Expense.

Consolidated Financials – Comparisons to Q3 2016

22

Date

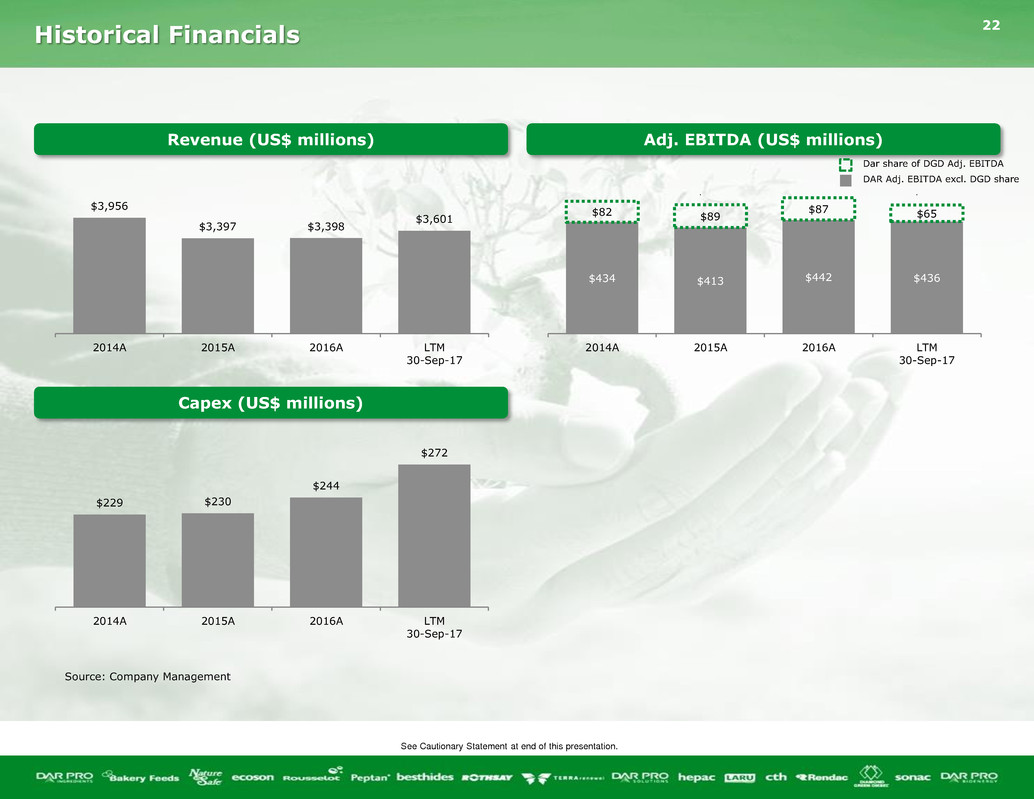

Source: Company Management

See Cautionary Statement at end of this presentation.

Revenue (US$ millions) Adj. EBITDA (US$ millions)

Capex (US$ millions)

Historical Financials

$3,956

$3,397 $3,398

$3,601

2014A 2015A 2016A LTM

30-Sep-17

$434 $413 $442 $436

$82 $89

$87 $65

$515 501

529

$501

2014A 2015A 2016A LTM

30-Sep-17

$229 $230

$244

$272

2014A 2015A 2016A LTM

30-Sep-17

Dar share of DGD Adj. EBITDA

DAR Adj. EBITDA excl. DGD share

23

Date

Key Credit Highlights

Global, Diversified Platform Across Feed, Food, and Fuel Segments

Producer of High Quality Sustainable Ingredients, Supported by Industry and Macro

Dynamics

Proven Economic Model with High Barriers to Entry

Track Record of Strong Financial Performance and Margin Stability

Key Investments to Fuel Long-Term Earnings Power

Exceptional, Tenured Management Team

24

Date

Appendix

25

Date

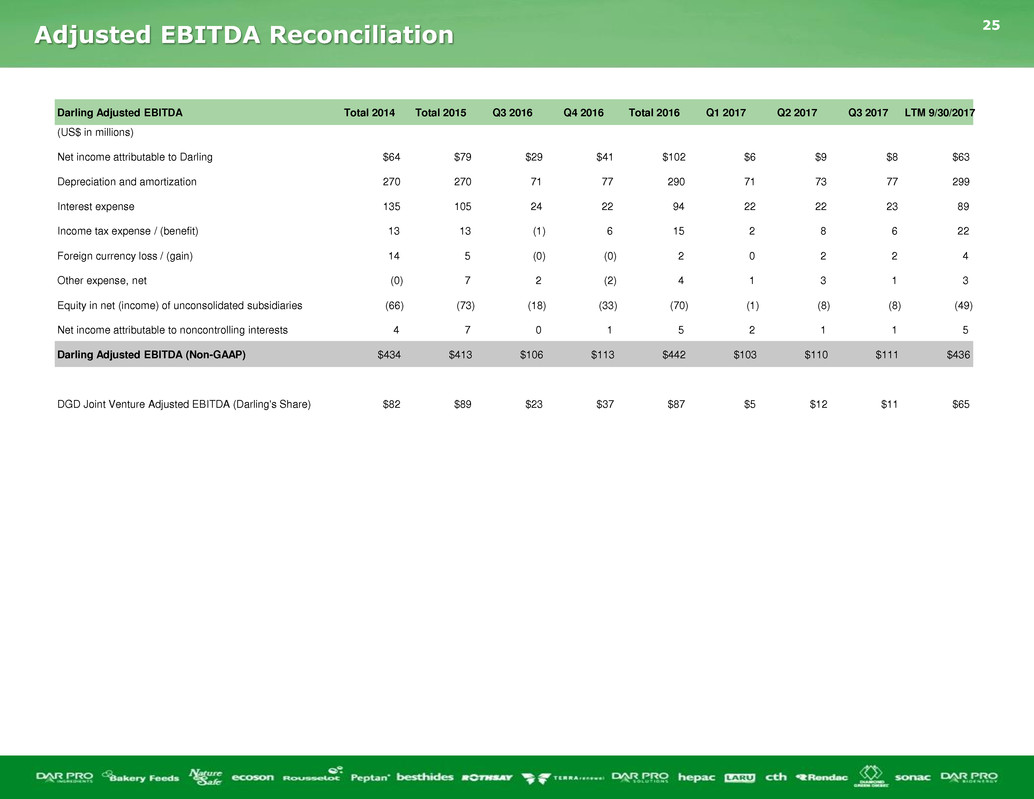

Adjusted EBITDA Reconciliation

Darling Adjusted EBITDA Total 2014 Total 2015 Q3 2016 Q4 2016 Total 2016 Q1 2017 Q2 2017 Q3 2017 LTM 9/30/2017

(US$ in millions)

Net income attributable to Darling $64 $79 $29 $41 $102 $6 $9 $8 $63

Depreciation and amortization 270 270 71 77 290 71 73 77 299

Interest expense 135 105 24 22 94 22 22 23 89

Income tax expense / (benefit) 13 13 (1) 6 15 2 8 6 22

Foreign currency loss / (gain) 14 5 (0) (0) 2 0 2 2 4

Other expense, net (0) 7 2 (2) 4 1 3 1 3

Equity in net (income) of unconsolidated subsidiaries (66) (73) (18) (33) (70) (1) (8) (8) (49)

Net income attributable to noncontrolling interests 4 7 0 1 5 2 1 1 5

Darling Adjusted EBITDA (Non-GAAP) $434 $413 $106 $113 $442 $103 $110 $111 $436

DGD Joint Venture Adjusted EBITDA (Darling's Share) $82 $89 $23 $37 $87 $5 $12 $11 $65

26

Date

Adjusted Segment EBITDA Reconciliation

Feed Segment Adjusted EBITDA Q3 2016 Q4 2016 Total 2016 Q1 2017 Q2 2017 Q3 2017 LTM

(US$ in millions)

Segment Income $35 $25 $116 $31 $39 $34 $130

Depreciation and amortization 44 49 179 44 44 47 184

Equity in Net Income of Unconsolidated Subsidiaries -- -- -- -- -- 1 1

Adjusted EBITDA (Non-GAAP) $79 $74 $295 $75 $83 $80 $312

Food Segme t Adjusted EBITDA Q3 2016 Q4 2016 Total 2016 Q1 2017 Q2 2017 Q3 2017 LTM

(US$ in millions)

Segment Income $8 $12 $61 $14 $11 $15 $52

Depreciation and amortization 17 18 70 18 18 20 74

Equity in Net Income of Unconsolidated Subsidiaries -- -- -- -- -- -- --

Adjusted EBITDA (Non-GAAP) $25 $30 $131 $32 $29 $34 $125

Fuel Segment Adjusted EBITDA Q3 2016 Q4 2016 Total 2016 Q1 2017 Q2 2017 Q3 2017 LTM

(US$ in millions)

Segment Income $24 $43 $99 $4 $10 $7 $65

Depreciation and amortization 7 8 29 7 8 8 30

Equity in Net Income of Unconsolidated Subsidiaries 18 33 70 1 8 7 48

Adjusted EBITDA (Non-GAAP) $13 $18 $58 $10 $10 $8 $46

27

Date

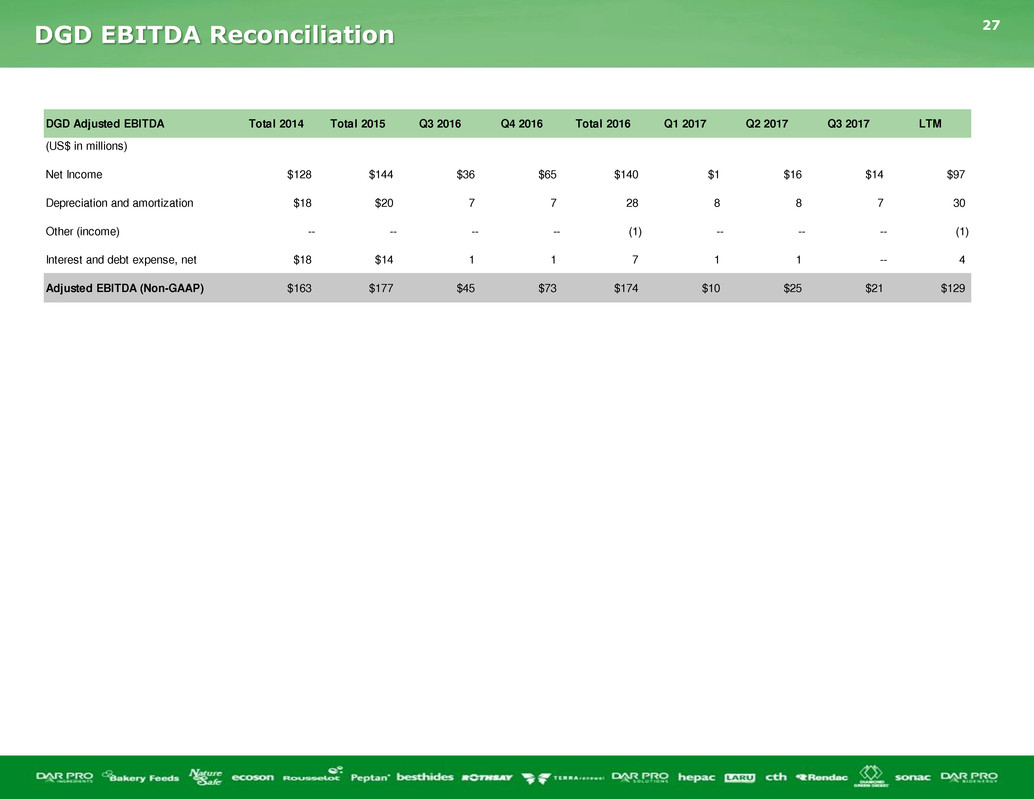

DGD EBITDA Reconciliation

DGD Adjusted EBITDA Total 2014 Total 2015 Q3 2016 Q4 2016 Total 2016 Q1 2017 Q2 2017 Q3 2017 LTM

(US$ in millions)

Net Income $128 $144 $36 $65 $140 $1 $16 $14 $97

Depreciation and amortization $18 $20 7 7 28 8 8 7 30

Other (income) -- -- -- -- (1) -- -- -- (1)

Interest and debt expense, net $18 $14 1 1 7 1 1 -- 4

Adjusted EBITDA (Non-GAAP) $163 $177 $45 $73 $174 $10 $25 $21 $129

28

Date

DGD Provides a “hedge” on Commodity Exposure of DAR’s U.S. Fats

o DAR collects approximately 1 billion pounds of used cooking oil annually

o Yielding nearly 700 million pounds of finished product to market

o Approximately 35% is under shared risk formula pricing

o The balance has commodity optionality or market risk

$16.5 $81.6 $88.5 $87.2

-$12.3

-$25.3

-$70.6 -$61.6

-$80

-$60

-$40

-$20

$0

$20

$40

$60

$80

$100

2013 20152014

2012

YG/UCO

Price

$37.31/cwt

2013

YG/UCO

Price

$34.57/cwt

2014

YG/UCO

Price

$28.95/cwt

2015

YG/UCO

Price

$21.79/cwt

$.0274 x 4.55 mm

= $(12.30)

$.1552 x 4.55 mm

= $(70.61)

$.1354 x 4.55 mm

= $(61.60)

Every penny of price movement = $4.55mm in Adj. EBITDA to feed segment

YG = Yellow Grease UCO = Used Cooking Oil cwt = 100 pounds

Pricing from The Jacobsen index

Compared to

Darling’s Share of Adj. EBITDA

DGD YG/UCO (each year compared to 2012 pricing)

2016

2016

YG/UCO

Price

$23.77/cwt

$.0562 x 4.55 mm

= $(25.29)

* Note: Diamond Green Diesel startup was in July 2013

*

*