Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - LHC Group, Inc | d495163dex991.htm |

| EX-2.1 - EX-2.1 - LHC Group, Inc | d495163dex21.htm |

| 8-K - FORM 8-K - LHC Group, Inc | d495163d8k.htm |

LHC Group and Almost Family: A Leading National Provider of In-Home Healthcare November 16, 2017 Exhibit 99.2

Forward-Looking Statements This presentation contains “forward-looking statements” (as defined in the Securities Litigation Reform Act of 1995) regarding, among other things, future events or the future financial performance of LHC Group, Inc. (“LHC Group”) and Almost Family, Inc. (“Almost Family”). Words such as “anticipate,” “expect,” “project,” “intend,” “believe,” “will,” “estimates,” “may,” “could,” “should” and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. The closing of the proposed transaction is subject to the approval of the stockholders of LHC Group and Almost Family, regulatory approvals and other customary closing conditions. There is no assurance that such conditions will be met or that the proposed transaction will be consummated within the expected time frame, or at all. Forward-looking statements relating to the proposed transaction include, but are not limited to: statements about the benefits of the proposed transaction, including anticipated earnings accretion, synergies and cost savings and future financial and operating results; LHC Group’s and Almost Family’s plans, objectives, expectations, projections and intentions; the expected timing of completion of the proposed transaction; and other statements relating to the transaction that are not historical facts. Forward-looking statements are based on information currently available to LHC Group and Almost Family and involve estimates, expectations and projections. Investors are cautioned that all such forward-looking statements are subject to risks and uncertainties, and important factors could cause actual events or results to differ materially from those indicated by such forward-looking statements. With respect to the proposed transaction, these risks, uncertainties and factors include, but are not limited to: the risk that LHC Group or Almost Family may be unable to obtain governmental and regulatory approvals required for the transaction, or that required governmental and regulatory approvals may delay the transaction or result in the imposition of conditions that could reduce the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction; the risk that required stockholder approvals may not be obtained; the risks that the other condition(s) to closing of the transaction may not be satisfied; the length of time necessary to consummate the proposed transaction, which may be longer than anticipated for various reasons; the risk that the businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the proposed transaction may not be fully realized or may take longer to realize than expected; the diversion of management time on transaction-related issues; the risk that costs associated with the integration of the businesses are higher than anticipated; and litigation risks related to the transaction. With respect to the businesses of LHC Group and/or Almost Family, including if the proposed transaction is consummated, these risks, uncertainties and factors include, but are not limited to: changes in, or failure to comply with, existing government regulations that impact LHC Group’s and/or Almost Family’s businesses; legislative proposals for healthcare reform; the impact of changes in future interpretations of fraud, anti-kickback, or other laws; changes in Medicare and Medicaid reimbursement levels; changes in laws and regulations with respect to Accountable Care Organizations; changes in the marketplace and regulatory environment for Health Risk Assessments; decrease in demand for LHC Group’s or Almost Family’s services; the potential impact of the announcement or consummation of the proposed transaction on relationships with customers, joint venture and other partners, competitors, management and other employees, including the loss of significant contracts or reduction in revenues associated with major payor sources; ability of customers to pay for services; risks related to any current or future litigation proceedings; potential audits and investigations by government and regulatory agencies, including the impact of any negative publicity or litigation; the ability to attract new customers and retain existing customers in the manner anticipated; the ability to hire and retain key personnel; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect and/or risks related to the ability to obtain financing; increased competition from other entities offering similar services as offered by LHC Group and Almost Family; reliance on and integration of information technology systems; ability to protect intellectual property rights; impact of security breaches, cyber-attacks or fraudulent activity on LHC Group’s or Almost Family’s reputation; the risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; the risks associated with the combined company’s expansion strategy, the successful integration of recent acquisitions, and if necessary, the ability to relocate or restructure current facilities; and the potential impact of an economic downturn or effects of tax assessments or tax positions taken, risks related to goodwill and other intangible asset impairment, tax adjustments, anticipated tax rates, benefit or retirement plan costs, or other regulatory compliance costs. Additional information concerning other risk factors is also contained in LHC Group’s and Almost Family’s most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other Securities and Exchange Commission (“SEC”) filings. Many of these risks, uncertainties and assumptions are beyond LHC Group’s or Almost Family’s ability to control or predict. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Furthermore, forward-looking statements speak only as of the information currently available to the parties on the date they are made, and neither LHC Group nor Almost Family undertakes any obligation to update publicly or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this presentation. Neither LHC Group nor Almost Family gives any assurance (1) that either LHC Group or Almost Family will achieve its expectations, or (2) concerning any result or the timing thereof. All subsequent written and oral forward-looking statements concerning LHC group, Almost Family, the proposed transaction, the combined company or other matters and attributable to LHC Group or Almost Family or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

Additional Information And Where To Find It The proposed transaction between LHC Group and Almost Family will be submitted to the respective stockholders of LHC Group and Almost Family for their consideration. LHC Group will file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of LHC Group and Almost Family that also constitutes a prospectus of LHC Group. LHC Group and Almost Family will deliver the joint proxy statement/prospectus to their respective stockholders as required by applicable law. LHC Group and Almost Family also plan to file other documents with the SEC regarding the proposed transaction. This presentation is not a substitute for any prospectus, proxy statement or any other document which LHC Group or Almost Family may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF LHC GROUP AND ALMOST FAMILY ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT LHC GROUP, ALMOST FAMILY, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and stockholders will be able to obtain free copies of the joint proxy statement/prospectus and other documents containing important information about LHC Group and Almost Family, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. LHC Group and Almost Family make available free of charge at www.lhcgroup.com and www.almostfamily.com, respectively (in the “Investor” or “Investor Relations” section, as applicable), copies of materials they file with, or furnish to, the SEC. Participants In The Merger Solicitation LHC Group, Almost Family, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of LHC Group and Almost Family in connection with the proposed transaction. Information about the directors and executive officers of LHC Group is set forth in its proxy statement for its 2017 annual meeting of stockholders, which was filed with the SEC on April 28, 2017. Information about the directors and executive officers of Almost Family is set forth in its proxy statement for its 2017 annual meeting of shareholders, which was filed with the SEC on April 7, 2017. These documents can be obtained free of charge from the sources indicated above. Other information regarding those persons who are, under the rules of the SEC, participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. No Offer or Solicitation This presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed transaction between LHC Group and Almost Family or otherwise, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Non-GAAP Financial Information This presentation includes certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), including EBITDA and Adjusted EBITDA. The companies use these non-GAAP financial measures in operating its business because management believes they are less susceptible to variances in actual operating performance that can result from the excluded items. The companies present these financial measures to investors because they believe they are useful to investors in evaluating the primary factors that drive the companies’ operating performance. The items excluded from these non-GAAP measures are important in understanding LHC Group’s and Almost Family’s financial performance, and any non-GAAP measures presented should not be considered in isolation of, or as an alternative to, GAAP financial measures. Since these non-GAAP financial measures are not measures determined in accordance with GAAP, have no standardized meaning prescribed by GAAP and are susceptible to varying calculations, these measures, as presented, may not be comparable to other similarly titled measures of other companies. EBITDA of LHC Group and Almost Family is defined as net income (loss) before income tax benefit (expense), interest expense, and depreciation and amortization expense. Adjusted EBITDA of LHC Group and Almost Family is defined as net income (loss) before income tax expense benefit (expense), depreciation and amortization expense, and transaction costs related to previous transactions.

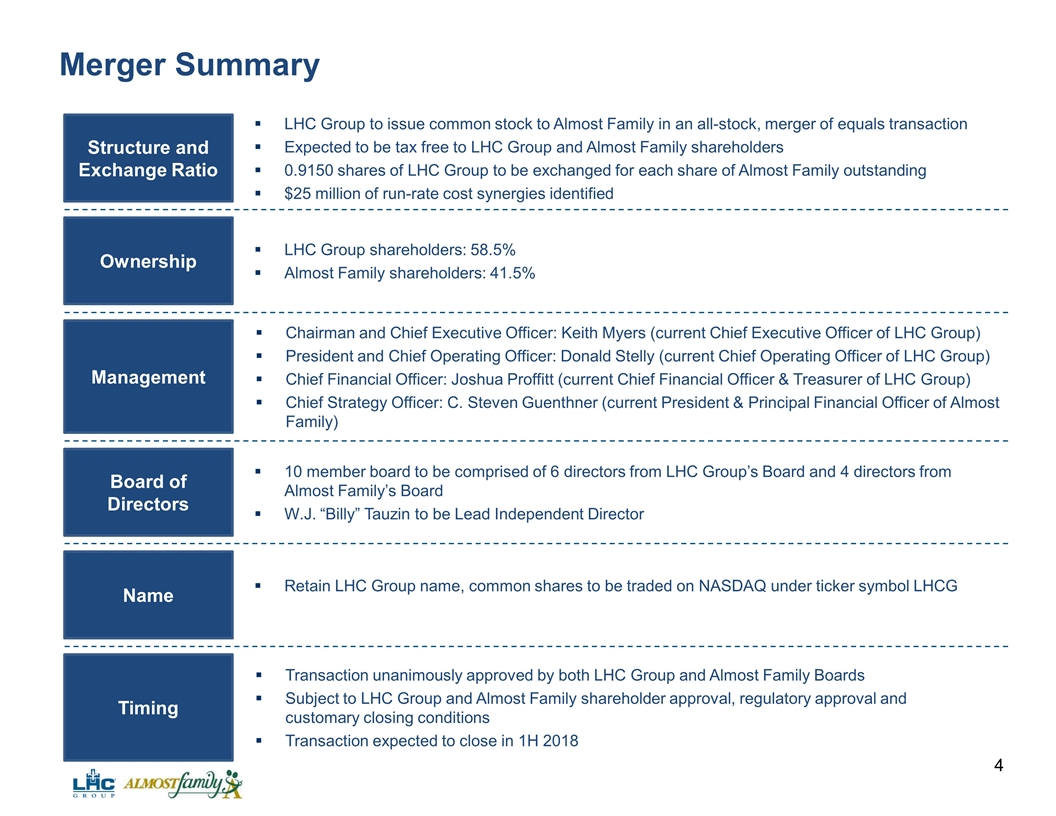

Merger Summary Ownership LHC Group shareholders: 58.5% Almost Family shareholders: 41.5% Timing Transaction unanimously approved by both LHC Group and Almost Family Boards Subject to LHC Group and Almost Family shareholder approval, regulatory approval and customary closing conditions Transaction expected to close in 1H 2018 Management Chairman and Chief Executive Officer: Keith Myers (current Chief Executive Officer of LHC Group) President and Chief Operating Officer: Donald Stelly (current Chief Operating Officer of LHC Group) Chief Financial Officer: Joshua Proffitt (current Chief Financial Officer & Treasurer of LHC Group) Chief Strategy Officer: C. Steven Guenthner (current President & Principal Financial Officer of Almost Family) Board of Directors 10 member board to be comprised of 6 directors from LHC Group’s Board and 4 directors from Almost Family’s Board W.J. “Billy” Tauzin to be Lead Independent Director Name Retain LHC Group name, common shares to be traded on NASDAQ under ticker symbol LHCG Structure and Exchange Ratio LHC Group to issue common stock to Almost Family in an all-stock, merger of equals transaction Expected to be tax free to LHC Group and Almost Family shareholders 0.9150 shares of LHC Group to be exchanged for each share of Almost Family outstanding $25 million of run-rate cost synergies identified

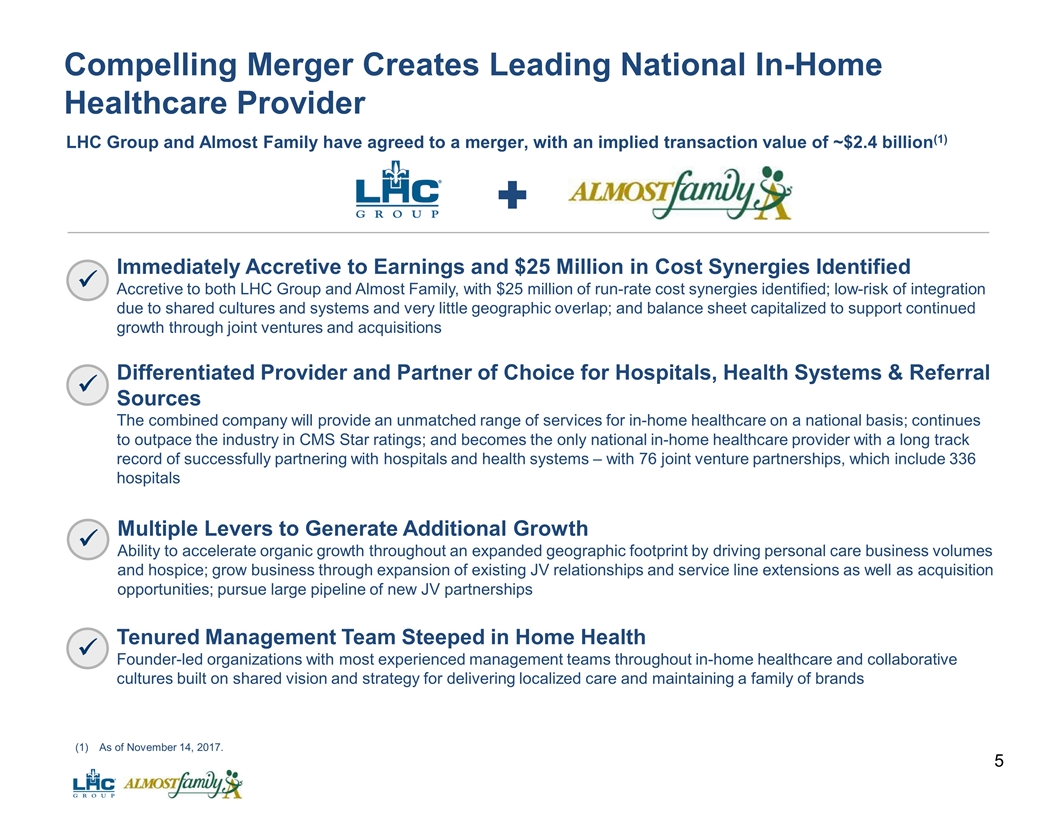

Compelling Merger Creates Leading National In-Home Healthcare Provider Multiple Levers to Generate Additional Growth Ability to accelerate organic growth throughout an expanded geographic footprint by driving personal care business volumes and hospice; grow business through expansion of existing JV relationships and service line extensions as well as acquisition opportunities; pursue large pipeline of new JV partnerships ü Differentiated Provider and Partner of Choice for Hospitals, Health Systems & Referral Sources The combined company will provide an unmatched range of services for in-home healthcare on a national basis; continues to outpace the industry in CMS Star ratings; and becomes the only national in-home healthcare provider with a long track record of successfully partnering with hospitals and health systems – with 76 joint venture partnerships, which include 336 hospitals ü Immediately Accretive to Earnings and $25 Million in Cost Synergies Identified Accretive to both LHC Group and Almost Family, with $25 million of run-rate cost synergies identified; low-risk of integration due to shared cultures and systems and very little geographic overlap; and balance sheet capitalized to support continued growth through joint ventures and acquisitions ü Tenured Management Team Steeped in Home Health Founder-led organizations with most experienced management teams throughout in-home healthcare and collaborative cultures built on shared vision and strategy for delivering localized care and maintaining a family of brands ü LHC Group and Almost Family have agreed to a merger, with an implied transaction value of ~$2.4 billion(1) As of November 14, 2017.

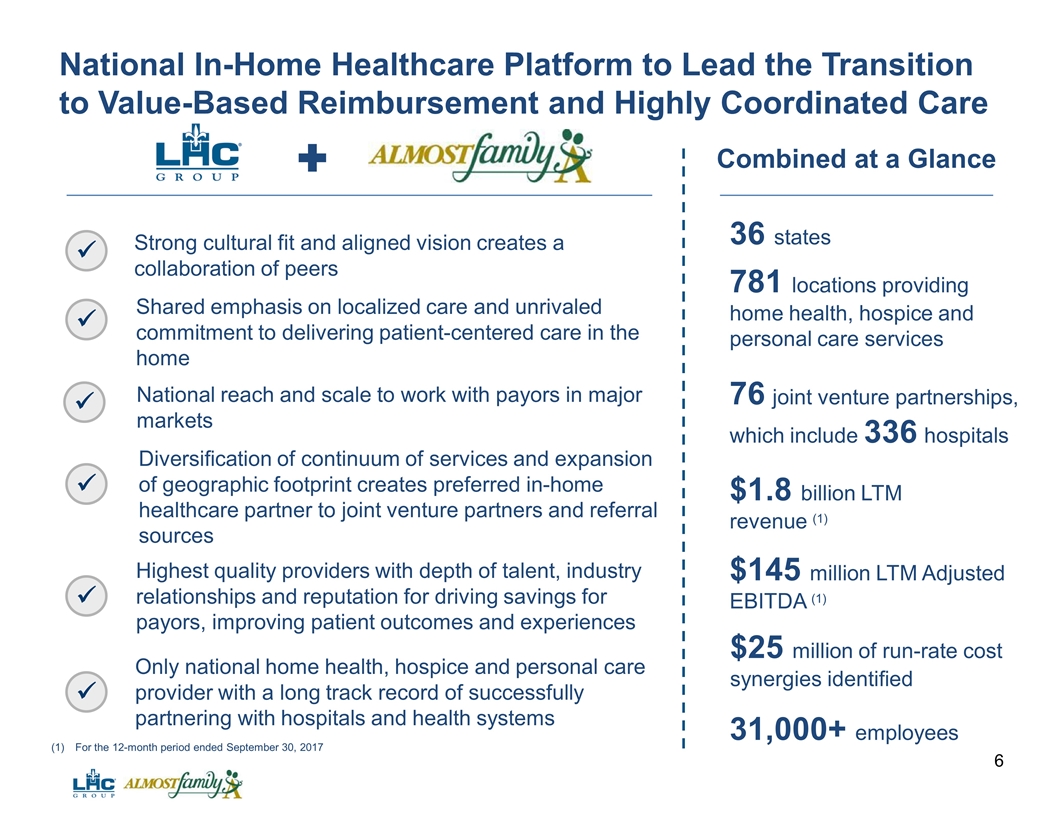

National In-Home Healthcare Platform to Lead the Transition to Value-Based Reimbursement and Highly Coordinated Care ü Strong cultural fit and aligned vision creates a collaboration of peers ü Shared emphasis on localized care and unrivaled commitment to delivering patient-centered care in the home ü Only national home health, hospice and personal care provider with a long track record of successfully partnering with hospitals and health systems ü Diversification of continuum of services and expansion of geographic footprint creates preferred in-home healthcare partner to joint venture partners and referral sources $1.8 billion LTM revenue (1) 36 states $145 million LTM Adjusted EBITDA (1) 31,000+ employees Combined at a Glance National reach and scale to work with payors in major markets ü ü Highest quality providers with depth of talent, industry relationships and reputation for driving savings for payors, improving patient outcomes and experiences 76 joint venture partnerships, which include 336 hospitals 781 locations providing home health, hospice and personal care services For the 12-month period ended September 30, 2017 $25 million of run-rate cost synergies identified

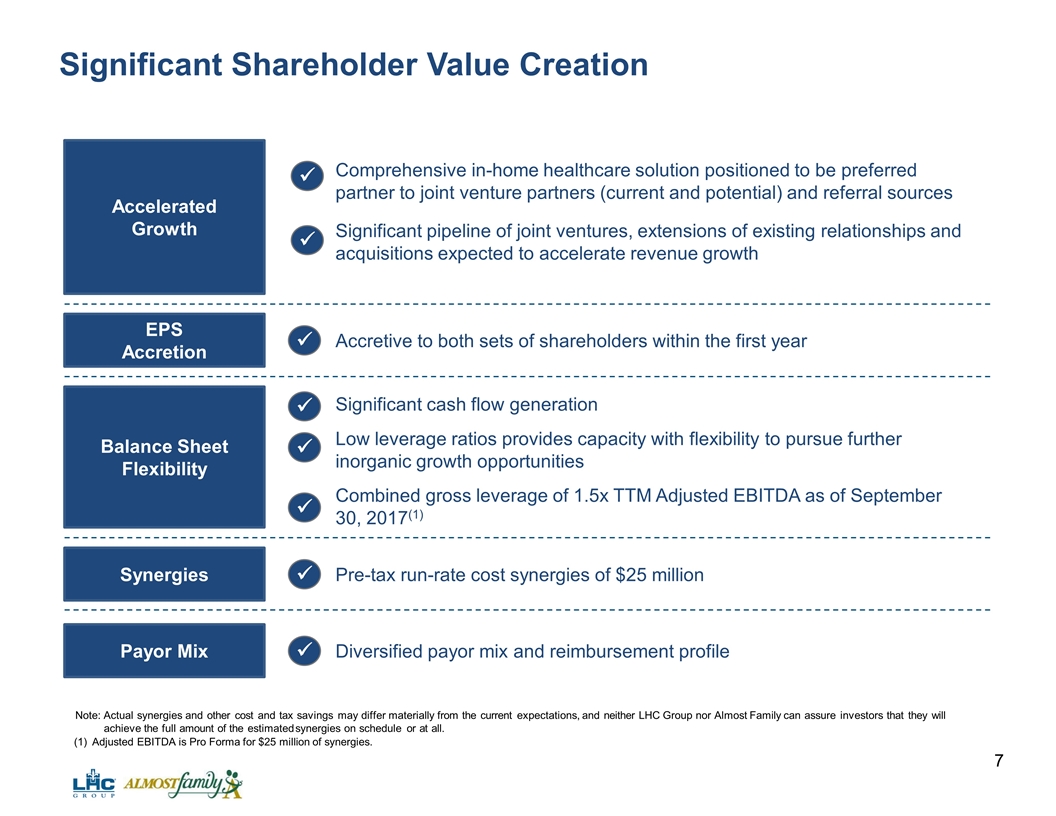

Significant Shareholder Value Creation Note: Actual synergies and other cost and tax savings may differ materially from the current expectations, and neither LHC Group nor Almost Family can assure investors that they will achieve the full amount of the estimated synergies on schedule or at all. Adjusted EBITDA is Pro Forma for $25 million of synergies. Payor Mix Diversified payor mix and reimbursement profile ü EPS Accretion Accretive to both sets of shareholders within the first year ü Accelerated Growth Comprehensive in-home healthcare solution positioned to be preferred partner to joint venture partners (current and potential) and referral sources Significant pipeline of joint ventures, extensions of existing relationships and acquisitions expected to accelerate revenue growth ü ü Balance Sheet Flexibility Significant cash flow generation Low leverage ratios provides capacity with flexibility to pursue further inorganic growth opportunities Combined gross leverage of 1.5x TTM Adjusted EBITDA as of September 30, 2017(1) ü ü ü Synergies Pre-tax run-rate cost synergies of $25 million ü

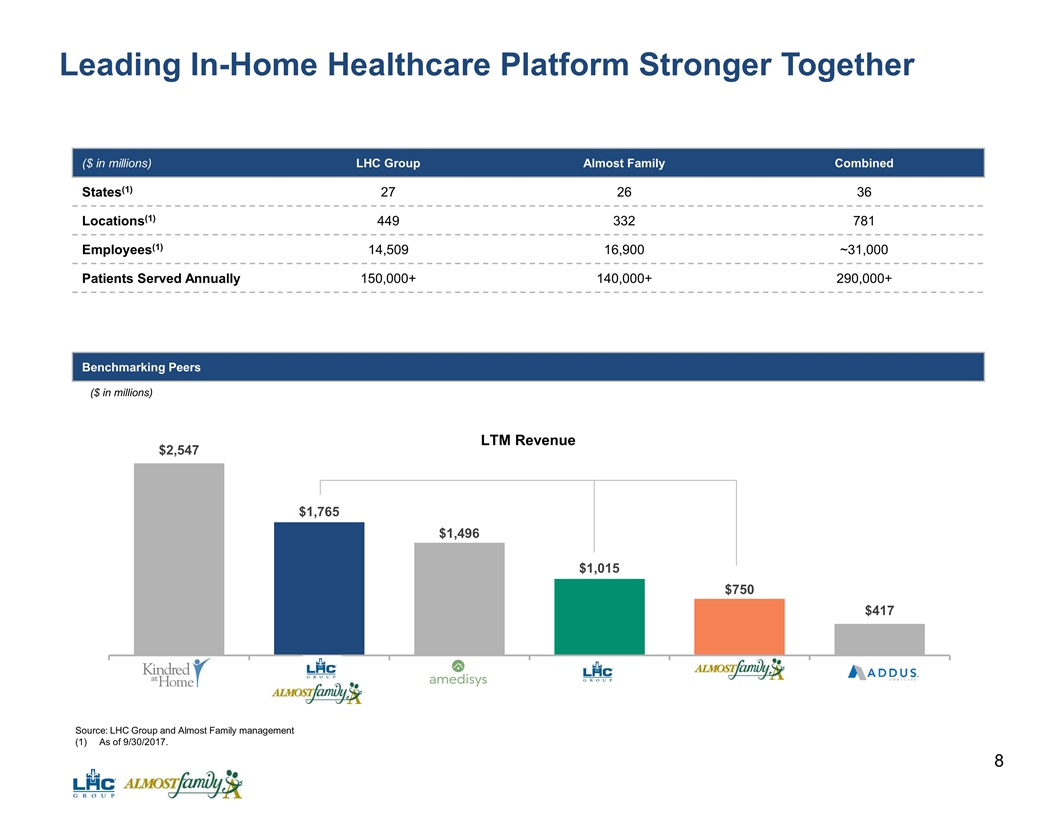

LTM Revenue Leading In-Home Healthcare Platform Stronger Together ($ in millions) LHC Group Almost Family Combined States(1) 27 26 36 Locations(1) 449 332 781 Employees(1) 14,509 16,900 ~31,000 Patients Served Annually 150,000+ 140,000+ 290,000+ Benchmarking Peers LTM EBITDA-MI ($ in millions) Source: LHC Group and Almost Family management As of 9/30/2017. LHC Group + Almost Family LHC Group Almost Family (3) (2)

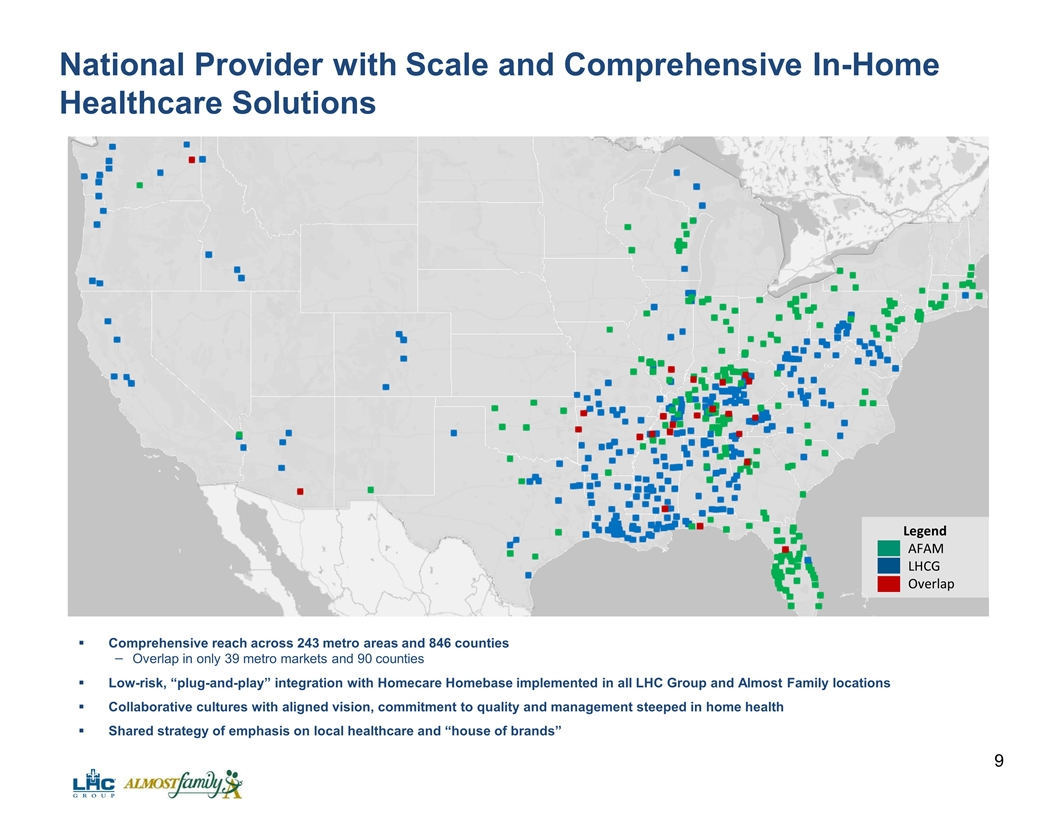

National Provider with Scale and Comprehensive In-Home Healthcare Solutions Should LHC Group home with some commentary bullets / take-away message that these are complementary footprints with limited overlap enabling growth across multiple homecare channels, diversifying local market risk and enabling the combination to find overhead synergies at the enterprise level that will do no harm at the local level Comprehensive reach across 243 metro areas and 846 counties Overlap in only 39 metro markets and 90 counties Low-risk, “plug-and-play” integration with Homecare Homebase implemented in all LHC Group and Almost Family locations Collaborative cultures with aligned vision, commitment to quality and management steeped in home health Shared strategy of emphasis on local healthcare and “house of brands” Legend AFAM LHCG Overlap

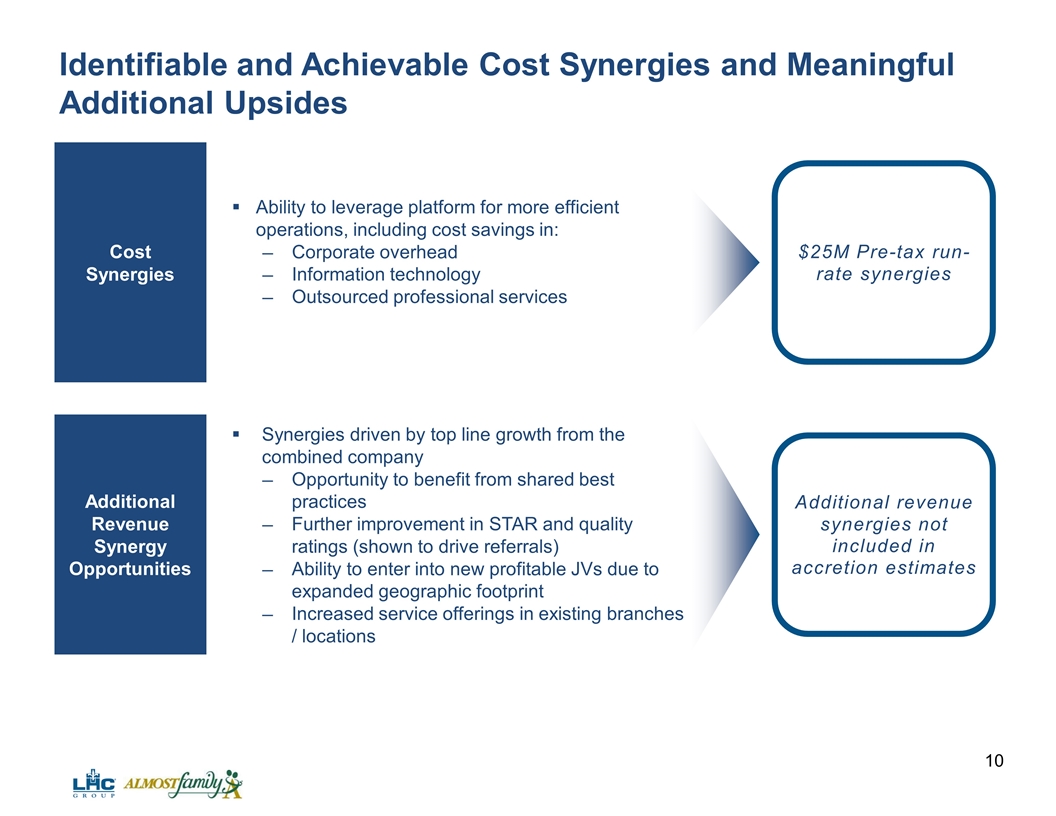

Identifiable and Achievable Cost Synergies and Meaningful Additional Upsides Cost Synergies Ability to leverage platform for more efficient operations, including cost savings in: Corporate overhead Information technology Outsourced professional services $25M Pre-tax run-rate synergies Additional Revenue Synergy Opportunities Synergies driven by top line growth from the combined company Opportunity to benefit from shared best practices Further improvement in STAR and quality ratings (shown to drive referrals) Ability to enter into new profitable JVs due to expanded geographic footprint Increased service offerings in existing branches / locations Additional revenue synergies not included in accretion estimates

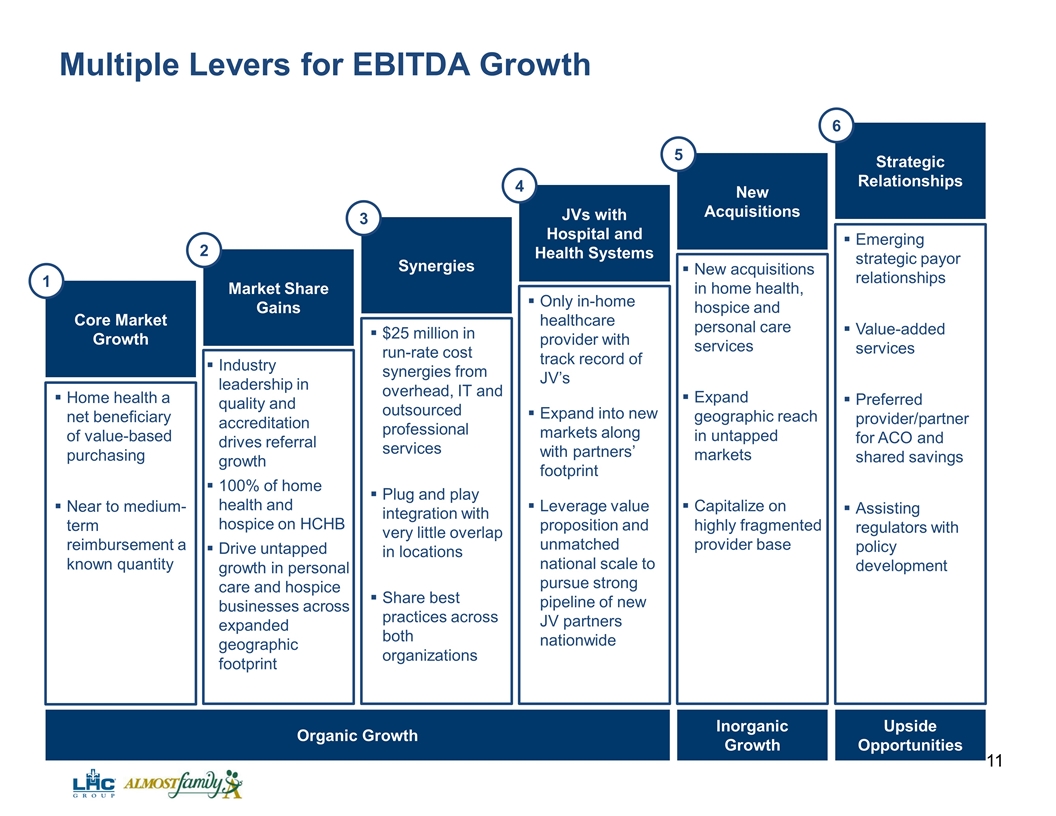

Multiple Levers for EBITDA Growth Organic Growth Inorganic Growth Upside Opportunities Emerging strategic payor relationships Value-added services Preferred provider/partner for ACO and shared savings Assisting regulators with policy development Core Market Growth Market Share Gains Synergies JVs with Hospital and Health Systems New Acquisitions Strategic Relationships New acquisitions in home health, hospice and personal care services Expand geographic reach in untapped markets Capitalize on highly fragmented provider base Only in-home healthcare provider with track record of JV’s Expand into new markets along with partners’ footprint Leverage value proposition and unmatched national scale to pursue strong pipeline of new JV partners nationwide Industry leadership in quality and accreditation drives referral growth 100% of home health and hospice on HCHB Drive untapped growth in personal care and hospice businesses across expanded geographic footprint $25 million in run-rate cost synergies from overhead, IT and outsourced professional services Plug and play integration with very little overlap in locations Share best practices across both organizations Home health a net beneficiary of value-based purchasing Near to medium-term reimbursement a known quantity 1 2 3 4 5 6

Preferred Partner for Hospitals & Health Systems Value Proposition to Partners Only national in-home healthcare provider with a long track record of successfully partnering with hospitals and health systems 284 home health, hospice and personal care joint venture locations Value proposition to JV partners: Provide a customized solution Collectively maintain established local brands Continuous focus on patient care and quality outcomes Comprehensive compliance program Generate substantial operating improvements and financial returns Decrease avoidable days Keeping patients in hospital’s network Hospital & Health Systems Partners 163 hh 44 hospice 7 LATCH

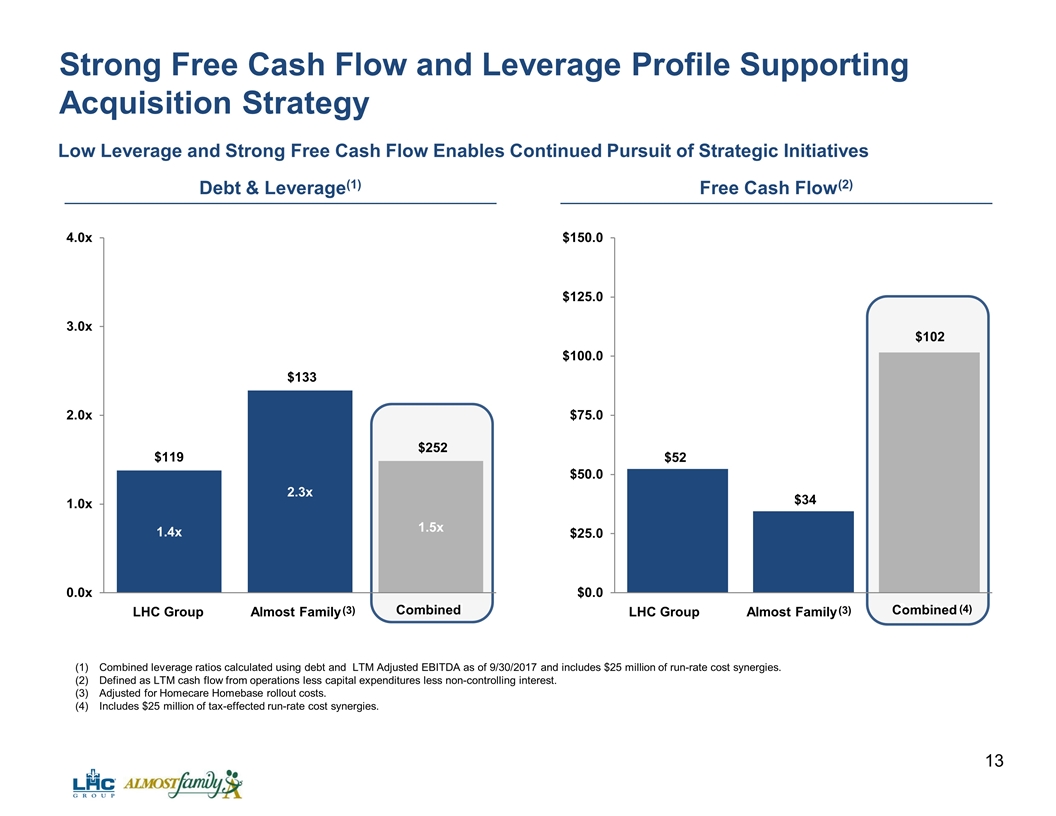

Strong Free Cash Flow and Leverage Profile Supporting Acquisition Strategy Low Leverage and Strong Free Cash Flow Enables Continued Pursuit of Strategic Initiatives Combined leverage ratios calculated using debt and LTM Adjusted EBITDA as of 9/30/2017 and includes $25 million of run-rate cost synergies. Defined as LTM cash flow from operations less capital expenditures less non-controlling interest. Adjusted for Homecare Homebase rollout costs. Includes $25 million of tax-effected run-rate cost synergies. Debt & Leverage(1) (3) LHC Group Almost Family Combined Free Cash Flow(2) (3) LHC Group Almost Family Combined (4)

Executive Team with Proven Track Record Precedent Transformational M&A and Joint Ventures Track Record of Developing Joint Ventures with Leading Hospitals & Health Systems Experienced Management Team History of Successful Capital Deployment & Seamless Integration Unique, Multi-Channel Growth Strategy Strong Operational Expertise, Ability to Scale and Share Best Practices Keith Myers Chairman and Chief Executive Officer Josh Proffitt Chief Financial Officer Donald Stelly President and Chief Operating Officer Steve Guenthner Chief Strategy Officer William Yarmuth Special Advisor to LHC Group(1) William Yarmuth to serve as special advisor to LHC Group for four year period post-close.

Contacts 163 hh 44 hospice 7 LATCH FOR LHC Group: Investors: Eric Elliott Senior Vice President of Finance LHC Group Tel: +1 (337) 769-0738 E-mail: Eric.Elliott@LHC Group.com FOR Almost Family: Investors: Steven Guenthner President and Principal Financial Officer Almost Family Tel: +1 (502) 891-1000 E-mail: SteveGuenthner@AlmostFamily.com Media: Rebecca Reid Schmidt Public Affairs Tel: +1 (410) 212-3843 E-mail: RReid@schmidtpa.com