Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ally Financial Inc. | bancanalystsassociationofb.htm |

1

Ally Financial Inc.

BancAnalysts Association of Boston Conference

November 2, 2017

2

Forward-Looking Statements and Additional Information

This presentation and related communications should be read in conjunction with the financial statements, notes, and other information contained

in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This information is preliminary and

based on company and third-party data available at the time of the presentation or related communication.

This presentation and related communications contain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as our statements

about targets and expectations for various financial and operating metrics. Forward-looking statements often use words such as ―believe,‖

―expect,‖ ―anticipate,‖ ―intend,‖ ―pursue,‖ ―seek,‖ ―continue,‖ ―estimate,‖ ―project,‖ ―outlook,‖ ―forecast,‖ ―potential,‖ ―target,‖ ―objective,‖ ―trend,‖

―plan,‖ ―goal,‖ ―initiative,‖ ―priorities,‖ or other words of comparable meaning or future-tense or conditional verbs such as ―may,‖ ―will,‖ ―should,‖

―would,‖ or ―could.‖ Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All

forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which

are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future

objectives, strategies, plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward-looking

statement. Some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking

statements are described in our Annual Report on Form 10-K for the year ended December 31, 2016, our subsequent Quarterly Reports on Form

10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange

Commission (collectively, our ―SEC filings‖). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was

made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the

date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including

disclosures of a forward-looking nature) that we may make in any subsequent SEC filings.

This presentation and related communications contain specifically identified non-GAAP financial measures, which supplement the results that are

reported according to generally accepted accounting principles (―GAAP‖). These non-GAAP financial measures may be useful to investors but

should not be viewed in isolation from, or as a substitute for, GAAP results. Differences between non-GAAP financial measures and comparable

GAAP financial measures are reconciled in the presentation.

Our use of the term ―loans‖ describes all of the products associated with our direct and indirect lending activities. The specific products include

loans, retail installment sales contracts, lines of credit, leases, and other financing products. The term ―lend‖ or ―originate‖ refers to our direct

origination of loans or our purchase or acquisition of loans.

3

Ally Overview

Note: Total Assets, Deposits, Asset Mix and Funding Mix as of 3Q 2017

Building the leading digital bank

Asset Mix

$164 billion of Assets

Zero branches Over 5 million customers

$90 billion of Deposits

Funding Mix

Unsecured

Debt

13%

Secured

Debt

13%

Deposits

61%

Other

Borrowings

13%

End of period balances. Excludes Core OID. See page 21 for details. End of period balances. „Other‟ includes Insurance premium receivables and Other assets.

Retail Auto Loan

41%

Auto Lease

5%

Commercial Auto

22%Cash and

Securities

18%

Mortgage

7%

Corporate Finance

2%

Other

5%

4

Strategic Direction

Demonstrate resilient returns in auto finance through the cycle

Relentlessly focus on customers

Grow deposit and customer base

Expand additional products to unlock more value from Ally banking franchise

Leverage position as leader in digital banking

5

3%

10%

12% +/-

2013 2016 Medium-term Target

Driving Higher Shareholder Returns

(1) Medium-term defined as over the next 3-4 years. Represents a non-GAAP financial measure. See page 21 for details.

Improving Core ROTCE(1) through efficient capital allocation and earnings growth

• Growing net financing revenue

• Increasing noninterest income

• Operating leverage

• Optimize capital deployment

6

Customer Growth Through Brand and New Offerings

Consumer Auto

Retail Deposit

Wealth

Management

Other

(includes Credit Card, Mortgage)

Commercial Auto

4.3

million serviced units

18.5

thousand dealer relationships

1.4

million customers

235

thousand customers

(1) represents total consumer and commercial dealer relationships as of 9/30/17

Note: primary, active customers as of 9/30/2017

68

thousand customers

+ Deepening existing

relationships

+ New offerings

+ Accelerating

deposit customer

growth

=

Positioned to deliver

steady customer

growth

(1)

7

Relentless Focus on Customers – Our Brand and Culture

Simple, straightforward approach to banking – customer is at the core

Do It Right Customer-centricity Digital Simple

Build emotional relationship

with customer beyond

financial transactions

24/7 human customer

service

No branches = Great Rates

No geographical

constraints

Customer service that

actually serves

Smart

Solutions oriented and

deliver products that are

never status quo

Innovative

Align with disruptive trends

Transparent

Deliver the plain and

simple truth – no hidden

messages or fees

Low Fee / Great Rate

Fair and transparent fees;

attractive, not top rate

DO RIGHT TIRELESSLY INNOVATE OBSESS OVER THE CUSTOMER

8

Strong Emotional Connection with Customers

Brand has resonated and provides foundation for product expansion

Emotional connection continues to increase

Consumers’ love for Ally driven by:

Sense of pride and making them feel smart

Status they realize from banking with an innovative, customer-centric, fun brand

Belief that Ally understands their unique financial needs

LoveQuotient

2016

73

2017

77

Source: Love Quotient Survey March 2017

9

Expanding Bank Franchise

(1) The Ally CashBack Credit Card is issued by TD Bank N.A.

A L L Y A U T O

I N S U R A N C E

Co-brand product(1)

C A S H B A C K C A R D

A L L Y H O M E

D E P O S I T S

C O R P O R A T E

F I N A N C E

A L L Y I N V E S T

10

Ally Bank Market Share Growth

Ally outpacing direct bank market share without being top rate payer

7.0%

8.3%

9.8%

11.9%

12.8%

13.4%

14.3%

15.1%

5.5%

6.1% 6.2%

6.6% 6.9%

7.2% 7.6%

8.0%

8th

7th

9th

7th

9th

11th

8th

12th

2Q10 2Q11 2Q12 2Q13 2Q14 2Q15 2Q16 2Q17

Ally Bank market share of direct bank deposits

Direct bank market share of retail deposits

Ally OSA Bankrate.com position

Source: Ally Bank estimates the Direct Bank Retail Deposit market size using various sources including FDIC, FFIEC, NIC, earnings releases, 10-K/Q (excludes brokered CDs and

MMDA Sweeps)”

11

Compounding Retail Deposit Growth

New and existing retail deposit customers fueling growth

Retail Deposit Growth from New and Existing Customers ($ billions)

$1.3

$2.1

$2.0

$0.5

$1.3

$3.5

$2.1

$4.5

$5.2

$6.1

$4.3

$6.2

$7.7

$6.2

2011 2012 2013 2014 2015 2016 YTD Sep 2017

$27.7B

$74.9B

Existing Customer Growth

New Customer Growth

12

Stable Deposit Vintages

Ally Bank’s retail deposit vintages have been stable over time

Ally Retail Deposit Balances by Vintage ($ millions)

$0

$15,000

$30,000

$45,000

$60,000

$75,000

Pre-2009 2009 2010 2011 2012 2013 2014 2015 2016 2017

13

Retail Deposit Customer Growth

Retail Deposit Customer Growth (thousands)

89

109

124

162

126

142

166

200

2009 2010 2011 2012 2013 2014 2015 2016 2017 est

300

~

~1,400

Accelerating retail deposit customer growth

14

Banking Dynamics: Long-Term Convergence of Models

Direct Banking

• Cost effective

• Fewer Products

• Higher rates

~$500

billion of

deposits(1)

Traditional Banking

• Brick & Mortar

• More products

• Lower rates

~$5

trillion of

deposits(2)

Functionality and customer adoption will continue to progress

Deposit pricing should converge as functionality and products converge

Move towards digital represents long-term tailwind

~$4 trillion in consumer

deposits with a rate paid of

< 0.25%(3)

(1) Ally Bank estimates the market size using various sources including FDIC, FFIEC, NIC, earnings

releases, 10K/Q

(2) FFIEC Call Reports / FDIC - Deposits ($ trillions) in all accounts up to $250k held in domestic offices

and in insured branches in PR and US territories and possessions

(3) Internal Ally estimate calculated utilizing FDIC Call Report Data combined with third party rate reports

15

Diverse Customer Demographics

Scalable national retail deposit platform Attractive demographic trends

1.4

million

Retail deposit customers

> 50% new customers from Millennial generation (YTD 2017)

in all 50 states

95% Customer satisfaction(1)

Retail deposit franchise positioned for growth

Note: a county is shaded Ally purple if there was at least one primary, active banking customer residing there.

New Retail Deposit Customers by Generation

25% 29%

34% 39%

44% 47% 50%

54%

26%

27%

26%

27%

25% 24%

21%

21%28%

26%

24%

21% 19% 19%

17% 15%

13% 11%

9% 7% 5% 5% 4% 3%

8% 7% 6% 6% 6% 6% 7% 7%

FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 YTD Sept.

2017

Millennial Gen X Baby Boomers Silent Generation Other

(1) Survey administered by Ally September 2017

(2) Accenture. The “Greater” Wealth Transfer – Capitalizing on the Intergenerational Shift in Wealth, 2015

94% Customers would recommend Ally to a friend or family member(1)

~$30 trillion estimated

wealth transfer to

Millennial generation over

the next 30 – 40 years(2)

16

Value of Deposit Growth

Retail deposit growth drives strategic and financial path

Entry point for new banking customers

Reduce expensive capital markets funding

Support smart asset growth

($ billions)

3Q 2013(1) 3Q 2017(1)

Average

Balance

Average

Yield

Average

Balance

Average

Yield

Deposits(2) $51 1.3% $88 1.3%

Secured Debt $31 1.6% $23 2.2%

Unsecured Debt $33 5.0% $20 5.1%

FHLB/Other(3) $5 1.0% $16 1.4%

Total Funding Sources(4) $120 2.4% $147 1.9%

(1) Balances and yields based on average daily balances for the quarter ending 3Q 2017 and 3Q 2013

(2) Includes brokered deposits

(3) Includes Demand Notes, FHLB borrowings, and Repurchase Agreements

(4) Represents a non-GAAP financial measure. Excludes OID. See page 21 for calculation methodology and details.

17

19%

YoY Deposit Yield Change (basis points) (1)

7

9

10

12

14 14 14

15 15

16 16

17 17

19

Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 ALLY Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13

Median

Peer Deposit Pricing Changes and Balance Growth

Strong deposit growth with modest rate change

Balance Growth (YoY %)(1)

11% -3% 10% 4% 7% 10% 4% 5% 6% 8% 5% 11% 4%

(1) Year-over-year change for yield and balance growth based on 3Q 17 vs. 3Q 16 interest bearing deposit yield and balances, respectively. Data from company filings.

Peers include: BAC, C, CFG, COF, DFS, JPM, KEY, PNC, RF, STI, SYF, USB and WFC

18

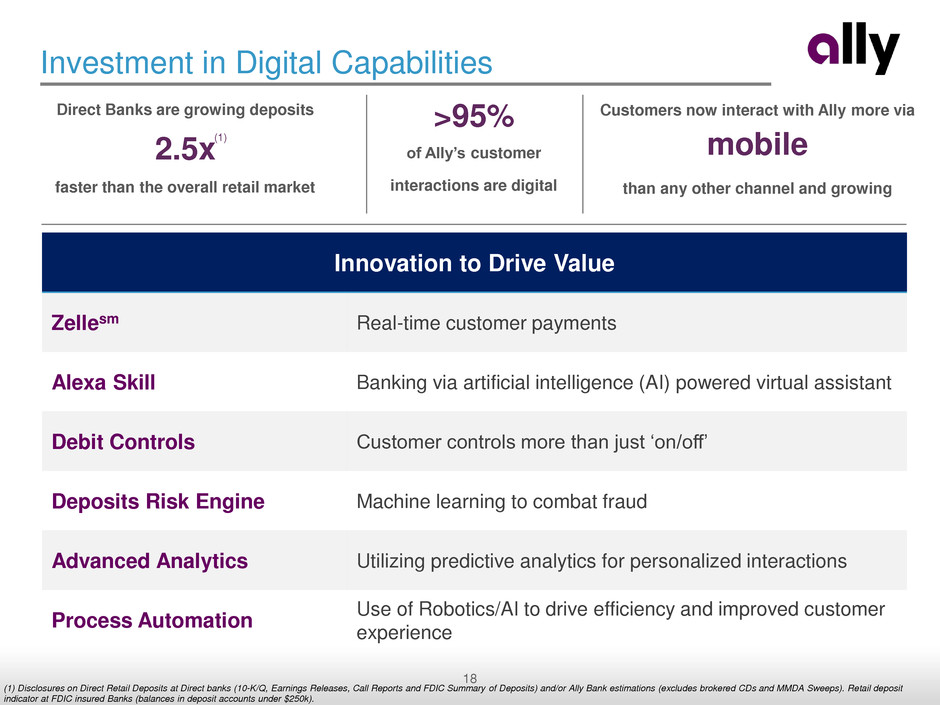

Investment in Digital Capabilities

Direct Banks are growing deposits

2.5x

faster than the overall retail market

Customers now interact with Ally more via

mobile

than any other channel and growing

>95%

of Ally’s customer

interactions are digital

(1)

(1) Disclosures on Direct Retail Deposits at Direct banks (10-K/Q, Earnings Releases, Call Reports and FDIC Summary of Deposits) and/or Ally Bank estimations (excludes brokered CDs and MMDA Sweeps). Retail deposit

indicator at FDIC insured Banks (balances in deposit accounts under $250k).

Innovation to Drive Value

Zellesm Real-time customer payments

Alexa Skill Banking via artificial intelligence (AI) powered virtual assistant

Debit Controls Customer controls more than just ‗on/off‘

Deposits Risk Engine Machine learning to combat fraud

Advanced Analytics Utilizing predictive analytics for personalized interactions

Process Automation

Use of Robotics/AI to drive efficiency and improved customer

experience

19

Wrap Up

Building the leading digital bank

Focused on demonstrating resilient returns in auto finance through the cycle

Secular digital trends are on our side

Deposit growth is a key driver of strategic and financial path

Developing new products to drive more value from banking franchise and

position for long-term growth

20 CONFIDENTIAL

Supplemental

21

Notes on non-GAAP and other financial measures

Supplemental

1) Core original issue discount (Core OID) is a non-GAAP financial measure for OID, primarily related to bond exchange OID which excludes international operations

and future issuances.

2) Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the

ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted

for unamortized Core OID and net DTA. As of 1Q 2016, Ally‟s Core net income available to common for purposes of calculating Core ROTCE is based on the actual

effective tax rate for the period adjusted for any discrete tax items including tax reserve releases, which aligns with the methodology used in calculating adjusted

earnings per share.

a) In the numerator of Core ROTCE, GAAP net income available to common is adjusted for discontinued operations net of tax, tax-effected Core OID expense, tax-

effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, certain discrete tax items and preferred stock

capital actions.

b) In the denominator, GAAP shareholder‟s equity is adjusted for preferred equity and goodwill and identifiable intangibles net of DTL, unamortized Core OID, and net

DTA.

Core Return on Tangible Common Equity ("Core ROTCE")

FY 2016 FY 2013

Numerator ($ millions)

GAAP net income available to common shareholders 1,037$ (688)$

less: Disc Ops, net of tax 44 55

add back: Core original issue discount expense ("Core OID expense") 59 249

add back: Repositioning Items 11 244

less: Core OID & Repo. Tax (35% in '16, 34% in '15) (24) (168)

Significant Discrete Tax Items & Other (84) 602

Series G Actions - -

Series A Actions 1 -

Core net income available to common shareholders [a] 1,043$ 294$

Denominator (2-period average, $ billions)

GAAP sh reholder's equity 13.4$ 17.1$

less: Preferred equity 0.3 4.1

l s: Go dwill & i tifi ble intangibles, net of deferred tax liabilities ("DTLs") 0.2 0.3

Tangibl common quity 12.9$ 12.7$

less: Core unamortized original issue discount ("Core OID discount") 1.3 1.7

less: Net deferred tax asset ("DTA") 1.2 1.6

Normalized common equity [b] 10.4$ 9.4$

Core Return on Tangible Common Equity [a] / [b] 10.0% 3.1%

Total Funding Sources (based on average balances)

($ millions) 3Q 17 3Q 13

Total Funding Sources (GAAP) 145,323$ 118,791$

Core OID 1,206 1,631

Total Funding Sources (ex OID) 146,529$ 120,422$

Unamortized Original Issue Discount (based on average balances)

($ millions) 3Q 17 3Q 13

Core unamortized original issue discount (1,206)$ (1,631)$

Other unamortized OID (65) (54)

GAAP unamortized original issue discount (1,271)$ (1,685)$

Un mortized Original Issue Discount (based on EOP balances)

($ millions) 3Q 17 3Q 13

Core unamortized original issue discount (1,197)$ (1,599)$

Ot r u amortized OID (62) (57)

GAAP u amortized original issue discount (1,259)$ (1,656)$

Unamortized Original Iss Di ount Expense

($ millions) 3Q 17 3Q 13

Core unamortized original issue discount 18$ 64$

Other unamortized OID 5 3

GAAP unamortized original issue discount 23$ 67$