Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LCNB CORP | form8-kinvestorconference1.htm |

Line

0.00

Left Margin

2.90

Right Margin

5.00

LCNB Investment Highlights

November 2017

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

From LCNB’s current Strategic Plan:

• Provide above average returns to shareholders by achieving the ROAA and ROAE

goals set forth in this plan (1.00% bank ROAA and 10.0% consolidated ROAE)

• Give back locally in both time and dollars to be the “Hometown Bank” in the

communities we serve

• Solidify and enhance customer relationships to become “Your Bank for Life” for our

customers

• Continue to attract and recruit high performing candidates while providing current

staff and management career growth opportunities, as well as, becoming the

“employer of choice” in our markets

• Continue to maintain strong regulatory standing as measured by the CAMELS

ratings

LCNB Corporate Goals

1

Shareholders

Communities

Customers

Employees

Regulators

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

Consistent high-performing driven by disciplined organic loan growth, diversified

revenue base, and low-cost, core deposits

– 37 of the last 40 years with 1% or above ROAA1

Consistently stable dividends (current yield of 3.05%)

Strong asset quality and capital ratios driven by conservative underwriting of loans

and robust earnings

Leverageable platform and ability to drive earnings growth through acquisitions

LCNB Overview

2

Stable &

Attractive

Markets

Consistent

High-Performing

Franchise

Seasoned

Management

Team

Financially

Attractive

Acquisitions

140 year-old community bank located in attractive markets in southwestern Ohio with

good demographics, stable home prices, and sound economic activity

Recently added Columbus to market with LPO opening June 2017

Seasoned management team with extensive history of working together

Top seven executives have an average of 32 years of experience

Source: S&P Global Market Intelligence, a division of S&P Global, Company documents.

1 Company data from 1975 to 2016.

2 BNB Bancorp acquisition completed 4/15, Eaton National Bank and Trust acquisition completed 1/14, and First Capital Bancshares acquisition completed 1/13

3 Defined as banks and thrifts (excluding mutuals and merger targets) headquartered in the following MSAs: Athens, Bellefontaine, Celina, Chillicothe, Cincinnati, Columbus, Dayton, Greenville, Huntington-

Ashland, Point Pleasant, Portsmouth, Sidney, Springfield, Urbana, Wapakoneta, Washington Court House and Wilmington.

LCNB viewed as “acquirer of choice” in its markets

Successfully completed three acquisitions since 20132

Target-rich environment for additional acquisitions

24 banks with assets between $200 million and $800 million in and around

current markets3

Highly selective in choosing right partner

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

Headquartered in Lebanon, Ohio (Warren County) with

$1.3 billion in assets and $1.1 billion in deposits

35 branches in southwestern Ohio, primarily in and

around the attractive Cincinnati MSA

10th largest bank in the Cincinnati MSA by deposits

– Warren County, inside Cincinnati MSA, is the fourth

fastest growing county of the 88 counties in Ohio

with a 3.9% projected 5-year population growth rate

– Warren County also possesses the second highest

median household income in Ohio at $88,000

compared to the national average of $61,000.

LCNB’s major business lines include:

– Retail

– Commercial

– Trust and Investments with $327 million under

management and an Investment Services Division

with $220 million

LCNB Franchise

3

LCNB Branch Map

LCNB Deposits in Top Three Markets

Source: S&P Global Market Intelligence, a division of S&P Global, Company documents. Deposit data and rankings as of 6/30/17

Loan production office in Columbus, Ohio.

2017 Deposits Percent of

Market Branches Rank ($000) Franchise (%)

Cincinnati 20 11 $727,118 63.5%

Dayton 4 14 $137,865 12.1%

Chillicothe 4 5 $102,837 9.0%

Total in Top 3 28 $967,820 84.6%

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Recent Events

4

Highlights of 3Q 2017

Current Strategic Initiatives Adding to Earnings Momentum

LCNB reported quarterly EPS of $0.31 and $0.93 for YTD ending 09/30/17.

Net interest income up from $10.07 million in 2Q 2017 to $10.15 million in 3Q 2017.

Quarterly ROAA and ROATCE remained strong at 0.94% and 11.12%, respectively.

Asset quality remained strong with 3Q 2017 NPAs/assets (excluding TDRs) of 0.34%, decreased charge-off

ratio from 0.08% in 2Q 2017 to 0.02% in net recoveries in 3Q 2017.

LCNB continued to be well capitalized, with 3Q 2017 tangible common equity to tangible assets of 9.02%.

Loan origination traction from Columbus LPO

Trust and Investment Services – new leadership

Asset sensitive balance sheet – well-positioned for rising rates

Low cost core deposit base and large off-balance sheet deposit balances

Branch network evaluation – 2 offices closed in 2017

M&A capacity – new operations center and main office

Greater efficiency through new LOS system

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Management Team

5

Experienced management team with an average of 32 years of banking experience and many executives have

worked together for over 20 years

Name

Years of

Banking

Experience Title Background

Stephen P. Wilson 42 Chairman

Joined LCNB in 1975 and LCNB Board of Directors in 1982. Former CEO of

LCNB, Chairman of the American Bankers Association (2010 - 2011), and a

former Board Member of the Federal Reserve Bank of Cleveland.

Steve P. Foster 43 CEO

Joined LCNB in 1977 and has served as Internal Auditor, Branch Manager,

Loan Officer, and CFO. He was elected to the LCNB Board of Directors in

2005.

Robert C. Haines 25

Chief Financial

Officer

Joined LCNB in 1992 and has served as Internal Auditor, Assistant Trust

Officer, Vice President of IT, and CFO. He also serves as LCNB's primary

contact with its transfer agent.

Eric J. Meilstrup 29

Executive Vice

President

Joined LCNB in 1988 and has served in Item Processing and various

positions in Operations. Currently runs LCNB Operations.

Michael R. Miller 33

Executive Vice

President

Joined LCNB in April of 2017 and serves as Head of the Trust Department.

Matthew P. Layer 35

Executive Vice

President

Joined LCNB in 1982 and has served as Branch Manager, Head of Secondary

Markets, Head of Real Estate Lending, and Chief Lending Officer.

Bradley A. Ruppert 18

Executive Vice

President

Joined LCNB in 2008 and serves as the bank’s Chief Investment Officer.

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Financial Performance – Consistently High-Performing

6

Source: S&P Global Market Intelligence, a division of S&P Global, Company documents

YTD

2012 2013 2014 2015 2016 9/30/17 12/31/16 3/31/17 6/30/17 9/30/17

Total Assets $788,637 $932,338 $1,108,066 $1,280,531 $1,306,799 $1,314,319 $1,306,799 $1,319,074 $1,335,571 $1,314,319

Gross Loans $453,783 $574,354 $698,956 $770,938 $819,803 $834,204 $819,803 $810,481 $826,933 $834,204

Reserves $3,437 $3,588 $3,121 $3,129 $3,575 $3,407 $3,575 $3,328 $3,382 $3,407

Deposits $671,471 $785,761 $946,205 $1,087,160 $1,110,905 $1,121,523 $1,110,905 $1,148,198 $1,143,920 $1,121,523

Total Equity $82,006 $118,873 $125,695 $140,108 $142,944 $149,713 $142,944 $145,318 $147,927 $149,713

Common Equity $82,006 $118,873 $125,695 $140,108 $142,944 $149,713 $142,944 $145,318 $147,927 $149,713

Loans / Deposits 67.58% 73.10% 73.87% 70.91% 73.80% 74.38% 73.80% 70.59% 72.29% 74.38%

Total Equity / Assets 10.40% 12.75% 11.34% 10.94% 10.94% 11.39% 10.94% 11.02% 11.08% 11.39%

Tangible Equity / Tangible Assets 9.71% 11.18% 8.72% 8.43% 8.54% 9.05% 8.54% 8.65% 8.76% 9.05%

Tangible Common Equity / Tangible Assets 9.71% 11.18% 8.72% 8.43% 8.54% 9.05% 8.54% 8.65% 8.76% 9.05%

Stated Net Income ($000) $8,270 $8,780 $9,869 $11,474 $12,482 $9,355 $3,654 $3,246 $3,003 $3,106

Core Net Income ($000) $7,154 $9,240 $11,055 $12,025 $12,431 $9,579 $3,696 $3,366 $3,034 $3,178

Core ROAA 0.89% 0.98% 0.99% 0.98% 0.95% 0.97% 1.12% 1.03% 0.92% 0.97%

Core ROAE 8.84% 9.49% 9.01% 8.83% 8.56% 8.66% 10.08% 9.31% 8.21% 8.47%

ROATCE 11.08% 10.96% 11.06% 11.68% 11.73% 11.42% 13.42% 12.19% 10.98% 11.12%

Net Interest Margin 3.52% 3.57% 3.66% 3.64% 3.51% 3.52% 3.58% 3.51% 3.49% 3.55%

Efficiency Ratio 62.85% 63.10% 61.77% 60.60% 61.21% 63.05% 58.07% 60.54% 64.05% 64.49%

NPAs / Assets (Excludes Restructured) 0.57% 0.47% 0.63% 0.20% 0.44% 0.33% 0.44% 0.29% 0.28% 0.33%

NCOs / Average Loans 0.18% 0.08% 0.21% 0.18% 0.06% 0.06% 0.14% 0.13% 0.08% -0.02%

Res rves / Gross Loans 0.76% 0.62% 0.45% 0.41% 0.44% 0.41% 0.44% 0.41% 0.41% 0.41%

Common Shares Outstanding 6,731,900 9,287,536 9,311,318 9,925,547 9,998,025 10,018,507 9,998,025 10,009,642 10,014,004 10,018,507

Book Value Per Share $12.18 $12.80 $13.50 $14.12 $14.30 $14.94 $14.30 $14.52 $14.77 $14.94

Tangible Book Value Per Share $11.29 $11.02 $10.08 $10.58 $10.86 $11.57 $10.86 $11.11 $11.38 $11.57

Stated EPS $1.22 $1.10 $1.05 $1.17 $1.25 $0.93 $0.37 $0.32 $0.30 $0.31

Core EPS $1.06 $1.16 $1.18 $1.23 $1.24 $0.95 $0.37 $0.33 $0.30 $0.32

Dividends Paid $0.64 $0.64 $0.64 $0.64 $0.64 $0.48 $0.16 $0.16 $0.16 $0.16

Dividend Payout Ratio 52.46% 58.18% 60.95% 54.70% 51.20% 51.61% 43.24% 50.00% 53.33% 51.61%

Quarter Ended

Ba

lan

ce

S

he

et

($0

00

)

Ca

pit

al

Ra

tio

s

(%

)

Pr

ofi

tab

ilit

y

(%

)

As

se

t

Qu

ali

ty

(%

)

Pe

r S

ha

re

Da

ta

(%

)

Calendar Year Ended

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Consistent Profitability - ROATCE

7

Source: S&P Global Market Intelligence, a division of S&P Global.

Note: Peer defined as public banks and thrifts with assets $500M - $5B (excludes current M&A targets and MHCs). Peer includes only those companies currently in operation.

LCNB has consistently delivered solid operating performance and profitability regardless of economic climate, as

demonstrated in the chart below. LCNB has exceeded 11% return on tangible common equity in each of the last

ten years and over the last twelve months.

0%

5%

10%

15%

20%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 LTM 06/17

R

O

A

T

C

E

LCNB Peer Median Peer Average

LTM 06/17

LCNB = 11.82%

Peer Median = 9.46%

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

1.80%

LCNB has an average ROAA of 1.23% and an average ROAE of 12.89% for the last 42 years, including the the

last financial crisis

LCNB Consistent Profitability – ROAA AND ROAE

8

ROAA ROAE

LCNB 42-Yr. Avg.: 1.23%

LCNB 42-Yr. Avg.: 12.89%

Avg. of U.S. public banks:

0.61%

Avg. of U.S. public banks:

6.24%

102%

Higher

107%

Higher

Source: S&P Global Market Intelligence, a division of S&P Global, Company documents. LTM as of 6/30/17

1 Average calculated from 1990-2017Q2, the longest time period for which public data are available.

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

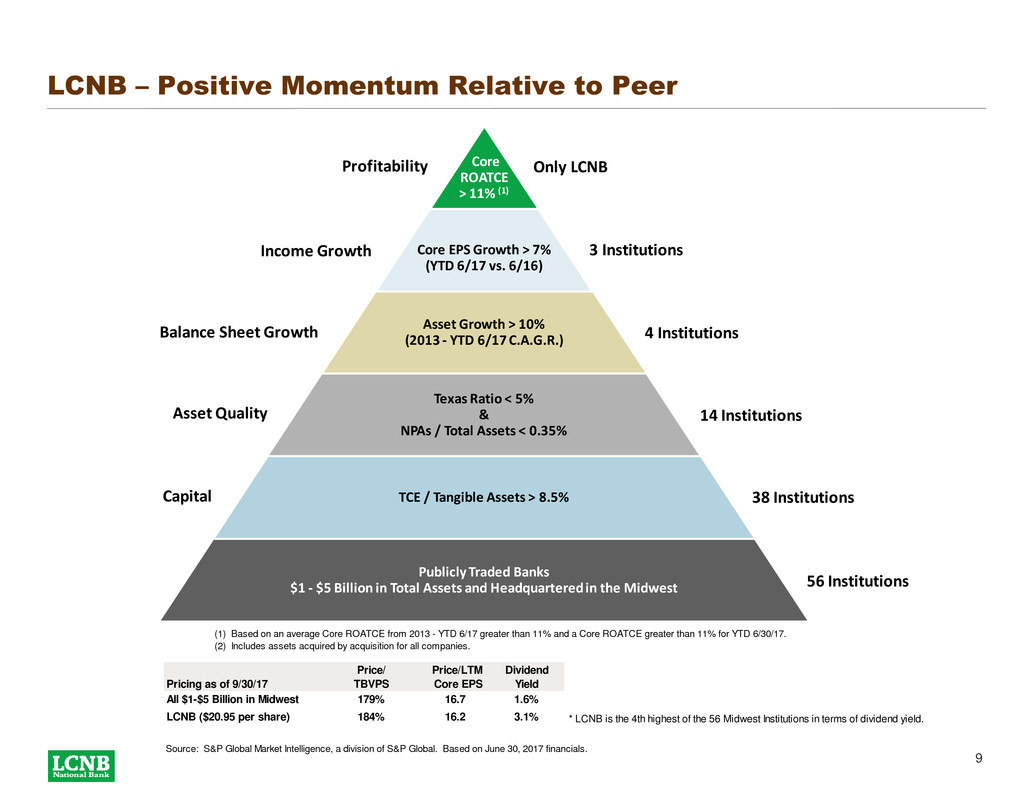

LCNB – Positive Momentum Relative to Peer

9

Price/ Price/LTM Dividend

Pricing as of 9/30/17 TBVPS Core EPS Yield

All $1-$5 Billion in Midwest 179% 16.7 1.6%

LCNB ($20.95 per share) 184% 16.2 3.1% * LCNB is the 4th highest of the 56 Midwest Institutions in terms of dividend yield.

Source: S&P Global Market Intelligence, a division of S&P Global. Based on June 30, 2017 financials.

(1) Based on an average Core ROATCE from 2013 - YTD 6/17 greater than 11% and a Core ROATCE greater than 11% for YTD 6/30/17.

(2) Includes assets acquired by acquisition for all companies.

Core

ROATCE

> 11% (1)

Core EPS Growth > 7%

(YTD 6/17 vs. 6/16)

Asset Growth > 10%

(2013 - YTD 6/17 C.A.G.R.)

Texas Ratio < 5%

&

NPAs / Total Assets < 0.35%

TCE / Tangible Assets > 8.5%

Publicly Traded Banks

$1 - $5 Billion in Total Assets and Headquartered in the Midwest

38 Institutions

56 Institutions

14 Institutions

4 Institutions

3 Institutions

Only LCNB

Asset Quality

Capital

Balance Sheet Growth

Income Growth

Profitability

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB – Deposit and Loan Mix Contributes to Strong NIM

10

Deposit Composition at 6/30/17 Loan Breakdown at 6/30/17

LCNB YTD Cost of Deposits: 0.30%

Peer Median YTD Cost of Deposits: 0.40%

LCNB YTD Yield on Loans: 4.40%

Peer Median YTD Yield on Loans: 4.60%

Source: S&P Global Market Intelligence, a division of S&P Global.

Note: Deposit and loan mix based on FR-Y 9C. Regulatory filings capture some transaction accounts as MMDA.

Peer defined as public banks and thrifts with assets $500M - $5B (excludes current M&A targets and MHCs). Peer includes only those companies currently in operation.

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Asset Quality – NCOs / Avg. Loans

11

LCNB has achieved consistently strong profitability without reaching for growth or compromising its credit

standards. LCNB’s intimate knowledge of its communities and its customers has resulted in minimal credit losses

throughout and since the recession.

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

1.4%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 LTM 06/17

LCNB Peer Median Peer Average

Source: S&P Global Market Intelligence, a division of S&P Global.

Note: Peer defined as public banks and thrifts with assets $500M - $5B (excludes current M&A targets and MHCs). Peer includes only those companies currently in operation.

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB – Stable Common Dividends

12

LCNB Common Dividend Payments Per Share

LCNB has never decreased or suspended its dividend since beginning dividend payments in 1998, LCNB has

consistently maintained or increased its quarterly dividend

LCNB shares currently yield 3.05% versus an average of 1.43% for publicly traded, small cap U.S. banks 1

Source: S&P Global Market Intelligence, a division of S&P Global.

*2017 annualized as of 9/30/17

1 Based on market data as of 9/30/17

$0.36

$0.40

$0.45

$0.46

$0.51

$0.53

$0.56

$0.58

$0.60

$0.62

$0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64 $0.64

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB – Dividend Payout Ratio

13

In nine of the last 10 years, and over the last 12 months, LCNB has returned half or more of its net income to

shareholders through dividends. Unlike many banks in the 2008 – 2011 period, LCNB never reduced its dividend

and maintains a strong dividend payout ratio.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 LTM 06/17

LCNB Peer Median Peer Average

Source: S&P Global Market Intelligence, a division of S&P Global.

Note: Peer defined as public banks and thrifts with assets $500M - $5B (excludes current M&A targets and MHCs). Peer includes only those companies currently in operation.

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

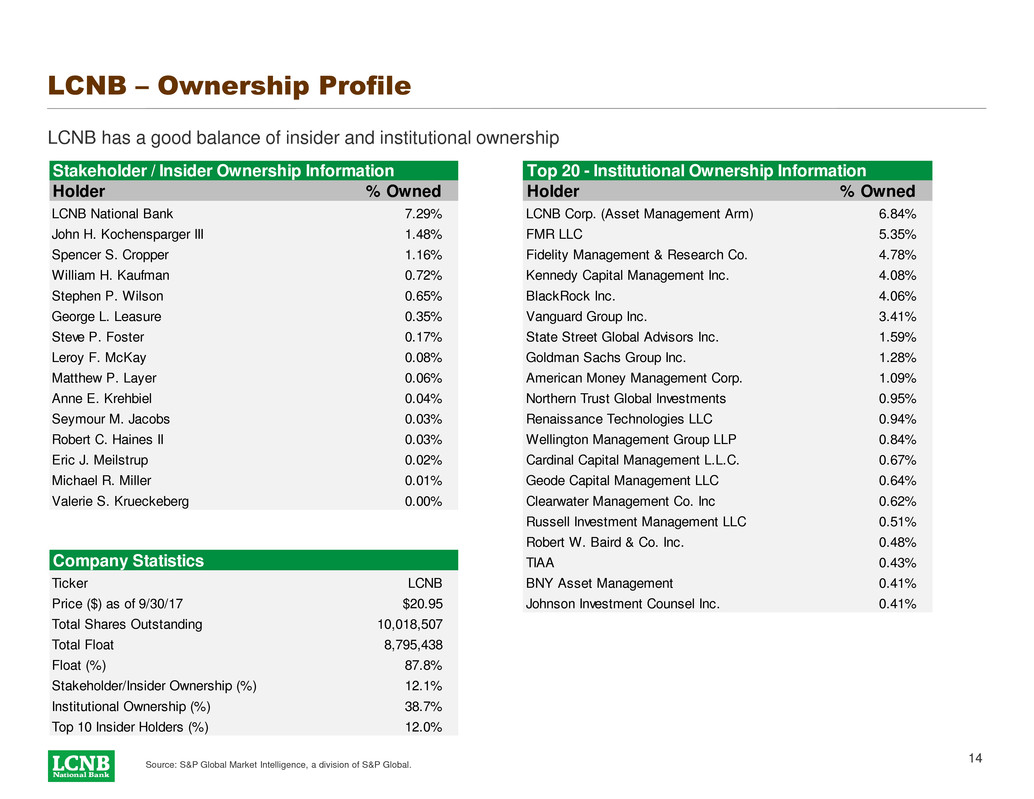

LCNB – Ownership Profile

14

Source: S&P Global Market Intelligence, a division of S&P Global.

Stakeholder / Insider Ownership Information Top 20 - Institutional Ownership Information

Holder % Owned Holder % Owned

LCNB National Bank 7.29% LCNB Corp. (Asset Management Arm) 6.84%

John H. Kochensparger III 1.48% FMR LLC 5.35%

Spencer S. Cropper 1.16% Fidelity Management & Research Co. 4.78%

William H. Kaufman 0.72% Kennedy Capital Management Inc. 4.08%

Stephen P. Wilson 0.65% BlackRock Inc. 4.06%

George L. Leasure 0.35% Vanguard Group Inc. 3.41%

Steve P. Foster 0.17% State Street Global Advisors Inc. 1.59%

Leroy F. McKay 0.08% Goldman Sachs Group Inc. 1.28%

Matthew P. Layer 0.06% American Money Management Corp. 1.09%

Anne E. Krehbiel 0.04% Northern Trust Global Investments 0.95%

Seymour M. Jacobs 0.03% Renaissance Technologies LLC 0.94%

Robert C. Haines II 0.03% Wellington Management Group LLP 0.84%

Eric J. Meilstrup 0.02% Cardinal Capital Management L.L.C. 0.67%

Michael R. Miller 0.01% Geode Capital Management LLC 0.64%

Valerie S. Krueckeberg 0.00% Clearwater Management Co. Inc 0.62%

Russell Investment Management LLC 0.51%

Robert W. Baird & Co. Inc. 0.48%

Company Statistics TIAA 0.43%

Ticker LCNB BNY Asset Management 0.41%

Price ($) as of 9/30/17 $20.95 Johnson Investment Counsel Inc. 0.41%

Total Shares Outstanding 10,018,507

Total Float 8,795,438

Float (%) 87.8%

Stakeholder/Insider Ownership (%) 12.1%

Institutional Ownership (%) 38.7%

Top 10 Insider Holders (%) 12.0%

LCNB has a good balance of insider and institutional ownership

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB – Stock Liquidity

15

Liquidity – Average Daily Trading Volume (“ADTV”)

Source: S&P Global Market Intelligence, a division of S&P Global. Data from September 30, 2007 through September 30, 2017.

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

45,000

S-07 S-08 S-09 S-10 S-11 S-12 S-13 S-14 S-15 S-16 S-17

LCNB Three Month ADTV

11,710

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

Three Month ADTV as of 9/30/17

LCNB 3 Month ADTV

LCNB has a steadily improved stock liquidity over the past 10 years

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

LCNB Stock – 10-Year Total Return

16

Source: S&P Global Market Intelligence, a division of S&P Global.

-100%

-50%

0%

50%

100%

150%

200%

Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16 Sep-17

LCNB SNL U.S. Bank and Thrift

LCNB has outperformed the overall banking index over the past 10 years

MS Margin

3.45

Text Margin

2.90

MS Margin

5.00

MS Margin

5.00

Footnote Margin

4.60

Colors

FBR Sky

178

210

224

FBR Forest

0

72

70

FBR Cream

222

215

170

FBR Burgundy

110

0

50

FBR Silver

178

178

178

FBR Blue

5

5

80

FBR Sage

122

178

175

FBR Tan

184

155

104

FBR Brick

200

100

100

FBR Charcoal

51

51

51

FBR Steel

45

55

125

FBR Brown

87

61

17

Shading

234

234

234

3.65

3.10

2.70

2.90

2.20

3.00

3.85

Forward-Looking Statements

17

This presentation, as well as other written or oral communications made from time to time by us, contains certain forward-looking

information within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended.

These statements relate to future events or future predictions, including events or predictions relating to our future financial

performance, and are generally identifiable by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,”

“should,” “plan,” “intend,” “target,” or “anticipates” or the negative thereof or comparable terminology, or by discussion of strategy or

goals or other future events, circumstances or effects. These forward-looking statements regarding future events and circumstances

involve known and unknown risks, including those risk factors set forth in our Annual Report on Form 10-K, our 10-Q filings, and

other SEC filings.

These forward-looking statements are subject to significant uncertainties and contingencies, many of which are beyond our control.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future

results, levels of activity, financial condition, performance or achievements. Accordingly, there can be no assurance that actual results

will meet our expectations or will not be materially lower than the results contemplated in this presentation. You are cautioned not to

place undue reliance on these forward-looking statements, which speak only as of the date of this document or, in the case of

documents referred to or incorporated by reference, the dates of those documents. We do not undertake any obligation to release

publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this document or to

reflect the occurrence of unanticipated events, except as may be required under applicable law.