Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ENTERPRISE FINANCIAL SERVICES CORP | a2017-118kinvestorpresenta.htm |

ENTERPRISE FINANCIAL SERVICES CORP

THIRD QUARTER 2017 INVESTOR PRESENTATION

2

Forward-Looking Statement

Some of the information in this report contains “forward‐looking statements” within the meaning of and intended to be covered by

the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward‐looking statements typically are

identified with use of terms such as “may,” “might,” “will, “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “could,” “continue” and the negative of these terms and similar words, although some forward‐looking statements may

be expressed differently. Forward‐looking statements also include, but are not limited to, statements regarding plans, objectives,

expectations or consequences of announced transactions and statements about the future performance, operations products and

services of the Company and its subsidiaries. Our ability to predict results or the actual effect of future plans or strategies is

inherently uncertain. You should be aware that our actual results could differ materially from those anticipated by the forward‐

looking statements or historical performance due to a number of factors, including, but not limited to: our ability to efficiently

integrate acquisitions into our operations, retain the customers of these businesses and grow the acquired operations; reputational

risks; credit risk; changes in the appraised valuation of real estate securing impaired loans; outcomes of litigation and other

contingencies; exposure to general and local economic conditions; risks associated with rapid increases or decreases in prevailing

interest rates; consolidation within the banking industry; competition from banks and other financial institutions; our ability to

attract and retain relationship officers and other key personnel; burdens imposed by federal and state regulation; changes in

regulatory requirements; changes in accounting regulation or standards applicable to banks; and other risks discussed under the

caption “Risk Factors” of our most recently filed Form 10‐K and in Part II, 1A of our most recently filed Form 10‐Q, all of which

could cause the Company’s actual results to differ from those set forth in the forward‐looking statements.

Readers are cautioned not to place undue reliance on our forward‐looking statements, which reflect management’s analysis and

expectations only as of the date of such statements. Forward‐looking statements speak only as of the date they are made, and the

Company does not intend, and undertakes no obligation, to publicly revise or update forward‐looking statements after the date of

this report, whether as a result of new information, future events or otherwise, except as required by federal securities law. You

should understand that it is not possible to predict or identify all risk factors. Readers should carefully review all disclosures we file

from time to time with the Securities and Exchange Commission (the “SEC”) which are available on our website at

www.enterprisebank.com under "Investor Relations."

3

Company Snapshot - EFSC

SNL Data

TOTAL ASSETS

$5.2 Billion

MARKET CAP

Concentrated on Private Businesses and

Owner Families

Relationship Driven

Attract Top Talent in Markets

Product Breadth

• Banking

• Trust & Wealth Management

• Treasury Management

Proven Ability to Grow Commercial &

Industrial “C&I” Loans

Strong Balance Sheet with Attractive Risk

Profile

FOCUSED BUSINESS MODEL:

Operates in

MSAs

St. Louis

Kansas City

Phoenix

$1.0 Billion

4

Executive Leadership Team

James B. Lally, 49, President & Chief Executive Officer, EFSC 14

Keene S. Turner, 38, Executive Vice President & Chief Financial Officer, EFSC 4

Scott R. Goodman, 53, President, Enterprise Bank & Trust 14

Douglas N. Bauche, 47, Chief Credit Officer, Enterprise Bank & Trust 17

Mark G. Ponder, 47, SVP, Controller and CFO, Enterprise Bank & Trust 5

Name, Age, Title Years at Enterprise

5

Differentiated Business Model: Built for Quality Earnings

Growth

Enterprise Bank

Financial & Estate Planning

Tax Credit Brokerage

Business & Succession Planning

Trust Administration

Enterprise Trust

Investment Management

Enterprise University

Treasury Management

Personal & Private Banking

Commercial & Business Banking

PRIVATE

BUSINESSES

& OWNER

FAMILIES

Mortgage Banking

• Focused and Well‐Defined Strategy Aimed at

Business Owners, Executives and Professionals

• Targeted Array of Banking and Wealth

Management Services to Meet our Clients’ Needs

• Experienced Bankers and Advisors

6

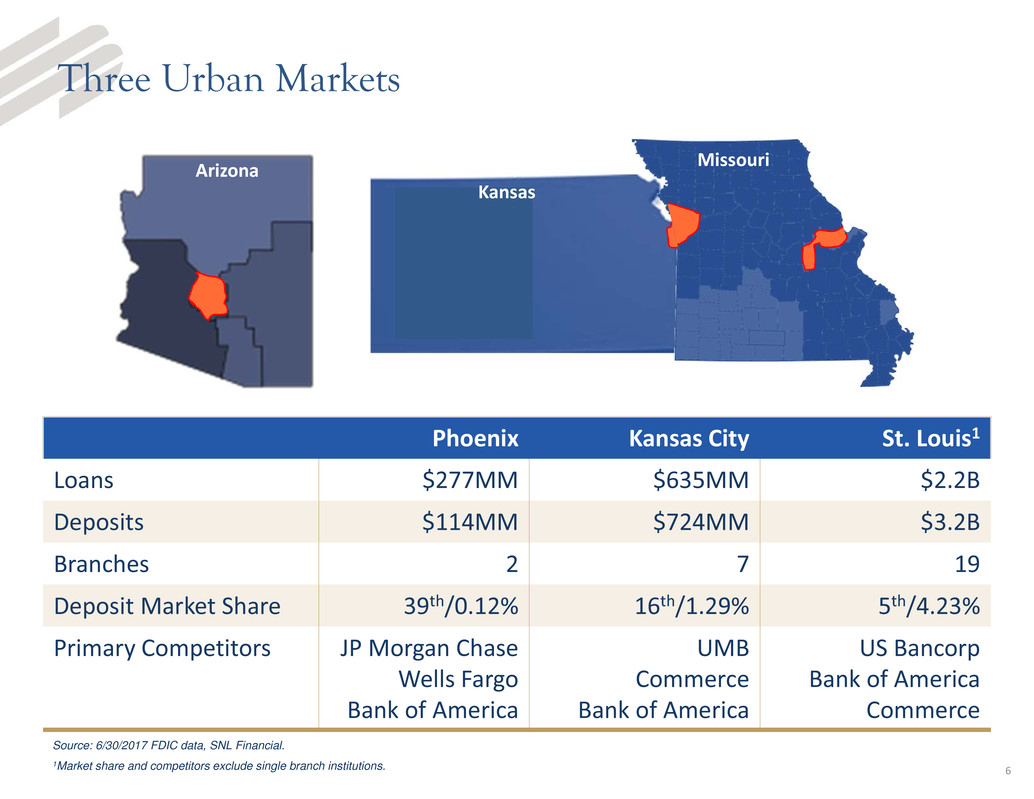

Three Urban Markets

Phoenix Kansas City St. Louis1

Loans $277MM $635MM $2.2B

Deposits $114MM $724MM $3.2B

Branches 2 7 19

Deposit Market Share 39th/0.12% 16th/1.29% 5th/4.23%

Primary Competitors JP Morgan Chase

Wells Fargo

Bank of America

UMB

Commerce

Bank of America

US Bancorp

Bank of America

Commerce

Arizona

Source: 6/30/2017 FDIC data, SNL Financial.

1Market share and competitors exclude single branch institutions.

Missouri

Kansas

7

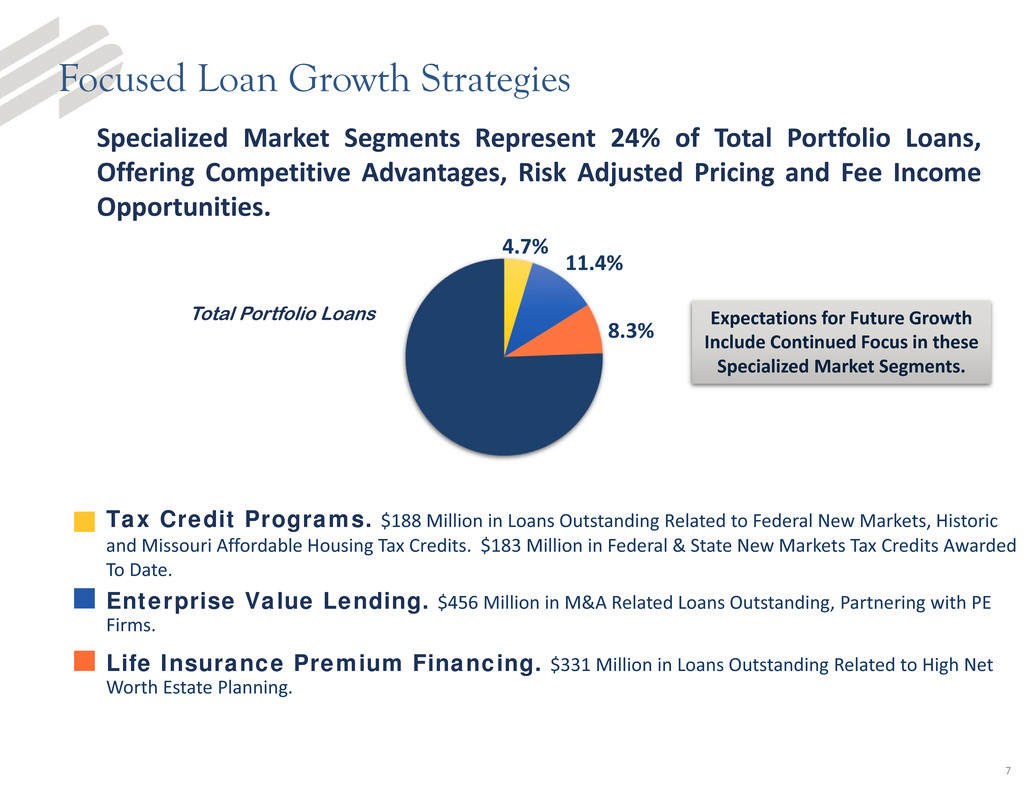

Focused Loan Growth Strategies

Tax Credit Programs. $188 Million in Loans Outstanding Related to Federal New Markets, Historic

and Missouri Affordable Housing Tax Credits. $183 Million in Federal & State New Markets Tax Credits Awarded

To Date.

Enterprise Value Lending. $456 Million in M&A Related Loans Outstanding, Partnering with PE

Firms.

Life Insurance Premium Financing. $331 Million in Loans Outstanding Related to High Net

Worth Estate Planning.

4.7%

11.4%

8.3%

Total Portfolio Loans

Specialized Market Segments Represent 24% of Total Portfolio Loans,

Offering Competitive Advantages, Risk Adjusted Pricing and Fee Income

Opportunities.

Expectations for Future Growth

Include Continued Focus in these

Specialized Market Segments.

8

History of Strong C&I Growth

$880

$1,007

$1,172

$1,371

$1,599

$1,862

Q3 '12 Q3 '13 Q3 '14 Q3 '15 Q3 '16 Q3 '17

In Millions

Awareness

Interest

Consideration

Intent

Evaluation

Purchase

9

Marketing & Sales Funnel

NOW… …FUTURE

Marketing

Sales

Marketing

Sales

10

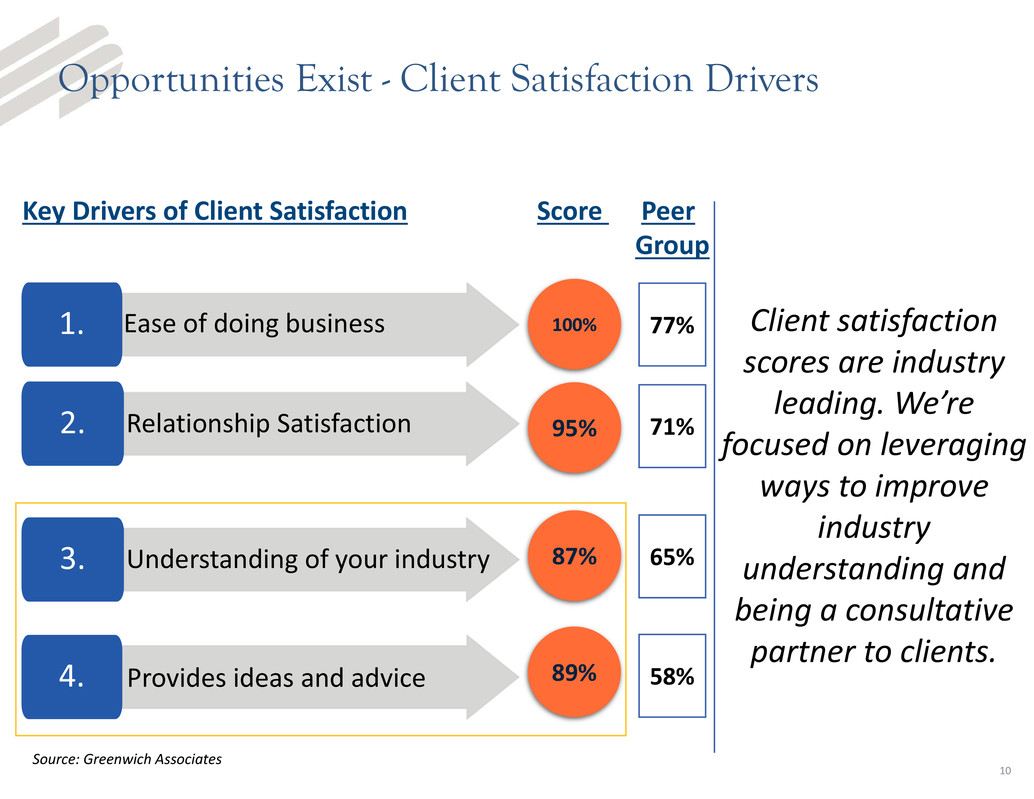

Opportunities Exist - Client Satisfaction Drivers

Client satisfaction

scores are industry

leading. We’re

focused on leveraging

ways to improve

industry

understanding and

being a consultative

partner to clients.

1. Ease of doing business

2. Relationship Satisfaction

3. Understanding of your industry

4. Provides ideas and advice

Key Drivers of Client Satisfaction Score Peer

Group

100%

95%

87%

89%

77%

71%

65%

58%

Source: Greenwich Associates

11

Acquisition of Jefferson County Bancshares, Inc. (JCB)

Closed February 10, 2017

Consistent with M&A Expansion Strategy

Enhanced EFSC’s footprint in the St. Louis MSA,

while building total balance sheet size to

$5 billion in assets

Top five deposit market share in the St. Louis

MSA

• Successfully completed core systems conversion on May 22, 2017

• Expanded branch presence

• ~$4 billion of deposits

• Strengthens & diversifies core deposit gathering capabilities

• Approximately $60 million in deposits per branch

St. Louis

MSA

EFSC (16 BRANCHES TOTAL,

6 BRANCHES IN ST. LOUIS MSA)

JEFFERSON (18 BRANCHES TOTAL,

17 BRANCHES IN ST. LOUIS MSA)

12

Portfolio Loan Trends

$3,038

$3,118

$3,853 $3,859

$3,997

Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17

In Millions

*Note: 9% excluding acquisition of JCB

JCB

$678

13

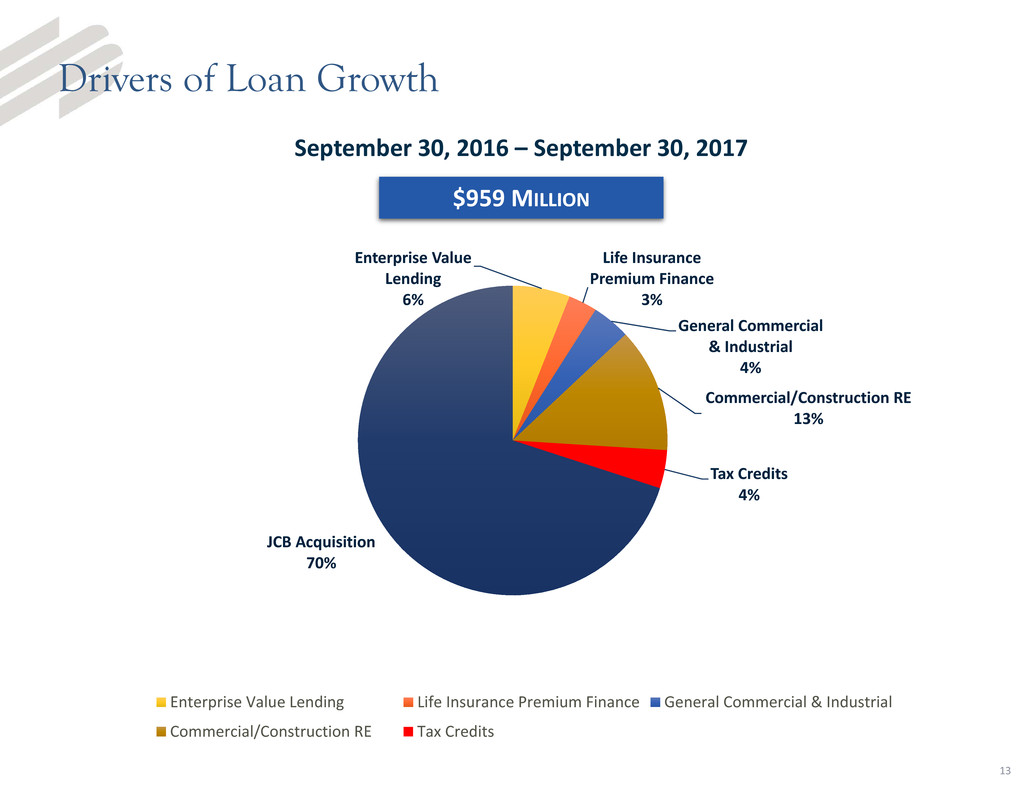

Drivers of Loan Growth

Enterprise Value

Lending

6%

Life Insurance

Premium Finance

3%

General Commercial

& Industrial

4%

Commercial/Construction RE

13%

Tax Credits

4%

JCB Acquisition

70%

Enterprise Value Lending Life Insurance Premium Finance General Commercial & Industrial

Commercial/Construction RE Tax Credits

$959 MILLION

September 30, 2016 – September 30, 2017

26%

39%15%

20%

14

Attractive Deposit Mix

CD

Interest Bearing

Transaction Accts

DDA

MMA &

Savings

SEPTEMBER 30, 2017

$4.1B

• Significant DDA Composition

• Stable Cost of Deposits

• Improving Core Funding

Cost of Deposits 0.46%

31% Core Deposit Growth

Q3 2016 – Q3 2017

In

Millions

$3,125

$3,233

$4,032 $3,921 $4,059

24.4% 26.8% 25.7% 26.0% 25.8%

Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17

Deposits JCB DDA %

JCB

$774

15

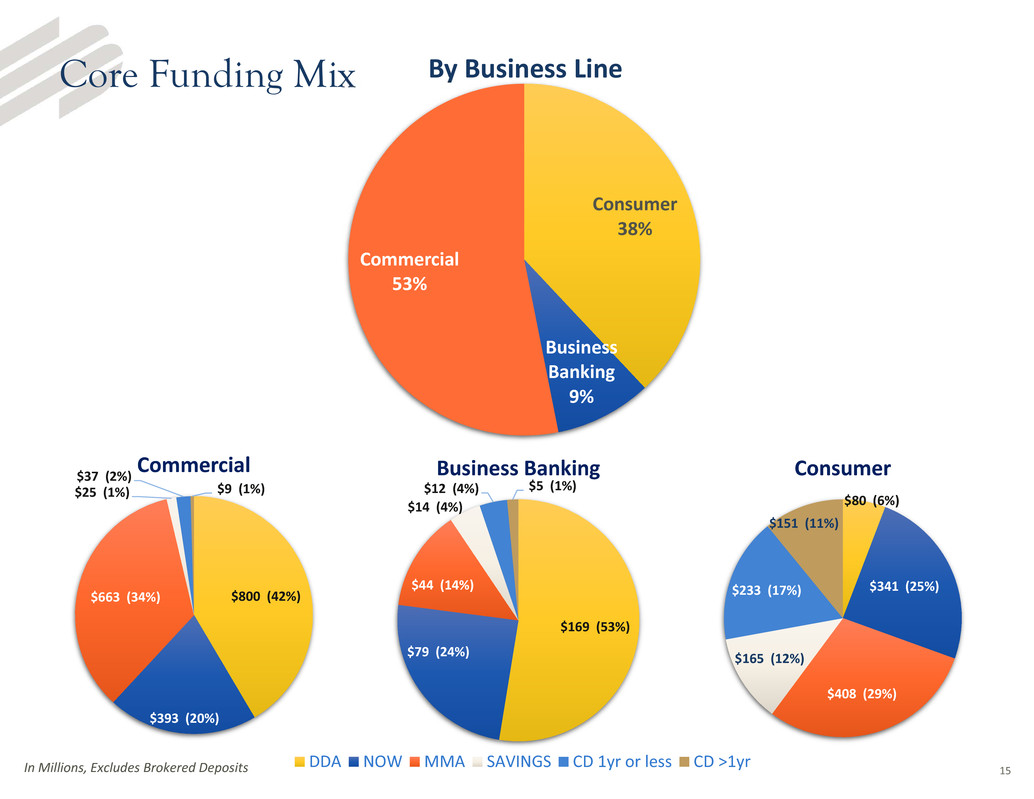

Core Funding Mix

$80 (6%)

$341 (25%)

$408 (29%)

$165 (12%)

$233 (17%)

$151 (11%)

Consumer

$169 (53%)

$79 (24%)

$44 (14%)

$14 (4%)

$12 (4%) $5 (1%)

Business Banking

DDA NOW MMA SAVINGS CD 1yr or less CD >1yr

$800 (42%)

$393 (20%)

$663 (34%)

$25 (1%)

$37 (2%)

$9 (1%)

Commercial

In Millions, Excludes Brokered Deposits

By Business Line

Consumer

38%

Business

Banking

9%

Commercial

53%

16

Financial Scorecard

Q3 2017 Compared to Q3 2016

40%

Drive Net Interest

Income Growth in

Dollars with Favorable

Loan Growth Trends

21 bps

Defend Net

Interest Margin

43 bps

NPLs/Loans

Maintain High Quality

Credit Profile

1%

Achieve Further

Improvement in

Operating Leverage

Continued Growth in Core EPS35%

Enhance Deposit Levels to Support Growth30%

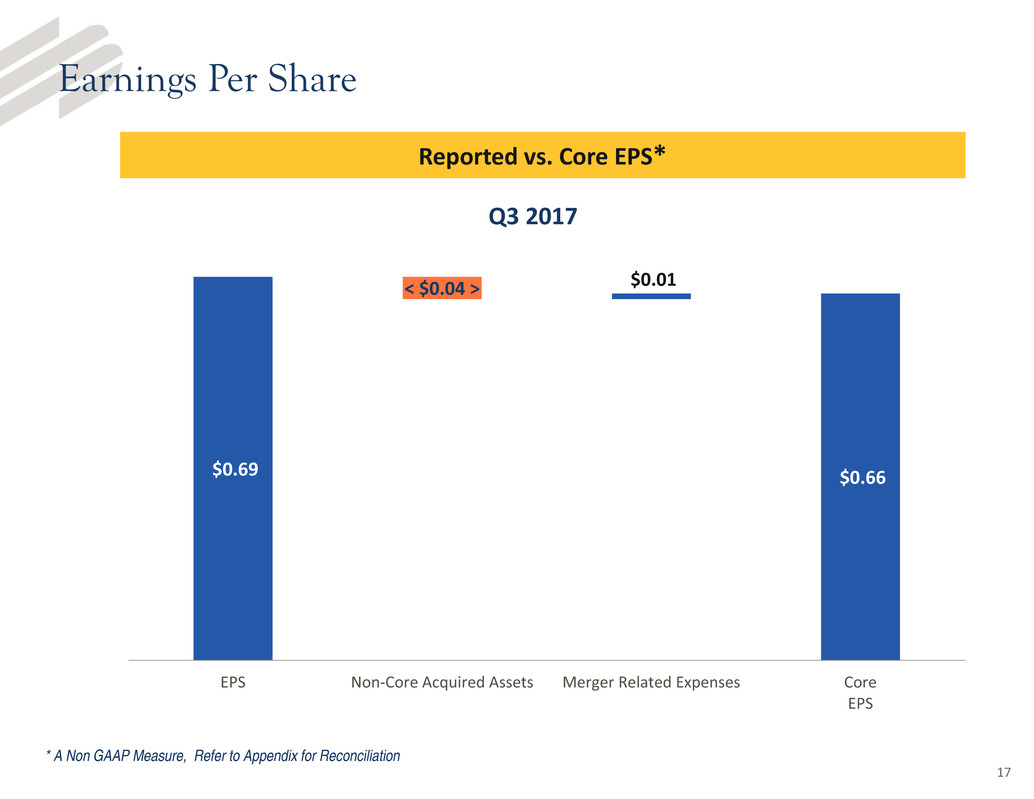

Earnings Per Share

$0.69

< $0.04 > $0.01

$0.66

EPS Non‐Core Acquired Assets Merger Related Expenses Core

EPS

* A Non GAAP Measure, Refer to Appendix for Reconciliation

Reported vs. Core EPS*

Q3 2017

17

Earnings Per Share Trend

$0.56

$0.04

$0.03 $0.01

$0.02 $0.66

Q2 '17 Net Interest

Income

Portfolio Loan Loss

Provision

Non Interest

Income

Non Interest

Expense

Q3 '17

Changes in Core EPS*

Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

18

19

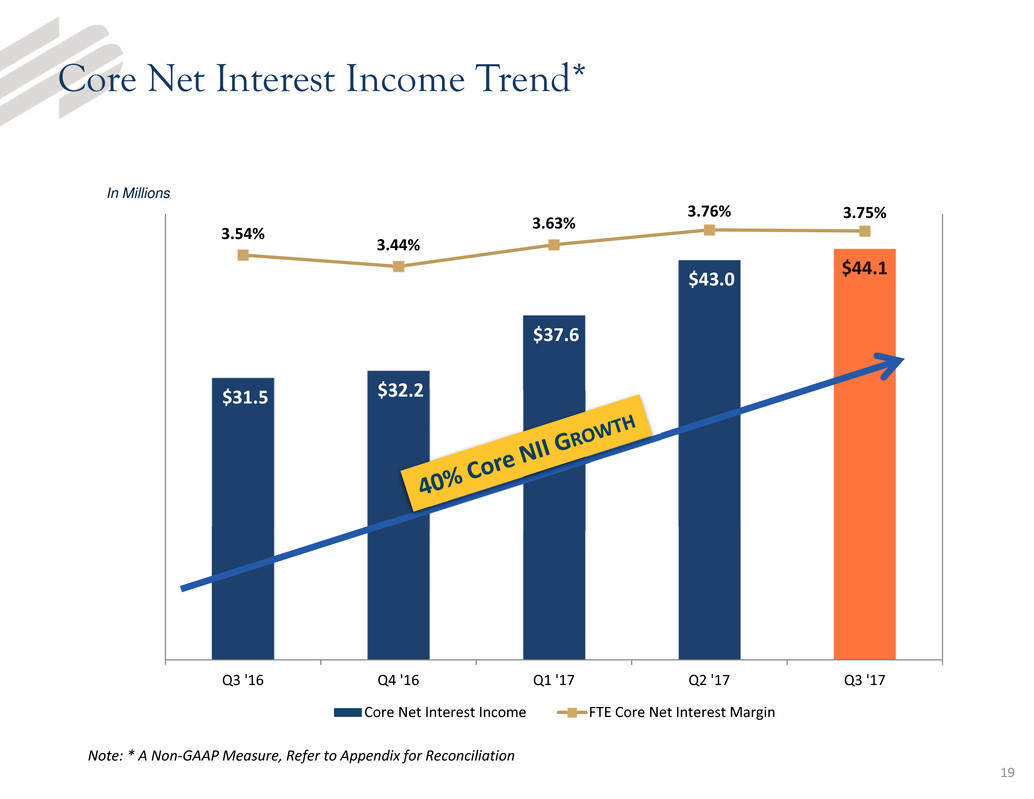

Core Net Interest Income Trend*

In Millions

Note: * A Non‐GAAP Measure, Refer to Appendix for Reconciliation

$31.5 $32.2

$37.6

$43.0

$44.1

3.54%

3.44%

3.63%

3.76% 3.75%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

$4.0

$5.0

$6.0

$7.0

$8.0

$9.0

$10.0

$11.0

$12.0

$13.0

$14.0

$15.0

$16.0

$17.0

$18.0

$19.0

$20.0

$21.0

$22.0

$23.0

$24.0

$25.0

$26.0

$27.0

$28.0

$29.0

$30.0

$31.0

$32.0

$33.0

$34.0

$35.0

$36.0

$37.0

$38.0

$39.0

$40.0

$41.0

$42.0

$43.0

$44.0

$45.0

$46.0

$47.0

Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17

Core Net Interest Income FTE Core Net Interest Margin

20

Credit Trends for Portfolio Loans

14 bps

12 bps

‐1 bps

64 bps

8 bps

Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17

2017 YTD NCO = 24 bps

Q3 2017 EFSC PEER(3)

NPA’S/ASSETS = 0.18% 0.71%

NPL’S/LOANS = 0.23% 0.85%

ALLL/NPL’S = 426.2% 112.3%

ALLL/LOANS = 0.97% 1.03%

(1) Portfolio loans only, excludes non‐core acquired loans; (2) Excludes JCB;

(3) Peer median data as of 6/30/2017 (source: SNL Financial)

In Millions

$154

$80

$56

$7

$138

Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17

Portfolio Loan Growth

In MillionsNet Charge‐offs (1)

$3.0

$1.0

$1.5

$3.6

$2.4

Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17

Provision for Portfolio Loans

(2)

Core Fee Income*

Note: * A Non‐GAAP Measure, Refer to Appendix for Reconciliation

Other Core Fee Income DetailCore Fee Income

$1.7 $1.7 $1.8 $2.0 $2.1

$2.2 $2.2 $2.5

$2.8 $2.8

$1.9 $1.3

$1.5

$1.7 $1.9$0.2

$1.7 $0.2

$0.1

$0.8

$0.9

$1.0

$1.4

$1.5

Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17

Wealth Management Deposit Services Charges

Other State Tax Credits

Card Services

$1.0 $1.0

$0.8

$1.0

$1.5

$0.2

$0.2

$0.4

$0.1

$0.3

$0.2

$0.4

$0.2

$0.2$0.4

$0.1

$0.1

$0.1

$0.1

Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17

Miscellaneous Swap Fees CDE Mortgage

In Millions

21

$6.8

$7.8 $7.9

$8.4

$7.0

$1.9

$1.5

$1.9

$1.3

$1.7

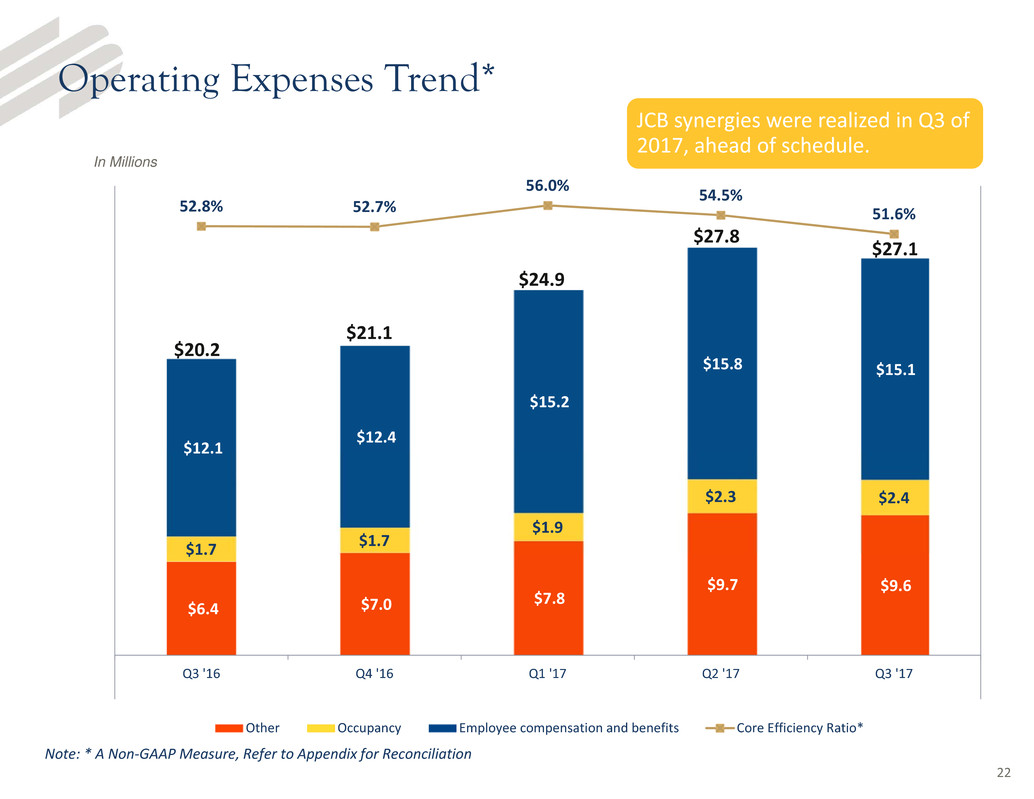

Operating Expenses Trend*

In Millions

Note: * A Non‐GAAP Measure, Refer to Appendix for Reconciliation

$6.4 $7.0

$7.8

$9.7 $9.6

$1.7 $1.7

$1.9

$2.3 $2.4

$12.1

$12.4

$15.2

$15.8 $15.1

52.8% 52.7%

56.0%

54.5%

51.6%

‐3

2

7

12

17

22

27

32

Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17

Other Occupancy Employee compensation and benefits Core Efficiency Ratio*

$27.1

$24.9

$21.1

$20.2

$27.8

22

JCB synergies were realized in Q3 of

2017, ahead of schedule.

23

Positive Momentum in Core* Earnings Per Share

$0.37

$0.33

$0.35

$0.38

$0.44

$0.49

$0.47

$0.49 $0.49

$0.59 $0.59

$0.56

$0.66

Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17

Note: * A Non‐GAAP Measure, Refer to Appendix for Reconciliation

78% Core EPS Growth from Q3 2014 to Q3 2017

24

Three-Year Financial Highlights

Note: Core is a Non GAAP Measure, Refer to Appendix for Reconciliation

Total Core Non‐Interest Income

Core Net Income

Core Earnings Per Share (diluted)

Core Return on Average Equity

Core Return on Average Assets

Total Assets

Core Net Interest Income

$26,787

$41,237

$2.03

11.10%

1.09%

$4,081,328

$123,515

$25,575

$33,791

$1.66

10.08%

1.00%

$3,608,483

$107,618

$24,548

$26,043

$1.29

8.63%

0.82%

$3,277,003

$98,438

$23,260

$41,917

$1.81

10.69%

1.14%

$5,231,488

$124,685

25

Capital Levels Prudently Managed to Facilitate Growth and

Returns

• 2,000,000 Share Common Stock

Repurchase Plan

• ~ 10% of EFSC Outstanding Shares

• No Specified End Date

• Disciplined, Patient Approach Based

on Market Conditions

• Repurchased 429,955 shares at an

average price of $38.69 in the third

quarter

• Sufficient Capital to Support

Growth Plans

• $0.11 per share quarterly dividend

6.02%

7.78%

8.69% 8.88% 8.76%

8.18%

TANGIBLE COMMON EQUITY/TANGIBLE ASSETS

26

Enterprise Financial

• Highly Focused, Proven Business Model

• Strong Track Record of Commercial Loan Growth

• Differentiated Competitive Lending Expertise

• Enhanced Core Funding Capabilities

• Increased Returns and Enhanced Shareholder Value

162%

91%

EFSC Index

3‐Year Total Shareholder Return

Note: Index = SNL U.S. Bank $1B ‐ $5B, as of 6/30/2017

Appendix

3Q 2017 EFSC INVESTOR PRESENTATION

28

Balance Sheet Positioned for Growth

Modest Asset

Sensitivity

(200 BPS Rate

Shock Increases

NII By 3.2%)

57% Floating

Rate Loans,

with Three‐Year

Average

Duration

High‐quality,

Cash‐flowing

Securities

Portfolio with

Four‐Year

Average

Duration

26%

Non‐Interest

Bearing DDA to

Total Deposits

8.18%

Tangible

Common

Equity/Tangible

Assets

29

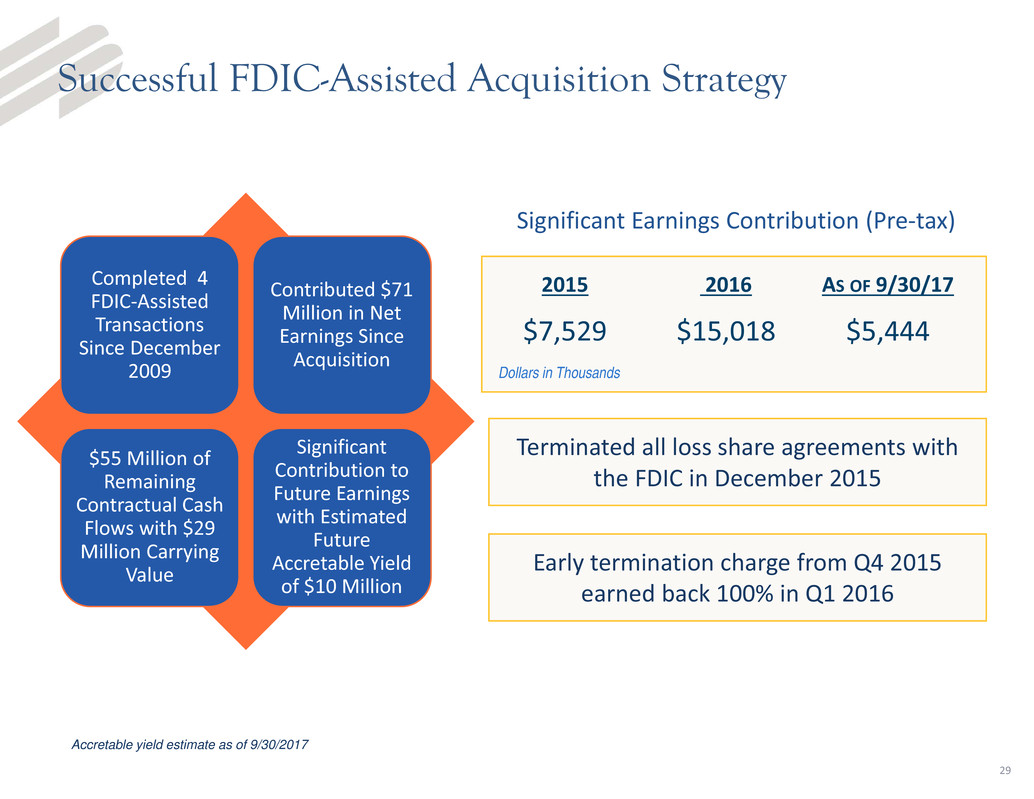

Successful FDIC-Assisted Acquisition Strategy

Significant Earnings Contribution (Pre‐tax)

Terminated all loss share agreements with

the FDIC in December 2015

Early termination charge from Q4 2015

earned back 100% in Q1 2016

2015 2016 AS OF 9/30/17

$7,529 $15,018 $5,444

Dollars in Thousands

Accretable yield estimate as of 9/30/2017

Completed 4

FDIC‐Assisted

Transactions

Since December

2009

Contributed $71

Million in Net

Earnings Since

Acquisition

$55 Million of

Remaining

Contractual Cash

Flows with $29

Million Carrying

Value

Significant

Contribution to

Future Earnings

with Estimated

Future

Accretable Yield

of $10 Million

30

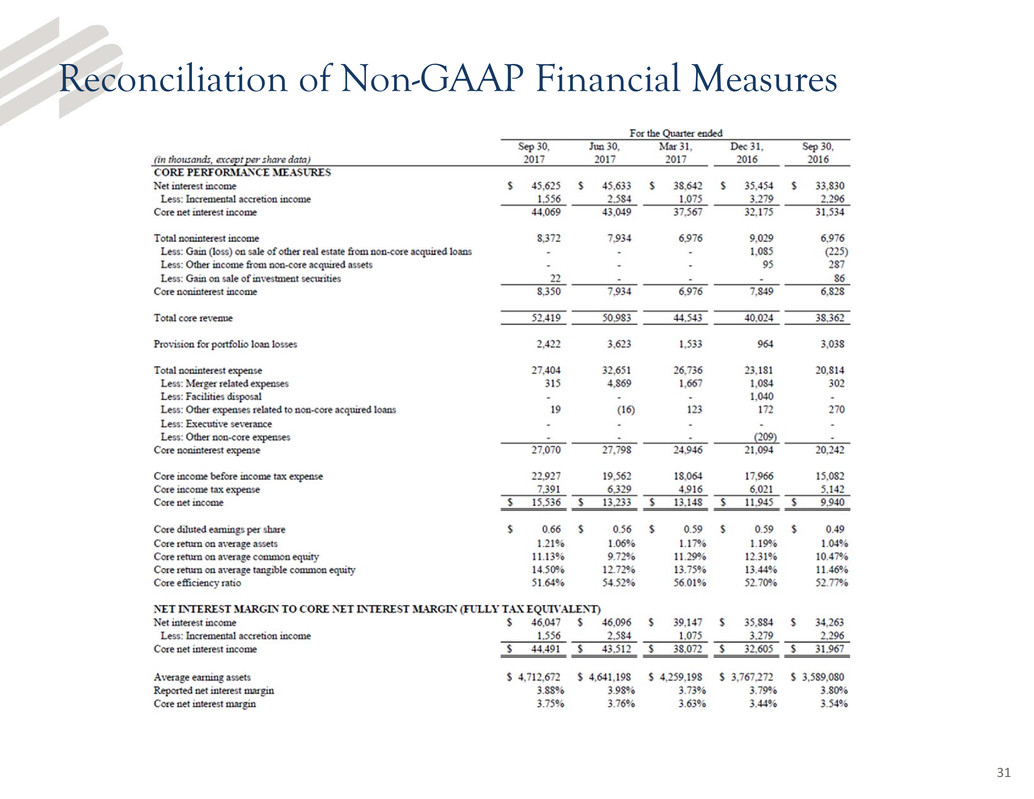

Use of Non-GAAP Financial Measures

The Company's accounting and reporting policies conform to generally accepted accounting principles in the United States

(“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as

Core net interest margin and other Core performance measures, in this presentation that are considered “non-GAAP financial

measures.” Generally, a non-GAAP financial measure is a numerical measure of a company's financial performance, financial

position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable

measure calculated and presented in accordance with GAAP.

The Company considers its Core performance measures presented in this presentation as important measures of financial

performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the

impact of non-core acquired loans and related income and expenses, the impact of nonrecurring items, and the Company's

operating performance on an ongoing basis. Core performance measures include contractual interest on non-core acquired

loans but exclude incremental accretion on these loans. Core performance measures also exclude Gain or loss of other real

estate from non-core acquired loans and expenses directly related to the non-core acquired loans and other assets formerly

covered under FDIC loss share agreements. Core performance measures also exclude certain other income and expense items,

such as executive separation costs, merger related expenses, facilities charges, and gain/loss on sale of investment securities,

the Company believes to be not indicative of or useful to measure the Company's operating performance on an ongoing basis.

The attached tables contain a reconciliation of these Core performance measures to the GAAP measures.

The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and

ratios, provide meaningful supplemental information regarding the Company's performance and capital strength. The Company's

management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the

Company's operating results and related trends and when forecasting future periods. However, these non-GAAP measures and

ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP.

In the tables below, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial

measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the

financial measure for the periods indicated.

Reconciliation of Non-GAAP Financial Measures

31

Q&A

3Q 2017 EFSC INVESTOR PRESENTATION