Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HEARTLAND FINANCIAL USA INC | ex991acquistionannouncemen.htm |

| 8-K - 8-K - HEARTLAND FINANCIAL USA INC | form8-kacquisitionannounce.htm |

Lynn B. Fuller

Chairman and CEO

Trading Symbol

HTLF | www.htlf.com

Acquisition of Signature Bancshares, Inc.

CREATING A TWIN CITIES PREMIER BUSINESS AND PRIVATE BANK

November 13, 2017

2

Cautionary Note Regarding Forward-Looking Statements

The following presentation relates to the proposed acquisition (the “Acquisition”) of Signature Bancshares, Inc. (“Signature”) by Heartland Financial USA, Inc. (“Heartland”).

Certain statements contained in this presentation are not statements of historical fact and are forward-looking statements. These forward-looking statements, which are based on certain assump-

tions and describe Heartland’s future plans, strategies and expectations, can generally be identified by the use of the words “may”, “would”, “could”, “will”, “expect”, “anticipate”, “project”, “believe”,

“intend”, “plan” and “estimate”, as well as similar expressions. These forward-looking statements include statements related to our projected growth, the Acquisition, including statements related to

the expected timing, completion and other effects our Acquisition, our anticipated future financial performance, and management’s long-term performance goals, as well as statements relating to

the anticipated effects on results of operations and financial condition from expected developments or events, or business and growth strategies, including projections of future amortization and

accretion, the impact of the expiration of loss share agreements, and anticipated internal growth.

These forward-looking statements involve significant risks and uncertainties that could cause our actual results to differ materially from those in such statements. Potential risks and uncertainties

include the following:

> the inability to obtain the requisite regulatory and shareholder approvals for the Acquisition and the inability to meet other closing terms and conditions;

> the reaction to the Acquisition by all of Heartland’s customers, employees and counter-parties, or difficulties related to the transition of services required by the Acquisition;

> general economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a continued

deterioration in credit quality, a further reduction in demand for credit and a further decline in real estate values;

> our ability to raise additional capital may be impaired if market disruption and volatility occurs;

> costs or difficulties related to the integration of Signature Bank (Signature’s wholly owned subsidiary bank) or other banks we may acquire may be greater than expected;

> restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals;

> legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us;

> competitive pressures among depository and other financial institutions may increase significantly;

> changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or acquire;

> other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can;

> our ability to attract and retain key personnel can be affected by the increased competition for experience employees in the banking industry;

> adverse changes may occur in the bond and equity markets;

> war or terrorist activities may cause deterioration in the economy or cause instability in credit markets;

> economic, governmental or other factors may prevent the projected residential and commercial growth in the markets in which we operate; and

> we will or may continue to face the risk factors discussed from time to time in the periodic reports we file with the Securities Exchange Commission ( the “SEC”)

For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

You should not place undue reliance on the forward-looking statements, which speak only as of the date of this presentation. All subsequent written and oral forward-looking statements

attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. We undertake no

obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. See Item 1A, Risk Factors, in our Annual Report on

form 10-K for the year ended December 31, 2016, for a description of some of the important risks of investing in Heartland common stock.

3

Additional Information about the Acquisition and Where to Find it

In connection with the proposed Acquisition, Heartland will file a registration statement on Form S-4 with the SEC to register shares of Heartland common stock that will

be issued to Signature shareholders in connection with the Acquisition. The registration statement will include a proxy statement of Signature and a prospectus of Heartland as well as other

relevant documents concerning the proposed Acquisition. The registration statement and the proxy statement/prospectus to be filed with the SEC relating to the proposed Acquisition will contain

important information about Heartland, Signature, the proposed Acquisition and related matters. WE URGE HOLDERS OF COMMON STOCK AND STOCK OPTIONS TO READ THE REGISTRATION

STATEMENT AND PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE ACQUISITION OR INCORPORATED

BY REFERENCE INTO THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS), BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Holders of Signature com-

mon stock and stock options may also obtain free copies of these documents and other documents filed with the SEC, at the SEC’s website at https://www.sec.gov. Security holders may also obtain

free copies of the documents filed with the SEC by Heartland at its website at https://www.htlf.com (which website is not incorporated herein by reference) or by contacting Bryan R. McKeag by

telephone at 563-589-1994. Security holders may also obtain free copies of the information relating to Signature at its website at www.signaturebankonline.com (which website is not incorporated

herein by reference) or by contacting Amy Reding by telephone at (952) 936.7800.

Signature and its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Signature in connection with the proposed

Acquisition. Information regarding these persons who may, under the rules of the SEC, be considered participants in the solicitation of shareholder votes in connection with the proposed Acqui-

sition will be provided in the proxy statement/prospectus described above when it is filed with SEC.

4

Heartland Acquires Signature to Power Growth in Vibrant Twin Cities Market

» Combination of Minnesota Bank & Trust, Heartland’s Minnesota bank subsidiary, (“MBT”), and Signature Bank creates a

$600 million franchise

» The merged operation will adopt the Minnesota Bank & Trust brand

» Triples Heartland’s assets in The Twin Cities creating a strong business focused bank in one of the country’s fastest growing markets

» MBT will operate two business banking centers located in Edina and Minnetonka

» High quality acquisition with an attractive deposit mix of 29% non-interest bearing and 83% non-time deposits

» Heartland is partnering with Signature and its Co-founders, Ken Brooks and Leif Syverson to continue their long banking history

in the Twin Cities

• Signature President and Co-founder, Kenneth Brooks will lead the new bank ‘s combined management team

• Signature Co-founder Leif Syverson will head Commercial Banking for the merged institution

• Signature shares a similar culture with Heartland ‘s community bank model of exceptional value added service

» Financially attractive to Heartland:

• Expected to be immediately accretive to EPS in 2018 and ~3% accretive to EPS in 2019

• Tangible book value earn-back in ~3.7 years

• Internal Rate of Return well in excess of 15%

» Projected to close in Q1 2018 when Heartland will cross $10 billion in total assets

» Low execution risk

5

Transaction Structure

STRUCTURE /

CONSIDERATION

PRICING

MULTIPLES1

MANAGEMENT

APPROVALS/

TIMING

(1) Based on HTLF’s closing price of $47.30 on November 10, 2017 and financials for Signature as of 09/30/17

(2) This amount includes payments to Signature stockholders and option holders but excludes the redemption of approximately

$10.5 million in notes and subordinated debentures

(3) The reported earnings of Signature Bancshares, a Chapter S corporation, have been tax effected at 40% for this calculation

• Each outstanding share of Signature common stock exchanged for 0.061 shares of Heartland common stock

and $0.335 in cash, subject to adjustment

• A total of approximately 922,100 shares of Heartland common stock and $5.1 million in cash, a 90%/10%

common stock and cash mix

• Signature option holders will receive approximately $4.8 million in cash or stock, at election of option holder

• Double trigger walk-away provision versus KBW Regional Bank Index (“KRX”)

• Signature will be merged into Heartland, and Signature Bank will be merged into MBT

• Surviving bank will operate under the Minnesota Bank & Trust brand name

• Aggregate Deal Value: ~ $53.4 million2

• Price/ Tangible Book value Per Share: ~ 1.82x

• Aggregate Deal Value/Tangible Book Value: ~ 2.00 x

• Aggregate Deal Value/LTM Earnings: ~ 16.1x 3

• Core Deposit Premium: ~ 9.3%

• Ken Brooks, President and CEO of Signature Bank immediately named CEO of the surviving bank

• Leif Syverson, commercial banking leader at Signature Bank named EVP, Commercial Banking at MBT

• Anticipated closing in Q1 2018 / systems conversion in Q2 2018

• Closing subject to customary regulatory approvals and approval by Signature shareholders

6

Partnering with Signature: Great People Deliver Great Results

Heartland will continue Ken Brooks’s and Leif Syverson’s dedication to exceptional client

service and community leadership as we share the same philosophies and values.

• Co-founders Ken Brooks and Leif Syverson bring over 30 years of Minnesota-based banking expertise

• Aligned values of integrity, fairness and service that exceeds client’s expectations

• Signature Bank was recognized five years in a row by the Minneapolis-St. Paul Business Journal as one of the

“Best Places to Work”.

• Heartland shares with Signature a strong commitment to expanding in rapidly growing markets such as the

Twin Cities metropolitan area.

• Both Heartland and Signature have each demonstrated this dedication to profitable growth through a 5-year

compound growth of assets of 16%

• The partnership with Signature is a major step toward an expanding platform in the Twin Cities metro

market similar in size to Heartland’s other key markets

Best Place to Work Winner in the Minneapolis St-Paul Business Journal

“Best Places to Work” for five years.

7

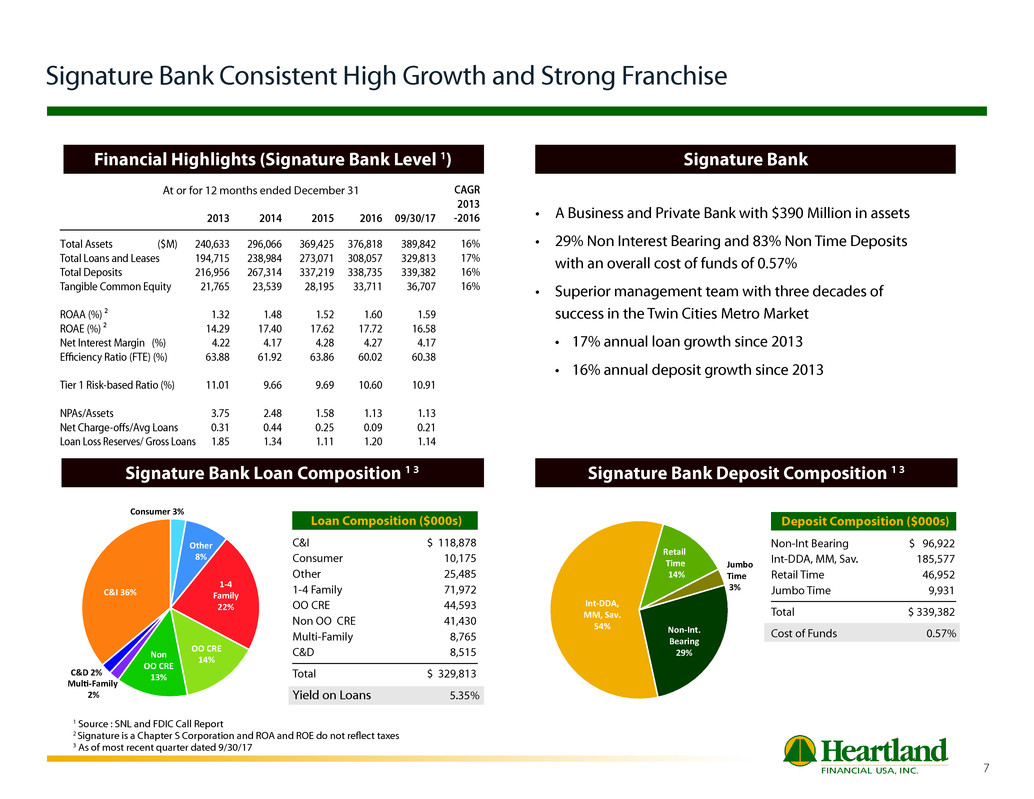

Signature Bank Consistent High Growth and Strong Franchise

Financial Highlights (Signature Bank Level 1) Signature Bank

Signature Bank Loan Composition 1 3 Signature Bank Deposit Composition 1 3

• A Business and Private Bank with $390 Million in assets

• 29% Non Interest Bearing and 83% Non Time Deposits

with an overall cost of funds of 0.57%

• Superior management team with three decades of

success in the Twin Cities Metro Market

• 17% annual loan growth since 2013

• 16% annual deposit growth since 2013

1 Source : SNL and FDIC Call Report

2 Signature is a Chapter S Corporation and ROA and ROE do not reflect taxes

3 As of most recent quarter dated 9/30/17

At or for 12 months ended December 31

Loan Composition ($000s)

C&I $ 118,878

Consumer 10,175

Other 25,485

1-4 Family 71,972

OO CRE 44,593

Non OO CRE 41,430

Multi-Family 8,765

C&D 8,515

Total $ 329,813

Yield on Loans 5.35%

2013 2014 2015 2016 09/30/17

Total Assets ($M) 240,633 296,066 369,425 376,818 389,842

Total Loans and Leases 194,715 238,984 273,071 308,057 329,813

Total Deposits 216,956 267,314 337,219 338,735 339,382

Tangible Common Equity 21,765 23,539 28,195 33,711 36,707

ROAA (%) ² 1.32 1.48 1.52 1.60 1.59

ROAE (%) ² 14.29 17.40 17.62 17.72 16.58

Net Interest Margin (%) 4.22 4.17 4.28 4.27 4.17

Efficiency Ratio (FTE) (%) 63.88 61.92 63.86 60.02 60.38

Tier 1 Risk-based Ratio (%) 11.01 9.66 9.69 10.60 10.91

NPAs/Assets 3.75 2.48 1.58 1.13 1.13

Net Charge-offs/Avg Loans 0.31 0.44 0.25 0.09 0.21

Loan Loss Reserves/ Gross Loans 1.85 1.34 1.11 1.20 1.14

CAGR

2013

-2016

16%

17%

16%

16%

Consumer 3%

Mulg415-Family

2%

C&D 2%

C&I 36%

1-4

Family

22%

Other

8%

OO CRE

14%

Int-DDA,

MM, Sav.

54% Non-Int.

Bearing

29%

Retail

Time

14%

Non

OO CRE

13%

Jumbo

Time

3%

Consumer 3%

Mulg415-Family

2%

C&D 2%

C&I 36%

1-4

Family

22%

Other

8%

OO CRE

14%

Int-DDA,

MM, Sav.

54% Non-Int.

Bearing

29%

Retail

Time

14%

Non

OO CRE

13%

Jumbo

Time

3%

Deposit Composition ($000s)

Non-Int Bearing $ 96,922

Int-DDA, MM, Sav. 185,577

Retail Time 46,952

Jumbo Time 9,931

Total $ 339,382

Cost of Funds 0.57%

8

Two Banks will Create a Premier Business and Private Bank in the Twin Cities,

one of the Best Growth Markets

Minnesota/ Twin Cities Market Demographics1

1Source: SNL Financial

• The Twin Cities location makes it the hub of the Upper

Midwest economy. It represents 60% of Minnesota’s

population and is home to most of the state’s 18 Fortune

500 companies

• Minnesota ranked 3rd among “Best States” for opportunities

for citizens in 2017 according to U.S. New & World report

• Minneapolis-St. Paul was ranked as the 13th best place for

business by Forbes in 2017

• The Twin Cities were ranked as the 2nd best city for young

professionals and 5th best city for Millennials in 2017

(Source Smart Asset/ Wallet Hub)

• Minneapolis-St Paul-Bloomington MSA enjoyed one of the

lowest rates of unemployment in the US at 3.4% in August

2017 (US Bureau of Labor statistics)

(Footprint) HTLF Twin Cities MSA U.S.

Projected Population 3.29% 7.45% 5.76%

Growth 2018-2023

2018 Household Income $61,096 $76,791 $61,045

Projected Household 8.27% 9.74% 8.86%

Income Growth 2018-2023

U.S. Branches: Current Ownership (1)

Branch Map

Signature Bank

Source: S&P Global Market Intelligence | Page 1 of 1

Minnesota Bank & Trust Signature Bank

9

Pro Forma Impact

Heartland Estimated Pro Forma Summary Financial Information:

(Dollars in billions except per share data)

• Total Assets $10.4B

• Total Gross Loans $6.7B

• Total Deposits $8.7B

• TBV/Share ~ (2)%

• TBV Earnback2 (Crossover Method) ~ 3.7 yrs

• 2018 EPS (Incl. merger expenses) ~ 1%

• 2019 EPS ~ 3%

• TCE/TA Ratio ~ 7.6%

• Leverage Ratio ~ 9.2%

• Total RBC Ratio ~ 13.3%

1 Pro Forma Balance Sheet and Capital Ratios as of anticipated closing date of 03/31/18

2 Crossover method defined as the number of years for projected pro forma TBV per share to exceed projected stand-alone TBV per share

PRO FORMA

BALANCE SHEET1

PRO FORMA PER

SHARE

ACCRETION/(DILUTION)

PRO FORMA

CAPITAL RATIOS1

10

Transaction Analysis

• Comprehensive due diligence process

• In-depth review of credit files, underwriting methodology and policy

• Approximately 60% of total loans reviewed and 100% of NPAs

• Detailed review of expenses on a line item basis

• Estimated 2.25% credit mark of $7.4 million

• Loan rate mark of 0.25% or $0.8 million accreted over 3.0 years

• Projected 25% cost savings, 100% phased-in by year-end 2018

• Pretax, one-time buyer and seller combined merger charges estimated at $4.1 million

• Core deposit intangibles of 1.50% amortized over 10 years using sum of years digits

• 10% mark down on OREO

• No revenue enhancements modeled

• Heartland will maintain assets of under $10 billion through year-end 2017

• Heartland anticipates Durbin amendment to be effective July 2019-Annualized impact ~ $ 5 million pretax

• Heartland has been investing for several years in people, systems and processes to meet

the requirements of crossing the $10 Billion mark

• Heartland anticipates delivery of first Dodd-Frank Test by 2020

11

An Expanding Franchise—Heartland Financial USA, Inc.

10

Independent

Bank Charters

117

Offices

88

Communities

Citizens Finance offices are in Iowa,

Illinois and Wisconsin

Mortgage Loan Offices are within the bank footprint

12

A Compelling Opportunity for Heartland and its Stockholders

» Market expansion in high growth Twin Cities market

» Triples Heartland’s assets in Minnesota

» High quality acquisition with an attractive deposit mix and low-cost core funding

» Retention of local management, board representation and relationship management talent to join our existing Twin Cities team

» Strategically attractive with compelling financial metrics

» Low execution risk

» When completed, the Acquisition will be Heartland’s thirteenth acquisition since 2012; Heartland has a history of successful merger

execution and integration

» Transaction enhances Heartland’s long-term stockholder value

13

Contact Information

BRUCE K. LEE

President

PHONE: (563) 587-4176

FAX: (563) 589-2011

TOLL-FREE: (888) 739-2100

blee@htlf.com

www.htlf.com

1398 CENTRAL AVENUE P.O. BOX 778 DUBUQUE, IA 52004-0778

LYNN B. FULLER

Chairman

PHONE: (563) 589-2105

FAX: (563) 589-2011

TOLL-FREE: (888) 739-2100

lfuller@htlf.com

www.htlf.com

1398 CENTRAL AVENUE P.O. BOX 778 DUBUQUE, IA 52004-0778

BRYAN R. McKEAG

Executive Vice President

Chief Financial Officer

PHONE: (563) 589-1994

CELL: (920) 284-0732

FAX: (563) 589-1951

TOLL-FREE: (888) 739-2100

bmckeag@htlf.com

www.htlf.com

1398 CENTRAL AVENUE DUBUQUE, IA 52001