Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Braemar Hotels & Resorts Inc. | ahpinvestorpresentation8-k.htm |

November 2017

Company Presentation // November 2017

Forward Looking Statements and Non-GAAP Measures

2

In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking

and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will

likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking

statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our

competition, current market trends and opportunities, projected operating results, and projected capital expenditures.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ

materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common

stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel;

changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our

competition. These and other risk factors are more fully discussed in the company's filings with the Securities and Exchange Commission.

EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA

divided by the purchase price or debt amount. A capitalization rate is determined by dividing the property's net operating income by the

purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross

revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and

other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC or in the

appendix to this presentation.

The calculation of implied equity value is derived from an estimated blended capitalization rate (“Cap Rate”) for the entire portfolio using

the capitalization rate method. The estimated Cap Rate is based on recent Cap Rates of publically traded peers involving a similar blend of

asset types found in the portfolio, which is then applied to Net Operating Income (“NOI”) of the company’s assets to calculate a Total

Enterprise Value (“TEV”) of the company. From the TEV, we deduct debt and preferred equity and then add back working capital and the

company’s investment in Ashford Inc. to derive an equity value.

The capitalization rate method is one of several valuation methods for estimating asset value and implied equity value. Among the

limitations of using the capitalization rate method for determining an implied equity value are that it does not take into account the

potential change or variability in future cash flows, potential significant future capital expenditures, the intended hold period of the asset, or

a change in the future risk profile of an asset.

This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford

Hospitality Prime, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such

security.

Company Presentation // November 2017

Management Team

3

20 years of hospitality

experience

1 year with Ashford

15 years with Morgan Stanley

Cornell School of Hotel

Administration, BS

University of Pennsylvania

MBA

RICHARD J. STOCKTON

Chief Executive Officer &

President

17 years of hospitality

experience

14 years with Ashford

3 years with ClubCorp

CFA charterholder

Southern Methodist University

BBA

DERIC S. EUBANKS, CFA

Chief Financial Officer

12 years of hospitality

experience

7 years with Ashford (5 years

with Ashford predecessor)

5 years with Stephens

Investment Bank

Oklahoma State University BS

JEREMY J. WELTER

EVP of Asset Management

Company Presentation // November 2017

Strategic Overview

4

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

The Ritz-Carlton St. Thomas

St. Thomas, USVI

Focused strategy of investing in luxury hotels and resorts

Grow organically through strong revenue and cost

control initiatives

Grow externally through accretive acquisitions of

high quality assets

Targets conservative leverage of Net Debt / Gross

Assets of 45% with non-recourse property debt

Highly-aligned management team and advisory

structure

Company Presentation // November 2017

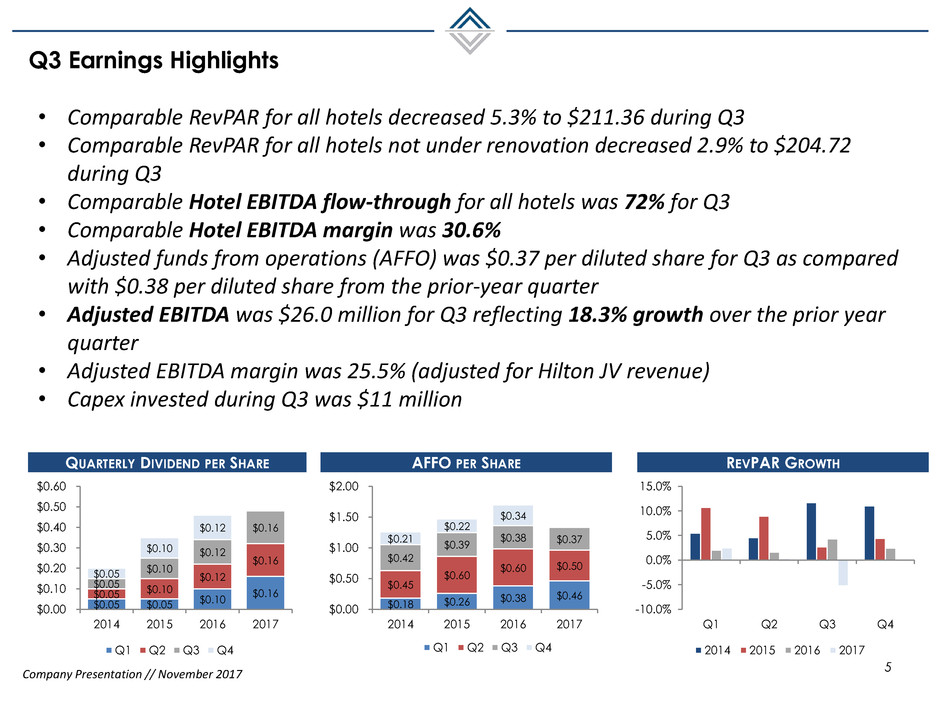

Q3 Earnings Highlights

5

• Comparable RevPAR for all hotels decreased 5.3% to $211.36 during Q3

• Comparable RevPAR for all hotels not under renovation decreased 2.9% to $204.72

during Q3

• Comparable Hotel EBITDA flow-through for all hotels was 72% for Q3

• Comparable Hotel EBITDA margin was 30.6%

• Adjusted funds from operations (AFFO) was $0.37 per diluted share for Q3 as compared

with $0.38 per diluted share from the prior-year quarter

• Adjusted EBITDA was $26.0 million for Q3 reflecting 18.3% growth over the prior year

quarter

• Adjusted EBITDA margin was 25.5% (adjusted for Hilton JV revenue)

• Capex invested during Q3 was $11 million

QUARTERLY DIVIDEND PER SHARE AFFO PER SHARE

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

Q1 Q2 Q3 Q4

2014 2015 2016 2017

REVPAR GROWTH

$0.18 $0.26

$0.38 $0.46

$0.45

$0.60

$0.60 $0.50

$0.42

$0.39

$0.38 $0.37 $0.21

$0.22

$0.34

$0.00

$0.50

$1.00

$1.50

$2.00

2014 2015 2016 2017

Q1 Q2 Q3 Q4

$0.05 $0.05 $0.10

$0.16 $0.05 $0.10

$0.12

$0.16

$0.05

$0.10

$0.12

$0.16

$0.05

$0.10

$0.12

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

2014 2015 2016 2017

Q1 Q2 Q3 Q4

Company Presentation // November 2017

Recent Developments

6

Announced

Refined

Strategy &

Amendment

to Advisory

Agreement

Common

Equity &

Convertible

Preferred

Equity Raise

Acquisition of

Park Hyatt

Beaver Creek

Acquisition of

Hotel

Yountville

Stockholders

Approve

Amendment

to Advisory

Agreement

Announced

Progress on

Non-Core

Hotels

Strategy #1

Announced

Progress on

Non-Core

Hotels

Strategy #2

JAN 2017

Refined Strategy

Luxury focus

Increase dividend by 33% to $0.16

45% Net Debt / Gross Assets

10%-15% of gross debt in cash on-

hand

Identified non-core hotels strategy

Amended Advisory Agmt

Removal of 1.1x multiple and tax

gross up

Change in majority no longer

triggers termination fee

Payment of $5 million to Ashford

Inc.

MAR 2017

Courtyard Philadelphia

Upbranding to Autograph

Collection by Marriott

Courtyard San Francisco

Upbranding to Autograph

Collection by Marriott

Marriott Plano Legacy

Sold 11/1 for $104MM

Tampa Renaissance

Listed for sale

MAR 2017 JUN 2017 JUN 2017 NOV 2017

$105M $145.5M $96.5M

PARK HYATT BEAVER CREEK

HOTEL YOUNTVILLE

$207

FY16 REVPAR(1)

$212

Q1 17 REVPAR(1)

$223

Q3 17 REVPAR(1),(2)

#1

REVPAR LEADER

(1) TTM comparable RevPAR as reported

(2) Pro forma for sale of Marriott Plano Legacy

MAY 2017

$217

Q2 17 REVPAR(1)

Company Presentation // November 2017

High-Quality Hotels in Leading Urban & Resort Markets

7 Non-Core Assets

Marriott Seattle

Seattle, WA

Hilton Torrey Pines

La Jolla, CA

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

Renaissance Tampa

Tampa, FL

Sofitel Chicago Magnificent Mile

Chicago, IL

Capital Hilton

Washington D.C.

Courtyard San Francisco

San Francisco, CA

Renaissance Tampa

Tampa, FL

Courtyard Philadelphia

Philadelphia, PA

Capital Hilton

Washington D.C.

The Ritz-Carlton St. Thomas

St. Thomas, USVI

Hotel Yountville

Yountville, CA

Park Hyatt Beaver Creek

Beaver Creek, CO

Core Assets

Company Presentation // November 2017

Number of TTM TTM TTM TTM Hotel % of

Core Location Rooms ADR(1) OCC(1) RevPAR(1) EBITDA(1),(2) Total

Bardessono Napa Valley, CA 62 $779 82% $640 $5,380 4.2%

Hotel Yountville Napa Valley, CA 80 $555 80% $442 $6,232 4.9%

Ritz-Carlton St. Thomas St. Thomas, USVI 180 $573 74% $424 $9,432 7.4%

Pier House Key West, FL 142 $426 80% $343 $9,994 7.9%

Park Hyatt Beaver Creek Beaver Creek, CO 190 $445 62% $277 $9,972 7.9%

Marriott Seattle Waterfront Seattle, WA 361 $270 87% $235 $15,927 12.6%

Capital Hilton Washington D.C. 550 $238 90% $214 $17,988 14.2%

Sofitel Chicago Magnificent Mile Chicago, IL 415 $205 82% $168 $6,389 5.0%

Hilton Torrey Pines La Jolla, CA 394 $203 85% $172 $14,831 11.7%

Total Core 2,374 $302 83% $250 $96,144 75.8%

Non-Core

Courtyard San Francisco Downtown San Francisco, CA 408 $268 83% $222 $12,288 9.7%

Renaissance Tampa Tampa, FL 293 $190 82% $155 $6,860 5.4%

Courtyard Philadelphia Downtown Philadelphia, PA 499 $171 81% $139 $11,497 9.1%

Total Non-Core 1,200 $209 82% $171 $30,645 24.2%

Total Portfolio 3,574 $271 82% $223 $126,789 100.0%

• Core portfolio quality unparalleled in the

public lodging REIT sector

• Geographically diversified portfolio

located in strong markets

Portfolio Overview

8

(1) As of September 30, 2017

(2) Reconciliations provided in Q3 earnings release filed on 11/1/17

(3) Announced repositioning to Autograph Collection by Marriott

Note: Hotel EBITDA in thousands

$223

OVERALL REVPAR

$250

CORE REVPAR

(3)

(3)

Company Presentation // November 2017

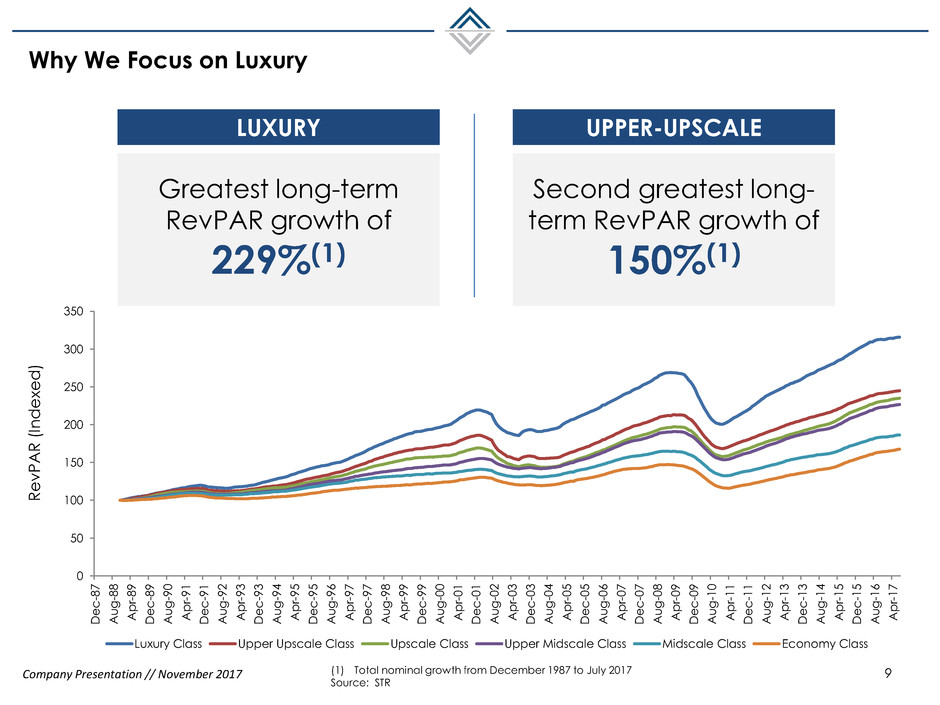

Why We Focus on Luxury

9 (1) Total nominal growth from December 1987 to July 2017

Source: STR

Greatest long-term

RevPAR growth of

229%(1)

LUXURY

Second greatest long-

term RevPAR growth of

150%(1)

UPPER-UPSCALE

0

50

100

150

200

250

300

350

D

e

c

-8

7

A

u

g

-8

8

A

p

r-

8

9

D

e

c

-8

9

A

u

g

-9

0

A

p

r-

9

1

D

e

c

-9

1

A

u

g

-9

2

A

p

r-

9

3

D

e

c

-9

3

A

u

g

-9

4

A

p

r-

9

5

D

e

c

-9

5

A

u

g

-9

6

A

p

r-

9

7

D

e

c

-9

7

A

u

g

-9

8

A

p

r-

9

9

D

e

c

-9

9

A

u

g

-0

0

A

p

r-

0

1

D

e

c

-0

1

A

u

g

-0

2

A

p

r-

0

3

D

e

c

-0

3

A

u

g

-0

4

A

p

r-

0

5

D

e

c

-0

5

A

u

g

-0

6

A

p

r-

0

7

D

e

c

-0

7

A

u

g

-0

8

A

p

r-

0

9

D

e

c

-0

9

A

u

g

-1

0

A

p

r-

1

1

D

e

c

-1

1

A

u

g

-1

2

A

p

r-

1

3

D

e

c

-1

3

A

u

g

-1

4

A

p

r-

1

5

D

e

c

-1

5

A

u

g

-1

6

A

p

r-

1

7

Luxury Class Upper Upscale Class Upscale Class Upper Midscale Class Midscale Class Economy Class

R

e

v

PA

R

(

In

d

exe

d

)

Company Presentation // November 2017

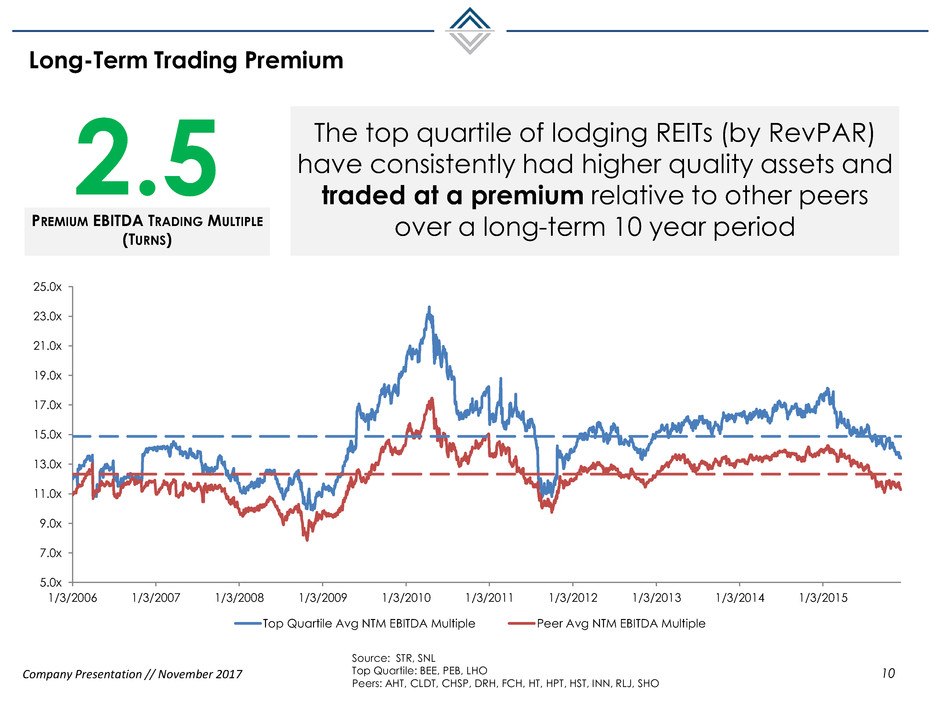

Long-Term Trading Premium

10

Source: STR, SNL

Top Quartile: BEE, PEB, LHO

Peers: AHT, CLDT, CHSP, DRH, FCH, HT, HPT, HST, INN, RLJ, SHO

The top quartile of lodging REITs (by RevPAR)

have consistently had higher quality assets and

traded at a premium relative to other peers

over a long-term 10 year period

5.0x

7.0x

9.0x

11.0x

13.0x

15.0x

17.0x

19.0x

21.0x

23.0x

25.0x

1/3/2006 1/3/2007 1/3/2008 1/3/2009 1/3/2010 1/3/2011 1/3/2012 1/3/2013 1/3/2014 1/3/2015

Top Quartile Avg NTM EBITDA Multiple Peer Avg NTM EBITDA Multiple

2.5

PREMIUM EBITDA TRADING MULTIPLE

(TURNS)

Company Presentation // November 2017

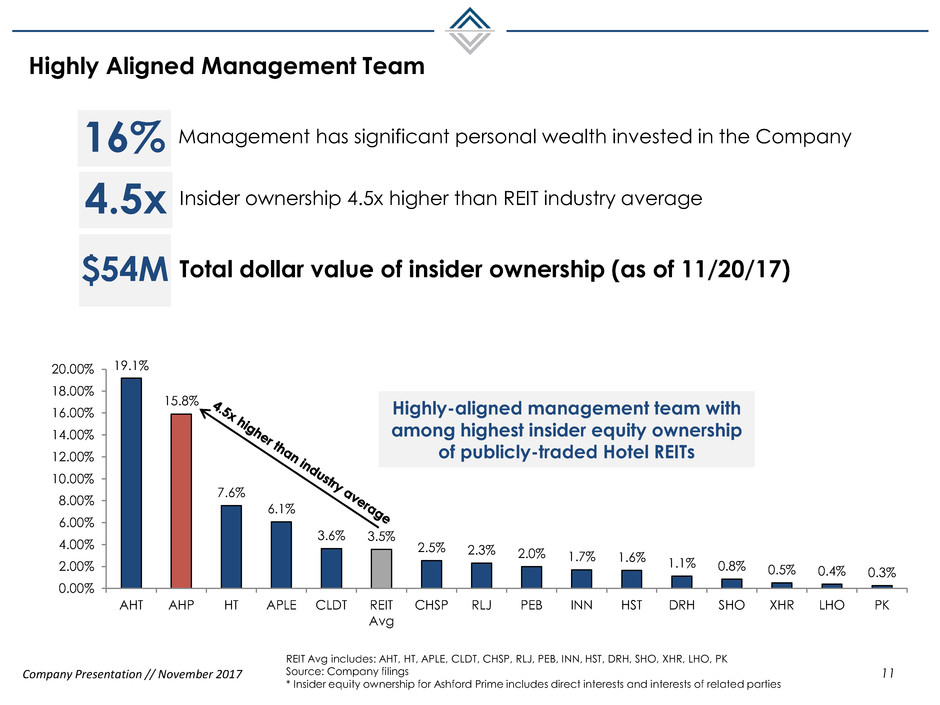

19.1%

15.8%

7.6%

6.1%

3.6% 3.5%

2.5% 2.3% 2.0% 1.7% 1.6% 1.1% 0.8% 0.5% 0.4% 0.3%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

AHT AHP HT APLE CLDT REIT

Avg

CHSP RLJ PEB INN HST DRH SHO XHR LHO PK

Highly Aligned Management Team

11

Management has significant personal wealth invested in the Company

Highly-aligned management team with

among highest insider equity ownership

of publicly-traded Hotel REITs

REIT Avg includes: AHT, HT, APLE, CLDT, CHSP, RLJ, PEB, INN, HST, DRH, SHO, XHR, LHO, PK

Source: Company filings

* Insider equity ownership for Ashford Prime includes direct interests and interests of related parties

16%

Insider ownership 4.5x higher than REIT industry average 4.5x

Total dollar value of insider ownership (as of 11/20/17) $54M

Company Presentation // November 2017

Asset Management Overview

12

TEAM

• 1 - EVP

• 10 - Asset managers

• 2 - Revenue optimization

• 3 - Risk & Insurance

• 4 - Capex specialists

• 2 - Legal

• 1 - Property tax specialist

• 4 - Analysts

MEETINGS WITH PROPERTY

MANAGEMENT

• Asset manager has a weekly

meeting with hotel

leadership

― Revenue trends

― Expense management

― Special projects

• Twice annual portfolio

meetings

PROPERTY SITE VISITS

• 4 times a year

• Full day meetings

― Revenue

― Market share

― Expenses

― Guest satisfaction

― Asset care

REVENUE OPTIMIZATION

• Monthly meetings

― All channels & segments

of business

• Annual business transient/

corporate negotiated RFP

discussions

• Annual budget guidance,

meetings, and revenue

discussions

• Team tests and implements

revenue enhancement and

upsell opportunities

STAFFING AND EXPENSES

Asset Management Team:

• Interviews / approvals of hotel

leadership candidates

• Benchmarks hourly

productivity and leadership

org charts

• From time to time engages

consultants for time and

motion studies

• Ensures hotels are evaluating

and negotiating hotel level

contracts for favorable terms

PROPERTY TAX APPEALS

• Dedicated professional on

the team with sole

responsibility to monitor and

appeal tax assessments

Company Presentation // November 2017

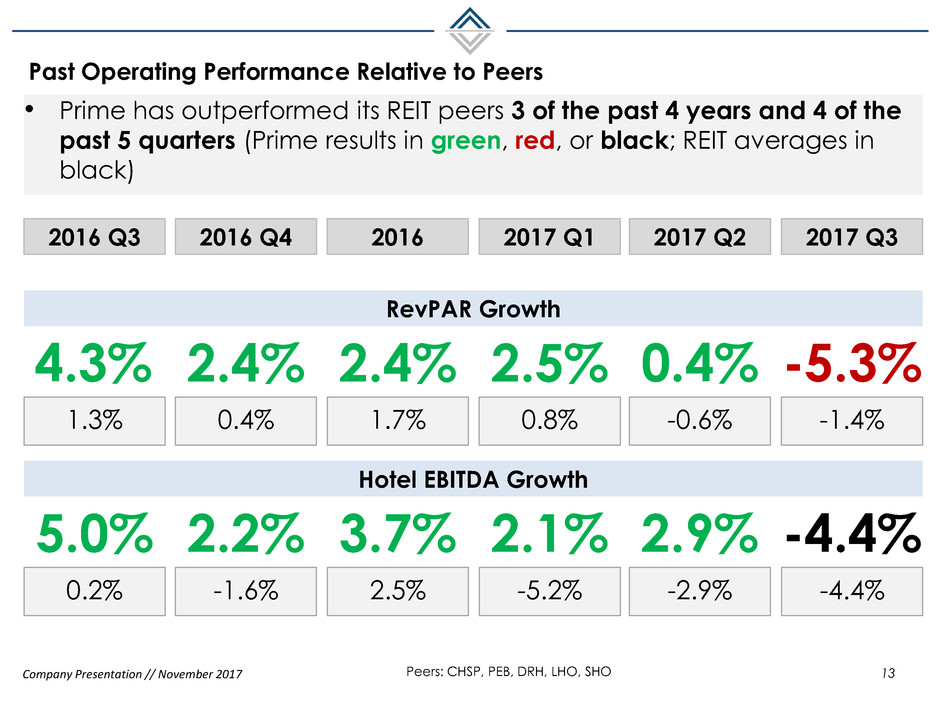

Past Operating Performance Relative to Peers

13

RevPAR Growth

2.4% 4.3% 2.4%

1.7% 1.3% 0.4%

Hotel EBITDA Growth

3.7% 5.0% 2.2%

2.5% 0.2% -1.6%

0.4%

-0.6%

2.9%

-2.9%

2016

2.5%

0.8%

2.1%

-5.2%

2016 Q3 2016 Q4 2017 Q1 2017 Q2

Peers: CHSP, PEB, DRH, LHO, SHO

• Prime has outperformed its REIT peers 3 of the past 4 years and 4 of the

past 5 quarters (Prime results in green, red, or black; REIT averages in

black)

2017 Q3

-5.3%

-1.4%

-4.4%

-4.4%

Investor and Analyst Day // New York

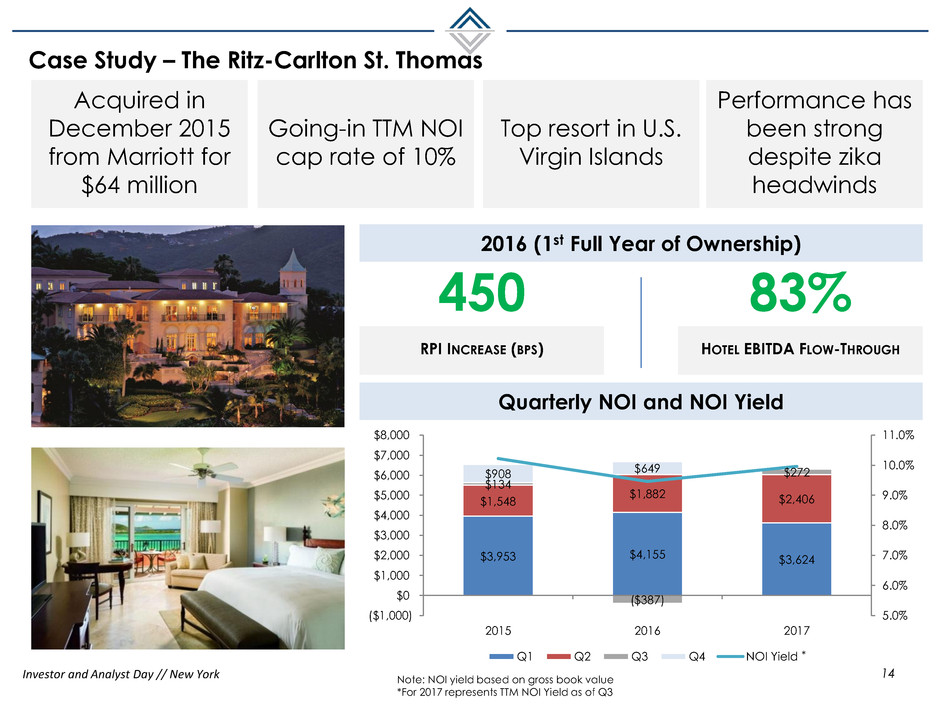

Case Study – The Ritz-Carlton St. Thomas

14

MAKE CHART RATHER THAN

TABLE; INCLUDE EBITDA

FLOWTHROUGH

2016 (1st Full Year of Ownership)

450 83%

RPI INCREASE (BPS) HOTEL EBITDA FLOW-THROUGH

Ritz Carlton St. Thomas Quarterly Performance

2016 Q1 2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2

GOP Flow % 114.1% 135.1% 55.4% 17.9% 2.1% 84.7%

RPI % Change 1.5% -1.4% 12.7 4.5 0.8 3.7

Acquired in

December 2015

from Marriott for

$64 million

Going-in TTM NOI

cap rate of 10%

Performance has

been strong

despite zika

headwinds

Top resort in U.S.

Virgin Islands

Quarterly NOI and NOI Yield

$3,953 $4,155 $3,624

$1,548

$1,882 $2,406

$134

($387)

$272 $908 $649

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

($1,000)

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

2015 2016 2017

Q1 Q2 Q3 Q4 NOI Yield

Note: NOI yield based on gross book value

*For 2017 represents TTM NOI Yield as of Q3

*

Company Presentation // November 2017

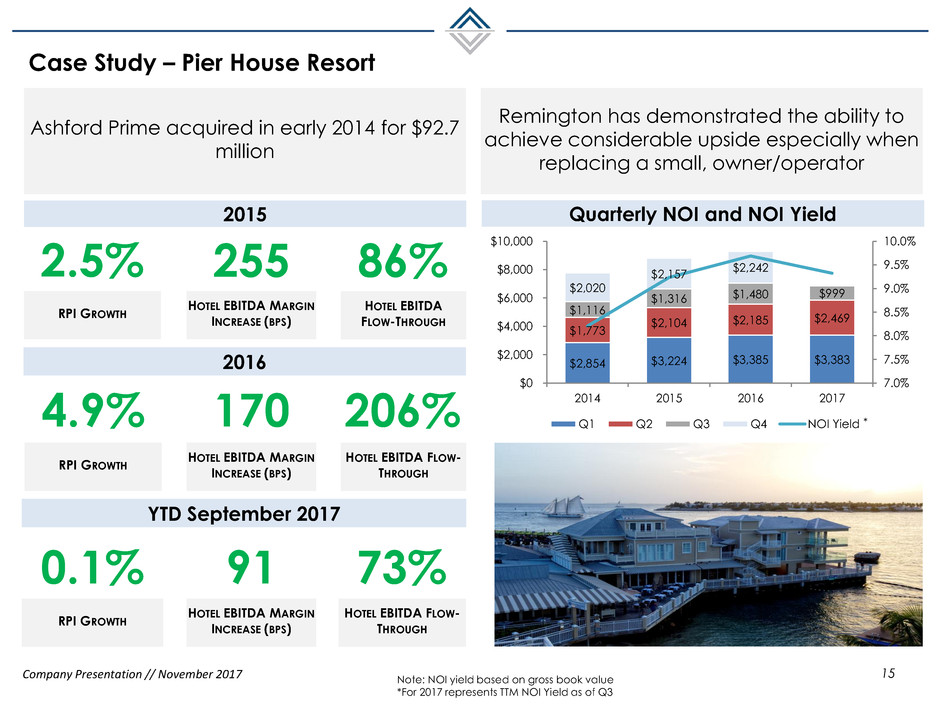

Case Study – Pier House Resort

15

Ashford Prime acquired in early 2014 for $92.7

million

2015

2.5% 255 86%

RPI GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA

FLOW-THROUGH

2016

4.9% 170 206%

RPI GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA FLOW-

THROUGH

Pier House Resort Performance

2015 2016 2017 YTD

RPI % Change 2.1% 4.0% 2.9%

RevPAR $357.88 $361.08 $403.42

Total Revenue % Change 5.8% 1.0% 2.1%

GOP Flow % 73.4% 195.1% 89.6%

YTD September 2017

0.1% 91 73%

RPI GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA FLOW-

THROUGH

Q1 Q2 Q3 Q4

2017 RPI % Change 4.4% 1.0%

2016 RPI hange 0.8 3.9 8.4% 4.5%

Remington has demonstrated the ability to

achieve considerable upside especially when

replacing a small, owner/operator

Quarterly NOI and NOI Yield

$2,854 $3,224 $3,385 $3,383

$1,773

$2,104 $2,185 $2,469

$1,116

$1,316 $1,480 $999

$2,020

$2,157

$2,242

7.0%

7.5%

8.0%

8.5%

9.0%

9.5%

10.0%

$0

$2,000

$4,000

$6,000

$8,000

$10,000

2014 2015 2016 2017

Q1 Q2 Q3 Q4 NOI Yield

Note: NOI yield based on gross book value

*For 2017 represents TTM NOI Yield as of Q3

*

Company Presentation // November 2017

Case Study – Bardessono Hotel & Spa

16

• Acquired in July 2015 for $85 million and installed affiliated property

manager Remington

• Proven ability to outperform

2016 (First Full Year of Ownership)

10% 518 242%

REVPAR GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA FLOW-

THROUGH

YTD September 2017

4.6% 211 181%

REVPAR GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA FLOW-

THROUGH

Quarterly NOI and NOI Yield

($438) $4

$93

$1,025 $1,339

$1,369

$1,566

$1,692 $1,915

$1,061

$1,238

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

($1,000)

$0

$1,000

$2,000

$3,000

$4,000

$5,000

2015 2016 2017

Q1 Q2 Q3 Q4 NOI Yield

Note: NOI yield based on gross book value

*For 2017 represents TTM NOI Yield as of Q3

*

Investor and Analyst Day // New York

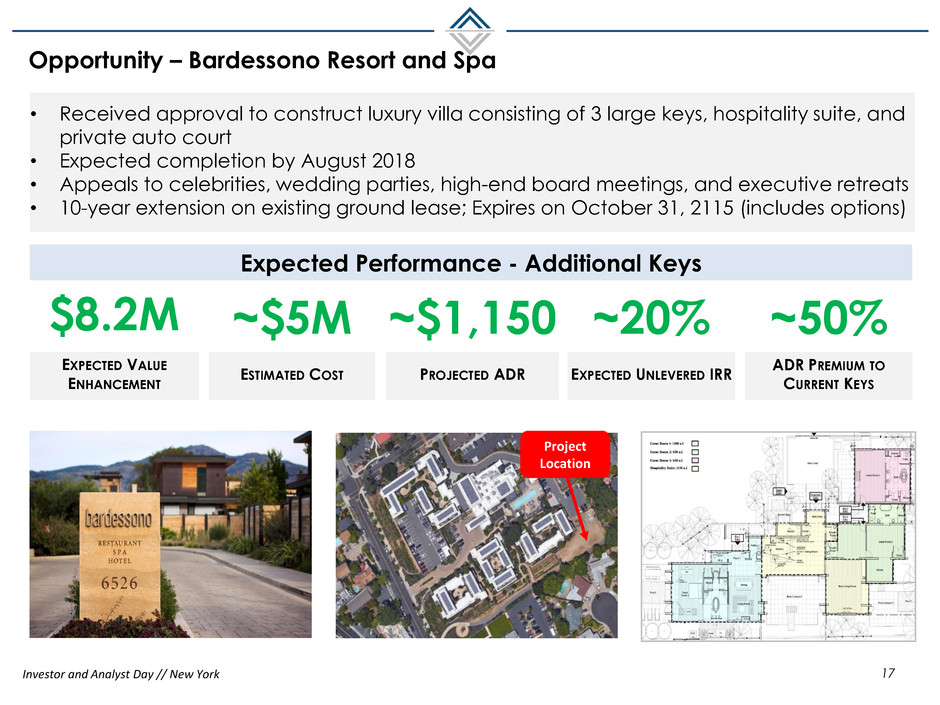

Opportunity – Bardessono Resort and Spa

17

Received approval to construct luxury villa consisting of 3 large keys, hospitality suite and private auto court

Favorable ground lease amendment to capture adjacent parcel

Unsatisfied demand for large luxury rooms

Appeals to celebrities, wedding parties, couples traveling in pairs, families, high-end board meetings, and

executive retreats

As part of transaction, Ashford is getting additional 10 years on existing ground lease

Project

Location

SEE RICHARD’S SLIDE IN

PRINTOUT (SLIDE 14), MAKE

SURE THAT WE ARE NOT

REPEATING AND THAT WE ARE

GOING IN TO MORE DETAIL

• Received approval to construct luxury villa consisting of 3 large keys, hospitality suite, and

private auto court

• Expected completion by August 2018

• Appeals to celebrities, wedding parties, high-end board meetings, and executive retreats

• 10-year extension on existing ground lease; Expires on October 31, 2115 (includes options)

$475

$495

$515

$535

$555

$575

$595

$615

$635

$655

2013 2014 2015 2016 2017 TTM

Consistent YoY RevPAR Growth

+26.7% increase in

RevPAR since Jan.

2013

Expected Performance - Additional Keys

$8.2M ~$5M

EXPECTED VALUE

ENHANCEMENT

ESTIMATED COST

~$1,150 ~50%

PROJECTED ADR

ADR PREMIUM TO

CURRENT KEYS

~20%

EXPECTED UNLEVERED IRR

Company Presentation // November 2017

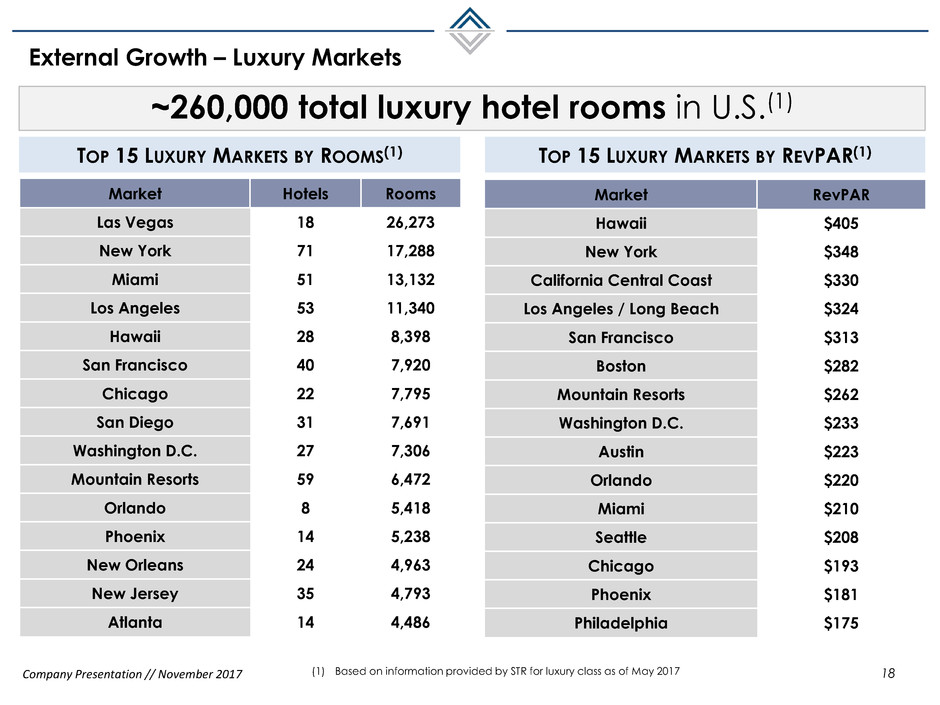

External Growth – Luxury Markets

18

TOP 15 LUXURY MARKETS BY ROOMS(1)

(1) Based on information provided by STR for luxury class as of May 2017

Market Hotels Rooms

Las Vegas 18 26,273

New York 71 17,288

Miami 51 13,132

Los Angeles 53 11,340

Hawaii 28 8,398

San Francisco 40 7,920

Chicago 22 7,795

San Diego 31 7,691

Washington D.C. 27 7,306

Mountain Resorts 59 6,472

Orlando 8 5,418

Phoenix 14 5,238

New Orleans 24 4,963

New Jersey 35 4,793

Atlanta 14 4,486

TOP 15 LUXURY MARKETS BY REVPAR(1)

Market RevPAR

Hawaii $405

New York $348

California Central Coast $330

Los Angeles / Long Beach $324

San Francisco $313

Boston $282

Mountain Resorts $262

Washington D.C. $233

Austin $223

Orlando $220

Miami $210

Seattle $208

Chicago $193

Phoenix $181

Philadelphia $175

~260,000 total luxury hotel rooms in U.S.(1)

Company Presentation // November 2017

0

5

10

15

20

25

30

35

40

45

50

Fundamentals Market Size Pricing

Target Market Analysis(1)

19 (1) Based on internal analysis

Market Size Fundamentals Pricing Desirability

Investor and Analyst Day // New York

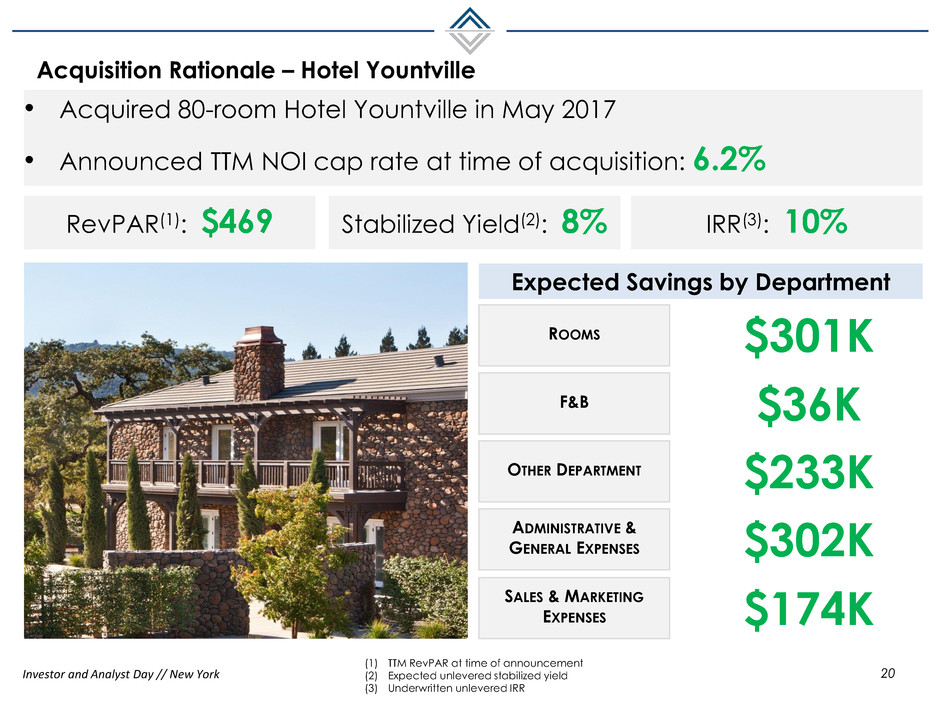

Acquisition Rationale – Hotel Yountville

20

Expected Savings by Department

ROOMS

OTHER DEPARTMENT

SALES & MARKETING

EXPENSES

• Acquired 80-room Hotel Yountville in May 2017

• Announced TTM NOI cap rate at time of acquisition: 6.2%

F&B

ADMINISTRATIVE &

GENERAL EXPENSES

Stabilized Yield(2): 8% IRR(3): 10%

$301K

$36K

$233K

$302K

$174K

RevPAR(1): $469

(1) TTM RevPAR at time of announcement

(2) Expected unlevered stabilized yield

(3) Underwritten unlevered IRR

Investor and Analyst Day // New York

Acquisition Rationale – Park Hyatt Beaver Creek

21

Purchased 190-room Park Hyatt Beaver Creek for $145.5 MM in April 2017

Immediately commenced PIP that found initial $230k in savings

Developing value-add program, including addition of upscale membership ski club

Club will provide ski valet, ski tuning and waxing, private locker rooms, and

complimentary breakfast and lunch during ski season

Daily passes will be available for purchase to hotel guests

Planning key additions in underutilized spa and office space

Planned lobby renovation to enhance and activate space, maximize apres ski and

evening beverage periods

Reviewing options for spa lease when it expires in 2018

NEED TO SELL HARD…

• Acquired 190-room Park Hyatt Beaver Creek in March 2017

• Announced TTM NOI cap rate at time of acquisition: 6.0%

Q2 2017 (First Full Quarter of Ownership)

19.7% 613 68%

REVPAR GROWTH

HOTEL EBITDA MARGIN

INCREASE (BPS)

HOTEL EBITDA FLOW-

THROUGH

Concierge lounge &

exclusive membership

club

Opportunities

7 Key additions in

underutilized spa and

office space

• 5 traditional

• 2 luxury suites

Lobby renovation to

enhance and activate

space

Changing spa manager

Maximize opportunities during soft

shoulder season

Acquired 190-room Park Hyatt Beaver Creek in April 2017

Developing value-add program, including addition of upscale membership ski club

Club will provide ski valet, ski tuning and waxing, private locker rooms, and complimentary breakfast and

lunch during ski season

Daily passes will be available for purchase to hotel guests

Planning key additions in underutilized spa and office space

Planned lobby renovation to enhance and activate space, maximize apres ski and evening beverage periods

Reviewing options for spa lease when it expires in 2018

Opportunity to renegotiate condo / spa agreements

Stabilized Yield(2): 8% IRR(3): 10%

(1) TTM RevPAR at time of announcement

(2) Expected unlevered stabilized yield

(3) Underwritten unlevered IRR

RevPAR(1): $271

Company Presentation // November 2017

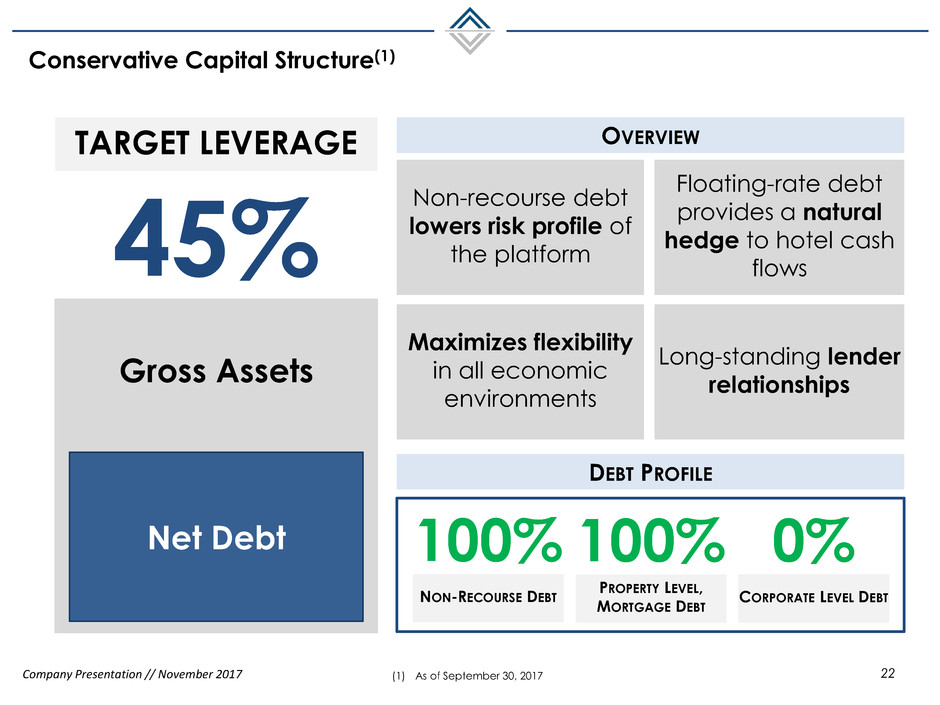

Conservative Capital Structure(1)

22

45%

TARGET LEVERAGE

Net Debt

Gross Assets

(1) As of September 30, 2017

Non-recourse debt

lowers risk profile of

the platform

OVERVIEW

Floating-rate debt

provides a natural

hedge to hotel cash

flows

Maximizes flexibility

in all economic

environments

Long-standing lender

relationships

100%

NON-RECOURSE DEBT

100%

PROPERTY LEVEL,

MORTGAGE DEBT

0%

CORPORATE LEVEL DEBT

DEBT PROFILE

Company Presentation // November 2017

Cash Management Strategy

23

(1) As of September 30, 2017

(2) Adjusted for sale of the Marriott Plano Legacy

(3) At market value as of November 20, 2017

NET WORKING CAPITAL(1)

10-15%

CASH TO GROSS DEBT TARGET

18%

CURRENT CASH TO

GROSS DEBT(2)

Defend our assets at financing maturity

BENEFITS

Hilton Torrey Pines

La Jolla, CA

$4.43

NWC / SHARE

(2)

(3)

Opportunistic investments in severe

economic downtown

Cash & Cash Equivalents $137.6

Restricted Cash 29.8

Accounts Receivable, net 18.9

Insurance Receivable 16.4

Prepaid Expenses 4.3

Due from Affiliates, net (0.7)

Due from Third-Party Hotel Managers, net 5.1

Investment in Ashford Inc. 16.7

Total Current Assets $228.1

Accounts Payable, net & Accrued Expenses $54.2

Dividends Payable 8.6

Total Current Liabilities $62.8

Net Working Capital $165.3

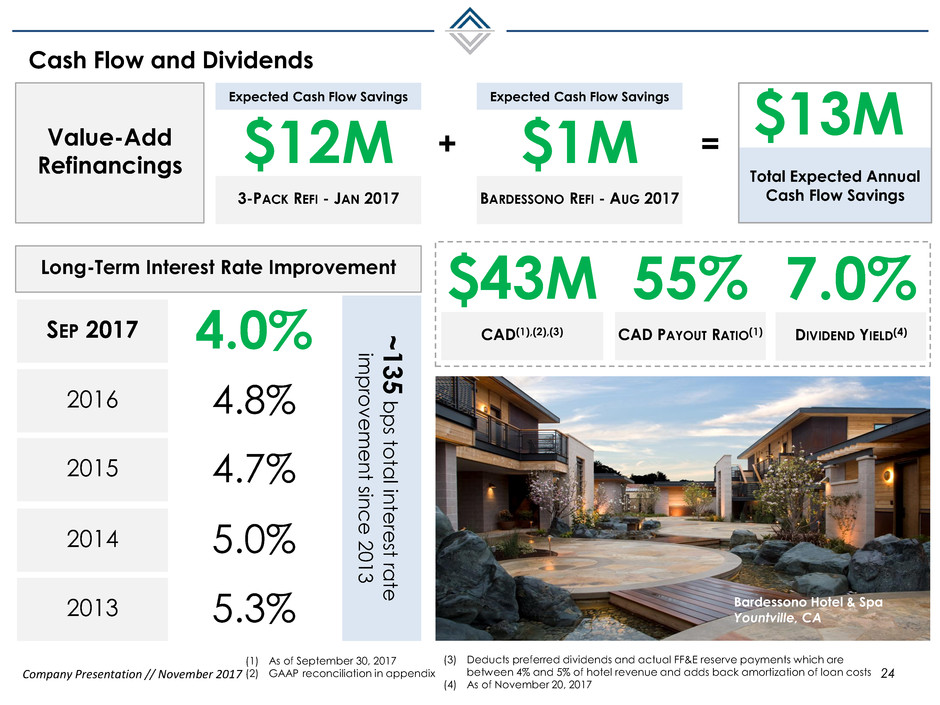

Company Presentation // November 2017

Value-Add

Refinancings

Long-Term Interest Rate Improvement

Cash Flow and Dividends

24

(1) As of September 30, 2017

(2) GAAP reconciliation in appendix

$12M

3-PACK REFI - JAN 2017

$43M

CAD(1),(2),(3) 4.0% SEP 2017

Expected Cash Flow Savings

$1M

BARDESSONO REFI - AUG 2017

Expected Cash Flow Savings

$13M

Total Expected Annual

Cash Flow Savings

+ =

4.8% 2016

4.7% 2015

5.0% 2014

5.3% 2013

~1

3

5

b

p

s to

ta

l inte

res

t ra

te

im

p

ro

v

e

m

e

n

t since

2

0

1

3

7.0%

DIVIDEND YIELD(4)

55%

CAD PAYOUT RATIO(1)

Bardessono Hotel & Spa

Yountville, CA

(3) Deducts preferred dividends and actual FF&E reserve payments which are

between 4% and 5% of hotel revenue and adds back amortization of loan costs

(4) As of November 20, 2017

Company Presentation // November 2017

$80.0 $112.0

$190.5

$436.1

0

50

100

150

200

250

300

350

400

450

500

2017 2018 2019 2020 2021 Thereafter

Fixed-Rate Floating-Rate

Laddered debt maturities

Debt Maturities

25

2019

NEXT HARD DEBT MATURITY

2.1x

FCCR

OVERVIEW(1)

(1) As of September 30, 2017

(2) Adjusted for sale of the Marriott Plano Legacy

Note: Excludes an $8.1 million TIF note maturing in 2018

Courtyard Philadelphia

Philadelphia, PA

(2)

Company Presentation // November 2017

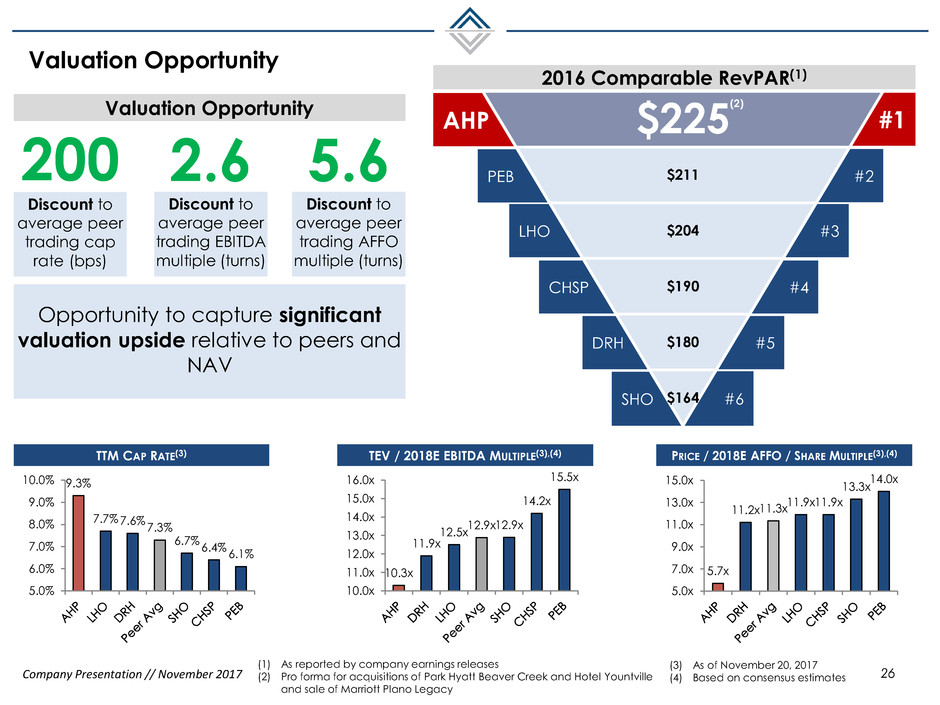

AHP

SHO

DRH

CHSP

LHO

PEB

Valuation Opportunity

26

(1) As reported by company earnings releases

(2) Pro forma for acquisitions of Park Hyatt Beaver Creek and Hotel Yountville

and sale of Marriott Plano Legacy

TEV / 2018E EBITDA MULTIPLE(3),(4) PRICE / 2018E AFFO / SHARE MULTIPLE(3),(4) TTM CAP RATE(3)

Discount to

average peer

trading cap

rate (bps)

Valuation Opportunity

2016 Comparable RevPAR(1)

200

Discount to

average peer

trading AFFO

multiple (turns)

5.6

Discount to

average peer

trading EBITDA

multiple (turns)

2.6

Opportunity to capture significant

valuation upside relative to peers and

NAV

#1

#2

#3

#4

#5

#6

$225

$211

$204

$190

$180

$164

(2)

(3) As of November 20, 2017

(4) Based on consensus estimates

9.3%

7.7% 7.6%

7.3%

6.7%

6.4%

6.1%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

10.3x

11.9x

12.5x

12.9x 12.9x

14.2x

15.5x

10.0x

11.0x

12.0x

13.0x

14.0x

15.0x

16.0x

5.7x

11.2x 11.3x

11.9x 11.9x

13.3x

14.0x

5.0x

7.0x

9.0x

11.0x

13.0x

15.0x

Company Presentation // November 2017

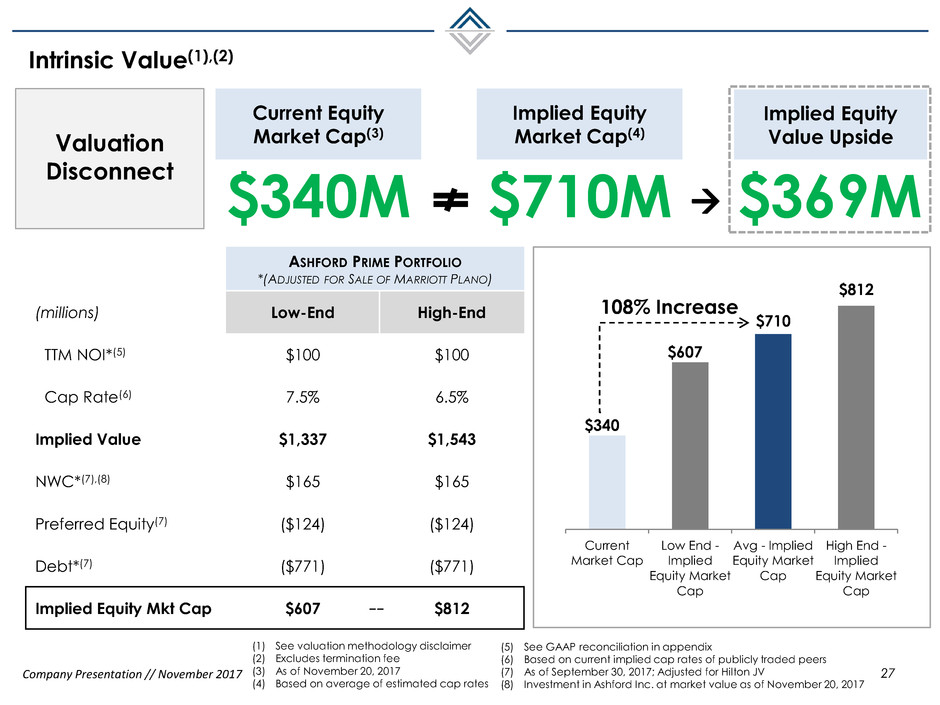

$340

$607

$710

$812

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

Current

Market Cap

Low End -

Implied

Equity Market

Cap

Avg - Implied

Equity Market

Cap

High End -

Implied

Equity Market

Cap

ASHFORD PRIME PORTFOLIO

*(ADJUSTED FOR SALE OF MARRIOTT PLANO)

(millions) Low-End High-End

TTM NOI*(5) $100 $100

Cap Rate(6) 7.5% 6.5%

Implied Value $1,337 $1,543

NWC*(7),(8) $165 $165

Preferred Equity(7) ($124) ($124)

Debt*(7) ($771) ($771)

Implied Equity Mkt Cap $607 $812

Intrinsic Value(1),(2)

27

Valuation

Disconnect

$340M

Current Equity

Market Cap(3)

$710M

Implied Equity

Market Cap(4)

$369M

Implied Equity

Value Upside

(1) See valuation methodology disclaimer

(2) Excludes termination fee

(3) As of November 20, 2017

(4) Based on average of estimated cap rates

(5) See GAAP reconciliation in appendix

(6) Based on current implied cap rates of publicly traded peers

(7) As of September 30, 2017; Adjusted for Hilton JV

(8) Investment in Ashford Inc. at market value as of November 20, 2017

--

108% Increase

Company Presentation // November 2017

Hurricane Irma Update

28

Accepting reservations and has resumed full operations

PIER HOUSE RESORT

Working with insurers to assess the damage and will be examining the

implementation of a planned renovation program

THE RITZ-CARLTON ST. THOMAS

Online reservations suspended while the resort remains open to walk-

ins and groups and currently has approximately 80 guest rooms

available

Working with insurers to assess the damage and will be examining the

implementation of a planned renovation program

All Ashford Prime hotels have comprehensive property, casualty, flood

and business interruption insurance. Expect uncovered losses of ~$5M.

Company Presentation // November 2017

Key Takeaways

29

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

The Ritz-Carlton St. Thomas

St. Thomas, USVI

Highest Quality Portfolio Amongst All Lodging REITs…In

The Segment With Greatest Growth Trajectory

Growing Organically: Rigorous Asset Management

While Mining Portfolio for Investment Opportunities

Growing Externally: Redeploying Capital into

Accretive Acquisitions

Shares Are Significantly Undervalued vs Peers

Highly Aligned Mgmt Team That Is a Major Shareholder

Appendix

Company Presentation // November 2017

Reconciliation of Net Income (Loss) to Hotel NOI

31

Three Months Ended Three Months Ended Three Months Ended Three Months Ended TTM Ended

September 30, 2017 June 30, 2017 March 31, 2017 December 31, 2016 September 30, 2017

Net income (loss) 10,705$ 21,607$ 14,951$ 12,615$ 59,878$

(Income) loss from consolidated entities attributable to noncontrolling

interest (872) (1,825) (1,444) (971) (5,112)

Net (income) loss attributable to redeemable noncontrolling interests in

operating partnership - - - - -

Net income (loss) attributable to the Company 9,833 19,782 13,507 11,644 54,766

Non-property adjustments 1,008 - - 1 1,009

Interest income (18) (10) (10) (10) (48)

Interest expense 2,744 2,204 1,280 1,672 7,900

Amortization of loan cost 307 271 130 135 843

Depreciation and amortization 14,134 13,468 11,851 11,555 51,008

Income tax expense (benefit) (404) 366 133 (21) 74

Non-hotel EBITDA ownership expense 4,554 465 396 379 5,794

Income (loss) from consolidated entities attributable to noncontrolling

interest 872 1,825 1,444 971 5,112

Hotel EBITDA including amounts attributable to noncontrolling interest 33,030 38,371 28,731 26,326 126,458

Less: EBITDA adjustments attributable to noncontrolling interest (746) (817) (779) (751) (3,093)

(Income) loss from consolidated entities attributable to noncontrolling

interest (872) (1,825) (1,444) (971) (5,112)

Net income (loss) attributable to redeemable noncontrolling interests in

operating partnership - - - - -

Hotel EBITDA attributable to the Company and OP unitholders 31,412$ 35,729$ 26,508$ 24,604$ 118,253$

Non-comparable adjustments (2,402) (2,474) 4,573 635 332

Comparable hotel EBITDA 30,628$ 35,897$ 33,304$ 26,961$ 126,790$

FFE reserve (4,738)$ (5,133)$ (5,143)$ (4,616)$ (19,630)

Comparable net operating income 25,890$ 30,764$ 28,161$ 22,345$ 107,160$

NOI adjustments attributable to noncontrolling interests (1,311) (2,284) (1,885) (1,416) (6,896)

NOI attributable to the Company and OP unitholders 24,579$ 28,480$ 26,277$ 20,929$ 100,264$

Company Presentation // November 2017

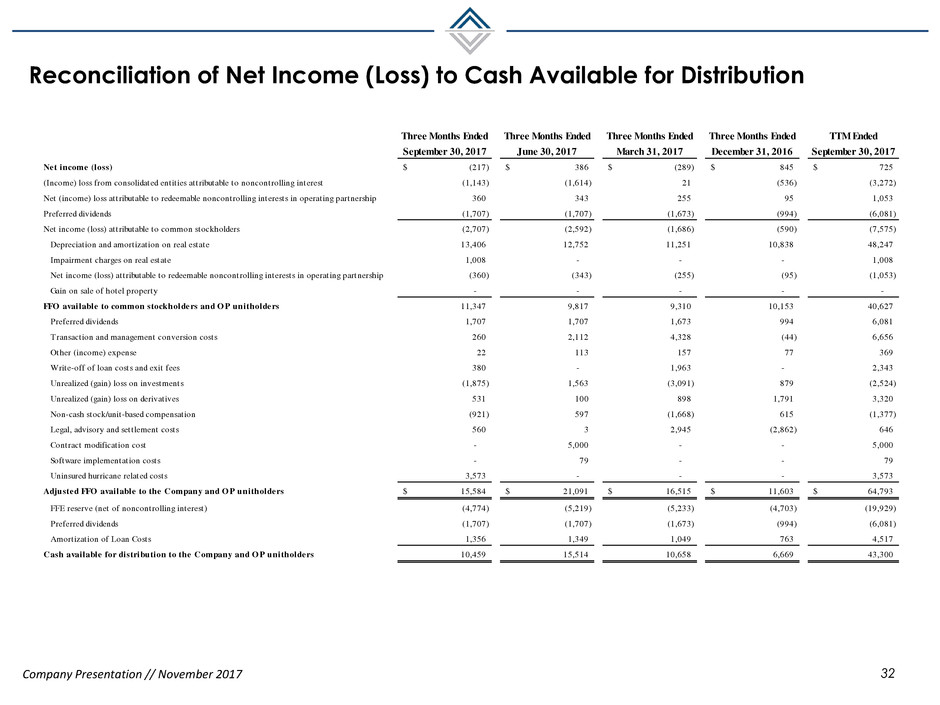

Reconciliation of Net Income (Loss) to Cash Available for Distribution

32

Three Months Ended Three Months Ended Three Months Ended Three Months Ended TTM Ended

September 30, 2017 June 30, 2017 March 31, 2017 December 31, 2016 September 30, 2017

Net income (loss) (217)$ 386$ (289)$ 845$ 725$

(Income) loss from consolidated entities attributable to noncontrolling interest (1,143) (1,614) 21 (536) (3,272)

Net (income) loss attributable to redeemable noncontrolling interests in operating partnership 360 343 255 95 1,053

Preferred dividends (1,707) (1,707) (1,673) (994) (6,081)

Net income (loss) attributable to common stockholders (2,707) (2,592) (1,686) (590) (7,575)

Depreciation and amortization on real estate 13,406 12,752 11,251 10,838 48,247

Impairment charges on real estate 1,008 - - - 1,008

Net income (loss) attributable to redeemable noncontrolling interests in operating partnership (360) (343) (255) (95) (1,053)

Gain on sale of hotel property - - - - -

FFO available to common stockholders and O P unitholders 11,347 9,817 9,310 10,153 40,627

Preferred dividends 1,707 1,707 1,673 994 6,081

Transaction and management conversion costs 260 2,112 4,328 (44) 6,656

Other (income) expense 22 113 157 77 369

Write-off of loan costs and exit fees 380 - 1,963 - 2,343

Unrealized (gain) loss on investments (1,875) 1,563 (3,091) 879 (2,524)

Unrealized (gain) loss on derivatives 531 100 898 1,791 3,320

Non-cash stock/unit-based compensation (921) 597 (1,668) 615 (1,377)

Legal, advisory and settlement costs 560 3 2,945 (2,862) 646

Contract modification cost - 5,000 - - 5,000

Software implementation costs - 79 - - 79

Uninsured hurricane related costs 3,573 - - - 3,573

Adjusted FFO available to the Company and O P unitholders 15,584$ 21,091$ 16,515$ 11,603$ 64,793$

FFE reserve (net of noncontrolling interest) (4,774) (5,219) (5,233) (4,703) (19,929)

Preferred dividends (1,707) (1,707) (1,673) (994) (6,081)

Amortization of Loan Costs 1,356 1,349 1,049 763 4,517

Cash available for distribution to the Company and O P unitholders 10,459 15,514 10,658 6,669 43,300