Attached files

| file | filename |

|---|---|

| EX-23 - EX-23.1 - BIOCEPT INC | bioc-ex231_128.htm |

As filed with the Securities and Exchange Commission on November 17, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Biocept, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

8071 |

80-0943522 |

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

5810 Nancy Ridge Drive

San Diego, CA 92121

(858) 320-8200

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Michael W. Nall

Chief Executive Officer and President

Biocept, Inc.

5810 Nancy Ridge Drive

San Diego, CA 92121

(858) 320-8200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Frederick T. Muto Charles J. Bair Cooley LLP 4401 Eastgate Mall San Diego, CA 92121 (858) 550-6142 |

Timothy C. Kennedy Chief Financial Officer Biocept, Inc. 5810 Nancy Ridge Drive San Diego, CA 92121 (858) 320-8200 |

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|||

|

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Securities being Registered |

|

|

|

Proposed Maximum |

|

|

Amount of |

|

Shares of common stock, $0.0001 par value per share |

|

|

|

|

|

|

|

|

Warrants to purchase shares of common stock |

|

|

|

|

|

|

|

|

Shares of common stock issuable upon exercise of the Warrants |

|

|

|

|

|

|

|

|

Total |

|

|

|

$10,000,000 |

|

|

$1,245.00 |

|

|

(1) |

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act. Includes the offering price of shares and warrants that the underwriters have the option to purchase to cover over-allotments, if any. |

|

|

(2) |

Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issuable to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED NOVEMBER 17, 2017

Shares of Common Stock

Warrants to Purchase Up to Shares of Common Stock

Biocept, Inc. is offering $ of shares of our common stock and warrants to purchase shares of our common stock. Each share of our common stock is being sold together with of a warrant to purchase one share of our common stock. Each warrant will have an exercise price per share of not less than 100% of the last reported sale price of our common stock on the trading day immediately preceding the pricing of this offering, will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The shares of our common stock and warrants are immediately separable and will be issued separately, but will be purchased together in this offering.

Our common stock is listed on The NASDAQ Capital Market under the symbol “BIOC.” On November 16, 2017, the last reported sale price of our common stock on The NASDAQ Capital Market was $0.6781 per share. There is no established trading market for the warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the warrants will be limited.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|||

|

|

|

Per Share and Related Warrant |

|

|

Total |

||||

|

Public offering price |

|

$ |

|

|

|

$ |

|

||

|

Underwriting discount(1) |

|

$ |

|

|

|

$ |

|

||

|

Proceeds, before expenses, to us |

|

$ |

|

|

|

$ |

|

||

|

(1) |

We have agreed to reimburse the underwriters for certain expenses. See “Underwriting.” |

||||||||

We have granted the underwriters a 30-day option to purchase up to additional shares of our common stock at a purchase price of $ per share and/or additional warrants to purchase up to shares of our common stock at a purchase price of $ per warrant to purchase one share of our common stock to cover over-allotments, if any.

The underwriters expect to deliver the common stock and the warrants to purchasers in this offering on or about , 2017.

The date of this prospectus is .

|

|

1 |

|

|

|

6 |

|

|

|

8 |

|

|

|

9 |

|

|

|

10 |

|

|

|

12 |

|

|

|

13 |

|

|

|

15 |

|

|

|

18 |

|

|

|

18 |

|

|

|

18 |

|

|

|

19 |

We have not, and the underwriters have not, authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our securities, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful.

For investors outside the United States: We have not, and the underwriters have not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside the United States.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We use in this prospectus our BIOCEPT logo, for which a United States trademark application has been filed. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear (after the first usage) without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the “Risk Factors” section of this prospectus before making an investment decision.

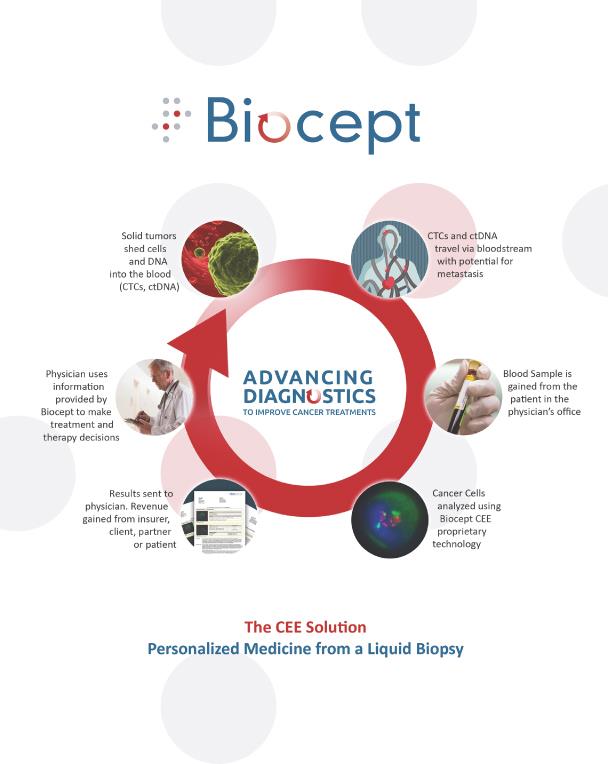

Our Company

We are an early stage molecular oncology diagnostics company that develops and commercializes proprietary circulating tumor cell, or CTC, and circulating tumor DNA, or ctDNA, assays utilizing a standard blood sample, or “liquid biopsy.” Our current and planned assays are intended to provide information to aid healthcare providers to identify specific oncogenic alterations that may qualify a subset of cancer patients for targeted therapy at diagnosis, progression or for monitoring in order to identify specific resistance mechanisms. Often, traditional methodologies such as tissue biopsies are insufficient or unavailable to provide the molecular subtype information necessary for clinical decisions. Our assays have the potential to provide more contemporaneous information on the characteristics of a patient’s disease compared with traditional methodologies such as tissue biopsy and radiographic imaging. Additionally, commencing in October 2017, our pathology program initiative provides the unique ability for pathologists to participate in the interpretation of liquid biopsy results, and is available to pathology practices and hospital systems throughout the United States. Further, our proprietary blood collection tubes, which allow for the intact transport of liquid biopsy samples for research use only, or RUO, from regions around the world, are anticipated to be sold to laboratory supply distributor(s) commencing in 2018.

Our current assays and our planned future assays focus on key solid tumor indications utilizing our Target-SelectorTM liquid biopsy technology platform for the biomarker analysis of CTCs and ctDNA from a standard blood sample. Our patented Target-Selector CTC offering is based on an internally developed microfluidics-based cell capture and analysis platform, with enabling features that change how CTC testing is used by clinicians. Our patent pending Target-Selector ctDNA technology enables mutation detection with enhanced sensitivity and specificity, and is applicable to nucleic acid from ctDNA or other sample types, such as CTCs, bone marrow, or cerebrospinal fluid. Our Target-Selector CTC and ctDNA platforms provide both biomarker detection as well as monitoring capabilities, and require only a patient blood sample. We believe that our Target-Selector platform technology has the potential to be developed and commercialized as in vitro diagnostic (IVD) test kits, and we are currently pursuing this option.

At our corporate headquarters facility located in San Diego, California, we operate a clinical laboratory that is certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA, and accredited by the College of American Pathologists, or CAP. We also performed research and development that led to our current assays, and we also intend to perform research and development for planned assays, at this facility. In addition, we manufacture our microfluidic channels, related equipment and certain reagents. The assays we offer and intend to offer are classified as laboratory developed tests, or LDTs, under CLIA regulations. CLIA certification is required before any clinical laboratory, including ours, may perform testing on human specimens for the purpose of obtaining information for the diagnosis, prevention, or treatment of disease or the assessment of health. In addition, we participate in and have received CAP accreditation, which includes rigorous bi-annual laboratory inspections and adherence to specific quality standards.

-1-

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. The risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

|

|

• |

we are an early stage company with a history of substantial net losses. We have never been profitable and we have an accumulated deficit of approximately $189.6 million (as of September 30, 2017); |

|

|

• |

we expect to incur net losses in the future, and we may never achieve sustained profitability; |

|

|

• |

we need to raise additional capital to continue as a going concern; |

|

|

• |

our failure to meet the continued listing requirements of The NASDAQ Capital Market could result in a de-listing of our common stock; |

|

|

• |

our financial condition may be materially adversely affected in an event of default under our credit facility; |

|

|

• |

our sale of our common stock may cause substantial dilution to our existing stockholders and could cause the price of our common stock to decline; |

|

|

• |

our business depends upon our ability to increase sales of our current products and assays and to develop and commercialize other products and assays; |

|

|

• |

our business depends on executing on our sales and marketing strategy for our products and diagnostic assays and gaining acceptance of our current products and assays and future products and assays in the market, for which we expect to continue to incur significant expenses; |

|

|

• |

our business depends on our ability to continually develop new products and diagnostic assays and enhance our current products assays and future products and assays, for which we expect to continue to incur significant expenses; |

|

|

• |

our business depends on our ability to effectively compete with other products and diagnostic assays, methods and services that now exist or may hereafter be developed; |

|

|

• |

our business depends on our senior management; |

|

|

• |

our business depends on our ability to attract and retain scientists, clinicians and sales personnel with extensive experience in oncology, who are in short supply; |

|

|

• |

our business depends on our ability to enter into agreements with commercialization partners, who may not perform adequately or be locatable, for the sales, marketing and commercialization of our current products and assays and our planned future products and assays; |

|

|

• |

we expect to expand our business internationally, which would increase our exposure to business, regulatory, political, operational, financial and economic risks associated with doing business outside of the United States; |

|

|

• |

our financial condition may be materially adversely affected by healthcare policy changes, including legislation reforming the United States health care system; |

|

|

• |

our business depends on being able to obtain coverage and adequate reimbursement from governmental and other third-party payers for assays and services; |

|

|

• |

our business depends on satisfying any applicable United States (including Food and Drug Administration) and international regulatory requirements with respect to products, assays and services, and many of these requirements are new and still evolving; and |

|

|

• |

we need to obtain or maintain patents or other appropriate protection for the intellectual property utilized in our current and planned products, assays and services, and we must avoid infringement of third-party intellectual property. |

Company Information

We maintain our principal executive offices at 5810 Nancy Ridge Drive, San Diego, California 92121. Our telephone number is (858) 320-8200 and our website address is www.biocept.com. The information contained in, or that can be accessed through, our

-2-

website is not incorporated into and is not part of this prospectus. We were incorporated in California on May 12, 1997 and reincorporated as a Delaware corporation on July 30, 2013.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

|

|

• |

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

|

|

• |

reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

|

|

• |

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until December 31, 2019. However, if certain events occur prior to December 31, 2019, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before such date.

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than the information you might receive from other public reporting companies in which you hold equity interests.

-3-

|

Common stock offered by us |

shares (assuming a combined public offering price of $ per share and related warrant, the last reported sale price of our common stock on The NASDAQ Capital Market on , 2017). |

|

|

|

|

Warrants offered by us |

Warrants to purchase up to shares of our common stock (assuming a combined public offering price of $ per share and related warrant, the last reported sale price of our common stock on The NASDAQ Capital Market on , 2017). Each share of our common stock is being sold together with of a warrant to purchase one share of our common stock. Each warrant will have an exercise price per share of not less than 100% of the last reported sale price of our common stock on the trading day immediately preceding the pricing of this offering, will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. |

|

|

|

|

Common stock outstanding after this offering |

shares (assuming a combined public offering price of $ per share and related warrant, the last reported sale price of our common stock on The NASDAQ Capital Market on , 2017) (or shares if the warrants sold in this offering are exercised in full). |

|

|

|

|

Over-allotment option(1) |

We have granted the underwriters a 30-day option to purchase up to additional shares of our common stock at a purchase price of $ per share and/or additional warrants to purchase up to shares of our common stock at a purchase price of $ per warrant to purchase one share of our common stock (assuming a combined public offering price of $ per share and related warrant, the last reported sale price of our common stock on The NASDAQ Capital Market on , 2017). |

|

|

|

|

Use of proceeds |

Based on an assumed combined public offering price of $ per share and related warrant (the last reported sale price of our common stock on The NASDAQ Capital Market on , 2017), we estimate that the net proceeds from our sale of shares of our common stock and warrants in this offering will be approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We currently expect to use the net proceeds from this offering for general corporate purposes and to fund ongoing operations and expansion of our business. For additional information please refer to the section entitled “Use of Proceeds” on page 9 of this prospectus. |

|

|

|

|

Risk Factors |

Investing in our securities involves a high degree of risk. You should carefully review and consider the “Risk Factors” section of this prospectus for a discussion of factors to consider before deciding to invest in shares of our common stock. |

|

|

|

|

Market Symbol and trading |

Our common stock is listed on The Nasdaq Capital Market under the symbol “BIOC.” There is no established trading market for the warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the warrants will be limited. |

-4-

The number of shares of our common stock to be outstanding after this offering is based on 30,258,743 shares of our common stock outstanding as of September 30, 2017 and excludes as of such date:

|

• |

2,484,286 shares of our common stock issuable upon the exercise of stock options, with a weighted-average exercise price of $3.93 per share; |

|

• |

360,920 shares of our common stock issuable upon the settlement of outstanding restricted stock units; |

|

• |

8,402,275 shares of our common stock issuable upon the exercise of outstanding warrants, with a weighted-average exercise price of $2.69 per share; |

|

• |

any shares of our common stock issuable upon exercise of the underwriters’ over-allotment option; and |

|

• |

813,771 other shares of our common stock reserved for future issuance under our 2013 Amended and Restated Equity Incentive Plan. |

Unless otherwise indicated, all information contained in this prospectus assumes no exercise by the underwriters of their over-allotment option to purchase up to additional shares of common stock and/or additional warrants.

-5-

A purchase of shares of our common stock is an investment in our securities and involves a high degree of risk. You should carefully consider the risks and uncertainties and all other information contained in or incorporated by reference in this prospectus, including the risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2017. All of these risk factors are incorporated by reference herein in their entirety. If any of these risks actually occur, our business, financial condition and results of operations would likely suffer. In that case, the market price of our common stock could decline, and you may lose part or all of your investment in our company. Additional risks of which we are not presently aware or that we currently believe are immaterial may also harm our business and results of operations.

Risks Relating to This Offering

If you purchase our securities in this offering, you will incur immediate and substantial dilution in the book value of your shares.

The combined public offering price per share of our common stock and related warrant will be substantially higher than the net tangible book value per share of our common stock immediately prior to the offering. After giving effect to the assumed sale of shares of our common stock and related warrants in this offering, at an assumed combined public offering price of $ per share and related warrant (the last reported sale price of our common stock on The NASDAQ Capital Market on , 2017), and after deducting the estimated underwriting discount and estimated offering expenses payable by us and attributing no value to the warrants sold in this offering, purchasers of our common stock in this offering will incur immediate dilution of $ per share in the net tangible book value of the common stock they acquire. In the event that you exercise your warrants, you will experience additional dilution to the extent that the exercise price of the warrants is higher than the tangible book value per share of our common stock. For a further description of the dilution that investors in this offering will experience, see “Dilution.”

In addition, to the extent that outstanding stock options or warrants have been or may be exercised or other shares issued, you may experience further dilution.

We have broad discretion in the use of the net proceeds we receive from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds we receive in this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether our management is using the net proceeds appropriately. Because of the number and variability of factors that will determine our use of our net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business and cause the price of our common stock to decline. Pending their use, we may invest our net proceeds from this offering in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders.

Future sales of substantial amounts of our common stock could adversely affect the market price of our common stock.

We may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. If additional capital is raised through the sale of equity or convertible debt securities, or perceptions that those sales could occur, the issuance of these securities could result in further dilution to investors purchasing our common stock in this offering or result in downward pressure on the price of our common stock, and our ability to raise capital in the future.

Holders of our warrants will have no rights as a common stockholder until they acquire our common stock.

Until you acquire shares of our common stock upon exercise of your warrants, you will have no rights with respect to shares of our common stock issuable upon exercise of your warrants. Upon exercise of your warrants, you will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

-6-

The warrants may not have any value.

Each warrant will have an exercise price of not less than 100% of the last reported sale price of our common stock as of the close of the trading day immediately preceding the pricing of this offering and will expire on the fifth anniversary of the date they first become exercisable. In the event our common stock price does not exceed the exercise price of the warrants during the period when the warrants are exercisable, the warrants may not have any value.

There is no public market for the warrants to purchase shares of our common stock being offered in this offering.

There is no established public trading market for the warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the warrants on any national securities exchange or other nationally recognized trading system, including The NASDAQ Capital Market. Without an active trading market, the liquidity of the warrants will be limited.

-7-

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, which reflect our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this prospectus and are subject to a number of risks, uncertainties and assumptions described under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2016, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, which are incorporated by reference herein. Forward-looking statements are identified by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on the information available to management at this time and which speak only as of this date. Examples of our forward-looking statements include:

|

|

• |

our ability to increase sales of our products, assays and services; |

|

|

• |

our ability to continually develop new products, diagnostic assays, services and enhance our current products, assays and services and future products, assays, and services; |

|

|

• |

our ability to effectively compete with other products, diagnostic assays, methods and services that now exist or may hereafter be developed; |

|

|

• |

our ability to expand our business internationally; |

|

|

• |

our ability to obtain coverage and adequate reimbursement from governmental and other third-party payers for assays and services; |

|

|

• |

our expectations regarding the use of our existing cash and the expected net proceeds of this offering; |

|

|

• |

our ability to enter into agreements with commercialization partners for the sales, marketing and commercialization of our current products, assays and services, and our planned future products, assays and services; |

|

|

• |

our ability to satisfy any applicable United States and international regulatory requirements with respect to products, assays and services; and |

|

|

• |

our ability to obtain or maintain patents or other appropriate protection for the intellectual property utilized in our current and planned products, assays and services. |

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. The forward-looking statements contained in this prospectus are excluded from the safe harbor protection provided by the Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities Act.

This prospectus also incorporates by reference estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

-8-

We estimate that the net proceeds of this offering will be approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full, assuming the sale of shares of our common stock and warrants to purchase up to shares of our common stock at an assumed combined public offering price of $ per share and related warrant (the last reported sale price of our common stock on The NASDAQ Capital Market on , 2017), after deducting the estimated underwriting discount and estimated offering expenses payable by us, and excluding the proceeds, if any, from the exercise of the warrants. Each $0.25 increase (decrease) in the assumed combined public offering price of $ per share would increase (decrease) the net proceeds to us from this offering by approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full, assuming the number of shares and warrants offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting the estimated underwriting discount and estimated offering expenses payable by us. We may also increase or decrease the number of shares of our common stock and warrants we are offering. An increase (decrease) of 1 million in the number of shares sold in this offering would increase (decrease) the expected net proceeds of the offering to us by approximately $ million, assuming that the assumed combined public offering price per share and the related warrant coverage remains the same. We currently intend to use the net proceeds of the offering for general corporate purposes and to fund ongoing operations and expansion of our business.

-9-

If you purchase shares of our common stock in this offering, you will experience dilution to the extent of the difference between the combined public offering price per share and related warrant in this offering and our as adjusted net tangible book value per share immediately after this offering assuming no value is attributed to the warrants, and such warrants are accounted for and classified as equity. Net tangible book value per share is equal to the amount of our total tangible assets, less total liabilities, divided by the number of outstanding shares of our common stock. As of September 30, 2017, our net tangible book value was approximately $4.0 million, or approximately $0.13 per share.

After giving effect to the assumed sale by us of shares of our common stock and warrants to purchase up to shares of our common stock in this offering at an assumed combined public offering price of $ per share and related warrant (the last reported sale price of our common stock on The NASDAQ Capital Market on , 2017), after deducting the estimated underwriting discount and estimated offering expenses payable by us, our as adjusted net tangible book value as of September 30, 2017 would have been approximately $ million, or approximately $ per share. This represents an immediate increase in net tangible book value of $ per share to existing stockholders and an immediate dilution of $ per share to new investors purchasing shares of our common stock and related warrants in this offering, attributing none of the assumed combined public offering price to the warrants offered hereby. The following table illustrates this per share dilution:

|

Assumed combined public offering price per share and related warrant |

|

|

|

|

$ |

|

|

|

Net tangible book value per share as of September 30, 2017 |

$ |

0.13 |

|

|

|

|

|

|

Increase in net tangible book value per share after this offering |

|

|

|

|

|

|

|

|

As adjusted net tangible book value per share after this offering |

|

|

|

|

|

|

|

|

Dilution per share to new investors |

|

|

|

|

$ |

|

|

If the underwriters exercise in full their option to purchase additional shares of our common stock and warrants to purchase up to shares of common stock at the assumed combined public offering price of $ per share and related warrant, our as adjusted net tangible book value would be approximately $ per share, an increase in adjusted net tangible book value of approximately $ per share to existing stockholders and a decrease of approximately $ per share in the dilution to the investors in this offering, after deducting the estimated underwriting discount and estimated offering expenses payable by us.

Because the warrants are not listed on a national securities exchange or other nationally recognized trading market, the underwriters will be unable to satisfy any overallotment of shares and warrants without exercising the underwriters’ overallotment option with respect to the warrants. As a result, the underwriters have informed us that they intend to exercise their overallotment option for all of the warrants which are over-allotted, if any, at the time of the initial offering of the shares and the warrants. However, because our common stock is publicly traded, the underwriters may satisfy some or all of the overallotment of shares of our common stock, if any, by purchasing shares in the open market and will have no obligation to exercise the overallotment option with respect to our common stock. If the underwriters exercise their overallotment option with respect to the warrants in full, but do not exercise their overallotment option with respect to our common stock, then the effective warrant coverage for each share of common stock sold in this offering would be % instead of the % stated on the cover page of this prospectus.

A $0.25 increase (decrease) in the assumed combined public offering price of $ per share and related warrant would result in an increase (decrease) in our as adjusted net tangible book value of approximately $ million or approximately $ per share, and would result in an increase (decrease) in the dilution to new investors of approximately $ per share, assuming that the number of shares of our common stock and related warrants sold by us remains the same, after deducting the estimated underwriting discount and estimated offering expenses payable by us.

We may also increase or decrease the number of shares of common stock and related warrants we are offering from the assumed number of share of common stock and related warrants set forth above. An increase of 1.0 million in the assumed number of shares of common stock and related warrants sold by us in this offering would result in an increase in our as adjusted net tangible book value of approximately $ million or approximately $ per share, and would result in an increase in the dilution to new investors of approximately $ per share, assuming that the assumed combined public offering price remains the same, after deducting the estimated underwriting discount and estimated offering expenses payable by us. A decrease of 1.0 million in the assumed number of shares of common stock and related warrants sold by us in this offering would result in a decrease in our as adjusted net tangible book value of approximately $ million or approximately $ per share, and would result in a decrease in the dilution to new investors of approximately $ per share, assuming that the assumed combined public offering price remains the same, after deducting the estimated underwriting discount and estimated offering expenses payable by us. The information discussed above is illustrative only and will adjust based on the actual public offering price, the actual number of shares and related warrants sold in this offering and other terms of this offering determined at pricing.

-10-

The foregoing discussion and table do not take into account further dilution to new investors that could occur upon the exercise of outstanding options or warrants having a per share exercise price less than the per share offering price to the public in this offering. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

The table and discussion above are based on 30,258,743 shares of our common stock outstanding as of September 30, 2017 and excludes as of such date:

|

|

• |

2,484,286 shares of our common stock issuable upon the exercise of stock options, with a weighted-average exercise price of $3.93 per share; |

|

|

• |

360,920 shares of our common stock issuable upon the settlement of outstanding restricted stock units; |

|

|

• |

8,402,275 shares of our common stock issuable upon the exercise of outstanding warrants, with a weighted-average exercise price of $2.69 per share; |

|

|

• |

any shares of our common stock issuable upon exercise of the underwriters’ over-allotment option; and |

|

|

• |

813,771 other shares of our common stock reserved for future issuance under our 2013 Amended and Restated Equity Incentive Plan. |

-11-

We have never declared dividends on our equity securities, and currently do not plan to declare dividends on shares of our common stock in the foreseeable future. We expect to retain our future earnings, if any, for use in the operation and expansion of our business. Subject to the foregoing, the payment of cash dividends in the future, if any, will be at the discretion of our board of directors and will depend upon such factors as earnings levels, capital requirements, our overall financial condition and any other factors deemed relevant by our board of directors.

-12-

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

As of the date of this prospectus, our amended certificate of incorporation authorizes us to issue 150,000,000 shares of common stock, par value $0.0001 per share, and 5,000,000 shares of preferred stock, par value $0.0001 per share.

We are offering shares of our common stock together with warrants to purchase up to an aggregate of shares of our common stock. Each share of our common stock is being sold together with of a warrant to purchase one share of common stock. The shares of our common stock and related warrants will be issued separately. We are also registering the shares of our common stock issuable from time to time upon exercise of the warrants offered hereby.

Common Stock

The holders of our common stock are entitled to the following rights:

Voting Rights

Holders of our common stock are entitled to one vote per share in the election of directors and on all other matters on which stockholders are entitled or permitted to vote. Holders of our common stock are not entitled to cumulative voting rights.

Dividend Rights

Subject to the terms of any then outstanding series of preferred stock, the holders of our common stock are entitled to dividends in the amounts and at times as may be declared by the board of directors out of funds legally available therefor.

Liquidation Rights

Upon liquidation or dissolution, holders of our common stock are entitled to share ratably in all net assets available for distribution to stockholders after we have paid, or provided for payment of, all of our debts and liabilities, and after payment of any liquidation preferences to holders of any then outstanding shares of preferred stock.

Other Matters

Holders of our common stock have no redemption, conversion or preemptive rights. There are no sinking fund provisions applicable to our common stock. The rights, preferences and privileges of the holders of our common stock are subject to the rights of the holders of shares of any series of preferred stock that we may issue in the future.

All of our outstanding shares of common stock are fully paid and nonassessable.

Registration Rights

Under the terms of the warrants issued to certain designees of the representative of the underwriters in connection with our initial public offering, the holders have demand and piggyback registration rights. The holder(s) of at least 51% of the registrable securities, as defined in the warrants, have the right, subject to specified exceptions, to make one demand that we file a registration statement to register all or a portion of their shares. These demand registration rights expire on February 4, 2019, and a demand pursuant to such rights must be made prior to February 4, 2018.

In addition, the holder of each warrant has the right to include its shares in any registration statement we file. If we register any securities for public sale, the holder will have the right to include its shares in the registration statement, provided that the underwriters of any such underwritten offering will have the right to limit the number of shares to be included in the registration statement. These piggyback registration rights expire on February 4, 2021.

Warrants

The following summary of certain terms and provisions of the warrants offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the warrant, the form of which has been filed as an exhibit to the registration statement of which this prospectus is a part. Prospective investors should carefully review the terms and provisions of the form of warrant for a complete description of the terms and conditions of the warrants.

-13-

Form. The warrants will be issued as individual warrant agreements to the investors.

Exercisability. The warrants are exercisable at any time after their original issuance, expected to be , 2017, and at any time up to the date that is five years after their original issuance. The warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of the shares of common stock underlying the warrants under the Securities Act is effective and available for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of shares of common stock purchased upon such exercise. If a registration statement registering the issuance of the shares of common stock underlying the warrants under the Securities Act is not effective or available and an exemption from registration under the Securities Act is not available for the issuance of such shares, the holder may, in its sole discretion, elect to exercise the warrant through a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of common stock determined according to the formula set forth in the warrant. No fractional shares of common stock will be issued in connection with the exercise of a warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price.

Exercise Limitation. A holder will not have the right to exercise any portion of the warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the warrants. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% upon at least 61 days’ prior notice from the holder to us.

Exercise Price. The warrants will have an exercise price of $ per share. The exercise price is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our common stock and also upon any distributions of assets, including cash, stock or other property to our stockholders.

Transferability. Subject to applicable laws, the warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing. There is no established trading market for the warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the warrants will be limited.

Fundamental Transactions. In the event of a fundamental transaction, as described in the warrants and generally including any reorganization, recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock, the holders of the warrants will be entitled to receive upon exercise of the warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the warrants immediately prior to such fundamental transaction.

Rights as a Stockholder. Except as otherwise provided in the warrants or by virtue of such holder’s ownership of shares of our common stock, the holder of a warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises the warrant.

Waivers and Amendments. Subject to certain exceptions, any term of the warrants may be amended or waived with our written consent and the written consent of the holders of at least two-thirds of the then-outstanding warrants.

Transfer Agent and Warrant Agent

The transfer agent of our common stock and the warrants being offered hereby is Continental Stock Transfer & Trust Company.

-14-

We have entered into an underwriting agreement with and with respect to the shares of common stock and warrants subject to this offering. Subject to certain conditions, we have agreed to sell to the underwriters, and the underwriters have severally agreed to purchase, the number of shares of common stock and warrants provided below opposite their respective names.

|

|

|

|

|

|

|

|

||||||

|

Underwriters |

|

Number of |

|

Number of |

|

|||||||

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

||||||

|

Total |

|

|

|

|

|

|

||||||

The underwriters are offering the shares of common stock and warrants subject to their acceptance of the shares of common stock and warrants from us and subject to prior sale. The underwriting agreement provides that the obligations of the several underwriters to pay for and accept delivery of the shares of common stock and warrants offered by this prospectus are subject to the approval of certain legal matters by their counsel and to certain other conditions. The underwriters are obligated to take and pay for all of the shares of common stock and warrants if any such shares and warrants are taken. However, the underwriters are not required to take or pay for the shares of common stock and warrants covered by the underwriters’ over-allotment option described below.

Over-Allotment Option

We have granted the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase up to additional shares of our common stock at a purchase price of $ per share and/or additional warrants to purchase up to shares of our common stock at a purchase price of $ per warrant to purchase one share of our common stock, to cover over-allotments, if any, of the shares of our common stock and warrants offered by this prospectus. If the underwriters exercise this option, each underwriter will be obligated, subject to certain conditions, to purchase a number of additional shares and/or warrants proportionate to that underwriter’s initial purchase commitment as indicated in the table above for which the option has been exercised. Because the warrants are not listed on a national securities exchange or other nationally recognized trading system, the underwriters will be unable to satisfy any overallotment of shares and warrants without exercising the underwriters’ overallotment option with respect to the warrants. As a result, the underwriters have informed us that they intend to exercise their overallotment option for all of the warrants which are over-allotted, if any, at the time of the initial offering of the shares and the warrants. However, because our common stock is publicly traded, the underwriters may satisfy some or all of the overallotment of shares of our common stock, if any, by purchasing shares in the open market and will have no obligation to exercise the overallotment option with respect to our common stock. If the underwriters exercise their overallotment option with respect to the warrants in full, but do not exercise their overallotment option with respect to our common stock, then the effective warrant coverage for each share of common stock sold in this offering would be % instead of the % stated on the cover page of this prospectus.

Discount, Commissions and Expenses

The underwriters have advised us that they propose to offer the shares of common stock and warrants to the public at the combined public offering price set forth on the cover page of this prospectus and to certain dealers at that price less a concession not in excess of $ per share and related warrant. The underwriters may allow, and certain dealers may reallow, a discount from the concession not in excess of $ per share and related warrant to certain brokers and dealers. After this offering, the combined public offering price, concession and reallowance to dealers may be changed by the underwriters. No such change shall change the amount of proceeds to be received by us as set forth on the cover page of this prospectus. The shares of common stock and warrants are offered by the underwriters as stated herein, subject to receipt and acceptance by them and subject to their right to reject any order in whole or in part. The underwriters have informed us that they do not intend to confirm sales to any accounts over which they exercise discretionary authority.

-15-

The following table shows the underwriting discount payable to the underwriters by us in connection with this offering. Such amounts are shown assuming both no exercise and full exercise of the underwriters’ over-allotment option to purchase additional shares and warrants.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|||||

|

|

|

Per |

|

Without |

|

With |

|

|||

|

Combined public offering price |

|

$ |

|

|

$ |

|

|

$ |

|

|

|

Underwriting discount |

|

$ |

|

|

$ |

|

|

$ |

|

|

We have agreed to reimburse the underwriters for certain out-of-pocket expenses (including the reasonable fees and disbursements of counsel to the underwriters) up to $ without our prior written approval, such approval not to be unreasonably withheld. We estimate that expenses payable by us in connection with this offering, other than the underwriting discount referred to above but including the reimbursement of the underwriters’ expenses, will be approximately $ .

Indemnification

We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended, or the Securities Act, and liabilities arising from breaches of representations and warranties contained in the underwriting agreement, or to contribute to payments that the underwriters may be required to make in respect of those liabilities.

Lock-up Agreements

We, our officers, directors and certain of our stockholders have agreed, subject to limited exceptions, for a period of 90 days after the date of the underwriting agreement, not to offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of, directly or indirectly any shares of common stock or any securities convertible into or exchangeable for our common stock either owned as of the date of the underwriting agreement or thereafter acquired without the prior written consent of the underwriters. The underwriters may, in their sole discretion and at any time or from time to time before the termination of the lock-up period, without notice, release all or any portion of the securities subject to lock-up agreements.

Price Stabilization, Short Positions and Penalty Bids

In connection with the offering the underwriters may engage in stabilizing transactions, over-allotment transactions, syndicate covering transactions and penalty bids in accordance with Regulation M under the Exchange Act:

|

|

• |

Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum. |

|

|

• |

Over-allotment involves sales by the underwriters of shares in excess of the number of securities the underwriters are obligated to purchase, which creates a syndicate short position. The short position may be either a covered short position or a naked short position. In a covered short position, the number of securities over-allotted by the underwriters is not greater than the number of securities that they may purchase in the over-allotment option. In a naked short position, the number of securities involved is greater than the number of securities in the over-allotment option. The underwriters may close out any covered short position by either exercising their over-allotment option and/or purchasing securities in the open market. |

-16-

|

|

• |

Penalty bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate member is purchased in a stabilizing or syndicate covering transaction to cover syndicate short positions. |

These stabilizing transactions, syndicate covering transactions and penalty bids may have the effect of raising or maintaining the market price of our common stock and warrants or preventing or retarding a decline in the market price of the common stock and warrants. As a result, the price of our common stock and warrants may be higher than the price that might otherwise exist in the open market. Neither we nor the underwriters make any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of the common stock and warrants. In addition, neither we nor the underwriters make any representations that the underwriters will engage in these stabilizing transactions or that any transaction, once commenced, will not be discontinued without notice.

Passive Market Making

In connection with this offering, the underwriters and any selling group members may engage in passive market making transactions in our common stock on The NASDAQ Stock Market in accordance with Rule 103 of Regulation M under the Securities Exchange Act of 1934, as amended, during a period before the commencement of offers or sales of common stock and extending through the completion of the distribution. A passive market maker must display its bid at a price not in excess of the highest independent bid of that security. However, if all independent bids are lowered below the passive market maker’s bid that bid must then be lowered when specified purchase limits are exceeded.

Listing, Transfer Agent and Warrant Agent

Our common stock is listed on The NASDAQ Capital Market under the symbol “BIOC.” There is no established trading market for the warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the warrants will be limited. The transfer agent of our common stock is Continental Stock Transfer & Trust Company. We will act as the warrant agent for the warrants.

Electronic Distribution

This prospectus in electronic format may be made available on websites or through other online services maintained by one or more of the underwriters, or by their affiliates. Other than this prospectus in electronic format, the information on any underwriter’s website and any information contained in any other website maintained by an underwriter is not part of this prospectus or the registration statement of which this prospectus forms a part, has not been approved and/or endorsed by us or any underwriter in its capacity as underwriter, and should not be relied upon by investors.

Other

From time to time, certain of the underwriters and/or their affiliates have provided, and may in the future provide, various investment banking and other financial services for us for which services they have received and, may in the future receive, customary fees. In the course of their businesses, the underwriters and their affiliates may actively trade our securities or loans for their own account or for the accounts of customers, and, accordingly, the underwriters and their affiliates may at any time hold long or short positions in such securities or loans. Except as described below and except for services provided in connection with this offering, no underwriter has provided any investment banking or other financial services to us during the 180-day period preceding the date of this prospectus and we do not expect to retain any underwriter to perform any investment banking or other financial services for at least 90 days after the date of this prospectus.

-17-

The validity of the shares of common stock being offered by this prospectus will be passed upon for us by Cooley LLP, San Diego, California. The underwriters are being represented by .

Mayer Hoffman McCann P.C., our independent registered public accounting firm, has audited our balance sheets as of December 31, 2015 and 2016, and the related statements of operations and comprehensive loss, changes in shareholders’ equity and cash flows for each of the two years in the period ended December 31, 2016, as set forth in their report. We have incorporated by reference our financial statements in this prospectus and in this registration statement in reliance on the report of Mayer Hoffman McCann P.C. given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the shares of common stock being offered by this prospectus. This prospectus does not contain all of the information in the registration statement and its exhibits. For further information with respect to us and the common stock offered by this prospectus, we refer you to the registration statement and its exhibits. Statements contained in this prospectus as to the contents of any contract or any other document referred to are not necessarily complete, and in each instance, we refer you to the copy of the contract or other document filed as an exhibit to the registration statement. Each of these statements is qualified in all respects by this reference.

You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website at www.sec.gov. You may also read and copy any document we file with the SEC at its public reference facilities at 100 F Street NE, Washington, D.C. 20549. You may also obtain copies of these documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facilities. You may also request a copy of these filings, at no cost, by writing us at 5810 Nancy Ridge Drive, San Diego, California 92121 or telephoning us at (858) 320-8200.

We are subject to the information and periodic reporting requirements of the Exchange Act, and we file periodic reports, proxy statements and other information with the SEC. These periodic reports, proxy statements and other information are available for inspection and copying at the public reference room and website of the SEC referred to above. We maintain a website at http://www.biocept.com. You may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC free of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not incorporated by reference in, and is not part of, this prospectus.

-18-

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to incorporate by reference the information and reports we file with it, which means that we can disclose important information to you by referring you to these documents. The information incorporated by reference is an important part of this prospectus. We incorporate by reference, as of their respective dates of filing, the documents listed below that we have filed with the SEC and any documents that we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of the offering of securities under this prospectus:

|

|

• |

our Annual Report on Form 10-K for the year ended December 31, 2016 (other than information furnished rather than filed), filed with the SEC on March 28, 2017; |

||

|

|

• |

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2017, June 30, 2017, and September 30, 2017 (other than information furnished rather than filed), filed with the SEC on May 15, 2017, August 14, 2017, and November 14, 2017; |

||

|

|

• |

our Current Reports on Form 8-K (other than information furnished rather than filed), filed with the SEC on January 25, 2017, February 9, 2017, March 23, 2017, March 30, 2017, May 5, 2017, August 10, 2017, September 8, 2017, and September 29, 2017; |

||

|

|

• |

the information specifically incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 from our definitive proxy statement on Schedule 14A (other than information furnished rather than filed) filed with the SEC on March 30, 2017; and |

||

|

|

• |

the description of our common stock, which is registered under Section 12 of the Exchange Act, in our registration statement on Form 8-A, filed with the SEC on January 28, 2014, including any amendments or reports filed for the purpose of updating such description. |

||

Upon request, we will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus is delivered a copy of the documents incorporated by reference into this prospectus. You may request a copy of these filings, and any exhibits we have specifically incorporated by reference as an exhibit in this prospectus, at no cost by writing or telephoning us at the following address:

Biocept, Inc.

5810 Nancy Ridge Drive

San Diego, California 92121

Telephone: (858) 320-8200

You also may access these filings on our Internet site at www.biocept.com. Our web site and the information contained on that site, or connected to that site, are not incorporated into this prospectus or the Registration Statement on Form S-1.

-19-

Shares of Common Stock

Warrants to Purchase Up to Shares of Common Stock

PROSPECTUS

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 13. |

Other Expenses of Issuance and Distribution |

The following table sets forth the costs and expenses, other than underwriting discounts and commissions, paid or payable by Biocept, Inc., or the Registrant, in connection with the sale and distribution of the securities being registered. All amounts are estimated except the SEC registration fee.

|

Item |

|

Amount |

|

|

|

SEC registration fee |

|

$ |

1,245 |

|

|

Legal fees and expenses |

|

|

|

|

|

Accounting fees and expenses |

|

|

|

|

|

Printing and engraving expenses |

|

|

|

|

|

Transfer agent and registrar fees and expenses |

|

|

|

|

|

Miscellaneous fees and expenses |

|

|

|

|

|

Total |

|

$ |

|

|

|

Item 14. |

Indemnification of Directors and Officers |

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities, including reimbursement for expenses incurred, arising under the Securities Act.

The Registrant’s amended certificate of incorporation provides for indemnification of its directors and executive officers to the maximum extent permitted by the Delaware General Corporation Law, and the Registrant’s amended and restated bylaws provide for indemnification of its directors and executive officers to the maximum extent permitted by the Delaware General Corporation Law.

In addition, the Registrant has entered into indemnification agreements with each of its current directors and executive officers. These agreements will require the Registrant to indemnify these individuals to the fullest extent permitted under Delaware law against liabilities that may arise by reason of their service to the Registrant and to advance expenses incurred as a result of any proceeding against them as to which they could be indemnified. The Registrant also intends to enter into indemnification agreements with its future directors and executive officers.

|

Item 15. |

Recent Sales of Unregistered Securities. |

Since January 1, 2014, the Registrant made sales of the unregistered securities discussed below. The offers, sales and issuances of the securities described below were exempt from registration under the Securities Act by virtue of Section 4(a)(2) of the Securities Act and/or, in the case of compensatory issuances, Securities Act Rule 701, and/or, in the case of conversions, Section 3(a)(9) of the Securities Act. No commissions were paid.

Ally Bridge Private Placement

On August 9, 2017, the Registrant entered into a common stock and warrant purchase agreement with Ally Bridge LB Healthcare Master Fund Limited pursuant to which the Registrant issued and sold in a private placement an aggregate of 1,466,667 shares of common stock, together with a warrant to purchase an additional 1,434,639 shares of common stock, for an aggregate purchase price of approximately $2.2 million. The warrant has an exercise price per share equal to $1.50, is immediately exercisable and will expire on the fifth anniversary of the original issuance date.