Attached files

| file | filename |

|---|---|

| 8-K - 8-K - American Railcar Industries, Inc. | form8kstephenspresentation.htm |

November

2017

Investor Contact: 636.940.6000

Website: americanrailcar.com

American Railcar Industries, Inc.

Forward Looking

Disclaimer

Safe Harbor Statement

This presentation contains statements relating to our expected financial performance, objectives, long-term strategies and/or

future business prospects, events and plans that are forward-looking statements. Forward-looking statements represent our

estimates and assumptions only as of the date of this presentation. Such statements include, without limitation, statements

regarding: our plans to continue to transition the management of our lease fleet from ARL to in-house and terminate our

contractual agreements with ARL, our plans to address the Federal Railroad Administration (FRA) directive released September 30,

2016 and subsequently revised and superseded on November 18, 2016 (Directive) and the settlement we entered into related

thereto, various estimates we have made in preparing our financial statements, expected future trends relating to our industry,

products and markets, anticipated customer demand for our products and services, trends relating to our shipments, leasing

business, railcar services, and revenues, trends related to shipments for direct sale versus lease, our strategic objectives and long-

term strategies, our results of operations, financial condition and the sufficiency of our capital resources, our capital expenditure

plans, short- and long-term liquidity needs, ability to service our current debt obligations and future financing plans, our stock

repurchase program, anticipated benefits regarding the growth of our leasing business, the mix of railcars, customers and

commodities in our lease fleet and our lease fleet financings, anticipated production schedules for our products and the

anticipated production schedules of our joint ventures, our backlog, and the anticipated performance and capital requirements

of our joint ventures. These forward-looking statements are subject to known and unknown risks and uncertainties that could cause

actual results to differ materially from those anticipated. Investors should not place undue reliance on forward-looking statements,

which speak only as of the date they are made and are not guarantees of future performance. Potential risks and uncertainties

that could adversely affect our business and prospects include, among other things: our prospects in light of the cyclical nature of

our business; the health of and prospects for the overall railcar industry; the risk of being unable to market or remarket railcars for

sale or lease at favorable prices or on favorable terms or at all; the highly competitive nature of the manufacturing, railcar leasing

and railcar services industries; risks relating to our compliance with the Directive and the settlement related thereto, any

developments related to the Directive and the settlement agreement related thereto or other regulatory actions and any costs or

loss of revenue related thereto; risks relating to the ongoing transition of the management of our railcar leasing business from ARL

to in-house management following completion of the ARL Sale; fluctuations in commodity prices, including oil and gas; the

impact, costs and expenses of any warranty claims to which we may be subject now or in the future; the risks associated with our

ongoing compliance with transportation, environmental, health, safety, and regulatory laws and regulations, which may be

subject to change; the variable purchase patterns of our railcar customers and the timing of completion, customer acceptance

and shipment of orders, as well as the mix of railcars for lease versus direct sale; our ability to recruit, retain and train qualified

personnel; our ability to manage overhead and variations in production rates; the impact of any economic downturn, adverse

market conditions or restricted credit markets; our reliance upon a small number of customers that represent a large percentage

of our revenues and backlog; fluctuations in the costs of raw materials, including steel and railcar components, and delays in the

delivery of such raw materials and components; fluctuations in the supply of components and raw materials that we use in railcar

manufacturing; the ongoing risks related to our relationship with Mr. Carl Icahn, our principal beneficial stockholder through Icahn

Enterprises L.P. (IELP), and certain of his affiliates; the impact, costs and expenses of any litigation to which we may be subject now

or in the future; the risks associated with our current joint ventures and anticipated capital needs of and production capabilities at

our joint ventures; the sufficiency of our liquidity and capital resources, including long-term capital needs to further support the

growth of our lease fleet; the impact of repurchases pursuant to our stock repurchase program on our current liquidity and the

ownership percentage of our principal beneficial stockholder through IELP, Mr. Carl Icahn; the conversion of our railcar backlog

into revenues equal to our reported estimated backlog value; the risks and impact associated with any potential joint ventures,

acquisitions, strategic opportunities or new business endeavors; the integration with other systems and ongoing management of

our new enterprise resource planning system; risks related to our and our subsidiaries’ indebtedness and compliance with

covenants contained in our and our subsidiaries’ financing arrangements; and the additional risk factors described in our filings

with the Securities and Exchange Commission. We expressly disclaim any duty to provide updates to any forward-looking

statements made in this presentation, whether as a result of new information, future events or otherwise.

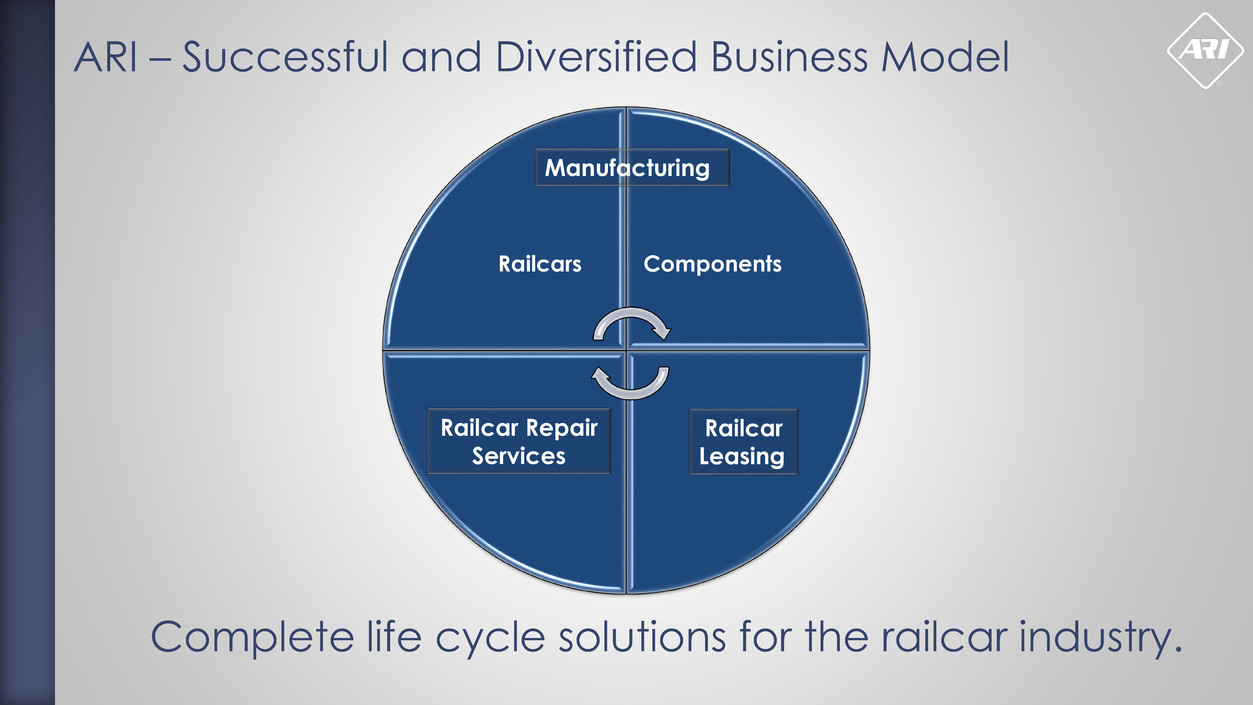

ARI – Successful and Diversified Business Model

Complete life cycle solutions for the railcar industry.

Railcars Components

Manufacturing

Railcar Repair

Services

Railcar

Leasing

Strategic Developments

• Integration of strong sales force and fleet management group

• Managing our lease fleet in-house gives us the opportunity to

streamline processes and realize synergies and cost savings in

integrating with the rest of our organization

• Our sales and marketing strategy begins with listening to our customers

and finding solutions to fit their needs

• ARI has now evolved into a one-stop shop with product offerings

including manufacturing, leasing and railcar services

• With all of these pieces in place, and with this fully integrated business

model, “It’s all here”

ARI Locations

Added strategically placed sales force to cover all of our customers’ needs

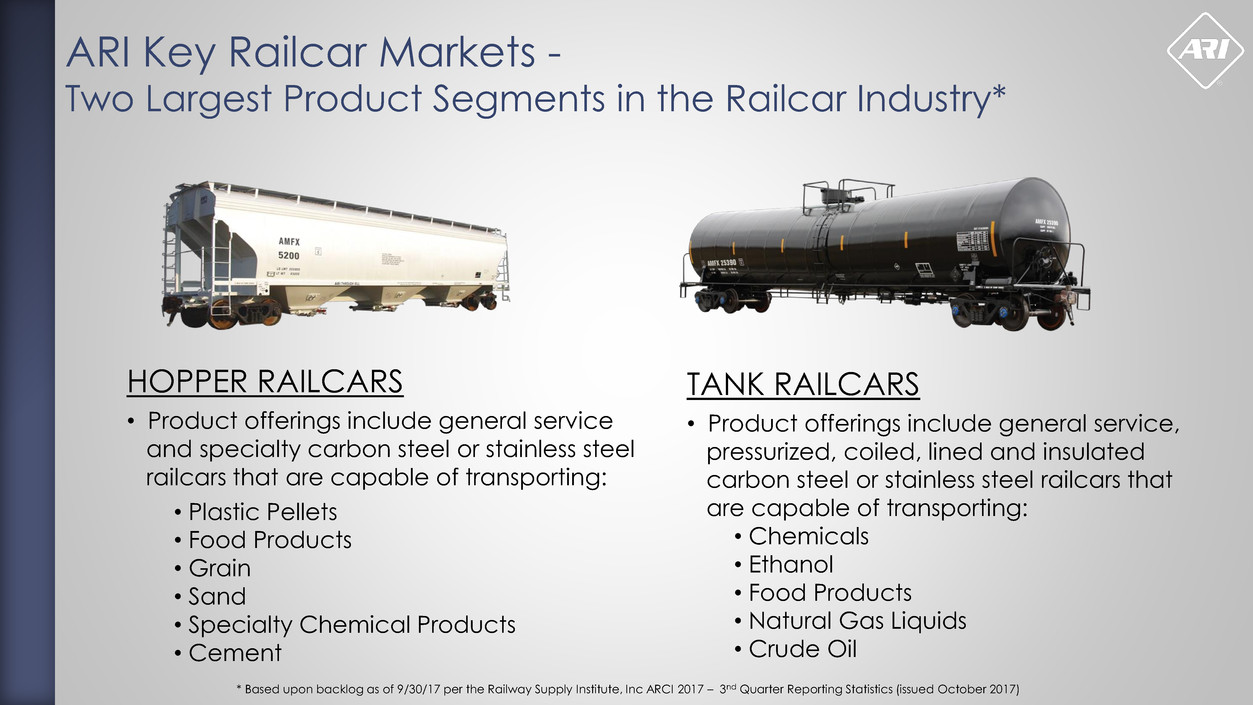

ARI Key Railcar Markets -

Two Largest Product Segments in the Railcar Industry*

TANK RAILCARS

• Product offerings include general service,

pressurized, coiled, lined and insulated

carbon steel or stainless steel railcars that

are capable of transporting:

• Chemicals

• Ethanol

• Food Products

• Natural Gas Liquids

• Crude Oil

HOPPER RAILCARS

• Product offerings include general service

and specialty carbon steel or stainless steel

railcars that are capable of transporting:

• Plastic Pellets

• Food Products

• Grain

• Sand

• Specialty Chemical Products

• Cement

* Based upon backlog as of 9/30/17 per the Railway Supply Institute, Inc ARCI 2017 – 3nd Quarter Reporting Statistics (issued October 2017)

North American Fleet by Railcar Type

58% of the North American fleet is Covered Hopper and Tank Railcars

The total North American railcar fleet was approximately 1.6 million railcars as of 10/1/2017.

Tank Cars

406,717 ,

25%

Covered Hoppers

543,555 , 33%

140,647 , 9%

216,016 ,

13%

200,324 ,

12%

17,469 ,

1%

108,142 ,

7%

Tank Cars Covered Hoppers Open-top Hoppers Gondolas Flat Cars Other Box Cars

North American Fleet

by Railcar Type

Source: Association of American Railroads’ Rail Time Indicators, issued 10/6/2017

Our core products are covered hopper and tank railcars but we continue to explore other strategic car types

that our manufacturing facilities can produce.

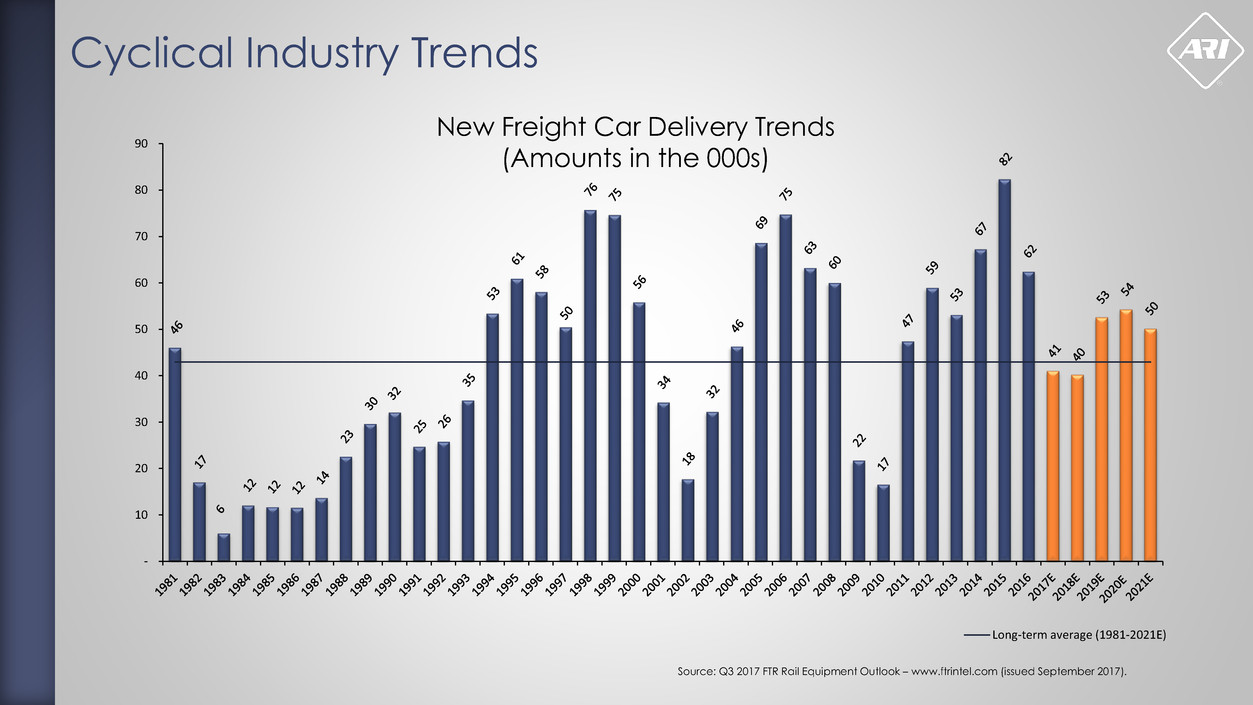

Cyclical Industry Trends

-

10

20

30

40

50

60

70

80

90

Long-term average (1981-2021E)

New Freight Car Delivery Trends

(Amounts in the 000s)

Source: Q3 2017 FTR Rail Equipment Outlook – www.ftrintel.com (issued September 2017).

2

4

6

15

19 20

17

5

6

20

21

11

20

30

26

17 17

21 21

19

-

5

10

15

20

25

30

35

Long-term average (1981 - 2021E)

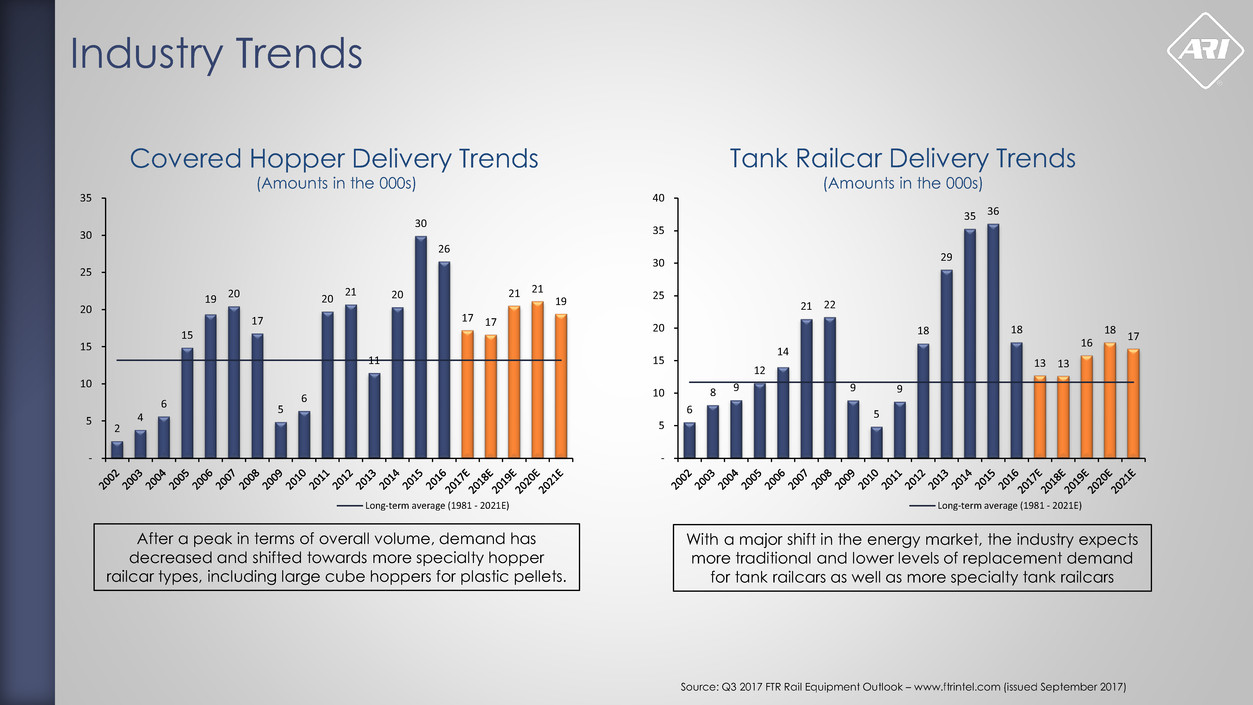

Industry Trends

Covered Hopper Delivery Trends

(Amounts in the 000s)

Tank Railcar Delivery Trends

(Amounts in the 000s)

After a peak in terms of overall volume, demand has

decreased and shifted towards more specialty hopper

railcar types, including large cube hoppers for plastic pellets.

With a major shift in the energy market, the industry expects

more traditional and lower levels of replacement demand

for tank railcars as well as more specialty tank railcars

Source: Q3 2017 FTR Rail Equipment Outlook – www.ftrintel.com (issued September 2017)

6

8 9

12

14

21 22

9

5

9

18

29

35 36

18

13 13

16

18

17

-

5

10

15

20

25

30

35

40

Long-term average (1981 - 2021E)

22%

Tank Cars

52%

Covered Hoppers

4%

2%

7%

6%

7%

74% of railcars delivered by the industry as a whole in the

12 months ended September 30, 2017 were covered

hopper and tank railcars

Freight Railcar Market Overview

Source: Railway Supply Institute, Inc. ARCI 2017 – 3nd Quarter Reporting Statistics (issued October 2017)

28%

Tank Cars

57%

Covered Hoppers

1%

3%

6%

3% 3% Tank Cars

Covered Hoppers

Open-top Hoppers

Gondolas

Flat Cars

Intermodal

Box Cars

85% of the industry railcar backlog as of

September 30, 2017 was for covered hopper and tank railcars

Industry Railcar Backlog as of

9/30/2017

The industry’s backlog of 64,253 railcars as of 9/30/2017

includes orders for deliveries that extend into 2018 and beyond.

Industry Railcar Deliveries

TTM 9/30/2017

ARI’s Railcar Backlog

Dec 2008 Dec 2009 Dec 2010 Dec 2011 Dec 2012 Dec 2013 Dec 2014 Dec 2015 Dec 2016 Sept 2017

Railcar backlog for lease - - - 2,200 1,810 2,330 2,844 1,452 1,637 657

Railcar backlog for direct sale 4,240 550 1,050 4,330 5,250 6,230 8,888 5,629 2,176 2,026

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

T

otal

Ra

il

c

ar

Ba

c

k

lo

g

1,050

6,530 7,060

8,560

11,732

7,081

4,240

550

3,813

2,683

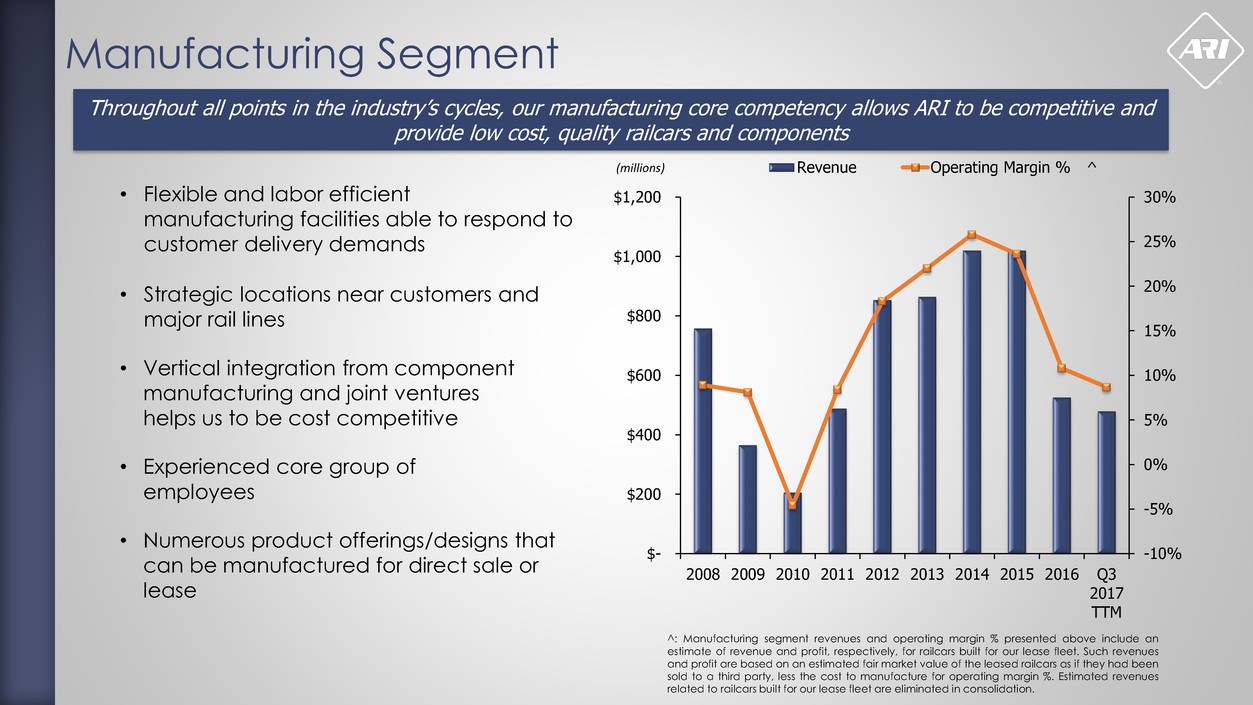

• Flexible and labor efficient

manufacturing facilities able to respond to

customer delivery demands

• Strategic locations near customers and

major rail lines

• Vertical integration from component

manufacturing and joint ventures

helps us to be cost competitive

• Experienced core group of

employees

• Numerous product offerings/designs that

can be manufactured for direct sale or

lease

Manufacturing Segment

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

$-

$200

$400

$600

$800

$1,000

$1,200

2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3

2017

TTM

Revenue Operating Margin % ^(millions)

^: Manufacturing segment revenues and operating margin % presented above include an

estimate of revenue and profit, respectively, for railcars built for our lease fleet. Such revenues

and profit are based on an estimated fair market value of the leased railcars as if they had been

sold to a third party, less the cost to manufacture for operating margin %. Estimated revenues

related to railcars built for our lease fleet are eliminated in consolidation.

Throughout all points in the industry’s cycles, our manufacturing core competency allows ARI to be competitive and

provide low cost, quality railcars and components

Railcar Leasing Segment

Diversifying and supplementing our business with revenue streams generated over the life of the railcar

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

$-

$20

$40

$60

$80

$100

$120

$140

$160

2012 2013 2014 2015 2016 Q3 2017

TTM

Revenue Lease Fleet(millions)

• Disciplined lease strategy balancing mix of customers,

commodities, acceptable market rates, and

staggered lease terms

• Relatively young lease fleet with low

maintenance expense

• Began in-house management of the

railcar leasing business as a result of the ARL

sale on June 1, 2017

• Added to our existing sales force, established

lease fleet management group, and added

other key supporting roles

• Further integration of ARI’s business model

• ARI obtained and is using software and data

owned and used by ARL to manage leased

railcars

• Further fleet growth expected to come from

existing liquidity and future railcar leveraged

financing(s)

• Unencumbered leased railcars available to

borrow against

Railcar Services Segment

Supporting both ARI’s lease fleet and customers' railcar needs, while gaining valuable industry insight

TRADITIONAL REPAIR

• Railcar qualifications and inspections

• Light/heavy railcar repairs

• Exterior and interior coatings

• Cleaning

• Valve replacement and testing

• Wheel and axle replacement

• Additional offerings for mini-shops and mobile

on-site customer repairs

TANK RAILCAR RETROFITTING

• Tank railcar manufacturing facility offers

retrofit capabilities along with traditional

repair services

0%

5%

10%

15%

20%

25%

$-

$10

$20

$30

$40

$50

$60

$70

$80

$90

2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3

2017

TTM

Revenue Operating Margin %

(millions)

ARI’s repair network has been inspecting railcars pursuant to the FRA’s Revised Directive,

including both its own leased railcars and railcars owned by its direct sale customers.

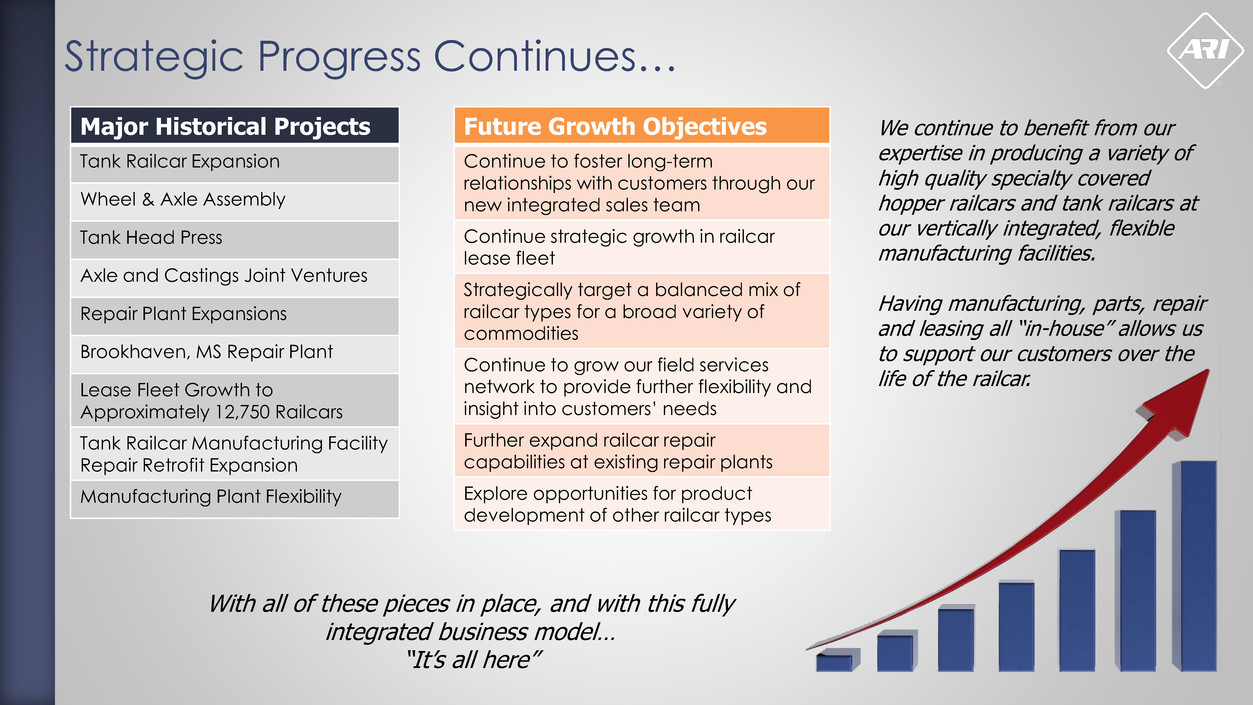

Strategic Progress Continues…

Major Historical Projects

Tank Railcar Expansion

Wheel & Axle Assembly

Tank Head Press

Axle and Castings Joint Ventures

Repair Plant Expansions

Brookhaven, MS Repair Plant

Lease Fleet Growth to

Approximately 12,750 Railcars

Tank Railcar Manufacturing Facility

Repair Retrofit Expansion

Manufacturing Plant Flexibility

Future Growth Objectives

Continue to foster long-term

relationships with customers through our

new integrated sales team

Continue strategic growth in railcar

lease fleet

Strategically target a balanced mix of

railcar types for a broad variety of

commodities

Continue to grow our field services

network to provide further flexibility and

insight into customers’ needs

Further expand railcar repair

capabilities at existing repair plants

Explore opportunities for product

development of other railcar types

We continue to benefit from our

expertise in producing a variety of

high quality specialty covered

hopper railcars and tank railcars at

our vertically integrated, flexible

manufacturing facilities.

Having manufacturing, parts, repair

and leasing all “in-house” allows us

to support our customers over the

life of the railcar.

With all of these pieces in place, and with this fully

integrated business model…

“It’s all here”

Strong Financial Profile

• Positive financial returns resulting from ARI’s participation in the largest railcar

markets: hopper and tank railcars

• Strong balance sheet with increased financing capacity to support operations

and future lease fleet growth

• 21st consecutive quarterly dividend declared (most recent - $0.40 per share)

• Stock Repurchase Program of up to $250 million with purchases of $86.0 million

through September 30, 2017

• Revolving credit capacity of up to $200 million

FRA Railworthiness Directive No. 2016-01 [Revised]

SETTLEMENT

In August 2017, ARI entered into a settlement agreement with the Federal Railroad

Administration (“FRA”)

• Settlement applies to railcars owned by ARI and certain of its affiliates and provides

regulatory clarity

• Extends deadline for completing inspection and testing of 15% highest mileage tank railcars

to December 31, 2017

• Provides that all other directive tank railcars are inspected, tested, and if necessary repaired

at the earlier of the next qualification, scheduled maintenance, shopping or repair event, or

December 31, 2025

• Provides flexibility if the FRA imposes, or fails to impose, requirements on the other owners of

the directive tank railcars

• Modifies and clarifies inspection protocol

• ARI dismissed its lawsuit against the FRA

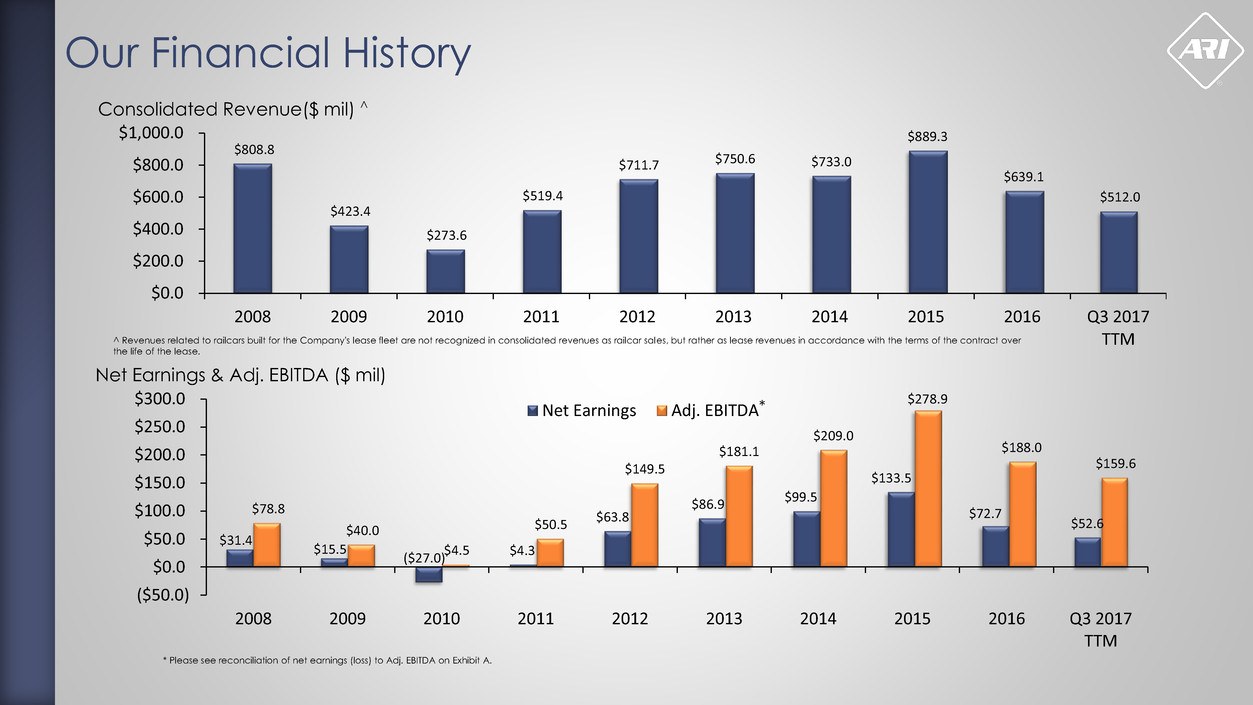

Our Financial History

$808.8

$423.4

$273.6

$519.4

$711.7 $750.6 $733.0

$889.3

$639.1

$512.0

$0.0

$200.0

$400.0

$600.0

$800.0

$1,000.0

2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3 2017

TTM^ Revenues related to railcars built for the Company's lease fleet are not recognized in consolidated revenues as railcar sales, but rather as lease revenues in accordance with the terms of the contract over

the life of the lease.

* Please see reconciliation of net earnings (loss) to Adj. EBITDA on Exhibit A.

$31.4

$15.5

($27.0)

$4.3

$63.8

$86.9 $99.5

$133.5

$72.7

$52.6

$78.8

$40.0

$4.5

$50.5

$149.5

$181.1

$209.0

$278.9

$188.0

$159.6

($50.0)

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3 2017

TTM

Net Earnings Adj. EBITDA*

Consolidated Revenue($ mil) ^

Net Earnings & Adj. EBITDA ($ mil)

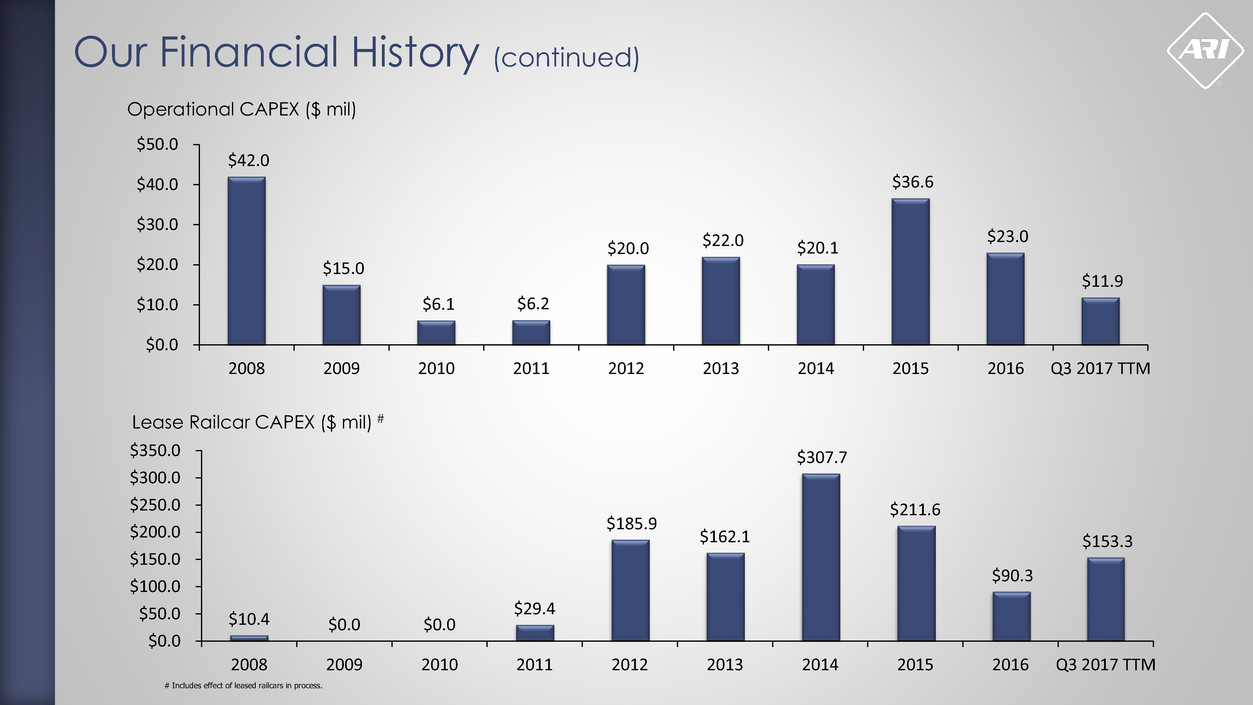

Our Financial History (continued)

$10.4 $0.0 $0.0

$29.4

$185.9

$162.1

$307.7

$211.6

$90.3

$153.3

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3 2017 TTM

Lease Railcar CAPEX ($ mil) #

Operational CAPEX ($ mil)

$42.0

$15.0

$6.1 $6.2

$20.0 $22.0 $20.1

$36.6

$23.0

$11.9

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

2008 2009 2010 2011 2012 2013 2014 2015 2016 Q3 2017 TTM

# Includes effect of leased railcars in process.

Quarterly Financial Comparison

$263.8

$192.0

$172.7

$260.9

$176.2

$150.5 $145.0

$167.5

$114.7 $109.0 $120.7

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

^ Revenues related to railcars built for the Company's lease fleet are not recognized in consolidated revenues as railcar sales, but rather as lease revenues in accordance with the terms of the contract over the life of the lease.

Consolidated Revenue ($ mil) ^

$35.0 $33.0 $29.4

$36.2

$22.8 $19.9

$7.7

$22.3

$10.6 $10.9 $8.9

$72.0 $68.5

$62.6

$75.8

$54.5 $50.4

$31.3

$51.8

$36.1 $37.0 $34.6

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

Net Earnings Adjusted EBITDA *

* Please see reconciliation of net earnings (loss) to Adj. EBITDA on Exhibit A.

Net Earnings & Adj. EBITDA ($ mil)

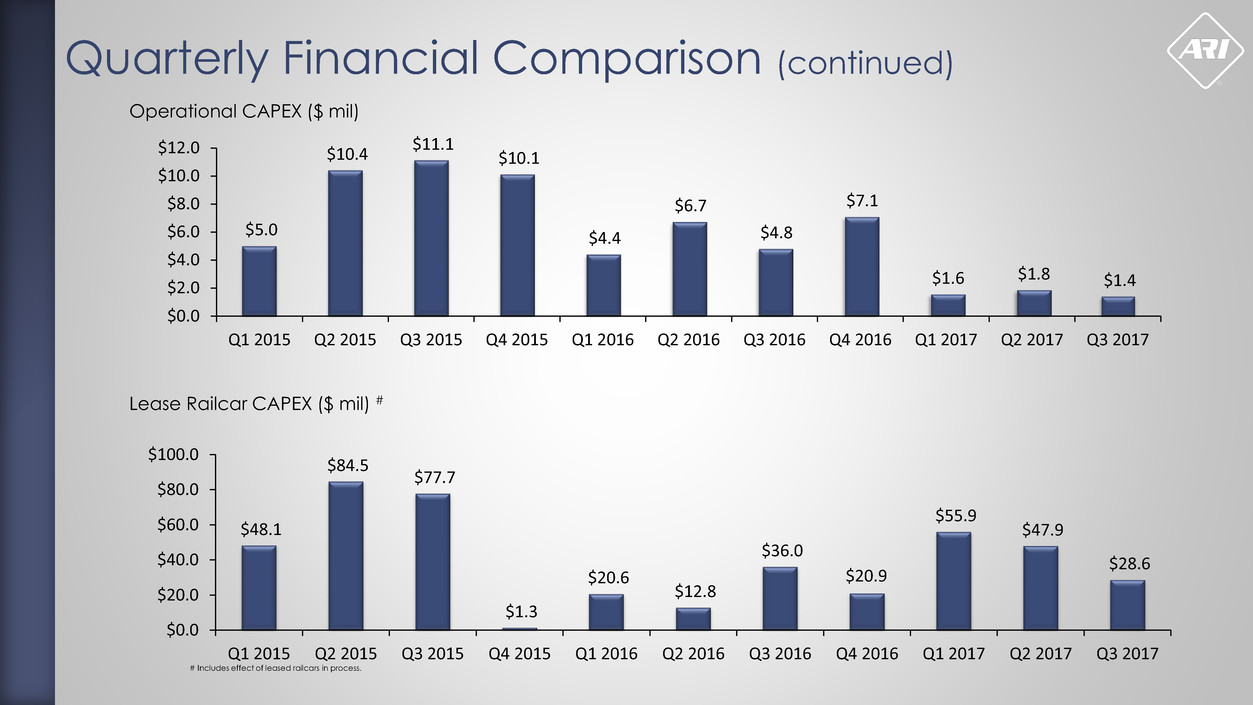

Quarterly Financial Comparison (continued)

$5.0

$10.4

$11.1

$10.1

$4.4

$6.7

$4.8

$7.1

$1.6 $1.8 $1.4

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

$48.1

$84.5

$77.7

$1.3

$20.6

$12.8

$36.0

$20.9

$55.9

$47.9

$28.6

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

# Includes effect of leased railcars in process.

Operational CAPEX ($ mil)

Lease Railcar CAPEX ($ mil) #

Exhibit A – Adj. EBITDA Reconciliation

In Thousands, unaudited

Exhibit A – Adj. EBITDA Reconciliation

EBITDA represents net earnings before income tax expense, interest expense (income) and depreciation of property, plant and

equipment. The Company believes EBITDA is useful to investors in evaluating ARI’s operating performance compared to that of other

companies in the same industry. In addition, ARI’s management uses EBITDA to evaluate operating performance. The calculation of

EBITDA eliminates the effects of financing, income taxes and the accounting effects of capital spending. These items may vary for

different companies for reasons unrelated to the overall operating performance of a company’s business. EBITDA is not a financial

measure presented in accordance with U.S. generally accepted accounting principles (U.S. GAAP). Accordingly, when analyzing the

Company’s operating performance, investors should not consider EBITDA in isolation or as a substitute for net earnings (loss), cash flows

provided by operating activities or other statements of operations or cash flow data prepared in accordance with U.S. GAAP. The

calculation of EBITDA is not necessarily comparable to that of other similarly titled measures reported by other companies.

Adjusted EBITDA represents EBITDA before share based compensation expense (income) related to stock appreciation rights (SARs)

and other income related to our short-term investments. Management believes that Adjusted EBITDA is useful to investors in evaluating

the Company’s operating performance, and therefore uses Adjusted EBITDA for that purpose. The Company’s SARs, which settle in

cash, are revalued each period based primarily upon changes in ARI’s stock price. Management believes that eliminating the

expense (income) associated with share-based compensation and income associated with short-term investments allows

management and ARI’s investors to understand better the operating results independent of financial changes caused by the

fluctuating price and value of the Company’s common stock and short-term investments. Adjusted EBITDA is not a financial measure

presented in accordance with U.S. GAAP. Accordingly, when analyzing operating performance, investors should not consider

Adjusted EBITDA in isolation or as a substitute for net earnings, cash flows provided by operating activities or other statements of

operations or cash flow data prepared in accordance with U.S. GAAP. The Company’s calculation of Adjusted EBITDA is not

necessarily comparable to that of other similarly titled measures reported by other companies.

A Tradition of Industry Leadership