Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Phillips Edison & Company, Inc. | pentr_20170930exhibit991.htm |

| 8-K - 8-K - Phillips Edison & Company, Inc. | pentr-20170930x8kearnings.htm |

Third Quarter 2017 Results Presentation

Thursday, November 9, 2017

2 www.phillipsedison.com

Agenda

R. Mark Addy - Executive Vice President

• Portfolio Results

• Financial Results

• Shareholder Repurchase Program (SRP)

Jeff Edison - Chairman and CEO

• Estimated Value per Share Update

• Acquisition of Phillips Edison Limited Partnership (PELP)

• Liquidity

Question and Answer Session

3 www.phillipsedison.com

Forward-Looking

Statement Disclosure

This presentation and the corresponding call may contain forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These

statements include, but are not limited to, statements related to the Company’s expectations regarding the

performance of its business, its financial results, its liquidity and capital resources, the quality of the Company’s

portfolio of grocery anchored shopping centers and other non-historical statements. You can identify these

forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward-

looking statements are subject to various risks and uncertainties, such as the risks that retail conditions may

adversely affect our base rent and, subsequently, our income, and that our properties consist primarily of retail

properties and our performance, therefore, is linked to the market for retail space generally, as well as other

risks described under the section entitled "Risk Factors" in the Company's Annual Report on Form 10-K for

the year ended December 31, 2016, and the Company's Quarterly Report on Form 10-Q for the quarter

ended September 30, 2017, as such factors may be updated from time to time in the Company’s periodic filings

with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be

important factors that could cause actual outcomes or results to differ materially from those indicated in

these statements. These factors should not be construed as exhaustive and should be read in conjunction with

the other cautionary statements that are included in this presentation, the corresponding call and in the

Company’s filings with the SEC. The Company undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information, future events, or otherwise.

4 www.phillipsedison.com

Portfolio Highlights

September 30,

2017

October 4,

2017

Total Properties 159 235

Leading Grocery

Anchors 25 34

States 28 32

Square Feet 17.4 million 26.1 million

Leased Occupancy 96.4% 94.4%

Rent from grocer,

national and

regional tenants

78.0% 77.5%

5 www.phillipsedison.com

Q3 2017 Portfolio Results

Grocer % of ABR

# of

Locations

Kroger 9.2% 41

Publix Super Markets 7.3% 32

Ahold Delhaize 4.0% 10

Albertsons Companies 3.7% 13

Giant Eagle 2.6% 7

Top 5 Grocers by % of Annualized Base Rent

Annualized Base Rent by Tenant Type Annualized Base Rent by Tenant Industry

We calculate annualized base rent as monthly contractual rent as of September 30, 2017, multiplied by 12 months.

6 www.phillipsedison.com

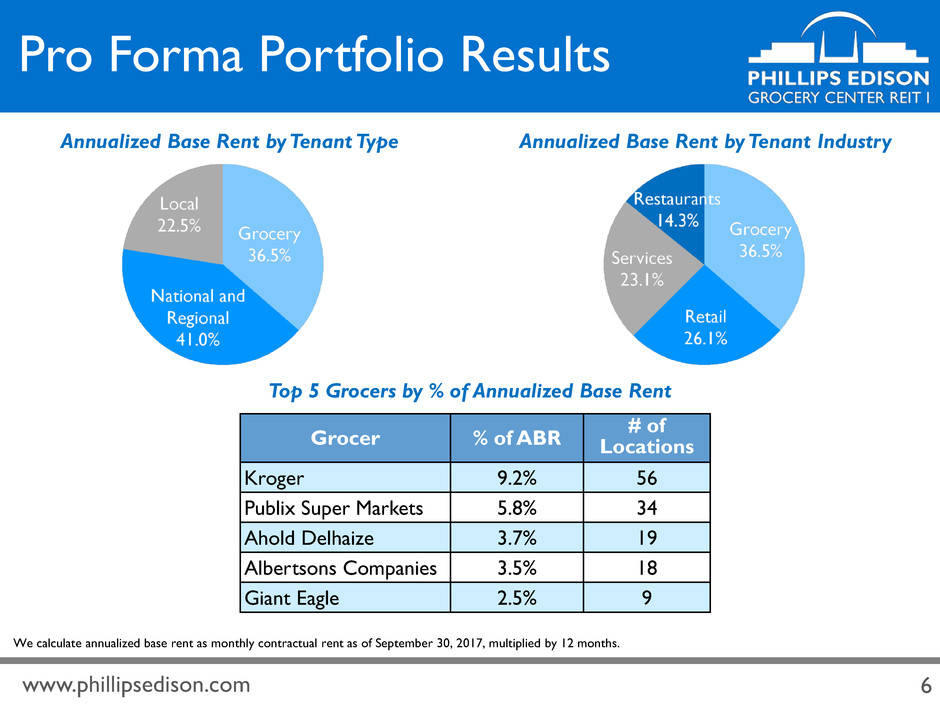

Pro Forma Portfolio Results

Grocer % of ABR

# of

Locations

Kroger 9.2% 56

Publix Super Markets 5.8% 34

Ahold Delhaize 3.7% 19

Albertsons Companies 3.5% 18

Giant Eagle 2.5% 9

Top 5 Grocers by % of Annualized Base Rent

Annualized Base Rent by Tenant Type Annualized Base Rent by Tenant Industry

We calculate annualized base rent as monthly contractual rent as of September 30, 2017, multiplied by 12 months.

7 www.phillipsedison.com

Acquisition Highlights

Q3 2017 Acquisition Activity

Name Location Grocer GLA

Hoffman Village Hoffman Estates, IL Marino's Fresh Market 159,443

Acquisition of Real Estate from PELP

# of Assets States

% ABR from Grocers, National

and Regional Tenants

GLA

76 25 76% 8.7 million

Acquisition of Third Party Asset Management Business from PELP

# of Centers Under

Management

GLA Under

Management

Value of Assets Under

Management

111 12.2 million $2.1 billion

8 www.phillipsedison.com

Q3 2017 Financials - 3 Month Results

Three Months Ended September 30,

(in 000s) 2017 2016 $ Change % Change

Net (Loss) Income Attributable to

Stockholders

$ (8,232 ) $ 2,464 $ (10,696 ) NM

Adjustments(1) $ 28,240 $ 26,186 $ 2,054 7.8 %

Funds from Operations (FFO) $ 20,008 $ 28,650 $ (8,642 ) (30.2 )%

Adjustments(2) $ 7,744 $ (1,115 ) $ 8,859 NM

Modified Funds from Operations

(MFFO)

$ 27,752 $ 27,535 $ 217 0.8 %

(1) Adjustments include Depreciation and amortization of real estate assets and Noncontrolling interest.

(2) Adjustments include Acquisition expenses, Loss (gain) on extinguishment of debt, Straight-line rental income, Amortization of market debt

adjustment, Change in fair value of derivatives, Transaction expenses, Termination of affiliate arrangements, and Noncontrolling interest.

See Appendix for a complete reconciliation of Net (loss) income to FFO and MFFO

9 www.phillipsedison.com

Q3 2017 Financials - 9 Month Results

Nine Months Ended June 30,

(in 000s) 2017 2016 $ Change % Change

Net (Loss) Income Attributable to

Stockholders

$ (8,319 ) $ 5,243 $ (13,562 ) NM

Adjustments(1) $ 83,237 $ 77,095 $ 6,142 8.0 %

Funds from Operations (FFO) $ 74,918 $ 82,338 $ (7,420 ) (9.0 )%

Adjustments(2) $ 10,147 $ (3,066 ) $ 13,213 NM

Modified Funds from Operations

(MFFO)

$ 85,065 $ 79,272 $ 5,793 7.3 %

(1) Adjustments include Depreciation and amortization of real estate assets and Noncontrolling interest.

(2) Adjustments include Acquisition expenses, Loss (gain) on extinguishment of debt, Straight-line rental income, Amortization of market debt

adjustment, Change in fair value of derivatives, Transaction expenses, Termination of affiliate arrangements, and Noncontrolling interest.

See Appendix for a complete reconciliation of Net (loss) income to FFO and MFFO

10 www.phillipsedison.com

Q3 2017 Same-Center(1) Net Operating

Income (NOI) - 3 Month Results

Three Months Ended September 30,

(in 000s) 2017 2016 $ Change % Change

Revenues:

Rental income(2) $ 42,621 $ 41,797 $ 824

Tenant recovery income 13,620 14,020 (400 )

Other property income 274 195 79

56,515 56,012 503 0.9 %

Operating expenses:

Property operating expenses 8,831 8,813 18

Real estate taxes 8,179 7,909 270

17,010 16,722 288 1.7 %

Total Same-Center NOI $ 39,505 $ 39,290 $ 215 0.5 %

(1) Represents 137 properties that we owned and operated prior to January 1, 2016, excluding nine properties classified as redevelopment.

(2) Excludes Straight-line rental income, Net amortization of above- and below-market leases, and Lease buyout income.

11 www.phillipsedison.com

Q3 2017 Same-Center(1) NOI -

9 Month Results

Nine Months Ended September 30,

(in 000s) 2017 2016 $ Change % Change

Revenues:

Rental income(2) $ 127,588 $ 124,664 $ 2,924

Tenant recovery income 41,337 42,583 (1,246 )

Other property income 615 562 53

169,540 167,809 1,731 1.0 %

Operating expenses:

Property operating expenses 26,563 26,673 (110 )

Real estate taxes 24,731 24,774 (43 )

51,294 51,447 (153 ) (0.3 )%

Total Same-Center NOI $ 118,246 $ 116,362 $ 1,884 1.6 %

(1) Represents 137 properties that we owned and operated prior to January 1, 2016, excluding nine properties classified as redevelopment.

(2) Excludes Straight-line rental income, Net amortization of above- and below-market leases, and Lease buyout income.

12 www.phillipsedison.com

Debt Profile

1) Calculated as net debt (total debt, excluding below-market debt adjustments and deferred financing costs, less cash and

cash equivalents) as a percentage of enterprise value (equity value, calculated as total common shares and OP units

outstanding multiplied by the estimated value per share of $10.20, plus net debt).

2) Calculates debt to enterprise value using the same method above, using the estimated value per share of $11.00.

September 30, 2017

Pro Forma as of

October 31, 2017

Debt to Enterprise Value: 39.1%1 41.9%2

Weighted-Average Interest Rate: 3.1% 3.4%

Weighted-Average Years to Maturity: 3.0 6.0

Fixed-Rate Debt: 68.1% 88.5%

Variable-Rate Debt: 31.9% 11.5%

13 www.phillipsedison.com

Share Repurchase Program

Our Share Repurchase Program (SRP) states that the cash available for repurchases on any particular date will generally be

limited to the proceeds from the DRIP during the preceding four fiscal quarters, less any cash already used for repurchases

since the beginning of the same period; however, subject to the limitation described above, we may use other sources of

cash at the discretion of the board of directors. In accordance with the SRP, shares will still be repurchased due to a

stockholder’s death, “qualifying disability,” or “determination of incompetence.”

14 www.phillipsedison.com

Estimated Value per Share Update

• Duff & Phelps, a third-party valuation firm, produced an estimated

value per share in the range of $10.34 to $11.70 as of October 5,

2017

• The Board of Directors increased the estimated value per share by 8%

to $11.00*

• 10% increase from the original offering price of $10.00 per share

· Represents the increased value of the company after the PELP acquisition

· Illustrates the value of the the company's real estate management

platform

· Confirms the strength of grocery-anchored retail real estate

*As of November 8, 2017. Please note that the estimated value per share is not intended to represent an enterprise or liquidation value of our company. It is important to remember that the estimated value per share

may not reflect the amount you would obtain if you were to sell your shares or if we liquidated our assets. Further, the estimated value per share is as of a moment in time, and the value of our shares and assets may

change over time as a result of several factors including, but not limited to, future acquisitions or dispositions, other developments related to individual assets, and changes in the real estate and capital markets, and we

do not undertake to update the estimated value per share to account for any such events. You should not rely on the estimated value per share as being an accurate measure of the then-current value of your shares in

making a decision to buy or sell your shares, including whether to participate in our dividend reinvestment plan or our SRP. For a description of the methodology and assumptions used to determine the estimated value

per share, see our recent 8-K filing made with the U.S. Securities and Exchange Commission.

15 www.phillipsedison.com

Acquired PELP

on October 4, 2017

• We acquired 76 real estate assets and the third-party asset

management businesses from our sponsor, PELP

• Formed an internally-managed REIT exclusively focused on

grocery-anchored shopping centers with a total enterprise

value of approximately $4 billion

• The combined enterprise owns:

· Diversified portfolio of 235 shopping centers comprising

approximately 26.1 million sq. ft. located in 32 states

· Third-party asset management business that manages over $2

billion of grocery-anchored shopping centers.

• The proposal to approve the transaction was approved by

91.4% of the shares which were voted by proxy on the matter

16 www.phillipsedison.com

Benefits of the Acquisition

• Expected to be immediately 8% - 10% accretive to MFFO per share

• Estimated pro forma dividend coverage expected to exceed 100%

• Realized meaningful cost synergies through internal management

• Strengthened balance sheet

• Increased future earnings growth potential

• Improved valuation potential resulting from increased earnings, scale and

internalized manager

• Asset management fees provide consistent, predictable income through market

cycles

• Managed portfolios provide embedded acquisition pipeline with increased

opportunities for growth

We are now the largest internally-managed REIT exclusively

focused on grocery-anchored properties

17 www.phillipsedison.com

Management Aligned with

Shareholders

• Equity-based consideration and earn-out aligned management with

stockholders and preserves capital for future investments

• Management is now the Company's largest stockholder, owning

10.0% of the combined company, with a long term view of increasing

stockholder value

• Earn-out structure incentivizes future performance - including a

liquidity event and achievement of certain fundraising targets for

REIT III

All positive steps toward a liquidity event

for PECO Shareholders

18 www.phillipsedison.com

Changing our Name to:

Phillips Edison & Company, Inc.

19 www.phillipsedison.com

Market Update - Competitive Market

Reflects Demand for Quality Real Estate

• Amazon - Whole Foods: $13.7 billion investment into brick & mortar

· Amazon Fresh cutting back delivery to select markets

• German grocers - Investing and expanding in the U.S. market

· Lidl - Investing $3.0 billion to open 100 stores by the end of summer 2018

· Aldi - Investing $3.4 billion to remodel stores and expand footprint

• Traditional Grocers continues to evolve

· Sprouts - reported strong Q3 results despite its meaningful geographic

overlap with Whole Foods' price reductions

· Raised sales and earnings estimates - opened 32 stores YTD

· Kroger: delivery (Instacart), ClickList (shop online, pick up in store),

private label, meal kits, ready-to-eat, data collection, etc.

· Q2 2017 rebound in same-store sales - positive quarter

20 www.phillipsedison.com

Question and Answer Session

If you are logged in to the webcast presentation, you can submit a

question by typing it into the text box, and clicking submit.

For More Information:

Thank You

InvestorRelations@PhillipsEdison.com

www.phillipsedison.com

DST: (888) 518-8073

Griffin Capital Securities: (866) 788-8614

Appendix

23 www.phillipsedison.com

We present Same-Center Net Operating Income (“Same-Center NOI”) as a supplemental measure of our performance. We define Net Operating Income (“NOI”) as total operating

revenues, adjusted to exclude lease buy-out income and non-cash revenue items, less property operating expenses and real estate taxes. Same-Center NOI represents the NOI for the

137 properties that were owned and operational for the entire portion of both comparable reporting periods, except for those properties we classify as redevelopment during either of

the periods presented. A property is removed from the Same-Center pool and classified as redevelopment when it is being repositioned in the market and such repositioning is

expected to have a significant impact on property operating income. While there is judgment surrounding changes in designations, once a redevelopment property has stabilized, it is

typically moved to the Same-Center pool the following year. Currently we have identified nine properties that we classify as redevelopment properties.

We believe that NOI and Same-Center NOI provide useful information to our investors about our financial and operating performance because each provides a performance measure

of the revenues and expenses directly involved in owning and operating real estate assets and provides a perspective not immediately apparent from net income. Because Same-Center

NOI excludes the change in NOI from properties acquired after December 31, 2015 and those considered redevelopment properties, it highlights operating trends such as occupancy

levels, rental rates, and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Same-Center

NOI, and accordingly, our Same-Center NOI may not be comparable to other REITs.

Same-Center NOI should not be viewed as an alternative measure of our financial performance since it does not reflect the operations of our entire portfolio, nor does it reflect the

impact of general and administrative expenses, acquisition expenses, depreciation and amortization, interest expense, other income, or the level of capital expenditures and leasing costs

necessary to maintain the operating performance of our properties that could materially impact our results from operations.

The table below is a comparison of Same-Center NOI for the three and nine months ended September 30, 2017, to the three and nine months ended September 30, 2016 (in

thousands):

Three Months Ended September 30, Nine Months Ended September 30,

2017 2016 $ Change % Change 2017 2016 $ Change % Change

Revenues:

Rental income(1) $ 42,621 $ 41,797 $ 824 $ 127,588 $ 124,664 $ 2,924

Tenant recovery income 13,620 14,020 (400 ) 41,337 42,583 (1,246 )

Other property income 274 195 79 615 562 53

56,515 56,012 503 0.9 % 169,540 167,809 1,731 1.0 %

Operating expenses:

Property operating expenses 8,831 8,813 18 26,563 26,673 (110 )

Real estate taxes 8,179 7,909 270 24,731 24,774 (43 )

17,010 16,722 288 1.7 % 51,294 51,447 (153 ) (0.3 )%

Total Same-Center NOI $ 39,505 $ 39,290 $ 215 0.5 % $ 118,246 $ 116,362 $ 1,884 1.6 %

(1) Excludes straight-line rental income, net amortization of above- and below-market leases, and lease buyout income.

Reconciliation of Non-GAAP

Financials

24 www.phillipsedison.com

Below is a reconciliation of net (loss) income to NOI and Same-Center NOI for the three and nine months ended September 30, 2017 and 2016 (in thousands):

Three Months Ended September

30,

Nine Months Ended September

30,

2017 2016(1) 2017 2016

Net (loss) income $ (8,376 ) $ 2,490 $ (8,463 ) $ 5,326

Adjusted to exclude:

Straight-line rental income (970 ) (1,067 ) (2,913 ) (2,793 )

Net amortization of above- and below-market leases (286 ) (355 ) (972 ) (936 )

Lease buyout income (9 ) — (1,120 ) (534 )

General and administrative expenses 8,712 7,722 25,438 23,736

Termination of affiliate arrangements 5,454 — 5,454 —

Acquisition expenses 202 870 466 2,392

Depreciation and amortization 28,650 26,583 84,481 78,266

Interest expense, net 10,646 8,504 28,537 23,837

Transaction expenses 3,737 — 9,760 —

Other (6 ) (33 ) (642 ) 125

NOI 47,754 44,714 140,026 129,419

Less: NOI from centers excluded from Same-Center (8,249 ) (5,424 ) (21,780 ) (13,057 )

Total Same-Center NOI $ 39,505 $ 39,290 $ 118,246 $ 116,362

Reconciliation of Non-GAAP

Financials

(1) Certain prior period amounts have been restated to conform with current year presentation.

25 www.phillipsedison.com

Funds from Operations and Modified Funds from Operations

FFO is a non-GAAP financial measure that is widely recognized as a measure of REIT operating performance. We use FFO as defined by the National Association of

Real Estate Investment Trusts (“NAREIT”) to be net income (loss), computed in accordance with GAAP, adjusted for gains (or losses) from sales of depreciable real

estate property (including deemed sales and settlements of pre-existing relationships), plus depreciation and amortization on real estate assets and impairment

charges, and after related adjustments for unconsolidated partnerships, joint ventures, and noncontrolling interests. We believe that FFO is helpful to our investors

and our management as a measure of operating performance because, when compared year over year, it reflects the impact on operations from trends in

occupancy rates, rental rates, operating costs, development activities, general and administrative expenses, and interest costs, which are not immediately apparent

from net income.

Since the definition of FFO was promulgated by NAREIT, GAAP has expanded to include several new accounting pronouncements, such that management and many

investors and analysts have considered the presentation of FFO alone to be insufficient. Accordingly, in addition to FFO, we use MFFO, which, as defined by us,

excludes from FFO the following items:

• acquisition and transaction expenses;

• straight-line rent amounts, both income and expense;

• amortization of above- or below-market intangible lease assets and liabilities;

• amortization of discounts and premiums on debt investments;

• gains or losses from the early extinguishment of debt;

• gains or losses on the extinguishment of derivatives, except where the trading of such instruments is a fundamental attribute of our operations;

• gains or losses related to fair value adjustments for derivatives not qualifying for hedge accounting;

• adjustments related to the above items for joint ventures and noncontrolling interests and unconsolidated entities in the application of equity accounting;

• termination of affiliate arrangements.

We believe that MFFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods and, in

particular, after our acquisition stage is complete, because MFFO excludes acquisition expenses that affect operations only in the period in which the property is

acquired. Thus, MFFO provides helpful information relevant to evaluating our operating performance in periods in which there is no acquisition activity.

Reconciliation of Non-GAAP

Financials

26 www.phillipsedison.com

Many of the adjustments in arriving at MFFO are not applicable to us. Nevertheless, as explained below, management’s evaluation of our operating performance may also

exclude items considered in the calculation of MFFO based on the following economic considerations.

• Adjustments for straight-line rents and amortization of discounts and premiums on debt investments—GAAP requires rental receipts and discounts and premiums on

debt investments to be recognized using various systematic methodologies. This may result in income recognition that could be significantly different than

underlying contract terms. By adjusting for these items, MFFO provides useful supplemental information on the realized economic impact of lease terms and

debt investments and aligns results with management’s analysis of operating performance. The adjustment to MFFO for straight-line rents, in particular, is made

to reflect rent and lease payments from a GAAP accrual basis to a cash basis.

• Adjustments for amortization of above- or below-market intangible lease assets—Similar to depreciation and amortization of other real estate-related assets that are

excluded from FFO, GAAP implicitly assumes that the value of intangibles diminishes ratably over the lease term and should be recognized in revenue. Since

real estate values and market lease rates in the aggregate have historically risen or fallen with market conditions, and the intangible value is not adjusted to

reflect these changes, management believes that by excluding these charges, MFFO provides useful supplemental information on the performance of the real

estate.

• Gains or losses related to fair value adjustments for derivatives not qualifying for hedge accounting—This item relates to a fair value adjustment, which is based on the

impact of current market fluctuations and underlying assessments of general market conditions and specific performance of the holding, which may not be

directly attributable to current operating performance. As these gains or losses relate to underlying long-term assets and liabilities, management believes MFFO

provides useful supplemental information by focusing on the changes in core operating fundamentals rather than changes that may reflect anticipated, but

unknown, gains or losses.

• Adjustment for gains or losses related to early extinguishment of derivatives and debt instruments—These adjustments are not related to continuing operations. By

excluding these items, management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable

between other reporting periods and to other real estate operators.

• Adjustment for the termination of affiliate arrangements—This adjustment is related to our redemption of Class B units at the current estimated value per share

that had been earned by our former advisor for historical asset management services, and is not related to continuing operations. By excluding this item,

management believes that MFFO provides supplemental information related to sustainable operations that will be more comparable between other reporting

periods and to other real estate operators.

Neither FFO nor MFFO should be considered as an alternative to net income (loss) or income (loss) from continuing operations under GAAP, nor as an indication of

our liquidity, nor is either of these measures indicative of funds available to fund our cash needs, including our ability to fund distributions. MFFO may not be a useful

measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated.

Accordingly, FFO and MFFO should be reviewed in connection with other GAAP measurements. FFO and MFFO should not be viewed as more prominent measures of

performance than our net income or cash flows from operations prepared in accordance with GAAP. Our FFO and MFFO, as presented, may not be comparable to

amounts calculated by other REITs.

Reconciliation of Non-GAAP

Financials

27 www.phillipsedison.com

Three Months Ended September 30, Nine Months Ended September 30,

(in 000s, except per share amounts) 2017 2016 2017 2016

Calculation of FFO

Net (loss) income attributable to stockholders $ (8,232 ) $ 2,464 $ (8,319 ) $ 5,243

Adjustments:

Depreciation and amortization of real estate assets 28,650 26,583 84,481 78,266

Noncontrolling interest (410 ) (397 ) (1,244 ) (1,171 )

FFO attributable to common stockholders $ 20,008 $ 28,650 $ 74,918 $ 82,338

Calculation of MFFO

FFO attributable to common stockholders $ 20,008 $ 28,650 $ 74,918 $ 82,338

Adjustments:

Acquisition expenses 202 870 466 2,392

Net amortization of above- and below-market leases (286 ) (354 ) (972 ) (936 )

Gain on extinguishment of debt (43 ) (184 ) (567 ) (79 )

Straight-line rental income (970 ) (1,068 ) (2,913 ) (2,793 )

Amortization of market debt adjustment (267 ) (285 ) (838 ) (1,631 )

Change in fair value of derivatives (30 ) (98 ) (153 ) (66 )

Transaction expenses 3,737 — 9,760 —

Termination of affiliate arrangements 5,454 — 5,454 —

Noncontrolling interest (53 ) 4 (90 ) 47

MFFO attributable to common stockholders $ 27,752 $ 27,535 $ 85,065 $ 79,272

FFO/MFFO per share:

Weighted-average common shares outstanding - basic 183,843 184,639 183,402 183,471

Weighted-average common shares outstanding - diluted(1) 186,502 187,428 186,150 186,260

FFO per share - basic $ 0.11 $ 0.16 $ 0.41 $ 0.45

FFO per share - diluted $ 0.11 $ 0.15 $ 0.40 $ 0.44

MFFO per share - basic and diluted $ 0.15 $ 0.15 $ 0.46 $ 0.43

Reconciliation of Non-GAAP

Financials

(1) OP units and restricted stock awards were dilutive to FFO/MFFO for the three and nine months ended September 30, 2017, and, accordingly, were included in the weighted

average common shares used to calculate diluted FFO/MFFO per share.