Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION - OCEANFIRST FINANCIAL CORP | ocfc8-kinvestorpresentatio.htm |

Investor Presentation

November 2017

OceanFirst Financial Corp.

OceanFirst Financial Corp.

Forward-Looking Statements

In addition to historical information, the Form 10-K contains certain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and

describe future plans, strategies and expectations of the Company. These forward-looking statements are

generally identified by use of the words “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project”, “will”,

“should”, “may”, “view”, “opportunity”, “potential”, or similar expressions or expressions of confidence. The

Company’s ability to predict results or the actual effect of plans or strategies is inherently uncertain. Factors

which could have a material adverse effect on the operations of the Company and its subsidiaries include, but

are not limited to, those items discussed under Item 1A. Risk Factors herein and the following: changes in

interest rates, general economic conditions, levels of unemployment in the Bank’s lending area, real estate

market values in the Bank’s lending area, future natural disasters and increases to flood insurance premiums,

the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary

and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the FRB, the quality or

composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand

for financial services in the Company’s market area, accounting principles and guidelines and the Bank's ability

to successfully integrate acquired operations. These risks and uncertainties should be considered in evaluating

forward-looking statements and undue reliance should not be placed on such statements. These risks and

uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2016 and subsequent securities filings and should be considered in evaluating forward-looking

statements and undue reliance should not be placed on such statements. The Company does not undertake,

and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to

any forward-looking statements to reflect events or circumstances after the date of such statements or to

reflect the occurrence of anticipated or unanticipated events.

2

OceanFirst Milestones – 115 Years of Growth

3

Founded,

Point Pleasant,

NJ

Branch Expansion

Into

Middlesex County

1902

1985

IPO To

Mutual

Depositors

1996

Established

Commercial

Lending

Created OceanFirst

Foundation

Branch Expansion

Into

Monmouth County

1999

Established

Trust and

Asset Management

2014 2015

Colonial American

Bank Acquired

Cape Bancorp

Acquired

2016

OceanFirst

Foundation Exceeds

$25 Million In

Cumulative Grants

Ocean Shore

Holding Co.

Acquired

2000

Commercial LPO

Expansion into

Mercer County

Announced Merger

Agreement with

Sun Bancorp, Inc.

2017

Serving Central and Southern New Jersey Markets

• OceanFirst is the largest Bank

headquartered in Central and

Southern New Jersey

• $5.4 billion in assets

• Branches located in 7 counties

• Market Cap $904 million

• Average Daily Share Volume of

117,000

OceanFirst Headquarters

OceanFirst Retail Branches,

Commercial Loan Production Offices,

and Wealth Management Office

30 million people, or approximately

10% of the total U.S. population,

reside within a 2-hour drive* and

7.3 million reside in market area**

4

*Includes New York – Newark NY-NJ-PA-CT CSA and

Philadelphia – Reading – Camden CSA.

**Refer to Appendix 2 for market area.

5

Atlantic City loan portfolio exposure totals

1.0% of total loans

OceanFirst Loan Portfolio Diversification by Geography

Least

Concentrated

Most

Concentrated

Opportunity for organic commercial loan

growth

Experienced Leadership

Name

Position

# of Years

at OCFC

# of Years

In Banking

Previous

Experience

Christopher D. Maher Chairman, President, Chief Executive Officer 4 29 Patriot National Bancorp; Dime Community Bancshares

Michael J. Fitzpatrick Executive Vice President, Chief Financial Officer 25 36 KPMG

Joseph R. Iantosca Executive Vice President, Chief Administrative Officer 13 39 BISYS Banking Solutions; Newtrend LLC; Brooklyn Federal Savings

Joseph J. Lebel III Executive Vice President, Chief Banking Officer 11 33

Wachovia Bank N.A.;

First Fidelity

Steven J. Tsimbinos Executive Vice President, General Counsel 7 23

Thacher Proffit & Wood;

Lowenstein Sandler PC

Grace M. Vallacchi Executive Vice President, Chief Risk Officer - 25 Office of the Comptroller of the Currency; First Fidelity; First Union

• Substantial insider ownership of 15.3% – aligned with shareholders’ interests

OceanFirst Bank ESOP 4.6%

Directors & Senior Executive Officers 6.7%

Director and Proxy Officer Stock Ownership Guidelines

OceanFirst Foundation 4.0%

From April 28, 2017 Proxy Statement and SEC Schedule 13G filings.

6

Deep Bench of Experienced Executives

Name

Position

# of Years

at OCFC

# of Years

In Banking

Previous

Experience

Gary S. Hett First Senior Vice President, Director of Human Resources 4 44

Patriot National

Bancorp;

Dime Community

Bancshares

David R. Howard First Senior Vice President, Direct Banking 4 27

Guggenheim

Partners;

GE Capital

Angela K. Ho Senior Vice President, Principal Accounting Officer 1 11

Northfield Bank;

Signature Bank;

KPMG

Michael C. Reda Senior Vice President, Chief Information Officer - 30

Patriot National

Bancorp;

Fidelity

7

Strategic Focus

8

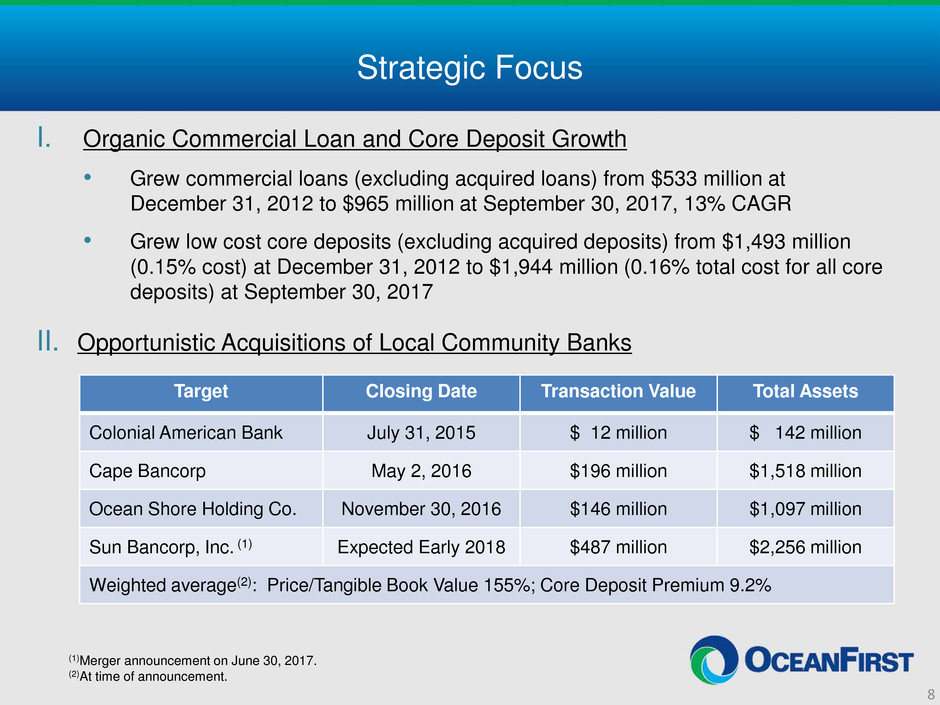

I. Organic Commercial Loan and Core Deposit Growth

• Grew commercial loans (excluding acquired loans) from $533 million at

December 31, 2012 to $965 million at September 30, 2017, 13% CAGR

• Grew low cost core deposits (excluding acquired deposits) from $1,493 million

(0.15% cost) at December 31, 2012 to $1,944 million (0.16% total cost for all core

deposits) at September 30, 2017

II. Opportunistic Acquisitions of Local Community Banks

Target Closing Date Transaction Value Total Assets

Colonial American Bank July 31, 2015 $ 12 million $ 142 million

Cape Bancorp May 2, 2016 $196 million $1,518 million

Ocean Shore Holding Co. November 30, 2016 $146 million $1,097 million

Sun Bancorp, Inc. (1) Expected Early 2018 $487 million $2,256 million

Weighted average(2): Price/Tangible Book Value 155%; Core Deposit Premium 9.2%

(1)Merger announcement on June 30, 2017.

(2)At time of announcement.

Strategic Focus (Continued)

9

III. Conservative Risk Management

• Credit Risk

Reduced non-performing loans from $43.4 million (2.8% of loans) at December 31, 2012 to

$15.1 million (0.39% of loans) at September 30, 2017

Strong credit culture – experienced and independent credit administration, resulting in nominal

loss history (Net charge-offs over prior four full years averaged 10.5 basis points excluding

charge-offs from bulk loan sales)

• Interest Rate Risk

Core deposits (all deposits except time deposits) are 85.7% of total deposits at September 30,

2017

Grew core deposits (excluding acquisitions) by $185.7 million in 2017, or 7.0% annualized, and

by $170 million in 2016, or 10.2%

• Regulatory/Compliance Risk

Regulatory approvals received for three acquisitions in a timely manner

Outstanding CRA rating received October 2015

Total Shareholder Return December 31, 2012 to September 30, 2017 –

129%, 19.0% CAGR

Strategic Focus (Continued)

10

IV. Direct Banking Initiative

• Current suite of digital offerings is at top of market for community banks

Website Apple Pay Finance Works

Online Banking Platform U Choose Rewards Online Account Opening

Mobile Application Pop Money Biometric ID Verification

Bill Pay Text Banking Card Valet

• Focused effort to transform customer usage to efficient channels

Enhancing branch staff training and goals specific to digital capabilities

One-on-one training and videos with customers on mobile and online tools

Upgrading account opening capabilities will enable staff outside the physical branch

Expanding use of video tellers to support in-person transactions in a more efficient manner

than traditionally staffed branches

Ensuring our digital capabilities remain top of market and meet customer expectations

• Increased digital usage will result in increased efficiency and customer retention

Especially important with acquisitions, conversions, and branch consolidations

Seamless customer experience will reinforce established OceanFirst brand

Strategic Focus (Continued)

11

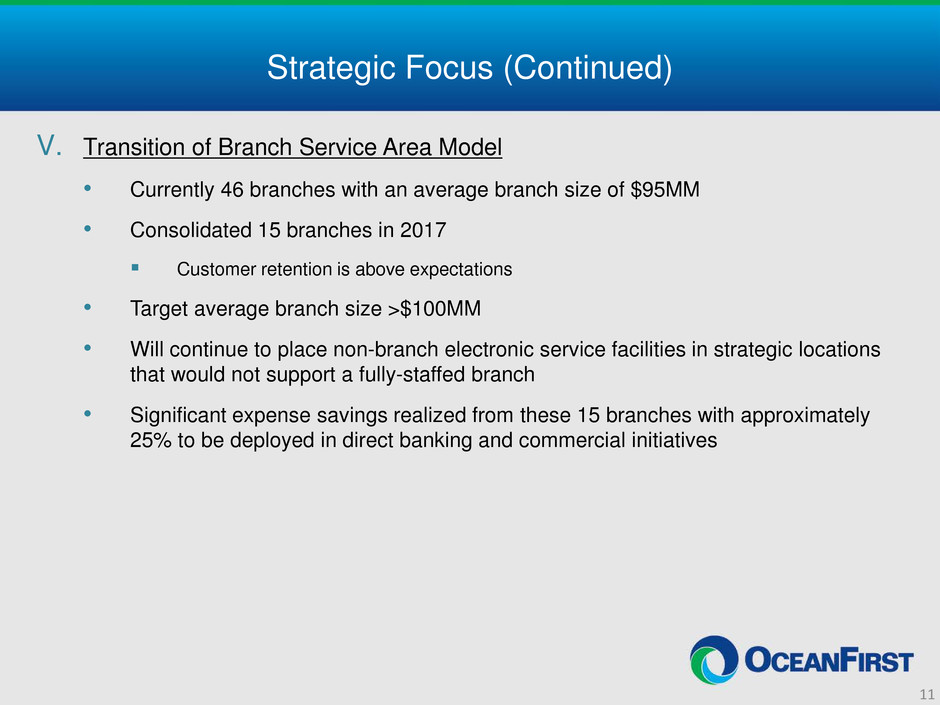

V. Transition of Branch Service Area Model

• Currently 46 branches with an average branch size of $95MM

• Consolidated 15 branches in 2017

Customer retention is above expectations

• Target average branch size >$100MM

• Will continue to place non-branch electronic service facilities in strategic locations

that would not support a fully-staffed branch

• Significant expense savings realized from these 15 branches with approximately

25% to be deployed in direct banking and commercial initiatives

Highlights – 2017

12

Third Quarter

• Core EPS of $0.45(1), an increase from $0.40(1) in Q3 2016

13.63% ROTE(1)(2) & 1.11% ROA(1)(2)

Net interest margin of 3.50%

• Deposits increased $173.4 million reducing the loan to deposit ratio to

89.0%, while the cost of deposits increased only one basis point to 0.29% at

September 30, 2017

• Asset quality improved as non-performing loans decreased to $15.1 million,

or 0.39% as a percentage of total loans

• The pending Sun Bancorp, Inc. (NASDAQ: SNBC) acquisition announced on

June 30, 2017, valued at approximately $487 million, has received

shareholder approvals and regulatory approval from the Federal Reserve

Bank of Philadelphia. Pending regulatory approval from the Office of the

Comptroller of the Currency, the Company expects to close the transaction in

January 2018

(1)Amounts and ratios exclude merger related and branch consolidation expenses, net of tax.

(2)Amounts are annualized.

Valued at approximately $487 million – 85% stock,

15% cash

• Price/TBV – 169% [156% net of DTA]

• Core deposit premium – 12.7%

Financially compelling:

• 2019E EPS accretion of 3.6% in addition to double

digit accretion from Cape and Ocean Shore

acquisitions

• Earnback of approximately 3.5 years

Overview of Sun Bancorp, Inc.

13

Branch Map Transaction Summary1

Financial Highlights2

Total Assets ($M) $2,168 ROAA 0.50%

Gross Loans ($M) $1,589 ROATCE 3.90%

Total Deposits ($M) $1,683 NIM 3.25%

TCE / TA 13.6% Yield on Loans 4.20%

Cash & Securities / Total Assets 16.9% Cost of Deposits 0.39%

NPAs / Total Assets3 0.19% Efficiency Ratio 77%

Source: SNL Financial.

1 As of June 30, 2017.

2 As of or for the quarter ended September 30, 2017.

3 NPAs defined as nonaccrual loans and leases and real estate owned, excluding renegotiated loans and leases, as of September 30, 2017.

SNBC has 15 branches

within 3 miles of an

OCFC branch

- OCFC Branches

- SNBC Branches

- Loan Office

Favorable Competitive Position

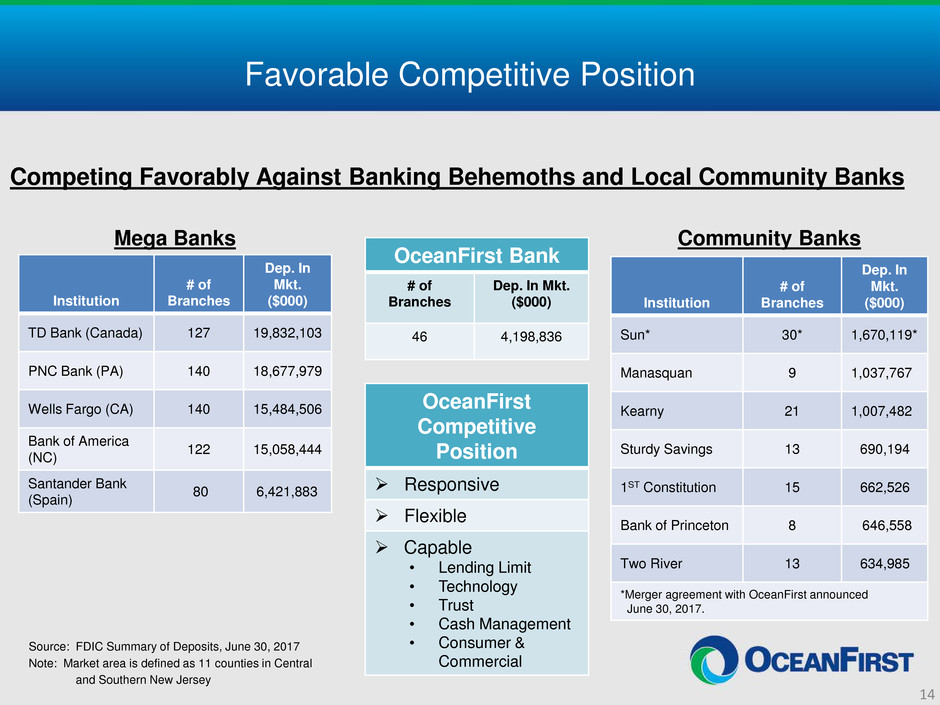

Competing Favorably Against Banking Behemoths and Local Community Banks

Source: FDIC Summary of Deposits, June 30, 2017

Note: Market area is defined as 11 counties in Central

and Southern New Jersey

Institution

# of

Branches

Dep. In

Mkt.

($000)

TD Bank (Canada) 127 19,832,103

PNC Bank (PA) 140 18,677,979

Wells Fargo (CA) 140 15,484,506

Bank of America

(NC) 122 15,058,444

Santander Bank

(Spain) 80 6,421,883

OceanFirst Bank

# of

Branches

Dep. In Mkt.

($000)

46 4,198,836

Institution

# of

Branches

Dep. In

Mkt.

($000)

Sun* 30* 1,670,119*

Manasquan 9 1,037,767

Kearny 21 1,007,482

Sturdy Savings 13 690,194

1ST Constitution 15 662,526

Bank of Princeton 8 646,558

Two River 13 634,985

*Merger agreement with OceanFirst announced

June 30, 2017.

OceanFirst

Competitive

Position

Responsive

Flexible

Capable

• Lending Limit

• Technology

• Trust

• Cash Management

• Consumer &

Commercial

Mega Banks Community Banks

14

Strategic Deposit Composition Transition

Non-

Interest

Checking

Non-

Interest

Checking

Interest Checking

Interest Checking

WAR 0.25%

MMDA &

Savings

MMDA &

Savings

MMDA & Savings

WAR 0.13%

Time Deposits

Time

Deposits

Time

Deposits

WAR 1.02%

0 400 800 1,200 1,600 2,000 2,400 2,800 3,200 3,600 4,000 4,400

Dec 1996

Dec 2011

September

2017

(In Millions)

47% 53%

September 30, 2017

Deposits by Customer

Segment

Consumer Commercial

Total

Cost of

Deposits

0.29%(1)

15

(1)Deposit costs are average for most recent quarter.

Online Banking & Bill Pay

In the most recent quarter, 45% of

deposit customers used online

banking and an average of 65,000 bills

were paid with online bill pay service

each month.

Check Card

Rewards program promotes usage driving

over $560 million of card transactions in

the last year with related fee income of

$6.8 million.

Full Suite of Technology and Delivery Systems

16

Corporate Cash Management

Remote Deposit Capture (RDC)

processed over 627,000 checks so

far this year for our most important

business customers.

ATM & Interactive Teller (ITM)

The intelligent ATM fleet is supplemented

with video teller ITMs now servicing seven

remote locations from central tellers.

Mobile Banking

Consistently adopting mobile-

centric options including P2P,

eWallet, biometrics and

wearables.

Customers using self-service

channels in September 2017

• 23,100 deposits totaling

$169.2 million.

• 13% of transaction volume and

24% of transaction value of

customer-presented deposits

for the Bank.

Strategic Loan Composition Transition

Investment

CRE(A)

Owner-

Occupied

CRE

Owner-

Occupied

CRE

C&I

C&I

Consumer

(Home

Equity)

Consumer

(Home

Equity)

Residential

Real Estate

Residential

Real Estate

Residential

Real Estate

0 400 800 1,200 1,600 2,000 2,400 2,800 3,200 3,600 4,000

Dec 1996

Dec 2011

September 2017

(In Millions)

Investment

CRE

&

Note (A): Investment CRE as a percent of risk-based capital is 237% at September 30, 2017.

48%

52%

September 30, 2017

Loans by Customer Segment

Consumer Commercial

17

Credit Underwriting Remains Conservative: Commercial Loan

Production 2016 and 2017

(Dollars in thousands)

Commercial

Loan Originations

Year Nine Months

Ended Ended

December 31, 2016 September 30, 2017

Commercial Loan

Portfolio at

September 30, 2017

Amount $261,301 $319,364 $1,873,355

Weighted average rate 4.13% 4.42% 4.41%

Weighted average debt service coverage ── 2.9X 2.3X

Weighted average loan-to-value (CRE only) 70% 60% 57%

Weighted average risk rating(1) 4.5 4.5 4.7

(1)Risk rating is on a scale from 1 (best) to 9 (worst). A rating of 4.5 represents an equivalent S&P rating of BBB.

18

19

OceanFirst Maintains Conservative CRE Portfolio Relative to Peers

0 200 400 600 800 1,000 1,200

Peer 1

Peer 2

OceanFirst Bank

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

Peer 9

Peer 10

Peer 11

Peer Group Average

Peer 12

Peer 13

Peer 14

Peer 15

Peer 16

Peer 17

Peer 18

(%)

CRE to Total Risk Based Capital

June 30, 2017

6/30/2017 6/30/2015

372

968

Capacity to grow Investor

CRE by $374 million while

remaining under 300% (A).

222

Domestic CRE Loans (Construction, Multifamily & Other Nonfarm Non-residential)

to Total Risk Based Capital. Supervisory guideline is 300% of TRBC.

Peers include: BMTC, DCOM, EGBN, FCF, FFIC, FISI, FLIC, INDB, LBAI, NFBK, ORIT, PGC, SASR, STBA,

TMP, TOWN, UVSP and WSFS.

Source: BankRegData.com

(A) Pro forma with Sun Bank, CRE to Total Risk Based Capital is 277% and capacity to grow investor CRE by $160 million while remaining below 300%.

300

Highlights – Risk Management 2017

• Interest Rate Risk Management

Core deposits(1) are 85.7% of total deposits, a significant hedge against a

rising rate environment

Non-interest bearing deposits are 18.0% of total deposits

Approximately $210 million of excess liquidity in interest-bearing deposits at

September 30, 2017; available for investment in future quarters

• Credit Risk Management

In 2017, $7.8 million of residential loans with high risk characteristics were

sold

(1)Core deposits are all deposits except time deposits.

20

Effective Interest Rate Risk Management

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

Mortgage Loans Consumer Loans Commercial Loans

(CRE & C&I)

Securities Total Assets

(Weighted Average)

Borrowings Deposits

Adjustable/Floating Fixed Core Deposits, Administered

Duration

Rate Characteristics

0.0

1.0

2.0

3.0

4.0

Securities Mortgage Loans Consumer Loans Commercial Loans Total Assets

(Weighted Average)

FHLB Term

Borrowings

Time Deposits

Ye

ar

s

All asset categories managed with limited duration

At September 30, 2017

21

Term Borrowings Extended as Interest Rate Hedge

0.00

10.00

20.00

30.00

40.00

50.00

60.00

70.00

80.00

90.00

2017 2018 2019 2020 2021 2022

M

ill

io

ns

o

f D

ol

la

rs

Maturity Periods

TOTAL

$259.2MM

1.76% AVG. COST

At September 30, 2017

22

0.00%

0.20%

0.40%

0.60%

0.80%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

2011 2012 2013 2014 2015 2016 YTD Q3

2017

N

et loan charge-offs as percent of average loans

N

on

-p

er

fo

rm

in

g

lo

an

s

as

p

er

ce

nt

o

f t

ot

al

lo

an

s

re

ce

iv

ab

le

Residential Consumer Commercial Real Estate Commercial Net Charge-Offs

Credit Metrics Reflect Conservative Culture

(1)Net charge-off ratio for 2014 excludes charge-off related to bulk sale of non-performing residential and consumer

mortgage loans. Including this charge-off, the ratio is 0.45%.

Half of the net

charge-offs relate to

the sale of three

high risk acquired

loan pools

(1)

23

2.77% 2.80%

2.88%

1.06%

0.91%

0.35%

0.58% 0.38% 0.17% 0.15% 0.07% 0.15% 0.06% NET CHARGE-OFFS

0.39%

Net Interest Margin

Expanded Net Interest Margin to Outperform both Historical Level and Peer Group

2.00%

2.20%

2.40%

2.60%

2.80%

3.00%

3.20%

3.40%

3.60%

3.80%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Q1 2017 Q2 2017 Q3 2017

Historical Average (1996 – 2016) Net Interest Margin (3.29%)

YTD 2017

consolidated

NIM at 3.54%

includes 19 BP

of net accretable

yield from

purchase

accounting

adjustments and

prepayment fees

3.62

3.37

3.15

3.25

3.35

3.45

3.55

3.65

OceanFirst Bank

OceanFirst Bank: Significant expansion since 2015

Peers: Steady decline since 2014 until recent quarter

24

Peers

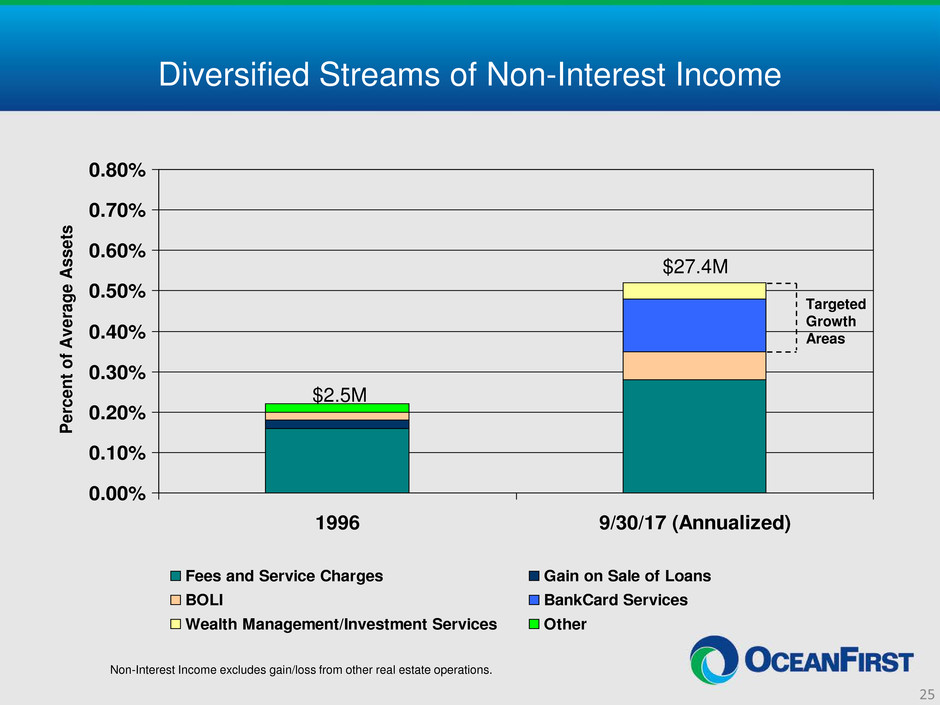

Diversified Streams of Non-Interest Income

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

0.60%

0.70%

0.80%

1996 9/30/17 (Annualized)

P

er

ce

nt

o

f A

ve

ra

ge

A

ss

et

s

Fees and Service Charges Gain on Sale of Loans

BOLI BankCard Services

Wealth Management/Investment Services Other

$2.5M

$27.4M

Targeted

Growth

Areas

Non-Interest Income excludes gain/loss from other real estate operations.

25

Generating Consistent Attractive Returns

7.0%

9.0%

11.0%

13.0%

2009 2010 2011 2012 2013 2014 2015 2016 YTD Q3 2017

(Annualized)

0.70%

0.80%

0.90%

1.00%

1.10%

Return on Tangible Equity Return on Assets

(1)For 2013, excludes after-tax impact of $3.1 million in charges related to strategic advance restructuring and branch consolidation.

(2)For 2015, 2016 and 2017, excludes merger related expenses. For 2016, also excludes Federal Home Loan Bank prepayment fee and loss on

sale of investment securities. For 2017, also excludes the effect of accelerated stock award expense and branch consolidation expense.

(1)

R

eturn on A

ssets

R

et

ur

n

on

T

an

gi

bl

e

C

om

m

on

E

qu

ity

26

12.9%

1.05%

(2) (2) (2)

Accelerating EPS Growth

27

$0.40

$0.80

$1.20

$1.60

$2.00

2011 2012 2013 2014 2015 2016 YTD Q3 2017

(Annualized)

Core Diluted EPS Reported Diluted EPS

(2)

(1)For 2013, excludes after-tax impact of $3.1 million in charges related to strategic advance restructuring and branch consolidation.

(2)For 2015, 2016 and 2017, excludes merger related expenses. For 2016, also excludes Federal Home Loan Bank prepayment fee and loss on

sale of investment securities. For 2017, also excludes the effect of accelerated stock award expense and branch consolidation expense.

(1) (2) (2)

2017 YTD

Prudently Managing Excess Capital in Near Term

$8.8 $8.6 $8.2 $8.2 $8.7

$12.6

$14.4

$2.1

$11.9

$8.1 $9.2 $6.5

$1.9

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

2011 2012 2013 2014 2015 2016 2017

A

nn

ua

l R

et

ur

n

of

C

ap

ita

l (

M

ill

io

ns

)

Cash Dividends Stock Repurchases

Notes: Stock Repurchases – $15.52 Average Cost per Share.

In Q4 2015 through Q3 2016, stock repurchases suspended as capital

was allocated to Cape and Ocean Shore acquisitions.

28

(9 Months)

Increased Quarterly

Dividend by 15% in Q4

2016, from $0.13 per

share to $0.15 per share

Why OCFC…?

• Fundamental franchise value

Preeminent community bank in Central and Southern New Jersey

Superior deposit profile

Significant commercial loan growth since December 2012; current focus on recent

portfolio integrations

Conservative credit culture

• Solid financial performance

Consistent attractive returns

Strong balance sheet and capital base

• Seasoned and effective management team

Substantial insider ownership – aligned with shareholders’ interests

Fully capable of executing on 5-year growth plan

29

Attractive Valuation Metrics

OCFC Peers(1)

30

Valuation

Price / Tangible Book Value 216% 225%

Price / 2017 Estimated EPS 17.0x 18.6x

Price / 2018 Estimated EPS 15.7x 17.1x

Core Deposit Premium(2) 12.5% 13.6%

Cash Dividend Yield 2.1% 2.1%

1) Peers include: AROW, BMTC, DCOM, EGBN, FFIC, FISI, FLIC, LBAI, NFBK, ORIT, PGC, SASR,

TMP, UVSP and WSFS

2) Core Deposits for FISI, SASR, UVSP and WSFS as of September 30, 2017 from Bank Call Reports;

Core Deposits for AROW, BMTC, DCOM, EGBN, FFIC, FLIC, LBAI, NFBK, ORIT, PGC and TMP as

of June 30, 2017 from Bank Call Reports

Note: Financial data as of September 30, 2017 (except FFIC and FLIC); market data as of October 27,

2017; OCFC stock price of $29.12. Source: SNL Financial

Appendix

31

OceanFirst Financial Corp. – Analyst Coverage

APPENDIX 1

Investor Relations Contacts

Christopher D. Maher

Chairman, President and

Chief Executive Officer

732-240-4500 Ext. 7504

cmaher@oceanfirst.com

Michael J. Fitzpatrick

Executive Vice President and

Chief Financial Officer

732-240-4500 Ext. 7506

mfitzpatrick@oceanfirst.com

Jill A. Hewitt

Senior Vice President and

Investor Relations Officer

732-240-4500 Ext. 7513

jhewitt@oceanfirst.com

32

Company

Analyst

Recommendation

Price

Target

Keefe Bruyette & Woods Collyn Gilbert Outperform $32.00

Sandler O’Neill & Partners Frank Schiraldi Buy $29.00

Piper Jaffray Matt Breese Overweight $31.00

FIG Partners David Bishop Outperform $33.00

Merion Capital Group Joe Gladue Outperform $32.00

D.A. Davidson Russell Gunther Buy $33.00

Hovde Group Brian Zabora Outperform $33.00

Market Demographics

Central

New Jersey(1)

Southern

New Jersey(2)

Philadelphia

Metro(3)

Total Bank Offices in Market 830 487 841

Total Bank Deposits in Market $89.4 billion $39.2 billion $97.4 billion

Number of OceanFirst Offices 29 23

% of OceanFirst Deposits 50 50

Market Rank 10 5

Market Share (%) 2.2 5.1

Population 2,434,160 1,829,011 3,027,447

Projected 2018-2023

Population Growth (%)

5.2 (3.8) 3.6

Data as of June 30, 2017.

Source: SNL Financial

Notes: 1 – Includes Monmouth, Ocean, Middlesex and Mercer counties, New Jersey

2 – Includes Burlington, Atlantic, Cape May, Camden, Gloucester, Salem and Cumberland counties, New Jersey

3 – Includes Philadelphia, Bucks and Montgomery counties, Pennsylvania

APPENDIX 2

Expansion

opportunity

33

Commercial Portfolio Metrics

APPENDIX 3

Commercial Real Estate (CRE)

Owner-Occupied

Investor

Total

$ 555.4 million

1,134.4 million

$1,689.8 million

% of Total Loan Portfolio 43.3%

Average Size of CRE Loans $796,000

Largest CRE Loan $24.0 million

Pipeline as of September 30, 2017 $37.8 million

Weighted Average Yield 4.40%

Weighted Average Repricing Term 5.6 years

Commercial Loans (C&I)

Total Portfolio $183.5 million

% of Total Loan Portfolio 4.7%

Average Size of Commercial Loans $309,000

Largest Commercial Loan $17.2 million

Pipeline as of September 30, 2017 $20.4 million

Weighted Average Yield 4.05%

Weighted Average Repricing Term 5.4 years

Note: The maximum loan exposure to a single borrower, including CRE and C&I loans,

was $35.1 million. Legal lending limit of $69 million in loans to one borrower.

34

Commercial Portfolio Segmentation

APPENDIX 3

(Cont’d)

Total Commercial Loan Exposure

by Industry Classification

Arts/Entertainment/

Recreation, 3.5%

Real Estate Investment,

52.5%

Other Services, 3.5%

Retail Trade, 5.7%

Public Administration,

2.1%

Miscellaneous, 5.2%

Manufacturing, 2.7%

Educational Services,

3.2%

Accommodations/ Food

Services, 8.0%

Healthcare, 6.0%

Wholesale Trade, 3.1%

Construction, 4.5%

Real Estate Investment by

Property Classification

Residential

Development, 9.7%

Industrial/

Warehouse, 5.6%

Single Purpose,

8.3%

Miscellaneous, 8.3%

Motel, 5.5%

Multi-Family, 7.4%

Retail Store, 8.2%

Shopping Center,

10.7%

Development, 5.8%

Office, 30.5%

Diversified portfolio provides

protection against industry-

specific credit events.

As of September 30, 2017.

35

Residential Portfolio Metrics

APPENDIX 4

Residential Real Estate

Total Portfolio $1,678.1 million

% of Total Loan Portfolio 43.0%

Average size of mortgage loans $214,000

% of loans for second homes 19%

Portfolio weighted average loan-to-value ratio (using original or most recent appraisal)

- Loans originated during 2017

58%

65%

Portfolio average FICO score

- Loans originated during 2017

755

764

% of loans outside the New York/New Jersey market 1.9%

As of September 30, 2017, unless otherwise noted.

36

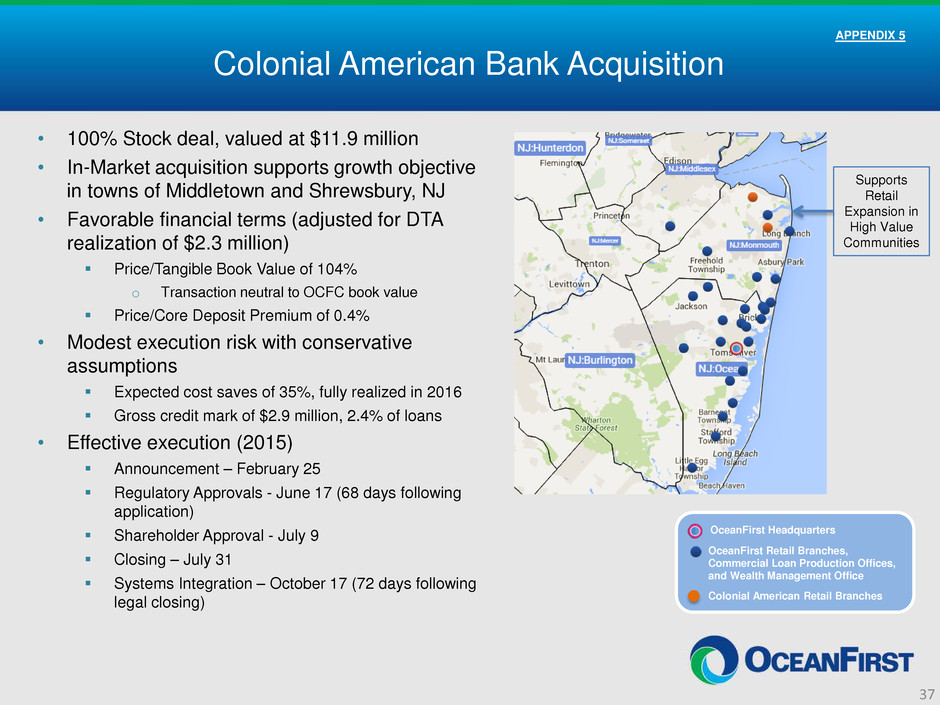

Colonial American Bank Acquisition

• 100% Stock deal, valued at $11.9 million

• In-Market acquisition supports growth objective

in towns of Middletown and Shrewsbury, NJ

• Favorable financial terms (adjusted for DTA

realization of $2.3 million)

Price/Tangible Book Value of 104%

o Transaction neutral to OCFC book value

Price/Core Deposit Premium of 0.4%

• Modest execution risk with conservative

assumptions

Expected cost saves of 35%, fully realized in 2016

Gross credit mark of $2.9 million, 2.4% of loans

• Effective execution (2015)

Announcement – February 25

Regulatory Approvals - June 17 (68 days following

application)

Shareholder Approval - July 9

Closing – July 31

Systems Integration – October 17 (72 days following

legal closing)

APPENDIX 5

Supports

Retail

Expansion in

High Value

Communities

OceanFirst Headquarters

OceanFirst Retail Branches,

Commercial Loan Production Offices,

and Wealth Management Office

Colonial American Retail Branches

37

Cape Bancorp Acquisition

• Creates the preeminent New Jersey based community

banking franchise operating throughout central and

southern New Jersey

• 85% stock and 15% cash, valued at $196 million

• Favorable financial terms

Price/Tangible Book Value of 139%

Price/Core Deposit Premium of 4.4%

Expected accretion to GAAP EPS of 17% in 2017

Expected tangible book value dilution of 7.2%, projected

earnback of approximately 3.3 years using the cross-over

method and 3.8 years on a simple tangible book value

earnback calculation

• Modest execution risk with conservative assumptions

Expected cost saves of 33%, fully realized by end of 2016

Expected one-time, pre-tax transaction expenses of

$15.5 million

Gross credit mark of $25.5 million, 2.3% of loans

• Effective execution (2016)

Announcement – January 5

Regulatory Approvals – March 28 (52 days following application)

Shareholder Approvals – April 25

Closing – May 2

Systems Integration – completed October 15

APPENDIX 6

38

OceanFirst Headquarters

OceanFirst Retail Branches,

Commercial Loan Production Offices,

and Wealth Management Office

Cape Bank Retail Branches and

Commercial Loan Offices

39

Ocean Shore Holding Co. Acquisition

- OCFC

Branches

- OSHC

Branches

APPENDIX 7

• Reinforces OceanFirst as the preeminent New Jersey

based community banking franchise operating

throughout central and southern New Jersey

• 80% stock and 20% cash, valued at $181 million

• Favorable financial terms(1)

Price/Tangible Book Value of 132%

Price/Core Deposit Premium of 4.9%

Expected accretion to GAAP EPS of over 5% in 2018

Expected tangible book value dilution of 3.1%, projected

earnback of approximately 3.7 years using the cross-over

method and 4.1 years on a simple tangible book value

earnback calculation

• Modest execution risk with conservative assumptions

Expected cost saves of 53%, fully realized by end of 2017

Expected one-time, pre-tax transaction expenses of $19 million

Gross credit mark of $10.0 million, 1.25% of loans

• Effective execution (2016)

Announcement – July 13, 2016

Regulatory Approvals – October 27, 2016 (72 days following

application)

Shareholder Approvals – November 22, 2016

Closing – November 30, 2016

Systems Integration – completed May 19, 2017

(1)At time of announcement

40

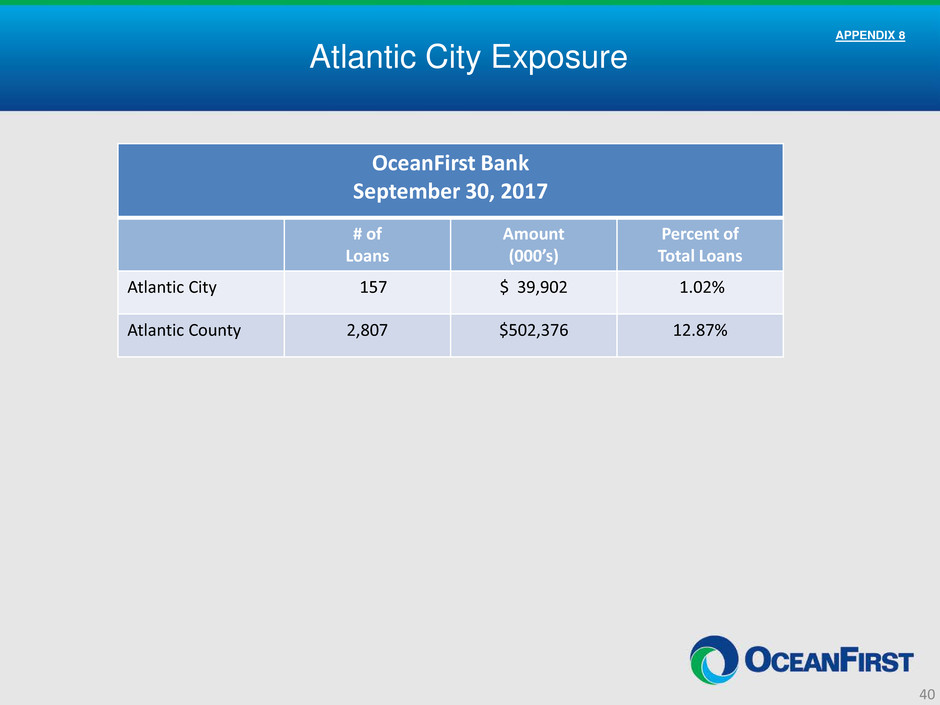

Atlantic City Exposure

OceanFirst Bank

September 30, 2017

# of

Loans

Amount

(000’s)

Percent of

Total Loans

Atlantic City 157 $ 39,902 1.02%

Atlantic County 2,807 $502,376 12.87%

APPENDIX 8

Serving Our Communities

• OceanFirst Foundation

As of September 30, 2017, over $33.0 million has been granted to

organizations serving the Bank’s market

Provided $500,000 in grants dedicated to assisting our neighbors

after Superstorm Sandy hit the Jersey Shore in 2012

First foundation established during a mutual conversion to IPO

(July 1996)

Completed merger of Cape Foundation into OceanFirst

Foundation in 2016 and anticipate merger of Ocean City Home

Foundation in 2017

As of September 30, 2017, OceanFirst Foundation has assets of

$34.5 million

APPENDIX 9

41