Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Atlantic Coast Financial CORP | tv479824_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Atlantic Coast Financial CORP | tv479824_ex2-1.htm |

| 8-K - 8-K - Atlantic Coast Financial CORP | tv479824_8k.htm |

Exhibit 99.2

Acquisition of Atlantic Coast Financial Corporation November 17, 2017

Forward - Looking Statements 2 This presentation contains “forward - looking statements” as defined in the Private Securities Litigation Reform Act of 1995. In general, forward - looking statements usually use words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, including statements related to the expected timing of the closing of the proposed merger transaction, the expected returns and other benefits of the proposed merger transaction to shareholders, expected improvement in operating efficiency resulting from the proposed merger transaction, estimated expense reductions resulting from the transactions and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the proposed merger transaction on the capital ratios of Ameris Bancorp (“Ameris”). Forward - looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward - looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors that could cause or contribute to such differences include, but are not limited to, the possibility that expected benefits may not materialize in the timeframes expected or at all, or may be more costly to achieve; that the proposed merger transaction may not be timely completed, if at all; that prior to completion of the proposed merger transaction or thereafter, the parties’ respective businesses may not perform as expected due to transaction - related uncertainties or other factors; that the parties are unable to implement successful integration strategies; that the required regulatory, shareholder or other closing conditions are not satisfied in a timely manner, or at all; reputational risks and the reaction of the parties’ customers to the proposed merger transaction; diversion of management time to merger - related issues; and other factors and risk influences contained in the cautionary language included under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in Ameris’ Form 10 - K for the year ended December 31, 2016 and other documents subsequently filed by Ameris with the Securities and Exchange Commission (the “SEC”). Consequently, no forward - looking statement can be guaranteed. Neither Ameris nor Atlantic Coast Financial Corp .,(“ Atlantic Coast”) undertakes any obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. For any forward - looking statements made in this presentation or any related documents, Ameris and Atlantic Coast claim protection of the safe harbor for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995.

Additional Information 3 Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction involving Ameris and Atlantic Coast. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger transaction, Ameris will file with the SEC a registration statement on Form S - 4 that will include a proxy statement/prospectus for the shareholders of Atlantic Coast. Ameris also plans to file other documents with the SEC regarding the proposed merger transaction with Atlantic Coast. Atlantic Coast will mail the final proxy statement/prospectus to its shareholders. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The proxy statement/prospectus, as well as other filings containing information about Ameris and Atlantic Coast, will be available without charge, at the SEC’s website (http://www.sec.gov). Copies of the proxy statement/prospectus and other documents filed with the SEC in connection with the proposed merger transaction can also be obtained, when available, without charge, from the Company’s website ( http://www.amerisbank.com ) and Atlantic Coast’s website ( https://www.atlanticcoastbank.net/ ). Participants in the Merger Solicitation Ameris and Atlantic Coast, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Atlantic Coast in respect of the proposed merger transaction. Information regarding the directors and executive officers of Ameris and Atlantic Coast and other persons who may be deemed participants in the solicitation of the shareholders of Atlantic Coast in connection with the proposed merger transaction will be included in the proxy statement/prospectus for Atlantic Coast’s special meeting of shareholders, which will be filed by Ameris with the SEC. Information about Ameris ’ directors and executive officers can also be found in Ameris ’ definitive proxy statement in connection with its 2017 annual meeting of shareholders, as filed with the SEC on April 3 , 2017, and other documents subsequently filed by Ameris with the SEC. Information about Atlantic Coast’s directors and executive officers can also be found in Atlantic Coast’s definitive proxy statement in connection with its 2017 annual meeting of shareholders, as filed with the SEC on April 18, 2017, and other documents subsequently filed by Atlantic Coast with the SEC. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and other relevant documents regarding the proposed merger transaction filed with the SEC when they become available.

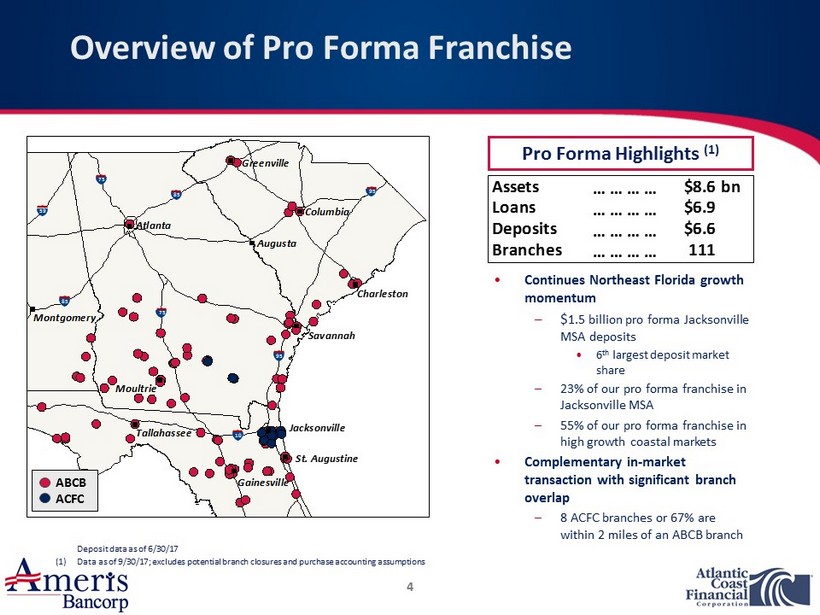

Montgomery Gainesville St. Augustine Tallahassee Savannah Greenville Atlanta Moultrie Charleston Jacksonville Augusta Columbia Overview of Pro Forma Franchise 4 Deposit data as of 6/30/17 (1) Data as of 9/30/17; excludes potential branch closures and purchase accounting assumptions Pro Forma Highlights (1) Assets … … … … $8.6bnLoans … … … … $6.9 Deposits … … … … $6.6 Branches … … … … 111 • Continues Northeast Florida growth momentum – $ 1.5 billion pro forma Jacksonville MSA deposits • 6 th largest deposit market share – 23% of our pro forma franchise in Jacksonville MSA – 55% of our pro forma franchise in high growth coastal markets • Complementary in - market transaction with significant branch overlap – 8 ACFC branches or 67% are within 2 miles of an ABCB branch 85 95 75 10 95 85 75 59 ABCB ACFC

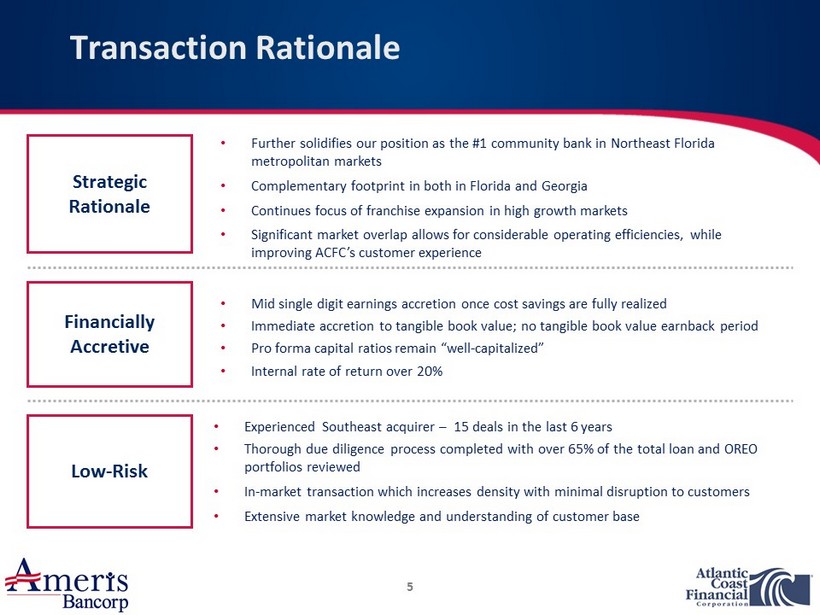

Transaction Rationale 5 • Experienced Southeast acquirer – 15 deals in the last 6 years • Thorough due diligence process completed with over 65 % of the total loan and OREO portfolios reviewed • In - market transaction which increases density with minimal disruption to customers • Extensive market knowledge and understanding of customer base Strategic Rationale Financially Accretive Low - Risk • Mid single digit earnings accretion once cost savings are fully realized • Immediate accretion to tangible book value; no tangible book value earnback period • Pro forma capital ratios remain “well - capitalized” • Internal rate of return over 20% • Further solidifies our position as the #1 community bank in Northeast Florida metropolitan markets • Complementary footprint in both in Florida and Georgia • Continues focus of franchise expansion in high growth markets • Significant market overlap allows for considerable operating efficiencies, while improving ACFC’s customer experience

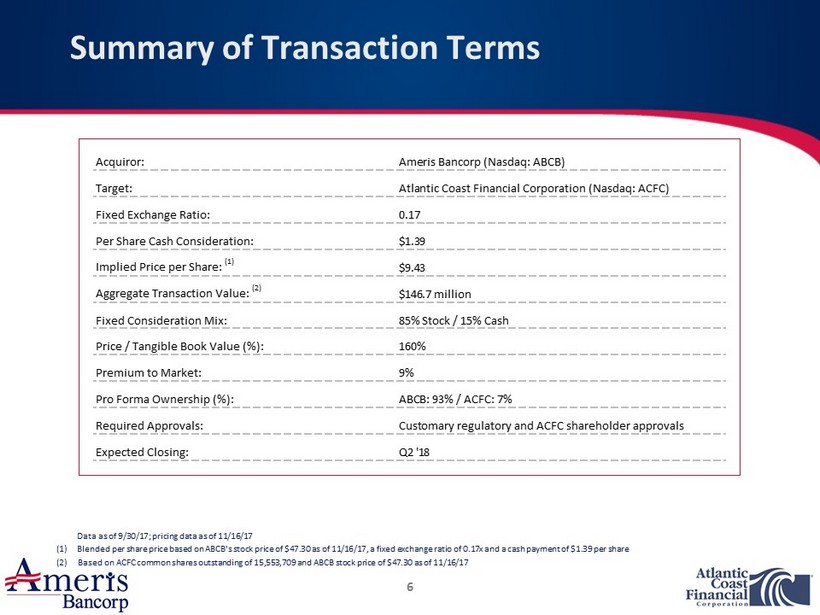

Summary of Transaction Terms 6 Data as of 9/30/17; pricing data as of 11/16/17 (1) Blended per share price based on ABCB’s stock price of $47.30 as of 11/16/17, a fixed exchange ratio of 0.17x and a cash payment of $1.39 per share (2) Based on ACFC common shares outstanding of 15,553,709 and ABCB stock price of $47.30 as of 11/16/17 Acquiror: Ameris Bancorp (Nasdaq: ABCB) Target: Atlantic Coast Financial Corporation (Nasdaq: ACFC) Fixed Exchange Ratio: 0.17 Per Share Cash Consideration: $1.39 Implied Price per Share: (1) $9.43 Aggregate Transaction Value: (2) $146.7 million Fixed Consideration Mix: 85% Stock / 15% Cash Price / Tangible Book Value (%): 160% Premium to Market: 9% Pro Forma Ownership (%): ABCB: 93% / ACFC: 7% Required Approvals: Customary regulatory and ACFC shareholder approvals Expected Closing: Q2 '18

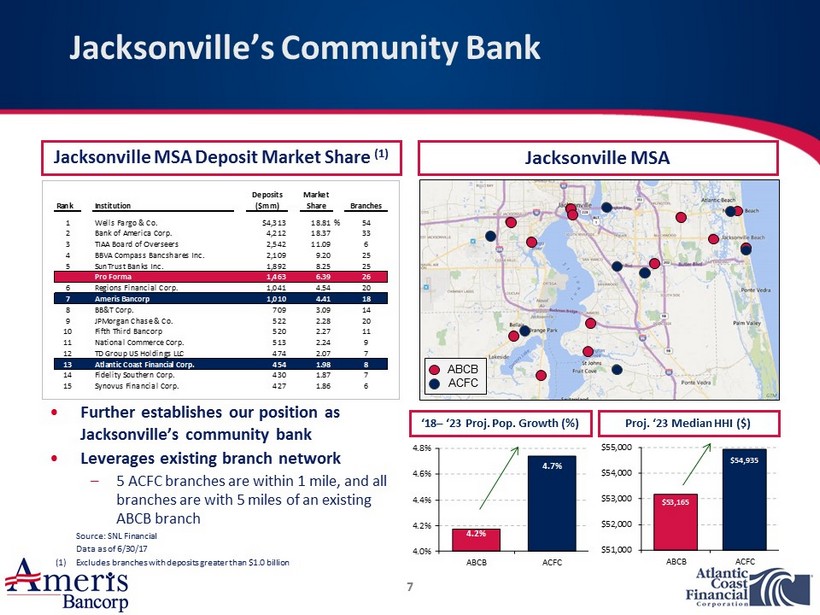

Jacksonville’s Community Bank 7 Jacksonville MSA Deposit Market Share (1) Jacksonville MSA ABCB ACFC • Further establishes our position as Jacksonville’s community bank • Leverages existing branch network – 5 ACFC branches are within 1 mile, and all branches are with 5 miles of an existing ABCB branch ‘18 – ‘23 Proj. Pop. Growth (%) Proj. ‘23 Median HHI ($) $53,165 $54,935 $51,000 $52,000 $53,000 $54,000 $55,000 ABCB ACFC 4.2% 4.7% 4.0% 4.2% 4.4% 4.6% 4.8% ABCB ACFC Source: SNL Financial Data as of 6/30/17 (1) Excludes branches with deposits greater than $1.0 billion Deposits Market Rank Institution ($mm) Share Branches 1 Wells Fargo & Co. $4,313 18.81% 54 2 Bank of America Corp. 4,212 18.37 33 3 TIAA Board of Overseers 2,542 11.09 6 4 BBVA Compass Bancshares Inc. 2,109 9.20 25 5 SunTrust Banks Inc. 1,892 8.25 25 Pro Forma 1,463 6.39 26 6 Regions Financial Corp. 1,041 4.54 20 7 Ameris Bancorp 1,010 4.41 18 8 BB&T Corp. 709 3.09 14 9 JPMorgan Chase & Co. 522 2.28 20 10 Fifth Third Bancorp 520 2.27 11 11 National Commerce Corp. 513 2.24 9 12 TD Group US Holdings LLC 474 2.07 7 13 Atlantic Coast Financial Corp. 454 1.98 8 14 Fidelity Southern Corp. 430 1.87 7 15 Synovus Financial Corp. 427 1.86 6

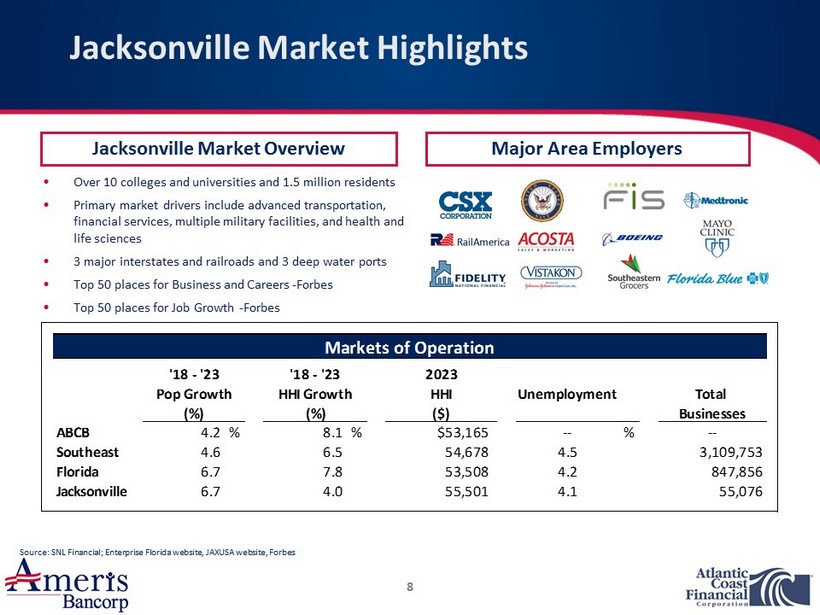

• Over 10 colleges and universities and 1.5 million residents • Primary market drivers include advanced transportation , financial services, multiple military facilities, and health and life sciences • 3 major interstates and railroads and 3 deep water ports • Top 50 places for Business and Careers - Forbes • Top 50 places for Job Growth - Forbes Jacksonville Market Highlights 8 Jacksonville Market Overview Source: SNL Financial; Enterprise Florida website, JAXUSA website, Forbes Major Area Employers Markets of Operation '18 - '23 '18 - '23 2023 Pop Growth HHI Growth HHI Unemployment Total (%) (%) ($) Businesses ABCB 4.2% 8.1% $53,165 -- % -- Southeast 4.6 6.5 54,678 4.5 3,109,753 Florida 6.7 7.8 53,508 4.2 847,856 Jacksonville 6.7 4.0 55,501 4.1 55,076

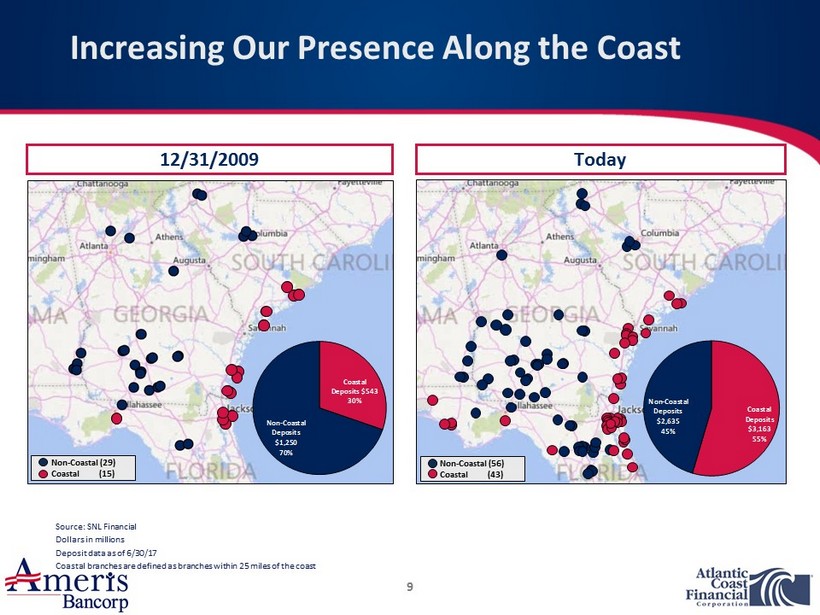

Increasing Our Presence Along the Coast 9 Source: SNL Financial Dollars in millions Deposit data as of 6/30/17 Coastal branches are defined as branches within 25 miles of the coast Non - Coastal (56) Coastal ( 43) 12/31/2009 Today Non - Coastal (29) Coastal ( 15) Coastal Deposits $543 30% Non - Coastal Deposits $1,250 70% Coastal Deposits $3,163 55% Non - Coastal Deposits $2,635 45%

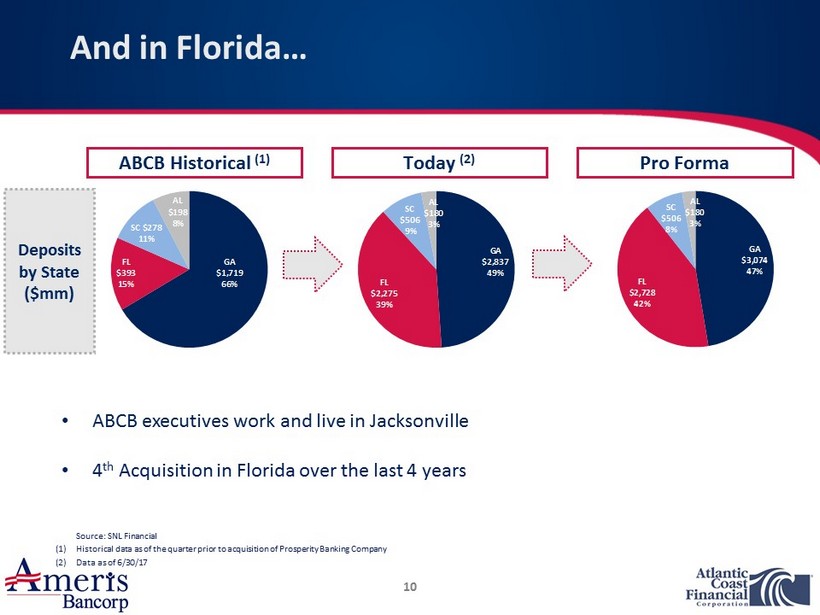

And in Florida… 10 Deposits by State ($mm) ABCB Historical (1) Pro Forma Today (2) GA $1,719 66% FL $393 15% SC $278 11% AL $198 8% GA $2,837 49% FL $2,275 39% SC $506 9% AL $180 3% GA $3,074 47% FL $2,728 42% SC $506 8% AL $180 3% Source: SNL Financial (1) Historical data as of the quarter prior to acquisition of Prosperity Banking Company (2) Data as of 6/30/17 • ABCB executives work and live in Jacksonville • 4 th Acquisition in Florida over the last 4 years

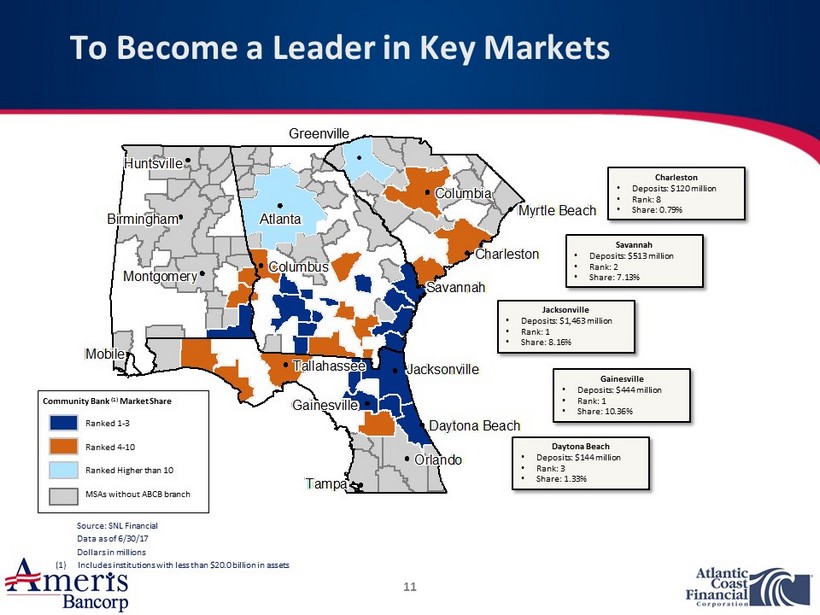

Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Gainesville Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Atlanta Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Jacksonville Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tallahassee Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa Tampa St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg St. Petersburg Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Birmingham Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Huntsville Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Montgomery Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Columbia Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Mobile Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Miami Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Columbus Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Orlando Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Fort Lauderdale Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Savannah Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Charleston Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Daytona Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach Myrtle Beach To Become a Leader in Key Markets 11 Source: SNL Financial Data as of 6/30/17 Dollars in millions (1) Includes institutions with less than $20.0 billion in assets Charleston • Deposits: $120 million • Rank: 8 • Share: 0.79% Savannah • Deposits: $513 million • Rank: 2 • Share: 7.13% Jacksonville • Deposits: $1,463 million • Rank: 1 • Share: 8.16% Gainesville • Deposits: $444 million • Rank: 1 • Share: 10.36% Daytona Beach • Deposits: $144 million • Rank: 3 • Share: 1.33% Ranked 1 - 3 Ranked 4 - 10 MSAs without ABCB branch Ranked Higher than 10 Community Bank (1) Market Share Greenville

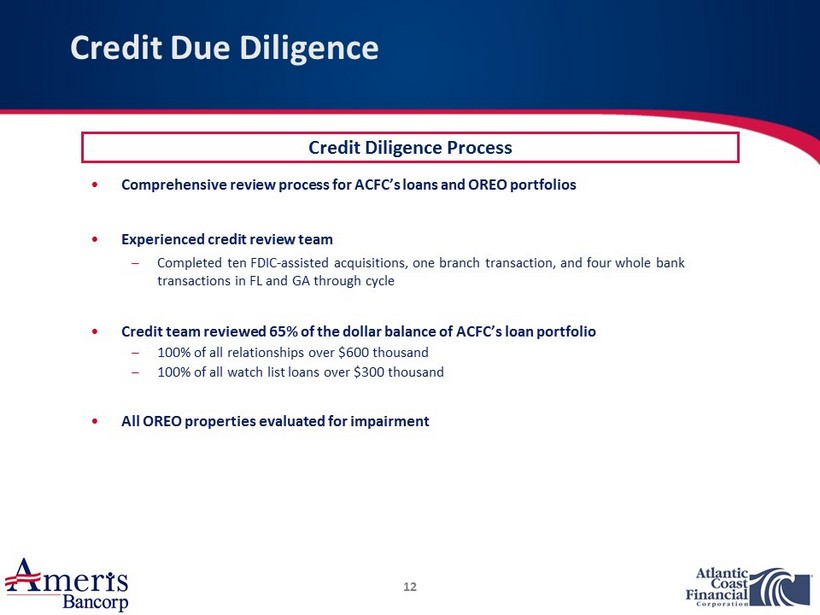

Credit Due Diligence 12 Credit Diligence Process • Comprehensive review process for ACFC’s loans and OREO portfolios • Experienced credit review team – Completed ten FDIC - assisted acquisitions, one branch transaction, and four whole bank transactions in FL and GA through cycle • Credit team reviewed 65% of the dollar balance of ACFC’s loan portfolio – 100% of all relationships over $ 600 thousand – 100% of all watch list loans over $300 thousand • All OREO properties evaluated for impairment

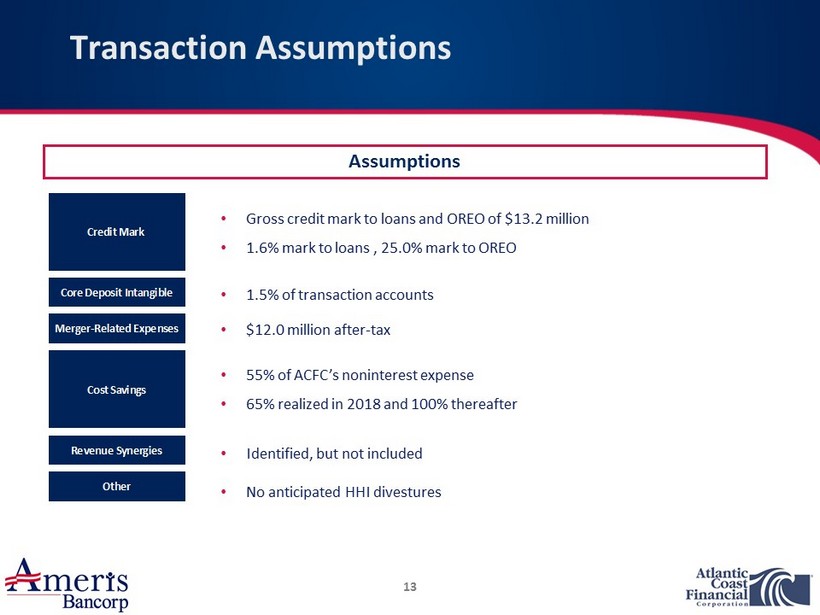

Transaction Assumptions 13 Assumptions • 55% of ACFC’s noninterest expense • 65% realized in 2018 and 100% thereafter • 1.5% of transaction accounts • $12.0 million after - tax • Identified, but not included • Gross credit mark to loans and OREO of $13.2 million • 1.6% mark to loans , 25.0% mark to OREO Credit Mark Core Deposit Intangible Merger-Related Expenses Cost Savings Revenue Synergies Other • No anticipated HHI divestures

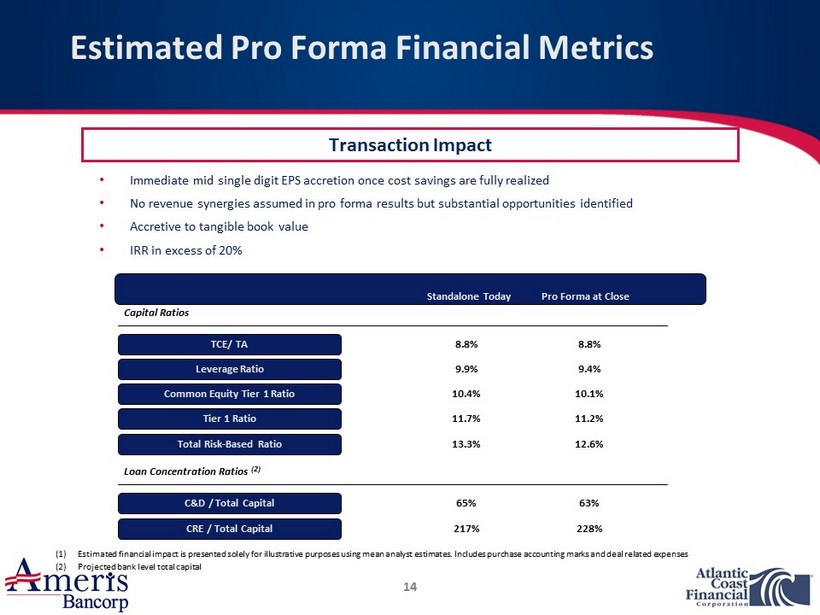

• Immediate mid single digit EPS accretion once cost savings are fully realized • No revenue synergies assumed in pro forma results but substantial opportunities identified • Accretive to tangible book value • IRR in excess of 20% Estimated Pro Forma Financial Metrics 14 Capital Ratios TCE/ TA Leverage Ratio Common Equity Tier 1 Ratio Tier 1 Ratio Total Risk - Based Ratio Loan Concentration Ratios (2) C&D / Total Capital CRE / Total Capital 8.8% 9.9% 10.4% 11.7% 13.3% 8.8% 9.4% 10.1% 11.2% 12.6% 65% 217% 63% 228% Standalone Today Pro Forma at Close (1) Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates. Includes purc has e accounting marks and deal related expenses (2) Projected bank level total capital Transaction Impact

Benefit to ACFC Stakeholders 15 • Larger organization offers employees greater opportunities for growth and enrichment • Experienced senior leadership • Long - term, dedicated teams Shareholders Customers Employees • Access to combined commercial and retail product capabilities • Convenience of expanded network of 111 branches across 4 states • Similar community banking model with a focus on strong customer service • Unlocks shareholder value • Increased liquidity • Benefit from ABCB’s dividend

Conclusion 16 • Further cements ABCB as the #1 Community Bank in Jacksonville • Significant opportunity to leverage existing branch network and community banking relationships • Continues ABCB’s focus in high growth, attractive markets

Appendix: Additional Information

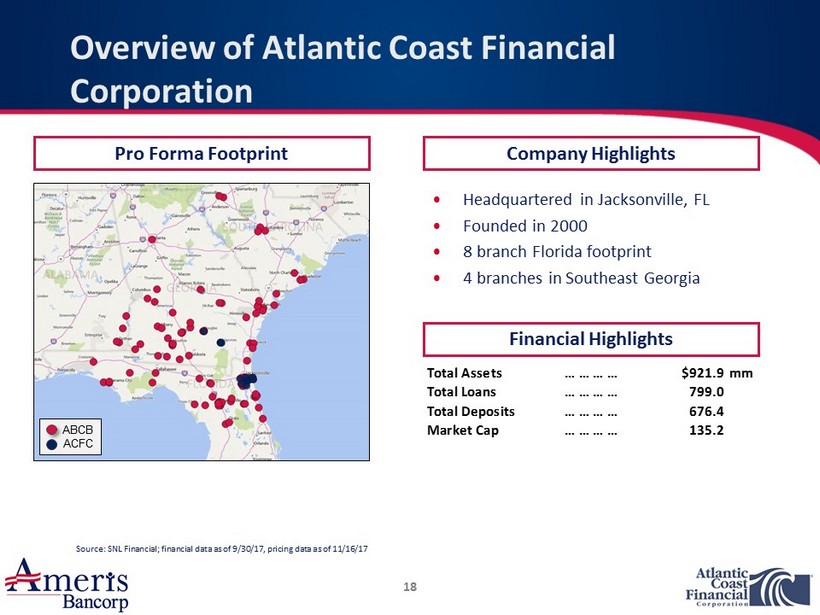

18 Pro Forma Footprint • Headquartered in Jacksonville, FL • Founded in 2000 • 8 branch Florida footprint • 4 branches in Southeast Georgia Overview of Atlantic Coast Financial Corporation Company Highlights Financial Highlights ABCB ACFC Source: SNL Financial; financial data as of 9/30/17 , pricing data as of 11/16/17 Total Assets … … … … $921.9mm Total Loans … … … … 799.0 Total Deposits … … … … 676.4 Market Cap … … … … 135.2

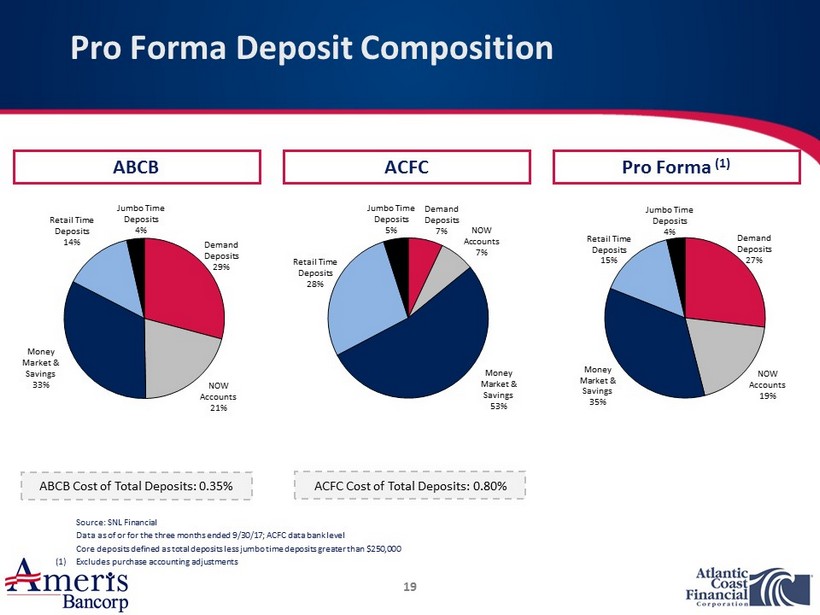

Pro Forma Deposit Composition 19 ACFC ABCB Pro Forma (1) ABCB Cost of Total Deposits: 0.35% ACFC Cost of Total Deposits: 0.80% Source : SNL Financial Data as of or for the three months ended 9/30/17; ACFC data bank level Core deposits defined as total deposits less jumbo time deposits greater than $250,000 (1) Excludes purchase accounting adjustments Demand Deposits 29% NOW Accounts 21% Money Market & Savings 33% Retail Time Deposits 14% Jumbo Time Deposits 4% Demand Deposits 27% NOW Accounts 19% Money Market & Savings 35% Retail Time Deposits 15% Jumbo Time Deposits 4% Demand Deposits 7% NOW Accounts 7% Money Market & Savings 53% Retail Time Deposits 28% Jumbo Time Deposits 5%

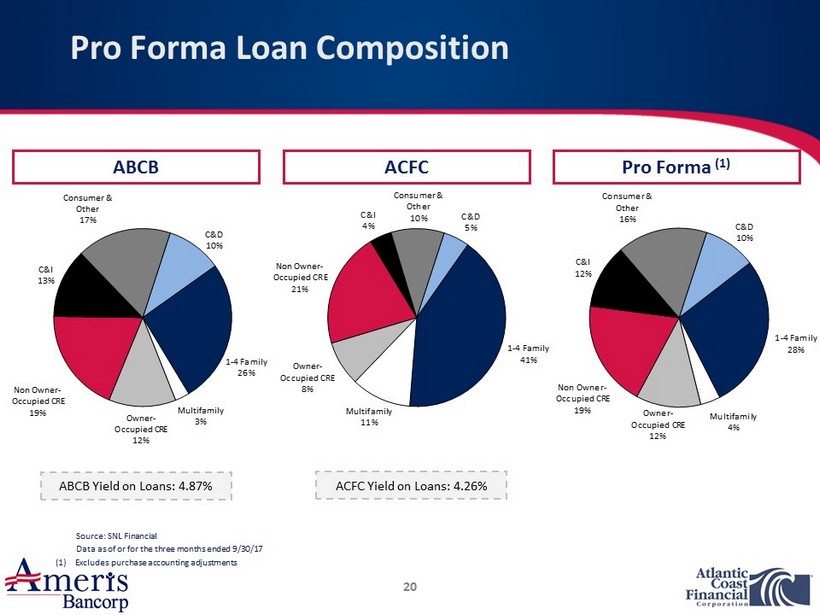

Pro Forma Loan Composition 20 ACFC ABCB Pro Forma (1) ABCB Yield on Loans: 4.87% ACFC Yield on Loans: 4.26% Source: SNL Financial Data as of or for the three months ended 9/30/17 (1) Excludes purchase accounting adjustments C&D 10% 1 - 4 Family 26% Multifamily 3% Owner - Occupied CRE 12% Non Owner - Occupied CRE 19% C&I 13% Consumer & Other 17% C&D 10% 1 - 4 Family 28% Multifamily 4% Owner - Occupied CRE 12% Non Owner - Occupied CRE 19% C&I 12% Consumer & Other 16% C&D 5% 1 - 4 Family 41% Multifamily 11% Owner - Occupied CRE 8% Non Owner - Occupied CRE 21% C&I 4% Consumer & Other 10%

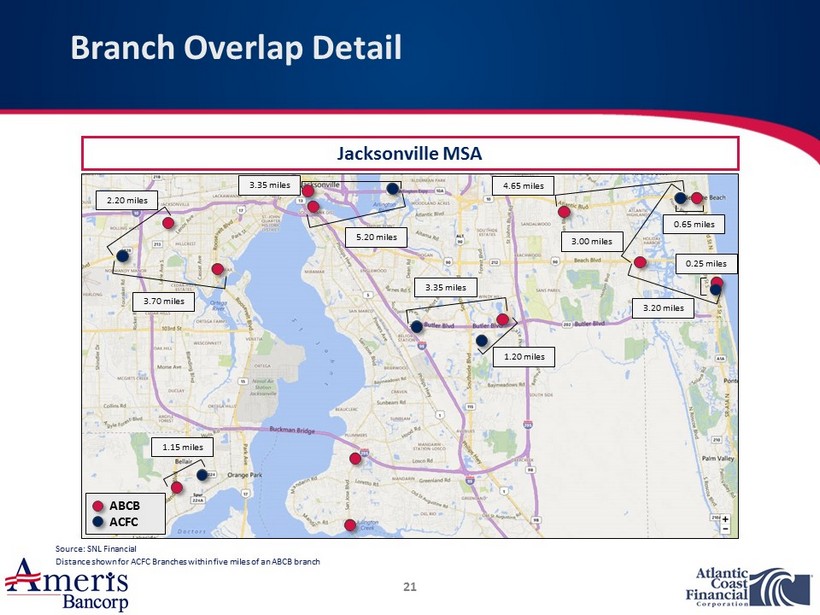

Branch Overlap Detail 21 Source: SNL Financial Distance shown for ACFC Branches within five miles of an ABCB branch Jacksonville MSA 5.20 miles 3.35 miles 2.20 miles 3.35 miles 1.20 miles 1.15 miles 0.25 miles 0.65 miles 3.00 miles 4.65 miles 3.20 miles 3.70 miles ABCB ACFC

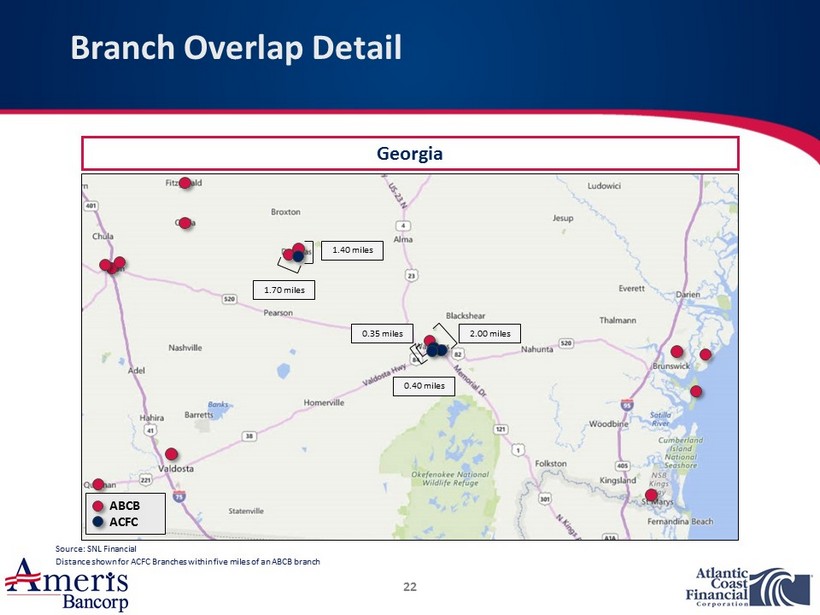

Branch Overlap Detail 22 Georgia 1.70 miles 1.40 miles 0.35 miles 0.40 miles 2.00 miles Source: SNL Financial Distance shown for ACFC Branches within five miles of an ABCB branch ABCB ACFC