Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Conifer Holdings, Inc. | a930178-kquarterinvestorpr.htm |

THIRD QUARTER 2017

INVESTOR CONFERENCE CALL

November 9, 2017

1

SAFE HARBOR STATEMENT

This presentation contains “forward-looking” statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

that are based on our management’s beliefs and assumptions and on information currently available to

management. These forward-looking statements include, without limitation, statements regarding our

industry, business strategy, plans, goals and expectations concerning our market position, product

expansion, future operations, margins, profitability, future efficiencies, and other financial and operating

information. When used in this discussion, the words “may,” “believes,” “intends,” “seeks,” “anticipates,”

“plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “potential,” “could,” “will,” “future” and the

negative of these or similar terms and phrases are intended to identify forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties, inherent risks and other

factors that may cause our actual results, performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by the forward-looking statements.

Forward-looking statements represent our management’s beliefs and assumptions only as of the date of

this presentation. Our actual future results may be materially different from what we expect due to factors

largely outside our control, including the occurrence of severe weather conditions and other catastrophes,

the cyclical nature of the insurance industry, future actions by regulators, our ability to obtain reinsurance

coverage at reasonable rates and the effects of competition. These and other risks and uncertainties

associated with our business are described under the heading “Risk Factors” in our most recently filed

Annual Report on Form 10-K, which should be read in conjunction with this presentation. The company

and subsidiaries operate in a dynamic business environment, and therefore the risks identified are not

meant to be exhaustive. Risk factors change and new risks emerge frequently. Except as required by law,

we assume no obligation to update these forward-looking statements publicly, or to update the reasons

actual results could differ materially from those anticipated in the forward-looking statements, even if new

information becomes available in the future.

1

2

Raised $30 million in sub debt (to pay for ADC and remove senior lender facility)

Executed an Adverse Development Cover for accident years 2005-2016

Strengthened 2017 reserves and announced storm losses for Harvey and Irma

Completed private placement of $5 million in common stock with management / Board

Poised to generate operating profits in Q4 and beyond

CONIFER: STATE OF THE BUSINESS

3

BUSINESS MIX: GROSS WRITTEN PREMIUM FOR Q3 2017

3

$14.8

$8.7

$0

$5

$10

$15

$20

$25

Q3 2017

M

I

L

L

I

O

N

S

Small Business

Hospitality

COMMERCIAL LINES OVERVIEW

• Commercial Lines represented roughly 80% of the premiums written

in the third quarter

• Quarter over quarter, Commercial gross written premiums were up 13% in Q3 2017

• The premium increase was mainly led by a 25% increase in Hospitality business in the third quarter

• Conifer continues to write Commercial Lines in all 50 states

4

GROSS WRITTEN PREMIUM

As of September 30, 2017

Top Five States

GROSS WRITTEN PREMIUM

$ in thousands

Florida $ 15,105 22.8%

Michigan 13,418 20.3%

Pennsylvania 6,309 9.5%

Texas 4,289 6.5%

Ohio 3,124 4.7%

All Other 24,014 36.2%

Total $ 66,258 100.0%

$11.9

$8.9

$0

$5

$10

$15

$20

$25

Q3 2016

M

I

L

L

I

O

N

S

Small Business

Hospitality

$5.1

$3.6

$2.6

$2.5

$0

$1

$2

$3

$4

$5

$6

$7

$8

$9

Q3 2016 Q3 2017

M

I

L

L

I

O

N

S

Wind-Exposed Low-Value Dwelling

• Personal Lines was approximately 20% of premium production in the third quarter

• Gross written premiums in wind-exposed business were down 31% quarter over quarter

Planned decrease in wind-exposed homeowners, specifically Florida homeowners

• Continuing efforts to reduce wind exposure & and non-renew Florida assumption business

PERSONAL LINES OVERVIEW

GROSS WRITTEN PREMIUM

$ in thousands

As of September 30, 2017

Top Five States

Texas 5,562 33.2%

Florida 4,828 28.8%

Hawaii 3,548 21.1%

Indiana 2,006 12.0%

Illinois 520 3.1%

All Other 314 1.8%

Total 16,778 100.0%

5

GROSS WRITTEN PREMIUM

21% decrease

$20.8

$23.5

$7.7

$6.1

$0

$5

$10

$15

$20

$25

$30

$35

Q3 2016 Q3 2017

M

I

L

L

I

O

N

S

Commercial Lines Personal Lines

Q3 2017 RESULTS OVERVIEW

Gross Written Premium increase:

• GWP increased roughly 4% in the third

quarter:

Strong commercial lines performance led by

our hospitality lines of business

• As a result of the Adverse Development Cover

and hurricane costs, net earned premium was

down to $17.7 million for Q3 2017

Before the impacts of the ADC and hurricane

costs, net earned premium was up 9% against

same period last year

• Again, directly as a result of the ADC and

hurricane costs, the Expense Ratio was up in

the quarter

Excluding the impacts of the ADC and

hurricane costs, the expense ratio ticked down

in the third quarter

Quarter over quarter, the expense ratio,

before ADC and hurricane costs was 42.9% in

Q3 2017 versus 46.3% in Q3 2016

Before the ADC and hurricanes, the expense

ratio declined 340 basis points quarter over

quarter

6

GROSS WRITTEN PREMIUM

7

48.0% 43.7%

61.9%

59.1%

2016 2017*

Expense Ratio Loss Ratio

RESULTS OVERVIEW: COMBINED RATIO

• As a result of the Adverse Development Cover and hurricane costs in general, the Combined

ratio spiked significantly in the third quarter and for the nine month period

• For the nine month period ended September 30, 2017, and excluding the affects of the ADC

and hurricanes, the Accident Year loss ratio was 59%.

109.9%

102.8%

*before impact of ADC and Q3 2017 hurricane activity

NINE MONTHS ENDED SEPTEMBER 30

8

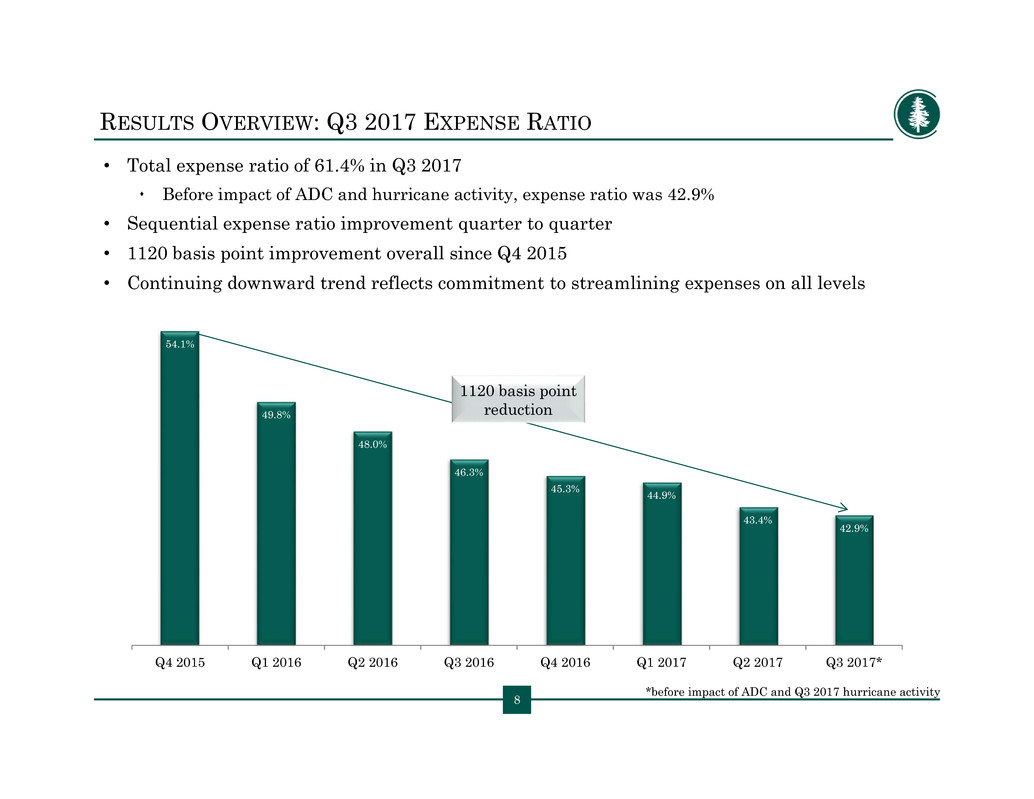

54.1%

49.8%

48.0%

46.3%

45.3%

44.9%

43.4%

42.9%

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017*

• Total expense ratio of 61.4% in Q3 2017

Before impact of ADC and hurricane activity, expense ratio was 42.9%

• Sequential expense ratio improvement quarter to quarter

• 1120 basis point improvement overall since Q4 2015

• Continuing downward trend reflects commitment to streamlining expenses on all levels

RESULTS OVERVIEW: Q3 2017 EXPENSE RATIO

1120 basis point

reduction

*before impact of ADC and Q3 2017 hurricane activity

9

BALANCE SHEET STRENGTHENING

ADVERSE DEVELOPMENT COVERAGE PURCHASE

COVERAGE AMOUNT: $19,500,000 xs $38,050,000 ($17,550,000 after co-participation)

COVERAGE YEARS: Accident dates from January 1, 2005 through December 31, 2016,

paid subsequent to June 30, 2017

PREMIUM: $7,200,000

CO-PARTICIPATION: 10% of development retained

PROFIT SHARING: 35% profit commission paid at commutation

SWISS RE CLAIMS AUDIT

• Results of Swiss Re claims audit as part of ADC transaction:

The Swiss Re team brought 7 auditors to review our claims department and files. In the follow up

meeting, they were universally positive about our claims operation, structure and management.

They reviewed some 10% (roughly 300 files) of our total outstanding claims universe and were within

$64,000 of our reserve estimates on those same 300 files that they reviewed. Our claims operation

overall was one of the best that they had reviewed / audited.

CATASTROPHE LOSSES

• Current estimated total loss of $5.6 million associated with Hurricanes Harvey and Irma

• Exposure to California wildfires limited to Quick Service Restaurant segment – no claims filed

10

CAPITAL RAISE: TRANSACTION SUMMARY

SUBORDINATED DEBT PLACEMENT

ISSUER: Conifer Holdings, Inc.

INVESTOR: Affiliates of Elanus Capital Management, LLC

DEAL SIZE: $30 million in subordinated notes

MATURITY: September 29, 2032 (15 Years)

ANNUAL INTEREST RATE: 8.0% Fixed

INTEREST DEFERRAL PERIOD: Up to four quarters

ISSUER CALL OPTIONS: 100% of par from July 31, 2018 through October 31, 2018;

105% of par after September 29, 2020

COVENANTS: Standard affirmative, financial, and negative covenants

COMMON EQUITY PRIVATE PLACEMENT

ISSUER: Conifer Holdings, Inc.

INVESTORS: Officers & Directors of the Company

DEAL SIZE: $5.0 million in common equity

ISSUE PRICE: $6.25 per share

11

Q3 2017 INCOME STATEMENT

• Company reported a net loss of $18.9 million, or $2.46 per share for Q3 2017

• $1.80 per share for valuation allowance against deferred tax assets not reflected in book value

• Book value per share of $6.16, or $52.5 million of shareholders’ equity

Three Months Ended

September 30,

($ in thousands, except per share data) 2017 2016

Gross Written Premium $29,581 $28,497

Net Written Premium 18,395 24,634

Net Earned Premium 17,659 23,380

Net Income (Loss) (18,898) (1,475)

EPS, Basic and Diluted $(2.46) $(0.19)

Adjusted Operating Income (Loss) (19,054) (1,523)

Adjusted Operating Income (Loss) per share $(2.48) $(0.20)

11

12

CONSERVATIVE INVESTMENT STRATEGY

• Investment philosophy is to maintain a

highly liquid portfolio of investment-grade

fixed income securities

• Total cash & investment securities of

$176.7M at September 30, 2017:

Average duration: 2.9 years

Average tax-equivalent yield: ~2.3%

Average credit quality: AA

FIXED INCOME PORTFOLIO

CREDIT RATING

$ in thousands September 30, 2017

Fair Value % of Total

AAA $ 32,299 26.5%

AA 48,875 40.1%

A 23,889 19.6%

BBB 14,748 12.1%

BB 731 0.6%

NR 1,341 1.1%

TOTAL

FIXED INCOME

INVESTMENTS

$ 121,883 100.0%

PORTFOLIO ALLOCATION

U.S.

Government

Obligations

7.0%

State & Local

Governments

12.3%

Corporate Debt

30.5%

Commercial

Mortgage &

Asset-Backed

Securities

42.5%

Equity

Securities

7.7%

APPENDIX

15

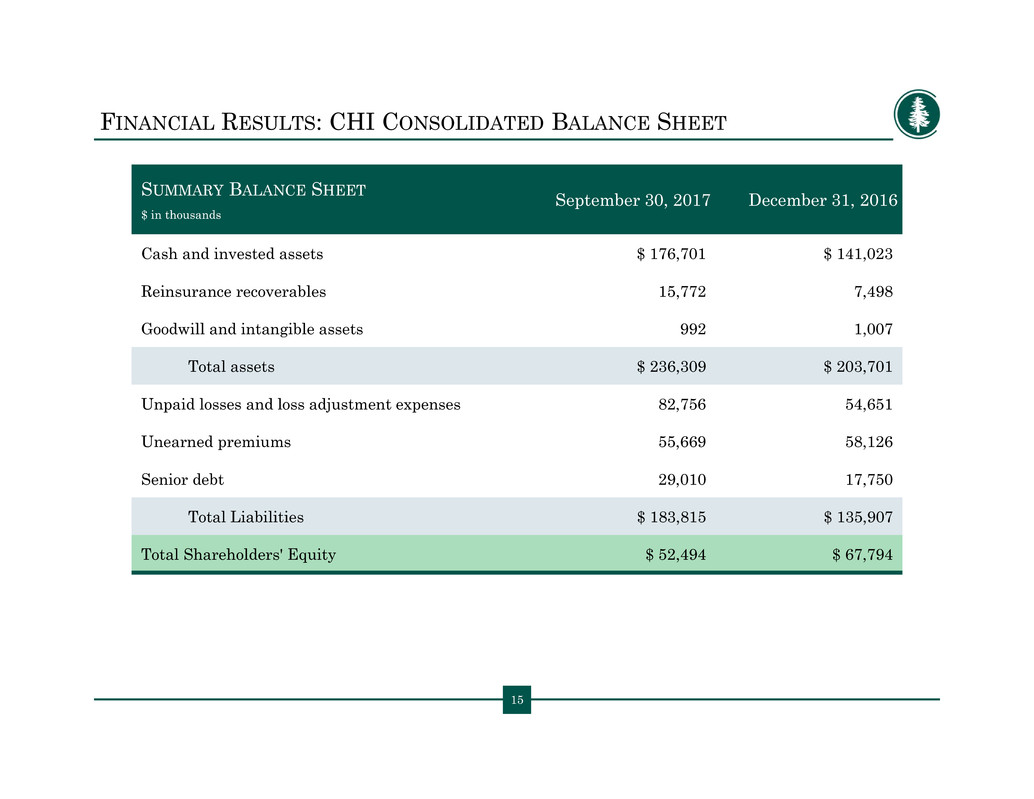

FINANCIAL RESULTS: CHI CONSOLIDATED BALANCE SHEET

SUMMARY BALANCE SHEET

$ in thousands

September 30, 2017 December 31, 2016

Cash and invested assets $ 176,701 $ 141,023

Reinsurance recoverables 15,772 7,498

Goodwill and intangible assets 992 1,007

Total assets $ 236,309 $ 203,701

Unpaid losses and loss adjustment expenses 82,756 54,651

Unearned premiums 55,669 58,126

Senior debt 29,010 17,750

Total Liabilities $ 183,815 $ 135,907

Total Shareholders' Equity $ 52,494 $ 67,794

16

SUMMARY FINANCIAL STATEMENTS: INCOME STATEMENT

16

OPERATING RESULTS Three Months Ended September 30,

$ in thousands, except per share data 2017 2016

Gross Written Premiums 29,581 28,497

Ceded Written Premiums 11,186 3,863

Net Written Premiums 18,395 24,634

Net Earned Premiums 17,659 23,380

Net investment income 768 560

Net realized investment gains 39 71

Other gains 0 0

Other income 477 303

Total revenue 18,943 24,314

Losses and loss adjustment expenses, net 26,468 14,582

Policy acquisition costs 6,655 6,266

Operating expenses 4,474 4,710

Interest expense 303 168

Total expenses 37,900 25,726

Income (loss) before equity earnings and income taxes (18,957) (1,412)

Equity earnings (losses) of affiliates, net of tax (76) (47)

Income tax (benefit) expense (135) 16

Net income (loss) (18,898) (1,475)

Earnings (loss) per common share, basic and diluted (2.46) (0.19)

Weighted average common shares outstanding, basic and diluted 7,675,952 7,608,284

17

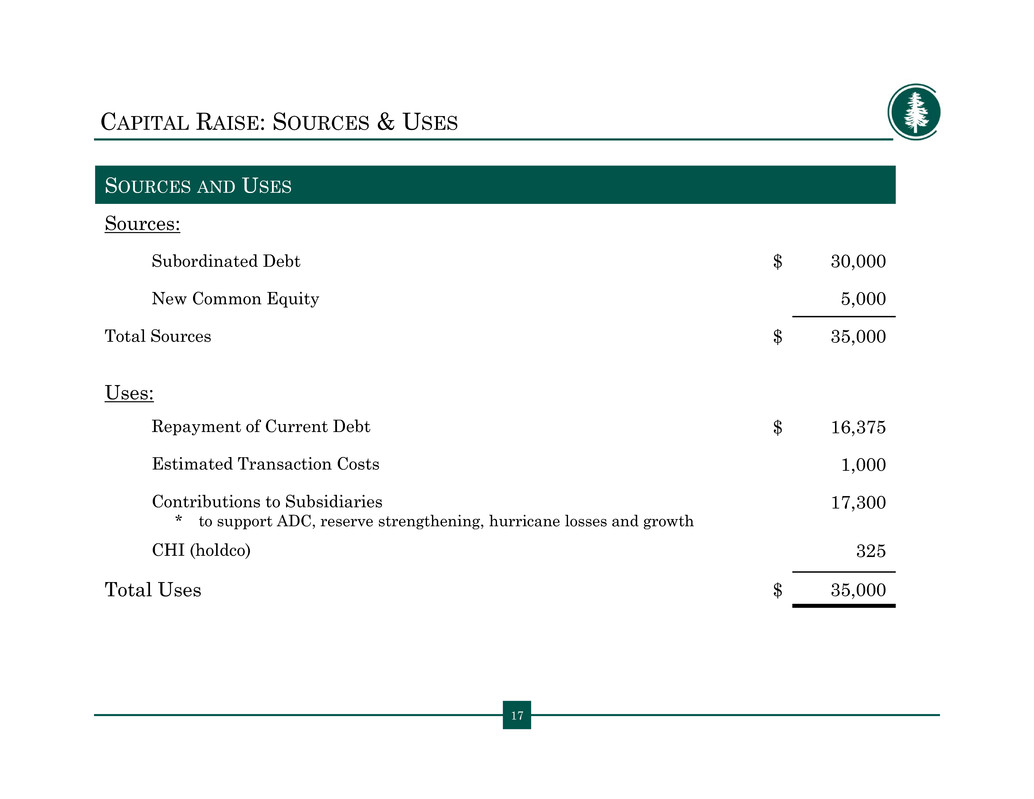

CAPITAL RAISE: SOURCES & USES

SOURCES AND USES

Sources:

Subordinated Debt $ 30,000

New Common Equity 5,000

Total Sources $ 35,000

Uses:

Repayment of Current Debt $ 16,375

Estimated Transaction Costs 1,000

Contributions to Subsidiaries

* to support ADC, reserve strengthening, hurricane losses and growth

17,300

CHI (holdco) 325

Total Uses $ 35,000