Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Hamilton Lane INC | earningsrelease8-kq22018.htm |

HAMILTON LANE INCORPORATED REPORTS SECOND QUARTER FISCAL 2018 RESULTS

BALA CYNWYD, PENN. – November 7, 2017 – Leading private markets asset management firm Hamilton Lane Incorporated (NASDAQ: HLNE) today reported its results for the second quarter of fiscal year 2018, the period ended September 30, 2017.

Hamilton Lane CEO Mario Giannini commented: “This quarter was a continuation of our strong momentum with client re-ups and new client wins resulting in our asset footprint reaching a new record high of approximately $405 billion. The macro environment remains favorable for the private markets, a trend that was reflected in the performance across each of our service and product offerings, which have all grown year-to-date versus the same period from the prior fiscal year. Our outlook for the remainder of the fiscal year remains favorable given our visibility into our existing business and our pipeline of new opportunities.”

Hamilton Lane issued a full detailed presentation of its second quarter fiscal 2018 results, which can be viewed at http://ir.hamiltonlane.com.

Dividend

Hamilton Lane has declared a quarterly dividend of $0.175 per share of Class A common stock to record holders at the close of business on December 15, 2017. This dividend will be paid on January 5, 2018.

Conference Call

Hamilton Lane will discuss second quarter fiscal 2018 results in a webcast and conference call today, Tuesday, November 7, 2017, at 11:00 a.m. Eastern Time. The call will be broadcast live via a webcast, which may be accessed on Hamilton Lane’s Investor Relations website. The call may also be accessed by dialing 1-866-393-4306 inside the U.S., or 1-734-385-2616 for international callers. The conference ID is 97303674.

A replay of the webcast will be available on Hamilton Lane’s Investor Relations website approximately two hours after the live broadcast for a period of one year, and can be accessed in the same manner as the live webcast at the Hamilton Lane Investor Relations website.

About Hamilton Lane

Hamilton Lane (NASDAQ: HLNE) is a leading alternative investment management firm providing innovative private markets solutions to sophisticated investors around the world. Dedicated to private markets investing for 26 years, the firm currently employs more than 330 professionals operating in offices throughout the U.S., Europe, Asia-Pacific, Latin America and the Middle East. With approximately $405 billion in total assets under management and supervision as of September 30, 2017, Hamilton Lane offers a full range of investment products and services that enable clients to participate in the private markets asset class on a global and customized basis. For more information, please visit www.hamiltonlane.com or follow Hamilton Lane on Twitter: @hamilton_lane.

Forward-Looking Statements

Some of the statements in this release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe” and similar expressions are used to identify these forward-looking statements. Forward-looking statements discuss management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be

materially different, including risks relating to our ability to manage growth, fund performance, risk, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to us; our ability to comply with investment guidelines set by our clients; our ability to consummate planned acquisitions and successfully integrate the acquired business with ours; the time, expense and effort associated with being a newly public company; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our payment of dividends, taxes and other expenses.

The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks that we face, you should refer to the “Risk Factors” detailed in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2017 and in our subsequent reports filed from time to time with the Securities and Exchange Commission. The forward-looking statements included in this release are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law.

Investor Contact

Demetrius Sidberry

dsidberry@hamiltonlane.com

+1 610 617 6768

Media Contact

Kate McGann

kmcgann@hamiltonlane.com

+1 610 617 5841

Fiscal Year 2018 Second Quarter Results

Earnings Presentation - November 7, 2017

Page 2

Today’s Speakers

Mario Giannini

Chief Executive Officer

Randy Stilman

Chief Financial Officer

Demetrius Sidberry

Head of Investor Relations

Erik Hirsch

Vice Chairman

Page 3

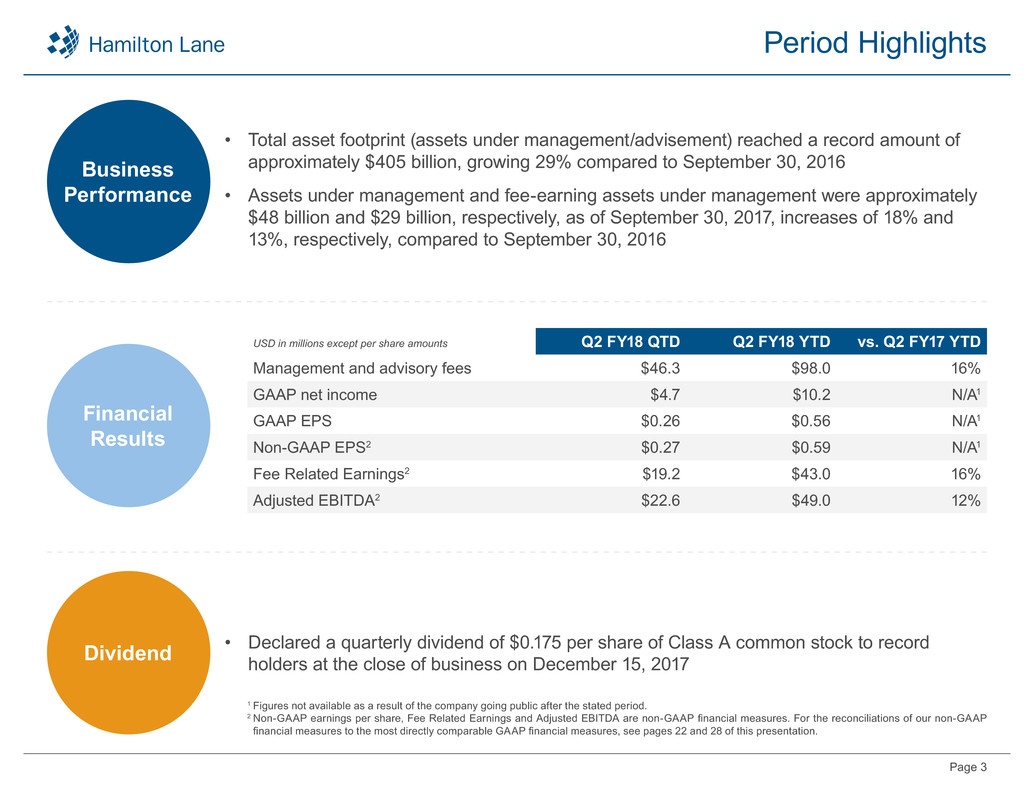

Period Highlights

• Total asset footprint (assets under management/advisement) reached a record amount of

approximately $405 billion, growing 29% compared to September 30, 2016

• Assets under management and fee-earning assets under management were approximately

$48 billion and $29 billion, respectively, as of September 30, 2017, increases of 18% and

13%, respectively, compared to September 30, 2016

• Declared a quarterly dividend of $0.175 per share of Class A common stock to record

holders at the close of business on December 15, 2017

Business

Performance

Financial

Results

Dividend

USD in millions except per share amounts Q2 FY18 QTD Q2 FY18 YTD vs. Q2 FY17 YTD

Management and advisory fees $46.3 $98.0 16%

GAAP net income $4.7 $10.2 N/A1

GAAP EPS $0.26 $0.56 N/A1

Non-GAAP EPS2 $0.27 $0.59 N/A1

Fee Related Earnings2 $19.2 $43.0 16%

Adjusted EBITDA2 $22.6 $49.0 12%

1 Figures not available as a result of the company going public after the stated period.

2 Non-GAAP earnings per share, Fee Related Earnings and Adjusted EBITDA are non-GAAP financial measures. For the reconciliations of our non-GAAP

financial measures to the most directly comparable GAAP financial measures, see pages 22 and 28 of this presentation.

Page 4

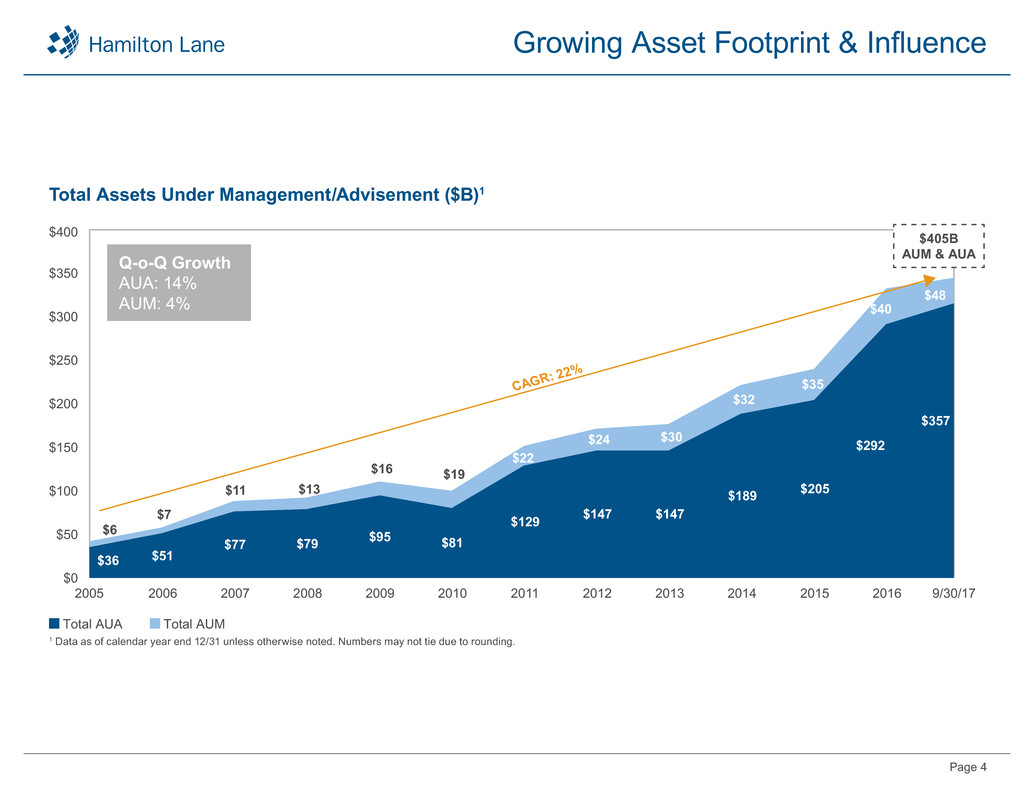

Growing Asset Footprint & Influence

$36 $51

$77 $79 $95 $81

$129 $147 $147

$189 $205

$292

$357

$6

$7

$11 $13

$16 $19

$22

$24 $30

$32

$35

$40

$48

$0

$50

$100

$150

$200

$250

$300

$350

$400

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 9/30/17

Total AUA Total AUM

Total Assets Under Management/Advisement ($B)1

1 Data as of calendar year end 12/31 unless otherwise noted. Numbers may not tie due to rounding.

CAGR

: 22%

$405B

AUM & AUAQ-o-Q Growth

AUA: 14%

AUM: 4%

Page 5

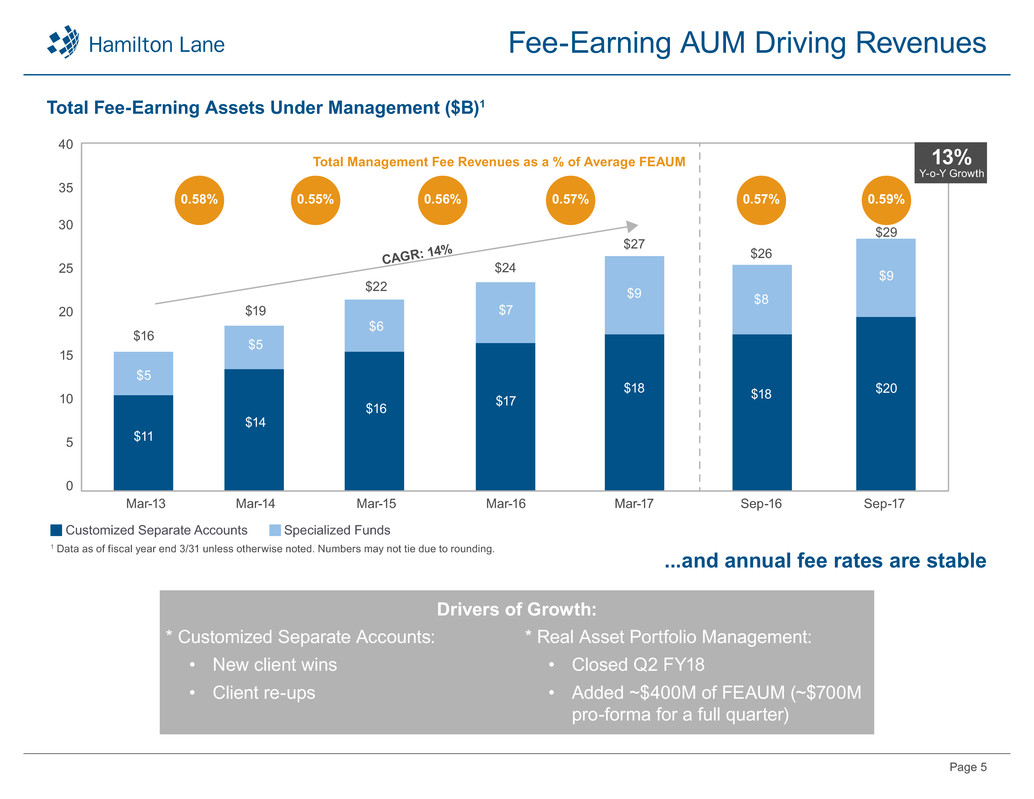

Drivers of Growth:

Fee-Earning AUM Driving Revenues

...and annual fee rates are stable

* Customized Separate Accounts:

• New client wins

• Client re-ups

* Real Asset Portfolio Management:

• Closed Q2 FY18

• Added ~$400M of FEAUM (~$700M

pro-forma for a full quarter)

Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Sep-16 Sep-17

Customized Separate Accounts Specialized Funds

CAGR: 1

4%

Total Fee-Earning Assets Under Management ($B)1

0

5

10

15

20

25

30

35

40

$11

$5

$16

$14

$5

$19

$16

$6

$22

$17

$7

$24

$18

$9

$27

$20

$9

$29

$18

$8

$26

13%

Y-o-Y Growth

0.58% 0.55% 0.56% 0.57% 0.59%0.57%

1 Data as of fiscal year end 3/31 unless otherwise noted. Numbers may not tie due to rounding.

Total Management Fee Revenues as a % of Average FEAUM

Page 6

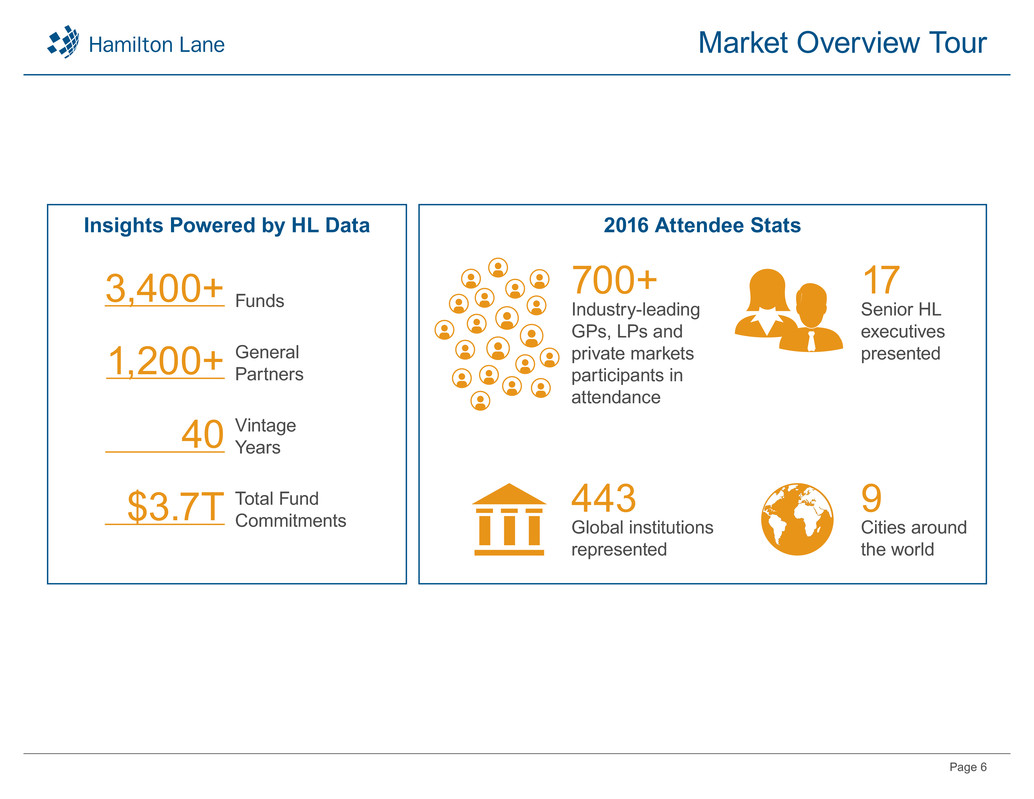

2016 Attendee StatsInsights Powered by HL Data

Market Overview Tour

700+

Industry-leading

GPs, LPs and

private markets

participants in

attendance

17

Senior HL

executives

presented

443

Global institutions

represented

9

Cities around

the world

Funds

General

Partners

Vintage

Years

Total Fund

Commitments

3,400+

1,200+

40

$3.7T

Page 7

• Founded in 1991, we are one of the largest allocators of capital to private markets worldwide with over $400B

of AUM / AUA

• Over 330 professionals dedicated to the private markets (substantially all are stockholders)

• 15 offices in key markets globally

• ~350 sophisticated clients globally (in 35 countries)

• Significant proprietary databases and suite of analytical tools

• $49B of discretionary commitments since 2000

Leading, Global Private Markets Solutions Provider

We operate at the epicenter of a large, fast-growing and highly desirable asset class, helping a wide

array of investors around the world navigate, access and succeed in the private markets

~$48B

of AUM1

~$357B

of AUA1

Buyout Growth Equity R

eal E

state

In

fr

as

tr

u

ct

ur

e

Cr

ed

it

Venture Capital Co-Investment Seco

nda

ry

N

at

. R

es

ou

rc

es

C

o

-Investm

ents

Se

co

nd

ar

y

Tr

an

sa

ct

io

n

s

Prim

ary Funds

Private Markets Funds

Private Companies

Investors/Limited

Partners (LPs)

1 As of 9/30/2017

Page 8

What We Do for Our ClientsWho We Serve

Clients and Offerings

Customized

Separate Accounts

Public/Corporate

Pensions Specialized Funds

Sovereign

Wealth Funds

Advisory ServicesTaft Hartley

Reporting,

Monitoring,

Data and Analytics

Financial Institutions HNW/Family Office Distribution Management

Endowment Funds

Page 9

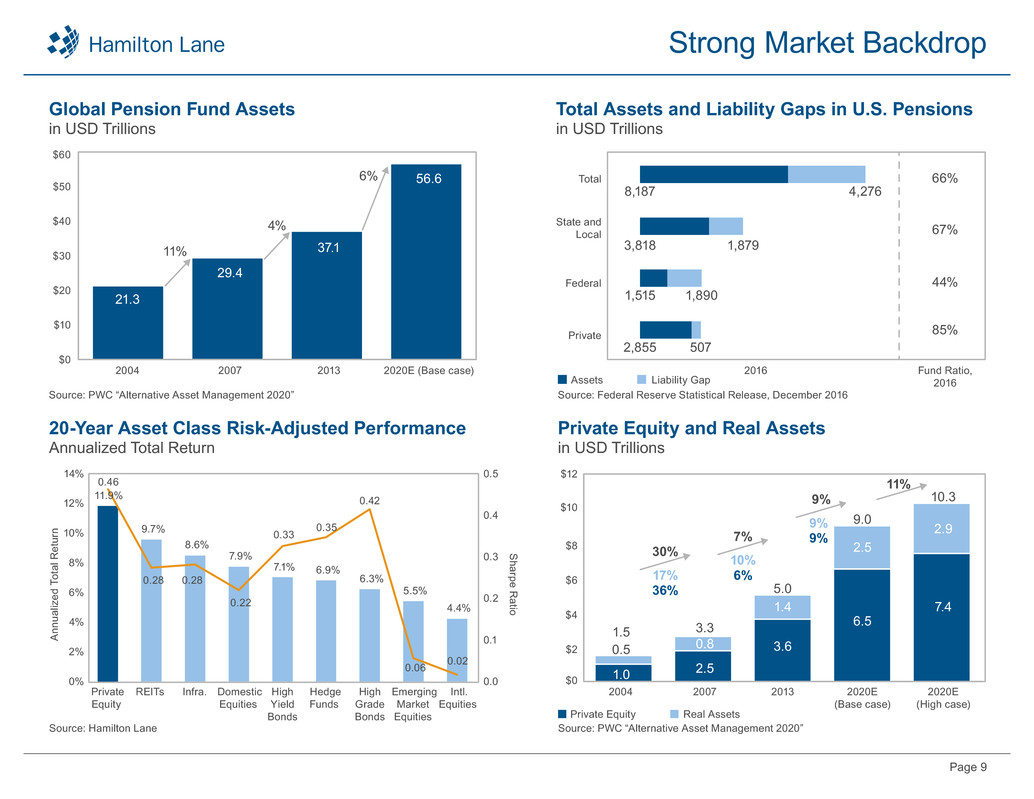

Strong Market Backdrop

Total Assets and Liability Gaps in U.S. Pensions

in USD Trillions

8,187

3,818

1,515

2,855 507

1,890

1,879

4,276

2016 Fund Ratio,

2016

85%

44%

67%

66%Total

State and

Local

Federal

Private

Assets Liability Gap

Private Equity Real Assets

Source: Federal Reserve Statistical Release, December 2016Source: PWC “Alternative Asset Management 2020”

Source: PWC “Alternative Asset Management 2020”Source: Hamilton Lane

$0

$10

$20

$30

$40

$50

$60

Global Pension Fund Assets

in USD Trillions

2004 2007 2013 2020E (Base case)

21.3

29.4

37.1

56.6

11%

4%

6%

$0

$2

$4

$6

$8

$10

$12

Private Equity and Real Assets

in USD Trillions

2004 2007 2013 2020E

(Base case)

2020E

(High case)

1.0 2.5

3.6

6.5

7.4

2.9

2.5

1.4

0.80.5

30%

17%

36%

1.5 3.3

5.0

9.0

10.3

7%

10%

6%

9%

9%

9%

11%

S

harpe R

atio

A

nn

ua

liz

ed

To

ta

l R

et

ur

n

20-Year Asset Class Risk-Adjusted Performance

Annualized Total Return

11.9%

9.7%

8.6%

7.9%

7.1% 6.9%

6.3%

5.5%

4.4%

0.46

0.28 0.28

0.22

0.33

0.35

0.42

0.06

0.02

0.0

0.1

0.2

0.3

0.4

0.5

0%

2%

4%

6%

8%

10%

12%

14%

Private

Equity

REITs Infra. Domestic

Equities

High

Yield

Bonds

Hedge

Funds

High

Grade

Bonds

Emerging

Market

Equities

Intl.

Equities

Page 10

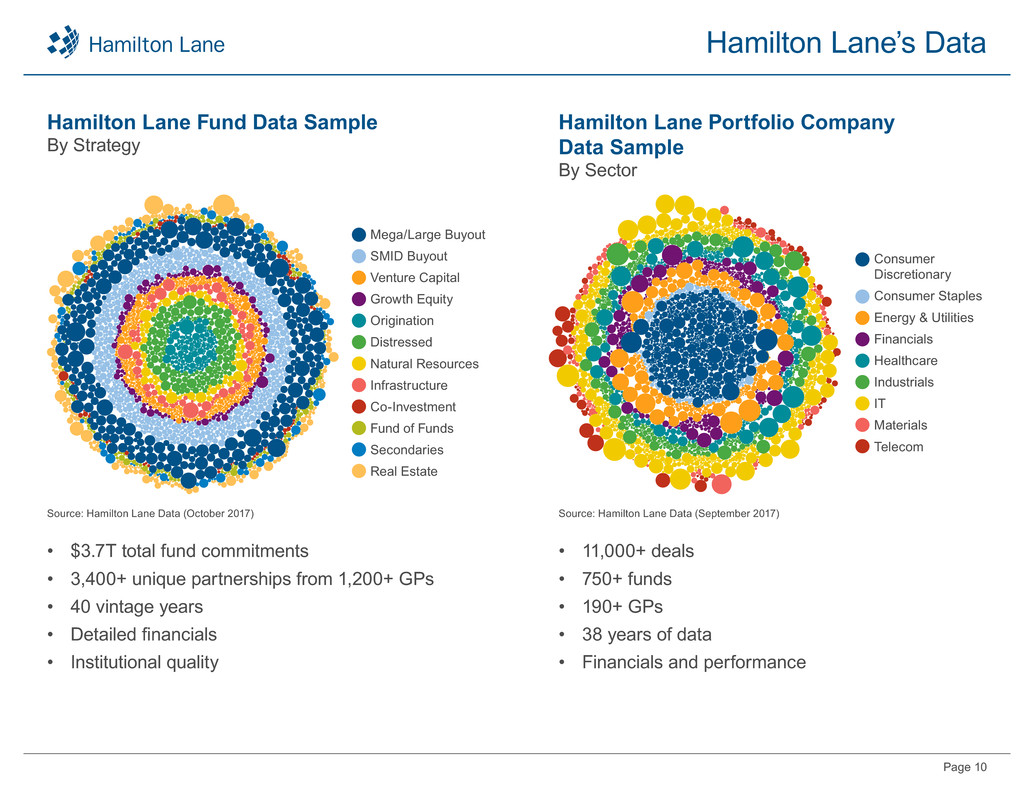

Hamilton Lane’s Data

Hamilton Lane Portfolio Company

Data Sample

By Sector

• $3.7T total fund commitments

• 3,400+ unique partnerships from 1,200+ GPs

• 40 vintage years

• Detailed financials

• Institutional quality

• 11,000+ deals

• 750+ funds

• 190+ GPs

• 38 years of data

• Financials and performance

Source: Hamilton Lane Data (October 2017) Source: Hamilton Lane Data (September 2017)

Hamilton Lane Fund Data Sample

By Strategy

Consumer

Discretionary

Consumer Staples

Energy & Utilities

Financials

Healthcare

Industrials

IT

Materials

Telecom

Mega/Large Buyout

SMID Buyout

Venture Capital

Growth Equity

Origination

Distressed

Natural Resources

Infrastructure

Co-Investment

Fund of Funds

Secondaries

Real Estate

Page 11

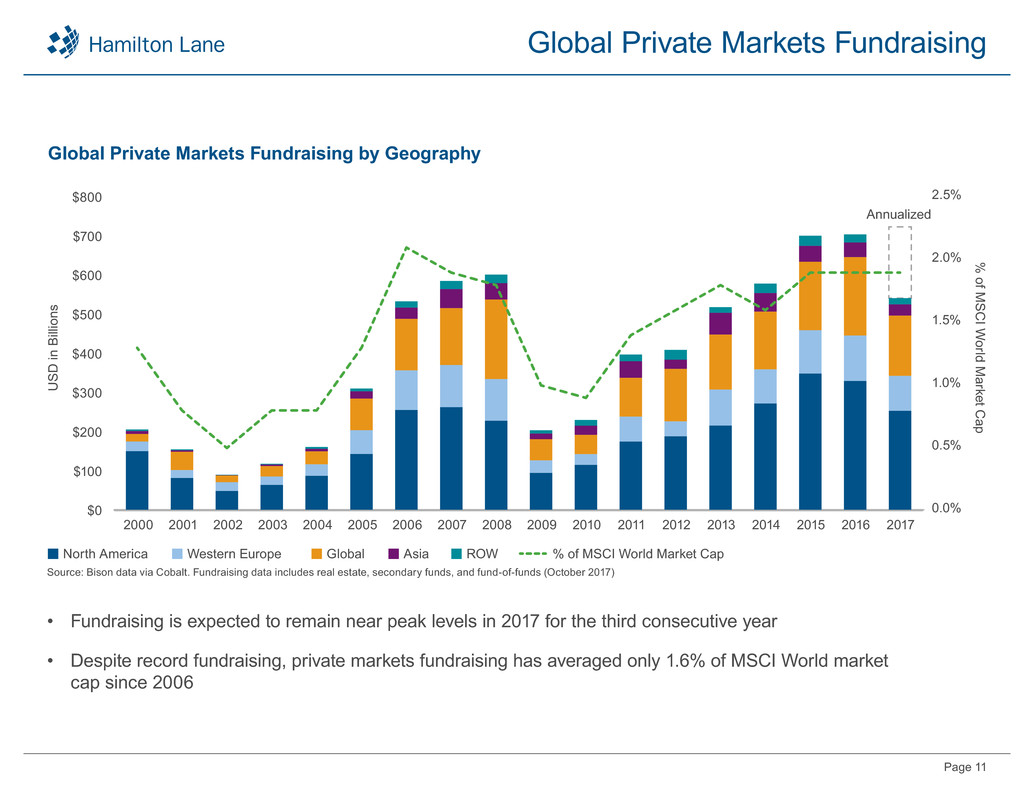

Global Private Markets Fundraising

Global Private Markets Fundraising by Geography

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

%

of M

S

CI

W

orld

M

arket C

ap

U

S

D

in

B

ill

io

ns

$0

$100

$200

$300

$400

$500

$600

$700

$800

2017

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

North America

Source: Bison data via Cobalt. Fundraising data includes real estate, secondary funds, and fund-of-funds (October 2017)

% of MSCI World Market CapWestern Europe Global Asia ROW

Annualized

• Fundraising is expected to remain near peak levels in 2017 for the third consecutive year

• Despite record fundraising, private markets fundraising has averaged only 1.6% of MSCI World market

cap since 2006

Page 12

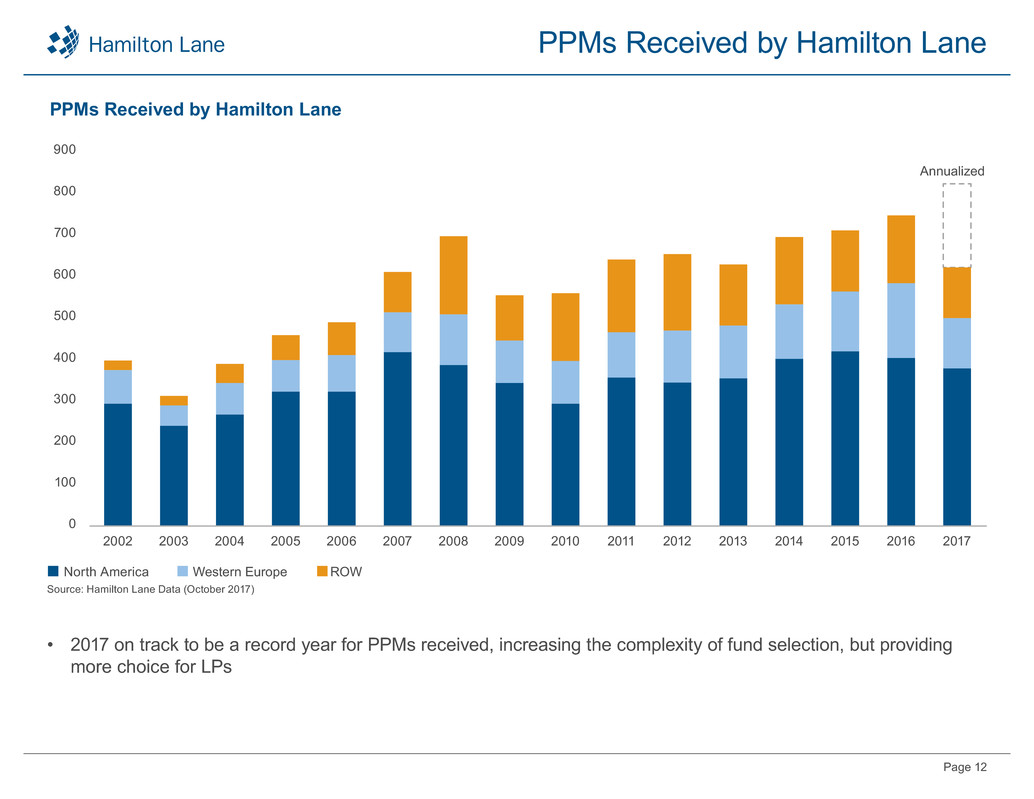

PPMs Received by Hamilton Lane

PPMs Received by Hamilton Lane

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

100

200

300

400

500

600

700

800

900

North America

Source: Hamilton Lane Data (October 2017)

Western Europe ROW

Annualized

• 2017 on track to be a record year for PPMs received, increasing the complexity of fund selection, but providing

more choice for LPs

Page 13

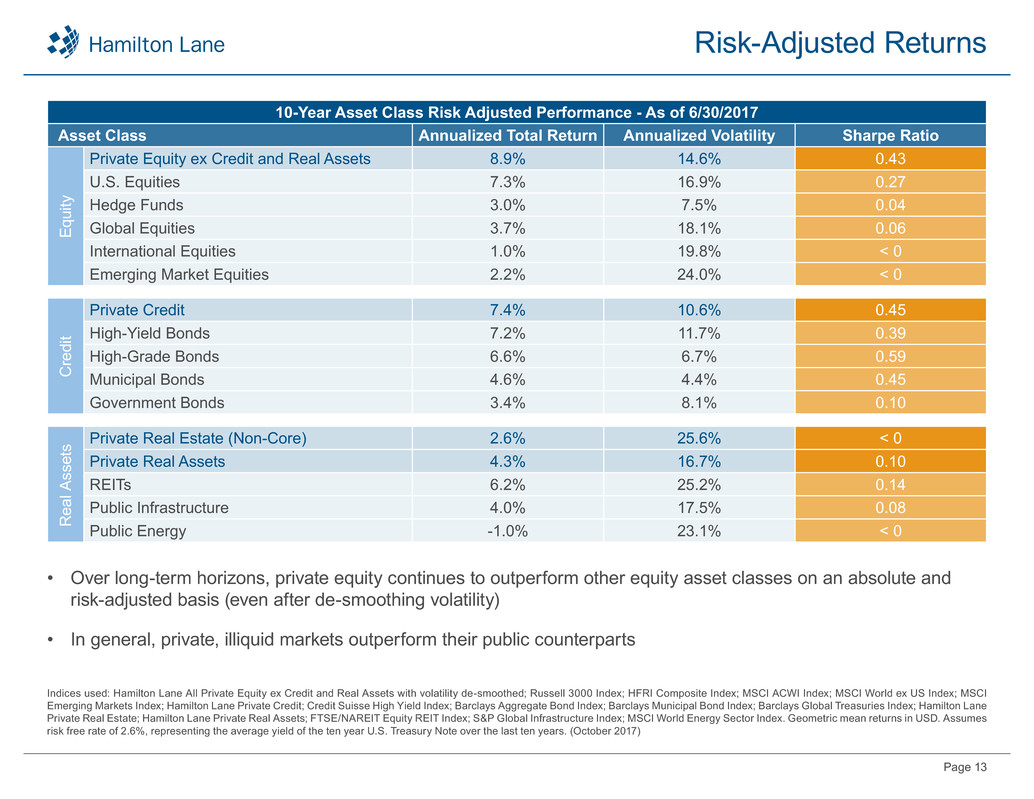

Risk-Adjusted Returns

10-Year Asset Class Risk Adjusted Performance - As of 6/30/2017

Asset Class Annualized Total Return Annualized Volatility Sharpe Ratio

Private Equity ex Credit and Real Assets 8.9% 14.6% 0.43

U.S. Equities 7.3% 16.9% 0.27

Hedge Funds 3.0% 7.5% 0.04

Global Equities 3.7% 18.1% 0.06

International Equities 1.0% 19.8% < 0

Emerging Market Equities 2.2% 24.0% < 0

Private Credit 7.4% 10.6% 0.45

High-Yield Bonds 7.2% 11.7% 0.39

High-Grade Bonds 6.6% 6.7% 0.59

Municipal Bonds 4.6% 4.4% 0.45

Government Bonds 3.4% 8.1% 0.10

Private Real Estate (Non-Core) 2.6% 25.6% < 0

Private Real Assets 4.3% 16.7% 0.10

REITs 6.2% 25.2% 0.14

Public Infrastructure 4.0% 17.5% 0.08

Public Energy -1.0% 23.1% < 0

Indices used: Hamilton Lane All Private Equity ex Credit and Real Assets with volatility de-smoothed; Russell 3000 Index; HFRI Composite Index; MSCI ACWI Index; MSCI World ex US Index; MSCI

Emerging Markets Index; Hamilton Lane Private Credit; Credit Suisse High Yield Index; Barclays Aggregate Bond Index; Barclays Municipal Bond Index; Barclays Global Treasuries Index; Hamilton Lane

Private Real Estate; Hamilton Lane Private Real Assets; FTSE/NAREIT Equity REIT Index; S&P Global Infrastructure Index; MSCI World Energy Sector Index. Geometric mean returns in USD. Assumes

risk free rate of 2.6%, representing the average yield of the ten year U.S. Treasury Note over the last ten years. (October 2017)

• Over long-term horizons, private equity continues to outperform other equity asset classes on an absolute and

risk-adjusted basis (even after de-smoothing volatility)

• In general, private, illiquid markets outperform their public counterparts

E

qu

ity

C

re

di

t

R

ea

l A

ss

et

s

Page 14

Opportunity Pipeline

Customized Separate

Accounts

Specialized

Funds

Advisory

Services

Diverse mix of existing and

prospective clients seeking to

further or establish relationship

with Hamilton Lane

Select funds in market:

• Co-Investment Fund

• Credit-Oriented Fund

• Private Equity Fund of Funds

Typically larger clients with

wide-ranging mandates;

opportunity set continues to

be robust

Financial Highlights

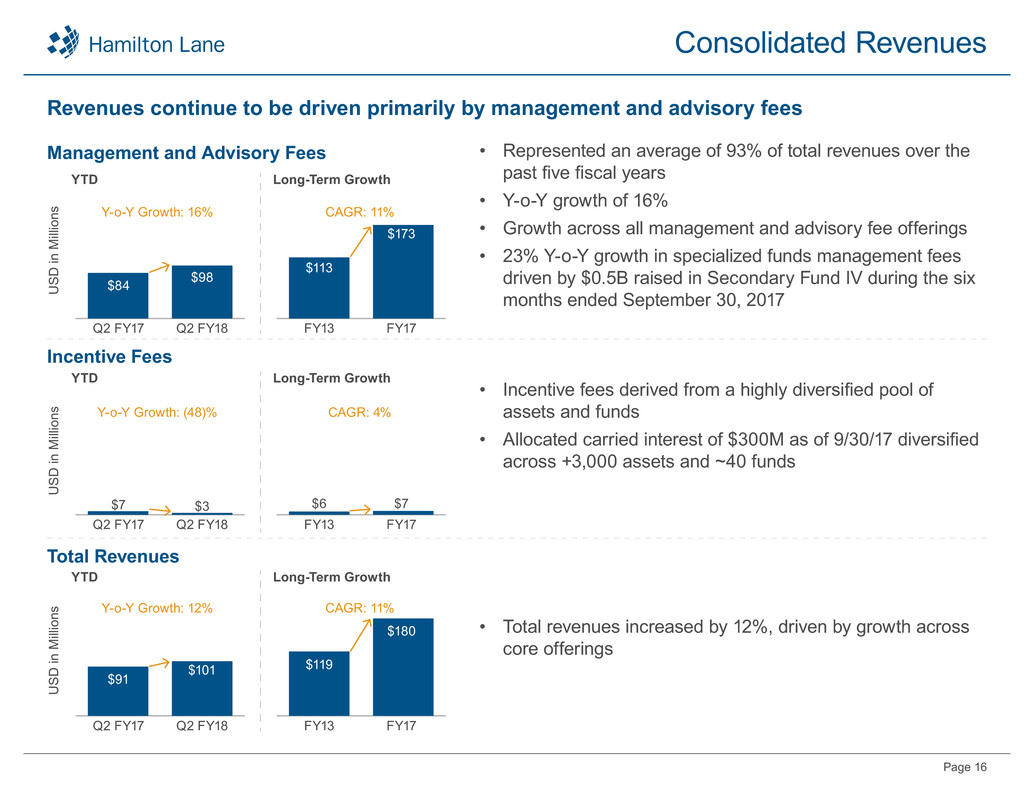

Page 16

Revenues continue to be driven primarily by management and advisory fees

Consolidated Revenues

• Represented an average of 93% of total revenues over the

past five fiscal years

• Y-o-Y growth of 16%

• Growth across all management and advisory fee offerings

• 23% Y-o-Y growth in specialized funds management fees

driven by $0.5B raised in Secondary Fund IV during the six

months ended September 30, 2017

• Incentive fees derived from a highly diversified pool of

assets and funds

• Allocated carried interest of $300M as of 9/30/17 diversified

across +3,000 assets and ~40 funds

• Total revenues increased by 12%, driven by growth across

core offerings

0

50

100

150

200

FY13 FY17Q2 FY17 Q2 FY18

$113

$173

Management and Advisory Fees

Incentive Fees

Total Revenues

$84

$98

Y-o-Y Growth: 16% CAGR: 11%

0

50

100

150

200

FY13 FY17Q2 FY17 Q2 FY18

$6 $7$7 $3

Y-o-Y Growth: (48)% CAGR: 4%

0

50

100

150

200

FY13 FY17Q2 FY17 Q2 FY18

$119

$180

$91

$101

Y-o-Y Growth: 12% CAGR: 11%

Long-Term GrowthYTD

Long-Term GrowthYTD

Long-Term GrowthYTD

U

S

D

in

M

ill

io

ns

U

S

D

in

M

ill

io

ns

U

S

D

in

M

ill

io

ns

Page 17

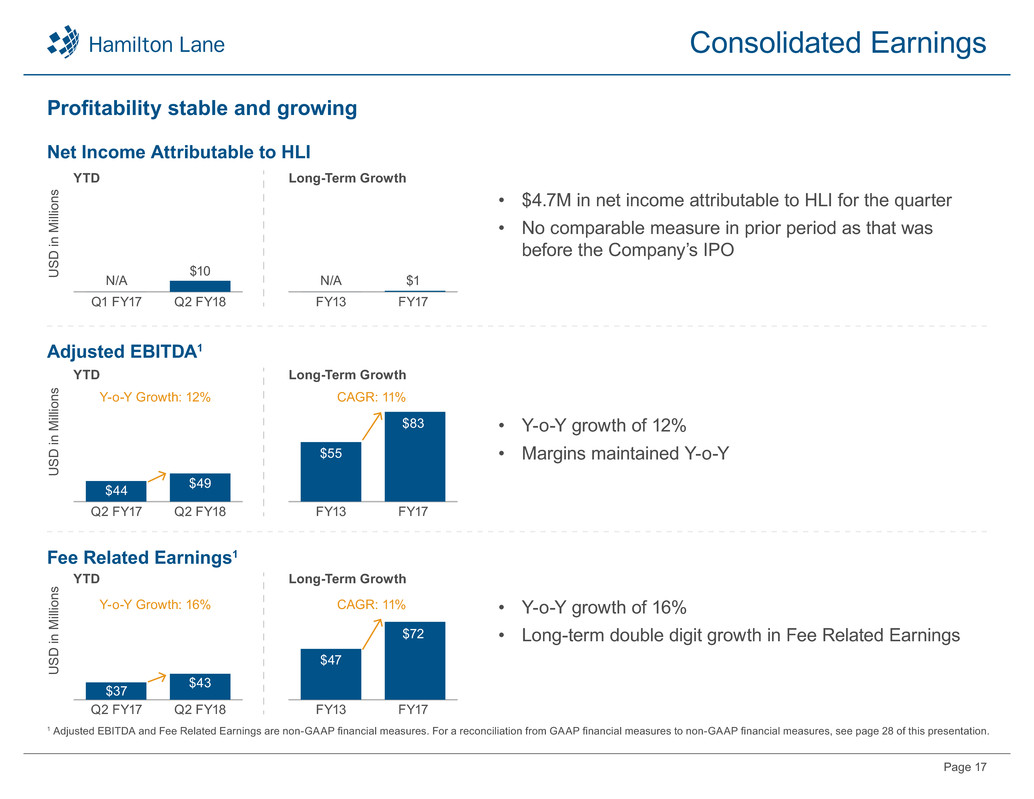

Profitability stable and growing

Consolidated Earnings

• Y-o-Y growth of 12%

• Margins maintained Y-o-Y

• $4.7M in net income attributable to HLI for the quarter

• No comparable measure in prior period as that was

before the Company’s IPO

• Y-o-Y growth of 16%

• Long-term double digit growth in Fee Related Earnings

1 Adjusted EBITDA and Fee Related Earnings are non-GAAP financial measures. For a reconciliation from GAAP financial measures to non-GAAP financial measures, see page 28 of this presentation.

Adjusted EBITDA1

Fee Related Earnings1

U

S

D

in

M

ill

io

ns

Long-Term GrowthYTD

U

S

D

in

M

ill

io

ns

FY13 FY17Q2 FY17 Q2 FY18

$55

$83

$44 $49

Y-o-Y Growth: 12% CAGR: 11%

Net Income Attributable to HLI

U

S

D

in

M

ill

io

ns

Long-Term GrowthYTD

FY13 FY17Q1 FY17 Q2 FY18

N/A N/A

$10

$1

Long-Term GrowthYTD

FY13 FY17Q2 FY17 Q2 FY18

$47

$72

$37

$43

Y-o-Y Growth: 16% CAGR: 11%

Page 18

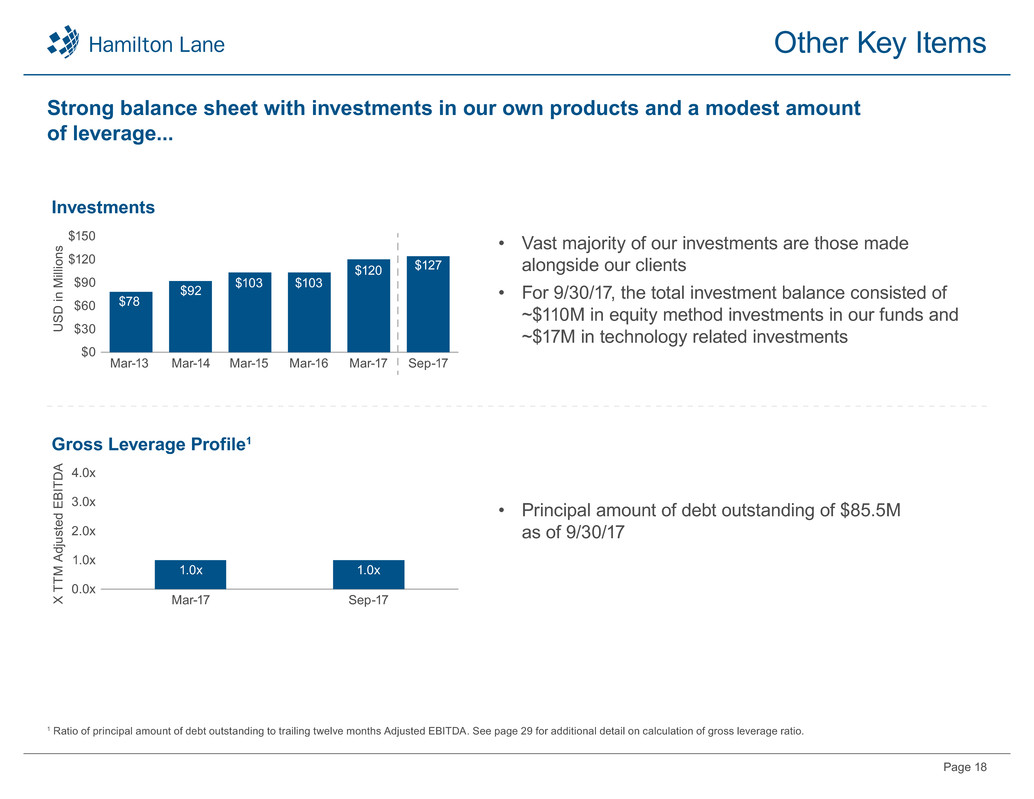

Strong balance sheet with investments in our own products and a modest amount

of leverage...

Other Key Items

• Vast majority of our investments are those made

alongside our clients

• For 9/30/17, the total investment balance consisted of

~$110M in equity method investments in our funds and

~$17M in technology related investments

• Principal amount of debt outstanding of $85.5M

as of 9/30/17

$0

$30

$60

$90

$120

$150

Mar-13 Mar-14 Mar-15 Mar-16 Mar-17

$78

$92 $103 $103

$120

Sep-17

$127

Investments

0.0x

1.0x

2.0x

3.0x

4.0x

Sep-17

1.0x

Mar-17

1.0x

Gross Leverage Profile1

U

S

D

in

M

ill

io

ns

X T

T

M

A

dj

us

te

d

E

B

IT

D

A

1 Ratio of principal amount of debt outstanding to trailing twelve months Adjusted EBITDA. See page 29 for additional detail on calculation of gross leverage ratio.

Fiscal Year 2018 Second Quarter Results

Earnings Presentation - November 7, 2017

Appendix

Page 21

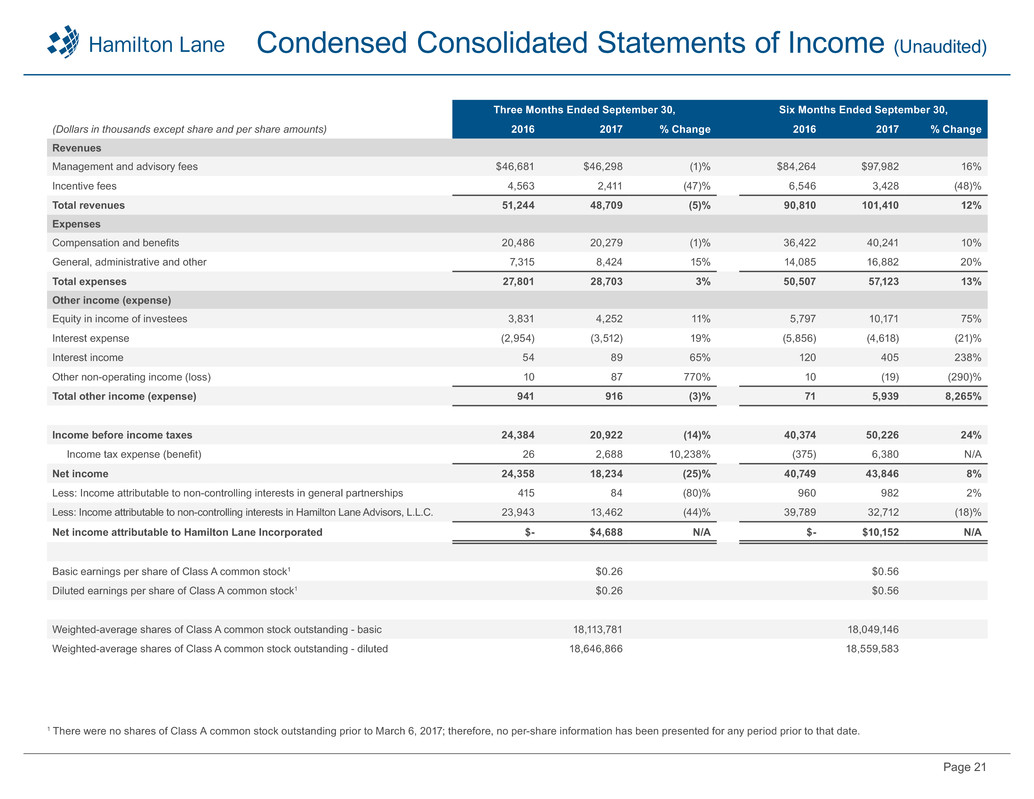

Condensed Consolidated Statements of Income (Unaudited)

Three Months Ended September 30, Six Months Ended September 30,

(Dollars in thousands except share and per share amounts) 2016 2017 % Change 2016 2017 % Change

Revenues

Management and advisory fees $46,681 $46,298 (1)% $84,264 $97,982 16%

Incentive fees 4,563 2,411 (47)% 6,546 3,428 (48)%

Total revenues 51,244 48,709 (5)% 90,810 101,410 12%

Expenses

Compensation and benefits 20,486 20,279 (1)% 36,422 40,241 10%

General, administrative and other 7,315 8,424 15% 14,085 16,882 20%

Total expenses 27,801 28,703 3% 50,507 57,123 13%

Other income (expense)

Equity in income of investees 3,831 4,252 11% 5,797 10,171 75%

Interest expense (2,954) (3,512) 19% (5,856) (4,618) (21)%

Interest income 54 89 65% 120 405 238%

Other non-operating income (loss) 10 87 770% 10 (19) (290)%

Total other income (expense) 941 916 (3)% 71 5,939 8,265%

Income before income taxes 24,384 20,922 (14)% 40,374 50,226 24%

Income tax expense (benefit) 26 2,688 10,238% (375) 6,380 N/A

Net income 24,358 18,234 (25)% 40,749 43,846 8%

Less: Income attributable to non-controlling interests in general partnerships 415 84 (80)% 960 982 2%

Less: Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 23,943 13,462 (44)% 39,789 32,712 (18)%

Net income attributable to Hamilton Lane Incorporated $- $4,688 N/A $- $10,152 N/A

Basic earnings per share of Class A common stock1 $0.26 $0.56

Diluted earnings per share of Class A common stock1 $0.26 $0.56

Weighted-average shares of Class A common stock outstanding - basic 18,113,781 18,049,146

Weighted-average shares of Class A common stock outstanding - diluted 18,646,866 18,559,583

1 There were no shares of Class A common stock outstanding prior to March 6, 2017; therefore, no per-share information has been presented for any period prior to that date.

Page 22

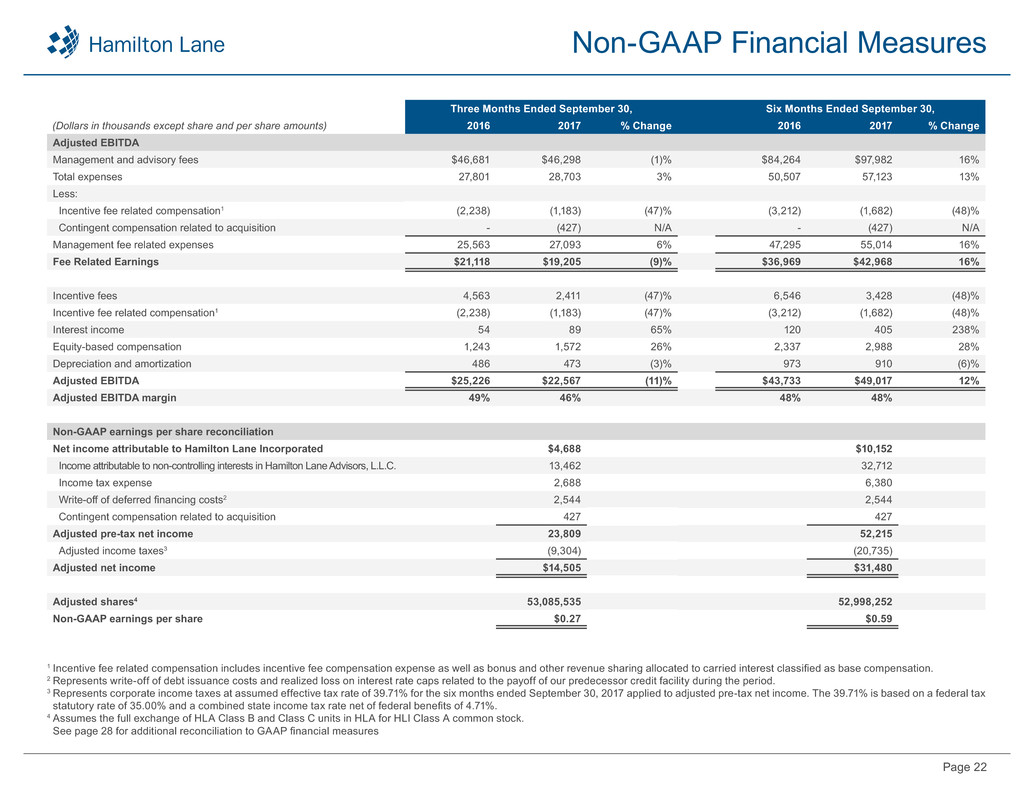

Non-GAAP Financial Measures

Three Months Ended September 30, Six Months Ended September 30,

(Dollars in thousands except share and per share amounts) 2016 2017 % Change 2016 2017 % Change

Adjusted EBITDA

Management and advisory fees $46,681 $46,298 (1)% $84,264 $97,982 16%

Total expenses 27,801 28,703 3% 50,507 57,123 13%

Less:

Incentive fee related compensation1 (2,238) (1,183) (47)% (3,212) (1,682) (48)%

Contingent compensation related to acquisition - (427) N/A - (427) N/A

Management fee related expenses 25,563 27,093 6% 47,295 55,014 16%

Fee Related Earnings $21,118 $19,205 (9)% $36,969 $42,968 16%

Incentive fees 4,563 2,411 (47)% 6,546 3,428 (48)%

Incentive fee related compensation1 (2,238) (1,183) (47)% (3,212) (1,682) (48)%

Interest income 54 89 65% 120 405 238%

Equity-based compensation 1,243 1,572 26% 2,337 2,988 28%

Depreciation and amortization 486 473 (3)% 973 910 (6)%

Adjusted EBITDA $25,226 $22,567 (11)% $43,733 $49,017 12%

Adjusted EBITDA margin 49% 46% 48% 48%

Non-GAAP earnings per share reconciliation

Net income attributable to Hamilton Lane Incorporated $4,688 $10,152

Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 13,462 32,712

Income tax expense 2,688 6,380

Write-off of deferred financing costs2 2,544 2,544

Contingent compensation related to acquisition 427 427

Adjusted pre-tax net income 23,809 52,215

Adjusted income taxes3 (9,304) (20,735)

Adjusted net income $14,505 $31,480

Adjusted shares4 53,085,535 52,998,252

Non-GAAP earnings per share $0.27 $0.59

1 Incentive fee related compensation includes incentive fee compensation expense as well as bonus and other revenue sharing allocated to carried interest classified as base compensation.

2 Represents write-off of debt issuance costs and realized loss on interest rate caps related to the payoff of our predecessor credit facility during the period.

3 Represents corporate income taxes at assumed effective tax rate of 39.71% for the six months ended September 30, 2017 applied to adjusted pre-tax net income. The 39.71% is based on a federal tax

statutory rate of 35.00% and a combined state income tax rate net of federal benefits of 4.71%.

4 Assumes the full exchange of HLA Class B and Class C units in HLA for HLI Class A common stock.

See page 28 for additional reconciliation to GAAP financial measures

Page 23

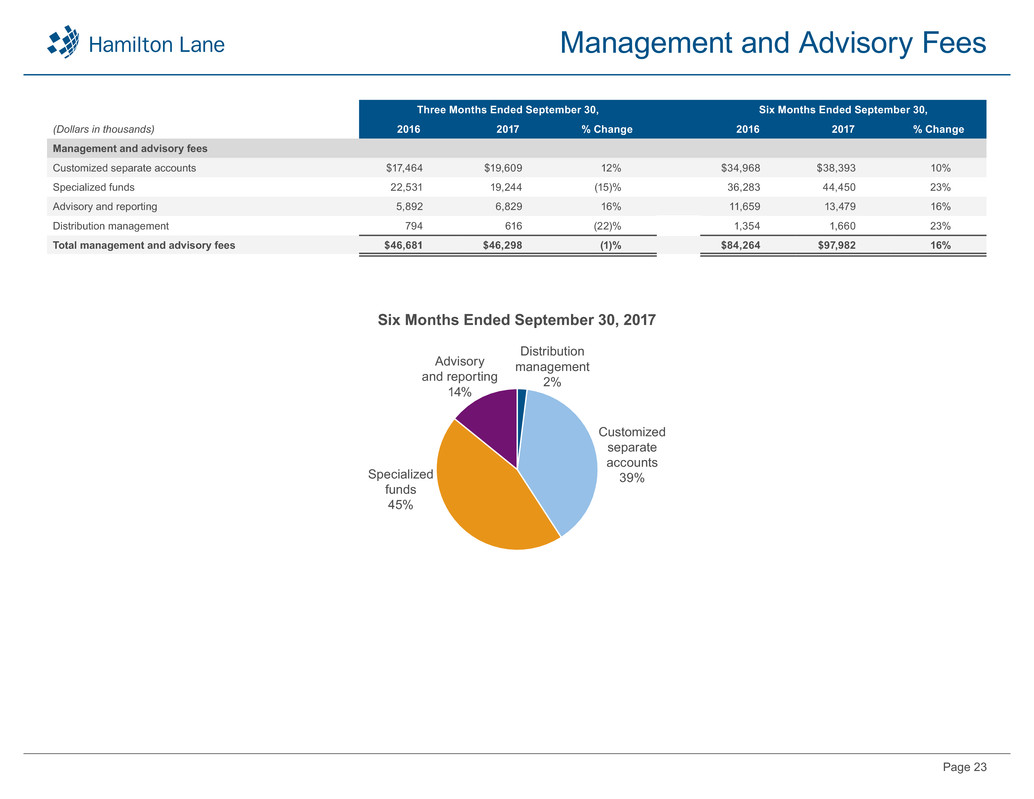

Management and Advisory Fees

Three Months Ended September 30, Six Months Ended September 30,

(Dollars in thousands) 2016 2017 % Change 2016 2017 % Change

Management and advisory fees

Customized separate accounts $17,464 $19,609 12% $34,968 $38,393 10%

Specialized funds 22,531 19,244 (15)% 36,283 44,450 23%

Advisory and reporting 5,892 6,829 16% 11,659 13,479 16%

Distribution management 794 616 (22)% 1,354 1,660 23%

Total management and advisory fees $46,681 $46,298 (1)% $84,264 $97,982 16%

Specialized

funds

45%

Customized

separate

accounts

39%

Advisory

and reporting

14%

Distribution

management

2%

Six Months Ended September 30, 2017

Page 24

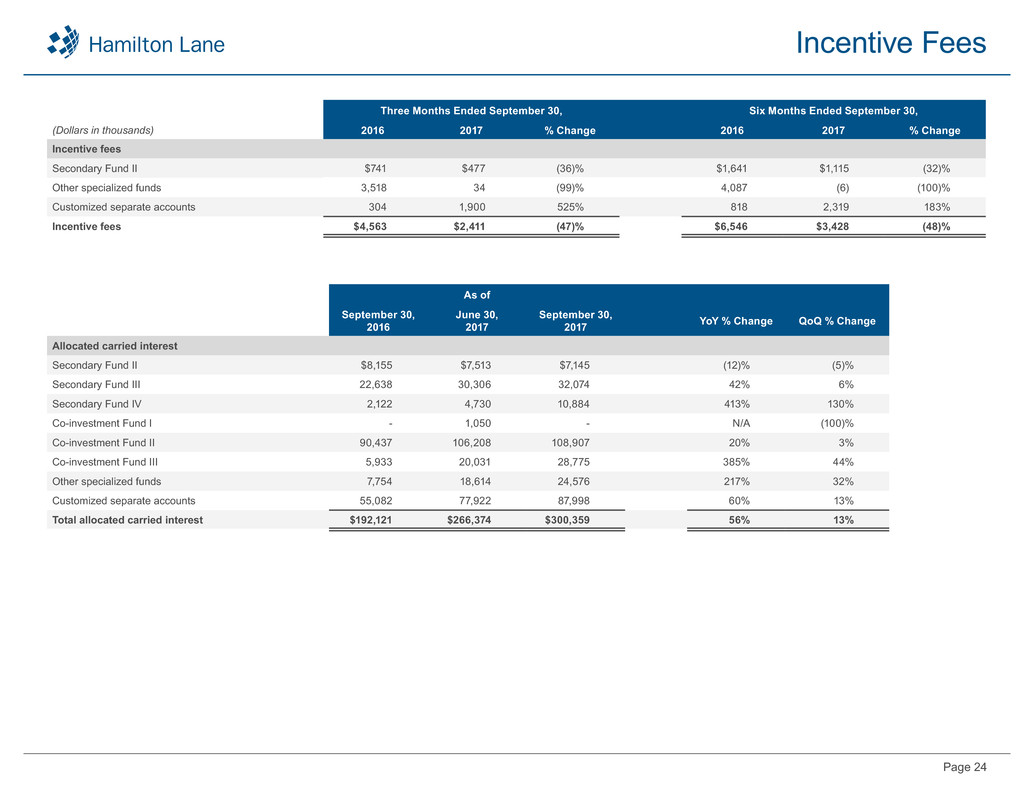

Incentive Fees

(Dollars in thousands)

Three Months Ended September 30, Six Months Ended September 30,

2016 2017 % Change 2016 2017 % Change

Incentive fees

Secondary Fund II $741 $477 (36)% $1,641 $1,115 (32)%

Other specialized funds 3,518 34 (99)% 4,087 (6) (100)%

Customized separate accounts 304 1,900 525% 818 2,319 183%

Incentive fees $4,563 $2,411 (47)% $6,546 $3,428 (48)%

As of

September 30,

2016

June 30,

2017

September 30,

2017 YoY % Change QoQ % Change

Allocated carried interest

Secondary Fund II $8,155 $7,513 $7,145 (12)% (5)%

Secondary Fund III 22,638 30,306 32,074 42% 6%

Secondary Fund IV 2,122 4,730 10,884 413% 130%

Co-investment Fund I - 1,050 - N/A (100)%

Co-investment Fund II 90,437 106,208 108,907 20% 3%

Co-investment Fund III 5,933 20,031 28,775 385% 44%

Other specialized funds 7,754 18,614 24,576 217% 32%

Customized separate accounts 55,082 77,922 87,998 60% 13%

Total allocated carried interest $192,121 $266,374 $300,359 56% 13%

Page 25

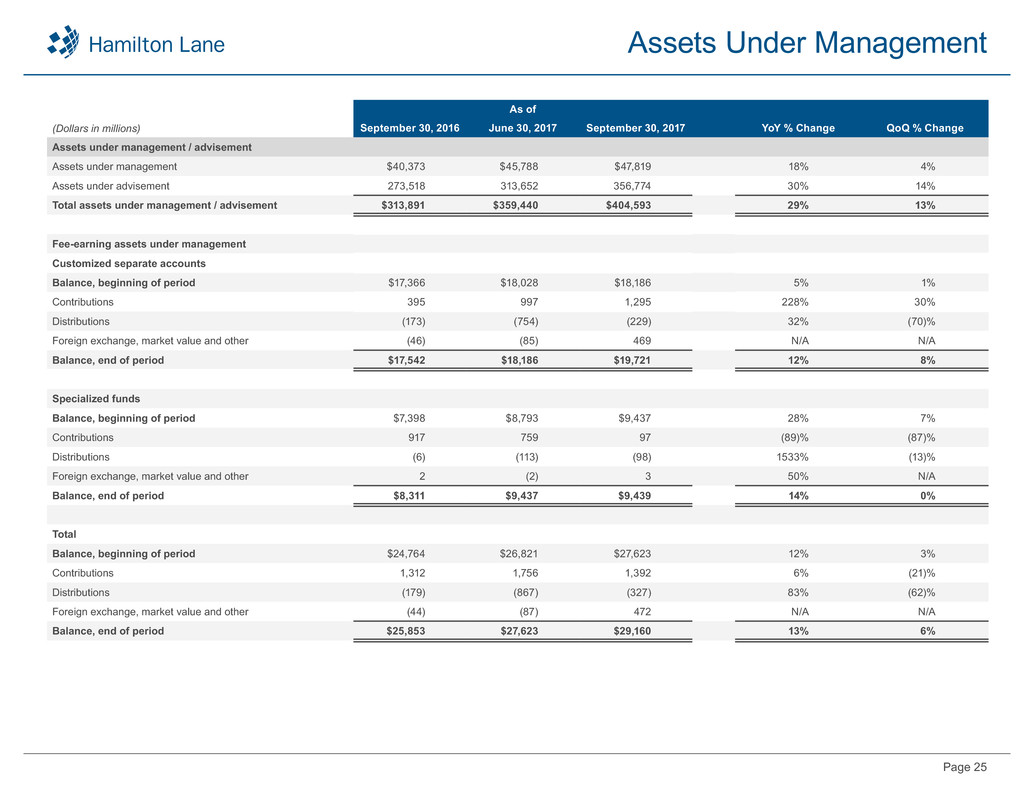

Assets Under Management

As of

(Dollars in millions) September 30, 2016 June 30, 2017 September 30, 2017 YoY % Change QoQ % Change

Assets under management / advisement

Assets under management $40,373 $45,788 $47,819 18% 4%

Assets under advisement 273,518 313,652 356,774 30% 14%

Total assets under management / advisement $313,891 $359,440 $404,593 29% 13%

Fee-earning assets under management

Customized separate accounts

Balance, beginning of period $17,366 $18,028 $18,186 5% 1%

Contributions 395 997 1,295 228% 30%

Distributions (173) (754) (229) 32% (70)%

Foreign exchange, market value and other (46) (85) 469 N/A N/A

Balance, end of period $17,542 $18,186 $19,721 12% 8%

Specialized funds

Balance, beginning of period $7,398 $8,793 $9,437 28% 7%

Contributions 917 759 97 (89)% (87)%

Distributions (6) (113) (98) 1533% (13)%

Foreign exchange, market value and other 2 (2) 3 50% N/A

Balance, end of period $8,311 $9,437 $9,439 14% 0%

Total

Balance, beginning of period $24,764 $26,821 $27,623 12% 3%

Contributions 1,312 1,756 1,392 6% (21)%

Distributions (179) (867) (327) 83% (62)%

Foreign exchange, market value and other (44) (87) 472 N/A N/A

Balance, end of period $25,853 $27,623 $29,160 13% 6%

Page 26

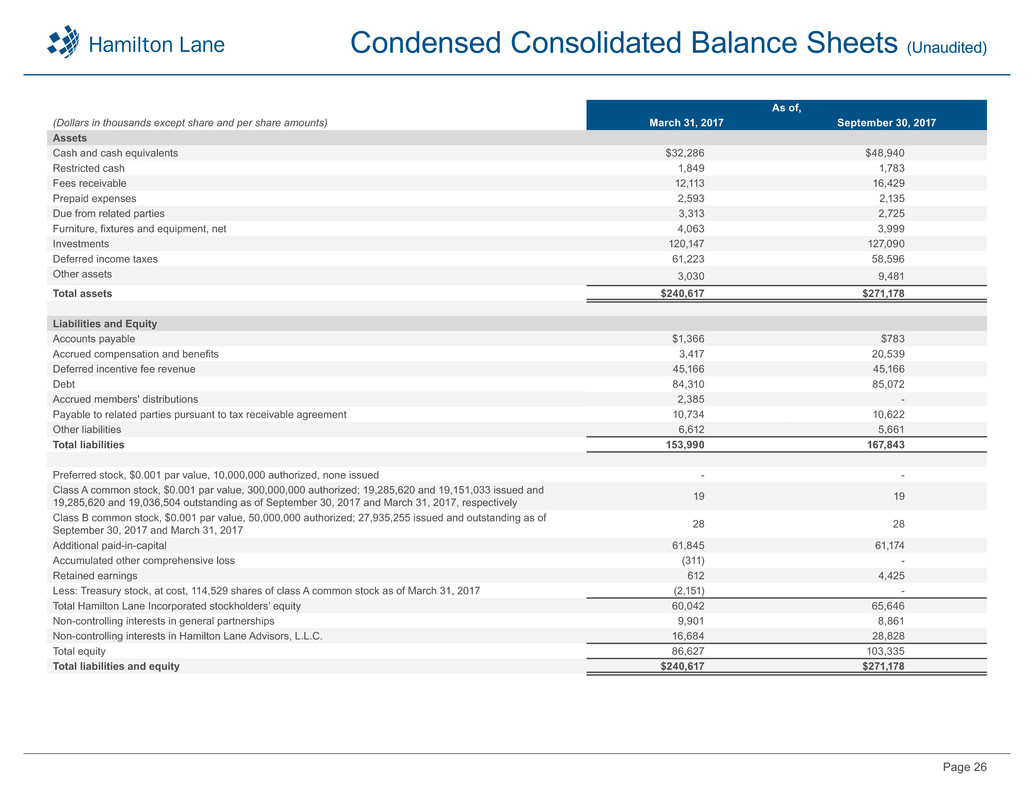

Condensed Consolidated Balance Sheets (Unaudited)

As of,

(Dollars in thousands except share and per share amounts) March 31, 2017 September 30, 2017

Assets

Cash and cash equivalents $32,286 $48,940

Restricted cash 1,849 1,783

Fees receivable 12,113 16,429

Prepaid expenses 2,593 2,135

Due from related parties 3,313 2,725

Furniture, fixtures and equipment, net 4,063 3,999

Investments 120,147 127,090

Deferred income taxes 61,223 58,596

Other assets 3,030 9,481

Total assets $240,617 $271,178

Liabilities and Equity

Accounts payable $1,366 $783

Accrued compensation and benefits 3,417 20,539

Deferred incentive fee revenue 45,166 45,166

Debt 84,310 85,072

Accrued members' distributions 2,385 -

Payable to related parties pursuant to tax receivable agreement 10,734 10,622

Other liabilities 6,612 5,661

Total liabilities 153,990 167,843

Preferred stock, $0.001 par value, 10,000,000 authorized, none issued - -

Class A common stock, $0.001 par value, 300,000,000 authorized; 19,285,620 and 19,151,033 issued and

19,285,620 and 19,036,504 outstanding as of September 30, 2017 and March 31, 2017, respectively 19 19

Class B common stock, $0.001 par value, 50,000,000 authorized; 27,935,255 issued and outstanding as of

September 30, 2017 and March 31, 2017 28 28

Additional paid-in-capital 61,845 61,174

Accumulated other comprehensive loss (311) -

Retained earnings 612 4,425

Less: Treasury stock, at cost, 114,529 shares of class A common stock as of March 31, 2017 (2,151) -

Total Hamilton Lane Incorporated stockholders’ equity 60,042 65,646

Non-controlling interests in general partnerships 9,901 8,861

Non-controlling interests in Hamilton Lane Advisors, L.L.C. 16,684 28,828

Total equity 86,627 103,335

Total liabilities and equity $240,617 $271,178

Page 27

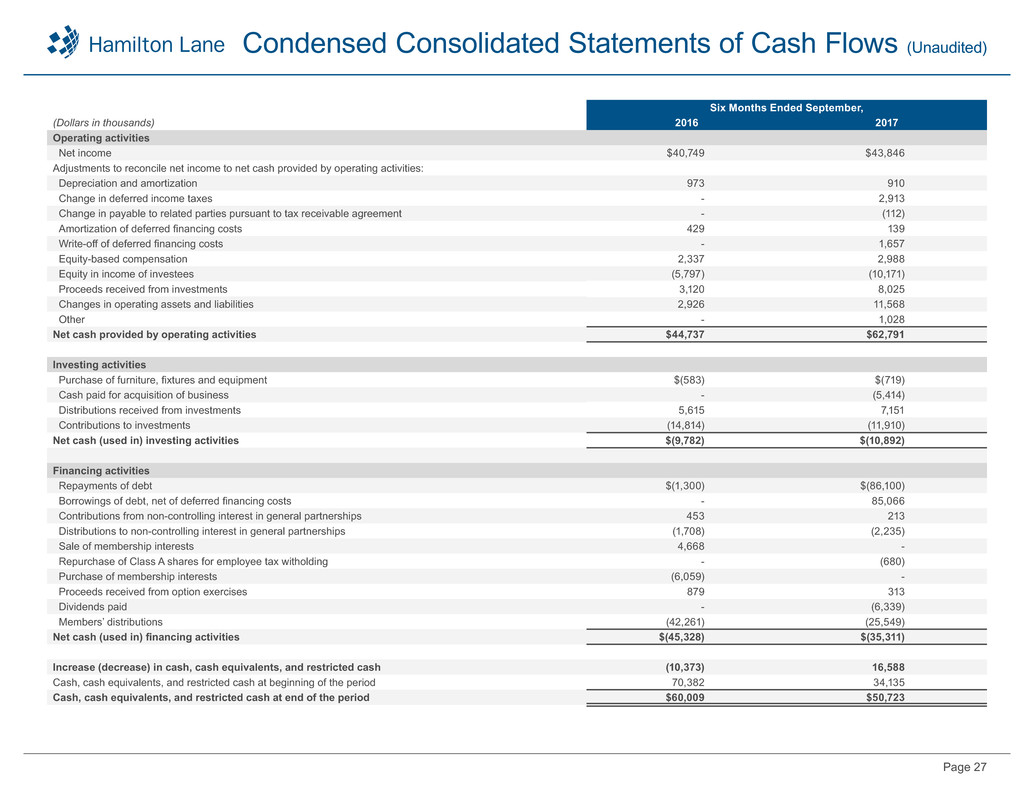

Condensed Consolidated Statements of Cash Flows (Unaudited)

Six Months Ended September,

(Dollars in thousands) 2016 2017

Operating activities

Net income $40,749 $43,846

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization 973 910

Change in deferred income taxes - 2,913

Change in payable to related parties pursuant to tax receivable agreement - (112)

Amortization of deferred financing costs 429 139

Write-off of deferred financing costs - 1,657

Equity-based compensation 2,337 2,988

Equity in income of investees (5,797) (10,171)

Proceeds received from investments 3,120 8,025

Changes in operating assets and liabilities 2,926 11,568

Other - 1,028

Net cash provided by operating activities $44,737 $62,791

Investing activities

Purchase of furniture, fixtures and equipment $(583) $(719)

Cash paid for acquisition of business - (5,414)

Distributions received from investments 5,615 7,151

Contributions to investments (14,814) (11,910)

Net cash (used in) investing activities $(9,782) $(10,892)

Financing activities

Repayments of debt $(1,300) $(86,100)

Borrowings of debt, net of deferred financing costs - 85,066

Contributions from non-controlling interest in general partnerships 453 213

Distributions to non-controlling interest in general partnerships (1,708) (2,235)

Sale of membership interests 4,668 -

Repurchase of Class A shares for employee tax witholding - (680)

Purchase of membership interests (6,059) -

Proceeds received from option exercises 879 313

Dividends paid - (6,339)

Members’ distributions (42,261) (25,549)

Net cash (used in) financing activities $(45,328) $(35,311)

Increase (decrease) in cash, cash equivalents, and restricted cash (10,373) 16,588

Cash, cash equivalents, and restricted cash at beginning of the period 70,382 34,135

Cash, cash equivalents, and restricted cash at end of the period $60,009 $50,723

Page 28

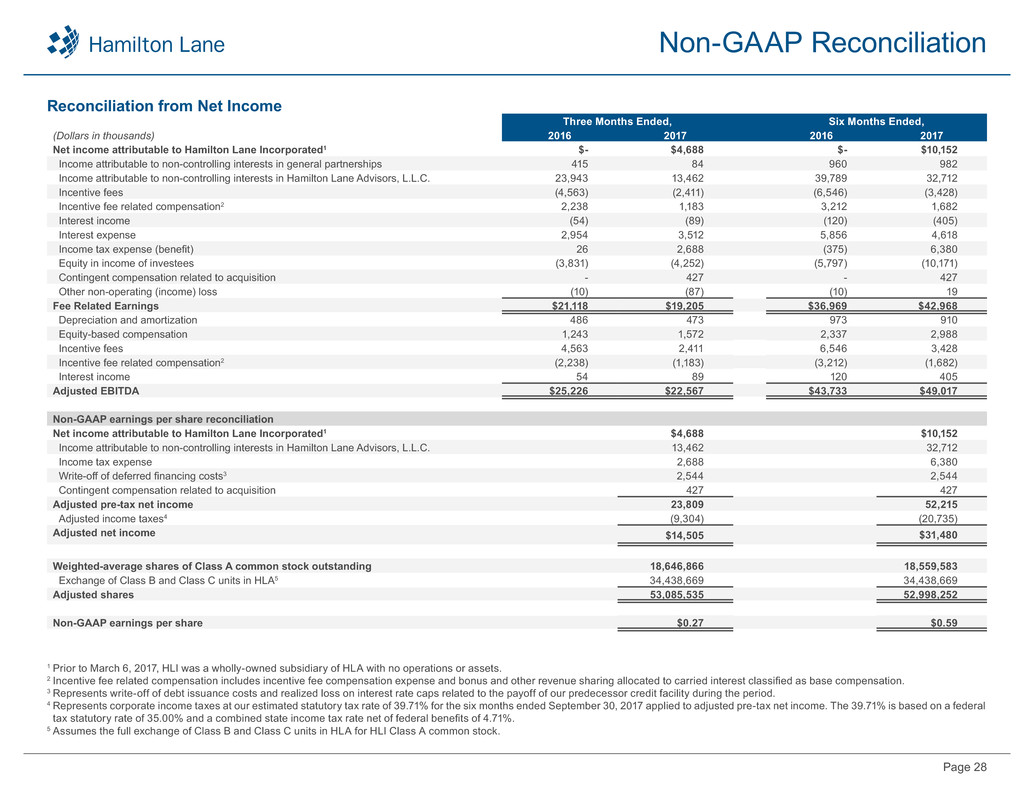

Non-GAAP Reconciliation

Three Months Ended, Six Months Ended,

(Dollars in thousands) 2016 2017 2016 2017

Net income attributable to Hamilton Lane Incorporated1 $- $4,688 $- $10,152

Income attributable to non-controlling interests in general partnerships 415 84 960 982

Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 23,943 13,462 39,789 32,712

Incentive fees (4,563) (2,411) (6,546) (3,428)

Incentive fee related compensation2 2,238 1,183 3,212 1,682

Interest income (54) (89) (120) (405)

Interest expense 2,954 3,512 5,856 4,618

Income tax expense (benefit) 26 2,688 (375) 6,380

Equity in income of investees (3,831) (4,252) (5,797) (10,171)

Contingent compensation related to acquisition - 427 - 427

Other non-operating (income) loss (10) (87) (10) 19

Fee Related Earnings $21,118 $19,205 $36,969 $42,968

Depreciation and amortization 486 473 973 910

Equity-based compensation 1,243 1,572 2,337 2,988

Incentive fees 4,563 2,411 6,546 3,428

Incentive fee related compensation2 (2,238) (1,183) (3,212) (1,682)

Interest income 54 89 120 405

Adjusted EBITDA $25,226 $22,567 $43,733 $49,017

Non-GAAP earnings per share reconciliation

Net income attributable to Hamilton Lane Incorporated1 $4,688 $10,152

Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 13,462 32,712

Income tax expense 2,688 6,380

Write-off of deferred financing costs3 2,544 2,544

Contingent compensation related to acquisition 427 427

Adjusted pre-tax net income 23,809 52,215

Adjusted income taxes4 (9,304) (20,735)

Adjusted net income $14,505 $31,480

Weighted-average shares of Class A common stock outstanding 18,646,866 18,559,583

Exchange of Class B and Class C units in HLA5 34,438,669 34,438,669

Adjusted shares 53,085,535 52,998,252

Non-GAAP earnings per share $0.27 $0.59

1 Prior to March 6, 2017, HLI was a wholly-owned subsidiary of HLA with no operations or assets.

2 Incentive fee related compensation includes incentive fee compensation expense and bonus and other revenue sharing allocated to carried interest classified as base compensation.

3 Represents write-off of debt issuance costs and realized loss on interest rate caps related to the payoff of our predecessor credit facility during the period.

4 Represents corporate income taxes at our estimated statutory tax rate of 39.71% for the six months ended September 30, 2017 applied to adjusted pre-tax net income. The 39.71% is based on a federal

tax statutory rate of 35.00% and a combined state income tax rate net of federal benefits of 4.71%.

5 Assumes the full exchange of Class B and Class C units in HLA for HLI Class A common stock.

Reconciliation from Net Income

Page 29

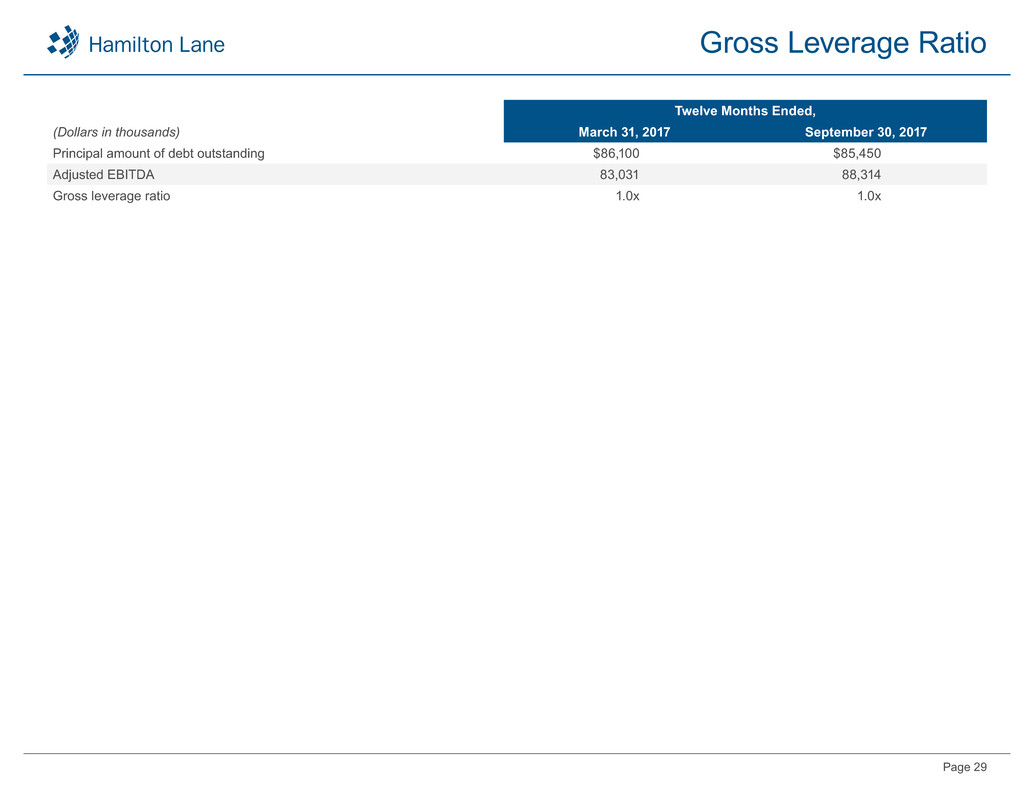

Gross Leverage Ratio

Twelve Months Ended,

(Dollars in thousands) March 31, 2017 September 30, 2017

Principal amount of debt outstanding $86,100 $85,450

Adjusted EBITDA 83,031 88,314

Gross leverage ratio 1.0x 1.0x

Page 30

Terms

Adjusted EBITDA is our primary internal measure of profitability. We believe Adjusted EBITDA is useful to investors because it enables them to better evaluate the performance of our core business

across reporting periods. Adjusted EBITDA represents net income excluding (a) interest expense on our loan agreements and predecessor credit facility, (b) income tax expense, (c) depreciation and

amortization expense, (d) equity-based compensation expense, (e) non-operating income (loss) and (f) certain other significant items that we believe are not indicative of our core performance.

Fee Related Earnings (“FRE”) is used to highlight earnings of the Company from recurring management fees. FRE represents net income excluding (a) incentive fees and related compensation, (b)

interest income and expense, (c) income tax expense, (d) equity in income of investees and (e) other non-operating income. We believe FRE is useful to investors because it provides additional insight

into the operating profitability of our business. FRE is presented before income taxes.

Non-GAAP earnings per share measures our per-share earnings of the Company assuming all Class B and Class C units in HLA were exchanged for Class A common stock in HLI. Non-GAAP earnings

per share is calculated as adjusted net income divided by adjusted shares outstanding. Adjusted net income is income before taxes fully taxed at our estimated statutory tax rate. We believe Non-GAAP

earnings per share is useful to investors because it enables them to better evaluate per-share operating performance across reporting periods.

Our assets under management (“AUM”) comprise primarily the assets associated with our customized separate accounts and specialized funds. We classify assets as AUM if we have full discretion

over the investment decisions in an account. We calculate our AUM as the sum of:

(1) the net asset value of our clients’ and funds’ underlying investments;

(2) the unfunded commitments to our clients’ and funds’ underlying investments; and

(3) the amounts authorized for us to invest on behalf of our clients and fund investors but not committed to an underlying investment.

Management fee revenue is based on a variety of factors and is not linearly correlated with AUM. However, we believe AUM is a useful metric for assessing the relative size and scope of our asset

management business.

Our assets under advisement (“AUA”) comprise assets from clients for which we do not have full discretion to make investments in their account. We generally earn revenue on a fixed fee basis on

our AUA client accounts for services including asset allocation, strategic planning, development of investment policies and guidelines, screening and recommending investments, legal negotiations,

monitoring and reporting on investments and investment manager review and due diligence. Advisory fees vary by client based on the amount of annual commitments, services provided and other factors.

Since we earn annual fixed fees from the majority of our AUA clients, the growth in AUA from existing accounts does not have a material impact on our revenues. However, we view AUA growth as a

meaningful benefit in terms of the amount of data we are able to collect and the degree of influence we have with fund managers.

Fee-earning assets under management, or fee-earning AUM, is a metric we use to measure the assets from which we earn management fees. Our fee-earning AUM comprise assets in our customized

separate accounts and specialized funds from which we derive management fees. We classify customized separate account revenue as management fees if the client is charged an asset-based fee,

which includes the majority of our discretionary AUM accounts but also includes certain non-discretionary AUA accounts. Our fee-earning AUM is equal to the amount of capital commitments, net invested

capital and net asset value of our customized separate accounts and specialized funds depending on the fee terms. Substantially all of our customized separate accounts and specialized funds earn

fees based on commitments or net invested capital, which are not affected by market appreciation or depreciation. Therefore, revenues and fee-earning AUM are not significantly affected by changes in

market value. Our calculations of fee-earning AUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other

asset managers. Our definition of fee-earning AUM is not based on any definition that is set forth in the agreements governing the customized separate accounts or specialized funds that we manage.

Hamilton Lane Incorporated (or “HLI”) was incorporated in the State of Delaware on December 31, 2007. The Company was formed for the purpose of completing an initial public offering (“IPO”) and

related transactions (“Reorganization”) in order to carry on the business of Hamilton Lane Advisors, L.L.C. (“HLA”) as a publicly-traded entity. As of March 6, 2017, HLI became the sole managing

member of HLA.

Page 31

Disclosures

As of November 7, 2017

Some of the statements in this presentation may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of

1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe” and similar expressions are used to identify these forward-looking statements. Forward-looking

statements discuss management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All forward-looking

statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to our ability to manage

growth, fund performance, risk, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to

maintain our fee structure; our ability to attract and retain key employees; our ability to consummate planned acquisitions and successfully integrate the acquired business with ours; our ability to manage

our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to us; our ability to comply with investment guidelines set by our clients; the time, expense and

effort associated with being a newly public company; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our payment of dividends, taxes and other expenses.

The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks that we face, you should refer to the “Risk Factors” detailed in Part

I, Item 1A of our Annual Report on Form 10K for the fiscal year ended March 31, 2017, and in our subsequent reports filed from time to time with the Securities and Exchange Commission. The forward-

looking statements included in this presentation are made only as of the date presented. We undertake no obligation to update or revise any forward-looking statement as a result of new information or

future events, except as otherwise required by law.