Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Kearny Financial Corp. | d485014dex992.htm |

| EX-2.1 - EX-2.1 - Kearny Financial Corp. | d485014dex21.htm |

| 8-K - 8-K - Kearny Financial Corp. | d485014d8k.htm |

Acquisition of Clifton Bancorp Inc. (CSBK) November 2, 2017 Exhibit 99.1

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the merger between Kearny Financial Corp. (“Kearny”) and Clifton Bancorp Inc. (“Clifton”), including anticipated future results, cost savings and accretion to reported earnings that may be realized from the merger; (ii) Kearny and Clifton’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (iii) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. The following factors, among others, could cause actual results to differ materially from the anticipated results expressed in the forward-looking statements: the businesses of Kearny and Clifton may not be combined successfully, or such combination may take longer than expected; the cost savings from the merger may not be fully realized or may take longer than expected; operating costs, customer loss and business disruption following the merger may be greater than expected; governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger or otherwise; the stockholders of Clifton or Kearny may fail to approve the merger; the interest rate environment may further compress margins and adversely affect new interest income; the risks associated with continued diversification of assets and adverse changes to credit quality; and difficulties associated with achieving expected future financial results. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Kearny’s and Clifton’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission (the “SEC”) and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Kearny or Clifton or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, Kearny and Clifton do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made. Forward Looking Statements

Investors and stockholders are urged to carefully review and consider each of Kearny’s and Clifton’s public filings with the SEC, including, but not limited to, their Annual Reports on Form 10-K, their proxy statements, their Current Reports on Form 8-K and their Quarterly Reports on Form 10-Q. The documents filed by Kearny with the Securities and Exchange Commission (the “SEC”) may be obtained at the SEC’s Internet site (www.sec.gov). You will also be able to obtain these documents, free of charge, from Kearny at www.kearnybank.com under the tab “Company Info” under “Investor Relations” or by requesting them in writing to Kearny Financial Corp., 120 Passaic Avenue, Fairfield, New Jersey 07004, Attention: Sharon Jones, or from Clifton at www.csbk.bank under the tab “About Us” under “Investor Relations” or by requesting them in writing to Clifton Bancorp Inc., 1433 Van Houten Avenue, Clifton, New Jersey 07015, Attention: Michael Lesler. In connection with the proposed merger, Kearny will file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Kearny and Clifton and a prospectus of Kearny, as well as other relevant documents concerning the proposed merger. Investors and stockholders are urged to read the registration statement and the joint proxy statement/prospectus regarding the proposed merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. Copies of the registration statement and joint proxy statement/prospectus and the filings that will be incorporated by reference therein, as well as other filings containing information about Kearny and Clifton, when they become available, may be obtained at the SEC’s Internet site (www.sec.gov). Free copies of these documents may be obtained as described in the preceding paragraph. Clifton and Kearny and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Kearny and Clifton in connection with the proposed merger. Information about the directors and executive officers of Kearny is set forth in the proxy statement for the Kearny 2017 annual meeting of stockholders, as filed with the SEC on Schedule 14A on September 15, 2017. Information about the directors and executive officers of Clifton is set forth in the proxy statement for the Clifton 2017 annual meeting of stockholders, as filed with the SEC on Schedule 14A on June 29, 2017. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the joint proxy statement/prospectus and other relevant documents regarding the proposed merger to be filed with the SEC when they become available. Free copies of these documents may be obtained as described above. Additional Information About the Proposed Merger and Where to Find It

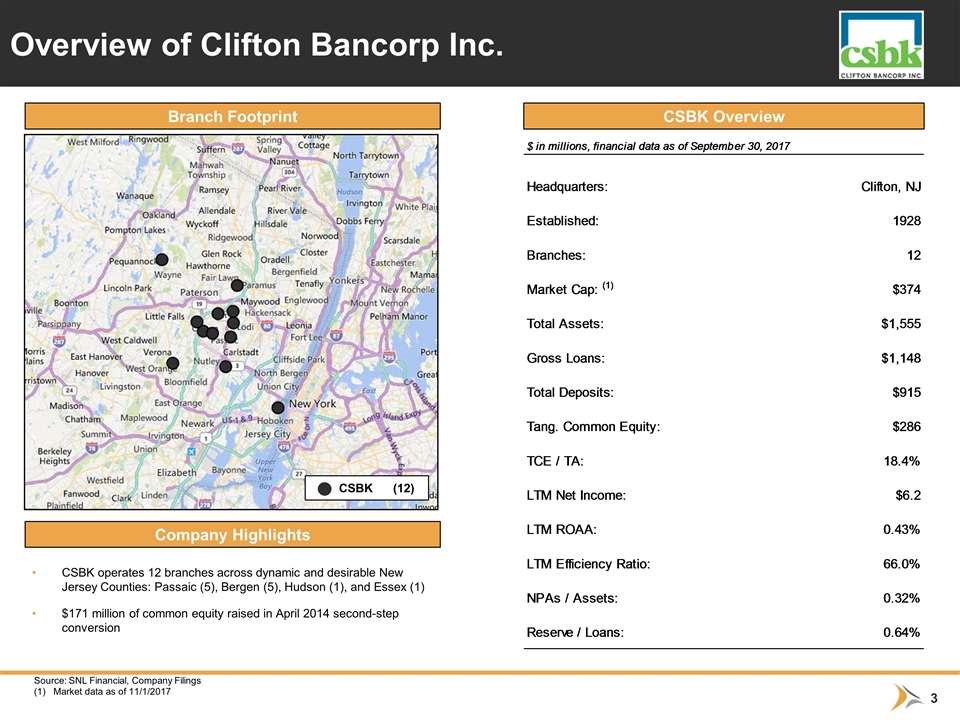

CSBK operates 12 branches across dynamic and desirable New Jersey Counties: Passaic (5), Bergen (5), Hudson (1), and Essex (1) $171 million of common equity raised in April 2014 second-step conversion Overview of Clifton Bancorp Inc. Source: SNL Financial, Company Filings (1) Market data as of 11/1/2017 Branch Footprint Company Highlights CSBK Overview CSBK (12)

Immediate and significant earnings accretion Modest TBV dilution, with TBV earnback period just over 2 years Low-risk acquisition, with solid asset quality characteristics in familiar markets Preserves capital flexibility for future organic growth, regular and special dividends, share repurchases, and opportunistic M&A Kearny improves to #7 New Jersey deposit position among New Jersey-based regional and community banks Meaningfully enhances Kearny’s position in economically attractive northern New Jersey markets including Bergen and Passaic Counties Achievable cost savings, and opportunity to further scale expense base Transaction Rationale

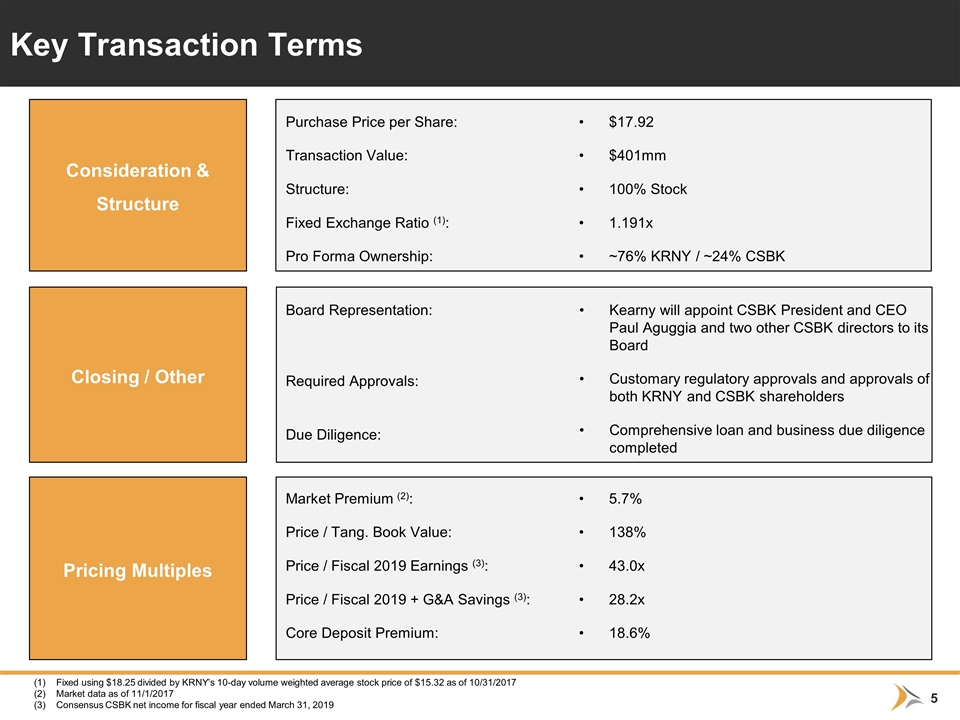

Key Transaction Terms Consideration & Structure Purchase Price per Share: Transaction Value: Structure: Fixed Exchange Ratio (1): Pro Forma Ownership: $17.92 $401mm 100% Stock 1.191x ~76% KRNY / ~24% CSBK Pricing Multiples Market Premium (2): Price / Tang. Book Value: Price / Fiscal 2019 Earnings (3): Price / Fiscal 2019 + G&A Savings (3): Core Deposit Premium: 5.7% 138% 43.0x 28.2x 18.6% Closing / Other Board Representation: Required Approvals: Due Diligence: Kearny will appoint CSBK President and CEO Paul Aguggia and two other CSBK directors to its Board Customary regulatory approvals and approvals of both KRNY and CSBK shareholders Comprehensive loan and business due diligence completed (1) Fixed using $18.25 divided by KRNY’s 10-day volume weighted average stock price of $15.32 as of 10/31/2017 (2) Market data as of 11/1/2017 (3) Consensus CSBK net income for fiscal year ended March 31, 2019

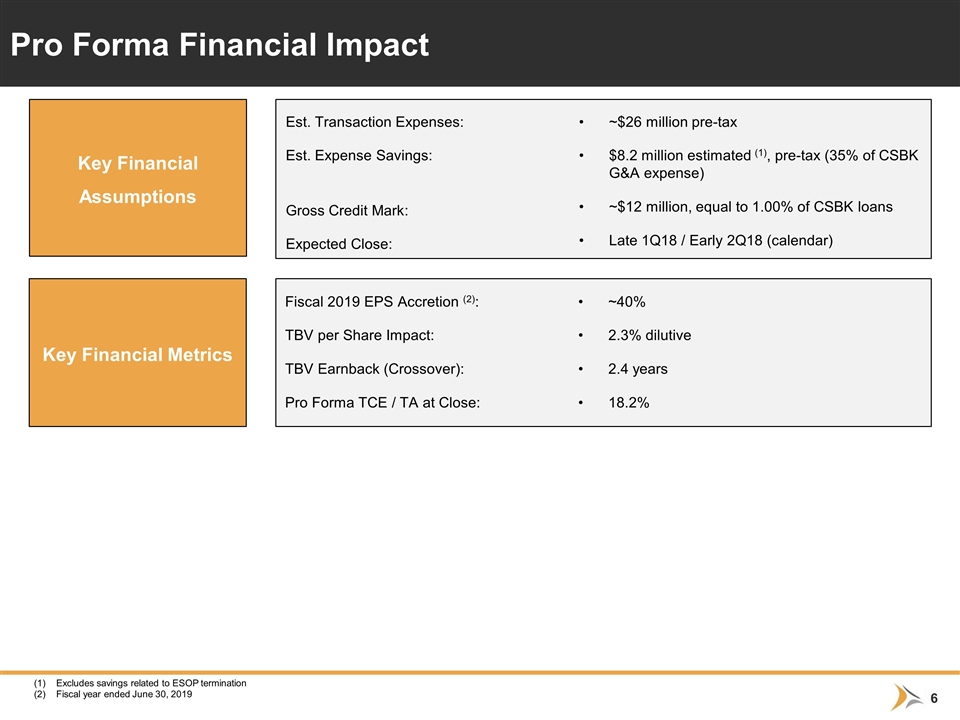

Pro Forma Financial Impact Key Financial Assumptions Est. Transaction Expenses: Est. Expense Savings: Gross Credit Mark: Expected Close: Key Financial Metrics Fiscal 2019 EPS Accretion (2): TBV per Share Impact: TBV Earnback (Crossover): Pro Forma TCE / TA at Close: (1) Excludes savings related to ESOP termination (2) Fiscal year ended June 30, 2019 ~$26 million pre-tax $8.2 million estimated (1), pre-tax (35% of CSBK G&A expense) ~$12 million, equal to 1.00% of CSBK loans Late 1Q18 / Early 2Q18 (calendar) ~40% 2.3% dilutive 2.4 years 18.2%

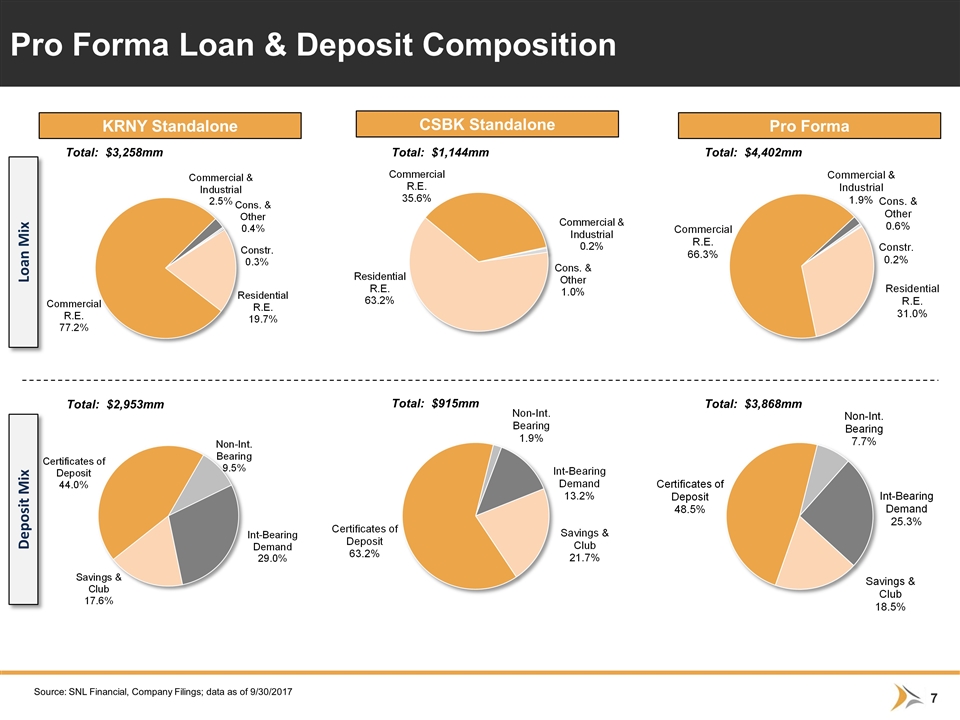

Pro Forma Loan & Deposit Composition KRNY Standalone CSBK Standalone Pro Forma Total: $3,258mm Total: $1,144mm Total: $4,402mm Loan Mix Deposit Mix Total: $2,953mm Total: $915mm Total: $3,868mm Source: SNL Financial, Company Filings; data as of 9/30/2017

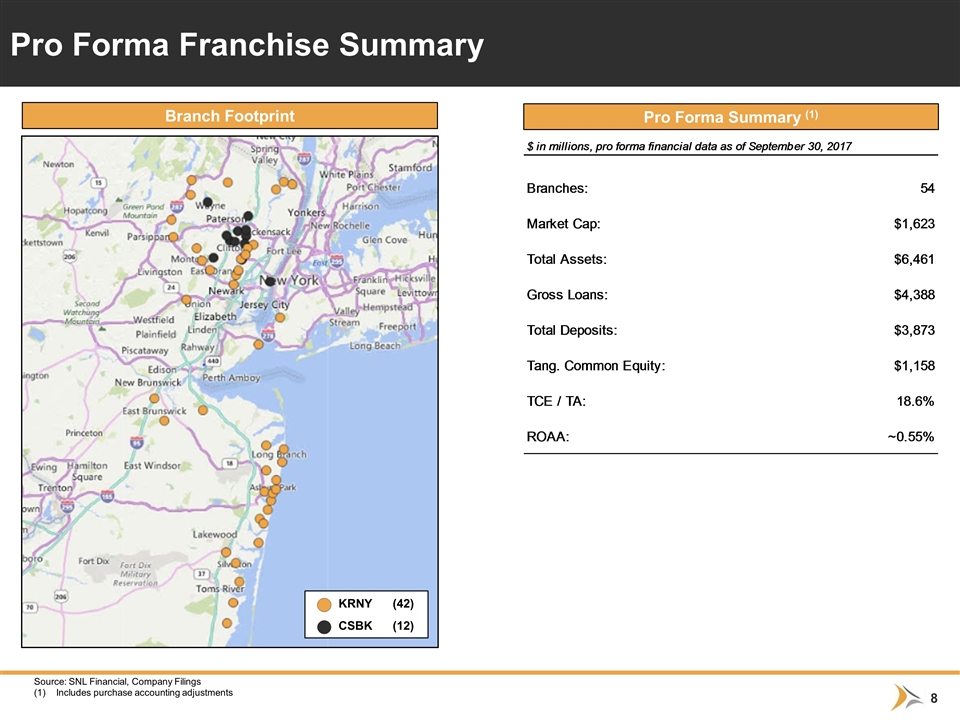

Pro Forma Franchise Summary Source: SNL Financial, Company Filings (1) Includes purchase accounting adjustments Branch Footprint Pro Forma Summary (1) KRNY (42) CSBK (12)

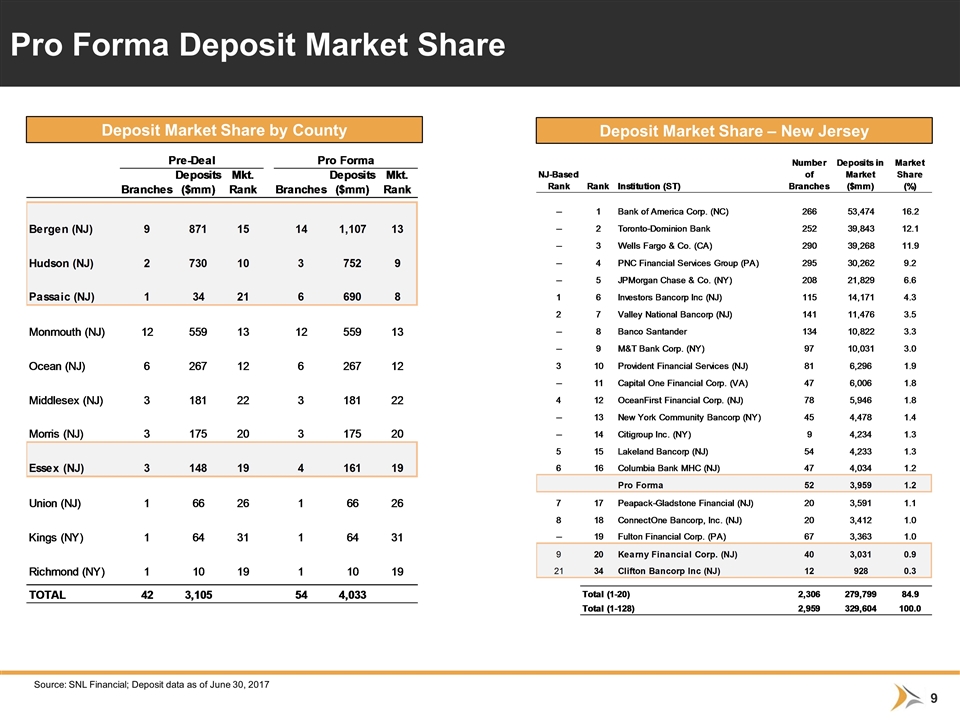

Pro Forma Deposit Market Share Deposit Market Share – New Jersey Deposit Market Share by County Source: SNL Financial; Deposit data as of June 30, 2017

Strong financial impacts, including substantial earnings accretion Strengthens Kearny’s strategic position in New Jersey as one of the state’s largest independent community banks Specifically enhances Kearny’s presence in economically attractive northern New Jersey markets Low execution risk Preserves strategic optionality and capital flexibility Transaction Summary