Attached files

| file | filename |

|---|---|

| EX-32.2 - ADAMANT DRI PROCESSING & MINERALS GROUP | e617484_ex32-2.htm |

| EX-32.1 - ADAMANT DRI PROCESSING & MINERALS GROUP | e617484_ex32-1.htm |

| EX-31.2 - ADAMANT DRI PROCESSING & MINERALS GROUP | e617484_ex31-2.htm |

| EX-31.1 - ADAMANT DRI PROCESSING & MINERALS GROUP | e617484_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED September 30, 2017 |

OR

| o |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _______ TO ________. |

COMMISSION FILE NUMBER: 000-49729

Adamant DRI Processing and Minerals Group

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 61-1745150 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| Chunshugou Luanzhuang Village, Zhuolu County, Zhangjiakou, Hebei Province, China | 075600 |

| (Address of principal executive offices) | (Zip code) |

Issuer's telephone number: 86-313-6732526

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | |

| Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x | |

| Do not check if Smaller Reporting Company | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the number of shares outstanding of each of the issuer's classes of common equity, for the period covered by this report and as at the latest practicable date:

At November 13, 2017 we had 66,760,110 shares of common stock outstanding.

ADAMANT DRI PROCESSING AND MINERALS GROUP

PART I

FINANCIAL INFORMATION

| PART II | |

| OTHER INFORMATION | |

| Item 1A. Risk Factors | 30 |

| Item 6. Exhibits | 31 |

| Signatures | 32 |

Special Note Regarding Forward Looking Statements

This report contains forward-looking statements. The forward-looking statements are contained principally in the section entitled “Management's Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

PART I

FINANCIAL INFORMATION

ADAMANT DRI PROCESSING AND MINERALS GROUP

CONSOLIDATED BALANCE SHEETS

SEPTEMBER 30, 2017 (UNAUDITED) AND DECEMBER 31, 2016

| 2017 | 2016 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash & equivalents | $ | 78,374 | $ | 86,519 | ||||

| Restricted cash | 9,106 | 94,320 | ||||||

| Prepaid expense | 590,625 | — | ||||||

| Advance to suppliers, net | 549,855 | 16,353 | ||||||

| Value-added tax receivable | 2,778,239 | 2,651,258 | ||||||

| Inventory, net | 724,642 | 693,518 | ||||||

| Total current assets | 4,730,841 | 3,541,968 | ||||||

| NONCURRENT ASSETS | ||||||||

| Property and equipment, net | 23,469,851 | 24,576,039 | ||||||

| Intangible assets, net | 3,076,026 | 3,014,121 | ||||||

| Construction in progress | 6,162,642 | 6,036,736 | ||||||

| Goodwill | 6,029,437 | 5,768,599 | ||||||

| Total noncurrent assets | 38,737,956 | 39,395,495 | ||||||

| TOTAL ASSETS | $ | 43,468,797 | $ | 42,937,463 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Bank overdraft | $ | — | $ | 94,169 | ||||

| Accounts payable | 2,862,958 | 2,859,960 | ||||||

| Accrued liabilities and other payables | 12,538,266 | 11,280,414 | ||||||

| Unearned revenue | 580,666 | — | ||||||

| Income tax payable | 126,624 | 119,173 | ||||||

| Short term loan | 195,875 | 187,401 | ||||||

| Payable to contractors | 828,700 | 792,850 | ||||||

| Advance from related parties | 42,561,453 | 40,201,667 | ||||||

| Total current liabilities | 59,694,542 | 55,535,634 | ||||||

| NONCURRENT LIABILITIES | ||||||||

| Deferred tax liability | — | 2,485 | ||||||

| Accrued expense | 12,334 | 11,800 | ||||||

| Total noncurrent liabilities | 12,334 | 14,285 | ||||||

| Total liabilities | 59,706,876 | 55,549,919 | ||||||

| STOCKHOLDERS' DEFICIT | ||||||||

| Convertible preferred stock: $0.001 par value; 1,000,000 shares authorized, no shares issued and outstanding | — | — | ||||||

| Common stock, $0.001 par value; authorized shares 100,000,000; issued and outstanding 66,760,110 and 63,760,110 shares as of September 30, 2017 and December 31, 2016 | 66,760 | 63,760 | ||||||

| Additional paid in capital | 7,996,954 | 7,015,579 | ||||||

| Statutory reserves | 557,253 | 557,253 | ||||||

| Accumulated other comprehensive income | 1,085,256 | 1,741,618 | ||||||

| Accumulated deficit | (25,944,302 | ) | (21,990,666 | ) | ||||

| Total stockholders' deficit | (16,238,079 | ) | (12,612,456 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | $ | 43,468,797 | $ | 42,937,463 | ||||

The accompanying notes are an integral part of these consolidated financial statements

1

ADAMANT DRI PROCESSING AND MINERALS GROUP

CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE

LOSS NINE AND THREE MONTHS ENDED SEPTEMBER 30, 2017 AND 2016 (UNAUDITED)

| Nine months ended September 30 | Three months ended September 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Net sales | $ | 590,421 | $ | 1,476 | $ | 590,421 | $ | 1,476 | ||||||||

| Cost of goods sold | 586,011 | — | 586,011 | — | ||||||||||||

| Gross profit (loss) | 4,410 | 1,476 | 4,410 | 1,476 | ||||||||||||

| Operating expenses | ||||||||||||||||

| General and administrative | 3,051,943 | 2,990,052 | 1,026,977 | 1,065,900 | ||||||||||||

| Total operating expenses | 3,051,943 | 2,990,052 | 1,026,977 | 1,065,900 | ||||||||||||

| Loss from operations | (3,047,533 | ) | (2,988,576 | ) | (1,022,567 | ) | (1,064,424 | ) | ||||||||

| Non-operating income (expenses) | ||||||||||||||||

| Interest income | 118 | 99 | 46 | 15 | ||||||||||||

| Other income (expenses) | (144,175 | ) | 10 | — | — | |||||||||||

| Interest expense | (762,242 | ) | (797,561 | ) | (256,667 | ) | (263,648 | ) | ||||||||

| Bank charges | (252 | ) | (887 | ) | (83 | ) | (211 | ) | ||||||||

| Total non-operating expenses, net | (906,551 | ) | (798,339 | ) | (256,704 | ) | (263,844 | ) | ||||||||

| Loss before income tax | (3,954,084 | ) | (3,786,915 | ) | (1,279,271 | ) | (1,328,268 | ) | ||||||||

| Income tax (benefit) expense | (448 | ) | (26,047 | ) | 1,795 | (8,719 | ) | |||||||||

| Net loss | (3,953,636 | ) | (3,760,868 | ) | (1,281,066 | ) | (1,319,549 | ) | ||||||||

| Other comprehensive income | ||||||||||||||||

| Foreign currency translation gain (loss) | (656,362 | ) | 266,256 | (335,324 | ) | 71,431 | ||||||||||

| Net comprehensive loss | $ | (4,609,998 | ) | $ | (3,494,612 | ) | $ | (1,616,390 | ) | $ | (1,248,118 | ) | ||||

| Basic and diluted weighted average shares outstanding | 66,727,143 | 63,760,110 | 66,760,110 | 63,760,110 | ||||||||||||

| Basic and diluted net loss per share | $ | (0.06 | ) | $ | (0.06 | ) | $ | (0.02 | ) | $ | (0.02 | ) | ||||

The accompanying notes are an integral part of these consolidated financial statements

2

ADAMANT DRI PROCESSING AND MINERALS GROUP

CONSOLIDATED STATEMENTS OF CASH FLOWS

NINE MONTHS ENDED SEPTEMBER 30, 2017 AND 2016 (UNAUDITED)

| 2017 | 2016 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (3,953,636 | ) | $ | (3,760,868 | ) | ||

| Adjustments to reconcile net loss to net cash | ||||||||

| provided by (used in) operating activities: | ||||||||

| Depreciation and amortization | 2,147,235 | 2,139,204 | ||||||

| Bad debt provision | 8,416 | — | ||||||

| Stock compensation expense | 393,750 | — | ||||||

| Changes in deferred taxes | (1,600 | ) | (26,047 | ) | ||||

| Loss on asset disposal | 103,998 | — | ||||||

| (Increase) decrease in assets and liabilities: | ||||||||

| Advance to suppliers | (523,123 | ) | (45,986 | ) | ||||

| Other receivables | — | 185 | ||||||

| Restricted cash | 86,456 | — | ||||||

| Inventory | 227 | 621 | ||||||

| Bank overdraft | (95,092 | ) | — | |||||

| Accounts payable | (114,520 | ) | 129,504 | |||||

| Accrued liabilities and other payables | 762,622 | 452,456 | ||||||

| Unearned revenue | 560,989 | — | ||||||

| Taxes payable | (4,866 | ) | (46,516 | ) | ||||

| Net cash used in operating activities | (629,143 | ) | (1,157,447 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Construction in progress | — | (105,822 | ) | |||||

| Acquisition of fixed assets | (6,099 | ) | — | |||||

| Net cash used in investing activities | (6,099 | ) | (105,822 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Advance from related parties | 623,650 | 1,327,880 | ||||||

| Net cash provided by financing activities | 623,650 | 1,327,880 | ||||||

| EFFECT OF EXCHANGE RATE CHANGE ON CASH & EQUIVALENTS | 3,448 | (1,620 | ) | |||||

| NET INCREASE (DECREASE) IN CASH & EQUIVALENTS | (8,145 | ) | 62,990 | |||||

| CASH & EQUIVALENTS, BEGINNING OF PERIOD | 86,519 | 26,957 | ||||||

| CASH & EQUIVALENTS, END OF PERIOD | $ | 78,374 | $ | 89,947 | ||||

| Supplemental Cash Flow Data: | ||||||||

| Income tax paid | $ | 2,093 | $ | — | ||||

| Interest paid | $ | 9,446 | $ | 14,803 | ||||

The accompanying notes are an integral part of these consolidated financial statements

3

ADAMANT DRI PROCESSING AND MINERALS GROUP

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2017 (UNAUDITED) AND DECEMBER 31, 2016

1. ORGANIZATION AND DESCRIPTION OF BUSINESS

Adamant DRI Processing and Minerals Group (“Adamant’ or “the Company” or “Group”), is a Nevada corporation incorporated in July 2014 and successor by merger to UHF Incorporated, a Delaware corporation (“UHF”).

The Company produces Direct Reduced Iron (“DRI”) using advanced reduction rotary kiln technology with iron ore as the principal raw material. ‘Reduced Iron’ derives its name from the chemical change that iron ore undergoes when it is heated in a furnace at high temperatures in the presence of hydrocarbon-rich gasses. ‘Direct reduction’ refers to processes which reduce iron oxides to metallic iron below iron’s melting point.

UHF was the successor to UHF Incorporated, a Michigan corporation (“UHF Michigan”), as a result of domicile merger effected on December 29, 2011.

On June 30, 2014, UHF entered into and closed a share exchange agreement, or the Target Share Exchange Agreement, with Target Acquisitions I, Inc., a Delaware corporation (“Target”), and the stockholders of Target (the “Target Stockholders”), pursuant to which UHF acquired 100% of the issued and outstanding capital stock of Target for 43,375,638 shares of UHF’s common stock and one share of UHF’s series A convertible preferred stock, convertible into 17,839,800 shares of common stock. Since UHF’s certificate of incorporation only authorized the issuance of 50,000,000 shares of common stock, UHF did not have sufficient authorized but unissued shares of common stock to complete the acquisition of Target, so the Board of Directors authorized the issuance to one of the Target Stockholders one share of series A convertible preferred stock convertible into 17,839,800 shares of common stock at such time as UHF amended its certificate of incorporation to increase the number of authorized shares of common stock or merged with and into another corporation which had sufficient shares of authorized but unissued shares of common stock for issuance upon conversion. Following the share exchange, UHF had outstanding 45,920,310 shares of common stock and one share of series A convertible preferred stock, which was converted into 17,839,800 common shares on August 29, 2014.

For accounting purposes, the share exchange transaction with Target and the Target Stockholders was treated as a reverse acquisition, with Target as the acquirer and UHF as the acquired party. The shares issued to Target’s shareholders were accounted for as a recapitalization of Target and were retroactively restated for the periods presented because after the share exchange, Target’s shareholders owned the majority of UHF’s outstanding shares and exercised significant influence over the operating and financial policies of the consolidated entity, and UHF was a non-operating shell with nominal net assets prior to the acquisition. Pursuant to Securities and Exchange Commission (“SEC”) rules, this is considered a capital transaction in substance, rather than a business combination.

On July 4, 2014, the Company entered into an Agreement and Plan of Merger with UHF, pursuant to which UHF merged with and into Adamant with Adamant as the surviving entity (the “Merger”), as a result of which each outstanding share of common stock of UHF at the time of the Merger was converted into one share of the common stock of Adamant, and the outstanding share of series A Preferred Stock was converted into 17,839,800 shares of common stock. The Merger was effected on August 29, 2014.

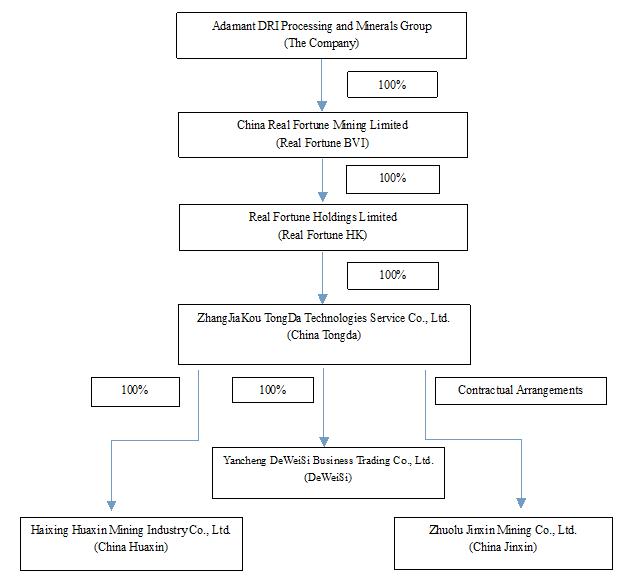

As a result of the acquisition of Target and UHF, the Company now owns all of the issued and outstanding capital stock of Real Fortune BVI, which in turn owns all of the issued and outstanding capital stock of Real Fortune Holdings Limited, a Hong Kong limited company (“Real Fortune HK”), which in turn owns all of the issued and outstanding capital stock of Zhangjiakou Tongda Mining Technologies Service Co., Ltd. (“China Tongda”), a Chinese limited company.

4

The Company operates in China through Zhuolu Jinxin Mining Co., Ltd. (“China Jinxin”), the Company’s variable interest entity which the Company controls through a series of agreements between China Jinxin and China Tongda and, as of January 24, 2014, through Haixing Huaxin Mining Industry Co., Ltd. (“China Huaxin”) which is owned by China Tongda. The Group’s current structure is as follows:

China Jinxin is an early stage mining company which processes iron ore at its production facility in Hebei Province. China Jinxin currently does not own any mines or hold any mining rights. In 2015, management determined to further upgrade the facility to enable it to produce DRI due to increased demand for DRI products in China; accordingly, China Jinxin will produce DRI at its facility. Through contractual arrangements among China Tongda and China Jinxin, and its shareholders, the Company controls China Jinxin’s operations and financial affairs. As a result of these agreements, China Tongda is considered the primary beneficiary of China Jinxin (see Note 2) and accordingly, China Jinxin’s results of operations and financial condition are consolidated in the Group’s financial statements. All issued and outstanding shares of China Jinxin are held by 15 Chinese citizens.

On January 17, 2014, the Company entered into a series of substantially identical agreements with five shareholders of Haixing Huaxin Mining Industry Co., Ltd. (“China Huaxin”) pursuant to which the Company acquired 100% of the outstanding shares of China Huaxin. The consideration paid to the shareholders of China Huaxin for their interests consisted of cash of RMB 10 million ($1.64 million) and 5.1 million shares of the Company’s common stock, valued at $0.014 per share ($71,400).

5

China Tongda, the Company’s wholly-owned Chinese subsidiary, filed a notice of transfer with respect to the change of ownership of China Huaxin with the local company registration authority which was approved on January 23, 2014.

China Huaxin was established in August 2010 and is located in Haixing Qingxian Industrial Park, Cangzhou, Hebei Province PRC. China Huaxin produce and sell DRI. Prior to 2015, China Huaxin conducted no business activities other than construction of its DRI production facility. Construction of the DRI Facility was completed, and China Huaxin completed trial production and expected to commence commercial production in May 2015. However, as a result of environmental initiatives by national, provincial and local government authorities in China, starting in June 2015, China Huaxin began upgrading the DRI facilities by converting the existing coal-gas station systems to liquefied natural gas (“LNG”) station systems. The conversion to LNG systems will reduce pollutants and produce higher quality DRIs with less impurities. China Huaxin completed the upgrading and resumed trial production from its upgraded DRI facilities; until, once again, ordered by the authorities to shut down and make further adjustments to its equipment which it is currently doing. The Company expects that production will not resume in 2017.

On April 25, 2017, China Tongda incorporated Yancheng DeWeiSi Business Trading Co., Ltd (“DeWeiSi”) with registered capital of RMB 10,000,000 ($1.48 million), to be paid before April 19, 2047. DeWeiSi is a wholly-owned subsidiary of China Tongda. DeWeiSi sells mineral products (except petroleum and petroleum products), hardware products, construction materials, and steel.

The consolidated interim financial information as of September 30, 2017 and for the nine and three month periods ended September 30, 2017 and 2016 was prepared without audit, pursuant to the rules and regulations of the SEC. Certain information and footnote disclosures, which are normally included in consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) was not included. The interim consolidated financial information should be read in conjunction with the Financial Statements and the notes thereto, included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, previously filed with the SEC. In the opinion of management, all adjustments (which include normal recurring adjustments) necessary to present a fair statement of the Company’s consolidated financial position as of September 30, 2017, results of operations for the nine and three months ended September 30, 2017 and 2016, and cash flows for the nine months ended September 30, 2017 and 2016, as applicable, were made. The interim results of operations are not necessarily indicative of the operating results for the full fiscal year or any future periods.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying Consolidated Financial Statements (“CFS”) are prepared in conformity with US GAAP. Adamant, Real Fortune BVI and Real Fortune HK’s functional currency is the US Dollar (‘‘USD’’ or “$”), and China Tongda and its wholly owned subsidiaries' DeWeiSi, China Jinxin and China Huaxin’s functional currency is Chinese Renminbi (‘‘RMB’’). The accompanying CFS are translated from functional currencies and presented in USD.

Principles of Consolidation

The CFS include the financial statements of the Company, its subsidiaries and its VIE (China Jinxin) for which the Company’s subsidiary China Tongda is the primary beneficiary; and China Tongda’s 100% owned subsidiaries China Huaxin and DeWeiSi. All transactions and balances among the Company, its subsidiaries and VIE are eliminated in consolidation.

The Company follows the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 810 which requires a VIE to be consolidated by a company if that company is subject to a majority of the risk of loss from the VIE or is entitled to a majority of the VIE’s residual returns. In determining China Jinxin to be the VIE of China Tongda, the Company considered the following indicators, among others:

China Tongda has the right to control and administer the financial affairs and operations of China Jinxin and to manage and control all assets of China Jinxin. The equity holders of China Jinxin as a group have no right to make any decision about China Jinxin’s activities without the consent of China Tongda. China Tongda will be paid quarterly, management consulting and technical support fees equal to all pre-tax profits, if any, of that quarter. If there are no earnings before taxes and other cash expenses, during any quarter, no fee shall be paid. If China Jinxin sustains losses, they will be carried to the next period and deducted from the next service fee. China Jinxin has the right to require China Tongda to pay China Jinxin the amount of any loss incurred by China Jinxin.

6

The shareholders of China Jinxin pledged their equity interests in China Jinxin to China Tongda to guarantee China Jinxin’s performance of its obligations under the Management Entrustment and Option Agreements. If either China Jinxin or its equity owners is in breach of the Equity Pledge or Exclusive Purchase Option Agreements, then China Tongda is entitled to require the equity owners of China Jinxin to transfer their equity interests in China Jinxin to it.

The shareholders of China Jinxin irrevocably granted China Tongda or its designated person an exclusive option to acquire, at any time, all of the assets or outstanding shares of China Jinxin, to the extent permitted by PRC law. The purchase price for the shareholders’ equity interests in China Jinxin shall be the lower of (i) the actual registered capital of China Jinxin or (ii) RMB 500,000 ($74,000), unless an appraisal is required by the laws of China.

Each shareholder of China Jinxin executed an irrevocable power of attorney to appoint China Tongda as its attorney-in-fact to exercise all of its rights as equity owner of China Jinxin, including 1) attend the shareholders’ meetings of China Jinxin and/or sign the relevant resolutions; 2) exercise all the shareholder's rights and shareholder's voting rights that the shareholder is entitled to under the laws of the PRC and the Articles of Association of China Jinxin, including but not limited to the sale or transfer or pledge or disposition of the shares in part or in whole; 3) designate and appoint the legal representative, Chairman of the Board of Directors (“BOD”), Directors, Supervisors, the Chief Executive Officer, Financial Officer and other senior management members of China Jinxin; and 4) execute the relevant share purchases and other terms stipulated in the Exclusive Purchase Option and Share Pledge Agreements.

The VIE is monitored by the Company to determine if any events have occurred that could cause its primary beneficiary status to change. These events include whether:

| a. | China Jinxin's governing documents or contractual arrangements are changed in a manner that changes the characteristics or adequacy of China Tongda's equity investment at risk. |

| b. | The equity investment in China Jinxin or some part thereof is returned to its shareholders or China Tongda, and other entities become exposed to expected losses of China Jinxin. |

| c. | China Jinxin undertakes additional activities or acquires additional assets, beyond those anticipated at the later of the inception of China Jinxin or the latest reconsideration event, that increase the entity's expected losses. |

| d. | China Jinxin receives an additional equity investment that is at risk, or China Jinxin curtails or modifies its activities in a way that decreases its expected losses. |

There has been no change in the VIE structure during the nine and three months ended September 30, 2017 and 2016, and none of the events listed in a-d above have occurred.

The accompanying CFS include the accounts of Adamant, Real Fortune BVI, Real Fortune HK, China Tongda, China Jinxin, China Huaxin and DeWeiSi, which are collectively referred to as the "Company". All significant intercompany accounts and transactions were eliminated in the CFS.

Going Concern

The Company incurred a net loss of $3.95 million for the nine months ended September 30, 2017. The Company also had a working capital deficit of $54.96 million as of September 30, 2017. In addition, China Jinxin refused to sell its iron ore concentrate to its sole customer because of the low price offered. These conditions raise substantial doubt about the Company's ability to continue as a going concern. The CFS do not include any adjustments that might result from the outcome of this uncertainty. China Jinxin is upgrading its facility and equipment, which when completed, will enable the Company to produce DRI. China Jinxin's DRI facility upgrade was almost complete as of the date of this report and the Company is currently in the final stage of adjusting the equipment and making certain modifications to the facility after the relevant authority's inspection and testing. A shareholder of the Company indicated she will continue to fund China Jinxin, although there is no written agreement in place and China Jinxin currently owes her $10.64 million. In addition, China Huaxin currently owes $25.40 million to three of the Company's shareholders for constructing its DRI facility; one is the major lender of China Jinxin who lent $17.45 million to China Huaxin, and the other two are members of the Company's management. In addition, China Huaxin borrowed $5.21 million from companies owned by its major shareholder. China Huaxin completed trial production and expected to commence commercial production in May 2015. However, as a result of environmental initiatives by national, provincial and local government authorities in China, in June 2015, China Huaxin began upgrading the DRI facilities by converting the existing coal-gas station systems to LNG station systems. The conversion to LNG systems will reduce pollutants and produce higher quality DRIs with less impurities. China Huaxin has completed the upgrading and resumed trial production at its upgraded DRI facilities; until, once again, ordered by the authorities to shut down and make further adjustments to its equipment which it is currently doing. The Company expects that production will not resume in 2017.

7

Use of Estimates

In preparing financial statements in conformity with US GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Significant estimates, required by management, include the recoverability of long-lived assets, allowance for doubtful accounts, and the reserve for obsolete and slow-moving inventories. Actual results could differ from these estimates.

Business Combination

For a business combination, the assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree are recognized at the acquisition date, measured at their fair values as of that date. In a business combination achieved in stages, the identifiable assets and liabilities, as well as the noncontrolling interest in the acquiree, are recognized at the full amounts of their fair values. In a bargain purchase in which the total acquisition-date fair value of the identifiable net assets acquired exceeds the fair value of the consideration transferred plus any noncontrolling interest in the acquiree that excess in fair value is recognized as a gain attributable to the acquirer.

Deferred tax liability and assets are recognized for the deferred tax consequences of differences between the tax bases and the recognized values of assets acquired and liabilities assumed in a business combination in accordance with FASB ASC Subtopic 740-10.

Goodwill

Goodwill is the excess of purchase price and related costs over the value assigned to the net tangible and identifiable intangible assets of businesses acquired. In accordance with FASB ASC Topic 350, “Intangibles-Goodwill and Other,” goodwill is not amortized but is tested for impairment, annually or when circumstances indicate a possible impairment may exist. Impairment testing is performed at a reporting unit level. An impairment loss generally would be recognized when the carrying amount of the reporting unit exceeds its fair value, with the fair value of the reporting unit determined using discounted cash flow (“DCF”) analysis. A number of significant assumptions and estimates are involved in the application of DCF analysis to forecast operating cash flows, including the discount rate, the internal rate of return and projections of realizations and costs to produce. Management considers historical experience and all available information at the time the fair values of its reporting units are estimated.

On January 23, 2014, the Company completed the acquisition of China Huaxin. Under the acquisition method of accounting, the total purchase price is allocated to tangible assets and intangible assets acquired and liabilities assumed based on their fair values with the excess recorded to goodwill. The Company recognized RMB 40.02 million ($6.54 million) of goodwill from the acquisition. At December 31, 2015, the Company reappraised the fair value of China Huaxin by using the replacement cost method since China Huaxin did not start official production in 2015 due to the upgrading of its DRI facilities. As of September 30, 2017 and December 31, 2016, the Company evaluated and concluded the goodwill of Huaxin was not impaired.

8

Cash and Equivalents

For financial statement purposes, the Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents. The Company's account in the Agriculture Bank of China, Zhuolu Branch of China Jinxin was required to be frozen for RMB 654,300.00 ($94,320) since October 2016 as a result of a civil judgement for accidental death in favor of a deceased employee (see Note 17). The Company's bank account in the Bank of China, Cangzhou Bohai district Branch of China Huaxin was required to be frozen for RMB79,852 ($11,574) as a result of two civil judgements against the Company to ensure repayment of two personal loans (see Note 17). Due to limited cash balances in its bank accounts, the Company recorded $9,106 and $94,320 as restricted cash as of September 30, 2017 and December 31, 2016, respectively.

Accounts Receivable, net

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. The Company had $0 bad debt allowances at September 30, 2017 and December 31, 2016.

Inventory, net

Inventory mainly consists of iron ore, iron ore concentrate, mineral powder and coal slime for DRI. Inventory is valued at the lower of average cost or market, cost being determined on a moving weighted average basis method; including labor and all production overheads.

Property and Equipment, net

Property and equipment are stated at cost, less accumulated depreciation. Major repairs and betterments that significantly extend original useful lives or improve productivity are capitalized and depreciated over the period benefited. Maintenance and repairs are expensed as incurred. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation of property and equipment is computed using shorter of useful lives of the property or the unit of depletion method. For shorter-lived assets the straight-line method over estimated lives ranging from 3 to 20 years is used as follows:

| Office Equipment | 3-5 years | |

| Machinery | 10 years | |

| Vehicles | 5 years | |

| Building | 20 years |

Impairment of Long-Lived Assets

Long-lived assets, which include property and equipment and intangible assets, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Recoverability of long-lived assets to be held and used is measured by comparing the carrying amount of an asset to the estimated undiscounted future cash flows expected to be generated by it. If the carrying amount of an asset exceeds its estimated undiscounted future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds its fair value (“FV”). FV is generally determined using the asset’s expected future discounted cash flows or market value, if readily determinable. Based on its review, the Company believes that, as of September 30, 2017 and December 31, 2016, there were $0.79 million and $1.07 million in impairments of its long-lived assets, respectively (See Note 6).

Income Taxes

The Company follows FASB ASC Topic 740, “Income Taxes”, which requires recognition of deferred tax assets and liabilities for expected future tax consequences of events included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

9

When tax returns are filed, it is likely that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about their merits or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50% likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Interest associated with unrecognized tax benefits are classified as interest expense and penalties are classified in selling, general and administrative expenses in the statements of income. At September 30, 2017 and December 31, 2016, the Company did not take any uncertain positions that would necessitate recording a tax related liability.

Revenue Recognition

The Company’s revenue recognition policies comply with FASB ASC Topic 605, “Revenue Recognition”. Sales are recognized when a formal arrangement exists, which is generally represented by a contract between the Company and the buyer; the price is fixed or determinable; title has passed to the buyer, which generally is at the time of delivery; no other significant obligations of the Company exist and collectability is reasonably assured. Payments received before all of the relevant criteria for revenue recognition are recorded as unearned revenue.

Sales are the invoiced value of iron ore concentrate and DRI products, net of value-added tax (“VAT”). All of the Company’s iron ore concentrate sold in the PRC is subject to a value-added tax of 17% of the gross sales price. This VAT may be offset by VAT paid by the Company on raw materials and other materials included in the cost of producing the finished product. The Company records VAT payable and VAT receivable net of payments in the financial statements. The VAT tax return is filed offsetting the payables against the receivables. Sales and purchases are recorded net of VAT collected and paid as the Company acts as an agent for the government.

Cost of Goods Sold

Cost of goods sold (“COGS”) consists primarily of fuel and power, direct material and labor, depreciation of mining plant and equipment, attributable to the production of iron ore concentrate. Any write-down of inventory to lower of cost or market is also recorded in COGS.

Concentration of Credit Risk

The operations of the Company are in the PRC. Accordingly, the Company’s business, financial condition, and results of operations may be influenced by the political, economic, and legal environments in the PRC, and by the general state of the PRC economy.

The Company has cash on hand and demand deposits in accounts maintained with state-owned banks within the PRC. Cash in state-owned banks is not covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in these bank accounts.

Statement of Cash Flows

In accordance with FASB ASC Topic 230, “Statement of Cash Flows”, cash flows from the Company’s operations are calculated based upon local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows may not necessarily agree with changes in the corresponding balances on the balance sheet. Cash from operating, investing and financing activities is net of assets and liabilities acquired.

10

Fair Value of Financial Instruments

For certain of the Company's financial instruments, including cash and equivalents, accrued liabilities and accounts payable, carrying amounts approximate their fair values ("FV") due to their short maturities. FASB ASC Topic 825, "Financial Instruments," requires disclosure of the FV of financial instruments held by the Company. The carrying amounts reported in the balance sheets for current liabilities each qualify as financial instruments and are a reasonable estimate of their fair values because of the short period of time between the origination of such instruments and their expected realization and the current market rate of interest.

Fair Value Measurements and Disclosures

FASB ASC Topic 820, “Fair Value Measurements and Disclosures,” defines FV, and establishes a three-level valuation hierarchy for disclosures of fair value measurement that enhances disclosure requirements for FV measures. The three levels are defined as follow:

| ● | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. | |

| ● |

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. | |

| ● | Level 3 inputs to the valuation methodology are unobservable and significant to the FV measurement. |

As of September 30, 2017 and December 31, 2016, the Company did not identify any assets and liabilities that are required to be presented on the balance sheet at FV.

Foreign Currency Translation and Comprehensive Income (Loss)

The functional currency of China Jinxin and China Huaxin is RMB. For financial reporting purposes, RMB is translated into USD as the reporting currency. Assets and liabilities are translated at the exchange rate in effect at the balance sheet dates. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period.

Translation adjustments arising from the use of different exchange rates from period to period are included as a component of stockholders’ equity as “Accumulated other comprehensive income”. Gains and losses resulting from foreign currency transactions are included in income. There was no significant fluctuation in the exchange rate for the conversion of RMB to USD after the balance sheet date.

The Company uses FASB ASC Topic 220, “Comprehensive Income”. Comprehensive income (loss) is comprised of net income and all changes to the statements of stockholders’ equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders. Comprehensive loss for the nine and three months ended September 30, 2017 and 2016 consisted of net loss and foreign currency translation adjustments.

Share-based compensation

The Company accounts for share-based compensation awards to employees in accordance with FASB ASC Topic 718, “Compensation – Stock Compensation”, which requires that share-based payment transactions with employees be measured based on the grant-date FV of the equity instrument issued and recognized as compensation expense over the requisite service period.

The Company accounts for share-based compensation awards to non-employees in accordance with FASB ASC Topic 718 and FASB ASC Subtopic 505-50, “Equity-Based Payments to Non-employees”. Share-based compensation associated with the issuance of equity instruments to non-employees is measured at the FV of the equity instrument issued or committed to be issued, as this is more reliable than the FV of the services received. The FV is measured at the date that the commitment for performance by the counterparty has been reached or the counterparty's performance is complete.

11

Earnings (loss) per Share (EPS)

Basic EPS is computed by dividing net income by the weighted average number of common shares outstanding for the period. Diluted EPS is computed similar to basic EPS except that the denominator is increased to include the number of additional common shares that would have been outstanding if all the potential common shares, warrants and stock options had been issued and if the additional common shares were dilutive. Diluted EPS is based on the assumption that all dilutive convertible shares and stock options and warrants were converted or exercised. Dilution is computed by applying the treasury stock method for the outstanding options and warrants, and the if-converted method for the outstanding convertible instruments. Under the treasury stock method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later) and as if funds obtained thereby were used to purchase common stock at the average market price during the period. Under the if-converted method, outstanding convertible instruments are assumed to be converted into common stock at the beginning of the period (or at the time of issuance, if later).

Segment Reporting

FASB ASC Topic 280, “Segment Reporting”, requires use of the “management approach” model for segment reporting. The management approach model is based on the way a company’s management organizes segments within the Company for making operating decisions and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company.

FASB ASC Topic 280 has no effect on the Company’s CFS as substantially all of its operations are conducted in one industry segment – iron ore production. With the upgrading of DRI facilities for both China Jinxin and China Huaxin, the Company will be shifting its main product from iron ore to DRI.

New Accounting Pronouncements

In February 2016, the FASB issued Accounting Standards Update (“ASU”) No. 2016-02, Leases (Topic 842). The guidance in ASU 2016-02 supersedes the lease recognition requirements in ASC Topic 840, Leases (FAS 13). ASU 2016-02 requires an entity to recognize assets and liabilities arising from a lease for both financing and operating leases, along with additional qualitative and quantitative disclosures. ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, with early adoption permitted. The Company is currently evaluating the effect this standard will have on its CFS.

In August 2016, the FASB issued ASU No. 2016-15, Classification of Certain Cash Receipts and Cash Payments. ASU 2016-15 clarifies the presentation and classification of certain cash receipts and cash payments in the statement of cash flows. This ASU is effective for public business entities for fiscal years, and interim periods within those years, beginning after December 15, 2017. Early adoption is permitted. The Company is currently assessing the potential impact of ASU 2016-15 on its CFS.

In October 2016, the FASB issued ASU No. 2016-16—Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory. This ASU improves the accounting for the income tax consequences of intra-entity transfers of assets other than inventory. For public business entities, the amendments in this update are effective for annual reporting periods beginning after December 15, 2017, including interim reporting periods within those annual reporting periods. Early adoption is permitted. The Company does not anticipate that the adoption of this ASU will have a significant impact on its CFS.

In November 2016, the FASB issued ASU No. 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash. The guidance requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. Therefore, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. The standard is effective for fiscal years beginning after December 15, 2017, and interim period within those fiscal years. Early adoption is permitted, including adoption in an interim period. The standard should be applied using a retrospective transition method to each period presented. The Company does not anticipate that the adoption of this ASU will have a significant impact on its CFS.

12

In January 2017, the FASB issued ASU No. 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business, which clarifies the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions or disposals of assets or businesses. The standard is effective for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. Early adoption is permitted. The standard should be applied prospectively on or after the effective date. The Company will evaluate the impact of adopting this standard prospectively upon any transactions of acquisitions or disposals of assets or businesses.

In January 2017, the FASB issued ASU 2017-04, Simplifying the Test for Goodwill Impairment. The guidance removes Step 2 of the goodwill impairment test, which requires a hypothetical purchase price allocation. A goodwill impairment will now be the amount by which a reporting unit’s carrying value exceeds its FV, not to exceed the carrying amount of goodwill. The guidance should be adopted on a prospective basis for the annual or any interim goodwill impairment tests beginning after December 15, 2019. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. The Company is currently evaluating the impact of adopting this standard on its CFS.

Other recent accounting pronouncements issued by the FASB, including its Emerging Issues Task Force, the American Institute of Certified Public Accountants, and the SEC did not or are not believed by management to have a material impact on the Company’s present or future CFS.

3. INVENTORY

Inventory consisted of the following at September 30, 2017 and December 31, 2016:

| 2017 | 2016 | |||||||

| Material | $ | 318,955 | $ | 305,381 | ||||

| Finished goods | 620,935 | 594,073 | ||||||

| Less: inventory impairment allowance | (215,248 | ) | (205,936 | ) | ||||

| Total | $ | 724,642 | $ | 693,518 | ||||

4. MINING RIGHTS

The Company is currently negotiating with the Department of Land and Resources of Hebei Province and the local Zhuolu County government to obtain the rights to mine in Zhuolu County where one of its production facilities is located. Pending the final contract, the Company accrued the cost of mining rights based on the quantity of ore extracted (see Note 11). The Company used $0.68 (RMB 2.4 per ton) based on a royalty rate prescribed by the local authority based on the purity of ore in the subject mines. If the rate per ton of ore changes when the contract is finalized, the Company will account for the change prospectively as a change in an accounting estimate. The Company did not extract any ore in the nine and three months ended September 30, 2017 and 2016, and accordingly did not accrue the cost of mining rights for the nine and three months ended September 30, 2017 and 2016.

5. VALUE-ADDED TAX RECEIVABLE

At September 30, 2017 and December 31, 2016, the Company had VAT receivable of $2,778,239 and $2,651,258, respectively. It was the VAT paid on purchases, and it can be carried forward indefinitely for offsetting against future VAT payable.

13

6. PROPERTY AND EQUIPMENT, NET

Property and equipment consisted of the following at September 30, 2017 and December 31, 2016:

| 2017 | 2016 | |||||||

| Building | $ | 21,323,482 | $ | 20,401,012 | ||||

| Production equipment | 15,728,659 | 16,030,128 | ||||||

| Transportation equipment | 1,223,116 | 1,170,203 | ||||||

| Office equipment | 255,934 | 238,822 | ||||||

| Total | 38,531,191 | 37,840,165 | ||||||

| Less: Accumulated depreciation | (14,275,968 | ) | (12,197,221 | ) | ||||

| Less: impairment allowance | (785,372 | ) | (1,066,905 | ) | ||||

| Net | $ | 23,469,851 | $ | 24,576,039 | ||||

Depreciation for the nine months ended September 30, 2017 and 2016 was $2,075,372 and $2,064,144, respectively. Depreciation for the three months ended September 30, 2017 and 2016 was $714,771 and $678,654, respectively.

7. RELATED PARTIES TRANSACTIONS

Advances from related parties

At September 30, 2017 and December 31, 2016, China Jinxin owed one of its shareholders $10,638,042 and $10,039,155, respectively, for the purchase of equipment used in construction in progress and for working capital needs. This advance will not bear interest prior to the commencement of the Company's production pursuant to an amended loan agreement entered on January 16, 2013. Commencing on the production date, interest will begin to accrue at the bank's annual interest rate on certificates of deposit at that time on the amount outstanding from time to time and all amounts inclusive of accrued interest is to be repaid within three years of commencement of production at the Zhuolu Mine. China Jinxin had not commenced production as of September 30, 2017.

At September 30, 2017, China Huaxin owed three shareholders, two of whom are also the Company's management, $25.40 million used to construct its DRI facility. Of the $ 25.40 million, $7.19 million bore interest of 10% and a due date of six months from the start date of official production. The remaining payable bears no interest, and is payable upon demand. China Huaxin also borrowed $5.21 million from certain companies owned by its major shareholder, which bear no interest and is payable upon demand. At September 30, 2017, China Huaxin also owed one related party who is the brother of the Company's major shareholder the amount of $75,336, this loan bear interest of 10% and is payable upon demand.

At December 31, 2016, China Huaxin owed three shareholders, two of whom are members of the Company’s management, $23.88 million used to construct its DRI facility. Of the $23.88 million, $6.88 million bore interest of 10% and had a due date of six months from the start date of official production. The remaining payable bore no interest, and is payable upon demand. China Huaxin also borrowed $4.99 million from certain companies owned by its major shareholder, which bore no interest and is payable upon demand. At December 31, 2016, China Huaxin also owed one related party who is the brother of the Company’s major shareholder $72,077, this loan bore interest of 10% and is payable upon demand.

At September 30, 2017 and December 31, 2016, Real Fortune HK owed one shareholder $1.20 million for advances to meet operating needs. This advance bears no interest and is payable upon demand.

Below is the summary of advances from related parties at September 30, 2017 and December 31, 2016, respectively.

| 2017 | 2016 | |||||||

| Advance from shareholders (also management) | $ | 37,277,075 | $ | 35,145,896 | ||||

| Advance from a related party individual | 75,336 | 72,077 | ||||||

| Advance from related party companies | 5,213,535 | 4,987,993 | ||||||

| Total | 42,565,946 | 40,205,966 | ||||||

| Less: Advance to related parties’ companies | (4,493 | ) | (4,299 | ) | ||||

| Advance from related parties, net | $ | 42,561,453 | $ | 40,201,667 | ||||

14

8. INTANGIBLE ASSETS, NET

Intangible assets consisted solely of land use rights. All land in the PRC is government-owned and cannot be sold to any individual or company. However, the government grants the user a “land use right” to use the land. China Jinxin acquired land use rights during 2006 for $0.75 million (RMB 5 million). China Huaxin acquired land use rights for $2.96 million (RMB 18.24 million) in November 2012 with FV of $5.04 million (RMB 31 million) at acquisition date. China Jinxin and China Huaxin have the right to use their land for 20 and 49 years, respectively, and are amortizing such rights on a straight-line basis for 20 and 49 years, respectively.

Intangible assets consisted of the following at September 30, 2017 and December 31, 2016:

| 2017 | 2016 | |||||||

| Land use rights | $ | 3,815,131 | $ | 3,541,654 | ||||

| Less: Accumulated amortization | (739,105 | ) | (527,533 | ) | ||||

| Net | $ | 3,076,026 | $ | 3,014,121 | ||||

Amortization of intangible assets for the nine months ended September 30, 2017 and 2016 was $71,863 and $75,060, respectively. Amortization of intangible assets for the three months ended September 30, 2017 and 2016 was $32,998 and $24,691, respectively. Annual amortization for the next five years from October 1, 2017, is expected to be $99,178, $99,178, $99,178, $99,178 and $99,178.

9. CONSTRUCTION IN PROGRESS

Construction in progress is for the purchase and installation of equipment for future iron ore refining for China Jinxin. China Jinxin had construction in progress of $6,162,642 and $6,036,736 at September 30, 2017 and December 31, 2016, respectively. China Jinxin completed most of the construction for iron ore refining; however, management plans to further upgrade the facility for DRI production due to increased demand for DRI products in China. The construction for China Jinxin's DRI facility upgrade was almost completed as of the date of this report and the Company is currently in the final stage of adjusting the equipment and making certain modifications to the facility after the relevant authority's inspection and testing.

10. DEFERRED TAX LIABILITY

At September 30, 2017, deferred tax liability was $0.

At December 31, 2016, deferred tax liability of $2,485 arose from the differences between the tax bases and book bases of property and equipment and intangible assets arising from the acquisition of China Huaxin.

11. ACCRUED LIABILITIES AND OTHER PAYABLES

CURRENT

Accrued liabilities and other payables consisted of the following at September 30, 2017 and December 31, 2016:

| 2017 | 2016 | |||||||

| Accrued payroll | $ | 168,807 | $ | 150,960 | ||||

| Accrued mining rights (see note 4) | 66,655 | 63,771 | ||||||

| Accrued interest | 5,628,436 | 4,639,453 | ||||||

| Due to unrelated parties | 6,411,380 | 6,134,019 | ||||||

| Payable for social insurance | 54,294 | 45,022 | ||||||

| Payable for construction | 100,040 | 138,959 | ||||||

| Other | 108,654 | 108,230 | ||||||

| Total | $ | 12,538,266 | $ | 11,280,414 | ||||

15

As of September 30, 2017, the $6,411,380 due to unrelated parties were short-term advances from unrelated companies or individuals for the Company’s construction and working capital needs, of which, $2,645,588 bore interest of 10% and is due six months after the commencement of China Huaxin’s official production. The remaining amount of short-term advances bore no interest, and is payable upon demand.

As of December 31, 2016, the $6,134,019 due to unrelated parties were short-term advances from unrelated companies or individuals for the Company’s construction and working capital needs, of which, $2,629,384 bore interest of 10% and is due 6 months after the commencement of China Huaxin’s official production. The remaining amount of short-term advances bore no interest, and is payable upon demand.

NONCURRENT

Under local environmental regulations, the Company is obligated at the end of the mine’s useful life to restore and rehabilitate the land that is used in its mining operations. The Company estimates it would cost $560,000 (RMB 3.5 million) to restore the entire Zhuolu mine after extracting all the economical ore for such efforts.

The Company accrued certain mine restoration expenses based on the actual production volume during the period it extracted ore. As of September 30, 2017 and December 31, 2016, the long term accrued mine restoration cost was $12,334 and $11,800, respectively. There was no production during the nine months ended September 30, 2017 and 2016.

12. SHORT TERM LOAN

At September 30, 2017 and December 31, 2016, China Jinxin had a short-term bank loan of $195,875 and $187,401, respectively. This loan was entered in June 2013 for one year, and renewed on June 27, 2014 to June 26, 2015, with monthly interest of 0.9%. This loan was renewed on June 30, 2015, for a one-year term to June 29, 2016, and was further renewed to June 26, 2017, with monthly interest of 0.83375%. The loan was secured by a lien on a fixed asset of China Jinxin. As of this report date, China Jinxin is in the process of extending the loan.

13. PAYABLE TO CONTRACTORS

In 2007 and 2008, the Company entered into contracts with an equipment supplier and a construction company for equipment and construction of a water pipeline for $5.75 million (RMB 38 million). The Company recorded the payable in 2009. In 2010, the Company amended the payment terms and paid $2.2 million (RMB 14.5 million) and agreed to pay the remaining balance as follows: $2.08 million (RMB 13.5 million) on December 31, 2011, and $1.47 million (RMB 10 million) on December 31, 2012. During 2011, the Company paid $2.86 million (RMB 18.0 million). During 2012, the Company did not make any payment on this payable. On March 20, 2013, the Company amended the payment terms and agreed to pay the remaining balance of $902,098 (RMB 5,500,000) on December 31, 2014. Based on the amended agreement, if the Company paid in full by December 31, 2014, no interest would be charged. The Company agreed that if it defaulted it would pay interest starting on January 1, 2015 based on the current bank interest rate for the remaining balance at that time. Starting from January 1, 2015, the Company agreed to pay interest based on the current bank interest rate of 5.35% for the outstanding balance at December 31, 2014. As of September 30, 2017 and December 31, 2016, the Company has $828,700 and $792,850 of payable to contractors, respectively.

The Company recorded the restructuring of this payable in accordance with ASC 470-60-35-5, as it was a modification of its terms, it did not involve a transfer of assets or grant of an equity interest. Accordingly, the Company accounted for the effects of the restructuring prospectively from the time of restructuring, and did not change the carrying amount of the payable at the time of the restructuring as the carrying amount did not exceed the total future cash payments specified by the new terms.

16

14. STOCKHOLDERS’ EQUITY

Shares issued to consulting firm (prepaid expense)

On November 15, 2016, the Company entered into a consulting agreement with a consulting firm. The Company issued 3,000,000 shares of the Company's common stock to the firm for 24 months of consulting services including financial analysis, business plan advisory services, due diligence assistance for financing and IR services. The shares were issued in January 2017; and the FV was $1,050,000, which was recorded as prepaid expense; the FV was calculated based on the stock price of $0.35 per share on November 15, 2016, and amortized over the service term. At September 30, 2017, the Company had prepaid expense of $590,625. During the nine months ended September 30, 2017, the Company amortized $393,750 as stock compensation expense. During the three months ended September 30, 2017, the Company amortized $131,250 as stock compensation expense. In addition to the 3,000,000 shares, the Company also agreed to pay the consultant $4,000 cash per month on or before the 5th day of each calendar month.

15. INCOME TAXES

The Company’s operating subsidiary is governed by the Income Tax Laws of the PRC and various local tax laws. Effective January 1, 2008, China adopted a uniform tax rate of 25% for all enterprises (including foreign-invested enterprises).

The following table reconciles the statutory rates to the Company’s effective tax rate for the nine months ended September 30, 2017 and 2016:

| 2017 | 2016 | |||||||

| US statutory rates (benefit) | (33.4 | )% | (34.0 | )% | ||||

| Tax rate difference | 9.1 | % | 9.2 | % | ||||

| Valuation allowance on NOL | 24.3 | % | 24.1 | % | ||||

| Tax per financial statements | (0.0 | )% | (0.7 | )% | ||||

The following table reconciles the statutory rates to the Company’s effective tax rate for the three months ended September 30, 2017 and 2016:

| 2017 | 2016 | |||||||

| US statutory rates (benefit) | (33.3 | )% | (34.0 | )% | ||||

| Tax rate difference | 9.2 | % | 9.2 | % | ||||

| Valuation allowance on NOL | 24.2 | % | 24.2 | % | ||||

| Tax per financial statements | 0.1 | % | (0.7 | )% | ||||

The income tax for the nine months ended September 30, 2017 and 2016, consisted of the following:

| 2017 | 2016 | |||||||

| Income tax (benefit) expense – current | $ | 1,152 | $ | — | ||||

| Income tax (benefit) expense – deferred | (1,600 | ) | (26,047 | ) | ||||

| Total income tax benefit | $ | (448 | ) | $ | (26,047 | ) | ||

The income tax for the three months ended September 30, 2017 and 2016, consisted of the following:

| 2017 | 2016 | |||||||

| Income tax (benefit) expense — current | $ | 1,152 | $ | — | ||||

| Income tax (benefit) expense — deferred | 643 | (8,719 | ) | |||||

| Total income tax expense | $ | 1,795 | $ | (8,719 | ) | |||

16. MAJOR CUSTOMER AND VENDORS

Sales for the nine months ended September 30, 2017 and 2016 were $590,421 and $1,476, respectively.

Sales for the three months ended September 30, 2017 and 2016 were $590,421 and $1,476, respectively.

China Jinxin made a 10-year contract with Handan Steel Group Company (“HSG”) a state-owned enterprise, and agreed to sell all of its output from its Zhuolu production facility to HSG. The selling price was to be based on the market price. HSG agreed to purchase all the Company’s products from its Zhuolu production facility regardless of changes in the market. China Jinxin is economically dependent on HSG. However, as of today, China Jinxin has refused to sell its iron ore concentrate to its sole customer because of the low price offered.

17

17. LITIGATION

On September 4, 2012, Shijiazhuang City QiaoXi District People’s Court ruled China Huaxin had to repay a loan of RMB 49,067 ($7,073) plus court fees of RMB 510 ($74) to a plaintiff within 10 days of the judgment. China Huaxin paid RMB 10,216 ($1,481) in January 2017.

On April 7, 2013, the Zhulu County Labor Dispute Arbitration Committee ruled that China Jinxin had to pay RMB 654,300 ($94,320) to an employee as a result of her death in a traffic accident in 2010 when she was on the way to China Jinxin. China Jinxin denied it had an employment relationship with the plaintiff and appealed to Hebei Province Zhulu County People’s Court; on August 3, 2015, Hebei Province Zhulu County People’s Court confirmed there was an employment relationship and affirmed the original judgement in favor of the plaintiff. The Court froze the Company’s bank account in October 2016. This liability was accrued as of December 31, 2016. As of this report date, the Company has not yet paid this liability due to its lack of cash.

On December 30, 2016, Hebei Province Haixing County People’s Court ruled that China Huaxin had to pay the outstanding balance of RMB 410,537 ($59,181) electricity fee plus RMB 3,288 ($474) in court fees that it owed to GuoWang Hebei Province Electric Company Haixing County branch before January 9th, 2017. China Huaxin accrued this liability in 2016 and paid the balance in full in March 2017.

On August 13, 2014, Heibei Province Haixing County People’s Court ruled that China Huaxin had to repay a loan of RMB 60,000 ($8,697) plus applicable interest which is calculated based on the Bank of China’s interest rate for the loan with the same term to a plaintiff within 10 days of the judgment. At September 30, 2017, China Huaxin had outstanding balance of RMB 39,502 ($5,726).

18. STATUTORY RESERVES

Pursuant to the corporate law of the PRC effective January 1, 2006, the Company is now only required to maintain one statutory reserve by appropriating money from its after-tax profit before declaration or payment of dividends. The statutory reserve represents restricted retained earnings.

19. OPERATING RISKS

The Company’s operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

The Company’s sales, purchases and expenses are denominated in RMB and all of the Company’s assets and liabilities are also denominated in RMB. The RMB is not freely convertible into foreign currencies under the current law. In China, foreign exchange transactions are required by law to be transacted only by authorized financial institutions. Remittances in currencies other than RMB may require certain supporting documentation in order to effect the remittance.

All mineral resources in China are owned by the state. Thus, the Company’s ability to obtain iron ore depends upon its ability to obtain mineral rights from the relevant state authorities, purchase ore from another party that has mining rights from the state or import ore from outside the PRC. It is generally not feasible to transport iron ore any significant distance before processing. The Company has yet to obtain long term rights to any iron mine and there is no assurance the Company will be able to do so. Although the Company has extracted iron ore from the Zhuolu Mine on which the Company’s production facilities are located, the Company does not have the right to do so and can be subjected to various fines and penalties. The Company is not able to determine the amount of fines and penalties at the current stage; however, the Company believes the fines and penalties are negotiable with the authorities. If the Company is not able to obtain mining rights to the Zhuolu Mine in the future, the Company will have to cease mining operations at the Zhuolu Mine and the Company will seek to acquire iron ore from third parties. The failure to obtain iron ore reserves for processing at all or on reasonably acceptable terms would have a material adverse impact on our business and financial results.

18

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Overview

We seek to profit by participating in various aspects of the Chinese steel making industry including the mining and processing of iron ore and other forms of iron, which can be used to produce iron concentrate, fines, pellets or sinter. To date we have been engaged in iron ore processing and the production of iron ore concentrate in the People’s Republic of China (“PRC”) through our variable interest entity (‘VIE’), China Jinxin, and through the production of DRI by our subsidiary, China Huaxin.

China Jinxin owns a production facility in Zhuolu county, Hebei Province. The facility was operational by 2011. China Jinxin entered into a long term contract with Hebei Steel and Iron Company which expires in 2019 whereby China Jinxin is to sell all of the output of its Zhuolu facility to Hebei Steel at prices to be agreed upon. Since 2011, as a result of various demands by governmental authorities that the Company reduce the pollutants from the Zhuolu facility, the Company has repeatedly closed the facility to complete upgrades. Further, because the prices offered by Hebui have been so low, the Company has refused to sell it any ore. China Jinxin is currently in the final stage of adjusting its equipment and making certain modification to the facility after the relevant authority's most recent inspection and testing.

On January 17, 2014, we acquired a direct reduced iron (“DRI”) production facility in Haixing County, Hebei Province. We completed trial production at this facility and expected to commence commercial production in May 2015. However, as a result of environmental initiatives by government authorities in China, starting in June 2015, we began upgrading the DRI facilities by converting the existing coal-gas station systems to liquefied natural gas (“LNG”) station systems. The conversion to LNG systems will reduce pollutants and produce higher quality DRIs with less impurities. China Huaxin completed the upgrading necessary for conversion to LNG and resumed trial production from its upgraded DRI facilities. The government has again forced China Huaxin to close its facility and make additional anti-pollutant upgrades, The Company does not expect to resume production at this facility during 2017.

We have effective control of the management and operations of China Jinxin, an iron ore processing and high-grade iron ore concentrate producer with a production line located in Zhuolu County, Zhangjiakou City, Hebei Province, China, through a series of agreements among China Tongda, Mining Technologies Service Co., Ltd. (“China Tongda”), China Jinxin and its shareholders, referred to as “VIE agreements.” China Jinxin has an annual capacity of approximately 300,000 tons. Under the VIE agreements, China Tongda is entitled to receive the pre-tax profits of China Jinxin.

On January 17, 2014, China Tongda acquired all of the outstanding shares of China Huaxin. China Huaxin produces Direct Reduced Iron (DRI) at its DRI production facility (the “DRI Facility”) in Haixing County, Hebei Province, about 50 km from the nearest port, using advanced reduction rotary kiln technology with iron sand as the principal raw material. China Huaxin imports iron sands from New Zealand, Australia, Indonesia and the Philippines. The total amount expended to construct the DRI Facility, inclusive of both hard and soft costs, was approximately 244,270,000 RMB or $39 million. Unlike China Jinxin, which we control through the VIE agreements, China Huaxin is directly owned by China Tongda, our wholly owned subsidiary.

19

On April 25, 2017, China Tongda incorporated Yancheng DeWeiSi Business Trading Co., Ltd ("DeWeiSi") with registered capital of RMB 10,000,000 ($1.48 million), to be paid before April 19, 2047. DeWeiSi is a wholly-owned subsidiary of China Tongda. DeWeiSi is engaged in sale of mineral products (except petroleum and petroleum products), hardware products, construction materials, and steel. During the quarter ended June 30, 2017, DeWeiSi entered two contracts for selling the Powder ore with aggregate contract prices of RMB 5.11 million ($754,000). The sales were initiated and part of the purchase prices were received as of September 30, 2017. Because production has been halted at China Huaxin’s facility, the buyers under these contracts have looked to alternate sources to fill their needs.

To date, we have received only temporary manufacturing licenses granted by the agencies of the local government, which allowed us to process ore that we obtained from the Zhuolu Mine, the mine on which our facility is located, or third parties.

Our ability to profit from our facility in Zhuolu depends upon our ability to extract and process iron ore from the Zhuolu Mine and sell the output for a price that enables us to profit. To date, all of our sales from this facility were made to a single customer. We entered into a 10-year contract with this customer, which expires in January 2019. Pursuant to this agreement, we agreed to sell the customer, HSG, all of the output from our Zhuolu facility, which it agreed to purchase. The price paid to us by HSG is to be determined by HSG in light of the quality of our product and market prices and is to be such that it results in a proper margin to us. Thus, our ability to profit from our current production facility at the Zhuolu Mine over the next few years will be determined by the prices we receive from HSG. We cannot guarantee that HSG will not offer a price below what it pays to the Company’s competitors. The lower price will reduce our profit margin. However, if we are not satisfied with the price set by HSG, we can attempt to renegotiate the price. In an effort to obtain a higher price from HSG, we have yet to deliver iron ore concentrate we produced in the fourth quarter of 2011. We are continuing to negotiate with HSG to resolve our dispute over the price to be paid for our output.

Sales for the nine and three months ended September 30, 2017 and 2016 is $590,421 and $1,476. China Huaxin is currently doing the equipment debugging and adjustment. As noted above, this facility has again been shut down by the government authorities. The Company does not expect production to resume at this facility during 2017.