Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Fibrocell Science, Inc. | a2233838zex-23_1.htm |

As filed with the Securities and Exchange Commission on November 16, 2017

Registration Statement No. 333-221375

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FIBROCELL SCIENCE, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

87-0458888 (I.R.S. Employer Identification Number) |

405 Eagleview Boulevard

Exton, Pennsylvania 19341

(484) 713-6000

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

John M. Maslowski

President and Chief Executive Officer

Fibrocell Science, Inc.

405 Eagleview Boulevard

Exton, Pennsylvania 19341

(484) 713-6000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Steven J. Abrams Hogan Lovells US LLP 1735 Market Street, 23rd Floor Philadelphia, PA 19103 (267) 675-4600 |

Steven M. Skolnick, Esq. Lowenstein Sandler LLP 1251 Avenue of the Americas New York, New York 10020 (212) 262-6700 |

|

Approximate date of commencement of proposed sale to public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

|

||||

| Title of Each Class of Securities To Be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2)(5) |

||

|---|---|---|---|---|

Common stock, $0.001 par value per share |

$23,322,000.00 | $2,903.59 | ||

Underwriter's warrants to purchase common stock(3) |

— | — | ||

Common stock issuable upon exercise of the underwriter's warrants(4) |

$1,166,100.00 | $145.18 | ||

Total |

$24,488,100.00 | $3,048.77 | ||

|

||||

- (1)

- Estimated

solely for purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes

shares subject to the underwriter's option to purchase additional shares.

- (2)

- Calculated

pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price of the securities registered hereunder.

- (3)

- No

additional registration fee is payable pursuant to Rule 457(g) under the Securities Act.

- (4)

- Represents

warrants to purchase a number of shares of common stock equal to 4% of the number of shares of common stock that are being offered in this offering at an

exercise price equal to 125% of the offering price.

- (5)

- The Registrant previously paid $3,006.68 in connection with the initial filing of the Registration Statement.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 16, 2017

PRELIMINARY PROSPECTUS

13,000,000 Shares

Fibrocell Science, Inc.

Common Stock

We are offering 13,000,000 shares of our common stock.

Our common stock is listed on the Nasdaq Capital Market under the symbol "FCSC." The last reported sale price for our common stock on the Nasdaq Capital Market on November 15, 2017 was $1.56 per share. The actual offering price per share will be as determined between us and the underwriter at the time of pricing, and may be at a discount to the current market price.

You should rely only on the information contained herein or incorporated by reference in this prospectus. We have not authorized any other person to provide you with different information.

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 9 of this prospectus and under similar headings in the documents incorporated by reference into this prospectus.

|

||||

| |

Per Share |

Total |

||

|---|---|---|---|---|

Public offering price |

$ | $ | ||

Underwriting discounts and commissions(1) |

$ | $ | ||

Proceeds, before expenses, to us |

$ | $ | ||

|

||||

- (1)

- See the section titled "Underwriting" for a description of the compensation payable to the underwriter.

We have granted the underwriter the option to purchase up to an additional 1,950,000 shares of common stock to cover over-allotments, if any, at the public offering price less the underwriting discounts and commissions. The underwriter may exercise its option at any time within 30 days from the date of this prospectus. If the underwriter exercises the option in full, the total underwriting discounts and commissions payable by us will be $ , and the total proceeds to us, before expenses, will be $ .

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares of common stock to purchasers on , 2017.

Sole Book-Running Manager

H.C. Wainwright & Co.

The date of this prospectus is , 2017.

TABLE OF CONTENTS

You should read this prospectus, including the information incorporated by reference herein, and any related free writing prospectus that we have authorized for use in connection with this offering.

You should rely only on the information that we have included or incorporated by reference in this prospectus and any related free writing prospectus that we may authorize to be provided to you. We have not authorized any underwriter, dealer or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus or any related free writing prospectus that we may authorize to be provided to you. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or any related free writing prospectus. This prospectus and any related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus or any related free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You should not assume that the information contained in this prospectus or any related free writing prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference herein or therein is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus or any related free writing prospectus is delivered, or securities are sold, on a later date.

This prospectus contains or incorporates by reference summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed or have been incorporated by reference as exhibits to the registration statement of which this prospectus forms a part, and you may obtain copies of those documents as described in this prospectus under the headings "Incorporation by Reference" and "Where You Can Find More Information."

i

This summary highlights information contained in other parts of this prospectus and in the documents we incorporate by reference. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus, any applicable free writing prospectus and the documents incorporated by reference herein and therein. You should read all such documents carefully, especially the risk factors and our consolidated financial statements and the related notes included or incorporated by reference herein or therein, before deciding to buy shares of our common stock. Unless the context requires otherwise, references in this prospectus to "Fibrocell," "we," "us" and "our" refer to Fibrocell Science, Inc. and its subsidiaries.

Company Overview

We are an autologous cell and gene therapy company focused on translating personalized biologics into medical breakthroughs for diseases affecting the skin and connective tissue. Our distinctive approach to personalized biologics is based on our proprietary autologous fibroblast technology. Fibroblasts are the most common cell in skin and connective tissue and are responsible for synthesizing extracellular matrix proteins, including collagen and other growth factors, that provide structure and support. Because fibroblasts naturally reside in the localized environment of the skin and connective tissue, they represent an ideal delivery vehicle for proteins targeted to these areas. We target the underlying cause of disease by using fibroblast cells from a patient's skin and genetically modifying them to create localized therapies that are compatible with the unique biology of the patient, which are autologous.

We are focused on discovering and developing localized therapies for diseases affecting the skin and connective tissue, where there are high unmet needs, to improve the lives of patients and their families. In that regard, we commit significant resources to our research and development programs. Currently, all of our research and development operations and focus are on gaining regulatory approvals to commercialize our product candidates in the United States; however, we may seek to expand into international markets in the future.

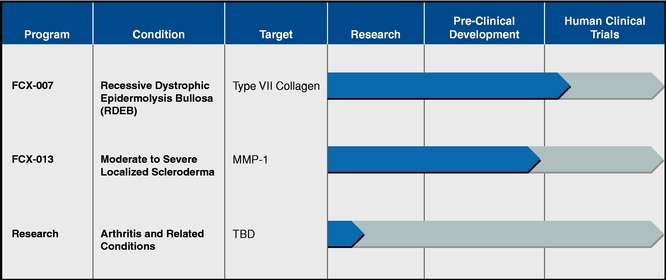

Our current pipeline consists of the following product candidates which we are developing in collaboration with Intrexon Corporation, or Intrexon:

Our most advanced product candidate, FCX-007, is currently in a Phase 1/2 trial for the treatment of recessive dystrophic epidermolysis bullosa, or RDEB. We are also in pre-clinical development of

1

FCX-013, our product candidate for the treatment of moderate to severe localized scleroderma. In addition, we have a third program in the research phase for the treatment of arthritis and related conditions. See further discussion of our gene-therapy product candidates under the heading "Development Programs" below.

Intrexon Collaborations

We collaborate with Intrexon, a related party, through two distinct exclusive channel collaboration agreements, consisting of the Exclusive Channel Collaboration Agreement entered into in October 2012, as amended, or the 2012 ECC, and the Exclusive Channel Collaboration Agreement entered into in December 2015, or the 2015 ECC. Pursuant to these agreements, we engage Intrexon for support services for the research and development of product candidates covered under the respective agreements and reimburse Intrexon for its cost for time and materials for such work. In addition, we are required to pay Intrexon quarterly cash royalties on all products developed under the 2012 ECC in an amount equal to 7% of aggregate quarterly net sales up to $25 million, plus 14% on aggregate quarterly net sales greater than $25 million. Under the 2015 ECC, we are required to pay Intrexon development milestones of up to $30 million for the first product developed under the 2015 ECC (and development milestones of up to $55 million for each subsequent product developed under the 2015 ECC) and commercialization milestones of up to $22.5 million for each product developed, a low double-digit royalty on our net sales of such products and half of any sublicensing revenues we receive from third parties in consideration for sublicenses granted by us with respect to such products but only to the extent such sublicensing revenues are not included in net sales subject to royalties.

We are developing FCX-007 and FCX-013 under the 2012 ECC and we are in the research phase for a gene-therapy treatment for arthritis and related conditions under the 2015 ECC.

Development Programs

FCX-007 for Recessive Dystrophic Epidermolysis Bullosa

RDEB is the most severe form of dystrophic epidermolysis bullosa, or DEB, a congenital, progressive, devastatingly painful and debilitating genetic disorder that often leads to death. RDEB is caused by a mutation of the COL7A1 gene, the gene which encodes for type VII collagen, or COL7, a protein that forms anchoring fibrils. Anchoring fibrils hold together the layers of skin, and without them, skin layers separate causing severe blistering, open wounds and scarring in response to friction, including normal daily activities like rubbing or scratching. Children who inherit this condition are often called "butterfly children" because their skin can be as fragile as a butterfly's wings. We estimate that there are approximately 1,100 - 2,500 RDEB patients in the U.S. Currently, treatments for RDEB address only the sequelae, including daily bandaging (which can cost a patient in excess of $10,000 per month), hydrogel dressings, antibiotics, feeding tubes and surgeries.

Our lead product candidate, FCX-007, is in clinical development for the treatment of RDEB. FCX-007 is a genetically-modified autologous fibroblast that encodes the gene for COL7 for localized treatment of RDEB and is being developed in collaboration with Intrexon. By genetically modifying autologous fibroblasts ex vivo to produce COL7, culturing them and then treating blisters and wounds locally via injection, FCX-007 offers the potential to address the underlying cause of the disease by providing high levels of COL7 directly to the affected areas, thereby avoiding systemic treatment. In addition, we believe the autologous nature of the cells, localized delivery, use of an integrative vector and the low turnover rate of the protein will contribute to long-term persistence of the COL7 produced by FCX-007.

FCX-007 has received Orphan Drug Designation for the treatment of DEB, including RDEB, Rare Pediatric Disease Designation for the treatment of RDEB and Fast Track Designation for the treatment of RDEB from the United States Food and Drug Administration, or FDA.

2

Phase 1/2 Clinical Trial of FCX-007 for RDEB

The primary objective of this open-label trial is to evaluate the safety of FCX-007 in RDEB patients. Additionally, the trial will assess (i) the mechanism of action of FCX-007 through the evaluation of COL7 expression and the presence of anchoring fibrils and (ii) the efficacy of FCX-007 through intra-subject paired analysis of target wound area by comparing FCX-007 treated wounds to untreated wounds in Phase 1 and to wounds administered with sterile saline in Phase 2 through the evaluation of digital imaging of wounds. Twelve patients are targeted to be treated with FCX-007 consisting of six adults in the Phase 1 portion of the trial and six patients in the Phase 2 portion of the trial. Prior to conducting clinical trials on pediatric patients, we are required to obtain allowance from the FDA by submitting evidence of FCX-007 safety and benefit in adult patients and data from its completed pre-clinical toxicology study.

We are actively recruiting adult patients to complete enrollment in the Phase 1 portion of the trial and currently have four of the six adult patients enrolled. The patients in the Phase 1 portion of the trial are divided into two equal cohorts in order to evaluate the safety of FCX-007 in each population type. One cohort is comprised of patients who have positive expression of the non-collagenous portion of the COL7 protein (NC1+) and the other cohort is comprised of patients who do not express the non-collagenous portion of the protein (NC1–). Patients enrolled to date fulfilled the NC1+ cohort and also provided the first patient for the NC1– cohort. Two more patients are required for the NC1– cohort to complete enrollment in the Phase 1 portion of the trial. The clinical trial protocol is designed to allow a cohort to move into the Phase 2 portion of the trial even if the other cohort is still enrolling or in the follow-up evaluation period.

The first adult patient in the NC1+ cohort in the Phase 1 portion of the Phase 1/2 clinical trial was dosed in the first quarter of 2017. In April 2017, the Data Safety Monitoring Board, or DSMB, recommended continuation of the Phase 1/2 clinical trial of FCX-007 for the treatment of RDEB, following a planned review of safety data from the first patient treated in the Phase 1 portion of the trial. No product-related adverse events were reported. Based on the DSMB's recommendation, the remaining two patients in the NC1+ cohort in the Phase 1 portion of the trial were dosed in June 2017.

In September 2017, we reported interim results from the Phase 1 portion of the Phase 1/2 clinical trial of FCX-007. Three adult NC1+ patients were dosed with a single intradermal injection session of FCX-007 in the margins of and across targeted wounds, as well as in separate intact skin sites. Five wounds were treated on the three subjects, ranging in size from 4.4cm2 to 13.1cm2. Data from these patients show FCX-007 was well-tolerated through 12 weeks post-administration. There were no serious adverse events and no product related adverse events reported.

The targeted wounds were evaluated during a monitoring period prior to dosing and were observed to be open for up to eight months. Compared to the baseline measurement collected at Day 0 before the single intradermal injection session of FCX-007, at four weeks post-administration 100% (5/5) of wounds were ³ 75% healed. At 12 weeks post-administration, 80% (4/5) of wounds were ³ 70% healed. The wound that was < 70% healed from the twelve week data set was biopsied by the investigator in the middle of the wound bed rather than on the wound edge, which we believe may have contributed to the wound's instability. We plan to continue to monitor this and other wounds throughout the follow-up visits.

Various pharmacology signals for vector DNA, COL7 mRNA, or COL7 protein expression were detected throughout the data set in each patient for one or more assays up to 12 weeks post-administration (qPCR, electron microscopy or immunofluorescence). Anchoring fibrils have not been detected to date, whereas expressed COL7 mRNA and COL7 protein have been confirmed in multiple patient samples including one that detected linear expression of COL7 at the basement

3

membrane zone. The DSMB for the trial reviewed the interim data and concluded that safety and potential benefit were established, and allowed continuation of enrollment and dosing.

We plan to use the interim data from the Phase 1 portion of the Phase 1/2 clinical trial to support a future filing for Regenerative Medicine Advanced Therapy or Breakthrough Therapy Designation for FCX-007. We also believe the interim data will support an FDA filing to obtain allowance for pediatric enrollment in the Phase 2 portion of the Phase 1/2 clinical trial, which we expect to initiate in the first quarter of 2018. The FDA previously required us to file safety and potential benefit data from adults in the Phase 1 portion of the trial for review prior to enrolling pediatric patients.

With data from the first three patients meeting the primary trial objective of safety, we plan to increase expression and dosing of FCX-007. We expect to perform additional dosing of adult patients in the Phase 1 portion of the trial in the fourth quarter of 2017. In addition, we enrolled an RDEB adult as the first patient of the Phase 2 portion of the Phase 1/2 clinical trial of FCX-007, and we expect to initiate the Phase 2 portion of the trial, through the additional dosing of adult patients, in the fourth quarter of 2017. Furthermore, subject to FDA allowance, we expect to initiate enrollment of pediatric patients in the Phase 2 portion of the trial in the first quarter of 2018.

We have designated our existing, current good manufacturing practices, or cGMP, cell therapy manufacturing facility in Exton, PA as the production site for FCX-007 after incorporation into FCX-007's IND. The facility will be used for the remaining clinical and future commercial manufacture of FCX-007, with capacity to serve the U.S. market for RDEB. The approximately 13,000 square foot facility previously supported our commercial autologous fibroblast manufacturing, with multiple FDA inspections conducted at the site. The facility includes cleanroom cell therapy manufacturing, quality control testing, cryogenic storage, shipping/receiving and warehousing space.

FCX-013 for Moderate to Severe Localized Scleroderma

Localized scleroderma is a chronic autoimmune skin disorder that manifests as excess production of extracellular matrix, specifically collagen, resulting in thickening of the skin and connective tissue. Localized scleroderma encompasses several subtypes which are classified based on the depth and pattern of the lesion(s). The moderate to severe forms of the disorder include linear, generalized, deep, pansclerotic and mixed morphea subtypes. Linear scleroderma is the most common subtype in juvenile localized scleroderma and is associated with high morbidity and lifelong disability. Linear lesions of the limbs may cause limb length discrepancy due to impaired growth, muscle atrophy and joint contractures-orthopedic complications are reported in 30% to 50% of patients. Current treatments for localized scleroderma, which include systemic or topical corticosteroids, UVA light therapy and physical therapy, only address the symptoms of the disorder. We estimate that there are approximately 90,000 patients in the U.S. considered to have moderate to severe localized scleroderma.

Our second gene-therapy product candidate, FCX-013, is in pre-clinical development for the treatment of moderate to severe localized scleroderma. FCX-013 is an autologous fibroblast genetically-modified using lentivirus and encoded for matrix metalloproteinase 1 (MMP-1), the protein responsible for breaking down collagen. FCX-013 incorporates Intrexon's proprietary RheoSwitch Therapeutic System®, or RTS®, a biologic switch activated by an orally administered compound to control protein expression at the site of localized scleroderma lesions. FCX-013 is designed to be injected under the skin at the location of the fibrotic lesions where the genetically-modified fibroblast cells will produce MMP-1 to break down excess collagen accumulation. With the FCX-013 therapy, the patient will take an oral compound to facilitate protein expression. Once the fibrosis is resolved, the patient will stop taking the oral compound which will halt further MMP-1 production.

We have successfully completed a proof-of-concept study for FCX-013 in which the primary objective was to determine whether FCX-013 had the potential to reduce dermal thickness in fibrotic tissue. In this study, FCX-013 was evaluated in a bleomycin-induced scleroderma model utilizing severe

4

combined immunodeficiency, or SCID, mice. Data from the study demonstrated that FCX-013 reduced dermal thickness of fibrotic tissue to levels similar to that of the non-treated control and further reduced the thickness of the sub-dermal muscle layer. Based upon these data and the FDA's feedback to our pre-Investigational New Drug application, or IND, briefing package, we advanced FCX-013 into a pre-clinical dose-ranging study which has been completed. We expect to complete a toxicology/biodistribution study and submit an IND application for FCX-013 to the FDA in the fourth quarter of 2017. In addition, we expect to initiate a human safety clinical trial for FCX-013 in 2018.

FCX-013 has received Orphan Drug Designation from the FDA for the treatment of localized scleroderma and Rare Pediatric Disease Designation for moderate to severe localized scleroderma.

New Gene Therapy Program for Arthritis and Related Conditions

Arthritis is a broad term that covers a group of more than 100 different types of diseases that affect the joints, as well as connective tissues and organs, including the skin. According to the Centers for Disease Control and Prevention, arthritis—characterized by joint inflammation, pain and decreased range of motion—is the United States' most common cause of disability affecting more than 52 million adults as well as 300,000 children at a cost exceeding $120 billion.

Our third gene-therapy program is in the research phase and is focused on the treatment of arthritis and related conditions. Our goal is to deliver a protein therapy locally to the joint to provide sustained efficacy while avoiding key side effects typically associated with systemic therapy.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the "Risk Factors" section of this prospectus immediately following this prospectus summary and in Part I, Item 1A "Risk Factors" of our Annual Report on Form 10-K filed with the Securities and Exchange Commission, or SEC, on March 9, 2017, in Part II, Item 1A. "Risk Factors" of our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2017, filed with the SEC on August 9, 2017 and in Part II, Item 1A. "Risk Factors" of our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2017, filed with the SEC on November 13, 2017, which are incorporated by reference in this prospectus. These risks include the following:

- •

- We have incurred significant losses since our inception, which we anticipate will continue for the foreseeable future. As of

September 30, 2017, we had an accumulated deficit of $181.7 million.

- •

- We have never generated significant revenue from product sales and may never be profitable.

- •

- Our business is highly dependent on the success of FCX-007, our lead product candidate.

- •

- We may encounter difficulties enrolling or retaining subjects in our clinical trials.

- •

- Clinical product development is costly and time consuming and involves uncertain outcomes, and results of earlier studies and trials may not be

predictive of future trial results.

- •

- We may not be able to submit INDs, commence clinical trials or report data on the timelines we expect, and even if we are able to, the FDA may

not permit us to proceed.

- •

- If our product candidates fail to demonstrate quality, safety and efficacy to the satisfaction of regulatory authorities, we may incur

additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of our product candidates.

- •

- The net proceeds from this offering will not be sufficient to commercialize any of our product candidates and we will need to obtain additional funding for commercialization. Failure to

5

- •

- There is substantial doubt relating to our ability to continue as a going concern as determined by management and as reflected in the report of

our independent public accounting firm. We will need to raise substantial additional capital to fund our operations.

- •

- We have relied and expect to rely on third parties to conduct aspects of our research and development and clinical trials. If they terminate

our arrangements, fail to meet deadlines or perform in an unsatisfactory manner, our business could be harmed.

- •

- The potential commercial success of any current or future product candidate will depend upon the degree of market acceptance by physicians, patients, third-party payors and others in the medical community.

obtain additional funding when needed may force us to delay, limit or terminate our product development efforts or other operations.

Corporate Information

Our corporate headquarters is located at 405 Eagleview Boulevard, Exton, Pennsylvania 19341. Our phone number is (484) 713-6000. Our corporate website is www.fibrocell.com. We make available free of charge on our website our annual, quarterly and current reports, including amendments to such reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider information contained on our website as part of this prospectus.

6

Common stock offered by us |

13,000,000 shares (14,950,000 shares if the underwriter's option to purchase additional shares is exercised in full). | |

Common stock to be outstanding after this offering |

27,719,987 shares (29,669,987 shares if the underwriter's option to purchase additional shares is exercised in full). |

|

Option to purchase additional shares |

The underwriter has the option to purchase from us up to a maximum of 1,950,000 additional shares of common stock. The underwriter can exercise this option at any time within 30 days from the date of this prospectus. |

|

Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $18.4 million ($21.2 million if the underwriter's option to purchase additional shares is exercised in full), assuming an offering price of $1.56 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on November 15, 2017. The actual offering price per share will be as determined between us and the underwriter at the time of pricing, and may be at a discount to the current market price. We currently intend to use the net proceeds from this offering for the continued clinical and pre-clinical development of our product candidates, FCX-007 and FCX-013, and for the research of potential product candidates under the 2015 ECC, and for other general corporate purposes, which may include working capital, research and development expenditures, the funding of in-licensing agreements for product candidates, additional technologies or other forms of intellectual property, expenditures relating to manufacturing infrastructure and other capital expenditures and general and administrative expenses. See "Use of Proceeds" on page 17. |

|

Risk Factors |

An investment in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 9 of this prospectus and the similarly titled sections in the documents incorporated by reference into this prospectus. |

|

Nasdaq Capital Market symbol |

FCSC. |

Outstanding Shares

The number of shares of our common stock to be outstanding after this offering is based on 14,719,987 shares of our common stock outstanding as of September 30, 2017, and excludes:

- •

- 5,515,404 shares of our common stock issuable upon the conversion of our outstanding convertible promissory notes, including accrued interest

thereon, payable in shares of our common stock, outstanding as of September 30, 2017;

- •

- 3,512,000 shares of our common stock issuable upon the conversion of our Series A Convertible Preferred Stock, par value $0.001 per share, or the Series A Preferred Stock, including accrued

7

- •

- 1,116,350 shares of our common stock issuable upon the exercise of stock options outstanding as of September 30, 2017, at a weighted

average exercise price of $13.38 per share, of which stock options to purchase 660,225 shares of our common stock were then exercisable;

- •

- 10,411,177 shares of our common stock issuable upon the exercise of warrants at a weighted average exercise price of $4.85 per share, all of

which warrants were then exercisable;

- •

- an aggregate of 1,403,899 shares of our common stock reserved for future grants of stock options (or other similar equity instruments) under

the Fibrocell Science, Inc. 2009 Equity Incentive Plan, as amended, or the Equity Incentive Plan; and

- •

- 520,000 shares (or 598,000 shares if the underwriter's option to purchase additional shares is exercised in full) of our common stock issuable upon exercise of the warrants being issued to the underwriter in connection with this offering.

dividends thereon, payable in shares of our common stock, outstanding as of September 30, 2017;

Additionally, one of our outstanding warrants, which is currently exercisable for 46,430 shares of our common stock at an exercise price per share of $2.10, contains so-called full-ratchet anti-dilution provisions which may be triggered by the issuance of the shares of our common stock being offered hereby or upon any future issuance by us of shares of our common stock or common stock equivalents at a per share price below the then-exercise price of the warrant, subject to some exceptions. See "Dilution" on page 21 of this prospectus for more information about these possible anti-dilution adjustments.

Except as otherwise indicated herein, all information in this prospectus, including the number of shares that will be outstanding after this offering, does not assume or give effect to the exercise of options or warrants outstanding as of September 30, 2017.

Unless otherwise indicated, all information contained in this prospectus assumes no exercise by the underwriter of its over-allotment option.

8

An investment in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should carefully consider the risks described below and those discussed under the Section captioned "Risk Factors" contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2017 and our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2017, which are incorporated by reference in this prospectus, together with the information included in this prospectus and documents incorporated by reference herein, and in any free writing prospectus that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment.

Risks Related to this Offering

We have a significant number of outstanding convertible notes, convertible preferred stock, warrants and stock options, and future sales of the underlying shares of common stock could adversely affect the market price of our common stock.

As of September 30, 2017, we had outstanding convertible notes convertible for 5,515,404 shares of our common stock (including accrued interest thereon), outstanding convertible preferred stock convertible for 3,512,000 shares of our common stock (including accrued interest thereon), outstanding warrants exercisable for 10,411,177 shares of our common stock at a weighted average exercise price of $4.85 per share, all of which warrants were then exercisable, and outstanding stock options exercisable for 1,116,350 shares of our common stock at a weighted average exercise price of $13.38 per share, of which stock options to purchase 660,625 shares of our common stock were then exercisable. One of our outstanding warrants, which is currently exercisable for 46,430 shares of our common stock at an exercise price per share of $2.10, contains so-called full-ratchet anti-dilution provisions which may be triggered by the issuance of the shares of our common stock being offered hereby or upon any future issuance by us of shares of our common stock or common stock equivalents at a per share price below the then-exercise price of the warrant, subject to some exceptions. Upon conversion of these notes or preferred stock or exercise of these warrants or stock options, we would issue additional shares of our common stock. As a result, our current stockholders as a group would own a substantially smaller interest in us and may have less influence on our management and policies than they now have. Furthermore, the holders may sell these shares in the public markets from time to time, without limitations on the timing, amount or method of sale. As our stock price rises, the holders may convert more of their notes or preferred stock or exercise more of their warrants or stock options and sell a large number of shares. This could cause the market price of our common stock to decline.

We may be required to raise additional financing by issuing new securities with terms or rights superior to those of our existing securityholders, which could adversely affect the market price of shares of our common stock and our business.

We will require additional financing to fund future operations, including expansion in current and new markets, development and acquisition, capital costs and the costs of any necessary implementation of technological innovations or alternative technologies. We may not be able to obtain financing on favorable terms, if at all. If we raise additional funds by issuing equity securities, the percentage ownership of our current stockholders will be reduced, and the holders of the new equity securities may have rights superior to those of our existing securityholders, which could adversely affect the market price of our common stock and the voting power of shares of our common stock. If we raise additional funds by issuing debt securities, the holders of these debt securities would similarly have some rights senior to those of our existing securityholders, and the terms of these debt securities could impose

9

restrictions on operations and create a significant interest expense for us which could have a materially adverse effect on our business.

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion with respect to the use of proceeds of this offering, including for any of the purposes described in the section of this prospectus entitled "Use of Proceeds." You will be relying on the judgment of our management regarding the application of the proceeds of this offering. The results and effectiveness of the use of proceeds are uncertain, and we could spend the proceeds in ways that you do not agree with or that do not improve our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively could harm our business, delay the development of our product candidates and cause the price of our common stock to decline.

You will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

Since the public offering price for our common stock in this offering is substantially higher than the net tangible book deficit per share of our common stock outstanding prior to this offering, you will suffer immediate and substantial dilution in the net tangible book value of the common stock you purchase in this offering. See the section titled "Dilution" below for a more detailed discussion of the dilution you will incur if you purchase shares in this offering.

Issuances of shares of our common stock or securities convertible into or exercisable for shares of our common stock following this offering, as well as the exercise of options and warrants outstanding, will dilute your ownership interests and may adversely affect the future market price of our common stock.

The issuance of additional shares of our common stock could be dilutive to stockholders if they do not invest in future offerings. We intend to use the net proceeds from this offering for the continued clinical and pre-clinical development of our product candidates, FCX-007 and FCX-013, and for the research of potential product candidates under the 2015 ECC, and for other general corporate purposes, which may include working capital, research and development expenditures, the funding of in-licensing agreements for product candidates, additional technologies or other forms of intellectual property, expenditures relating to manufacturing infrastructure and other capital expenditures and general and administrative expenses. We may seek additional capital through a combination of private and public equity offerings, debt financings, strategic partnerships and alliances and licensing arrangements, which may cause your ownership interest to be diluted.

In addition, we have a significant number of options and warrants to purchase shares of our common stock outstanding. If these securities are converted or exercised, you may incur further dilution. Moreover, to the extent that we issue additional convertible notes, convertible preferred stock, options or warrants to purchase, or securities convertible into or exchangeable for, shares of our common stock in the future and those options, warrants or other securities are exercised, converted or exchanged, stockholders may experience further dilution.

A significant portion of our total outstanding shares are eligible to be sold into the market, which could cause the market price of our common stock to drop significantly, even if our business is doing well.

Sales of a substantial number of shares of our common stock in the public market, either by us or by our current stockholders, or the perception that these sales could occur, could cause a decline in the market price of our securities. Such sales, along with any other market transactions, could adversely affect the market price of our common stock.

10

Upon completion of this offering, based on our shares outstanding as of September 30, 2017, we will have 27,719,987 shares of common stock outstanding based on the issuance and sale of 13,000,000 shares of our common stock in this offering. Of these shares, only 5,548,810 are subject to a contractual lock-up with the underwriter for this offering for a period of 90 days following this offering. These shares can be sold, subject to any applicable volume limitations under federal securities laws, after the earlier of the expiration of, or release from, the 90 day lock-up period. The balance of our outstanding shares of common stock, including any shares purchased in this offering other than shares purchased by our current stockholders who are also subject to the contractual lock-up, may be resold into the public market immediately without restriction, unless owned or purchased by our affiliates. Moreover, some of the holders of our common stock have the right, subject to specified conditions, to require us to file registration statements covering their shares or to include their shares in registration statements that we may file for ourselves or other stockholders.

As of September 30, 2017, there were approximately 2,511,915 shares subject to outstanding options or that are otherwise issuable under our Equity Incentive Plan, all of which shares we have registered under the Securities Act of 1933, as amended, or the Securities Act, on a registration statement on Form S-8. These shares can be freely sold in the public market upon issuance, subject to volume limitations applicable to affiliates and the lock-up agreements described above, to the extent applicable.

11

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this prospectus or the documents incorporated herein by reference regarding our strategy, future operations, future product research or development, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words "anticipate," "believe," "goals," "estimate," "expect," "intend," "may," "might," "plan," "predict," "project," "target," "potential," "will," "would," "could," "should," "continue" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this prospectus include, among other things, statements about:

- •

- our expectations related to the use of the proceeds from this offering;

- •

- our expectation that our existing cash resources, plus the net proceeds of this offering, will be sufficient to enable us to fund our

operations into the second quarter of 2019;

- •

- future expenses and capital expenditures;

- •

- our estimates regarding expenses, future revenues, capital requirements and needs for, and ability to obtain, additional financing;

- •

- our plans to address our future capital requirements and the consequences of failing to do so;

- •

- our need to raise substantial additional capital to fund our operations;

- •

- our expectation to initiate the Phase 2 portion of the Phase 1/2 clinical trial of FCX-007 in the fourth quarter of 2017;

- •

- our expectation to initiate enrollment of pediatric patients in the Phase 2 portion of our Phase 1/2 clinical trial of

FCX-007 in the first quarter of 2018;

- •

- our expectation to complete a toxicology/biodistribution study and submit an IND for FCX-013 to the FDA in the fourth quarter of 2017;

- •

- our expectation to initiate a human safety clinical trial for FCX-013 in 2018;

- •

- our product development goals under our collaborations with Intrexon for all of our product candidates;

- •

- the potential benefits of Fast Track, Orphan Drug and Rare Pediatric Disease designations;

- •

- the potential advantages of our product candidates and technologies; and

- •

- the effect of legal and regulatory developments.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this prospectus, particularly under "Risk Factors" on page 9 of this prospectus and the documents incorporated herein that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, collaborations or investments we may make.

You should read this prospectus and the documents that we have filed as exhibits to this prospectus completely and with the understanding that our actual future results may be materially different from what we expect.

12

Except as required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. You should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. Before deciding to purchase our securities, you should carefully consider the risk factors discussed and incorporated by reference in this prospectus and the documents incorporated herein.

13

You should read the following selected financial data together with our financial statements and the related notes contained in Item 8 of Part II of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and in Item 1 of Part I of our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2017, which are incorporated by reference into this prospectus, except that share and per share information for the periods ended December 31, 2016 and December 31, 2015 have been revised to reflect the 1-for-3 reverse stock split of our issued and outstanding shares of common stock effective at the close of business on March 10, 2017.

We have derived the statements of operations data for each of the two years ended December 31, 2016 and December 31, 2015 from the audited financial statements contained in Item 8 of Part II of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. We have derived the statements of operation data for the nine months ended September 30, 2017 and September 30, 2016 from our unaudited historical condensed financial statements and related notes thereto contained in Item 1 of Part I of our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2017.

The historical financial information set forth below may not be indicative of our future performance and should be read together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our historical financial statements and notes to those statements included in Item 7 of Part II and Item 8 of Part II, respectively, of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, and any amendment or update thereto reflected in subsequent filings with the SEC, and all other annual, quarterly and other reports that we file with the SEC after the date of the initial registration statement of which this prospectus forms a part and that also are incorporated herein by reference.

14

Fibrocell Science, Inc.

Statement of Operations Summary

($ in thousands except share and per share data)

| |

Nine Months Ended September 30, (Unaudited) |

(Adjusted for Stock Split) Year Ended December 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2017 | 2016 | 2016 | 2015 | |||||||||

Total revenue |

— | 318 | $ | 355 | $ | 492 | |||||||

Total cost of revenue |

— | 697 | 697 | 722 | |||||||||

| | | | | | | | | | | | | | |

Gross loss |

— | (379 | ) | (342 | ) | (230 | ) | ||||||

Operating Expenses |

14,077 | 21,625 | 26,137 | 37,177 | |||||||||

| | | | | | | | | | | | | | |

Operating loss |

(14,077 | ) | (22,004 | ) | (26,479 | ) | (37,407 | ) | |||||

Other income (expense) |

(5,063 | ) | 10,206 | 11,187 | 2,954 | ||||||||

| | | | | | | | | | | | | | |

Loss before income taxes |

(19,140 | ) | (11,798 | ) | (15,292 | ) | (34,453 | ) | |||||

Income taxes |

— | — | — | — | |||||||||

| | | | | | | | | | | | | | |

Net loss |

(19,140 | ) | (11,798 | ) | $ | (15,292 | ) | $ | (34,453 | ) | |||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Per Share Information: |

|||||||||||||

Net loss: |

|||||||||||||

Basic* |

(1.58 | ) | (0.81 | ) | $ | (1.04 | ) | $ | (2.45 | ) | |||

Diluted |

(1.58 | ) | (0.94 | ) | $ | (1.18 | ) | $ | (2.55 | ) | |||

Weighted average number of common shares outstanding: |

|||||||||||||

Basic |

14,702,624 | 14,632,988 | 14,641,528 | 14,059,360 | |||||||||

| | | | | | | | | | | | | | |

Diluted |

14,702,624 | 14,640,996 | 14,647,534 | 14,117,010 | |||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

- *

- Basic and Diluted net loss for the nine months ended September 30, 2017 includes $4,163 in dividends paid in kind and deemed dividends to preferred stockholders.

15

Fibrocell Science, Inc.

Loss per Share Summary

($ in thousands except share and per share data)

| |

Nine Months Ended September 30, (Unaudited) |

(Adjusted for Stock Split) Year Ended December 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2017 | 2016 | 2016 | 2015 | |||||||||

Loss per share—Basic: |

|||||||||||||

Numerator for basic loss per share |

(23,303 | ) | (11,798 | ) | $ | (15,292 | ) | $ | (34,453 | ) | |||

| | | | | | | | | | | | | | |

Denominator for basic loss per share |

14,702,624 | 14,632,988 | 14,641,528 | 14,059,360 | |||||||||

| | | | | | | | | | | | | | |

Basic loss per common share |

(1.58 | ) | (0.81 | ) | $ | (1.04 | ) | $ | (2.45 | ) | |||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Loss per share—Diluted: |

|||||||||||||

Numerator for basic loss per share |

(23,303 | ) | (11,798 | ) | $ | (15,292 | ) | $ | (34,453 | ) | |||

Adjust: Change in fair value of dilutive warrants outstanding |

— | 1,958 | 1,958 | 1,529 | |||||||||

| | | | | | | | | | | | | | |

Numerator for diluted loss per share |

(23,303 | ) | (13,756 | ) | $ | (17,250 | ) | $ | (35,982 | ) | |||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Denominator for basic loss per share |

14,702,624 | 14,632,988 | 14,641,528 | 14,059,360 | |||||||||

Plus: Incremental shares underlying "in the money" warrants outstanding |

— | 8,008 | 6,006 | 57,650 | |||||||||

| | | | | | | | | | | | | | |

Denominator for diluted loss per share |

14,702,624 | 14,640,996 | 14,647,534 | 14,117,010 | |||||||||

| | | | | | | | | | | | | | |

Diluted loss per common share |

(1.58 | ) | (0.94 | ) | $ | (1.18 | ) | $ | (2.55 | ) | |||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Shares underlying "in the money" options outstanding |

208,840 | 170,226 | 150,120 | 629,449 | |||||||||

Shares underlying "out of the money" options outstanding |

763,442 | 1,228,224 | 1,218,563 | 391,197 | |||||||||

Shares underlying "in the money" warrants outstanding |

48,979 | — | 17,858 | 299,081 | |||||||||

Shares underlying "out of the money" warrants outstanding |

9,521,152 | 3,534,122 | 4,382,445 | 1,573,803 | |||||||||

Shares underlying convertible notes |

5,297,059 | 5,304,533 | 5,304,533 | — | |||||||||

Shares underlying convertible accrued interest on convertible notes |

177,059 | 13,545 | 40,137 | — | |||||||||

Shares underlying convertible preferred stock |

3,477,333 | — | — | — | |||||||||

16

We estimate that the net proceeds from our issuance and sale of 13,000,000 shares of our common stock in this offering will be approximately $18.4 million, or approximately $21.2 million if the underwriter exercises its over-allotment option in full, assuming a public offering price of $1.56 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on November 15, 2017, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

A $0.50 increase or decrease in the assumed public offering price of $1.56 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on November 15, 2017, would increase or decrease the net proceeds to us from this offering by $6.0 million or $(6.0) million, respectively, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriter discounts and commissions and estimated offering expenses payable by us.

Similarly, each increase or decrease of 1,000,000 shares offered by us would increase or decrease the net proceeds to us by approximately $1.5 million or $(1.5) million, respectively, assuming the assumed public offering price of $1.56 per share remains the same, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

As of September 30, 2017, we had cash and cash equivalents of $11.9 million. We intend to use the net proceeds from this offering to continue to fund the clinical and pre-clinical development of FCX-007 and FCX-013, and for the research of potential product candidates under the 2015 ECC, and for other general corporate purposes, which may include, without limitation:

- •

- working capital;

- •

- research and development expenditures;

- •

- the funding of in-licensing agreements for product candidates, additional technologies or other forms of intellectual property;

- •

- expenditures relating to manufacturing infrastructure and other capital expenditures; and

- •

- general administrative expenses.

This expected use of net proceeds from this offering and our existing cash and cash equivalents represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. The amounts and timing of our use of the net proceeds from this offering will depend on a number of factors, such as the timing and progress of our research and development efforts, the timing and progress of any partnering efforts, technological advances and the competitive environment for our product candidates. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds to us from the sale of the securities offered by us hereunder. Accordingly, our management will have broad discretion in the timing and application of these proceeds. Pending application of the net proceeds as described above, we intend to temporarily invest the proceeds in short-term, interest-bearing instruments.

Although it is difficult to predict future liquidity requirements, we believe that the net proceeds from this offering, together with our existing cash resources, will be sufficient to enable us to fund our operations into the second quarter of 2019. We have based this estimate on assumptions that may prove to be incorrect, and we could use our available capital resources sooner than we currently expect.

17

MARKET PRICE OF OUR COMMON STOCK

Our common stock trades on the Nasdaq Capital Market under the symbol "FCSC." The following table sets forth for the periods indicated the high and low sale prices per share for our common stock, adjusted to reflect the effect of the reverse stock split of our common stock on March 10, 2017, as reported on the Nasdaq Capital Market for the periods indicated:

| |

Market Price | ||||||

|---|---|---|---|---|---|---|---|

| |

High | Low | |||||

First quarter 2015 |

$ | 17.97 | $ | 7.14 | |||

Second quarter 2015 |

$ | 19.20 | $ | 9.75 | |||

Third quarter 2015 |

$ | 22.80 | $ | 11.04 | |||

Fourth quarter 2015 |

$ | 18.54 | $ | 10.50 | |||

First quarter 2016 |

$ | 13.86 | $ | 6.12 | |||

Second quarter 2016 |

$ | 11.34 | $ | 2.73 | |||

Third quarter 2016 |

$ | 4.14 | $ | 2.10 | |||

Fourth quarter 2016 |

$ | 3.15 | $ | 1.56 | |||

First quarter 2017 |

$ | 3.51 | $ | 1.86 | |||

Second quarter 2017 |

$ | 4.64 | $ | 1.80 | |||

Third quarter 2017 |

$ | 4.17 | $ | 2.41 | |||

Fourth quarter 2017 (through November 15, 2017) |

$ | 3.29 | $ | 1.54 | |||

As of November 15, 2017, the closing price of our common stock as reported by the Nasdaq Capital Market was $1.56. As of November 15, 2017, we had approximately 31 holders of record of our common stock. This number does not include beneficial owners whose shares were held in street name.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain all of our future earnings, if any, to finance the growth and development of our business. We do not intend to pay cash dividends in respect of our common stock in the foreseeable future. In addition, our outstanding convertible promissory notes and our outstanding Series A convertible preferred stock each restrict our ability to pay cash dividends on our equity securities.

18

The following table sets forth our cash and cash equivalents and capitalization as of September 30, 2017:

- •

- on an actual basis;

- •

- on an as adjusted basis to give further effect to our issuance and sale of 13,000,000 shares of our common stock in this offering at an assumed public offering price of $1.56 per share, the last reported sale price for our common stock on the Nasdaq Capital Market on November 15, 2017, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

Our capitalization following the closing of this offering will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. You should read this table together with our consolidated financial statements and the related notes and the "Management's Discussion and Analysis of Financial Condition and Results of Operations" section of our Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, filed with the SEC on November 13, 2017, which is incorporated by reference into this prospectus.

| |

As of September 30, 2017 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted(1) | |||||

| |

(in thousands except share data) |

||||||

Cash and cash equivalents |

$ | 11,911 | $ | 30,321 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Warrant liability |

10,735 | 10,735 | |||||

Derivative liability |

1,442 | 1,442 | |||||

Convertible promissory notes, net of debt discount $18,003* |

— | — | |||||

Stockholders' equity (deficit) |

|||||||

Preferred stock, $0.001 par value per share; 5,000,000 shares authorized |

|||||||

Series A nonredeemable convertible preferred stock; 8,000 shares designated, 8,000 shares issued and outstanding as of September 30, 2017; aggregate liquidation preference of $8,182 at September 30, 2017 |

— | — | |||||

Common stock, $0.001 par value per share; 150,000,000 shares authorized, 14,719,987 shares issued and outstanding, actual; 150,000,000 shares authorized; 27,719,987 shares issued and outstanding, as adjusted |

15 | 28 | |||||

Additional paid-in capital |

178,362 | 196,759 | |||||

Accumulated deficit |

(181,703 | ) | (181,703 | ) | |||

| | | | | | | | |

Total stockholders' equity (deficit) |

(3,326 | ) | 15,084 | ||||

| | | | | | | | |

Total capitalization |

$ | 8,851 | $ | 27,261 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

- *

- The

principal value of the convertible promissory notes is $18,003 as of September 30, 2017.

- (1)

- Each $0.50 increase or decrease in the assumed public offering price per share would increase or decrease the amount of cash and cash equivalents, working capital, total assets, and total stockholders' equity by approximately $6.0 million or $(6.0) million, respectively, assuming the number of shares offered by us, as set forth on the cover page

19

of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares of common stock to be issued in this offering. Each increase or decrease of 1,000,000 shares offered by us would increase or decrease the as adjusted amount of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $1.5 million or $(1.5) million, respectively, assuming that the assumed public offering price remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. The as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering as determined between us and the underwriter at pricing.

The foregoing table and calculations are based on 14,719,987 shares of our common stock outstanding as of September 30, 2017, and excludes:

- •

- 5,515,404 shares of our common stock issuable upon the conversion of our outstanding convertible promissory notes, including accrued interest

thereon, payable in shares of our common stock, outstanding as of September 30, 2017;

- •

- 3,512,000 shares of our common stock issuable upon the conversion of our convertible preferred stock, including accrued dividends thereon,

payable in shares of our common stock, outstanding as of September 30, 2017;

- •

- 1,116,350 shares of our common stock issuable upon the exercise of stock options outstanding as of September 30, 2017, at a weighted

average exercise price of $13.38 per share, of which stock options to purchase 660,625 shares of our common stock were then exercisable;

- •

- 10,411,177 shares of our common stock issuable upon the exercise of warrants at a weighted average exercise price of $4.85 per share, all of

which warrants were then exercisable;

- •

- an aggregate of 1,403,899 shares of our common stock reserved for future grants of stock options (or other similar equity instruments) under

the Equity Incentive Plan; and

- •

- 520,000 shares (or 598,000 shares if the underwriter's option to purchase additional shares is exercised in full) of our common stock issuable upon exercise of the warrants being issued to the underwriter in connection with this offering.

20

If you invest in our common stock in this offering, your ownership interest will be diluted immediately to the extent of the difference between the public offering price per share of our common stock and the as adjusted net tangible book deficit per share of our common stock after this offering.

Our historical net tangible book deficit as of September 30, 2017 was $(3.3) million, or $(0.23) per share of our common stock. Historical net tangible book deficit per share represents the amount of our total tangible assets less total liabilities, divided by the number of shares of our common stock outstanding as of September 30, 2017.

After giving effect to our issuance and sale of 13,000,000 shares of our common stock in this offering at an assumed offering price of $1.56 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on November 15, 2017, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of September 30, 2017 would have been $15.1 million, or $0.54 per share. This represents an immediate increase in net tangible book value per share of $0.77 to existing stockholders and immediate dilution of $1.02 per share to new investors purchasing common stock in this offering. Dilution per share to new investors is determined by subtracting as adjusted net tangible book value per share after this offering from the public offering price per share paid by new investors. The following table illustrates this dilution on a per share basis:

Assumed public offering price per share |

$ | 1.56 | |||||

Historical net tangible book deficit per share as of September 30, 2017 |

$ | (0.23 | ) | ||||

Increase in net tangible book value per share attributable to new investors |

0.77 | ||||||

| | | | | | | | |

As adjusted net tangible book value per share after this offering |

0.54 | ||||||

| | | | | | | | |

Dilution per share to new investors |

$ | 1.02 | |||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Each $0.50 increase or decrease in the assumed public offering price of $1.56 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on November 15, 2017, would increase or decrease our as adjusted net tangible book value per share after this offering by approximately $0.22 or $(0.22), respectively, and the dilution per share to new investors purchasing shares in this offering by $0.28 and $(0.28), respectively, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares to be issued in this offering. Each increase (decrease) of 1,000,000 shares offered by us would increase (decrease) our as adjusted net tangible book value per share by $0.03 and $(0.03), respectively, and the dilution per share to new investors purchasing shares in this offering by $0.03 and $(0.03), respectively, assuming that the assumed public offering price remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. The information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering as determined between us and the underwriter at pricing.

If the underwriter exercises its over-allotment option in full, the as adjusted net tangible book value per share after this offering would be $0.60 per share, the increase in net tangible book value per share to existing stockholders would be $0.83 per share and the dilution to new investors purchasing shares in this offering would be $0.96 per share.

21

The foregoing table and calculations are based on 14,719,987 shares of our common stock outstanding as of September 30, 2017, and excludes:

- •

- 5,515,404 shares of our common stock issuable upon the conversion of our outstanding convertible promissory notes, including accrued interest

thereon, payable in shares of our common stock, outstanding as of September 30, 2017;

- •

- 3,512,000 shares of our common stock issuable upon the conversion of our convertible preferred stock, including accrued dividends thereon,

payable in shares of our common stock, outstanding as of September 30, 2017;

- •

- 1,116,350 shares of our common stock issuable upon the exercise of stock options outstanding as of September 30, 2017, at a weighted

average exercise price of $13.38 per share, of which stock options to purchase 660,625 shares of our common stock were then exercisable;

- •

- 10,411,177 shares of our common stock issuable upon the exercise of warrants at a weighted average exercise price of $4.85 per share, all of

which warrants were then exercisable;

- •

- an aggregate of 1,403,899 shares of our common stock reserved for future grants of stock options (or other similar equity instruments) under

the Equity Incentive Plan; and

- •

- 520,000 shares (or 598,000 shares if the underwriter's option to purchase additional shares is exercised in full) of our common stock issuable upon exercise of the warrants being issued to the underwriter in connection with this offering.

Additionally, one of our outstanding warrants, which is currently exercisable for 46,430 shares of our common stock at an exercise price per share of $2.10, contains so-called full-ratchet anti-dilution provisions which may be triggered by the issuance of the shares of our common stock being offered hereby or upon any future issuance by us of shares of our common stock or common stock equivalents at a per share price below the then-exercise price of the warrant, subject to some exceptions. Upon consummation of the offering, we anticipate that the exercise price of this outstanding warrant will be adjusted downward to the public offering price in this offering and the number of shares underlying this warrant will be increased to 62,502, assuming an offering price of $1.56 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on November 15, 2017.

To the extent that any convertible notes, convertible preferred stock, options or warrants are exercised or converted, new options are issued under our Equity Incentive Plan or we otherwise issue additional shares of common stock in the future at a price less than the public offering price, there may be further dilution to new investors purchasing common stock in this offering.

22

The following description of our capital stock and provisions of our Restated Certificate of Incorporation, as amended, or the Certificate of Incorporation, and our Fourth Amended and Restated Bylaws, as amended, or the Bylaws, are summaries and are qualified by reference to the Certificate of Incorporation and the Bylaws. We have filed copies of these documents with the SEC as exhibits to our registration statement of which this prospectus forms a part.

Our authorized capital stock consists of 150,000,000 shares of our common stock, par value $0.001 per share, and 5,000,000 shares of our preferred stock, par value $0.001 per share, 8,000 of which preferred stock is designated as Series A Convertible Preferred Stock, or the Series A Preferred Stock.

As of September 30, 2017, we had 14,719,987 shares of our common stock and 8,000 shares of our Series A Preferred Stock issued and outstanding held by 30 and 5 stockholders of record, respectively. This number does not include beneficial owners whose shares were held in street name.

Common Stock

Holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders and do not have cumulative voting rights. Each election of directors by our stockholders will be determined by a plurality of the votes cast by the stockholders entitled to vote on the election. Holders of common stock are entitled to receive proportionately any dividends as may be declared by our board of directors, subject to any preferential dividend rights of then outstanding preferred stock.

In the event of our liquidation or dissolution, the holders of our common stock are entitled to receive proportionately all assets available for distribution to stockholders after the payment of all debts and other liabilities and subject to the prior rights of any of our then outstanding preferred stock. Holders of our common stock have no preemptive, subscription, redemption or conversion rights. The rights, preferences and privileges of holders of our common stock are subject to and may be adversely affected by the rights of the holders of shares of any series of our preferred stock that we may designate and issue in the future.

Preferred Stock

Under the terms of our Certificate of Incorporation, our board of directors is authorized to issue shares of preferred stock in one or more series without stockholder approval. Our board of directors has the discretion to determine the rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, of each series of preferred stock.