Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASSOCIATED BANC-CORP | form8-kcoverpage4q17invest.htm |

Associated Banc-Corp

Bank of America Merrill Lynch

Future of Financials Conference

FOURTH QUARTER

2017

Exhibit 99.1

DISCLAIMER

Important note regarding forward-looking statements:

Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities

Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations,

products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may

be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” “outlook” or similar

expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and

uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause

actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s

most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference.

Non-GAAP Measures

This presentation includes certain non-GAAP financial measures. These non-GAAP measures are provided in addition to, and not as

substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP

measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in

the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in

isolation from, or as a substitute for, related GAAP measures. Reconciliations of these non- GAAP financial measures to the most

directly comparable GAAP financial measures can be found at the end of this presentation.

Trademarks:

All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective

owners.

1

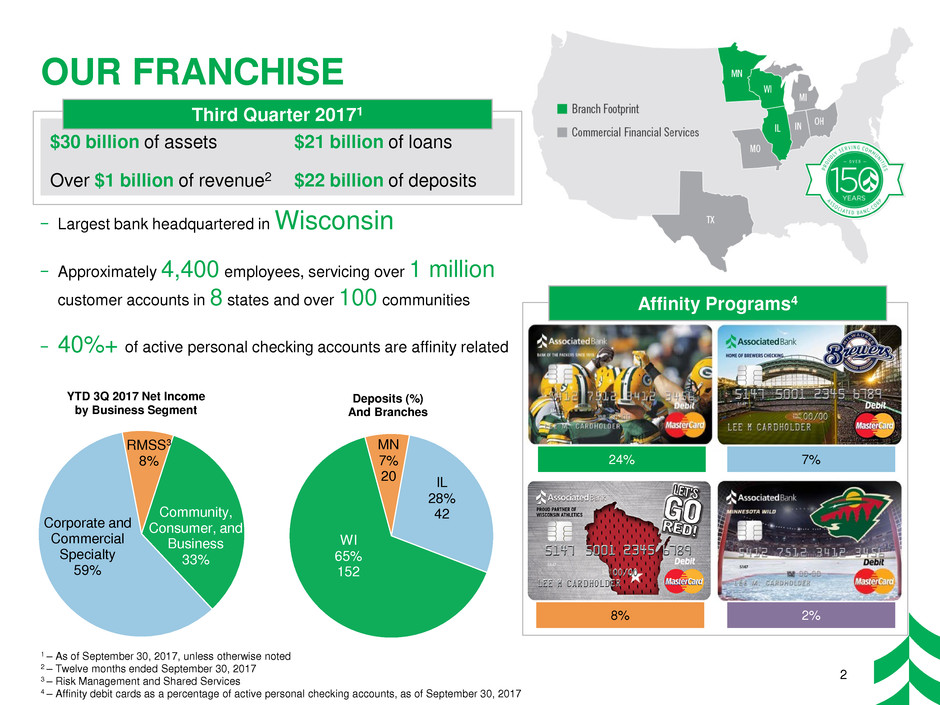

Community,

Consumer, and

Business

33%

Corporate and

Commercial

Specialty

59%

RMSS3

8%

YTD 3Q 2017 Net Income

by Business Segment

24%

8%

7%

2%

Affinity Programs4

OUR FRANCHISE

2

$30 billion of assets $21 billion of loans

Over $1 billion of revenue2 $22 billion of deposits

Third Quarter 20171

1 – As of September 30, 2017, unless otherwise noted

2 – Twelve months ended September 30, 2017

3 – Risk Management and Shared Services

4 – Affinity debit cards as a percentage of active personal checking accounts, as of September 30, 2017

− Largest bank headquartered in Wisconsin

− Approximately 4,400 employees, servicing over 1 million

customer accounts in 8 states and over 100 communities

− 40%+ of active personal checking accounts are affinity related

WI

65%

152

MN

7%

20 IL

28%

42

Deposits (%)

And Branches

Manufacturing

& Wholesale

Trade

25%

ATTRACTIVE MIDWEST MARKETS

3.2% 3.5% 3.7%

3.8% 3.8% 4.2% 4.3%

5.0% 5.3%

IA WI MN IN MO U.S. MI IL OH

Midwest

30%

All other

regions

70%

U.S.

Manufacturing

Jobs

1 – U.S. Census Bureau, Annual Estimates of the Resident Population, 2016

2 – U.S. Bureau of Labor Statistics, Manufacturing Industry Employees, seasonally adjusted, September 2017 (preliminary)

3 – U.S. Bureau of Labor Statistics, Unemployment Rates by State, seasonally adjusted, September 2017 (preliminary)

4 – U.S. Bureau of Labor Statistics, Unemployment Rates, Midwest Information Office, seasonally adjusted, September 2017 (preliminary)

Midwest holds ~20% of the U.S. population1 and

30% of all U.S. manufacturing jobs2

3

Large Population Base With a Manufacturing and Wholesale Trade-Centric Economy

Several Midwestern states have unemployment rates3 below

the national average

Dark green bars denote ASB branch states

Commercial and Business Lending

ASB Loan Composition by Industry

Madison, WI……………………

Rochester, MN…………………

Wausau, WI……………………

Green Bay, WI…………………

Minneapolis – St. Paul, MN…..

2.3%

2.5%

2.7%

2.8%

2.9%

Supporting Strong Employment Base and Healthy Consumer Credit

Select ASB Metro Market

Unemployment Rates4

THIRD QUARTER UPDATE

4

Growing

Interest Income

Improving

Credit Dynamics

Continued Efficiency

Improvement

Expanding

Bottom Line

3Q17: Net income available to common equity of $63 million, or $0.41 per common share

Balance

Sheet

Management

Mid-to-high single digit

annual average loan

growth

Maintain Loan to

Deposit ratio under

100%

Improving NIM trend

Fee

Businesses

Improving year over

year fee-based

revenues

Declining year over

year mortgage banking

revenue

Expense

Management

Capital

& Credit

Management

Approximately 1%

higher than the prior

year

Continued

improvement to our

efficiency ratio

Continue to follow stated

corporate priorities for

capital deployment

Provision expected to

adjust with changes to

risk grade, other

indications of credit

quality, and loan volume

YoY

Progress

YoY

Progress

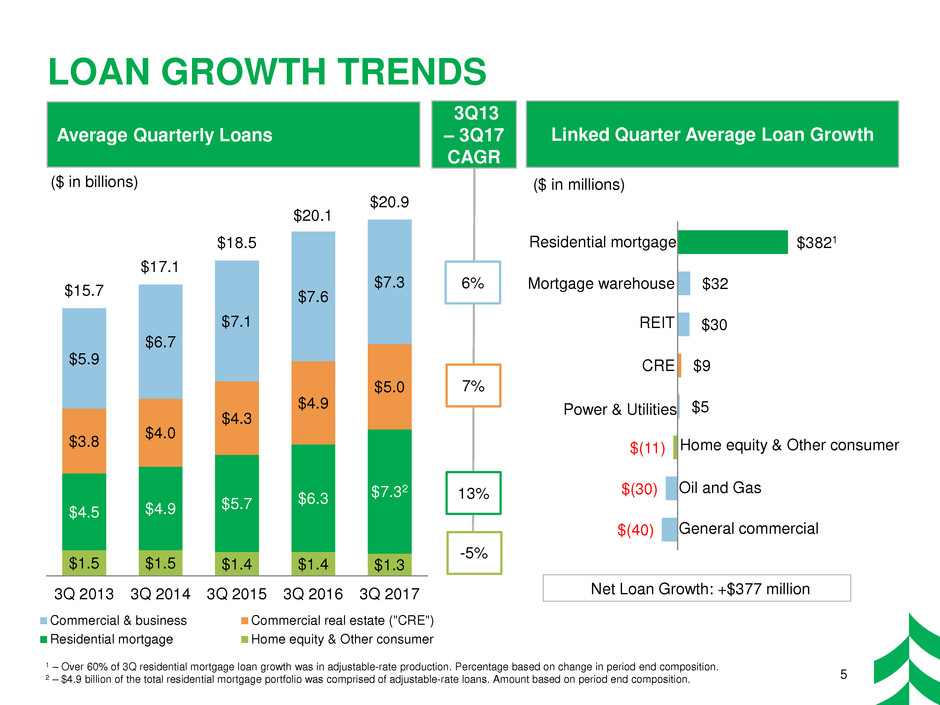

$1.5 $1.5 $1.4 $1.4 $1.3

$4.5 $4.9 $5.7

$6.3 $7.3

2

$3.8 $4.0

$4.3

$4.9

$5.0

$5.9

$6.7

$7.1

$7.6

$7.3 $15.7

$17.1

$18.5

$20.1

$20.9

3Q 2013 3Q 2014 3Q 2015 3Q 2016 3Q 2017

Commercial & business Commercial real estate ("CRE")

Residential mortgage Home equity & Other consumer

Net Loan Growth: +$377 million

LOAN GROWTH TRENDS

($ in billions)

5%

Average Quarterly Loans

6%

7%

13%

$(40)

$(30)

$(11)

$5

$9

$30

$32

$3821

Home equity & Other consumer

CRE

Residential mortgage

Power & Utilities

Mortgage warehouse

REIT

Oil and Gas

General commercial

Linked Quarter Average Loan Growth

1 – Over 60% of 3Q residential mortgage loan growth was in adjustable-rate production. Percentage based on change in period end composition.

2 – $4.9 billion of the total residential mortgage portfolio was comprised of adjustable-rate loans. Amount based on period end composition.

($ in millions)

5

3Q13

– 3Q17

CAGR

-5%

$2.2 $2.2

$3.2

$3.7

$2.6

$18.9 $18.7

$21.1

$22.2 $22.6

3Q 2013 3Q 2014 3Q 2015 3Q 2016 3Q 2017

12.1% 12.1%

15.6%

17.2%

11.7%

Loan to Deposit Ratio

CONSISTENT DEPOSIT GROWTH

($ in billions)

Period End Deposits &

Customer Funding

Average Quarterly Deposits

6%

6%

$1.8 $1.5 $1.6 $1.6 $2.2

$1.2 $1.3 $1.4 $1.4

$1.5

$7.6 $7.7

$9.5 $9.1

$9.4

$2.8 $3.1

$3.2 $4.2

$4.3 $4.3 $4.2

$4.6

$5.2

$5.0

$17.6 $17.9

$20.3

$21.4

$22.4

3Q 2013 3Q 2014 3Q 2015 3Q 2016 3Q 2017

Time deposits Savings

Money market Interest-bearing demand

Noninterest-bearing demand

($ in billions)

NTDs as % of Total Deposits

Network Transaction Deposits ("NTD")

Customer Funding

Customer Deposits1 6

1 – Total deposits excluding network transaction deposits

12%

85%

94%

90% 91%

94%

3Q13

– 3Q17

CAGR

4%

5%

ACQUISITION OF BANK MUTUAL

7

Associated Banc-Corp

Acquisition of

July 20, 2017

Bank Mutual Profile

Third Quarter 2017

Branches1 58

Loans $2.0bn

Deposits $1.9bn

Revenue2 $99mm

Expenses2 $71mm

Transaction Pricing

100% stock transaction

- 0.422 exchange ratio

1.6x price / tangible book value per share

of $6.33 as of June 30, 2017

12.5x price / 2017E EPS with fully phased-

in 45% after-tax cost savings3

Founded 1892

Milwaukee, WI

1 – 57 branches in WI and one branch in MN

2 – Twelve months ended September 30, 2017

3 – Based on BKMU IBES median 2017E EPS of $0.38

ASSOCIATED’S PRO FORMA FOOTPRINT

Pro Forma Branch Footprint

Strengthens our position as largest bank

headquartered in the state of Wisconsin

- > $32bn combined total assets

- Adds > 120,000 customer accounts to

the Associated franchise

Significant efficiency opportunities

- 50% of Bank Mutual branches are within

1 mile of an Associated branch

- Several shared key technology vendors

- Positioned to further invest in and better

support the customer experience

Continued commitment to supporting the

socioeconomic health of our combined

communities and markets

- Expanding services into nearly a dozen

new markets

- Offers new customers access to

Associated's broader network and

solutions

Improved Scale and Customer Reach

8

Commercial

& Business

Lending

34%

CRE

Investor

18%

Construction

8%

Residential

Mortgage

34%

Home Equity

& Other

Consumer

6%

Money

Market

36%

Noninterest-

bearing

demand

23%

Interest-

bearing

demand

22%

Savings

7%

Time

Deposit

12%

Money

Market

37%

Noninterest-

bearing

demand

23%

Interest-

bearing

demand

22%

Savings

7%

Time

Deposit

11%

Money

Market

28%

Noninterest-

bearing

demand

16%

Interest-

bearing

demand

12%

Savings

12% Time

Deposit

32%

Commercial

& Business

Lending

18%

CRE

Investor

42%

Construction

8%

Residential

Mortgage

23%

Home Equity

& Other

Consumer

9%

PRO FORMA LOANS & DEPOSITS

Note: Figures as of September 30, 2017

1 – Cost of deposits includes interest-bearing deposits only

Lo

an

s

D

ep

os

its

Associated

Bank Mutual

Pro Forma

Associated

Bank Mutual

Pro Forma

9

Total Loans = $20.9bn

Yield on Loans = 3.77%

Total Loans = $2.0bn

Yield on Loans = 4.09%

Total Loans = $22.9bn

Yield on Loans = 3.80%

Total Deposits = $22.3bn

Cost of Deposits1 = 0.63%

Total Deposits = $1.9bn

Cost of Deposits1 = 0.45%

Total Deposits = $24.3bn

Cost of Deposits1 = 0.62%

Commercial

& Business

Lending

35%

CRE

Investor

16%

Construction

8%

Residential

Mortgage

35%

Home Equity

& Other

Consumer

6%

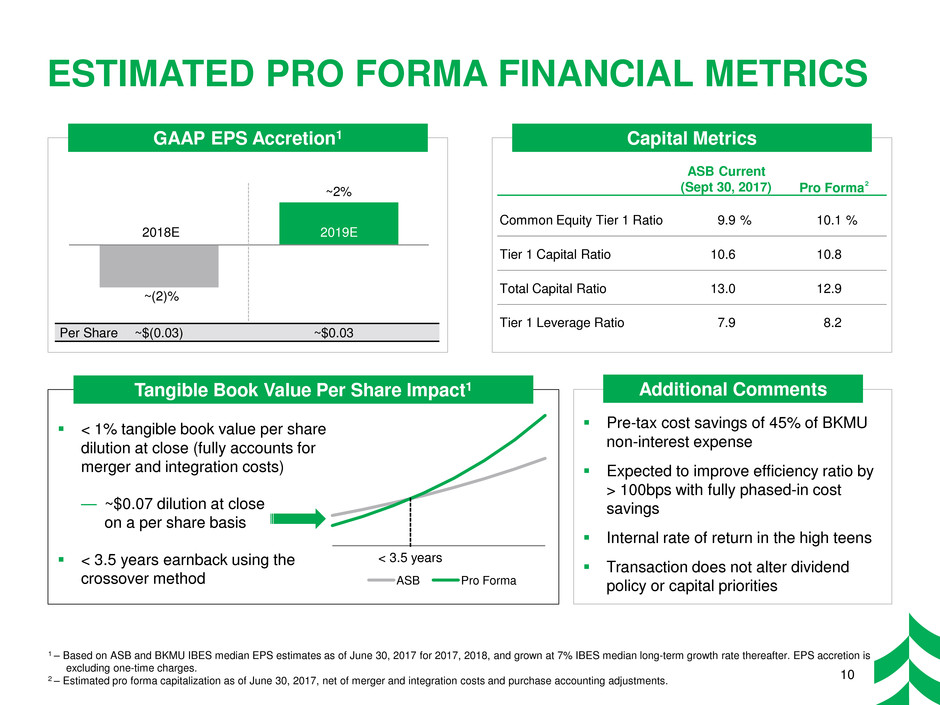

ESTIMATED PRO FORMA FINANCIAL METRICS

1 – Based on ASB and BKMU IBES median EPS estimates as of June 30, 2017 for 2017, 2018, and grown at 7% IBES median long-term growth rate thereafter. EPS accretion is

excluding one-time charges.

2 – Estimated pro forma capitalization as of June 30, 2017, net of merger and integration costs and purchase accounting adjustments.

GAAP EPS Accretion1

Pre-tax cost savings of 45% of BKMU

non-interest expense

Expected to improve efficiency ratio by

> 100bps with fully phased-in cost

savings

Internal rate of return in the high teens

Transaction does not alter dividend

policy or capital priorities

Additional Comments

Capital Metrics

Tangible Book Value Per Share Impact1

< 1% tangible book value per share

dilution at close (fully accounts for

merger and integration costs)

— ~$0.07 dilution at close

on a per share basis

< 3.5 years earnback using the

crossover method

Per Share ~$(0.03) ~$0.03

~2%

~(2)%

2018E 2019E

10

2

ASB Current

(Sept 30, 2017)

Pro Forma

Common Equity Tier 1 Ratio 9.9 % 10.1 %

Tier 1 Capital Ratio 10.6 10.8

Total Capital Ratio 13.0 12.9

Tier 1 Leverage Ratio 7.9 8.2

ASB Pro Forma

< 3.5 years

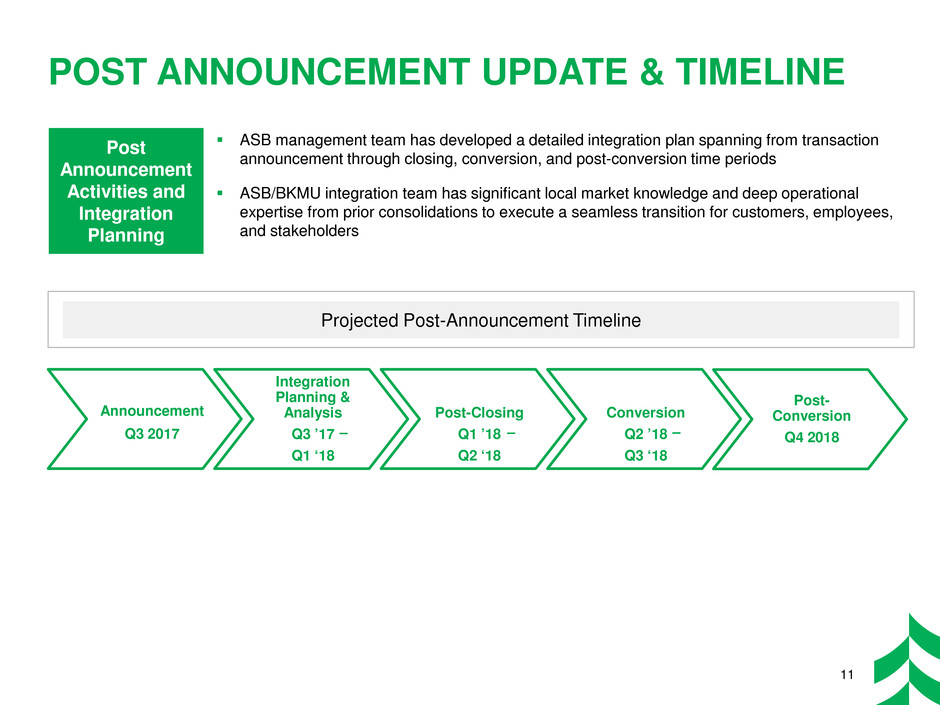

POST ANNOUNCEMENT UPDATE & TIMELINE

Post

Announcement

Activities and

Integration

Planning

ASB management team has developed a detailed integration plan spanning from transaction

announcement through closing, conversion, and post-conversion time periods

ASB/BKMU integration team has significant local market knowledge and deep operational

expertise from prior consolidations to execute a seamless transition for customers, employees,

and stakeholders

Projected Post-Announcement Timeline

Integration

Planning &

Analysis

Q3 ’17

Q1 ‘18

Post-Closing

Q1 ’18

Q2 ‘18

Conversion

Q2 ’18

Q3 ‘18

Post-

Conversion

Q4 2018

Announcement

Q3 2017 –

–

–

11

ACCELERATES 2017 STRATEGIC PRIORITIES

Strengthening

Customer

Relationships

Delivering

on our

Strategy

Expanding our

Community

Presence

Providing

Long-term Value

to Shareholders

A low-risk transaction with significant opportunities for cost savings

Expected to produce modest initial dilution to tangible book value per share

with positive EPS accretion in 2019

Expected to improve efficiency ratio by > 100bps with fully phased-in cost

savings

Strengthens core deposit franchise

Enhances branch network and density

Increases current market share and expands services to new communities

Delivers smaller sized, in-market, depository institution acquisition

Drives efficiency through improved scale and distribution

Disciplined transaction terms with attractive economics

Adds over 120,000 customer accounts and nearly 1,000 commercial

relationships

Extends Associated’s specialized products to Bank Mutual’s customer base

Positions Associated to gain efficiencies and further invest in customer

experience

12

$46 $48 $49 $47 $49

$15 $16 $15 $16 $17

$7 $61 $64 $64 $63

$73

2013 2014 2015 2016 20172

• On October 2, 2017, we completed the acquisition of a wealth management organization, Whitnell & Co., an Oak

Brook, Illinois based, $1 billion AUM registered investment advisor, to further complement Associated’s investment

and asset management capabilities, especially in Chicago

• Whitnell’s 28 professionals provide affluent Mid-Western clients with a complete set of family office services

centered around wealth management and generational wealth transfer

− The acquisition adds a strong team to our existing Chicago-land private banking presence and introduces

new services and capabilities to Associated’s existing client base

− The acquisition increases both assets under management and related run-rate revenue by more than 10%

ASSET MANAGEMENT EXPANSION

Enhanced Big-Firm Financial Services With a Family Touch

Assets Under Management (“AUM”) Trust Service Fees and Brokerage

and Annuity Commissions

($ in billions) ($ in millions)

13

ATC Whitnell Trust Service Fees Whitnell

$7.4

$8.0 $7.7

$8.3

$9.2

$1.0

2013 2014 2015 2016 Sept 20171

1 – Pro Forma Associated Trust Company (“ATC”), including Whitnell

2 – Pro Forma Associated Trust Company, including Whitnell, for the twelve months ended September 30, 2017

Brokerage & Annuity Commissions

>$10Bn

70% 70% 70%

68%

66% 68% 68% 68%

66%

64%

YTD 3Q13 YTD 3Q14 YTD 3Q15 YTD 3Q16 YTD 3Q17

Federal Reserve Fully tax-equivalent

Efficiency Ratio1

Enhanced

Automation

Operational

Efficiencies

Branch

Consolidations

Branch Staffing

Initiatives

OVERALL EXPENSE EFFICIENCY

Efficiency Drivers

1 – The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the

sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio, which is a non-GAAP

financial measure, is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully

tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Refer to the appendix for a reconciliation of the Federal

Reserve efficiency ratio to the fully tax-equivalent efficiency ratio.

14

~240

214

2.92%

2.41%

2013 2014 2015 2016 Sept 2017

Branches (period end)

Annualized YTD

Noninterest Expense /

YTD Average Assets

240

214

~

73%

44%

September 2013 September 2017

27%

56%

September 2013 September 2017

Customers continue to seek more efficient ways to bank. Digital capabilities are key to meeting their

rising expectations. Associated is actively enhancing its multichannel approach and will be deploying

new mobile solutions in early 2018.

SHIFT TO DIGITAL CHANNELS

15

Branch Transactions / Total Transactions Adopting a Multichannel Approach

Online

Banking

Branch

ATM

Chat,

Email,

Text

Snap

Deposit

Call

Center

Branches

Transactions by Digital & Remote Channels

ATM

Lockbox

Remote Deposit Capture

SnapDeposit

Funding Organic Growth Paying a Competitive Dividend

Non-Organic Growth Opportunities Share Repurchases

$15.7 $17.1

$18.5

$20.1 $20.9

3Q 2013 3Q 2014 3Q 2015 3Q 2016 3Q 2017

CAPITAL PRIORITIES

16

$0.33

$0.37

$0.41

$0.45

$0.50

2013 2014 2015 2016 2017

11%

CAGR

7%

CAGR

Average Quarterly Loans; ($ in billions) Full Year Declared Dividends

2015

$60

$180

$439

$532 $552

$589

2012 2013 2014 2015 2016 YTD 2017

Cumulative Common Share Repurchases

($ in millions)

2017

2017

Announced

Completed

1 2

3 4

Earnings Per Share Dividends

Shareholder Gain Return on Average Common Equity

$0.34

$0.41

3Q 2016 3Q 2017

Return on average CET11

$0.12 $0.14

4Q 2016 4Q 2017

15%

annualized

TSR

EXPANDING BOTTOM LINE

17

As of September 30, 2017

Exceptional Value

1 – Refer to the appendix for a reconciliation of average common equity Tier 1 to average common equity

“We’ve shaped our success

around a shared vision to

become the Midwest’s

premier financial services

company, distinguished by

consistent, quality customer

experiences, built upon a

strong commitment to our

colleagues and the

communities we serve,

resulting in exceptional

value to our shareholders

through economic cycles.”

+21%

YoY

+17%

YoY

10.5%

11.7%

Return on average common equity

4Q Dividend Declared

49%

105%

Three Years Five Years

7.1% 8.2%

3Q 2016 3Q 2017

APPENDIX

$163 $128 $126 $118 $119

$127 $147 $134 $114 $92

$290 $275 $260 $232 $211

3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017

1.4% 1.4% 1.4% 1.4% 1.3%

5.5% 5.7%

6.7%

5.4% 5.2%

3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017

ALLL / Total Loans

Oil and Gas ALLL / Oil and Gas Loans

CREDIT QUALITY

($ IN MILLIONS)

Potential Problem Loans Nonaccrual Loans

19

($4)

$3

$0

$1 $3

$22

$6 $12 $8

$9

$6

$13

$11

3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017

$18

$270 $276 $262 $226 $220

$171

$75 $78

$37 $39

$441

$351 $340

$263 $259

3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017

Net Charge Offs (Recoveries) Allowance to Total Loans / Oil and Gas Loans

Oil and Gas Oil and Gas

Oil and Gas

Manufacturing

and Wholesale

Trade

25%

Power &

Utilities

14%

Real Estate

12%

Oil & Gas

8%

Finance &

Insurance

12%

Health Care and

Soc. Assist.

5% 1 – Excludes $0.4 billion Other consumer portfolio

2 – Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa

3 – Principally reflects the oil and gas portfolio

4 – Based on outstanding commitments of $917 million

5 – Our largest tenant exposure is 5%, spread over six loans, to a national investment grade grocer

C&BL by Geography

$7.3 billion

CRE by Geography

$5.0 billion

Multi-Family

29%

Retail5

24%

Office / Mixed

Use

20%

Industrial

10%

1-4 Family

Construction

9%

Hotel / Motel

5%

Other

3%

East Texas

North

Louisiana

Arkansas

17%

South Texas

& Eagle Ford

17%

Permian

16%

Rockies

14%

Marcellus

Utica

Appalachia

11%

Mid-

Continent

(primarily OK

& KS)

8% Gulf Shallow

4%

Gulf Coast

4%

Bakken

3%

Other

(Onshore

Lower 48)

6%

Wisconsin

28%

Illinois

15%

Minnesota

7%

Texas3

10%

Other

Midwest2

9%

Other

31%

Wisconsin

28%

Illinois

21%

Minnesota

9%

Other

Midwest2

26%

Texas

4%

Other

12%

LOANS STRATIFICATION OUTSTANDINGS AS OF SEPTEMBER 30, 2017

20

Total Loans1

Wisconsin

31%

Illinois

26%

Other

Midwest2

13%

Minnesota

10%

Texas

4%

Other

16%

C&BL by Industry

$7.3 billion

Oil and Gas Lending4

$577 million

CRE by Property Type

$5.0 billion

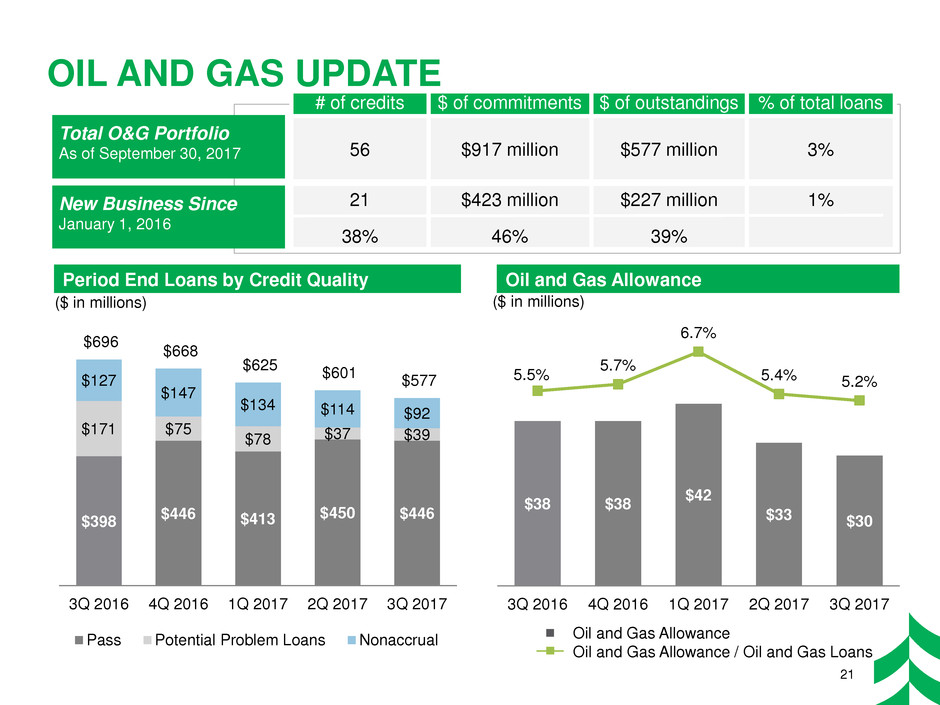

OIL AND GAS UPDATE

$398 $446 $413 $450 $446

$171 $75

$78 $37 $39

$127

$147

$134 $114 $92

$696 $668

$625 $601 $577

3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017

Pass Potential Problem Loans Nonaccrual

Period End Loans by Credit Quality Oil and Gas Allowance

$38 $38 $42

$33 $30

5.5% 5.7%

6.7%

5.4% 5.2%

3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017

($ in millions) ($ in millions)

21

Total O&G Portfolio

As of September 30, 2017

# of credits $ of commitments $ of outstandings % of total loans

56 $917 million $577 million 3%

21

38%

$423 million

46%

$227 million

39%

1%

New Business Since

January 1, 2016

Oil and Gas Allowance

Oil and Gas Allowance / Oil and Gas Loans

$90 $93 $93 $103

$122

$57 $60 $64

$66

$76 $34

$38 $39

$36

$39

$181

$191 $195

$205

$237

3Q 2013 3Q 2014 3Q 2015 3Q 2016 3Q 2017

Commercial Retail Investment and other1

POSITIONED FOR HIGHER INTEREST RATES

ASSET SENSITIVE PROFILE

($ in millions)

22

Interest Income & Net Interest Margin Average Deposit Rates

3.13% 3.06%

2.82% 2.77% 2.84%

Net interest margin

1 – Our LIBOR-based loans typically reprice the first of the month in arrears. Since the Fed tends to raise rates mid-month, we tend to see a 6+ week lag in repricing.

3Q13 vs 3Q17

Interest

Income

Change

+$56 million

3Q13 vs 3Q17

NII Change

+$29 million

3Q13 vs 3Q17

Interest

Expense

Change

-$27 million

Savings

Money Market without NTD Time Deposits

Network Transaction Deposits

Money Market with NTD (As Reported)

0.05% 0.05% 0.05% 0.05% 0.06%

0.30% 0.31%

0.42%

0.52%

0.65%

0.78% 0.78% 0.79%

0.85%

0.97%

3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017

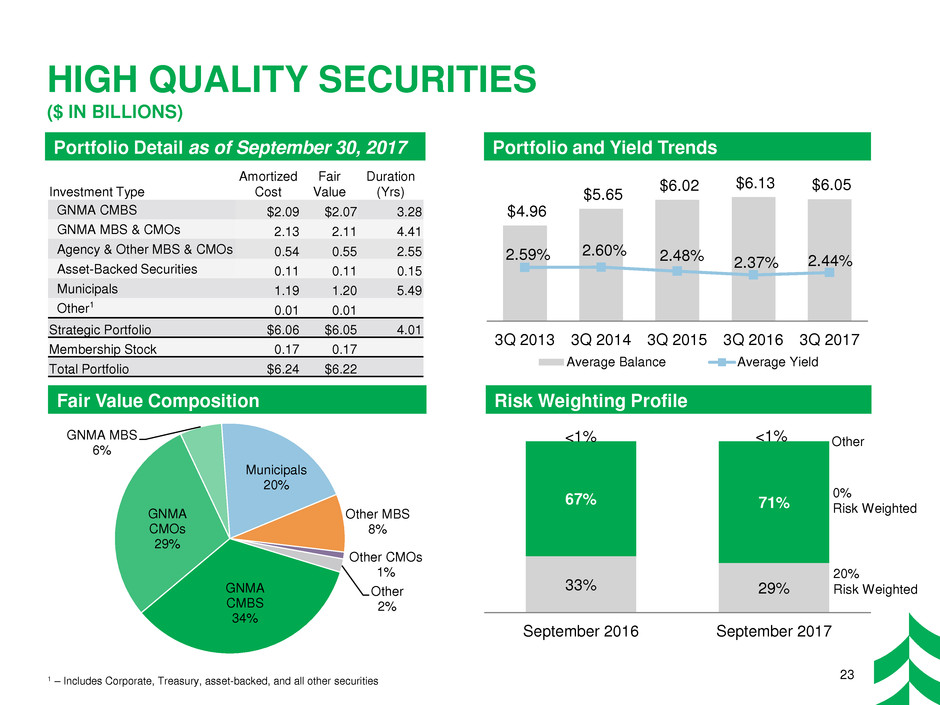

Fair Value Composition Risk Weighting Profile

$4.96

$5.65 $6.02

$6.13 $6.05

2.59% 2.60% 2.48% 2.37% 2.44%

1.00%

2.00%

3.00%

4.00%

5.00%

3Q 2013 3Q 2014 3Q 2015 3Q 2016 3Q 2017

Average Balance Average Yield

33% 29%

67% 71%

<1% <1%

September 2016 September 2017

HIGH QUALITY SECURITIES

($ IN BILLIONS)

Investment Type

Amortized

Cost

Fair

Value

Duration

(Yrs)

GNMA CMBS $2.09 $2.07 3.28

GNMA MBS & CMOs 2.13 2.11 4.41

Agency & Other MBS & CMOs 0.54 0.55 2.55

Asset-Backed Securities 0.11 0.11 0.15

Municipals 1.19 1.20 5.49

Other1 0.01 0.01

Strategic Portfolio $6.06 $6.05 4.01

Membership Stock 0.17 0.17

Total Portfolio $6.24 $6.22

GNMA

CMBS

34%

GNMA

CMOs

29%

GNMA MBS

6%

Municipals

20%

Other MBS

8%

Other CMOs

1%

Other

2%

Portfolio Detail as of September 30, 2017 Portfolio and Yield Trends

0%

Risk Weighted

Other

20%

Risk Weighted

1 – Includes Corporate, Treasury, asset-backed, and all other securities 23

Efficiency Ratio YTD 3Q13 YTD 3Q14 YTD 3Q15 YTD 3Q16 YTD 3Q17

Federal Reserve efficiency ratio 70.20% 70.19% 69.79% 67.51% 65.64%

Fully tax-equivalent adjustment (1.44)% (1.35)% (1.38)% (1.32)% (1.27)%

Other intangible amortization (0.42)% (0.40)% (0.34)% (0.20)% (0.18)%

Fully tax-equivalent efficiency ratio 68.34% 68.44% 68.07% 65.99% 64.19%

The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by

the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio, which is a

non-GAAP financial measure, is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization,

divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Management

believes the fully tax-equivalent efficiency ratio, which adjusts net interest income for the tax-favored status of certain loans and investment securities, to be

the preferred industry measurement as it enhances the comparability of net interest income arising from taxable and tax-exempt sources.

RECONCILIATION AND DEFINITIONS OF

NON-GAAP ITEMS

24

Average Tangible Common Equity and Average Common Equity Tier 1

($ in millions) 3Q 2016 3Q 2017

Average common equity $2,911 $3,025

Average goodwill and other intangible assets, net (988) (986)

Average tangible common equity 1,923 2,039

Less: Accumulated other comprehensive income / loss (3) 49

Less: Deferred tax assets / deferred tax liabilities, net 33 32

Average common equity Tier 1 $1,953 $2,120