Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CODORUS VALLEY BANCORP INC | codorus173059_8k.htm |

Exhibit 99.1

NASDAQ: CVLY Investor Presentation 2017 East Coast Financial Services Conference November 16, 2017 Larry J. Miller A. Dwight Utz Chairman, President and Chief Executive Officer Executive Vice President and Chief Operating Officer lmiller@peoplesbanknet.com dutz@peoplesbanknet.com 717-747-1500 717-747-1501

SAFE HARBOR NOTICE REGARDING FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements about Codorus Valley Bancorp, Inc. that are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts. These statements can be identified by the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,” “project,” “plan,” “seek,” “intend,” “anticipate” or similar terminology. Such forward-looking statements include, but are not limited to, discussions of strategy, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives, goals, expectations or consequences; and statements about future performance, operations, products and services of Codorus Valley Bancorp, Inc. and its subsidiaries. Codorus Valley Bancorp, Inc. cautions readers not to place undue reliance on forward-looking statements and to consider possible events or factors that could cause results or performance to materially differ from those expressed in the forward-looking statements, including, but not limited to: ineffectiveness of the corporation’s business strategy due to changes in current or future market conditions; the effects of competition, and of changes in laws and regulations on competition, including industry consolidation and development of competing financial products and services; inability to achieve merger-related synergies; interest rate movements; difficulties in integrating distinct business operations, including information technology difficulties; challenges in establishing and maintaining operations in new markets; volatilities in the securities markets; and deteriorating economic conditions. Additional factors that may affect forward-looking statements made in this presentation can be found in Codorus Valley Bancorp, Inc.’s Quarterly Reports on Forms 10-Q and its Annual Report on Form 10-K, as filed with the Securities and Exchange Commission and available on the corporation’s website at www.peoplesbanknet.com and on the Securities and Exchange Commission’s website at www.sec.gov. We include web addresses here as inactive textual references only. Information on these websites is not part of this presentation. Forward-looking statements in this presentation speak only as of the date of this presentation and Codorus Valley Bancorp, Inc. makes no commitment to revise or update such statements to reflect changes that occur after the date the forward-looking statement was made. 2

FRANCHISE OVERVIEW • Largest independent financial institution headquartered in York, Pennsylvania • Founded in Glen Rock, Pennsylvania in 1864 • 26 PeoplesBank Financial Centers in Pennsylvania and Maryland - 17 in York County, PA - 2 in Harford County, MD - 1 in Cumberland County, PA - 3 in Baltimore County, MD - 1 in Lancaster County, PA - 1 in Baltimore City, MD - 1 in Carroll County, MD • 11 Limited Services Facilities with deposits of over $45 million - 6 in York County, PA - 5 in Lancaster County, PA • Financial highlights as of September 30, 2017* - $1.67 billion in total assets - $1.40 billion in total loans - $1.32 billion in total deposits - $658 million in wealth management assets under management • Provides commercial, small business, and consumer banking services to over 31,400 households • Named one of the Top 200 Community Banks in the United States for four years in a row by American Banker Magazine** • Voted “Best Bank in York County” by readers of the York Sunday News in 2016 and 2017 • Added to the Russell 2000 Index in June 2016 *Unaudited **Based on average three year return on equity. 3

MARKET OVERVIEW • Ranked 2nd out of 15 banks in the York County market area with a deposit market share of 15.4%*. • Strategically positioned in one of the fastest-growing regions along the East Coast, within a short drive of the major metropolitan areas of Baltimore, Philadelphia, and Washington, D.C.** • The south central Pennsylvania and northern Maryland markets are home to a diverse mix of businesses and industries, including major manufacturing, health care, higher education, government, and retail services, with a highly-educated workforce and household incomes that are greater than state and national averages.** * Based on FDIC data as of June 30, 2017. ** Based on United States Census Bureau data. 4

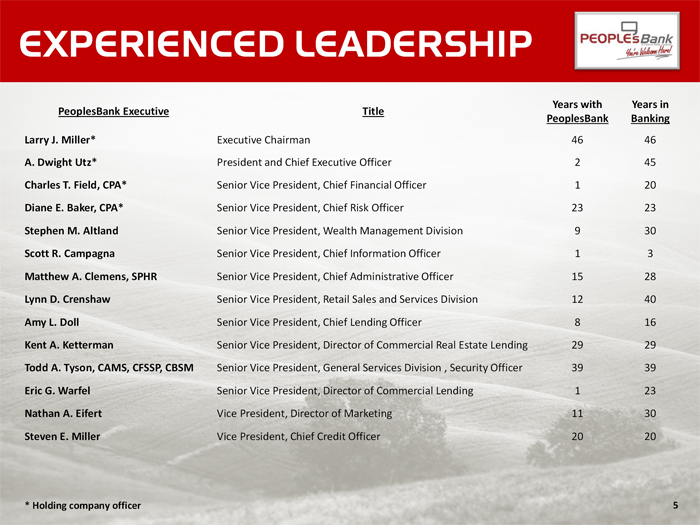

EXPERIENCED LEADERSHIP Years with Years in PeoplesBank Executive Title PeoplesBank Banking Larry J. Miller* Executive Chairman 46 46 A. Dwight Utz* President and Chief Executive Officer 2 45 Charles T. Field, CPA* Senior Vice President, Chief Financial Officer 1 20 Diane E. Baker, CPA* Senior Vice President, Chief Risk Officer 23 23 Stephen M. Altland Senior Vice President, Wealth Management Division 9 30 Scott R. Campagna Senior Vice President, Chief Information Officer 1 3 Matthew A. Clemens, SPHR Senior Vice President, Chief Administrative Officer 15 28 Lynn D. Crenshaw Senior Vice President, Retail Sales and Services Division 12 40 Amy L. Doll Senior Vice President, Chief Lending Officer 8 16 Kent A. Ketterman Senior Vice President, Director of Commercial Real Estate Lending 29 29 Todd A. Tyson, CAMS, CFSSP, CBSM Senior Vice President, General Services Division , Security Officer 39 39 Eric G. Warfel Senior Vice President, Director of Commercial Lending 1 23 Nathan A. Eifert Vice President, Director of Marketing 11 30 Steven E. Miller Vice President, Chief Credit Officer 20 20 * Holding company officer 5

STRATEGIC OBJECTIVES Focus on Establishing and Expanding Profitable Long-Term Client Relationships • High-quality personalized service practices and a broad range of delivery channels, including an enhanced digital platform, in order to optimize the client experience • Provide professional participation in and appropriate financial support for non-profit organizations located in communities within our service area Focus on Profitability and Operating Efficiency • Maintain a strong net interest margin through strategic loan pricing, selective investing, lower-cost funding, and effective management of interest rate risk • Continuously seek efficiency opportunities • Increase noninterest income through an expansion of wealth management activities, cash management and deposit services, and SBA Guaranteed Lender activities Focus on Risk Management • Regular and proactive asset quality assessments • Attract and retain talented executives and staff • Maintain appropriate policies, procedures, and enterprise risk management programs Focus on Capital • Managing capital by providing adequate resources and earnings retention in support of franchise growth initiatives • Return to shareholders through cash and stock dividends 6

TOTAL ASSETS $ in millions $1,665 $1,700 $1,612 $1,456 $1,500 $1,300 $1,214 $1,151 $1,060 $1,100 $900 $700 *Reflects the acquisition of Madison Bancorp, Inc. **Unaudited Note: 2013-2016 as of 12/31 Source: Company Documents 7

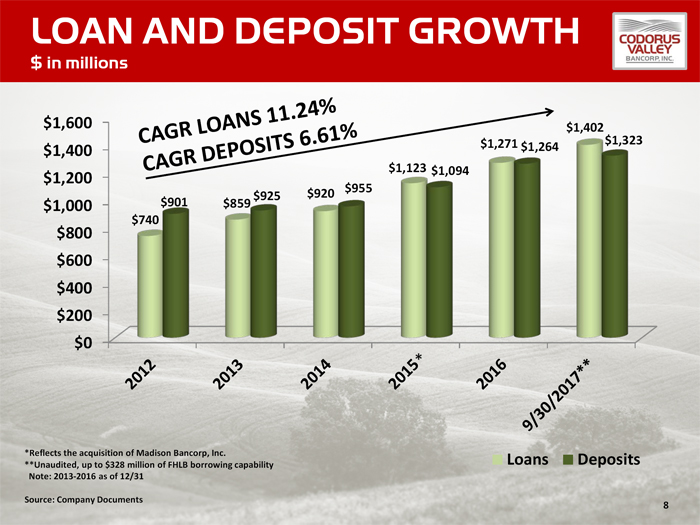

LOAN AND DEPOSIT GROWTH $ in millions $1,600 $1,402 $1,271 $1,264 $1,323 $1,400 $1,123 $1,094 $1,200 $920 $955 $901 $925 $1,000 $859 $740 $800 $600 $400 $200 $0 *Reflects the acquisition of Madison Bancorp, Inc. Loans Deposits **Unaudited, up to $328 million of FHLB borrowing capability Note: 2013-2016 as of 12/31 Source: Company Documents 8

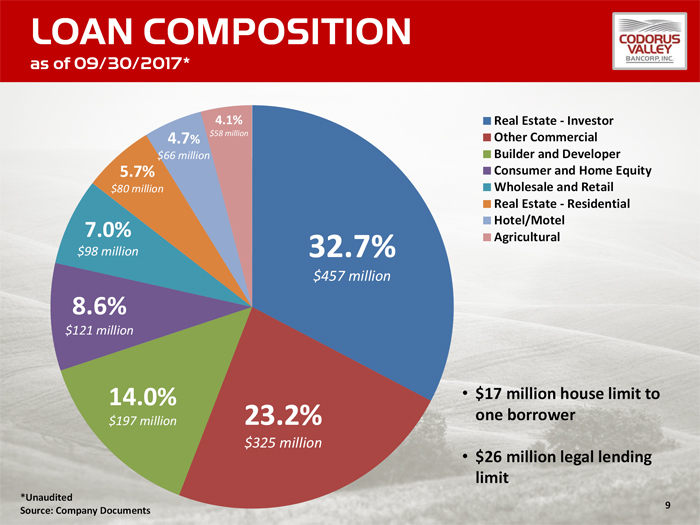

LOAN COMPOSITION as of 09/30/2017* 4.1% Real Estate - Investor 4.7% $58 million Other Commercial $66 million Builder and Developer 5.7% Consumer and Home Equity $80 million Wholesale and Retail Real Estate - Residential 7.0% Hotel/Motel Agricultural $98 million 32.7% $457 million 8.6% $121 million 14.0% • $17 million house limit to $197 million 23.2% one borrower $325 million • $26 million legal lending limit *Unaudited Source: Company Documents 9

COMPOSITION OF NON-PERFORMING ASSETS 12/31/2012 12/31/2013 12/31/2014 12/31/2015 12/31/2016 9/30/2017* Nonaccrual loans $8,342 $15,300 $8,626 $3,233 $3,114 $6,315 Foreclosed real estate, net 186 4,068 2,542 2,913 2,705 0 90-days past due 3,633 0 54 484 733 76 Total nonperforming assets $12,161 $19,368 $11,222 $6,630 $6,552 $6,391 NPA ratio 1.64% 2.24% 1.22% 0.59% 0.51% 0.46% Total loans, not available for sale $737,134 $859,384 $920,090 $1,123,211 $1,270,771 $1,402,262 Allowance for loan/lease losses $11,162 $9,975 $11,162 $12,704 $14,992 $16,792 ALLL ratio 1.26% 1.16% 1.21% 1.13% 1.18% 1.20% Net charge-off ratio 0.16% 0.10% 0.05% 0.19% 0.06% 0.17%** Note: Dollars in thousands. *Unaudited **Annualized Source: Company Documents 10

DEPOSIT COMPOSITION as of 09/30/2017* Money Market 6.3% Time Deposits less than $100,000 $84 million Noninterest-bearing demand 10.8% Time Deposits $100,000 or More $142 million 33.8% NOW Savings $448 million 13.8% $182 million • Noninterest-bearing deposits grew $35.9 16.9% million, or 19.2%, from September 30, 2016 18.4% to September 30, 2017 $223 million $243 million *Unaudited Source: Company Documents 11

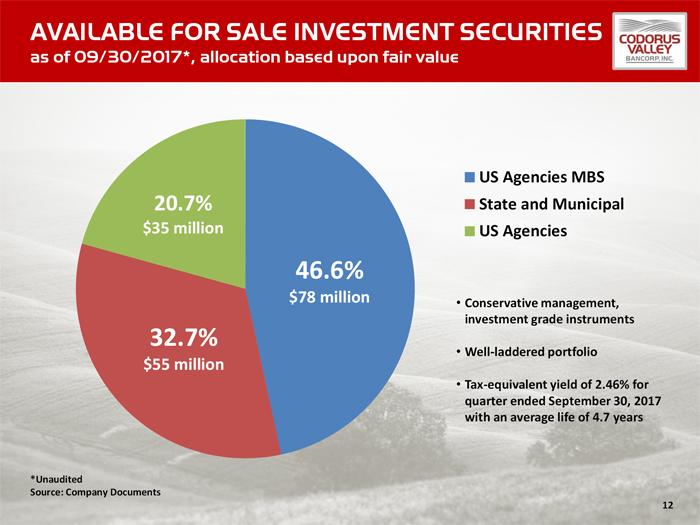

AVAILABLE FOR SALE INVESTMENT SECURITIES as of 09/30/2017*, allocation based upon fair value US Agencies MBS 20.7% State and Municipal $35 million US Agencies 46.6% $78 million • Conservative management, investment grade instruments 32.7% • Well-laddered portfolio $55 million • Tax-equivalent yield of 2.46% for quarter ended September 30, 2017 with an average life of 4.7 years *Unaudited Source: Company Documents 12

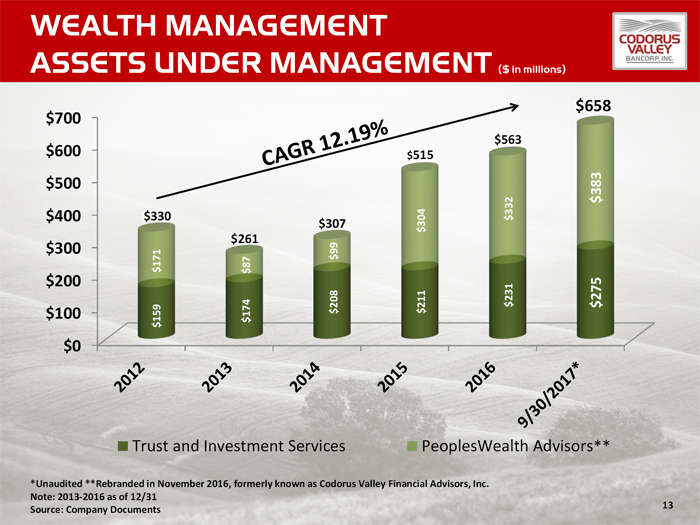

WEALTH MANAGEMENT ASSETS UNDER MANAGEMENT ($ in millions) $658 $700 $563 $600 $515 $500 $383 $400 $330 $332 $307 $304 $261 $300 $99 $171 $87 $200 $208 $211 $231 $275 $100 $159 $174 $0 Trust and Investment Services PeoplesWealth Advisors** *Unaudited **Rebranded in November 2016, formerly known as Codorus Valley Financial Advisors, Inc. Note: 2013-2016 as of 12/31 Source: Company Documents 13

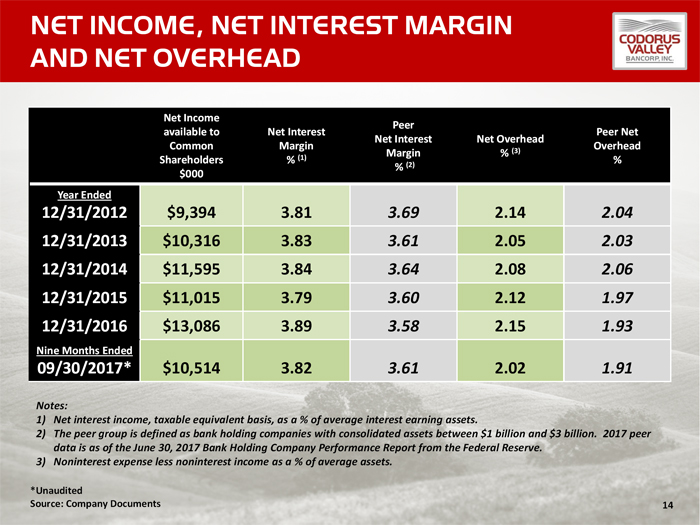

NET INCOME, NET INTEREST MARGIN AND NET OVERHEAD Net Income Peer available to Net Interest Peer Net Net Interest Net Overhead Common Margin Overhead Margin % (3) Shareholders % (1) % % (2) $000 Year Ended 12/31/2012 $9,394 3.81 3.69 2.14 2.04 12/31/2013 $10,316 3.83 3.61 2.05 2.03 12/31/2014 $11,595 3.84 3.64 2.08 2.06 12/31/2015 $11,015 3.79 3.60 2.12 1.97 12/31/2016 $13,086 3.89 3.58 2.15 1.93 Nine Months Ended 09/30/2017* $10,514 3.82 3.61 2.02 1.91 Notes: 1) Net interest income, taxable equivalent basis, as a % of average interest earning assets. 2) The peer group is defined as bank holding companies with consolidated assets between $1 billion and $3 billion. 2017 peer data is as of the June 30, 2017 Bank Holding Company Performance Report from the Federal Reserve. 3) Noninterest expense less noninterest income as a % of average assets. *Unaudited Source: Company Documents 14

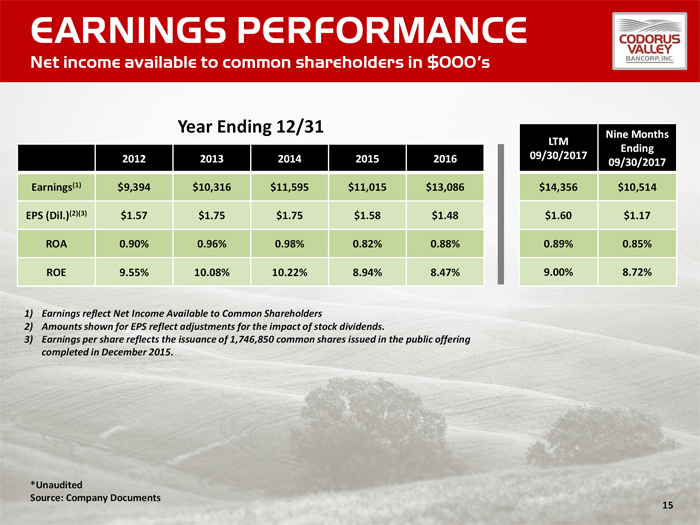

EARNINGS PERFORMANCE Net income available to common shareholders in $000’s Year Ending 12/31 Nine Months LTM Ending 2012 2013 2014 2015 2016 09/30/2017 09/30/2017 Earnings(1) $9,394 $10,316 $11,595 $11,015 $13,086 $14,356 $10,514 EPS (Dil.)(2)(3) $1.57 $1.75 $1.75 $1.58 $1.48 $1.60 $1.17 ROA 0.90% 0.96% 0.98% 0.82% 0.88% 0.89% 0.85% ROE 9.55% 10.08% 10.22% 8.94% 8.47% 9.00% 8.72% 1) Earnings reflect Net Income Available to Common Shareholders 2) Amounts shown for EPS reflect adjustments for the impact of stock dividends. 3) Earnings per share reflects the issuance of 1,746,850 common shares issued in the public offering completed in December 2015. *Unaudited Source: Company Documents 15

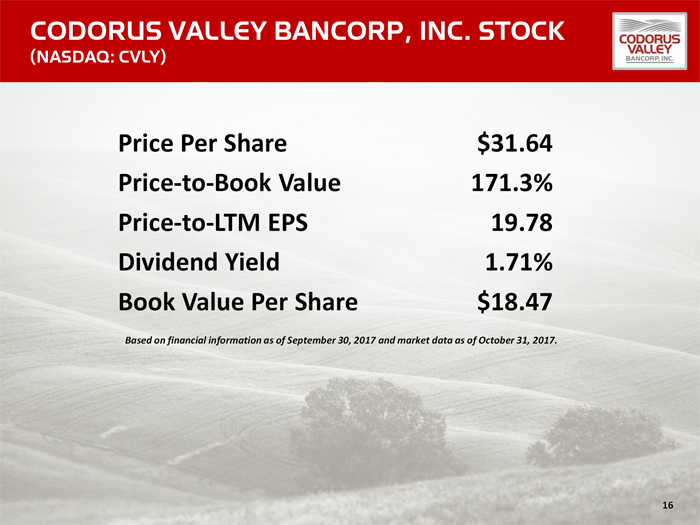

CODORUS VALLEY BANCORP, INC. STOCK (NASDAQ: CVLY) Price Per Share $31.64 Price-to-Book Value 171.3% Price-to-LTM EPS 19.78 Dividend Yield 1.71% Book Value Per Share $18.47 Based on financial information as of September 30, 2017 and market data as of October 31, 2017. 16

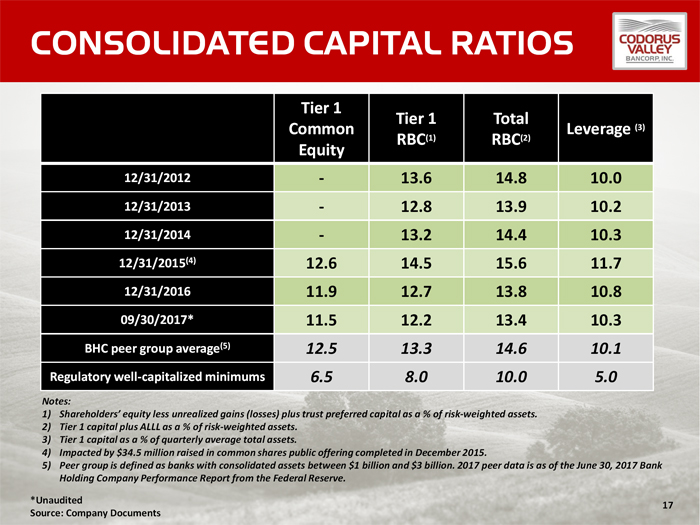

CONSOLIDATED CAPITAL RATIOS Tier 1 Tier 1 Total Common Leverage (3) RBC(1) RBC(2) Equity 12/31/2012 - 13.6 14.8 10.0 12/31/2013 - 12.8 13.9 10.2 12/31/2014 - 13.2 14.4 10.3 12/31/2015(4) 12.6 14.5 15.6 11.7 12/31/2016 11.9 12.7 13.8 10.8 09/30/2017* 11.5 12.2 13.4 10.3 BHC peer group average(5) 12.5 13.3 14.6 10.1 Regulatory well-capitalized minimums 6.5 8.0 10.0 5.0 Notes: 1) Shareholders’ equity less unrealized gains (losses) plus trust preferred capital as a % of risk-weighted assets. 2) Tier 1 capital plus ALLL as a % of risk-weighted assets. 3) Tier 1 capital as a % of quarterly average total assets. 4) Impacted by $34.5 million raised in common shares public offering completed in December 2015. 5) Peer group is defined as banks with consolidated assets between $1 billion and $3 billion. 2017 peer data is as of the June 30, 2017 Bank Holding Company Performance Report from the Federal Reserve. *Unaudited 17 Source: Company Documents

INVESTMENT CONSIDERATIONS • Strong and consistent core profitability • 150+ year market presence with a continued commitment to community banking • Strategic geographic positioning with compelling opportunities going forward in an economically strong and demographically diverse market • Growing fee income platforms that provide a consistent stream of revenue • Loan portfolio generating a solid net interest margin while maintaining a NPA ratio well below 1.00% • Experienced management team and dedicated Board that possess a clear understanding of the risks, opportunities, and challenges facing our industry and the communities we serve • Demonstrated organic growth and proven ability to execute acquisitions 18

APPENDIX

CONSISTENT RETURN OF CAPITAL Total Cash Stock Dividend Year Dividends Per Issued Share* 2012 $0.300 5.0% 2013 $0.360 5.0% 2014 $0.404 5.0% 2015 $0.440 5.0% 2016 $0.472 5.0% 09/30/2017(1,2) $0.516 5.0% *Dividends per share adjusted for 5% stock dividend impact (1) Dividends paid year-to-date through November 14, 2017 (2) Includes stock dividend declared on October 10, 2017 payable on December 12, 2017 Total Return Since the Beginning of 2012: 491.17%* *As of October 31, 2017. Source: SNL Financial 20

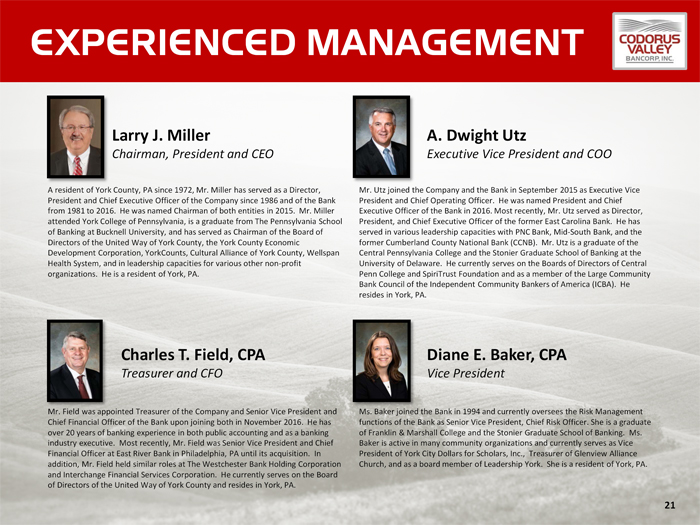

EXPERIENCED MANAGEMENT Larry J. Miller A. Dwight Utz Chairman, President and CEO Executive Vice President and COO A resident of York County, PA since 1972, Mr. Miller has served as a Director, Mr. Utz joined the Company and the Bank in September 2015 as Executive Vice President and Chief Executive Officer of the Company since 1986 and of the Bank President and Chief Operating Officer. He was named President and Chief from 1981 to 2016. He was named Chairman of both entities in 2015. Mr. Miller Executive Officer of the Bank in 2016. Most recently, Mr. Utz served as Director, attended York College of Pennsylvania, is a graduate from The Pennsylvania School President, and Chief Executive Officer of the former East Carolina Bank. He has of Banking at Bucknell University, and has served as Chairman of the Board of served in various leadership capacities with PNC Bank, Mid-South Bank, and the Directors of the United Way of York County, the York County Economic former Cumberland County National Bank (CCNB). Mr. Utz is a graduate of the Development Corporation, YorkCounts, Cultural Alliance of York County, Wellspan Central Pennsylvania College and the Stonier Graduate School of Banking at the Health System, and in leadership capacities for various other non-profit University of Delaware. He currently serves on the Boards of Directors of Central organizations. He is a resident of York, PA. Penn College and SpiriTrust Foundation and as a member of the Large Community Bank Council of the Independent Community Bankers of America (ICBA). He resides in York, PA. Charles T. Field, CPA Diane E. Baker, CPA Treasurer and CFO Vice President Mr. Field was appointed Treasurer of the Company and Senior Vice President and Ms. Baker joined the Bank in 1994 and currently oversees the Risk Management Chief Financial Officer of the Bank upon joining both in November 2016. He has functions of the Bank as Senior Vice President, Chief Risk Officer. She is a graduate over 20 years of banking experience in both public accounting and as a banking of Franklin & Marshall College and the Stonier Graduate School of Banking. Ms. industry executive. Most recently, Mr. Field was Senior Vice President and Chief Baker is active in many community organizations and currently serves as Vice Financial Officer at East River Bank in Philadelphia, PA until its acquisition. In President of York City Dollars for Scholars, Inc., Treasurer of Glenview Alliance addition, Mr. Field held similar roles at The Westchester Bank Holding Corporation Church, and as a board member of Leadership York. She is a resident of York, PA. and Interchange Financial Services Corporation. He currently serves on the Board of Directors of the United Way of York County and resides in York, PA. 21

105 Leader Heights Road, York, Pennsylvania 17403 www.peoplesbanknet.com