Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - 1ST CONSTITUTION BANCORP | ex99_2.htm |

| 8-K - 1ST CONSTITUTION BANCORP | j1161708k.htm |

Exhibit 99.1

Announces the Acquisition of: November 6, 2017

Forward Looking Statements and Safe Harbor Cautionary Language Concerning Forward-Looking StatementsInformation set forth in this communication, including financial estimates and statements as to the expected timing, completion and effects of the proposed merger between 1st Constitution Bank (the “Bank”), a wholly-owned subsidiary of 1st Constitution Bancorp (the “Company”), and New Jersey Community Bank (“NJCB”) (the “Merger”), constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the rules, regulations and releases of the Securities and Exchange Commission (the “Commission”). Such forward-looking statements include, but are not limited to, statements about the benefits of the Merger, including future financial and operating results, and the combined company’s plans, objectives, expectations and intentions. Any statements that are not statements of historical fact, including statements containing such words as “will,” “could,” “plans,” “intends,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “anticipate,” “estimated,” or similar expressions, should also be considered forward-looking statements, although not all forward-looking statements contain these identifying words. Readers should not place undue influence on these forward-looking statements, which are based upon the current beliefs and expectations of the management of the Company and NJCB. These forward-looking statements are subject to risks and uncertainties, and actual results might differ materially from those discussed in, or implied by, the forward-looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to, the following: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Agreement and Plan of Merger, dated as of November 6, 2017, by and among the Company, the Bank and NJCB (the “Merger Agreement”); (2) the risk that NJCB’s shareholders may not adopt the Merger Agreement; (3) the risk that the necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated; (4) delays in closing the Merger or other risks that any of the closing conditions to the Merger may not be satisfied in a timely manner; (5) the inability to realize expected cost savings and synergies from the Merger in the amounts or in the timeframe anticipated; (6) the diversion of management’s time from ongoing business operations due to issues relating to the Merger; (7) costs or difficulties relating to integration matters might be greater than expected; (8) material adverse changes in the Company’s or NJCB’s operations or earnings; (9) potential litigation in connection with the Merger; (10) an increase or decrease in the common stock price of the Company during the 10 day pricing period prior to the closing of the Merger, which could cause an adjustment to the exchange ratio or give NJCB the right to terminate the Merger Agreement under certain circumstances; (11) the inability to retain NJCB’s customers and employees; and (12) the potential change in Federal tax law that could have a negative impact on the Company’s tax benefit from the Merger. There are important, additional factors that could cause actual results or events to differ materially from those indicated by such forward looking statements, including the factors described in the Company’s Annual Report on From 10-K, which was filed with the Commission on March 16, 2017. Although management has taken certain steps to mitigate any negative effect of the aforementioned items, significant unfavorable changes could severely impact the assumptions used and could have an adverse effect on profitability. The Company undertakes no obligation to update, alter, or otherwise revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise.

Forward Looking Statements and Safe Harbor No Offer or SolicitationThis communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Additional Information and Where to Find ItIn connection with the proposed Merger, the Company intends to file a registration statement on Form S-4 with the Commission. The Company may file other documents with the Commission regarding the proposed Merger. A definitive proxy statement/prospectus will be mailed to the shareholders of NJCB. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE COMMISSION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO SUCH DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available), including the proxy statement/prospectus, and other documents containing information about the Company at the Commission’s website at www.sec.gov. Copies of these documents may also be obtained from the Company (when available) by directing a request to Robert F. Mangano, President and Chief Executive Officer, 1st Constitution Bancorp, at 2650 Route 130 North, P.O. Box 634, Cranbury, New Jersey 08512, telephone (609) 655-4500.Certain Information Regarding Participants The Company, NJCB, their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from NJCB’s shareholders in respect of the proposed Merger. Information regarding the directors and executive officers of the Company may be found in its definitive proxy statement relating to its 2017 Annual Meeting of Shareholders, which was filed with the Commission on April 24, 2017 and can be obtained free of charge from the Commission’s website at www.sec.gov or from the Company by directing a request to Robert F. Mangano, President and Chief Executive Officer, 1st Constitution Bancorp, at 2650 Route 130 North, P.O. Box 634, Cranbury, New Jersey 08512, telephone (609) 655-4500. Information regarding the directors and executive officers of NJCB may be found in its proxy statement relating to its 2017 Annual Meeting of Shareholders, which can be obtained free of charge from William H. Placke, President and Chief Executive officer, New Jersey Community Bank, at 3441 U.S. Highway 9, Freehold, New Jersey 07728, telephone (732) 431-2265. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the Commission when they become available.The Company undertakes no obligation to update, alter, or otherwise revise these presentation materials, as a result of written or oral statements that may be made from time to time, whether as a result of new information, future events, or otherwise.

$4.00 per share¹ Transaction Overview Based on a 1st Constitution stock price of $18.00 per share.Based on 1,908,415 shares of NJCB common stock outstanding and the cash out of 35,400 in-the-money options at $4.00 per share (net of exercise cost). Per Share Consideration $7.6 million Transaction Value¹,² 60% stock / 40% cash Consideration Mix $1.60 in cash and 0.1333 shares of 1st Constitution, subject to adjustment Exchange 254,392 shares of 1st Constitution common stock, subject to adjustment Shares to be Issued Customary regulatory approvals (FDIC and State of New Jersey)NJCB shareholder approval Required Approvals Conducted comprehensive due diligence Due Diligence End of First Quarter of 2018 Expected Closing Price / September 30, 2017 TBV: 82%Premium to November 3, 2017 Closing Price: 18% Pricing Ratios

Total Assets: $103.6 millionGross Loans: $83.4 millionTotal Deposits: $93.8 millionTotal Equity: $9.3 millionLTM Net Income: $(1.3) millionTangible Book Value / Share: $4.85LTM ROAA: NMLTM RAOE: NMLTM Efficiency Ratio: 136%NPAs / Assets: 3.62%NPAs excluding Performing TDRs/ Assets: 3.10% Overview of New Jersey Community Bank Source: SNL Financial. Financial information as of September 30, 2017; market data as of November 3, 2017. Ticker: NJCBPrice: $3.40Market Capitalization: $6.5 million52-Week High / Low: $4.80 / $3.0152 Week Avg. Daily Volume: 1,476Market Price / TBV: 70% Branch Map

Accretive transaction due to economies of scale and transaction structureAttractive markets of operationExpansion to contiguous Freehold market area, which has attractive demographic and growth characteristicsFreehold branch is attractively located on Rt. 9, which is a principal commercial and business centerNeptune City branch enhances Asbury Park presence1st Constitution’s management has a strong knowledge of both marketsSufficient operational capacity to support increased operationsDisciplined pricing: Accretive to Book Value per share, Tangible Book Value per share and EPS in 2018 ¹Identified cost saving opportunitiesAccounting bargain purchase gain expected to offset the transaction costsOffers NJCB customers access to new product offerings and servicesLeverages 1st Constitution management’s M&A capabilities Transaction Rationale Based on current Federal tax law

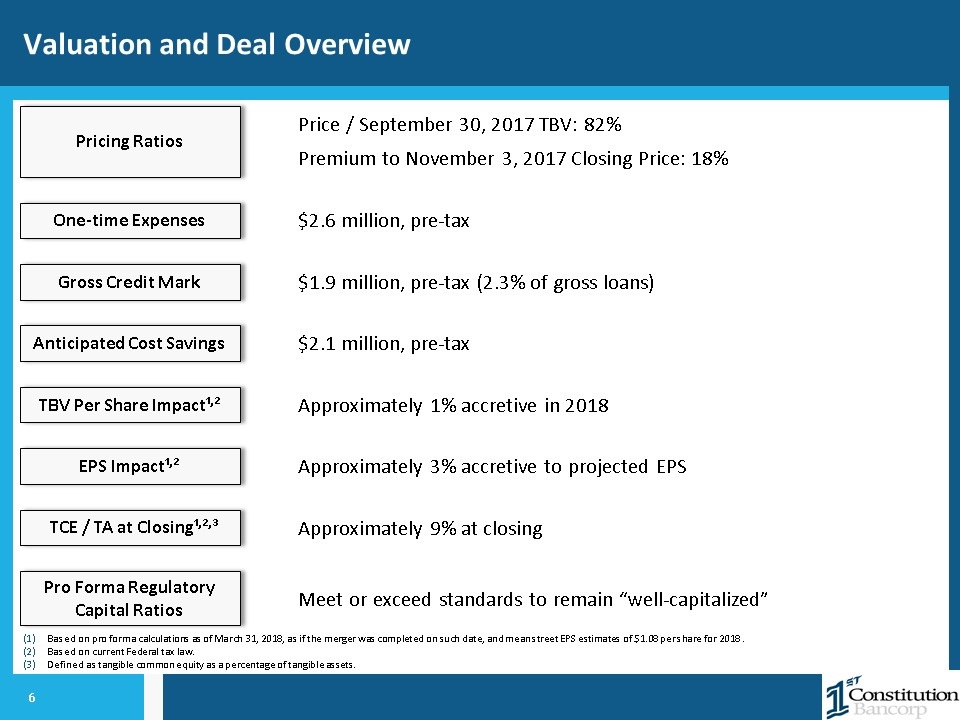

Valuation and Deal Overview Price / September 30, 2017 TBV: 82%Premium to November 3, 2017 Closing Price: 18% Pricing Ratios $2.6 million, pre-tax One-time Expenses $1.9 million, pre-tax (2.3% of gross loans) Gross Credit Mark $2.1 million, pre-tax Anticipated Cost Savings Approximately 1% accretive in 2018 TBV Per Share Impact¹,² Approximately 3% accretive to projected EPS EPS Impact¹,² Approximately 9% at closing TCE / TA at Closing¹,2,³ Based on pro forma calculations as of March 31, 2018, as if the merger was completed on such date, and mean street EPS estimates of $1.08 per share for 2018 .Based on current Federal tax law.Defined as tangible common equity as a percentage of tangible assets. Meet or exceed standards to remain “well-capitalized” Pro Forma Regulatory Capital Ratios

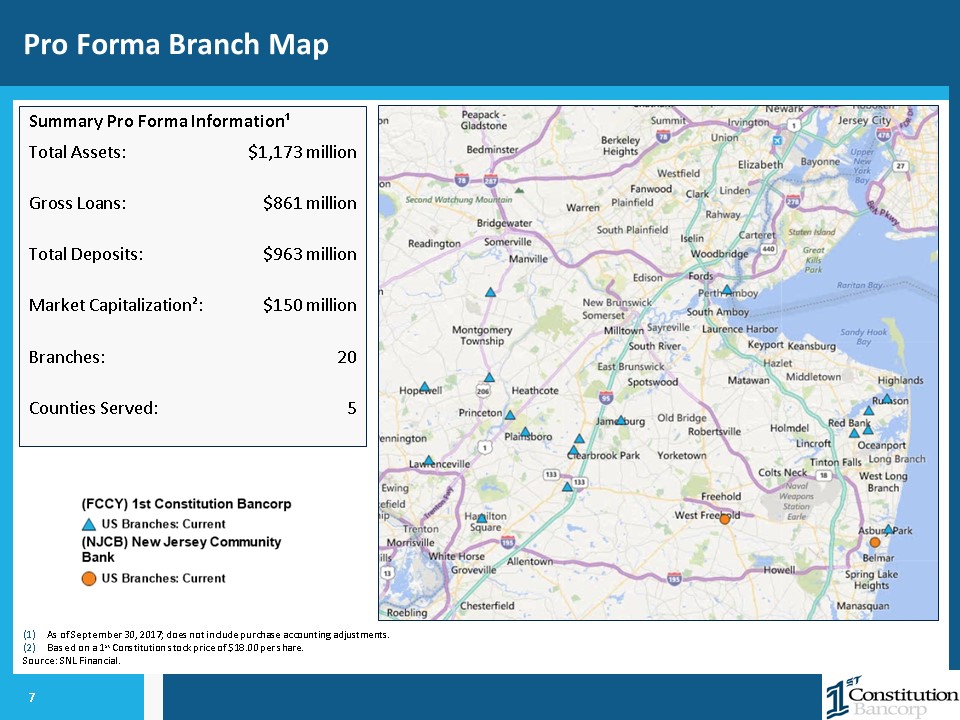

Pro Forma Branch Map As of September 30, 2017; does not include purchase accounting adjustments.Based on a 1st Constitution stock price of $18.00 per share.Source: SNL Financial. Summary Pro Forma Information¹Total Assets: $1,173 millionGross Loans: $861 millionTotal Deposits: $963 millionMarket Capitalization²: $150 millionBranches: 20Counties Served: 5

Opportunity to acquire a franchise operating in the State’s most attractive geographic areasStrategic acquisition that is anticipated to improve franchise value of 1st Constitution’s strong footprint in attractive markets in central New Jersey Expands upon 1st Constitution’s 2014 acquisition of Rumson-Fair Haven Bank & Trust CompanyProvides significant loan and deposit growth opportunities and revenue expansion opportunitiesExpected to be accretive to both EPS and TBV per share in 2018 Conclusions