Attached files

EXHIBIT 10.6

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

AMENDMENT NUMBER 21

TO

Special Business Provisions (SBP) BCA-MS-65530-0019

BETWEEN

THE BOEING COMPANY

AND

SPIRIT AEROSYSTEMS, INC.

THIS AMENDMENT NUMBER 21 (“Amendment No. 21”) is entered into this July 1, 2014, by and between Spirit AeroSystems, Inc. (“Spirit”), a Delaware corporation having its principal office in Wichita, Kansas, and The Boeing Company, a Delaware corporation, acting by and through its division, Boeing Commercial Airplanes (“Boeing”). Herein, Spirit and Boeing may be referred to jointly as the “Parties”.

The Parties have entered into the General Terms Agreement, GTA BCA-65520-0032, dated June 16, 2005 as amended from time to time (the “GTA”), and the Special Business Provisions, BCA-MS-65530-0019, dated June 16, 2005 as amended from time to time (the "SBP"), and now desire to again modify the SBP.

Background

The 787 Program includes designing and building the Program Airplane and Derivatives and Mission Improvement work as identified by Boeing. This Amendment No. 21 updates the SBP to address the following:

1. | Incorporation of signed One Plans Document and associated settlement values (as defined in SBP Attachment 23). |

2. SBP 8.5 and SBP Attachments 1, 2, 3, 16, 23, 25, 27 and 29 are revised.

1

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

Agreement

THEREFORE, the Parties hereby agree to amend the SBP as follows:

1. SBP 8.5 | “Retention of Quality Records” is herby deleted in its entirety and replaced with the text set forth in Exhibit 1 hereto. |

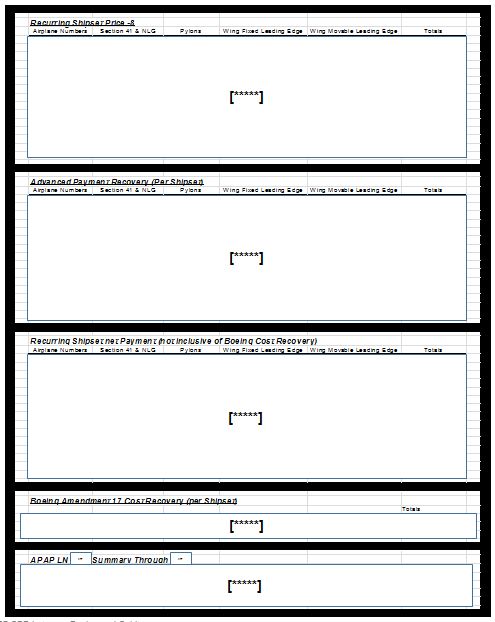

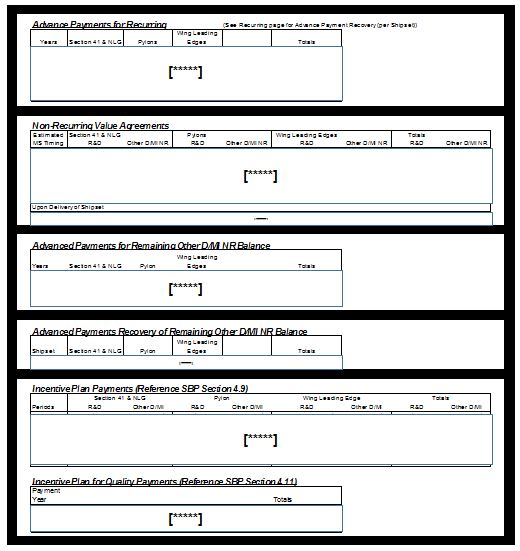

2. SBP Attachment 1, “Work Statement and Pricing” is hereby amended as set forth in Exhibit 2 hereto to incorporate revisions to the following sections: “Recurring Shipset Price -8”, “Recurring Shipset Net Payment (not inclusive of Boeing Cost Recovery)”, “APAP LN [*****] Summary through [*****]”, “Non-Recurring Value Agreements”, “Advance Payments for Remaining Other D/MI NR Balance”, “Incentive Plan Payments” (Reference SBP Section 4.9),” “Incentive Plan for Quality Payments (Reference SBP Section 4.11).”

3. | SBP Attachment 2, “Production Article Definition and Contract Change Notices” is hereby amended in its entirety as set forth in Exhibit 3 hereto to incorporate revisions to Section B “Contract Change Notices”. |

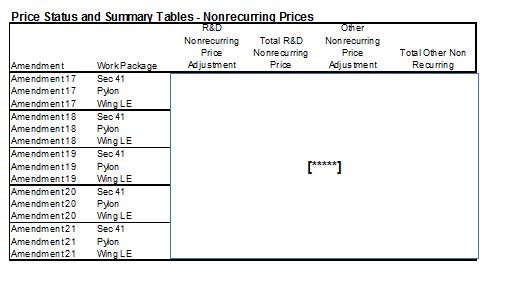

4. | SBP Attachment 3, “Price Status and Summary Tables” is hereby amended to revise “Price Status and Summary Tables- Non Recurring Prices” as set forth in Exhibit 4 hereto. |

5. | SBP Attachment 16, “Pricing Methodologies” is hereby amended to revise Table A.1 of Section A.1 “Boeing Performed Repair and Rework” as set forth in Exhibit 5 hereto. |

6. SBP Attachment 23, “Derivatives and Mission Improvement Performance to Plan” is hereby amended to revise Exhibit D - “Criteria for Performance Based R&D Payments and Advance Payments”, Sections 1 and 2 and Exhibit E - “One Plan Document Record” as set forth in Exhibit 6 hereto.

7. SBP Attachment 25, “Incentive Payment” is hereby amended to revise Section B “Incentive Payment Pool”, Section F “Incentive Payments Granted”, 1 and 2 as set forth in Exhibit 7 hereto.

8. SBP Attachment 27, “Risk Sharing” is hereby amended to revise Section II “Baseline Prices and Risk Sharing Control Limits” A. as set forth in Exhibit 8 hereto.

9. SBP Attachment 29, “Incentive Payment for Quality” is hereby amended to revise Section C “Incentive Payment for Quality Plan Term,” Section D “Evaluation Methodology,” and Exhibit A as set forth in Exhibit 9 hereto.

2

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

Except as otherwise indicated, all terms defined in the GTA or SBP shall have the same meanings when used in this Amendment No. 21. This Amendment No. 21 constitutes the complete and exclusive agreement between the parties with respect to the subject matter of Amendment No. 21, and Amendment No. 21 supersedes all previous agreements between the parties relating to the subject matter of Amendment No. 21, whether written or oral. This Amendment No. 21 shall be governed by the laws of the state of Washington, other than the conflict of law rules thereof. The amendments made to the SBP by this Amendment No. 21 shall be effective as of the date of this Amendment No. 21 or as of such other date as specified herein. The GTA and SBP remain in full force and effect and are not modified, revoked or superseded except as specifically stated in this Amendment No. 21. EXECUTED in duplicate as of the date and year first set forth above by the duly authorized representatives of the Parties:

The scope of Amendment No. 21 is limited to the impact of the Contract Change Notifications (CCNs) identified herein on 787-8 recurring pricing, 787-8 non-recurring pricing, and 787-9 non-recurring pricing. Boeing and Spirit reserve any and all rights with regards to initial Derivative pricing matters outside the scope of Amendment No. 21.

The Boeing Company | Spirit AeroSystems Inc. | |||

Acting by and through its division | ||||

Boeing Commercial Airplanes | ||||

By: | /s/ Crystal Francois | By: | /s/ Leanna Hampton | |

Name: | Crystal Francois | Name: | Leanna Hampton | |

Title: | Procurement Agent | Title: | Contracts Administrator | |

Date: | 7/1/2014 | Date: | 7/1/2014 | |

3

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

AMENDMENTS

Number 17 18 19 20 21 | Description MOA Dated 12-21-10 (Blockpoint 20 Settlement) Amended or added: SBP Table of Contents, Sections 1.0, 3.1.1, 3.2.1, 3.3.1, 3.3.2.2, 3.3.4.3 and 3.3.4.8, 3.3.7, 3.3.7.1, 3.3.7.2, 3.3.7.3, 3.4.2.1, 3.4.5, 4.1.1, 4.1.3, 4.2, 4.3.1, 4.3.1.1, 4.4, 4.7, 4.8, 4.9, 4.10, 4.11, 5.5, 5.6, 5.7, 5.8, 5.8.1, 5.8.2, 6.1, 6.2, 6.3, 7.1, 7.2, 7.2.1, 7.2.2, 7.2.3, 7.5, 7.5.1, 7.5.2, 7.8, 7.8.1, 7.8.2, 11.2 Deleted SBP Sections 3.3.2.3.I, 3.4.2.3, 7.9, 7.10 Amended or added SBP Attachments 1, 2, 3, 4, 7, 14, 16, 23, 25, 26, 27, 28, 29 Deleted SBP Attachments 13 and 19 Throughout SBP, various references to: “SBP Attachment 7 Indentured Parts Price List and Spare Parts Pricing” are revised to “the SPPC”. D&MI One Plan Update Updated SBP Attachments 1, 3, 23, 25 Amended: SBP Section 7.4 per Amendment 3 D&MI One Plan Update Updated SBP Attachments 1, 2, 3, 16, 23, 25 D&MI One Plan Update 1. Updated SBP Attachments 1, 2, 3, 16, 23, 25, 27 D&MI One Plan Update 1. Amended: SBP Section 8.5 2. Updated SBP Attachments 1, 2, 3, 16, 23, 25, 27, 29 | Date 5/12/11 8/24/11 7/30/12 6/5/13 7/1/14 | Approval R. Parks M. Kurimsky M. Guillen M. Kurimsky A. Mauldin M. Kurimsky Jeff Loomis C. Cotner C. Francois L. Hampton |

4

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 1

SPECIAL BUSINESS PROVISIONS

8.5 | Retention of Quality Records |

Spirit shall maintain, on file at Spirit’s facility, quality records traceable to the conformance of Products delivered to Boeing. Spirit shall make such records available to regulatory authorities and Boeing’s authorized representatives. Spirit shall retain such records for a period of not less than ten (10) years from the date of shipment under each applicable Order for all Products unless otherwise specified on the Order. Spirit shall maintain all records related to the current first article inspection (“FAI”) for ten (10) years past final delivery of the last Product covered by the FAI.

At the expiration of such period, Boeing reserves the right to request delivery of a copy of such records. In the event Boeing chooses to exercise this right, Spirit shall promptly deliver such copy to Boeing at no additional cost on media agreed to by both Parties.

5

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 2

SBP ATTACHMENT 1 TO

SPECIAL BUSINESS PROVISIONS

WORK STATEMENT AND PRICING

(Reference SBP Sections 3.1.1, 3.4.1, 4.1, 4.3.4.3, 4.7, 5.8, 22.0; GTA Section 1)

FOR PURPOSES OF SBP Section 3.1, “OBLIGATION TO PURCHASE AND SELL,” Boeing shall be defined as the following organizations, divisions, groups or entities:

BCA Suppler Management, The Boeing Company, Seattle, WA

The price for Products to be delivered on or before [*****], except as otherwise noted below, will be as follows:

6

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 2

SBP ATTACHMENT 1 TO

SPECIAL BUSINESS PROVISIONS

WORK STATEMENT AND PRICING (cont.)

7

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 2

SBP ATTACHMENT 1 TO

SPECIAL BUSINESS PROVISIONS

WORK STATEMENT AND PRICING (cont.)

8

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 3

SBP ATTACHMENT 2 TO

SPECIAL BUSINESS PROVISIONS

PRODUCTION ARTICLE DEFINITION AND CONTRACT CHANGE NOTICES

(Reference SBP Sections 3.3.2.1, 3.3.2.2, 3.3.4.6, 3.4.1; GTA Section 1.0N, 1.0.P)

A. Configuration

The configuration of each Production Article shall be as described in the Integrated Control Station Plan revision identified below, and in the Contract Change Notices listed in Paragraph B below as such Contract Change Notices relate to the configuration of any Production Article

Type | Product Number | Name | Manufacturing Change Level | Current Mfg Frozen LN | Extended Eff (Usage) |

[*****] | |||||

9

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 3

SBP ATTACHMENT 2 TO

SPECIAL BUSINESS PROVISIONS

PRODUCTION ARTICLE DEFINITION AND CONTRACT CHANGE NOTICES (Continued)

Type | Product Number | Name | Manufacturing Change Level | Current Mfg Frozen LN | Extended Eff (Usage) |

[*****] | |||||

Contract Change Notices

The following Contract Change Notices (CCN’s) are hereby incorporated into this SBP.

B.1 | Non-D/MI Contract Change Notices: |

All CCN’s listed in this Section B.1 are inclusive of all revisions and cancellations issued on or before December 21, 2010:

CCN 1 through 318, 320 through 542, 544 through 762, 764 through 766, 768 through 779, 781 through 871, 873 through 889, 891 through 984, 986 through 990, 992 through 1024, 1028 through 1100, 1102 through 1142, 1144 through 1148, 1150 through 1162, 1164 through 1170, 1172 through 1240, 1242 through 1295, 1298 through 1420, 1422 through 1440, 1442 through 1452, 1454 through 1461, 1463 through 1472, 1474 through 1503, 1505 through 1564, 1566 through 1593, 1595 through 1611, 1613 through 1616, 1618 through 1623, 1625 through 1633, 1635 through 1658, 1661 through 1671, 1673 through 1686, 1688 through 1696, 1698, 1700 through 1709, 1710, 1712 through 1716, 1718 through 1748, 1750, 1751, 1753 through 1763, 1765 through 1810, 1814 through 1833, 1837 through 1844, 1846 through 1856, 1858 through 1866, 1868 through 1895, 1897, 1898, 1901, 1904 through 1906, 1908, 1909, 1911 through 1914, 1919, 1921 through 1925, 1928, 1933 through 1937, 1940 through 1943, 1946 through 1950, 1952 through 1963, 1968, 1973 through 1976, 1980, 1982, 1984, 1985, 1988 through 1993, 1995, 1999, 2000, 2004, 2005, 2007, 2014 through 2019, 2021.

10

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 3

SBP ATTACHMENT 2 TO

SPECIAL BUSINESS PROVISIONS

PRODUCTION ARTICLE DEFINITION AND CONTRACT CHANGE NOTICES (Continued)

B. All CCN’s listed in this Section B1.B. are inclusive of all revisions committed on and before December 31, 2011 and which are effective on or before Shipset Line Number [*****]

CCN 319, 543, 763, 767, 780, 991,1025 through 1027, 1101, 1143, 1149, 1171,1296,1297,1421,1441,1473,1504,1565,1594,1617,1624,1634,1659,1660,1687, 1697,1699,1717,1749,1752,1764,1770,1834,1836,1926,1927,1929 through 1932, 1938,1939,1945,1951,1966,1967,1969,1971,1972,1977 through 1979, 1981,1983,1986,1987,1994,1996 through 1998, 2002,2003,2006,2008 through, 2013, 2020, 2022 through 2037, 2039 through 2058, 2060 through 2073, 2075 through 2111, 2113, 2115, 2116, 2118, 2120 through 2108, 2130 through 2135, 2137 through 2139, 2141, 2143, 2145 through 2157, 2160, 2161, 2162.

C. Subject to the statement of scope of Amendment 21 as set forth above, all CCN’s listed in this Section B1.C. are inclusive of all revisions commited on and before December 31, 2012 and which are effective on or before Shipset Line Number [*****]:

CCN 1835, 1899, 1902, 1903, 1944, 1965, 1970, 2038, 2074, 2112, 2114, 2117, 2142, 2144, 2178.

B.2 D/MI PtP Contract Change Notices:

Section 41 D/MI CCN’s: 1163, 1241, 1915, 1916, 2158, 2159, 2168, 2170R2, 2179

Pylon D/MI CCN: 2166, 2179

Wing LE D/MI CCN: 2167, 2170R2

CCN’s listed above are inclusive of any numerical formatting convention, i.e. CCN 1 is the same as CCN-00001 or CCN 0001.

11

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 4 SBP ATTACHMENT 3 TO

SPECIAL BUSINESS PROVISIONS

PRICE STATUS AND SUMMARY TABLES

(Reference SBP Section 7.8.2)

12

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 5

SBP ATTACHMENT 16 TO

SPECIAL BUSINESS PROVISIONS

PRICING METHODOLOGIES (cont.)

Boeing shall notify Spirit of the total number of Line Unit OSSN EPDs due to traveled non-conformances. These shall be multiplied by the prices per unit in table A.1. The resulting values shall be the costs and expenses incurred by Boeing for such repair or rework as provided in SBP Section 11.1.

Table A.1

Traveled Work Nomenclature | Price Per Unit |

SOI-A | $[*****] |

SOI-B | $[*****] |

Non-conformance EPD | $[*****] |

13

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 6

SBP ATTACHMENT 23 TO

SPECIAL BUSINESS PROVISIONS

Derivatives and Mission Improvement Prformance to Plan (cont.)

Exhibit D - Criteria for Performance Based R&D Payments and Advance Payments

1. Performance Based Payments for Research and Development (reference SBP Section 5.6)

Performance Based Payments for Research and Development consist of four (4) individual performance events plus a final payment. This Exhibit provides a description of each performance event, the success criterion and verification for each event.

*The amounts for each event are initially for D&MI work negotiated through December 21, 2010 and shall be amended as additional D&MI work statement is negotiated in accordance with this SBP Attachment 23.

Event No. | Performance Event | Completion Criteria | Verification | *Amount (as of 2/21/14 and Amendment 21) (Paid in accordance with SBP 5.6) |

1. | Section 41 Preliminary Layouts [*****]% Complete | i) [*****]% of Section 41 Preliminary Layouts ii) all other Section 41 R&D events scheduled prior to or concurrent to planned Section 41 [*****]% milestone are complete and iii) all Pylon R&D events scheduled prior to or concurrent to planned Section 41 [*****]% milestone are complete and iv) all WLE R&D events scheduled prior to or concurrent to planned Section 41 [*****]% milestone are complete | Events closed in ETAC | $[*****] |

14

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 6

SBP ATTACHMENT 23 TO

SPECIAL BUSINESS PROVISIONS

Derivatives and Mission Improvement Performance to Plan (cont.)

2. | CDR complete for [*****] Pylon | i) CDR completed for Sec 41 and [*****] Pylon ii) all Section 41 R&D events and all Pylon R&D events and all WLE R&D events scheduled prior to or concurrent to planned [*****] Pylon CDR | When all actions items are closed following CDR and applicable events are closed in ETAC | $[*****] |

3. | Sec 41 Approved Layouts [*****]% Complete | i) [*****]% of Section 41 Approved Layouts ii) all other Section 41 R&D events scheduled prior to or concurrent to planned Section 41 [*****]% milestone are complete and iii) all Pylon R&D events scheduled prior to or concurrent to planned Section 41 [*****]% milestone are complete iv) all WLE R&D events scheduled prior to or concurrent to planned Section 41 [*****]% milestone are complete | Events closed in ETAC | $[*****] |

4. | All Products On Dock to the Delivery Point | i) Delivery of all products to Boeing ii) all Section 41 R&D events scheduled prior to or concurrent to planned Section 41 delivery milestone are complete and iii) all Pylon R&D events scheduled prior to or concurrent to planned Section 41 delivery milestone are complete iv) all WLE R&D events scheduled prior to or concurrent to planned Section 41 delivery milestone are complete | Section 41 on dock at Boeing and applicable events are closed in ETAC | $[*****] |

5. | Final Payment | Airplane Certification | $[*****] | |

2.Performance Based Payments and Performance Based Advance Payments for Other D&MI Nonrecurring Work (reference SBP Section 5.8)

Performance Based Payments and Performance Based Advance Payments for Other D&MI Nonrecurring Work consist of six (6) individual performance events.

15

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 6

SBP ATTACHMENT 23 TO

SPECIAL BUSINESS PROVISIONS

Derivatives and Mission Improvement Performance to Plan (cont.)

This Exhibit provides a description of each performance event, the success criterion and verification for each event.

*The amounts for each event are initially for D&MI work negotiated through December 21, 2010 and shall be amended as additional D&MI work statement is negotiated in accordance with this SBP Attachment 23.

Event No. | Performance Event | Completion Criteria | Verification | * Amount (as of 2/11/14 and Amendment 21) (Paid in accordance with SBP 5.8) |

1. | BP [*****] Tooling & Birdstrike Forging | Line Unit [*****] delivered & Birdstrike forgings on dock Spirit | Line Unit [*****] loaded in LCF & FAI complete on forgings | $[*****] |

2. | BP [*****] Tooling | Line Unit [*****] delivered | Line Unit [*****] loaded in LCF | $[*****] |

3. | BP [*****] Tooling | Line Unit [*****] delivered | Line Unit [*****] loaded in LCF | $[*****] |

4. | Begin spinning of 1st 787-9 Sec 41 barrel | Planned Other D&MI NR Work completed prior to the beginning of spinning of 1st 787-9 Sec 41 barrel | Load of barrel in to AFP cell | $[*****] |

5. | 787-9 | First 787-9 Delivered | First 787-9 on LCF | $[*****] |

6. | Final Payment | Airplane Certification | $[*****] | |

16

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 6

SBP ATTACHMENT 23 TO

SPECIAL BUSINESS PROVISIONS

Exhibit E - One Plan Document Record

D&MI One Plan Documents:

• | 787 Section 41 IPT Derivatives and Mission Improvement One Plan Summary, Revision New, dated 01-15-09 |

• | 787 Section 41 IPT Derivatives and Mission Improvement One Plan Line [*****], Revision New, 01-15-09 |

• | 787 Section 41 IPT Derivatives and Mission Improvement One Plan Line [*****], Revision New, 01-15-09 |

• | 787 Section 41 IPT Derivatives and Mission Improvement One Plan Line [*****], Revision New, 01-15-09 |

• | 787 Section 41 IPT Derivatives and Mission Improvement One Plan 787-9, Revision New, 01-15-09 |

• | Spirit-Tulsa One Plan Grand Total, dated 4/16/09 |

• | 787-9 One-Plan Spirit Pylon April 7-8, 2009 |

• | 787-9 One-Plan Spirit S41 April 1, 2010 |

• | 787-9 One-Plan Spirit WLE (Interim Agreement) May 21, 2010 |

• | 787-9 One-Plan Spirit Pylon March 4, 2010 |

• | 787-9 & MI Phase 2 One-Plan - Wing LE (WP 10 & 12)” (Interim Agreement) dated 09/22/10 |

• | “787 Pylon Derivatives & Mission Improvement Phase II ONE PLAN UPDATE 2nd QUARTER - 2010” dated 7/1/2010 |

• | 787 Section 41 IPT Derivatives & Mission Improvement Phase II ONE PLAN dated 6/30/2010 |

• | 787 Section 41 IPT Derivatives & Mission Improvement Phase II ONE PLAN dated 8/26/2010 |

• | 787 Pylon Derivatives & Mission Improvement Phase IIIa ONE PLAN - November 2010 - August 2011 dated 11/4/2010 |

• | 787-9 & MI One-Plan; PtP Plan, Wing Leading Edge, dated 12/13, 2010, Rev 14 |

• | 787 Phase III PtP Negotiation Status Between Spirit Wichita and Boeing as of March 11, 2011 |

• | 787 Phase III PtP Negotiation Status Between Spirit Wichita and Boeing as of April 21, 2011 |

• | 787 Section 41 D&MI Improvement “Sec 41 Tooling One Plan Agreements March and April 2011” |

17

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 6 SBP ATTACHMENT 23 TO

SPECIAL BUSINESS PROVISIONS

Derivatives and Mission Improvement Performance to Plan (cont.)

Exhibit E - One Plan Document Record

D&MI One Plan Documents (cont.):

• | 787 Section 41 D&MI Improvement “CN 22067 - Sec 41 [*****]” dated June 1, 2011 |

• | 787 One Plan - Section 41 | SOW Hours Agreement “D_MI Sec 41 Engineering One Plan Agreements 6_9_11” |

• | 787 Section 41 D&MI Improvement “787 D_MI Sec 41 Tooling One Plan Agreements 6_7_11” |

• | 787 Pylon Derivatives & Mission Improvement Phase IIIa ONE PLAN Rev. B - November 2010 - June 2011 dated 7/7/2011 |

• | 787-9 One-Plan Phase IIIb; PtP Plan, Wing Leading Edge, dated 7/1/2011 |

• | 787-9 Section 41 D/MI PtP Phase IIIb One Plan Updates for the following NR changes: CN21389-[*****], dated 11-4-11, CN26217-[*****], dated 12-22-11, CN27164-ME Impact, dated 2-1-12, CN28726-[*****], dated 12-22-11, CN29139-[*****], dated 12-1-11, LMA CN643-[*****], dated 12-1-11, LMA CN646, dated 11-16-11, LMA CN647-[*****], dated 11-17-11, LMA CN648-[*****], dated 11-16-11, LMA CN651-[*****], dated 11-17-11, LMA CN655, dated 11-17-11, LMA CN659-[*****], dated 11-17-11, LMA CN665-dated 11-17-11, LMA CN671-[*****], dated 12-1-11, LMA CN677-SCN Package Updates, dated 12-1-11, LMA CN688-[*****], dated 1-12-12, LMA CN705-[*****], dated 1-12-12, LMA CN727-[*****], dated 1-12-12, LMA CN689-SCN Updates, dated 1-12-12, LMA CN690-[*****], dated 12-15-11, LMA CN691-[*****], dated 1-12-12 |

• | 787-9 Section 41 D/MI Tooling Phase IIIb One Plan Updates for non-recurring activities for the following changes: CN 22067, [*****], dated 6-1-11, CN 25334, [*****], dated 11-1-11, 787-9 [*****], dated 11-8-11 |

• | 787-9 Pylon Derivatives & Mission Improvement Phase IIIb One Plan -- July 2011 - [*****], dated 12/19/2011 |

• | 787-9 One Plan Phase IIIb, PTP Plan, Wing Leading Edge, Spirit AeroSystems, Tulsa, Dated 7/1/2011 |

• | 787-9 One Plan for Section 41 and Wing documented in CCN 2170R2 , Attach A |

• | 787-9 One Plan for Pylon [*****], CN 32338 and CN 32339, dated January , 2012. |

• | 787-9 One Plans for Section 41 and Pylon documented in CCN 2179 Attachment A dated 2/11/14 |

18

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 7

SBP ATTACHMENT 25 TO

SPECIAL BUSINESS PROVISIONS

Incentive Payment

(Reference SBP Sections 4.9)

B. Incentive Payment Pool

The available Incentive Payment Pool amount (“Incentive Payment Pool”) is $[*****] for Research and Development plus Other D&MI Nonrecurring Work and $[*****] for Tooling. Boeing shall pay Spirit the Incentive Payment amount as determined in accordance with Document [*****].

The Incentive Payment Pool will be updated by SBP Amendment in conjunction with the establishment of, and updates to, the D&MI SOW as described in SBP Attachment 23.

Incentive Payment Pool Methodology: The Incentive Payment Pool shall be established at [*****]% of the agreed D&MI NR Value (as defined in SBP Attachment 23, Section III.A), provided that if any D&MI Nonrecurring Work is to be paid in accordance with the Dispute Resolution clause of SBP Attachment 23, Section III.G, such work shall contribute to the Incentive Payment Pool at [*****]% of the Boeing initial estimate of the disputed value.

F. Incentive Payments Granted

1. Record of total amount of Incentive Payment payments for Research and Development (reference SPB Section 5.7)

Period | Dates | Amount |

[*****] | [*****] | [*****] |

[*****] | [*****] | [*****] |

[*****] | [*****] | [*****] |

[*****] | [*****] | [*****] |

[*****] | [*****] | [*****] |

[*****] | [*****] | [*****] |

2. Record of Incentive Payments for Other D&MI Nonrecurring Work (reference SBP Sections 4.9 and 5.7)

Period | Dates | Amount |

[*****] | [*****] | [*****] |

[*****] | [*****] | [*****] |

[*****] | [*****] | [*****] |

[*****] | [*****] | [*****] |

[*****] | [*****] | [*****] |

[*****] | [*****] | [*****] |

19

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 8

SBP ATTACHMENT 27 TO

SPECIAL BUSINESS PROVISIONS

Risk Sharing (cont.)

II. Baseline Prices and Risk Sharing Control Limits

A. The annual supplemental payment or credit process contained in this Attachment 27 shall utilize the following baseline prices and risk sharing control limits. All prices and calculations shall be made on a total Shipset basis and not at an individual Work Package basis. Upon the establishment of Pricing for a Derivative, a table applicable to such Derivative shall be established and used. Prior to each annual calculation of the supplemental payment or credit, Column (A) shall be updated to reflect the Shipset Prices as determined in each first calendar quarter update in accordance with SBP Section 7.2 and Attachment 16:

787-8 Model | (A) | (B) | (C) |

Attachment 1 Price | Upper Limit | Lower Limit | |

Shipsets [*****] - [*****] | $[*****] | +[*****]% | -[*****]% |

Shipsets [*****] - [*****] | $[*****] | +[*****]% | -[*****]% |

Shipsets [*****] - [*****] | $[*****] | +[*****]% | -[*****]% |

Shipsets [*****] - [*****] | $[*****] | +[*****]% | -[*****]% |

Shipsets [*****] - [*****] | $[*****] | +[*****]% | -[*****]% |

Shipsets [*****] - [*****] | $[*****] | +[*****]% | -[*****]% |

20

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 9

SBP ATTACHMENT 29 TO

SPECIAL BUSINESS PROVISIONS

Incentive Payment for Quality

(Reference SBP Section 4.11)

A. Incentive Payment for Quality

An Incentive Payment for Quality is provided to further enhance quality performance in the execution of Spirit's statement of work.

B. Incentive Payment for Quality Pool

The available Incentive Payment for Quality amount (“Incentive Payment for Quality Pool”) is [*****] dollars ($[*****]). Boeing shall pay Spirit any awarded Incentive Payment for Quality amount as set forth in this SBP Attachment 29.

C. Incentive Payment for Quality Plan Term

The term of the Incentive Payment for Quality is [*****], consisting of [*****] evaluation periods of [*****] each. The [*****] evaluated shall be [*****] through [*****]. The Incentive Payment for Quality Pool shall be equally divided among each [*****] resulting in an available Incentive Payment for Quality amount of [*****] dollars ($[*****]) for each of the [*****] evaluated. A base year of 2013 shall establish the basis for evaluation for each of the [*****] through [*****].

D. Evaluation Methodology

D.1.1 In the [*****], Boeing shall calculate the total quantity of Nonconformance EPDs assigned to Spirit in accordance with SBP Attachment 16 for those Shipsets both 1) delivered by Spirit to Boeing after [*****] and 2) delivered by Boeing to its customers in the [*****]. This total quantity of Nonconformance EPDs shall be divided by the quantity of Shipsets both 1) delivered by Spirit to Boeing after [*****] and 2) delivered by Boeing to its customers in the [*****] to establish an average Nonconformance EPDs per Shipset value. An example of this calculation is set forth in Exhibit A to this Attachment 29.

For purposes of executing the methodology contained herein, the Shipsets delivered by Spirit to Boeing after [*****] will be based on the Section 41. For the avoidance of doubt, Section 41 line unit [*****] shall be considered delivered by Spirit to Boeing as of [*****].

21

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 9

SBP ATTACHMENT 29 TO

SPECIAL BUSINESS PROVISIONS

Incentive Payment for Quality (cont.)

D.1.2 In [*****], Spirit shall calculate the total quantity of Spirit Tags for those Shipsets both 1) delivered by Spirit to Boeing after December 20, 2010 and 2) delivered by Boeing to its customers in the [*****]. This total quantity of Spirit Tags shall be divided by the quantity of Shipsets both 1) delivered by Spirit to Boeing after [*****] and 2) delivered by Boeing to its customers in the [*****] to establish an average Spirit Tags per Shipset value. An example of this calculation is set forth in Exhibit A to this Attachment 29.

D.1.3 Introduction of 787-9: In the [*****] Boeing delivers the first 787-9 Derivative, all of the 787-9 Shipsets delivered by Boeing to its Customers in [*****] shall be excluded from the performance calculation set forth in D.2.1, D.2.2, D.3 or D4 as applicable. All such 787-9 Shipsets excluded from such performance calculation shall be included in the calculation establishing the performance basis for [*****]. An example of this provision is set forth in Exhibit B to this Attachment 29.

D.2.1 In the [*****], Boeing shall calculate the total quantity of Nonconformance EPDs assigned to Spirit in accordance with SBP Attachment 16 for those Shipsets delivered by Boeing to its customers in the [*****]. This total quantity of Nonconformance EPDs shall be divided by the quantity of Shipsets delivered by Boeing to its customers in the [*****] to establish an average Nonconformance EPDs per Shipset value for [*****].

22

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 9

SBP ATTACHMENT 29 TO

SPECIAL BUSINESS PROVISIONS

Incentive Payment for Quality (cont.)

D.2.2 In the [*****], Spirit shall calculate the total quantity of Spirit Tags for those Shipsets delivered by Boeing to its customers in the [*****]. This total quantity of Spirit Tags shall be divided by the quantity of Shipsets delivered by Boeing to its customers in the [*****] to establish an average Spirit Tags per Shipset value for [*****].

D.3 Both the average Nonconformance EPDs and Spirit Tags per Shipset for [*****] shall be compared to the average Nonconformance EPDs and Spirit Tags per Shipset for [*****]. If both the average Nonconformance EPDs and Spirit Tags per Shipset for [*****] are equal to or less than [*****] percent ([*****] %) of the average Nonconformance EPDs and Spirit Tags per Shipset for [*****], Spirit shall be awarded an Incentive Payment for Quality of [*****] dollars ($[*****]). If neither the average Nonconformance EPDs or Spirit Tags are greater than [*****] percent ([*****] %) of the average Nonconformance EPDs and Spirit Tags per Shipset for [*****], Spirit shall be awarded an Incentive Payment for Quality of [*****] dollars ($[*****]). If neither the average Nonconformance EPDs or Spirit Tags are greater than [*****] percent ([*****] %) of the average Nonconformance EPDs and Spirit Tags per Shipset for [*****], Spirit shall be awarded an Incentive Payment for Quality of [*****] dollars ($[*****]). If either the average Nonconformance EPDs or Spirit Tags per Shipset for [*****] are greater than [*****] percent ([*****] %) of the average Nonconformance EPDs or Spirit Tags per Shipset for [*****], Spirit shall not be awarded any Incentive Payment for Quality for the [*****]. An example of this calculation is set forth in Exhibit A to this Attachment 29.

D.4 In the [*****], Boeing and Spirit shall make the same calculation as described in D.2 to establish the average Nonconformance EPDs and Spirit Tags per Shipset for the [*****]. Such calculation shall be compared to the lowest value for average Nonconformance EPDs and Spirit Tags per Shipset of [*****] prior to that being evaluated and the calculation of any Incentive Payment for Quality shall be between those two values utilizing the same thresholds and Incentive Payment for Quality values described in paragraph D.3 of this Attachment 29. When determining the lowest value of [*****], such value shall exclude 787-9 Shipsets for the [*****].

23

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 9

SBP ATTACHMENT 29 TO

SPECIAL BUSINESS PROVISIONS

Incentive Payment for Quality (cont.)

E. Contract Termination

If this SBP is terminated after the start of an Incentive Payment for Quality evaluation period, the Incentive Payment for Quality deemed earned for that period shall be determined by Boeing using the Incentive Payment for Quality evaluation process, as specified herein, provided that the Incentive Payment for Quality amounts earned will be pro-rated based on the time period the SBP is in effect during the evaluation period. After termination, the remaining Incentive Payment for Quality amounts allocated to all subsequent Incentive Payment for Quality evaluation periods cannot be earned by Spirit and, therefore, shall not be paid.

24

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 9

SBP ATTACHMENT 29 TO

SPECIAL BUSINESS PROVISIONS

Incentive Payment for Quality (cont.)

Exhibit A

All stated Shipset deliveries, Nonconformance EPD quantities and calculation results are notional and for example purposes only.

1. | [*****] baseline calculation example per Attachment 29, paragraphs D.1.1 and D.1.2. Calculated in the [*****] |

A. Establish Shipsets to be included in base calculation:

In the year [*****] Spirit delivers Shipsets [*****] to Boeing.

In the year [*****], Boeing delivers Shipsets [*****] to its customers.

Result: The Shipsets used to establish the [*****] baseline calculation shall be Shipsets [*****].

B. Establish total Nonconformance EPD count:

The total quantity of Nonconformance EPDs assigned to Shipsets [*****] in accordance with SBP Attachment 16 are [*****].

C. Establish total Spirit Tags count:

The total quantity of Spirit Tags assigned to Shipsets [*****] are [*****]

D. Calculation:

Total Nonconformance EPDs of [*****] are divided by total Shipset count of [*****] (Shipsets [*****]). Result is average of [*****] Nonconformance EPDs per Shipset.

Total Spirit Tags of [*****] are divided by total Shipset count of [*****] (Shipsets [*****]). Result is average of [*****] Spirit Tags per Shipset.

25

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 9

SBP ATTACHMENT 29 TO

SPECIAL BUSINESS PROVISIONS

Incentive Payment for Quality (cont.)

Exhibit A (cont.)

2. | Quality Incentive Payment Calculation - Notional Calculations for [*****]. Calculated in the [*****] |

2.1 | Scenario 1 |

A. Establish Shipsets to be included in calculation:

In [*****], Boeing delivers Shipsets [*****] to its customers.

B. Establish total Nonconformance EPD count:

The total quantity of Nonconformance EPDs assigned to Shipsets [*****] is [*****].

The total quantity of Spirit Tags assigned to Shipsets [*****] is [*****].

C. Calculation:

Total Nonconformance EPDs of [*****] are divided by total Shipset count of [*****] (Shipsets [*****]). Result is average of [*****] Nonconformance EPDs per Shipset. This represents [*****]% of the [*****] baseline value of [*****].

Total Spirit Tags of [*****] are divided by total Shipset count of [*****]. Result is an average of [*****] Spirit Tags per Shipset. This represents [*****]% of the [*****] baseline value of [*****].

Both calculations are less than the [*****] % threshold required for the full Incentive Payment for Quality value and Spirit is awarded $[*****] for [*****].

2.2 | Scenario 2 |

A. Establish Shipsets to be included in calculation:

In [*****], Boeing delivers Shipsets [*****] to its customers.

B. Establish total Nonconformance EPD count:

The total quantity of Nonconformance EPD’s assigned to Shipsets [*****] is [*****].

The total quantity of Spirit Tags assigned to Shipsets [*****] is [*****].

26

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 9

SBP ATTACHMENT 29 TO

SPECIAL BUSINESS PROVISIONS

Incentive Payment for Quality (cont.)

Exhibit A (cont.)

C. Calculation:

Total Nonconformance EPDs of [*****] are divided by total Shipset count of [*****] (Shipsets [*****]). Result is average of [*****] Nonconformance EPDs per Shipset. This represents [*****]% of the [*****] baseline value of [*****].

Total Spirit Tags of [*****] are divided by total Shipset count of [*****]. Result is an average of [*****] Spirit Tags per Shipset. This represents [*****]% of the [*****] baseline value of [*****].

Neither calculation is greater than the [*****] % threshold required for the Incentive Payment for Quality value of $[*****] and Spirit is awarded $[*****] for [*****].

2.3 | Scenario 3 |

A. Establish Shipsets to be included in calculation:

In [*****], Boeing delivers Shipsets [*****] to its customers.

B. Establish total Nonconformance EPD count:

The total quantity of Nonconformance EPD’s assigned to Shipsets [*****] is [*****].

The total quantity of Spirit Tags assigned to Shipsets [*****] is [*****].

C. Calculation:

Total Nonconformance EPDs of [*****] are divided by total Shipset count of [*****] (Shipsets [*****]). Result is average of [*****] Nonconformance EPDs per Shipset. This represents [*****]% of the [*****] baseline value of [*****].

Total Spirit Tags of [*****] are divided by total Shipset count of [*****]. Result is an average of [*****] Spirit Tags per Shipset. This represents [*****] % of the [*****] baseline value of [*****].

Neither calculation is greater than the [*****]% threshold required for the Incentive Payment for Quality value of $[*****] and Spirit is awarded $[*****] for [*****].

27

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 9

SBP ATTACHMENT 29 TO

SPECIAL BUSINESS PROVISIONS

Incentive Payment for Quality (cont.)

Exhibit A (cont.)

2.4 | Scenario 4 |

A. Establish Shipsets to be included in calculation:

In [*****], Boeing delivers Shipsets [*****] to its customers.

B. Establish total Nonconformance EPD count:

The total quantity of Nonconformance EPDs assigned to Shipsets [*****] is [*****].

The total quantity of Spirit Tags assigned to Shipsets [*****] is [*****].

C. Calculation:

Total Nonconformance EPDs of [*****] are divided by total Shipset count of [*****] (Shipsets [*****]). Result is average of [*****] Nonconformance EPDs per Shipset. This represents [*****]% of the [*****] baseline value of [*****].

Total Spirit Tags of [*****] are divided by total Shipset count of [*****]. Result is an average of [*****] Spirit Tags per Shipset. This represents [*****]% of the [*****] baseline value of [*****].

One of the calculations is greater than the [*****]% threshold required for any Incentive Payment for Quality and no Incentive Payment for Quality is awarded for [*****].

28

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014

Confidential portions of this exhibit have been omitted pursuant to a request for confidential treatment filed separately with the Securities and Exchange Commission. Omissions are designated by the symbol [*****].

SBP BCA-MS-65530-0019, Amendment 21 Exhibit 9

SBP ATTACHMENT 29 TO

SPECIAL BUSINESS PROVISIONS

Incentive Payment for Quality (cont.)

Exhibit B

All stated Shipset deliveries are notional and for example purposes only.

1. Introduction of the 787-9

Assumptions: the first 787-9 is delivered by Boeing to its Customer in the [*****]. A total of [*****] 787-9’s are delivered by Boeing to its Customers in the [*****]. They are Shipsets [*****]. Boeing delivers Shipsets [*****] to its Customers in [*****].

In calculating the average Boeing EPDs per Shipset and Spirit Tags per Shipset for the [*****], Shipsets [*****] and any Boeing EPDs or Spirit Tags associated with Shipsets [*****] are not included in the calculation when comparing to [*****] results. However, Shipsets [*****] and any Boeing EPDs or Spirit Tags associated with Shipsets [*****] are included in the [*****] values when the [*****] results are compared to [*****].

29

787 SBP between Boeing and Spirit

SBP BCA-MS-65530-0019, Amendment 21, July 1, 2014