Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 Q3 2017 EARNINGS CALL TRANSCRIPT - Staffing 360 Solutions, Inc. | staf-ex993_47.htm |

| EX-99.1 - EX-99.1 Q3 2017 EARNINGS PRESS RELEASE - Staffing 360 Solutions, Inc. | staf-ex991_10.htm |

| 8-K - 8-K RE Q3 2017 EARNINGS RELEASE AND SLIDES - Staffing 360 Solutions, Inc. | staf-8k_20171115.htm |

Ticker: STAF Fiscal Q3 2017 Investor Call – November 15, 2017 Exhibit 99.2

Investor Call Agenda Introduction and Safe-HarborBrendan Flood, Executive Chairman Opening Remarks Brendan Flood, Executive Chairman Business and Industry UpdateMatt Briand, Chief Executive Officer Financial ResultsDavid Faiman, Chief Financial Officer Q&A Closing RemarksBrendan Flood, Executive Chairman

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding the business of the Company and its industry generally, business strategy and prospects. These statements are based on the Company’s estimates, projections, beliefs and assumptions and are not guarantees of future performance. These forward-looking statements are subject to various risks and uncertainties, which may cause actual results to differ materially from the forward-looking statements. The Company disclaims any obligation to update these forward-looking statements except as required by law.

Remarks from the Executive Chairman Completed two strategic acquisitions CBS Butler Holdings Limited (UK) Firstpro Georgia (US) Completed $40 million financing Amended US Accounts Receivable Lending Facility Pro Forma Trailing Twelve Months Adjusted EBITDA now $11 million Balance sheet significantly improved Cleaner capital structure Working capital deficit reduced to only $6.4 million Settled historical CSI arbitration matter Settled historical NewCSI earnout litigation

Business and Industry Update Acquisition and integration of CBS Butler and Firstpro Georgia Margins of overall business continue to improve New Light Industrial partnership agreements

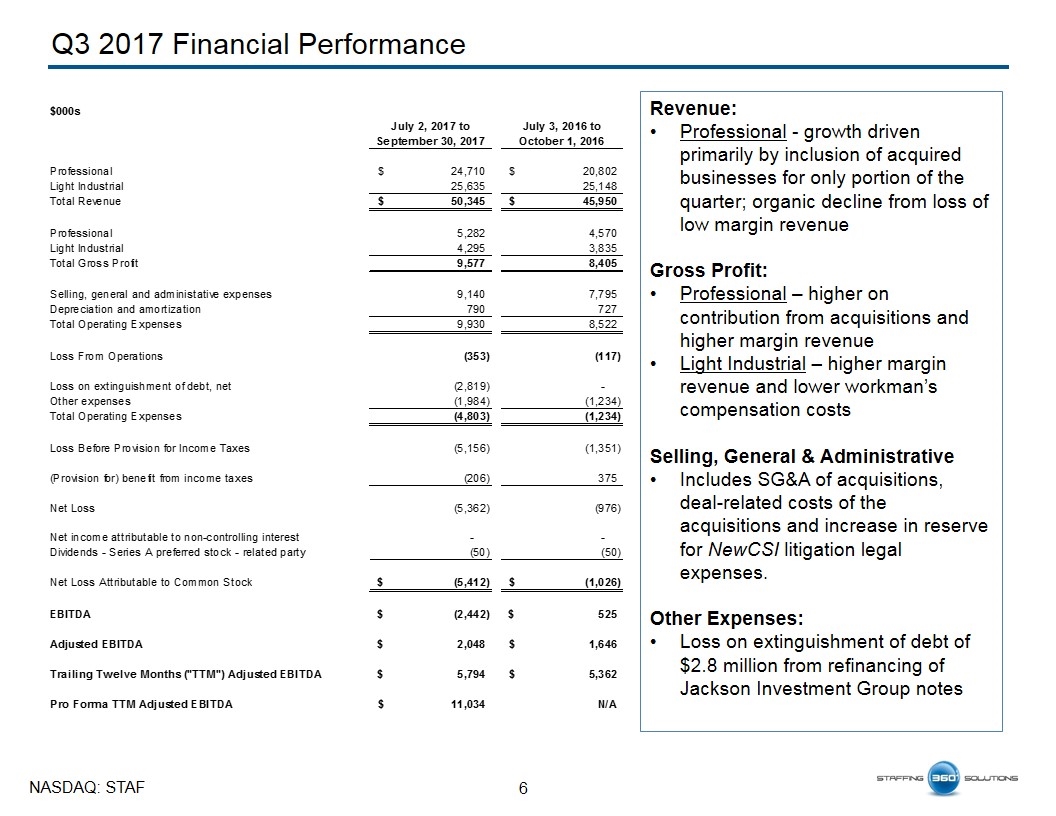

Q3 2017 Financial Performance Revenue: Professional - growth driven primarily by inclusion of acquired businesses for only portion of the quarter; organic decline from loss of low margin revenue Gross Profit: Professional – higher on contribution from acquisitions and higher margin revenue Light Industrial – higher margin revenue and lower workman’s compensation costs Selling, General & Administrative Includes SG&A of acquisitions, deal-related costs of the acquisitions and increase in reserve for NewCSI litigation legal expenses. Other Expenses: Loss on extinguishment of debt of $2.8 million from refinancing of Jackson Investment Group notes

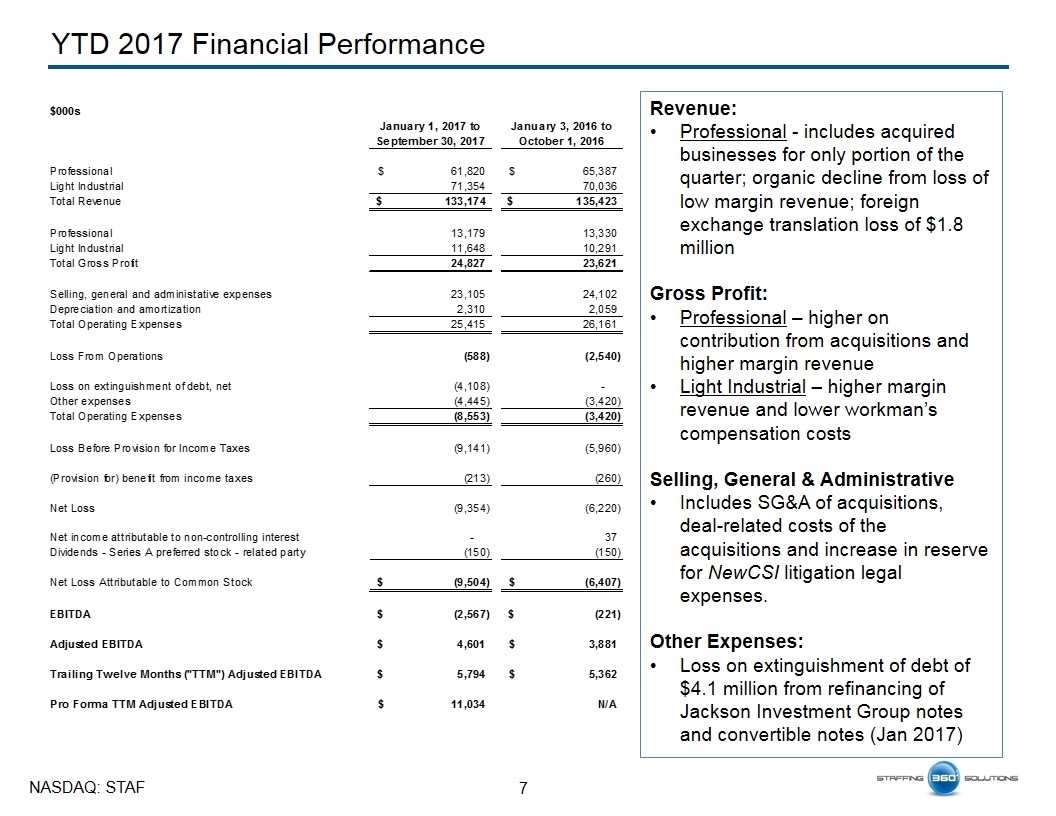

YTD 2017 Financial Performance Revenue: Professional - includes acquired businesses for only portion of the quarter; organic decline from loss of low margin revenue; foreign exchange translation loss of $1.8 million Gross Profit: Professional – higher on contribution from acquisitions and higher margin revenue Light Industrial – higher margin revenue and lower workman’s compensation costs Selling, General & Administrative Includes SG&A of acquisitions, deal-related costs of the acquisitions and increase in reserve for NewCSI litigation legal expenses. Other Expenses: Loss on extinguishment of debt of $4.1 million from refinancing of Jackson Investment Group notes and convertible notes (Jan 2017)

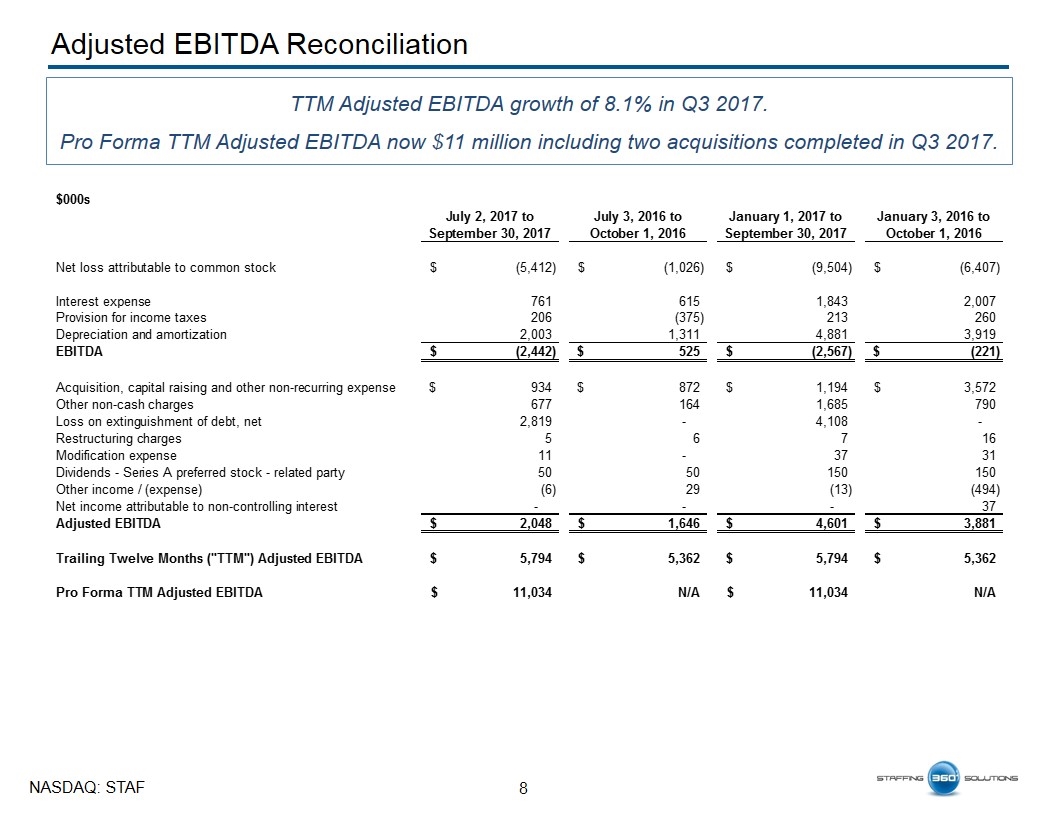

Adjusted EBITDA Reconciliation TTM Adjusted EBITDA growth of 8.1% in Q3 2017. Pro Forma TTM Adjusted EBITDA now $11 million including two acquisitions completed in Q3 2017.

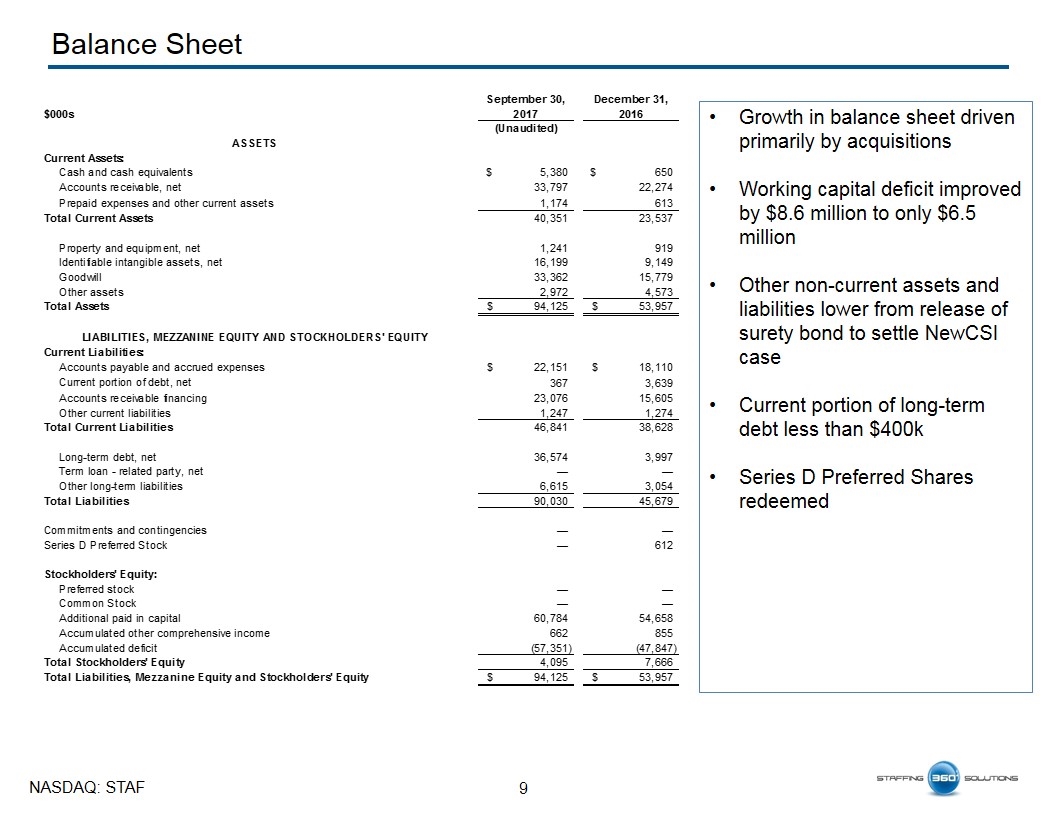

Balance Sheet Growth in balance sheet driven primarily by acquisitions Working capital deficit improved by $8.6 million to only $6.5 million Other non-current assets and liabilities lower from release of surety bond to settle NewCSI case Current portion of long-term debt less than $400k Series D Preferred Shares redeemed

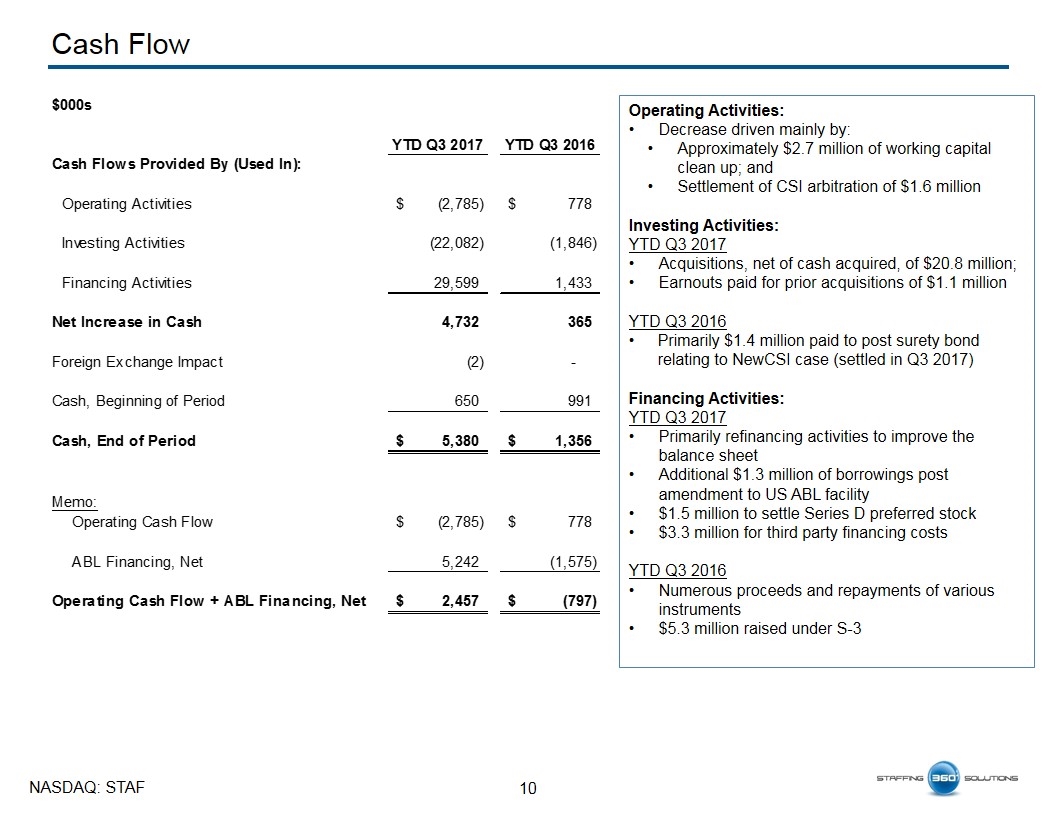

Cash Flow Operating Activities: Decrease driven mainly by: Approximately $2.7 million of working capital clean up; and Settlement of CSI arbitration of $1.6 million Investing Activities: YTD Q3 2017 Acquisitions, net of cash acquired, of $20.8 million; Earnouts paid for prior acquisitions of $1.1 million YTD Q3 2016 Primarily $1.4 million paid to post surety bond relating to NewCSI case (settled in Q3 2017) Financing Activities: YTD Q3 2017 Primarily refinancing activities to improve the balance sheet Additional $1.3 million of borrowings post amendment to US ABL facility $1.5 million to settle Series D preferred stock $3.3 million for third party financing costs YTD Q3 2016 Numerous proceeds and repayments of various instruments $5.3 million raised under S-3

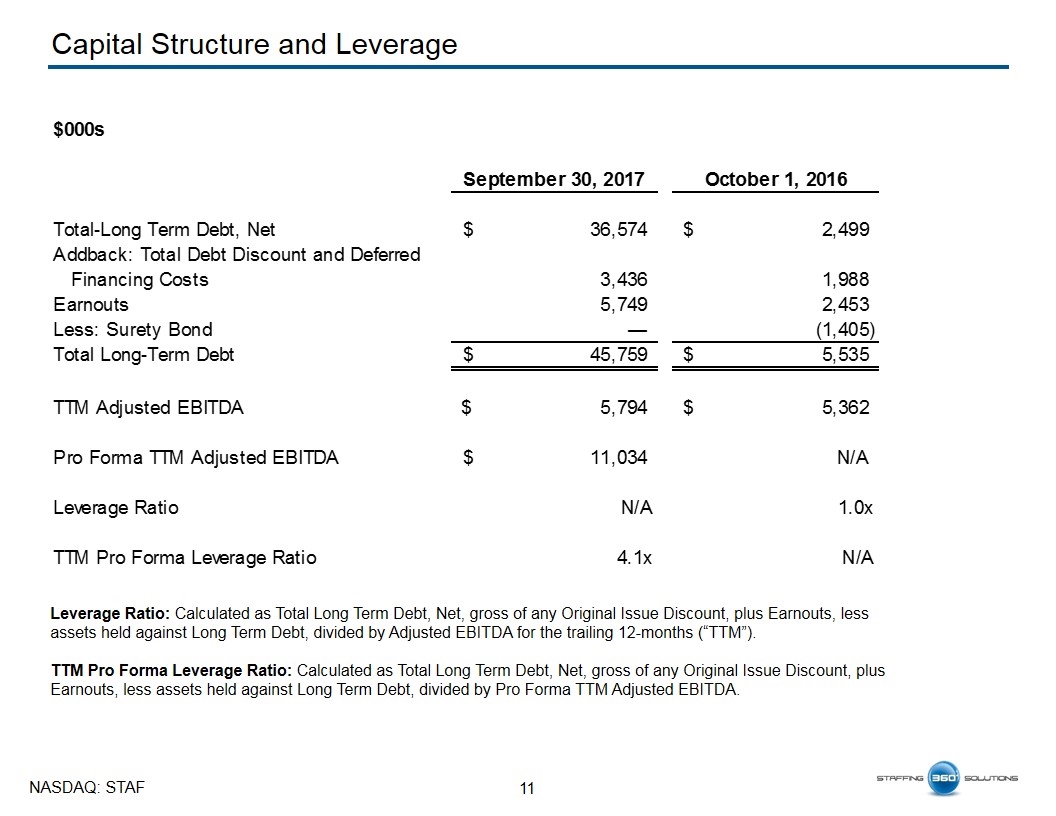

Capital Structure and Leverage Leverage Ratio: Calculated as Total Long Term Debt, Net, gross of any Original Issue Discount, plus Earnouts, less assets held against Long Term Debt, divided by Adjusted EBITDA for the trailing 12-months (“TTM”). TTM Pro Forma Leverage Ratio: Calculated as Total Long Term Debt, Net, gross of any Original Issue Discount, plus Earnouts, less assets held against Long Term Debt, divided by Pro Forma TTM Adjusted EBITDA.

Questions & Answers

Closing Remarks from Executive Chairman

Company Contact Information Staffing 360 Solutions, Inc. Investor Contact: Brendan Flood, Executive Chairman info@staffing360solutions.com Financial Contact: David Faiman, Chief Financial Officer david.faiman@staffing360solutions.com Headquarters: 641 Lexington Ave, Suite 2701 New York, NY 10022 646-507-5710 UK Office: 3a London Wall Buildings London Wall London EC2M 5SY +44 (0) 207 464 1985