Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ARROW ELECTRONICS INC | q32017pressreleaseexhibit9.htm |

| 8-K - 8-K - ARROW ELECTRONICS INC | q320178-kpressrelease.htm |

1 investor.arrow.com

Third Quarter

2017

CFO Commentary

As reflected in our earnings release, there are a

number of items that impact the comparability of

our results with those in the trailing quarter and

prior quarter of last year. The discussion of our

results may exclude these items to give you a

better sense of our operating results. As always,

the operating information we provide to you

should be used as a complement to GAAP

numbers. For a complete reconciliation between

our GAAP and non-GAAP results, please refer to

our earnings release and the earnings

reconciliation found at the end of this document.

The following reported and adjusted information

included in this CFO commentary is unaudited

and should be read in conjunction with the

company’s Form 10-Q for the quarterly period

ended September 30, 2017, and the Annual

Report on form 10-K as filed with the Securities

and Exchange Commission.

Third-quarter 2017

sales increased 17%

year over year.

Third-Quarter 2017 CFO Commentary

2 investor.arrow.com

Third-Quarter Summary

We delivered record third-quarter sales, gross profit, and earnings per share.

Third-quarter sales were above the high end of our expectation. Third-quarter

operating expenses were well-managed and aligned to our business mix.

Third-quarter gross profit, operating income, and earnings per share year-over-

year growth accelerated compared to the first and second quarters of 2017.

Global components achieved record third-quarter sales that exceeded our

expectation. Third-quarter global component sales increased 25% year over

year. Americas sales increased 24% year over year with growth from our core

distribution business, digital platform, and sustainable technology solutions.

Asia sales increased 24% year over year driven by our investments in sales

and engineering resources. Europe sales increased 25% year over year and

increased 19% year over year adjusted for changes in foreign currencies, the

18th straight quarter of adjusted year-over-year growth. Global components'

operating income increased 21% year over year and non-GAAP operating

income increased 20% year over year.

Third-quarter enterprise computing solutions sales increased 3% year over

year and were toward the higher end of our expectation. Europe sales

increased 16% year over year and increased 11% year over year adjusted for

changes in foreign currencies. Americas sales decreased 2% year over year.

Billings grew in all regions led by software, including cloud, and industry-

standard servers. Third-quarter enterprise computing solutions operating

income decreased 1% year over year and non-GAAP operating income

decreased 2% year over year.

We delivered record third-

quarter sales, gross profit,

and earnings per share.

Third-Quarter 2017 CFO Commentary

3 investor.arrow.com

P&L Highlights* Q3 2017 Y/Y Change

Y/Y Change Adjusted for

Acquisitions & Currency Q/Q Change

Sales $6,954 17% 16% 8%

Gross Profit Margin 12.1% -90 bps -100 bps -60 bps

Operating Income $236 19% 17% 3%

Operating Margin 3.4% 10 bps Flat -20 bps

Non-GAAP Operating

Income $265 12% 10% (1)%

Non-GAAP Operating

Margin 3.8% -20 bps -20 bps -30 bps

Net Income $135 14% 12% 35%

Diluted EPS $1.50 17% 15% 35%

Non-GAAP Net Income $163 14% 12% 2%

Non-GAAP Diluted EPS $1.82 17% 15% 2%

Consolidated Overview

Third Quarter 2017

$ in millions, except per share data; may reflect rounding

• Consolidated sales were $6.95 billion

– Above the high end of our prior expectation of

$6.325-$6.725 billion

• Consolidated gross profit margin was 12.1%

– Decreased 90 basis points points year over year due

to global components business mix, principally in the

Americas and Europe

– Decreased 60 basis points quarter over quarter due

to mix across the businesses

• Operating income margin was 3.4% and non-GAAP

operating income margin was 3.8%

– Operating expenses as a percentage of sales were

8.5%, down 80 basis points year over year

– Non-GAAP operating expenses as a percentage of

sales were 8.3%, down 70 basis points year over

year

– The decline in operating expense as a percentage of

sales reflects the operational efficiencies we

achieved to align our costs to our business mix

• Interest and other expense, net was $40 million

– Increased $3 million year over year due to higher

debt balances and higher interest rates on floating-

rate debt

Third-Quarter 2017 CFO Commentary

4 investor.arrow.com

• Effective tax rate for the quarter was 25.4%, and non-

GAAP effective tax rate was 27.5%

– Non-GAAP effective tax rate was below the

midpoint of our longer term range of 27-29%

• Diluted shares outstanding were 89.5 million

– Slightly above our prior expectation of 89 million

• Diluted earnings per share were $1.50

– In line with our prior expectation of $1.49 - 1.61

– Included a $0.11 charge for loss on investment

and for extinguishment of debt

• Non-GAAP diluted earnings per share were $1.82

– Toward the higher end of our prior expectation of

$1.74 - 1.86

A reconciliation of non-GAAP adjusted financial measures,

including sales, as adjusted, operating income, as

adjusted, net income attributable to shareholders, as

adjusted, and net income per share, as adjusted, to GAAP

financial measures is presented in the reconciliation tables

included herein.

Third-Quarter 2017 CFO Commentary

5 investor.arrow.com

Components

Global

• Sales increased 25% year over year

– Increased 23% year over year adjusted for

changes in foreign currencies

• Lead times are in line with historical norms

• Backlog increased significantly year over year

• Book-to-bill was 1.07, up from 1.04 in the third quarter

of 2016

• Operating margin of 4.4% decreased 10 basis points

year over year

• Non-GAAP operating margin of 4.5% decreased 20

basis points year over year

– The operating margin decline was principally

attributable to business mix in the Americas region

• Return on working capital decreased 60 basis points

year over year due to investments in inventory to

support growth and new supplier engagements, and

collections timing on rapidly growing sales

Global components

posted record third-

quarter sales and

operating income.

Non-GAAP Operating Income

($ in millions)

Third-Quarter 2017 CFO Commentary

6 investor.arrow.com

Components

Americas

• Sales increased 24% year over year

– Record third-quarter sales

– Strong growth in core components distribution

due to new and expanded supplier agreements

– Strong growth in digital platform and sustainable

technology solutions

– Strong growth in the aerospace & defense,

consumer, communications, and alternative

energy verticals year over year

– Growth in the industrial and medical devices

verticals and from large supply chain customers

Americas components

sales increased 24%

year over year.

Sales ($ in millions)

Third-Quarter 2017 CFO Commentary

7 investor.arrow.com

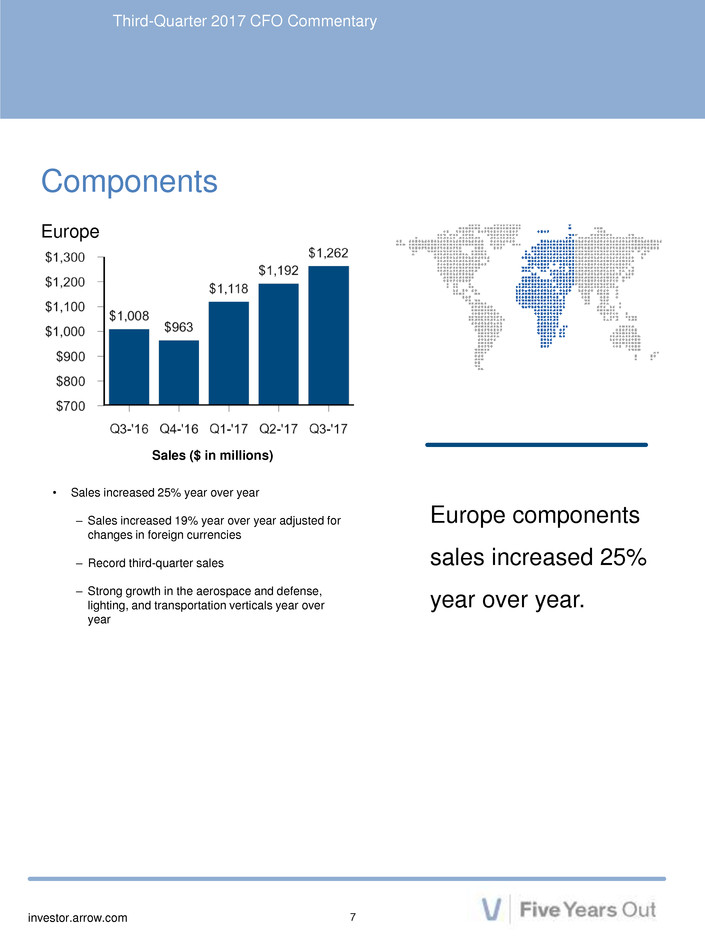

Components

Europe

• Sales increased 25% year over year

– Sales increased 19% year over year adjusted for

changes in foreign currencies

– Record third-quarter sales

– Strong growth in the aerospace and defense,

lighting, and transportation verticals year over

year

Europe components

sales increased 25%

year over year.

Sales ($ in millions)

Third-Quarter 2017 CFO Commentary

8 investor.arrow.com

Components

Asia

• Sales increased 24% year over year

– Record third-quarter sales

– Strong growth in the IoT and transportation

verticals year over year

Asia components sales

increased 24% year

over year.

Sales ($ in millions)

Third-Quarter 2017 CFO Commentary

9 investor.arrow.com

Enterprise Computing Solutions

Global

• Sales increased 3% year over year

– Sales increased 1% year over year adjusted for

changes in foreign currencies

• Billings increased year over year adjusted for

changes in foreign currencies

• Operating margin of 4.5% decreased 20 basis points

year over year

• Non-GAAP operating margin of 4.8% decreased 20

basis points year over year

• Return on working capital increased year over year

for the 16th consecutive quarter

Enterprise computing

solutions posted record

third-quarter sales.

Non-GAAP Operating Income

($ in millions)

Third-Quarter 2017 CFO Commentary

10 investor.arrow.com

Enterprise Computing Solutions

Americas

• Sales decreased 2% year over year

– Billings increased year over year

– Strong growth in industry-standard servers

– Growth in infrastructure software across the

portfolio

– Storage, networking and proprietary servers

decreased year over year

ECS Americas industry-

standard servers and

infrastructure software

increased year over

year.

Sales ($ in millions)

Third-Quarter 2017 CFO Commentary

11 investor.arrow.com

Enterprise Computing Solutions

Europe

• Sales increased 16% year over year

– Sales increased 11% year over year adjusted for

changes in foreign currencies

– Record third-quarter sales

– Strong growth in industry standard servers and in

infrastructure software across the portfolio

adjusted for changes in foreign currencies

– Growth in storage and proprietary servers year

over year adjusted for changes in foreign

currencies

– Networking declined year over year

– Operating income increased year over year

ECS Europe posted

record third-quarter

sales.

Sales ($ in millions)

Third-Quarter 2017 CFO Commentary

12 investor.arrow.com

Cash Flow from Operations

Cash flow from operating activities was $135 million in

the quarter.

Working Capital

Working capital to sales was 16.0% in the quarter, up 10

basis points year over year. Return on working capital

was 23.8% in the quarter, down 130 basis points year

over year.

Return on Invested Capital

Return on invested capital was 10.1% in the quarter, up

30 basis points year over year, and ahead of our

weighted average cost of capital.

Share Buyback

We repurchased approximately $0.3 million shares of

our stock for $25 million. Total cash returned to

shareholders over the last 12 months was

approximately $185 million.

Debt and Liquidity

Net-debt-to-last-12-months EBITDA ratio is

approximately 2.3x. Total liquidity of $2.9 billion when

including cash of $584 million.

We repurchased

approximately $25 million

of our stock in the third

quarter.

Third-Quarter 2017 CFO Commentary

13 investor.arrow.com

Arrow Electronics Outlook

Guidance

We are expecting the average USD-to-Euro exchange rate for the fourth quarter of 2017 to be $1.18 to €1

compared with $1.08 to €1 in the fourth quarter of 2016. We are expecting interest expense will total

approximately $44 million.

Fourth-Quarter 2017 Guidance

Consolidated Sales $7.2 billion to $7.6 billion

Global Components $4.75 billion to $4.95 billion

Global ECS $2.45 billion to $2.65 billion

Diluted Earnings Per Share1,2 $1.86 to 2.02

Non-GAAP Diluted Earnings Per Share1 $2.21 to 2.37

1 Assumes average diluted shares outstanding of 89 million, an average tax rate of 27 to 29%.

2 Includes an approximately $11 million or $0.12 per share post-tax pension settlement expense.

Third-Quarter 2017 CFO Commentary

14 investor.arrow.com

Risk Factors

The discussion of the company’s

business and operations should be

read together with the risk factors

contained in Item 1A of its 2016

Annual Report on Form 10-K, filed

with the Securities and Exchange

Commission, which describe various

risks and uncertainties to which the

company is or may become subject.

If any of the described events occur,

the company’s business, results of

operations, financial condition,

liquidity, or access to the capital

markets could be materially adversely

affected.

Information Relating

to Forward-Looking

Statements

This press release includes forward-looking

statements that are subject to numerous assumptions,

risks, and uncertainties, which could cause actual

results or facts to differ materially from such

statements for a variety of reasons, including, but not

limited to: industry conditions, company’s

implementation of its new enterprise resource

planning system, changes in product supply, pricing

and customer demand, competition, other vagaries in

the global components and global enterprise

computing solutions markets, changes in relationships

with key suppliers, increased profit margin pressure,

effects of additional actions taken to become more

efficient or lower costs, risks related to the integration

of acquired businesses, changes in legal and

regulatory matters, and the company’s ability to

generate additional cash flow. Forward-looking

statements are those statements which are not

statements of historical fact. These forward-looking

statements can be identified by forward-looking words

such as “expects,” “anticipates,” “intends,” “plans,”

“may,” “will,” “believes,” “seeks,” “estimates,” and

similar expressions. Shareholders and other readers

are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of

the date on which they are made. The company

undertakes no obligation to update publicly or revise

any of the forward-looking statements.

For a further discussion of factors to consider in

connection with these forward-looking statements,

investors should refer to Item 1A Risk Factors of the

company’s Annual Report on Form 10-K for the year

ended December 31, 2016.

Third-Quarter 2017 CFO Commentary

15 investor.arrow.com

Certain Non-GAAP Financial Information

The company believes that

such non-GAAP financial

information is useful to

investors to assist in

assessing and understanding

the company’s operating

performance.

In addition to disclosing financial results that are

determined in accordance with accounting

principles generally accepted in the United States

(“GAAP”), the company also provides certain non-

GAAP financial information relating to sales,

operating income, net income attributable to

shareholders, and net income per basic and

diluted share. The company provides sales,

income, or expense on a non-GAAP basis

adjusted for the impact of changes in foreign

currencies and the impact of acquisitions by

adjusting the company’s operating results for

businesses acquired, including the amortization

expense related to acquired intangible assets, as if

the acquisitions had occurred at the beginning of

the earliest period presented (referred to as

“impact of acquisitions”). Operating income, net

income attributable to shareholders, and net

income per basic and diluted share are adjusted to

exclude identifiable intangible amortization,

restructuring, integration, and other charges, and

certain charges, credits, gains, and losses that the

company believes impact the comparability of its

results of operations. These charges, credits,

gains, and losses arise out of the company’s

efficiency enhancement initiatives, acquisitions

(including intangible assets amortization expense),

and financing activities. A reconciliation of the

company’s non-GAAP financial information to

GAAP is set forth in the tables herein.

The company believes that such non-GAAP

financial information is useful to investors to assist

in assessing and understanding the company’s

operating performance and underlying trends in

the company’s business because management

considers these items referred to above to be

outside the company’s core operating results. This

non-GAAP financial information is among the

primary indicators management uses as a basis for

evaluating the company’s financial and operating

performance. In addition, the company’s Board of

Directors may use this non-GAAP financial

information in evaluating management

performance and setting management

compensation.

The presentation of this additional non-GAAP

financial information is not meant to be considered

in isolation or as a substitute for, or alternative to,

operating income, net income attributable to

shareholders and net income per basic and diluted

share determined in accordance with GAAP.

Analysis of results and outlook on a non-GAAP

basis should be used as a complement to, and in

conjunction with, data presented in accordance

with GAAP.

Third-Quarter 2017 CFO Commentary

16 investor.arrow.com

Three months ended September 30, 2017

Reported

GAAP

measure

Intangible

amortization

expense

Restructuring

& Integration

charges Other*

Non-GAAP

measure

Operating income $ 235,992 $ 12,645 $ 15,896 $ — $ 264,533

Income before income taxes 181,674 12,645 15,896 15,786 226,001

Provision for income taxes 46,199 4,474 5,319 6,089 62,081

Consolidated net income 135,475 8,171 10,577 9,697 163,920

Noncontrolling interests 845 146 — — 991

Net income attributable to shareholders $ 134,630 $ 8,025 $ 10,577 $ 9,697 $ 162,929

Net income per diluted share 1.50 0.09 0.12 0.11 1.82

Effective tax rate 25.4 % 27.5 %

Three months ended October 1, 2016

Reported

GAAP

measure

Intangible

amortization

expense

Restructuring

& Integration

charges Other

Non-GAAP

measure

Operating income $ 198,684 $ 13,893 $ 24,267 $ — $ 236,844

Income before income taxes 162,766 13,893 24,267 — 200,926

Provision for income taxes 44,931 4,959 7,439 — 57,329

Consolidated net income 117,835 8,934 16,828 — 143,597

Noncontrolling interests 108 347 — — 455

Net income attributable to shareholders $ 117,727 $ 8,587 $ 16,828 $ — $ 143,142

Net income per diluted share** 1.28 0.09 0.18 — 1.56

Effective tax rate 27.6 % 28.5 %

Three months ended July 1, 2017

Reported

GAAP

measure

Intangible

amortization

expense

Restructuring

& Integration

charges Other*

Non-GAAP

measure

Operating income $ 229,822 $ 12,364 $ 24,416 $ — $ 266,602

Income before income taxes 130,179 12,364 24,416 58,009 224,968

Provision for income taxes 29,575 4,388 7,576 22,377 63,916

Consolidated net income 100,604 7,976 16,840 35,632 161,052

Noncontrolling interests 925 157 — — 1,082

Net income attributable to shareholders $ 99,679 $ 7,819 $ 16,840 $ 35,632 $ 159,970

Net income per diluted share** 1.11 0.09 0.19 0.40 1.78

Effective tax rate 22.7 % 28.4 %

*Other includes loss on extinguishment of debt and loss on investment.

**The sum of the components for diluted EPS, as adjusted, may not agree to totals, as presented, due to rounding.

Earnings Reconciliation

($ in thousands, except per share data)