Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K INVESTOR PRESENTATION NOVEMBER 2017 - SUN COMMUNITIES INC | form8-kxinvestorpresentati.htm |

INVESTOR PRESENTATION

NOVEMBER 2017

PALM CREEK – CASA GRANDE, AZ

2

This presentation has been prepared for informational purposes only from information supplied by Sun Communities, Inc. (the “Company”, “Sun”) and from third-party

sources indicated herein. Such third-party information has not been independently verified. The Company makes no representation or warranty, expressed or implied, as to

the accuracy or completeness of such information.

This presentation contains various “forward-looking statements” within the meaning of the United States Securities Act of 1933, as amended, and the United States

Securities Exchange Act of 1934, as amended, and we intend that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any

statements contained in this presentation that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and

similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,”

“intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,”

“anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance” and similar expressions are intended to

identify forward-looking statements, although not all forward looking statements contain these words. These forward-looking statements reflect our current views with

respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this

presentation. These risks and uncertainties may cause our actual results to be materially different from any future results expressed or implied by such forward-looking

statements. In addition to the risks disclosed under “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2016, and our other filings

with the Securities and Exchange Commission from time to time, such risks and uncertainties include but are not limited to:

changes in general economic conditions, the real estate industry and the markets in which we operate;

difficulties in our ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully;

our liquidity and refinancing demands;

our ability to obtain or refinance maturing debt;

our ability to maintain compliance with covenants contained in our debt facilities;

availability of capital;

changes in foreign currency exchange rates, specifically between the U.S. dollar and Canadian dollar;

our ability to maintain rental rates and occupancy levels;

our failure to maintain effective internal control over financial reporting and disclosure controls and procedures;

increases in interest rates and operating costs, including insurance premiums and real property taxes;

risks related to natural disasters;

general volatility of the capital markets and the market price of shares of our capital stock;

our failure to maintain our status as a REIT;

changes in real estate and zoning laws and regulations;

legislative or regulatory changes, including changes to laws governing the taxation of REITs;

litigation, judgments or settlements;

competitive market forces;

the ability of manufactured home buyers to obtain financing; and

the level of repossessions by manufactured home lenders.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no

obligation to publicly update or revise any forward-looking statements included in this presentation, whether as a result of new information, future events, changes in our

expectations or otherwise, except as required by law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot

guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to us or persons acting on our behalf

are qualified in their entirety by these cautionary statements.

FORWARD-LOOKING STATEMENTS

SUN COMMUNITIES, INC. (NYSE: SUI) OVERVIEW

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 as well as Press Releases after September 30, 2017 for additional information.

4,882

1,595

680

149

1,757

25,756

3,009

1,277

916

1,156

2,904

548

2,150

698

237

672

481

1,049

475

413

976

226

2,483

473

7,802

42,921

4,614

324

6,501

3,420

349 communities

consisting of

~120,500 sites

across 29 states and

Ontario, Canada

Current Portfolio

As of November 1, 2017

3

9% 25%

66%

31 manufactured housing and recreational vehicle communities

89 recreational vehicle only communities

229 manufactured housing communities

66%

[VA

LUE

]

34

%

All-age communities

Age-restricted communities

Trailing Twelve Months Rental Revenue

As of September 30, 2017

88%

Annual

Revenues

Manufactured

Housing

72%

RV - Annual

16%

RV - Transient

12%

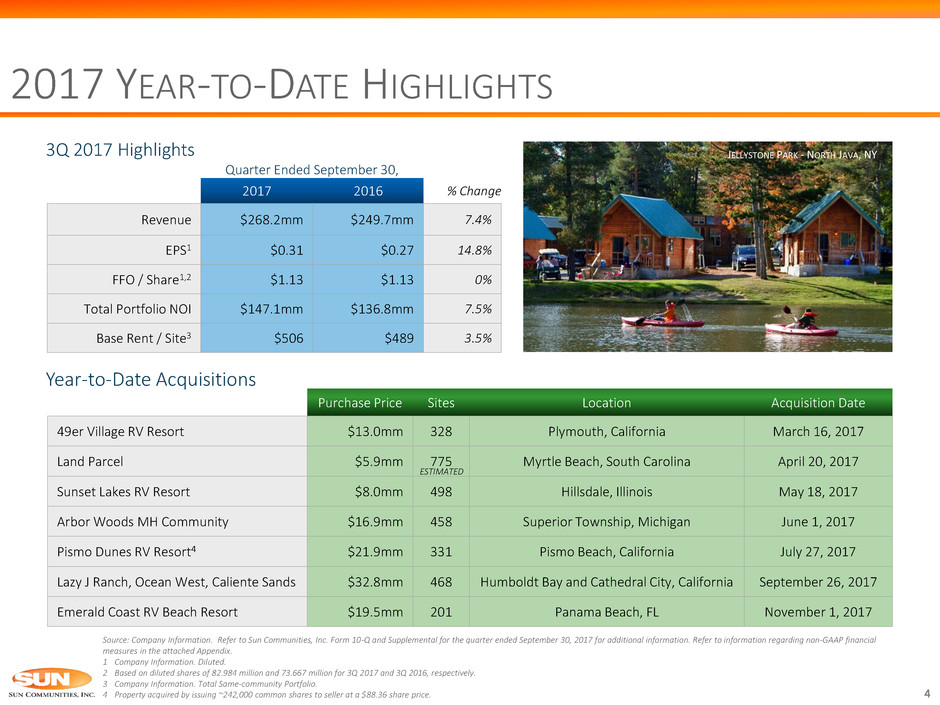

Purchase Price Sites Location Acquisition Date

49er Village RV Resort $13.0mm 328 Plymouth, California March 16, 2017

Land Parcel $5.9mm 775 Myrtle Beach, South Carolina April 20, 2017

Sunset Lakes RV Resort $8.0mm 498 Hillsdale, Illinois May 18, 2017

Arbor Woods MH Community $16.9mm 458 Superior Township, Michigan June 1, 2017

Pismo Dunes RV Resort4 $21.9mm 331 Pismo Beach, California July 27, 2017

Lazy J Ranch, Ocean West, Caliente Sands $32.8mm 468 Humboldt Bay and Cathedral City, California September 26, 2017

Emerald Coast RV Beach Resort $19.5mm 201 Panama Beach, FL November 1, 2017

2017 YEAR-TO-DATE HIGHLIGHTS

4

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. Refer to information regarding non-GAAP financial

measures in the attached Appendix.

1 Company Information. Diluted.

2 Based on diluted shares of 82.984 million and 73.667 million for 3Q 2017 and 3Q 2016, respectively.

3 Company Information. Total Same-community Portfolio.

4 Property acquired by issuing ~242,000 common shares to seller at a $88.36 share price.

Year-to-Date Acquisitions

Quarter Ended September 30,

2017 2016 % Change

Revenue $268.2mm $249.7mm 7.4%

EPS1 $0.31 $0.27 14.8%

FFO / Share1,2 $1.13 $1.13 0%

Total Portfolio NOI $147.1mm $136.8mm 7.5%

Base Rent / Site3 $506 $489 3.5%

ESTIMATED

3Q 2017 Highlights JELLYSTONE PARK - NORTH JAVA, NY

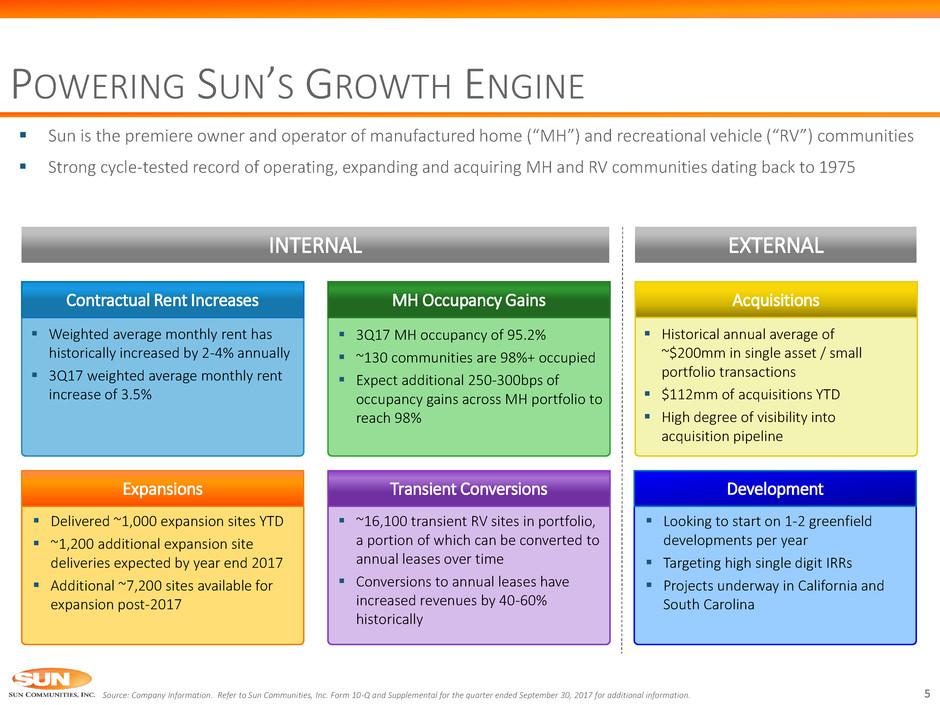

Sun is the premiere owner and operator of manufactured home (“MH”) and recreational vehicle (“RV”) communities

Strong cycle-tested record of operating, expanding and acquiring MH and RV communities dating back to 1975

5

POWERING SUN’S GROWTH ENGINE

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information.

INTERNAL EXTERNAL

Contractual Rent Increases

Weighted average monthly rent has

historically increased by 2-4% annually

3Q17 weighted average monthly rent

increase of 3.5%

MH Occupancy Gains

3Q17 MH occupancy of 95.2%

~130 communities are 98%+ occupied

Expect additional 250-300bps of

occupancy gains across MH portfolio to

reach 98%

Expansions

Delivered ~1,000 expansion sites YTD

~1,200 additional expansion site

deliveries expected by year end 2017

Additional ~7,200 sites available for

expansion post-2017

~16,100 transient RV sites in portfolio,

a portion of which can be converted to

annual leases over time

Conversions to annual leases have

increased revenues by 40-60%

historically

Historical annual average of

~$200mm in single asset / small

portfolio transactions

$112mm of acquisitions YTD

High degree of visibility into

acquisition pipeline

Acquisitions

Looking to start on 1-2 greenfield

developments per year

Targeting high single digit IRRs

Projects underway in California and

South Carolina

Development Transient Conversions

SUN’S FAVORABLE REVENUE DRIVERS

6

The average cost to move a home ranges

from $4K-$10K, resulting in low move-out

of homes

Tenure of homes in our communities is

44 years1

Tenure of residents in our communities is

approximately 13 years1

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. Refer to information regarding non-GAAP financial

measures in the attached Appendix.

1 Average since 2010.

Three Year Average Resident Move-out Trends

(Home stays in community) (Home leaves community)

COUNTR HILL VILLAGE – HUDSONVILLE, MI

WINDMILL VILLAGE - DAVENPORT, FL

6.13%

1.97%

Resident Re-sales Resident Move-outs

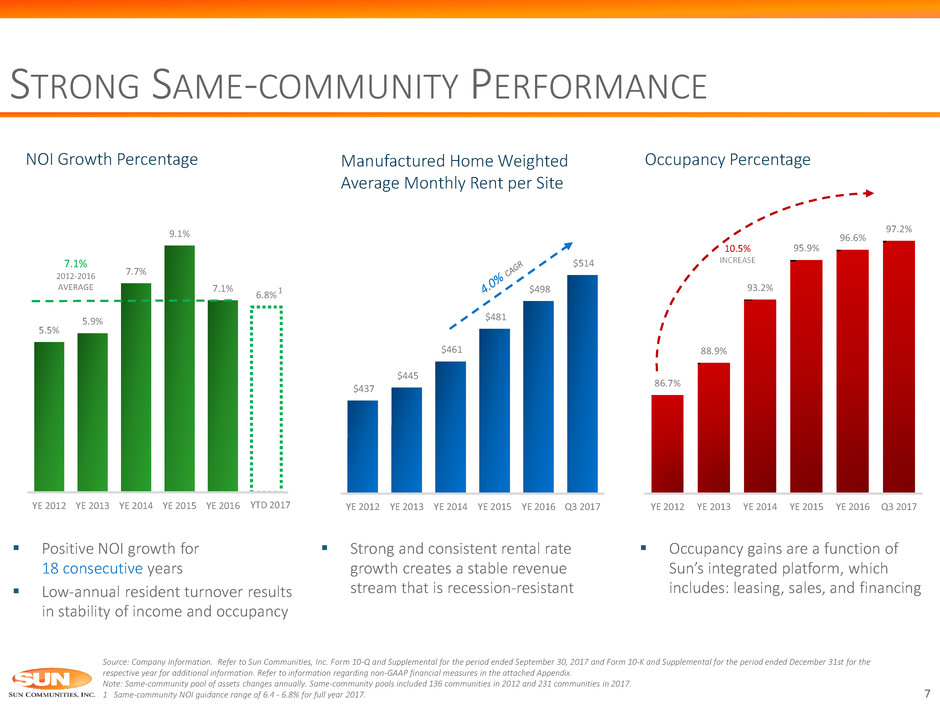

STRONG SAME-COMMUNITY PERFORMANCE

7

Positive NOI growth for

18 consecutive years

Low-annual resident turnover results

in stability of income and occupancy

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the period ended September 30, 2017 and Form 10-K and Supplemental for the period ended December 31st for the

respective year for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix.

Note: Same-community pool of assets changes annually. Same-community pools included 136 communities in 2012 and 231 communities in 2017.

1 Same-community NOI guidance range of 6.4 - 6.8% for full year 2017.

NOI Growth Percentage Occupancy Percentage Manufactured Home Weighted

Average Monthly Rent per Site

Strong and consistent rental rate

growth creates a stable revenue

stream that is recession-resistant

Occupancy gains are a function of

Sun’s integrated platform, which

includes: leasing, sales, and financing

$437

$445

$461

$481

$498

$514

YE 2012 YE 2013 YE 2014 YE 2015 YE 2016 Q3 2017

5.5%

5.9%

7.7%

9.1%

7.1%

6.8%

YE 2012 YE 2013 YE 2014 YE 2015 YE 2016 Q3 2017

7.1%

2012-2016

AVERAGE

86.7%

88.9%

93.2%

95.9%

96.6%

97.2%

YE 2012 YE 2013 YE 2014 YE 2015 YE 2016 Q3 2017

10.5%

INCREASE

YTD 2017

1

8

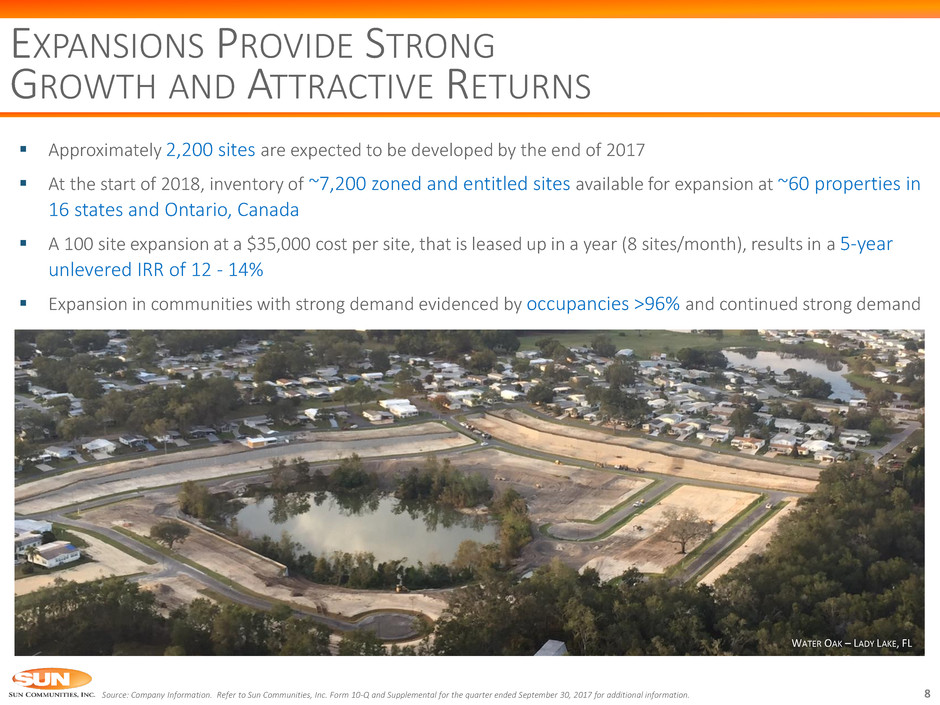

GROWTH AND ATTRACTIVE RETURNS

EXPANSIONS PROVIDE STRONG

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information.

Approximately 2,200 sites are expected to be developed by the end of 2017

At the start of 2018, inventory of ~7,200 zoned and entitled sites available for expansion at ~60 properties in

16 states and Ontario, Canada

A 100 site expansion at a $35,000 cost per site, that is leased up in a year (8 sites/month), results in a 5-year

unlevered IRR of 12 - 14%

Expansion in communities with strong demand evidenced by occupancies >96% and continued strong demand

PALM CREEK GOLF & RV RESORT – CASA GRANDE, AZ

PARK ROYALE - PINELLAS PARK, FL

WATER OAK – LADY LAKE, FL

9

SUPPORTED BY RENTAL PROGRAM

EXPANSION OPPORTUNITIES

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information.

1 Operating expenses include repairs and refurbishment, taxes and insurance, marketing, and commissions.

Sun’s rental program is a key onboarding and conversion tool for our communities

Rental Program All-in 5-Year Unlevered IRR

$42,000 initial investment in new home

Weighted average monthly rental rate $900 x 12 = $10,800 (3% annual increases)

Monthly operating expenses1 +1 month vacancy factor $275 x 12 = $3,300 (3% annual increases)

End of 5-year period sell the home and recoup ~90% of original invoice price

All-in 5-year unlevered IRR in the high teens

RENTAL: EAST VILLAGE ESTATES – WASHINGTON, MI RENTAL: CIDER MILL CROSSING – FENTON, MI

2013

EXTRACTING VALUE FROM STRATEGIC ACQUISITIONS

10

Since May 2011, Sun has acquired communities valued in excess of $4.4 billion, increasing its number of sites

and communities by ~180%

1

2011

159 communities

54,811 sites

173 communities

63,697 sites

188 communities

69,789 sites

217 communities

79,554 sites

231 communities

88,612 sites

341 communities

117,376 sites

Source: Company Information. Refer to Sun Communities, Inc. Form 10-K and Supplemental for the period ended December 31st for the respective year as well as Sun Communities, Inc. Form 10-Q and Supplemental for

the period ended September 30, 2017 for additional information.

1 Includes 30 community dispositions realized in 2014 and 2015.

2012 2014 2015 2016

349 communities

120,544 sites

2017

Year-end Communities and Sites

Y T D

HOME SALES

& RENTAL

PROGRAM

CALL CENTER

& DIGITAL

MARKETING

OUTREACH

SKILLED

EXPENSE

MANAGEMENT

REPOSITIONING

WITH ADDIT’L

CAPEX

ADDING

VALUE WITH

EXPANSIONS

INCREASING

MARKET

RENT

PROFESSIONAL

OPERATIONAL

MANAGEMENT

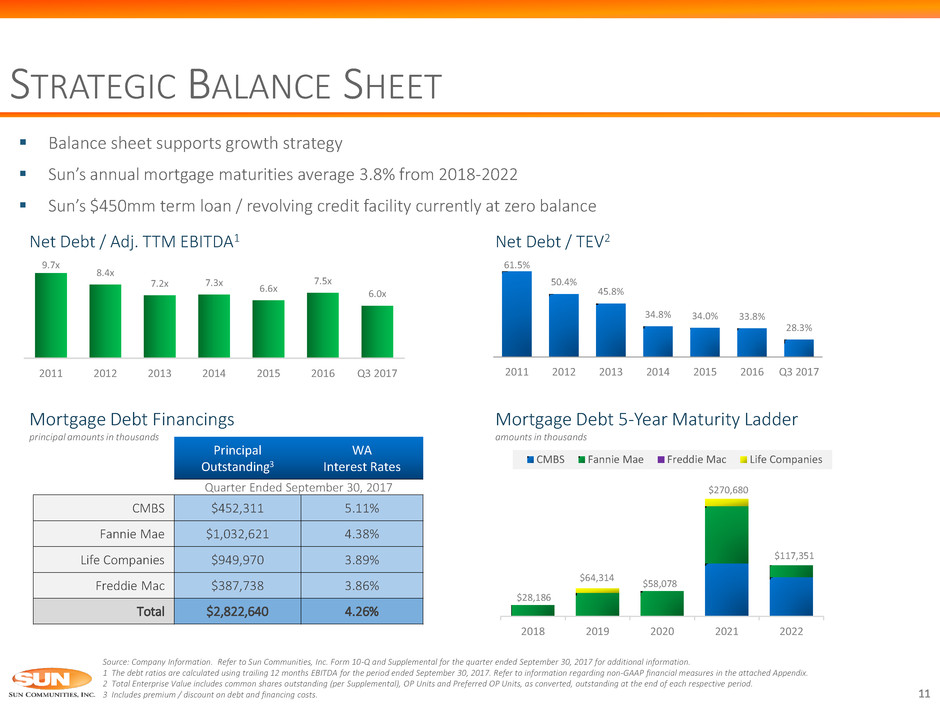

STRATEGIC BALANCE SHEET

11

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information.

1 The debt ratios are calculated using trailing 12 months EBITDA for the period ended September 30, 2017. Refer to information regarding non-GAAP financial measures in the attached Appendix.

2 Total Enterprise Value includes common shares outstanding (per Supplemental), OP Units and Preferred OP Units, as converted, outstanding at the end of each respective period.

3 Includes premium / discount on debt and financing costs.

61.5%

50.4%

45.8%

34.8% 34.0% 33.8%

28.3%

2011 2012 2013 2014 2015 2016 Q3 2017

GWYNN’S ISLAND RV RESORT – GWYNNS ISLAND, VA

Net Debt / Adj. TTM EBITDA1 Net Debt / TEV2

Principal

Outstanding3

WA

Interest Rates

Quarter Ended September 30, 2017

CMBS $452,311 5.11%

Fannie Mae $1,032,621 4.38%

Life Companies $949,970 3.89%

Freddie Mac $387,738 3.86%

Total $2,822,640 4.26%

Mortgage Debt Financings

principal amounts in thousands

Mortgage Debt 5-Year Maturity Ladder

amounts in thousands

Balance sheet supports growth strategy

Sun’s annual mortgage maturities average 3.8% from 2018-2022

Sun’s $450mm term loan / revolving credit facility currently at zero balance

2018 2019 2020 2021 2022

CMBS Fannie Mae Freddie Mac Life Companies

$64,314

$117,351

$270,680

$58,078

9.7x

8.4x

7.2x 7.3x 6.6x

7.5x

6.0x

2011 2012 2013 2014 2015 2016 Q3 2017

$28,186

-10%

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

1Q

02

2Q

02

3Q

02

4Q

02

1Q

03

2Q

03

3Q

03

4Q

03

1Q

04

2Q

04

3Q

04

4Q

04

1Q

05

2Q

05

3Q

05

4Q

05

1Q

06

2Q

06

3Q

06

4Q

06

1Q

07

2Q

07

3Q

07

4Q

07

1Q

08

2Q

08

2Q

09

3Q

09

4Q

09

1Q

10

2Q

10

3Q

10

4Q

10

1Q

11

2Q

11

3Q

11

4Q

11

1Q

12

2Q

12

3Q

12

4Q

12

1Q

13

2Q

13

3Q

13

4Q

13

1Q

14

2Q

14

3Q

14

4Q

14

1Q

15

2Q

15

3Q

15

4Q

15

1Q

16

2Q

16

3Q

16

4Q

16

1Q

17

2Q

17

3Q

17

Sun Communities, Inc.

Apartments

Sun's Average (4.4%)

Apartment Average (2.7%)

REIT Industry Average (2.5%)

4.4%

2.5%

2.7%

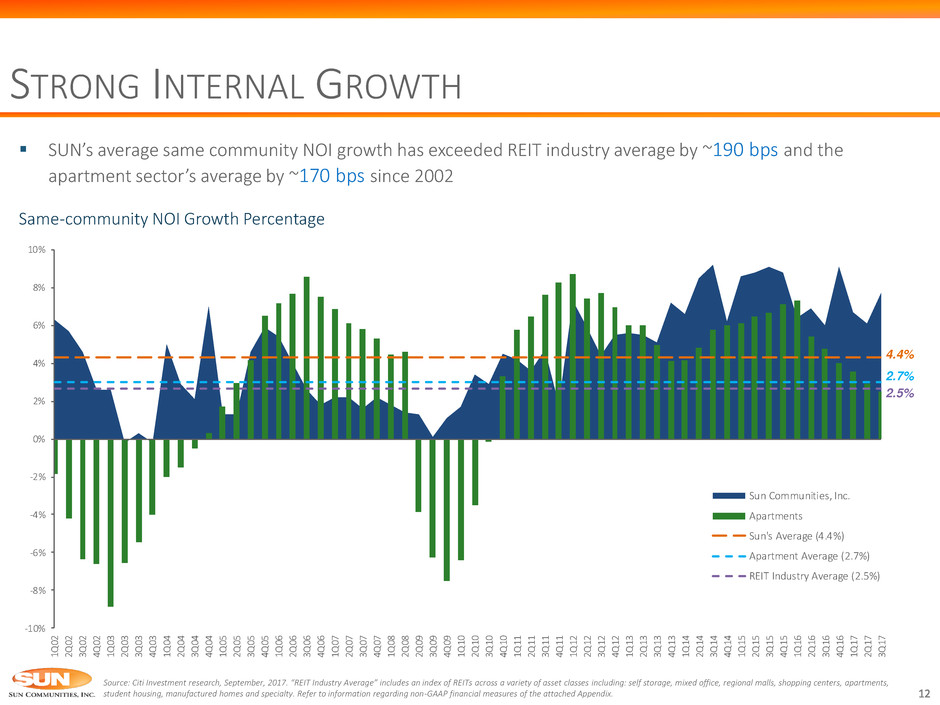

STRONG INTERNAL GROWTH

12

Source: Citi Investment research, September, 2017. “REIT Industry Average” includes an index of REITs across a variety of asset classes including: self storage, mixed office, regional malls, shopping centers, apartments,

student housing, manufactured homes and specialty. Refer to information regarding non-GAAP financial measures of the attached Appendix.

SUN’s average same community NOI growth has exceeded REIT industry average by ~190 bps and the

apartment sector’s average by ~170 bps since 2002

Same-community NOI Growth Percentage

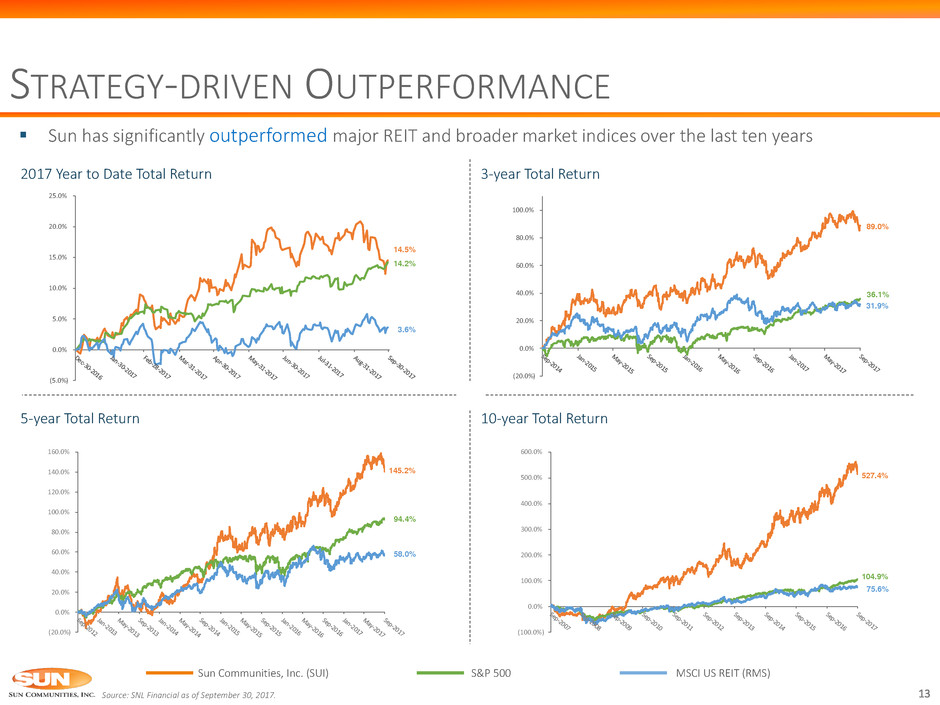

5-year Total Return

STRATEGY-DRIVEN OUTPERFORMANCE

13

Sun has significantly outperformed major REIT and broader market indices over the last ten years

2017 Year to Date Total Return

Source: SNL Financial as of September 30, 2017.

3-year Total Return

10-year Total Return

Sun Communities, Inc. (SUI) MSCI US REIT (RMS) S&P 500

(20.0%)

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

140.0%

160.0%

145.2%

94.4%

58.0%

(5.0%)

0.0%

5.0%

0.0%

15.0%

20.0%

25.0%

14.5%

14.2%

3.6%

(100.0%)

0.0%

100.0%

200.0%

300.0%

400.0%

500.0%

600.0%

527.4%

104.9%

75.6%

(20.0%)

0. %

20. %

40. %

60.0%

80.0%

100.0%

89.0%

36.1

31.9%

APPENDIX

PETERS POND RV RESORT – SANDWICH, MA

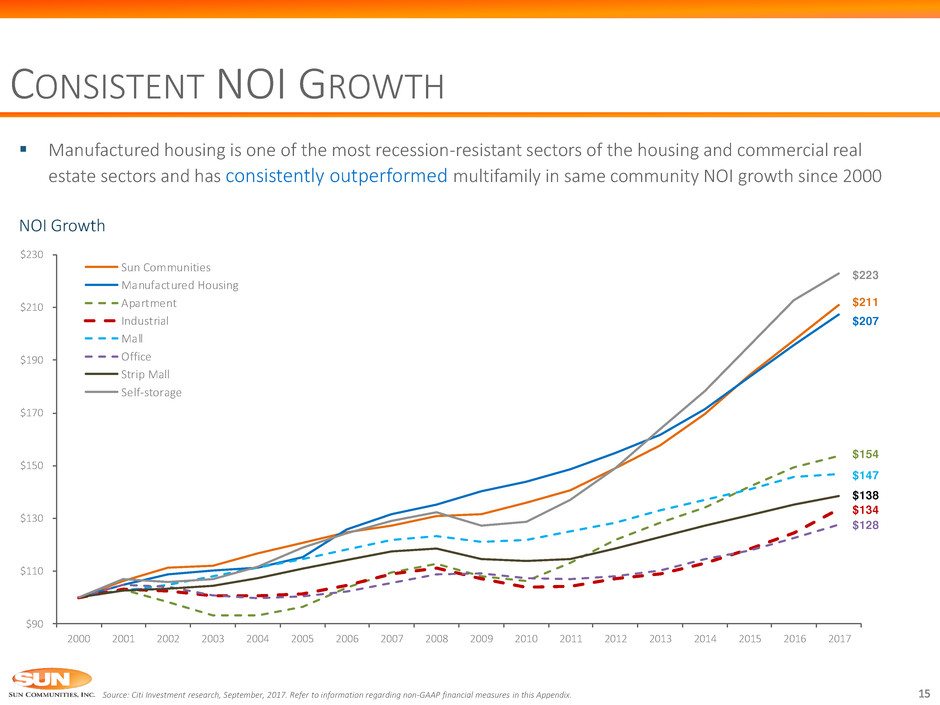

CONSISTENT NOI GROWTH

15

Manufactured housing is one of the most recession-resistant sectors of the housing and commercial real

estate sectors and has consistently outperformed multifamily in same community NOI growth since 2000

NOI Growth

Source: Citi Investment research, September, 2017. Refer to information regarding non-GAAP financial measures in this Appendix.

$90

$110

$130

$150

$170

$190

$210

$230

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Sun Communities

Manufactured Housing

Apartment

Industrial

Mall

Office

Strip Mall

Self-storage

$211

$207

$154

$223

$147

$138

$128

$134

16

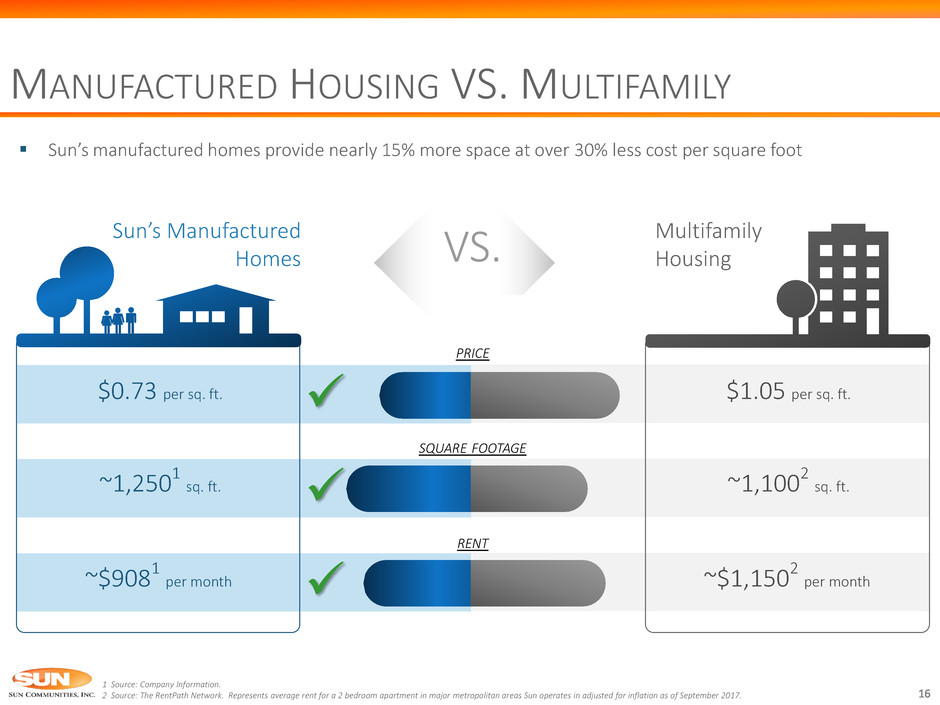

MANUFACTURED HOUSING VS. MULTIFAMILY

Sun’s manufactured homes provide nearly 15% more space at over 30% less cost per square foot

Sun’s Manufactured

Homes VS.

RENT

~$908

1 per month

Multifamily

Housing

~$1,1502 per month

SQUARE FOOTAGE

PRICE

~1,2501 sq. ft. ~1,1002 sq. ft.

$0.73 per sq. ft. $1.05 per sq. ft.

1 Source: Company Information.

2 Source: The RentPath Network. Represents average rent for a 2 bedroom apartment in major metropolitan areas Sun operates in adjusted for inflation as of September 2017.

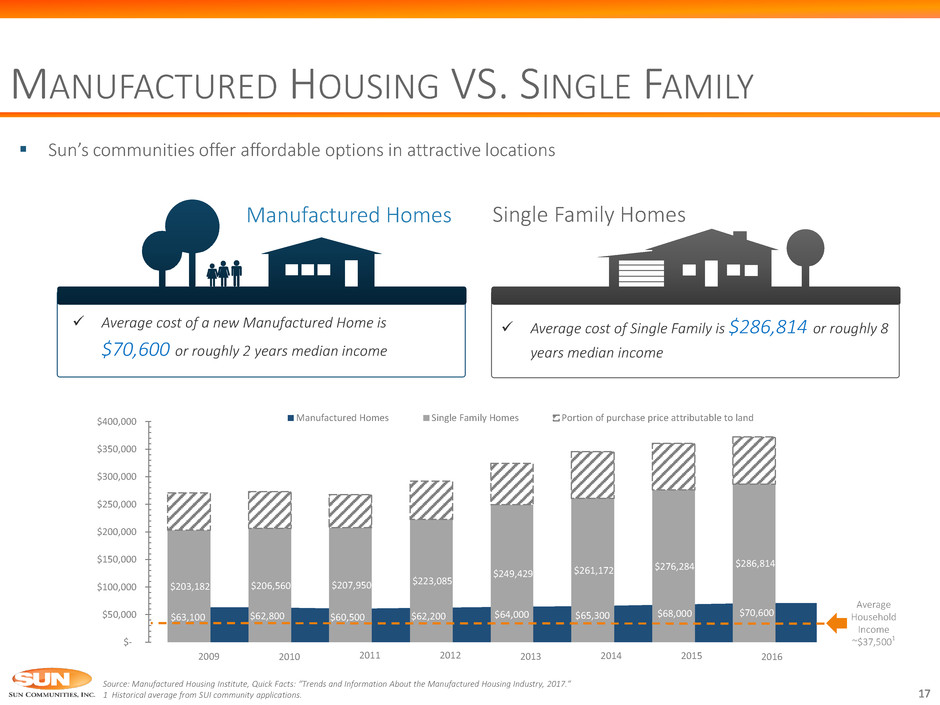

Source: Manufactured Housing Institute, Quick Facts: “Trends and Information About the Manufactured Housing Industry, 2017.”

1 Historical average from SUI community applications. 17

MANUFACTURED HOUSING VS. SINGLE FAMILY

Single Family Homes Manufactured Homes

Average cost of Single Family is $286,814 or roughly 8

years median income

Average cost of a new Manufactured Home is

$70,600 or roughly 2 years median income

Sun’s communities offer affordable options in attractive locations

$63,100 $62,800 $60,500 $62,200 $64,000 $65,300 $68,000 $70,600

$203,182 $206,560 $207,950

$223,085

$249,429 $261,172

$276,284 $286,814

$-

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000 Manufactured Homes Single Family Homes Portion of purchase price attributable to land

Average

Household

Income

~$37,5001

2009 2010 2011 2012 2013 2014 2015 2016

NON-GAAP TERMS DEFINED

18

Investors in and analysts following the real estate industry utilize funds from operations (“FFO”), net operating income (“NOI”), and recurring earnings before interest, tax, depreciation and

amortization (“Recurring EBITDA”) as supplemental performance measures. We believe FFO, NOI, and Recurring EBITDA are appropriate measures given their wide use by and relevance to investors

and analysts. FFO, reflecting the assumption that real estate values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation/amortization of real estate assets. NOI

provides a measure of rental operations and does not factor in depreciation/amortization and non-property specific expenses such as general and administrative expenses. Recurring EBITDA, a

metric calculated as EBITDA exclusive of certain nonrecurring items, provides a further tool to evaluate ability to incur and service debt and to fund dividends and other cash needs. Additionally, FFO,

NOI, and Recurring EBITDA are commonly used in various ratios, pricing multiples/yields and returns and valuation calculations used to measure financial position, performance and value.

FFO is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) as net income (loss) computed in accordance with generally accepted accounting principles (“GAAP”),

excluding gains (or losses) from sales of depreciable operating property, plus real estate-related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint

ventures. FFO is a non-GAAP financial measure that management believes is a useful supplemental measure of the Company’s operating performance. Management generally considers FFO to be a

useful measure for reviewing comparative operating and financial performance because, by excluding gains and losses related to sales of previously depreciated operating real estate assets,

impairment and excluding real estate asset depreciation and amortization (which can vary among owners of identical assets in similar condition based on historical cost accounting and useful life

estimates), FFO provides a performance measure that, when compared period over period, reflects the impact to operations from trends in occupancy rates, rental rates, and operating costs,

providing perspective not readily apparent from net income (loss). Management believes that the use of FFO has been beneficial in improving the understanding of operating results of REITs among

the investing public and making comparisons of REIT operating results more meaningful. FFO is computed in accordance with the Company's interpretation of standards established by NAREIT, which

may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than

the Company. The Company also uses FFO excluding certain items, which excludes certain gain and loss items that management considers unrelated to the operational and financial performance of

our core business. We believe that this provides investors with another financial measure of our operating performance that is more comparable when evaluating period over period results.

Because FFO excludes significant economic components of net income (loss) including depreciation and amortization, FFO should be used as an adjunct to net income (loss) and not as an alternative

to net income (loss). The principal limitation of FFO is that it does not represent cash flow from operations as defined by GAAP and is a supplemental measure of performance that does not replace

net income (loss) as a measure of performance or net cash provided by operating activities as a measure of liquidity. In addition, FFO is not intended as a measure of a REIT’s ability to meet debt

principal repayments and other cash requirements, nor as a measure of working capital. FFO only provides investors with an additional performance measure that, when combined with measures

computed in accordance with GAAP such as net income (loss), cash flow from operating activities, investing activities and financing activities, provide investors with an indication of our ability to

service debt and to fund acquisitions and other expenditures. Other REITs may use different methods for calculating FFO, accordingly, our FFO may not be comparable to other REITs.

NOI is derived from revenues minus property operating expenses and real estate taxes. NOI does not represent cash generated from operating activities in accordance with GAAP and should not be

considered to be an alternative to net income (loss) (determined in accordance with GAAP) as an indication of the Company's financial performance or to be an alternative to cash flow from

operating activities (determined in accordance with GAAP) as a measure of the Company's liquidity; nor is it indicative of funds available for the Company's cash needs, including its ability to make

cash distributions. The Company believes that net income (loss) is the most directly comparable GAAP measurement to NOI. Because of the inclusion of items such as interest, depreciation, and

amortization, the use of net income (loss) as a performance measure is limited as these items may not accurately reflect the actual change in market value of a property, in the case of depreciation

and in the case of interest, may not necessarily be linked to the operating performance of a real estate asset, as it is often incurred at a parent company level and not at a property level. The

Company believes that NOI is helpful to investors as a measure of operating performance because it is an indicator of the return on property investment, and provides a method of comparing

property performance over time. The Company uses NOI as a key management tool when evaluating performance and growth of particular properties and/or groups of properties. The principal

limitation of NOI is that it excludes depreciation, amortization interest expense and non-property specific expenses such as general and administrative expenses, all of which are significant costs,

therefore, NOI is a measure of the operating performance of the properties of the Company rather than of the Company overall.

EBITDA is defined as NOI plus other income, plus (minus) equity earnings (loss) from affiliates, minus general and administrative expenses. EBITDA includes EBITDA from discontinued operations. The

Company believes that net income (loss) is the most directly comparable GAAP measurement to EBITDA.

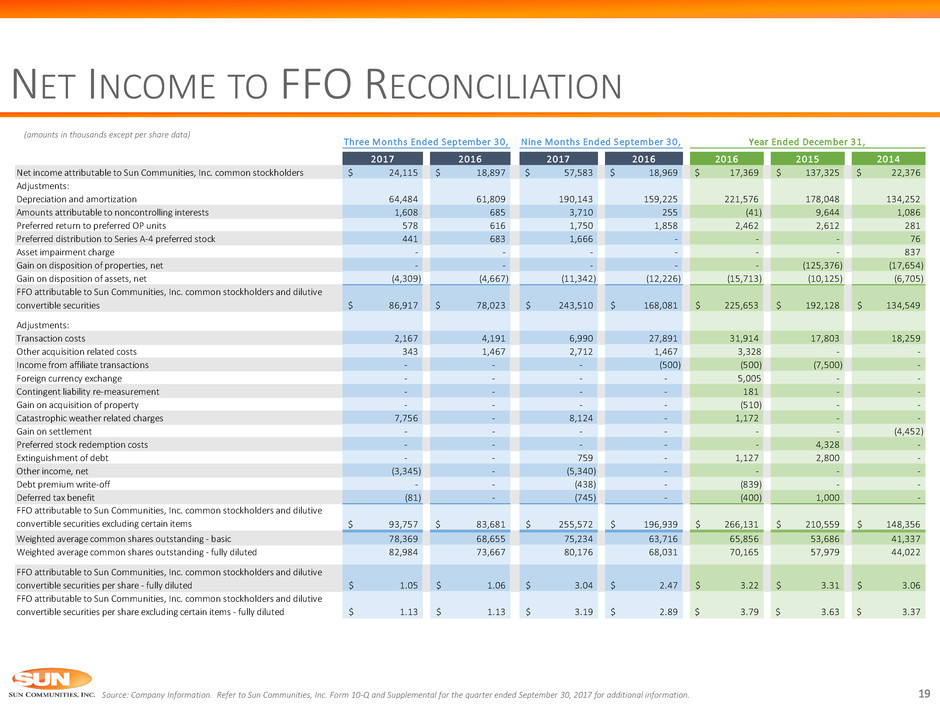

NET INCOME TO FFO RECONCILIATION

19

(amounts in thousands except per share data)

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information.

2017 2016 2017 2016 2016 2015 2014

Net income attributable to Sun Communities, Inc. common stockholders 24,115$ 18,897$ 57,583$ 18,969$ 17,369$ 137,325$ 22,376$

Adjustments:

Depreciation and amortization 64,484 61,809 190,143 159,225 221,576 178,048 134,252

Amounts attributable to noncontrolling interests 1,608 685 3,710 255 (41) 9,644 1,086

Preferred return to preferred OP units 578 616 1,750 1,858 2,462 2,612 281

Preferred distribution to Series A-4 preferred stock 441 683 1,666 - - - 76

Asset impairment charge - - - - - - 837

Gain on disposition of properties, net - - - - - (125,376) (17,654)

Gain on disposition of assets, net (4,309) (4,667) (11,342) (12,226) (15,713) (10,125) (6,705)

FFO attributable to Sun Communities, Inc. common stockholders and dilutive

convertible securities 86,917$ 78,023$ 243,510$ 168,081$ 225,653$ 192,128$ 134,549$

Adjustments:

Transaction costs 2,167 4,191 6,990 27,891 31,914 17,803 18,259

Other acquisition related costs 343 1,467 2,712 1,467 3,328 - -

Income from affiliate transactions - - - (500) (500) (7,500) -

Foreign currency exchange - - - - 5,005 - -

Contingent liability re-measurement - - - - 181 - -

Gain on acquisition of property - - - - (510) - -

Catastrophic weather related charges 7,756 - 8,124 - 1,172 - -

Gain on settlement - - - - - - (4,452)

Preferred stock redemption costs - - - - - 4,328 -

Extinguishment of debt - - 759 - 1,127 2,800 -

Other income, net (3,345) - (5,340) - - - -

Debt premium write-off - - (438) - (839) - -

Deferred tax benefit (81) - (745) - (400) 1,000 -

FFO attributable to Sun Communities, Inc. common stockholders and dilutive

convertible securities excluding certain items 93,757$ 83,681$ 255,572$ 196,939$ 266,131$ 210,559$ 148,356$

Weighted average common shares outstanding - basic 78,369 68,655 75,234 63,716 65,856 53,686 41,337

W ighted average common shares outstanding - fully diluted 82,984 73,667 80,176 68,031 70,165 57,979 44,022

FFO attributable to Sun Communities, Inc. common stockholders and dilutive

convertible securities per share - fully diluted 1.05$ 1.06$ 3.04$ 2.47$ 3.22$ 3.31$ 3.06$

FFO attributable to Sun Communities, Inc. common stockholders and dilutive

convertible securities per share excluding certain items - fully diluted 1.13$ 1.13$ 3.19$ 2.89$ 3.79$ 3.63$ 3.37$

Three Months Ended September 30, Nine Months Ended September 30, Year Ended December 31,

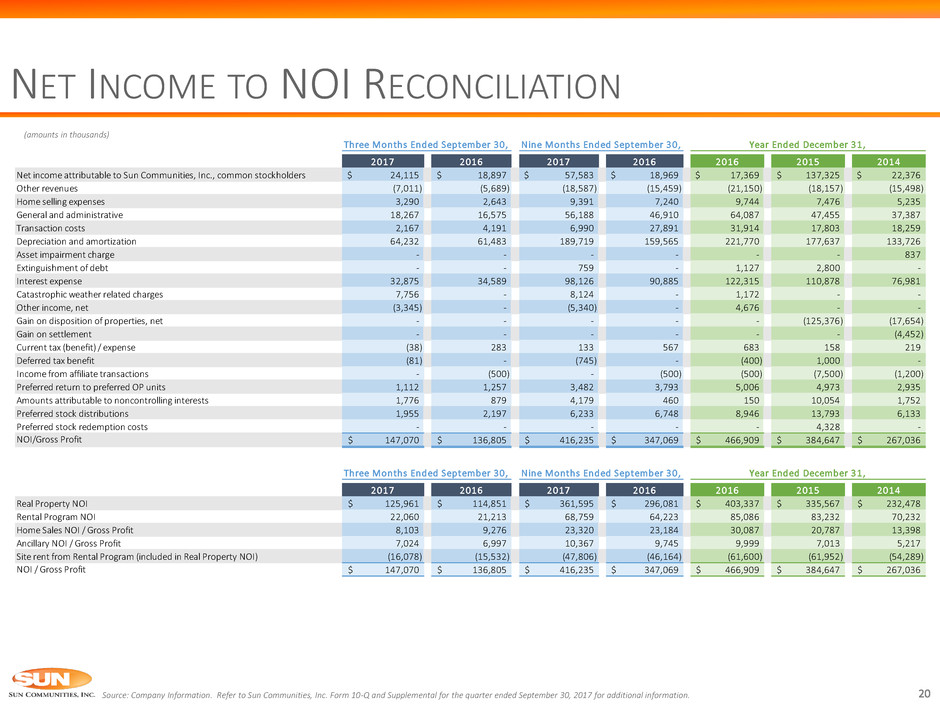

NET INCOME TO NOI RECONCILIATION

20

(amounts in thousands)

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information.

2017 2016 2017 2016 2016 2015 2014

Net income attributable to Sun Communities, Inc., common stockholders 24,115$ 18,897$ 57,583$ 18,969$ 17,369$ 137,325$ 22,376$

Other revenues (7,011) (5,689) (18,587) (15,459) (21,150) (18,157) (15,498)

Home selling expenses 3,290 2,643 9,391 7,240 9,744 7,476 5,235

General and administrative 18,267 16,575 56,188 46,910 64,087 47,455 37,387

Transaction costs 2,167 4,191 6,990 27,891 31,914 17,803 18,259

Depreciation and amortization 64,232 61,483 189,719 159,565 221,770 177,637 133,726

Asset impairment charge - - - - - - 837

Extinguishment of debt - - 759 - 1,127 2,800 -

Interest expense 32,875 34,589 98,126 90,885 122,315 110,878 76,981

Catastrophic weather related charges 7,756 - 8,124 - 1,172 - -

Other income, net (3,345) - (5,340) - 4,676 - -

Gain on disposition of properties, net - - - - - (125,376) (17,654)

Gain on settlement - - - - - - (4,452)

Current tax (benefit) / expense (38) 283 133 567 683 158 219

Deferred tax benefit (81) - (745) - (400) 1,000 -

Income from affiliate transactions - (500) - (500) (500) (7,500) (1,200)

Preferred return to preferred OP units 1,112 1,257 3,482 3,793 5,006 4,973 2,935

Amounts attributable to noncontrolling interests 1,776 879 4,179 460 150 10,054 1,752

Preferred stock distributions 1,955 2,197 6,233 6,748 8,946 13,793 6,133

Preferred stock redemption costs - - - - - 4,328 -

NOI/Gross Profit 147,070$ 136,805$ 416,235$ 347,069$ 466,909$ 384,647$ 267,036$

2017 2016 2017 2016 2016 2015 2014

Real Property NOI 125,961$ 114,851$ 361,595$ 296,081$ 403,337$ 335,567$ 232,478$

Rental Program NOI 22,060 21,213 68,759 64,223 85,086 83,232 70,232

Home Sales NOI / Gross Profit 8,103 9,276 23,320 23,184 30,087 20,787 13,398

Ancillary NOI / Gross Profit 7,024 6,997 10,367 9,745 9,999 7,013 5,217

Site rent from Rental Program (included in Real Property NOI) (16,078) (15,532) (47,806) (46,164) (61,600) (61,952) (54,289)

NOI / Gross Profit 147,070$ 136,805$ 416,235$ 347,069$ 466,909$ 384,647$ 267,036$

Three Months Ended September 30, Nine Months Ended September 30, Year Ended December 31,

Three Months Ended September 30, Nine Months Ended September 30, Year Ended December 31,

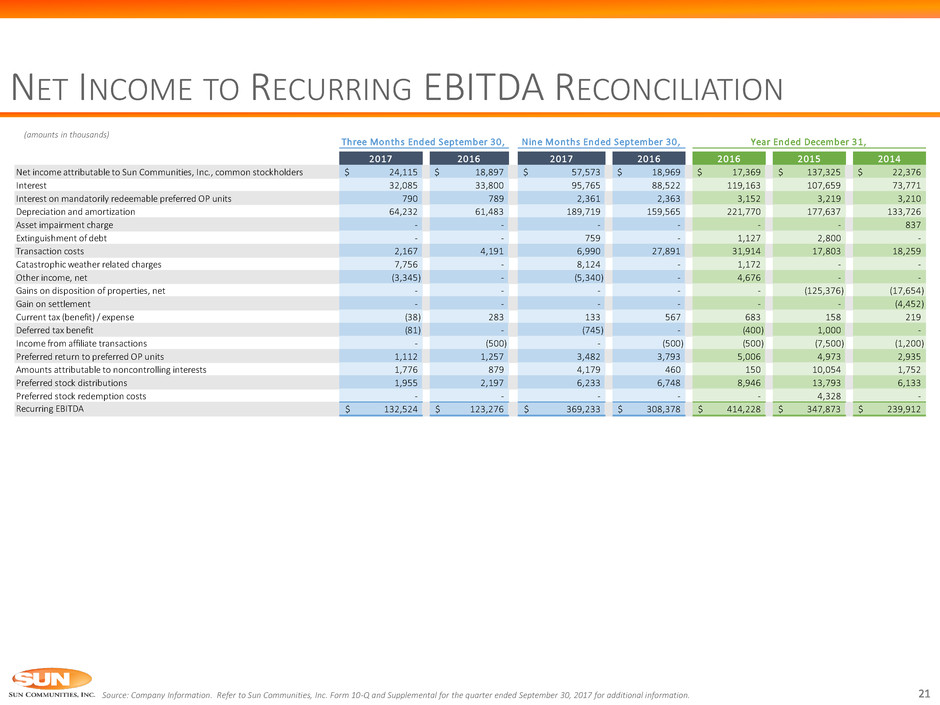

21

NET INCOME TO RECURRING EBITDA RECONCILIATION

(amounts in thousands)

Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information.

2017 2016 2017 2016 2016 2015 2014

Net income attributable to Sun Communities, Inc., common stockholders 24,115$ 18,897$ 57,573$ 18,969$ 17,369$ 137,325$ 22,376$

Interest 32,085 33,800 95,765 88,522 119,163 107,659 73,771

Interest on mandatorily redeemable preferred OP units 790 789 2,361 2,363 3,152 3,219 3,210

Depreciation and amortization 64,232 61,483 189,719 159,565 221,770 177,637 133,726

Asset impairment charge - - - - - - 837

Extinguishment of debt - - 759 - 1,127 2,800 -

Transaction costs 2,167 4,191 6,990 27,891 31,914 17,803 18,259

Catastrophic weather related charges 7,756 - 8,124 - 1,172 - -

Other income, net (3,345) - (5,340) - 4,676 - -

Gains on disposition of properties, net - - - - - (125,376) (17,654)

Gain on settlement - - - - - - (4,452)

Current tax (benefit) / expense (38) 283 133 567 683 158 219

Deferred tax benefit (81) - (745) - (400) 1,000 -

Income from affiliate transactions - (500) - (500) (500) (7,500) (1,200)

Preferred return to preferred OP units 1,112 1,257 3,482 3,793 5,006 4,973 2,935

Amounts attributable to noncontrolling interests 1,776 879 4,179 460 150 10,054 1,752

Preferred stock distributions 1,955 2,197 6,233 6,748 8,946 13,793 6,133

Preferred stock redemption costs - - - - - 4,328 -

Recurring EBITDA 132,524$ 123,276$ 369,233$ 308,378$ 414,228$ 347,873$ 239,912$

Three Months Ended September 30, Nine Months Ended September 30, Year Ended December 31,