Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Broadcom Pte. Ltd. | d488238dex991.htm |

| 8-K - FORM 8-K - Broadcom Pte. Ltd. | d488238d8k.htm |

Broadcom Proposal to Acquire Qualcomm Creating a leading diversified communications semiconductor company Investor Presentation November 6, 2017 Exhibit 99.2

Cautions Regarding Forward-Looking Statements This communication contains forward-looking statements (including within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended, and Section 27A of the United States Securities Act of 1933, as amended) concerning Broadcom and Qualcomm. These statements include, but are not limited to, statements that address Broadcom’s expected future business and financial performance and statements about (i) proposed transaction involving Broadcom and Qualcomm and the expected benefits of the proposed transaction, (ii) the expected benefits of other acquisitions, (iii) Broadcom’s plans, objectives and intentions with respect to future operations and products, (iv) Broadcom’s competitive position and opportunities, (v) the impact of acquisitions on the market for Broadcom’s products, and (vi) other statements identified by words such as “will”, “expect”, “believe”, “anticipate”, “estimate”, “should”, “intend”, “plan”, “potential”, “predict”, “project”, “aim”, and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of the management of Broadcom, as well as assumptions made by, and information currently available to, such management, current market trends and market conditions and involve risks and uncertainties, many of which are outside Broadcom’s and management’s control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements. Such risks, uncertainties and assumptions include: the ultimate outcome of any possible transaction between Broadcom and Qualcomm, including the possibility that Qualcomm will reject the proposed transaction with Broadcom; uncertainties as to whether Qualcomm will cooperate with Broadcom regarding the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Broadcom and Qualcomm to retain customers, to retain and hire key personnel and to maintain favorable relationships with suppliers or customers; the timing of the proposed transaction; the ability to obtain regulatory approvals and satisfy other closing conditions to the completion of the proposed transaction (including shareholder approvals); and other risks related to the completion of the proposed transaction and actions related thereto. Other risks, uncertainties and assumptions that could materially affect future results include: any risks associated with loss of Broadcom’s significant customers and fluctuations in the timing and volume of significant customer demand; Broadcom’s dependence on contract manufacturers and outsourced supply chain; any acquisitions Broadcom may make, as well as delays, challenges and expenses associated with receiving governmental and regulatory approvals and satisfying other closing conditions, and with integrating acquired companies with Broadcom’s existing businesses and Broadcom’s ability to achieve the benefits, growth prospects and synergies expected from such acquisitions, including Broadcom’s pending acquisition of Brocade Communications Systems, Inc. and Broadcom’s proposed acquisition of Qualcomm; the ability of Broadcom to integrate Qualcomm’s business and make changes to its business model, and to resolve legal proceedings, governmental investigations and customer disputes relating to Qualcomm’s licensing practices; Broadcom’s ability to accurately estimate customers’ demand and adjust Broadcom’s manufacturing and supply chain accordingly; Broadcom’s significant indebtedness, including the substantial indebtedness Broadcom expects to incur in connection with Broadcom’s proposed acquisition of Qualcomm, and the need to generate sufficient cash flows to service and repay such debt; dependence on and risks associated with distributors of Broadcom’s products; Broadcom’s ability to improve its manufacturing efficiency and quality; increased dependence on a small number of markets; quarterly and annual fluctuations in operating results; cyclicality in the semiconductor industry or in Broadcom’s target markets; global economic conditions and concerns; Broadcom’s competitive performance and ability to continue achieving design wins with its customers, as well as the timing of those design wins; rates of growth in Broadcom’s target markets; prolonged disruptions of Broadcom’s or its contract manufacturers’ manufacturing facilities or other significant operations; Broadcom’s dependence on outsourced service providers for certain key business services and their ability to execute to its requirements; Broadcom’s ability to maintain or improve gross margin; Broadcom’s ability to maintain tax concessions in certain jurisdictions; Broadcom’s ability to protect its intellectual property and the unpredictability of any associated litigation expenses; any expenses or reputational damage associated with resolving customer product and warranty and indemnification claims; Broadcom’s ability to sell to new types of customers and to keep pace with technological advances; market acceptance of the end products into which Broadcom’s products are designed; and other events and trends on a national, regional and global scale, including those of a political, economic, business, competitive and regulatory nature. Broadcom’s filings with the Securities and Exchange Commission (“SEC”), which you may obtain for free at the SEC’s website at http://www.sec.gov, discuss some of the important risk factors that may affect Broadcom’s business, results of operations and financial condition. Broadcom undertakes no intent or obligation to publicly update or revise any of these forward looking statements, whether as a result of new information, future events or otherwise, except as required by law. Additional Information This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which Broadcom has made for an acquisition of Qualcomm. In furtherance of this proposal and subject to future developments, Broadcom (and, if a negotiated transaction is agreed, Qualcomm) may file one or more registration statements, proxy statements, tender offer statements or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, tender offer statement, prospectus or other document Broadcom and/or Qualcomm may file with the SEC in connection with the proposed transaction. Investors and security holders of Broadcom and Qualcomm are urged to read the proxy statement(s), registration statement, tender offer statement, prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to stockholders of Broadcom and/or Qualcomm, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Broadcom through the web site maintained by the SEC at http://www.sec.gov. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Broadcom and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. You can find information about Broadcom’s executive officers and directors in Broadcom’s definitive proxy statement filed with the SEC on February 17, 2017. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender offer statements or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website http://www.sec.gov. This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which Broadcom has made for an acquisition of Qualcomm. In furtherance of this proposal and subject to future developments, Broadcom (and, if a negotiated transaction is agreed, Qualcomm) may file one or more registration statements, proxy statements, tender offer statements or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, tender offer statement, prospectus or other document Broadcom and/or Qualcomm may file with the SEC in connection with the proposed transaction. Investors and security holders of Broadcom and Qualcomm are urged to read the proxy statement(s), registration statement, tender offer statement, prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to stockholders of Broadcom and/or Qualcomm, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Broadcom through the web site maintained by the SEC at http://www.sec.gov. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Broadcom and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. You can find information about Broadcom’s executive officers and directors in Broadcom’s definitive proxy statement filed with the SEC on February 17, 2017. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender offer statements or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website http://www.sec.gov. Forward-Looking Statements

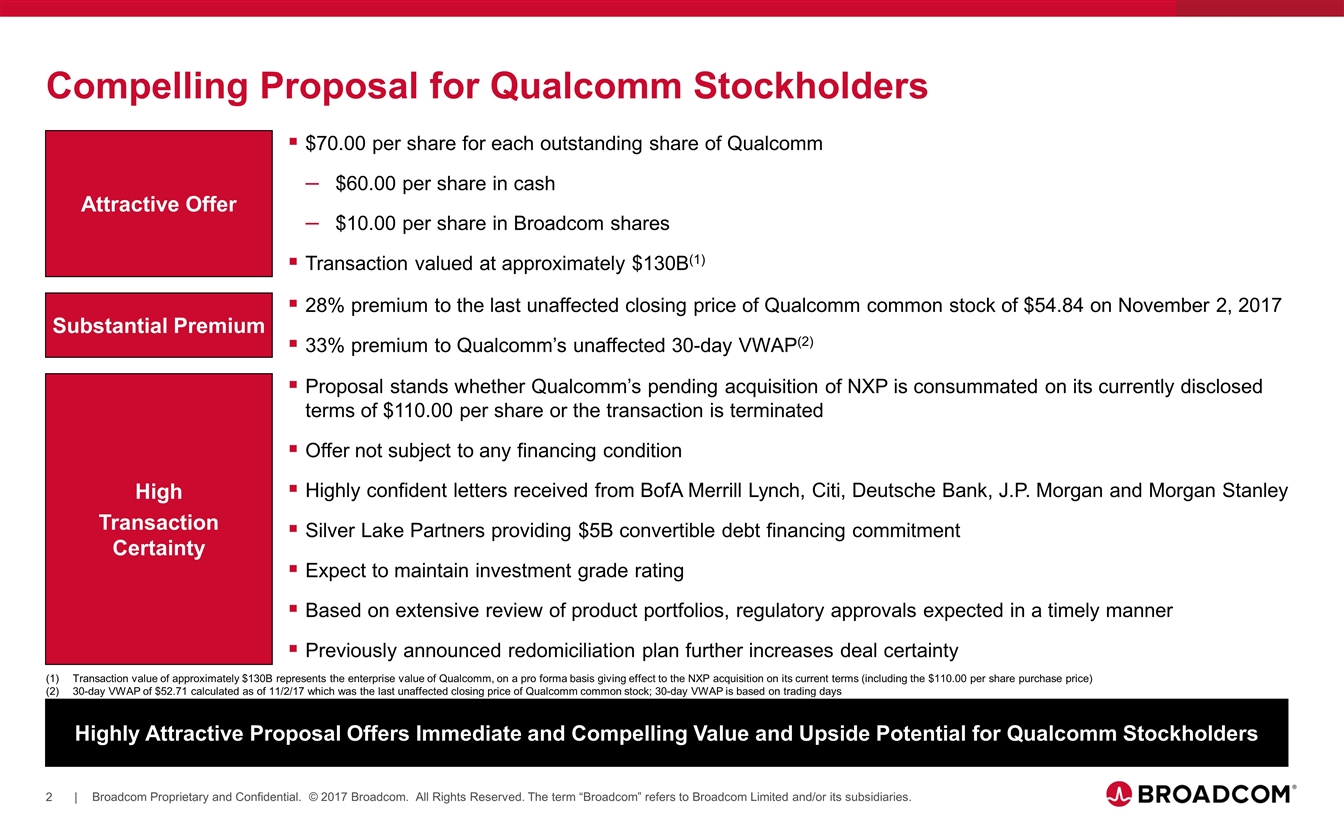

Attractive Offer Substantial Premium High Transaction Certainty Highly Attractive Proposal Offers Immediate and Compelling Value and Upside Potential for Qualcomm Stockholders $70.00 per share for each outstanding share of Qualcomm $60.00 per share in cash $10.00 per share in Broadcom shares Transaction valued at approximately $130B(1) 28% premium to the last unaffected closing price of Qualcomm common stock of $54.84 on November 2, 2017 33% premium to Qualcomm’s unaffected 30-day VWAP(2) Proposal stands whether Qualcomm’s pending acquisition of NXP is consummated on its currently disclosed terms of $110.00 per share or the transaction is terminated Offer not subject to any financing condition Highly confident letters received from BofA Merrill Lynch, Citi, Deutsche Bank, J.P. Morgan and Morgan Stanley Silver Lake Partners providing $5B convertible debt financing commitment Expect to maintain investment grade rating Based on extensive review of product portfolios, regulatory approvals expected in a timely manner Previously announced redomiciliation plan further increases deal certainty Compelling Proposal for Qualcomm Stockholders Transaction value of approximately $130B represents the enterprise value of Qualcomm, on a pro forma basis giving effect to the NXP acquisition on its current terms (including the $110.00 per share purchase price) 30-day VWAP of $52.71 calculated as of 11/2/17 which was the last unaffected closing price of Qualcomm common stock; 30-day VWAP is based on trading days

Strategically and Financially Attractive Transaction Creates a leading diversified communications semiconductor company Strengthens the portfolio of category leading segments in mobile, wired infrastructure and automotive / industrial Accelerates innovation and ability to deliver advanced semiconductor solutions to global customers Enhances financial profile: scale, diversification, immediate EPS accretion and strong free cash flow generation Clear Transaction Rationale Supported by Significant Value Creation for Both Broadcom and Qualcomm Stockholders

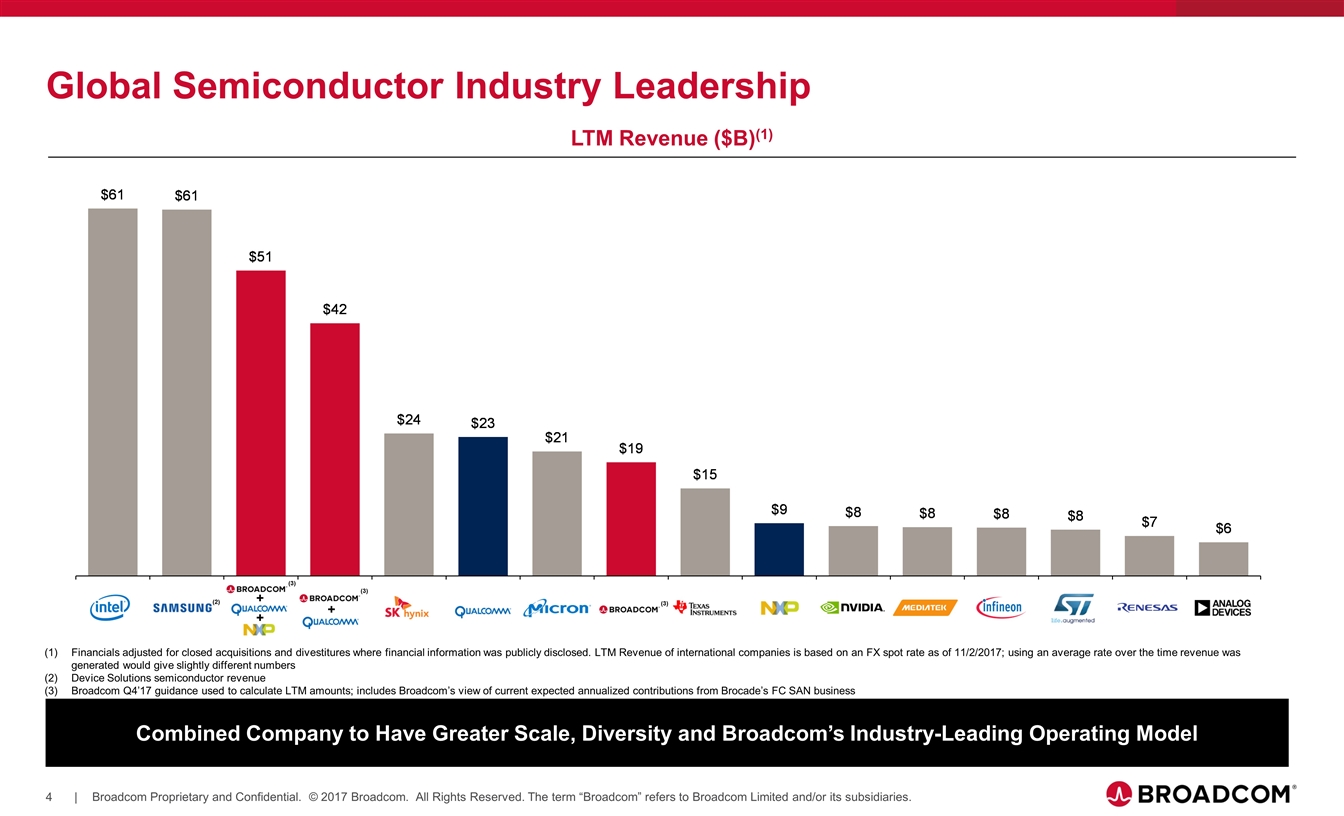

Global Semiconductor Industry Leadership Financials adjusted for closed acquisitions and divestitures where financial information was publicly disclosed. LTM Revenue of international companies is based on an FX spot rate as of 11/2/2017; using an average rate over the time revenue was generated would give slightly different numbers Device Solutions semiconductor revenue Broadcom Q4’17 guidance used to calculate LTM amounts; includes Broadcom’s view of current expected annualized contributions from Brocade’s FC SAN business Combined Company to Have Greater Scale, Diversity and Broadcom’s Industry-Leading Operating Model (3) + + + (3) (3) LTM Revenue ($B)(1) (2)

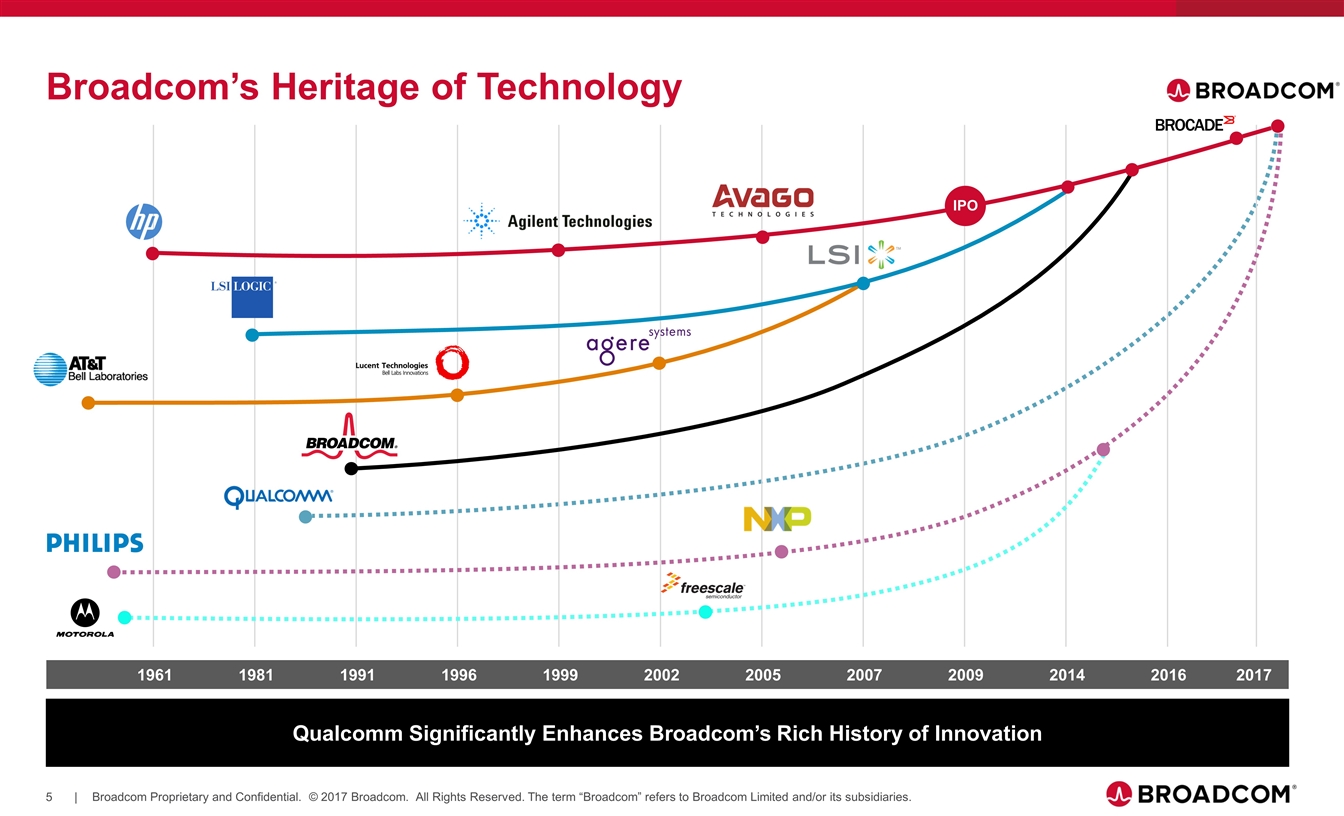

Qualcomm Significantly Enhances Broadcom’s Rich History of Innovation Broadcom’s Heritage of Technology IPO 1961 1981 1991 1996 1999 2002 2005 2007 2009 2014 2016 2017

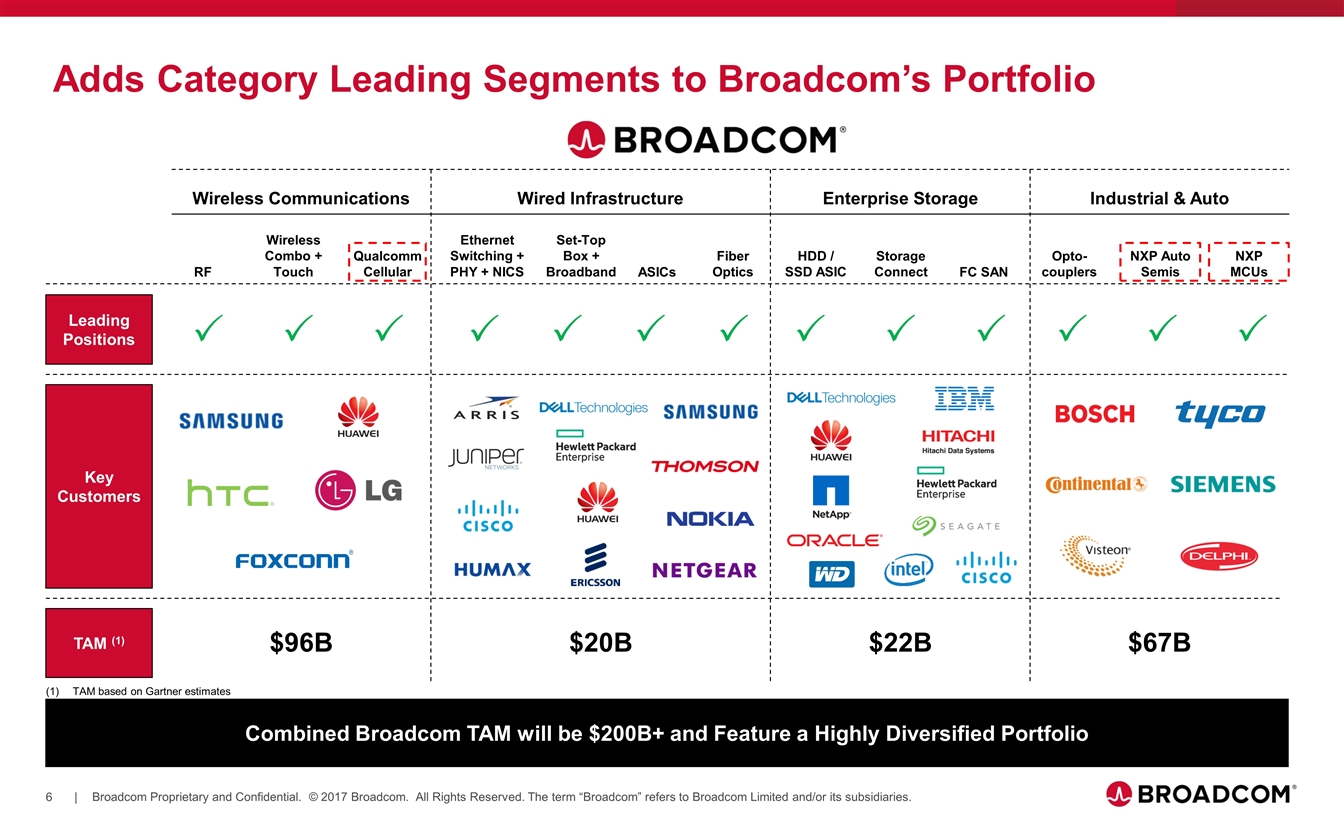

NXP Auto Semis NXP MCUs Leading Positions Key Customers TAM (1) RF Wireless Combo + Touch Set-Top Box + Broadband Ethernet Switching + PHY + NICS ASICs Fiber Optics HDD / SSD ASIC Storage Connect FC SAN P P P P P P P P P P P P Opto-couplers P Wireless Communications Wired Infrastructure Enterprise Storage Industrial & Auto $96B $20B $22B $67B Qualcomm Cellular Combined Broadcom TAM will be $200B+ and Feature a Highly Diversified Portfolio TAM based on Gartner estimates Adds Category Leading Segments to Broadcom’s Portfolio

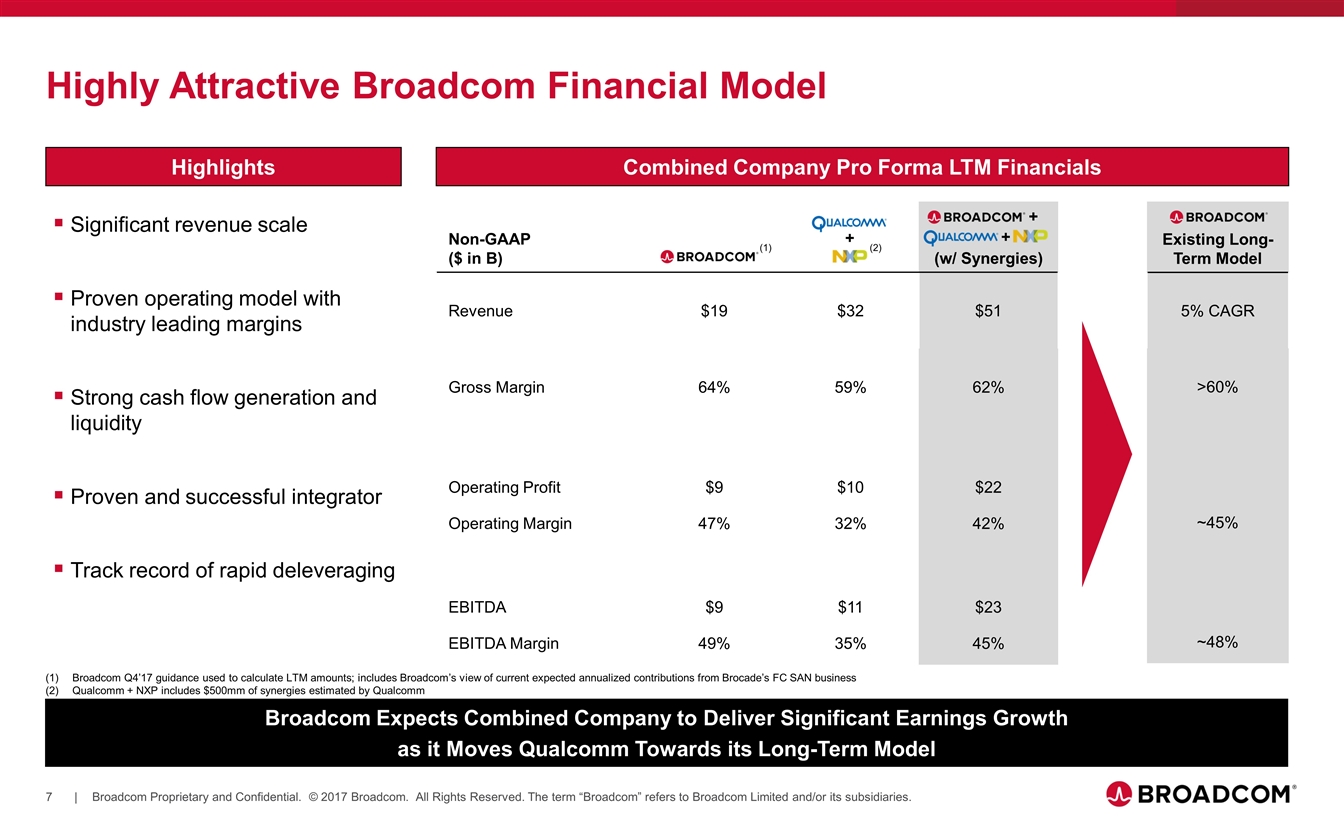

Existing Long-Term Model 5% CAGR >60% ~45% ~48% Highly Attractive Broadcom Financial Model Significant revenue scale Proven operating model with industry leading margins Strong cash flow generation and liquidity Proven and successful integrator Track record of rapid deleveraging Highlights Broadcom Q4’17 guidance used to calculate LTM amounts; includes Broadcom’s view of current expected annualized contributions from Brocade’s FC SAN business Qualcomm + NXP includes $500mm of synergies estimated by Qualcomm Combined Company Pro Forma LTM Financials Non-GAAP ($ in B) (w/ Synergies) Revenue $19 $32 $51 Gross Margin 64% 59% 62% Operating Profit $9 $10 $22 Operating Margin 47% 32% 42% EBITDA $9 $11 $23 EBITDA Margin 49% 35% 45% Broadcom Expects Combined Company to Deliver Significant Earnings Growth as it Moves Qualcomm Towards its Long-Term Model (1) + + + (2)

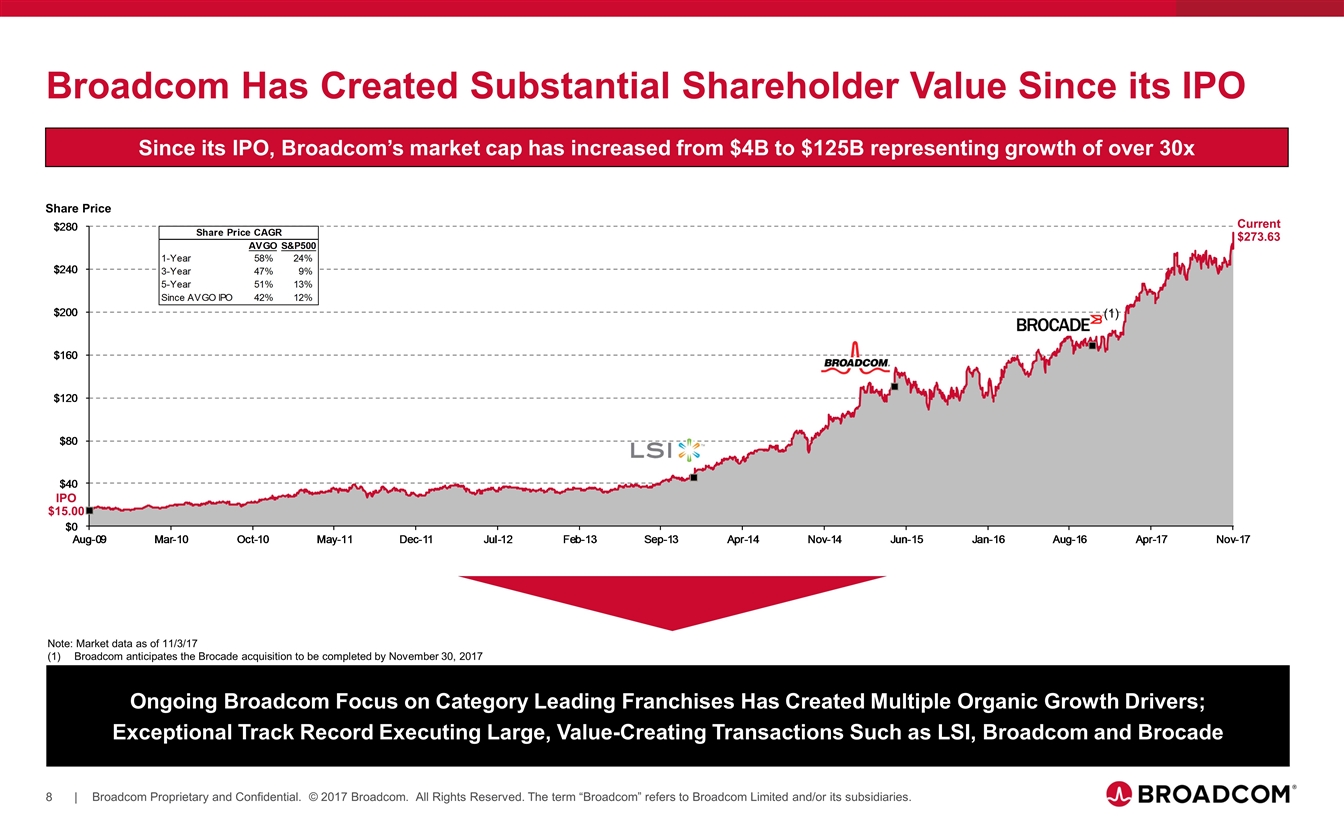

Broadcom Has Created Substantial Shareholder Value Since its IPO Ongoing Broadcom Focus on Category Leading Franchises Has Created Multiple Organic Growth Drivers; Exceptional Track Record Executing Large, Value-Creating Transactions Such as LSI, Broadcom and Brocade Share Price IPO $15.00 Current $273.63 Since its IPO, Broadcom’s market cap has increased from $4B to $125B representing growth of over 30x (1) Note: Market data as of 11/3/17 Broadcom anticipates the Brocade acquisition to be completed by November 30, 2017

Expects to maintain investment grade rating; ensures access to large, low-cost financing markets Robust Financing Strategy Rapid deleveraging profile as a result of strong free cash flow generation while maintaining an attractive dividend Highly confident letters received from BofA Merrill Lynch, Citi, Deutsche Bank, J.P. Morgan and Morgan Stanley Silver Lake Partners $5B convertible debt financing commitment validates transaction merits and Broadcom’s ongoing strategy

Clear Roadmap to Completion Regulatory Approvals Expected in Timely Manner Transaction subject to: HSR in U.S. and regulatory approvals in relevant jurisdictions globally Redomiciling plan further increases deal certainty Broadcom expects transaction would close within approximately 12 months of definitive agreement Committed to Transaction Broadcom has devoted substantial time and effort to understanding merits of transaction and has made good faith efforts to discuss a business combination with Qualcomm Unanimous Broadcom Board approval No financing condition Proposal stands whether Qualcomm’s pending acquisition of NXP is consummated on its currently disclosed terms of $110.00 per share or the transaction is terminated Broadcom and its advisors are prepared to engage immediately to work towards definitive agreement Broadcom Believes the Transaction will Significantly Benefit Both Qualcomm and Broadcom Stakeholders