Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BlueLinx Holdings Inc. | november2017investorpresen.htm |

BlueLinx

Investor Presentation

November 16, 2017

This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995. All of these forward-looking statements are based on estimates and assumptions made by our management

that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and

uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our

control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements.

These risks and uncertainties may include, among other things: changes in the prices, supply and/or demand for

products that it distributes; inventory management and commodities pricing; new housing starts and inventory levels of

existing homes for sale; general economic and business conditions in the United States; acceptance by our customers of

our privately branded products; financial condition and creditworthiness of our customers; supply from our key vendors;

reliability of the technologies we utilize; the activities of competitors, including consolidation of our competitors; changes

in significant operating expenses; fuel costs; risk of losses associated with accidents; exposure to product liability claims;

changes in the availability of capital and interest rates; adverse weather patterns or conditions; acts of cyber intrusion;

variations in the performance of the financial markets, including the credit markets; and other factors described in the

“Risk Factors” section in the Form S-3 filed with the Securities and Exchange Commission (“SEC”) on August 28, 2017

and the related prospectus supplement filed with the SEC on October 19, 2017, and in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2016, its quarterly Reports on Form 10-Q, and in its periodic reports filed

with the SEC from time to time. Given these risks and uncertainties, you are cautioned not to place undue reliance on

forward-looking statements. Unless otherwise indicated, all forward-looking statements are as of the date they are made,

and we undertake no obligation to update these forward-looking statements, whether as a result of new information, the

occurrence of future events, or otherwise.

Some of the forward-looking statements discuss the company’s plans, strategies, expectations and intentions. They use

words such as “expects”, “may”, “will”, “believes”, “should”, “approximately”, “anticipates”, “estimates”, “outlook”,

and “plans”, and other variations of these and similar words, and one or more of which may be used in a positive or

negative context.

Immaterial Rounding Differences - Immaterial rounding adjustments and differences may exist between slides, press

releases, and previously issued presentations.

Forward-Looking Statements

2

BlueLinx reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). The Company

also believes that presentation of certain non-GAAP measures may be useful to investors. Any non-GAAP measures used herein are reconciled to

the financial tables set forth in the appendices hereto. The Company cautions that non-GAAP measures should be considered in addition to, but

not as a substitute for, the Company’s reported GAAP results.

We define Adjusted EBITDA as an amount equal to net income plus interest expense and all interest expense related items, income taxes,

depreciation and amortization, and further adjusted to exclude certain non-cash items and other adjustments to Consolidated Net Income.

Further, we also exclude, as an additional measure, the effects of the operational efficiency initiatives, to determine same-center (comparable)

Adjusted EBITDA, which is useful for period over period comparability.

We present Adjusted EBITDA (and the exclusion of the effects of the operational efficiency initiatives) because it is a primary measure used by

management to evaluate operating performance and, we believe, helps to enhance investors’ overall understanding of the financial performance

and cash flows of our business. However, Adjusted EBITDA is not a presentation made in accordance with GAAP, and is not intended to present

a superior measure of the financial condition from those determined under GAAP. Adjusted EBITDA, as used herein, is not necessarily

comparable to other similarly titled captions of other companies due to differences in methods of calculation. We believe Adjusted EBITDA is

helpful in highlighting operating trends. We also believe that Adjusted EBITDA is frequently used by securities analysts, investors and other

interested parties in their evaluation of companies, many of which present an Adjusted EBITDA measure when reporting their results. We

compensate for the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete

understanding of the factors and trends affecting the business than using GAAP results alone.

We define the non-GAAP metrics of adjusted same-center (comparable) net sales and adjusted same-center (comparable) gross profit as net sales

and gross profit excluding the effects of both closed facilities and the inventory rationalization initiative. These measures are not a presentation

made in accordance with GAAP, and are not intended to present a superior measure of the financial condition from those determined under

GAAP. Adjusted same-center net sales and adjusted same-center gross profit, as used herein, are not necessarily comparable to other similarly

titled captions of other companies due to differences in methods of calculation.

We believe adjusted same-center net sales and adjusted same-center gross profit are helpful in presenting comparability across periods without

the full-year effect of our operational efficiency initiatives. We also believe that these non-GAAP metrics are used by securities analysts, investors,

and other interested parties in their evaluation of our company, to illustrate the effects of these initiatives. We compensate for the limitations of

using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete understanding of the factors and

trends affecting the business than using GAAP results alone.

We believe supplementary GAAP-based information such as operating working capital and debt principal are helpful to investors in explaining

the impacts of our operating efficiencies. Operating working capital is defined as current assets less current liabilities plus the current portion of

long-term debt. Operating working capital is an important measure we use to determine the efficiencies of our operations and our ability to

readily convert assets into cash. Debt principal is defined as the principal amount of debt payable at the stated period-end date and is used by

management to monitor our progress in meeting our goals to reduce the debt on our balance sheet.

Non-GAAP Financial Measures

3

Executive Management

4

Executive Time Period Role

Mitchell B. Lewis,

CEO, President and

Director

2014 – Present

2008 – 2014

1998 - 2008

1992 – 1998

1987 – 1989

CEO, BlueLinx

CEO, Euramax International

SVP, EVP, COO Euramax International

President, Amerimax Building Products

Attorney, Alston & Bird LLP

Susan C. O’Farrell,

CFO and Treasurer

2014 – Present

1999 – 2014

1996 – 1999

1984 – 1996

CFO and Treasurer, BlueLinx

VP of Finance, The Home Depot

Director, Southern Company Gas

Associate Partner, Accenture

Shyam K. Reddy,

Chief Admin. Officer,

General Counsel and

Corporate Secretary

2015 – Present

2013 – 2015

2010 – 2013

2000 – 2010

Chief Administrative Officer, General Counsel &

Corporate Secretary, BlueLinx

Chief Administrative Officer, General Counsel &

Corporate Secretary, Euramax International

Regional Administrator, U.S. GSA

Partner, Kilpatrick Townsend & Stockton LLP

Boa

rd of

D

ir

ect

o

rs

Dom DiNapoli, Director Kim S. Fennebresque, Chairman

Mitchell B. Lewis, Director

Alan H. Schumacher, Director

J. David Smith, Director Steven F. Mayer, Director

John Tisera,

SVP Sales & Marketing

2017 – Present

2015 – 2016

2006 – 2015

2003 – 2006

1988 - 2003

Senior Vice President, Sales & Marketing, BlueLinx

Executive Vice President, Anixter Power Solutions

President, HD Power Solutions, HD Supply Crown Bolt

VP Sales, Stanley, Black & Decker

Sales & Operational leadership roles at General Electric

BlueLinx Overview

BlueLinx operates 39 warehouses across the central and

eastern United States with approximately 1,600 employees

Revenue generated from the sale of structural and

specialty products

Structural and specialty products are utilized in home

construction

The company offers over 10,000 branded and private-

label products

BlueLinx also provides a wide-range of value-added

services, including:

Milling & fabrication services

“Less-than-truckload” delivery services

Inventory stocking & automated order processing

Backhaul services

Several end markets including new residential and light

commercial construction, industrial OEM, and residential

repair & remodel

Bluelinx’s product suite provides a “one-stop” shopping

experience for its customers

Denotes corporate headquarters in Atlanta, Georgia

NATIONAL FOOTPRINT

STRUCTURAL PRODUCTS

Representative

Products

Lumber

Plywood

Rebar

Remesh

Oriented Strand Board

SPECIALTY PRODUCTS

Representative

Products

Outdoor Living

Particle Board

Insulation

Moulding

Roofing & Siding

Engineered Lumber

5

Diversified Customer Base

Industrial

Manufacturers

Makers of furniture,

sheds, crates and other

wood-based products

Regional

Dealers

Contractors, builders,

renovators and other

end-users

National

Dealers

Contractors, builders,

renovators and other

end-users

Home Improvement

Centers

Retailers with national

scale

Manufactured

Housing

Makers of mobile

homes, prefab homes

and RVs

BlueLinx has an extensive roster of high-quality national and regional customers

6

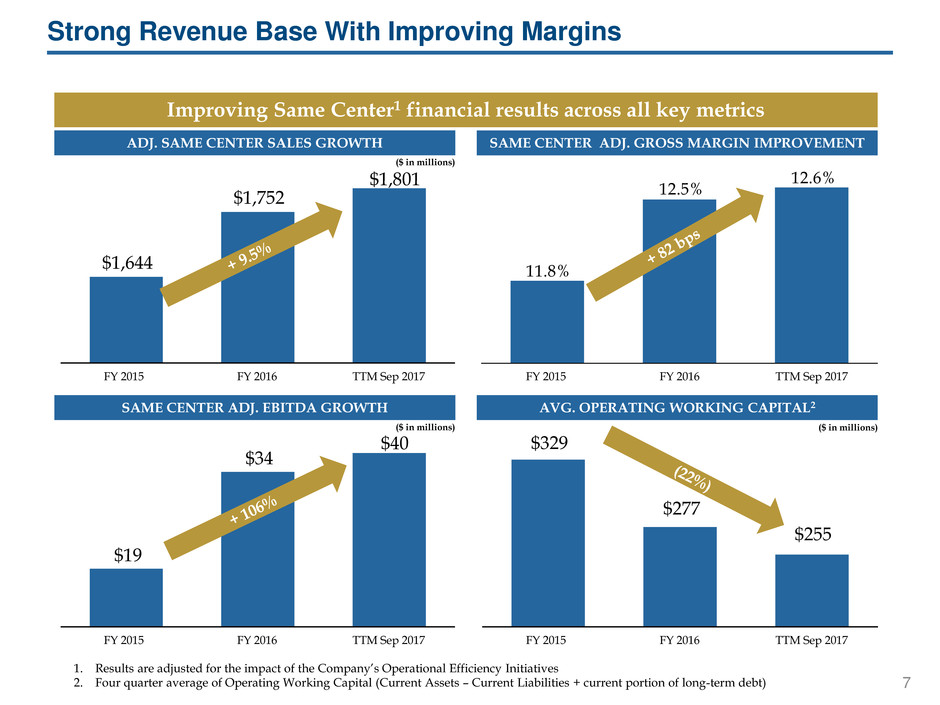

Strong Revenue Base With Improving Margins

1. Results are adjusted for the impact of the Company’s Operational Efficiency Initiatives

2. Four quarter average of Operating Working Capital (Current Assets – Current Liabilities + current portion of long-term debt)

Improving Same Center1 financial results across all key metrics

$1,644

$1,752

$1,801

FY 2016 TTM Sep 2017 FY 2015

ADJ. SAME CENTER SALES GROWTH

12.6%

12.5%

11.8%

FY 2016 TTM Sep 2017 FY 2015

SAME CENTER ADJ. GROSS MARGIN IMPROVEMENT

$19

$34

$40

TTM Sep 2017 FY 2015 FY 2016

SAME CENTER ADJ. EBITDA GROWTH

$329

$277

$255

FY 2016 TTM Sep 2017 FY 2015

AVG. OPERATING WORKING CAPITAL2

($ in millions)

($ in millions) ($ in millions)

7

Investment Highlights

OPPORTUNITY TO DE-LEVER THROUGH REAL ESTATE MONETIZATION 4

INDUSTRY CONSOLIDATION 2

LEVERAGING TECHNOLOGY TO ENHANCE MARGIN 3

ABILITY TO CAPITALIZE ON STRONG HOUSING MARKET MOMENTUM 1

8

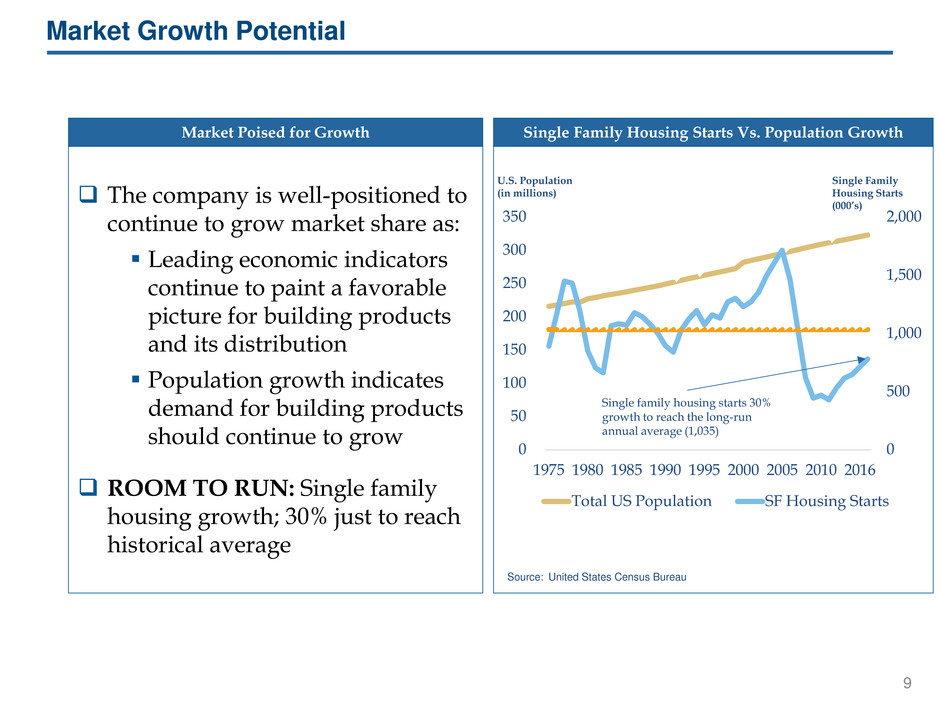

Market Growth Potential

Source: United States Census Bureau

Single Family Housing Starts Vs. Population Growth

0

500

1,000

1,500

2,000

0

50

100

150

200

250

300

350

1975 1980 1985 1990 1995 2000 2005 2010 2016

Total US Population SF Housing Starts

U.S. Population

(in millions)

Single Family

Housing Starts

(000’s)

Single family housing starts 30%

growth to reach the long-run

annual average (1,035)

The company is well-positioned to

continue to grow market share as:

Leading economic indicators

continue to paint a favorable

picture for building products

and its distribution

Population growth indicates

demand for building products

should continue to grow

ROOM TO RUN: Single family

housing growth; 30% just to reach

historical average

Market Poised for Growth

9

Ma

n

u

factu

re

s

Weyerhaeuser / Plum Creek

Boise Cascade / Wood

Products LLC

Boise Cascade / Georgia

Pacific EWP

West Fraser / Gilman

Canfor / Anthony Forest

Products

Norbord / Ainsworth

Benefits of Consolidation

BXC benefits from wholesale distribution consolidation in a number of ways

Enables BXC to capture market share through market disruption

Greater institutional involvement in the space

Relevance to manufacturers is enhanced

Tw

o

-S

te

p

D

ist

ri

b

u

to

rs

US Lumber / Madison

Dearborn Partners

NILCO / Platinum Equity

US Lumber / NILCO

Lumbe

ry

a

rds

/

R

et

a

il

er

s

BMC / Stock Building

Supply

Builders FirstSource /

ProBuild

US LBM / Ridout Lumber

Recent Consolidation

Industry Consolidation

10

Developed

Internally

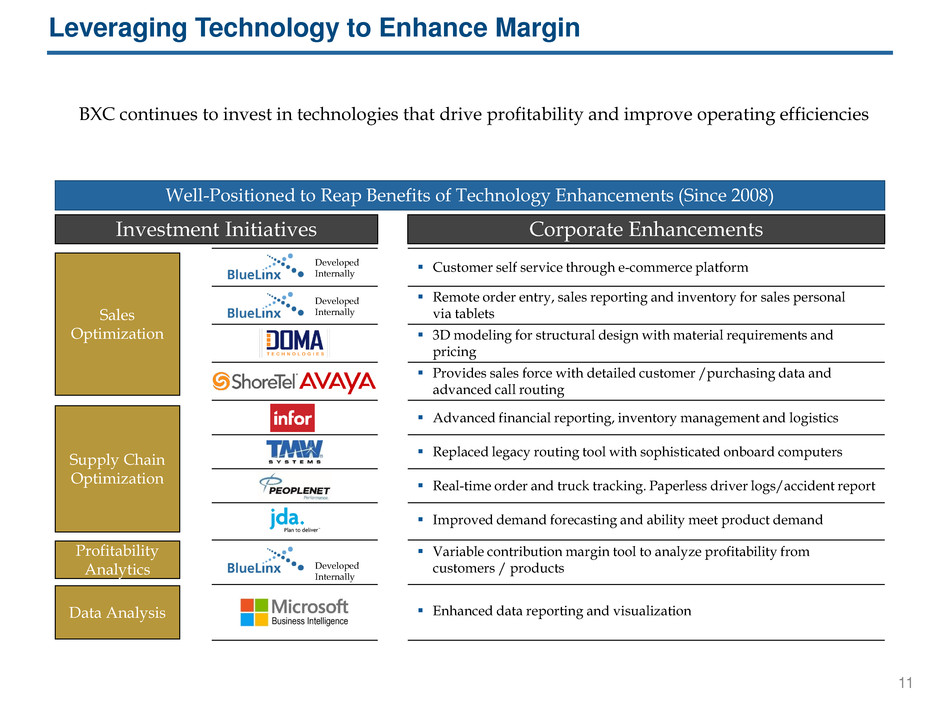

Well-Positioned to Reap Benefits of Technology Enhancements (Since 2008)

Investment Initiatives Corporate Enhancements

Data Analysis

Sales

Optimization

Profitability

Analytics

Replaced legacy routing tool with sophisticated onboard computers

3D modeling for structural design with material requirements and

pricing

Variable contribution margin tool to analyze profitability from

customers / products

Remote order entry, sales reporting and inventory for sales personal

via tablets

Customer self service through e-commerce platform

Enhanced data reporting and visualization

Supply Chain

Optimization

Improved demand forecasting and ability meet product demand

Real-time order and truck tracking. Paperless driver logs/accident report

Advanced financial reporting, inventory management and logistics

Provides sales force with detailed customer /purchasing data and

advanced call routing

BXC continues to invest in technologies that drive profitability and improve operating efficiencies

Developed

Internally

Developed

Internally

Leveraging Technology to Enhance Margin

11

BlueLinx Leverage with Sale Leasebacks

7.9x

6.1x

2.3x

1 Assumes a 9% cap rate on sale leasebacks and 50% rent expense/50% mortgage interest

Leverage Sensitivity Analysis

Illustrative Sale Leaseback Sensitivity

With $98M SLB With $250M SLB

Credit Facility 218$ 218$ 66$

CMBS Mortgage Loan Balance 98 0 0

Total Bank Debt 316$ 218$ 66$

Net Proceeds from Sale Leasebacks 0 98 250

TTM dj. EBITDA 40 40 40

Rent Expense for Sale-Leasebacks 1 0 (4) (11)

TTM Adj. EBITDA less Rent Expense 40$ 36$ 29$

Total Bank Debt / Adjusted EBITDA 7.9x 6.1x 2.3x

Q3 2017 Actual

Pro Forma

The value of our underlying real estate is important when assessing BlueLinx leverage

Today $98M SLB $250M SLB

In millions

12

Opportunity to Delever

Key Initiatives

The Company’s initiatives seek to solidify its place as a market leader

Emphasize Sales

Growth

Emphasize local

customer interaction to

grow market share

Develop and deploy

best practices in selling

processes

Prioritize

underpenetrated

markets and products

1

Closely Manage Real

Estate Value and

Working Capital

Management

Assessing sale of

certain real estate

assets

Continue working

capital emphasis

3

Enhance Margins

Emphasis on products

and markets with high

margin profiles

Differentiate offering

based on customer

characteristics

Maintain price

discipline with

systematic pricing

processes

2

America’s Building Products Distributor

13

Strong Collateral Base

BlueLinx’s real estate and working capital are substantially greater than its bank debt

The Company has high-quality ABL

collateral, significantly exceeding the

total net ABL debt

o Inventory with quick turnover and low

obsolescence

o Relatively low bad debt expense over

the last three years

Real estate value well above the

associated mortgage debt

Excellent recovery of working capital

assets from 2016 strategic initiatives

o Inventory: ~94%

o Accounts Receivable: ~99%

1. Based on extrapolation of net proceeds from 13 property sales in 2016/2017 relative to their net book value

2. Revolving Credit Facility, net of balance sheet cash of $4.8M

Capitalization ($ millions) 9/30/2017

Working Capital

Accounts Receivable 174

Inventory 207

Total Working Capital Assets 381

Total Net ABL Debt1 (212)

Working Capital Asset Value Above ABL 168

BlueLinx Estimated Real Estate1 269

Total Mortgage Debt (98)

Real Estate Value Above Mortgage Debt 171

Revolving Credit Facility2 212

Existing CMBS Loan 98

Total Net Debt 310

Total Working Capital & RE Value Above Debt 340

Leverage & Asset Ratios

(A/R + Inventory) / (Total Net ABL Debt) 1.8x

Total Assets / Total Net Debt 2.1x

14

$335

$291

$255

6.7%

12.0%

15.6%

1.0%

3.0%

5.0%

7.0%

9.0%

11.0%

13.0%

15.0%

17.0%

$0

$50

$100

$150

$200

$250

$300

$350

$400

Q3 '15 Q3 '16 Q3 '17

Operating Working Capital ROWC

Q3 Return on Working Capital Trend

Return on Working Capital: TTM Adjusted EBITDA / TTM Average Operating Working Capital

Operating Working Capital: Current Assets less Current Liabilities plus the current portion of long-term debt

Q3 '15 Q3 '16 Q3 '17

TTM Adj. EBITDA $22.5M $34.9M $39.8M

Avg. Operating Working Capital $335M $291M $255M

Adjusted ROWC 6.7% 12.0% 15.6%

Successful Reduction of Working Capital

Accelerating operating

performance with

Adjusted EBITDA

growth and working

capital reductions

($ in millions)

15

Real estate monetization has generated proceeds that

provided opportunities to continue to delever

4

Continued consolidation in the market likely to

provide near-term opportunities for market-share

capture

3

Strategically positioned professionals to capitalize on

positive momentum in single family housing industry

To date, BlueLinx has largely executed on its strategic

objectives and is well-positioned for continued outperformance

America’s Building Products Distributor

Demonstrated operational improvement and efficiency

expected to facilitate future growth

1

Conclusion

2

16

Conclusion

16

Appendix

Statements of Income

In thousands, except per share data

(unaudited)

2017 2016 2017 2016

Q3 Q3 Q3 YTD Q3 YTD

Net sales $ 479,318 $ 476,049 $ 1,381,927 $ 1,459,386

Cost of sales 418,773 415,999 1,206,402 1,284,354

Gross profit 60,545 60,050 175,525 175,032

Operating expenses (income):

Selling, general, and administrative 46,817 49,152 148,742 157,006

Gains from sales of property — (13,940 ) (6,700 ) (14,701 )

Depreciation and amortization 2,249 2,220 6,865 7,091

Total operating expenses 49,066 37,432 148,907 149,396

Operating income 11,479 22,618 26,618 25,636

Non-operating expenses (income):

Interest expense 5,670 6,105 16,280 19,562

Other income, net — (17 ) (2 ) (255 )

Income before provision for income taxes 5,809 16,530 10,340 6,329

Provision for income taxes 123 1,522 832 609

Net income $ 5,686 $ 15,008 $ 9,508 $ 5,720

Basic earnings per share $ 0.63 $ 1.69 $ 1.05 $ 0.64

Diluted earnings per share $ 0.62 $ 1.68 $ 1.04 $ 0.64

18

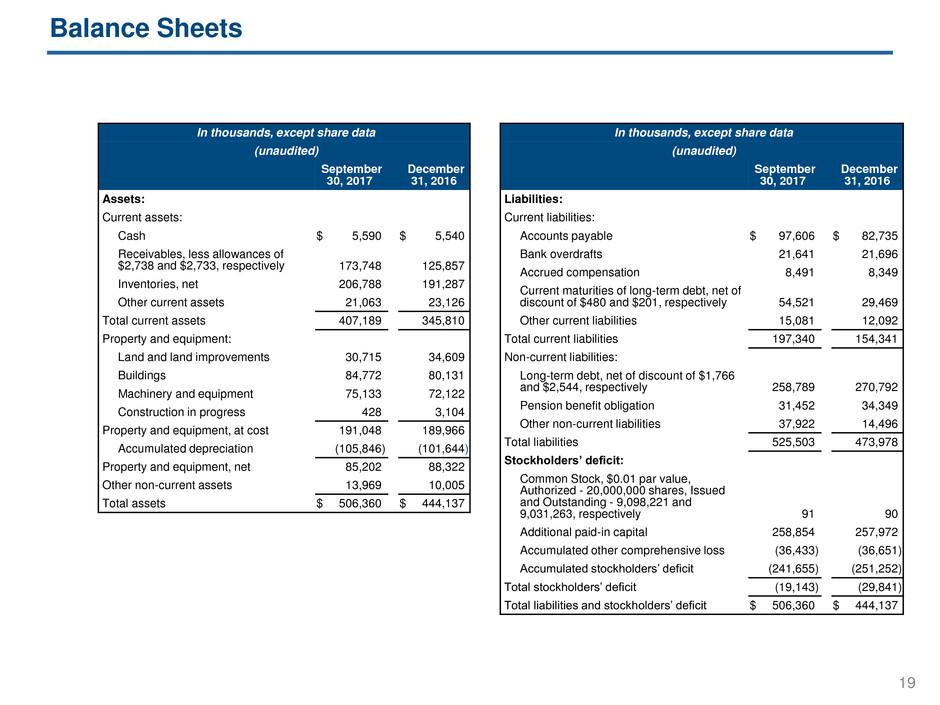

Balance Sheets

In thousands, except share data

(unaudited)

September

30, 2017

December

31, 2016

Assets:

Current assets:

Cash $ 5,590 $ 5,540

Receivables, less allowances of

$2,738 and $2,733, respectively 173,748 125,857

Inventories, net 206,788 191,287

Other current assets 21,063 23,126

Total current assets 407,189 345,810

Property and equipment:

Land and land improvements 30,715 34,609

Buildings 84,772 80,131

Machinery and equipment 75,133 72,122

Construction in progress 428 3,104

Property and equipment, at cost 191,048 189,966

Accumulated depreciation (105,846 ) (101,644 )

Property and equipment, net 85,202 88,322

Other non-current assets 13,969 10,005

Total assets $ 506,360 $ 444,137

In thousands, except share data

(unaudited)

September

30, 2017

December

31, 2016

Liabilities:

Current liabilities:

Accounts payable $ 97,606 $ 82,735

Bank overdrafts 21,641 21,696

Accrued compensation 8,491 8,349

Current maturities of long-term debt, net of

discount of $480 and $201, respectively 54,521 29,469

Other current liabilities 15,081 12,092

Total current liabilities 197,340 154,341

Non-current liabilities:

Long-term debt, net of discount of $1,766

and $2,544, respectively 258,789 270,792

Pension benefit obligation 31,452 34,349

Other non-current liabilities 37,922 14,496

Total liabilities 525,503 473,978

Stockholders’ deficit:

Common Stock, $0.01 par value,

Authorized - 20,000,000 shares, Issued

and Outstanding - 9,098,221 and

9,031,263, respectively 91 90

Additional paid-in capital 258,854 257,972

Accumulated other comprehensive loss (36,433 ) (36,651 )

Accumulated stockholders’ deficit (241,655 ) (251,252 )

Total stockholders’ deficit (19,143 ) (29,841 )

Total liabilities and stockholders’ deficit $ 506,360 $ 444,137

19

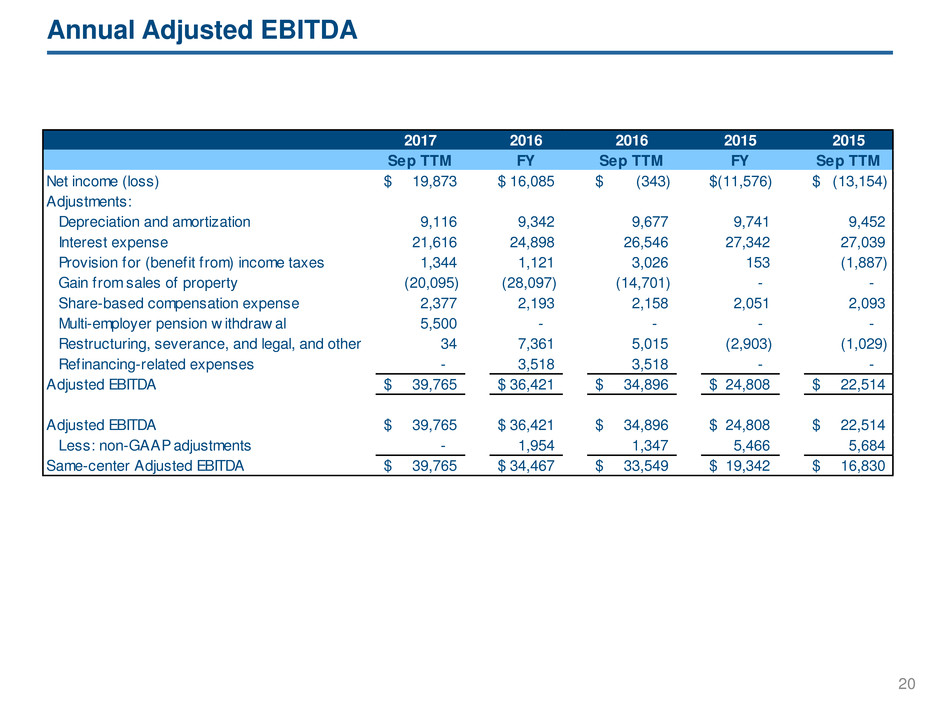

Annual Adjusted EBITDA

20

2017 2016 2016 2015 2015

Sep TTM FY Sep TTM FY Sep TTM

Net income (loss) $ 19,873 $ 16,085 $ (343) $(11,576) $ (13,154)

Adjustments:

Depreciation and amortization 9,116 9,342 9,677 9,741 9,452

Interest expense 21,616 24,898 26,546 27,342 27,039

Provision for (benefit from) income taxes 1,344 1,121 3,026 153 (1,887)

Gain from sales of property (20,095) (28,097) (14,701) - -

Share-based compensation expense 2,377 2,193 2,158 2,051 2,093

Multi-employer pension w ithdraw al 5,500 - - - -

Restructuring, severance, and legal, and other 34 7,361 5,015 (2,903) (1,029)

Refinancing-related expenses - 3,518 3,518 - -

Adjusted EBITDA $ 39,765 $ 36,421 $ 34,896 $ 24,808 $ 22,514

Adjusted EBITDA $ 39,765 $ 36,421 $ 34,896 $ 24,808 $ 22,514

Less: non-GAAP adjustments - 1,954 1,347 5,466 5,684

Same-center Adjusted EBITDA $ 39,765 $ 34,467 $ 33,549 $ 19,342 $ 16,830

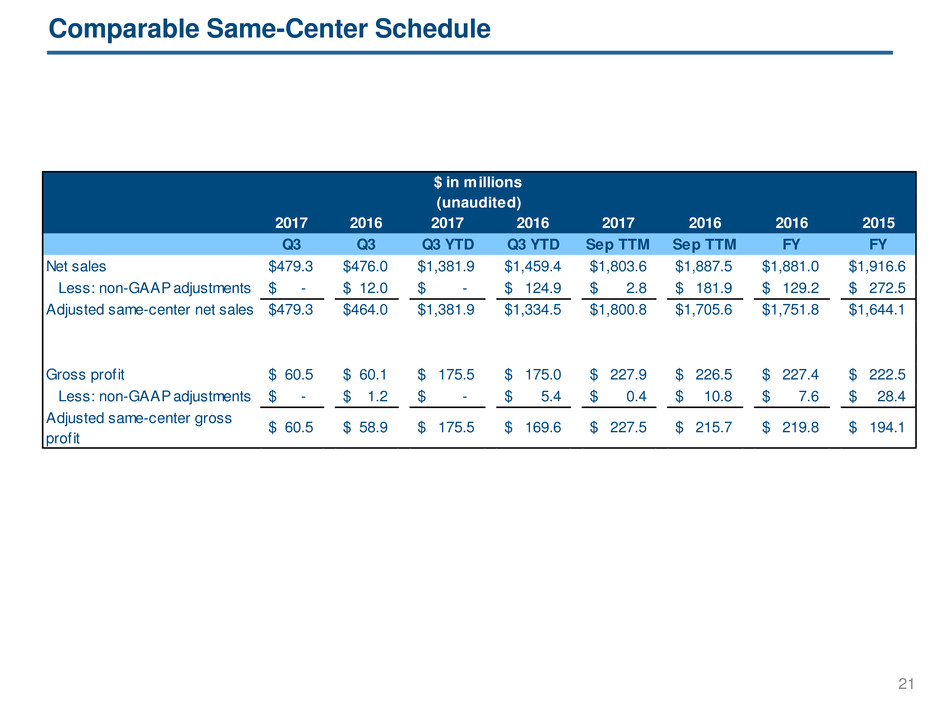

Comparable Same-Center Schedule

21

2017 2016 2017 2016 2017 2016 2016 2015

Q3 Q3 Q3 YTD Q3 YTD Sep TTM Sep TTM FY FY

Net sales $479.3 $476.0 $1,381.9 $1,459.4 $1,803.6 $1,887.5 $1,881.0 $1,916.6

Less: non-GAAP adjustments $ - $ 12.0 $ - $ 124.9 $ 2.8 $ 181.9 $ 129.2 $ 272.5

Adjusted same-center net sales $479.3 $464.0 $1,381.9 $1,334.5 $1,800.8 $1,705.6 $1,751.8 $1,644.1

Gross profit $ 60.5 $ 60.1 $ 175.5 $ 175.0 $ 227.9 $ 226.5 $ 227.4 $ 222.5

Less: non-GAAP adjustments $ - $ 1.2 $ - $ 5.4 $ 0.4 $ 10.8 $ 7.6 $ 28.4

Adjusted same-center gross

profit

$ 60.5 $ 58.9 $ 175.5 $ 169.6 $ 227.5 $ 215.7 $ 219.8 $ 194.1

$ in millions

(unaudited)

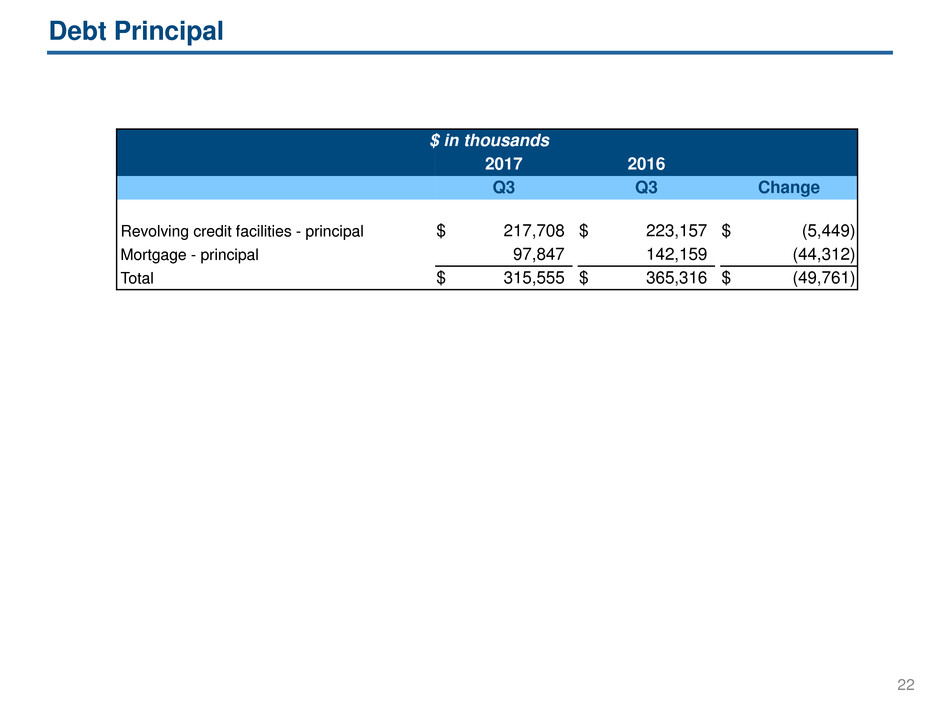

Debt Principal

$ in thousands

2017 2016

Q3 Q3 Change

Revolving credit facilities - principal $ 217,708 $ 223,157 $ (5,449 )

Mortgage - principal 97,847 142,159 (44,312 )

Total $ 315,555 $ 365,316 $ (49,761 )

22

Operating Working Capital

$ in thousands

2017 2016

Q3 Q3 Change

Current assets:

Cash $ 5,590 $ 4,704 $ 886

Receivables, less allowance for doubtful

accounts 173,748 163,388 10,360

Inventories, net 206,788 207,909 (1,121 )

Other current assets 21,063 25,176 (4,113 )

Total current assets $ 407,189 $ 401,177 $ 6,012

Current liabilities:

Accounts Payable (1) $ 119,247 $ 109,331 $ 9,916

Accrued compensation 8,491 7,581 910

Current maturities of long-term debt, net of

discount 54,521 44,909 9,612

Other current liabilities 15,081 12,728 2,353

Total current liabilities $ 197,340 $ 174,549 $ 22,791

Operating working capital $ 264,370 $ 271,537 $ (7,167 )

(1) Accounts payable includes bank overdrafts

23

Please reference our

Earnings Release and 10-Q

available on our website

www.BlueLinxCo.com