Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-kpptinvestorpresenta.htm |

NOVEMBER 7, 2017 | PHOENIX, AZ

CREDIT SUISSE

HEALTHCARE CONFERENCE

1

FORWARD LOOKING STATEMENT

Cautionary Statement Regarding Forward Looking Statements

This presentation contains forward-looking statements which are subject to change based on various important

factors, including without limitation, competitive actions in the marketplace, and adverse actions of governmental

and other third-party payers.

Actual results could differ materially from those suggested by these forward-looking statements. Further

information on potential factors that could affect the operating and financial results of Laboratory Corporation of

America Holdings (the “Company”) is included in the Company’s Form 10-K for the year ended December 31, 2016,

and subsequent Forms 10-Q, including in each case under the heading risk factors, and in the Company’s other

filings with the SEC. The Company has no obligation to provide any updates to these forward-looking statements

even if its expectations change.

2

AGENDA

Company Overview

Capital Deployment

Financial Performance

3

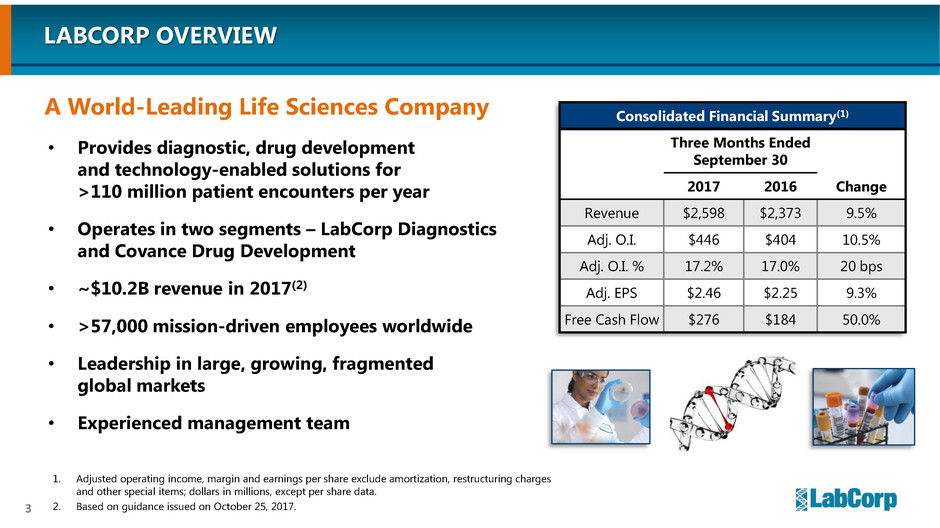

LABCORP OVERVIEW

• Provides diagnostic, drug development

and technology-enabled solutions for

>110 million patient encounters per year

• Operates in two segments – LabCorp Diagnostics

and Covance Drug Development

• ~$10.2B revenue in 2017(2)

• >57,000 mission-driven employees worldwide

• Leadership in large, growing, fragmented

global markets

• Experienced management team

A World-Leading Life Sciences Company

Consolidated Financial Summary(1)

Three Months Ended

September 30

Change 2017 2016

Revenue $2,598 $2,373 9.5%

Adj. O.I. $446 $404 10.5%

Adj. O.I. % 17.2% 17.0% 20 bps

Adj. EPS $2.46 $2.25 9.3%

Free Cash Flow $276 $184 50.0%

1. Adjusted operating income, margin and earnings per share exclude amortization, restructuring charges

and other special items; dollars in millions, except per share data.

2. Based on guidance issued on October 25, 2017.

4

LABCORP DIAGNOSTICS OVERVIEW

• ~$7.2B revenue in 2017(2)

• National network of 41 primary clinical laboratories

and approximately 1,750 patient service centers

• Offers broad range of 4,800+ clinical, anatomic

pathology, genetic and genomic tests

• Processes ~500,000 patient specimens daily

• Vast and growing patient database -- approximately

50% of U.S. population

• Serves hundreds of thousands of customers,

including physicians, government agencies, managed

care organizations, hospitals and

health systems, patients and consumers

1. Adjusted operating income and margin exclude unallocated corporate expenses, amortization,

restructuring charges and other special items; dollars in millions.

2. Based on guidance issued on October 25, 2017.

Leading National Clinical Laboratory

Segment Financial Summary(1)

Three Months Ended

September 30

Change 2017 2016

Revenue $1,837 $1,672 9.9%

Adj. O.I. $374 $342 9.4%

Adj. O.I. % 20.3% 20.4% (10 bps)

5

COVANCE DRUG DEVELOPMENT OVERVIEW

• ~$3.0B revenue in 2017(2)

• Market leader in early development, central

laboratory, and Phase I-IV clinical trial

management services

• Collaborated on 86% of the 22 new drugs approved

by FDA in 2016, including 4 of 5 approved oncology

drugs, and 8 of 9 drugs treating rare and orphan

diseases

• Xcellerate® is the world’s most comprehensive

investigator performance database

• Acquired Chiltern, a leading global CRO among

emerging-to-mid biopharma customers, for $1.2

billion in cash

Leading CRO / Drug Development Services Provider

1. Adjusted operating income and margin exclude unallocated corporate expenses, amortization,

restructuring charges and other special items; dollars in millions.

2. Based on guidance issued on October 25, 2017.

Segment Financial Summary(1)

Three Months Ended

September 30

Change 2017 2016

Revenue $761 $701 8.6%

Adj. O.I. $109 $95 14.0%

Adj. O.I. % 14.3% 13.6% 70 bps

6

EXPANDED GROWTH OPPORTUNITIES WITH INCREASED GLOBAL PRESENCE

1. 2014 revenue excludes Covance.

2. 2014 & 2016 revenue excludes Chiltern.

3. Based on industry publications and company estimates.

4. Over 30 currencies in 2016 and no single currency (other than US dollar) accounts for more than 10% of 2016 revenue.

2014 Revenue Distribution(1)(2)

>$70 billion

addressable

market(3)

2016 Revenue Distribution(2)

0%

25%

50%

75%

100%

USA Rest of World

92.7%

80.9%

7.3%

19.1%

0%

25%

50%

75%

100%

USA Rest of World

92.7%

Markets Served

North American

Clinical Reference Laboratory

Central Laboratory

Market Opportunities

Global Clinical Reference Laboratory Drug Development

Central Laboratory Market Access

Food Safety and Chemistry

>$200 billion

addressable

market(3)

(4)

7

29%

32%

23%

11% 3% 3%

Pharma & Biotech

Managed Care (Fee for Service)

Other Payers

Medicare & Medicaid

Patient

Managed Care (Capitated)

(2)

DIVERSIFIED REVENUE BASE

1. Based on nine months ended September 30, 2017. Does not tie due to rounding.

2. Includes physicians and hospitals, occupational testing services, non-U.S. clinical diagnostic laboratory operations,

nutritional chemistry and food safety operations, and Beacon LBS.

Unique Customer Mix(1)

8

AGENDA

Company Overview

Capital Deployment

Financial Performance

9

EFFECTIVE CAPITAL DEPLOYMENT TO BUILD SHAREHOLDER VALUE

Share Repurchase

$1.9 Billion (19%)

LabCorp

Diagnostics

Acquisitions

$1.3 Billion (13%)

Covance Acquisition

$5.6 Billion (57%)

Approximately $10 Billion in Capital

Deployment Between 2012 and 2016

10

EFFECTIVE CAPITAL DEPLOYMENT TO BUILD SHAREHOLDER VALUE

Share Repurchase

$1.9 Billion (19%)

LabCorp

Diagnostics

Acquisitions

$1.3 Billion (13%)

Covance Acquisition

$5.6 Billion (57%)

Approximately $10 Billion in Capital

Deployment Between 2012 and 2016

Approximately $2.3 Billion in Capital

Deployment YTD 2017(1)

Chiltern Acquisition

$1.2 Billion (52%)

LabCorp

Diagnostics

Acquisitions

$0.6 Billion (26%)

1. Based on nine months ended September 30, 2017.

11

HISTORY OF VALUE ADDED ACQUISITIONS

Target Acquisition Criteria

Healthcare related businesses that leverage

our core competencies

Market leader

Strong management team

International presence

Accretive to earnings and cash flow year 1

Earn cost of capital by year 4

Mount Sinai

Clinical Outreach

Lab Assets

12

Advances our strategy of combining strengths of

leading diagnostics and drug development capabilities to create

a unique business whose mission is to Improve Health and Improve Lives

• Enhances customer offering to include a dedicated focus on the high-growth emerging and

mid-market biopharma segments

• Deepens therapeutic experience, with distinctive leadership in oncology, to provide innovative

solutions for customers’ most challenging problems across the healthcare ecosystem

• Increases global scale, bolstering presence in Asia-Pacific and Eastern Europe, to improve

competitiveness of clinical development offerings

• Expands Functional Service Provider solutions with added monitoring, biometrics and safety

expertise and capabilities

• Accretive to adjusted EPS and free cash flow in year one and earns cost of capital by year three

ACQUISITION OF CHILTERN

COMPLEMENTS AND STRENGTHENS OUR EXISTING BUSINESS

13

ACQUISITION OF PAML

COMPLEMENTS AND STRENGTHENS OUR EXISTING BUSINESS

Shared vision and commitment to

provide high-quality, community-based laboratory services

• LabCorp will provide outreach testing and reference laboratory services

• Strengthens relationships with anchor health systems

• Increases engagement with multiple community-based hospitals

• Expands geographic presence into important markets

• Continue to consolidate joint ventures

• Meets stated financial criteria

14

AGENDA

Company Overview

Capital Deployment

Financial Performance

15

LONG-TERM REVENUE(1) GROWTH (DOLLARS IN BILLIONS)

(1) 2006-2014 revenues excludes Covance results. 2008 revenue includes a $7.5 million adjustment relating to certain historic overpayments made

by Medicare for claims submitted by a subsidiary of the Company.

$3.6

$4.1

$4.5

$4.7 $5.0

$5.5 $5.7

$5.8 $6.0

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

$8.5

$9.4

$9.9

$6.2

$6.6

$7.0

10-Year CAGR : 10%

Drug

Development

Diagnostics

16

LONG-TERM REVENUE(1) GROWTH (DOLLARS IN BILLIONS)

(1) 2006-2014 revenues excludes Covance results. 2008 revenue includes a $7.5 million adjustment relating to certain historic overpayments made

by Medicare for claims submitted by a subsidiary of the Company.

(2) Guidance issued on October 25, 2017.

2017 Guidance(2)

Midpoint 8.3%

$3.6

$4.1

$4.5

$4.7 $5.0

$5.5 $5.7

$5.8 $6.0

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

$8.5

$9.4

$10.2

$6.2

$6.6

$7.2

Drug

Development

Diagnostics

17

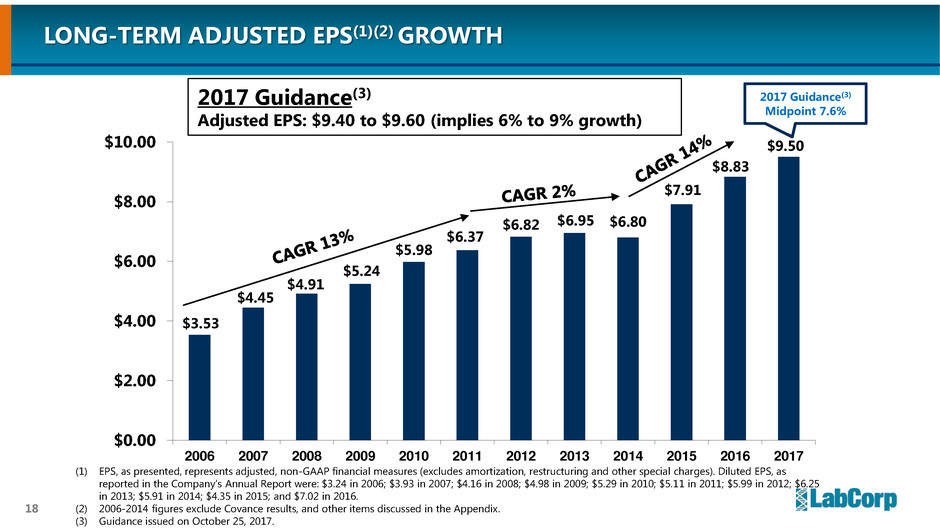

LONG-TERM ADJUSTED EPS(1)(2) GROWTH

(1) EPS, as presented, represents adjusted, non-GAAP financial measures (excludes amortization, restructuring and other special charges). Diluted EPS, as

reported in the Company’s Annual Report were: $3.24 in 2006; $3.93 in 2007; $4.16 in 2008; $4.98 in 2009; $5.29 in 2010; $5.11 in 2011; $5.99 in 2012;

$6.25 in 2013; $5.91 in 2014; $4.35 in 2015; and $7.02 in 2016.

(2) 2006-2014 figures exclude Covance results, and other items discussed in the Appendix.

$3.53

$4.45

$4.91

$5.24

$5.98

$6.37

$6.82 $6.95 $6.80

$7.91

$8.83

$9.53

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

10-Year CAGR : 10%

18

LONG-TERM ADJUSTED EPS(1)(2) GROWTH

(1) EPS, as presented, represents adjusted, non-GAAP financial measures (excludes amortization, restructuring and other special charges). Diluted EPS, as

reported in the Company’s Annual Report were: $3.24 in 2006; $3.93 in 2007; $4.16 in 2008; $4.98 in 2009; $5.29 in 2010; $5.11 in 2011; $5.99 in 2012; $6.25

in 2013; $5.91 in 2014; $4.35 in 2015; and $7.02 in 2016.

(2) 2006-2014 figures exclude Covance results, and other items discussed in the Appendix.

(3) Guidance issued on October 25, 2017.

2017 Guidance(3)

Adjusted EPS: $9.40 to $9.60 (implies 6% to 9% growth)

2017 Guidance(3)

Midpoint 7.6%

$3.53

$4.45

$4.91

$5.24

$5.98

$6.37

$6.82 $6.95 $6.80

$7.91

$8.83

$9.50

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

19

FREE CASH FLOW(1) (DOLLARS IN MILLIONS)

(1) Free Cash Flow represents Operating Cash Flow less Capital Expenditures in each of the years presented.

2007-2014 figures exclude Covance results, and other items discussed in the Appendix.

$567

$624

$748

$758 $759

$668

$617

$536

$727

$897

$950

$0

$200

$400

$600

$800

$1,000

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

10 Year Average Free Cash Flow: $690 million

20

FREE CASH FLOW(1) (DOLLARS IN MILLIONS)

(1) Free Cash Flow represents Operating Cash Flow less Capital Expenditures in each of the years presented.

2007-2014 figures exclude Covance results, and other items discussed in the Appendix.

(2) Guidance issued on October 25, 2017.

2017 Guidance(2)

Free Cash Flow: $970 to $1,010 million (implies 8% to 13% growth)

2017 Guidance(2)

Midpoint

10.4%

$567

$624

$748

$758 $759

$668

$617

$536

$727

$897

$990

$0

$200

$400

$600

$800

$1,000

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

21

WELL POSITIONED FOR PROFITABLE GROWTH

• Protecting Access to Medicare Act (PAMA), if implemented

• Organic revenue growth in LabCorp Diagnostics and Covance Drug Development

• Continued progress with LaunchPad initiative

• Full-year benefit of acquisitions (e.g. Chiltern, PAML, Mount Sinai clinical outreach lab assets)

• Deployment of free cash flow

NOVEMBER 7, 2017 | PHOENIX, AZ

CREDIT SUISSE

HEALTHCARE CONFERENCE

23

Appendix

24

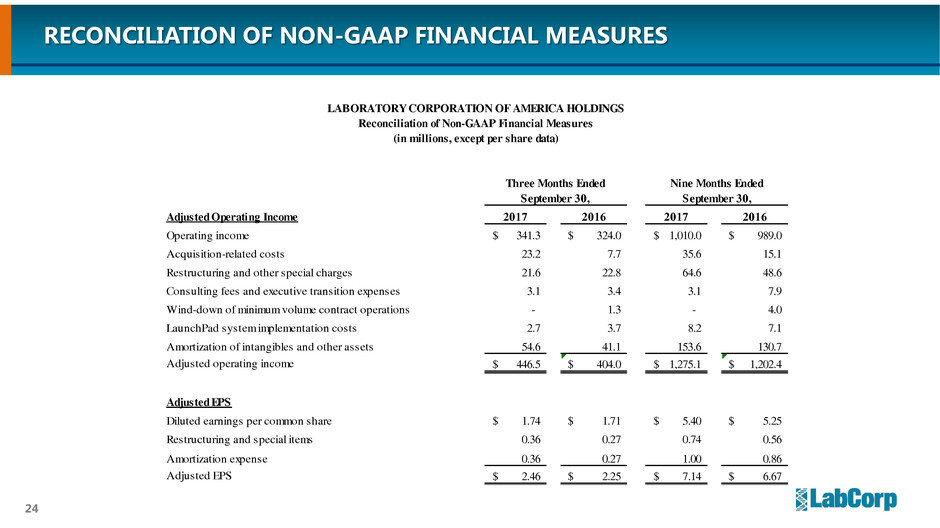

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Adjusted Operating Income 2017 2016 2017 2016

Operating income 341.3$ 324.0$ 1,010.0$ 989.0$

Acquisition-related costs 23.2 7.7 35.6 15.1

Restructuring and other special charges 21.6 22.8 64.6 48.6

Consulting fees and executive transition expenses 3.1 3.4 3.1 7.9

Wind-down of minimum volume contract operations - 1.3 - 4.0

LaunchPad system implementation costs 2.7 3.7 8.2 7.1

Amortization of intangibles and other assets 54.6 41.1 153.6 130.7

Adjusted operating income 446.5$ 404.0$ 1,275.1$ 1,202.4$

Adjusted EPS

Diluted earnings per common share 1.74$ 1.71$ 5.40$ 5.25$

Restructuring and special items 0.36 0.27 0.74 0.56

Amortization expense 0.36 0.27 1.00 0.86

Adjusted EPS 2.46$ 2.25$ 7.14$ 6.67$

LABORATORY CORPORATION OF AMERICA HOLDINGS

Reconciliation of Non-GAAP Financial Measures

(in millions, except per share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

25

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Free Cash Flow: 2017 2016 2017 2016

Net cash provided by operating activities 350.9$ 249.9$ 895.4$ 727.0$

Less: Capital expenditures (75.3) (66.2) (216.8) (204.6)

Free cash flow 275.6$ 183.7$ 678.6$ 522.4$

LABORATORY CORPORATION OF AMERICA HOLDINGS

Reconciliation of Non-GAAP Financial Measures

(in millions)

Three Months Ended

September 30,

Nine Months Ended

September 30,

26

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – FOOTNOTES

1) During the third quarter of 2017, the Company recorded net restructuring and other special charges of $21.6 million. The charges included $4.6 million in severance and other personnel

costs along with $12.1 million in costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.9 million, primarily in

unused severance reserves. The Company also recognized asset impairment losses of $5.8 million related to the termination of a software development project within the Covance Drug

Development segment and the forgiveness of indebtedness for LabCorp Diagnostics customers in areas heavily impacted by hurricanes experienced during the quarter.

The Company incurred legal and other costs of $23.2 million primarily relating to the acquisition of Chiltern. The Company also recorded $3.1 million in consulting and other expenses relating

to Covance and Chiltern integration initiatives. In addition, the Company incurred $2.7 million of non-capitalized costs associated with the implementation of a major system as part of its

LaunchPad business process improvement initiative (all recorded in selling, general and administrative expenses).

The after tax impact of these charges decreased net earnings for the quarter ended September 30, 2017, by $37.2 million and diluted earnings per share by $0.36 ($37.2 million divided by

103.7 million shares)

During the first two quarters of 2017, the Company recorded net restructuring and other special charges of $43.0 million. The charges included $22.6 million in severance and other personnel

costs along with $5.8 million in costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.5 million, primarily in

unused severance reserves. The Company also recognized an asset impairment loss of $15.1 million related to the termination of a software development project.

The Company incurred legal and other costs of $6.6 million relating to recent acquisition activity. The Company also recorded $4.9 million in consulting expenses relating to fees incurred as

part of its Covance integration and compensation analysis, along with $0.9 million in short-term equity retention arrangements relating to the acquisition of Covance. In addition, the Company

incurred $5.5 million of non-capitalized costs associated with the implementation of a major system as part of its LaunchPad business process improvement initiative (all recorded in selling,

general and administrative expenses).

The after tax impact of these combined charges decreased net earnings for the nine months ended September 30, 2017, by $77.0 million and diluted earnings per share by $0.74 ($77.0 million

divided by 103.9 million shares).

27

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – FOOTNOTES

2) During the third quarter of 2016, the Company recorded net restructuring and special items of $22.8 million. The charges included $14.1 million in severance and other personnel costs along

with $9.1 million in facility-related costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.2 million in unused facility-

related costs and $0.2 million in unused personnel costs.

The Company incurred $5.9 million in fees and expenses associated with acquisitions completed during the quarter and incurred additional legal and other costs of $1.3 million relating to the

wind-down of its minimum volume contract operations. The Company also recorded $1.4 million in consulting expenses relating to fees incurred as part of its Covance integration costs and

compensation analysis, along with $0.5 million in short-term equity retention arrangements relating to the acquisition of Covance, $3.4 million of accelerated equity and other final compensation

relating to executive transition announced during the third quarter, and $3.7 million of non-capitalized costs associated with the implementation of a major system as part of its LaunchPad

business process improvement initiative (all recorded in selling, general and administrative expenses).

In addition, the Company also incurred $5.6 million of interest expense relating to the early retirement of subsidiary indebtedness acquired as part of its recent acquisition of Sequenom.

The after tax impact of these charges decreased net earnings for the quarter ended September 30, 2016, by $28.5 million and diluted earnings per share by $0.27 ($28.5 million divided by 105.0

million shares).

During the first two quarters of 2016, the Company recorded net restructuring and other special charges of $25.8 million. The charges included $9.0 million in severance and other personnel costs

along with $21.6 million in facility-related costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $2.2 million in unused

facility-related costs and $2.6 million in unused severance reserves.

The Company incurred $1.5 million in fees and expenses associated with completed acquisitions and incurred additional legal and other costs of $2.7 million relating to the wind-down of its

minimum volume contract operations. The Company also recorded $3.0 million in consulting expenses relating to fees incurred as part of its Covance integration costs and compensation analysis,

along with $1.8 million in short-term equity retention arrangements relating to the acquisition of Covance, $4.1 million of accelerated equity compensation relating to the announced retirement of

a Company executive and $4.8 million of non-capitalized costs associated with the implementation of a major system as part of its LaunchPad business process improvement initiative (all recorded

in selling, general and administrative expenses). In conjunction with certain international legal entity tax structuring, the Company also recorded a one-time tax liability of $1.1 million.

The after tax impact of these charges decreased net earnings for the nine months ended September 30, 2016, by $58.1 million and diluted earnings per share by $0.56 ($58.1 million divided by

104.2 million shares).

28

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES – FOOTNOTES

3) The Company continues to grow the business through acquisitions and uses Adjusted EPS excluding amortization as a measure of operational performance, growth and shareholder

returns. The Company believes adjusting EPS for amortization provides investors with better insight into the operating performance of the business. For the quarters ended September 30,

2017 and 2016, intangible amortization was $53.7 million and $41.1 million, respectively ($36.4 million and $31.3 million net of tax, respectively) and decreased EPS by $0.35 ($36.4 million

divided by 103.7 million shares) and $0.27 ($28.4 million divided by 105.0 million shares), respectively. For the nine months ended September 30, 2017 and 2016, intangible amortization

was $152.7 million and $130.7 million, respectively ($103.6 million and $89.4 million net of tax, respectively) and decreased EPS by $1.00 ($103.6 million divided by 103.9 million shares) and

$0.86 ($89.4 million divided by 104.2 million shares), respectively.

29

FOOTNOTES TO “LONG-TERM ADJUSTED EPS GROWTH” SLIDE

1) EPS, as presented, represents adjusted, non-GAAP financial measures (excludes amortization, restructuring and other special charges). Diluted EPS, as reported in the Company’s

Annual Report were: $3.24 in 2006; $3.93 in 2007; $4.16 in 2008; $4.98 in 2009; $5.29 in 2010; $5.11 in 2011; $5.99 in 2012; $6.25 in 2013; $5.91 in 2014; $4.34 in 2015; and $7.02 in

2016.

2) 2006-2014 figures exclude Covance results. Excluding the $0.06 per diluted share impact of restructuring and other special charges and the $0.23 per diluted share impact from

amortization in 2006; excluding the $0.25 per diluted share impact of restructuring and other special charges and the $0.27 per diluted share impact from amortization in 2007;

excluding the $0.44 per diluted share impact of restructuring and other special charges and the $0.31 per diluted share impact from amortization in 2008; excluding the ($0.09) per

diluted share impact of restructuring and other special charges and the $0.35 per diluted share impact from amortization in 2009; excluding the $0.26 per diluted share impact of

restructuring and other special charges and the $0.43 per diluted share impact from amortization in 2010; excluding the $0.72 per diluted share impact of restructuring and other

special charges, the $0.03 per diluted share impact from a loss on the divestiture of assets and the $0.51 per diluted share impact from amortization in 2011; excluding the $0.29 per

diluted share impact of restructuring and other special charges and the $0.54 per diluted share impact from amortization in 2012; excluding the $0.15 per diluted share impact of

restructuring and other special charges and the $0.55 per diluted share impact from amortization in 2013; excluding the $0.34 per diluted share impact of restructuring and other

special charges and the $0.55 per diluted share impact from amortization in 2014; excluding the $2.44 per diluted share impact of restructuring and other special charges and the

$1.13 per diluted share impact from amortization in 2015; and excluding the $0.64 per diluted share impact of restructuring and other special charges and the $1.17 per diluted

share impact from amortization in 2016.

3) Guidance issued on October 25, 2017.

30

FOOTNOTES TO “FREE CASH FLOW” SLIDE(1)

(1) 2007-2014 figures exclude Covance results.

(2) Operating Cash Flow and Free Cash Flow in 2011 exclude the $49.5 million Hunter Labs settlement.

LABORATORY CORPORATION OF AMERICA HOLDINGS

Reconciliation of Non-GAAP Financial Measures

(in millions)

Free Cash Flow: 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Operating Cash Flow 710$ 781$ 862$ 884$ 905$ 841$ 819$ 739$ 982$ 1,176$

Less: Capital Expenditures (143) (157) (115) (126) (146) (174) (202) (204) (256) (279)

Free Cash Flow 567$ 624$ 748$ 758$ 759$ 668$ 617$ 536$ 727$ 897$

(2)

(2)