Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CENTURY CASINOS INC /CO/ | cnty-20171106xex99_1.htm |

| 8-K - 8-K - CENTURY CASINOS INC /CO/ | cnty-20171106x8k.htm |

CENTURY CASINOS Financial Results Q3 2017

Forward - Looking Statements, Business Environment and Risk Factors This presentation may contain “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, Section 21 E of the Securities Exchange Act of 1934 , as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995 . In addition, Century Casinos, Inc . (together with its subsidiaries, the “Company”) may make other written and oral communications from time to time that contain such statements . Forward - looking statements include statements as to industry trends and future expectations of the Company and other matters that do not relate strictly to historical facts and are based on certain assumptions by management at the time such statements are made . Forward - looking statements in this presentation include statements regarding future results of operations, operating efficiencies, synergies and operational performance, the prospects for and timing and costs of new projects, projects in development and other opportunities, including the Century Mile and Saw Close Casino Ltd . (“SCCL”) projects, debt repayment, investments in joint ventures, outcomes of legal proceedings and plans for our casinos and our Company . These statements are often identified by the use of words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue,” and similar expressions or variations . These statements are based on the beliefs and assumptions of the management of the Company based on information currently available to management . Such forward - looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward - looking statements . Important factors that could cause actual results to differ materially from the forward - looking statements include, among others, the risks described in the section entitled “Risk Factors” under Item 1 A in our Annual Report on Form 10 - K for the year ended December 31 , 2016 and our subsequent periodic and current reports filed with the SEC . We caution the reader to carefully consider such factors . Furthermore, such forward - looking statements speak only as of the date on which such statements are made . We undertake no obligation to update any forward - looking statements to reflect events or circumstances after the date of such statements.

Forward - Looking Statements, Business Environment and Risk Factors continued In this presentation the term “USD” refers to US dollars, the term “CAD” refers to Canadian dollars, the term “PLN” refers to Polish zloty and the term “GBP” refers to the British pound . Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures . See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin . The 2016 financial statements reflect adjustments to net operating revenue, earnings from operations, net earnings attributable to Century Casinos, Inc . shareholders and Adjusted EBITDA to correct an erroneously recognized reduction in pari - mutuel revenue totaling $ 0 . 7 million (CAD 0 . 9 million ) in the nine months ended September 30 , 2016 . Amounts presented are rounded . As such, rounding differences could occur in period - over - period changes and percentages reported throughout this presentation . The names of the Company’s subsidiaries and certain operating segments are abbreviated on certain of the following slides . See Appendix A for a list of the subsidiaries and their abbreviations .

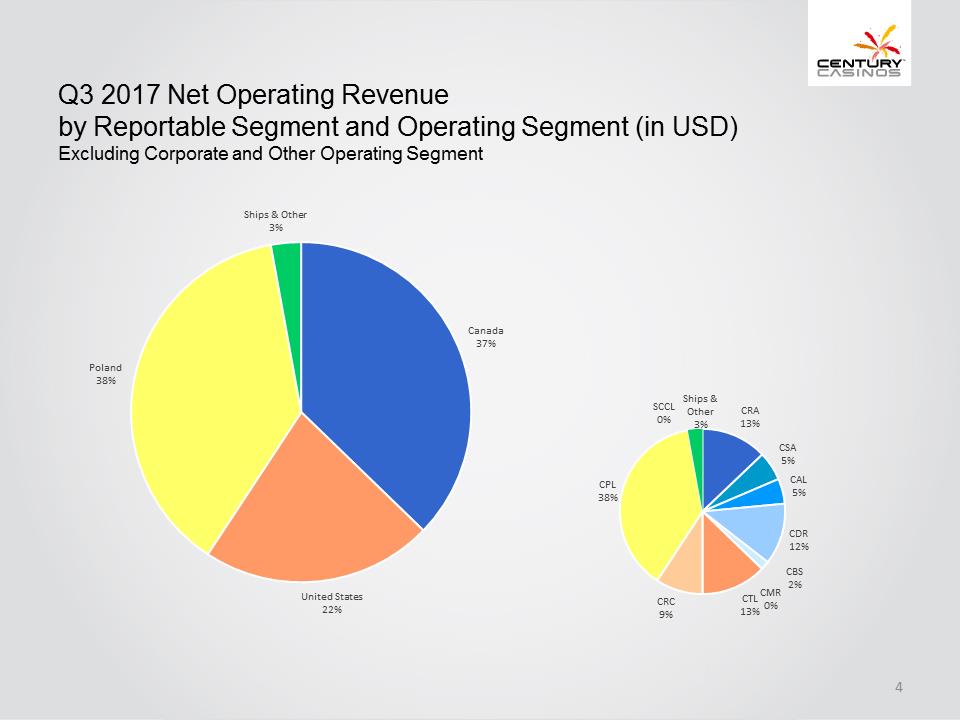

Q3 2017 Net Operating Revenue by Reportable Segment and Operating Segment (in USD) Excluding Corporate and Other Operating Segment Screen Shot 2015-11-03 at 13.59.39.png nur Logo.pdf Canada 37% United States 22% Poland 38% Ships & Other 3% CRA 13% CSA 5% CAL 5% CDR 12% CBS 2% CMR 0% CTL 13% CRC 9% CPL 38% SCCL 0% Ships & Other 3%

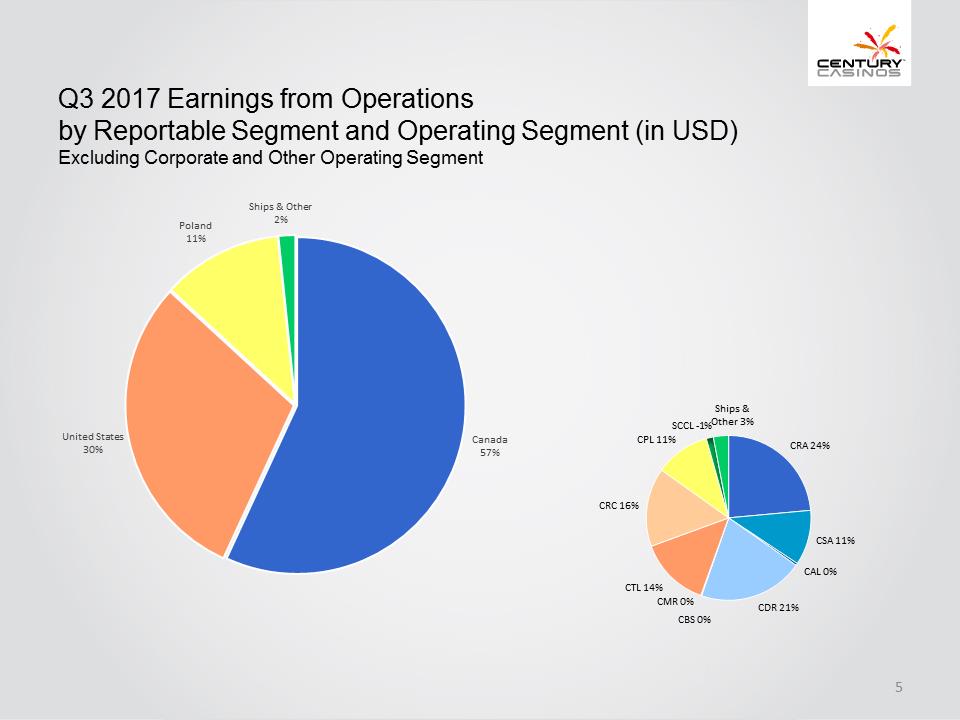

Q3 2017 Earnings from Operations by Reportable Segment and Operating Segment (in USD) Excluding Corporate and Other Operating Segment Screen Shot 2015-11-03 at 13.59.39.png Canada 57% United States 30% Poland 11% Ships & Other 2% CRA 24% CSA 11% CAL 0% CDR 21% CBS 0% CMR 0% CTL 14% CRC 16% CPL 11% SCCL - 1% Ships & Other 3%

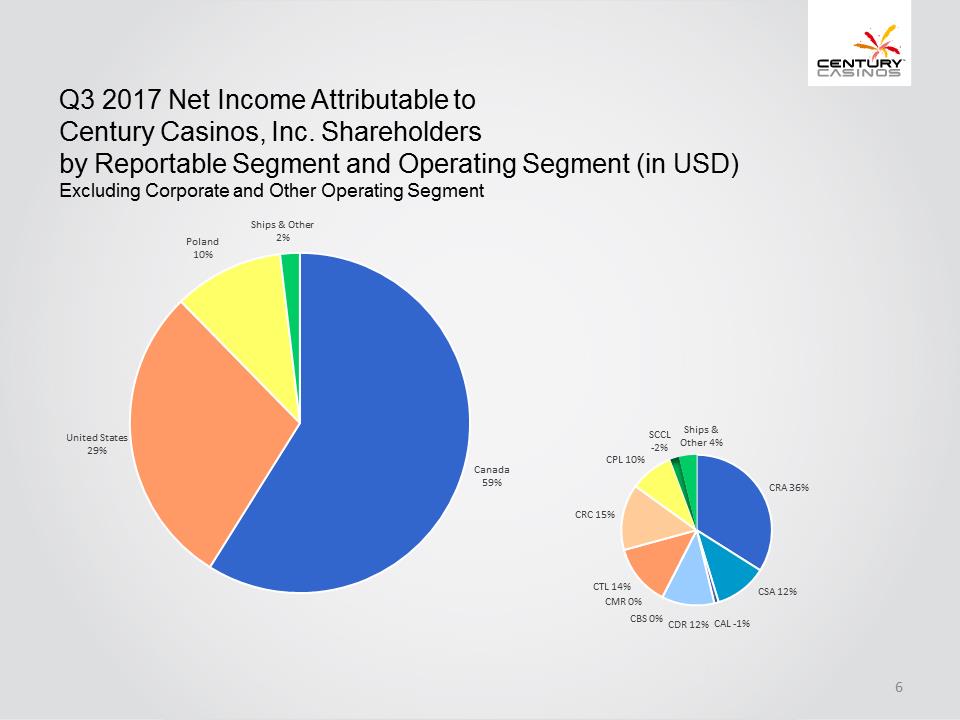

Q3 2017 Net Income Attributable to Century Casinos, Inc. Shareholders by Reportable Segment and Operating Segment (in USD) Excluding Corporate and Other Operating Segment Screen Shot 2015-11-03 at 13.59.39.png Canada 59% United States 29% Poland 10% Ships & Other 2% CRA 36% CSA 12% CAL - 1% CDR 12% CBS 0% CMR 0% CTL 14% CRC 15% CPL 10% SCCL - 2% Ships & Other 4%

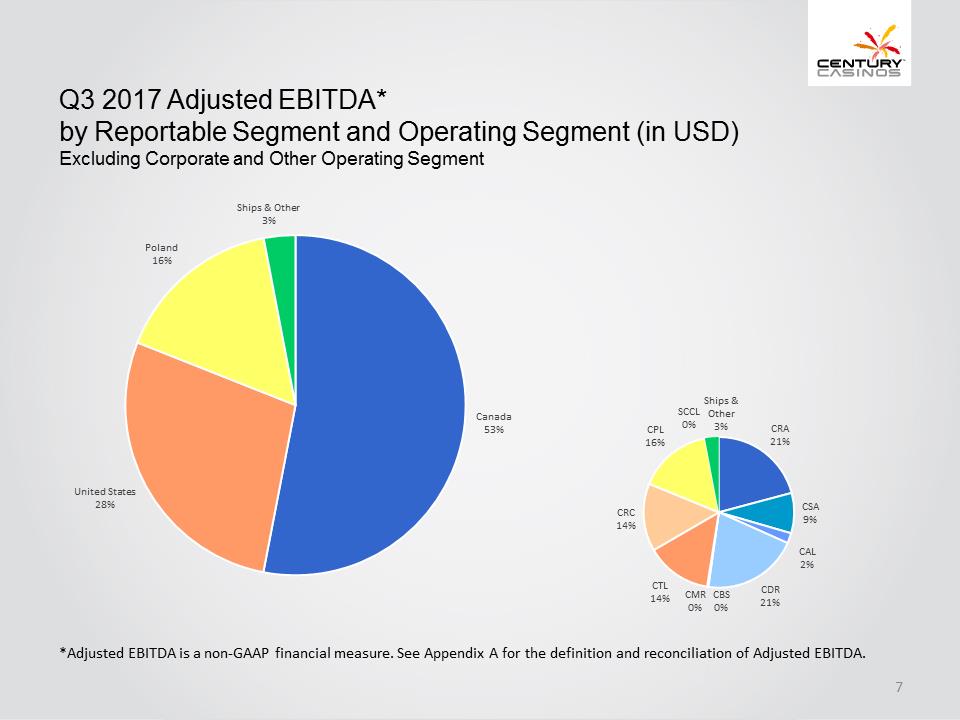

Q3 2017 Adjusted EBITDA* by Reportable Segment and Operating Segment (in USD) Excluding Corporate and Other Operating Segment Screen Shot 2015-11-03 at 13.59.39.png Canada 53% United States 28% Poland 16% Ships & Other 3% CRA 21% CSA 9% CAL 2% CDR 21% CBS 0% CMR 0% CTL 14% CRC 14% CPL 16% SCCL 0% Ships & Other 3% *Adjusted EBITDA is a non - GAAP financial measure. See Appendix A for the definition and reconciliation of Adjusted EBITDA.

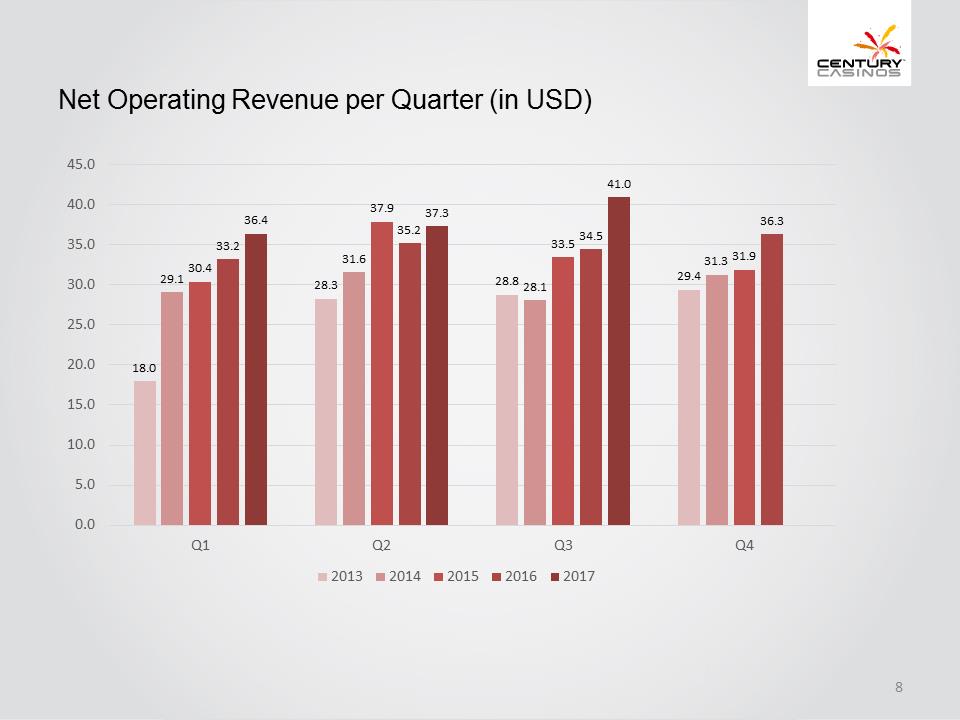

Net Operating Revenue per Quarter (in USD) Screen Shot 2015-11-03 at 13.59.39.png 18.0 28.3 28.8 29.4 29.1 31.6 28.1 31.3 30.4 37.9 33.5 31.9 33.2 35.2 34.5 36.3 36.4 37.3 41.0 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 45.0 Q1 Q2 Q3 Q4 2013 2014 2015 2016 2017

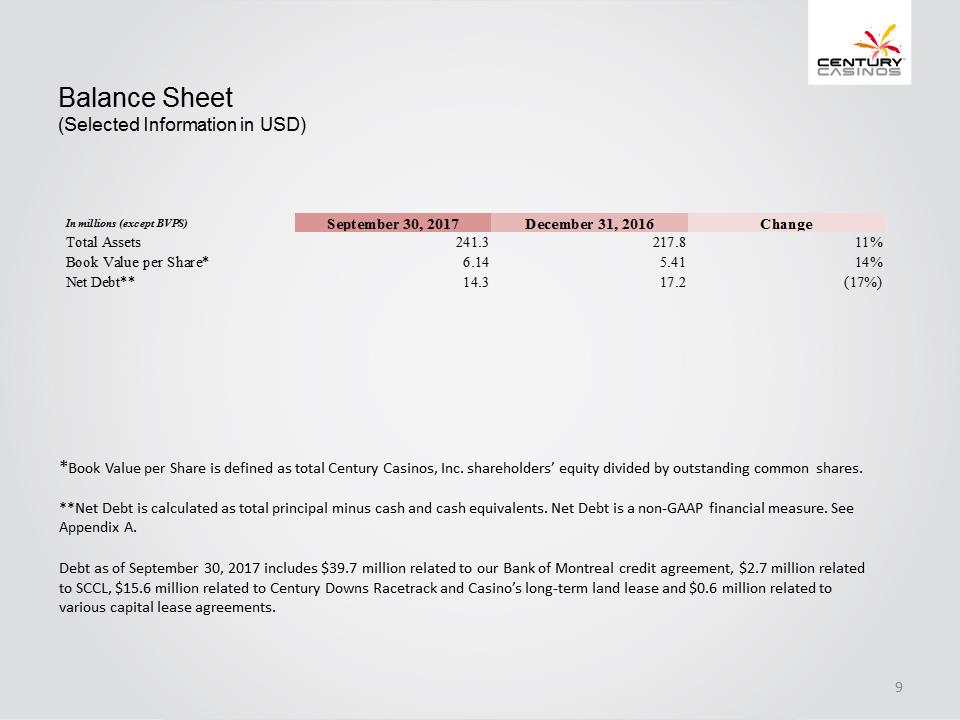

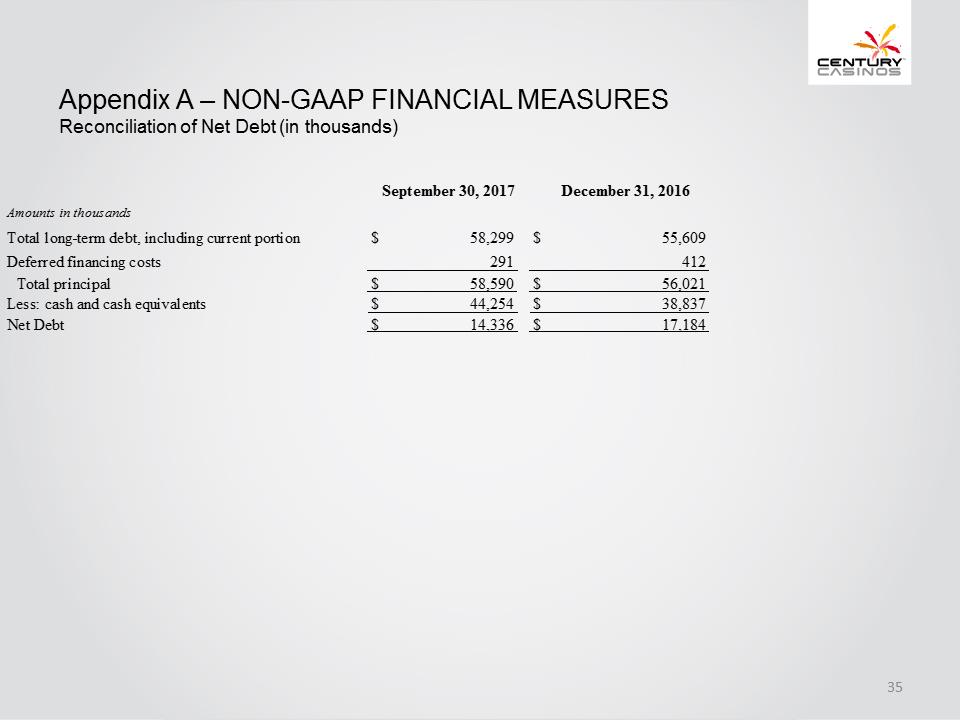

Balance Sheet (Selected Information in USD) * Book Value per Share is defined as total Century Casinos, Inc. shareholders’ equity divided by outstanding common shares. **Net Debt is calculated as total principal minus cash and cash equivalents. Net Debt is a non - GAAP financial measure. See Appendix A. Debt as of September 30, 2017 includes $39.7 million related to our Bank of Montreal credit agreement, $2.7 million related to SCCL, $ 15.6 million related to Century Downs Racetrack and Casino’s long - term land lease and $ 0.6 million related to various capital lease agreements . In millions (except BVPS)September 30, 2017December 31, 2016ChangeTotal Assets 241.3 217.8 11% Book Value per Share*6.14 5.41 14% Net Debt**14.3 17.2 (17%)

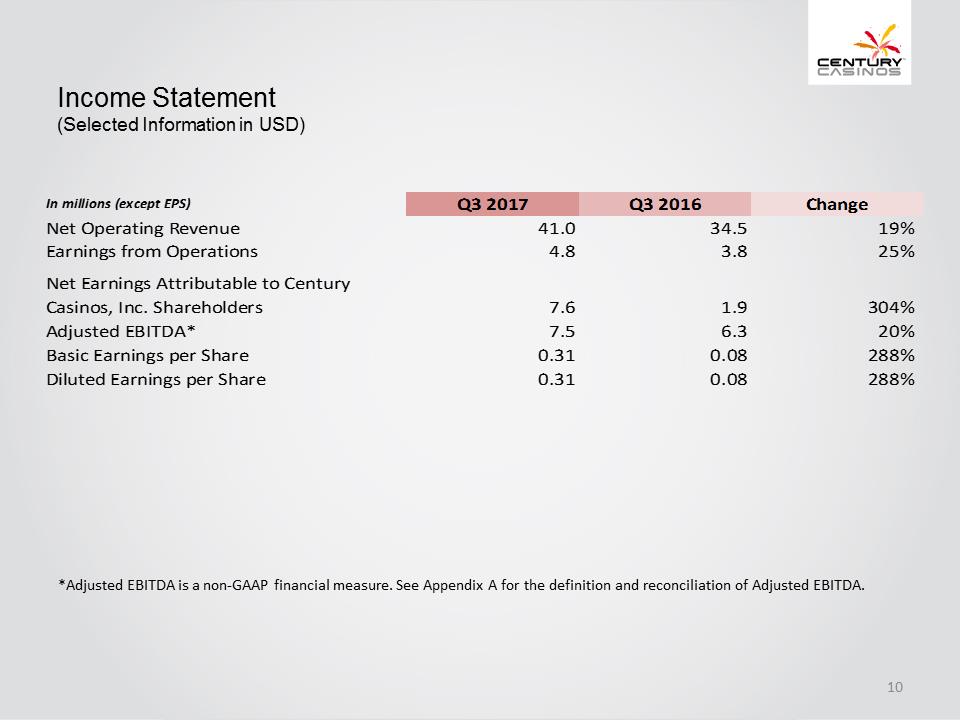

Income Statement (Selected Information in USD) *Adjusted EBITDA is a non - GAAP financial measure. See Appendix A for the definition and reconciliation of Adjusted EBITDA. In millions (except EPS)Q3 2017Q3 2016 Change Net Operating Revenue 41.0 34.5 19% Earnings from Operations 4.8 3.8 25% Net Earnings Attributable to Century Casinos, Inc. Shareholders 7.6 1.9 304% Adjusted EBITDA* 7.5 6.3 20% Basic Earnings per Share 0.31 0.08 288% Diluted Earnings per Share 0.31 0.08 288%

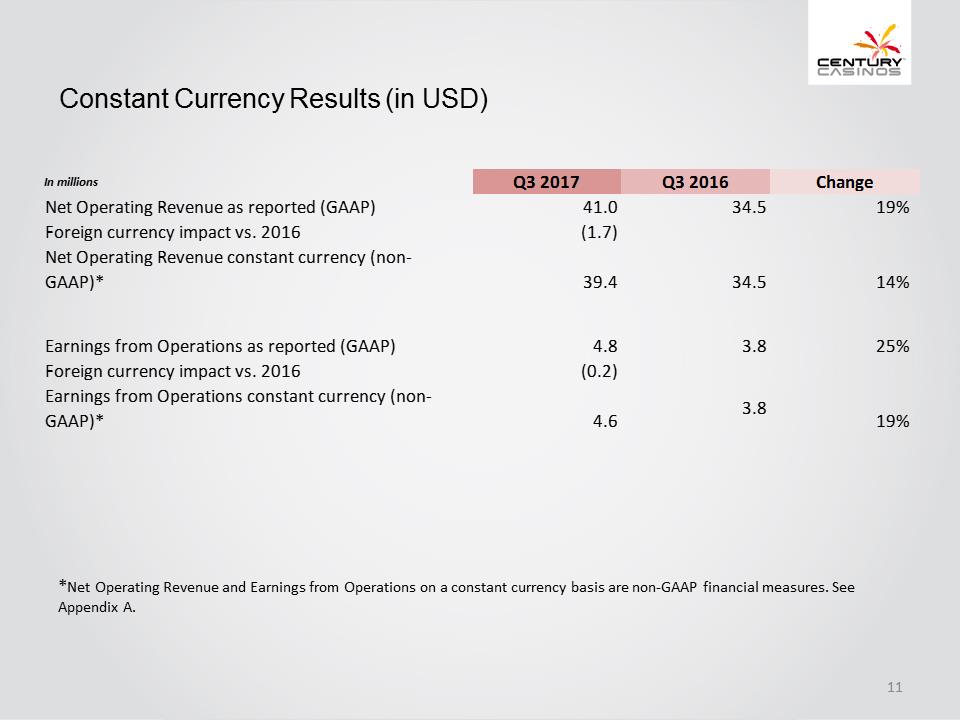

Constant Currency Results (in USD) * Net Operating Revenue and Earnings from Operations on a constant currency basis are non - GAAP financial measures . See Appendix A. In millions Q3 2017 Q3 2016 Change Net Operating Revenue as reported (GAAP) 41.0 34.5 19% Foreign currency impact vs. 2016 (1.7) Net Operating Revenue constant currency (non- GAAP)* 39.4 34.5 14% Earnings from Operations as reported (GAAP) 4.8 3.8 25% Foreign currency impact vs. 2016 (0.2) Earnings from Operations constant currency (non- GAAP)*4.6 3.8 19%

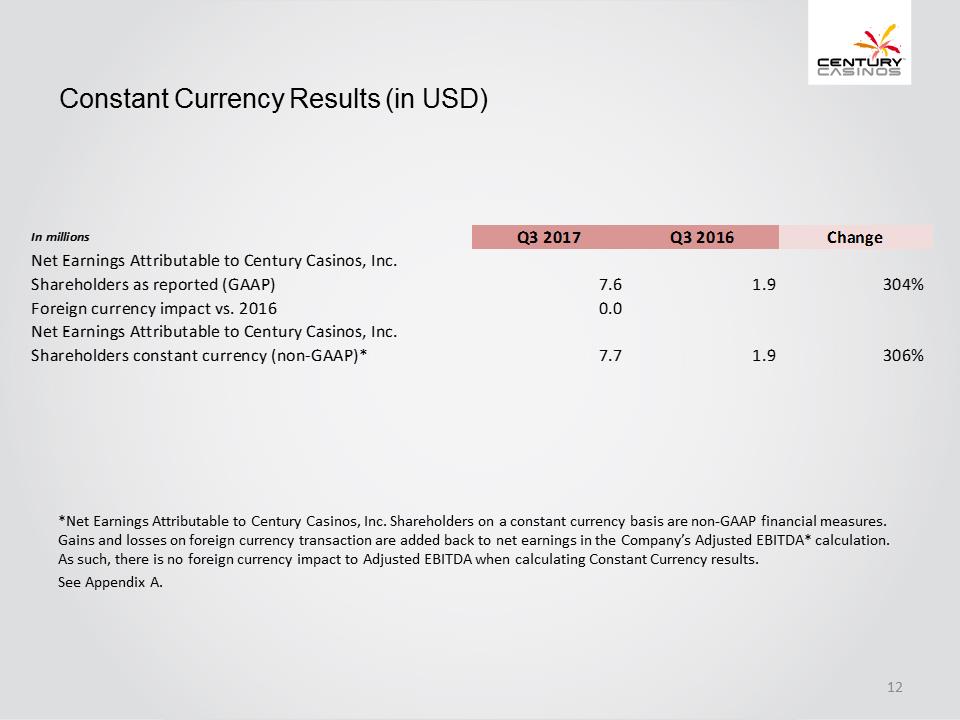

Constant Currency Results (in USD) *Net Earnings Attributable to Century Casinos, Inc. Shareholders on a constant currency basis are non - GAAP financial measures . Gains and losses on foreign currency transaction are added back to net earnings in the Company’s Adjusted EBITDA* calculation . As such, there is no foreign currency impact to Adjusted EBITDA when calculating Constant Currency results. See Appendix A. In millions Q3 2017 Q3 2016 ChangeNet Earnings Attributable to Century Casinos, Inc. Shareholders as reported (GAAP) 7.6 1.9 304% Foreign currency impact vs. 2016 0.0 Net Earnings Attributable to Century Casinos, Inc. Shareholders constant currency (non-GAAP)*7.7 1.9 306%

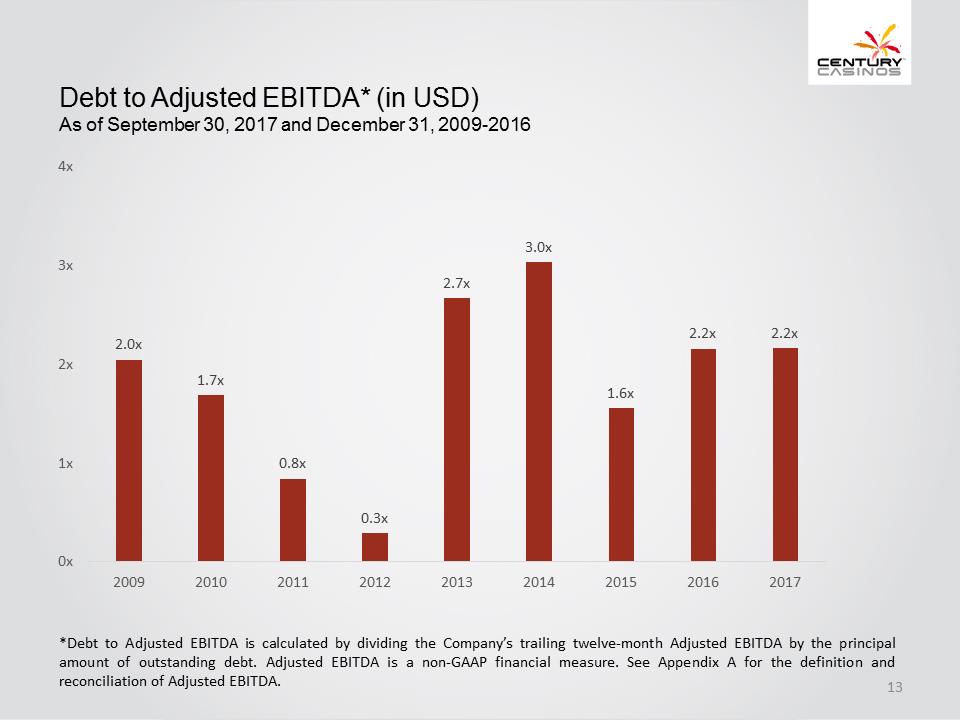

Debt to Adjusted EBITDA* (in USD) As of September 30, 2017 and December 31, 2009 - 2016 2.0x 1.7x 0.8x 0.3x 2.7x 3.0x 1.6x 2.2x 2.2x 0x 1x 2x 3x 4x 2009 2010 2011 2012 2013 2014 2015 2016 2017 *Debt to Adjusted EBITDA is calculated by dividing the Company’s trailing twelve - month Adjusted EBITDA by the principal amount of outstanding debt . Adjusted EBITDA is a non - GAAP financial measure . See Appendix A for the definition and reconciliation of Adjusted EBITDA .

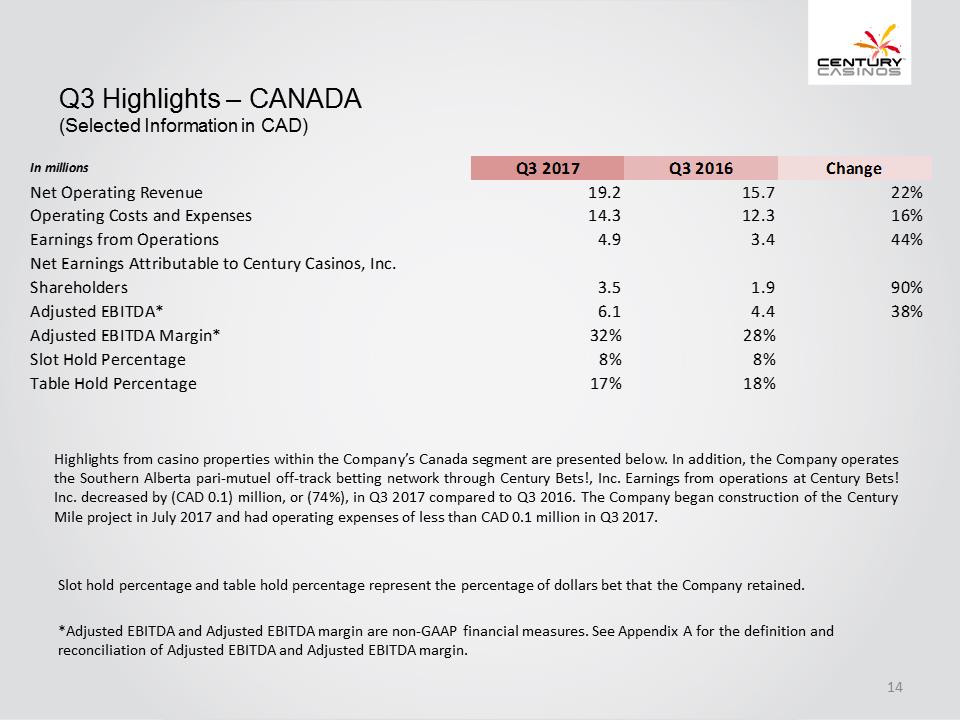

Q3 Highlights – CANADA (Selected Information in CAD) Slot hold percentage and table hold percentage represent the percentage of dollars bet that the Company retained. * Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. In millions Q3 2017Q3 2016ChangeNet Operating Revenue19.2 15.7 22% Operating Costs and Expenses14.3 12.3 16% Earnings from Operations4.9 3.4 44% Net Earnings Attributable to Century Casinos, Inc. Shareholders3.5 1.9 90% Adjusted EBITDA*6.1 4.4 38% Adjusted EBITDA Margin*32%28% Slot Hold Percentage8%8% Table Hold Percentage17%18% Highlights from casino properties within the Company’s Canada segment are presented below . In addition, the Company operates the Southern Alberta pari - mutuel off - track betting network through Century Bets!, Inc . Earnings from operations at Century Bets! Inc . decreased by (CAD 0 . 1 ) million, or ( 74 % ), in Q 3 2017 compared to Q 3 2016 . The Company began construction of the Century Mile project in July 2017 and had operating expenses of less than CAD 0 . 1 million in Q 3 2017 .

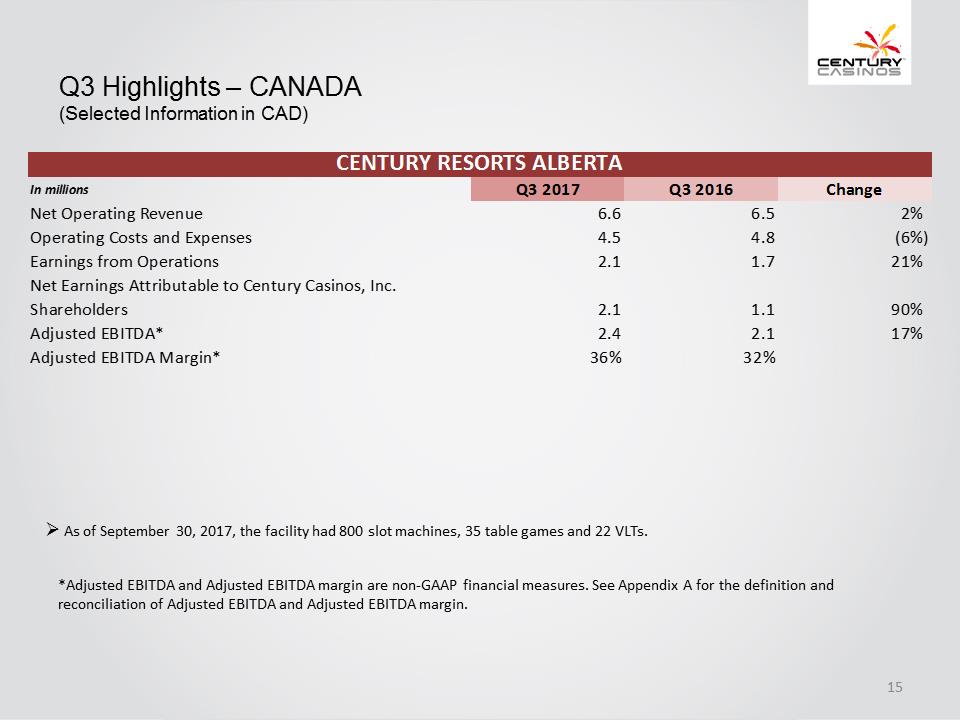

Q3 Highlights – CANADA (Selected Information in CAD) *Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. . As of September 30 , 2017 , the facility had 800 slot machines, 35 table games and 22 VLTs . In millions Q3 2017 Q3 2016 Change Net Operating Revenue 6.6 6.5 2% Operating Costs and Expenses 4.5 4.8 (6%) Earnings from Operations 2.1 1.7 21% Net Earnings Attributable to Century Casinos, Inc. Shareholders 2.1 1.1 90% Adjusted EBITDA*2.4 2.1 17% Adjusted EBITDA Margin*36% 32% CENTURY RESORTS ALBERTA

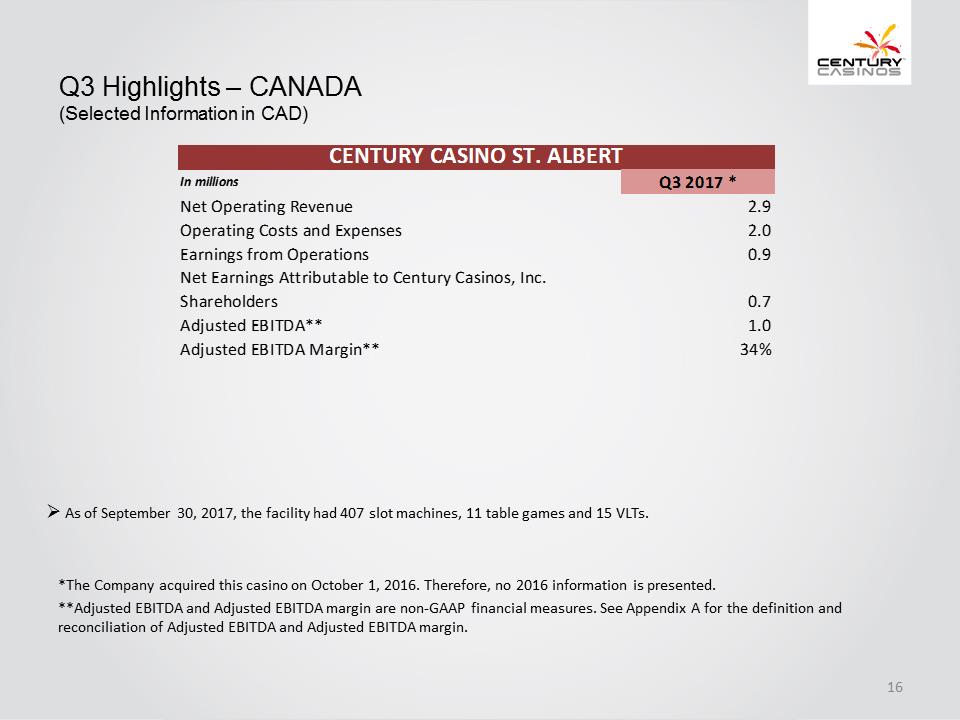

Q3 Highlights – CANADA (Selected Information in CAD) *The Company acquired this casino on October 1, 2016. Therefore , no 2016 information is presented. ** Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. . As of September 30 , 2017 , the facility had 407 slot machines, 11 table games and 15 VLTs . In millions Q3 2017 * Net Operating Revenue2.9 Operating Costs and Expenses2.0 Earnings from Operations0.9 Net Earnings Attributable to Century Casinos, Inc. Shareholders0.7 Adjusted EBITDA**1.0 Adjusted EBITDA Margin**34% CENTURY CASINO ST. ALBERT

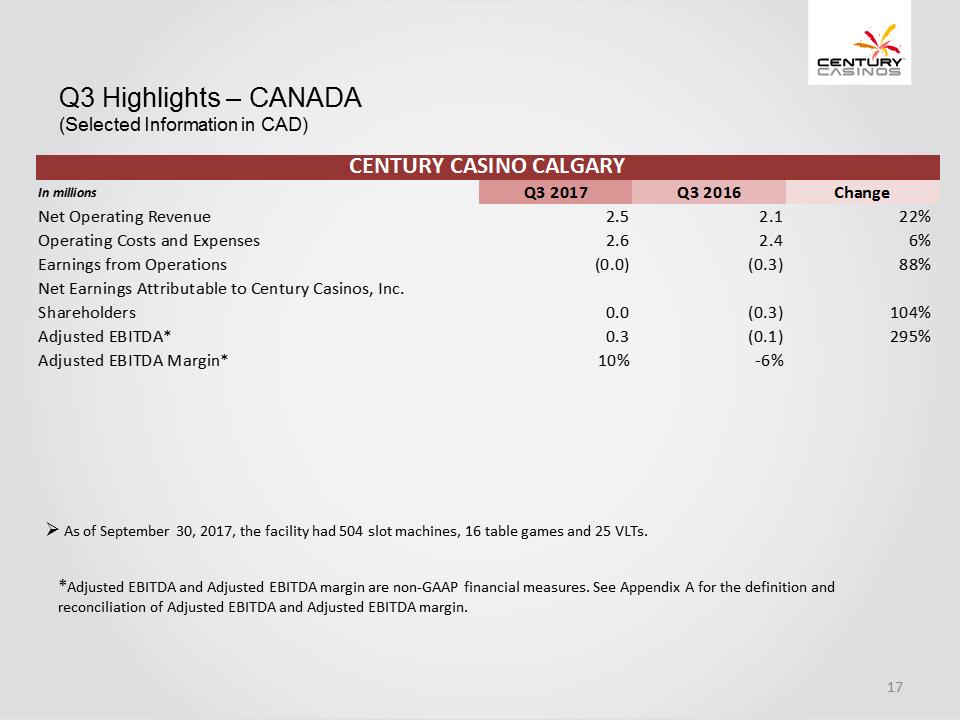

Q3 Highlights – CANADA (Selected Information in CAD) * Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. . As of September 30 , 2017 , the facility had 504 slot machines, 16 table games and 25 VLTs . In millions Q3 2017Q3 2016ChangeNet Operating Revenue2.5 2.1 22% Operating Costs and Expenses2.6 2.4 6% Earnings from Operations(0.0)(0.3)88% Net Earnings Attributable to Century Casinos, Inc. Shareholders0.0 (0.3) 104% Adjusted EBITDA*0.3 (0.1) 295% Adjusted EBITDA Margin*10%-6% CENTURY CASINO CALGARY

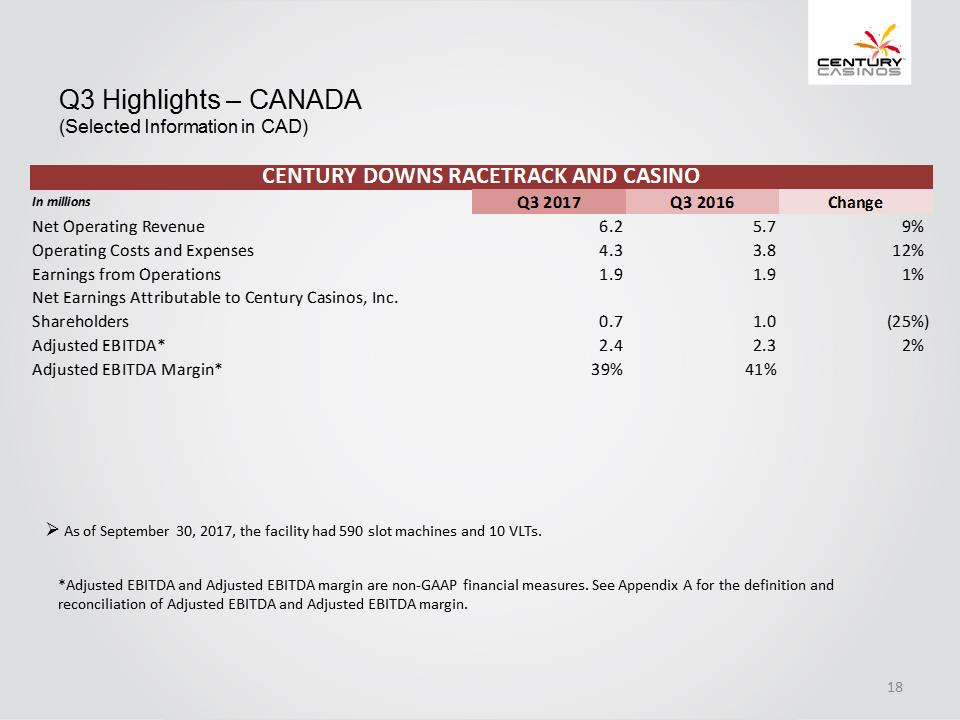

Q3 Highlights – CANADA (Selected Information in CAD) *Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. . As of September 30 , 2017 , the facility had 590 slot machines and 10 VLTs . In millions Q3 2017Q3 2016ChangeNet Operating Revenue6.2 5.7 9% Operating Costs and Expenses4.3 3.8 12% Earnings from Operations1.9 1.9 1% Net Earnings Attributable to Century Casinos, Inc. Shareholders0.7 1.0 (25%) Adjusted EBITDA*2.4 2.3 2% Adjusted EBITDA Margin*39%41% CENTURY DOWNS RACETRACK AND CASINO

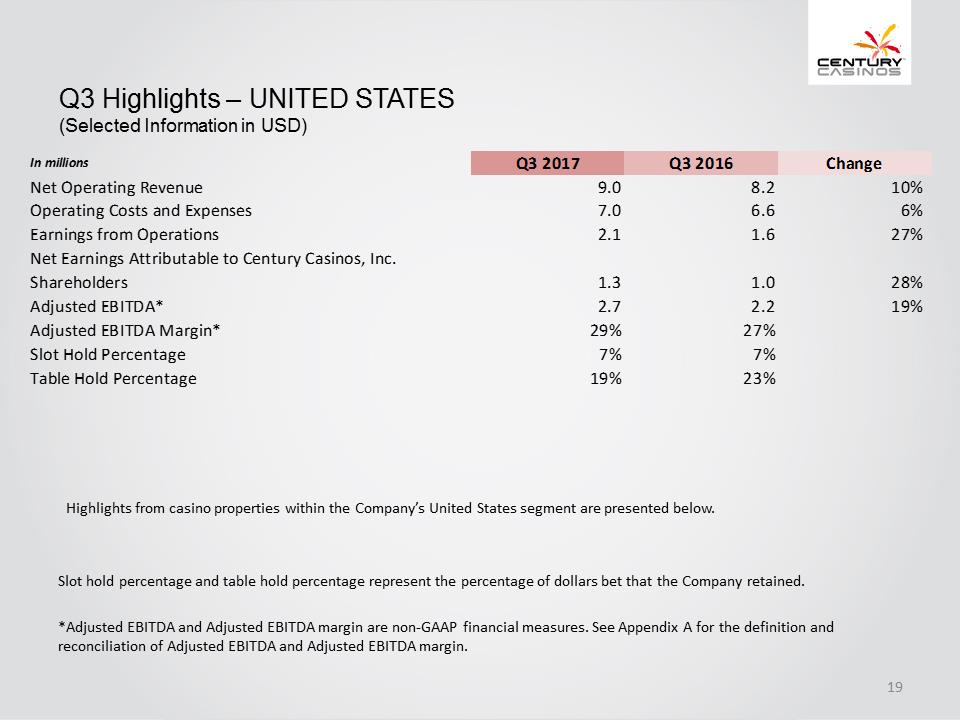

Q3 Highlights – UNITED STATES (Selected Information in USD) Slot hold percentage and table hold percentage represent the percentage of dollars bet that the Company retained. * Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. In millions Q3 2017Q3 2016ChangeNet Operating Revenue9.0 8.2 10% Operating Costs and Expenses7.0 6.6 6% Earnings from Operations2.1 1.6 27% Net Earnings Attributable to Century Casinos, Inc. Shareholders1.3 1.0 28% Adjusted EBITDA*2.7 2.2 19% Adjusted EBITDA Margin*29%27% Slot Hold Percentage7%7% Table Hold Percentage19%23% Highlights from casino properties within the Company’s United States segment are presented below.

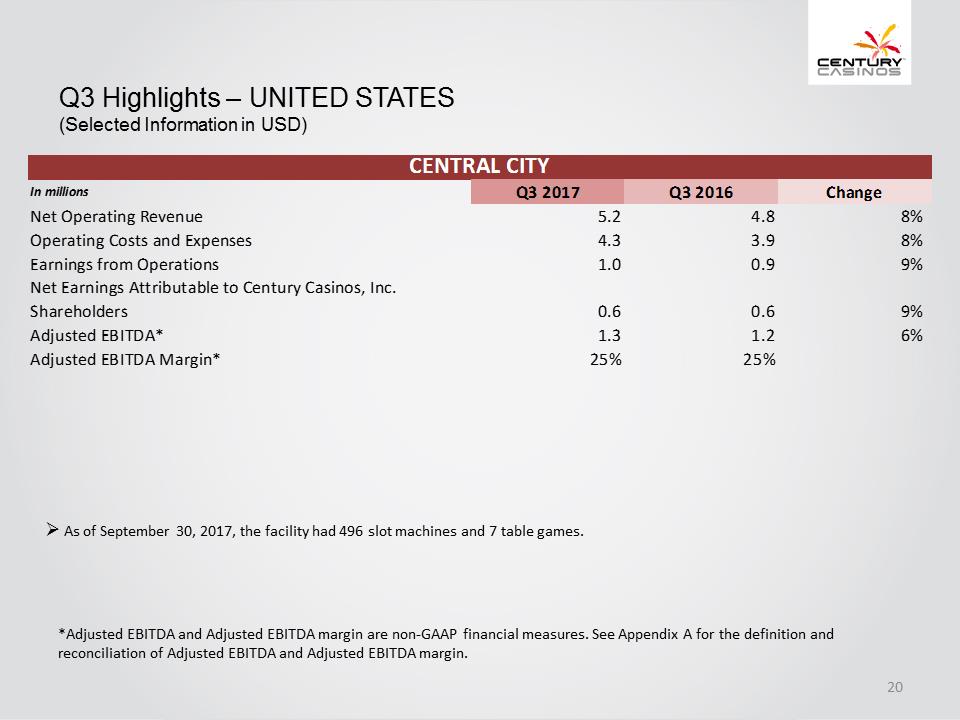

Q3 Highlights – UNITED STATES (Selected Information in USD) *Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. . As of September 30 , 2017 , the facility had 496 slot machines and 7 table games . In millions Q3 2017Q3 2016ChangeNet Operating Revenue5.2 4.8 8% Operating Costs and Expenses4.3 3.9 8% Earnings from Operations1.0 0.9 9% Net Earnings Attributable to Century Casinos, Inc. Shareholders0.6 0.6 9% Adjusted EBITDA*1.3 1.2 6% Adjusted EBITDA Margin*25%25% CENTRAL CITY

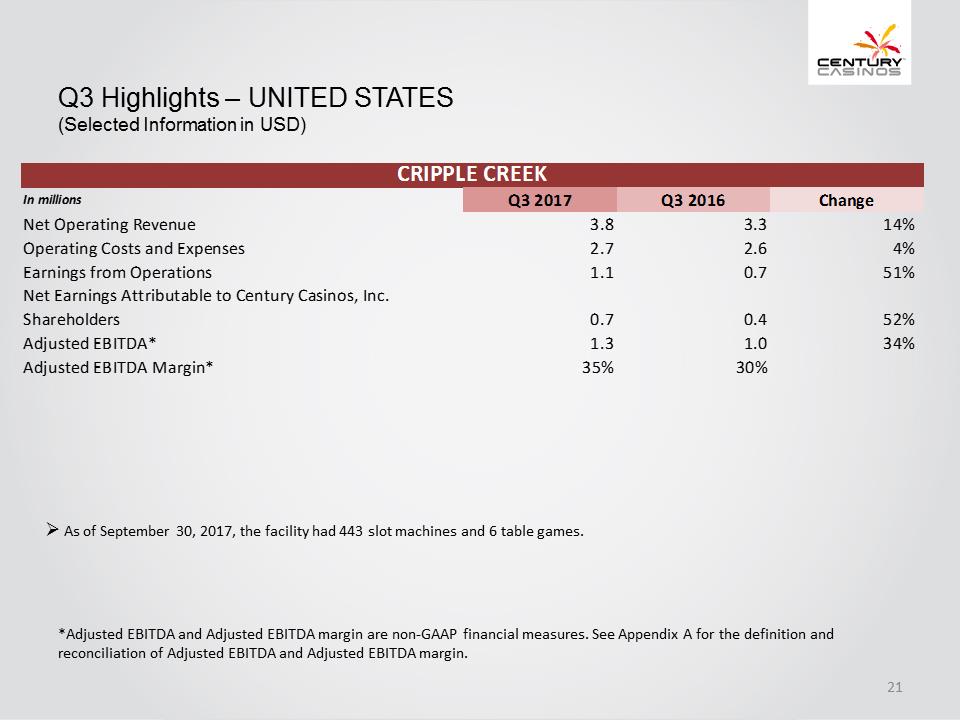

Q3 Highlights – UNITED STATES (Selected Information in USD) *Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. . As of September 30 , 2017 , the facility had 443 slot machines and 6 table games . In millions Q3 2017Q3 2016ChangeNet Operating Revenue3.8 3.3 14% Operating Costs and Expenses2.7 2.6 4% Earnings from Operations1.1 0.7 51% Net Earnings Attributable to Century Casinos, Inc. Shareholders0.7 0.4 52% Adjusted EBITDA*1.3 1.0 34% Adjusted EBITDA Margin*35%30% CRIPPLE CREEK

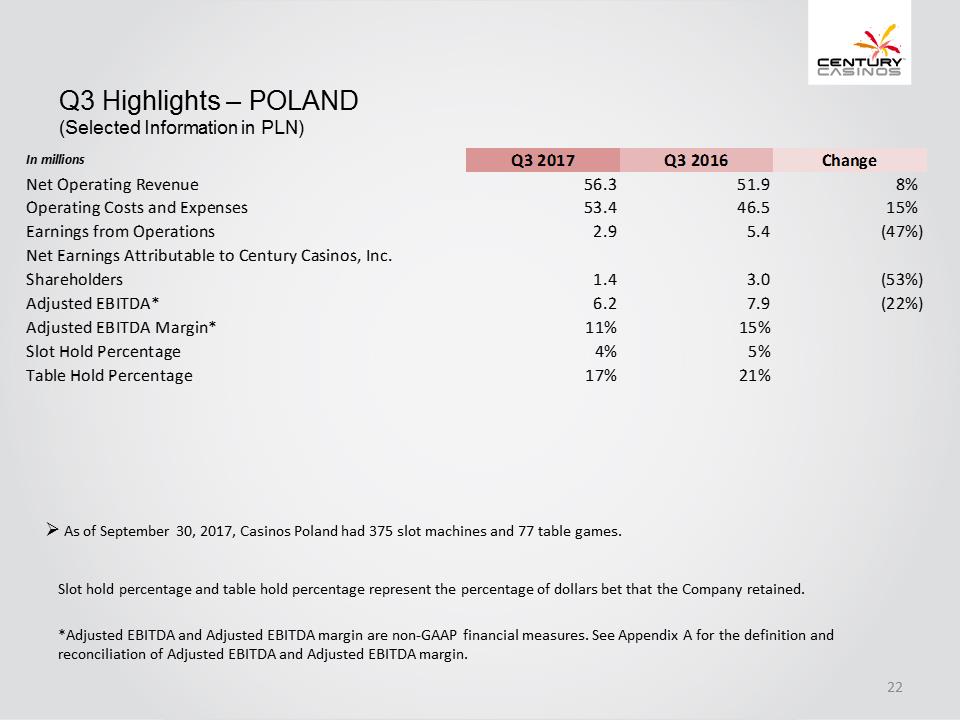

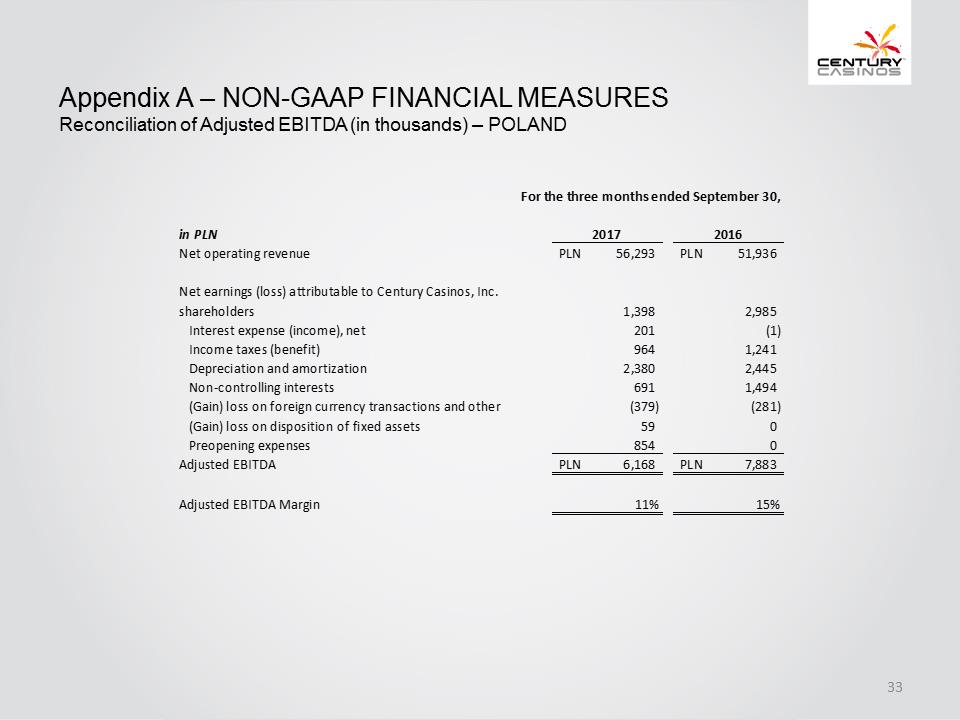

Q3 Highlights – POLAND (Selected Information in PLN) Slot hold percentage and table hold percentage represent the percentage of dollars bet that the Company retained. * Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. . As of September 30 , 2017 , Casinos Poland had 375 slot machines and 77 table games . In millions Q3 2017Q3 2016ChangeNet Operating Revenue56.3 51.9 8% Operating Costs and Expenses53.4 46.5 15% Earnings from Operations2.9 5.4 (47%) Net Earnings Attributable to Century Casinos, Inc. Shareholders1.4 3.0 (53%) Adjusted EBITDA*6.2 7.9 (22%) Adjusted EBITDA Margin*11%15% Slot Hold Percentage4%5% Table Hold Percentage17%21%

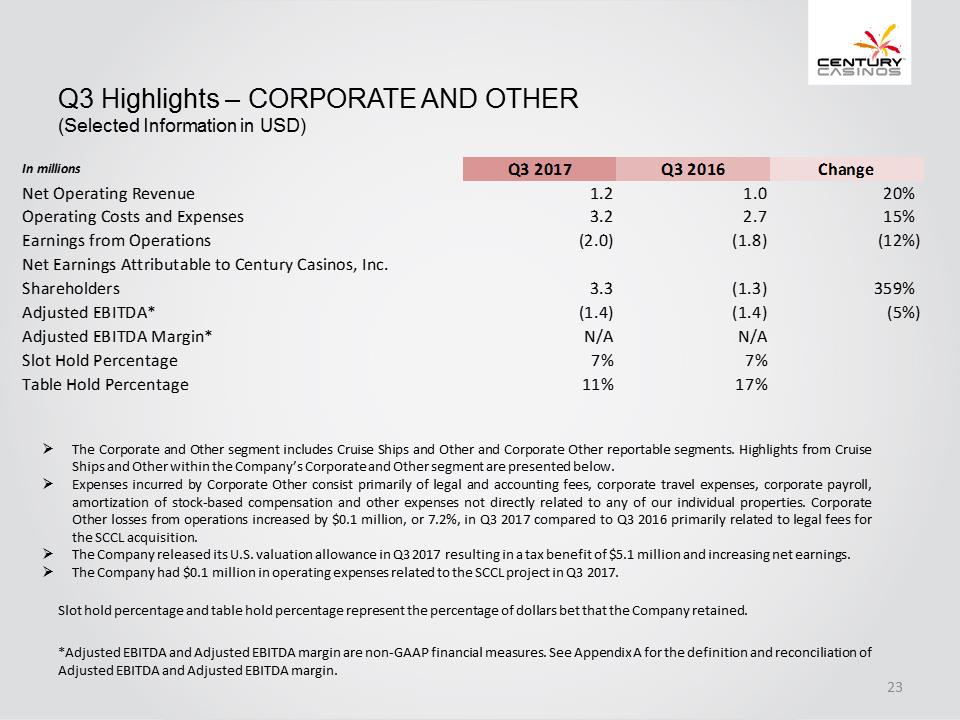

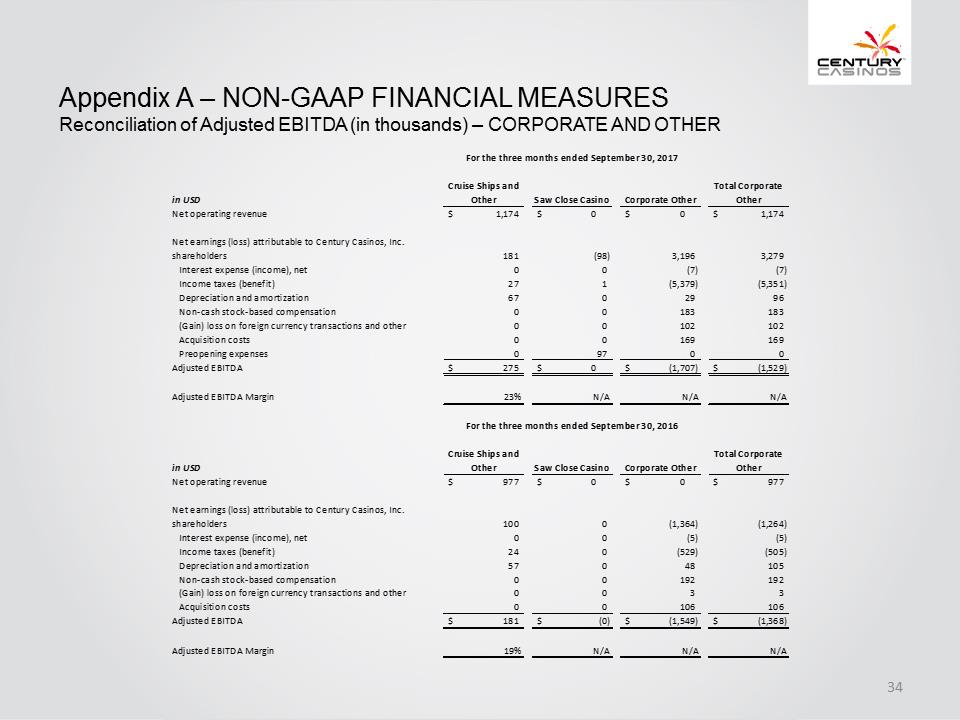

Q3 Highlights – CORPORATE AND OTHER (Selected Information in USD) Slot hold percentage and table hold percentage represent the percentage of dollars bet that the Company retained. * Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. . The Corporate and Other segment includes Cruise Ships and Other and Corporate Other reportable segments . Highlights from Cruise Ships and Other within the Company’s Corporate and Other segment are presented below . . Expenses incurred by Corporate Other consist primarily of legal and accounting fees, corporate travel expenses, corporate payroll, amortization of stock - based compensation and other expenses not directly related to any of our individual properties . Corporate Other losses from operations increased by $ 0 . 1 million, or 7 . 2 % , in Q 3 2017 compared to Q 3 2016 primarily related to legal fees for the SCCL acquisition . . The Company released its U . S . valuation allowance in Q 3 2017 resulting in a tax benefit of $ 5 . 1 million and increasing net earnings . . The Company had $ 0 . 1 million in operating expenses related to the SCCL project in Q 3 2017 . In millions Q3 2017Q3 2016ChangeNet Operating Revenue1.2 1.0 20% Operating Costs and Expenses3.2 2.7 15% Earnings from Operations(2.0)(1.8)(12%) Net Earnings Attributable to Century Casinos, Inc. Shareholders3.3 (1.3)359% Adjusted EBITDA*(1.4)(1.4)(5%) Adjusted EBITDA Margin*N/AN/ASlot Hold Percentage7%7% Table Hold Percentage11%17%

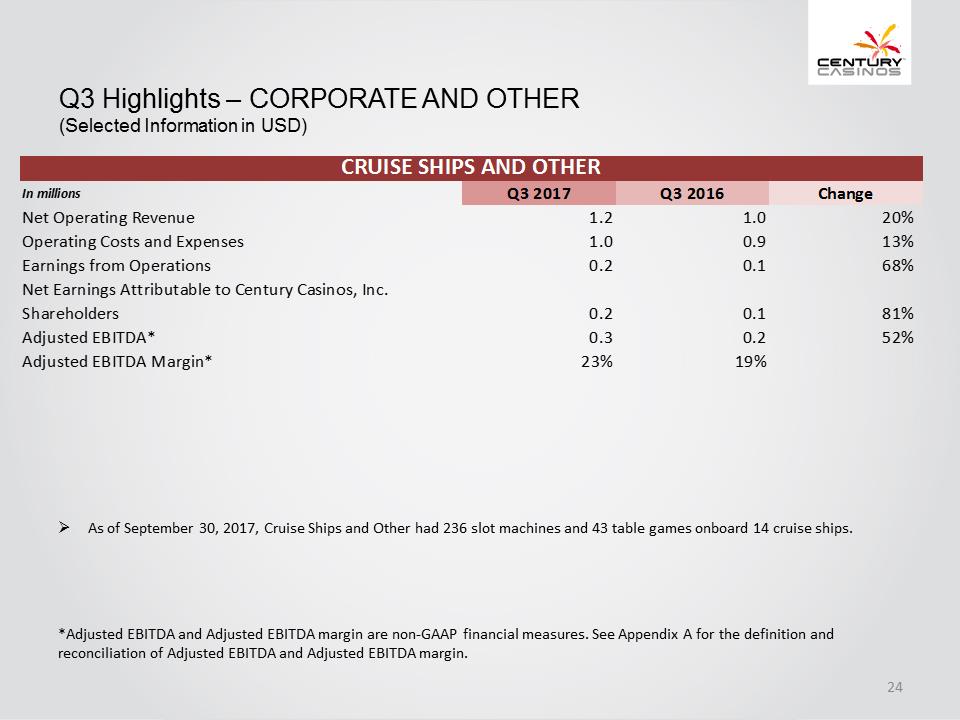

Q3 Highlights – CORPORATE AND OTHER (Selected Information in USD) *Adjusted EBITDA and Adjusted EBITDA margin are non - GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. . As of September 30, 2017, Cruise Ships and Other had 236 slot machines and 43 table games onboard 14 cruise ships. In millions Q3 2017Q3 2016ChangeNet Operating Revenue1.2 1.0 20% Operating Costs and Expenses1.0 0.9 13% Earnings from Operations0.2 0.1 68% Net Earnings Attributable to Century Casinos, Inc. Shareholders0.2 0.1 81% Adjusted EBITDA*0.3 0.2 52% Adjusted EBITDA Margin*23%19% CRUISE SHIPS AND OTHER

Q3 Highlights – ADDITIONAL PROJECTS UNDER DEVELOPMENT Saw Close Casino Ltd . In June 2017 , the Company acquired 100 % of the outstanding common stock and the casino licenses held by Saw Close Casino Ltd . (“ SCCL”) . The Company plans to utilize the casino licenses to develop and operate a casino in Bath, England . The Company estimates that the project will cost approximately $ 7 . 5 million and that the casino will open in the first half of 2018 , subject to the receipt of certain regulatory and governmental approvals . Century Mile In September 2016 , the Company was selected as the successful applicant by Horse Racing Alberta to own, build and operate a horse racing facility in the Edmonton market area, which the Company will operate as Century Mile Racetrack and Casino . Century Mile will be a one - mile horse racetrack and multi - level racing and entertainment center . The project is located on Edmonton International Airport land close to the city of Leduc, south of Edmonton and positioned off Queen Elizabeth II highway . The Company estimates that the project will cost approximately $ 48 . 1 million . Construction of the Century Mile project began in July 2017 . The Company estimates that construction of the project will take approximately 15 months and that it will be completed by the fourth quarter of 2018 . The Company is seeking to obtain financing for the Century Mile project . Bermuda In August 2017 , the Company announced that, together with Hamilton Properties Limited, it had submitted a license application for a casino to the Bermudan government for a casino at the Hamilton Princess Hotel & Beach Club in Hamilton, Bermuda . The Company’s subsidiary, CCE, entered into a long - term management agreement with Hamilton Properties Limited pursuant to which the Company will assist with the license application and manage the operations of the casino for which it will receive a management fee, should the license be awarded . The Bermudan government will issue a provisional casino license as the next step of the application process . The conditions of the provisional casino license must be agreed upon by the Bermudan government and the company awarded the license . The Company currently has no estimated time frame on when this will be completed, and there is no assurance a license will be issued .

Appendix A – ABBREVIATIONS OF CENTURY CASINOS, INC. SUBSIDIARIES AND CERTAIN OPERATING SEGMENTS Subsidiary Abbreviation Century Casino & Hotel - Edmonton CRA Century Casino Calgary CAL Century Downs Racetrack and Casino CDR Century Bets! CBS Century Mile Racetrack and Casino CMR Century Casino & Hotel – Central City CTL Century Casino & Hotel – Cripple Creek CRC Saw Close Casino Ltd. SCCL Operating Segment Abbreviation Cruise Ships & Other Ships & Other Corporate Other N/A

Appendix A – NON - GAAP FINANCIAL MEASURES The Company supplements its condensed consolidated financial statements prepared in accordance with U . S . generally accepted accounting principles (“US GAAP”) by using the following non - GAAP financial measures, which management believes are useful in properly understanding the Company’s short - term and long - term financial trends . Management uses these non - GAAP financial measures to forecast and evaluate the operational performance of the Company as well as to compare results of current periods to prior periods on a consolidated basis . . Adjusted EBITDA . Adjusted EBITDA margin . Constant currency results . Net Debt Management believes presenting the non - GAAP financial measures used in this presentation provides investors greater transparency to the information used by management for financial and operational decision - making and allows investors to see the Company’s results “through the eyes” of management . Management also believes providing this information better enables our investors to understand the Company’s operating performance and evaluate the methodology used by management to evaluate and measure such performance . The adjustments made to U . S . GAAP financial measures result from facts and circumstances that vary in frequency and impact on the Company’s results of operations . The following is an explanation of each of the adjustments that management excludes in calculating its non - GAAP financial measures .

Appendix A – NON - GAAP FINANCIAL MEASURES The Company defines Adjusted EBITDA as net earnings (loss) attributable to Century Casinos, Inc . shareholders before interest expense (income), net, income taxes (benefit), depreciation, amortization, non - controlling interest (earnings) losses and transactions, pre - opening expenses, acquisition costs, non - cash stock - based compensation charges, asset impairment costs, (gain) loss on disposition of fixed assets, discontinued operations, (gain) loss on foreign currency transactions and other, gain on business combination and certain other one - time items, such as acquisition costs . Intercompany transactions consisting primarily of management and royalty fees and interest, along with their related tax effects, are excluded from the presentation of net earnings (loss) and Adjusted EBITDA reported for each segment and property . Not all of the aforementioned items occur in each reporting period, but have been included in the definition based on historical activity . These adjustments have no effect on the consolidated results as reported under US GAAP . Adjusted EBITDA is not considered a measure of performance recognized under US GAAP . Management believes that Adjusted EBITDA is a valuable measure of the relative performance of the Company and its properties . The gaming industry commonly uses Adjusted EBITDA as a method of arriving at the economic value of a casino operation . Management uses Adjusted EBITDA to compare the relative operating performance of separate operating units by eliminating the above mentioned items associated with the varying levels of capital expenditures for infrastructure required to generate revenue, and the often high cost of acquiring existing operations . Adjusted EBITDA is used by the Company’s lending institution to gauge operating performance . The Company’s computation of Adjusted EBITDA may be different from, and therefore may not be comparable to, similar measures used by other companies within the gaming industry . Please see the reconciliation of Adjusted EBITDA to net earnings (loss) attributable to Century Casinos, Inc . shareholders below . The Company defines Adjusted EBITDA margin as Adjusted EBITDA divided by net operating revenue . Management uses this margin as one of several measures to evaluate the efficiency of the Company’s casino operations .

Appendix A – NON - GAAP FINANCIAL MEASURES The impact of foreign exchange rates is highly variable and difficult to predict . The Company uses a Constant Currency basis to show the impact from foreign exchange rates on current period revenue compared to prior period revenue using the prior period’s foreign exchange rates . In order to properly understand the underlying business trends and performance of the Company’s ongoing operations, management believes that investors may find it useful to consider the impact of excluding changes in foreign exchange rates from the Company’s net operating revenue, net earnings (loss) attributable to Century Casinos, Inc . shareholders and Adjusted EBITDA . The Company defines Net Debt as total long - term debt (including current portion) plus deferred financing costs minus cash and cash equivalents . Net Debt is not considered a liquidity measure recognized under US GAAP . Management believes that Net Debt is a valuable measure of our overall financial situation . Net Debt provides investors with an indication of our ability to pay off all of our long - term debt if it became due simultaneously .

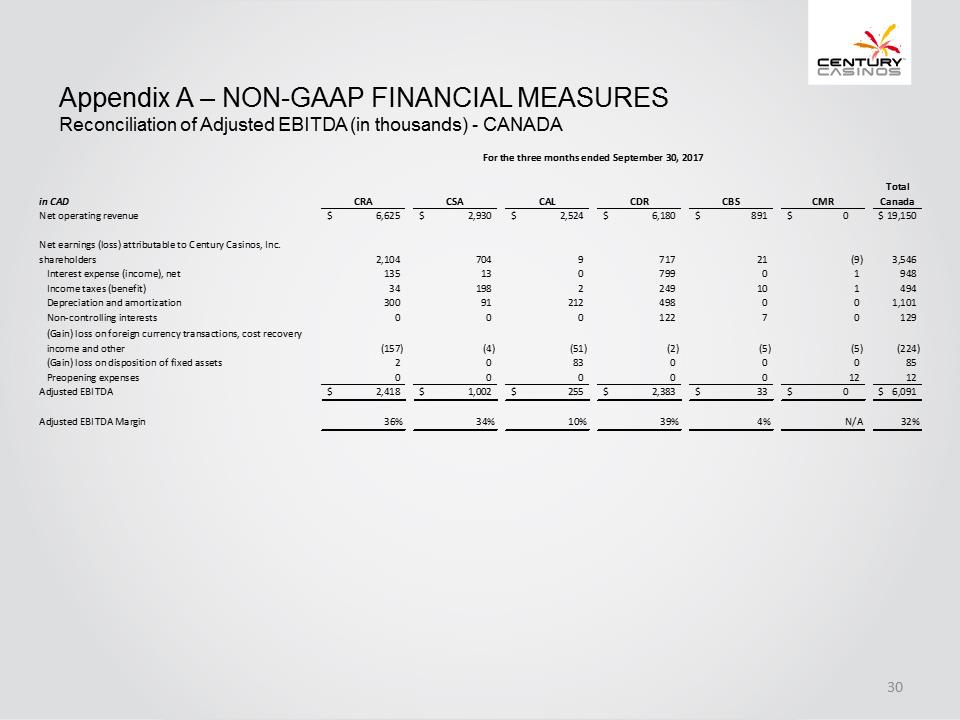

Appendix A – NON - GAAP FINANCIAL MEASURES Reconciliation of Adjusted EBITDA (in thousands) - CANADA in CAD CRA CSA CAL CDR CBS CMR Total Canada Net operating revenue 6,625 $ 2,930 $ 2,524 $ 6,180 $ 891 $ 0 $ 19,150 $ Net earnings (loss) attributable to Century Casinos, Inc. shareholders 2,104 704 9 717 21 (9) 3,546 Interest expense (income), net 135 13 0 799 0 1 948 Income taxes (benefit) 34 198 2 249 10 1 494 Depreciation and amortization 300 91 212 498 0 0 1,101 Non-controlling interests 0 0 0 122 7 0 129 (Gain) loss on foreign currency transactions, cost recovery income and other (157) (4) (51) (2) (5) (5) (224) (Gain) loss on disposition of fixed assets 2 0 83 0 0 0 85 Preopening expenses 0 0 0 0 0 12 12 Adjusted EBITDA 2,418 $ 1,002 $ 255 $ 2,383 $ 33 $ 0 $ 6,091 $ Adjusted EBITDA Margin 36% 34% 10% 39% 4% N/A 32% For the three months ended September 30, 2017

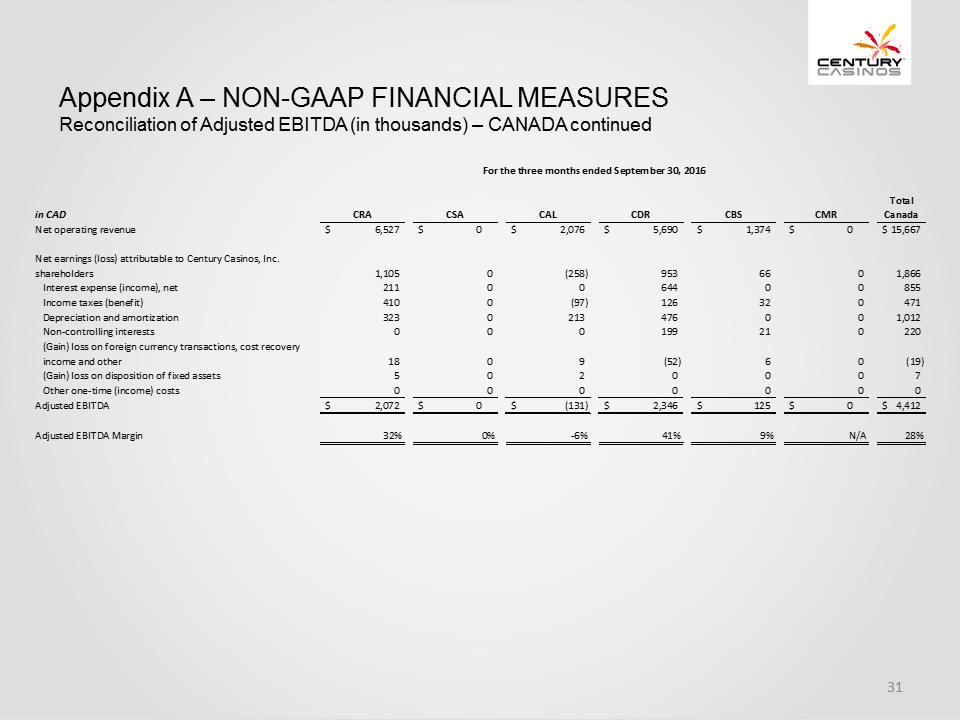

Appendix A – NON - GAAP FINANCIAL MEASURES Reconciliation of Adjusted EBITDA (in thousands) – CANADA continued in CAD CRA CSA CAL CDR CBS CMR Total Canada Net operating revenue 6,527$ 0$ 2,076$ 5,690$ 1,374$ 0$ 15,667$ Net earnings (loss) attributable to Century Casinos, Inc. shareholders 1,105 0 (258) 953 66 0 1,866 Interest expense (income), net 211 0 0 644 0 0 855 Income taxes (benefit) 410 0 (97) 126 32 0 471 Depreciation and amortization 323 0 213 476 0 0 1,012 Non-controlling interests 0 0 0 199 21 0 220 (Gain) loss on foreign currency transactions, cost recovery income and other 18 0 9 (52) 6 0 (19) (Gain) loss on disposition of fixed assets 5 0 2 0 0 0 7 Other one-time (income) costs 0 0 0 0 0 0 0 Adjusted EBITDA 2,072$ 0$ (131)$ 2,346$ 125$ 0$ 4,412$ Adjusted EBITDA Margin32%0%-6%41%9%N/A28% For the three months ended September 30, 2016

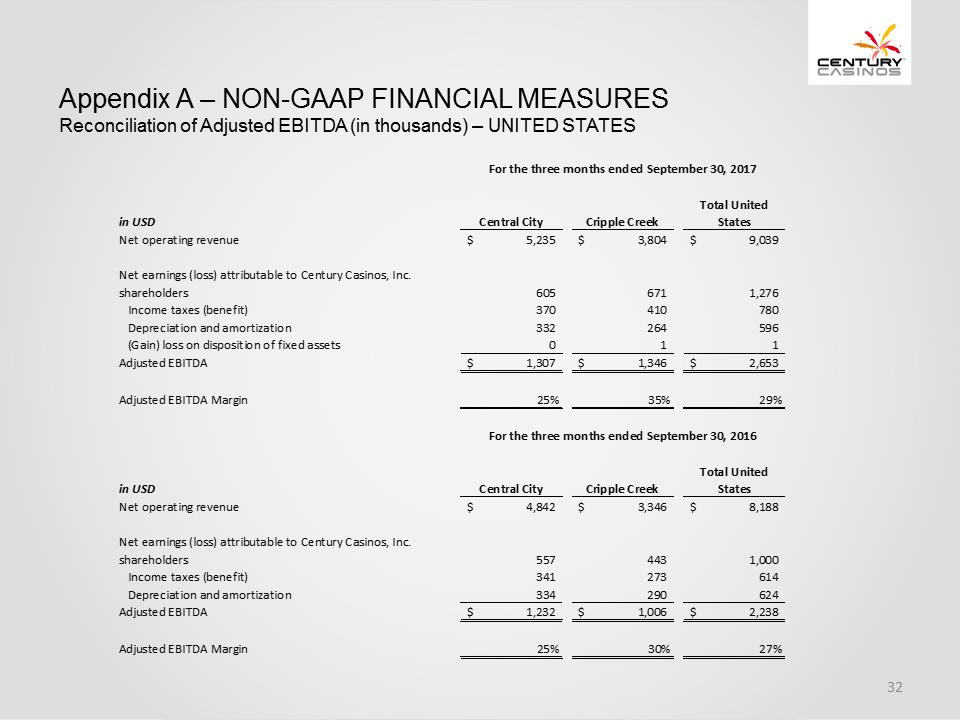

Appendix A – NON - GAAP FINANCIAL MEASURES Reconciliation of Adjusted EBITDA (in thousands) – UNITED STATES in USD Central City Cripple Creek Total United States Net operating revenue 5,235$ 3,804$ 9,039$ Net earnings (loss) attributable to Century Casinos, Inc. shareholders 605 671 1,276 Income taxes (benefit) 370 410 780 Depreciation and amortization 332 264 596 (Gain) loss on disposition of fixed assets 0 1 1 Adjusted EBITDA1,307$ 1,346$ 2,653$ Adjusted EBITDA Margin25%35%29% in USD Central City Cripple Creek Total United States Net operating revenue4,842$ 3,346$ 8,188$ Net earnings (loss) attributable to Century Casinos, Inc. shareholders 557 443 1,000 Income taxes (benefit) 341 273 614 Depreciation and amortization 334 290 624 Adjusted EBITDA1,232$ 1,006$ 2,238$ Adjusted EBITDA Margin25%30%27% For the three months ended September 30, 2017For the three months ended September 30, 2016

Appendix A – NON - GAAP FINANCIAL MEASURES Reconciliation of Adjusted EBITDA (in thousands) – POLAND in PLN 2017 2016 Net operating revenue 56,293 PLN 51,936PLN Net earnings (loss) attributable to Century Casinos, Inc. shareholders 1,398 2,985 Interest expense (income), net 201 (1) Income taxes (benefit) 964 1,241 Depreciation and amortization 2,380 2,445 Non-controlling interests 691 1,494 (Gain) loss on foreign currency transactions and other(379)(281) (Gain) loss on disposition of fixed assets 59 0 Preopening expenses 854 0 Adjusted EBITDA6,168PLN 7,883PLN Adjusted EBITDA Margin11%15% For the three months ended September 30,

Appendix A – NON - GAAP FINANCIAL MEASURES Reconciliation of Adjusted EBITDA (in thousands) – CORPORATE AND OTHER in USD Cruise Ships and Other Saw Close Casino Corporate Other Total Corporate Other Net operating revenue1,174$ 0$ 0$ 1,174$ Net earnings (loss) attributable to Century Casinos, Inc. shareholders 181 (98) 3,196 3,279 Interest expense (income), net 0 0 (7) (7) Income taxes (benefit) 27 1 (5,379) (5,351) Depreciation and amortization 67 0 29 96 Non-cash stock-based compensation 0 0 183 183 (Gain) loss on foreign currency transactions and other 0 0 102 102 Acquisition costs 0 0 169 169 Preopening expenses 0 97 0 0 Adjusted EBITDA275$ 0$ (1,707)$ (1,529)$ Adjusted EBITDA Margin23%N/AN/AN/Ain USDCruise Ships and Other Saw Close Casino Corporate Other Total Corporate Other Net operating revenue977$ 0$ 0$ 977$ Net earnings (loss) attributable to Century Casinos, Inc. shareholders 100 0 (1,364) (1,264) Interest expense (income), net 0 0 (5) (5) Income taxes (benefit) 24 0 (529) (505) Depreciation and amortization 57 0 48 105 Non-cash stock-based compensation 0 0 192 192 (Gain) loss on foreign currency transactions and other 0 0 3 3 Acquisition costs00106106Adjusted EBITDA181$ (0)$ (1,549)$ (1,368)$ Adjusted EBITDA Margin19% N/A N/A N/A For the three months ended September 30, 2017For the three months ended September 30, 2016

Appendix A – NON - GAAP FINANCIAL MEASURES Reconciliation of Net Debt (in thousands) September 30, 2017 December 31, 2016Amounts in thousands Total long-term debt, including current portion$58,299$55,609 Deferred financing costs 291 412 Total principal$58,590$56,021Less: cash and cash equivalents$44,254$38,837Net Debt$14,336$17,184