Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MedEquities Realty Trust, Inc. | mrt-ex991_6.htm |

| 8-K - 8-K - MedEquities Realty Trust, Inc. | mrt-8k_20171107.htm |

Exhibit 99.2

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Table of ContentsIntroductionManagement, Board of Directors & Investor Contacts2Executive Summary3Capitalization Analysis & Research Coverage42017 Guidance5Financial InformationConsolidated Balance Sheets6Consolidated Statements of Operations - GAAP7Funds from Operations (FFO) & Adjusted Funds from Operations (AFFO)8Consolidated EBITDA & Consolidated Adjusted EBITDA9Debt Overview10Operational & Portfolio InformationOperator Overview & Lease Coverage11Market Summary12Annualized Rental Income Expiration Schedule13Payor Mix by Revenue & Facility-Level Occupancy14Transaction Activity15Additional InformationGlossary16Forward looking statements: This supplemental package contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements provide our current expectations or forecasts of future events and are not statements of historical fact. These forward-looking statements include information about our 2017 guidance and related assumptions, the strategic plans and objectives, potential property acquisitions and investments, anticipated capital expenditures (and access to capital), amounts of anticipated cash distributions to our stockholders in the future and other matters. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” "will" and variations of these words and other similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and/or could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Forward-looking statements involve inherent uncertainty and may ultimately prove to be incorrect or false. For a description of factors that may cause the Company’s actual results or performance to differ from its forward-looking statements, see the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016, which was filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2017, and other documents filed by the Company with the SEC. You are cautioned to not place undue reliance on forward-looking statements. Except as otherwise may be required by law, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or actual operating results.Information regarding our operators, tenants and guarantors: This supplemental package includes information regarding certain of our tenants and guarantors, which are not subject to SEC reporting requirements. The information related to our tenants and guarantors contained in this report was provided to us by such tenants or guarantors, as applicable, or was derived from publicly available information. We have not independently investigated or verified this information. We have no reason to believe that this information is inaccurate in any material respect, but we cannot provide any assurance of its accuracy. We are providing this data for informational purposes only. The most recent completed period for which financial and operating information is available for our tenants and guarantors is the period ended June 30, 2017.Definitions and reconciliations: For definitions of certain terms used throughout this supplemental, including certain non-GAAP financial measures, see the Glossary on pages 16-17. For reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures, see pages 8-9. On the cover: TOP - Vibra Rehabilitation Hospital of Amarillo, Amarillo, TX; Mountain's Edge Hospital, Las Vegas, NV; Castle Manor Nursing and Rehabilitation Center, National City, CA; MIDDLE - The Rio at Mission Trails, San Antonio, TX; Baylor Scott & White Medical Center - Lakeway, Lakeway, TX; Physical Rehabilitation and Wellness Center of Spartanburg, Spartanburg, SC; Horizon Specialty Hospital of Henderson, Las Vegas, NV; BOTTOM - Kemp Care Center, Kemp, TX; Heritage Park Nursing Center, Upland, CA; Mira Vista Court, Fort Worth, TX.

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Management, Board of Directors & Investor ContactsCorporate3100 West End Avenue, Suite 1000Nashville, Tennessee 37203615.627.4710www.medequities.comExecutive and Senior ManagementJohn McRobertsBill HarlanJeff WalravenChairman and ChiefPresident, Chief OperatingExecutive Vice PresidentExecutive OfficerOfficer and Directorand Chief Financial OfficerForrest GardnerSteve GrahamMichael HammillDavid TravisSVP of Asset & SVP, Director of Post AcuteSVP of Finance & CapitalSVP & Chief Accounting OfficerInvestment ManagementAcquisition & DevelopmentMarketsBoard of DirectorsRandall ChurcheyJohn FoySteven GeringerStephen GuillardBill HarlanLead Independent DirectorIndependent DirectorIndependent DirectorIndependent DirectorPresident & Chief OperatingOfficerElliott MandelbaumJohn McRobertsStuart McWhorterJames PieriIndependent DirectorChairman & Chief ExecutiveIndependent DirectorIndependent DirectorOfficerTransfer AgentAmerican Stock Transfer & Trust Co.59 Maiden LaneNew York, New York 10038800.937.5449Investor RelationsJeff WalravenTripp SullivanExecutive Vice President & Chief Financial OfficerSCR Partners615.627.4710615.760.1104jwalraven@medequities.comIR@medequities.com

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Executive SummaryCompany overview: MedEquities Realty Trust (NYSE: MRT) is a self-managed and self-administered real estate investment trust that invests in a diversified mix of healthcare properties and healthcare-related real estate debt investments. The Company’s management team has extensive industry experience in acquiring, owning, developing, financing, operating, leasing and monetizing many types of healthcare properties and portfolios. MedEquities’ strategy is to become an integral capital partner with high-quality and growth-oriented facility-based providers of healthcare services on a nationwide basis, primarily through net-leased real estate investment. For more information, please visit www.medequities.com.Unaudited As of 09/30/17Select Portfolio Statistics Number of Properties31Licensed Beds (1)2,635 Facility-Level Occupancy (2)83%Markets / States12/7Weighted Average Lease Term Remaining (3)13.1TTM Portfolio EBITDARM/Rent Coverage (4)2.1xBalance Sheet ($ in thousands)Cash$7,264Gross Assets (5)$608,380Total Debt (6)$207,500Net Debt (Total Debt less Cash)$200,236Net Debt / Gross Assets32.9%Net Debt to Consolidated Adjusted EBITDA, annualized3.7x(1) Excludes the 166 beds in the AAC sober living facilities that are not licensed for treatment.(2) Reflects the facility-level occupancy of our total stabilized, single-tenanted portfolio. See Glossary for definition of our stabilized portfolio.(3) Excludes the medical office building in Brownsville, TX.(4) Includes guarantor-level coverage for our stabilized, single-tenanted buildings for the trailing 12 months as of June 30, 2017.(5) The carrying amount of total assets plus accumulated depreciation and amortization, as reported in the Company's consolidated financial statements.(6) Excludes approximately $718,000 of net deferred financing costs reported as a component of the debt balance in the Company's consolidated financial statements.

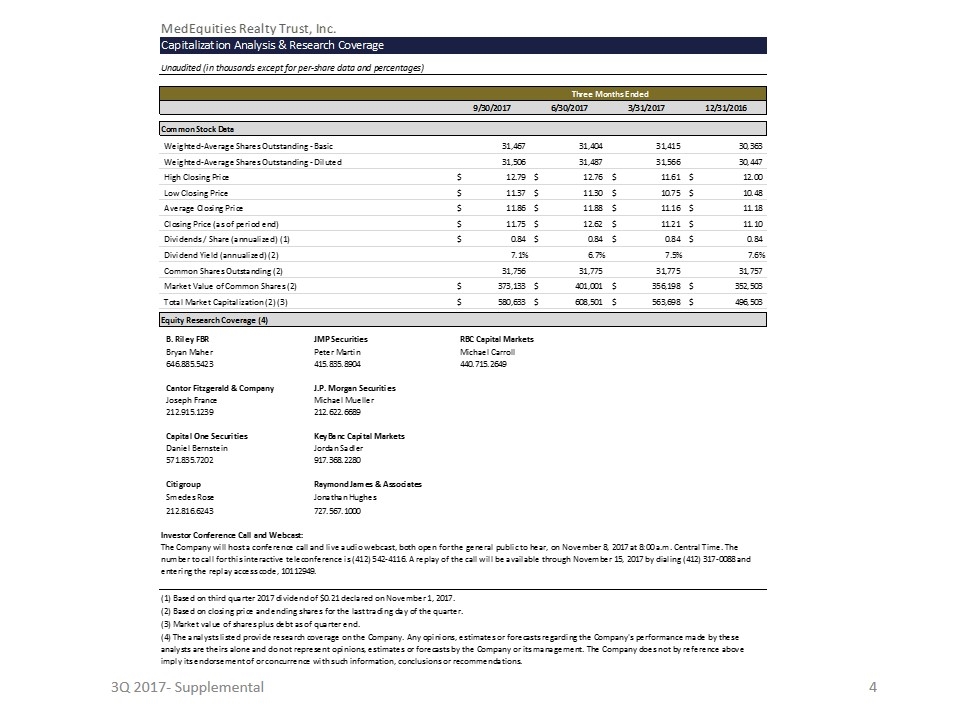

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Capitalization Analysis & Research CoverageUnaudited (in thousands except for per-share data and percentages)Three Months Ended9/30/20176/30/20173/31/201712/31/2016Common Stock Data Weighted-Average Shares Outstanding - Basic31,467 31,404 31,415 30,363 Weighted-Average Shares Outstanding - Diluted31,506 31,487 31,566 30,447 High Closing Price $12.79 $12.76 $11.61 $12.00 Low Closing Price $11.37 $11.30 $10.75 $10.48 Average Closing Price $11.86 $11.88 $11.16 $11.18 Closing Price (as of period end) $11.75 $12.62 $11.21 $11.10 Dividends / Share (annualized) (1) $0.84 $0.84 $0.84 $0.84 Dividend Yield (annualized) (2)7.1%6.7%7.5%7.6% Common Shares Outstanding (2)31,756 31,775 31,775 31,757 Market Value of Common Shares (2) $373,133 $401,001 $356,198 $352,503 Total Market Capitalization (2) (3) $580,633 $608,501 $563,698 $496,503 Equity Research Coverage (4)B. Riley FBRJMP SecuritiesRBC Capital MarketsBryan MaherPeter MartinMichael Carroll646.885.5423415.835.8904440.715.2649Cantor Fitzgerald & CompanyJ.P. Morgan SecuritiesJoseph FranceMichael Mueller212.915.1239212.622.6689Capital One SecuritiesKeyBanc Capital MarketsDaniel BernsteinJordan Sadler571.835.7202917.368.2280B. Riley FBR, Inc.CitigroupRaymond James & AssociatesBryan MaherSmedes RoseJonathan Hughes646.885.5423212.816.6243727.567.1000"Investor Conference Call and Webcast:The Company will host a conference call and live audio webcast, both open for the general public to hear, on November 8, 2017 at 8:00 a.m. Central Time. The number to call for this interactive teleconference is (412) 542-4116. A replay of the call will be available through November 15, 2017 by dialing (412) 317-0088 and entering the replay access code, 10112949."(1) Based on third quarter 2017 dividend of $0.21 declared on November 1, 2017.(2) Based on closing price and ending shares for the last trading day of the quarter.(3) Market value of shares plus debt as of quarter end.(4) The analysts listed provide research coverage on the Company. Any opinions, estimates or forecasts regarding the Company's performance made by these analysts are theirs alone and do not represent opinions, estimates or forecasts by the Company or its management. The Company does not by reference above imply its endorsement of or concurrence with such information, conclusions or recommendations.

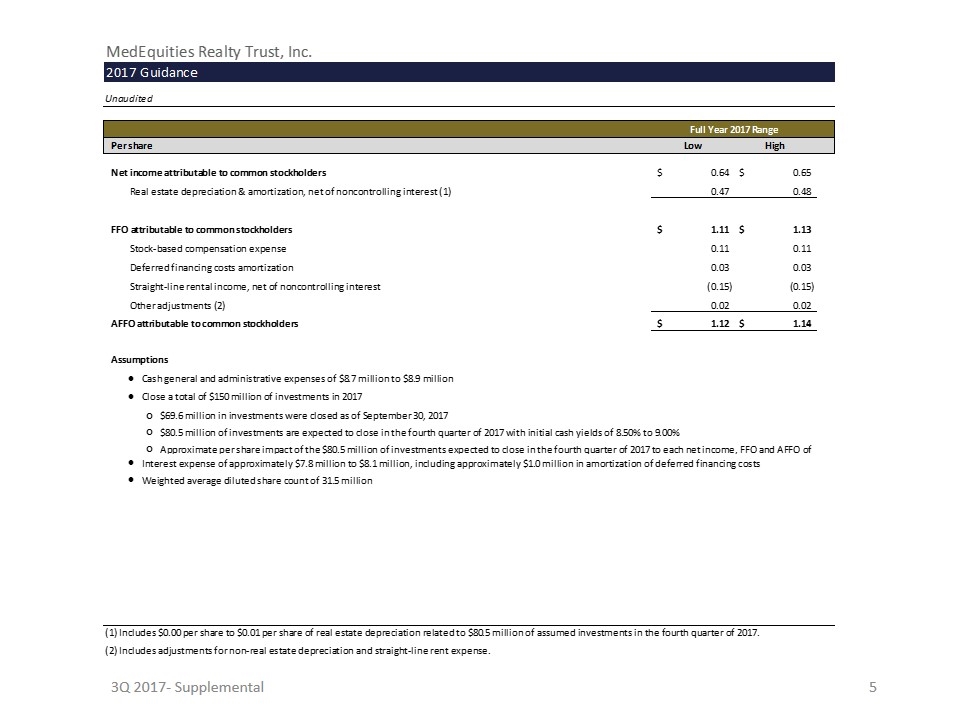

3Q 2017- Supplemental MedEquities Realty Trust, Inc.2017 GuidanceUnauditedFull Year 2017 RangePer shareLowHighNet income attributable to common stockholders $0.64 $0.65 Real estate depreciation & amortization, net of noncontrolling interest (1) 0.47 0.48 FFO attributable to common stockholders $1.11 $1.13 Stock-based compensation expense 0.11 0.11 Deferred financing costs amortization 0.03 0.03 Straight-line rental income, net of noncontrolling interest (0.15) (0.15)Other adjustments (2) 0.02 0.02 AFFO attributable to common stockholders $1.12 $1.14 AssumptionslCash general and administrative expenses of $8.7 million to $8.9 millionlClose a total of $150 million of investments in 2017¢$69.6 million in investments were closed as of September 30, 2017¢$80.5 million of investments are expected to close in the fourth quarter of 2017 with initial cash yields of 8.50% to 9.00%¢Approximate per share impact of the $80.5 million of investments expected to close in the fourth quarter of 2017 to each net income, FFO and AFFO of $0.00 to $0.01lInterest expense of approximately $7.8 million to $8.1 million, including approximately $1.0 million in amortization of deferred financing costslWeighted average diluted share count of 31.5 million (1) Includes $0.00 per share to $0.01 per share of real estate depreciation related to $80.5 million of assumed investments in the fourth quarter of 2017.(2) Includes adjustments for non-real estate depreciation and straight-line rent expense.

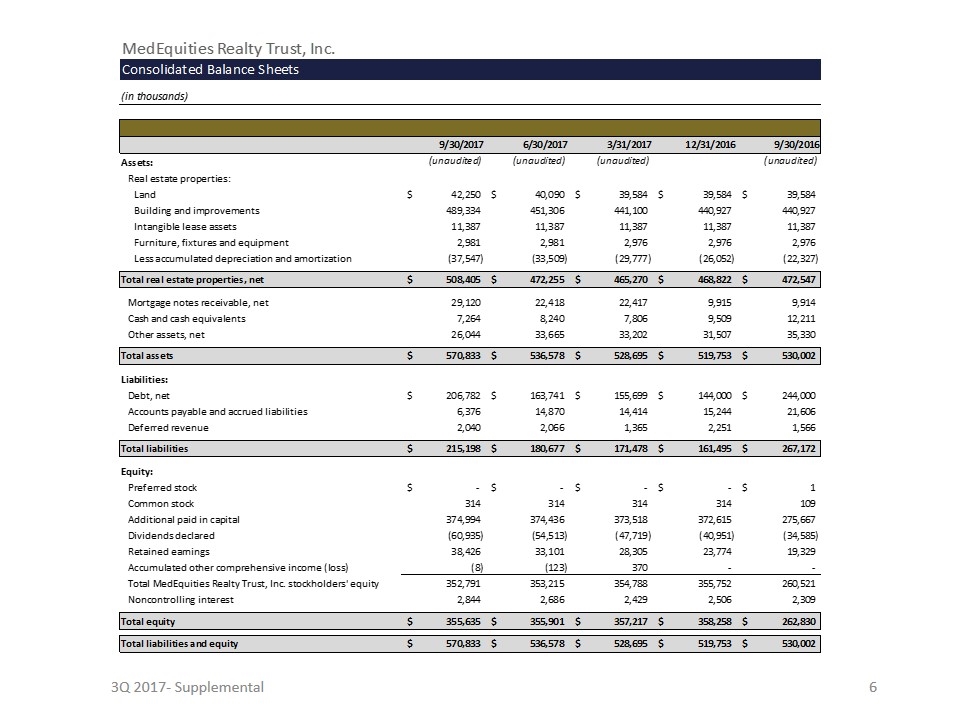

3Q 2017- Supplemental MedEquities Realty Trust, Inc. Consolidated Balance Sheets(in thousands)9/30/20176/30/20173/31/201712/31/20169/30/2016Assets:(unaudited)(unaudited)(unaudited)(unaudited)Real estate properties:Land $42,250 $40,090 $39,584 $39,584 $39,584 Building and improvements 489,334 451,306 441,100 440,927 440,927 Intangible lease assets 11,387 11,387 11,387 11,387 11,387 Furniture, fixtures and equipment 2,981 2,981 2,976 2,976 2,976 Less accumulated depreciation and amortization (37,547) (33,509) (29,777) (26,052) (22,327)Total real estate properties, net $508,405 $472,255 $465,270 $468,822 $472,547 Mortgage notes receivable, net 29,120 22,418 22,417 9,915 9,914 Cash and cash equivalents 7,264 8,240 7,806 9,509 12,211 Other assets, net 26,044 33,665 33,202 31,507 35,330 Total assets $570,833 $536,578 $528,695 $519,753 $530,002 Liabilities:Debt, net $206,782 $163,741 $155,699 $144,000 $244,000 Accounts payable and accrued liabilities 6,376 14,870 14,414 15,244 21,606 Deferred revenue 2,040 2,066 1,365 2,251 1,566 Total liabilities $215,198 $180,677 $171,478 $161,495 $267,172 Equity:Preferred stock $- $- $- $- $1 Common stock 314 314 314 314 109 Additional paid in capital 374,994 374,436 373,518 372,615 275,667 Dividends declared (60,935) (54,513) (47,719) (40,951) (34,585)Retained earnings 38,426 33,101 28,305 23,774 19,329 Accumulated other comprehensive income (loss) (8) (123) 370 - - Total MedEquities Realty Trust, Inc. stockholders' equity 352,791 353,215 354,788 355,752 260,521 Noncontrolling interest 2,844 2,686 2,429 2,506 2,309 Total equity $355,635 $355,901 $357,217 $358,258 $262,830 Total liabilities and equity $570,833 $536,578 $528,695 $519,753 $530,002

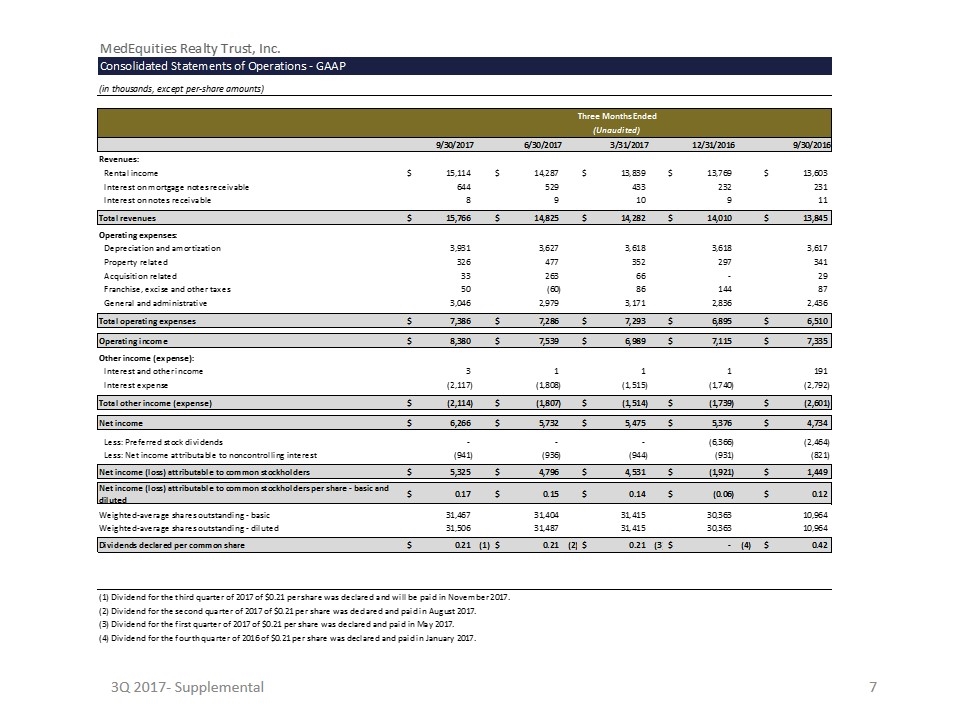

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Consolidated Statements of Operations - GAAP(in thousands, except per-share amounts)Three Months Ended(Unaudited)9/30/20176/30/20173/31/201712/31/20169/30/2016Revenues:Rental income $15,114 $14,287 $13,839 $13,769 $13,603 Interest on mortgage notes receivable 644 529 433 232 231 Interest on notes receivable 8 9 10 9 11 Total revenues $15,766 $14,825 $14,282 $14,010 $13,845 Operating expenses:Depreciation and amortization 3,931 3,627 3,618 3,618 3,617 Property related 326 477 352 297 341 Acquisition related 33 263 66 - 29 Franchise, excise and other taxes 50 (60) 86 144 87 General and administrative 3,046 2,979 3,171 2,836 2,436 Total operating expenses $7,386 $7,286 $7,293 $6,895 $6,510 Operating income $8,380 $7,539 $6,989 $7,115 $7,335 Other income (expense):Interest and other income 3 1 1 1 191 Interest expense (2,117) (1,808) (1,515) (1,740) (2,792)Total other income (expense) $(2,114) $(1,807) $(1,514) $(1,739) $(2,601)Net income $6,266 $5,732 $5,475 $5,376 $4,734 Less: Preferred stock dividends - - - (6,366) (2,464)Less: Net income attributable to noncontrolling interest (941) (936) (944) (931) (821)Net income (loss) attributable to common stockholders $5,325 $4,796 $4,531 $(1,921) $1,449 Net income (loss) attributable to common stockholders per share - basic and diluted $0.17 $0.15 $0.14 $(0.06) $0.12 Weighted-average shares outstanding - basic31,467 31,404 31,415 30,363 10,964 Weighted-average shares outstanding - diluted31,506 31,487 31,415 30,363 10,964 Dividends declared per common share $0.21 (1) $0.21 (2) $0.21 (3) $- (4) $0.42 (1) Dividend for the third quarter of 2017 of $0.21 per share was declared and will be paid in November 2017.(2) Dividend for the second quarter of 2017 of $0.21 per share was declared and paid in August 2017.(3) Dividend for the first quarter of 2017 of $0.21 per share was declared and paid in May 2017.(4) Dividend for the fourth quarter of 2016 of $0.21 per share was declared and paid in January 2017.

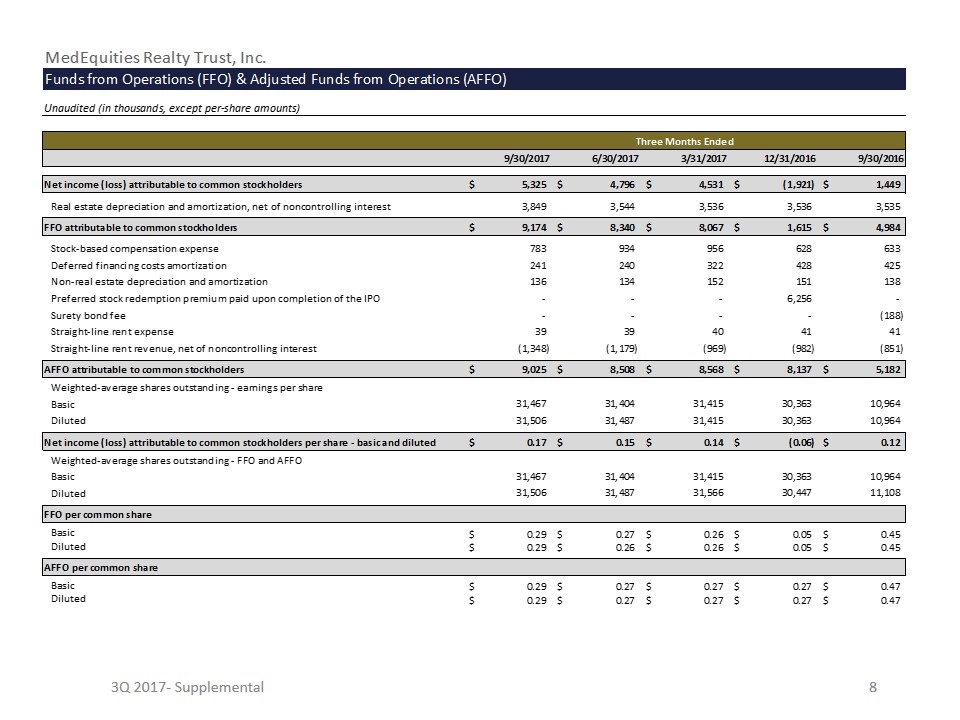

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Funds from Operations (FFO) & Adjusted Funds from Operations (AFFO)Unaudited (in thousands, except per-share amounts)Three Months Ended9/30/20176/30/20173/31/201712/31/20169/30/2016Net income (loss) attributable to common stockholders $5,325 $4,796 $4,531 $(1,921) $1,449 Real estate depreciation and amortization, net of noncontrolling interest 3,849 3,544 3,536 3,536 3,535 FFO attributable to common stockholders $9,174 $8,340 $8,067 $1,615 $4,984 Stock-based compensation expense 783 934 956 628 633 Deferred financing costs amortization 241 240 322 428 425 Non-real estate depreciation and amortization 136 134 152 151 138 Preferred stock redemption premium paid upon completion of the IPO - - - 6,256 - Surety bond fee - - - - (188)Straight-line rent expense 39 39 40 41 41 Straight-line rent revenue, net of noncontrolling interest (1,348) (1,179) (969) (982) (851)AFFO attributable to common stockholders $9,025 $8,508 $8,568 $8,137 $5,182 Weighted-average shares outstanding - earnings per shareBasic 31,467 31,404 31,415 30,363 10,964 Diluted 31,506 31,487 31,415 30,363 10,964 Net income (loss) attributable to common stockholders per share - basic and diluted $0.17 $0.15 $0.14 $(0.06) $0.12 Weighted-average shares outstanding - FFO and AFFOBasic 31,467 31,404 31,415 30,363 10,964 Diluted 31,506 31,487 31,566 30,447 11,108 FFO per common shareBasic $0.29 $0.27 $0.26 $0.05 $0.45 Diluted $0.29 $0.26 $0.26 $0.05 $0.45 AFFO per common shareBasic $0.29 $0.27 $0.27 $0.27 $0.47 Diluted $0.29 $0.27 $0.27 $0.27 $0.47

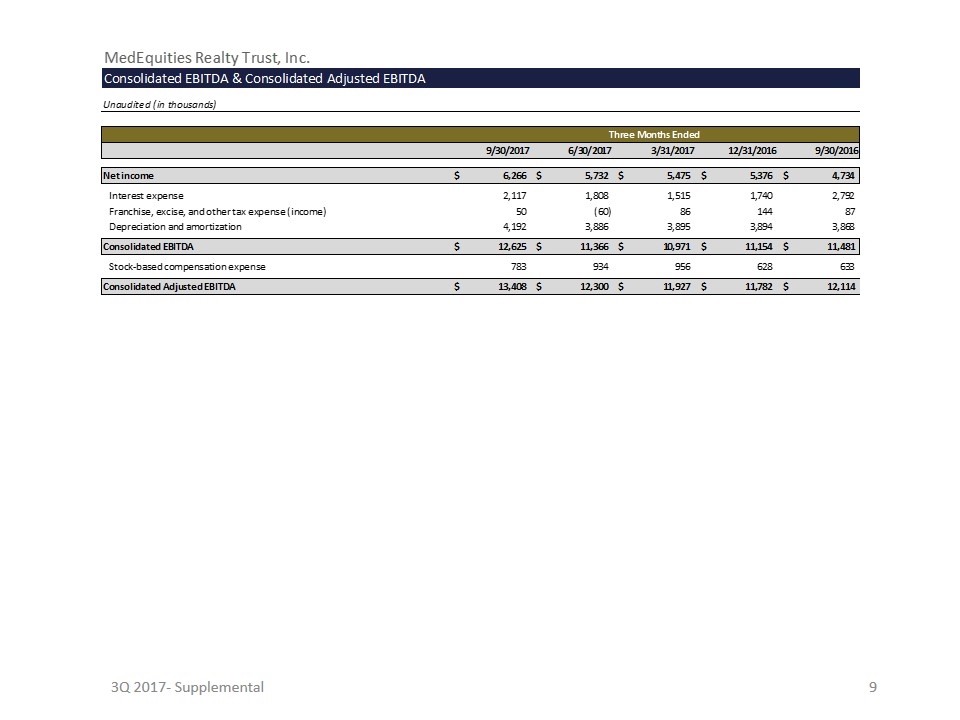

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Consolidated EBITDA & Consolidated Adjusted EBITDAUnaudited (in thousands)Three Months Ended9/30/20176/30/20173/31/201712/31/20169/30/2016Net income $6,266 $5,732 $5,475 $5,376 $4,734 Interest expense 2,117 1,808 1,515 1,740 2,792 Franchise, excise, and other tax expense (income) 50 (60) 86 144 87 Depreciation and amortization 4,192 3,886 3,895 3,894 3,868 Consolidated EBITDA $12,625 $11,366 $10,971 $11,154 $11,481 Stock-based compensation expense 783 934 956 628 633 Consolidated Adjusted EBITDA $13,408 $12,300 $11,927 $11,782 $12,114

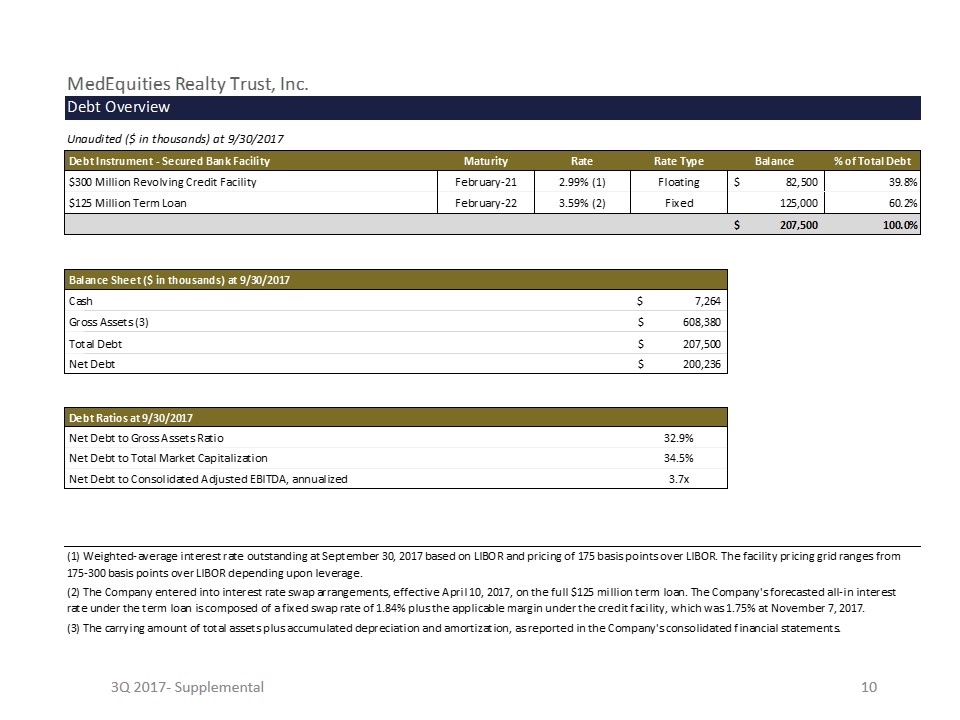

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Debt OverviewUnaudited ($ in thousands) at 9/30/2017 Debt Instrument - Secured Bank FacilityMaturityRateRate TypeBalance % of Total Debt $300 Million Revolving Credit FacilityFebruary-212.99% (1)Floating $82,500 39.8% $125 Million Term LoanFebruary-223.59% (2)Fixed 125,000 60.2% $207,500 100.0% Balance Sheet ($ in thousands) at 9/30/2017 Cash $7,264 Gross Assets (3) $608,380 Total Debt $207,500 Net Debt $200,236 Debt Ratios at 9/30/2017 Net Debt to Gross Assets Ratio32.9% Net Debt to Total Market Capitalization34.5% Net Debt to Consolidated Adjusted EBITDA, annualized3.7x(1) Weighted-average interest rate outstanding at September 30, 2017 based on LIBOR and pricing of 175 basis points over LIBOR. The facility pricing grid ranges from 175-300 basis points over LIBOR depending upon leverage. (2) The Company entered into interest rate swap arrangements, effective April 10, 2017, on the full $125 million term loan. The Company's forecasted all-in interest rate under the term loan is composed of a fixed swap rate of 1.84% plus the applicable margin under the credit facility, which was 1.75% at November 7, 2017.(3) The carrying amount of total assets plus accumulated depreciation and amortization, as reported in the Company's consolidated financial statements.

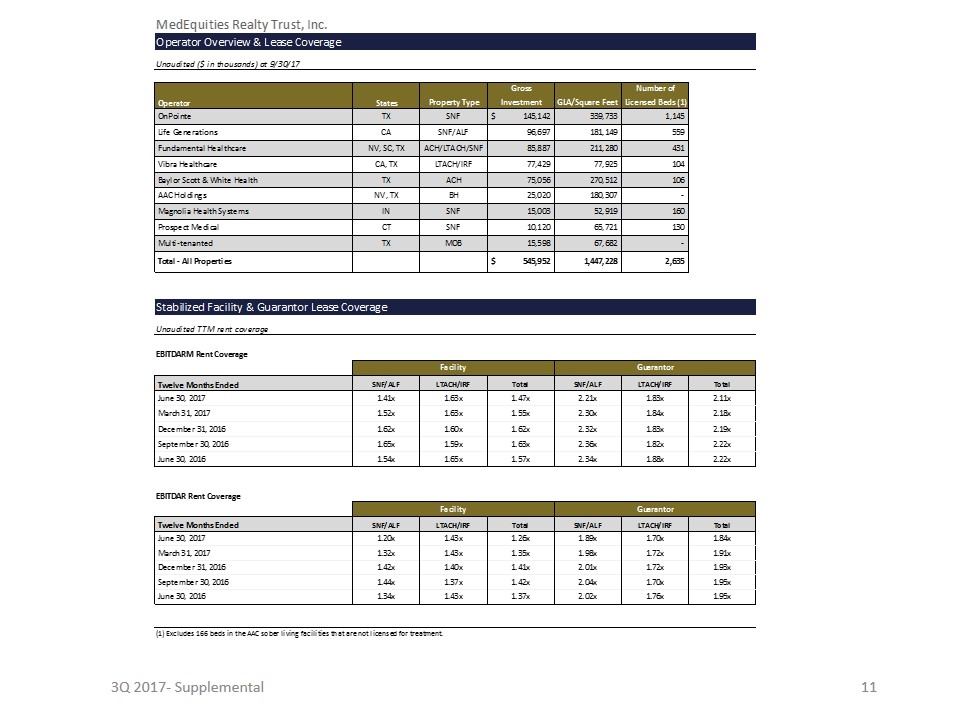

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Operator Overview & Lease CoverageUnaudited ($ in thousands) at 9/30/17 Gross Number of Operator States Property Type Investment GLA/Square Feet Licensed Beds (1) OnPointeTX SNF $145,142 339,733 1,145 Life GenerationsCA SNF/ALF 96,697 181,149 559 Fundamental HealthcareNV, SC, TX ACH/LTACH/SNF 85,887 211,280 431 Vibra HealthcareCA, TX LTACH/IRF 77,429 77,925 104 Baylor Scott & White HealthTX ACH 75,056 270,512 106 AAC HoldingsNV, TX BH 25,020 180,307 - Magnolia Health SystemsIN SNF 15,003 52,919 160 Prospect MedicalCT SNF 10,120 65,721 130 Multi-tenantedTX MOB 15,598 67,682 - Total - All Properties $545,952 1,447,228 2,635 Stabilized Facility & Guarantor Lease CoverageUnaudited TTM rent coverage EBITDARM Rent CoverageFacilityGuarantor Twelve Months EndedSNF/ALFLTACH/IRFTotalSNF/ALFLTACH/IRFTotal June 30, 20171.41x1.63x1.47x2.21x1.83x2.11x March 31, 20171.52x1.63x1.55x2.30x1.84x2.18x December 31, 20161.62x1.60x1.62x2.32x1.83x2.19x September 30, 20161.65x1.59x1.63x2.36x1.82x2.22x June 30, 20161.54x1.65x1.57x2.34x1.88x2.22xEBITDAR Rent CoverageFacilityGuarantor Twelve Months EndedSNF/ALFLTACH/IRFTotalSNF/ALFLTACH/IRFTotal June 30, 20171.20x1.43x1.26x1.89x1.70x1.84x March 31, 20171.32x1.43x1.35x1.98x1.72x1.91x December 31, 20161.42x1.40x1.41x2.01x1.72x1.93x September 30, 20161.44x1.37x1.42x2.04x1.70x1.95x June 30, 20161.34x1.43x1.37x2.02x1.76x1.95x(1) Excludes 166 beds in the AAC sober living facilities that are not licensed for treatment.

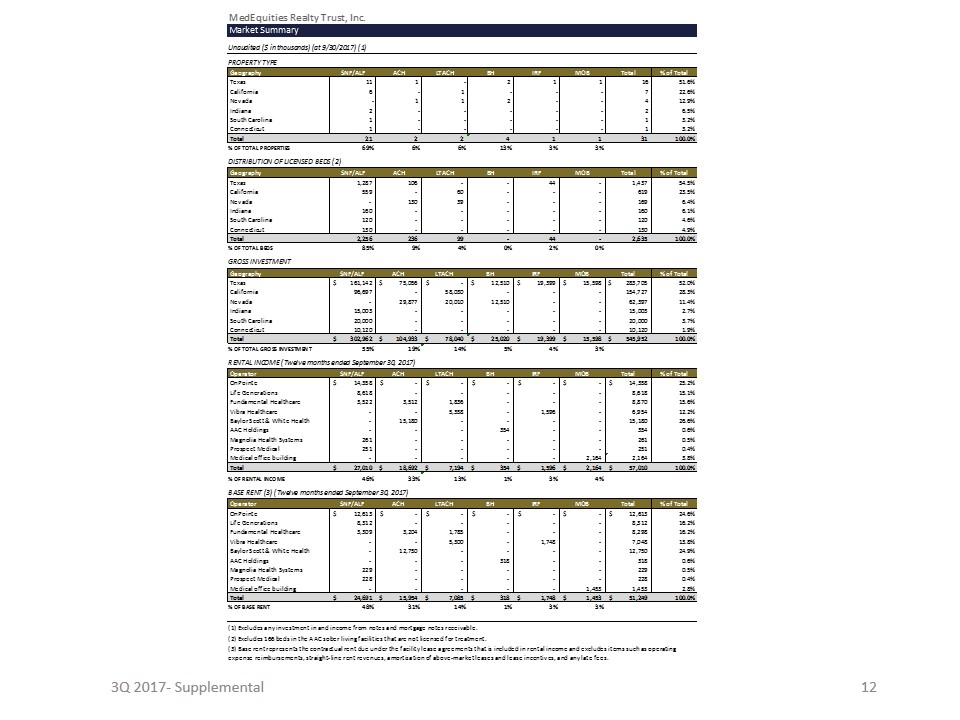

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Market SummaryUnaudited ($ in thousands) (at 9/30/2017) (1)PROPERTY TYPE Geography SNF/ALF ACH LTACH BH IRF MOB Total % of Total Texas11 1 -2 1 1 16 51.6% California6 -1 ---7 22.6% Nevada-1 1 2 --4 12.9% Indiana2 -----2 6.5% South Carolina1 -----1 3.2% Connecticut1 -----1 3.2% Total21 2 2 4 1 1 31 100.0%% OF TOTAL PROPERTIES69%6%6%13%3%3%DISTRIBUTION OF LICENSED BEDS (2) Geography SNF/ALF ACH LTACH BH IRF MOB Total % of Total Texas 1,287 106 - - 44 - 1,437 54.5% California 559 - 60 - - - 619 23.5% Nevada - 130 39 - - - 169 6.4% Indiana 160 - - - - - 160 6.1% South Carolina 120 - - - - - 120 4.6% Connecticut 130 - - - - - 130 4.9% Total 2,256 236 99 - 44 - 2,635 100.0%% OF TOTAL BEDS85%9%4%0%2%0%GROSS INVESTMENT GeographySNF/ALFACHLTACHBHIRFMOBTotal% of Total Texas $161,142 $75,056 $- $12,510 $19,399 $15,598 $283,705 52.0% California 96,697 - 58,030 - - - 154,727 28.3% Nevada - 29,877 20,010 12,510 - - 62,397 11.4% Indiana 15,003 - - - - - 15,003 2.7% South Carolina 20,000 - - - - - 20,000 3.7% Connecticut 10,120 - - - - - 10,120 1.9% Total $302,962 $104,933 $78,040 $25,020 $19,399 $15,598 $545,952 100.0%% OF TOTAL GROSS INVESTMENT55%19%14%5%4%3%RENTAL INCOME (Twelve months ended September 30, 2017) OperatorSNF/ALFACHLTACHBHIRFMOBTotal% of Total OnPointe $14,358 $- $- $- $- $- $14,358 25.2% Life Generations 8,618 - - - - - 8,618 15.1% Fundamental Healthcare 3,522 3,512 1,836 - - - 8,870 15.6% Vibra Healthcare - - 5,358 - 1,596 - 6,954 12.2% Baylor Scott & White Health - 15,180 - - - - 15,180 26.6% AAC Holdings - - - 354 - - 354 0.6% Magnolia Health Systems 261 - - - - - 261 0.5% Prospect Medical 251 - - - - - 251 0.4% Medical office building - - - - - 2,164 2,164 3.8% Total $27,010 $18,692 $7,194 $354 $1,596 $2,164 $57,010 100.0%% OF RENTAL INCOME46%33%13%1%3%4%BASE RENT (3) (Twelve months ended September 30, 2017) OperatorSNF/ALFACHLTACHBHIRFMOBTotal% of Total OnPointe $12,613 $- $- $- $- $- $12,613 24.6% Life Generations 8,312 - - - - - 8,312 16.2% Fundamental Healthcare 3,309 3,204 1,785 - - - 8,298 16.2% Vibra Healthcare - - 5,300 - 1,748 - 7,048 13.8% Baylor Scott & White Health - 12,750 - - - - 12,750 24.9% AAC Holdings - - - 318 - - 318 0.6% Magnolia Health Systems 229 - - - - - 229 0.5% Prospect Medical 228 - - - - - 228 0.4% Medical office building - - - - - 1,453 1,453 2.8% Total $24,691 $15,954 $7,085 $318 $1,748 $1,453 $51,249 100.0%% OF BASE RENT48%31%14%1%3%3%(1) Excludes any investment in and income from notes and mortgage notes receivable.(2) Excludes 166 beds in the AAC sober living facilities that are not licensed for treatment.(3) Base rent represents the contractual rent due under the facility lease agreements that is included in rental income and excludes items such as operating expense reimbursements, straight-line rent revenues, amortization of above-market leases and lease incentives, and any late fees.

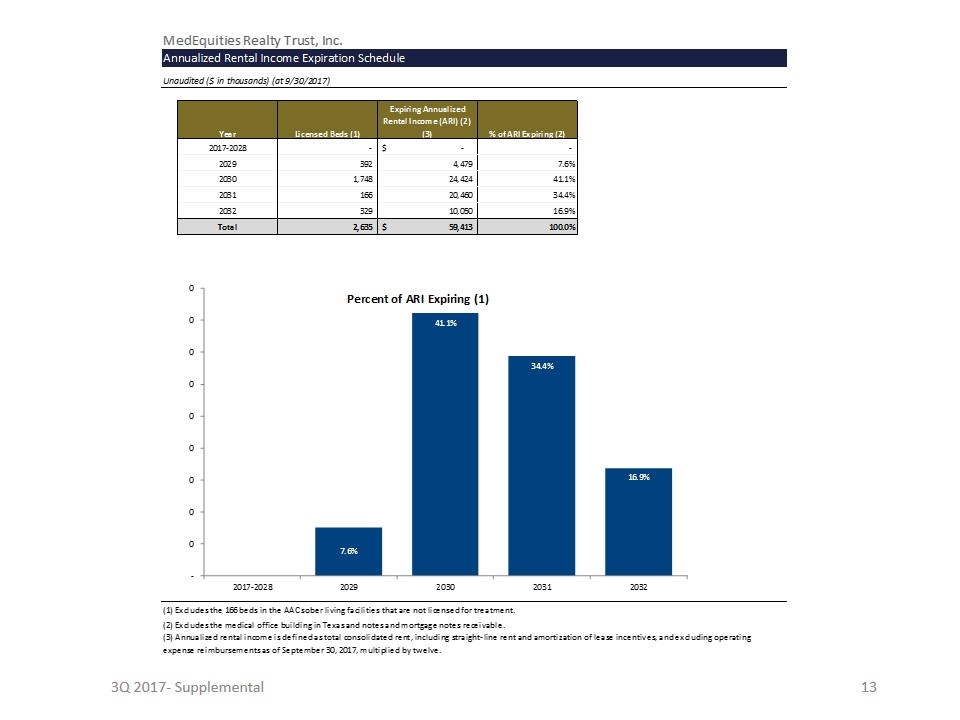

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Annualized Rental Income Expiration ScheduleUnaudited ($ in thousands) (at 9/30/2017)YearLicensed Beds (1) Expiring Annualized Rental Income (ARI) (2) (3) % of ARI Expiring (2)2017-2028 - $- - 2029 392 4,479 7.6%2030 1,748 24,424 41.1%2031 166 20,460 34.4%2032 329 10,050 16.9%Total 2,635 $59,413 100.0%(1) Excludes the 166 beds in the AAC sober living facilities that are not licensed for treatment.(2) Excludes the medical office building in Texas and notes and mortgage notes receivable.(3) Annualized rental income is defined as total consolidated rent, including straight-line rent and amortization of lease incentives, and excluding operating expense reimbursements as of September 30, 2017, multiplied by twelve.

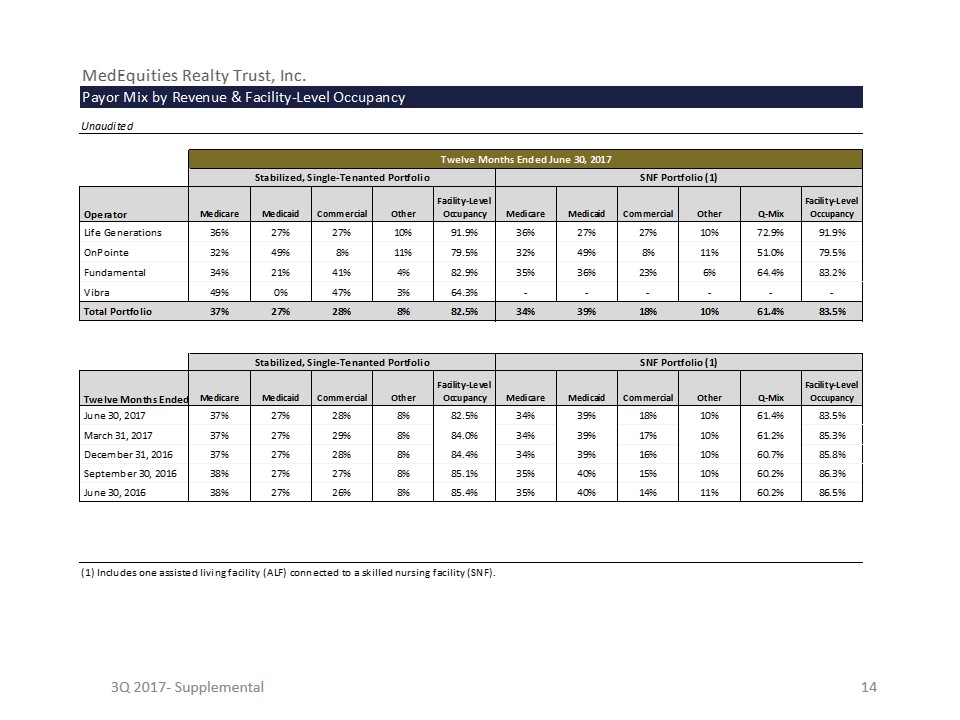

3Q 2017- Supplemental MedEquities Realty Trust, Inc. Payor Mix by Revenue & Facility-Level OccupancyUnauditedTwelve Months Ended June 30, 2017Stabilized, Single-Tenanted PortfolioSNF Portfolio (1) OperatorMedicareMedicaidCommercialOtherFacility-Level OccupancyMedicareMedicaidCommercialOtherQ-MixFacility-Level Occupancy Life Generations36%27%27%10%91.9%36%27%27%10%72.9%91.9% OnPointe32%49%8%11%79.5%32%49%8%11%51.0%79.5% Fundamental34%21%41%4%82.9%35%36%23%6%64.4%83.2% Vibra49%0%47%3%64.3%------ Total Portfolio37%27%28%8%82.5%34%39%18%10%61.4%83.5% Stabilized, Single-Tenanted PortfolioSNF Portfolio (1) Twelve Months EndedMedicareMedicaidCommercialOtherFacility-Level OccupancyMedicareMedicaidCommercialOtherQ-MixFacility-Level Occupancy June 30, 201737%27%28%8%82.5%34%39%18%10%61.4%83.5% March 31, 201737%27%29%8%84.0%34%39%17%10%61.2%85.3% December 31, 201637%27%28%8%84.4%34%39%16%10%60.7%85.8% September 30, 201638%27%27%8%85.1%35%40%15%10%60.2%86.3% June 30, 201638%27%26%8%85.4%35%40%14%11%60.2%86.5%(1) Includes one assisted living facility (ALF) connected to a skilled nursing facility (SNF).

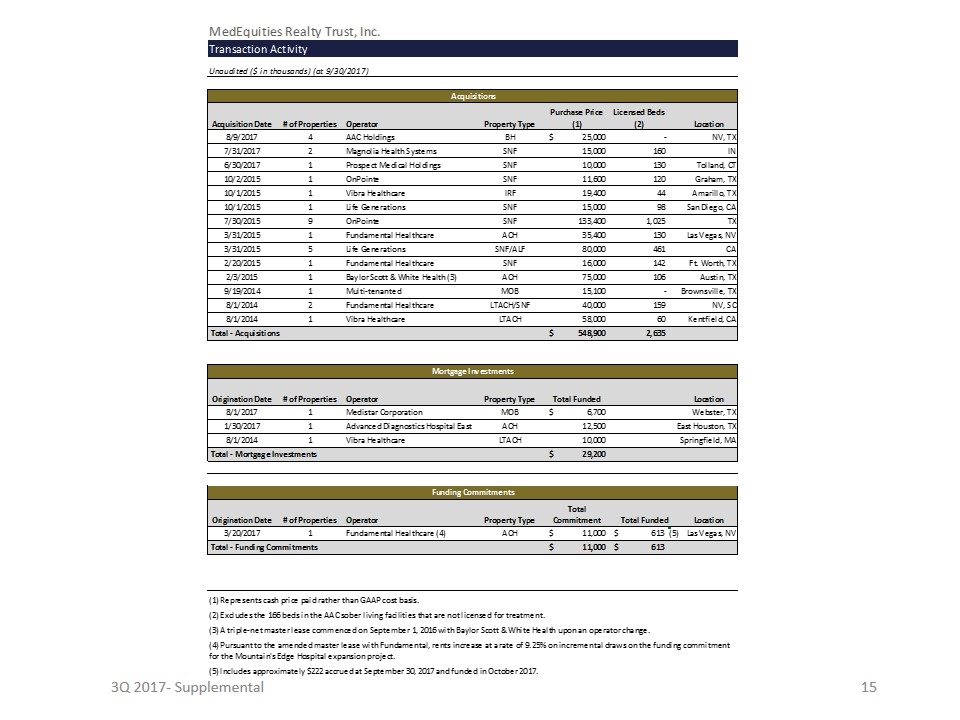

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Transaction ActivityUnaudited ($ in thousands) (at 9/30/2017) AcquisitionsAcquisition Date# of PropertiesOperatorProperty TypePurchase Price (1)Licensed Beds (2)Location8/9/20174AAC HoldingsBH $25,000 -NV, TX7/31/20172Magnolia Health SystemsSNF 15,000 160 IN6/30/20171Prospect Medical HoldingsSNF 10,000 130 Tolland, CT10/2/20151OnPointeSNF 11,600 120 Graham, TX10/1/20151Vibra HealthcareIRF 19,400 44 Amarillo, TX10/1/20151Life GenerationsSNF 15,000 98 San Diego, CA7/30/20159OnPointeSNF 133,400 1,025 TX3/31/20151Fundamental HealthcareACH 35,400 130 Las Vegas, NV3/31/20155Life GenerationsSNF/ALF 80,000 461 CA2/20/20151Fundamental HealthcareSNF 16,000 142 Ft. Worth, TX2/3/20151Baylor Scott & White Health (3)ACH 75,000 106 Austin, TX9/19/20141Multi-tenantedMOB 15,100 -Brownsville, TX8/1/20142Fundamental HealthcareLTACH/SNF 40,000 159 NV, SC8/1/20141Vibra HealthcareLTACH 58,000 60 Kentfield, CA Total - Acquisitions $548,900 2,635 Mortgage InvestmentsOrigination Date# of PropertiesOperatorProperty TypeTotal FundedLocation8/1/20171Medistar CorporationMOB $6,700 Webster, TX1/30/20171Advanced Diagnostics Hospital EastACH 12,500 East Houston, TX8/1/20141Vibra HealthcareLTACH 10,000 Springfield, MA Total - Mortgage Investments $29,200 Funding CommitmentsOrigination Date# of PropertiesOperatorProperty TypeTotal CommitmentTotal FundedLocation3/20/20171Fundamental Healthcare (4)ACH $11,000 $613 (5) Las Vegas, NV Total - Funding Commitments $11,000 $613 (1) Represents cash price paid rather than GAAP cost basis.(2) Excludes the 166 beds in the AAC sober living facilities that are not licensed for treatment.(3) A triple-net master lease commenced on September 1, 2016 with Baylor Scott & White Health upon an operator change.(4) Pursuant to the amended master lease with Fundamental, rents increase at a rate of 9.25% on incremental draws on the funding commitment for the Mountain's Edge Hospital expansion project.(5) Includes approximately $222 accrued at September 30, 2017 and funded in October 2017.

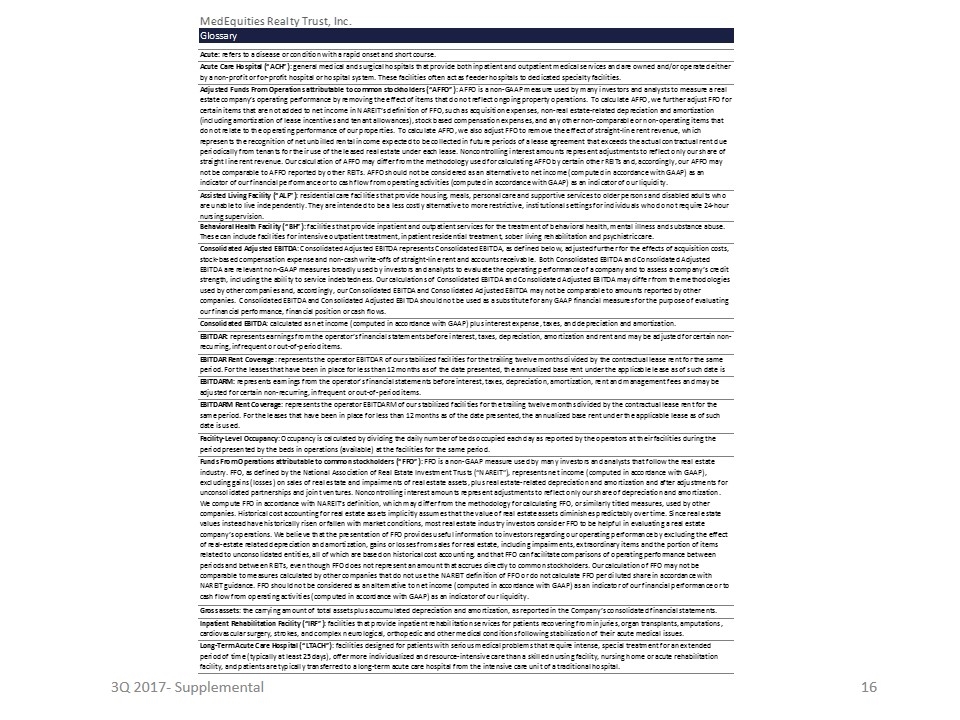

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Glossary"Acute: refers to a disease or condition with a rapid onset and short course.""Acute Care Hospital (“ACH”): general medical and surgical hospitals that provide both inpatient and outpatient medical services and are owned and/or operated either by a non-profit or for-profit hospital or hospital system. These facilities often act as feeder hospitals to dedicated specialty facilities.""Adjusted Funds From Operations attributable to common stockholders (“AFFO”): AFFO is a non-GAAP measure used by many investors and analysts to measure a real estate company’s operating performance by removing the effect of items that do not reflect ongoing property operations. To calculate AFFO, we further adjust FFO for certain items that are not added to net income in NAREIT’s definition of FFO, such as acquisition expenses, non-real estate-related depreciation and amortization (including amortization of lease incentives and tenant allowances), stock based compensation expenses, and any other non-comparable or non-operating items that do not relate to the operating performance of our properties. To calculate AFFO, we also adjust FFO to remove the effect of straight-line rent revenue, which represents the recognition of net unbilled rental income expected to be collected in future periods of a lease agreement that exceeds the actual contractual rent due periodically from tenants for their use of the leased real estate under each lease. Noncontrolling interest amounts represent adjustments to reflect only our share of straight line rent revenue. Our calculation of AFFO may differ from the methodology used for calculating AFFO by certain other REITs and, accordingly, our AFFO may not be comparable to AFFO reported by other REITs. AFFO should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity.""Assisted Living Facility (“ALF”): residential care facilities that provide housing, meals, personal care and supportive services to older persons and disabled adults who are unable to live independently. They are intended to be a less costly alternative to more restrictive, institutional settings for individuals who do not require 24-hour nursing supervision."Behavioral Health Facility (“BH”): facilities that provide inpatient and outpatient services for the treatment of behavioral health, mental illness and substance abuse. These can include facilities for intensive outpatient treatment, inpatient residential treatment, sober living rehabilitation and psychiatric care."Consolidated Adjusted EBITDA: Consolidated Adjusted EBITDA represents Consolidated EBITDA, as defined below, adjusted further for the effects of acquisition costs, stock-based compensation expense and non-cash write-offs of straight-line rent and accounts receivable. Both Consolidated EBITDA and Consolidated Adjusted EBITDA are relevant non-GAAP measures broadly used by investors and analysts to evaluate the operating performance of a company and to assess a company’s credit strength, including the ability to service indebtedness. Our calculations of Consolidated EBITDA and Consolidated Adjusted EBITDA may differ from the methodologies used by other companies and, accordingly, our Consolidated EBITDA and Consolidated Adjusted EBITDA may not be comparable to amounts reported by other companies. Consolidated EBITDA and Consolidated Adjusted EBITDA should not be used as a substitute for any GAAP financial measures for the purpose of evaluating our financial performance, financial position or cash flows."Consolidated EBITDA: calculated as net income (computed in accordance with GAAP) plus interest expense, taxes, and depreciation and amortization."EBITDAR: represents earnings from the operator’s financial statements before interest, taxes, depreciation, amortization and rent and may be adjusted for certain non-recurring, infrequent or out-of-period items.""EBITDAR Rent Coverage: represents the operator EBITDAR of our stabilized facilities for the trailing twelve months divided by the contractual lease rent for the same period. For the leases that have been in place for less than 12 months as of the date presented, the annualized base rent under the applicable lease as of such date is used.""EBITDARM: represents earnings from the operator’s financial statements before interest, taxes, depreciation, amortization, rent and management fees and may be adjusted for certain non-recurring, infrequent or out-of-period items.""EBITDARM Rent Coverage: represents the operator EBITDARM of our stabilized facilities for the trailing twelve months divided by the contractual lease rent for the same period. For the leases that have been in place for less than 12 months as of the date presented, the annualized base rent under the applicable lease as of such date is used."Facility-Level Occupancy: Occupancy is calculated by dividing the daily number of beds occupied each day as reported by the operators at their facilities during the period presented by the beds in operations (available) at the facilities for the same period.Funds From Operations attributable to common stockholders (“FFO”): FFO is a non-GAAP measure used by many investors and analysts that follow the real estate industry. FFO, as defined by the National Association of Real Estate Investment Trusts (“NAREIT”), represents net income (computed in accordance with GAAP), excluding gains (losses) on sales of real estate and impairments of real estate assets, plus real estate-related depreciation and amortization and after adjustments for unconsolidated partnerships and joint ventures. Noncontrolling interest amounts represent adjustments to reflect only our share of depreciation and amortization. We compute FFO in accordance with NAREIT’s definition, which may differ from the methodology for calculating FFO, or similarly titled measures, used by other companies. Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, most real estate industry investors consider FFO to be helpful in evaluating a real estate company’s operations. We believe that the presentation of FFO provides useful information to investors regarding our operating performance by excluding the effect of real-estate related depreciation and amortization, gains or losses from sales for real estate, including impairments, extraordinary items and the portion of items related to unconsolidated entities, all of which are based on historical cost accounting, and that FFO can facilitate comparisons of operating performance between periods and between REITs, even though FFO does not represent an amount that accrues directly to common stockholders. Our calculation of FFO may not be comparable to measures calculated by other companies that do not use the NAREIT definition of FFO or do not calculate FFO per diluted share in accordance with NAREIT guidance. FFO should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of our financial performance or to cash flow from operating activities (computed in accordance with GAAP) as an indicator of our liquidity."Gross assets: the carrying amount of total assets plus accumulated depreciation and amortization, as reported in the Company’s consolidated financial statements.""Inpatient Rehabilitation Facility (“IRF”): facilities that provide inpatient rehabilitation services for patients recovering from injuries, organ transplants, amputations, cardiovascular surgery, strokes, and complex neurological, orthopedic and other medical conditions following stabilization of their acute medical issues.""Long-Term Acute Care Hospital (“LTACH”): facilities designed for patients with serious medical problems that require intense, special treatment for an extended period of time (typically at least 25 days), offer more individualized and resource-intensive care than a skilled nursing facility, nursing home or acute rehabilitation facility, and patients are typically transferred to a long-term acute care hospital from the intensive care unit of a traditional hospital."

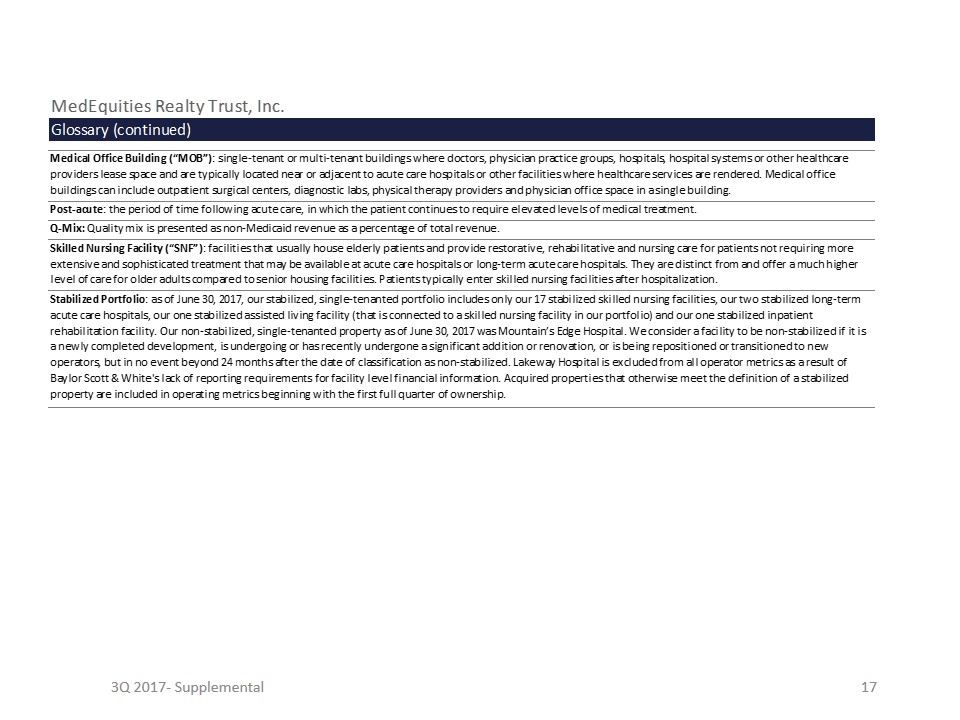

3Q 2017- Supplemental MedEquities Realty Trust, Inc.Glossary (continued)"Medical Office Building (“MOB”): single-tenant or multi-tenant buildings where doctors, physician practice groups, hospitals, hospital systems or other healthcare providers lease space and are typically located near or adjacent to acute care hospitals or other facilities where healthcare services are rendered. Medical office buildings can include outpatient surgical centers, diagnostic labs, physical therapy providers and physician office space in a single building.""Post-acute: the period of time following acute care, in which the patient continues to require elevated levels of medical treatment.""Q-Mix: Quality mix is presented as non-Medicaid revenue as a percentage of total revenue. ""Skilled Nursing Facility (“SNF”): facilities that usually house elderly patients and provide restorative, rehabilitative and nursing care for patients not requiring more extensive and sophisticated treatment that may be available at acute care hospitals or long-term acute care hospitals. They are distinct from and offer a much higher level of care for older adults compared to senior housing facilities. Patients typically enter skilled nursing facilities after hospitalization."Stabilized Portfolio: as of June 30, 2017, our stabilized, single-tenanted portfolio includes only our 17 stabilized skilled nursing facilities, our two stabilized long-term acute care hospitals, our one stabilized assisted living facility (that is connected to a skilled nursing facility in our portfolio) and our one stabilized inpatient rehabilitation facility. Our non-stabilized, single-tenanted property as of June 30, 2017 was Mountain’s Edge Hospital. We consider a facility to be non-stabilized if it is a newly completed development, is undergoing or has recently undergone a significant addition or renovation, or is being repositioned or transitioned to new operators, but in no event beyond 24 months after the date of classification as non-stabilized. Lakeway Hospital is excluded from all operator metrics as a result of Baylor Scott & White's lack of reporting requirements for facility level financial information. Acquired properties that otherwise meet the definition of a stabilized property are included in operating metrics beginning with the first full quarter of ownership.