Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGIONS FINANCIAL CORP | rf2017-1114ir.htm |

Bank of America Merrill Lynch

Conference

“Future of Financials”

November 15, 2017

Scott Peters

Consumer Services Group Head

Logan Pichel

Consumer Lending Group Head

Exhibit 99.1

Strategic initiatives

2

GROW AND DIVERSIFY REVENUE

▪ Leverage to grow customers and households and deepen

existing relationships

▪ Prudently grow non-interest income

▪ Balance growth across geographies and businesses

DISCIPLINED EXPENSE MANAGEMENT

▪ Majority of $400MM in expense saves by 2018

▪ Continuously focus on efficiency and effectiveness

▪ Generate positive operating leverage

OPTIMIZE AND EFFECTIVELY DEPLOY REGULATRORY CAPITAL

▪ Attractive ROA and Risk Adjusted Returns

▪ Return appropriate capital to shareholders

®

Consumer

56%

Corporate

33%

Wealth

11%

3

Consumer Bank leading the way

Demonstrated track record of growth

Consumer Growth Metrics

• Strong deposit balance growth while

maintaining pricing discipline

• Solid account growth

• Consumer exports ~$100MM in revenue to

other businesses

• Positive Operating Leverage each

year ‘15-17

• Efficiency ratio improved

~330bps ‘15–17

1 September YTD results as reported in 3Q17 Form 10-Q

2 Excludes Other revenue

$2,316

$2,362

$2,429

2015 2016 2017

Consumer Total Revenue (1)

September YTD ($ millions)

$563

$603

$668

2015 2016 2017

Consumer Pre-Tax Income (1)

September YTD ($ millions)

Total Revenue(1,2)

®

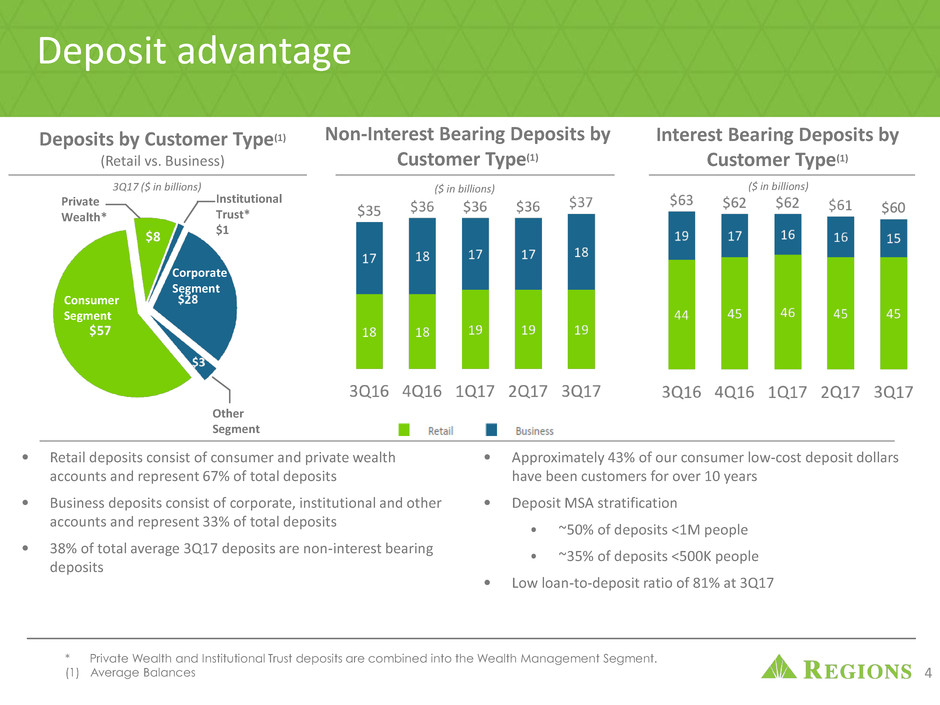

Interest Bearing Deposits by

Customer Type(1)

($ in billions)

Non-Interest Bearing Deposits by

Customer Type(1)

($ in billions)

Other

Segment

Deposit advantage

Deposits by Customer Type(1)

(Retail vs. Business)

• Retail deposits consist of consumer and private wealth

accounts and represent 67% of total deposits

• Business deposits consist of corporate, institutional and other

accounts and represent 33% of total deposits

• 38% of total average 3Q17 deposits are non-interest bearing

deposits

• Approximately 43% of our consumer low-cost deposit dollars

have been customers for over 10 years

• Deposit MSA stratification

⦁ ~50% of deposits <1M people

⦁ ~35% of deposits <500K people

• Low loan-to-deposit ratio of 81% at 3Q17

Consumer

Segment

Private

Wealth*

Corporate

Segment

Institutional

Trust*

$1

* Private Wealth and Institutional Trust deposits are combined into the Wealth Management Segment.

(1) Average Balances

3Q17 ($ in billions)

4

5

Helping customers make better financial decisions

Consumers + Small Businesses

Creating a seamless experience

DIGITAL

ENHANCEMENTS

REMOVE FRICTION &

CREATE EFFICIENCIES

Optimizing

Network and

Loan Portfolios

RESHAPE &

EXPAND

DISTRIBUTION

Leveraging Innovation

✓ New responsive platform

✓ Optimized application and reduced abandonment

✓ Behaviorally targeted ads and advice

✓ Personalized product recommendations

✓ Driving adoption of underutilized sticky services

✓ Optimizing Digital Account Opening

✓ Single Sign On for Consumer/Small Business accounts

Virtual Assistant (rolling out in 2018)

Enhanced 2-way alerts through partnership with FICO (rolling out in 2018)

Key Outcomes:

• 30% increase in digital checking account openings YTD

• 99% increase in mobile deposits and 30% increase in mobile deposit fee income

• Agile environment promotes 4x increased speed to market for new releases

6

6

Digital Enhancements

Providing everything you need at your finger tips

A seamless experience delivered in an Agile environment

Regions Digital Assistant

7

✓ Actively deploy advice, guidance and education content to

customers and prospects through digital and banker channels

✓ Developed and deployed “Build Best Banker (B3)” training

program for retail associates

✓ Launched guided needs assessment tool in branch and digital

Key Outcomes:

• Since 2015, over 700 pieces of advice, guidance and education

content produced with >5 million page views

• Customers engaging with content are 2.25x more likely to

complete online application

• ~4,000 bankers certified through B3 training

Advice, Guidance, and Education

Meeting needs faster and smarter

At every point of customer interaction

7

✓ Targeted and timely customer offers and messages across

channels

✓ Enables targeting of messages throughout entire customer and

prospect lifecycle

✓ Aggregated data and automated decisioning drives an “always

on” environment

✓ Analytics determine the optimal offer and refine ongoing

activities

✓ Continuously learning which improves messaging effectiveness

Key Outcomes:

• Delivering >8 million targeted intercept messages monthly

• Generating over 25% return on investment

Addressable Marketing System

8

8

LockIt

✓ Enhanced card security for both credit and debit

✓ Seamlessly turn transaction types on or off through mobile

device

✓ Pilot rolled out Nov. 1 with full rollout in 2018

✓ Launched in 2017

✓ Leverages customer deposits

✓ Provides credit solutions for everyone

✓ Accounting for ~20% of total new cards monthly

Secured Credit Card

✓ Top performing debit card portfolio for 14 consecutive

quarters(1)

✓ Participate in Apple Pay, Samsung Pay, Android Pay and Visa

Checkout

Debit Card

(1) Visa Quarterly Power Score Survey

Comprehensive and expanding payment solutions

Early participant in all payment networks

TM

✓ Providing unique payment solutions to meet customer needs

✓ Differentiated remote deposit options that allow for expedited

availability of funds

✓ Check cashing solutions across channels

✓ Western Union bill payment and money transfer

✓ General Purpose Reloadable card solution

Key Outcomes:

• Meeting needs for ~575,000 Now Banking households

• 41% CAGR in mobile check cashing revenue last 3 years of

program

Enhanced person-to-person payments

will be rolled out early 2018

9

NOW BANKING ®

Comprehensive and expanding payment solutions

Early participant in all payment networks (continued)

10

Retail Network Strategy

• Critical component of our go to market strategy

• Consolidate non-strategic and lower performing locations

• Adding distribution in dense fast growing markets in our footprint

• Goal: 10% decrease in branches and 10% increase in bankable population

Target Growth Markets

Closed Branches (16-17)

10

The right branches in the right places

Retail network strategy

✓ By the end of 2017 - 163 consolidations & ~10% reduction in

branches since Investor Day 2015

✓ 21% reduction in branches since YE 2009

1895

1627

1489

2009 YE 2015 YE 2017 YTD

Branch Count

75% Routine Transactions

25% Customer Value Add

75% Customer Value Add

25% Routine Transactions

Historic

State:

Target

State:

▪ Customer completes routine transactions digitally

▪ Customers rely on branch bankers to help make better financial

decisions

▪ All associates will be revenue generating

▪ Reduced ~1,300 Tellers (23%) since Jan 2016 with more to come

▪ Trained Bankers now exceed Tellers in FTE count

▪ Customer completes routine transactions in the branch

▪ Customers rely on branch bankers to help make better financial

decisions

▪ Staffing two job families to peak times creates latency

11

Making Banking Easier strives to move routine transactions out of the branch to other channels and

increase the focus on high value interactions

11

Improving the customer experience in the branch

Making Banking Easier

✓ Launched responsive design for Regions.com allowing customers

seamless access from any device

✓ Leveraging artificial intelligence to meet customer needs in contact

center, while reducing headcount

✓ Provided small business customers single sign on capability to access

personal and business accounts

✓ Fully deployed deposit smart ATM fleet

✓ Remote deposit platform with multiple availability options migrating

routine transactions to lower cost channel

✓ E-signature capabilities provide for significant improvement

opportunities in back-end processes

Launch Paid Solutions for Small Businesses in online banking

Key Outcomes:

• Regions ranked 2nd out of 257 companies across 20 industries in the

2016 Temkin Web Experience Ratings

• Consumer Bank efficiency ratio improvement of ~330 bps over last 3

years

12

12

Continuous Improvement

Reducing friction while creating efficiencies

Journey of continuous improvement

✓ In 2010 high concentration of real-estate

✓ Needed to create better diversification in the portfolio

✓ Expanded indirect auto lending with dealerships

✓ Developed a point-of-sale relationship

✓ Purchased our credit card portfolio and continued to

expand

✓ Piloted a fully digital loan experience

13

Diversifying the consumer loan portfolio

Loan Diversification Strategy and

Accomplishments

Innovation driving consumer loan growth

✓ Originated $3.0B in production and $1.2B in balances since program

inception in December 2014

✓ Completed first bulk purchase of $138MM in June 2017

✓ Recently expanded our commitment from $1.0B to $2.0B

✓ Exceeding volume expectations and meeting credit expectations

Next Step: Looking to add additional partnerships

GreenSky® / Indirect Lending Other

Fully digital loan originations / Direct Lending

✓ Growing rapidly, represents almost 10% of direct loan production

✓ 500% increase in digital lending in last year

✓ Maintained high credit quality standards

Next Step: Expand to other products beyond unsecured lines of credit

to all consumer loan products

Non-Real Estate Consumer Loan

Balances

($ in millions)

1.8

2.2

0.2

1.3

0.9

1.1

1.0

1.2

$3.9

$5.8

12/31/2014 9/30/2017

14

Leveraging innovation with lending capabilities

15

Fully Digital Loan Experience

Regions.com ………. Online Banking

• Changing customer expectations

• Create a better customer experience

• Increase productivity of bankers

• Leverage partnerships with Avant® and

FundationTM

• Expand online lending capabilities

• Pre-approved loans

• No application process

• Click to accept terms and receive

funds

Online Application for Small Business Loans and Lines of Credit

Funds for working capital to manage

cash flow or for inventory

Funds for business expansion or

capital improvements

Funds to purchase equipment Funds to purchase real estate or

to refinance a loan on real estate

• Average time to complete

application: 5 minutes

• Average decision time: 3 seconds

• % of loans funded same day: 35%

• Regions + Avant®: August 2016

• Regions + FundationTM: August 2015

• Regions Online Banking: July 2017

Our Quickest Loan Application. Designed Just for You.

Creating a fully digital loan experience for all consumer loans

Universal Application

• Online applications

• Device-driven responsiveness

• Phones, tablets, PCs, etc.

Information Collection

• Document upload

• Automated data retrieval

Digital Closing

• eSignature

• eDelivery

Processing

• Automated decision making

• Status alerts

• Document imaging

• Workflow automation

Digital Servicing

• Automated boarding

• Electronic statements

• Online payments

• Maintenance

16

New online application for

mortgage and home equity

loans/lines (Dec. 2017)

• 48% fewer questions

• Device-driven responsiveness

• Intuitive questions

• Prefills customer information

• Reduces application time to

< 5 minutes

Our goal… make it easier for consumers to borrow

and develop a more productive banker

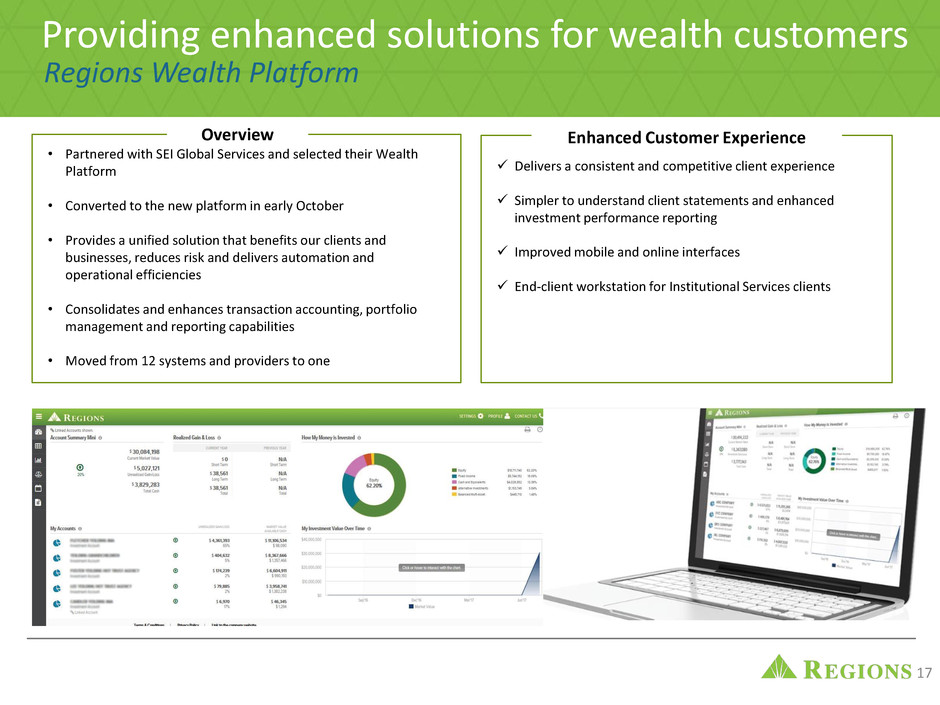

Overview Enhanced Customer Experience

✓ Delivers a consistent and competitive client experience

✓ Simpler to understand client statements and enhanced

investment performance reporting

✓ Improved mobile and online interfaces

✓ End-client workstation for Institutional Services clients

• Partnered with SEI Global Services and selected their Wealth

Platform

• Converted to the new platform in early October

• Provides a unified solution that benefits our clients and

businesses, reduces risk and delivers automation and

operational efficiencies

• Consolidates and enhances transaction accounting, portfolio

management and reporting capabilities

• Moved from 12 systems and providers to one

17

Providing enhanced solutions for wealth customers

Regions Wealth Platform

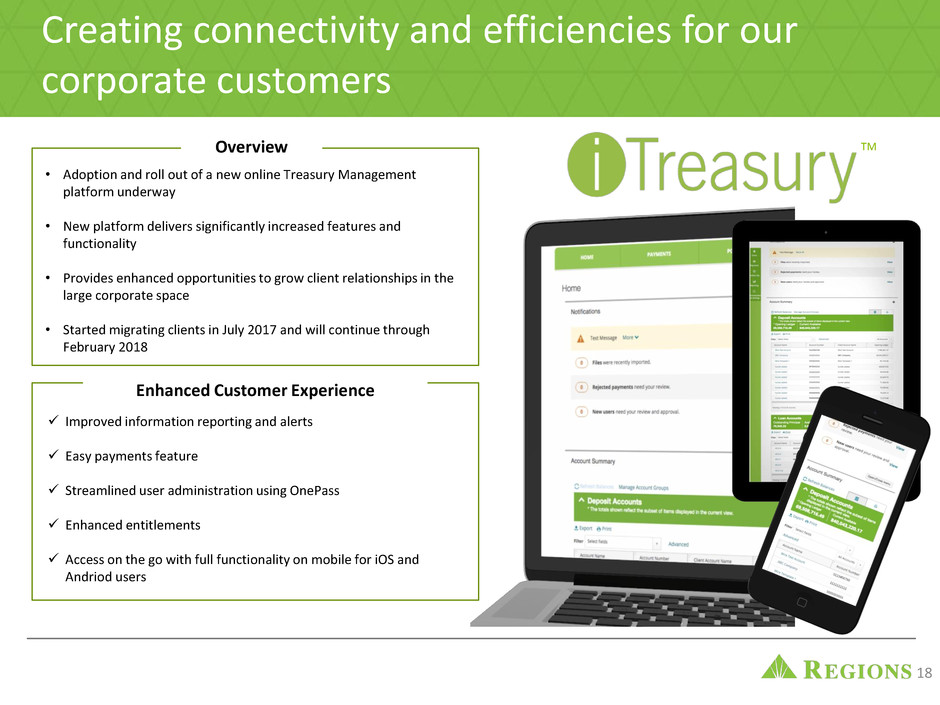

Overview

• Adoption and roll out of a new online Treasury Management

platform underway

• New platform delivers significantly increased features and

functionality

• Provides enhanced opportunities to grow client relationships in the

large corporate space

• Started migrating clients in July 2017 and will continue through

February 2018

Enhanced Customer Experience

✓ Improved information reporting and alerts

✓ Easy payments feature

✓ Streamlined user administration using OnePass

✓ Enhanced entitlements

✓ Access on the go with full functionality on mobile for iOS and

Andriod users

18

Creating connectivity and efficiencies for our

corporate customers

TM

Innovation strategy supports our strategic initiatives

Grow and

Diversify

Revenue

Disciplined

Expense

Management

Optimize and

Effectively

Deploy Capital

✓ Making Banking Easier

✓ Addressable Marketing

✓ Website redesign and online

enhancements

✓ Payment innovations

✓ Point-of-sale lending partnerships

✓ iTreasury

Fully Digital Loan Experience

✓ Optimized digital account opening

✓ Agile

✓ Imaging

✓ Regions Wealth Platform

Artificial intelligence

eSignature

eClosings / eContracting

System consolidation

✓ Retail network strategy

✓ Consumer loan diversification

Enhanced 2-way alerts

Automated decision making

Enterprise data strategy

19

®

20

21

Appendix

Forward-looking statements

This presentation may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. The terms “Regions,” the “Company,” “we,” “us” and “our” mean Regions Financial Corporation, a

Delaware corporation, and its subsidiaries when or where appropriate. The words “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,”

“can,” and similar expressions often signify forward-looking statements. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other

developments. Forward-looking statements are based on management’s current expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made.

Those statements are based on general assumptions and are subject to various risks, and because they also relate to the future they are likewise subject to inherent uncertainties and other factors that may cause actual results to differ

materially from the views, beliefs and projections expressed in such statements. Therefore, we caution you against relying on any of these forward-looking statements. These risks, uncertainties and other factors include, but are not

limited to, those described below:

• Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of declines in property values, unemployment rates and potential reductions of economic growth, which

may adversely affect our lending and other businesses and our financial results and conditions.

• Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings.

• The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict.

• Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity.

• Any impairment of our goodwill or other intangibles, any repricing of assets, or any adjustment of valuation allowances on our deferred tax assets due to adverse changes in the economic environment, declining operations of the reporting

unit, adverse consequences related to tax reform, or other factors.

• Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases.

• Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, loan loss provisions or actual loan losses where our allowance for loan losses may not be adequate to cover our eventual losses.

• Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities.

• Our ability to effectively compete with other financial services companies, some of whom possess greater financial resources than we do and are subject to different regulatory standards than we are.

• Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs.

• Our inability to develop and gain acceptance from current and prospective customers for new products and services in a timely manner could have a negative impact on our revenue.

• The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries.

• Changes in laws and regulations affecting our businesses, such as the Dodd-Frank Act and other legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and

regulations by applicable governmental and self-regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our

businesses.

• Our ability to obtain a regulatory non-objection (as part of the CCAR process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current

or future programs, or redeem preferred stock or other regulatory capital instruments, may impact our ability to return capital to stockholders and market perceptions of us.

• Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance and intensity of such

tests and requirements.

• Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards and the LCR rule), including our ability to generate capital internally or raise capital on favorable terms, and

if we fail to meet requirements, our financial condition could be negatively impacted.

• The Basel III framework calls for additional risk-based capital surcharges for globally systemically important banks. Although we are not subject to such surcharges, it is possible that in the future we may become subject to similar surcharges.

• The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to

which we or any of our subsidiaries are a party, and which may adversely affect our results.

• Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our business.

22

• Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and non-financial benefits relating to our strategic initiatives.

• The success of our marketing efforts in attracting and retaining customers.

• Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income.

• Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time.

• Fraud or misconduct by our customers, employees or business partners.

• Any inaccurate or incomplete information provided to us by our customers or counterparties.

• The risks and uncertainties related to our acquisition and integration of other companies.

• Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or

security systems as a result of a cyber attack or similar act.

• The inability of our internal disclosure controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts.

• The effects of geopolitical instability, including wars, conflicts and terrorist attacks and the potential impact, directly or indirectly, on our businesses.

• The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage, which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting

business.

• Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities

prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those

industries.

• Our inability to keep pace with technological changes could result in losing business to competitors.

• Our ability to identify and address cyber-security risks such as data security breaches, malware, “denial of service” attacks, malware, “hacking” and identity theft, a failure of which could disrupt our business and result in the disclosure of

and/or misuse or misappropriation of confidential or proprietary information; disruption or damage to our systems; increased costs; losses; or adverse effects to our reputation.

• Our ability to realize our adjusted efficiency ratio target as part of our expense management initiatives.

• Significant disruption of, or loss of public confidence in, the Internet and services and devices used to access the Internet could affect the ability of our customers to access their accounts and conduct banking transactions.

• Possible downgrades in our credit ratings or outlook could increase the costs of funding from capital markets.

• The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or

otherwise negatively affect our businesses.

• The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses; result in the disclosure of and/or misuse of confidential information or proprietary information; increase our

costs; negatively affect our reputation; and cause losses.

• Our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends to stockholders.

• Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect how we report our financial results.

• Other risks identified from time to time in reports that we file with the SEC.

• The effects of any damage to our reputation resulting from developments related to any of the items identified above.

The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” of Regions’ Annual Report

on Form 10-K for the year ended December 31, 2016, as filed with the SEC. Regions’ Investor Relations contact is Dana Nolan at (205) 264-7040; Regions’Media contact is Evelyn Mitchell at (205) 264-4551.

Forward-looking statements continued

23