Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HomeTrust Bancshares, Inc. | htbi-20171127x8kx2.htm |

Positioned for

growth

Annual Meeting

November 27, 2017

Positioned for

growth 2

Forward-Looking Statements

This presentation includes “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements often include words such as “believe,” “expect,”

“anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,”

“could,” or “may.” Forward-looking statements are not historical facts but instead represent

management’s current expectations and forecasts regarding future events many of which are

inherently uncertain and outside of our control. Actual results may differ, possibly materially, from

those currently expected or projected in these forward-looking statements. Factors that could cause

our actual results to differ materially from those described in the forward-looking statements, include

expected cost savings, synergies and other financial benefits from acquisitions might not be realized

within the expected time frames or at all, and costs or difficulties relating to integration matters might

be greater than expected; increased competitive pressures; changes in the interest rate environment;

changes in general economic conditions and conditions within the securities markets; legislative and

regulatory changes; and other factors described in HomeTrust’s latest annual Report on Form 10-K

and Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission-

which are available on our website at www.hometrustbanking.com and on the SEC’s website at

www.sec.gov. Any of the forward-looking statements that we make in this presentation or our SEC

filings are based upon management’s beliefs and assumptions at the time they are made and may turn

out to be wrong because of inaccurate assumptions we might make, because of the factors illustrated

above or because of other factors that we cannot foresee. We do not undertake and specifically

disclaim any obligation to revise any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date of such statements. These risks

could cause our actual results for fiscal 2018 and beyond to differ materially from those expressed in

any forward-looking statements by, or on behalf of, us and could negatively affect our operating and

stock performance.

Positioned for

growth

HomeTrust Bancshares, Inc. Overview

Headquarters: Asheville, NC Exchange/Ticker: NASDAQ: HTBI

Founded: 1926

Number of

Employees:

489

Locations: 43 (NC, SC, VA, TN) Stock Price: $26.30

Total Assets: $3.2 billion Price to TBV: 133%

Total Loans: $2.4 billion Market Cap: $500 million

Total Deposits: $2.1 billion Average Daily Volume: 34,040

Outstanding Shares:

18,962,075 Shares Repurchased

(since Feb 19, 2013)

5,351,065

or approx. 26%

3

Financial data as of September 30, 2017

Market data as of November 22, 2017

Positioned for

growth

Phase I: Created a Foundation For Growth

Lines of Business – Infrastructure and Talent

New markets for growth

Phase II: Executing Our Strategic Plan with a Sense of Urgency

Sound and Profitable Organic Growth

Loans

Deposits

Lower our efficiency ratio

Noninterest income growth

Expense management

Streamlining current processes

Repurchase shares opportunistically

Highly accretive in-market acquisitions

Phase III: Consistently improving performance

Transitioning to a High Performing Community Bank

4

Positioned for

growth 5

Strong Footprint for Growth

Positioned for

growth 6

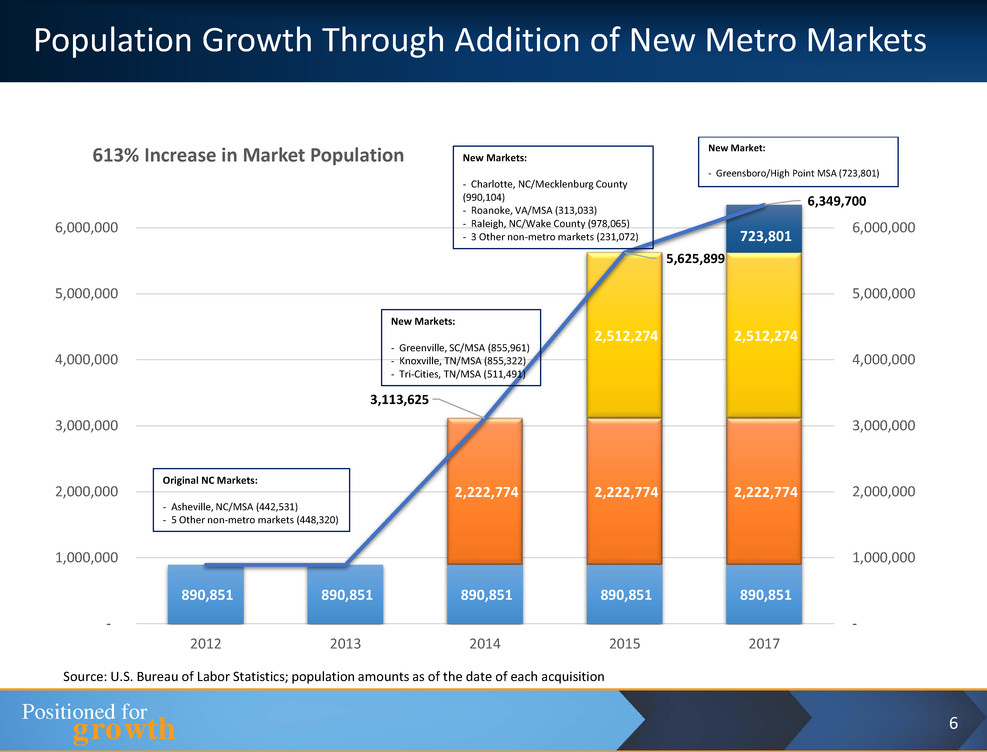

Population Growth Through Addition of New Metro Markets

890,851 890,851 890,851 890,851 890,851

2,222,774 2,222,774 2,222,774

2,512,274 2,512,274

3,113,625

5,625,899

6,349,700

-

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

-

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

2012 2013 2014 2015 2017

613% Increase in Market Population New Market:

- Greensboro/High Point MSA (723,801)

723,801

Original NC Markets:

- Asheville, NC/MSA (442,531)

- 5 Other non-metro markets (448,320)

New Markets:

- Greenville, SC/MSA (855,961)

- Knoxville, TN/MSA (855,322)

- Tri-Cities, TN/MSA (511,491)

New Markets:

- Charlotte, NC/Mecklenburg County

(990,104)

- Roanoke, VA/MSA (313,033)

- Raleigh, NC/Wake County (978,065)

- 3 Other non-metro markets (231,072)

Source: U.S. Bureau of Labor Statistics; population amounts as of the date of each acquisition

Positioned for

growth 7

Commercial Production by Market

22,571 38,151

56,969 53,551 69,902 62,413

12,264

141,336

255,636

461,851

5 5

8

15

19

30

-

5

10

15

20

25

30

2012 2013 2014 2015 2016 2017

$-

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

$450,000

$500,000

$550,000

Legacy New markets CRM/Lenders

88%

12%

69,538

Production by market above excludes municipal leases.

Dollars in thousands

194,887

524,264

325,538

Legacy/New Markets

Positioned for

growth 8

Loan Portfolio Composition

$

6

2

1

$

6

0

2

$

6

6

0

$

6

5

0

$

6

2

4

$

6

8

4

$200 $182

$223 $336

$459

$518 $411 $383

$615

$700

$750

$1,1

5

0

$-

$500

$1,000

$1,500

$2,000

$2,500

2012 2013 2014 2015 2016 2017

Lo

an

B

ala

n

ce

Fiscal Year

1-4 Family HELOCs & Other Consumer Commercial

5-Year CAGR of 13.81%

29%

22%

31.0%

8%

10%

Loans: 6/30/17

1-4 Family ($684MM)

HELOCs & Other Consumer ($518MM)

Commercial RE ($730MM)

Commercial Construction ($198MM)

Other Commercial ($222MM)

Commercial 48%

Dollars in millions

51%

16%

19%

3%

11%

Loans: 6/30/12

1-4 Family ($621MM) HELOCs & Other Consumer ($200MM)

Commercial RE ($239MM) Commercial Construction ($42MM)

Other Commercial ($130MM)

Commercial 33%

Increased commercial loan

portfolio by $739 million or

180% since 2012

Positioned for

growth 10/26/2017 9

Total Deposits

51% 47% 40% 31% 25%

49%

53%

60%

69%

75%

77%

$0

$250

$500

$750

$1,000

$1,250

$1,500

$1,750

$2,000

$2,250

2012* 2013 2014 2015 2016 2017

Time Deposits Core Deposits (checking, savings, money market)

$1,803

$1,155

$1,239

$1,583

$1,872

Fiscal Year Ended

$2,048

Dollars in millions

*Excludes $264.2 million in stock conversion escrow account

23%

Positioned for

growth 10/26/2017 10

Checking Accounts

$231 $256

$419

$591

$629

$780

$0

$100

$200

$300

$400

$500

$600

$700

$800

2012 2013 2014 2015 2016 2017

Dollars in millions

Fiscal Year Ended

Positioned for

growth 11

Growing Noninterest Income

New SBA Line of Business

Gain from loan sales

Third party servicer to keep overhead low

Mortgage Banking

Expanded into 5 of our new metro markets

Added 10 new mortgage loan officers in the last 12 months

Increasing rates to enhance gain on loan sales

Moving to a “mortgage banking” model and process and away from the

“traditional thrift” model

Treasury Management

Focus on increasing fees and appropriate pricing

Additional debit card revenue from purchase card program

Increased fees from new merchant services program

Increased discipline and monitoring of fee waivers and refunds – reduced

64% in fiscal 2017

Positioned for

growth 12

Creating Efficiencies/Expense Management

Consolidated 10 branch offices

Closed 6 overlapping rural offices

Consolidated 4 offices related to acquisitions

Branch optimization staffing study reduced expense $375,000

annually

Changed health care insurance providers to avoid $700,000 increase

Reduced REO-related expense by $385,000, or 21% in fiscal 2017

Achieved 50% cost savings in TriSummit acquisition

Positioned for

growth 13

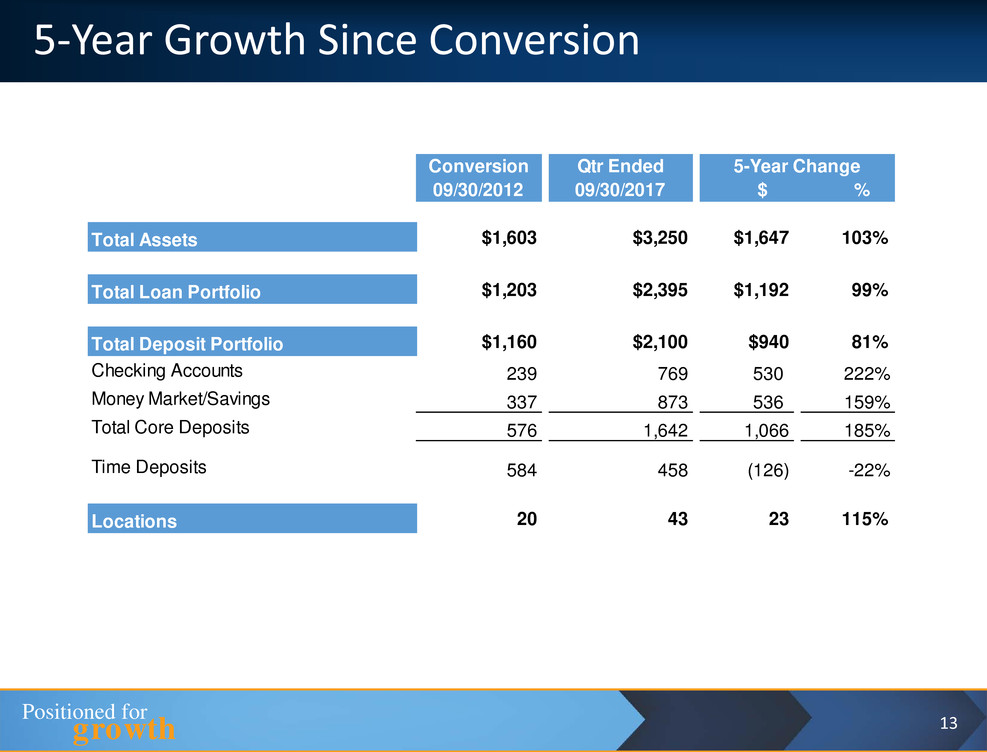

5-Year Growth Since Conversion

Conversion Qtr Ended

09/30/2012 09/30/2017 $ %

Total Assets $1,603 $3,250 $1,647 103%

Total Loan Portfolio $1,203 $2,395 $1,192 99%

Total Deposit Portfolio $1,160 $2,100 $940 81%

Checking Accounts 239 769 530 222%

Money Market/Savings 337 873 536 159%

Total Core Deposits 576 1,642 1,066 185%

Time Deposits 584 458 (126) -22%

Locations 20 43 23 115%

5-Year Change

Positioned for

growth 14

Improving Earnings Performance

$9,746

$8,256

$11,784

$12,228

$17,111

$5,595

$22,380

$0.49

$0.44

$0.61

$0.70

$0.94

$1.20

$-

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018

(annualized)

Net Income - Annualized

Net Income - Adjusted

Diluted EPS - Adjusted

Dollars in thousands

See Non-GAAP Disclosure Appendix

Positioned for

growth

100.0

120.0

140.0

160.0

180.0

200.0

220.0

240.0

07/11/12 06/30/13 06/30/14 06/30/15 06/30/2016 06/30/2017 09/30/2017

Total Return Performance

HomeTrust Bancshares, Inc. NASDAQ Bank NASDAQ Composite

Total Shareholder Return

15

Positioned for

growth 16

Fiscal Year Ended June 30, 2017 Highlights

A. As Reported 06/30/2017 06/30/2016 Amount Percent

Net income 11,847$ 11,456$ 391$ 3%

EPS - diluted 0.65$ 0.65$ -$ 0%

ROA 0.40% 0.42% (0.02%) -5%

Net interest margin (tax equivalent) 3.49% 3.37% 0.12% 3.56%

Noninterest income 15,440$ 13,503$ 1,937$ 14%

B. Core Earnings (1)

Net income 17,111$ 12,228$ 4,883$ 40%

EPS - diluted 0.94$ 0.70$ 0.24$ 34%

ROA 0.58% 0.45% 0.13% 29%

C. Organic Loan Growth

$ Growth 242,501$ 74,757$ 167,744$ 224%

% Growth 14.40% 4.43% 9.97% 225%

Loan originations:

Commercial portfolio 541,515$ 336,655$ 204,860$ 61%

Retail portfolio 305,395 266,512 38,883 15%

1-4 family originated for sale 134,258 91,963 42,295 46%

Total loan originations 981,168$ 695,130$ 286,038 41%

Year Ended Change

(Dollars in thousands, except per share amounts)

Source: Company documents previously filed with the SEC

(1) See Non-GAAP Disclosure Appendix.

Positioned for

growth 17

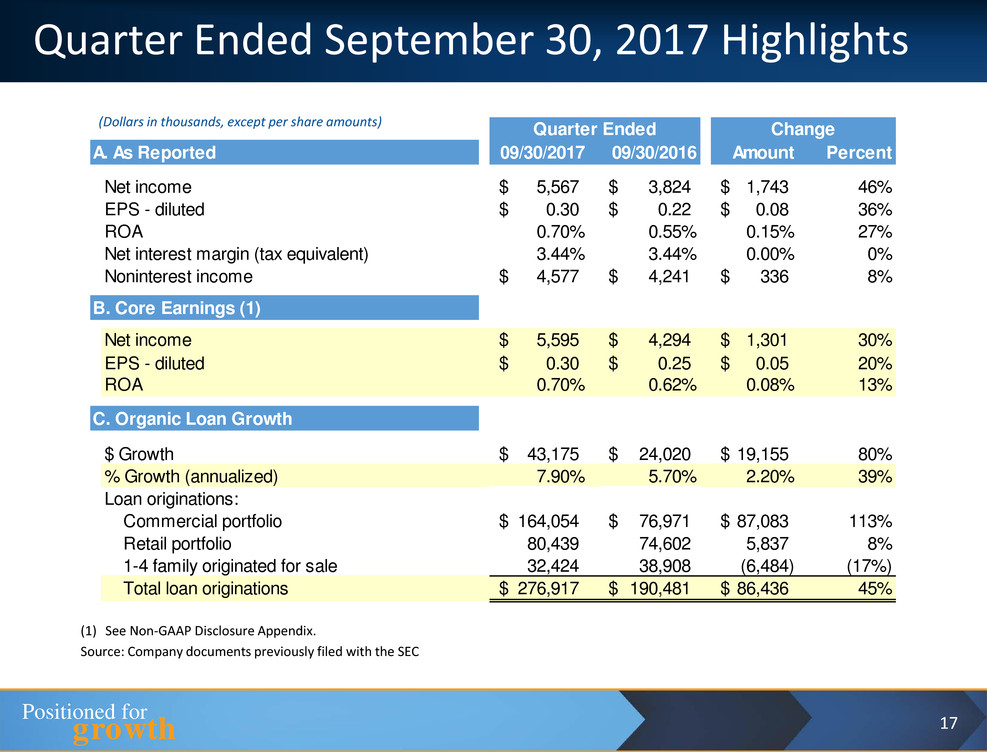

Quarter Ended September 30, 2017 Highlights

(Dollars in thousands, except per share amounts)

A. As Reported 09/30/2017 09/30/2016 Amount Percent

Net income 5,567$ 3,824$ 1,743$ 46%

EPS - diluted 0.30$ 0.22$ 0.08$ 36%

ROA 0.70% 0.55% 0.15% 27%

Net interest margin (tax equivalent) 3.44% 3.44% 0.00% 0%

Noninterest income 4,577$ 4,241$ 336$ 8%

B. Core Earnings (1)

Net income 5,595$ 4,294$ 1,301$ 30%

EPS - diluted 0.30$ 0.25$ 0.05$ 20%

ROA 0.70% 0.62% 0.08% 13%

C. Organic Loan Growth

$ Growth 43,175$ 24,020$ 19,155$ 80%

% Growth (annualized) 7.90% 5.70% 2.20% 39%

Loan originations:

Commercial portfolio 164,054$ 76,971$ 87,083$ 113%

Retail portfolio 80,439 74,602 5,837 8%

1-4 family originated for sale 32,424 38,908 (6,484) (17%)

Total loan originations 276,917$ 190,481$ 86,436$ 45%

Quarter Ended Change

(1) See Non-GAAP Disclosure Appendix.

Source: Company documents previously filed with the SEC

Positioned for

growth 18

Market Price and Price to Tangible Book

$16.96

$15.77

$16.76

$18.50

$24.40

$25.65

96.1%

89.2%

92.8% 97.1%

126.0%

129.4%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

140.0%

$-

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

06/30/2013 06/30/2014 06/30/2015 06/30/2016 06/30/2017 09/30/2017

Market Price per Share

Price to Tangible Book

Positioned for

growth

Transitioning to a High Performing Community Bank

19

Phase I: Created a Foundation For Growth

Phase II: Executing Our Strategic Plan with a Sense of Urgency

Transitioning to a High Performing Community Bank

Consistently improving performance

Creating value for shareholders

Positioned for

growth

Looking Ahead

The cumulative impact of our team’s

work over the past five years has

positioned HomeTrust to make fiscal

2018 an inflection point for our financial

performance and stockholder returns.

20

Positioned for

growth

Questions and Comments

In accordance with the Rules of Conduct, each shareholder

or proxyholder has an opportunity to ask questions or make

comments.

After you are recognized, proceed to the microphone.

Please identify yourself by stating your name and whether

you are a stockholder or hold the proxy for a shareholder.

In order to provide all shareholders an opportunity to

speak, questions and/or comments should be limited

to two minutes per shareholder.

Please direct all questions and comments to the Chairman,

President and Chief Executive Officer.

21

Positioned for

growth

Thank You Shareholders and

HomeTrust Team!

Positioned for

growth

Non-GAAP Disclosure Appendix

23

Positioned for

growth

In addition to results presented in accordance with generally accepted accounting principles utilized in the

United States ("GAAP"), this presentation contains certain non-GAAP financial measures, which include:

tangible book value per share, net income excluding merger-related expenses, nonrecurring state tax

expense, gain from the sale of premises and equipment, and impairment charges for branch

consolidation; and return on assets ("ROA") and earnings per share ("EPS") excluding merger expenses,

nonrecurring state tax expense, gain from the sale of premises and equipment, and impairment charges

for branch consolidation. The Company believes these non-GAAP financial measures and ratios as

presented are useful for both investors and management to understand the effects of certain items and

provides an alternative view of the Company's performance over time and in comparison to the

Company's competitors.

Management elected to obtain additional FHLB borrowings beginning in November 2014 as part of a plan

to increase net interest income. The Company believes that showing the effects of the additional

borrowings on net interest income and net interest margins is useful to both management and investors

as these measures are commonly used to measure financial institutions performance and performance

against peers.

The Company believes these measures facilitate comparison of the quality and composition of the

Company's capital and earnings ability over time and in comparison to its competitors. These non-GAAP

measures have inherent limitations, are not required to be uniformly applied and are not audited. They

should not be considered in isolation or as a substitute for total stockholders' equity or operating results

determined in accordance with GAAP. These non-GAAP measures may not be comparable to similarly

titled measures reported by other companies.

24

Non-GAAP Disclosure Reconciliation

Positioned for

growth 25

Non-GAAP Disclosure Reconciliation

Set forth below is a reconciliation to GAAP of tangible book value, tangible book value per share, and

share price to tangible book:

Positioned for

growth 26

Non-GAAP Disclosure Reconciliation

Set forth to the right is a reconciliation

to GAAP net income, ROA, and EPS as

adjusted to exclude merger-related

expenses, nonrecurring state tax

expense, gain on sale of premises and

equipment, and impairment charge for

branch consolidation:

Positioned for

growth 27

Non-GAAP Disclosure Reconciliation

Set forth below is a reconciliation to GAAP net income and EPS as adjusted to exclude merger-related expenses, nonrecurring state tax

expense, gain on sale of premises and equipment, loan loss provision (recovery), and impairment charge for branch consolidation: