Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Lipocine Inc. | tv478656_8k.htm |

Enabling oral drug delivery to improve patient compliance November 8, 2017 Corporate Presentation Exhibit 99.1

Forward - Looking Statements This presentation contains forward - looking statements about Lipocine Inc. (the “Company”). These forward - looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward - looking statement s relate to the Company’s product candidates, the expected timing of the FDA review process related to our resubmitted NDA for TLANDO™, clini cal and regulatory processes and objectives, potential benefits of the Company’s product candidates, intellectual property and relate d m atters, all of which involve known and unknown risks and uncertainties. Actual results may differ materially from the forward - looking statemen ts discussed in this presentation . Accordingly, the Company cautions investors not to place undue reliance on the forward - looking statements contained in, or made in connection with, this presentation . Several factors may affect the initiation and completion of clinical trials, the potential advantages of the Company’s product candidates and the Company’s capital needs. Among other things, the projected commencement and completion of the Company’s clinical trials may be affected by difficulties or delays. We may encounter delays or other issues in the FDA appro val process, including that the FDA may determine there are deficiencies in our resubmitted NDA. We are also subject to risks related to t he possibility of an advisory committee meeting related to TLANDO™. In addition, the Company’s results may be affected by its ability to manage it s financial resources, difficulties or delays in developing manufacturing processes for its product candidates, preclinical and toxicolog y t esting and regulatory developments. Delays in clinical programs, whether caused by competitive developments, adverse events, patient en rol lment rates, regulatory issues or other factors, could adversely affect the Company’s financial position and prospects. Prior clin ica l trial program designs and results are not necessarily predictive of future clinical trial designs or results. If the Company’s product can did ates do not meet safety or efficacy endpoints in clinical evaluations, they will not receive regulatory approval and the Company will not be a ble to market them. The Company may not be able to enter into any strategic partnership agreements. The Company’s commercial success depends on i ts ability to manufacture, market and sell products without infringing the proprietary rights of third parties. Operating expense and ca sh flow projections involve a high degree of uncertainty, including variances in future spending rates due to changes in corporate pr ior ities, the timing and outcomes of clinical trials, competitive developments and the impact on expenditures and available capital from licensing an d strategic collaboration opportunities. If the Company is unable to raise additional capital when required or on acceptable terms, it m ay have to significantly delay, scale back or discontinue one or more of its drug development or discovery research programs. The Compa ny is at an early stage of development and may not ever have any products that generate significant revenue. The forward - looking statements contained in this presentation are further qualified by the detailed discussion of risks and uncertainties set forth in the Company’s a nnu al report on Form 10 - K and other periodic reports filed by the Company with the Securities and Exchange Commission, all of which can be obtai ned on the Company’s website at www.lipocine.com or on the SEC website at www.sec.gov . The forward - looking statements contained in this document represent the Company’s estimates and assumptions only as of the date of this presentation and the Company undertakes no duty or obligation to update or revise publicly any forward - looking statements contained in this presentation as a result of new information, future events or changes in the Company’s expectations. 2

Men's Health Franchise Testosterone Replacement Therapy (“TRT”) Women's Health Preterm Birth (“PTB”) Proprietary Drug Delivery Platform Significant Unmet Need In Both Therapeutic Areas 3 Unique Specialty Pharmaceutical Company Advanced Pipeline

Late - Stage Pipeline 4 Oral Product Candidates Targeting Significant Opportunities PRODUCT (Indication) PRECLINICAL PHASE 1 PHASE 2 PHASE 3 NDA MEN’S HEALTH TLANDO™ (Oral Testosterone Replacement Therapy, TRT) NDA PDUFA Date Feb 8, 2018 LPCN 1111 (Next Gen. Oral TRT) FDA Meeting 1Q 2018 WOMEN’S HEALTH LPCN 1107 (Prevention of Preterm Birth, PTB) CMC: process characteri - zation & scale - up complete 4Q 2017

Lipocine is Positioned for Success Because…… 5 Significant Advantages Over Existing Approved Products LPCN 1107 • Poised to be First oral to the market • Potentially better PTB results • Orphan drug designation – Major contribution to patient care TRT Franchise TLANDO™ • Patient preferred first oral option • Positive head to head clinical results vs the $ market leader • No additional doctor visits as fixed dose LPCN 1111 (Next generation potential once - daily oral T) • Potential for sustained and enhanced revenues with QD dosing • Positive top - line Phase 2b study results Significant Technical and Commercial Expertise on the team Prevention of Preterm Birth

The Oral TRT Challenge • Native testosterone has poor oral bioavailability with a very short half life (~30 minutes) – Impractical frequent daily doses would be required to obtain effective levels – Inconsistent and unpredictable performance • Methyl testosterone – Liver toxicity – Unsafe for chronic use TLANDO™ Overcomes Historical Issues With Developing an Oral T Product 6

TLANDO™ TLANDO ® (LPCN 1021) Transported via Lymph Not prone to liver issues METHYL TESTOSTERONE (MT) Transported via Liver Prone to liver toxicity Systemic Circulation Thoracic Duct Lymph Duct Liver Liver GI Lumen GI Lumen Systemic Circulation Lipocine’s Innovative Lipr’al Technology • Primarily directing bioreversible Testosterone Undecanoate (“TU”) into the lymphatic system • Bypasses liver • Able to reliably increase testosterone levels for 10 - 12 hours on a single dose Key to Success 7

8

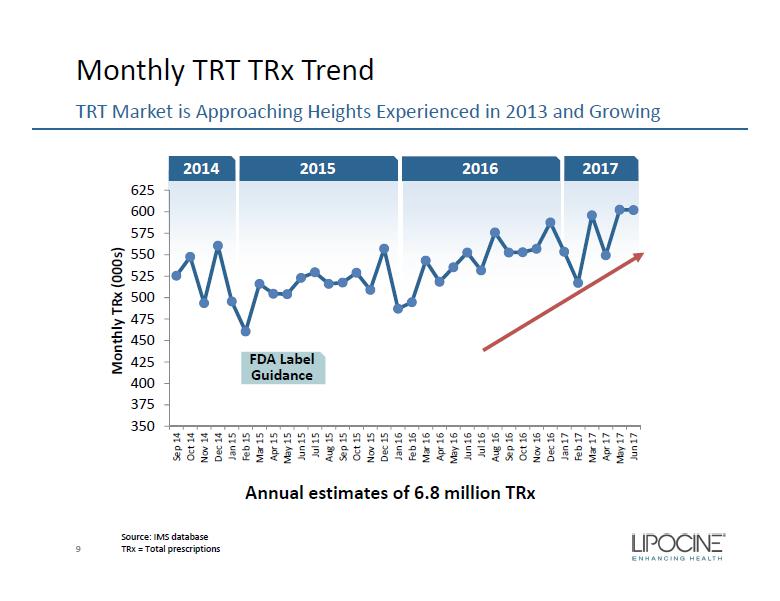

2017 2016 2014 2015 350 375 400 425 450 475 500 525 550 575 600 625 Sep 14 Oct 14 Nov 14 Dec 14 Jan 15 Feb 15 Mar 15 Apr 15 May 15 Jun 15 Jul 15 Aug 15 Sep 15 Oct 15 Nov 15 Dec 15 Jan 16 Feb 16 Mar 16 Apr 16 May 16 Jun 16 Jul 16 Aug 16 Sep 16 Oct 16 Nov 16 Dec 16 Jan 17 Feb 17 Mar 17 Apr 17 May 17 Jun 17 Monthly TRx (000s) FDA Label Guidance Monthly TRT TRx Trend 9 TRT Market is Approaching Heights Experienced in 2013 and Growing Annual estimates of 6.8 million TRx Source: IMS database TRx = Total prescriptions

TRT $ Market Opportunity Is Large $0 $500,000,000 $1,000,000,000 $1,500,000,000 $2,000,000,000 $2,500,000,000 Jul-15 Jul-16 Jul-17 Dollar Volume Is Steady With Minimal Promotional Investment In 2016, Branded Products accounted for 80+ % of total TRT $ market volume 10 Source: IMS July 2017

Hypogonadism Affects Up to 20 MM American Men 1,2 TLANDO™ Has The Potential To Drive Significant Market Expansion 1.5MM 2.2MM 6MM 700,000 Available switch patients Men currently being treated 4 Men with diagnosed hypogonadism 3 Available naïve patients per year 5 3.8MM diagnosed but untreated patients 1. US Census data. http://www.infoplease.com/us/census/data/demographic.html. 2. Mulligan T, et al. Int J Clin Pract . 2006 Jul;60(7):762 - 9. 3. Araujo, et al. J Clin Endo Metabol 2007. 92(11):4241 - 7. 4. Symphony Healthcare 2014 for FDA Advisory Meeting. 5. IMS Health Sept 2015. 11

Issues with Current Non - oral TRT Options • Black Box Warning – Secondary exposure to testosterone – Pulmonary oil micro embolism (POME) and anaphylaxis shock • Inconvenient application or painful injection • Poor persistence reflects need for oral – Average days on therapy is 100 days • More than 50% of patients need dosage adjustment – Burdensome for patients due to multiple doctor visits Potential Barrier To Newly Diagnosed and Existing Patients 12

TRT Market Research Results Patients And Physicians Are Asking For A Novel Oral Option • Unprompted physicians mention the need for an oral • A product with no titration is seen as an advantage • Physicians have a strong interest for an oral BID product 8.5 out of 10 • Physician’s allocate 38% of prescribing to TLANDO™ • Three - quarters of the respondents mention unprompted oral as desirable • Patients are willing to consider a co - pay higher for an oral product than their current costs • Patients likelihood to ask there Dr. about TLANDO™ is high 9.4 out of 10 Likelihood to Ask Their Dr. about TLANDO™ 94% of Interviewed TRT Patients Have a Strong Interest in an Oral 85% of Interviewed Physicians Physicians Patients 13

TLANDO™: Potential First Oral Option Profile Demonstrated Clinically with Target Label Regimen ▪ Met primary endpoint - 80% response rate in “worst - case analysis” vs. FDA requirement of 75% ▪ Met key secondary endpoint - No eligible subjects with T levels >2500 ng/ dL ▪ Other secondary endpoints generally consistent with approved products Efficacy ✔ ▪ 525 unique hypogonadal men exposure ▪ Well tolerated in 52 week exposure - AE profile comparable to active control, including GI - No cardiac, hepatic or drug related SAEs ▪ No apparent correlation of the observed Cmax excursions - ADRs - AEs - Meaningful changes in critical lab parameters Safety ▪ Preferred oral option - No risk of accidental T transference - Non - invasive - Less cumbersome - Less burdensome - Simpler to prescribe - Fewer doctor visits - Easier for patients to properly use Clear Benefits 14

Current Area of Interest by the FDA SOAR Phase 3 Clinical Trial Results: Mean Blood Pressure 50 70 90 110 130 150 0 13 26 39 52 Blood Pressure (mmHg) Time (Week) Mean Blood Pressure at Each Visit (SOAR Trial) Diastolic TLANDO Diastolic Androgel 1.62% Systolic TLANDO Systolic Androgel 1.62% ▪ Mean Blood pressure: Consistent throughout the SOAR study in both arms and between TLANDO™ and Androgel 1.62%® x No increase observed in systolic or diastolic mean blood pressure values 15

Current Area of Interest by the FDA SOAR Phase 3 Clinical Trial Results: AE’s related to Increased Blood Pressure / Hypertension System Organ Classification / Preferred Term TLANDO™ (N=210) Androgel 1.62% (N=104) n (%) Events (n) n (%) Events (n) Investigations: Blood Pressure Increased 1 (0.5) 1 2 (1.9) 3 Vascular Disorders: Hypertension 6 (2.9) 6 5 (4.8) 5 Total 7 (3.4) 7 7 (6.7) 8 Lipocine Confidential 16 ▪ Fewer TLANDO™ subjects as a percentage experienced AE’s as a result of increased blood pressure / hypertension as compared to Androgel 1.62% subjects x No AE’s in DV or DF Studies related to increased blood pressure / hypertension ▪ No subject discontinuations in SOAR, DV or DF studies related to increased blood pressure / hypertension

TLANDO™: Addresses Previous FDA Concerns Salient 2014 Oral TU ADCOM Approvability Issues Primary Efficacy End point: Robust with only one subject dropout Consistent efficacy in multiple trials with target dosing regimen Fixed dose: No titration requirement Stable to varied dietary fat consumption Safety comparable to active control No safety signal: Zero drug related SAEs No blood pressure changes Consistent intra day/inter day performance Cmax excursions: No eligible subject exceeded supra - therapeutic level (>2500 ng/ dL ) Significant long - term safety exposure with “to be marketed” dosing regimen 17

Next Steps to Bring TLANDO™ to Patients Regulatory Approval Focus • PDUFA goal date of February 8, 2018 • Advisory Committee meeting to be held on January 10, 2018 Partnering/licensing due diligence and discussions on - going Key required pre - commercial readiness activities progressing to ensure launch excellence 18 Poised To Meet And Exceed Unmet Need

19 LPCN 1111 QD TLANDO

Higher Prescribing Preference for QD Product 20 Potential For Increased TRT Market Share CE11. Now, please assume that Product X was dosed QD rather than BID as originally presented. Please re - estimate the percentage of patients for whom you would prescribe each of the following therapies 31% 4% 9% 1% 53% 1% 24% 4% 7% 1% 64% 1% Future Prescribing Patterns with Entrenchment of Product X BID Future Prescribing Patterns with Entrenchment of Product X QD The difference in Product X market share is highly statistically significant with a p<0.01

LPCN 1111: Next - Generation Oral TRT • Novel bio - reversible prodrug of testosterone for oral delivery • Once - daily potential expected to sustain and improve market share of oral T franchise • Once - daily feasibility established in Phase 2a and 2b clinical trials – Single - daily oral dose provides T levels in eugonadal range • Development status Next steps: – Preclinical toxicity study complete, data analysis on - going – FDA meeting with FDA in 1Q 2018 post preclinical toxicity study 21 Potential Once - Daily Dosing

22

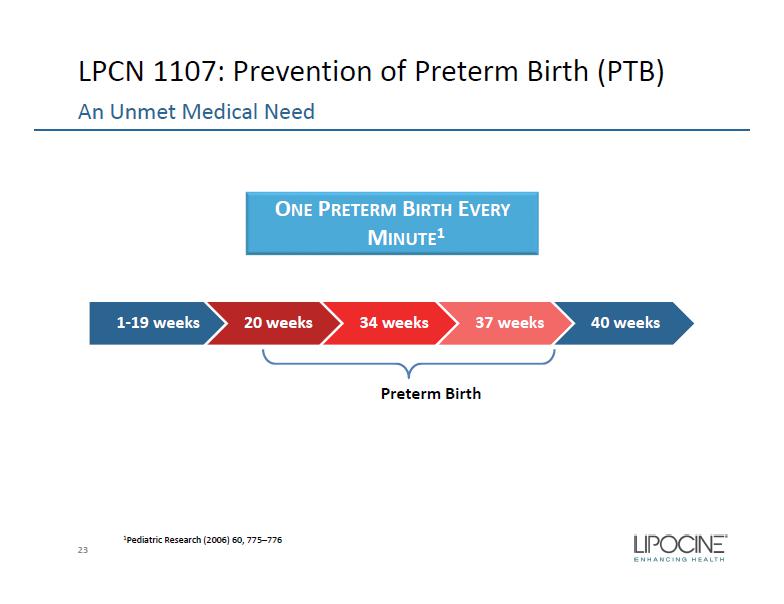

LPCN 1107: Prevention of Preterm Birth (PTB) 23 An Unmet Medical Need 1 Pediatric Research (2006) 60, 775 – 776 Preterm Birth 1 - 19 weeks 20 weeks 34 weeks 37 weeks 40 weeks O NE P RETERM B IRTH E VERY M INUTE 1

High PTB Medical Costs • 12% of all US pregnancies 1 (475 - 500K) result in PTB (< 37 weeks) - a leading cause of neonatal mortality and morbidity • First year medical costs for PTB infants are ~ 10x higher than for full term infants 2 • 28% of preterm births are to women with histories of early delivery 24 ≥ $26 Billion Economic Impact 3 1. CDC (2010) 2. J. Maternal - Fetal and Neonatal Medicine, Dec. 2006, 19(12), 773 – 782 3 . Institute of Medicine of the National Academies. Jul.200

LPCN 1107: First Oral PTB Candidate 25 Characteristics Of The Only Approved Product for PTB IM HPC, Makena ® : Current preterm birth standard of care ▪ $334 M in sales in 2016 ; on track to do ~$385M - $395M in 2017 ▪ 20 - 25% patients below reported better efficacy HPC level threshold ▪ Total of 18 - 22 injections – Viscous oily weekly injection – Injection takes up to 1 min – Weekly visit to/by health care provider – ~35% of patients experienced injection site pain during clinical trial – ~17% of patients reported site swelling - much greater than placebo during clinical trial Makena 21 gauge needle

LPCN 1107 - Oral HPC ▪ Potential for superior efficacy with Phase 3 target dose ▪ No patient discomfort upon administration ▪ Steady state achieved in 7 days ▪ Orphan drug designation – Major contribution to patient care LPCN 1107: First Oral PTB Candidate 26 Addresses Unmet Need

LPCN 1107: First Oral PTB Candidate First Oral HPC for Prevention of Recurrent PTB • Preferred route - of - administration is oral Strong Exclusivity Position • Orphan Drug Designation • Technology/IP protection Potential for Superior Efficacy • Fewer PTB babies with significant healthcare cost savings Strong Pharmaco - Economic Justification • Minimize travel related cost/time and healthcare provider cost/time • Premium pricing potential to generic IM injections 27 Commercial Outlook/Drivers

LPCN 1107: Advancing to Phase 3 Readiness 28 Key Design Elements for Phase 3 Study Proposed indication • To reduce the risk of preterm birth in women with a singleton pregnancy who have a history of singleton spontaneous preterm birth Design Elements • Open label, RCT, non - inferiority (“NI”) study with two treatment arms (LPCN 1107 and IM, Makena®) with 1:1 randomization • The primary efficacy analysis to demonstrate NI to Makena using a pre - specified NI margin of 7% • A standard statistical NI design of 90% power leads to ~ 1,100 subjects per arm • Phase 3 protocol includes an adaptive design that could lower patient per arm • Interim analysis with pre - specified actions Next Steps • Continue Interactions with FDA on Phase 3 protocol via Special Protocol Assessment • Conduct CMC activities ongoing in preparation of Phase 3 study

Upcoming Milestones 29 Driving Value in 2017 Event Expected Timing TLANDO™ Advisory Committee meeting January 10, 2018 PDUFA goal date February 8, 2018 LPCN 1111 FDA meeting to discuss Phase 3 clinical trial 1Q 2018 LPCN 1107 CMC: process characterization & scale - up completed 4Q 2017

Key Financial Metrics 30 Stock Price, Market Cap, Cash Balance Ticker Symbol LPCN (Nasdaq Capital Market) Closing Stock Price (11/3/17) $3.50/share Market Capitalization (11/3/17) $74.2 million Fully Diluted Shares Outstanding (9/30/17) 23.5 million Cash Balance (9/30/17) $25.7 million Bank Debt (9/30/17) None

MEN’S HEALTH Testosterone Replacement Therapy (“TRT”) Franchise • TLANDO™ : Potential first oral TRT option - Differentiated product targeting ~$2.0 billion established US TRT market - Poised to meet and exceed unmet need • LPCN 1111 : Next generation potential once - daily oral TRT option - Positive top - line Phase 2b study results WOMEN’S HEALTH LPCN 1107: Orphan designated oral alternative for the prevention of preterm birth • EOP2 meeting completed • Phase 3 protocol submitted to FDA via Special Protocol Assessment • CMC scale up work on - going Lipocine Investment Highlights 31 Innovative Technology with Advanced Products Proven Proprietary Technology Platform

Appendix 32

TLANDO™: DV Study (Pivotal Efficacy) – Efficacy Results Primary Endpoints – Demonstrated Robust Efficacy Measure FDA Targets Safety Set* “Worst Case” Analysis # Number of subjects 95 95 % subjects with C avg w ithin normal range (300 - 1080 ng/ dL ) ≥75% 81% 80% 95% CI lower bound ≥ 65% 72% 72% * Subjects randomized into the study and who took at least one dose of the study drug. Missing data imputed by multiple imput ati on # Subjects randomized into the study and who took at least one dose of the study drug. Missing data imputed by baseline carri ed forward (i.e., considered treatment failures) 33

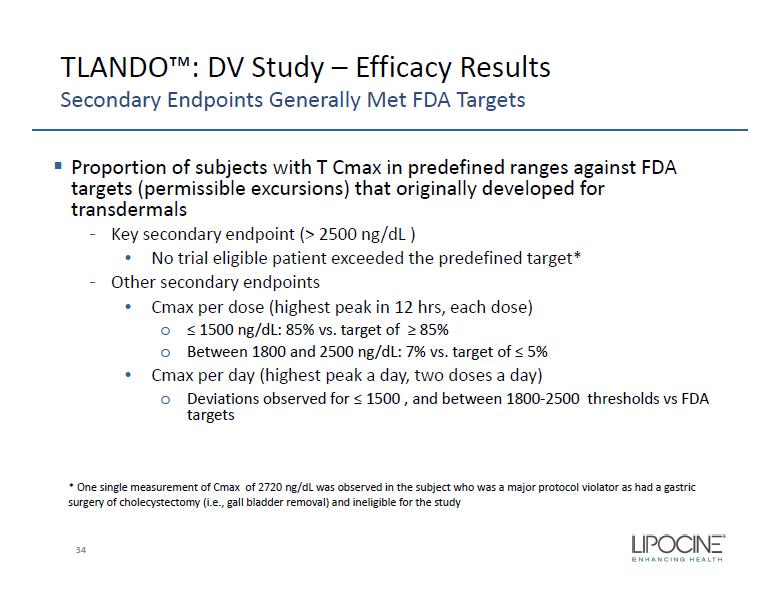

TLANDO™: DV Study – Efficacy Results Secondary Endpoints Generally Met FDA Targets ▪ Proportion of subjects with T Cmax in predefined ranges against FDA targets (permissible excursions) that originally developed for transdermals - Key secondary endpoint (> 2500 ng/ dL ) • No trial eligible patient exceeded the predefined target* - Other secondary endpoints • Cmax per dose (highest peak in 12 hrs , each dose) o ≤ 1500 ng/ dL : 85% vs. target of ≥ 85% o Between 1800 and 2500 ng/ dL : 7% vs. target of ≤ 5% • Cmax per day (highest peak a day, two doses a day) o Deviations observed for ≤ 1500 , and between 1800 - 2500 thresholds vs FDA targets 34 * One single measurement of Cmax of 2720 ng/ dL was observed in the subject who was a major protocol violator as had a gastric surgery of cholecystectomy (i.e., gall bladder removal) and ineligible for the study

TLANDO™: Long Term Safety Demonstrated Over 52 Weeks in SOAR (Pivotal Safety) Study AE’s greater than 5% TLANDO Active Control Upper Respiratory Tract Infection 5.2% 5.8% Fatigue 2.4% 6.7% ADRs greater than 2% TLANDO Active Control Headache 0.5% 2.9% Acne 2.4% 0.0% Safety Population: Subjects who received at least one dose of study drug, comprised of 314 subjects; 210 who received TLANDO and 104 who received the active control 35

TLANDO™: Phase 3 Design Study of Androgen Replacement (SOAR) 36 Open - label, randomized, active - controlled study of LPCN 1021 in hypogonadal men Screening N=315 0 Week 4 Week 8 Randomization LPCN 1021 225 mg, TU, BID with Meal (n=210) Active Control (n=105) PK/Dose Titration PK/Dose Titration PK/Efficacy Assessment Safety Assessment Week 13 Week 52 Safety Extension (up to Week 52)

TLANDO™: DV Study vs SOAR Trial Key Design & Efficacy Result Differences DV Study – 225 mg BID without titration – Taken with meal – No BMI restriction – Mean Cavg (CV): 476 ng/ dL (37%)* SOAR Trial – 225 mg BID with titration – Taken with standard (20% – 35% fat) meal – Exclude BMI > 38 kg/m2 – Mean Cavg (CV): 471 ng/ dL (41%)** 37 * Safety set **Full Analysis Set (FAS) ▪ Cmax excursions in DV study (fixed dose) are comparable or better than in SOAR Trial (titration) ▪ Much lower unacceptably high (> 2500 ng/ dL ) T level excursions in DV study than in SOAR trial ▪ AE profile and changes in key lab parameters were generally consistent between studies

38

TLANDO™: DV Study vs SOAR Trial Cmax * Outside the Pre - defined Ranges are Transient 39 22.3 23.0 21.9 22.0 1.7 1.0 2.1 2.0 0 4 8 12 16 20 24 T Cmax > 1500 ng/dL T Cmax > 1800 ng/dL T Cmax > 1500 ng/dL T Cmax > 1800 ng/dL Time ( hr ) Time Spent in a day below (hr) Time Spent in a day above (hr) *All Cmax including permissible excursions DV Study SOAR Trial

AE’s greater than 5% in all patients Cmax (ng/dL) > 1500 ≤ 1500 Upper Respiratory Tract Infection 2.6% 5.9% Fatigue 0% 2.5% ADRs greater than 2% in all patients Cmax (ng/dL) > 1500 ≤ 1500 Headache 0% 0.9% Acne 2.6% 0.9% AEs Impact * Cmax on Efficacy day and AEs / ADRs following Efficacy day Safety Relevance of Cmax > 1500 ng/ dL TLANDO™: SOAR Trial ADRs Impact • Lack of correlation in AEs and ADRs in subjects experiencing Cmax > 1500 ng/ dL or Cmax ≤ 1500 ng/ dL suggests no safety relevance 40

HPC Concentration and PTB Rates 41

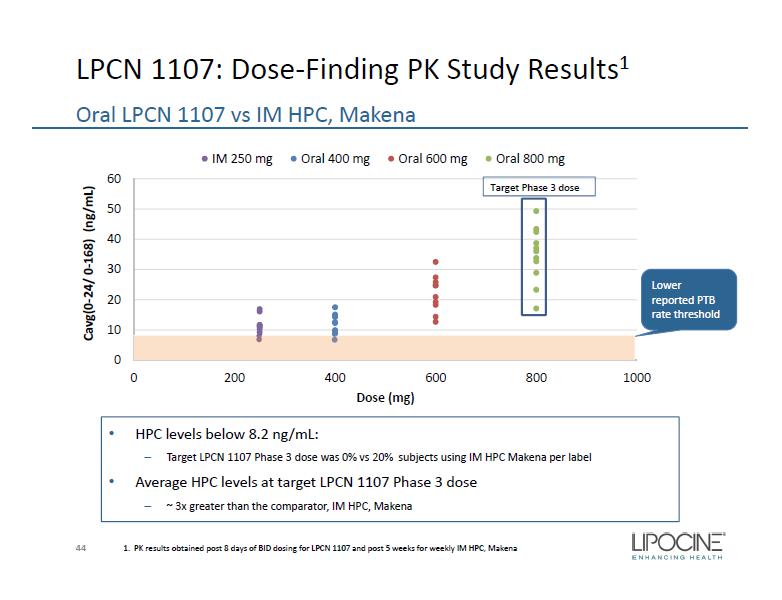

LPCN 1107: HPC PK - PD Correlation 42 HPC Concentration and PTB Rate with IM HPC, Makena 1 46.3 % 27.0 % 29.6 % 31.3 % Quartile 1: 3.7 - 8.1 ng/mL Quartile 2: 8.2 - 9.8 ng/mL Quartile 3: 9.9 - 12.4 ng/mL Quartile 4: 12.5 - 56 ng/mL 15 25 35 45 55 6 8 10 12 14 16 PTB rate (%, N=315) HPC trough plasma concentration (ng/mL) • Lower % PTB rate can be expected with daily Cavg 2 HPC levels ≥ 8.2 ng/mL 1. Caritis et al., Am J Obstet Gynecol. 2014 (N=315 subjects) 2. Ctrough Cavg for IM HPC, Makena N=315

LPCN 1107: Dose Finding Study Design • Open - label, four - period, four - treatment study • 12 healthy pregnant women - Ages 18 - 35 years; 16 - 18 weeks gestation • All subjects received all four treatments 43 PK Study: Oral LPCN 1107 vs IM HPC, Makena Treatment A 400 mg BID Treatment B 600 mg BID Treatment C 800 mg BID Treatment D 250 mg Weekly LPCN 1107, Oral HPC IM HPC, Makena Multiple doses for 8 days Multiple dose: 5 weeks

LPCN 1107: Dose - Finding PK Study Results 1 44 Oral LPCN 1107 vs IM HPC, Makena 1. PK results obtained post 8 days of BID dosing for LPCN 1107 and post 5 weeks for weekly IM HPC, Makena Lower reported PTB rate threshold 0 10 20 30 40 50 60 0 200 400 600 800 1000 Cavg(0 - 24/ 0 - 168) (ng/mL) Dose (mg) IM 250 mg Oral 400 mg Oral 600 mg Oral 800 mg Target Phase 3 dose • HPC levels below 8.2 ng/mL: – Target LPCN 1107 Phase 3 dose was 0% vs 20% subjects using IM HPC Makena per label • Average HPC levels at target LPCN 1107 Phase 3 dose – ~ 3x greater than the comparator, IM HPC, Makena

LPCN 1107: Economic Impact Potential Lower PTB Rate – US and Resulting Savings Assuming 4.3% lower PTB rate relative to Makena® ~6000 fewer annual PTBs ‡ Estimated annual cost saving in ~$310M ‡‡ 45 ‡: Assuming 100% of 140,000 eligible US population treated ‡‡: Assuming ~$51,600 medical costs/PTB