Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Time Inc. | mgmtpresentation.htm |

Management

Presentation

November 2017

Caution Concerning Forward Looking Statements and

Non-GAAP Financial Measures

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995;

particularly statements regarding future financial and operating results of Time Inc. (the “Company”) and its business. These statements

are based on management’s current expectations or beliefs, and are subject to uncertainty and changes in circumstances. Actual results

may vary materially from those expressed or implied in this presentation due to changes in economic, business, competitive, technological,

strategic, regulatory and/or other factors. More detailed information about these factors may be found in the Company’s filings with the

Securities and Exchange Commission, including its most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form

10-Q. The Company is under no obligation, and expressly disclaims any such obligation, to update or alter its forward-looking statements,

whether as a result of new information, future events or otherwise.

Management’s outlook does not include the impact of potential divestitures.

Non-GAAP financial measures such as Operating income (loss) excluding Depreciation and Amortization of intangible assets (“OIBDA”),

Adjusted OIBDA, Adjusted Diluted Earnings Per Share (EPS) and Free cash flow, as included in this presentation, are supplemental

measures that are not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). Definitions of these

measures and reconciliations to the most directly-comparable U.S. GAAP measures are included at the end of this presentation deck. Our

non-GAAP financial measures have limitations as analytical and comparative tools and you should consider OIBDA, Adjusted OIBDA,

Adjusted Diluted EPS and Free cash flow in addition to, and not as a substitute for, the Company’s Operating income (loss), Net income

(loss) attributable to Time Inc., Diluted EPS and various cash flow measures (e.g., Cash provided by (used in) operations), as well as other

measures of financial performance and liquidity reported in accordance with U.S. GAAP.

Note: Throughout the presentation, certain numbers may not sum to the total due to rounding.

All trademarks and service marks referenced herein are owned by the respective trademark or service mark owners. ©2017 Time Inc. Published

2017.

2

Sue D’Emic

EVP and Chief Financial Officer

With over 30 years’ experience in finance and accounting, Sue has served in a variety of senior

accounting and finance positions, including at Trusted Media Brands

Sue also oversees Technology, Production and Time Inc. India

Today’s Participants

3

Rich Battista

President and Chief Executive Officer

25-year veteran in entertainment with an impressive background of leading diverse media organizations,

including Fox and Gemstar-TV Guide

Proven experience in launching, building and managing large-scale businesses across media platforms, both

traditional and digital, and at various stages of development

Jen Wong

Chief Operating Officer and President, Digital

Leading industry expert with significant digital experience from her time at POPSUGAR, where Jen was

Chief Business Officer, and at AOL, where she held several top executive management positions

Jen has accelerated Time Inc.’s digital growth since joining the company

Overview

120MM+

monthly

global print 3

230MM+

global print and

digital 6

Hundred

s

of events

annually

274MM+

via global social

media

250MM+

U.S. consumer

registrations

3x

Video production

growth since 2014

~30MM

Subscribers4

4.6B

(2016) video

starts

Top U.S. Digital Media Property1

U.S. Multi-Platform Monthly Uniques (MM)

~40MM

Moms 5

~7 out

of 10

Millennials 5

Up from 81MM in June

2014

2

Sources: 1) comScore Multi-Platform September 2017; 2) comScore Multi-Platform for Time Inc. custom entity June 2014; ; 3) MRI Spring 2017, A.I.R. NRS

(Jan.-Dec. 2015), TGI (2Q 2016), ABC (Jan.-Dec. 2015); 4) AAM 1H 2017; 5) comScore Multi-Platform//GfK/MRI Fusion (7-17/Spring 2017; 6) 2017 comScore

Multi-Platform, custom entity August 2017

Massive Audience and Scale

5

245

205

196 196

182

165 164

149 145

142 139

100,000

105,000

110,000

115,000

120,000

125,000

130,000

135,000

140,000

145,000

-

50

100

150

200

250

300

M

a

y-

1

4

J

u

n

-1

4

J

u

l-

1

4

A

u

g

-1

4

S

e

p

-1

4

O

c

t-

1

4

N

o

v-

1

4

D

e

c-

1

4

J

a

n

-1

5

F

e

b

-1

5

M

a

r-

1

5

A

p

r-

1

5

M

a

y-

1

5

J

u

n

-1

5

J

u

l-

1

5

A

u

g

-1

5

S

e

p

-1

5

O

c

t-

1

5

N

o

v-

1

5

D

e

c-

1

5

J

a

n

-1

6

F

e

b

-1

6

M

a

r-

1

6

A

p

r-

1

6

M

a

y-

1

6

J

u

n

-1

6

J

u

l-

1

6

A

u

g

-1

6

S

e

p

-1

6

O

c

t-

1

6

N

o

v-

1

6

D

e

c-

1

6

J

a

n

-1

7

F

e

b

-1

7

M

a

r-

1

7

A

p

r-

1

7

M

a

y-

1

7

J

u

n

-1

7

J

u

l-

1

7

A

u

g

-1

7

S

e

p

-1

7

O

c

t-

1

7

N

o

v-

1

7

M

ill

io

n

s

Snapchat Flipboard LinkedIn Youtube Pinterest

Instagram Google Plus Twitter Facebook

365

446 490

605

826

1,003

1,251

1,507

2,622

2,989

3,628

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 6

SOCIAL REACH (MM)

Experiencing Significant Growth

274MM+

TOTAL

GLOBAL

FOLLOWERS

11/2017

TOTAL U.S. UNIQUE VISITORS (MM)

139MM

TOTAL

UVs1

9/2017

QUARTERLY U.S. VIDEO STARTS (MM)

3B+

TOTAL

STARTS

3Q 2017

6 Sources: 1) comScore Multi-Platform September 2017

Diverse Set of Influential Iconic Brands

Covering virtually every interest and passion

CELEBRITY &

ENTERTAINMENT

NEWS & BUSINESS SPORTS LIFESTYLE

Source:

1) comScore Multi-Platform//GfK/MRI Fusion (7-17/Spring 2017) ; 2) comScore Multi-Platform September 2017

Time Inc. Brands Over-Index with Millennials (18-34)2 for Digital Consumption - More Millennials than Vice and Vox

91MM

CONSUMERS 1

84MM

CONSUMERS 1

66MM

CONSUMERS 1

65MM

CONSUMERS 1

7

Sustaining the strength of

our print products

Growing our large digital

revenues

Extending our brands

through high-margin and

high-value areas, such as

events, licensing, TV and

international

Expanding the ARPU of

our ~30 million total

subscribers with other

products and services

Building our programmatic

and people-based

targeting capabilities

through unique first-party

data

Growth Strategy

Aggressive cost

reengineering program

Portfolio rationalization Enhanced financial

flexibility

8

Recent Strategic Initiatives

Strategic

Transformation

Program

CONFIDENTIAL

Strategic Transformation Program

10

In August 2017, after engaging in a thorough review of the business, management

announced the following:

1. Management has already targeted more than $400 million of run-rate cost savings, with the majority

of initiatives expected to be implemented by the end of 2018

2. Program utilizes a portion of proceeds to invest in our future in key growth areas including native and

branded content, video, data and targeting, paid products and services, and brand extensions

3. Management projects a minimum range of $500 million to $600 million of Adjusted OIBDA within 3 to

4 years

Program to accelerate the optimization of cost and revenue growth drivers

10

Management’s outlook does not include the impact of any potential divestitures.

See Cautionary Statement and reconciliations of non-GAAP financial measures in this presentation.

11

Reimagination of Print

Reimagining how we create, produce, distribute and monetize print

• Cost initiatives – including editorial delayering and hubbing, web content in books, editorial cost

innovation

• Format changes – including frequency and rate base, eventizing of covers

• Ad Sales innovation – new high impact cover integrations and experiences

• Better use of data – aligning print audience with digital in one audience sell and guarantee with

downstream point of sale information; enhancing CRM capabilities in subscription marketing

• Joint marketing activations with Time Inc. Retail

• Bookazines – increasing volume of product and growing the business through more extensions and

topical content

See Cautionary Statement and reconciliations of non-GAAP financial measures in this presentation.

Key

Growth

Areas

The Foundry has established a strong reputation for native,

and it is organized for category expertise and to build content

across print and digital.

Time Inc. native revenues grew almost 2x from 2015 to 2016.

Our sales team is experienced in selling content creation and

distribution, our most credible asset, built upon 100 years of

editorial know-how.

We are investing behind our Foundry Enterprise product,

which makes content and operates sites and social accounts

for marketers.

We are also investing in a proprietary native ad platform to

enable Time Inc. to scale fast-growing native operations.

Native /Branded Content

Our immersive content

experiences help brands tell their

stories so they resonate with the

right audiences at the right time

DIGITAL ADVERTISING

>2x1

$9B1

Market will grow

From 2015-18 to

13

Source:

1) Socintel 360

~600

Native & Branded Programs in 2016

14

Time Inc. Video is attracting fans at a record

rate, including an entirely new generation of

viewers.

In 2017, we plan to produce more than 50,000

videos - including 150 new and returning

franchises and series, and over 1,500 live

programming hours.

In 3Q 2017, we achieved over 3 billion video

views across our network and are on pace to

exceed 10 billion views this year, nearly

doubling versus the previous year.

This year, we are launching social-only video

brands to feed the insatiable demand for social

video and drive the native revenue opportunity

in key ad verticals:

• Food: Well Done (launched March

2017)

• Beauty: The Pretty (launched May

2017)

• Exploring launches in other verticals

Video

Time Inc. has built major video capabilities and video has

quickly become the new way we tell stories.

VIDEO STARTS (MM)

Sources:

1) Internal, Omniture, Facebook, Google, Snapchat, Twitter

DIGITAL ADVERTISING

Record

quarterly

level

Time Inc.

3B+ video

views

365 446

490

605

826

1,003

1,251

1,507

2,622

2,989

3,628

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

S O C I A L V I D E O L O N G F O R M T V V I R T U A L R E A L I T Y

O T T D I G I T A L V I D E O 3 R D P A R T Y P L A T F O R M S

Leading the Way Across the Video Ecosystem

2

BRANDS

LAUNCHED

YTD 2017

360o

INTERACTIVE

EXPERIENCES

2MM+

DOWNLOADS

9/2017

50hrs+

ON THE AIR

1B+

STREAMS PER

MONTH

3

SNAP

CHANNELS

6/2017

15

Content Capabilities Across All Platforms and Formats

IG-Exclusive Elevator Videos

16

The average U.S. household owns 7.8 Internet-connected devices1, but

marketers typically can identify only one of them during Web visits, making it

challenging to optimize frequency and measure ROI.

Leveraging the shift to programmatic buying, Time Inc. + Viant offers both

premium brands and first-party data which enables us to generate content,

connect with audiences and efficiently message and re-target.

Multiple market approaches:

1. Time Inc. Audience Amplify: Ability to target and extend Time Inc.’s

premium audiences with Viant people-based targeting (on and off

owned sites)

2. Viant + Adelphic: Adelphic’s self-service media planning and execution

tools, including its ability to reach consumers across all screens and

formats, bolsters Viant’s people-based data and analytics offerings.

250 MM

Programmatic &

People-Based Targeting

Time Inc. and Viant help advertisers reach specific

targeted people and audiences, maximizing ROI

Registered U.S.

Profiles

4B

Ad Requests / Day

Time Inc. + Viant: Advertisers can find and

measure ROI against people-based targets

across owned and third-party sites

Open platform with self-serve,

programmatic integrations

SCALABLE

Time Inc. Sites

PREMIUM

17

Source:

1) March 2016 NPD report

DIGITAL ADVERTISING

BRAND LICENSING TV & LONG FORM EVENTS

Extending Time Inc.’s brands to products

worldwide, and monetizing against our

existing editorial

Time Inc. Productions is a full-service

production company leveraging Time

Inc.’s iconic brands to create and

monetize original programming

Time Inc. has the power to convene

consumers and industry leaders across

the globe

ONLINE PROGRAMS

Brand Extensions

18

Financial

Highlights

Solid Quarter for Adjusted OIBDA Despite Challenging Print Environment

Total revenues of $679 million, declined 9% year-over-year.

Operating income of $51 million versus Operating loss of $167 million in the prior year.

Adjusted OIBDA of $115 million versus $100 million in the prior year.

In October 2017, Leverage-Neutral Refinancing Transaction Extended Debt

Maturities and Balanced Capital Structure

Strategic Transformation Program – Developed Detailed Bottom-Up Plans; Affirming

Target of More Than $400 Million of Run-Rate Cost Savings

Portfolio Rationalization – Sold INVNT in July; Processes Underway for Sunset,

Golf, Time Inc. UK, TCS, and majority stake in Essence

3Q17 Financial Highlights

20 See Cautionary Statement and reconciliations of non-GAAP financial measures in this presentation.

3Q17 Sources of Revenues

Sources of Revenues

In millions Three Months Ended

September 30,

Nine Months Ended

September 30,

2017 2016 % Change 2017 2016 % Change

Magazines $ 433

$ 506

(14 )% $ 1,300

$ 1,560

(17 )%

Digital 165 160 3 % 480 429 12 %

Brand Extensions & Other 81 84 (4 )% 229 220 4 %

Total revenues $ 679 $ 750 (9 )% $ 2,009 $ 2,209 (9 )%

Enhanced Revenue Disclosure to Better Convey Time Inc.’s Diversifying Revenues – Added 3Q17

Magazines consists of revenues generated from the sale of printed magazines, bundled print and digital offers and magazine distribution, fulfillment and

marketing services provided to third-party publishers.

Digital consists of revenues generated on digital platforms, such as Digital advertising (including programmatic, native and branded content and video), content

licensing and syndication, digital-only subscriptions and digitally-transacted paid products and services.

Brand Extensions & Other represents revenues generated by leveraging our brands and other intellectual property. Brand Extensions & Other consists of

branded book publishing, including bookazines, events, brand licensing, and television licensing, as well as revenues from custom publishing, INVNT (our event

production subsidiary sold in July 2017), and other revenues.

See Cautionary Statement and reconciliations of non-GAAP financial measures in this presentation. 21

Diversifying Sources of Revenues

Magazines consists of revenues generated from the sale of printed magazines, bundled print and digital offers and magazine distribution, fulfillment and marketing services provided to

third-party publishers.

Digital consists of revenues generated on digital platforms, such as Digital advertising (including programmatic, native and branded content and video), content licensing and syndication,

digital-only subscriptions and digitally-transacted paid products and services.

Brand Extensions & Other represents revenues generated by leveraging our brands and other intellectual property. Brand Extensions & Other consists of branded book publishing,

including bookazines, events, brand licensing, and television licensing, as well as revenues from custom publishing, INVNT (our event production subsidiary sold in July 2017), and other

revenues.

See Cautionary Statement and reconciliations of non-GAAP financial measures in this presentation. 22

78%

13%

9%

2015

22%

Non-Magazines

70%

20%

10%

2016

30%

Non-Magazines

65%

24%

11%

9ME 9/30/17

Magazines

Digital

Brand Extensions &

Other

35%

Non-Magazines

Appendix

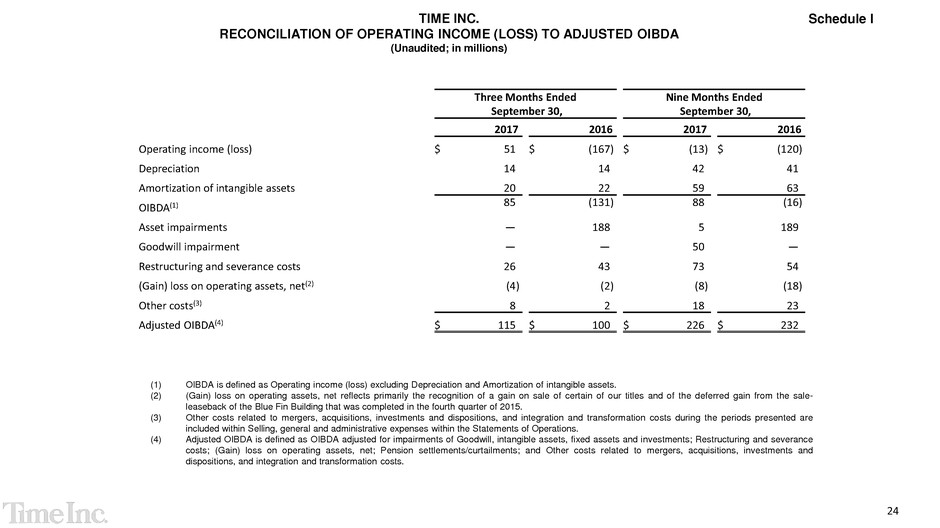

(1) OIBDA is defined as Operating income (loss) excluding Depreciation and Amortization of intangible assets.

(2) (Gain) loss on operating assets, net reflects primarily the recognition of a gain on sale of certain of our titles and of the deferred gain from the sale-

leaseback of the Blue Fin Building that was completed in the fourth quarter of 2015.

(3) Other costs related to mergers, acquisitions, investments and dispositions, and integration and transformation costs during the periods presented are

included within Selling, general and administrative expenses within the Statements of Operations.

(4) Adjusted OIBDA is defined as OIBDA adjusted for impairments of Goodwill, intangible assets, fixed assets and investments; Restructuring and severance

costs; (Gain) loss on operating assets, net; Pension settlements/curtailments; and Other costs related to mergers, acquisitions, investments and

dispositions, and integration and transformation costs.

TIME INC.

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED OIBDA

(Unaudited; in millions)

Schedule I

Three Months Ended

September 30,

Nine Months Ended

September 30,

2017 2016 2017 2016

Operating income (loss) $ 51 $ (167 ) $ (13 ) $ (120 )

Depreciation 14 14 42 41

Amortization of intangible assets 20 22 59 63

OIBDA(1) 85 (131 ) 88 (16 )

Asset impairments — 188 5 189

Goodwill impairment — — 50 —

Restructuring and severance costs 26 43 73 54

(Gain) loss on operating assets, net(2) (4 ) (2 ) (8 ) (18 )

Other costs(3) 8 2 18 23

Adjusted OIBDA(4) $ 115 $ 100 $ 226 $ 232

24

Schedule II TIME INC.

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED OIBDA –

2017 & 2021 OUTLOOK

(Unaudited; in millions)

(1) Adjusted OIBDA is defined as OIBDA adjusted for impairments of Goodwill, intangible assets, fixed assets and investments; Restructuring and severance costs;

(Gain) loss on operating assets, net; Pension settlements/curtailments; and Other costs related to mergers, acquisitions, investments and dispositions, and

integration and transformation costs. Management's Outlook does not include the impact of potential divestitures.

(2) OIBDA is defined as Operating income (loss) excluding Depreciation and Amortization of intangible assets.

Full Year 2017 Outlook Range Full Year 2021 Outlook Range

Adjusted OIBDA(1) $400 to $414 $500 to $600

Asset impairments, Goodwill impairment,

Restructuring and severance costs, (Gains) losses on

operating assets, net; Pension

settlements/curtailments; and Other costs related to

mergers, acquisitions, investments and dispositions,

and integration and transformation costs

Unable to estimate beyond the $138

recognized from

January 1, 2017 through

September 30, 2017

Unable to estimate

OIBDA(2) Unable to estimate Unable to estimate

Amortization of intangible assets ~$75 Unable to estimate

Depreciation ~$60 Unable to estimate

Operating income (loss) Unable to estimate Unable to estimate

25

Management

Presentation

November 2017