Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMERICA FIRST MULTIFAMILY INVESTORS, L.P. | atax-8k_20171113.htm |

Exhibit 99.1

|

Supplemental Financial Report for Quarter Ended September 30, 2017 |

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS, L.P.

All statements in this document other than statements of historical facts, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. When used, statements which are not historical in nature, including those containing words such as “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” and similar expressions, are intended to identify forward-looking statements. We have based forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. This document may also contain estimates and other statistical data made by independent parties and by us relating to market size and growth and other industry data. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the statistical and other industry data generated by independent parties contained in this supplement and, accordingly, we cannot guarantee their accuracy or completeness. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described under the headings “Item 1A Risk Factors” in our 2016 Annual Report on Form 10-K and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017. These forward-looking statements are subject to various risks and uncertainties and America First Multifamily Investors, L.P. expressly disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Most, but not all, of the selected financial information furnished herein is derived from the America First Multifamily Investors, L.P.’s (“ATAX” or “Partnership”) consolidated financial statements and related notes prepared in accordance with GAAP and management’s discussion and analysis of financial condition and results of operations included in the Partnership’s reports on Forms 10-K and 10-Q. The Partnership’s annual consolidated financial statements were subject to an independent audit, dated March 3, 2017. The third quarter 2017 Form 10-Q materials are dated November 6, 2017 and the Partnership does not undertake to update the materials after that date.

Disclosure Regarding Non-GAAP Measures

This document refers to certain financial measures that are identified as non-GAAP. We believe these non-GAAP measures are helpful to investors because they are the key information used by management to analyze our operations. This supplemental information should not be considered in isolation or as a substitute for the related GAAP measures.

Please see the consolidated financial statements we filed with the Securities and Exchange Commission on Forms 10-K and 10-Q. Our GAAP consolidated financial statements can be located upon searching for the Partnership’s filings at www.sec.gov.

|

|

|

|

|

|

|

PARTNERSHIP FINANCIAL INFORMATION

TABLE OF CONTENTS

|

|

Pages |

|

|

|

Supplemental Letter from the CEO |

4 |

|

|

Quarterly Fact Sheet |

5 |

|

|

Financial Performance Trend Graphs |

6-11 |

|

|

Other Partnership Information |

12 |

|

|

Partnership Financial Statements |

13-15 |

|

|

Partnership Financial Measures and Schedules |

16-20 |

|

|

|

|

|

|

|

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS L.P.

SUPPLEMENTAL LETTER FROM THE CEO

During Q3 2017, ATAX continued to focus its efforts to “fine tune” the Balance Sheet. To forward this effort we have successfully executed on the following transactions during the quarter:

|

|

• |

Acquired approximately $12.5 million of mortgage revenue bonds |

|

|

• |

Invested an additional $1.6 million in the Investment in unconsolidated entities, |

|

|

• |

Executed on a subscription agreement from an institutional investor to purchase $20 million of ATAX’s Series A Preferred Units, |

|

|

• |

Extended the maturity of the M24 TEBS I debt financing to September 15, 2020, and |

|

|

• |

Acquired an interest rate cap with a notional value of approximately $60.2 million for approximately $52,000. |

In addition to the transactions above, the following results were realized in the third quarter of 2017:

|

|

• |

Total revenue increased approximately 22.7% to $16.2 million, compared to $13.2 million in the third quarter of 2016, and |

|

|

• |

Total assets increased to $1.05 billion at September 30, 2017, compared to $944.1 million at December 31, 2016. |

We are pleased with our efforts to attract qualified institutional investors to our Series A Preferred Unit private placement program. As of September 30, 2017, we have raised $77 million of low-cost, non-cumulative, non-convertible and non-voting Preferred Unit equity capital. This remains an ongoing focus for our team as we head into the fourth quarter of 2017.

We are pleased with the results of the third quarter 2017 and the efforts of our team as we continue to execute on our strategy to “fine tune” the Balance Sheet. Thank you for your continued support!

Chad Daffer

Chief Executive Officer

|

|

4 |

|

|

|

|

|

PARTNERSHIP DETAILS |

|

ATAX was formed for the primary purpose of acquiring a portfolio of mortgage revenue bonds (“MRBs”) that are issued to provide construction and/or permanent financing of multifamily residential properties. We continue to expect most of the interest paid on these MRBs is excludable from gross income for federal income tax purposes. We continue to pursue a business strategy of acquiring additional MRBs and other investments on a leveraged basis. We also invest in other securities which, if not secured by a direct or indirect interest in a property, must be rated in one of the four highest rating categories by at least one nationally recognized securities rating agency. We have also acquired interests in multifamily apartments (“MF Properties”) in order to position ourselves for future investments in mortgage revenue bonds issued to finance these properties. In addition, we have invested in equity interests of multifamily, market rate, projects throughout the U.S. |

|||

|

(As of September 30, 2017) |

|

||||

|

Symbol (NASDAQ) |

|

|

ATAX |

|

|

|

Annual Distribution |

|

$ |

0.50 |

|

|

|

Price |

|

$ |

6.05 |

|

|

|

Yield |

|

|

8.3% |

|

|

|

|

|

|

|

|

|

|

Units Outstanding (including Restricted Units) |

|

|

60,252,928 |

|

|

|

Market Capitalization |

|

$ |

364,530,214 |

|

|

|

52-week Unit price range |

|

|

$5.30 to $6.25 |

|

|

|

|

|

|

|

|

|

|

Partnership Financial Information for the Q3 2017 (amounts in thousands, except per Unit) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue |

|

$ |

16,235 |

|

|

|

Net Income – ATAX Partnership |

|

$ |

3,545 |

|

|

|

Total Assets |

|

$ |

1,053,196 |

|

|

|

Ratio of Debt to Total Assets at Par and Cost |

|

|

66% |

|

|

|

Cash Available for Distribution (“CAD”)1 |

|

$ |

5,440 |

|

|

|

Distribution Declared per unit2 |

|

$ |

0.125 |

|

|

|

1 |

Management utilizes a calculation of Cash Available for Distribution (“CAD”) to assess the Partnership’s operating performance. This is a non-GAAP financial measure and a reconciliation of our GAAP net income to CAD is provided on page 16 of the Supplement herein. |

|

2 |

The most recent distribution was paid on October 31, 2017 for Unitholders of record as of September 29, 2017. The distribution is payable to Unitholders of record as of the last business day of the quarter end and ATAX trades ex-dividend two days prior to the record date, with a payable date of the last business day of the subsequent month. |

|

|

5 |

|

|

|

|

|

|

• |

Total mortgage revenue bonds, core assets of ATAX, have increased to 74% of Total Assets at September 30, 2017, from 35% of Total Assets at December 31, 2012. |

|

|

|

6 |

|

|

|

|

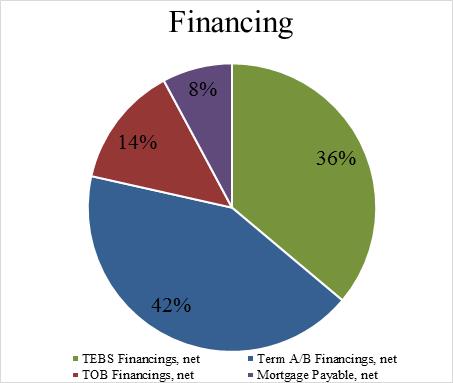

At September 30, 2017

TOTAL DEBT ($ in 000’s)

|

|

7 |

|

|

|

|

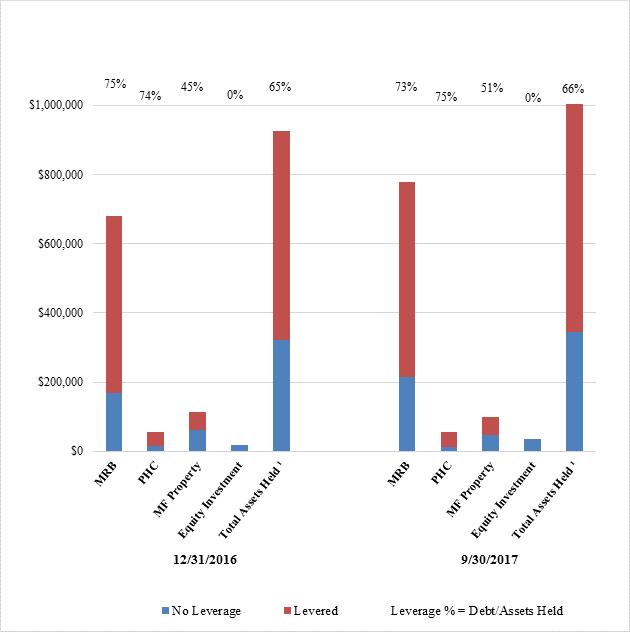

ATAX ASSETS HELD - $ AND LEVERAGE %’s

|

|

1 |

Total outstanding debt divided by total assets using the carrying value of the MRBs, PHC Certificates, initial finance costs and the MF Properties at cost. |

|

|

|

8 |

|

|

|

|

REVENUE AND OTHER INCOME TRENDS

Revenue and other income decreased year-over-year due to a gain on sale in the third quarter of 2016.

Highlighted transactions recorded during the past eight quarters include the following:

|

|

• |

During the second quarter of 2017, we recognized contingent interest of approximately $87,000, |

|

|

• |

During the first quarter of 2017, we recognized a gain on the sale of Northern View (an MF Property) of approximately $3.2 million, net of income taxes and Tier 2 income paid to the general partner, and before direct and indirect expense, and contingent interest of approximately $133,000, |

|

|

• |

During the fourth quarter of 2016, we recognized contingent interest of approximately $1.7 million, |

|

|

• |

During the third quarter of 2016, we recognized a gain of approximately $1.1 million, net of tax, on the sale of Woodland Park, an MF Property, and contingent interest of $90,000, |

|

|

• |

During the second quarter of 2016, we recognized a gain of approximately $8.3 million, net of tax, on the sale of the Arboretum, an MF Property, and contingent interest income of approximately $45,000, |

|

|

• |

During the first quarter of 2016, we recognized contingent interest income of approximately $174,000, and |

|

|

• |

During the fourth quarter of 2015, we recognized contingent interest and note interest income of approximately $6.2 million from the sale of the Consolidated VIEs. |

|

|

9 |

|

|

|

|

|

|

• |

Since December 31, 2015, the ratio of “Salaries and benefits” and “General and administrative” expenses has averaged approximately 0.45% of Total Assets. |

|

|

10 |

|

|

|

|

|

|

• |

In 2017, we realized approximately $219,000 of contingent interest, of which $55,000 was due to the General Partner. In addition, we reported the sale of Northern View, which resulted in a gain of approximately $4.3 million, net of tax, of which approximately $1.1 million was due to the General Partner. There was approximately $3.3 million that was allocated to the Unitholders. |

|

|

• |

In 2016, we realized approximately $2.0 million of contingent interest, of which $505,000 was due the General Partner. In addition, we reported the sale of the Arboretum and Woodland Park which resulted in gains of approximately $8.3 million and $1.1 million, respectively, net of tax, of which approximately $2.4 million was due the General Partner. There was approximately $8.6 million that was allocated to the Unitholders. |

|

|

• |

In 2015, we realized approximately $4.8 million of contingent interest, of which approximately $1.2 million was due the General Partner. In addition, we reported the sale of Glynn Place and The Colonial which resulted in gains of approximately $1.2 million and $3.4 million, respectively, of which approximately $297,000 and $854,000, respectively, was due the General Partner. There was approximately $7.0 million that was allocated to the Unitholders. |

|

|

11 |

|

|

|

|

|

OTHER PARTNERSHIP INFORMATION |

|||||

|

|

|

|

|

||

|

Corporate Office: |

|

|

Transfer Agent:

|

||

|

1004 Farnam Street |

|

|

American Stock Transfer & Trust Company |

||

|

Suite 400 |

|

|

59 Maiden Lane |

||

|

Omaha, NE 68102 |

|

|

Plaza Level |

||

|

Phone: |

402-444-1630 |

|

New York, NY 10038 |

||

|

Investor Services: |

402-930-3098 |

|

|

Phone: 718-921-8124 |

|

|

K-1 Services: |

855-4AT-AXK1 |

|

|

888-991-9902 |

|

|

Fax: |

402-930-3047 |

|

|

Fax:718-236-2641 |

|

|

Web Site: |

www.ataxfund.com |

|

|

|

|

|

K-1 Services Email: |

k1s@ataxfund.com |

|

|

|

|

|

Ticker Symbol: |

ATAX |

|

|

|

|

|

Corporate Counsel: |

|

Independent Accountants: |

|

Barnes & Thornburg LLP |

|

PwC |

|

11 S. Meridian Street |

|

1 North Wacker Drive |

|

Indianapolis, IN 46204 |

|

Chicago, Illinois 60606 |

|

|

|

|

|

Burlington Capital LLC, General Partner of the General Partner for ATAX

Board of Managers |

||

|

|

|

|

|

Michael B. Yanney |

|

Chairman Emeritus of the Board |

|

Lisa Y. Roskens |

|

Chairman of the Board |

|

Mariann Byerwalter |

|

Manager |

|

Dr. William S. Carter |

|

Manager |

|

Patrick J. Jung |

|

Manager |

|

George Krauss |

|

Manager |

|

Dr. Gail Yanney |

|

Manager |

|

Walter K. Griffith |

|

Manager |

|

Senator Michael Johanns |

|

Manager |

|

|

|

|

|

Corporate Officers |

||

|

Chief Executive Officer – Chad L. Daffer |

||

|

Chief Financial Officer – Craig S. Allen |

||

|

|

12 |

|

Partnership Financial Statements and Information Schedules |

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS, L.P. BALANCE SHEETS

|

|

|

September 30, 2017 |

|

|

December 31, 2016 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

|

35,556,115 |

|

$ |

|

20,748,521 |

|

|

Restricted cash |

|

|

2,449,346 |

|

|

|

6,757,699 |

|

|

Interest receivable |

|

|

7,319,913 |

|

|

|

6,983,203 |

|

|

Mortgage revenue bonds, held in trust |

|

|

739,967,192 |

|

|

|

590,194,179 |

|

|

Mortgage revenue bonds |

|

|

39,346,686 |

|

|

|

90,016,872 |

|

|

Public housing capital fund trusts |

|

|

54,913,748 |

|

|

|

57,158,068 |

|

|

Real estate assets: |

|

|

|

|

|

|

|

|

|

Land and improvements |

|

|

10,798,832 |

|

|

|

17,354,587 |

|

|

Buildings and improvements |

|

|

105,323,268 |

|

|

|

113,089,041 |

|

|

Real estate assets before accumulated depreciation |

|

|

116,122,100 |

|

|

|

130,443,628 |

|

|

Accumulated depreciation |

|

|

(17,623,467 |

) |

|

|

(16,217,028 |

) |

|

Net real estate assets |

|

|

98,498,633 |

|

|

|

114,226,600 |

|

|

Investment in equity interests |

|

|

34,335,649 |

|

|

|

19,470,006 |

|

|

Property loans, net |

|

|

31,194,704 |

|

|

|

29,763,334 |

|

|

Other assets |

|

|

9,613,734 |

|

|

|

8,795,192 |

|

|

Total Assets |

$ |

|

1,053,195,720 |

|

$ |

|

944,113,674 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other liabilities |

$ |

|

8,297,418 |

|

$ |

|

7,255,327 |

|

|

Distribution payable |

|

|

7,607,693 |

|

|

|

8,017,950 |

|

|

Unsecured lines of credit |

|

|

12,471,000 |

|

|

|

40,000,000 |

|

|

Secured line of credit, net |

|

- |

|

|

|

19,816,667 |

|

|

|

Debt financing, net |

|

|

594,635,819 |

|

|

|

495,383,033 |

|

|

Mortgages payable and other secured financing, net |

|

|

50,579,400 |

|

|

|

51,379,512 |

|

|

Derivative swaps |

|

|

1,196,701 |

|

|

|

1,339,283 |

|

|

Total Liabilities |

|

|

674,788,031 |

|

|

|

623,191,772 |

|

|

Redeemable preferred units |

|

|

76,855,492 |

|

|

|

40,788,034 |

|

|

Partners' Capital |

|

|

|

|

|

|

|

|

|

General Partner |

|

|

331,429 |

|

|

|

102,536 |

|

|

Beneficial Unit Certificate holders |

|

|

301,220,768 |

|

|

|

280,026,669 |

|

|

Total Partners' Capital |

|

|

301,552,197 |

|

|

|

280,129,205 |

|

|

Noncontrolling interest |

|

|

- |

|

|

|

4,663 |

|

|

Total Capital |

|

|

301,552,197 |

|

|

|

280,133,868 |

|

|

Total Liabilities and Partners' Capital |

$ |

|

1,053,195,720 |

|

$ |

|

944,113,674 |

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS, L.P.

PARTNERSHIP INCOME STATEMENTS

|

|

|

For The Three Months Ended September 30, 2017 |

|

For The Three Months Ended September 30, 2016 |

|

For The Nine Months Ended September 30, 2017 |

|

For The Nine Months Ended September 30, 2016 |

|

||||

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income |

|

$ |

12,242,533 |

|

$ |

9,071,460 |

|

$ |

35,886,934 |

|

$ |

27,238,601 |

|

|

Property revenues |

|

|

3,244,440 |

|

|

3,414,788 |

|

|

10,280,940 |

|

|

13,483,760 |

|

|

Contingent interest income |

|

- |

|

|

90,000 |

|

|

219,217 |

|

|

309,396 |

|

|

|

Other interest income |

|

|

735,123 |

|

|

645,691 |

|

|

2,047,056 |

|

|

2,043,162 |

|

|

Other Income |

|

|

12,734 |

|

- |

|

|

75,371 |

|

- |

|

||

|

Total Revenues |

|

|

16,234,830 |

|

|

13,221,939 |

|

|

48,509,518 |

|

|

43,074,919 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate operating (exclusive of items shown below) |

|

|

2,225,845 |

|

|

2,252,939 |

|

|

6,331,145 |

|

|

7,259,071 |

|

|

Impairment charge |

|

- |

|

- |

|

- |

|

|

61,506 |

|

|||

|

Depreciation and amortization |

|

|

1,259,055 |

|

|

1,361,259 |

|

|

4,122,260 |

|

|

5,292,889 |

|

|

Amortization of deferred financing costs |

|

|

577,413 |

|

|

425,520 |

|

|

1,880,236 |

|

|

1,350,200 |

|

|

Interest expense |

|

|

5,714,181 |

|

|

3,485,172 |

|

|

16,997,761 |

|

|

12,577,361 |

|

|

General and administrative |

|

|

3,197,853 |

|

|

2,377,148 |

|

|

9,205,183 |

|

|

7,474,500 |

|

|

Total Expenses |

|

|

12,974,347 |

|

|

9,902,038 |

|

|

38,536,585 |

|

|

34,015,527 |

|

|

Other Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of real estate assets |

|

|

- |

|

|

1,633,973 |

|

|

7,152,512 |

|

|

14,076,902 |

|

|

Gain on sale of securities |

|

|

- |

|

|

- |

|

|

- |

|

|

8,097 |

|

|

Income before income taxes |

|

|

3,260,483 |

|

|

4,953,874 |

|

|

17,125,445 |

|

|

23,144,391 |

|

|

Income tax expense |

|

|

(285,000 |

) |

|

331,000 |

|

|

2,110,047 |

|

|

4,984,000 |

|

|

Net income before noncontrolling interest |

|

|

3,545,483 |

|

|

4,622,874 |

|

|

15,015,398 |

|

|

18,160,391 |

|

|

Income (loss) attributable to noncontrolling interest |

|

|

- |

|

|

(668 |

) |

|

71,653 |

|

|

(781 |

) |

|

Net income - ATAX Partnership |

|

$ |

3,545,483 |

|

$ |

4,623,542 |

|

$ |

14,943,745 |

|

$ |

18,161,172 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income - ATAX Partnership |

|

|

3,545,483 |

|

|

4,623,542 |

|

|

14,943,745 |

|

|

18,161,172 |

|

|

Redeemable preferred unit distributions and accretion |

|

|

(523,682 |

) |

|

(181,969 |

) |

|

(1,280,874 |

) |

|

(308,635 |

) |

|

Net income available to Partners |

|

$ |

3,021,801 |

|

$ |

4,441,573 |

|

$ |

13,662,871 |

|

$ |

17,852,537 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Segment Data (Partnership): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue and Other Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage Revenue Bond Investments |

|

$ |

11,035,530 |

|

$ |

8,504,675 |

|

$ |

32,683,968 |

|

$ |

26,082,649 |

|

|

MF Properties |

|

|

3,257,174 |

|

|

5,048,761 |

|

|

17,508,823 |

|

|

27,560,662 |

|

|

Public Housing Capital Fund Trusts |

|

|

711,823 |

|

|

724,735 |

|

|

2,139,791 |

|

|

2,178,627 |

|

|

MBS Securities Investments |

|

|

- |

|

|

- |

|

|

- |

|

|

48,755 |

|

|

Other Investments |

|

|

1,230,303 |

|

|

577,741 |

|

|

3,329,448 |

|

|

1,289,225 |

|

|

Total Revenue and Other Income |

|

$ |

16,234,830 |

|

$ |

14,855,912 |

|

$ |

55,662,030 |

|

$ |

57,159,918 |

|

|

Total Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage Revenue Bond Investments |

|

$ |

8,430,541 |

|

$ |

5,586,175 |

|

$ |

25,257,158 |

|

$ |

18,913,133 |

|

|

MF Properties |

|

|

3,884,001 |

|

|

4,294,320 |

|

|

14,372,058 |

|

|

19,101,702 |

|

|

Public Housing Capital Fund Trusts |

|

|

371,830 |

|

|

351,875 |

|

|

1,086,094 |

|

|

987,140 |

|

|

MBS Securities Investments |

|

|

- |

|

|

- |

|

|

- |

|

|

(3,229 |

) |

|

Other Investments |

|

|

2,975 |

|

|

- |

|

|

2,975 |

|

|

- |

|

|

Total |

|

$ |

12,689,347 |

|

$ |

10,232,370 |

|

$ |

40,718,285 |

|

$ |

38,998,746 |

|

|

Net Income (loss) - ATAX Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage Revenue Bond Investments |

|

$ |

2,604,989 |

|

$ |

2,918,500 |

|

$ |

7,426,810 |

|

$ |

7,169,516 |

|

|

MF Properties |

|

|

(626,827 |

) |

|

754,441 |

|

|

3,136,765 |

|

|

8,458,960 |

|

|

Public Housing Capital Fund Trusts |

|

|

339,993 |

|

|

372,860 |

|

|

1,053,697 |

|

|

1,191,487 |

|

|

MBS Securities Investments |

|

|

- |

|

|

- |

|

|

- |

|

|

51,984 |

|

|

Other Investments |

|

|

1,227,328 |

|

|

577,741 |

|

|

3,326,473 |

|

|

1,289,225 |

|

|

Income from continuing operations |

|

$ |

3,545,483 |

|

$ |

4,623,542 |

|

$ |

14,943,745 |

|

$ |

18,161,172 |

|

|

|

15 |

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS, L.P.

PARTNERSHIP CASH AVAILABLE FOR DISTRIBUTION AND OTHER PERFORMANCE MEASURES

FOR THE THREE MONTHS ENDED

The following table contains reconciliations of the Partnership’s GAAP net income to its CAD:

|

|

September 30, 2017 |

|

June 30, 2017 |

|

March 31, 2017 |

|

December 31, 2016 |

|

September 30, 2016 |

|

June 30, 2016 |

|

March 31, 2016 |

|

December 31, 2015 |

|

||||||||

|

Partnership only net income |

$ |

3,545,483 |

|

$ |

4,109,400 |

|

$ |

7,288,862 |

|

$ |

5,623,335 |

|

$ |

4,623,542 |

|

$ |

11,005,930 |

|

$ |

2,531,700 |

|

$ |

9,549,326 |

|

|

Change in fair value of derivatives and interest rate derivative amortization |

|

66,917 |

|

|

181,420 |

|

|

121,349 |

|

|

(1,395,730 |

) |

|

(263,684 |

) |

|

531,389 |

|

|

1,110,407 |

|

|

(153,039 |

) |

|

Depreciation and amortization expense (Partnership only) |

|

1,259,055 |

|

|

1,270,379 |

|

|

1,592,826 |

|

|

1,569,641 |

|

|

1,361,259 |

|

|

1,806,732 |

|

|

2,124,898 |

|

|

2,208,551 |

|

|

Impairment charge |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

61,506 |

|

|

- |

|

|

- |

|

|

Amortization of deferred financing costs |

|

577,413 |

|

|

562,585 |

|

|

740,238 |

|

|

512,309 |

|

|

425,520 |

|

|

392,493 |

|

|

532,187 |

|

|

554,128 |

|

|

Restricted units compensation expense |

|

550,390 |

|

|

438,893 |

|

|

170,840 |

|

|

802,092 |

|

|

31,050 |

|

|

- |

|

|

- |

|

|

- |

|

|

Deferred income taxes |

|

(9,000 |

) |

|

(201,000 |

) |

|

(164,000 |

) |

|

(51,000 |

) |

|

(136,000 |

) |

|

553,000 |

|

|

- |

|

|

- |

|

|

Redeemable preferred unit distributions and accretion |

|

(523,682 |

) |

|

(432,550 |

) |

|

(324,642 |

) |

|

(274,772 |

) |

|

(181,969 |

) |

|

(124,982 |

) |

|

(1,684 |

) |

|

- |

|

|

Bond purchase premium/discount accretion (net of cash received) |

|

(26,270 |

) |

|

(26,741 |

) |

|

(23,507 |

) |

|

(27,770 |

) |

|

(147,033 |

) |

|

33,668 |

|

|

34,696 |

|

|

171,717 |

|

|

Tier 2 Income distributable to the General Partner |

|

- |

|

|

(16,224 |

) |

|

(1,104,401 |

) |

|

(426,774 |

) |

|

(291,295 |

) |

|

(2,096,982 |

) |

|

(43,599 |

) |

|

(1,187,639 |

) |

|

Amortization related to discontinued operations |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1,344 |

|

|

CAD |

$ |

5,440,306 |

|

$ |

5,886,162 |

|

$ |

8,297,565 |

|

$ |

6,331,331 |

|

$ |

5,421,390 |

|

$ |

12,162,754 |

|

$ |

6,288,605 |

|

$ |

11,144,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of units outstanding, basic |

|

59,811,578 |

|

|

59,862,969 |

|

|

60,037,687 |

|

|

59,995,789 |

|

|

60,176,937 |

|

|

60,252,928 |

|

|

60,252,928 |

|

|

60,252,928 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partnership Only: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income, basic and diluted, per unit |

$ |

0.05 |

|

$ |

0.06 |

|

$ |

0.10 |

|

$ |

0.09 |

|

$ |

0.07 |

|

$ |

0.15 |

|

$ |

0.04 |

|

$ |

0.14 |

|

|

CAD per unit, basic |

$ |

0.09 |

|

$ |

0.10 |

|

$ |

0.14 |

|

$ |

0.11 |

|

$ |

0.09 |

|

$ |

0.20 |

|

$ |

0.10 |

|

$ |

0.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions declared, per unit |

$ |

0.125 |

|

$ |

0.125 |

|

$ |

0.125 |

|

$ |

0.125 |

|

$ |

0.125 |

|

$ |

0.125 |

|

$ |

0.125 |

|

$ |

0.125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS, L.P.

MORTGAGE REVENUE BOND INVESTMENT SCHEDULE SEPTEMBER 30, 2017

|

|

|

|

|

|

|

Base |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maturity |

|

Interest |

|

|

Principal |

|

Estimated |

|

|||

|

Property Name |

|

Location |

|

Date |

|

Rate |

|

|

Outstanding |

|

Fair Value |

|

|||

|

15 West Apartments |

|

Vancouver, WA |

|

7/1/2054 |

|

|

6.25 |

% |

|

$ |

9,812,357 |

|

$ |

11,546,126 |

|

|

Arbors at Hickory Ridge |

|

Memphis, TN |

|

1/1/2049 |

|

|

6.25 |

% |

|

|

11,266,283 |

|

|

13,028,600 |

|

|

Ashley Square |

|

Des Moines, IA |

|

12/1/2025 |

|

|

6.25 |

% |

|

|

4,994,000 |

|

|

5,007,538 |

|

|

Avistar on the Boulevard - Series A |

|

San Antonio, TX |

|

3/1/2050 |

|

|

6.00 |

% |

|

|

16,150,587 |

|

|

17,815,399 |

|

|

Avistar at Chase Hill - Series A |

|

San Antonio, TX |

|

3/1/2050 |

|

|

6.00 |

% |

|

|

9,773,429 |

|

|

9,492,751 |

|

|

Avistar at Copperfield - Series A |

|

Houston, TX |

|

5/1/2054 |

|

|

5.75 |

% |

|

|

10,000,000 |

|

|

10,423,447 |

|

|

Avistar at Copperfield - Series B |

|

Houston, TX |

|

6/1/2054 |

|

|

12.00 |

% |

|

|

4,000,000 |

|

|

4,012,278 |

|

|

Avistar at the Crest - Series A |

|

San Antonio, TX |

|

3/1/2050 |

|

|

6.00 |

% |

|

|

9,480,225 |

|

|

10,501,275 |

|

|

Avistar (February 2013 Acquisition) - Series B (3 Bonds) |

|

San Antonio, TX |

|

4/1/2050 |

|

|

9.00 |

% |

|

|

2,150,422 |

|

|

2,167,468 |

|

|

Avistar at the Oak - Series A |

|

San Antonio, TX |

|

8/1/2050 |

|

|

6.00 |

% |

|

|

7,654,594 |

|

|

8,535,033 |

|

|

Avistar in 09 - Series A |

|

San Antonio, TX |

|

8/1/2050 |

|

|

6.00 |

% |

|

|

6,609,446 |

|

|

7,275,678 |

|

|

Avistar on the Hill - Series A |

|

San Antonio, TX |

|

8/1/2050 |

|

|

6.00 |

% |

|

|

5,288,542 |

|

|

5,896,835 |

|

|

Avistar (June 2013 Acquisition) - Series B (2 Bonds) |

|

San Antonio, TX |

|

9/1/2050 |

|

|

9.00 |

% |

|

|

1,001,662 |

|

|

1,060,108 |

|

|

Avistar at the Parkway - Series A |

|

San Antonio, TX |

|

5/1/2052 |

|

|

6.00 |

% |

|

|

13,262,378 |

|

|

14,170,981 |

|

|

Avistar at the Parkway - Series B |

|

San Antonio, TX |

|

6/1/2052 |

|

|

12.00 |

% |

|

|

124,922 |

|

|

155,701 |

|

|

Avistar at Wilcrest - Series A |

|

Houston, TX |

|

5/1/2054 |

|

|

5.75 |

% |

|

|

3,775,000 |

|

|

3,982,425 |

|

|

Avistar at Wilcrest - Series B |

|

Houston, TX |

|

6/1/2054 |

|

|

12.00 |

% |

|

|

1,550,000 |

|

|

1,554,816 |

|

|

Avistar at Wood Hollow - Series A |

|

Austin, TX |

|

5/1/2054 |

|

|

5.75 |

% |

|

|

31,850,000 |

|

|

33,198,678 |

|

|

Avistar at Wood Hollow - Series B |

|

Austin, TX |

|

6/1/2054 |

|

|

12.00 |

% |

|

|

8,410,000 |

|

|

8,437,395 |

|

|

Bella Vista |

|

Gainesville, TX |

|

4/1/2046 |

|

|

6.15 |

% |

|

|

6,295,000 |

|

|

6,395,991 |

|

|

Bridle Ridge |

|

Greer, SC |

|

1/1/2043 |

|

|

6.00 |

% |

|

|

7,465,000 |

|

|

7,522,667 |

|

|

Brookstone |

|

Waukegan, IL |

|

5/1/2040 |

|

|

5.45 |

% |

|

|

9,004,023 |

|

|

9,567,665 |

|

|

Bruton |

|

Dallas, TX |

|

8/1/2054 |

|

|

6.00 |

% |

|

|

18,080,240 |

|

|

20,688,022 |

|

|

Columbia Gardens |

|

Columbia, SC |

|

12/1/2050 |

|

|

5.50 |

% |

|

|

14,969,000 |

|

|

15,673,452 |

|

|

Companion at Thornhill Apartments |

|

Lexington, SC |

|

1/1/2052 |

|

|

5.80 |

% |

|

|

11,431,237 |

|

|

12,746,002 |

|

|

Concord at Gulfgate - Series A |

|

Houston, TX |

|

2/1/2032 |

|

|

6.00 |

% |

|

|

19,185,000 |

|

|

21,796,745 |

|

|

Concord at Little York - Series A |

|

Houston, TX |

|

2/1/2032 |

|

|

6.00 |

% |

|

|

13,440,000 |

|

|

15,336,349 |

|

|

Concord at Williamcrest - Series A |

|

Houston, TX |

|

2/1/2032 |

|

|

6.00 |

% |

|

|

20,820,000 |

|

|

23,654,325 |

|

|

Copper Gate Apartments |

|

Lafayette, IN |

|

12/1/2029 |

|

|

6.25 |

% |

|

|

5,145,000 |

|

|

6,012,844 |

|

|

Courtyard Apartments - Series A |

|

Fullerton, CA |

|

12/1/2033 |

|

|

5.00 |

% |

|

|

10,230,000 |

|

|

11,375,338 |

|

|

Courtyard Apartments - Series B |

|

Fullerton, CA |

|

12/1/2018 |

|

|

5.50 |

% |

|

|

6,228,000 |

|

|

6,220,807 |

|

|

Cross Creek |

|

Beaufort, SC |

|

3/1/2049 |

|

|

6.15 |

% |

|

|

8,191,568 |

|

|

9,148,365 |

|

|

Crossing at 1415 - Series A |

|

San Antonio, TX |

|

12/1/2052 |

|

|

6.00 |

% |

|

|

7,590,000 |

|

|

7,885,343 |

|

|

Crossing at 1415 - Series B |

|

San Antonio, TX |

|

1/1/2053 |

|

|

12.00 |

% |

|

|

335,000 |

|

|

336,079 |

|

|

Decatur Angle |

|

Fort Worth, TX |

|

1/1/2054 |

|

|

5.75 |

% |

|

|

22,834,591 |

|

|

25,353,589 |

|

|

Glenview - Series A |

|

Cameron Park, CA |

|

12/1/2031 |

|

|

5.75 |

% |

|

|

4,638,152 |

|

|

5,278,395 |

|

|

Greens of Pine Glen - Series A |

|

Durham, NC |

|

10/1/2047 |

|

|

6.50 |

% |

|

|

8,147,000 |

|

|

9,377,615 |

|

|

Greens of Pine Glen - Series B |

|

Durham, NC |

|

10/1/2047 |

|

|

9.00 |

% |

|

|

938,204 |

|

|

1,149,746 |

|

|

Harden Ranch - Series A |

|

Salinas, CA |

|

3/1/2030 |

|

|

5.75 |

% |

|

|

6,862,983 |

|

|

7,949,314 |

|

|

Harmony Court Bakersfield - Series A |

|

Bakersfield, CA |

|

12/1/2033 |

|

|

5.00 |

% |

|

|

3,730,000 |

|

|

4,128,115 |

|

|

Harmony Terrace - Series A |

|

Simi Valley, CA |

|

1/1/2034 |

|

|

5.00 |

% |

|

|

6,900,000 |

|

|

7,713,042 |

|

|

Harmony Terrace - Series B |

|

Simi Valley, CA |

|

1/1/2019 |

|

|

5.50 |

% |

|

|

7,400,000 |

|

|

7,399,765 |

|

|

Heights at 515 - Series A |

|

San Antonio, TX |

|

12/1/2052 |

|

|

6.00 |

% |

|

|

6,435,000 |

|

|

6,764,490 |

|

|

Heights at 515 - Series B |

|

San Antonio, TX |

|

1/1/2053 |

|

|

12.00 |

% |

|

|

510,000 |

|

|

511,815 |

|

|

Heritage Square - Series A |

|

Edinburg, TX |

|

9/1/2051 |

|

|

6.00 |

% |

|

|

11,088,157 |

|

|

12,077,271 |

|

|

Lake Forest Apartments |

|

Daytona Beach, FL |

|

12/1/2031 |

|

|

6.25 |

% |

|

|

8,540,000 |

|

|

10,025,248 |

|

|

Las Palmas II - Series A |

|

Coachella, CA |

|

11/1/2033 |

|

|

5.00 |

% |

|

|

1,695,000 |

|

|

1,874,814 |

|

|

Las Palmas II - Series B |

|

Coachella, CA |

|

11/1/2018 |

|

|

5.50 |

% |

|

|

1,770,000 |

|

|

1,769,214 |

|

|

|

17 |

|

|

|

|

|

Live 929 |

|

Baltimore, MD |

|

7/1/2049 |

|

|

5.78 |

% |

|

|

40,010,000 |

|

|

44,555,656 |

|

|

Montclair - Series A |

|

Lemoore, CA |

|

12/1/2031 |

|

|

5.75 |

% |

|

|

2,512,746 |

|

|

2,913,798 |

|

|

Montecito at Williams Ranch Apartments - Series A |

|

Salinas, CA |

|

10/1/2034 |

|

|

5.50 |

% |

|

|

7,690,000 |

|

|

7,690,000 |

|

|

Montecito at Williams Ranch Apartments - Series B |

|

Salinas, CA |

|

10/1/2019 |

|

|

5.50 |

% |

|

|

4,781,000 |

|

|

4,781,000 |

|

|

Oaks at Georgetown - Series A |

|

Georgetown, TX |

|

1/1/2034 |

|

|

5.00 |

% |

|

|

12,330,000 |

|

|

13,144,421 |

|

|

Oaks at Georgetown - Series B |

|

Georgetown, TX |

|

1/1/2019 |

|

|

5.50 |

% |

|

|

5,512,000 |

|

|

5,505,838 |

|

|

Ohio Bond - Series A |

|

Ohio |

|

6/1/2050 |

|

|

7.00 |

% |

|

|

14,140,000 |

|

|

15,136,412 |

|

|

Ohio Bond - Series B |

|

Ohio |

|

6/1/2050 |

|

|

10.00 |

% |

|

|

3,539,620 |

|

|

3,732,274 |

|

|

Pro Nova - 2014-1 |

|

Knoxville, TN |

|

5/1/2034 |

|

|

6.00 |

% |

|

|

10,000,000 |

|

|

10,233,522 |

|

|

Renaissance - Series A |

|

Baton Rouge, LA |

|

6/1/2050 |

|

|

6.00 |

% |

|

|

11,267,286 |

|

|

12,896,186 |

|

|

Runnymede |

|

Austin, TX |

|

10/1/2042 |

|

|

6.00 |

% |

|

|

10,200,000 |

|

|

10,368,797 |

|

|

Santa Fe - Series A |

|

Hesperia, CA |

|

12/1/2031 |

|

|

5.75 |

% |

|

|

3,044,098 |

|

|

3,570,075 |

|

|

San Vicente - Series A |

|

Soledad, CA |

|

11/1/2033 |

|

|

5.00 |

% |

|

|

3,495,000 |

|

|

3,776,588 |

|

|

San Vicente - Series B |

|

Soledad, CA |

|

11/1/2018 |

|

|

5.50 |

% |

|

|

1,825,000 |

|

|

1,822,687 |

|

|

Seasons at Simi Valley - Series A |

|

Simi Valley, CA |

|

9/1/2032 |

|

|

5.75 |

% |

|

|

4,376,000 |

|

|

5,160,070 |

|

|

Seasons at Simi Valley - Series B |

|

Simi Valley, CA |

|

9/1/2018 |

|

|

8.00 |

% |

|

|

1,944,000 |

|

|

1,944,084 |

|

|

Seasons Lakewood - Series A |

|

Lakewood, CA |

|

1/1/2034 |

|

|

5.00 |

% |

|

|

7,350,000 |

|

|

8,177,218 |

|

|

Seasons Lakewood - Series B |

|

Lakewood, CA |

|

1/1/2019 |

|

|

5.50 |

% |

|

|

5,260,000 |

|

|

5,255,104 |

|

|

Seasons San Juan Capistrano - Series A |

|

San Juan Capistrano, CA |

|

1/1/2034 |

|

|

5.00 |

% |

|

|

12,375,000 |

|

|

13,509,909 |

|

|

Seasons San Juan Capistrano - Series B |

|

San Juan Capistrano, CA |

|

1/1/2019 |

|

|

5.50 |

% |

|

|

6,574,000 |

|

|

6,566,159 |

|

|

Silver Moon - Series A |

|

Albuquerque, NM |

|

8/1/2055 |

|

|

6.00 |

% |

|

|

7,893,310 |

|

|

8,973,048 |

|

|

Southpark |

|

Austin, TX |

|

12/1/2049 |

|

|

6.13 |

% |

|

|

13,435,000 |

|

|

15,001,374 |

|

|

Summerhill - Series A |

|

Bakersfield, CA |

|

12/1/2033 |

|

|

5.00 |

% |

|

|

6,423,000 |

|

|

7,108,547 |

|

|

Summerhill - Series B |

|

Bakersfield, CA |

|

12/1/2018 |

|

|

5.50 |

% |

|

|

3,372,000 |

|

|

3,371,261 |

|

|

Sycamore Walk - Series A |

|

Bakersfield, CA |

|

1/1/2033 |

|

|

5.25 |

% |

|

|

3,632,000 |

|

|

4,098,553 |

|

|

Sycamore Walk - Series B |

|

Bakersfield, CA |

|

1/1/2018 |

|

|

8.00 |

% |

|

|

1,815,000 |

|

|

1,813,922 |

|

|

The Palms at Premier Park |

|

Columbia, SC |

|

1/1/2050 |

|

|

6.25 |

% |

|

|

19,284,860 |

|

|

22,223,008 |

|

|

Tyler Park Townhomes |

|

Greenfield, CA |

|

1/1/2030 |

|

|

5.75 |

% |

|

|

5,980,454 |

|

|

6,857,802 |

|

|

Vantage at Judson |

|

San Antonio, TX |

|

1/1/2053 |

|

|

9.00 |

% |

|

|

26,187,732 |

|

|

29,590,746 |

|

|

Vantage at Harlingen |

|

San Antonio, TX |

|

9/1/2053 |

|

|

9.00 |

% |

|

|

24,379,208 |

|

|

26,300,680 |

|

|

The Village at Madera - Series A |

|

Madera, CA |

|

12/1/2033 |

|

|

5.00 |

% |

|

|

3,085,000 |

|

|

3,398,244 |

|

|

The Village at Madera - Series B |

|

Madera, CA |

|

12/1/2018 |

|

|

5.50 |

% |

|

|

1,719,000 |

|

|

1,717,464 |

|

|

Westside Village Market |

|

Shafter, CA |

|

1/1/2030 |

|

|

5.75 |

% |

|

|

3,908,215 |

|

|

4,512,784 |

|

|

Willow Run |

|

Columbia, SC |

|

12/1/2050 |

|

|

5.50 |

% |

|

|

14,970,000 |

|

|

15,311,952 |

|

|

Woodlynn Village |

|

Maplewood, MN |

|

11/1/2042 |

|

|

6.00 |

% |

|

|

4,289,000 |

|

|

4,299,736 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

715,651,531 |

|

$ |

779,313,878 |

|

OTHER INVESTMENTS SEPTEMBER 30, 2017

|

|

|

|

|

Weighted |

|

Weighted Avg. |

|

|

|

|

|

|

|||

|

Name |

|

|

|

Average Lives |

|

Coupon Rate |

|

|

Principal Outstanding |

|

Estimated Fair Value |

|

|||

|

Public Housing Capital Fund Trust Certificate I |

|

|

|

7.76 |

|

|

5.39 |

% |

$ |

|

24,913,137 |

$ |

|

25,810,657 |

|

|

Public Housing Capital Fund Trust Certificate II |

|

|

|

6.80 |

|

|

4.32 |

% |

|

|

9,763,546 |

|

|

9,404,297 |

|

|

Public Housing Capital Fund Trust Certificate III |

|

|

|

8.19 |

|

|

5.45 |

% |

|

|

20,043,767 |

|

|

19,698,794 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

54,720,450 |

$ |

|

54,913,748 |

|

|

|

18 |

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS, L.P.

MORTGAGE REVENUE BOND INVESTMENT SCHEDULE DECEMBER 31, 2016

|

|

|

|

|

|

|

Base |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maturity |

|

Interest |

|

|

|

Principal |

|

|

Estimated |

|

|||

|

Property Name |

|

Location |

|

Date |

|

Rate |

|

|

|

Outstanding |

|

|

Fair Value |

|

|||

|

15 West Apartments |

|

Vancouver, WA |

|

7/1/2054 |

|

|

6.25 |

% |

|

|

$ |

9,850,000 |

|

|

$ |

11,434,281 |

|

|

Arbors at Hickory Ridge |

|

Memphis, TN |

|

1/1/2049 |

|

|

6.25 |

% |

|

|

|

11,351,321 |

|

|

|

12,352,993 |

|

|

Ashley Square |

|

Des Moines, IA |

|

12/1/2025 |

|

|

6.25 |

% |

|

|

|

5,039,000 |

|

|

|

5,377,556 |

|

|

Avistar on the Boulevard - Series A |

|

San Antonio, TX |

|

3/1/2050 |

|

|

6.00 |

% |

|

|

|

16,268,850 |

|

|

|

17,552,122 |

|

|

Avistar at Chase Hill - Series A |

|

San Antonio, TX |

|

3/1/2050 |

|

|

6.00 |

% |

|

|

|

9,844,994 |

|

|

|

10,434,017 |

|

|

Avistar at the Crest - Series A |

|

San Antonio, TX |

|

3/1/2050 |

|

|

6.00 |

% |

|

|

|

9,549,644 |

|

|

|

10,302,911 |

|

|

Avistar (February 2013 Acquisition) - Series B (3 Bonds) |

|

San Antonio, TX |

|

4/1/2050 |

|

|

9.00 |

% |

|

|

|

2,158,382 |

|

|

|

2,302,595 |

|

|

Avistar at the Oak - Series A |

|

San Antonio, TX |

|

8/1/2050 |

|

|

6.00 |

% |

|

|

|

7,709,040 |

|

|

|

8,272,178 |

|

|

Avistar in 09 - Series A |

|

San Antonio, TX |

|

8/1/2050 |

|

|

6.00 |

% |

|

|

|

6,656,458 |

|

|

|

7,016,020 |

|

|

Avistar on the Hill - Series A |

|

San Antonio, TX |

|

8/1/2050 |

|

|

6.00 |

% |

|

|

|

5,326,157 |

|

|

|

5,749,653 |

|

|

Avistar (June 2013 Acquisition) - Series B (2 Bonds) |

|

San Antonio, TX |

|

9/1/2050 |

|

|

9.00 |

% |

|

|

|

1,005,226 |

|

|

|

1,091,418 |

|

|

Avistar at the Parkway - Series A |

|

San Antonio, TX |

|

5/1/2052 |

|

|

6.00 |

% |

|

|

|

13,300,000 |

|

|

|

13,221,251 |

|

|

Avistar at the Parkway - Series B |

|

San Antonio, TX |

|

6/1/2052 |

|

|

12.00 |

% |

|

|

|

125,000 |

|

|

|

121,659 |

|

|

Bella Vista |

|

Gainesville, TX |

|

4/1/2046 |

|

|

6.15 |

% |

|

|

|

6,365,000 |

|

|

|

6,865,162 |

|

|

Bridle Ridge |

|

Greer, SC |

|

1/1/2043 |

|

|

6.00 |

% |

|

|

|

7,535,000 |

|

|

|

8,052,881 |

|

|

Brookstone |

|

Waukegan, IL |

|

5/1/2040 |

|

|

5.45 |

% |

|

|

|

9,076,558 |

|

|

|

8,920,018 |

|

|

Bruton |

|

Dallas, TX |

|

8/1/2054 |

|

|

6.00 |

% |

|

|

|

18,145,000 |

|

|

|

18,494,886 |

|

|

Columbia Gardens |

|

Columbia, SC |

|

12/1/2050 |

|

|

5.50 |

% |

|

|

|

15,000,000 |

|

|

|

14,287,193 |

|

|

Companion at Thornhill Apartments |

|

Lexington, SC |

|

1/1/2052 |

|

|

5.80 |

% |

|

|

|

11,500,000 |

|

|

|

12,145,552 |

|

|

Concord at Gulfgate - Series A |

|

Houston, TX |

|

2/1/2032 |

|

|

6.00 |

% |

|

|

|

19,185,000 |

|

|

|

20,385,246 |

|

|

Concord at Little York - Series A |

|

Houston, TX |

|

2/1/2032 |

|

|

6.00 |

% |

|

|

|

13,440,000 |

|

|

|

14,484,752 |

|

|

Concord at Williamcrest - Series A |

|

Houston, TX |

|

2/1/2032 |

|

|

6.00 |

% |

|

|

|

20,820,000 |

|

|

|

22,122,534 |

|

|

Copper Gate Apartments |

|

Lafayette, IN |

|

12/1/2029 |

|

|

6.25 |

% |

|

|

|

5,145,000 |

|

|

|

5,673,855 |

|

|

Courtyard Apartments - Series A |

|

Fullerton, CA |

|

12/1/2033 |

|

|

5.00 |

% |

|

|

|

10,230,000 |

|

|

|

10,230,000 |

|

|

Courtyard Apartments - Series B |

|

Fullerton, CA |

|

12/1/2018 |

|

|

5.50 |

% |

|

|

|

6,228,000 |

|

|

|

6,228,000 |

|

|

Cross Creek |

|

Beaufort, SC |

|

3/1/2049 |

|

|

6.15 |

% |

|

|

|

8,258,605 |

|

|

|

8,778,042 |

|

|

Crossing at 1415 - Series A |

|

San Antonio, TX |

|

12/1/2052 |

|

|

6.00 |

% |

|

|

|

7,590,000 |

|

|

|

7,544,445 |

|

|

Crossing at 1415 - Series B |

|

San Antonio, TX |

|

1/1/2053 |

|

|

12.00 |

% |

|

|

|

335,000 |

|

|

|

332,386 |

|

|

Decatur Angle |

|

Fort Worth, TX |

|

1/1/2054 |

|

|

5.75 |

% |

|

|

|

22,950,214 |

|

|

|

22,659,229 |

|

|

Glenview - Series A |

|

Cameron Park, CA |

|

12/1/2031 |

|

|

5.75 |

% |

|

|

|

4,670,000 |

|

|

|

4,802,402 |

|

|

Greens of Pine Glen - Series A |

|

Durham, NC |

|

10/1/2047 |

|

|

6.50 |

% |

|

|

|

8,210,000 |

|

|

|

9,054,585 |

|

|

Greens of Pine Glen - Series B |

|

Durham, NC |

|

10/1/2047 |

|

|

9.00 |

% |

|

|

|

940,479 |

|

|

|

1,058,695 |

|

|

Harden Ranch - Series A |

|

Salinas, CA |

|

3/1/2030 |

|

|

5.75 |

% |

|

|

|

6,912,535 |

|

|

|

7,282,273 |

|

|

Harmony Court Bakersfield - Series A |

|

Bakersfield, CA |

|

12/1/2033 |

|

|

5.00 |

% |

|

|

|

3,730,000 |

|

|

|

3,735,159 |

|

|

Harmony Court Bakersfield - Series B |

|

Bakersfield, CA |

|

12/1/2018 |

|

|

5.50 |

% |

|

|

|

1,997,000 |

|

|

|

2,021,093 |

|

|

Harmony Terrace - Series A |

|

Simi Valley, CA |

|

1/1/2034 |

|

|

5.00 |

% |

|

|

|

6,900,000 |

|

|

|

6,900,000 |

|

|

Harmony Terrace - Series B |

|

Simi Valley, CA |

|

1/1/2019 |

|

|

5.50 |

% |

|

|

|

7,400,000 |

|

|

|

7,400,000 |

|

|

Heights at 515 - Series A |

|

San Antonio, TX |

|

12/1/2052 |

|

|

6.00 |

% |

|

|

|

6,435,000 |

|

|

|

6,396,377 |

|

|

Heights at 515 - Series B |

|

San Antonio, TX |

|

1/1/2053 |

|

|

12.00 |

% |

|

|

|

510,000 |

|

|

|

506,023 |

|

|

Heritage Square - Series A |

|

Edinburg, TX |

|

9/1/2051 |

|

|

6.00 |

% |

|

|

|

11,161,330 |

|

|

|

12,066,785 |

|

|

Lake Forest Apartments |

|

Daytona Beach, FL |

|

12/1/2031 |

|

|

6.25 |

% |

|

|

|

8,639,000 |

|

|

|

9,538,694 |

|

|

Las Palmas II - Series A |

|

Coachella, CA |

|

11/1/2033 |

|

|

5.00 |

% |

|

|

|

1,695,000 |

|

|

|

1,695,000 |

|

|

Las Palmas II - Series B |

|

Coachella, CA |

|

11/1/2018 |

|

|

5.50 |

% |

|

|

|

1,770,000 |

|

|

|

1,785,139 |

|

|

Live 929 |

|

Baltimore, MD |

|

7/1/2049 |

|

|

5.78 |

% |

|

|

|

40,085,000 |

|

|

|

44,275,418 |

|

|

Montclair - Series A |

|

Lemoore, CA |

|

12/1/2031 |

|

|

5.75 |

% |

|

|

|

2,530,000 |

|

|

|

2,638,608 |

|

|

Oaks at Georgetown - Series A |

|

Georgetown, TX |

|

1/1/2034 |

|

|

5.00 |

% |

|

|

|

12,330,000 |

|

|

|

12,330,000 |

|

|

Oaks at Georgetown - Series B |

|

Georgetown, TX |

|

1/1/2019 |

|

|

5.50 |

% |

|

|

|

5,512,000 |

|

|

|

5,512,000 |

|

|

|

19 |

|

|

|

|

|

Ohio Bond - Series A |

|

Ohio |

|

6/1/2050 |

|

|

7.00 |

% |

|

|

|

14,215,000 |

|

|

|

16,542,468 |

|

|

Ohio Bond - Series B |

|

Ohio |

|

6/1/2050 |

|

|

10.00 |

% |

|

|

|

3,549,780 |

|

|

|

3,998,848 |

|

|

Pro Nova - 2014-1 |

|

Knoxville, TN |

|

5/1/2034 |

|

|

6.00 |

% |

|

|

|

10,000,000 |

|

|

|

10,727,500 |

|

|

Renaissance - Series A |

|

Baton Rouge, LA |

|

6/1/2050 |

|

|

6.00 |

% |

|

|

|

11,348,364 |

|

|

|

12,174,733 |

|

|

Runnymede |

|

Austin, TX |

|

10/1/2042 |

|

|

6.00 |

% |

|

|

|

10,250,000 |

|

|

|

11,024,285 |

|

|

Santa Fe - Series A |

|

Hesperia, CA |

|

12/1/2031 |

|

|

5.75 |

% |

|

|

|

3,065,000 |

|

|

|

3,242,093 |

|

|

San Vicente - Series A |

|

Soledad, CA |

|

11/1/2033 |

|

|

5.00 |

% |

|

|

|

3,495,000 |

|

|

|

3,457,646 |

|

|

San Vicente - Series B |

|

Soledad, CA |

|

11/1/2018 |

|

|

5.50 |

% |

|

|

|

1,825,000 |

|

|

|

1,832,334 |

|

|

Seasons at Simi Valley - Series A |

|

Simi Valley, CA |

|

9/1/2032 |

|

|

5.75 |

% |

|

|

|

4,376,000 |

|

|

|

4,684,335 |

|

|

Seasons at Simi Valley - Series B |

|

Simi Valley, CA |

|

9/1/2017 |

|

|

8.00 |

% |

|

|

|

1,944,000 |

|

|

|

1,971,727 |

|

|

Seasons Lakewood - Series A |

|

Lakewood, CA |

|

1/1/2034 |

|

|

5.00 |

% |

|

|

|

7,350,000 |

|

|

|

7,350,000 |

|

|

Seasons Lakewood - Series B |

|

Lakewood, CA |

|

1/1/2019 |

|

|

5.50 |

% |

|

|

|

5,260,000 |

|

|

|

5,260,000 |

|

|

Seasons San Juan Capistrano - Series A |

|

San Juan Capistrano, CA |

|

1/1/2034 |

|

|

5.00 |

% |

|

|

|

12,375,000 |

|

|

|

12,375,000 |

|

|

Seasons San Juan Capistrano - Series B |

|

San Juan Capistrano, CA |

|

1/1/2019 |

|

|

5.50 |

% |

|

|

|

6,574,000 |

|

|

|

6,574,000 |

|

|

Silver Moon - Series A |

|

Albuquerque, NM |

|

8/1/2055 |

|

|

6.00 |

% |

|

|

|

7,933,259 |

|

|

|

8,398,641 |

|

|

Southpark |

|

Austin, TX |

|

12/1/2049 |

|

|

6.13 |

% |

|

|

|

13,435,000 |

|

|

|

15,038,064 |

|

|

Summerhill - Series A |

|

Bakersfield, CA |

|

12/1/2033 |

|

|

5.00 |

% |

|

|

|

6,423,000 |

|

|

|

6,261,324 |

|

|

Summerhill - Series B |

|

Bakersfield, CA |

|

12/1/2018 |

|

|

5.50 |

% |

|

|

|

3,372,000 |

|

|

|

3,358,695 |

|

|

Sycamore Walk - Series A |

|

Bakersfield, CA |

|

1/1/2033 |

|

|

5.25 |

% |

|

|

|

3,632,000 |

|

|

|

3,762,431 |

|

|

Sycamore Walk - Series B |

|

Bakersfield, CA |

|

1/1/2018 |

|

|

5.50 |

% |

|

|

|

1,815,000 |

|

|

|

1,750,568 |

|

|

The Palms at Premier Park |

|

Columbia, SC |

|

1/1/2050 |

|

|

6.25 |

% |

|

|

|

19,826,716 |

|

|

|

21,611,102 |

|

|

Tyler Park Townhomes |

|

Greenfield, CA |

|

1/1/2030 |

|

|

5.75 |

% |

|

|

|

6,024,120 |

|

|

|

6,261,702 |

|

|

Vantage at Judson |

|

San Antonio, TX |

|

1/1/2053 |

|

|

9.00 |

% |

|

|

|

26,356,498 |

|

|

|

28,015,005 |

|

|

Vantage at Harlingen |

|

San Antonio, TX |

|

9/1/2053 |

|

|

9.00 |

% |

|

|

|

24,529,580 |

|

|

|

25,447,299 |

|

|

The Village at Madera - Series A |

|

Madera, CA |

|

12/1/2033 |

|

|

5.00 |

% |

|

|

|

3,085,000 |

|

|

|

3,007,346 |

|

|

The Village at Madera - Series B |

|

Madera, CA |

|

12/1/2018 |

|

|

5.50 |

% |

|

|

|

1,719,000 |

|

|

|

1,712,217 |

|

|

Westside Village Market |

|

Shafter, CA |

|

1/1/2030 |

|

|

5.75 |

% |

|

|

|

3,936,750 |

|

|

|

4,039,391 |

|

|

Willow Run |

|

Columbia, SC |

|

12/1/2050 |

|

|

5.50 |

% |

|

|

|

15,000,000 |

|

|

|

14,296,235 |

|

|

Woodlynn Village |

|

Maplewood, MN |

|

11/1/2042 |

|

|

6.00 |

% |

|

|

|

4,310,000 |

|

|

|

4,604,976 |

|

|

Total Mortgage Revenue Bonds |

|

|

|

|

|

|

|

|

|

$ |

|

648,439,860 |

|

$ |

|

680,211,051 |

|

OTHER INVESTMENTS DECEMBER 31, 2016

|

|

|

|

|

Weighted |

|

|

Weighted Avg. |

|

|

|

Principal |

|

|

Estimated |

|

||||

|

Name |

|

|

|

Average Lives |

|

|

Coupon Rate |

|

|

|

Outstanding |

|

|

Fair Value |

|

||||

|

Public Housing Capital Fund Trust Certificate I |

|

|

|

|

8.31 |

|

|

|

5.36 |

% |

|

$ |

|

24,923,137 |

|

$ |

|

26,749,255 |

|

|

Public Housing Capital Fund Trust Certificate II |

|

|

|

|

7.65 |

|

|

|

4.31 |

% |

|

|

|

10,938,848 |

|

|

|

10,685,723 |