Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CUMULUS MEDIA INC | d487464d8k.htm |

In connection with restructuring discussions, Cumulus Media Inc. (“Cumulus” or the “Company”) prepared a long-term business plan and financial forecast (the “Business Plan Forecast”). The Business Plan Forecast is a four year financial forecast of the Company’s existing operations. It also incorporates the impact of the management team’s operational initiatives and multi-year turnaround strategy that are currently being implemented. Introduction Exhibit 99.1

Financial Projections This presentation contains certain financial projections. These financial projections relate to future performance and reflect the Company’s views as of May 31, 2017, subsequently updated for actual financial results, and are subject to known and unknown risks, uncertainties and assumptions that may cause future results, performance or achievements to differ materially from those projected. The Company believes these financial projections are reasonable but no assurance can be given that the underlying assumptions will prove to be correct and these financial projections should not be unduly relied upon. The Company cannot guarantee future results, level of activity, performance or achievements. Consequently, the Company makes no representation that the actual results achieved will be the same in whole or in part as those set out in the financial projections. The financial projections contained in this presentation are expressly qualified by this cautionary statement. Readers are cautioned not to place undue reliance upon any such financial projections, which speak only to results based on certain assumptions and only as of the date made. Except as required by applicable law, we do not undertake or accept any obligation or undertaking to release any updates or revisions to any financial projections to reflect any change in the Company’s expectations or any change in events, conditions, assumptions or circumstances on which any such financial projections are based.

General Securities Laws This presentation is not, and under no circumstances is to be construed as, an offering to sell or a solicitation to buy the securities referred to herein in any jurisdiction.

Non-GAAP Financial Measure and Definition From time to time the Company utilizes certain financial measures that are not prepared or calculated in accordance with GAAP to assess the Company’s financial performance and profitability. Adjusted EBITDA is the financial metric utilized by the Company to analyze the cash flow generated by the Company’s business. This measure isolates the amount of income generated by The Company’s core operations after the incurrence of corporate, general and administrative expenses. The Company also uses this measure to determine the contribution of the Company’s core operations to the funding of the Company’s corporate resources utilized to manage the Company’s operations and the Company’s non-operating expenses including debt service and acquisitions. In addition, consolidated Adjusted EBITDA, excluding the impact of local marketing agreement fees, is a key metric for purposes of calculating and determining the Company’s compliance with certain covenants contained in the Company’s Credit Agreement. In deriving this measure, the Company excludes depreciation, amortization and stock-based compensation expense, as these do not represent cash payments for activities directly related to the Company’s core operations. The Company also excludes any gain or loss on the exchange or sale of any assets and any gain or loss on derivative instruments, early extinguishment of debt, and local marketing agreement fees as they are not associated with core operations. Expenses relating to acquisitions and restructuring costs are also excluded from the calculation of Adjusted EBITDA as they are not directly related to our ongoing core operations. The Company also excludes any costs associated with impairment of assets as they do not require a cash outlay. The Company believes that Adjusted EBITDA, although not a measure that is calculated in accordance with GAAP, is commonly employed by the investment community as a measure for determining the market value of a media company and comparing the operational and financial performance among media companies. The Company has also observed that Adjusted EBITDA is routinely employed to evaluate and negotiate the potential purchase price for media companies. Given the relevance to the Company’s overall value, the Company believes that investors consider the metric to be extremely useful. Adjusted EBITDA should not be considered in isolation or as a substitute for net income (loss), operating income, cash flows from operating activities or any other measure for determining the Company’s operating performance or liquidity that is calculated in accordance with GAAP. In addition, Adjusted EBITDA may be defined or calculated differently by other companies, and comparability may be limited.

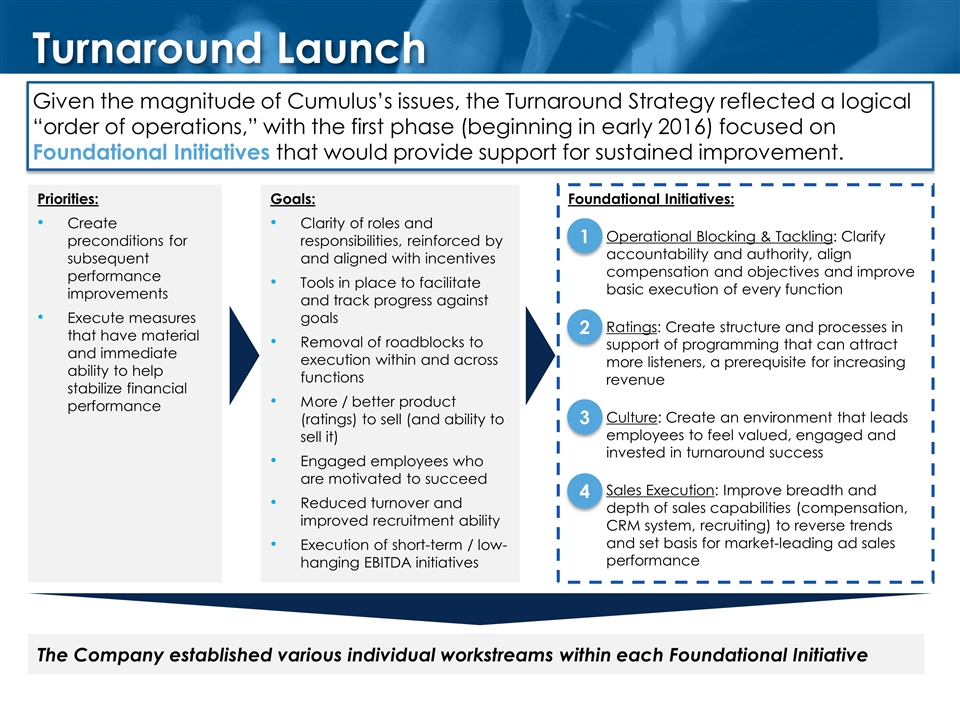

Turnaround Launch Given the magnitude of Cumulus’s issues, the Turnaround Strategy reflected a logical “order of operations,” with the first phase (beginning in early 2016) focused on Foundational Initiatives that would provide support for sustained improvement. Priorities: Create preconditions for subsequent performance improvements Execute measures that have material and immediate ability to help stabilize financial performance Foundational Initiatives: Operational Blocking & Tackling: Clarify accountability and authority, align compensation and objectives and improve basic execution of every function Ratings: Create structure and processes in support of programming that can attract more listeners, a prerequisite for increasing revenue Culture: Create an environment that leads employees to feel valued, engaged and invested in turnaround success Sales Execution: Improve breadth and depth of sales capabilities (compensation, CRM system, recruiting) to reverse trends and set basis for market-leading ad sales performance 1 2 3 4 Goals: Clarity of roles and responsibilities, reinforced by and aligned with incentives Tools in place to facilitate and track progress against goals Removal of roadblocks to execution within and across functions More / better product (ratings) to sell (and ability to sell it) Engaged employees who are motivated to succeed Reduced turnover and improved recruitment ability Execution of short-term / low-hanging EBITDA initiatives The Company established various individual workstreams within each Foundational Initiative

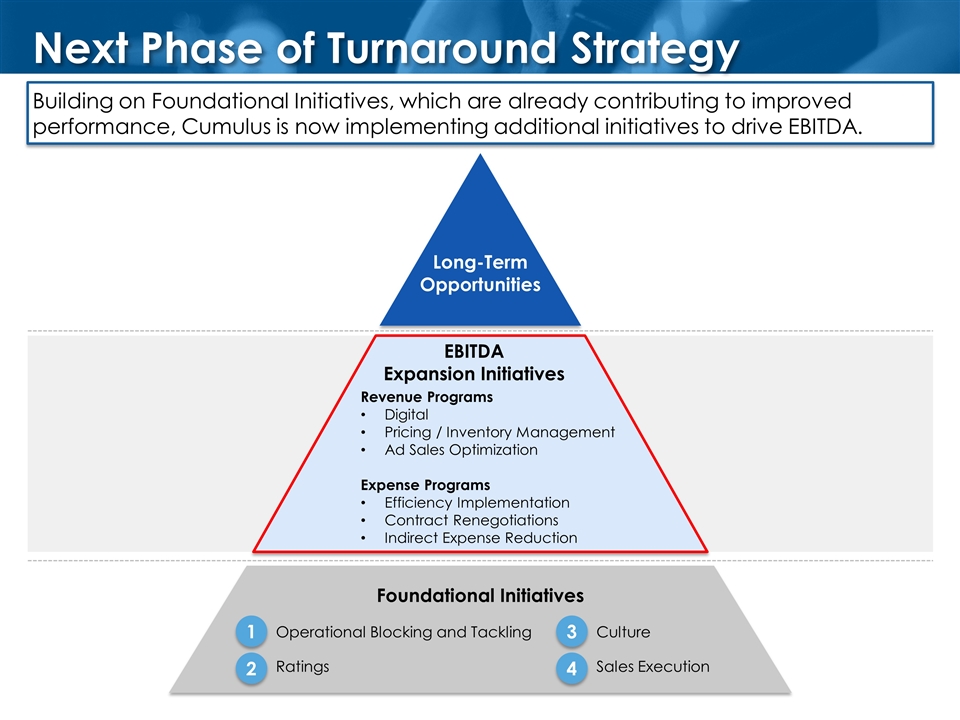

Next Phase of Turnaround Strategy Building on Foundational Initiatives, which are already contributing to improved performance, Cumulus is now implementing additional initiatives to drive EBITDA. Operational Blocking and Tackling Ratings Culture Sales Execution Revenue Programs Digital Pricing / Inventory Management Ad Sales Optimization Expense Programs Efficiency Implementation Contract Renegotiations Indirect Expense Reduction EBITDA Expansion Initiatives Foundational Initiatives 1 2 3 4 Long-Term Opportunities

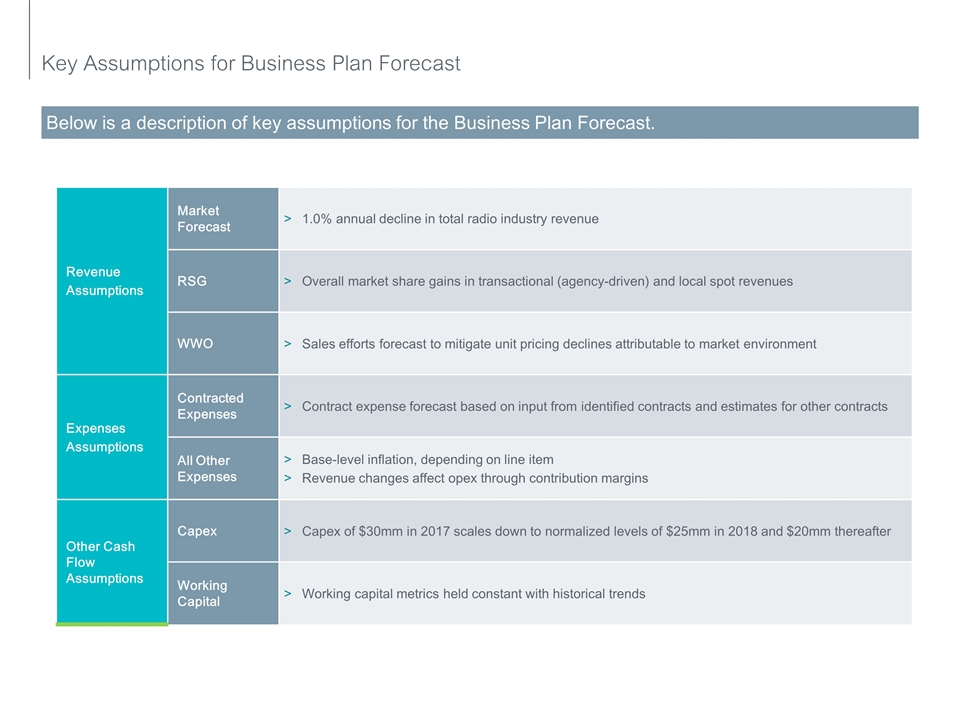

Below is a description of key assumptions for the Business Plan Forecast. Key Assumptions for Business Plan Forecast Revenue Assumptions Market Forecast 1.0% annual decline in total radio industry revenue RSG Overall market share gains in transactional (agency-driven) and local spot revenues WWO Sales efforts forecast to mitigate unit pricing declines attributable to market environment Expenses Assumptions Contracted Expenses Contract expense forecast based on input from identified contracts and estimates for other contracts All Other Expenses Base-level inflation, depending on line item Revenue changes affect opex through contribution margins Other Cash Flow Assumptions Capex Capex of $30mm in 2017 scales down to normalized levels of $25mm in 2018 and $20mm thereafter Working Capital Working capital metrics held constant with historical trends

Foundational Initiatives Assumptions Revenue RSG: Ratings Low single digit ratings share increases RSG: Sales Execution Improving conversion of ratings share growth into revenue share growth over time WWO 1.0% YoY growth in total impressions Market-driven CPM declines of 1.0% YoY (offset by EBITDA Expansion Initiatives noted on following page) Expense Programming Cost Elimination / Reduction Comprehensive programming contract renegotiations projected to produce annualized savings of $6.0mm by 2020 Other Blocking & Tackling / Efficiencies / Expense Reductions Ongoing expense reductions offsetting imbedded contractual escalations

EBITDA Expansion Initiatives Assumptions Revenue Digital C-Suite: Integrated portfolio of branded Cumulus streaming products and (white label) digital solutions Westwood One Podcasts Streaming / Display: Partnership with NextRadio Pricing / Inventory Management Implementation of third party pricing and inventory systems in order to improve upon and replace existing internal systems Sales / Platform Optimization Creation of additional national-to-local platforms like Nash Next to address demand from passion groups beyond country music fans Expense Efficiency Implementation Identification and realization of opportunities to reduce waste or improve processes Contract Renegotiations Continued efforts to negotiate or eliminate low margin / unprofitable contracts Indirect Expense Reduction Additional, smaller expense reductions in areas other than content and programming

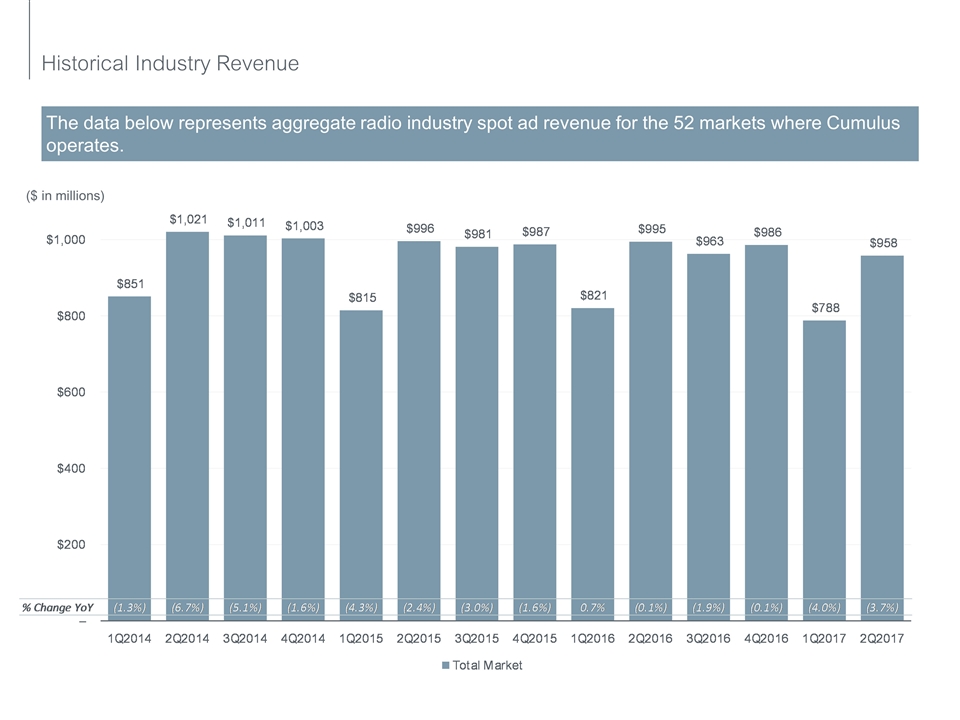

The data below represents aggregate radio industry spot ad revenue for the 52 markets where Cumulus operates. Historical Industry Revenue ($ in millions)

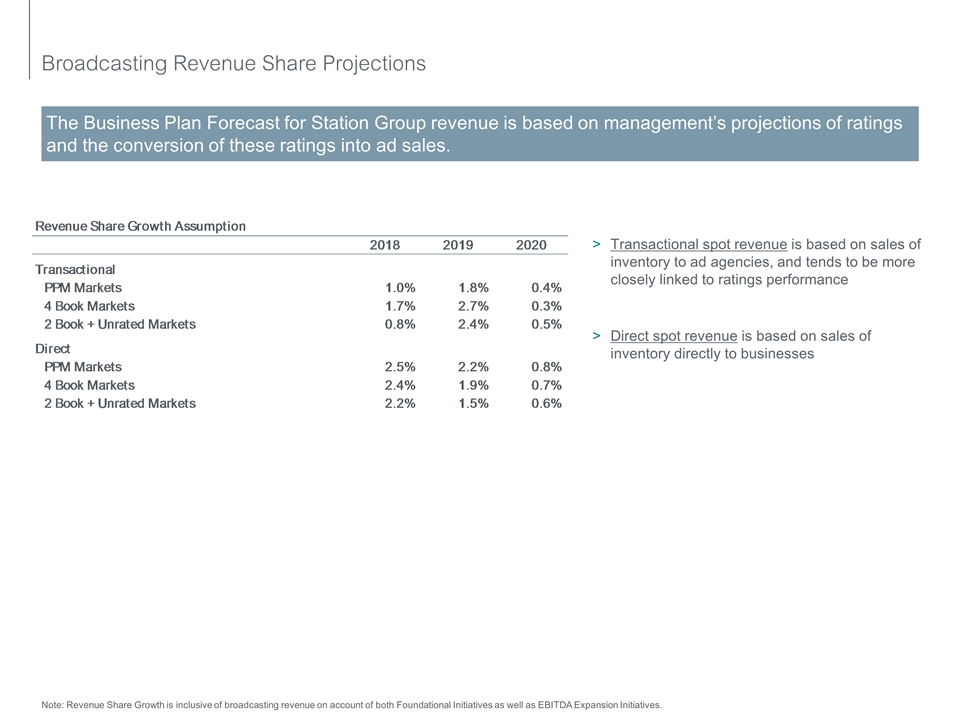

The Business Plan Forecast for Station Group revenue is based on management’s projections of ratings and the conversion of these ratings into ad sales. Note: Revenue Share Growth is inclusive of broadcasting revenue on account of both Foundational Initiatives as well as EBITDA Expansion Initiatives. Broadcasting Revenue Share Projections Transactional spot revenue is based on sales of inventory to ad agencies, and tends to be more closely linked to ratings performance Direct spot revenue is based on sales of inventory directly to businesses

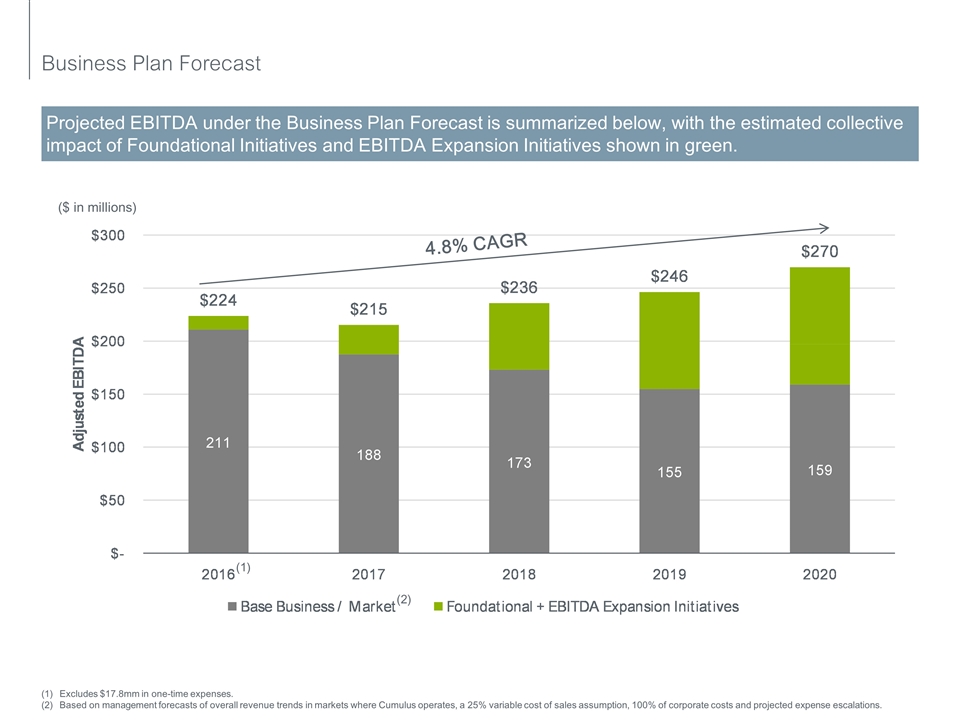

Projected EBITDA under the Business Plan Forecast is summarized below, with the estimated collective impact of Foundational Initiatives and EBITDA Expansion Initiatives shown in green. Excludes $17.8mm in one-time expenses. Based on management forecasts of overall revenue trends in markets where Cumulus operates, a 25% variable cost of sales assumption, 100% of corporate costs and projected expense escalations. Business Plan Forecast ($ in millions) 4.8% CAGR (2) (1)

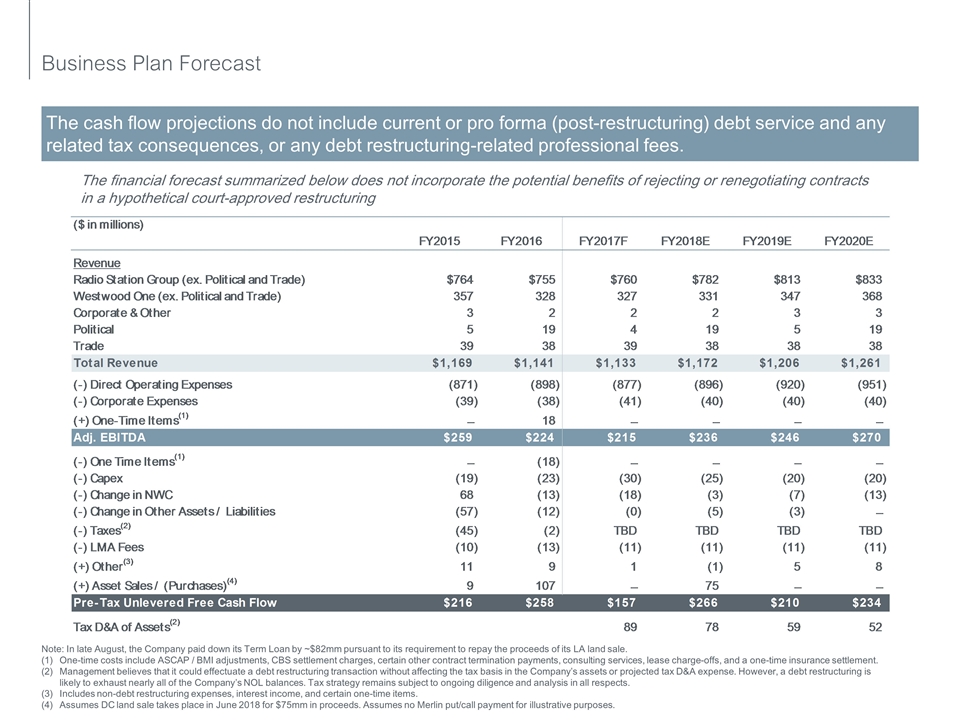

The cash flow projections do not include current or pro forma (post-restructuring) debt service and any related tax consequences, or any debt restructuring-related professional fees. Note: In late August, the Company paid down its Term Loan by ~$82mm pursuant to its requirement to repay the proceeds of its LA land sale. One-time costs include ASCAP / BMI adjustments, CBS settlement charges, certain other contract termination payments, consulting services, lease charge-offs, and a one-time insurance settlement. Management believes that it could effectuate a debt restructuring transaction without affecting the tax basis in the Company’s assets or projected tax D&A expense. However, a debt restructuring is likely to exhaust nearly all of the Company’s NOL balances. Tax strategy remains subject to ongoing diligence and analysis in all respects. Includes non-debt restructuring expenses, interest income, and certain one-time items. Assumes DC land sale takes place in June 2018 for $75mm in proceeds. Assumes no Merlin put/call payment for illustrative purposes. Business Plan Forecast The financial forecast summarized below does not incorporate the potential benefits of rejecting or renegotiating contracts in a hypothetical court-approved restructuring

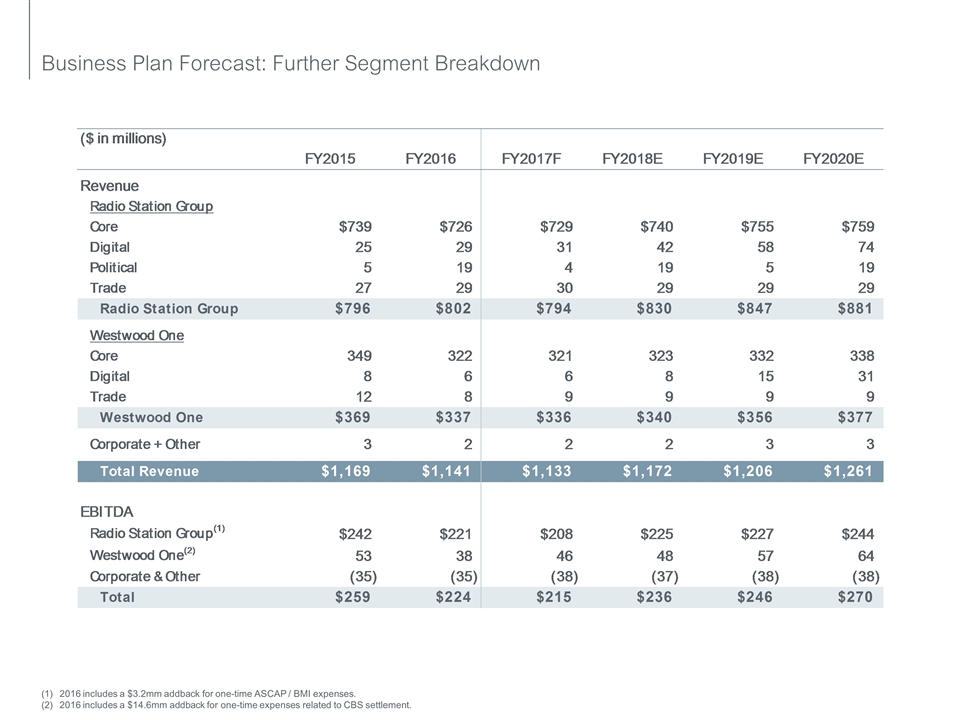

2016 includes a $3.2mm addback for one-time ASCAP / BMI expenses. 2016 includes a $14.6mm addback for one-time expenses related to CBS settlement. Business Plan Forecast: Further Segment Breakdown

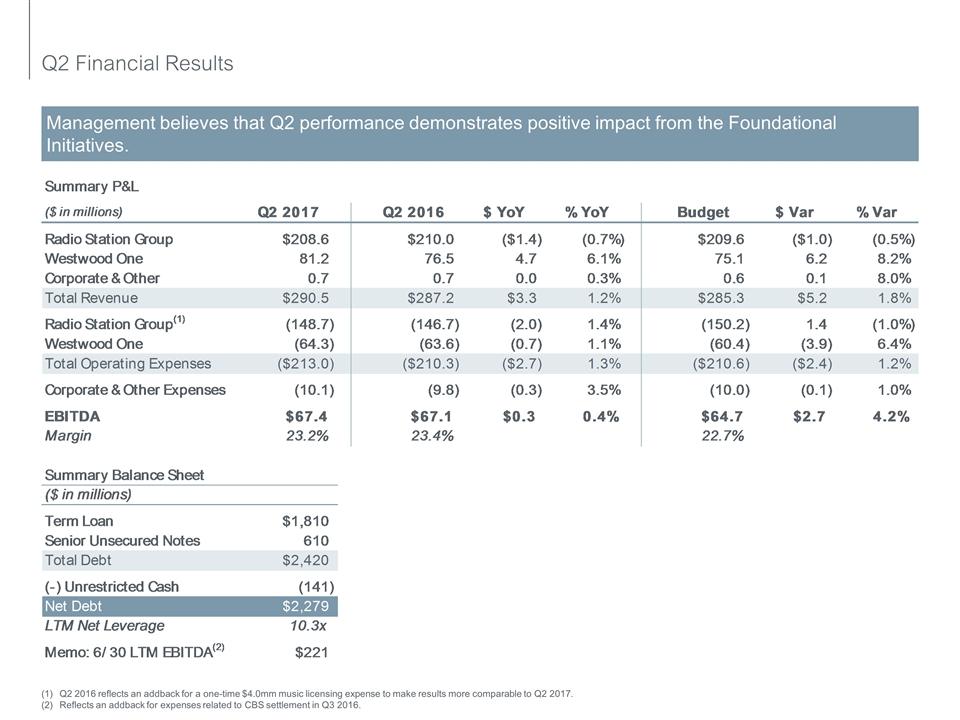

Management believes that Q2 performance demonstrates positive impact from the Foundational Initiatives. Q2 2016 reflects an addback for a one-time $4.0mm music licensing expense to make results more comparable to Q2 2017. Reflects an addback for expenses related to CBS settlement in Q3 2016. Q2 Financial Results

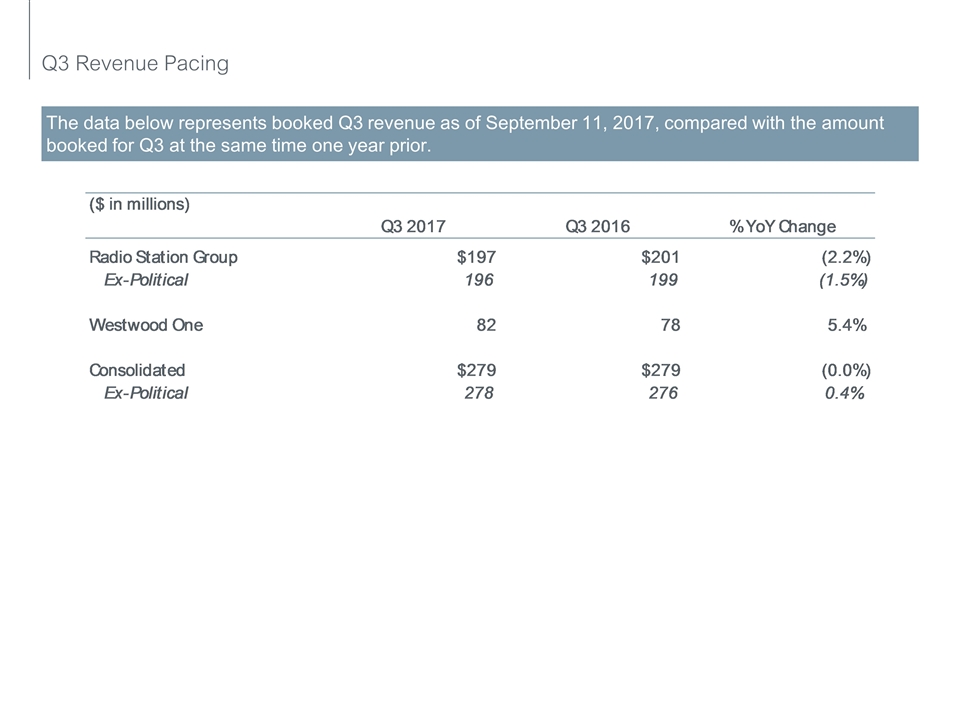

The data below represents booked Q3 revenue as of September 11, 2017, compared with the amount booked for Q3 at the same time one year prior. Q3 Revenue Pacing

The Company has approximately 185 properties that management believes have a value below the $20 million threshold from the credit agreement. Based upon internal analysis, the Company estimates that these properties could have a value of $60 to 100 million. No formal appraisals have been completed. Formal appraisals could result in different suggested values. Real Estate

Management has identified $30-45 million of present value savings that could be achieved as a result of rejecting certain contracts in chapter 11, which would be incremental to the cost savings captured in the Business Plan Forecast. All or a portion of these savings could be achieved through renegotiations either in- or out-of-court rather than through in-court rejection. Contract rejection savings estimates do not include associated offsetting bankruptcy costs, which could total approximately $20 million or more(1). Additionally, rejection of contracts in chapter 11 would create additional unsecured claims, which could total as much as $85 million. Estimate based on potential length of chapter 11 case, professional fee run rate, and additional time needed to resolve contract rejection claims, which could be longer than estimated. Contract Savings

Preliminary Indicative Summary of Terms

of the Steering Committee of First Lien Lenders

10/1/17

The following summary of terms provides a good faith outline of the indicative terms of a potential restructuring whereby the Term Lenders consent to the Company’s bondholders obtaining ownership and control of Cumulus Media, Inc. (with its subsidiaries and affiliates, the “Company”). This summary is subject to, among other things, material change, final agreement and approval of the Term Lenders, business due diligence regarding the Company and satisfactory documentation.

| Subject |

Terms | |

| Bondholder Investment and Equitization | Bondholders will invest $350 million, the proceeds of which will be used to pay down the Term Loan

100% of the $610 million of outstanding bonds will be converted into the common equity of Cumulus | |

| Interest | The Term Loan interest rate will be increased to LIBOR + 6.0% | |

| Term Loan Reduction | Company will use excess cash, as of the effective date of the restructuring, to pay down the Term Loan | |

| Credit Agreement | Terms to be reviewed and tightened where appropriate to, among other things, prevent cash leakage (e.g. dividends) | |

| Security | Unencumbered assets will be secured | |

K&E Draft 10/31/17

CUMULUS MEDIA INC.

Restructuring Term Sheet

The following is a summary of the principal terms with respect to a proposed restructuring of Cumulus Media Inc. (the “Company”) and certain of its direct and indirect subsidiaries and affiliates. The basic terms of the Restructuring (as defined below) are outlined below and are subject to fully and properly executed documentation.

THIS TERM SHEET IS NOT AN OFFER OR A SOLICITATION WITH RESPECT TO ANY SECURITIES OR DEBT OF THE COMPANY. ANY SUCH OFFER OR SOLICITATION SHALL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE, AS APPLICABLE.

THIS TERM SHEET IS PROVIDED IN CONFIDENCE AND MAY BE DISTRIBUTED ONLY WITH THE EXPRESS WRITTEN CONSENT OF THE AD HOC COMMITTEE (AS DEFINED HEREIN) AND THE COMPANY. THIS TERM SHEET IS PROVIDED IN THE NATURE OF A SETTLEMENT PROPOSAL IN FURTHERANCE OF SETTLEMENT DISCUSSIONS. ACCORDINGLY, THIS TERM SHEET IS ENTITLED TO THE PROTECTIONS OF RULE 408 OF THE FEDERAL RULES OF EVIDENCE AND ANY OTHER APPLICABLE STATUTES OR DOCTRINES PROTECTING THE USE OR DISCLOSURE OF CONFIDENTIAL INFORMATION AND INFORMATION EXCHANGED IN THE CONTEXT OF SETTLEMENT DISCUSSIONS. FURTHER, NOTHING IN THIS TERM SHEET SHALL BE AN ADMISSION OF FACT OR LIABILITY OR DEEMED BINDING ON THE AD HOC COMMITTEE, THE COMPANY, OR THEIR RESPECTIVE AFFILIATES.

| Restructuring Summary |

The outstanding indebtedness of, and equity interests in, the Company shall be restructured (the “Restructuring”) through either (i) an out-of-court Restructuring consistent with the terms and conditions described in this Term Sheet (the “Out-Of-Court Transaction”) or, to the extent the conditions precedent to consummating an Out-Of-Court Transaction cannot be timely satisfied then, (ii) as voluntary pre-packaged cases (the “Chapter 11 Cases”) under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”), to be filed in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”) and pursuant to a pre-packaged plan of reorganization (the “Pre-Packaged Chapter 11 Plan”) with the support of the members of the ad hoc committee of 7.75% senior noteholders (the “Ad Hoc Committee”), on the terms |

1

| and subject to the conditions set forth in the plan term sheet attached to those certain restructuring support agreements to be entered into between the Company, on the one hand, and each member of the Ad Hoc Committee, on the other hand (as amended, supplemented, or otherwise modified from time to time, the “RSAs”) as Exhibit [B] (the “Plan Term Sheet”).

Prior to the commencement of any solicitation of creditors related to the Restructuring, not less than 66 2/3% in outstanding principal amount of the Notes shall have signed RSAs.

The “Restructuring Effective Date” shall be the date on which all the transactions described in this Term Sheet are consummated or, if the filing of the Pre-Packaged Chapter 11 Plan is made as provided in this Term Sheet, the “Effective Date” under such Pre-Packaged Chapter 11 Plan.

| ||

|

Current Capital Structure |

The current capital structure of the Company is as follows:

(a) Indebtedness under that certain amended and restated credit agreement, dated as of December 23, 2013, among the Company, Cumulus Media Holdings Inc. (“Holdings”), as borrower, JPMorgan Chase Bank, N.A. as administrative agent, and the lenders (the “First Lien Lenders”) party thereto, as may be further amended, supplemented, amended and restated, or otherwise modified from time to time, (the “First Lien Credit Agreement”), comprised of term loans (the “First Lien Term Loans”) in an aggregate principal amount outstanding of $1.729 billion as of August 29, 2017 and revolving loans in an aggregate principal amount outstanding of $0 as of June 30, 2017.

(b) Indebtedness under that certain amended and restated receivables funding and administration agreement, dated as of March 15, 2017, among CMI Receivables Funding LLC, as borrower, Wells Fargo Bank, NA, as administrative agent, and the lenders party thereto, as may be further amended, supplemented, amended and restated, or otherwise modified from time to time (the “A/R Securitization Agreement”) comprised of revolving loans in an aggregate principal amount outstanding of $0 as of June 30, 2017.

(c) Indebtedness under that certain indenture, dated as of May 13, 2011, by and among the Company, Holdings, as issuer, and U.S. Bank National Association as trustee, (as | |

2

|

amended by that certain First Supplemental Indenture, dated as of September 16, 2011, that certain Second Supplemental Indenture, dated as of October 16, 2011, that certain Third Supplemental Indenture, dated as of October 17, 2011, and that certain Fourth Supplemental Indenture, dated as of December 23, 2013, and as may be further amended, supplemented, amended and restated, or otherwise modified from time to time, the “Indenture”), comprised of 7.75% senior unsecured notes (the “Notes” and the holders thereof, the “Noteholders”) in an aggregate principal amount outstanding of $610 million as of June 30, 2017.

(d) Equity interests in the Company, including warrants, rights and options to acquire such equity interests, if any (such interests, collectively, the “Existing Equity Interests” and the holders of the Existing Equity Interests, the “Existing Equityholders”).

(e) Direct and indirect interests in the Company and certain of its direct and indirect subsidiaries and affiliates, other than the Existing Equity Interests (such interests, the “Intercompany Interests”).

| ||

|

First Lien Term Loans |

In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, First Lien Term Loan lenders shall receive the treatment set forth for them in the Plan Term Sheet.

In the event that the Restructuring is consummated pursuant to the Out-Of-Court Transaction, the First Lien Term Loans outstanding under the First Lien Credit Agreement, together with all accrued interest thereon and all other outstanding obligations thereunder, shall be unaltered and left in place.

| |

|

Notes |

In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, holders of the Notes shall receive the treatment set forth for them in the Plan Term Sheet.

In the event that the Restructuring is consummated pursuant to the Out-Of-Court Transaction, in exchange for their Notes, on the Restructuring Effective Date, the Noteholders participating in the Restructuring (the “Participating Noteholders”) shall receive, on a pro rata basis, newly issued common equity of the Reorganized Company constituting 97% of the Reorganized Company Equity on the Restructuring Effective Date after giving effect to the Restructuring (the “Note Exchange”), subject to | |

3

| dilution by the MIP (as defined below). Noteholders that are not Participating Noteholders will not receive Reorganized Company Equity.

The Reorganized Company Equity issued to Noteholders shall be solicited and issued in accordance with Section 4(a)(2) of the Securities Act of 1933, as amended, pursuant to an offering memorandum (which shall also serve as the Disclosure Statement for the Pre-Packaged Chapter 11 Plan solicitation). In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, such Reorganized Company Equity shall be exempt from registration pursuant to section 1145 of the Bankruptcy Code to the extent set forth in the Plan Term Sheet.

| ||

|

Existing Equityholders |

In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, Existing Equityholders shall receive the treatment set forth for them in the Plan Term Sheet.

In the event that the Restructuring is consummated pursuant to the Out-Of-Court Transaction, and solely in the event that 50.1% of the Existing Equityholders (the “Required Consenting Equityholders”) consent to the Restructuring, including, without limitation, consent to and vote in favor of (a) the increase in the authorized shares of the Company, (b) the approvals required pursuant to NASDAQ Rules 5635(b) and 5635(d), and (c) such other matters to come before the special meeting of the Company’s Existing Equityholders contemplated below, the Existing Equityholders shall receive 3% of the Reorganized Company Equity, subject to dilution by the MIP (as defined below).

The Reorganized Company Equity issued to Existing Equityholders shall be solicited and issued in accordance with Section 3(a)(9) of the Securities Act of 1933, as amended, pursuant to an offering memorandum (which shall also serve as the Disclosure Statement for the Pre-Packaged Chapter 11 Plan solicitation). In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, such Reorganized Company Equity shall be exempt from registration pursuant to section 1145 of the Bankruptcy Code to the extent set forth in the Plan Term Sheet.

| |

|

Consenting Stockholders |

The Company shall use commercially reasonable efforts to cause Crestview Radio Investors, LLC (“Crestview”) and Lewis W. Dickey, Jr., John W. Dickey, Michael W. Dickey, Lewis W. Dickey, Sr., and DDBC, LLC (collectively, the “Dickey Group | |

4

|

Stockholders,” and, together with Crestview and any other stockholder that executes an RSA, the “Consenting Stockholders”) to execute RSAs binding them to take or refrain from taking certain actions in support of the Restructuring, including (i) voting in favor of the Restructuring in all respects (including attending any special meeting of the Company’s Existing Equityholders and voting in favor of an increase in the authorized shares of the Company and the approvals pursuant to NASDAQ Rules 5635(b) and 5635(d)), (ii) terminating the existing stockholders agreement, and (iii) preserving the value of the Company’s tax attributes on terms and conditions materially consistent with this Restructuring Term Sheet.

| ||

| Special Shareholder Meeting | Contemporaneously with the launch of solicitation of votes on the Out-Of-Court Transaction and Pre-Packaged Chapter 11 Plan pursuant to the offering memoranda described above, the Company shall file a preliminary proxy statement setting the date and time of a special meeting of the Company’s Existing Equityholders to vote on certain issues related to the Restructuring, including an increase in the authorized shares of the Company and approvals pursuant to NASDAQ Rules 5635(b) and 5635(d).

| |

| Equity Interests of Company and Reorganized Company Upon Consummation of the Restructuring | Upon consummation of the Restructuring, the equity interests of Reorganized Company shall consist of:

• Common stock, which will be voting interests in the Company and entitle holders thereof to 100% of Cumulus Media Inc., subject to dilution by the MIP.

• The equity interests representing the MIP.

| |

| Participation Threshold | The Out-Of-Court Transaction shall include a minimum participation condition that 98% of the Notes be tendered in the Note Exchange (the “Participation Threshold”). The Participation Threshold can be waived only by mutual consent of (a) the Company and (b) (i) 50% of the principal amount of Notes held by the members of the Ad Hoc Committee and (ii) a majority in number of the members of the Ad Hoc Committee ((i) and (ii) collectively, the “Required Consenting Noteholders”).

If the Participation Threshold is not met or waived as set forth above, the Restructuring shall be consummated pursuant to the Pre-Packaged Chapter 11 Plan.

| |

5

| Transaction Structure | In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, the Restructuring transaction steps shall be as set forth in the Plan Term Sheet.

In the event that the Restructuring is consummated pursuant to the Out-Of-Court Transaction, the Restructuring shall be implemented in the following manner and in the order below on the Restructuring Effective Date (other than the formation of the Reorganized Company, which shall occur prior to the Restructuring Effective Date):

• On the Restructuring Effective Date, the Participating Noteholders transfer 100% of their Notes to the Reorganized Company in exchange for 97% of the Reorganized Company Equity (the “Note Exchange”).

• On the Restructuring Effective Date and as a result of the Note Exchange, the Company will dilute the Existing Equity Interests to 3% of the Reorganized Company Equity.

• The Notes of Participating Noteholders will be discharged and extinguished in full on the Restructuring Effective Date.

| |

| Restructuring Fees and Expenses | The Company shall pay all reasonable and documented fees and out of pocket expenses of one primary counsel to the Ad Hoc Committee, Akin Gump Strauss Hauer & Feld LLP, and one financial advisor to the Ad Hoc Committee, Houlihan Lokey Capital, Inc. (“Houlihan”), in each case, that are due and owing after receipt of applicable invoices, and in accordance with the terms of the applicable engagement letters, with any balance(s) paid on the Restructuring Effective Date, including, for the avoidance of doubt, the Deferred Fee (as defined in, and if earned in accordance with the terms of, the Houlihan engagement letter).

| |

| Chapter 11 Cases | If (i) filing of the Pre-Packaged Chapter 11 Plan becomes necessary and the conditions precedent set forth in the RSAs have been satisfied, or (ii) the Company and the Required Consenting Noteholders mutually determine, for any reason, to pursue the Chapter 11 Cases in lieu of the Out-Of-Court Transaction, the Company and certain of its direct and indirect subsidiaries and affiliates shall file the Chapter 11 Cases in the Bankruptcy Court. The Pre-Packaged Chapter 11 Plan and the disclosure statement describing the Pre-Packaged Chapter 11 Plan (the “Disclosure Statement”) shall be filed on the same

| |

6

| day as the filing of the Chapter 11 Cases or as soon thereafter as is reasonably practicable, but in no event later than the date set forth in the RSAs. The Pre-Packaged Chapter 11 Plan shall be in all material respects consistent with the Plan Term Sheet.

| ||

|

Corporate Governance |

Existing corporate governance documents will be amended and restated or terminated, as necessary, to, among other things, set forth the rights and obligations of the parties (consistent with this Term Sheet) (collectively, the “Corporate Governance Documents”). Subject to the terms of the Restructuring Term Sheet, the Plan Term Sheet, the RSAs, and the Chapter 11 Plan (if any), the Corporate Governance Documents shall be acceptable to the Required Consenting Noteholders, in their sole and absolute discretion; provided that the Corporate Governance Documents shall provide, among other things, (i) that the Chief Executive Officer of the Company shall at all times be a member of the Board of Directors, and (ii) for ordinary and customary indemnification obligations of the Company for the benefit of officers and directors of the Company.

Notwithstanding anything to the contrary in this Restructuring Term Sheet, the Company’s indemnification obligations in place as of the date hereof, whether in the bylaws, certificates of incorporation or formation, limited liability company agreements, other organizational or formation documents, board resolutions, management or indemnification agreements, employment contracts, or otherwise, for the benefit of the Company’s current and former directors and officers, shall remain in place on the Restructuring Effective Date.

| |

|

Board of Directors |

The Board of Directors will be composed of seven (7) directors, one of whom shall be Mary G. Berner, as President and Chief Executive Officer of the Company, and six (6) of whom shall be designated by the Ad Hoc Committee following good faith consultation with the Chief Executive Officer, including an opportunity on reasonable notice for an in-person meeting between such proposed director and the Chief Executive Officer prior to such designation. The Consenting Noteholders shall agree to meet and interview in good faith and in a timely manner any potential members of the New Board identified by Mary G. Berner. The new members of the Board of Directors shall initially be appointed seriatim by the members of the existing board of directors (or by members of the board of directors that have been appointed by members of the existing board of directors) and otherwise composed in a manner consistent with the provisions of the First Lien Credit Agreement. The initial directors as of the Restructuring Effective Date shall be set forth

| |

7

| in the Corporate Governance Documents. The initial term of the Board of Directors will be through the date of the 2019 annual meeting (the “Initial Term”).

| ||

| Management Incentive Plans | As set forth in Exhibit A.

| |

| Tax Matters | The parties will work together in good faith and will use reasonable best efforts to structure and implement the Restructuring and the transactions related thereto in a tax efficient and cost-effective manner for the Company and the Noteholders. The parties intend to structure the Restructuring to preserve favorable tax attributes to the extent practicable and not materially adverse to the Consenting Noteholders or the Company.

| |

| Employment Agreements | In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, the terms of the Plan Term Sheet shall govern the treatment of existing employment and compensation related agreements of the Company.

In the event that the Restructuring is consummated pursuant to the Out-Of-Court Transaction, then, effective as of the Restructuring Effective Date, all employment and compensation related agreements of the Company existing as of the Restructuring Effective Date, including any indemnification and severance obligations, and incentive compensation plans related thereto, shall remain in place and continue in the ordinary course of business.

| |

| Non-Transfer | Each Consenting Noteholder will agree not to assign, sell, or otherwise transfer any Notes held by such Consenting Noteholder and will prevent any of its affiliates from transferring any such Notes, in each case, (i) unless the transferee(s) agree to be bound by the terms of the applicable RSA to which such Consenting Noteholder is a party or (ii) unless subject to a customary market-maker exception but with the ultimate transferee agreeing to be bound by the terms of the applicable RSA to which such Consenting Noteholder is a party.

Each Consenting Stockholder will agree not to assign, sell, or otherwise transfer any Existing Equity Interests or other claims against or interests in the Company held by such Consenting Stockholder, or claim a worthless stock deduction in any such Existing Equity Interests or other claims or interests, and will prevent any of its affiliates from transferring any such Existing Equity Interests, claims or interests.

| |

8

|

Coupon Waiver |

Subject to the terms of the applicable RSAs and the satisfaction of certain agreed upon conditions precedent, including no default or breach of the RSAs, and no litigation or proceedings challenging such waiver or the Note Exchange, the Consenting Noteholders shall agree to prospectively waive all interest owed to them on November 1, 2017 until the occurrence of certain agreed upon events, including a designated time period or the occurrence of an RSA termination event as described below.

| |

|

Revolving Credit Facility |

On the Restructuring Effective Date, the A/R Securitization Agreement shall remain in place and be available, or the Company shall have the option, with the consent of the Required Consenting Noteholders, to enter into a new ABL facility or another revolving facility (the “Revolving Facility”) providing commitments of up to $50 million. If the Company elects to exercise this option, the Revolving Facility shall be undrawn on the Restructuring Effective Date.

| |

|

Regulatory Requirements |

All parties shall abide by, and use their commercially reasonable efforts to satisfy or obtain, any regulatory and licensing requirements or approvals to consummate the Restructuring as promptly as practicable including, but not limited to, requirements or approvals that may arise as a result of such party’s equity holdings in the Company.

| |

|

Fiduciary Duties |

Nothing in this Restructuring Term Sheet, the Plan Term Sheet, any RSA, or any related document shall require the Company to take any action, or to refrain from taking any action, if the Company’s board of directors or any committee thereof determines in good faith that to do so, or that the failure to do so, would be inconsistent with the directors’ fiduciary duties under applicable law.

Full disclosure of this “fiduciary out” (the “Fiduciary Out”) shall be included in the definitive offering memoranda, proxy statement, and Chapter 11 Plan described in this Restructuring Term Sheet.

| |

|

Definitive Documents |

This Restructuring Term Sheet does not include a description of all of the terms, conditions, and other provisions that will be contained in the definitive documentation governing the Restructuring. The material documents implementing the Restructuring shall be materially consistent with this Restructuring Term Sheet, the Plan Term Sheet, and the RSAs, as applicable, and shall be in form and substance reasonably acceptable to each of the Company and the Required Consenting Noteholders (collectively, the “Definitive Documents”);

| |

9

| provided that, subject to the terms of this Restructuring Term Sheet, the Plan Term Sheet, the RSAs, and the Chapter 11 Plan (if any), the Corporate Governance Documents shall be determined by, and acceptable to, the Required Consenting Noteholders in their sole and absolute discretion; provided further that the Corporate Governance Documents shall provide, among other things, (i) that the Chief Executive Officer of the Company shall at all times be a member of the Board of Directors and (ii) for ordinary and customary indemnification obligations of the Company for the benefit of officers and directors of the Company.

| ||

| RSA Termination Events | The RSAs shall include, inter alia, the following termination events: (i) failure by the Company to execute the Required Documents (as set forth below) by November 30, 2017, (ii) failure to consummate the Pre-Packaged Chapter 11 Plan, if any, by 60 days after commencement of the Chapter 11 Cases, (iii) entry of any order of the Bankruptcy Court approving the Company’s use of cash collateral that is not reasonably acceptable to the Required Consenting Noteholders, (iv) the Company’s Board of Directors or any committee thereof exercises the Fiduciary Out pursuant to its terms, (v) the existing shareholders agreement is not terminated or rejected, and (vi) the Company and the Required Consenting Noteholders mutually determine, prior to the Restructuring Effective Date, that the Company’s tax attributes on the Restructuring Effective Date will be materially worse than the Company’s tax attributes, pro forma for the Restructuring, that are described in the offering memoranda.

| |

| Governing Law and Forum | New York governing law and consent to exclusive New York jurisdiction. Notwithstanding the preceding sentence, in the event the Chapter 11 Cases are commenced, the Bankruptcy Court shall have exclusive jurisdiction over all matters arising out of or in connection with the Restructuring.

| |

| Required Documents | The applicable parties will enter into the following documents (the “Required Documents”):

• The RSAs (to be entered into, individually, by each member of the Ad Hoc Committee and any Consenting Stockholders).

• The Offering Memorandum and related documents (including the letters of transmittal), for the purposes of effectuating the exchange of claims under the Indenture as part of the Out-Of-Court Transaction and effecting the Proposed Amendments.

| |

10

|

• The Solicitation Package, including the Pre-Packaged Chapter 11 Plan, the Disclosure Statement (the offering memorandum shall also serve as the Disclosure Statement) for the Pre-Packaged Chapter 11 Plan solicitation, proxy statement, and Plan Ballot, for purposes of effectuating the Out-Of-Court Transaction or the Pre-Packaged Chapter 11 Plan.

• Unless the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan (in which case such releases shall be governed by the Pre-Packaged Chapter 11 Plan), mutual release agreements by and among the Company, the Ad Hoc Committee and its members, any Consenting Stockholders, the manager, management company or investment advisor of any of the foregoing, and with respect to each of the foregoing, their affiliates, subsidiaries, officers, directors, principals, members, employees, agents, financial advisors, attorneys, accountants, investment bankers, consultants, representatives, equityholders, partners, and other professionals that are acceptable in form and substance to the Company, the Required Consenting Noteholders, and the Required Consenting Equityholders.

• Amendments to the articles of incorporation and bylaws of the Company and each of the Company’s subsidiaries and affiliates as necessary to effectuate the Restructuring.

• Any other ancillary documents necessary or desirable to effectuate the Restructuring.

|

11

Exhibit A

MANAGEMENT INCENTIVE PLAN

The following term sheet (this “Term Sheet”) summarizes the principal terms of an Management Incentive Plan (the “Plan”) to be sponsored by Cumulus Media Inc. (the “Company”) and its subsidiaries (collectively, the “Company Group”) and of grants to be made under the Plan at Closing.

| Overview: |

• Incentive Equity Pool. There will be reserved, exclusively for management employees, a pool of equity equal to 15% of the Company’s common stock outstanding at Closing on a fully diluted and fully distributed basis (such reserve, the “EIP Pool”).

• Closing Grants. Two-thirds (66.66%) of the EIP Pool will be allocated at Closing (the “Closing Grants”) in accordance with this Term Sheet and the allocations set forth on Appendix A. Each Closing Grant will be 33% in the form of restricted stock units (“RSUs”) and 67% in the form of ten (10) year stock options (“Options”) priced at a per share exercise price equal to the thirty (30) day volume-weighted average closing price of Company stock on the date of Closing.

• Supplemental Incentive Plan. To reflect the significant leverage continued to be carried by the Company, the Company will continue the Company’s current Supplemental Incentive Plan for two years following Closing on its current terms and conditions.

• Other Awards. The balance of the EIP Pool will be granted after Closing in the form of equity-based awards as determined by the Compensation Committee of the Company taking into account the then prevailing practices of the Company’s publicly traded peer group (the “Other Awards”). The precise amount of equity and number of shares to be reserved will be determined in a manner consistent with the intended effect of this Term Sheet.

| |

| Vesting: |

• Normal Vesting. Subject to an Executive’s continued employment through each applicable vesting date, each Closing Grant will vest in ratable installments on the first four anniversaries of the Closing.

• Accelerated Vesting Upon Termination Without Cause, for Good Reason or Due to Death or Disability. If an Executive is terminated without Cause, terminates for Good Reason or is terminated due to death or disability (any such termination, a “Qualifying Termination”), the Executive will become vested in an additional tranche of the Executive’s unvested Closing Grant as if the Executive’s employment continued for one additional year following the Qualifying Termination date; provided that with respect to the Senior Executives listed on Appendix A, (i) 100% of the unvested Closing Grant will accelerate and vest and (ii) Options will remain outstanding until the earlier of the fifth anniversary of such Qualifying Termination and the original expiration date of the Option.

• Accelerated Vesting Upon a Change in Control. If an Executive’s employment is terminated (i) by the Company without Cause,(ii) by the Executive for Good Reason, or (iii) by non-renewal of an Executive’s employment agreement, in each case, within three months prior to, or at any time following, a Change in Control, 100% of the Executive’s unvested RSUs and Options will accelerate and vest, subject to the Executive’s continued employment through consummation of the Change in Control. | |

1

| Final Documentation: | The final documentation related to Closing Grants shall not contain any material restrictions, limitations or additional obligations that are not set forth in this Term Sheet or in an Executive’s existing employment agreement.

| |

| Other: | Final documentation will clarify that (i) consummation of the transaction does not constitute a Change in Control under management arrangements and contracts and (ii) SIP component not included in severance calculations.

| |

2

Appendix A

|

Position |

Closing Grant: % of EIP Pool | |

| President & CEO* | 50% | |

| CFO* | 25% | |

| Members of Key Leadership** | 25% | |

| 100.00% |

| * | Senior Executive |

| ** | Amounts within these bands to be allocated by the CEO. To the extent not fully allocated, the CEO may allocate within other groups. |

3

K&E Draft 10/31/17

THIS PLAN TERM SHEET1 IS FOR DISCUSSION PURPOSES ONLY AND IS NOT A SOLICITATION OF ACCEPTANCES OR REJECTIONS WITH RESPECT TO A CHAPTER 11 PLAN OF REORGANIZATION. IT DOES NOT CONTAIN ALL OF THE TERMS OF A PROPOSED PLAN OF REORGANIZATION. THIS PLAN TERM SHEET SHALL NOT BE CONSTRUED AS (I) AN OFFER CAPABLE OF ACCEPTANCE, (II) A BINDING AGREEMENT OF ANY KIND, (III) A COMMITMENT TO ENTER INTO, OR OFFER TO ENTER INTO, ANY AGREEMENT OR (IV) AN AGREEMENT TO FILE ANY CHAPTER 11 PLAN OF REORGANIZATION OR DISCLOSURE STATEMENT OR CONSUMMATE ANY TRANSACTION OR TO VOTE FOR OR OTHERWISE SUPPORT ANY PLAN OF REORGANIZATION.

CUMULUS MEDIA INC.

Plan Term Sheet

This Plan Term Sheet sets forth the principal terms of the proposed Pre-Packaged Chapter 11 Plan of Cumulus Media Inc. (the “Company”) and certain of its direct and indirect subsidiaries and affiliates, which is to be filed in the Chapter 11 Cases commenced in the Bankruptcy Court. This Plan Term Sheet is a component of a restructuring transaction described in a restructuring term sheet (the “Restructuring Term Sheet”) and the RSAs entered into by and among the Company and certain existing creditors of the Company that are signatories thereto. This Plan Term Sheet shall be attached to, and incorporated into, the RSAs. This Plan Term Sheet is not a complete list of all the terms and conditions of the restructuring transaction contemplated in the RSAs, and shall not constitute an offer to sell or buy, nor the solicitation of an offer to sell or buy any of the debt or securities referred to herein or the solicitation of acceptances of a chapter 11 plan. Any such offer or solicitation shall only be made in compliance with applicable laws. Without limiting the generality of the foregoing, this Plan Term Sheet and the undertakings contemplated herein are subject in all respects to the negotiation, execution, and delivery of mutually acceptable definitive documentation consistent herewith. In the event of an inconsistency between this Plan Term Sheet and the definitive documentation, the provisions of such definitive documentation shall govern. This Plan Term Sheet is proffered in the nature of a settlement proposal in furtherance of settlement discussions and is entitled to protection from any use or disclosure to any party or person pursuant to Federal Rule of Evidence 408 and other rules of similar import.

THIS PLAN TERM SHEET IS BEING PROVIDED AS PART OF A PROPOSED COMPREHENSIVE RESTRUCTURING TRANSACTION, EACH ELEMENT OF WHICH IS CONSIDERATION FOR THE OTHER ELEMENTS AND AN INTEGRAL ASPECT OF THE PROPOSED RESTRUCTURING. NOTHING IN THIS PLAN TERM SHEET SHALL CONSTITUTE OR BE CONSTRUED AS AN ADMISSION OF ANY FACT OR LIABILITY, A STIPULATION, OR A WAIVER, AND EACH STATEMENT CONTAINED HEREIN IS MADE WITHOUT PREJUDICE, WITH A FULL RESERVATION OF ALL RIGHTS, REMEDIES, CLAIMS, AND DEFENSES OF THE COMPANY OR ANY CREDITOR PARTY.

| 1 | Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Restructuring Term Sheet, as defined below. |

1

| TERMS AND CONDITIONS OF THE PLAN

| ||

|

A. Defined Terms and Capital Structure

| ||

| The Company and Filing Entities | The entities that file voluntary petitions commencing the Chapter 11 Cases are referred to herein as the “Debtors.” The date on which the Chapter 11 Cases are commenced shall be the “Petition Date.” A list of Debtors is attached hereto as Exhibit A.

All of the Debtors from and after the Effective Date (as defined below) shall be referred to herein as the “Reorganized Debtors.”

| |

| Plan Filing and Proponents | If the Company and the Required Consenting Noteholders determine for any reason to pursue the Chapter 11 Cases in lieu of the Out-Of-Court Transaction, the Pre-Packaged Chapter 11 Plan shall be filed by the Debtors. The Debtors shall use all commercially reasonable efforts to obtain confirmation of the Pre-Packaged Chapter 11 Plan as promptly as is practicable but no later than the date set forth in the RSAs. The votes in support of the Pre-Packaged Chapter 11 Plan will be solicited simultaneously with launch of the Note Exchange.

Claims under the First Lien Credit Agreement are the “First Lien Lender Claims” and claims under the Indenture are the “Note Claims.”

| |

| Consenting Stockholders | The Company shall use commercially reasonable efforts to cause Crestview Radio Investors, LLC (“Crestview”) and Lewis W. Dickey, Jr., John W. Dickey, Michael W. Dickey, Lewis W. Dickey, Sr., and DDBC, LLC (collectively, the “Dickey Group Stockholders,” and, together with Crestview and any other stockholder that executes an RSA, the “Consenting Stockholders”) to execute RSAs binding them to take or refrain from taking certain actions in support of the restructuring including to (i) vote in favor of the Restructuring in all respects, (ii) terminate the existing stockholders agreement, and (iii) preserve the value of the Debtors’ tax attributes on terms and conditions materially consistent with this Plan Term Sheet.

| |

2

| Effective Date | The date on which all the conditions to consummation of the Pre-Packaged Chapter 11 Plan have been satisfied in full or waived, and the Pre-Packaged Chapter 11 Plan becomes effective shall be referred to herein as the “Effective Date.” On the Effective Date, all Debtors shall be reorganized pursuant to the Pre-Packaged Chapter 11 Plan in accordance with and pursuant to the Bankruptcy Code.

| |

|

B. Treatment of Claims and Interests

| ||

| Administrative, Priority Tax, and Other Priority Claims | Each holder of an allowed administrative, priority tax or other priority claim shall be paid in full in cash on the Effective Date, or in the ordinary course of business as and when due, or otherwise receive treatment consistent with the provisions of section 1129(a) of the Bankruptcy Code, in each case, as reasonably determined by the Debtors and the Required Consenting Noteholders.

The Debtors shall pay all reasonable and documented fees and out of pocket expenses of one primary counsel to the Ad Hoc Committee, Akin Gump Strauss Hauer & Feld LLP and one financial advisor to the Ad Hoc Committee, Houlihan Lokey Capital, Inc. (“Houlihan”), in each case, that are due and owing after receipt of applicable invoices, without any requirement for the filing of fee or retention applications in the Chapter 11 Cases, and in accordance with the terms of the applicable engagement letters, with any balance(s) paid on the Effective Date, including, for the avoidance of doubt, the Deferred Fee (as defined in, and if earned in accordance with the terms of, the Houlihan engagement letter) (collectively, the “Restructuring Expenses”).

| |

| Professional Fee Claims | All final requests for payment of the claims for professional services rendered or costs incurred on or after the Petition Date and on or prior to the date of confirmation of the Chapter 11 Plan by professional persons retained by the Debtors or any statutory committee appointed in the Chapter 11 Cases pursuant to sections 327, 328, 329, 330, 331, 503(b), or 1103 of the Bankruptcy Code must be filed no later than sixty (60) days after the Effective Date.

| |

3

| First Lien Lender Claims | On the Effective Date, the First Lien Credit Agreement shall be reinstated and rendered unimpaired in accordance with section 1124 of the Bankruptcy Code.

| |

| Other Secured Claims | On or as soon as practicable after the Effective Date, all other secured claims allowed as of the Effective Date, if not paid previously, shall, at the option of the Debtors, with the reasonable consent of the Required Consenting Noteholders, either (i) be satisfied by payment in full in cash, (ii) be reinstated pursuant to section 1124 of the Bankruptcy Code, or (iii) receive such other recovery necessary to satisfy section 1129 of the Bankruptcy Code.

| |

| Note Claims | The Note Claims shall be allowed in an aggregate principal amount of $610 million, plus accrued and unpaid interest as of the Effective Date.

Except to the extent that the holder of a Note Claim agrees to lesser treatment, on the Effective Date, each holder of a Note Claim shall receive on account of its Note Claim in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for such Note Claim either (i) if the holders of Existing Equity Interests voted to approve an increase in the Company’s authorized shares and the Company settled the Merlin Claims, in each case, prior to the petition date, its pro rata share of 97% of the equity of the Reorganized Debtors (subject to dilution on account of the Post-Emergence Equity Incentive Program), or (ii) if the holders of Existing Equity Interest did not vote to approve an increase in the Company’s authorized shares or the Company did not settle the Merlin Claims, in either case, prior to the petition date, its pro rata share of 100% of the equity of the Reorganized Debtors (subject to dilution on account of the Post-Emergence Equity Incentive Program).

| |

| General Unsecured Claims | Except to the extent that a holder of an allowed general unsecured claim agrees to lesser treatment with the Debtors, each holder of an allowed general unsecured claim shall be paid (i) in the ordinary course of business or (ii) on or as soon as reasonably practicable after the Effective Date.

| |

4

| Existing Equity Interests | Either (i) if the holders of Existing Equity Interests voted to approve an increase in the Company’s authorized shares and the Company settles the Merlin Claims, in each case, prior to the petition date, then except to the extent that a holder of an Existing Equity Interest agrees to lesser treatment, on the Effective Date, each holder of an allowed Existing Equity Interest will receive, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for such Existing Equity Interest, its pro rata share of a number of shares of the Reorganized Debtors that is equal to 3% of the total shares of the Reorganized Debtors multiplied by the quotient of: the total amount of allowed Existing Equity Interests divided by the sum of the total allowed amount of Section 510(b) Claims plus the total allowed amount of Existing Equity Interests (subject to dilution on account of the Post-Emergence Equity Incentive Program), or (ii) if the holders of Existing Equity Interests did not vote to approve an increase in the Company’s authorized shares or the Company did not settle the Merlin Claims, in either case, prior to the petition date, all Existing Equity Interests, whether represented by stock, preferred share purchase rights, or otherwise, will be cancelled, released, and extinguished and the Existing Equityholders will receive no distribution under the Plan on account thereof. | |

| Section 510(b) Claims | The Section 510(b) Claims (as defined below) shall be subordinated to all other claims against the Debtors.

Either (i) if the holders of Existing Equity Interests voted to approve an increase in the Company’s authorized shares and the Company settles the Merlin Claims, in each case, prior to the petition date, then except to the extent that a holder of a Section 510(b) Claim (as defined below) agrees to other treatment that is consistent with the Bankruptcy Code and acceptable to the Debtors, on the Effective Date, each holder of an allowed Section 510(b) Claim will receive, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for such Section 510(b) Claim, a number of shares of the Reorganized Debtors that is equal to 3% of the total shares of the Reorganized Debtors multiplied by the quotient of: the total amount of allowed Section 510(b) Claims divided by the sum of the total allowed amount of Section 510(b) Claims plus the total allowed amount of Existing Equity Interests (subject to dilution on | |

5

| account of the Post-Emergence Equity Incentive Program), or (ii) if the holders of Existing Equity Interests did not vote to approve an increase in the Company’s authorized shares or the Company did not settle the Merlin Claims, in either case, prior to the petition date, the Section 510(b) Claims shall receive no distribution under the Plan on account thereof.

As used in this Plan Term Sheet, “Section 510(b) Claims” means all claims (as defined in section 101(5) of the Bankruptcy Code) against the Company that are described in section 510(b) of the Bankruptcy Code. Pursuant to section 510(b) of the Bankruptcy Code, the Merlin Claims (as defined below) will be classified as Section 510(b) Claims.

As used in this Plan Term Sheet, “Merlin Claims” means all claims (as defined in section 101(5) of the Bankruptcy Code) against the Company arising under, relating to, or in connection with that certain Put and Call Agreement, dated as of January 2, 2014, by and among Merlin Media, LLC, Merlin Media License, LLC, Chicago FM Radio Assets, LLC, and Radio License Holdings LLC for WLUP-FM and WIQI(FM).

| ||

| Intercompany Claims | All allowed intercompany claims shall be adjusted, continued, or discharged to the extent determined appropriate by the Debtors, with the reasonable consent of the Required Consenting Noteholders.

| |

| Intercompany Interests | All Intercompany Interests shall be reinstated for administrative convenience, or cancelled as determined by the Debtors, with the reasonable consent of the Required Consenting Noteholders.

| |

|

C. Other Provisions

| ||

| Executory Contracts | Each executory contract and unexpired lease shall be assumed.

| |

| Employment Agreements | Employment and compensation-related agreements for certain officers and employees of the Company existing as of the Effective Date, including any indemnification and severance obligations, and cash incentive compensation plans related thereto, shall be assumed.

| |

| Management Incentive Plans | As set forth in Exhibit B.

| |

6

| Board Members/Governance | As of the Effective Date, all holders of the equity of the Reorganized Debtors shall enter into governing documents and agreements of the Reorganized Debtors, which documents and agreements shall, subject to the terms of the Restructuring Term Sheet, the Plan Term Sheet, the RSAs, and the Chapter 11 Plan, be acceptable to the Required Consenting Noteholders in their sole and absolute discretion; provided that such governing documents shall provide, among other things, (i) that the Chief Executive Officer of the Company shall at all times be a member of the Board of Directors, and (ii) for ordinary and customary indemnification obligations of the Reorganized Debtors for the benefit of officers and directors of the Reorganized Debtors.

The Board of Directors will be composed of seven (7) directors, one of whom shall be Mary G. Berner, as President and Chief Executive Officer of the Company, and six (6) of whom shall be designated by the Ad Hoc Committee following good faith consultation with the Chief Executive Officer, including an opportunity on reasonable notice for an in-person meeting between such proposed director and the Chief Executive Officer prior to such designation. The Consenting Noteholders shall agree to meet and interview in good faith and in a timely manner any potential members of the New Board identified by Mary G. Berner. The new members of the Board of Directors shall initially be appointed seriatim by the members of the existing board of directors (or by members of the board of directors that have been appointed by members of the existing board of directors) and otherwise composed in a manner consistent with the provisions of the First Lien Credit Agreement. The initial directors as of the Restructuring Effective Date shall be set forth in the Corporate Governance Documents. The initial term of the Board of Directors will be through the date of the 2019 annual meeting (the “Initial Term”).

| |

| Issuance of New Equity Under Plan | Except as otherwise noted, it is the intent of the parties that any “securities” as defined in section 2(a)(1) of the Securities Act of 1933 issued under the Pre-Packaged Chapter 11 Plan, except with respect to any entity that is an underwriter, shall be exempt from registration under U.S. state and federal securities laws pursuant to section 1145 of the Bankruptcy Code and the | |

7

| Reorganized Debtors will utilize section 1145 of the Bankruptcy Code, or to the extent that such exemption is unavailable, shall utilize any other available exemptions from registration, as applicable.

| ||

| Tax Matters | The parties will work together in good faith and will use reasonable best efforts to structure and implement the Restructuring and the transactions related thereto, in a tax efficient and cost-effective manner for the Reorganized Debtors and the Noteholders. The parties intend to structure the Restructuring to preserve favorable tax attributes to the extent practicable and not materially adverse to the Consenting Noteholders or the Company.

| |

| Retained Causes of Action | The Pre-Packaged Chapter 11 Plan shall contain customary provisions regarding retention of causes of action.

| |

| Releases and Exculpation | The Pre-Packaged Chapter 11 Plan and the order confirming the Pre-Packaged Chapter 11 Plan shall include full releases (including Debtor and third-party releases) and exculpation provisions, for the benefit of the Debtors, the members of the Ad Hoc Committee, the Consenting Stockholders, the manager, management company or investment advisor of any of the foregoing, and, each of such entities’ respective current and former affiliates, and such entities’ and their current and former affiliates’ current and former officers, managers, directors, equity holders (regardless of whether such interests are held directly or indirectly), predecessors, successors, assigns, subsidiaries, principals, members, employees, agents, managed accounts or funds, management companies, fund advisors, advisory board members, financial advisors, partners, attorneys, accountants, investment bankers, consultants, representatives, and other professionals, each in their capacity as such.

| |

| Indemnification | The Debtors’ indemnification obligations in place as of the Effective Date, whether in the bylaws, certificates of incorporation or formation, limited liability company agreements, other organizational or formation documents, board resolutions, management or indemnification agreements, employment contracts, or otherwise, for the Debtors’ current and former directors and officers, shall be assumed pursuant to any Chapter 11 Plan.

|

8

| Non-Transfer | Each Consenting Noteholder will agree not to assign, sell, or otherwise transfer any Notes held by such Consenting Noteholder and will prevent any of its affiliates from transferring any such Notes, in each case, (i) unless the transferee(s) agree to be bound by the terms of the applicable RSA to which such Consenting Noteholder is a party or (ii) unless subject to a customary market-maker exception but with the ultimate transferee agreeing to be bound by the terms of the applicable RSA to which such Consenting Noteholder is a party.

Each Consenting Stockholder will agree not to assign, sell, or otherwise transfer any Existing Equity Interests or other claims against or interests in the Company held by such Consenting Stockholder, or claim a worthless stock deduction in any such Existing Equity Interests or other claims or interests, and will prevent any of its affiliates from transferring any such Existing Equity Interests, claims or interests.

| |

| Conditions Precedent to Consummation of the Pre-Packaged Chapter 11 Plan | The Pre-Packaged Chapter 11 Plan shall contain the following conditions to effectiveness:

(a) The Pre-Packaged Chapter 11 Plan and all documentation with respect to the Pre-Packaged Chapter 11 Plan and all documents contained in any supplement thereto, including any exhibits, schedules, amendments, modifications or supplements thereto, which shall be in form and substance reasonably acceptable to the Debtors and the Required Consenting Noteholders, and otherwise consistent with the terms and conditions described in this Plan Term Sheet or the RSAs.

(b) Any customary organizational documents, which shall be in form and substance reasonably acceptable to the Required Consenting Noteholders in their sole discretion.

(c) The Bankruptcy Court shall have entered an order in form and substance acceptable to the Debtors and the Required Consenting Noteholders approving the disclosure statement related to the Pre-Packaged Chapter 11 Plan.

|

9

| (d) The order confirming the Pre-Packaged Chapter 11 Plan, in form and substance acceptable to the Debtors and the Required Consenting Noteholders and otherwise consistent with the terms and conditions described in this Plan Term Sheet or the RSAs, as applicable, shall have been entered.

(e) As of the Effective Date, the aggregate amount of all allowed or projected administrative expense (not including professional fees and expenses of retained professionals) and priority claims shall not exceed $[ ].

The Debtors shall have paid the Restructuring Expenses in full, in cash.

| ||

| Revolving Credit Facility | On the Effective Date, the Reorganized Debtors shall have the option, with the consent of the Required Consenting Noteholders, to enter into an ABL facility or another revolving facility (the “Revolving Facility”) providing commitments of up to $50 million. If the Company elects to exercise this option, the Revolving Facility shall be undrawn on the Effective Date.

| |

| Regulatory Requirements | All parties shall abide by, and use their commercially reasonable efforts to satisfy or obtain, any regulatory and licensing requirements or approvals to consummate the restructuring as promptly as practicable including, but not limited to requirements or approvals that may arise as a result of such party’s equity holdings in the Reorganized Debtors.

| |

| Fiduciary Duties | Nothing in this Plan Term Sheet, the Restructuring Term Sheet, any RSA, or any related document shall require the Company to take any action, or to refrain from taking any action, if the Company’s board of directors or any committee thereof determines in good faith that to do so, or that the failure to do so, would be inconsistent with the directors’ fiduciary duties under applicable law.

Full disclosure of this “fiduciary out” (the “Fiduciary Out”) shall be included in the Pre-Packaged Chapter 11 Plan described in this Plan Term Sheet.

|

10

| Other Provisions | Other provisions set forth in the RSAs and/or the Pre-Packaged Chapter 11 Plan and Disclosure Statement shall be reasonably acceptable to the Required Consenting Noteholders and the Debtors, to the extent set forth therein; provided that no provision in the Pre-Packaged Chapter 11 Plan or Disclosure Statement may be materially inconsistent with the terms in this Plan Term Sheet.

|

11

Exhibit A

Cumulus Subsidiaries

| 1. | Cumulus Media Inc. |

| 2. | Cumulus Media Holdings Inc. |

| 3. | Consolidated IP Company LLC |

| 4. | Broadcast Software International |

| 5. | Incentrev-Radio Half Off, LLC |

| 6. | Cumulus Intermediate Holdings Inc. |

| 7. | Incentrev LLC |

| 8. | Cumulus Network Holdings Inc. |

| 9. | Cumulus Radio Corporation |

| 10. | LA Radio, LLC |

| 11. | KLOS-FM Radio Assets, LLC |

| 12. | Detroit Radio, LLC |

| 13. | DC Radio Assets, LLC |

| 14. | Chicago FM Radio Assets, LLC |

| 15. | Chicago Radio Assets, LLC |

| 16. | Atlanta Radio, LLC |

| 17. | Minneapolis Radio Assets, LLC |

| 18. | NY Radio Assets, LLC |

| 19. | Radio Assets LLC |

| 20. | San Francisco Radio Assets, LLC |

| 21. | WBAP-KSCS Assets, LLC |

| 22. | WPPLJ Radio, LLC |

| 23. | Westwood One, Inc. |

| 24. | CMP Susquehanna Radio Holdings Corp. |

| 25. | Cumulus Broadcasting LLC |

| 26. | Dial Communications Global Media, LLC |

| 27. | Radio Networks, LLC |

| 28. | Westwood One Radio Networks, Inc. |

| 29. | CMP Susquehanna Corp. |

| 30. | Catalyst Media, Inc. |

| 31. | CMI Receivables Funding LLC |

| 32. | Susquehanna Pfaltzgraff Co. |

| 33. | CMP KC Corp. |

| 34. | Susquehanna Media Corp. |

| 35. | Susquehanna Radio Corp. |

| 36. | KLIF Broadcasting, Inc. |

| 37. | Radio Metroplex, Inc. |

1

AG Draft 11/2/17

CUMULUS MEDIA INC.

Restructuring Term Sheet

The following is a summary of the principal terms with respect to a proposed restructuring of Cumulus Media Inc. (the “Company”) and certain of its direct and indirect subsidiaries and affiliates. The basic terms of the Restructuring (as defined below) are outlined below and are subject to fully and properly executed documentation.

THIS TERM SHEET IS NOT AN OFFER OR A SOLICITATION WITH RESPECT TO ANY SECURITIES OR DEBT OF THE COMPANY. ANY SUCH OFFER OR SOLICITATION SHALL COMPLY WITH ALL APPLICABLE SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE, AS APPLICABLE.

THIS TERM SHEET IS PROVIDED IN CONFIDENCE AND MAY BE DISTRIBUTED ONLY WITH THE EXPRESS WRITTEN CONSENT OF THE AD HOC COMMITTEE (AS DEFINED HEREIN) AND THE COMPANY. THIS TERM SHEET IS PROVIDED IN THE NATURE OF A SETTLEMENT PROPOSAL IN FURTHERANCE OF SETTLEMENT DISCUSSIONS. ACCORDINGLY, THIS TERM SHEET IS ENTITLED TO THE PROTECTIONS OF RULE 408 OF THE FEDERAL RULES OF EVIDENCE AND ANY OTHER APPLICABLE STATUTES OR DOCTRINES PROTECTING THE USE OR DISCLOSURE OF CONFIDENTIAL INFORMATION AND INFORMATION EXCHANGED IN THE CONTEXT OF SETTLEMENT DISCUSSIONS. FURTHER, NOTHING IN THIS TERM SHEET SHALL BE AN ADMISSION OF FACT OR LIABILITY OR DEEMED BINDING ON THE AD HOC COMMITTEE, THE COMPANY, OR THEIR RESPECTIVE AFFILIATES.

| Restructuring Summary | The outstanding indebtedness of, and equity interests in, the Company shall be restructured (the “Restructuring”) through either (i) an out-of-court Restructuring consistent with the terms and conditions described in this Term Sheet (the “Out-Of-Court Transaction”) or, to the extent the conditions precedent to consummating an Out-Of-Court Transaction cannot be timely satisfied then, (ii) as voluntary pre-packaged cases (the “Chapter 11 Cases”) under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”), to be filed in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”) and pursuant to a pre-packaged plan of reorganization (the “Pre-Packaged Chapter 11 Plan”) with the support of the members of the ad hoc committee of 7.75% senior noteholders (the “Ad Hoc Committee”), on the terms | |

1

| and subject to the conditions set forth in the plan term sheet attached to those certain restructuring support agreements to be entered into between the Company, on the one hand, and each member of the Ad Hoc Committee, on the other hand (as amended, supplemented, or otherwise modified from time to time, the “RSAs”) as Exhibit [B] (the “Plan Term Sheet”).

Prior to the commencement of any solicitation of creditors related to the Restructuring, not less than 66 2/3% in outstanding principal amount of the Notes shall have signed RSAs.

The “Restructuring Effective Date” shall be the date on which all the transactions described in this Term Sheet are consummated or, if the filing of the Pre-Packaged Chapter 11 Plan is made as provided in this Term Sheet, the “Effective Date” under such Pre-Packaged Chapter 11 Plan.

| ||

| Current Capital Structure | The current capital structure of the Company is as follows:

(a) Indebtedness under that certain amended and restated credit agreement, dated as of December 23, 2013, among the Company, Cumulus Media Holdings Inc. (“Holdings”), as borrower, JPMorgan Chase Bank, N.A. as administrative agent, and the lenders (the “First Lien Lenders”) party thereto, as may be further amended, supplemented, amended and restated, or otherwise modified from time to time, (the “First Lien Credit Agreement”), comprised of term loans (the “First Lien Term Loans”) in an aggregate principal amount outstanding of $1.729 billion as of August 29, 2017 and revolving loans in an aggregate principal amount outstanding of $0 as of June 30, 2017.

(b) Indebtedness under that certain amended and restated receivables funding and administration agreement, dated as of March 15, 2017, among CMI Receivables Funding LLC, as borrower, Wells Fargo Bank, NA, as administrative agent, and the lenders party thereto, as may be further amended, supplemented, amended and restated, or otherwise modified from time to time (the “A/R Securitization Agreement”) comprised of revolving loans in an aggregate principal amount outstanding of $0 as of June 30, 2017.

(c) Indebtedness under that certain indenture, dated as of May 13, 2011, by and among the Company, Holdings, as issuer, and U.S. Bank National Association as trustee, (as | |

2

|

amended by that certain First Supplemental Indenture, dated as of September 16, 2011, that certain Second Supplemental Indenture, dated as of October 16, 2011, that certain Third Supplemental Indenture, dated as of October 17, 2011, and that certain Fourth Supplemental Indenture, dated as of December 23, 2013, and as may be further amended, supplemented, amended and restated, or otherwise modified from time to time, the “Indenture”), comprised of 7.75% senior unsecured notes (the “Notes” and the holders thereof, the “Noteholders”) in an aggregate principal amount outstanding of $610 million as of June 30, 2017.

(d) Equity interests in the Company, including warrants, rights and options to acquire such equity interests, if any (such interests, collectively, the “Existing Equity Interests” and the holders of the Existing Equity Interests, the “Existing Equityholders”).

(e) Direct and indirect interests in the Company and certain of its direct and indirect subsidiaries and affiliates, other than the Existing Equity Interests (such interests, the “Intercompany Interests”).

| ||

| First Lien Term Loans | In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, First Lien Term Loan lenders shall receive the treatment set forth for them in the Plan Term Sheet.

In the event that the Restructuring is consummated pursuant to the Out-Of-Court Transaction, the First Lien Term Loans outstanding under the First Lien Credit Agreement, together with all accrued interest thereon and all other outstanding obligations thereunder, shall be unaltered and left in place.

| |

| Notes | In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, holders of the Notes shall receive the treatment set forth for them in the Plan Term Sheet.

In the event that the Restructuring is consummated pursuant to the Out-Of-Court Transaction, in exchange for their Notes, on the Restructuring Effective Date, the Noteholders participating in the Restructuring (the “Participating Noteholders”) shall receive, on a pro rata basis, newly issued common equity of the Reorganized Company constituting 97% of the Reorganized Company Equity on the Restructuring Effective Date after giving effect to the Restructuring (the “Note Exchange”), subject to | |

3

| dilution by the MIP (as defined below). Noteholders that are not Participating Noteholders will not receive Reorganized Company Equity.

The Reorganized Company Equity issued to Noteholders shall be solicited and issued in accordance with Section 4(a)(2) of the Securities Act of 1933, as amended, pursuant to an offering memorandum (which shall also serve as the Disclosure Statement for the Pre-Packaged Chapter 11 Plan solicitation). In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, such Reorganized Company Equity shall be exempt from registration pursuant to section 1145 of the Bankruptcy Code to the extent set forth in the Plan Term Sheet.

| ||

| Existing Equityholders | In the event that the Restructuring is consummated pursuant to the Pre-Packaged Chapter 11 Plan, Existing Equityholders shall receive the treatment set forth for them in the Plan Term Sheet.

In the event that the Restructuring is consummated pursuant to the Out-Of-Court Transaction, and solely in the event that 50.1% of the Existing Equityholders (the “Required Consenting Equityholders”) consent to the Restructuring, including, without limitation, consent to and vote in favor of (a) the increase in the authorized shares of the Company, (b) the approvals required pursuant to NASDAQ Rules 5635(b) and 5635(d), and (c) such other matters to come before the special meeting of the Company’s Existing Equityholders contemplated below, the Existing Equityholders shall receive 3% of the Reorganized Company Equity, subject to dilution by the MIP (as defined below).