Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Regional Management Corp. | d464495d8k.htm |

Exhibit 99.1

Investor Presentation November 2017

2 Safe Harbor Statement This presentation, the related remarks, and the responses to various questions may contain various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which represent Regional Management Corp.’s expectations or beliefs concerning future events. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,” and similar expressions may be used to identify these forward-looking statements. Such forward-looking statements are about matters that are inherently subject to risks and uncertainties, many of which are outside of the control of Regional Management. Factors that could cause actual results or performance to differ from the expectations expressed or implied in such forward-looking statements include, but are not limited to, the following: changes in general economic conditions, including levels of unemployment and bankruptcies; risks associated with Regional Management’s transition to a new loan origination and servicing software system; risks related to opening new branches, including the ability or inability to open new branches as planned; risks inherent in making loans, including repayment risks and value of collateral, which risks may increase in light of adverse or recessionary economic conditions; changes in interest rates; the risk that Regional Management’s existing sources of liquidity become insufficient to satisfy its needs or that its access to these sources becomes unexpectedly restricted; changes in federal, state, or local laws, regulations, or regulatory policies and practices, and risks associated with the manner in which laws and regulations are interpreted, implemented, and enforced; the timing and amount of revenues that may be recognized by Regional Management; changes in current revenue and expense trends (including trends affecting delinquencies and credit losses); changes in Regional Management’s markets and general changes in the economy (particularly in the markets served by Regional Management); changes in the competitive environment in which Regional Management operates or in the demand for its products; risks related to acquisitions; changes in operating and administrative expenses; and the departure, transition, or replacement of key personnel. Such factors and others are discussed in greater detail in Regional Management’s filings with the Securities and Exchange Commission. We cannot guarantee future events, results, actions, levels of activity, performance, or achievements. Except to the extent required by law, neither Regional Management nor any of its respective agents, employees, or advisors intend or have any duty or obligation to supplement, amend, update, or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise. The information and opinions contained in this document are provided as at the date of this presentation and are subject to change without notice. This document has not been approved by any regulatory or supervisory authority.

3 Investment Highlights Attractive Long-Term Market Opportunity Diverse Product Offering (with graduation from small to large loans) Multi- Channel Origination Platform Deep Management Experience Numerous Avenues for Potential Growth

4 Company Overview ï,§ 30-year old consumer finance company focused on installment lending based primarily in the Southeast and South Central U.S. ï,§ Branch-based with 344 storefronts in 9 states as of September 30, 2017 ï,§ Products include small and large personal loans and retail loans—Large loans have been key focus since late 2014 ï,§ Channels include direct mail, branches, website, lead sources, and retail dealers

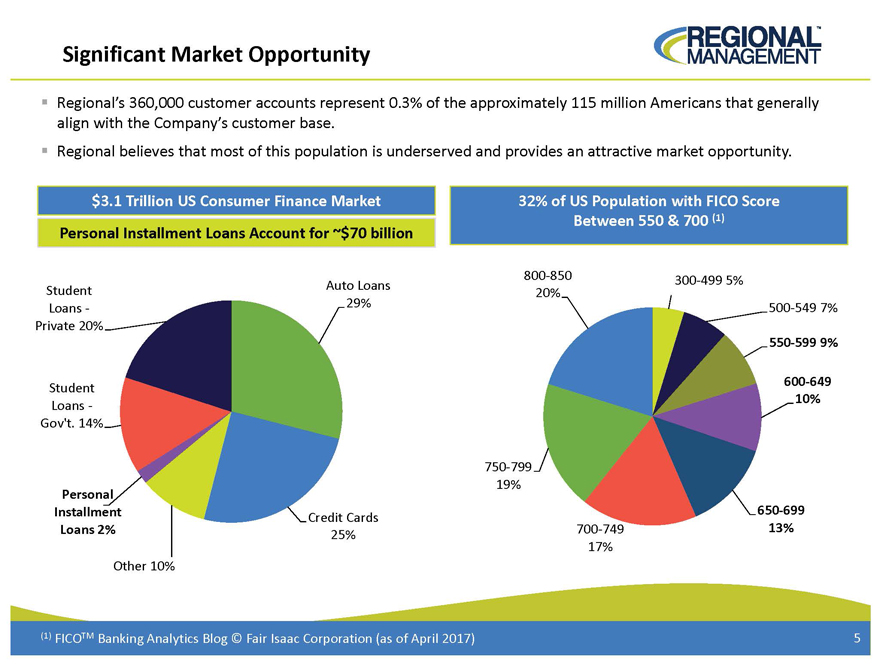

5 Significant Market Opportunity ï,§ Regional’s 360,000 customer accounts represent 0.3% of the approximately 115 million Americans that generally align with the Company’s customer base. ï,§ Regional believes that most of this population is underserved and provides an attractive market opportunity. Auto Loans 29% Credit Cards 25% Other 10% Personal Installment Loans 2% Student Loans - Gov’t. 14% Student Loans - Private 20% Personal Installment Loans Account for ~$70 billion 300-499 5% 500-549 7% 550-599 9% 600-649 10% 650-699 700-749 13% 17% 750-799 19% 800-850 20% (1) FICOTM Banking Analytics Blog © Fair Isaac Corporation (as of April 2017) $3.1 Trillion US Consumer Finance Market 32% of US Population with FICO Score Between 550 & 700 (1)

6 Significant Market Opportunity ï,§ Numerous smaller competitors ï,§ Consolidation in consumer finance industry ï,§ Online lending ï,§ Regional branch footprint in only nine states represents strong expansion opportunities ï,§ Well-positioned and compliant within evolving regulatory landscape ï,§ Considerable underserved addressable market ï,§ Continued credit need ï,§ Easy to understand ï,§ Amortizing ï,§ Based on credit underwriting and ability to repay ï,§ Continued growth in large loans ï,§ Community-based branch network and face-to-face contact ï,§ Piloting digital capabilities to provide optionality for consumers—Acquisitions—Online portal—Text messaging Competition Customers Products Delivery V

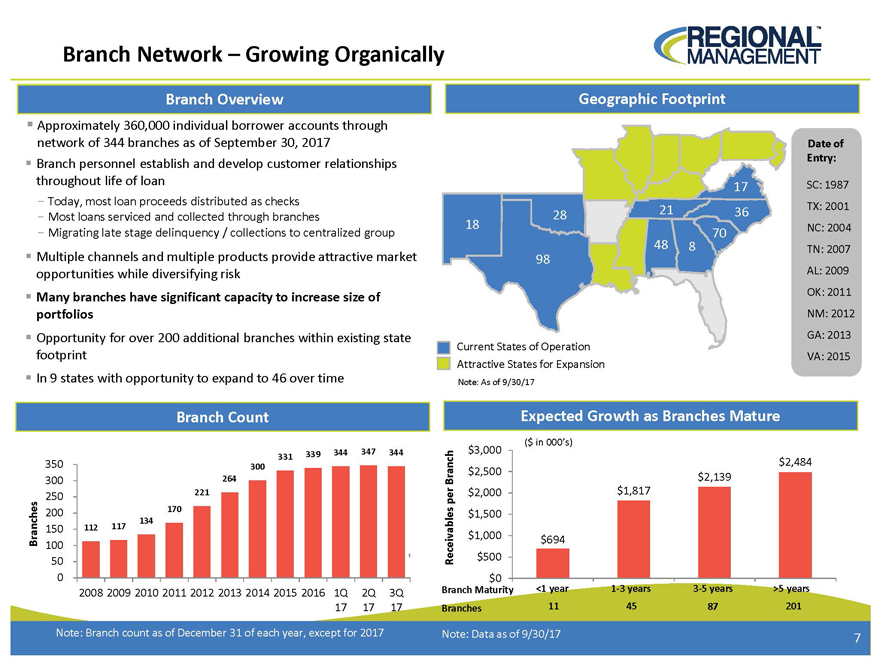

7 Branch Network – Growing Organically 112 117 134 170 221 264 300 331 339 344 347 344 0 50 100 150 200 250 300 350 2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q 17 2Q 17 3Q 17 Branches 18 98 28 21 48 8 70 36 Branch Maturity Branches <1 year 11 1-3 years 45 3-5 years 87 >5 years 201 $694 $1,817 $2,139 $2,484 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Receivables per Branch ($ in 000’s) Note: Branch count as of December 31 of each year, except for 2017 17 Branch Overview Geographic Footprint Branch Count Expected Growth as Branches Mature Note: Data as of 9/30/17 ï,§ Approximately 360,000 individual borrower accounts through network of 344 branches as of September 30, 2017 ï,§ Branch personnel establish and develop customer relationships throughout life of loan—Today, most loan proceeds distributed as checks—Most loans serviced and collected through branches—Migrating late stage delinquency / collections to centralized group ï,§ Multiple channels and multiple products provide attractive market opportunities while diversifying risk ï,§ Many branches have significant capacity to increase size of portfolios ï,§ Opportunity for over 200 additional branches within existing state footprint ï,§ In 9 states with opportunity to expand to 46 over time Date of Entry: SC: 1987 TX: 2001 NC: 2004 TN: 2007 AL: 2009 OK: 2011 NM: 2012 GA: 2013 VA: 2015 Current States of Operation Attractive States for Expansion Note: As of 9/30/17 18 98 28 17 36 70 48 8 21

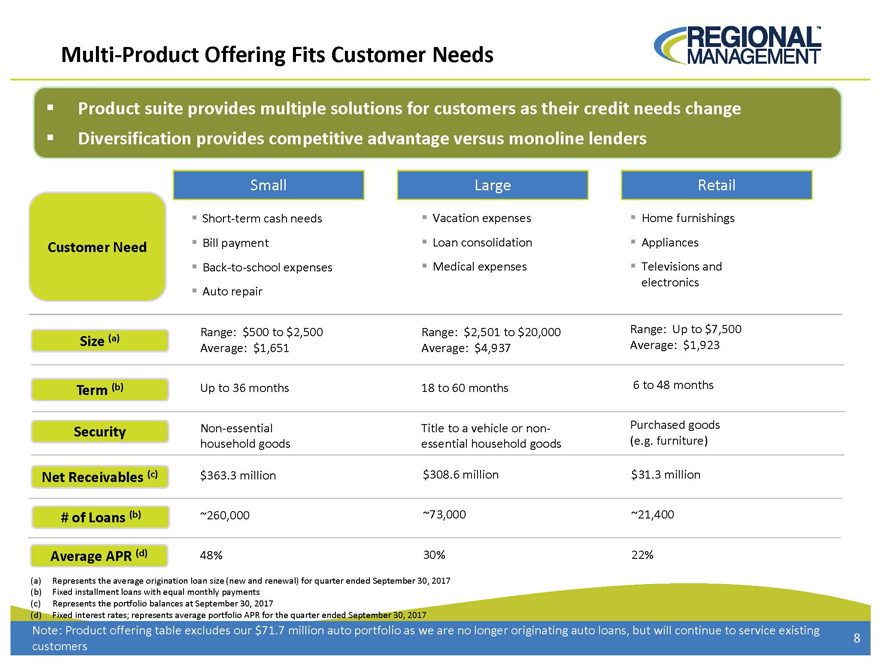

8 Multi-Product Offering Fits Customer Needs Size (a) Term (b) Security Net Receivables (c) # of Loans (b) Average APR (d) Range: $500 to $2,500 Average: $1,651 Up to 36 months Non-essential household goods $363.3 million ~260,000 48% Range: $2,501 to $20,000 Average: $4,937 18 to 60 months Title to a vehicle or nonessential household goods $308.6 million ~73,000 30% Range: Up to $7,500 Average: $1,923 6 to 48 months Purchased goods (e.g. furniture) $31.3 million ~21,400 22% Customer Need ï,§ Short-term cash needs ï,§ Bill payment ï,§ Back-to-school expenses ï,§ Auto repair ï,§ Home furnishings ï,§ Appliances ï,§ Televisions and electronics ï,§ Vacation expenses ï,§ Loan consolidation ï,§ Medical expenses ï,§ Product suite provides multiple solutions for customers as their credit needs change ï,§ Diversification provides competitive advantage versus monoline lenders Small Large Retail (a) Represents the average origination loan size (new and renewal) for quarter ended September 30, 2017 (b) Fixed installment loans with equal monthly payments (c) Represents the portfolio balances at September 30, 2017 (d) Fixed interest rates; represents average portfolio APR for the quarter ended September 30, 2017 Note: Product offering table excludes our $71.7 million auto portfolio as we are no longer originating auto loans, but will continue to service existing Customers

9 ï,§ Regional’s “Net Promoter Score” (NPS) of 66%, which measures customer loyalty, compares favorably to other companies in the financial services industry and in other industries. ï,§ Top-three box (8, 9, or 10 out of 10) customer satisfaction of 88% ï,§ Over 75% of customers say they will apply to Regional Finance first the next time they need a loan ï,§ ~90% favorable ratings for key attributes:—Loan process was quick, easy, affordable, understandable—People are professional, responsive, respectful, knowledgeable, helpful, friendly ï,§ Customers pleased with products/services; anticipate that enhancements such as texting, online account self-service, electronic payments, and digital lending should increase customer satisfaction High Customer Satisfaction

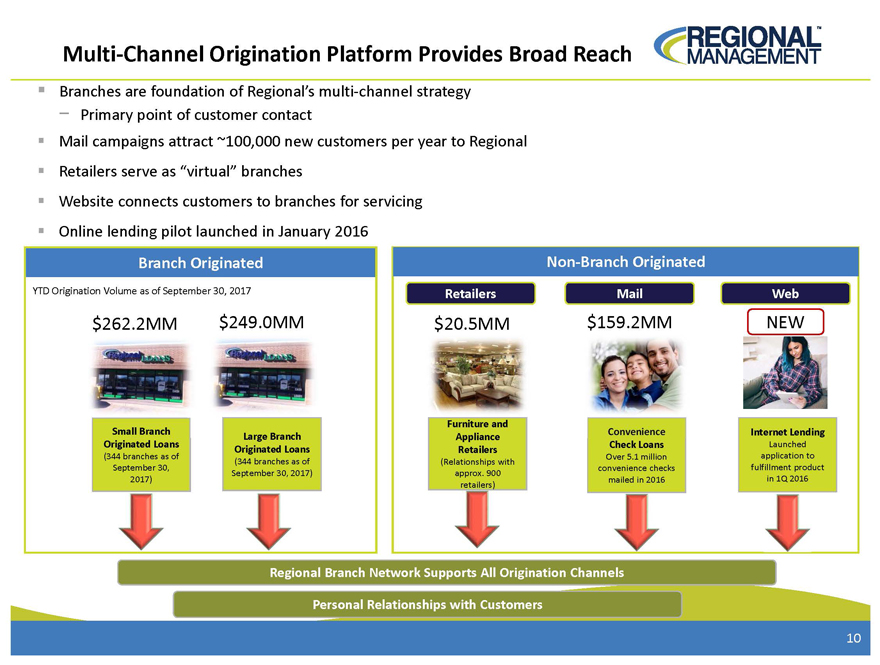

10 Multi-Channel Origination Platform Provides Broad Reach ï,§ Branches are foundation of Regional’s multi-channel strategy—Primary point of customer contact ï,§ Mail campaigns attract ~100,000 new customers per year to Regional ï,§ Retailers serve as “virtual” branches ï,§ Website connects customers to branches for servicing ï,§ Online lending pilot launched in January 2016 Small Branch Originated Loans (344 branches as of September 30, 2017) Regional Branch Network Supports All Origination Channels Convenience Check Loans Over 5.1 million convenience checks mailed in 2016 Furniture and Appliance Retailers (Relationships with approx. 900 retailers) Personal Relationships with Customers $262.2MM $159.2MM Large Branch Originated Loans (344 branches as of September 30, 2017) $249.0MM $20.5MM Branch Originated Non-Branch Originated Internet Lending Launched application to fulfillment product in 1Q 2016 NEW YTD Origination Volume as of September 30, 2017 Retailers Mail Web

11 Historical Financial Performance ï,§ Receivables and revenue have grown in parallel and over time should create opportunity for improved net income margins $57 $67 $73 $87 $105 $136 $171 $205 $217 $241 $0 $50 $100 $150 $200 $250 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 $3.1 $6.5 $9.9 $16.4 $21.2 $25.4 $28.8 $14.8 $23.4 $24.0 $0 $5 $10 $15 $20 $25 $30 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 ($ in millions) ($ in millions) ($ in millions) $168 $192 $215 $247 $307 $438 $545 $546 $628 $718 7.8% 8.4% 8.6% 7.9% 6.3% 6.5% 6.5% 11.1% 8.8% 9.0% 0.0% 4.0% 8.0% 12.0% 16.0% 20.0% $0 $100 $200 $300 $400 $500 $600 $700 $800 Total Receivables NCL Net Income Total Receivables and Net Credit Losses Total Revenue

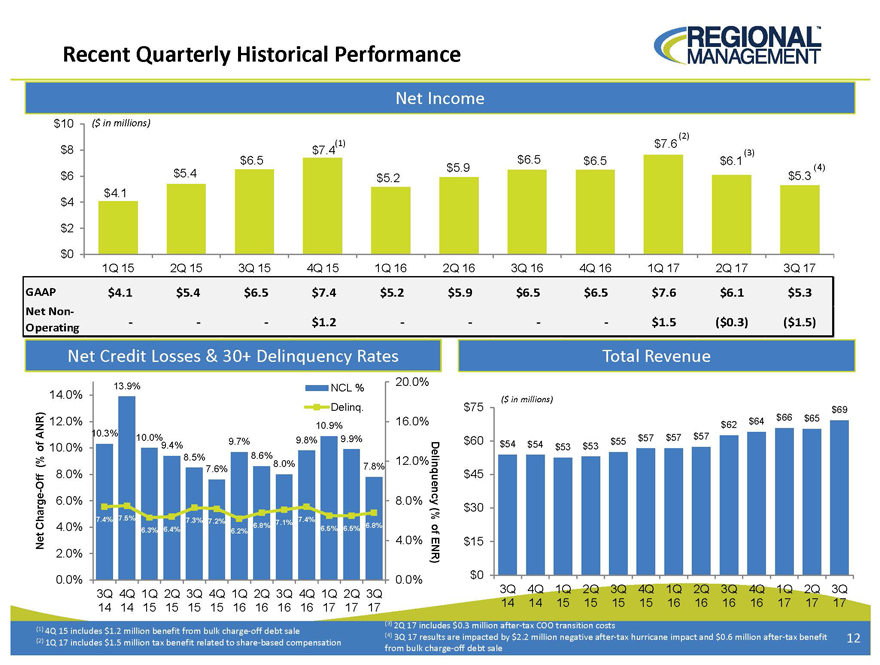

$4.1 $5.4 $6.5 $7.4 $5.2 $5.9 $6.5 $6.5 $7.6 $6.1 $5.3 $0 $2 $4 $6 $8 $10 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 (4) 12 Recent Quarterly Historical Performance $54 $54 $53 $53 $55 $57 $57 $57 $62 $64 $66 $65 $69 $0 $15 $30 $45 $60 $75 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 10.3% 13.9% 10.0% 9.4% 8.5% 7.6% 9.7% 8.6% 8.0% 9.8% 10.9% 9.9% 7.8% 7.4% 7.5% 6.3% 6.4% 7.3% 7.2% 6.2% 6.8% 7.1% 7.4% 6.5% 6.5% 6.8% 0.0% 4.0% 8.0% 12.0% 16.0% 20.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 Delinquency (% of ENR) Net Charge-Off (% of ANR) NCL % Delinq. ($ in millions) ($ in millions) Net Income Net Credit Losses & 30+ Delinquency Rates Total Revenue (1) 4Q 15 includes $1.2 million benefit from bulk charge-off debt sale (2) 1Q 17 includes $1.5 million tax benefit related to share-based compensation (3) 2Q 17 includes $0.3 million after-tax COO transition costs (4) 3Q 17 results are impacted by $2.2 million negative after-tax hurricane impact and $0.6 million after-tax benefit from bulk charge-off debt sale (3) (2) (1) GAAP $4.1 $5.4 $6.5 $7.4 $5.2 $5.9 $6.5 $6.5 $7.6 $6.1 $5.3 Net Non- Operating - - - $1.2 - - - - $1.5 ($0.3) ($1.5)

ï,§ Nortridge Loan System (NLS) Implementation — Conversion to NLS progressing — Successfully built enhanced functionality (texting, imaging, and customer portal) — Successfully converted Texas in October; 80% of all accounts on new system — On schedule to complete conversion of all states by end of 2017 ï,§ Auto Business—Beginning in November, we are no longer originating auto loans—We expect losses and delinquencies to remain stable as we maintain our focus on collections ï,§ Centralized Collections — Strong results from limited testing in Texas, North Carolina, and South Carolina — Continue to expand centralized collections function in other geographies ï,§ Marketing / De Novo Branches — Hybrid growth model o Increase receivable growth within existing branch footprint o Modest de novo expansion in 2017 while completing our system conversion — Developing next generation risk and response models to improve direct mail targeting — Cost reductions improve direct mail campaign efficiency ï,§ Digital Channel / Online Lending Update — Continued expansion of Lending Tree relationship driving growth in the channel — Actively recruiting and testing of additional affiliate partnerships — Continue the rollout of texting and our customer portal with each state conversion to NLS — Enhancing digital foundation through website design and search engine optimization 13 Strategic Focus

14 Diverse Funding and Liquidity Profile ï,§ Amended and Upsized the Senior Revolver—Committed line of $638 million – $459 million outstanding at September 30, 2017—Accordion feature of $700 million—The senior revolving credit facility allows for a warehouse facility and for subsequent securitizations using warehouse collateral—Maturity date of June 2020 ï,§ Revolving Warehouse Facility—Committed facility of $125 million – $56 million outstanding at September 30, 2107—Expandable to $150 million and will be funded by large loan receivables—Initial term of 18 months, to be followed by a 12-month amortization period—Facility is being funded by Credit Suisse and Wells Fargo

15 Investment Highlights Attractive Long-Term Market Opportunity Diverse Product Offering (with graduation from small to large loans) Multi- Channel Origination Platform Deep Management Experience Numerous Avenues for Potential Growth

RM Listed NYSE