Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Q3 2017 INVESTOR PRESENTATION - MVB FINANCIAL CORP | form8kq3investorpresentati.htm |

Larry F. Mazza, CEO & President

Donald T. Robinson, Executive Vice President & CFO

Sandler O'Neill - 2017 East Coast Financial Services Conference

November 16, 2017

Exhibit 99.1

2

DISCLAIMERS

Forward Looking Statements

MVB Financial Corp. has made forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, in this Presentation. These forward-looking statements are based on current expectations about the future and subject

to risks and uncertainties. Forward-looking statements include information concerning possible or assumed future results of operations of the Company and its

subsidiaries. When words such as "believes," "expects," "anticipates," "may," or similar expressions occur in this Presentation, the Company is making forward-looking

statements. Note that many factors could affect the future financial results of the Company and its subsidiaries, both individually and collectively, and could cause

those results to differ materially from those expressed in the forward-looking statements contained in this Presentation. Those factors include, but are not limited

to: credit risk, changes in market interest rates, inability to achieve merger-related synergies, competition, economic downturn or recession, and government regulation

and supervision. Additional factors that may cause our actual results to differ materially from those described in our forward-looking statements can be found in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2016, as well as its other filings with the SEC, which are available on the SEC website at

www.sec.gov. Except as required by law, the Company undertakes no obligation to update or revise any forward-looking statements.

Accounting standards require the consideration of subsequent events occurring after the balance sheet date for matters that require adjustment to, or disclosure in,

the consolidated financial statements. The review period for subsequent events extends up to and including the filing date of a public company's financial statements

when filed with the Securities and Exchange Commission. Accordingly, the consolidated financial information in this announcement is subject to change.

Non-GAAP Financial Measures

The Company uses certain non-GAAP financial measures, such as tangible common equity to tangible assets, to provide information useful to investors in understanding

the Company’s operating performance and trends, and facilitate comparisons with the performance of the Company’s peers. The non-GAAP financial measures used

may differ from the non-GAAP financial measures other financial institutions use to measure their results of operations. Non-GAAP financial measures should be

viewed in addition to, and not as an alternative for, the Company’s reported results prepared in accordance with U.S. GAAP. Reconciliations of these non-GAAP financial

measures to the most directly comparable U.S. GAAP financial measures are provided in the Appendix to this Presentation.

Exhibit 99.1

3

The MVB Team's goal today is to...

• Share the MVB growth story – Past, Present, Future

• Provide our vision of profitable community banking

• Explain why we believe we are an "up-and-comer" in

our industry

Exhibit 99.1

4

MVB Overview

• MVB Financial Corp.

◦ Total Assets: $1.5 billion

◦ 15 branches, 18 mortgage offices, and a central operations

center

◦ Two operating companies (MVB Bank and MVB Mortgage)

◦ Divested MVB Insurance as of June 30, 2016

◦ Strong fee income streams

▪ Mortgage: $28.6 million

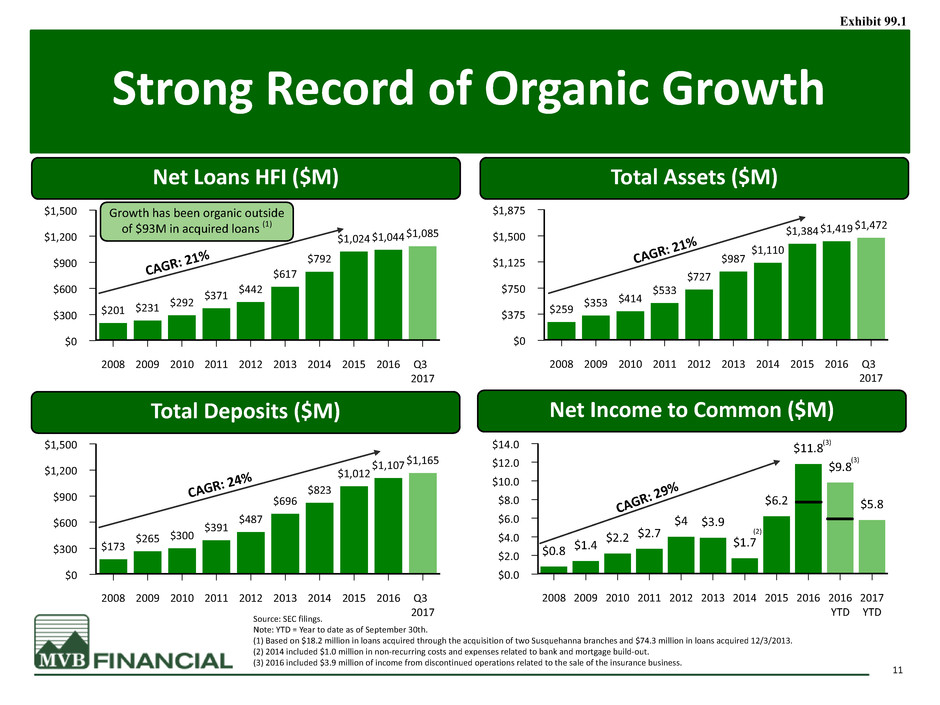

◦ 21% loan and 24% deposit CAGRs (2008–Q3'17)

• Well-positioned in our markets

◦ #4 community bank in West Virginia(1)

◦ Recent branch expansion into fast-growing DC Metro area

• Historical banking growth has been almost 100% organic

• Strong credit quality

• BauerFinancial, Inc., recognized MVB Bank as a 5-star

Superior bank(2) for 26 consecutive quarters

(1) SNL Financial. Ranking by deposits as of June 30, 2017.

(2) Star rating based on June 30, 2017 data.

Exhibit 99.1

5

Value of Growth

$750M - $1.5B

34 public banks / 38 total banks

P / TBV: 1.43x

P / EPS: 15.8x

Sca

rcity

Valu

e Target vision and

valuation

Source: SNL Financial. Market data as of 8/9/2017.

Note: Peer groups include publicly traded banks headquartered in PA, VA, WV, and MD. Multiples represent median.

$1.5B - $3B

13 public banks / 13 total banks

P / TBV: 1.80x

P / EPS: 15.4x

$3B - $5B

P / TBV: 2.04x

P / EPS: 16.3x

$5B - $10B

$10B - $25B

Exhibit 99.1

6

Our Growth Strategies

Organic Growth

Opportunistic

Growth

Fee Income

Streams

• Increase the productivity of existing relationships

• Enhance existing geographic footprint

• Measure expansion into new geographies

• Enhance profitability through improved core funding

• Explore potential acquisitions of branches, fee income

businesses, and whole banks

• Focus on deposit-heavy banking targets

• Acquire team lift-outs

• Increase profitability in low interest rate environment

• Develop other fee channels, i.e. FinTech

• Enhance mortgage profitability

Exhibit 99.1

7

Demographics Accretive to MVB Franchise

Est. Household Income Growth ('18-'23)

Source: SNL Financial, United States Bureau of Labor Statistics, West Virginia Chamber of Commerce.

MVBF current franchise deposits weighted by county.

(1) Washington Business Journal, 7/17/17

(2) PR Newswire, 11/9/17

8.0%

6.0%

4.0%

2.0%

MVBF West Virginia Wash. DC MSA

4.5% 4.3%

6.1%

West Virginia is within 500 miles of

two-thirds of the U.S. population

• Eight of the 25 most affluent places in America are

communities within the Washington DC region(1)

• China Energy Investment Corporation Limited

announced plans to invest $83.7 billion in shale

gas development and chemical manufacturing

projects in West Virginia(2)

Exhibit 99.1

8

Targeting Attractive Markets

East Region:

Washington D.C.

Metropolitan Area

Central WV Region:

Morgantown, Fairmont,

Bridgeport, & Clarksburg

South Region:

Charleston, WV

• 6.2 million people, high-growth, median HHI >$99,400,

and 3.7% unemployment(1)

• Leverages MVB Mortgage in Northern Virginia

• Recently opened Leesburg, VA branch

• West Virginia University, health care, growing private

sector, and U.S. government facilities

• Morgantown is the #1 MSA by population growth and

per capita income metrics(2); opportunity to expand

current 5% market share

• 2nd largest deposit base(3) in WV ($5.6B); provides

MVB with significant opportunity to expand on 2%

market share

• WV State Capital and large health care center

Expansion Markets:

SW Pennsylvania, Central

Virginia, & Carolinas

• Focus on attractive, growth markets in the Mid-

Atlantic and contiguous Southeastern region

• MVB Mortgage presence provides brand recognition

for expansion

Source: SNL Financial, United States Bureau of Labor Statistics

(1) Unemployment data per United States Bureau of Labor Statistics as of August 2017.

(2) Based upon MSAs primarily in West Virginia, Excludes the Washington D.C. MSA.

(3) Measured by MSA deposits.

Exhibit 99.1

9

Acquisition of Talent

2009

2018

2020

BB&T L/O

(2005)-12

HNB L/O

(2009)-4

(2011)-7

Wells Fargo

Insurance L/O

(2013)-23

VA Commerce L/O

(2013)-5

Middleburg L/O

(2017)-4

PMG

(2012)

Acacia

(2013)

BB&T

(2015)

MVB Insurance

Divestiture

(2016)

Acquisition

Exhibit 99.1

10

• CEO – MVB Mortgage

• 25 years of mortgage

experience

• Co-founded Potomac

Mortgage Group, Inc.

(PMG) in 2009

• Chief Lending Officer

• 30+ years of

experience

• Chair of Management

Loan Committee

Experienced Management Team

Larry Mazza, Chief Executive Officer Don Robinson, Chief Financial Officer

Ed Dean John Schirripa David Jones

• 30+ years of banking sector management –

including service in a Big 8 accounting firm

• Named CEO of MVB Financial Corp. in 2009

• Served as Retail Banking Manager for BB&T's

North Region (which included $2 billion in

assets)

• Delivers public company corporate

governance experience

• Chief Risk Officer

• 33 years of

experience

• Background in bank

auditing from Big 8

firm

• 20 years of banking, financial institution, and

Big 8 accounting experience

• Named Chief Operating Officer of MVB

Financial Corp. in 2012, CFO in 2016

• Served as Market President and Commercial

Regional head with HBAN

• Served as EVP and Chief Accounting Officer of

Linn Energy (NASDAQ: LINE)

• Grew George Mason Mortgage from $1 billion

to $4 billion prior to acquisition by UBSI

• Served as Senior Vice President/Community

President of Huntington National Bank

• Served as Vice President and Relationship

Manager with Chase

• Has held management positions with

Huntington National Bank and BB&T

• Former MVB Chief Credit Officer

Exhibit 99.1

11

Strong Record of Organic Growth

Total Assets ($M)Net Loans HFI ($M)

Net Income to Common ($M)Total Deposits ($M)

$1,500

$1,200

$900

$600

$300

$0

2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3

2017

$201 $231

$292 $371

$442

$617

$792

$1,024 $1,044 $1,085

$1,875

$1,500

$1,125

$750

$375

$0

2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3

2017

$259 $353

$414

$533

$727

$987

$1,110

$1,384 $1,419 $1,472

$14.0

$12.0

$10.0

$8.0

$6.0

$4.0

$2.0

$0.0

2008 2009 2010 2011 2012 2013 2014 2015 2016 2016

YTD

2017

YTD

$0.8 $1.4

$2.2 $2.7

$4 $3.9

$1.7

$6.2

$11.8

$9.8

$5.8

$1,500

$1,200

$900

$600

$300

$0

2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3

2017

$173

$265 $300

$391

$487

$696

$823

$1,012

$1,107 $1,165

Growth has been organic outside

of $93M in acquired loans (1)

(2)

(3)

Source: SEC filings.

Note: YTD = Year to date as of September 30th.

(1) Based on $18.2 million in loans acquired through the acquisition of two Susquehanna branches and $74.3 million in loans acquired 12/3/2013.

(2) 2014 included $1.0 million in non-recurring costs and expenses related to bank and mortgage build-out.

(3) 2016 included $3.9 million of income from discontinued operations related to the sale of the insurance business.

CAGR: 21%

CAGR: 29%

CAGR: 24%

CAGR: 21%

(3)

Exhibit 99.1

12

Selective and Strategic M&A Growth

M&A Assessment Model

Asset

Quality

Drives

Shareholder

Value

Additional

Growth

Potential

Deposits

Attractive

Geographic

Markets

Talent &

New

Expertise

Cultural Fit

• Conducting Disciplined Deal-making:

M&A deals will be rooted in a reasonable

transaction price – based upon asset quality

and deposits – and must demonstrate a true

value for MVB shareholders

• Focusing on the Right Targets:

Strategic opportunities in West Virginia and

contiguous geographies (Maryland, Virginia,

North Carolina, and Pennsylvania) targeting

attractive markets with growth opportunities

• Growing and Cultivating a Strong Team:

M&A must ensure perpetuation of MVB's

culture, while also infusing complementary

talent to the existing MVB team. Ideally target

management will deliver new expertise and

enhance growth opportunities

Exhibit 99.1

13

Recent MVB Bank Notable Events

• Applied to list common stock on the

Nasdaq Capital Market

• Opened two new, technology-focused

branch locations, with automated

interactive systems

◦ Morgantown, WV

◦ Leesburg, VA

• Core conversion to Jack Henry &

Associates completed in April 2017

Leesburg, VA

AIT Branch

Exhibit 99.1

14

Third Quarter Financial Highlights

2017 YTD Financial Highlights

• Gross loans HFI increased 4% from year

end, while reducing commercial real

estate concentration levels from 373% at

9/30/16 to 311% at 9/30/17

• Deposits increased 3% YoY

• Nearly 15% of YoY deposit growth from

noninterest bearing deposits

• Nonperforming assets declined 23.9% as

of 9/30/17 compared to 9/30/16

• 2017 YTD net charge-offs of 0.10% of

average loans

• 2016 YTD net income includes after-tax

income of $3.9 million in discontinued

operations

• Well-positioned with respect to the

current interest rate environment

$ in thousands, except per share FY 2015 FY 2016 2016 YTD 2017 YTD

Balance Sheet

Total Assets $ 1,384,476 $ 1,418,804 $ 1,468,595 $ 1,471,590

Gross Loans HFI 1,032,170 1,052,865 1,076,073 1,094,467

Total Deposits 1,012,314 1,107,017 1,126,790 1,165,199

Consolidated Capital (%)

Tier 1 Risk-Based Ratio 9.47% 11.92% 9.51% 11.79%

CET 1 Ratio 7.59 10.11 7.78 10.76

Risk-Based Capital Ratio 12.91 15.36 12.76 15.18

Asset Quality (%)

NPAs / Assets (1) 0.76% 0.47% 0.69% 0.54%

NCOs / Loans 0.08 0.24 0.23 0.10

Reserves / Gross Loans HFI 0.78 0.86 0.85 0.86

Profitability

Net Income to Common $ 6,241 $ 11,784 $ 9,791 $ 5,778

ROAA (2) 0.56% 0.91% 0.99% 0.57%

ROAE (2) 6.08 10.50 11.78 5.73

Noninterest Inc. / Operating Rev. (3) 50.0 49.5 50.7 48.4

Net Interest Margin 3.07 3.22 3.22 3.29

Diluted EPS $ 0.77 $ 1.31 $ 1.08 $ 0.56

Source: SEC filings and company documents.

Note: Reserves / Loans excludes loans held for sale. YTD = Year to date as of September 30.

(1) NPAs include non-accruing loans, 90+ days still accruing, and OREO.

(2) FY & YTD 2016 includes $3.9 million of net income from discontinued operations. Excluding this income, ROAA and ROAE would have been 0.63% and 7.30% for

FY 2016 and 0.62% and 7.41% for YTD 2016.

(3) Non-GAAP financial measure. Please see "Non-GAAP Reconciliations" in this presentation for details.

Exhibit 99.1

15

Current Loan Portfolio

CRE LoansLoan Portfolio Composition

Commercial Business:

33.4%

Commercial Real Estate:

27.2% Acquisition & Development:

8.6%

Acquisition &

Development -

HVCRE: 2.4%

Residential: 21.4%

Home Equity: 5.9%

Consumer: 1.2%

($ in thousands) As of 9/30/2017

Amount

Commercial Business(1) $ 365,710

Commercial Real Estate 297,603

Acquisition & Development 93,811

Acquisition & Development - HVCRE 25,739

Residential(1) 234,236

Home Equity 64,273

Consumer 13,095

Total Loans $ 1,094,467

Source: SEC filings.

Note: Data includes loans held for investment.

(1) Commercial business includes owner occupied CRE and residential includes 1-4 family construction loans.

Hotels: 15.9%

Office: 24.4%

Retail: 18.3%

Storage Units:

2.2%

Nursing homes:

17.2%

Other: 2.7%

Apartments low

income: 2.6%

Apartments

market: 16.6%

Exhibit 99.1

16

Strong Asset Quality

Nonperforming Assets ($000)

NPAs / Assets

Nonaccrual OREO 90+ Days Past Due

$16,000

$12,000

$8,000

$4,000

$0

2011 2012 2013 2014 2015 2016 Q3 2017

$6,643 $7,946

$3,452 $3,661

$1,224

$9,830 $10,492

MVBF Regional Peers

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

2011 2012 2013 2014 2015 2016 Q3 2017

0.65% 0.50%

0.12% 0.89% 0.76%

0.47%

0.54%

2.21%

1.91%

1.70%

1.19% 1.01% 1.19% 1.00%

Note: Nonperforming assets include nonaccruals, OREO, and 90+ days past due.

Source: SEC filings and SNL Financial. Regional peers defined as public institutions headquartered in West Virginia, Maryland, Virginia, and the Washington D.C. MSA

with assets between $750 million and $2.0 billion.

Exhibit 99.1

17

Current Deposit Portfolio

Non-Time Deposits ($M)Deposit Composition(1) ($M)

Source: SEC filings.

(1) Based on Q3 2017 average balances.

Interest bearing demand:

39.3%

Noninterest bearing

demand: 10.4%

Savings and money

markets: 26.4%

Time deposits including

CDs and IRAs: 24.0%

Q3 2017 Cost of Deposits = 0.74%

Non-Time Deposit Balance Cost of Deposits

$1,000.0

$875.0

$750.0

$625.0

$500.0

$375.0

$250.0

$125.0

$0.0

Non-Tim

e

Deposit

s($M

)

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

Co

st

of

Deposit

s(%

)

2009 2010 2011 2012 2013 2014 2015 2016 Q3

2017

$153.0

$206.9

$297.5

$328.8

$454.7

$586.7

$682.5

$831.4

$911.0

Exhibit 99.1

18

MVB Mortgage Volume Analysis

2017 YTD Dollar Volume by State(1)Historical Volume Comparison(1) ($M)

2017 YTD Volume by Transaction Type(2)

Source: Company documents.

YTD totals as of September 30.

(1) Volume displayed by dollars closed.

(2) Volume displayed by number of loans closed.

2013 2014 2015 2016 2016 YTD 2017 YTD

$1,012

$838

$1,339

$1,643

$1,206

$1,168

NC/SC: 25.3%

Other: 2.1%

DC: 6.1%

MD: 7.5%

VA: 51.1%

WV: 8.0%

Purchase: 60.4%

Construction

Origination: 15.3%

Construction

Refinance: 9.2%

Refinance: 15.1%

Exhibit 99.1

19

• Strong community engagement with

those we serve

• Community Reinvestment Act (CRA)

focus – sponsorship and outreach

• Annual Team MVB Cares Week in all

markets accents MVB's year-round

commitment

Investing in Our Communities

Habitat for Humanity in

Monongalia County, WV

'Sledgehammer Ceremony' for the

M.O.R.E revitalization project in

Clarksburg, WV

Team MVB Marion sorted clothes and

served meals at Sobrania Soup Opera in

Fairmont, WV

Exhibit 99.1

20

Investment Thesis

Value of s

cale and s

ca

rcit

y

Opportunity for immediate

performance improvement

Excellent team in excellent markets

Proven track record of capitalizing on market disruption

Exhibit 99.1

21

Thank You

IR.MVBbanking.com

844-MVB-BANK

Question and Answer Session

Exhibit 99.1

22

Non-GAAP Reconciliation

NONINTEREST INCOME / OPERATING REVENUE

At or for the year ended, At or for the 9 months ended,

(Dollars in Thousands) 12/31/2015 12/31/2016 9/30/2016 9/30/2017

Total Noninterest Income 34,955 43,205 33,139 30,549

Less: Realized Gain on Securities (130) (1,082) (1,082) (455)

Less: Gain on Sale of Subsidiary — — — —

Operating Noninterest Income 34,825 42,123 33,139 30,549

Net Interest Income 34,875 42,991 32,166 32,614

Plus: Operating Noninterest Income 34,825 42,123 33,139 30,549

Operating Revenue 69,700 85,114 65,305 63,163

Operating Noninterest Income 34,825 42,123 33,139 30,549

÷ Operating Revenue 69,700 85,114 65,305 63,163

Noninterest Income / Operating Revenue (%) 50.0 49.5 50.7 48.4

Source: SEC filings and Company documents.

Exhibit 99.1