Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DUNKIN' BRANDS GROUP, INC. | a8krevrec.htm |

Revenue Recognition:

New Accounting Standard

November 16, 2017

Forward-Looking Statements

► Certain information contained in this presentation, particularly information regarding future

economic performance, finances, and expectations and objectives of management

constitutes forward-looking statements. Forward-looking statements can be identified by

the fact that they do not relate strictly to historical or current facts and generally contain

words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,”

“intends,” “plans,” “estimates” or “anticipates” or similar expressions. Our forward-looking

statements are subject to risks and uncertainties, which may cause actual results to differ

materially from those projected or implied by the forward-looking statement.

► Forward-looking statements are based on current expectations and assumptions and

currently available data and are neither predictions nor guarantees of future events or

performance. You should not place undue reliance on forward-looking statements, which

speak only as of the date hereof. We do not undertake to update or revise any forward-

looking statements after they are made, whether as a result of new information, future

events, or otherwise, except as required by applicable law. For discussion of some of the

important factors that could cause these variations, please consult the “Risk Factors”

section of the Company’s most recent Annual Report on Form 10-K.

► The examples provided in this presentation are meant to be illustrative only and should not

be relied on as representative of any actual result in making any investment decisions.

► The information contained in this presentation is based on accounting guidance published

to date and any related interpretations, which could be subject to change prior to the

applicable effective date of such guidance.

2

Agenda

►Overview of new revenue recognition standard

►Key impacts to Dunkin’ Brands

►Transition timeline

3

►Global, principles-based model

►Eliminates industry-specific (i.e. franchisor) guidance

►Effective in FY2018 for December year-end companies

New revenue accounting standard (ASC 606)

4

Key impacts to Dunkin’ Brands

What is impacted?

►Franchise fees, including

initial and renewal fees (all

segments)

►Advertising fund

presentation

►Certain other revenue

streams (impacts generally

expected to be immaterial)

What is not impacted?

►Royalty income

►Rental income

►License fees, including CPG

►Expense recognition

►Cash flows of the business

5

No impact to our cash flows or

how we operate our business

Franchise Fees

Franchise fees: Recognize over the franchise term

7

Current standard – recognize upfront

New standard (ASC 606) – recognize over time

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

$40,000 initial fee

recognized at

store opening

$20,000 renewal

fee recognized

at execution

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

$40,000 initial fee

recognized over

20-year initial term

@ $2,000 per year

$20,000 renewal fee

recognized over

10-year renewal term

@ $2,000 per year

Renewal recognition begins

later under new standard

Illustrative example: Single store with $40K

initial fee (20-year initial term) and a $20K,

10-year renewal term executed in year 10

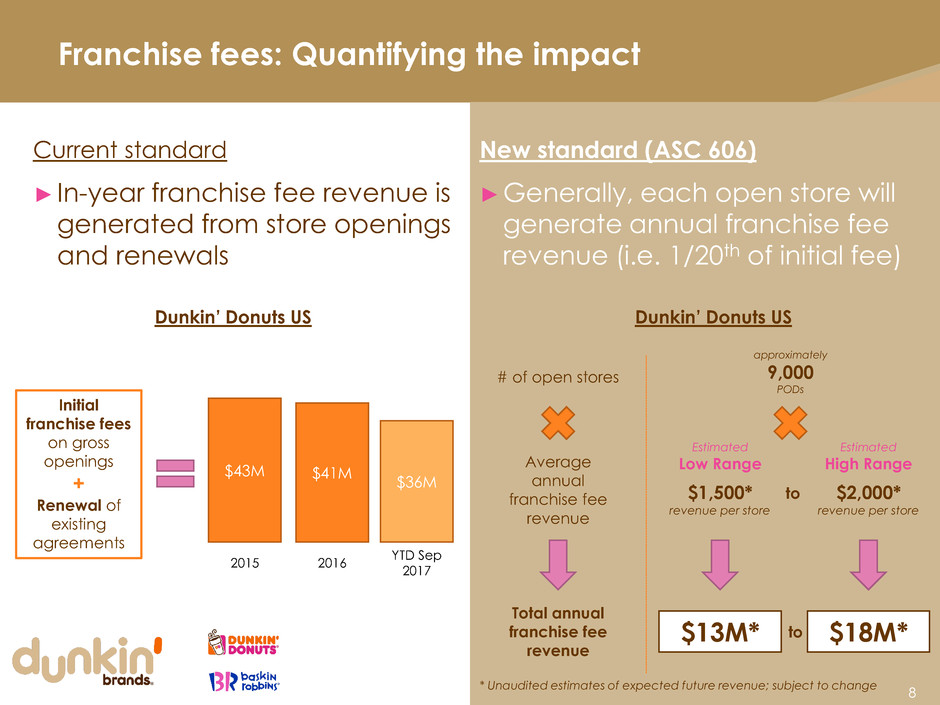

Franchise fees: Quantifying the impact

New standard (ASC 606)

►Generally, each open store will

generate annual franchise fee

revenue (i.e. 1/20th of initial fee)

8

Current standard

► In-year franchise fee revenue is

generated from store openings

and renewals

$41M

2016

Initial

franchise fees

on gross

openings

+

Renewal of

existing

agreements

Dunkin’ Donuts US Dunkin’ Donuts US

approximately

9,000

PODs

$43M

2015

YTD Sep

2017

# of open stores

Average

annual

franchise fee

revenue

Total annual

franchise fee

revenue

$13M* $18M*

$1,500*

revenue per store

Estimated

Low Range

$2,000*

revenue per store

Estimated

High Range

* Unaudited estimates of expected future revenue; subject to change

to

to

$36M

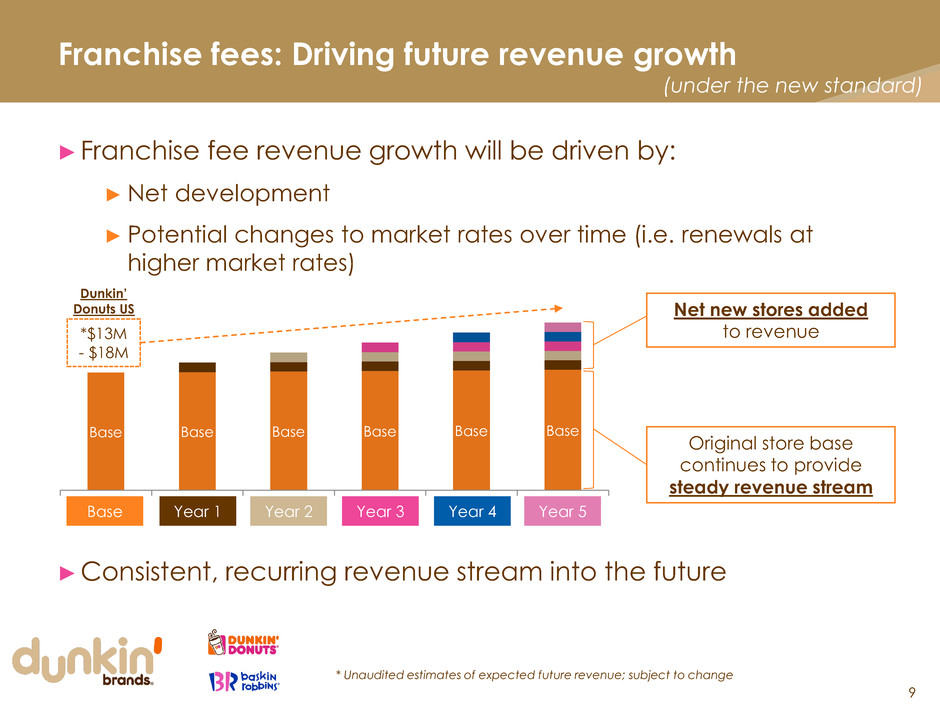

Franchise fees: Driving future revenue growth

►Franchise fee revenue growth will be driven by:

►Net development

► Potential changes to market rates over time (i.e. renewals at

higher market rates)

►Consistent, recurring revenue stream into the future

9

Base Base Base Base Base Base

Base Year 1 Year 2 Year 3 Year 4 Year 5

Original store base

continues to provide

steady revenue stream

Net new stores added

to revenue *$13M

- $18M

(under the new standard)

Dunkin’

Donuts US

* Unaudited estimates of expected future revenue; subject to change

Advertising Funds

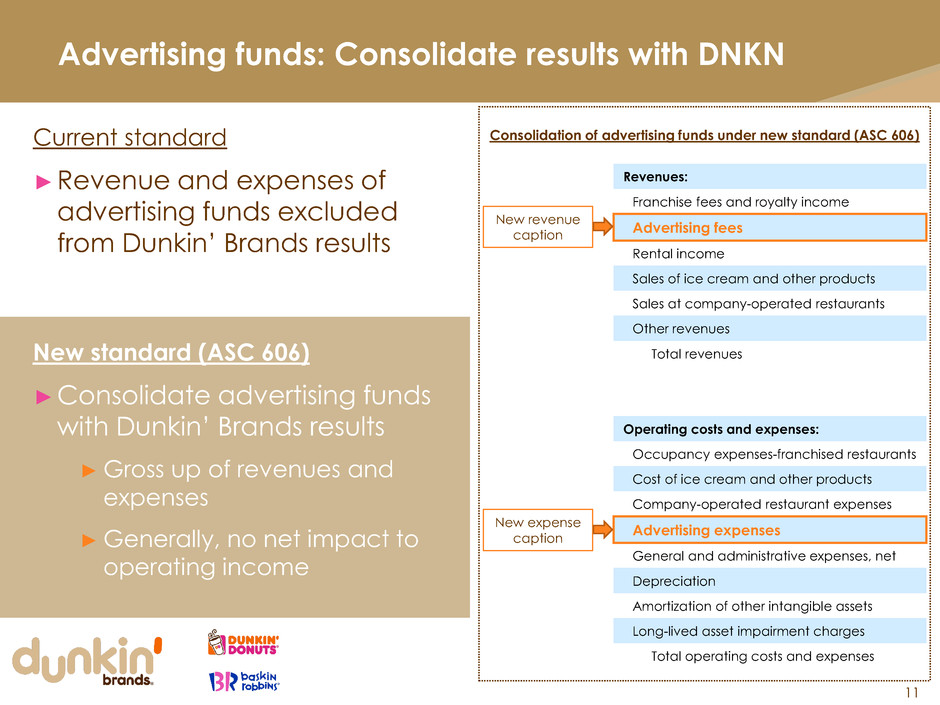

Advertising funds: Consolidate results with DNKN

11

Current standard

►Revenue and expenses of

advertising funds excluded

from Dunkin’ Brands results

Revenues:

Franchise fees and royalty income

Advertising fees

Rental income

Sales of ice cream and other products

Sales at company-operated restaurants

Other revenues

Total revenues

Operating costs and expenses:

Occupancy expenses-franchised restaurants

Cost of ice cream and other products

Company-operated restaurant expenses

Advertising expenses

General and administrative expenses, net

Depreciation

Amortization of other intangible assets

Long-lived asset impairment charges

Total operating costs and expenses

New standard (ASC 606)

►Consolidate advertising funds

with Dunkin’ Brands results

► Gross up of revenues and

expenses

►Generally, no net impact to

operating income

New revenue

caption

New expense

caption

Consolidation of advertising funds under new standard (ASC 606)

Advertising funds: Quantifying the impact

►FY16 franchisee contributions to U.S. advertising funds

►Advertising fund revenues and expenses will offset, except for:

► Fund in a cumulative deficit – expenses will exceed revenues

► Fund returns to a surplus – revenues will exceed expenses

12

$430M*

* Includes $403M and $27M to the Dunkin’ Donuts US

and Baskin-Robbins US advertising funds, respectively

Advertising fees $400M

Advertising expenses $401M

DNKN operating income impact ($1M)

Year 1

Cumulative Deficit

Year 2

Return to Cumulative Surplus

Example Consolidation of Advertising Funds

(for illustrative purposes only)

Advertising fees $420M

Advertising expenses $419M

DNKN operating income impact $1M

Transition Timeline

New standard (ASC 606) – Transition

14

Feb 2018 Mar 2018 Apr 2018 May 2018

Q4 2017 Earnings

Presented on a

current standard

basis

Q4 2017 Earnings

Disclosure of 2016

and 2017

financial

information

restated for the

new standard as

an appendix item

2018 Guidance

Provided on a

new standard

basis

2017 Form 10-K

Footnote disclosure

of 2016 and 2017

financial

information

restated for the

new standard

2017 Form 10-K

Presented on a

current standard

basis

Q1 2018 Earnings

Presented on a

new standard

basis

Q1 2018 Form 10-Q

Presented on a

new standard basis

Q4 2017 Reporting Q1 2018 Reporting

No financial information presented

under the current standard Cu

rre

n

t

St

an

d

ar

d

N

e

w

St

an

d

ar

d

Q&A

Revenue Recognition:

New Accounting Standard

November 16, 2017