Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mueller Water Products, Inc. | form8-k11x07x17xinvestorpr.htm |

Where Intelligence

Meets Infrastructure

F E B R U A R Y 2 0 1 7

M U E L L E R W A T E R P R O D U C T S . C O M

Baird’s Global Industrial Conference

November 8, 2017

PAGE 2

NON-GAAP Financial Measures

M U E L L E R W A T E R P R O D U C T S . C O M 2 N O V E M E B R 2 0 1 7

In an effort to provide investors with additional information

regarding its results as determined by GAAP, the Company

also provides non-GAAP information that management

believes is useful to investors. These non-GAAP measures

have limitations as analytical tools, and securities analysts,

investors and other interested parties should not consider

any of these non-GAAP measures in isolation or as a

substitute for analysis of its results as reported under GAAP.

These non-GAAP measures may not be comparable to

similarly titled measures used by other companies.

The Company presents adjusted income from continuing

operations, adjusted income from continuing operations per

share, adjusted operating income from continuing

operations, adjusted operating margin, adjusted EBITDA and

adjusted EBITDA margin as performance measures because

management uses these measures in evaluating the

Company's underlying performance on a consistent basis

across periods and in making decisions about operational

strategies. Management also believes these measures are

frequently used by securities analysts, investors and other

interested parties in the evaluation of the Company's

recurring performance.

The Company presents net debt and net debt leverage

as performance measures because management uses

them in evaluating its capital management, and the

investment community commonly uses them as

measures of indebtedness. Free cash flow is presented

because management believes it is commonly used by

the investment community to measure the Company's

ability to create liquidity.

The calculations of these non-GAAP measures and

reconciliations to GAAP results are included as an

attachment to this presentation and have been posted

online at www.muellerwaterproducts.com.

This presentation contains certain statements that may be deemed “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. All statements that address activities that

may occur in the future are forward-looking statements. The words “projected,” “designed,” “will,”

“expects,” “intend,” and other similar expressions identify forward-looking statements.

Forward-looking statements are based on certain assumptions and assessments made by the Company in

light of its experience, historical trends, current conditions and expected future developments. Actual

results and the timing of events may differ materially from those contemplated by the forward-looking

statements due to a number of factors, including regional, national or global political, economic, business,

competitive, market and regulatory conditions and the other factors that are described in the section

entitled “RISK FACTORS” in Item 1A of the Company's most recently filed Annual Report on Form 10-K

and subsequent Quarterly Reports on Form 10-Q. Undue reliance should not be placed on any forward-

looking statements. Management does not have any intent to update forward-looking statements, except

as required by law.

Forward-looking Statements

M U E L L E R W A T E R P R O D U C T S . C O M 3 N O V E M E B R 2 0 1 7

Reclassified Financials

We sold Anvil in January 2017

As a result, Anvil's operating results for all prior periods, and the gain from its

sale, have been classified as discontinued operations

Mueller Co. is now called Infrastructure

Mueller Technologies is now called Technologies

PAGE 4 M U E L L E R W A T E R P R O D U C T S . C O M 4 N O V E M E B R 2 0 1 7

Renamed Segments

Investment Highlights

M U E L L E R W A T E R P R O D U C T S . C O M 5 N O V E M E B R 2 0 1 7

Market opportunity is substantial and

growing

Restoring and expanding existing water systems to serve growing populations through

2050 require a $1.7 trillion investment, according to the American Water Works Association

Industry leading brands and market position

Providing one of the largest installed bases of iron gate valves and fire hydrants in the U.S.

with product specifications in the top 100 U.S. municipal markets

Manufacturing excellence driving margin

expansion Delivering productivity which helps drive margin expansion and free

cash flow generation

Intelligent water infrastructure products

Offering smart technology products and services that help utilities actively diagnose,

monitor and control the delivery of drinking water

Strategic capital deployment to create value

Pursuing acquisitions, repurchasing shares, developing new products, and making capital

investments in manufacturing and equipment upgrades

Our Company

and Markets

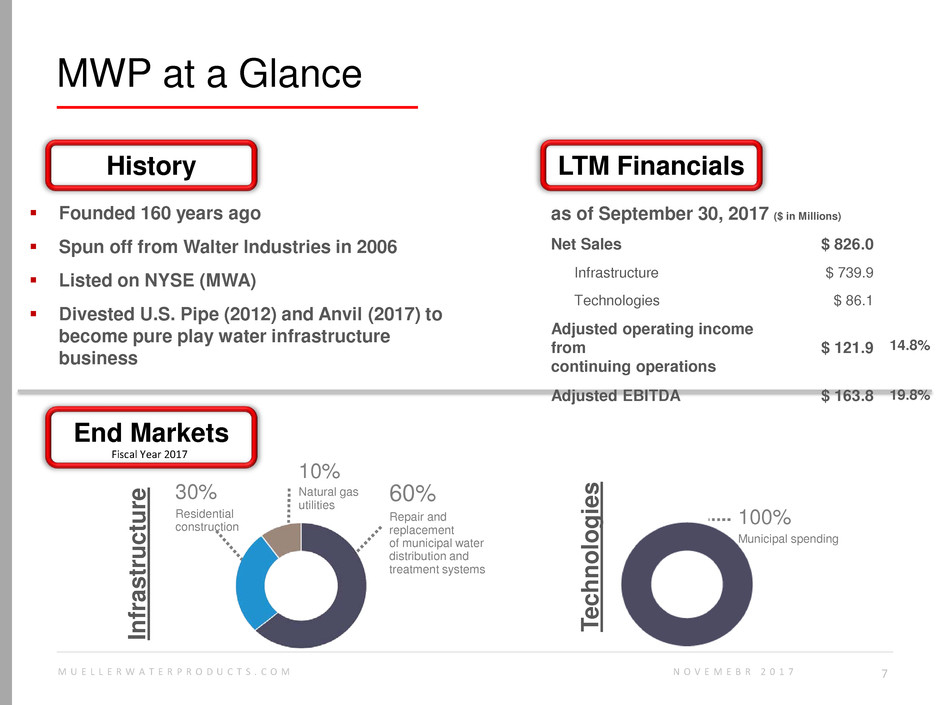

MWP at a Glance

M U E L L E R W A T E R P R O D U C T S . C O M 7 N O V E M E B R 2 0 1 7

100%

Municipal spending

60%

Repair and

replacement

of municipal water

distribution and

treatment systems

30%

Residential

construction

10%

Natural gas

utilities

as of September 30, 2017 ($ in Millions)

Net Sales $ 826.0

Infrastructure $ 739.9

Technologies $ 86.1

Adjusted operating income

from

continuing operations

$ 121.9

14.8%

Adjusted EBITDA $ 163.8 19.8%

In

fr

as

tr

uc

tu

re

Te

ch

no

lo

gi

es

Founded 160 years ago

Spun off from Walter Industries in 2006

Listed on NYSE (MWA)

Divested U.S. Pipe (2012) and Anvil (2017) to

become pure play water infrastructure

business

History

End Markets

LTM Financials

Fiscal Year 2017

Our Leading Product Positions

M U E L L E R W A T E R P R O D U C T S . C O M 8

#1 PRODUCT POSITION #1 PRODUCT POSITION #1

PRODUCT

POSITION #2 PRODUCT POSITION

Company estimates based on internal analysis and information from trade associations and distributor networks, where available.

N O V E M E B R 2 0 1 7

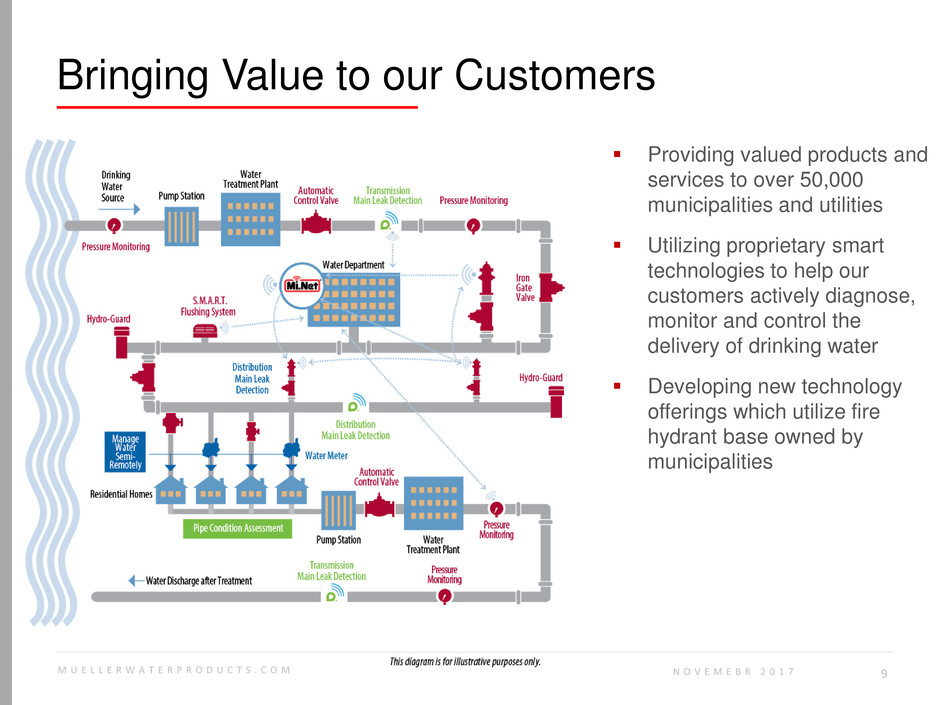

Bringing Value to our Customers

Providing valued products and

services to over 50,000

municipalities and utilities

Utilizing proprietary smart

technologies to help our

customers actively diagnose,

monitor and control the

delivery of drinking water

Developing new technology

offerings which utilize fire

hydrant base owned by

municipalities

M U E L L E R W A T E R P R O D U C T S . C O M 9 N O V E M E B R 2 0 1 7

U.S. Water Infrastructure Requires Substantial

Long-Term Investment

M U E L L E R W A T E R P R O D U C T S . C O M 1 0

Repair & Replacement Market

(1) American Water Works Association, Buried No Longer: Confronting America’s Water Infrastructure Challenge 2012

(2) ASCE: 2017 Report Card for America’s Infrastructure

(3) The EPA Clean Water and Drinking Water Infrastructure Gap Analysis 2002

(4) EPA 2013 Drinking Water Needs Survey and Assessment

Future Drinking Water Infrastructure

Expenditure Needs (4)

Restoring existing water systems and expanding them to serve a

growing population through 2050 will require a $1.7 trillion investment (1)

ASCE graded drinking water infrastructure a D (2)

At least 40 cities under consent decrees: Atlanta, Baltimore,

Washington, D.C., Suburban Washington, D.C. (WSSC), New Orleans

EPA analysis indicates the need to address aging transmission and

distribution pipes is accelerating (see chart below); valves and hydrants

are generally replaced along with pipe replacement and repair

(3)

N O V E M E B R 2 0 1 7

Accelerating

Need

-50

50

150

250

350

450

550

19

54

19

57

19

60

19

63

19

66

19

69

19

72

19

75

19

78

19

81

19

84

19

87

19

90

19

93

19

96

19

99

20

02

20

05

20

08

20

11

20

14

20

17

CPI Water CPI Nat Gas CPI Postage CPI Electricity CPI All Items

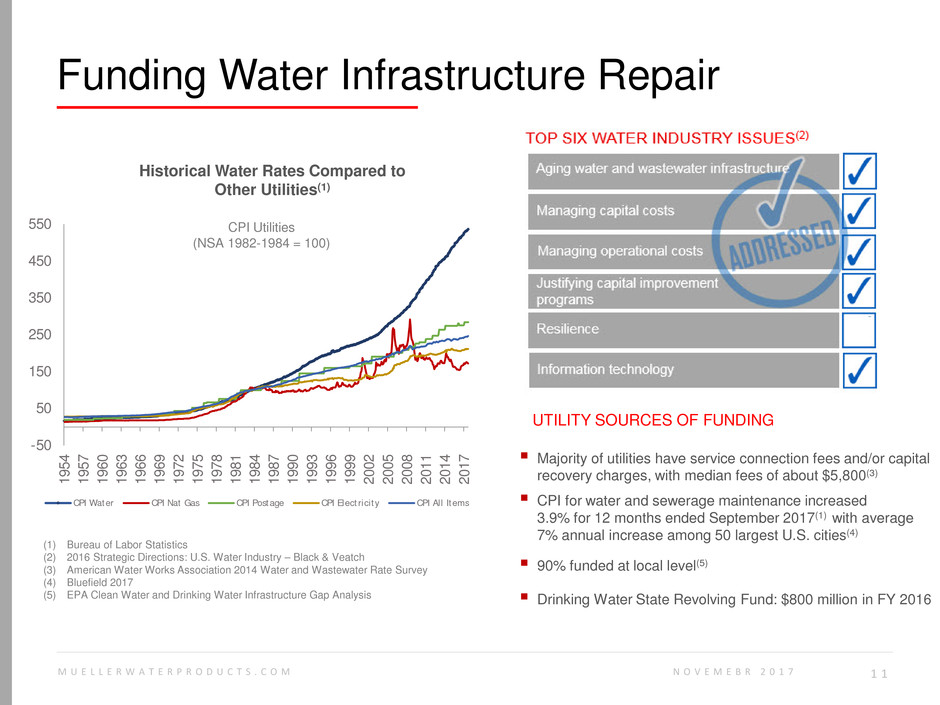

Funding Water Infrastructure Repair

Historical Water Rates Compared to

Other Utilities(1)

M U E L L E R W A T E R P R O D U C T S . C O M 1 1

CPI Utilities

(NSA 1982-1984 = 100)

UTILITY SOURCES OF FUNDING

Majority of utilities have service connection fees and/or capital

recovery charges, with median fees of about $5,800(3)

CPI for water and sewerage maintenance increased

3.9% for 12 months ended September 2017(1) with average

7% annual increase among 50 largest U.S. cities(4)

90% funded at local level(5)

Drinking Water State Revolving Fund: $800 million in FY 2016

(1) Bureau of Labor Statistics

(2) 2016 Strategic Directions: U.S. Water Industry – Black & Veatch

(3) American Water Works Association 2014 Water and Wastewater Rate Survey

(4) Bluefield 2017

(5) EPA Clean Water and Drinking Water Infrastructure Gap Analysis

N O V E M E B R 2 0 1 7

Bringing Intelligence to Water Infrastructure

Water Conservation

M U E L L E R W A T E R P R O D U C T S . C O M 1 2

Customer Service Focus

Awareness/education

Ongoing monitoring

Sustainability

11% of U.S. experiencing

drought or abnormally dry

conditions(1)

240,000 water main breaks

per year(2)

Non-Revenue Water

Up to 30% of treated water is

lost or unaccounted for in the

water system(3)

Growing number of states

requiring water loss audits(4)

(1) U.S. Drought Monitor October 2017

(2) EPA Aging Water Infrastructure Research Program

(3) Navigant Research

(4) National Resource Defense Council

N O V E M E B R 2 0 1 7

“Smart metering is a highly successful way of accurately

identifying water loss.”

Black & Veatch 2016 Strategic Directions in the U.S. Water Industry

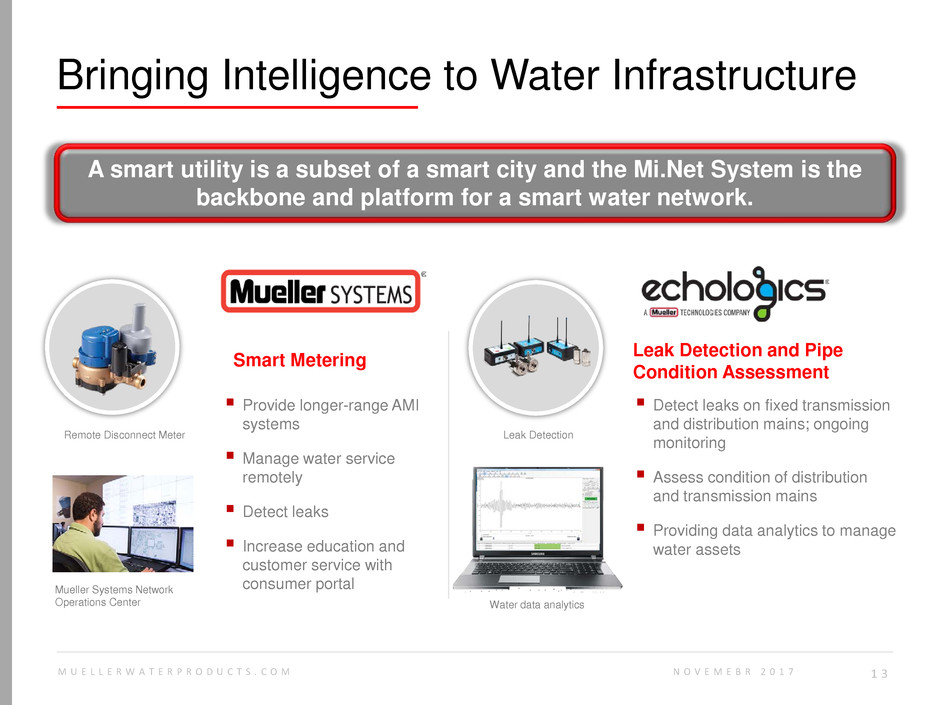

Bringing Intelligence to Water Infrastructure

M U E L L E R W A T E R P R O D U C T S . C O M 1 3

Provide longer-range AMI

systems

Manage water service

remotely

Detect leaks

Increase education and

customer service with

consumer portal

Detect leaks on fixed transmission

and distribution mains; ongoing

monitoring

Assess condition of distribution

and transmission mains

Providing data analytics to manage

water assets

Smart Metering Leak Detection and Pipe

Condition Assessment

Remote Disconnect Meter

Mueller Systems Network

Operations Center Water data analytics

Leak Detection

N O V E M E B R 2 0 1 7

A smart utility is a subset of a smart city and the Mi.Net System is the

backbone and platform for a smart water network.

Execution &

Business Results

Execution and Business Results

Reorganized the Company around

product value streams

Implemented cost savings to fund

investments in manufacturing and new

product development

Divested Anvil and U.S. Pipe

Implemented Lean Six Sigma and

other manufacturing improvements:

Increased production capacity

within existing footprint

Lowered labor costs

Reduced manufacturing footprint

Produced strong record of free

cash flow generation driven by

improvements in operating results

and management of working

capital

Generated free cash flow of

approximately $20 million in

FY2017 and $80 million in FY2016

Reduced debt by more than $600

million from September 30, 2008

through September 30, 2017

Amended term loan credit

agreement and reduced applicable

interest rate spread by 75 basis

points

Improved productivity

and reduced costs

Generated free

cash flow

Leveraged Mueller brand to drive

organic growth

Acquired automatic control valves

Acquired and investing in leak

detection and pipe condition

assessment technologies

Acquired and investing in AMI

technology

Enhanced Smart Water offering

with remote disconnect meter,

integrated leak detection, and

longer-range communications

capabilities

M U E L L E R W A T E R P R O D U C T S . C O M 1 5 N O V E M E B R 2 0 1 7

Pursued strategic

opportunities

Delivered 7.5 percent net sales growth in

Infrastructure

Increased overall consolidated net sales

5.2 percent due to volume growth, pricing

and the addition of Singer Valve to

Infrastructure portfolio, partially offset by

lower volume in Technologies' meter

business

Achieved increased pricing to cover

higher material costs this quarter.

Improved manufacturing productivity

Reported adjusted operating margin

which benefited from price, productivity

and volume, but was more than offset by

inflation, Singer Valve dilution and higher

SG&A personnel-related costs

PAGE 16

Q4 2017 Consolidated Financial Highlights

M U E L L E R W A T E R P R O D U C T S . C O M 1 6

Fourth Quarter 2017 2016

Net sales $ 226.9 $ 215.6

Adj. operating income from

continuing operations $ 38.9 $ 38.8

Adj. operating margin 17.1 % 18.0 %

Adj. income from continuing

operations per share $ 0.15 $ 0.12

Adj. EBITDA $ 49.7 $ 49.0

Adj. EBITDA margin 21.9 % 22.7 %

$ in millions except per share amounts

N O V E M E B R 2 0 1 7

4Q17 results exclude charges totaling $5.6 million, $4.0 million net of tax

4Q16 results exclude charges totaling $1.0 million, $0.6 million net of tax

PAGE 17

Capital Allocation

M U E L L E R W A T E R P R O D U C T S . C O M 1 7 N O V E M E B R 2 0 1 7

Acquisitions

Share Repurchases

Internal Cap Ex & New Product Investments

Dividends

Debt Reduction

Historical

Reduced debt by $1 Billion since 2006

Acquired Singer Valve to enter control valve market

Repurchased $55M worth of shares in fiscal 2017

More than doubled dividend payment since 2014

$1,549

$1,127 $1,101 $1,096

$740 $692 $678

$623 $601

$546

$489 $484 $480

$0

$300

$600

$900

$1,200

$1,500

$1,800

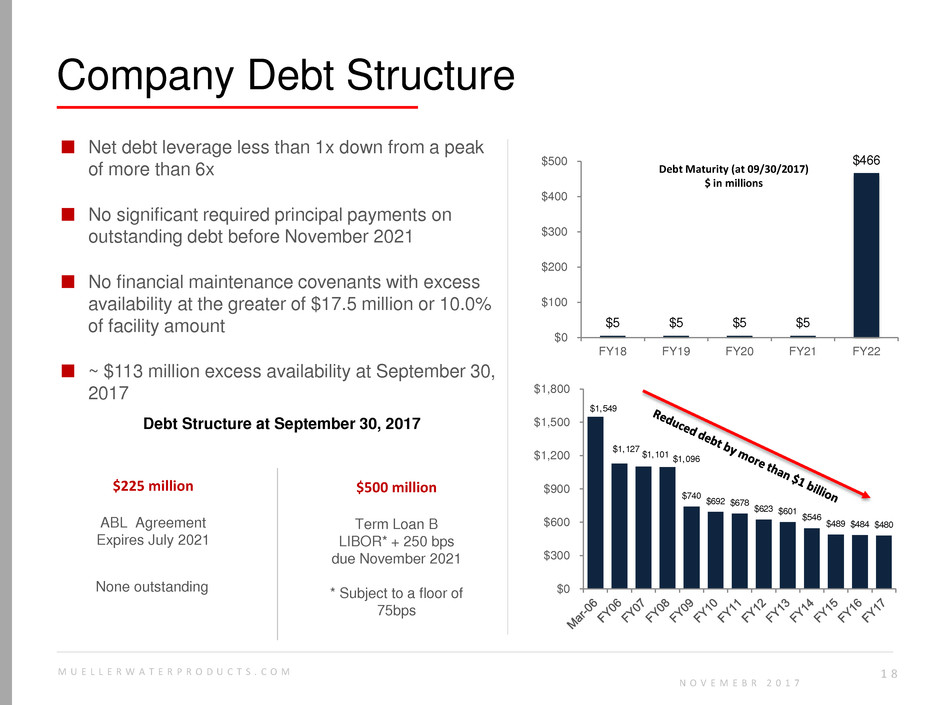

Company Debt Structure

M U E L L E R W A T E R P R O D U C T S . C O M 1 8

■ Net debt leverage less than 1x down from a peak

of more than 6x

■ No significant required principal payments on

outstanding debt before November 2021

■ No financial maintenance covenants with excess

availability at the greater of $17.5 million or 10.0%

of facility amount

■ ~ $113 million excess availability at September 30,

2017

Debt Maturity (at 09/30/2017)

$ in millions

Debt Structure at September 30, 2017

$225 million

ABL Agreement

Expires July 2021

$500 million

Term Loan B

LIBOR* + 250 bps

due November 2021

* Subject to a floor of

75bps

None outstanding

N O V E M E B R 2 0 1 7

$5 $5 $5 $5

$466

$0

$100

$200

$300

$400

$500

FY18 FY19 FY20 FY21 FY22

Why Invest in MWA?

M U E L L E R W A T E R P R O D U C T S . C O M 1 9

Aging infrastructure driving need for investment

Increasing public awareness of the need to

upgrade water infrastructure

Limited number of end-market suppliers

Growing residential construction market

Increased need for municipal spending

Enhanced operational excellence initiatives

Leading brand and municipal specification

positions

Large installed base

Comprehensive distribution network and strong

end-user relationships

Low-cost manufacturing operations using lost

foam process for valves and hydrants

Intelligent Water TechnologyTM solutions

Proprietary fixed leak detection offerings - both

domestically and internationally

Smart metering

Strategic acquisitions / partnerships

N O V E M B E R 2 0 1 7

Fundamentally sound long-term dynamics Strong operating leverage as end markets grow

Strong competitive position Leveraging strengths with emerging trends

Supplemental

Data

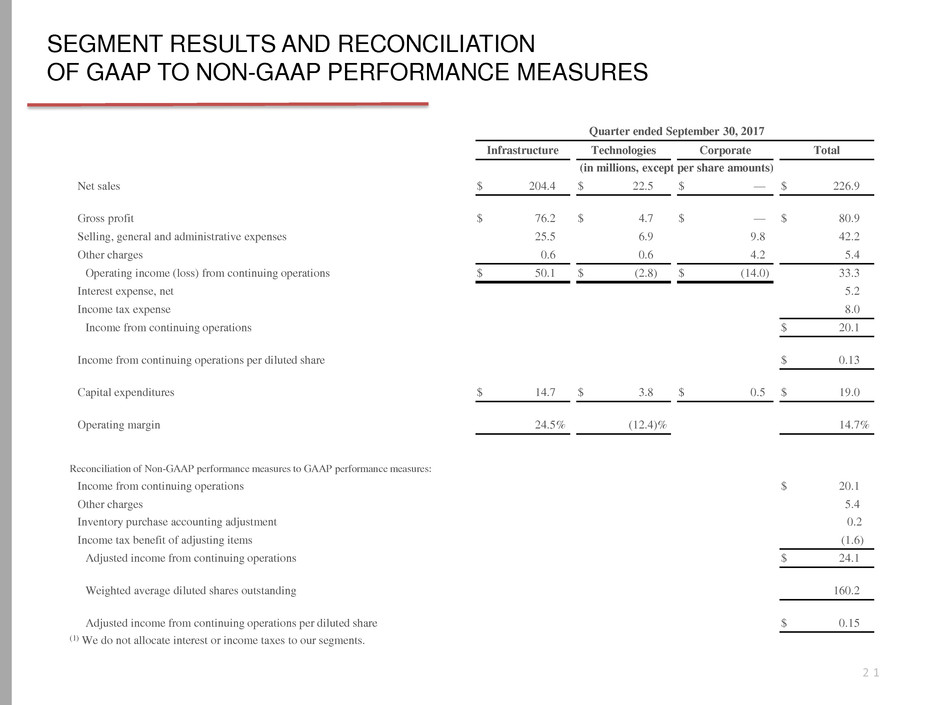

SEGMENT RESULTS AND RECONCILIATION

OF GAAP TO NON-GAAP PERFORMANCE MEASURES

PAGE 21

Quarter ended September 30, 2017

Infrastructure Technologies Corporate Total

(in millions, except per share amounts)

Net sales $ 204.4 $ 22.5 $ — $ 226.9

Gross profit $ 76.2 $ 4.7 $ — $ 80.9

Selling, general and administrative expenses 25.5 6.9 9.8 42.2

Other charges 0.6 0.6 4.2 5.4

Operating income (loss) from continuing operations $ 50.1 $ (2.8 ) $ (14.0 ) 33.3

Interest expense, net 5.2

Income tax expense 8.0

Income from continuing operations $ 20.1

Income from continuing operations per diluted share $ 0.13

Capital expenditures $ 14.7 $ 3.8 $ 0.5 $ 19.0

Operating margin 24.5 % (12.4 )% 14.7 %

Reconciliation of Non-GAAP performance measures to GAAP performance measures:

Income from continuing operations $ 20.1

Other charges 5.4

Inventory purchase accounting adjustment 0.2

Income tax benefit of adjusting items (1.6 )

Adjusted income from continuing operations $ 24.1

Weighted average diluted shares outstanding 160.2

Adjusted income from continuing operations per diluted share $ 0.15

(1) We do not allocate interest or income taxes to our segments.

2 1

SEGMENT RESULTS AND RECONCILIATION

OF GAAP TO NON-GAAP PERFORMANCE MEASURES

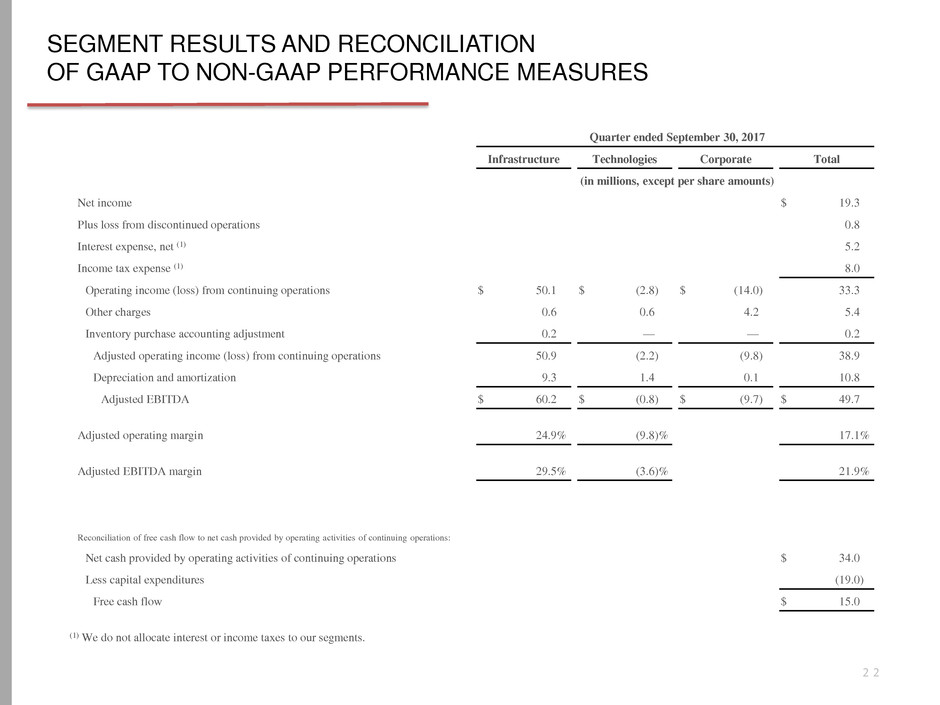

PAGE 22

Quarter ended September 30, 2017

Infrastructure Technologies Corporate Total

(in millions, except per share amounts)

Net income $ 19.3

Plus loss from discontinued operations 0.8

Interest expense, net (1) 5.2

Income tax expense (1) 8.0

Operating income (loss) from continuing operations $ 50.1 $ (2.8 ) $ (14.0 ) 33.3

Other charges 0.6 0.6 4.2 5.4

Inventory purchase accounting adjustment 0.2 — — 0.2

Adjusted operating income (loss) from continuing operations 50.9 (2.2 ) (9.8 ) 38.9

Depreciation and amortization 9.3 1.4 0.1 10.8

Adjusted EBITDA $ 60.2 $ (0.8 ) $ (9.7 ) $ 49.7

Adjusted operating margin 24.9 % (9.8 )% 17.1 %

Adjusted EBITDA margin 29.5 % (3.6 )% 21.9 %

Reconciliation of free cash flow to net cash provided by operating activities of continuing operations:

Net cash provided by operating activities of continuing operations $ 34.0

Less capital expenditures (19.0 )

Free cash flow $ 15.0

(1) We do not allocate interest or income taxes to our segments.

2 2

SEGMENT RESULTS AND RECONCILIATION

OF GAAP TO NON-GAAP PERFORMANCE MEASURES

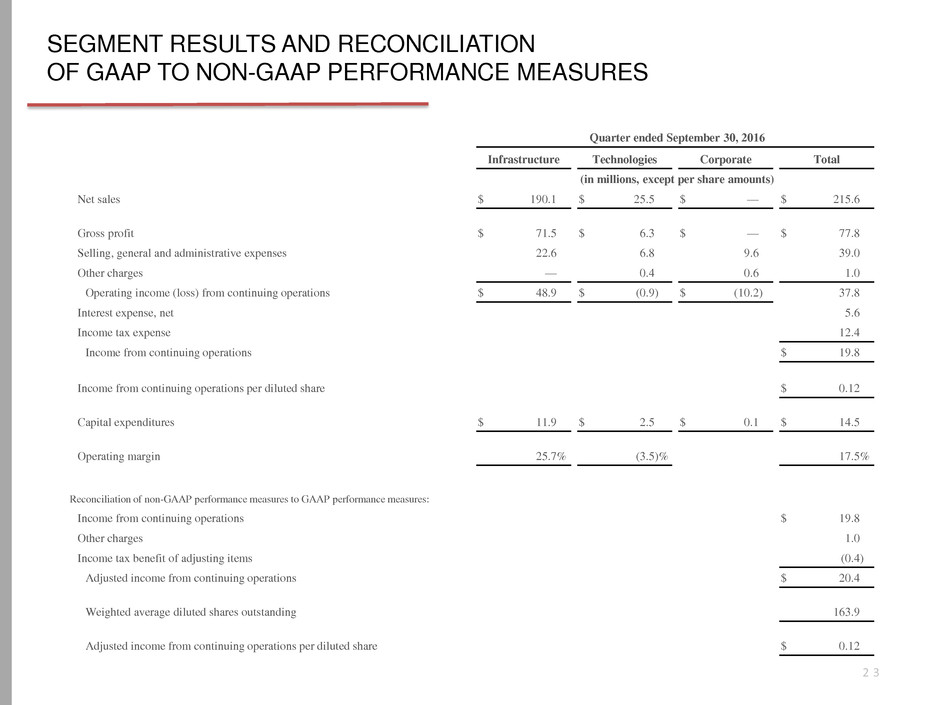

PAGE 23

Quarter ended September 30, 2016

Infrastructure Technologies Corporate Total

(in millions, except per share amounts)

Net sales $ 190.1 $ 25.5 $ — $ 215.6

Gross profit $ 71.5 $ 6.3 $ — $ 77.8

Selling, general and administrative expenses 22.6 6.8 9.6 39.0

Other charges — 0.4 0.6 1.0

Operating income (loss) from continuing operations $ 48.9 $ (0.9 ) $ (10.2 ) 37.8

Interest expense, net 5.6

Income tax expense 12.4

Income from continuing operations $ 19.8

Income from continuing operations per diluted share $ 0.12

Capital expenditures $ 11.9 $ 2.5 $ 0.1 $ 14.5

Operating margin 25.7 % (3.5 )% 17.5 %

Reconciliation of non-GAAP performance measures to GAAP performance measures:

Income from continuing operations $ 19.8

Other charges 1.0

Income tax benefit of adjusting items (0.4 )

Adjusted income from continuing operations $ 20.4

Weighted average diluted shares outstanding 163.9

Adjusted income from continuing operations per diluted share $ 0.12

2 3

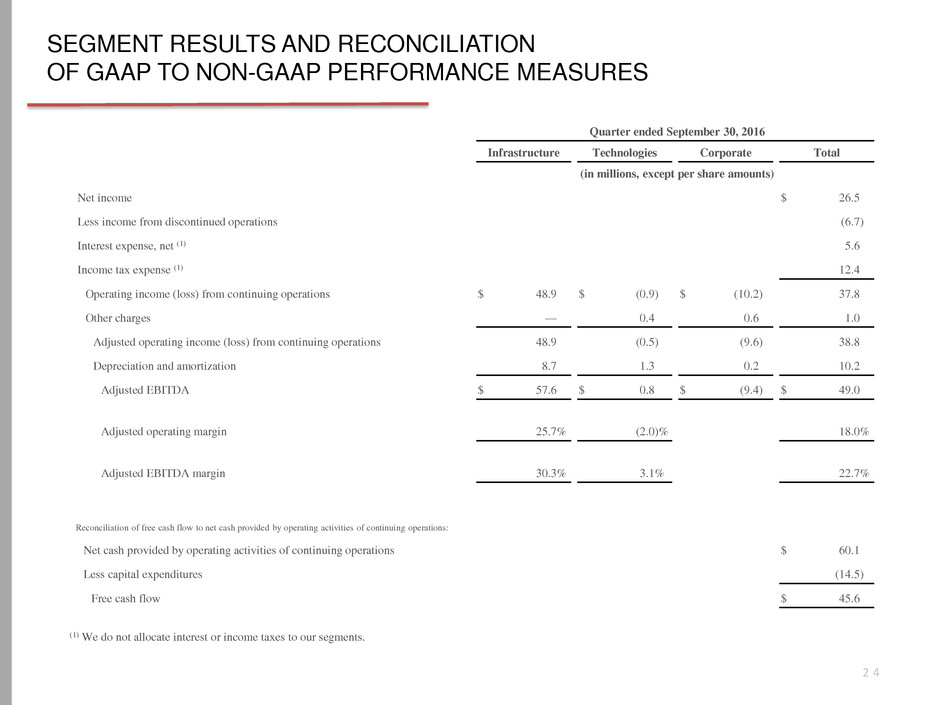

SEGMENT RESULTS AND RECONCILIATION

OF GAAP TO NON-GAAP PERFORMANCE MEASURES

PAGE 24

Quarter ended September 30, 2016

Infrastructure Technologies Corporate Total

(in millions, except per share amounts)

Net income $ 26.5

Less income from discontinued operations (6.7 )

Interest expense, net (1) 5.6

Income tax expense (1) 12.4

Operating income (loss) from continuing operations $ 48.9 $ (0.9 ) $ (10.2 ) 37.8

Other charges — 0.4 0.6 1.0

Adjusted operating income (loss) from continuing operations 48.9 (0.5 ) (9.6 ) 38.8

Depreciation and amortization 8.7 1.3 0.2 10.2

Adjusted EBITDA $ 57.6 $ 0.8 $ (9.4 ) $ 49.0

Adjusted operating margin 25.7 % (2.0 )% 18.0 %

Adjusted EBITDA margin 30.3 % 3.1 % 22.7 %

Reconciliation of free cash flow to net cash provided by operating activities of continuing operations:

Net cash provided by operating activities of continuing operations $ 60.1

Less capital expenditures (14.5 )

Free cash flow $ 45.6

(1) We do not allocate interest or income taxes to our segments.

2 4

SEGMENT RESULTS AND RECONCILIATION

OF GAAP TO NON-GAAP PERFORMANCE MEASURES

PAGE 25

Year ended September 30, 2017

Infrastructure Technologies Corporate Total

(in millions, except per share amounts)

Net sales $ 739.9 $ 86.1 $ — $ 826.0

Gross profit $ 259.5 $ 8.0 $ — $ 267.5

Selling, general and administrative expenses 93.4 27.6 35.4 156.4

Other charges 2.7 0.7 7.0 10.4

Operating income (loss) from continuing operations $ 163.4 $ (20.3 ) $ (42.4 ) 100.7

Interest expense, net 22.2

Income tax expense 24.2

Income from continuing operations $ 54.3

Income from continuing operations per diluted share $ 0.34

Capital expenditures $ 28.5 $ 11.4 $ 0.7 $ 40.6

Operating margin 22.1 % (23.6 )% 12.2 %

Reconciliation of Non-GAAP performance measures to GAAP performance measures:

Income from continuing operations $ 54.3

Discrete warranty charge 9.8

Inventory purchase accounting adjustment 1.0

Other charges 10.4

Income tax benefit of adjusting items (4.3 )

Adjusted income from continuing operations $ 71.2

Weighted average diluted shares outstanding 161.8

Adjusted income from continuing operations per diluted share $ 0.44

2 5

SEGMENT RESULTS AND RECONCILIATION

OF GAAP TO NON-GAAP PERFORMANCE MEASURES

PAGE 26

Year ended September 30, 2017

Infrastructure Technologies Corporate Total

(in millions, except per share amounts)

Net income $ 123.3

Less income from discontinued operations (69.0 )

Interest expense, net (1) 22.2

Income tax expense (1) 24.2

Operating income (loss) from continuing operations $ 163.4 (20.3 ) $ (42.4 ) 100.7

Discrete warranty charge — 9.8 — 9.8

Inventory purchase accounting adjustment 1.0 — — 1.0

Other charges 2.7 0.7 7.0 10.4

Adjusted operating income (loss) from continuing operations 167.1 (9.8 ) (35.4 ) 121.9

Depreciation and amortization 36.3 5.2 0.4 41.9

Adjusted EBITDA $ 203.4 $ (4.6 ) $ (35.0 ) $ 163.8

Adjusted operating margin 22.6 % (11.4 )% 14.8 %

Adjusted EBITDA margin 27.5 % (5.3 )% 19.8 %

Reconciliation of net debt to total debt (end of period):

Current portion of long-term debt $ 5.6

Long-term debt 475.0

Total debt 480.6

Less cash and cash equivalents (361.7 )

Net debt $ 118.9

Net debt leverage (net debt divided by adjusted EBITDA) 0.7x

Reconciliation of free cash flow to net cash provided by operating activities:

Net cash provided by operating activities $ 59.4

Less capital expenditures (40.6 )

Free cash flow $ 18.8

(1) We do not allocate interest or income taxes to our segments.

2 6

SEGMENT RESULTS AND RECONCILIATION

OF GAAP TO NON-GAAP PERFORMANCE MEASURES

PAGE 27

Year ended September 30, 2016

Infrastructure Technologies Corporate Total

(in millions, except per share amounts)

Net sales $ 715.7 $ 84.9 $ — $ 800.6

Gross profit $ 250.7 $ 17.2 $ — $ 267.9

Selling, general and administrative expenses 88.4 27.4 35.4 151.2

Pension settlement 2.2 — 14.4 16.6

Other charges 0.8 0.9 5.5 7.2

Operating income (loss) from continuing operations $ 159.3 $ (11.1 ) $ (55.3 ) 92.9

Interest expense, net 23.6

Income tax expense 24.2

Income from continuing operations $ 45.1

Income per diluted share from continuing operations $ 0.28

Capital expenditures $ 24.3 $ 7.0 $ 0.2 $ 31.5

Operating margin 22.3 % (13.1 )% 11.6 %

Reconciliation of Non-GAAP performance measures to GAAP performance measures:

Income from continuing operations $ 45.1

Pension settlement 16.6

Other charges 7.2

Income tax benefit of adjusting items (8.1 )

Adjusted income from continuing operations $ 60.8

Weighted average diluted shares outstanding 163.4

Adjusted income from continuing operations per diluted share $ 0.37

2 7

SEGMENT RESULTS AND RECONCILIATION

OF GAAP TO NON-GAAP PERFORMANCE MEASURES

PAGE 28

Year ended September 30, 2016

Infrastructure Technologies Corporate Total

(in millions, except per share amounts)

Net income $ 63.9

Less income from discontinued operations 18.8

Interest expense, net (1) 23.6

Income tax expense (1) 24.2

Operating income (loss) from continuing operations $ 159.3 $ (11.1 ) $ (55.3 ) 92.9

Pension settlement 2.2 — 14.4 16.6

Other charges 0.8 0.9 5.5 7.2

Adjusted operating income (loss) from continuing operations 162.3 (10.2 ) (35.4 ) 116.7

Depreciation and amortization 34.2 4.8 0.5 39.5

Adjusted EBITDA $ 196.5 $ (5.4 ) $ (34.9 ) $ 156.2

Adjusted operating margin 22.7 % (12.0 )% 14.6 %

Adjusted EBITDA margin 27.5 % (6.4 )% 19.5 %

Reconciliation of net debt to total debt (end of period):

Current portion of long-term debt $ 5.6

Long-term debt 478.8

Total debt 484.4

Less cash and cash equivalents (195.0 )

Net debt $ 289.4

Net debt leverage (net debt divided by adjusted EBITDA) 1.9x

Reconciliation of free cash flow to net cash provided by operating activities:

Net cash provided by operating activities $ 114.5

Less capital expenditures (31.5 )

Free cash flow $ 83.0

(1) We do not allocate interest or income taxes to our segments.

2 8

2 9

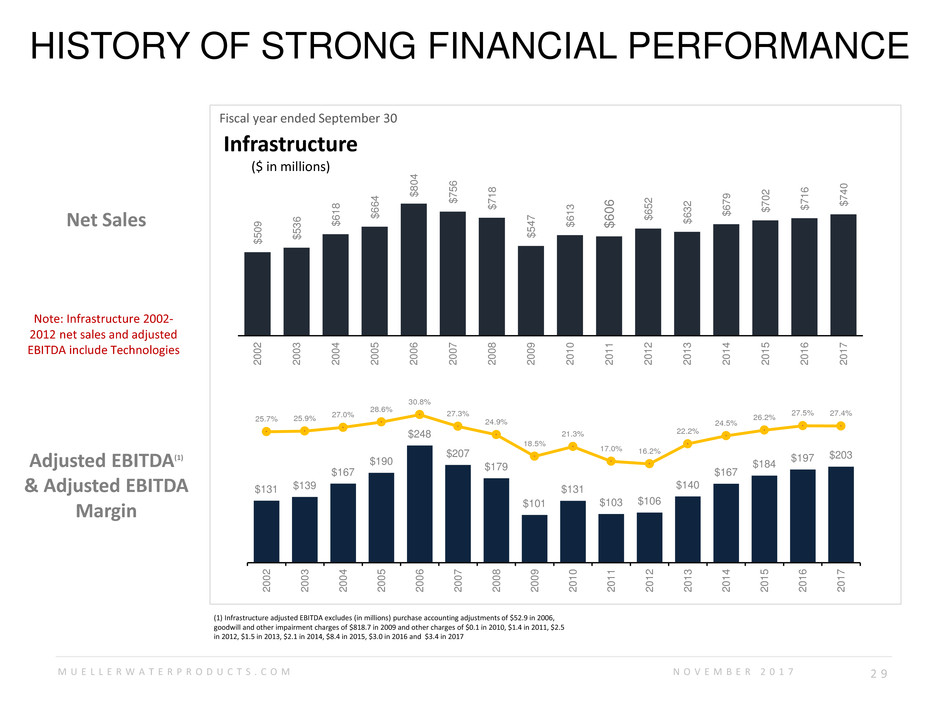

HISTORY OF STRONG FINANCIAL PERFORMANCE

Net Sales

Adjusted EBITDA(1)

& Adjusted EBITDA

Margin

(1) Infrastructure adjusted EBITDA excludes (in millions) purchase accounting adjustments of $52.9 in 2006,

goodwill and other impairment charges of $818.7 in 2009 and other charges of $0.1 in 2010, $1.4 in 2011, $2.5

in 2012, $1.5 in 2013, $2.1 in 2014, $8.4 in 2015, $3.0 in 2016 and $3.4 in 2017

Note: Infrastructure 2002-

2012 net sales and adjusted

EBITDA include Technologies

Infrastructure

($ in millions)

Fiscal year ended September 30

M U E L L E R W A T E R P R O D U C T S . C O M N O V E M B E R 2 0 1 7

$5

09

$5

36

$6

18

$6

64

$8

04

$7

56

$7

18

$5

47

$6

13

$

60

6

$6

52

$6

32

$6

79

$7

02

$

71

6

$7

40

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

$131 $139

$167

$190

$248

$207

$179

$101

$131

$103 $106

$140

$167

$184 $197

$203

25.7% 25.9% 27.0%

28.6%

30.8%

27.3%

24.9%

18.5%

21.3%

17.0% 16.2%

22.2%

24.5%

26.2% 27.5% 27.4%

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

20

17

Questions