Attached files

Exhibit 10.4

Execution Copy

PURCHASE AND SALE AGREEMENT

by and between

213 W INSTITUTE OWNER LLC, a Delaware limited liability company, and

218-224 W CHICAGO OWNER LLC, a Delaware limited liability company,

together, as Seller

and

KBSGI 213 WEST INSTITUTE PLACE, LLC, a Delaware limited liability company,

as Buyer

213 W. Institute Place and 218-224 W. Chicago Avenue,

Chicago, IL

Effective Date: August 29, 2017

NOTE: THE SUBMISSION OF THIS PURCHASE AND SALE AGREEMENT FOR REVIEW, COMMENT AND/OR EXECUTION BY BUYER SHALL NOT BE DEEMED AN OFFER BY SELLER TO SELL THE PROPERTY NOR SHALL THIS AGREEMENT BE BINDING UPON SELLER UNTIL IT IS EXECUTED BY SELLER AND AN ORIGINAL EXECUTED COUNTERPART THEREOF IS DELIVERED TO BUYER.

Table of Contents

Page | ||

ARTICLE I – CERTAIN DEFINITIONS | 3 | |

ARTICLE II – SALE OF PROPERTY | 10 | |

Section 2.1 Payment of Deposit | 10 | |

Section 2.2 Applicable Terms; Failure to Make Deposit | 10 | |

Section 2.3 Cash at Closing | 10 | |

Section 2.4 Independent Contract Consideration | 10 | |

ARTICLE III – TITLE MATTERS | 10 | |

Section 3.1 Title Defects | 10 | |

ARTICLE IV – BUYER'S DUE DILIGENCE/AS-IS SALE | 12 | |

Section 4.1 Buyer's Due Diligence | 12 | |

Section 4.2 As-Is Provisions | 12 | |

Section 4.3 Limitation on Seller's Liability | 14 | |

ARTICLE V – BANK ACCOUNTS | 14 | |

Section 5.1 Proration of Income | 14 | |

Section 5.2 Proration of Taxes and Other Property Expenses | 15 | |

Section 5.3 Closing Costs | 17 | |

Section 5.4 Delayed Adjustment; Delivery of Financial Data | 17 | |

Section 5.5 Survival | 18 | |

ARTICLE VI – CLOSING | 18 | |

Section 6.1 Closing Mechanics | 18 | |

Section 6.2 Seller's Closing Deliveries | 18 | |

Section 6.3 Buyer's Closing Deliveries | 20 | |

Section 6.4 Conditions to Buyer's Obligations | 21 | |

Section 6.5 Conditions to Seller's Obligations | 22 | |

Section 6.6 Waiver of Failure of Conditions Precedent | 22 | |

ARTICLE VII – REPRESENTATIONS AND WARRANTIES | 23 | |

Section 7.1 Buyer's Representations | 23 | |

Section 7.2 Seller's Representations | 24 | |

Section 7.3 General Provisions | 26 | |

ARTICLE VIII – COVENANTS | 27 | |

Section 8.1 Contracts, Title Instruments, and Leases | 27 | |

Section 8.2 Maintenance of Property | 29 | |

Section 8.3 Brokers | 29 | |

Section 8.4 Tax Protests; Tax Refunds and Credits | 29 | |

Section 8.5 Publicity | 30 | |

Section 8.6 Confidentiality | 30 | |

Section 8.7 Approved Estoppels and SNDAs | 31 | |

ARTICLE IX – FAILURE TO CLOSE | 31 | |

Section 9.1 Failure to Close by Buyer | 31 | |

Section 9.2 Failure to Close Due to Seller | 32 | |

Section 9.3 Indemnity Obligations | 32 | |

ARTICLE X – CASUALTY/CONDEMNATION | 32 | |

Section 10.1 Right to Terminate | 32 | |

1

Section 10.2 Allocation of Proceeds and Awards | 33 | |

Section 10.3 Insurance | 33 | |

Section 10.4 Waiver | 33 | |

ARTICLE XI – MISCELLANEOUS | 33 | |

Section 11.1 Buyer's Assignment | 33 | |

Section 11.2 Survival/Merger | 34 | |

Section 11.3 Integration; Waiver | 34 | |

Section 11.4 Governing Law | 35 | |

Section 11.5 Captions Not Binding; Exhibits | 35 | |

Section 11.6 Binding Effect | 35 | |

Section 11.7 Severability | 35 | |

Section 11.8 Notices | 35 | |

Section 11.9 Counterparts; Electronic Signatures | 37 | |

Section 11.10 No Recordation | 37 | |

Section 11.11 Additional Agreements; Further Assurances | 37 | |

Section 11.12 Construction | 37 | |

Section 11.13 Time of Essence | 37 | |

Section 11.14 JURISDICTION | 37 | |

Section 11.15 WAIVER OF JURY TRIAL | 37 | |

Section 11.16 RELEASES | 38 | |

Section 11.17 Exculpation | 38 | |

Section 11.18 Extension Rights | 38 | |

Exhibit A-1 Legal Description of 213 W Institute Property

Exhibit A-2 Legal Description of 218-224 W Chicago Property

Exhibit B List of Contracts

Exhibit C Escrow Provisions

Exhibit D Form of Deed

Exhibit E Form of Bill of Sale

Exhibit F Form of Assignment of Leases and Intangible Property

Exhibit G Form of Notice to Tenants

Exhibit H Form of FIRPTA Affidavit

Exhibit I Form of Title Affidavit

Exhibit J Form of Tenant Estoppel Certificate

Exhibit K Due Diligence Deliveries

Exhibit L List of Leases

Exhibit M Exceptions to Seller’s Warranties

Exhibit N Leasing Expense Credits to Buyer

Exhibit O Purchase Price Allocation

Exhibit P Documents Required for 3-14 Audit

Exhibit Q Form of Escrow Holdback

Exhibit R Form of Indemnity Agreement

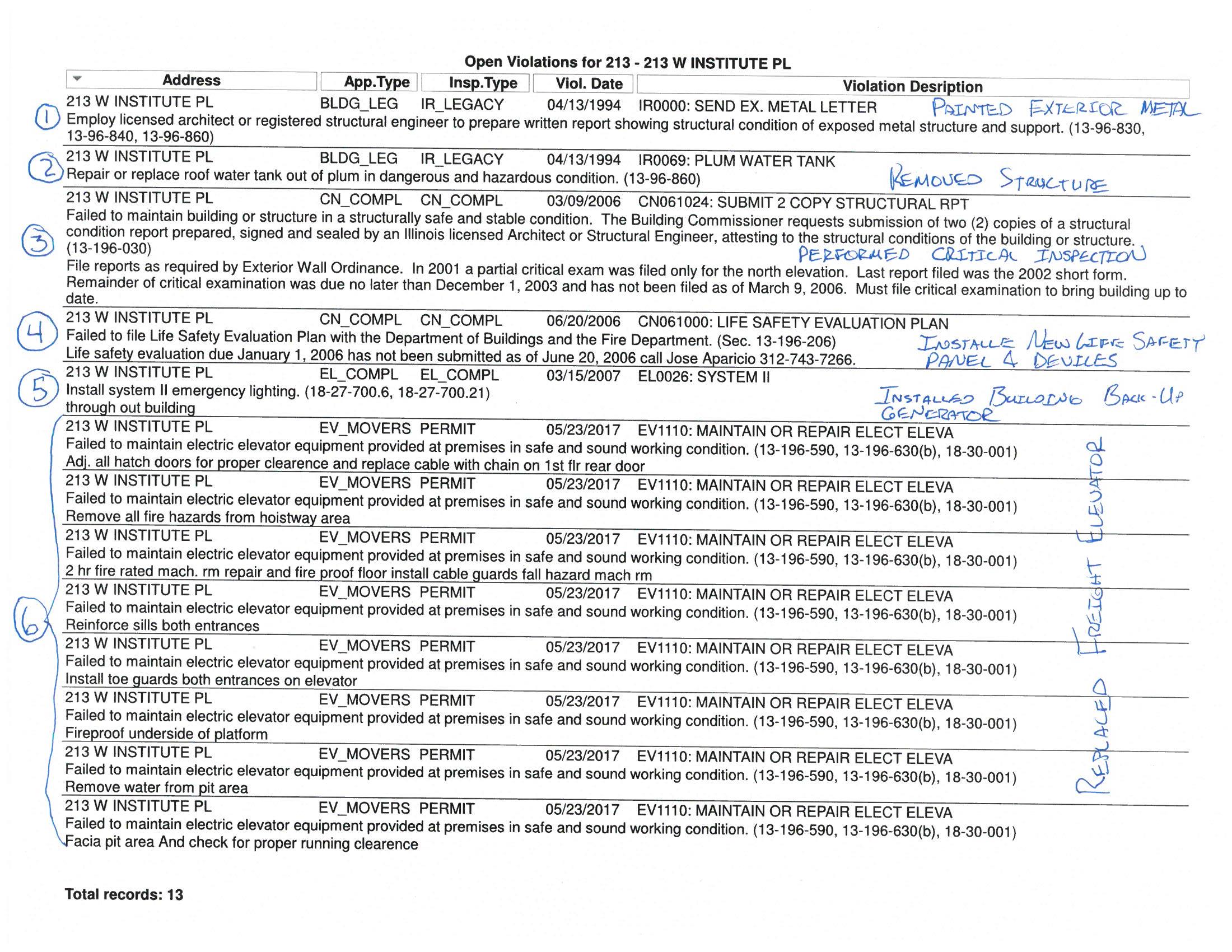

Exhibit S Outstanding Violations

2

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT (this “Agreement”) is made to be effective as of August 29, 2017 (the “Effective Date”) by and among 213 W INSTITUTE OWNER LLC, a Delaware limited liability company (“Institute Owner”) and 218-224 W CHICAGO OWNER LLC, a Delaware limited liability company (“Chicago Owner” and, collectively with Institute Owner, “Seller”) and KBSGI 213 WEST INSTITUTE PLACE, LLC, a Delaware limited liability company (together with its successors and permitted assigns, collectively, “Buyer”).

W I T N E S S E T H:

In consideration of the mutual covenants and agreements set forth herein the parties hereto do hereby agree as follows:

ARTICLE I - CERTAIN DEFINITIONS

In addition to terms defined elsewhere in this Agreement, as used herein, the following terms shall have the following meanings:

“213 W Institute Real Property” means Institute Owner’s fee interest in the real estate legally described in Exhibit A-1 attached hereto, together with all improvements and fixtures located thereon and owned by Institute Owner as of the Closing and any rights, privileges, easements, rights of way and appurtenances benefitting the foregoing real estate and improvements.

“218-224 W Chicago Real Property” means Chicago Owner’s fee interest in the real estate legally described in Exhibit A-2 attached hereto, together with all improvements and fixtures located thereon and owned by Chicago Owner as of the Closing and any rights, privileges, easements, rights of way and appurtenances benefitting the foregoing real estate and improvements.

“Access Agreement” shall have the meaning set forth in Section 4.1.

“Agreement” shall have the meaning set forth in the introductory paragraph.

“Apportionment Time” shall have the meaning set forth in Section 5.1.1.

“Approved Estoppels” shall have the meaning set forth in Section 8.7(a).

“Assignee” shall have the meaning set forth in the introductory paragraph.

“Assignment” shall have the meaning set forth in the introductory paragraph.

“Assignment Agreement” shall have the meaning set forth in Section 6.2(c).

“Bulk Sales Provisions” shall have the meaning set forth in Section 6.2(n).

3

“Business Day” shall mean any day other than Saturday, Sunday, any Federal holiday, or any holiday in the State of Illinois. If any period expires or action is to be taken on a day which is not a Business Day, the time frame for the same shall be extended until the next Business Day.

“Buyer” shall have the meaning set forth in the introductory paragraph.

“Buyer’s 3-14 Audit” shall have the meaning set forth in Section 4.1.

“Buyer’s Closing Statement” shall have the meaning set forth in Section 6.3(f).

“Buyer’s Representatives” shall mean, subject to the terms of this definition below, Buyer and any officers, directors, employees, agents, consultants, lenders, investors, representatives and attorneys of Buyer or any direct or indirect owner of any beneficial interest in Buyer if the same conduct Due Diligence on any component of the Property or are otherwise involved in the Transaction.

“Buyer’s Warranties” shall mean Buyer’s representations and warranties set forth in Section 7.1, as such representations and warranties may be deemed modified or waived by Buyer pursuant to the terms of this Agreement.

“Casualty/Condemnation Proceeds” shall have the meaning set forth in Section 10.2.

“Chicago Owner” shall have the meaning set forth in the introductory paragraph.

“Closing” shall mean the closing of the Transaction.

“Closing Date” shall mean the day that the Transaction closes, which shall not be later than the Scheduled Closing Date.

“Closing Documents” shall mean all documents executed and delivered by Buyer or Seller as required by Section 6.2 and Section 6.3 or as otherwise executed and delivered by Buyer or Seller as part of the Closing.

“Contracts” shall mean all service, supply, maintenance and utility agreements, all equipment leases, and all other contracts, subcontracts and agreements relating to the Real Property and/or the Personal Property entered into by or on behalf of Seller on or before the Effective Date which remain in effect on the Effective Date (including, without limitation, any of the foregoing relating to the construction of tenant improvements) listed on Exhibit B attached hereto, together with any additional contracts, equipment leases and agreements and any modifications of any of the foregoing that are entered into in accordance with the terms of Section 8.1 (including, without limitation, any Permitted Contracts in effect on the Closing Date), excluding, however, any Contracts terminated pursuant to the terms of this Agreement and the Leases.

“Deed” shall have the meaning set forth in Section 6.2(a).

4

“Deposit” shall mean the sum of One Million Five Hundred Thousand Dollars ($1,500,000.00), if paid, in accordance with the terms of Section 2.1 hereof, together with all interest thereon.

“Documents” shall mean the documents and materials with respect to the Seller and/or the Property or any portion thereof that any of the Seller Parties or Seller’s Broker delivers or makes available to any Buyer Representative prior to Closing or which are otherwise obtained by or are or were at any time in the possession of any Buyer Representative prior to Closing, including, without limitation, the Title Documents, the Title Commitment, Seller’s Title Policy, the Existing Survey, the Survey, any documents relating to the Property and the Property Documents.

“DOR” shall have the meaning set forth in Section 6.2(n).

“Due Diligence” shall mean any examinations, inspections, tests, studies, analyses, appraisals, evaluations and/or investigations with respect to the Property, the Documents, and any other information and documents regarding the Property, including, without limitation, Buyer’s review and approval, in its sole and absolute discretion, of all title matters, applicable land use and zoning Laws and regulations, the physical and environmental condition of the Property, leases and contracts affecting the Property, the economic status of the Property, the availability of financing, market conditions, and such other matters related to the Property as Buyer may in its sole and absolute discretion elect to examine and investigate in connection with the Transaction.

“Due Diligence Period” shall mean the period commencing prior to the execution of this Agreement and expiring upon the Effective Date.

“Effective Date” shall have the meaning set forth in the introductory paragraph.

“Elevator Work” shall have the meaning set forth in Section 6.4(e).

“Environmental Liability” shall have the meaning set forth in Section 4.2.2.

“Escrow Agent” shall mean Commonwealth Land Title Insurance Company, 4100 Newport Place Drive, Suite 120, Newport Beach, California 92660, Attention: Joy Eaton; Telephone: (949) 724-3145; Facsimile: (949) 271-5762; E-mail: joyeaton@cltic.com.

“ERISA” shall mean the Employee Retirement Income Security Act of 1974, as amended.

“Existing Survey” means, collectively, (i) “ALTA/ACSM Land Title Survey, 213 West Institute Place, Chicago, Illinois” dated January 28, 2015, prepared by Bock & Clark National Surveyors, and (ii) “ALTA/ACSM Land Title Survey, 218 W. Chicago Avenue, Chicago, Illinois” dated May 18, 2015, prepared by Gremley & Biedermann.

“Indemnitor” means, jointly and severally, Alcion Real Estate Partners Master Fund III, L.P. and Alcion Real Estate Partners Strategic Parallel Fund III, L.P.

“Independent Contract Consideration” shall have the meaning set forth in Section 2.4.

5

“Institute Owner” shall have the meaning set forth in the introductory paragraph.

“Intangible Property” shall mean the “Intangible Property” as defined in the Assignment Agreement attached hereto as Exhibit F.

“Laws” shall mean all municipal, county, State or Federal statutes, codes, ordinances, laws, rules or regulations, including, but not limited to, any environmental laws.

“Lease Expenses” shall mean, collectively, (i) leasing commission expenses, (ii) tenant improvement and landlord work expenses (either completed or to be completed), (iii) moving allowances, and (iv) free and reduced rent.

“Leases” shall mean the leases for tenants of the Real Property described on Exhibit L attached hereto (together with all new leases and modifications to leases, if any, entered after the Effective Date in accordance with Section 8.1), and all guaranties ensuring performance of the obligations under the Leases, together with all prepaid rent, damage, escrow and security deposits under the Leases, but excluding any such Lease which is not in effect at Closing.

“Liabilities” shall mean, collectively, any and all conditions, losses, costs, damages, claims, liabilities, expenses, demands or obligations of any kind or nature whatsoever, but expressly excluding speculative, consequential and punitive damages or claims for loss of profits.

“Major Casualty/Condemnation” shall have the meaning set forth in Section 10.1.

“Minimum Estoppel Threshold” shall have the meaning set forth in Section 6.4(c).

“Non-Terminable Contracts” means (a) all Permitted Contracts; and (b) the other Contracts marked on Exhibit B as Non-Terminable Contracts.

“Permitted Contracts” shall have the meaning set forth in Section 8.1(a).

“Permitted Exceptions” shall mean and include all of the following, subject to the rights of Buyer to object to title and survey matters pursuant to Article III: (a) applicable zoning, building and land use Laws, (b) such state of facts as would be disclosed by a physical inspection of the Property, (c) the lien of taxes, assessments and other governmental charges or fees not yet due and payable, (d) any exceptions caused by any Buyer’s Representative, (e) the rights of the tenants under the Leases as a tenant only, and (f) any matters deemed to constitute additional Permitted Exceptions under Section 3.1. For the avoidance of doubt, Permitted Exceptions shall not include any (i) Required Removal Exception, (ii) matters of record created by Seller in violation of Section 8.1, or (iii) any mechanics’ liens or exception for mechanics’ liens (so long as Buyer provides Seller with notice of any that appear on the Title Commitment or any update to the Title Commitment pursuant to the terms of Section 3.1), except and only to the extent Buyer either (x) receives a credit at Closing or (y) is responsible for such underlying amounts pursuant to Section 5.2.4 of this Agreement for any in process tenant improvement work that causes the Title Company to take exception for the same in the Title Policy. Notwithstanding any provision to the contrary contained in this Agreement

6

or any of the Closing Documents, any or all of the Permitted Exceptions may be omitted by Seller in the Deed without giving rise to any liability of Seller, irrespective of any covenant or warranty of Seller that may be contained in the Deed (which provisions shall survive the Closing and not be merged therein).

“Personal Property” shall mean the “Personal Property” as defined in the Bill of Sale attached hereto as Exhibit E.

“Pre-Closing Leasing Expenses” shall have the meaning set forth in Section 5.2.4(a).

“Prepared Estoppels” shall have the meaning set forth in Section 8.7(a).

“Press Release” shall have the meaning set forth in Section 8.5.

“Proceedings” shall have the meaning set forth in Section 11.4.

“Property” shall mean, collectively, (a) the Real Property, (b) the Personal Property, (c) the Leases, and (d) the Intangible Property.

“Property Documents” shall mean, collectively, (a) the Leases, (b) the Contracts, and (c) any other documents or instruments which constitute, evidence or otherwise create any portion of the Property or are used by Seller in connection with the operation thereof, including specifically, tenant correspondence files and records of tenant payables with respect to current tenants.

“Protected Information” shall mean any books, records or files (whether in a printed or electronic format) that consist of or contain any of the following: Seller’s organizational documents or files or records relating thereto; appraisals; budgets; strategic plans for the Property; internal analyses; information regarding the marketing of the Property for sale; submissions relating to obtaining internal authorization for the sale of the Property by Seller or any direct or indirect owner of any beneficial interest in Seller; attorney and accountant work product; attorney-client privileged documents; internal correspondence of Seller, any direct or indirect owner of any beneficial interest in Seller, or any of their respective affiliates and correspondence between or among such parties; or other information in the possession or control of Seller, Seller’s Property Manager or any direct or indirect owner of any beneficial interest in Seller which such party reasonably deems proprietary or privileged.

“Purchase Price” shall have the meaning set forth in the lead in paragraph of Article II.

“Remove” with respect to any exception to title shall mean that Seller causes the Title Company to remove of record and release from the Property, remove as an exception in the Title Policy (as opposed to merely “insuring over” the exception), or, to the extent such exception relates to a monetary obligation of no more than $100,000 in the aggregate, affirmatively insure over the same and provide a future coverage endorsement with respect to such affirmative insurance, without any additional cost to Buyer or any subsequent successor in title, whether such removal or affirmative insurance is made available in consideration of payment, bonding, indemnity of Seller or otherwise.

7

“Rents” shall mean all base rents, percentage rents, additional rent, rent concessions, license fees and any tax and operating expense reimbursements and escalations and common area maintenance or “CAM” charges due from the tenants of the Property under the Leases and/or their guarantors or sureties under the Leases.

“Real Property” shall mean collectively, the 213 W Institute Real Property and the 218-224 W Chicago Real Property.

“Reproration Adjustment Period” shall mean the period commencing upon the Closing Date and ending on May 31, 2018.

“Required Removal Exceptions” shall mean, collectively, (a) liens evidencing any mortgage loan encumbering the Property, (b) liens evidencing monetary and financing encumbrances (other than liens for non-delinquent real estate taxes or assessments) that were voluntarily created and caused by Seller’s acts, (c) mechanic’s liens relating to any landlord work under the leases or other construction work undertaken by or on behalf of Seller for which, and only to the extent, Buyer does not receive a credit at Closing, (d) other liens or encumbrances created as a result of the intentional acts or omissions of Seller from and after the date of this Agreement in violation of the terms of this Agreement; and (e) any exception to title that Seller has specifically agreed in writing to Remove pursuant to the terms of Section 3.1(c).

“Required Tenants” means tenants occupying and leasing at least seventy-five percent (75%) of the net rentable area of the Property, including the following tenants: (i) HQ Beercade, (ii) Cushing and Co, (iii) Haute Living, (iv) Digital Bootcamp, (v) Chicago Portfolio School, (vi) Codingdojo, (vii) Supernova Lending, and (viii) Quorn Foods.

“Scheduled Closing Date” shall mean October 16, 2017, as the same may be extended pursuant to the express terms of this Agreement.

“Seller” shall have the meaning set forth in the introductory paragraph.

“Seller Parties” shall mean and include, collectively, (a) Seller; (b) Seller’s Property Manager; (c) any direct or indirect owner of any beneficial interest in Seller; and (d) any officer, director, or employee of Seller, Seller’s Property Manager, or of any direct or indirect owner of any beneficial interest in Seller.

“Seller’s Broker” shall mean CBRE, Inc.

“Seller’s Closing Statement” shall have the meaning set forth in Section 6.2(k).

“Seller’s Knowledge” or words of similar import shall refer only to the current actual knowledge of Jeb Scherb and Ben Nummy (collectively, the “Designated Representatives”) and shall not be construed to impose upon any Designated Representative any duty to investigate the matters to which such knowledge, or the absence thereof, pertains, including, but not limited to, the contents of the materials delivered or made available to Buyer’s Representatives or the contents of files maintained by any Designated Representative. There shall be no personal liability on the part of any Designated Representative arising out of any of the Seller’s Warranties.

8

“Seller’s Liability Cap” shall mean Six Hundred Fifty-Two Thousand Five Hundred Dollars ($652,500).

“Seller’s Liability Materiality Threshold” shall mean Twenty-Five Thousand Dollars ($25,000).

“Seller’s Property Manager” shall mean Ameritus LLC or any replacement manager selected by Seller.

“Seller’s Title Policy” means, collectively, (i) that certain ALTA Owner’s Policy of Title Insurance No. 4478-1-N01140569-2015 issued to Institute Owner by Chicago Title Insurance Company in connection with the 213 W Institute Real Property, and (ii) that certain ALTA Owner’s Policy of Title Insurance No. 1401-008977809-D2 issued to Chicago Owner by Chicago Title Insurance Company in connection with the 218-224 W Chicago Real Property.

“Seller’s Warranties” shall mean Seller’s representations and warranties set forth in Section 7.2 and the Closing Documents executed by Seller for the benefit of Buyer, as such representations and warranties may be deemed modified or waived by Buyer pursuant to the terms of this Agreement.

“Seller’s Warranty Survival Period” shall have the meaning set forth in Section 7.3.3.

“SNDAs” shall have the meaning set forth in Section 8.7(b).

“Survey” shall have the meaning set forth in Section 3.1(a).

“Tax Certiorari Proceeding” shall have the meaning set forth in Section 8.4.

“Tenant Estoppel Deadline” shall have the meaning set forth in Section 6.4(c).

“Terminable Contracts” means each of the Contracts other than the Non-Terminable Contracts.

“Title Commitment” shall mean the commitment to issue an owner’s policy of title insurance with respect to the Property issued by the Title Company to Buyer.

“Title Company” shall mean Commonwealth Land Title Insurance Company, 888 S. Figueroa Street, Suite 2100, Los Angeles, California 90017, Title Coordinator: Amy Musselman; Telephone: (213) 330-3041; Facsimile: (213) 330-3085; E-mail: asmusselman@cltic.com.

“Title Documents” means all documents referred to on Schedule B II of the Title Commitment.

“Title Policy” shall have the meaning set forth in Section 6.4(b).

“Transaction” shall mean the transaction contemplated by this Agreement.

9

ARTICLE II - SALE OF PROPERTY

Subject to the terms of this Agreement and the Closing Documents, Seller agrees to sell and Buyer agrees to purchase all of Seller’s right, title and interest in and to the Property. In no event shall Buyer have any right to purchase less than all of the Property, and the purchase and sale of all of the Property shall be simultaneous.

In consideration therefor, Buyer shall pay to Seller Forty-Three Million Five Hundred Thousand Dollars ($43,500,000.00) (the “Purchase Price”). The Purchase Price shall be allocated between the Property in accordance with the schedule attached hereto as Exhibit O and made a part hereof. The Purchase Price shall be paid as follows:

Section 2.1 Payment of Deposit. On or before 5 p.m. Central time on the date which is two (2) Business Days following the Effective Date, and as a condition precedent to the effectiveness of this Agreement, Buyer shall pay the Deposit to Escrow Agent in immediately available funds.

Section 2.2 Applicable Terms; Failure to Make Deposit. Except as expressly otherwise set forth herein, the Deposit shall be applied against the Purchase Price at the Closing and shall otherwise be held and delivered by Escrow Agent in accordance with the provisions of Exhibit C. Notwithstanding any provision in this Agreement to the contrary, if Buyer fails to timely make the Deposit as provided herein, this Agreement shall automatically terminate and be of no further force or effect except for those provisions which expressly survive the termination of this Agreement.

Section 2.3 Cash at Closing. On the Scheduled Closing Date, Buyer shall (a) deposit into escrow with the Escrow Agent an amount equal to the balance of the Purchase Price in immediately available funds as more particularly set forth in Section 6.1, as prorated and adjusted as set forth in Article V, Section 6.1, or as otherwise provided under this Agreement, and (b) authorize and direct the Escrow Agent to simultaneously pay the Deposit into such escrow.

Section 2.4 Independent Contract Consideration. Contemporaneously with the deposit of the Deposit, Buyer shall deliver to Escrow Agent the amount of $100.00 (the “Independent Contract Consideration”), which amount the parties bargained for and agreed to as consideration for the Seller’s grant to Buyer of Buyer’s right to purchase the Property pursuant to the terms hereof and for Seller’s execution, delivery and performance of this Agreement. The Independent Contract Consideration is in addition to and independent of any other consideration or payment provided in this Agreement, is nonrefundable under any circumstances and will be retained by Seller notwithstanding any other provisions of this Agreement. Escrow Agent shall disburse the Independent Contract Consideration to Seller at the Closing or earlier termination of this Agreement.

ARTICLE III - TITLE MATTERS

Section 3.1 Title Defects.

(a) Seller has delivered to Buyer (x) Seller’s Title Policy and (y) the Existing Survey. Buyer shall obtain the Title Commitment and copies of all of the Title Documents, if available, and promptly provide a copy of such Title Commitment to Seller. During the Due Diligence Period, Buyer may also obtain an update of the

10

Existing Survey (the “Survey”). Prior to the expiration of the Due Diligence Period, Buyer shall have the right to object in writing to any title matters that appear on the Title Commitment, the Survey, and any updates thereto (whether or not such matters constitute Permitted Exceptions). After the expiration of the Due Diligence Period, Buyer shall have the right to object in writing to any title matters that are not Permitted Exceptions and that (i) first appear on any update to the Title Commitment or Survey issued after the expiration of the Due Diligence Period, and (ii) are not the result of any act or omission by any Buyer’s Representative. Any such objection must be made by Buyer within three (3) Business Days after such updated Title Commitment or Survey is received by Buyer (but, in any event, prior to the Scheduled Closing Date) in order to be effective. Unless Buyer is entitled to and timely objects to such title matters, all such title matters shall be deemed to constitute additional Permitted Exceptions.

(b) If this Agreement is not terminated by Buyer in accordance with the provisions hereof, Seller shall, prior to or concurrently with the Closing, Remove all Required Removal Exceptions at Seller’s sole cost and expense. If Seller is unable to Remove any Required Removal Exceptions, Buyer shall at Closing elect as its sole and exclusive remedy to either (i) exercise Buyer’s rights under Section 9.2, or (ii) accept such exceptions to title and the Closing shall occur as herein provided without any reduction of or credit against the Purchase Price. Seller may use any portion of the Purchase Price to Remove or cause to be Removed any Required Removal Exception. Regardless of whether Buyer expressly objects to any Required Removal Exceptions in writing as set forth in this Section 3.1.

(c) With respect to any title objections that are not Required Removal Exceptions, Seller may elect to Remove or to cause to be Removed any such exceptions to title and Seller may notify Buyer in writing within five (5) Business Days (but, in any event, prior to the Scheduled Closing Date) whether Seller elects to Remove the same. Failure of Seller to respond in writing within such period shall be deemed an election by Seller not to Remove Buyer’s title objections. If Seller elects or is deemed to have elected not to Remove one or more of Buyer’s title objections (other than Required Removal Exceptions), then, within five (5) Business Days after Seller’s election or deemed election (but, in any event, prior to the Scheduled Closing Date), Buyer may elect in writing to either (i) terminate this Agreement, in which event the Deposit shall be paid to Buyer and, thereafter, the parties shall have no further rights or obligations hereunder except for obligations which expressly survive the termination of this Agreement, or (ii) waive such title objections and proceed to Closing without any reduction of or credit against the Purchase Price. Failure of Buyer to respond in writing within such period shall be deemed an election by Buyer to waive such title objections and proceed to Closing. Any such title objection so waived (or deemed waived) by Buyer shall constitute a Permitted Exception, and Closing shall occur as herein provided without any reduction of or credit against the Purchase Price on account of such title objection.

(d) Seller shall be entitled to one or more extensions of the Scheduled Closing Date (not to exceed thirty (30) days in the aggregate) for the purpose of the Removal of any exceptions to title. Seller shall have the right to replace the Title Company with another nationally recognized title insurance company satisfactory to

11

Buyer in its sole, but good faith, discretion if the Title Company fails or refuses to Remove any exceptions to title that Seller elects or is required to Remove.

ARTICLE IV - BUYER'S DUE DILIGENCE/AS-IS SALE

Section 4.1 Buyer’s Due Diligence. All due diligence performed by Buyer’s Representatives shall be performed in accordance with and subject to the terms of that certain Confidentiality and Property Access Agreement dated as of July 28, 2017 (the “Access Agreement”), by and between Seller and Buyer, which agreement is hereby incorporated herein. Seller and Buyer hereby ratify and confirm their respective obligations under the Access Agreement. In order to assist Buyer’s due diligence review, Seller has made, will make, or will cause to be made available to Buyer, the documents described on Exhibit K attached hereto, to the extent in existence and in Seller’s possession. Buyer has informed Seller that Buyer is required by law to complete with respect to certain matters relating to the Property an audit commonly known as a “3-14” Audit (“Buyer’s 3-14 Audit”). In connection with the performance of Buyer’s 3-14 Audit, Seller shall during the Due Diligence Period and while this Agreement is in effect reasonably cooperate (at no cost, expense or liability of any kind to Seller) with Buyer and Buyer’s auditor in the conduct of Buyer’s 3-14 Audit. Without limiting the foregoing, during the Due Diligence Period and while this Agreement is in effect (a) Buyer or its designated independent or other auditor may audit the operating statements of the Property, at Buyer’s expense and (b) upon Buyer’s reasonable prior written request, Seller shall allow Buyer’s auditors reasonable access during normal business hours, on a date to be reasonably agreed upon by Buyer and Seller, to such books and records maintained by Seller in respect to the Property as necessary to conduct Buyer’s 3-14 Audit as listed on Exhibit P attached hereto; provided, however, that, to the extent that such reasonably requested book and records or other information required for Buyer’s 3-14 Audit can reasonably be e-mailed to Buyer or uploaded to the existing data site for this transaction, Seller shall provide the same to Buyer by e-mail or through the data site. Buyer acknowledges that all such information shall be provided to Buyer on an “AS IS” basis, and Seller shall not have any liability or obligation in connection with any information obtained in connection with any audit, and Buyer hereby waives any and all rights in connection with the same. To the extent any provisions of the Access Agreement conflict with the provisions of this Agreement, the provisions of this Agreement shall control. Buyer hereby acknowledges that the Due Diligence Period has expired and that it does not have any right to terminate this Agreement except as expressly provided for in this Agreement (including, without limitation, Sections 6.4, 6.6, 9.2 and 10.1). Buyer and Seller each acknowledge and agree that any access to the Property or Due Diligence conducted by Buyer after the expiration of the Due Diligence Period shall not provide Buyer with the right to terminate this Agreement or to receive a refund of the Deposit; provided however, nothing herein shall impair the right of Buyer to terminate this Agreement as elsewhere expressly provided in this Agreement.

Section 4.2 As-Is Provisions.

4.2.1 As-Is Sale. Buyer acknowledges and agrees that:

(a) Buyer has or will have conducted during the Due Diligence Period, or waive its right to conduct, such Due Diligence as Buyer has deemed or shall deem necessary or appropriate.

12

(b) The Property shall be sold, and Buyer shall accept possession of the Property as of the Closing, “AS IS, WHERE IS, WITH ALL FAULTS”, with no right of setoff or reduction in the Purchase Price, except as expressly set forth to the contrary in this Agreement and the Closing Documents.

(c) Except for Seller’s Warranties, none of the Seller Parties nor Seller’s Broker shall be deemed to have made any verbal or written representations, warranties, promises or guarantees (whether express, implied, statutory or otherwise) to Buyer with respect to the Property, any matter set forth, contained or addressed in the materials delivered or made available to Buyer’s Representatives, including, but not limited to, the accuracy and completeness thereof, or the results of Buyer’s Due Diligence.

(d) Buyer has had, or shall have had prior to the expiration of the Due Diligence Period, the opportunity to independently confirm to its satisfaction all information that it considers material to its purchase of the Property and the Transaction.

4.2.2 Release. By accepting the Deed and closing the Transaction, Buyer, on behalf of itself and its successors and assigns, shall thereby be deemed to have released each of the Seller Parties from, and waived any and all Liabilities against each of the Seller Parties for, attributable to, or in connection with the Property, whether arising or accruing before, on or after the Closing and whether attributable to events or circumstances which arise or occur before, on or after the Closing, including, without limitation, the following: (a) except for Seller’s Warranties, any and all statements or opinions heretofore or hereafter made, or information furnished, by any Seller Parties or Seller’s Broker to any Buyer’s Representatives; and (b) any and all Liabilities with respect to the structural, physical, or environmental condition of the Property, including, without limitation, all Liabilities relating to the release, presence, discovery or removal of any hazardous or regulated substance, chemical, waste or material that may be located in, at, about or under the Property, or connected with or arising out of any and all claims or causes of action based upon CERCLA (Comprehensive Environmental Response, Compensation, and Liability Act of 1980, 42 U.S.C. §§9601 et seq., as amended by SARA (Superfund Amendment and Reauthorization Act of 1986) and as may be further amended from time to time), the Resource Conservation and Recovery Act of 1976, 42 U.S.C. §§6901 et seq., or any related claims or causes of action (collectively, “Environmental Liabilities”); and (c) any implied or statutory warranties or guaranties of fitness, merchantability or any other statutory or implied warranty or guaranty of any kind or nature regarding or relating to any portion of the Property. For the avoidance of doubt, no Buyer’s Representative shall look to any Seller Party in connection with any of the foregoing for any redress or relief. This release shall be given full force and effect according to each of its expressed terms and provisions, including, without limitation, those related to unknown or unsuspected claims, damages or causes of action. Notwithstanding the foregoing, the foregoing release and waiver is not intended and shall not be construed as affecting or impairing any rights or remedies that Buyer may have against Seller with respect to (i) a breach of any of Seller’s Warranties, (ii) any of the obligations of Seller under this Agreement that expressly survive the Closing, or (iii) any acts constituting fraud by Seller.

13

4.2.3 Property Conveyed Subject To. By accepting the Deed and closing the Transaction, Buyer acknowledges and agrees that it is accepting the Deed and purchasing the Property subject to the following: (a) any and all Liabilities attributable to the Property to the extent that the same arise or accrue on or after the Closing and are attributable to events or circumstances which arise or occur on or after the Closing; and (b) any and all Liabilities with respect to the structural, physical or environmental condition of the Property, whether such Liabilities are latent or patent, whether the same arise or accrue before, on or after the Closing, and whether the same are attributable to events or circumstances which may arise or occur before, on or after the Closing, including, without limitation, all Environmental Liabilities; and (c) any and all Liabilities with respect to which Buyer receives a credit at Closing, but only to the extent of such credit. Buyer acknowledges and agrees that the Liabilities referenced in each of the foregoing clauses are intended to be independent of one another, so Buyer shall accept the Deed and purchase the Property subject to each of the Liabilities described in each of the clauses even though some of those Liabilities may be read to be excluded by another clause. Notwithstanding the foregoing, the foregoing provision is not intended to and shall not be construed as affecting or impairing any rights or remedies that Buyer may have against Seller with respect to a breach of any of Seller’s Warranties.

4.2.4 Reaffirmation and Survival. The provisions of this Section 4.2 shall be deemed reaffirmed by Buyer by acceptance of the Deed and shall survive Closing.

Section 4.3 Limitation on Seller’s Liability.

4.3.1 Maximum Aggregate Liability. Notwithstanding any provision to the contrary contained in this Agreement or the Closing Documents, the maximum aggregate liability of the Seller Parties, and the maximum aggregate amount which may be awarded to and collected by Buyer, in connection with the Transaction, the Property under this Agreement, and under all Closing Documents (including, without limitation, in connection with the breach of any of Seller’s Warranties for which a claim is timely made by Buyer) shall not exceed Seller’s Liability Cap, is subject to Seller’s Warranty Survival Period and Seller’s Liability Materiality Threshold. Notwithstanding the foregoing, Seller’s Liability Cap shall not be applicable to any amounts owed pursuant to Article V or Seller’s indemnity obligations under Section 8.3.

4.3.2 Survival. The provisions of this Section 4.3 shall survive the Closing (and not be merged therein) or any earlier termination of this Agreement.

ARTICLE V - ADJUSTMENTS AND PRORATIONS

Section 5.1 Proration of Income.

5.1.1 Rents. All collected Rents and any other income from Property operations, including parking revenue and any license fees, shall be prorated (based on the periods to which they relate and are applicable, and regardless of when payable) between Seller and Buyer as of 12:01 a.m. on the Closing Date (the “Apportionment Time”). Rents or other income from Property operations not collected as of the Closing Date shall not be

14

prorated at the time of Closing. Percentage rent due from any tenant shall be prorated as herein provided at such time as Buyer collects the same in accordance with Section 5.1.2.

5.1.2 Post-Closing Collections. For the period commencing upon the Closing Date and ending on May 31, 2018, Buyer shall use commercially reasonable efforts (by rendering regular invoices only) to collect any Rents and other income from Property operations not collected as of the Closing on Seller’s behalf and to tender the same to Seller promptly upon receipt; provided, however, that all Rents collected by Buyer or Seller on or after the Closing Date shall first be applied to all amounts due under the applicable Lease at the time of collection (i.e., current Rents and sums due Buyer as the current owner and landlord) with the balance (if any) payable to Seller to the extent of amounts delinquent and due Seller. Notwithstanding the foregoing, Buyer shall not be required to institute any legal or collection proceedings to collect any delinquent Rents. Following the Closing, Seller will retain ownership rights relating to any such delinquent amounts owed by any tenant under the Leases or other party for sums due with respect to periods prior to the Closing, and if Buyer has not collected with same within ninety (90) days after the Closing, Seller shall be entitled to pursue claims against any tenant under the Leases for sums due with respect to periods prior to the Closing Date; provided, however, with respect to any legal proceedings against any tenant under a Lease, Seller (a) shall be required to notify Buyer in writing of its intention to pursue such legal proceedings; (b) shall only be permitted to pursue any legal proceedings after the date which is six (6) months after the Closing; and (c) shall not be permitted to pursue any legal proceedings against any tenant seeking eviction of such tenant or the termination of such tenant’s Lease. Any Rents received by Seller after the Closing shall be promptly remitted to Buyer for distribution accordance with the provisions hereof.

5.1.3 Cash Security Deposits. At Closing, Seller shall give Buyer a credit in the aggregate amount of all cash security deposits then required to be held by Seller under the Leases. Unless and until this Agreement is terminated, Seller shall not apply any security deposits reflected in the rent roll delivered by Seller to Buyer prior to the Effective Date of this Agreement to any obligations under the Leases.

Section 5.2 Proration of Taxes and Other Property Expenses.

5.2.1 Real Estate and Personal Property Taxes. Subject to Section 8.4, all real estate, personal property, ad valorem taxes and special assessments, and any vault charges, payable during the calendar year in which the Closing occurs (regardless of the fiscal year, tax year or other period to which such taxes or charges may be attributable), will be prorated between Seller and Buyer as of the Apportionment Time on the basis of actual bills therefor, if available, which proration shall be made on a cash basis. For example, if the Closing occurs on or before December 31, 2017, the 2016 taxes, which are payable in calendar year 2017, shall be prorated as of the Apportionment Time and the 2017 taxes, which are payable in calendar year 2018, will not be prorated at Closing and Buyer shall be solely responsible for the payment of the same. If the actual taxes payable in the calendar year in which the Closing occurs have not been established as of the Closing, then Seller and Buyer shall prorate taxes based on the most recent available proposed assessed value, tax rate and equalization factor with such proration to be recalculated and reconciled in cash between Seller and Buyer promptly after presentation

15

of written evidence that the actual taxes payable in the calendar year in which the Closing occurs differ from the amounts used for proration purposes at Closing. In no event shall Seller be charged with or be responsible for any increase in the 2016 taxes (taxes payable in calendar year 2017) for the Property resulting from the sale of the Property contemplated by this Agreement. Buyer agrees that it shall be solely responsible for paying all such taxes, charges and assessments due on account of any period from and after the Closing Date. Subject to Section 8.4, any and all rebates or reductions in taxes received subsequent to Closing payable for the calendar year in which Closing occurs, net of costs of obtaining the same (including without limitation reasonable attorneys’ fees) and net of any amounts due to tenants, shall be prorated as of the Apportionment Time, when received.

5.2.2 Insurance. Premiums on insurance policies will not be adjusted. As of the Closing Date, Seller will terminate its insurance coverage with respect to the Property and Buyer will obtain its own insurance coverage.

5.2.3 Contracts and Other Property Operating Expenses. All charges and payments under the Contracts assigned to, and assumed by, Buyer hereunder and operating expenses for the Property payable by Seller shall be prorated as of the Apportionment Time. To the extent that the amount of actual consumption of any utility services is not determined prior to the Closing Date, a proration shall be made at Closing based on the last available reading and post-closing adjustments between Buyer and Seller shall be made within thirty (30) days following the date that actual consumption for such pre-closing period is determined. Seller shall not assign to Buyer any deposits which Seller has with any of the utility services or companies servicing the Property. Buyer shall arrange with such services and companies to have accounts opened in Buyer’s name beginning at 12:01 a.m. on the Closing Date.

5.2.4 Lease Expenses.

(a) At Closing, Buyer shall receive a credit on the Buyer’s Closing Statement for all unsatisfied Lease Expenses, including but not limited to those Lease Expenses set forth on Exhibit N, which were incurred, or are to be incurred, in connection with any and all Leases executed, modified or extended by Seller prior to the Effective Date, or in the case of free or reduced rent, a credit for amounts for the periods attributable from and after the Closing Date (collectively, the “Pre-Closing Leasing Expenses”). Seller shall remain responsible for satisfying any Pre-Closing Leasing Expenses which were not credited, but which were supposed to be credited, to Buyer at Closing, provided that Buyer provides written notice to Seller of such Pre-Closing Lease Expense prior to the expiration of the Reproration Adjustment Period. Notwithstanding the foregoing to the contrary, (i) Seller shall not credit to Buyer, and Buyer shall be and remain responsible for, any Lease Expenses due and owing with respect to the Loan Depot Lease; and (ii) Buyer and Seller shall equally share any Lease Expenses due and owing with respect to the HPZS Lease (the “HPZS Lease Costs”), Seller shall credit to Buyer fifty percent (50%) of HPZS Lease Costs, and Buyer shall be responsible for the HPZS Lease Costs. The parties acknowledge that the amount of the HPZS Lease Costs listed on Exhibit N is an estimate that is subject to adjustment at Closing.

16

(b) At Closing, Seller shall receive a credit on the Seller’s Closing Statement for all Lease Expenses paid or incurred by or on behalf of Seller prior to Closing arising out of or in connection with any new Lease or modification of any Lease entered into between the Effective Date and the Closing in accordance with Section 8.1, but only to the extent that the amounts of such Lease Expenses were disclosed to Buyer in writing in the new Lease or modification at the time of the approval (or deemed approval) of Buyer of such new Lease or modification.

(c) At Closing, Buyer shall assume Seller’s obligations to pay, when due (whether on a stated due date or accelerated) Lease Expenses unpaid as of the Closing, but only to the extent (i) such Lease Expenses are in connection with the Loan Depot Lease and the HPZS Lease, or (ii) are Lease Expenses listed on Exhibit N for which Buyer received a credit at Closing pursuant to Section 5.2.4(a).

Section 5.3 Closing Costs. Closing costs shall be allocated between Buyer and Seller as follows:

(a) Buyer shall pay the following closing costs: (i) the cost of preparation of the Survey, (ii) City of Chicago transfer taxes in the amount of $7.50/$1,000.00 of the Purchase Price, (iii) one-half of escrow or closing charges charged by the Escrow Agent, (iv) the commission due any broker representing Buyer, (v) all fees due Buyer’s attorneys and all costs of Buyer’s Due Diligence (including, without limitation, fees due its consultants), (vi) all lenders’ fees, mortgage taxes, and similar charges, if any, related to any financing to be obtained by Buyer, including all recording and filing charges for documents recorded in connection with Buyer’s financing, and (vii) all premiums and charges of the Title Company for any upgrade of the title policy for additional coverage, any endorsements requested by Buyer and the premium for any lender’s title policy.

(b) Seller shall pay the following closing costs: (i) the premiums and charges of the Title Company for the Title Commitment and standard title insurance policy to be issued to Buyer, including extended coverage (but excluding any endorsements requested by Buyer), (ii) the commission due Seller’s Broker, (iii) all fees due Seller’s attorneys, (iv) all State and county transfer taxes due upon recordation of the Deed, (v) City of Chicago transfer taxes in the amount of $3.00/$1,000.00 of the Purchase Price; (vi) all recording and filing charges in connection with the instrument by which Seller conveys the Property, (vii) one-half of escrow or closing charges charged by the Escrow Agent, and (viii) all costs incurred in connection with causing the Title Company to Remove any Required Removal Exceptions.

Section 5.4 Delayed Adjustment; Delivery of Financial Data. If at any time following the Closing Date but before expiration of the Reproration Adjustment Period, the amount of an item prorated or credited at Closing shall prove to be incorrect (whether as a result of an error in calculation, a lack of complete and accurate information or otherwise (including, but not limited to, the HPZS Lease Costs or any CAM reconciliations due to the same being based upon estimates at Closing)) or otherwise require adjustment as a result of any year-end or periodic reconciliations of any amount, including, without limitation, percentage rent, tenant reimbursements or operating expenses, the party owing money as a result of such error or adjustment shall pay to the other party

17

the sum necessary to correct such error or adjustment within thirty (30) days following receipt of a recalculation of any and all amounts due or subject to proration under this Article V and supporting documentation for such recalculation. In order to enable Seller to determine whether any such delayed adjustment is necessary, Buyer shall provide to Seller current operating and financial statements (or such excerpts thereof as are sufficient to provide the information necessary for the determination of such adjustments) for the Property and copies of any applicable correspondence and statements sent to tenants in connection with any reconciliation promptly after the same are prepared, but, in any event, no later than the date that is thirty (30) days prior to the expiration of the Reproration Adjustment Period.

Section 5.5 Survival. The obligations of the parties under this Article V shall survive Closing (and not be merged therein) or, if applicable, any earlier termination of this Agreement.

ARTICLE VI - CLOSING

Section 6.1 Closing Mechanics.

(a) The parties shall conduct an escrow-style closing through the Escrow Agent so that it will not be necessary for any party to attend the Closing.

(b) Provided all conditions precedent to Seller’s obligations hereunder have been satisfied (or waived by Seller), Seller agrees to convey the Property to Buyer upon confirmation of receipt of the Purchase Price by the Escrow Agent as set forth below. Provided all conditions precedent to Buyer’s obligations hereunder have been satisfied (or waived by Buyer), Buyer agrees to pay the amount specified in Section 2.3 by timely delivering the same to the Escrow Agent on the Scheduled Closing Date and unconditionally authorizing and directing the Escrow Agent no later than 1:00 p.m. Central Time on the Scheduled Closing Date to deposit the same in Seller’s designated account.

(c) The items to be delivered by Seller or Buyer in accordance with the terms of Sections 6.2 or 6.3 shall be delivered to Escrow Agent no later than 5:00 p.m. Central Time on the last Business Day prior to the Scheduled Closing Date except that (i) the items in the paragraph entitled “Keys and Original Documents” shall be delivered by Seller at the Property or made available for pick-up from Seller’s Property Manager on the Closing Date, and (ii) the Purchase Price shall be delivered by Buyer in accordance with the terms of Section 6.1(b).

Section 6.2 Seller’s Closing Deliveries. At Closing, Seller shall deliver the following:

(a) Deed. Seller shall deliver a deed in the form of Exhibit D attached hereto (“Deed”), executed and acknowledged by Seller, together with a water certification from the City of Chicago.

(b) Bill of Sale. Two (2) duly executed counterparts of a bill of sale in the form of Exhibit E attached hereto, executed by Seller.

(c) Assignment Agreement. Two (2) duly executed counterparts of an assignment and assumption of the Leases and Intangible Property, in the form of Exhibit F attached hereto (“Assignment Agreement”), executed by Seller.

18

(d) Notice to Tenants. A single form letter in the form of Exhibit G attached hereto, executed by Seller, duplicate copies of which shall be sent by Buyer after Closing to each tenant under the Leases.

(e) Non-Foreign Status Affidavit. A non-foreign status affidavit in the form of Exhibit H attached hereto, as required by Section 1445 of the Internal Revenue Code, executed by Seller.

(f) Title Affidavit. A title affidavit and gap indemnity agreement in the form of Exhibit I attached hereto, executed by Seller.

(g) Evidence of Authority. Documentation to establish to the Title Company’s reasonable satisfaction the due authorization of Seller’s consummation of the Transaction, including Seller’s execution of this Agreement and the Closing Documents required to be delivered by Seller.

(h) Closing Certificate. A certificate, dated as of the Closing Date, certifying that the representations and warranties made by Seller under Section 7.2 of this Agreement remain true, correct and complete in all material respects as of the Closing Date, except to the extent of changes necessary to reflect any changed facts or circumstances arising or occurring between the Effective Date and the Closing Date which are permitted by the terms of this Agreement.

(i) Other Documents. Any applicable transfer or sales tax filings, and such other documents as may be reasonably required by the Title Company or as may be agreed upon by Seller and Buyer to consummate the Transaction.

(j) Letters of Credit as Tenant Security Deposits. All original letters of credit which are security deposits under the Leases and the transfer documentation as described in Section 8.1(d).

(k) Closing Statement. A separate Seller closing statement, setting forth the prorations and adjustments to the Purchase Price to be made pursuant to this Agreement in respect of each Property (the “Seller’s Closing Statement”), executed by Seller.

(l) Keys and Original Documents. Keys to all locks on the Real Property in Seller’s or Seller’s Property Manager’s possession and originals or, if originals are not available, copies, of all of the Leases, Contracts, and other Property documents, to the extent not previously delivered to Buyer.

(m) Intentionally Deleted.

(n) Department of Revenue Releases. Release letters or certificates from (i) the Illinois Department of Revenue,

19

(ii) the Cook County Department of Revenue and (iii) the City of Chicago Department of Revenue (collectively, the "DOR") stating that no assessed but unpaid taxes, penalties or interest are due under (x) Section 902(d) of the Illinois Income Tax Act, or any similar statute of the State of Illinois, (y) Section 34-92 of the Cook County Uniform Penalties, Interest and Procedures Ordinance, or any similar ordinance of Cook County, or (z) the City of Chicago Bulk Sales Ordinance (Sec. 3-4-140 of the Uniform Revenue Procedures Ordinance of the Municipal Code of Chicago), or any similar ordinance of the City of Chicago (said statutes or ordinances, or any similar statute or ordinance, are hereinafter collectively called the "Bulk Sales Provisions"). Seller covenants and agrees that, within one (1) Business Day after the Effective Date, Seller shall submit to each DOR such applications and documents as are required to procure such release letters or certificates. In the event such release letters or certificates disclose there are amounts claimed due to the DOR under the Bulk Sales Provisions, those amounts shall be separated from the Purchase Price at the Closing and retained in an escrow with the Escrow Agent (the “Bulk Sales Escrow”), to be paid to Seller when Seller obtains the applicable release or, if prior to Seller obtaining the applicable release, to the DOR upon a demand by the DOR, and the escrow instructions shall so provide. In the alternative, if Seller does not by the Closing Date obtain release letters showing no unpaid taxes, at Seller's election the Closing will not be delayed, and Seller shall agrees to cause the Indemnitor to indemnify, defend and hold Buyer harmless from and against any and all damages, claims, liabilities, judgments, expenses and costs (including, without limitation, reasonable attorneys' fees and unpaid taxes, interest and penalties) arising out of the Bulk Sales Provisions, such indemnity shall be in the form of Exhibit R attached hereto. Upon delivery to Buyer of clean release letters, such indemnity will be null and void. If and to the extent applicable, the Bulk Sales Escrow shall be separate from the escrow of Holdback Amount described in Section 7.3.3.

Section 6.3 Buyer’s Closing Deliveries. At the Closing, Buyer shall deliver the following:

(a) Purchase Price. The Purchase Price, as adjusted for apportionments and other adjustments required under this Agreement, plus any other amounts required to be paid by Buyer at Closing.

(b) Assignment Agreement. Two (2) counterparts of the Assignment Agreement, executed by Buyer.

(c) Evidence of Authority. Documentation to establish to the Title Company’s reasonable satisfaction the due authorization of Buyer’s consummation of the Transaction, including Buyer’s execution of this Agreement and the Closing Documents required to be delivered by Buyer.

(d) Buyer’s Closing Certificate. A certificate, dated as of the Closing Date, certifying that the representations and warranties made by Buyer under Section 7.1 of this Agreement remain true, correct and complete in all material respects as of the Closing Date, except to the extent of changes necessary to reflect any changed facts or circumstances arising or occurring between the Effective Date and the Closing Date which are permitted by the terms of this Agreement.

20

(e) Other Documents. Applicable transfer or sales tax filings and such other documents as may be reasonably required by the Title Company or may be agreed upon by Seller and Buyer to consummate the Transaction.

(f) Closing Statement. A separate Buyer closing statement, setting forth the prorations and adjustments to the Purchase Price to be made pursuant to this Agreement in respect of each Property (the “Buyer’s Closing Statement”), executed by Buyer.

Section 6.4 Conditions to Buyer’s Obligations. Buyer’s obligation to close the Transaction is conditioned on all of the following:

(a) Representations True. All Seller’s Warranties in this Agreement, as the same may be deemed modified as provided in Section 7.3, shall be true and correct in all material respects on and as of the Scheduled Closing Date, as if made on and as of such date; provided that changes to Seller’s Warranties necessary to reflect any changed facts or circumstances arising or occurring between the Effective Date and the Closing Date which are permitted by the terms of this Agreement shall not constitute a failure of this condition of Closing.

(b) Title Conditions Satisfied. Delivery at the time of Closing of the standard current form of an owner’s policy of title insurance (the “Title Policy”), or an irrevocable commitment to issue the same, with liability in the amount of the Purchase Price issued by the Title Company, insuring that fee title to the Real Property vests in Buyer subject only to the Permitted Exceptions. At its option, Buyer may direct the Title Company to issue an extended coverage policy or additional title insurance endorsements if Buyer pays for the extra cost of such extended coverage policy or additional endorsements, provided that the Title Company’s failure to issue any such extended coverage policy or additional endorsements shall not affect Buyer’s obligations under this Agreement.

(c) Estoppel Certificates. Buyer shall have received, no less than three (3) business days prior to the Scheduled Closing Date (the “Tenant Estoppel Deadline”), executed Approved Estoppels (as defined in Section 8.7 below), with those changes reasonably acceptable to Buyer and not disclosing the existence of any default under the Leases referenced to therein, from each of the Required Tenants (the “Minimum Estoppel Threshold”). Buyer shall be required to accept any such estoppel certificate if the same: (1) is dated no earlier than the Effective Date, and (2) is substantially in the form of the Approved Estoppels, it being agreed that (i) the inclusion of qualifications as to knowledge or word of similar import to Paragraphs 7 or 10 to the form of Approved Estoppel, (ii) solely in relation to audit rights, references to a general condition statement such as “we reserve all rights” or “subject to our audit of ____ years’ operating expenses or taxes” and (iii) modifications thereof to correct scrivener’s errors in order to conform the same to Leases or other information delivered or available to Buyer prior to the date of the execution of this Agreement shall not give Buyer, in each instance (i) through (iii) herein, any basis to not accept such estoppel. In addition, either party may elect to postpone the Scheduled Closing Date for a period not to exceed thirty (30) days in order to allow Seller additional time to satisfy the Minimum Estoppel Threshold.

21

Notwithstanding any provisions in this Agreement to the contrary, if Buyer fails to object in writing to an estoppel certificate executed by any tenant within five (5) Business Days after the date a copy of the same has been delivered to any Buyer’s Representative, Buyer shall be deemed to have approved the same.

(d) Seller’s Deliveries Complete. Seller shall have timely delivered all of the documents and other items required pursuant to Section 6.2 and shall have duly performed all other covenants, agreements and obligations to be performed by Seller pursuant to the terms of this Agreement at or prior to the Closing.

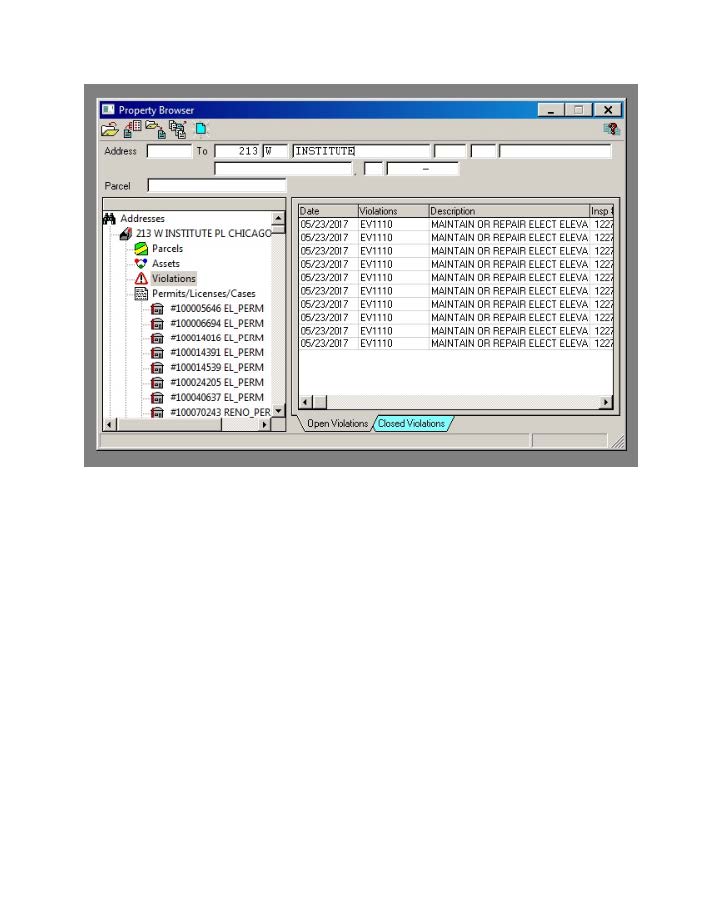

(e) Completion of Elevator Work / Outstanding Violations. Seller shall have caused the ongoing elevator modernization and modification work at the 213 W Institute Real Property (the “Elevator Work”) to be completed and shall have paid in full all amounts due and owing to any and all contractors, subcontractors and other third parties involved with the Elevator Work and provided Buyer with evidence satisfactory to Buyer, in Buyer’s sole but good faith discretion, of the completion and payment of all costs incurred in connection with the Elevator Work. Prior to Closing, Seller shall use commercially reasonable efforts to provide Buyer with sufficient evidence, which evidence shall be acceptable to Buyer in Buyer’s sole but good faith discretion, that the outstanding violations affecting the Property and listed on Exhibit S have been cleared, cured, or resolved. Unless Buyer elects to waive the condition set forth in this Section 6.4(e), either party may elect to postpone the Scheduled Closing Date for a period not to exceed thirty (30) days in order to allow Seller additional time to satisfy the condition set forth in this Section 6.4(e), upon delivery of written notice to the non-extending party no later than three (3) Business Days prior to the Closing Date. Failure of the Seller to satisfy the condition set forth in this Section 6.4(e) prior to Closing shall not constitute a default by Seller hereunder and Buyer’s sole remedy shall be to either waive the condition to Closing or to terminate this Contract and receive a return of the Deposit from Escrow Agent.

Section 6.5 Conditions to Seller’s Obligations. Seller’s obligation to close the Transaction is conditioned on all of the following:

(a) Representations True. All representations and warranties made by Buyer in this Agreement shall be true and correct in all material respects on and as of the Scheduled Closing Date, as if made on and as of such date.

(b) Buyer’s Deliveries Complete. Buyer shall have delivered the funds required hereunder and all of the documents to be executed by Buyer set forth in Section 6.3 and shall have duly performed all other covenants, agreements and obligations to be performed by Buyer pursuant to the terms of this Agreement at or prior to the Closing.

Section 6.6 Waiver of Failure of Conditions Precedent. At any time on or before the date specified for the satisfaction of any condition, Seller or Buyer may elect in writing to waive the benefit of any such condition to its obligations hereunder. By closing the Transaction, Seller and Buyer shall be conclusively deemed to have waived the benefit of any remaining unfulfilled conditions set forth in this Article VI, except to the extent that the same expressly survive Closing.

22

In the event any of the conditions set forth in this Article VI are neither waived nor fulfilled, Seller or Buyer (as appropriate) shall have such rights and remedies, if any, that such party may have pursuant to the terms of Article IX. If this Agreement is terminated as a result of the failure of any condition set forth in this Article VI that is not also a default or breach by Buyer hereunder, then the Deposit shall be returned to Buyer and, thereafter, neither party shall have any further rights or obligations hereunder except for obligations which expressly survive termination of this Agreement.

ARTICLE VII - REPRESENTATIONS AND WARRANTIES

Section 7.1 Buyer’s Representations. Buyer represents and warrants to Seller as follows:

7.1.1 Buyer’s Authorization. Buyer (a) is duly organized (or formed), validly existing and in good standing under the Laws of its State of organization and, to the extent required by applicable Laws and prior to Closing, the State in which the Property is located, and (b) is authorized to execute this Agreement and consummate the Transaction and fulfill all of its obligations hereunder and under all Closing Documents to be executed by Buyer and such instruments, obligations and actions are valid and legally binding upon Buyer, enforceable in accordance with their respective terms. The execution and delivery of this Agreement and all Closing Documents to be executed by Buyer and the performance of the obligations of Buyer hereunder or thereunder will not (x) result in the violation of any Law or any provision of Buyer’s organizational documents, (y) conflict with any order of any court or governmental instrumentality binding upon Buyer, or (z) conflict or be inconsistent with, or result in any default under, any contract, agreement or commitment to which Buyer is bound.

7.1.2 Buyer’s Financial Condition. No petition has been filed by or, to Buyer’s knowledge, against Buyer under the Federal Bankruptcy Code or any similar Laws.

7.1.3 Patriot Act Compliance. Neither Buyer nor any person, group, entity or nation that Buyer is acting, directly or, to Buyer’s knowledge, indirectly for, or on behalf of, is named by any Executive Order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism) or the United States Treasury Department as a terrorist, “Specially Designated National and Blocked Person,” or is otherwise a banned or blocked person, group, entity, or nation pursuant to any Law that is enforced or administered by the Office of Foreign Assets Control, and Buyer is not engaging in this Transaction, directly or indirectly, on behalf of, or instigating or facilitating this Transaction, directly or indirectly, on behalf of, any such person, group, entity or nation. Buyer is not engaging in this Transaction, directly or indirectly, in violation of any Laws relating to drug trafficking, money laundering or predicate crimes to money laundering. None of the funds of Buyer have been or will be derived from any unlawful activity with the result that the investment of direct or, to Buyer’s knowledge, indirect equity owners in Buyer is prohibited by Law or that the Transaction or this Agreement is or will be in violation of Law. Buyer has and will continue to implement procedures, and has consistently and will continue to consistently apply those procedures, to ensure the

23

foregoing representations and warranties remain true and correct at all times prior to Closing.

7.1.4 ERISA. Buyer is not acquiring the Property with the assets of an employee benefit plan (as defined in Section 3(3) of ERISA). Buyer is not a "party in interest" within the meaning of Section 3(3) of ERISA with respect to any beneficial owner of Seller.

Buyer’s representations and warranties in this Section 7.1 shall survive the Closing and not be merged therein.

Section 7.2 Seller’s Representations. Seller represents and warrants to Buyer as follows:

7.2.1 Seller’s Authorization. Seller (a) is duly organized (or formed), validly existing and in good standing under the Laws of its State of organization and, to the extent required by applicable Laws, the State in which the Property is located, and (b) is authorized to execute this Agreement and consummate the Transaction and fulfill all of its obligations hereunder and under all Closing Documents to be executed by Seller and such instruments, obligations and actions are valid and legally binding upon Seller, enforceable in accordance with their respective terms. The execution and delivery of this Agreement and all Closing Documents to be executed by Seller and the performance of the obligations of Seller hereunder or thereunder will not (x) result in the violation of any Law or any provision of Seller’s organizational documents, (y) conflict with any order of any court or governmental instrumentality binding upon Seller, or (z) conflict or be inconsistent with, or result in any default under, any contract, agreement or commitment to which Seller is bound.

7.2.2 Seller’s Financial Condition. No petition has been filed by Seller, nor has Seller received written notice of any petition filed against Seller, under the Federal Bankruptcy Code or any similar Laws.

7.2.3 Patriot Act Compliance. Neither Seller nor any entity that Seller is acting, directly or, to Seller’s knowledge, indirectly for, or on behalf of, any person, group, entity or nation named by any Executive Order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism) or the United States Treasury Department as a terrorist, “Specially Designated National and Blocked Person,” or other banned or blocked person, entity, or nation pursuant to any Law that is enforced or administered by the Office of Foreign Assets Control and Seller is not engaging in this Transaction, directly or indirectly, on behalf of, or instigating or facilitating this Transaction, directly or indirectly, on behalf of, any such person, group, entity or nation. Seller is not engaging in this Transaction, directly or indirectly, in violation of any Laws relating to drug trafficking, money laundering or predicate crimes to money laundering. None of the funds of Seller have been or will be derived from any unlawful activity with the result that the investment of direct or, to Seller’s Knowledge, indirect equity owners in Seller is prohibited by Law or that the Transaction or this Agreement is or will be in violation of Law. Seller has and will continue to implement procedures, and has consistently and will continue to consistently apply those procedures, to ensure the

24

foregoing representations and warranties remain true and correct at all times prior to Closing.

7.2.4 Third-Party Rights. Seller has not entered into any agreements currently in effect pursuant to which Seller has granted any rights of first refusal to purchase all or any part of the Property, options to purchase all or any part of the Property or other rights whereby any individual or entity has the right to purchase all or any part of the Property (except for any options to purchase the Property or a portion thereof that may be contained in any of the Leases).

7.2.5 Leases. The copies of the Leases between Seller and any third parties affecting the Property delivered or furnished and made available by Seller to Buyer pursuant to this Agreement constitute all of the Leases relating to the Property. All of the Leases in effect as of the date hereof are listed on Exhibit L attached hereto, which Exhibit L includes, to Seller’s Knowledge, the dates of all Leases and Lease amendments.

7.2.6 Contracts. As of the Effective Date, Seller has not entered into or assumed any contracts, equipment leases or other agreements affecting the Property which will be binding upon Buyer after the Closing other than (i) the Contracts listed in Exhibit B attached hereto, (ii) the Leases, and (iii) liens, encumbrances, covenants, conditions, restrictions, easements and other matters of record. As of the Effective Date, (i) Seller has heretofore delivered to Buyer true, correct and complete copies of each of the Contracts listed in Exhibit B; (ii) to Seller’s Knowledge, Seller is not in default on any of its obligations under any of the Contracts and knows of no default on the part of the other parties thereto; and (iii) the Contracts represent the complete agreement between Seller and such other parties as to the services to be performed or materials to be provided thereunder and the compensation to be paid for such services or materials, as applicable, and such other parties possess no unsatisfied claim against Seller.

7.2.7 Notices. As of the Effective Date, except as set forth on Exhibit M attached hereto and except for defaults cured on or before the Effective Date, Seller has neither (i) received any written notice from any tenant of the Property asserting or alleging that Seller is in default under such tenant’s Lease, nor (ii) sent to any tenant of the Property any written notice alleging or asserting that such tenant is in default under such tenant’s Lease.

7.2.8 Litigation. As of the Effective Date, except as listed in Exhibit M attached hereto, Seller has not received any written notice of any current or pending (i) claims, suits, actions or arbitrations, or any condemnation proceedings affecting the Property or Seller’s rights and obligations under this Agreement, or (ii) any regulatory proceedings which would, in the reasonable judgment of Seller, adversely affect the Property in any material way or Seller’s ability to consummate the transaction contemplated in this Agreement.

7.2.9 Violations of Law. Except for violations cured or remedied on or before the Effective Date and except as listed in Exhibits M and S attached hereto, as of the Effective Date, Seller has not received any written notice from any governmental authority of any violation of any Law applicable to the Property.

25

Section 7.3 General Provisions.