Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - Aptiv PLC | d498099dex994.htm |

| EX-99.2 - EX-99.2 - Aptiv PLC | d498099dex992.htm |

| EX-99.1 - EX-99.1 - Aptiv PLC | d498099dex991.htm |

| EX-2.1 - EX-2.1 - Aptiv PLC | d498099dex21.htm |

| 8-K - FORM 8-K - Aptiv PLC | d498099d8k.htm |

Exhibit 99.3

November 15, 2017 Barclays Global Automotive Conference Joe Massaro Chief Financial Officer and Senior Vice President

Forward-looking statements This presentation, as well as other statements made by Delphi Automotive PLC (the “Company”), contain forward-looking statements that reflect, when made, the Company’s current views with respect to current events, certain investments and acquisitions and financial performance. Such forward-looking statements are subject to many risks, uncertainties and factors relating to the Company’s operations and business environment, which may cause the actual results of the Company to be materially different from any future results. All statements that address future operating, financial or business performance or the Company’s strategies or expectations are forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements are discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s filings with the Securities and Exchange Commission. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect the Company. It should be remembered that the price of the ordinary shares and any income from them can go down as well as up. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events and/or otherwise, except as may be required by law.

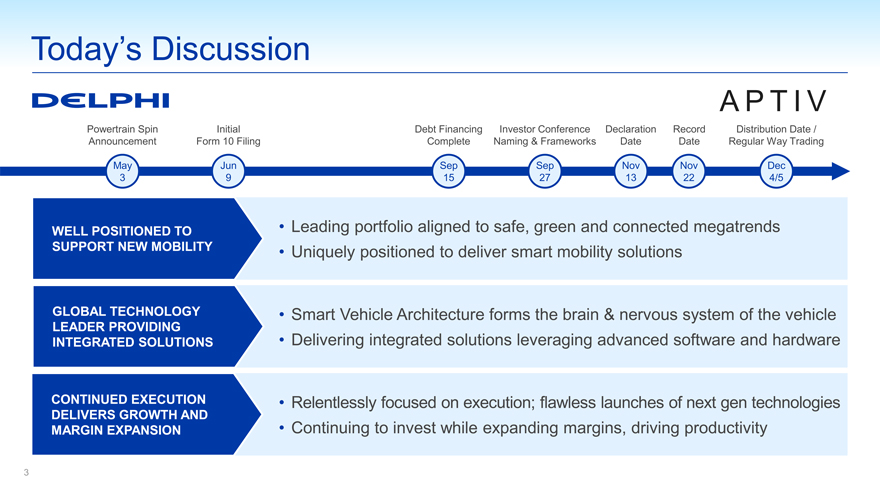

Today’s Discussion APTIV Powertrain Spin Initial Debt Financing Investor Conference Declaration Record Distribution Date / Announcement Form 10 Filing Complete Naming & Frameworks Date Date Regular Way Trading May Jun Sep Sep Nov Nov Dec 3 9 15 27 13 22 4/5 WELL POSITIONED TO • Leading portfolio aligned to safe, green and connected megatrends SUPPORT NEW MOBILITY • Uniquely positioned to deliver smart mobility solutions GLOBAL TECHNOLOGY • Smart Vehicle Architecture forms the brain & nervous system of the vehicle LEADER PROVIDING • Delivering integrated solutions leveraging advanced software and hardware INTEGRATED SOLUTIONS CONTINUED EXECUTION • Relentlessly focused on execution; flawless launches of next gen technologies DELIVERS GROWTH AND • Continuing to invest while expanding margins, driving productivity MARGIN EXPANSION 3

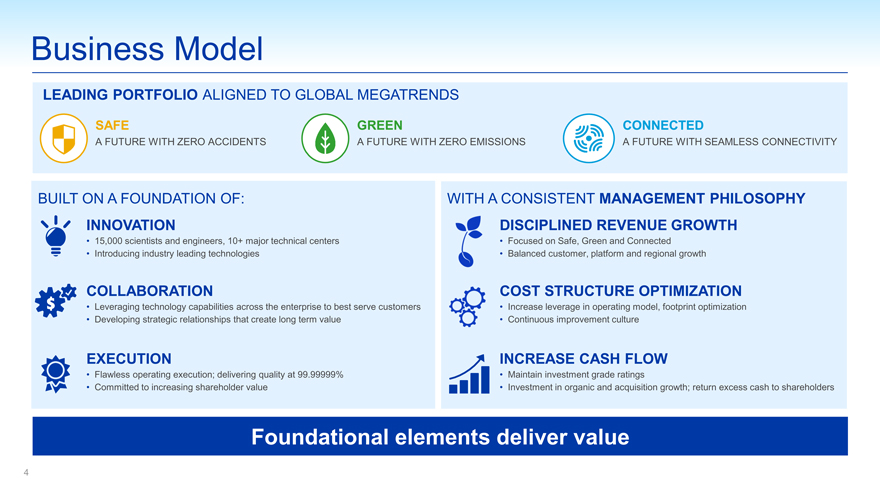

Business Model LEADING PORTFOLIO ALIGNED TO GLOBAL MEGATRENDS SAFE GREEN CONNECTED A FUTURE WITH ZERO ACCIDENTS A FUTURE WITH ZERO EMISSIONS A FUTURE WITH SEAMLESS CONNECTIVITY BUILT ON A FOUNDATION OF: INNOVATION • 15,000 scientists and engineers, 10+ major technical centers • Introducing industry leading technologies COLLABORATION • Leveraging technology capabilities across the enterprise to best serve customers • Developing strategic relationships that create long term value EXECUTION • Flawless operating execution; delivering quality at 99.99999% • Committed to increasing shareholder value WITH A CONSISTENT MANAGEMENT PHILOSOPHY DISCIPLINED REVENUE GROWTH • Focused on Safe, Green and Connected • Balanced customer, platform and regional growth COST STRUCTURE OPTIMIZATION • Increase leverage in operating model, footprint optimization • Continuous improvement culture INCREASE CASH FLOW • Maintain investment grade ratings • Investment in organic and acquisition growth; return excess cash to shareholders Foundational elements deliver value

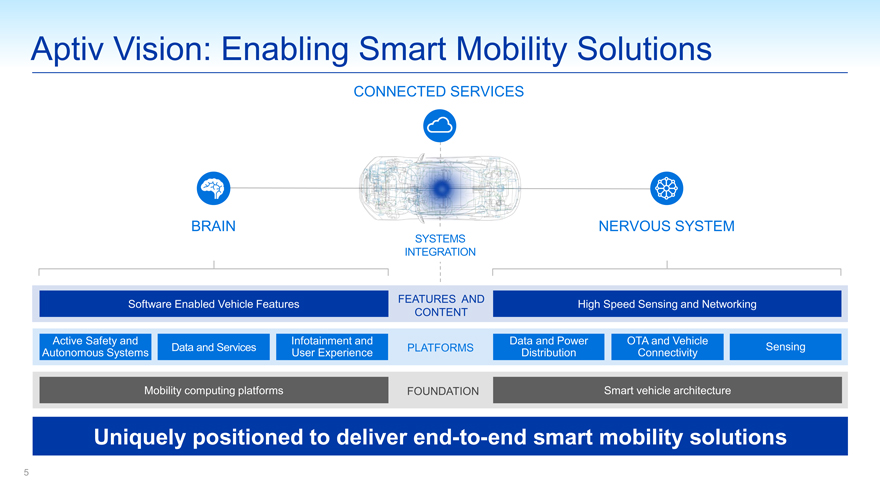

Aptiv Vision: Enabling Smart Mobility Solutions CONNECTED SERVICES BRAIN NERVOUS SYSTEM SYSTEMS INTEGRATION FEATURES AND Software Enabled Vehicle Features High Speed Sensing and Networking CONTENT Active Safety and Infotainment and Data and Power OTA and Vehicle Data and Services PLATFORMS Sensing Autonomous Systems User Experience Distribution Connectivity Mobility computing platforms FOUNDATION Smart vehicle architecture Uniquely positioned to deliver end-to-end smart mobility solutions

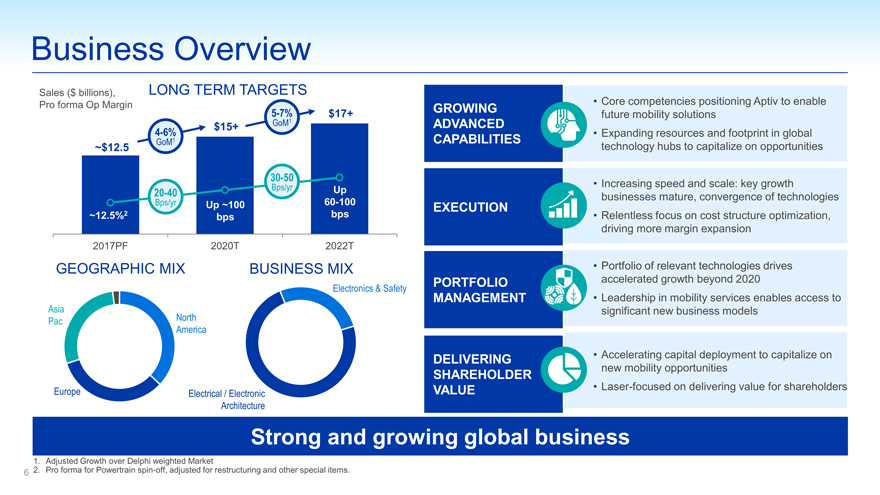

Business Overview Sales ($ billions), LONG TERM TARGETS Pro forma Op Margin 5-7% $17+ GoM1 $15+ 4-6% GoM1 ~$12.5 30-50 20-40 Bps/yr Up Bps/yr Up ~100 60-100 ~12.5%2 bps bps 2017PF 2020T 2022T GEOGRAPHIC MIX BUSINESS MIX Electronics & Safety Asia Pac North America Europe Electrical / Electronic Architecture • Core competencies positioning Aptiv to enable GROWING future mobility solutions ADVANCED • Expanding resources and footprint in global CAPABILITIES technology hubs to capitalize on opportunities • Increasing speed and scale: key growth EXECUTION businesses mature, convergence of technologies • Relentless focus on cost structure optimization, driving more margin expansion • Portfolio of relevant technologies drives PORTFOLIO accelerated growth beyond 2020 MANAGEMENT • Leadership in mobility services enables access to significant new business models DELIVERING • Accelerating capital deployment to capitalize on new mobility opportunities SHAREHOLDER VALUE • Laser-focused on delivering value for shareholders Strong and growing global business 1. Adjusted Growth over Delphi weighted Market 6 2. Pro forma for Powertrain spin-off, adjusted for restructuring and other special items.

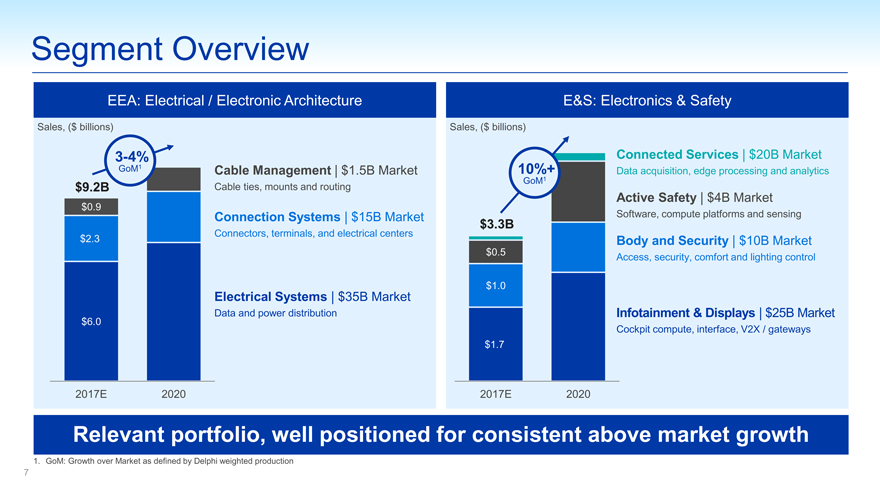

Segment Overview EEA: Electrical / Electronic Architecture Sales, ($ billions) 3-4% GoM1 Cable Management | $1.5B Market $9.2B Cable ties, mounts and routing $0.9 Connection Systems | $15B Market Connectors, terminals, and electrical centers $2.3 Electrical Systems | $35B Market $6.0 Data and power distribution 2017E 2020 E&S: Electronics & Safety Sales, ($ billions) Connected Services | $20B Market 10%+ Data acquisition, edge processing and analytics GoM1 Active Safety | $4B Market $3.3B Software, compute platforms and sensing Body and Security | $10B Market $0.5 Access, security, comfort and lighting control $1.0 Infotainment & Displays | $25B Market Cockpit compute, interface, V2X / gateways $1.7 2017E 2020 Relevant portfolio, well positioned for consistent above market growth 1. GoM: Growth over Market as defined by Delphi weighted production 7

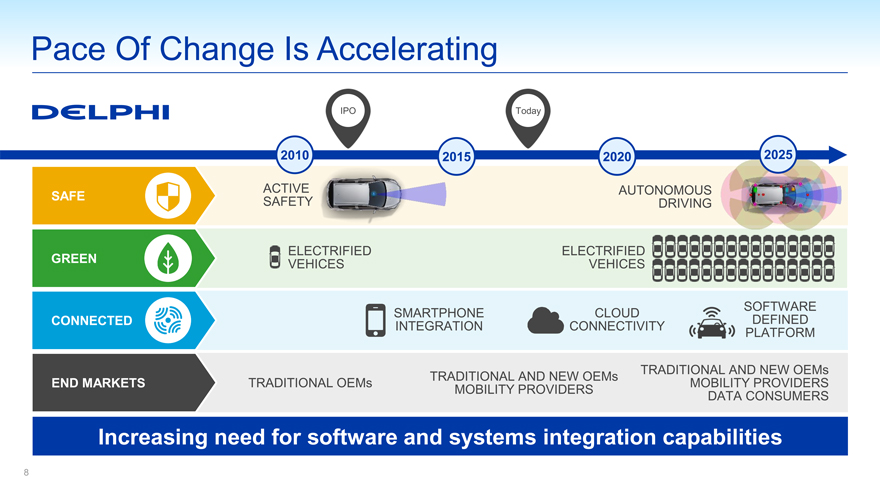

Pace Of Change Is Accelerating IPO Today 2010 2015 2020 2025 ACTIVE AUTONOMOUS SAFE SAFETY DRIVING ELECTRIFIED ELECTRIFIED GREEN VEHICES VEHICES SOFTWARE SMARTPHONE CLOUD CONNECTED DEFINED INTEGRATION CONNECTIVITY PLATFORM TRADITIONAL AND NEW OEMs TRADITIONAL AND NEW OEMs END MARKETS TRADITIONAL OEMs MOBILITY PROVIDERS MOBILITY PROVIDERS DATA CONSUMERS Increasing need for software and systems integration capabilities 8

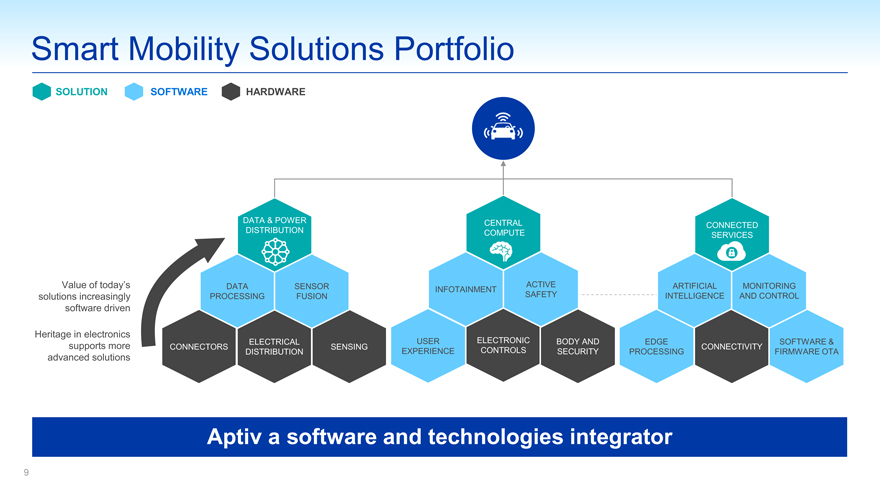

Smart Mobility Solutions Portfolio SOLUTION SOFTWARE HARDWARE DATA & POWER CENTRAL CONNECTED DISTRIBUTION COMPUTE SERVICES Value of today’s DATA SENSOR ACTIVE ARTIFICIAL MONITORING INFOTAINMENT solutions increasingly PROCESSING FUSION SAFETY INTELLIGENCE AND CONTROL software driven Heritage in electronics ELECTRICAL USER ELECTRONIC BODY AND EDGE SOFTWARE & supports more CONNECTORS SENSING CONNECTIVITY DISTRIBUTION EXPERIENCE CONTROLS SECURITY PROCESSING FIRMWARE OTA advanced solutions Aptiv a software and technologies integrator 9

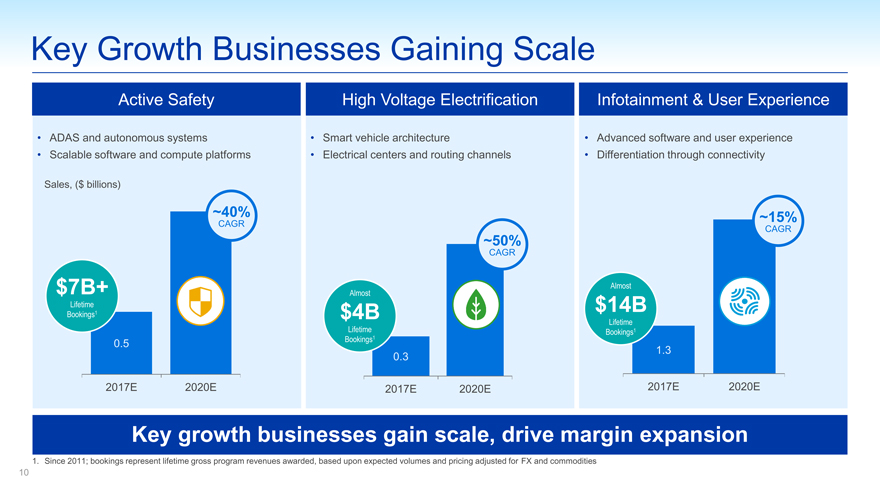

Key Growth Businesses Gaining Scale Active Safety • ADAS and autonomous systems • Scalable software and compute platforms Sales, ($ billions) ~40% CAGR $7B+ Lifetime Bookings1 0.5 2017E 2020E High Voltage Electrification • Smart vehicle architecture • Electrical centers and routing channels ~50% CAGR Almost $4B Lifetime Bookings1 0.3 2017E 2020E Infotainment & User Experience • Advanced software and user experience • Differentiation through connectivity ~15% CAGR Almost $14B Lifetime Bookings1 1.3 2017E 2020E Key growth businesses gain scale, drive margin expansion 1. Since 2011; bookings represent lifetime gross program revenues awarded, based upon expected volumes and pricing adjusted for FX and commodities 10

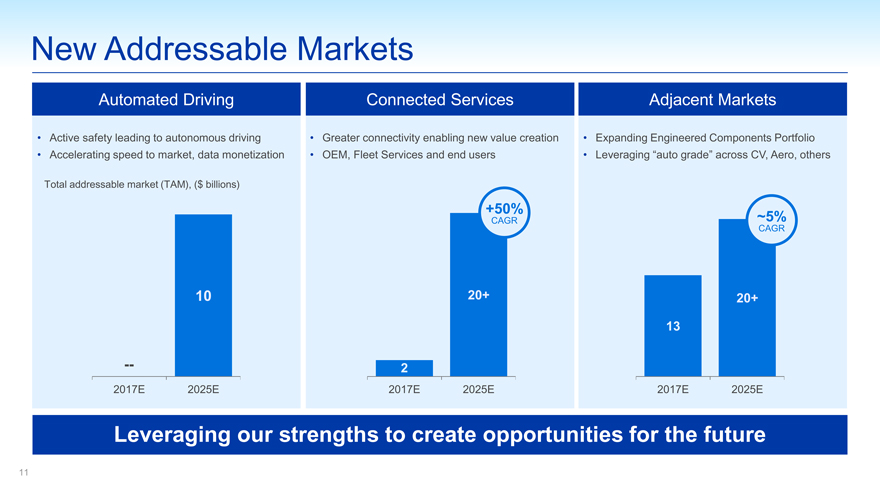

New Addressable Markets Automated Driving • Active safety leading to autonomous driving • Accelerating speed to market, data monetization Total addressable market (TAM), ($ billions) 10 — 2017E 2025E Connected Services • Greater connectivity enabling new value creation • OEM, Fleet Services and end users +50% CAGR 20+ 2 2017E 2025E Adjacent Markets • Expanding Engineered Components Portfolio • Leveraging “auto grade” across CV, Aero, others ~5% CAGR 20+ 13 2017E 2025E Leveraging our strengths to create opportunities for the future 11

Unlocking Next Generation Features AUDI A8: FIRST LEVEL 3 PARTNER OF CHOICE ACROSS MULTIPLE AUTOMATED DRIVING SYSTEM AUTOMATED DRIVING PARTNERSHIPS VOLVO 2020 INTEGRATED COCKPIT CONTROLLER SMART CITY PILOTS AND CONNECTED ENABLING ADVANCED USER EXPERIENCE SERVICES LEADING TO DATA MONITIZATION Delivering next generation capabilities for today’s production vehicles

Investing For Growth And Margin Expansion Engineering Spend Capital Expenditures 2017 Breakeven Summary Advanced Engineering Supports Growth Efficient Deployment Flexible Operating Model ($ billions) Production volume decline vs. today’s levels 1.1 Cost Savings / Actual Breakeven Advanced Other 25% 0.9 Engineering 2017 Growth 55% Maintenance Advanced 20% Engineering 30% 40% ($ billion) 0.8 0.7 ~7% ~7-8% Of Sales Of Sales 2017E 2020E 2017E 2020E Cash Flow 1 EBITDA 2 Well positioned to seize opportunities while managing risks 1. Restructuring cash included in cash flow break-even analysis 13 2. Adjusted for restructuring and other special items

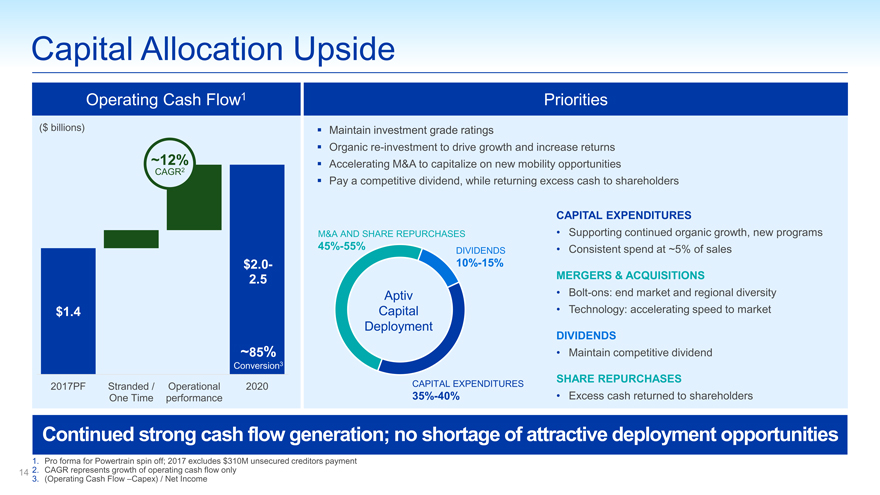

Capital Allocation Upside Operating Cash Flow1 Priorities ($ billions)ï,§ Maintain investment grade ratings ï,§ Organic re-investment to drive growth and increase returns ~12%ï,§ Accelerating M&A to capitalize on new mobility opportunities CAGR2 ï,§ Pay a competitive dividend, while returning excess cash to shareholders CAPITAL EXPENDITURES M&A AND SHARE REPURCHASES • Supporting continued organic growth, new programs 45%-55% • Consistent spend at ~5% of sales DIVIDENDS $2.0- 10%-15% 2.5 MERGERS & ACQUISITIONS Aptiv • Bolt-ons: end market and regional diversity $1.4 Capital • Technology: accelerating speed to market Deployment DIVIDENDS ~85% • Maintain competitive dividend Conversion3 SHARE REPURCHASES 2017PF Stranded / Operational 2020 CAPITAL EXPENDITURES One Time performance 35%-40% • Excess cash returned to shareholders Continued strong cash flow generation; no shortage of attractive deployment opportunities 1. Pro forma for Powertrain spin off; 2017 excludes $310M unsecured creditors payment 14 2. CAGR represents growth of operating cash flow only 3. (Operating Cash Flow –Capex) / Net Income

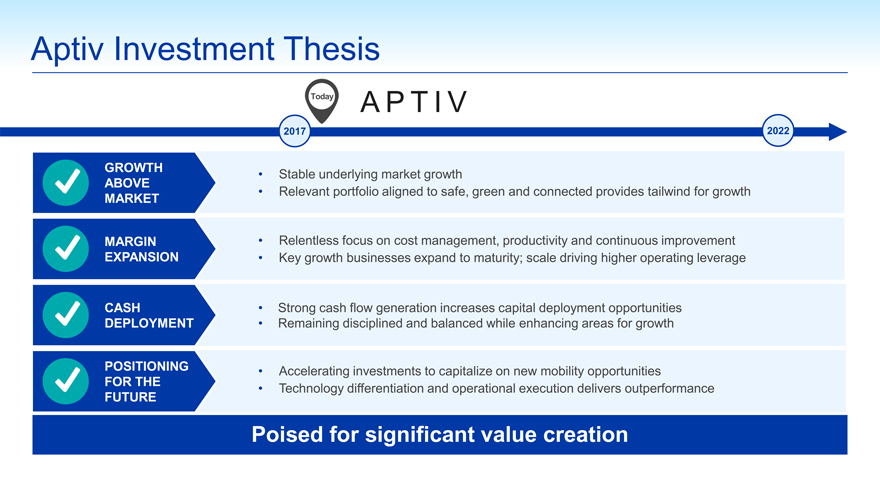

Aptiv Investment Thesis Today A P T I V 2017 2022 GROWTH • Stable underlying market growth ABOVE • Relevant portfolio aligned to safe, green and connected provides tailwind for growth MARKET MARGIN • Relentless focus on cost management, productivity and continuous improvement EXPANSION • Key growth businesses expand to maturity; scale driving higher operating leverage CASH • Strong cash flow generation increases capital deployment opportunities DEPLOYMENT • Remaining disciplined and balanced while enhancing areas for growth POSITIONING • Accelerating investments to capitalize on new mobility opportunities FOR THE • Technology differentiation and operational execution delivers outperformance FUTURE Poised for significant value creation

DELPHI Innovation for the Real World