Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CRAWFORD & CO | exhibit99111062017q3.htm |

| 8-K - 8-K - CRAWFORD & CO | a110620178-k.htm |

November 6, 2017

Third Quarter 2017

Earnings Conference Call

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

2

• Forward-Looking Statements

—This presentation contains forward-looking statements, including statements about the expected future financial condition, results of operations and

earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be "forward-

looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a

number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's present

expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are

made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise

or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of

results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and

uncertainties involved in forward-looking statements, please read Crawford & Company's reports filed with the Securities and Exchange Commission

and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawfordandcompany.com.

—Crawford's business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a

number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made

disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting.

• Revenues Before Reimbursements ("Revenues")

—Revenues Before Reimbursements are referred to as "Revenues" in both consolidated and segment charts, bullets and tables throughout this

presentation.

• Segment and Consolidated Operating Earnings

—Under the Financial Accounting Standards Board's Accounting Standards Codification ("ASC") Topic 280, "Segment Reporting," the Company has

defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its four operating segments.

Segment operating earnings represent segment earnings, including the direct and indirect costs of certain administrative functions required to operate

our business, but excludes unallocated corporate and shared costs and credits, net corporate interest expense, stock option expense, amortization of

customer-relationship intangible assets, restructuring and special charges, income taxes, and net income or loss attributable to noncontrolling

interests and redeemable noncontrolling interests.

• Earnings Per Share

—The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash

dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with respect

to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of Class B

Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class.

—In certain periods, the Company has paid a higher dividend on CRD-A than on CRD-B. This may result in a different earnings per share ("EPS") for

each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 - "Earnings Per Share". The two-class method is an

earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation

rights in undistributed earnings as if all such earnings had been distributed during the period.

• Non-GAAP Financial Information

—For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation.

FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

3

GLOBAL BUSINESS SERVICES LEADER

• The world's largest publicly listed

independent provider of global

claims management solutions

• Multiple globally recognized brand

names: Crawford®, Broadspire®,

GCG®

• Clients include multinational

insurance carriers, brokers and

local insurance firms as well as 200

of the Fortune® 500

//////////////////////////////////////////////////////////////////////////

TODAY'S AGENDA

--- Welcome and Opening Comments

--- Third Quarter 2017 Financial Review

--- 2017 Updated Guidance and Strategic Initiatives

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

5

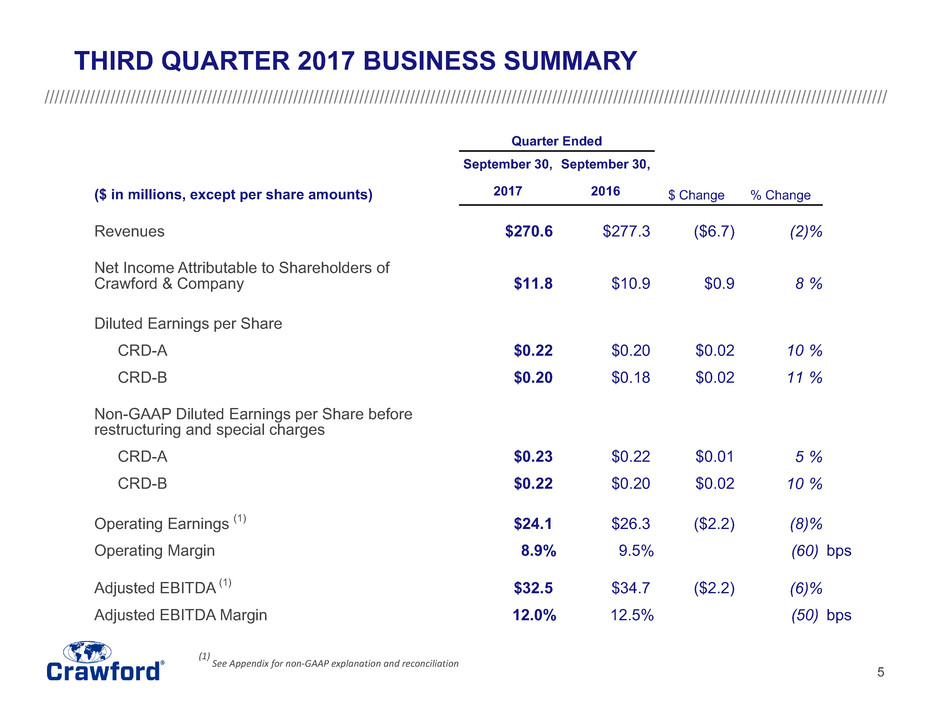

THIRD QUARTER 2017 BUSINESS SUMMARY

(1)

See Appendix for non-GAAP explanation and reconciliation

Quarter Ended

September 30, September 30,

($ in millions, except per share amounts) 2017 2016 $ Change % Change

Revenues $270.6 $277.3 ($6.7) (2)%

Net Income Attributable to Shareholders of

Crawford & Company $11.8 $10.9 $0.9 8 %

Diluted Earnings per Share

CRD-A $0.22 $0.20 $0.02 10 %

CRD-B $0.20 $0.18 $0.02 11 %

Non-GAAP Diluted Earnings per Share before

restructuring and special charges

CRD-A $0.23 $0.22 $0.01 5 %

CRD-B $0.22 $0.20 $0.02 10 %

Operating Earnings (1) $24.1 $26.3 ($2.2) (8)%

Operating Margin 8.9% 9.5% (60) bps

Adjusted EBITDA (1) $32.5 $34.7 ($2.2) (6)%

Adjusted EBITDA Margin 12.0% 12.5% (50) bps

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

6

THIRD QUARTER 2017 BUSINESS HIGHLIGHTS

• Consolidated revenues decreased by $6.7 million or 2.4% for the quarter.

After adjusting for the impact of foreign exchange and changes in

accounting for our U.K. contractor repair business, revenues were flat in

the quarter

• Increased revenues in our U.S. Services segment of 11.5% as a result of

increased hurricane related activity

• U.S. Services margins decreased due to start-up costs to mobilize staff in

hurricane affected areas - a strategic investment to support our clients,

build the Crawford brand, and ultimately grow market share over time

• International revenues decreased in the U.K. region primarily due to

changes in the contractor repair business model

• Broadspire delivered consistent revenues and margins

• Garden City Group continued to face a challenging market environment

with fewer larger, high value cases

• Ken Fraser appointed to Chief Client Officer, a new position at Crawford, to

exploit the many cross sell opportunities that exist across the Company's

global platform

//////////////////////////////////////////////////////////////////////////

THIRD QUARTER 2017

Financial Review

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

8

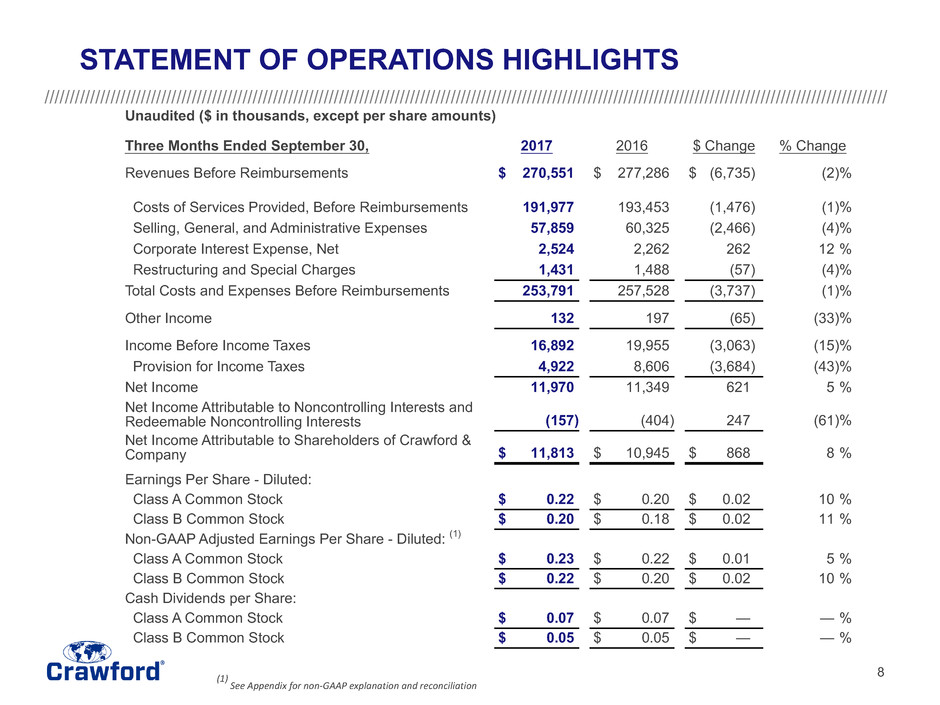

Unaudited ($ in thousands, except per share amounts)

Three Months Ended September 30, 2017 2016 $ Change % Change

Revenues Before Reimbursements $ 270,551 $ 277,286 $ (6,735) (2)%

Costs of Services Provided, Before Reimbursements 191,977 193,453 (1,476) (1)%

Selling, General, and Administrative Expenses 57,859 60,325 (2,466) (4)%

Corporate Interest Expense, Net 2,524 2,262 262 12 %

Restructuring and Special Charges 1,431 1,488 (57) (4)%

Total Costs and Expenses Before Reimbursements 253,791 257,528 (3,737) (1)%

Other Income 132 197 (65) (33)%

Income Before Income Taxes 16,892 19,955 (3,063) (15)%

Provision for Income Taxes 4,922 8,606 (3,684) (43)%

Net Income 11,970 11,349 621 5 %

Net Income Attributable to Noncontrolling Interests and

Redeemable Noncontrolling Interests (157) (404) 247 (61)%

Net Income Attributable to Shareholders of Crawford &

Company $ 11,813 $ 10,945 $ 868 8 %

Earnings Per Share - Diluted:

Class A Common Stock $ 0.22 $ 0.20 $ 0.02 10 %

Class B Common Stock $ 0.20 $ 0.18 $ 0.02 11 %

Non-GAAP Adjusted Earnings Per Share - Diluted: (1)

Class A Common Stock $ 0.23 $ 0.22 $ 0.01 5 %

Class B Common Stock $ 0.22 $ 0.20 $ 0.02 10 %

Cash Dividends per Share:

Class A Common Stock $ 0.07 $ 0.07 $ — — %

Class B Common Stock $ 0.05 $ 0.05 $ — — %

STATEMENT OF OPERATIONS HIGHLIGHTS

(1)

See Appendix for non-GAAP explanation and reconciliation

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

9

3Q 2017 3Q 2016

$25

$20

$15

$10

$5

$0

Claims Ops Tech Svcs CAT Cont. Conn. WGL

3Q 2017 3Q 2016

60

40

20

0

Claims Ops Tech Svcs CAT Cont. Conn. WGL

Revenues by Service Line

($ in millions)

Cases Received by Service Line

(In thousands)

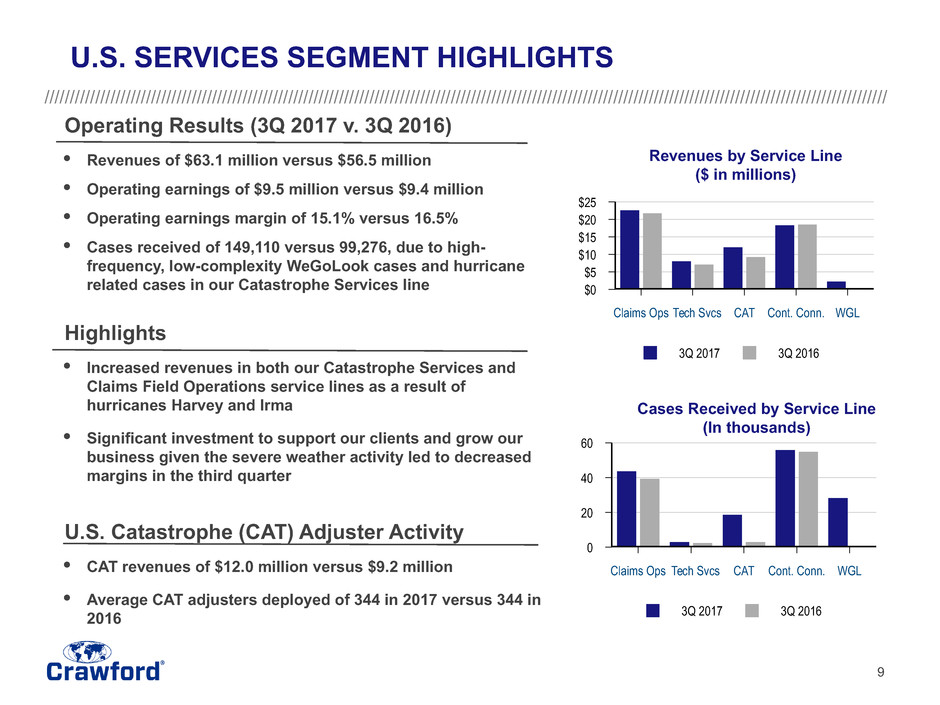

Operating Results (3Q 2017 v. 3Q 2016)

• Revenues of $63.1 million versus $56.5 million

• Operating earnings of $9.5 million versus $9.4 million

• Operating earnings margin of 15.1% versus 16.5%

• Cases received of 149,110 versus 99,276, due to high-

frequency, low-complexity WeGoLook cases and hurricane

related cases in our Catastrophe Services line

Highlights

• Increased revenues in both our Catastrophe Services and

Claims Field Operations service lines as a result of

hurricanes Harvey and Irma

• Significant investment to support our clients and grow our

business given the severe weather activity led to decreased

margins in the third quarter

U.S. Catastrophe (CAT) Adjuster Activity

• CAT revenues of $12.0 million versus $9.2 million

• Average CAT adjusters deployed of 344 in 2017 versus 344 in

2016

U.S. SERVICES SEGMENT HIGHLIGHTS

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

10

3Q 2017 3Q 2016

$50

$40

$30

$20

$10

$0

U.K. Canada Asia-Pacific Europe and ROW

Revenues by Geographic Region

($ in millions)

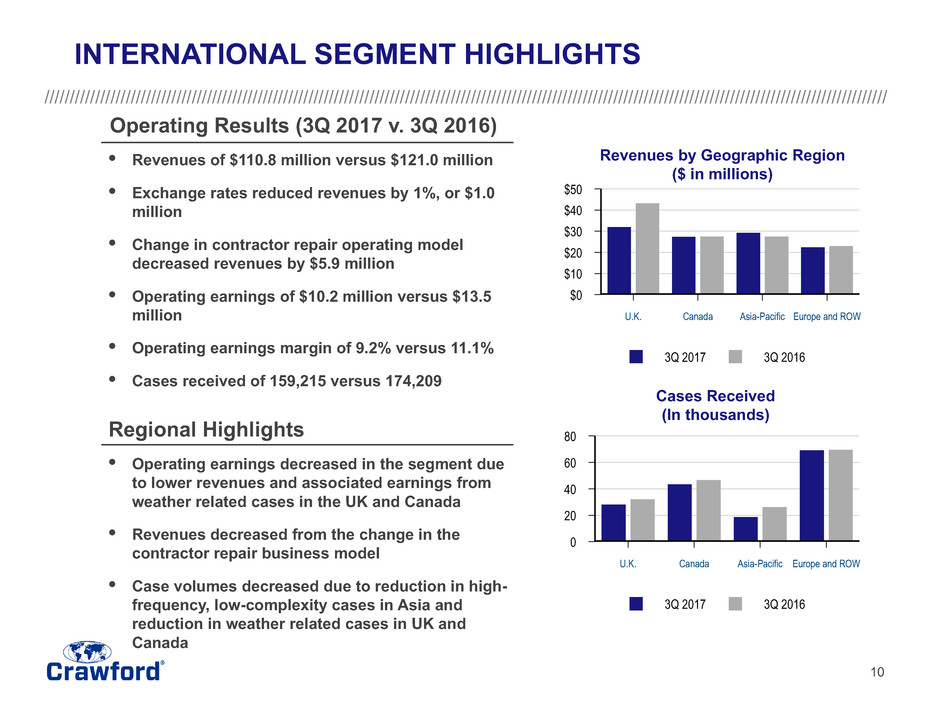

Operating Results (3Q 2017 v. 3Q 2016)

• Revenues of $110.8 million versus $121.0 million

• Exchange rates reduced revenues by 1%, or $1.0

million

• Change in contractor repair operating model

decreased revenues by $5.9 million

• Operating earnings of $10.2 million versus $13.5

million

• Operating earnings margin of 9.2% versus 11.1%

• Cases received of 159,215 versus 174,209

Regional Highlights

• Operating earnings decreased in the segment due

to lower revenues and associated earnings from

weather related cases in the UK and Canada

• Revenues decreased from the change in the

contractor repair business model

• Case volumes decreased due to reduction in high-

frequency, low-complexity cases in Asia and

reduction in weather related cases in UK and

Canada

INTERNATIONAL SEGMENT HIGHLIGHTS

3Q 2017 3Q 2016

80

60

40

20

0

U.K. Canada Asia-Pacific Europe and ROW

Cases Received

(In thousands)

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

11

3Q 2017 3Q 2016

60

45

30

15

0

Workers' Compensation Casualty Medical Management,

Disability and Other

3Q 2017 3Q 2016

$45

$30

$15

$0

Medical Management Claims Management Risk Management

Revenues by Service Line

($ in millions)

Broadspire Cases Received

(In thousands)

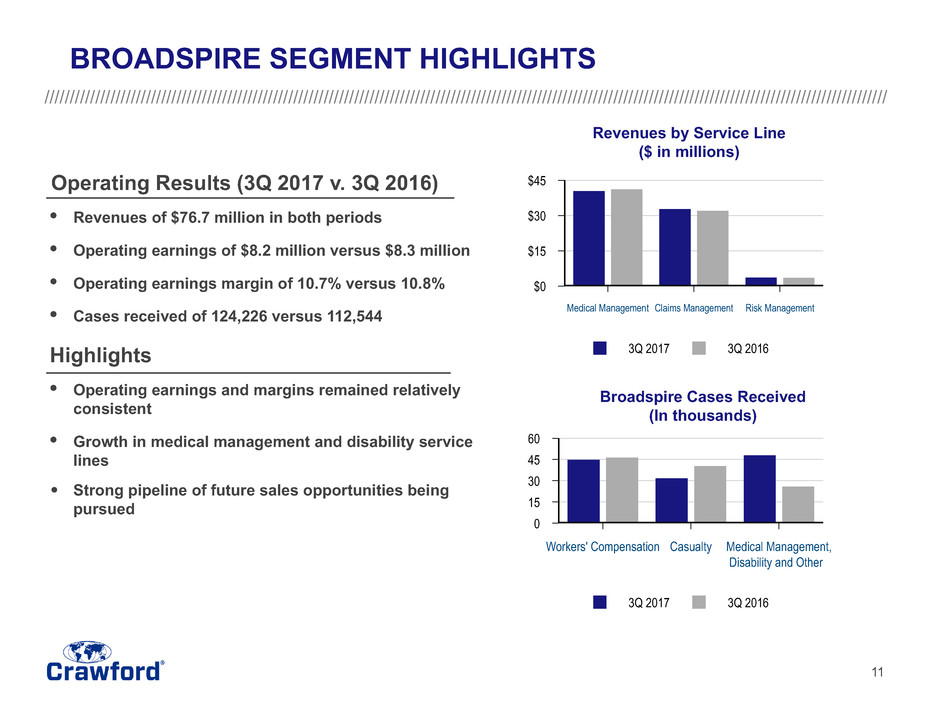

Operating Results (3Q 2017 v. 3Q 2016)

• Revenues of $76.7 million in both periods

• Operating earnings of $8.2 million versus $8.3 million

• Operating earnings margin of 10.7% versus 10.8%

• Cases received of 124,226 versus 112,544

Highlights

• Operating earnings and margins remained relatively

consistent

• Growth in medical management and disability service

lines

• Strong pipeline of future sales opportunities being

pursued

BROADSPIRE SEGMENT HIGHLIGHTS

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

12

3Q 2017 3Q 2016

$125

$100

$75

$50

$25

$0

66

94

Backlog

($ in millions)

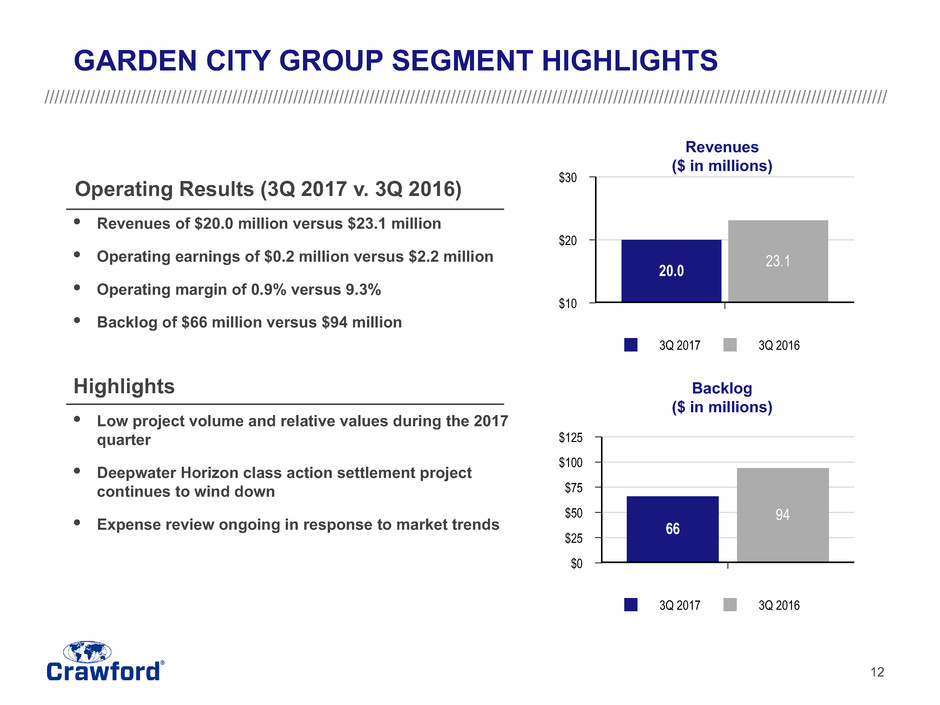

Operating Results (3Q 2017 v. 3Q 2016)

• Revenues of $20.0 million versus $23.1 million

• Operating earnings of $0.2 million versus $2.2 million

• Operating margin of 0.9% versus 9.3%

• Backlog of $66 million versus $94 million

Highlights

• Low project volume and relative values during the 2017

quarter

• Deepwater Horizon class action settlement project

continues to wind down

• Expense review ongoing in response to market trends

GARDEN CITY GROUP SEGMENT HIGHLIGHTS

Revenues

($ in millions)

3Q 2017 3Q 2016

$30

$20

$10

20.0 23.1

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

13

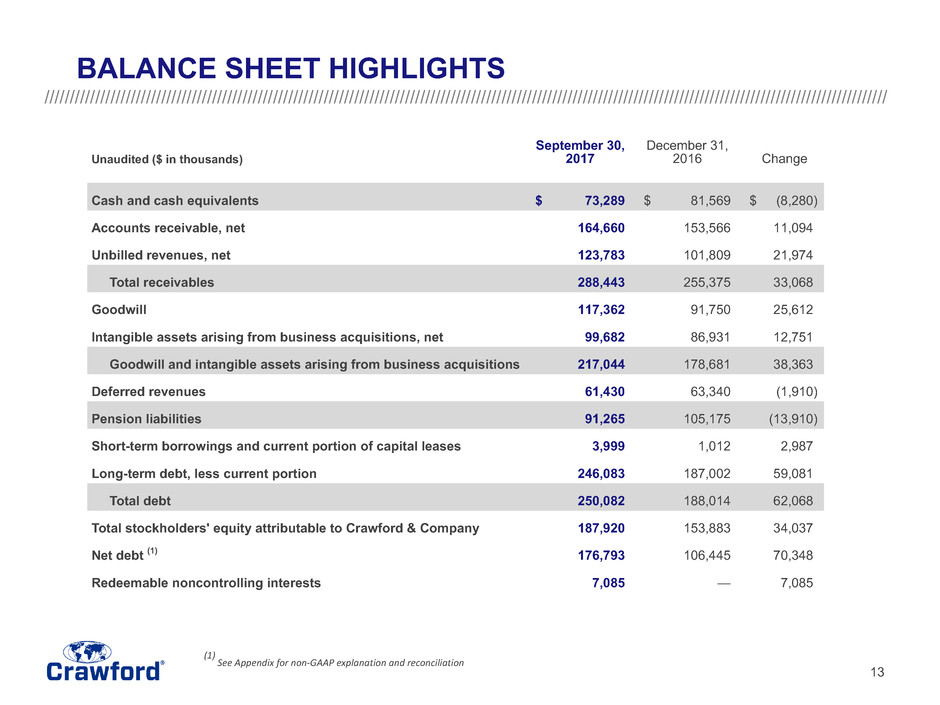

Unaudited ($ in thousands)

September 30,

2017

December 31,

2016 Change

Cash and cash equivalents $ 73,289 $ 81,569 $ (8,280)

Accounts receivable, net 164,660 153,566 11,094

Unbilled revenues, net 123,783 101,809 21,974

Total receivables 288,443 255,375 33,068

Goodwill 117,362 91,750 25,612

Intangible assets arising from business acquisitions, net 99,682 86,931 12,751

Goodwill and intangible assets arising from business acquisitions 217,044 178,681 38,363

Deferred revenues 61,430 63,340 (1,910)

Pension liabilities 91,265 105,175 (13,910)

Short-term borrowings and current portion of capital leases 3,999 1,012 2,987

Long-term debt, less current portion 246,083 187,002 59,081

Total debt 250,082 188,014 62,068

Total stockholders' equity attributable to Crawford & Company 187,920 153,883 34,037

Net debt (1) 176,793 106,445 70,348

Redeemable noncontrolling interests 7,085 — 7,085

(1)

See Appendix for non-GAAP explanation and reconciliation

BALANCE SHEET HIGHLIGHTS

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

14

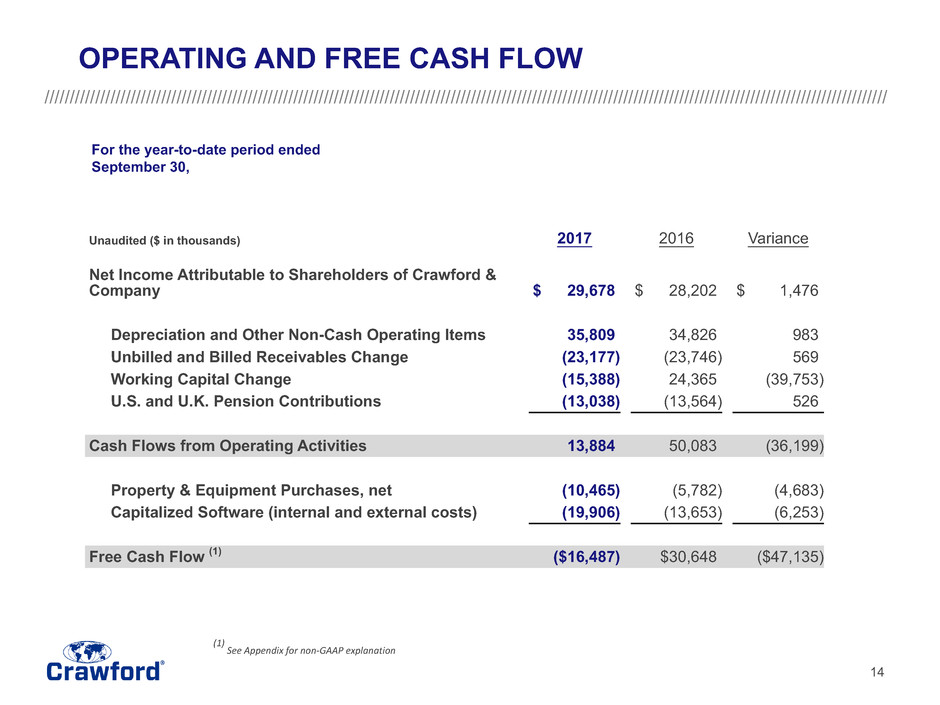

Unaudited ($ in thousands) 2017 2016 Variance

Net Income Attributable to Shareholders of Crawford &

Company $ 29,678 $ 28,202 $ 1,476

Depreciation and Other Non-Cash Operating Items 35,809 34,826 983

Unbilled and Billed Receivables Change (23,177) (23,746) 569

Working Capital Change (15,388) 24,365 (39,753)

U.S. and U.K. Pension Contributions (13,038) (13,564) 526

Cash Flows from Operating Activities 13,884 50,083 (36,199)

Property & Equipment Purchases, net (10,465) (5,782) (4,683)

Capitalized Software (internal and external costs) (19,906) (13,653) (6,253)

Free Cash Flow (1) ($16,487) $30,648 ($47,135)

For the year-to-date period ended

September 30,

OPERATING AND FREE CASH FLOW

(1)

See Appendix for non-GAAP explanation

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

15

2017 SHARE REPURCHASES

• During the third quarter 2017, Crawford repurchased 193,527 shares of

CRD-A for an average price of $7.77 per share, and 127,100 shares of

CRD-B for an average price of $8.87 per share

• The Company's share repurchase authorization, approved in August

2014, the ("2014 Repurchase Authorization"), was terminated at the

close of business July 28, 2017

• Effective July 29, 2017, the Company's Board of Directors authorized

the repurchase of up to 2,000,000 shares of CRD-A or CRD-B (or both)

through July 2020 ("2017 Repurchase Authorization")

• As of September 30, 2017 the Company had remaining authorization

to repurchase 1,829,263 under the 2017 Repurchase Authorization

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

16

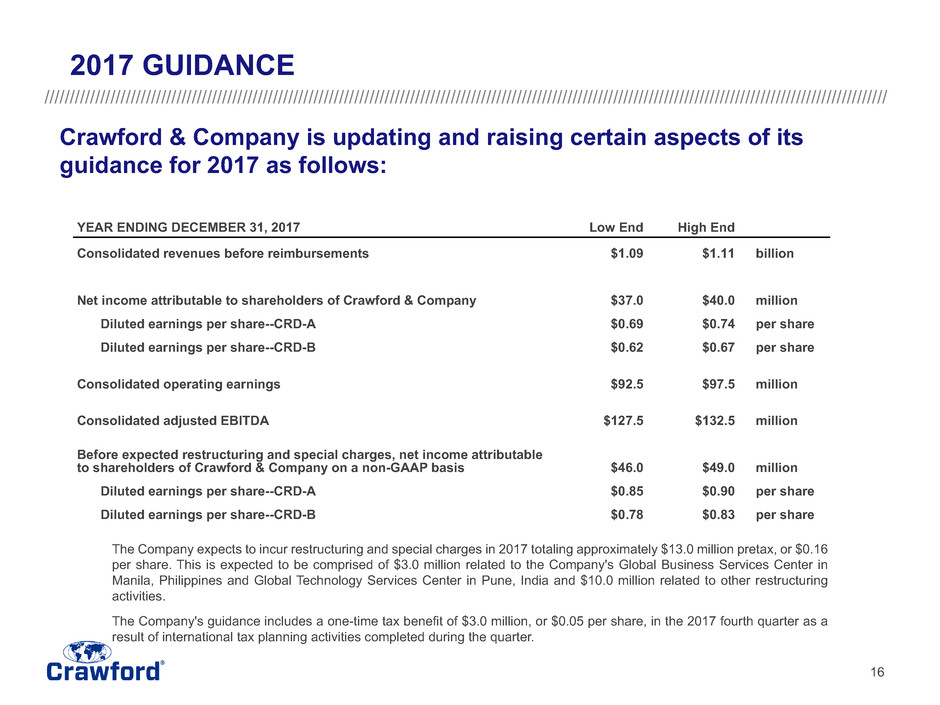

Crawford & Company is updating and raising certain aspects of its

guidance for 2017 as follows:

YEAR ENDING DECEMBER 31, 2017 Low End High End

Consolidated revenues before reimbursements $1.09 $1.11 billion

Net income attributable to shareholders of Crawford & Company $37.0 $40.0 million

Diluted earnings per share--CRD-A $0.69 $0.74 per share

Diluted earnings per share--CRD-B $0.62 $0.67 per share

Consolidated operating earnings $92.5 $97.5 million

Consolidated adjusted EBITDA $127.5 $132.5 million

Before expected restructuring and special charges, net income attributable

to shareholders of Crawford & Company on a non-GAAP basis $46.0 $49.0 million

Diluted earnings per share--CRD-A $0.85 $0.90 per share

Diluted earnings per share--CRD-B $0.78 $0.83 per share

2017 GUIDANCE

The Company expects to incur restructuring and special charges in 2017 totaling approximately $13.0 million pretax, or $0.16

per share. This is expected to be comprised of $3.0 million related to the Company's Global Business Services Center in

Manila, Philippines and Global Technology Services Center in Pune, India and $10.0 million related to other restructuring

activities.

The Company's guidance includes a one-time tax benefit of $3.0 million, or $0.05 per share, in the 2017 fourth quarter as a

result of international tax planning activities completed during the quarter.

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

17

2017 STRATEGIC INITIATIVES

• Having a strong financial foundation

Ø Implement cost reduction initiatives to drive margin expansion

• Building an entrepreneurial culture

Ø Identify attractive markets for expansion

• Enhancing global capabilities

Ø Explore strategic M&A opportunities

• Delivering excellence in execution

Ø Increase speed of doing business enterprise wide

• Being a sales and service driven organization

Ø Form a robust sales funnel and capitalize on cross-selling

• Providing new products and services that matter

Ø Deliver customized value propositions to clients

//////////////////////////////////////////////////////////////////////////

Appendix

THIRD QUARTER 2017

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

19

Measurements of financial performance not calculated in accordance with GAAP should be considered as

supplements to, and not substitutes for, performance measurements calculated or derived in accordance with

GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by

other companies.

Reimbursements for Out-of-Pocket Expenses

In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under

GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively,

in our consolidated results of operations. In this presentation, we do not believe it is informative to include in reported revenues the amounts of

reimbursed expenses and related revenues, as they offset each other in our consolidated results of operations with no impact to our net income or

operating earnings. As a result, unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses.

Net Debt

Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes

that net debt is useful because it provides investors with an estimate of what the Company's debt would be if all available cash was used to pay down

the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt.

Free Cash Flow

Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other

purposes, including additional contributions to the Company's defined benefit pension plans, discretionary prepayments of outstanding borrowings

under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company

available for discretionary expenditures. The reconciliation from Cash Flows from Operating Activities is provided on slide 14.

Segment and Consolidated Operating Earnings

Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker to evaluate the

financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management

believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same

criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings including certain

unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of customer-

relationship intangible assets, restructuring and special charges, income taxes, and net income or loss attributable to noncontrolling interests.

APPENDIX: NON-GAAP FINANCIAL INFORMATION

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

20

Adjusted EBITDA

Adjusted EBITDA is used by management to evaluate, assess and benchmark our operational results and the Company believes that adjusted

EBITDA is relevant and useful information widely used by analysts, investors and other interested parties. Adjusted EBITDA is defined as net income

with adjustments for depreciation and amortization, interest expense-net, income tax provision, restructuring and special charges, and non-cash stock-

based compensation expense. Adjusted EBITDA is not a term defined by GAAP and as a result our measure of adjusted EBITDA might not be

comparable to similarly titled measures used by other companies.

Non-GAAP Adjusted Net Income and Diluted Earnings per Share

Included in non-GAAP adjusted net income as an add back to GAAP net income and diluted earnings per share, are restructuring and special charges

net of tax, which arise from non-core items not directly related to our normal business or operations, or our future performance. Management believes

it is useful to exclude these charges when comparing net income and diluted earnings per share across periods, as these charges are not from

ordinary operations.

APPENDIX: NON-GAAP FINANCIAL INFORMATION (continued)

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

21

Quarter Ended Quarter Ended Full Year

September 30, September 30, Guidance

Unaudited ($ in thousands) 2017 2016 2017 *

Revenues Before Reimbursements

Total Revenues $ 286,666 $ 295,387 $ 1,168,000

Reimbursements (16,115) (18,101) (68,000)

Revenues Before Reimbursements $ 270,551 $ 277,286 $ 1,100,000

Costs of Services Provided, Before Reimbursements

Total Costs of Services $ 208,092 $ 211,554

Reimbursements (16,115) (18,101)

Costs of Services Provided, Before Reimbursements $ 191,977 $ 193,453

Revenues, Costs of Services Provided, and Operating Earnings

Quarter Ended Quarter Ended Full Year

September 30, September 30, Guidance

Unaudited ($ in thousands) 2017 2016 2017 *

Operating Earnings:

U.S. Services $ 9,537 $ 9,354

International 10,165 13,460

Broadspire 8,240 8,263

Garden City Group 188 2,152

Unallocated corporate and shared (costs) and credits, net (4,078) (6,947)

Consolidated Operating Earnings 24,052 26,282 $ 95,000

Deduct:

Net corporate interest expense (2,524) (2,262) (11,000)

Stock option expense (468) (176) (1,575)

Amortization expense (2,737) (2,401) (11,700)

Restructuring and special charges (1,431) (1,488) (13,165)

Income taxes (4,922) (8,606) (18,960)

Net income attributable to non-controlling interests and redeemable

noncontrolling interests (157) (404) (100)

Net Income Attributable to Shareholders of Crawford & Company $ 11,813 $ 10,945 $ 38,500

RECONCILIATION OF NON-GAAP ITEMS

* Midpoints of Company's Guidance, updated November 6, 2017

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

22

RECONCILIATION OF NON-GAAP ITEMS (continued)

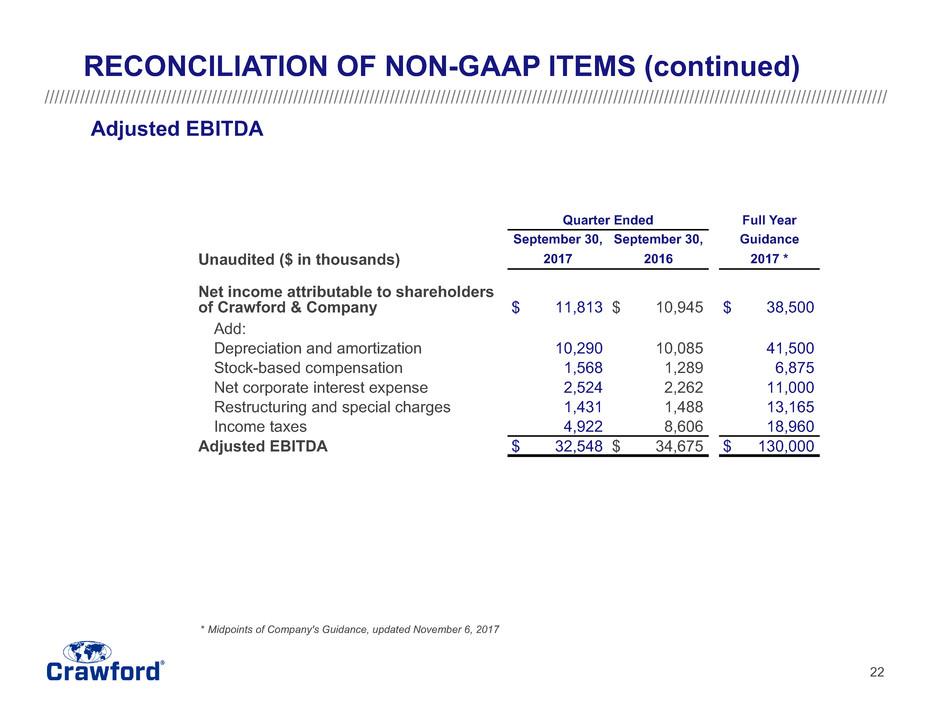

Adjusted EBITDA

Quarter Ended Full Year

September 30, September 30, Guidance

Unaudited ($ in thousands) 2017 2016 2017 *

Net income attributable to shareholders

of Crawford & Company $ 11,813 $ 10,945 $ 38,500

Add:

Depreciation and amortization 10,290 10,085 41,500

Stock-based compensation 1,568 1,289 6,875

Net corporate interest expense 2,524 2,262 11,000

Restructuring and special charges 1,431 1,488 13,165

Income taxes 4,922 8,606 18,960

Adjusted EBITDA $ 32,548 $ 34,675 $ 130,000

* Midpoints of Company's Guidance, updated November 6, 2017

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

23

RECONCILIATION OF NON-GAAP ITEMS (continued)

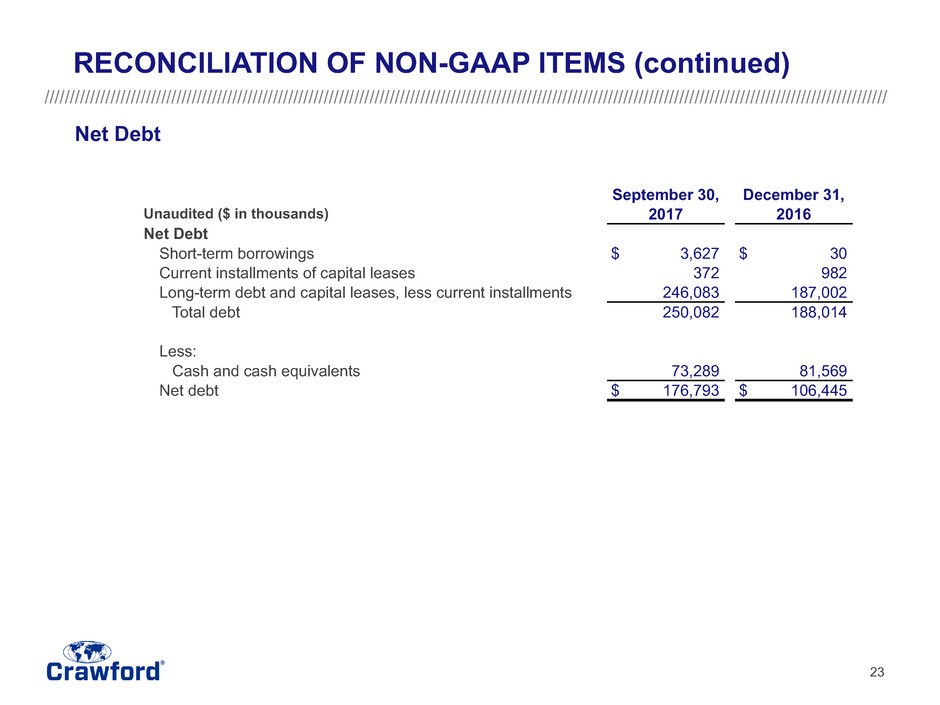

Net Debt

September 30, December 31,

Unaudited ($ in thousands) 2017 2016

Net Debt

Short-term borrowings $ 3,627 $ 30

Current installments of capital leases 372 982

Long-term debt and capital leases, less current installments 246,083 187,002

Total debt 250,082 188,014

Less:

Cash and cash equivalents 73,289 81,569

Net debt $ 176,793 $ 106,445

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

24

RECONCILIATION OF NON-GAAP ITEMS (continued)

Non-GAAP Adjusted Net Income and Diluted Earnings Per Share

Three Months Ended September 30, 2017

Unaudited ($ in

thousands)

Income

Before Taxes Income Taxes Net Income

Net Income

Attributable to

Crawford &

Company

Diluted

Earnings per

CRD-A Share

Diluted

Earnings per

CRD-B Share

GAAP $ 16,892 $ (4,922) $ 11,970 $ 11,813 $ 0.22 $ 0.20

Add back:

Restructuring and

special charges 1,431 (468) 963 963 0.01 0.02

Non-GAAP

Adjusted $ 18,323 $ (5,390) $ 12,933 $ 12,776 $ 0.23 $ 0.22

Three Months Ended September 30, 2016

Unaudited ($ in

thousands)

Income

Before Taxes Income Taxes Net Income

Net Income

Attributable to

Crawford &

Company

Diluted

Earnings per

CRD-A Share

Diluted

Earnings per

CRD-B Share

GAAP $ 19,955 $ (8,606) $ 11,349 $ 10,945 $ 0.20 $ 0.18

Add back:

Restructuring and

special charges 1,488 (486) 1,002 1,002 0.02 0.02

Non-GAAP

Adjusted $ 21,443 $ (9,092) $ 12,351 $ 11,947 $ 0.22 $ 0.20

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

25

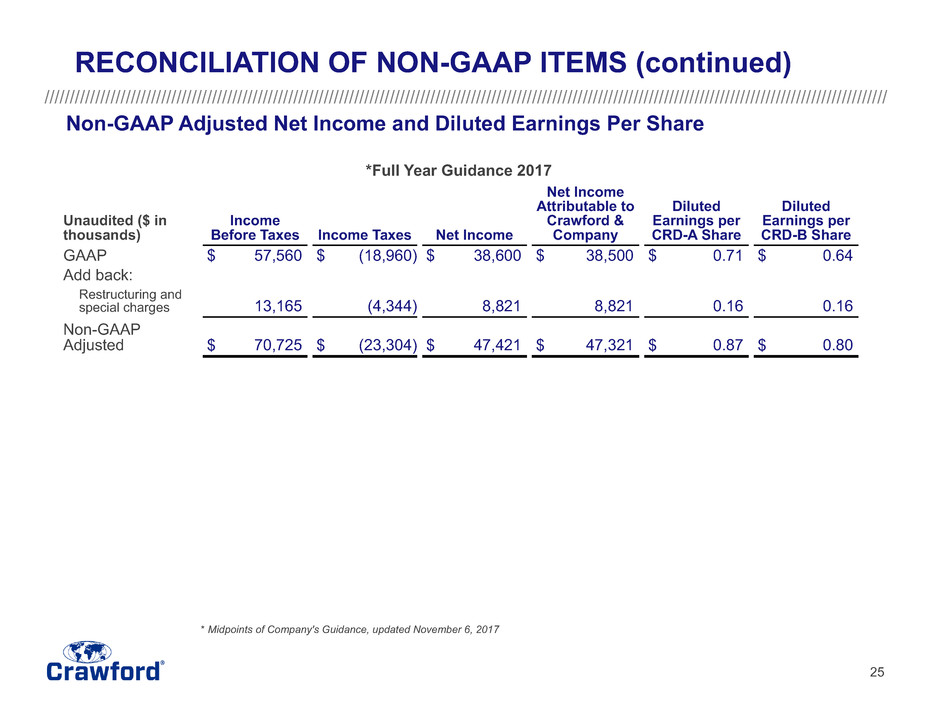

RECONCILIATION OF NON-GAAP ITEMS (continued)

Non-GAAP Adjusted Net Income and Diluted Earnings Per Share

*Full Year Guidance 2017

Unaudited ($ in

thousands)

Income

Before Taxes Income Taxes Net Income

Net Income

Attributable to

Crawford &

Company

Diluted

Earnings per

CRD-A Share

Diluted

Earnings per

CRD-B Share

GAAP $ 57,560 $ (18,960) $ 38,600 $ 38,500 $ 0.71 $ 0.64

Add back:

Restructuring and

special charges 13,165 (4,344) 8,821 8,821 0.16 0.16

Non-GAAP

Adjusted $ 70,725 $ (23,304) $ 47,421 $ 47,321 $ 0.87 $ 0.80

* Midpoints of Company's Guidance, updated November 6, 2017